baf7047438b9100fcbbf03c045ea6120.ppt

- Количество слайдов: 32

Chapter 16 The Money Supply Process Copyright 2011 Pearson Canada Inc. 16 - 1

Chapter 16 The Money Supply Process Copyright 2011 Pearson Canada Inc. 16 - 1

Players in the Money Supply Process • Central bank (Bank of Canada) • Banks (depository institutions; financial intermediaries) • Depositors (individuals and institutions) Copyright 2011 Pearson Canada Inc. 16 - 2

Players in the Money Supply Process • Central bank (Bank of Canada) • Banks (depository institutions; financial intermediaries) • Depositors (individuals and institutions) Copyright 2011 Pearson Canada Inc. 16 - 2

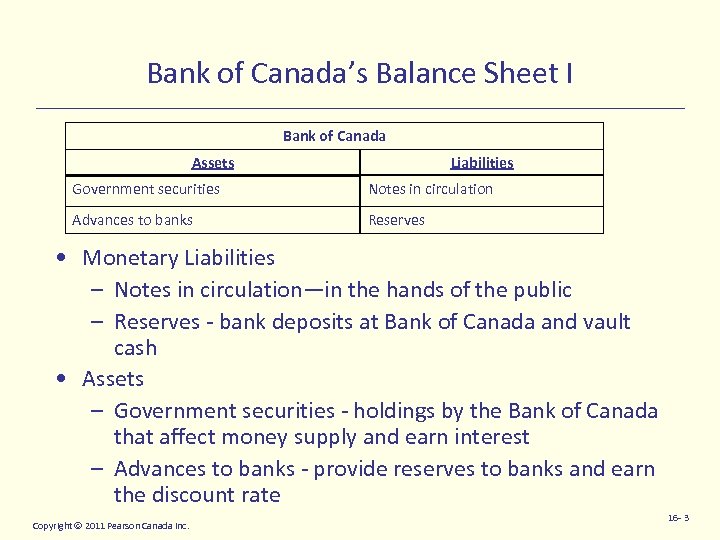

Bank of Canada’s Balance Sheet I Bank of Canada Assets Liabilities Government securities Notes in circulation Advances to banks Reserves • Monetary Liabilities – Notes in circulation—in the hands of the public – Reserves - bank deposits at Bank of Canada and vault cash • Assets – Government securities - holdings by the Bank of Canada that affect money supply and earn interest – Advances to banks - provide reserves to banks and earn the discount rate Copyright 2011 Pearson Canada Inc. 16 - 3

Bank of Canada’s Balance Sheet I Bank of Canada Assets Liabilities Government securities Notes in circulation Advances to banks Reserves • Monetary Liabilities – Notes in circulation—in the hands of the public – Reserves - bank deposits at Bank of Canada and vault cash • Assets – Government securities - holdings by the Bank of Canada that affect money supply and earn interest – Advances to banks - provide reserves to banks and earn the discount rate Copyright 2011 Pearson Canada Inc. 16 - 3

Bank of Canada’s Balance Sheet II • Monetary liabilities of the Bank = Notes in circulation + Settlement balances • Monetary base = Bank of Canada’s monetary liabilities + Royal Canadian Mint’s monetary liabilities (coins in circulation) Copyright 2011 Pearson Canada Inc. 16 - 4

Bank of Canada’s Balance Sheet II • Monetary liabilities of the Bank = Notes in circulation + Settlement balances • Monetary base = Bank of Canada’s monetary liabilities + Royal Canadian Mint’s monetary liabilities (coins in circulation) Copyright 2011 Pearson Canada Inc. 16 - 4

Bank of Canada’s Balance Sheet III • Define: – Currency = Notes + Coins – Reserves = Vault cash + Settlement balances • Banks hold desired reserves to manage their short term liquidity requirements and respond to clearing drains and currency drains • Reserves above that desired are known as excess reserves Copyright 2011 Pearson Canada Inc. 16 - 5

Bank of Canada’s Balance Sheet III • Define: – Currency = Notes + Coins – Reserves = Vault cash + Settlement balances • Banks hold desired reserves to manage their short term liquidity requirements and respond to clearing drains and currency drains • Reserves above that desired are known as excess reserves Copyright 2011 Pearson Canada Inc. 16 - 5

Monetary Base • MB = C + R – MB: monetary base (high-powered money) – C: currency in circulation (notes and coins held by the public outside banks) – R: total reserves in the banking system (vault cash + settlement balances) • The Bank of Canada controls the monetary base through open market operations and advances to banks Copyright 2011 Pearson Canada Inc. 16 - 6

Monetary Base • MB = C + R – MB: monetary base (high-powered money) – C: currency in circulation (notes and coins held by the public outside banks) – R: total reserves in the banking system (vault cash + settlement balances) • The Bank of Canada controls the monetary base through open market operations and advances to banks Copyright 2011 Pearson Canada Inc. 16 - 6

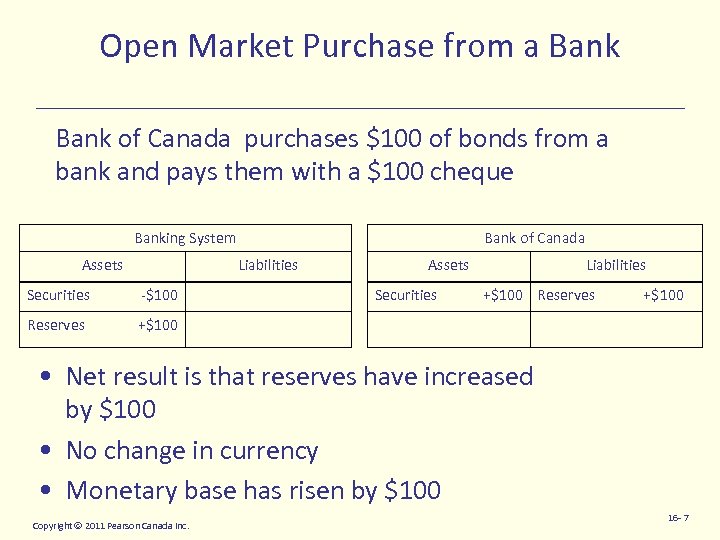

Open Market Purchase from a Bank of Canada purchases $100 of bonds from a bank and pays them with a $100 cheque Banking System Assets Bank of Canada Liabilities Securities -$100 Reserves Assets Securities Liabilities +$100 Reserves +$100 • Net result is that reserves have increased by $100 • No change in currency • Monetary base has risen by $100 Copyright 2011 Pearson Canada Inc. 16 - 7

Open Market Purchase from a Bank of Canada purchases $100 of bonds from a bank and pays them with a $100 cheque Banking System Assets Bank of Canada Liabilities Securities -$100 Reserves Assets Securities Liabilities +$100 Reserves +$100 • Net result is that reserves have increased by $100 • No change in currency • Monetary base has risen by $100 Copyright 2011 Pearson Canada Inc. 16 - 7

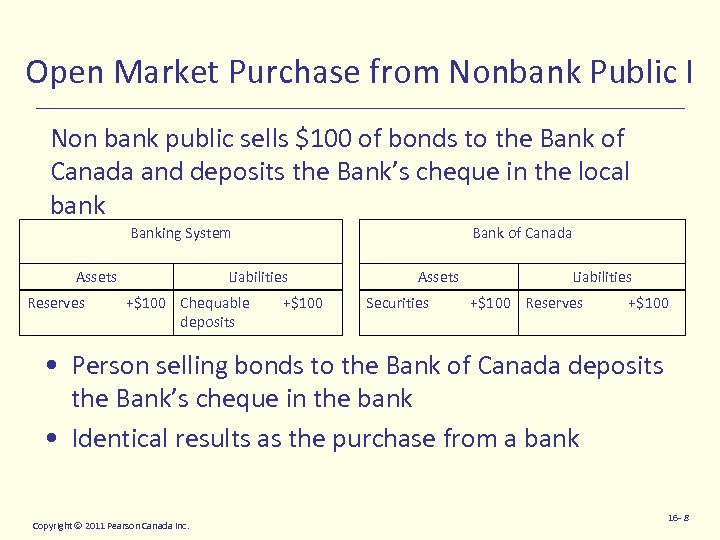

Open Market Purchase from Nonbank Public I Non bank public sells $100 of bonds to the Bank of Canada and deposits the Bank’s cheque in the local bank Banking System Assets Reserves Bank of Canada Liabilities +$100 Chequable deposits +$100 Assets Securities Liabilities +$100 Reserves +$100 • Person selling bonds to the Bank of Canada deposits the Bank’s cheque in the bank • Identical results as the purchase from a bank Copyright 2011 Pearson Canada Inc. 16 - 8

Open Market Purchase from Nonbank Public I Non bank public sells $100 of bonds to the Bank of Canada and deposits the Bank’s cheque in the local bank Banking System Assets Reserves Bank of Canada Liabilities +$100 Chequable deposits +$100 Assets Securities Liabilities +$100 Reserves +$100 • Person selling bonds to the Bank of Canada deposits the Bank’s cheque in the bank • Identical results as the purchase from a bank Copyright 2011 Pearson Canada Inc. 16 - 8

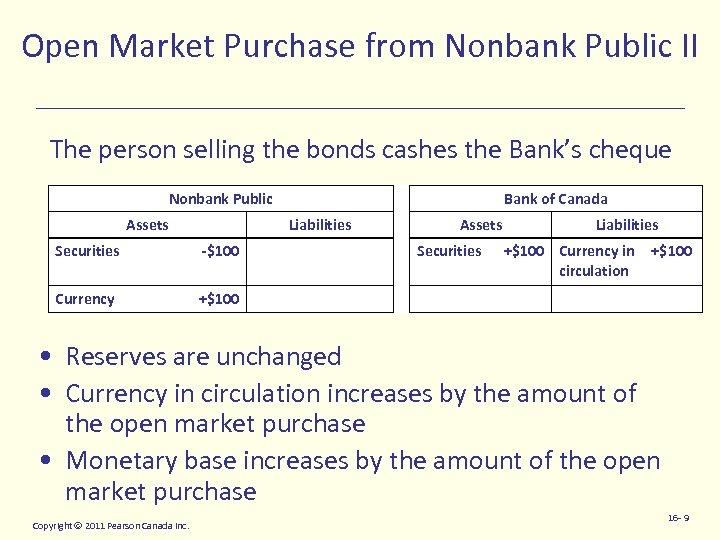

Open Market Purchase from Nonbank Public II The person selling the bonds cashes the Bank’s cheque Nonbank Public Assets Bank of Canada Liabilities Securities -$100 Currency Assets Securities Liabilities +$100 Currency in circulation +$100 • Reserves are unchanged • Currency in circulation increases by the amount of the open market purchase • Monetary base increases by the amount of the open market purchase Copyright 2011 Pearson Canada Inc. 16 - 9

Open Market Purchase from Nonbank Public II The person selling the bonds cashes the Bank’s cheque Nonbank Public Assets Bank of Canada Liabilities Securities -$100 Currency Assets Securities Liabilities +$100 Currency in circulation +$100 • Reserves are unchanged • Currency in circulation increases by the amount of the open market purchase • Monetary base increases by the amount of the open market purchase Copyright 2011 Pearson Canada Inc. 16 - 9

Open Market Purchase: Summary • The effect of an open market purchase on reserves depends on whether the seller of the bonds keeps the proceeds from the sale in currency or in deposits • The effect of an open market purchase on the monetary base (MB) always increases the base by the amount of the purchase Copyright 2011 Pearson Canada Inc. 16 - 10

Open Market Purchase: Summary • The effect of an open market purchase on reserves depends on whether the seller of the bonds keeps the proceeds from the sale in currency or in deposits • The effect of an open market purchase on the monetary base (MB) always increases the base by the amount of the purchase Copyright 2011 Pearson Canada Inc. 16 - 10

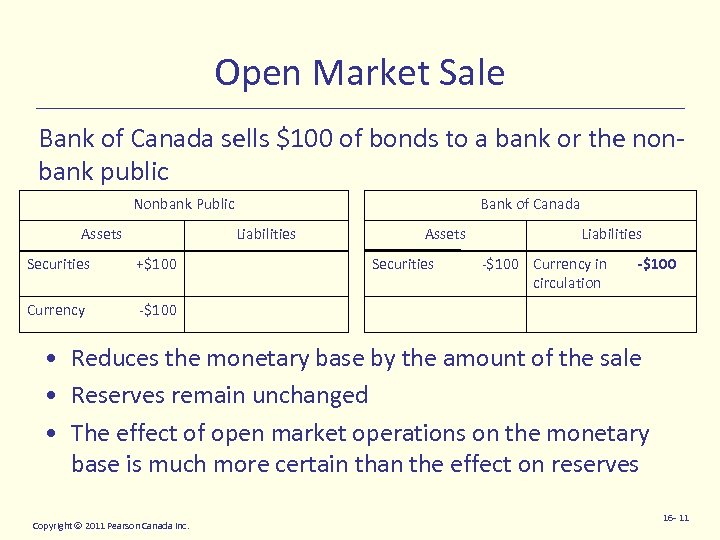

Open Market Sale Bank of Canada sells $100 of bonds to a bank or the nonbank public Nonbank Public Assets Bank of Canada Liabilities Securities +$100 Currency Assets Securities Liabilities -$100 Currency in circulation -$100 • Reduces the monetary base by the amount of the sale • Reserves remain unchanged • The effect of open market operations on the monetary base is much more certain than the effect on reserves Copyright 2011 Pearson Canada Inc. 16 - 11

Open Market Sale Bank of Canada sells $100 of bonds to a bank or the nonbank public Nonbank Public Assets Bank of Canada Liabilities Securities +$100 Currency Assets Securities Liabilities -$100 Currency in circulation -$100 • Reduces the monetary base by the amount of the sale • Reserves remain unchanged • The effect of open market operations on the monetary base is much more certain than the effect on reserves Copyright 2011 Pearson Canada Inc. 16 - 11

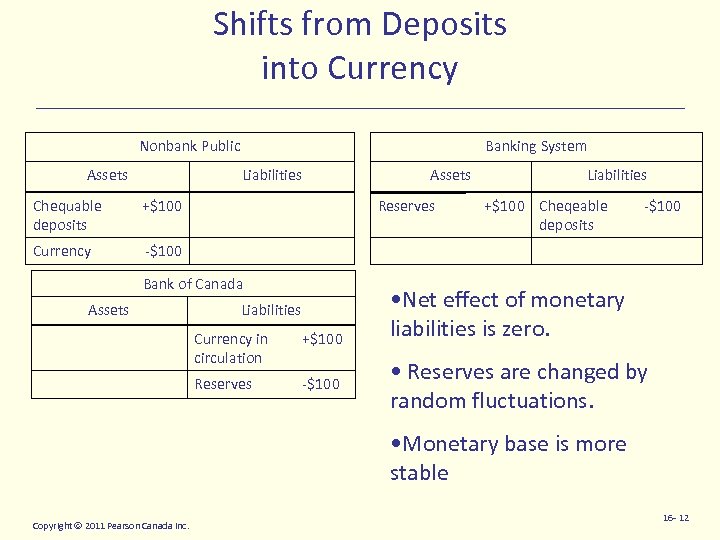

Shifts from Deposits into Currency Nonbank Public Assets Banking System Liabilities Chequable deposits +$100 Currency Assets Reserves Liabilities -$100 Bank of Canada Assets Liabilities Currency in circulation +$100 Reserves -$100 +$100 Cheqeable deposits -$100 • Net effect of monetary liabilities is zero. • Reserves are changed by random fluctuations. • Monetary base is more stable Copyright 2011 Pearson Canada Inc. 16 - 12

Shifts from Deposits into Currency Nonbank Public Assets Banking System Liabilities Chequable deposits +$100 Currency Assets Reserves Liabilities -$100 Bank of Canada Assets Liabilities Currency in circulation +$100 Reserves -$100 +$100 Cheqeable deposits -$100 • Net effect of monetary liabilities is zero. • Reserves are changed by random fluctuations. • Monetary base is more stable Copyright 2011 Pearson Canada Inc. 16 - 12

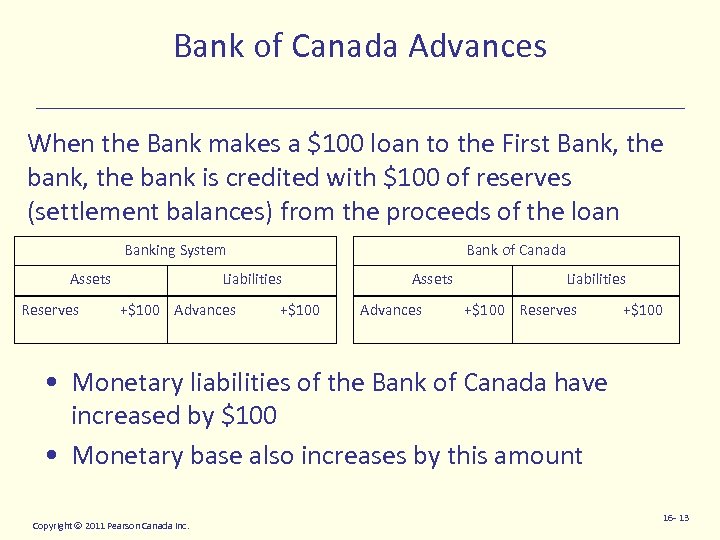

Bank of Canada Advances When the Bank makes a $100 loan to the First Bank, the bank is credited with $100 of reserves (settlement balances) from the proceeds of the loan Banking System Assets Reserves Bank of Canada Liabilities +$100 Advances +$100 Assets Advances Liabilities +$100 Reserves +$100 • Monetary liabilities of the Bank of Canada have increased by $100 • Monetary base also increases by this amount Copyright 2011 Pearson Canada Inc. 16 - 13

Bank of Canada Advances When the Bank makes a $100 loan to the First Bank, the bank is credited with $100 of reserves (settlement balances) from the proceeds of the loan Banking System Assets Reserves Bank of Canada Liabilities +$100 Advances +$100 Assets Advances Liabilities +$100 Reserves +$100 • Monetary liabilities of the Bank of Canada have increased by $100 • Monetary base also increases by this amount Copyright 2011 Pearson Canada Inc. 16 - 13

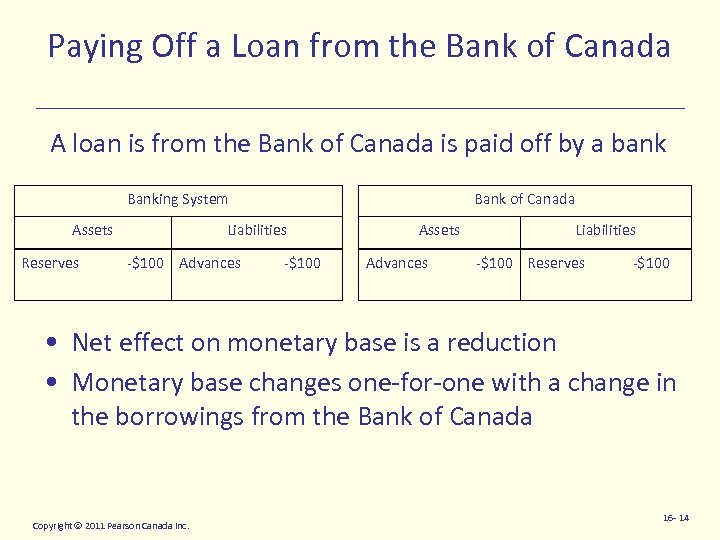

Paying Off a Loan from the Bank of Canada A loan is from the Bank of Canada is paid off by a bank Banking System Assets Reserves Bank of Canada Liabilities -$100 Advances -$100 Assets Advances Liabilities -$100 Reserves -$100 • Net effect on monetary base is a reduction • Monetary base changes one-for-one with a change in the borrowings from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 14

Paying Off a Loan from the Bank of Canada A loan is from the Bank of Canada is paid off by a bank Banking System Assets Reserves Bank of Canada Liabilities -$100 Advances -$100 Assets Advances Liabilities -$100 Reserves -$100 • Net effect on monetary base is a reduction • Monetary base changes one-for-one with a change in the borrowings from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 14

Other Factors Affecting the Monetary Base 1. Float 2. Government deposits at the Bank of Canada • Although technical and external factors complicate control of the monetary base, they do not prevent the Bank of Canada from accurately controlling it Copyright 2011 Pearson Canada Inc. 16 - 15

Other Factors Affecting the Monetary Base 1. Float 2. Government deposits at the Bank of Canada • Although technical and external factors complicate control of the monetary base, they do not prevent the Bank of Canada from accurately controlling it Copyright 2011 Pearson Canada Inc. 16 - 15

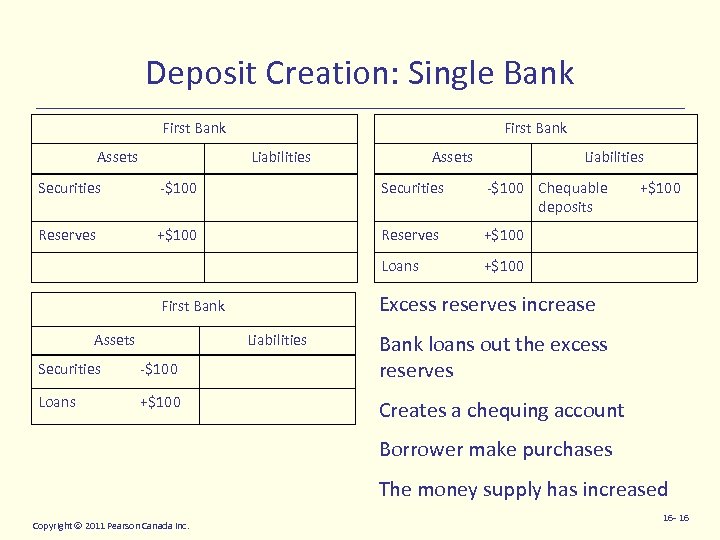

Deposit Creation: Single Bank First Bank Assets First Bank Liabilities Assets Liabilities Securities -$100 Chequable deposits Reserves +$100 Loans +$100 Excess reserves increase First Bank Assets Liabilities Securities -$100 Loans +$100 Bank loans out the excess reserves Creates a chequing account Borrower make purchases The money supply has increased Copyright 2011 Pearson Canada Inc. 16 - 16

Deposit Creation: Single Bank First Bank Assets First Bank Liabilities Assets Liabilities Securities -$100 Chequable deposits Reserves +$100 Loans +$100 Excess reserves increase First Bank Assets Liabilities Securities -$100 Loans +$100 Bank loans out the excess reserves Creates a chequing account Borrower make purchases The money supply has increased Copyright 2011 Pearson Canada Inc. 16 - 16

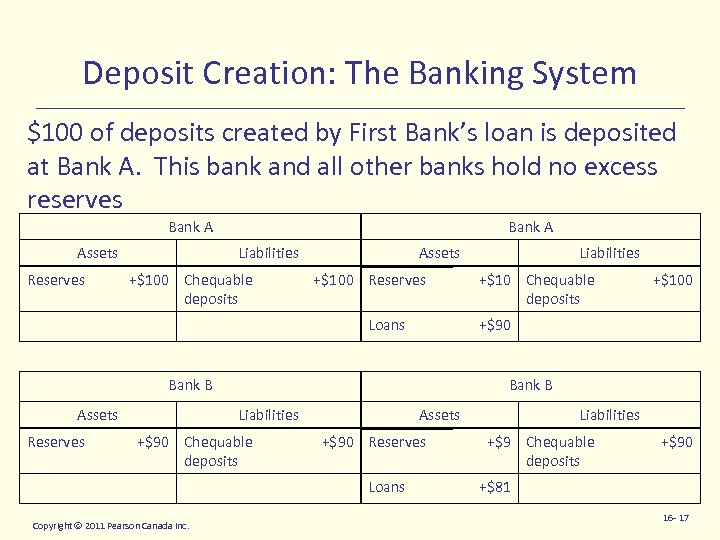

Deposit Creation: The Banking System $100 of deposits created by First Bank’s loan is deposited at Bank A. This bank and all other banks hold no excess reserves Bank A Assets Reserves Bank A Liabilities +$100 Chequable deposits Assets +$100 Reserves Loans Reserves +$100 Bank B Liabilities +$90 Chequable deposits Assets +$90 Reserves Loans Copyright 2011 Pearson Canada Inc. +$10 Chequable deposits +$90 Bank B Assets Liabilities +$9 Chequable deposits +$90 +$81 16 - 17

Deposit Creation: The Banking System $100 of deposits created by First Bank’s loan is deposited at Bank A. This bank and all other banks hold no excess reserves Bank A Assets Reserves Bank A Liabilities +$100 Chequable deposits Assets +$100 Reserves Loans Reserves +$100 Bank B Liabilities +$90 Chequable deposits Assets +$90 Reserves Loans Copyright 2011 Pearson Canada Inc. +$10 Chequable deposits +$90 Bank B Assets Liabilities +$9 Chequable deposits +$90 +$81 16 - 17

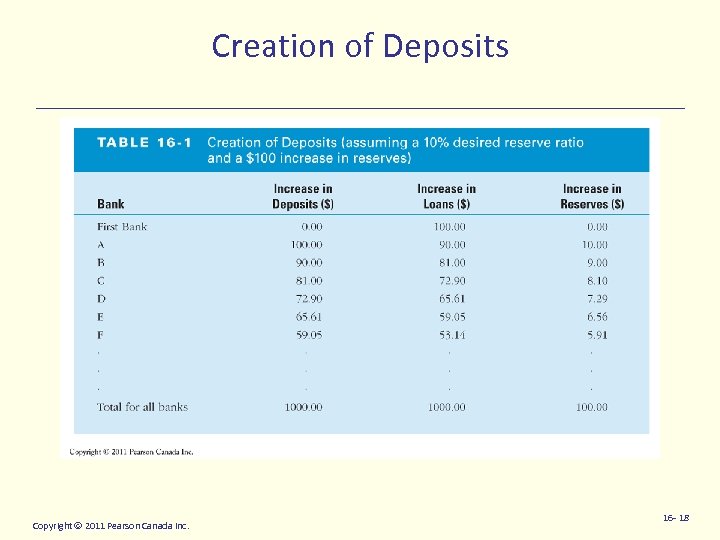

Creation of Deposits Copyright 2011 Pearson Canada Inc. 16 - 18

Creation of Deposits Copyright 2011 Pearson Canada Inc. 16 - 18

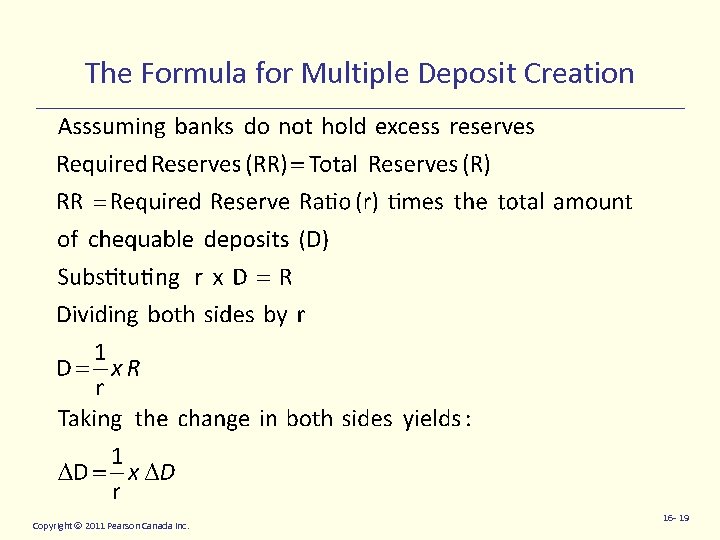

The Formula for Multiple Deposit Creation Copyright 2011 Pearson Canada Inc. 16 - 19

The Formula for Multiple Deposit Creation Copyright 2011 Pearson Canada Inc. 16 - 19

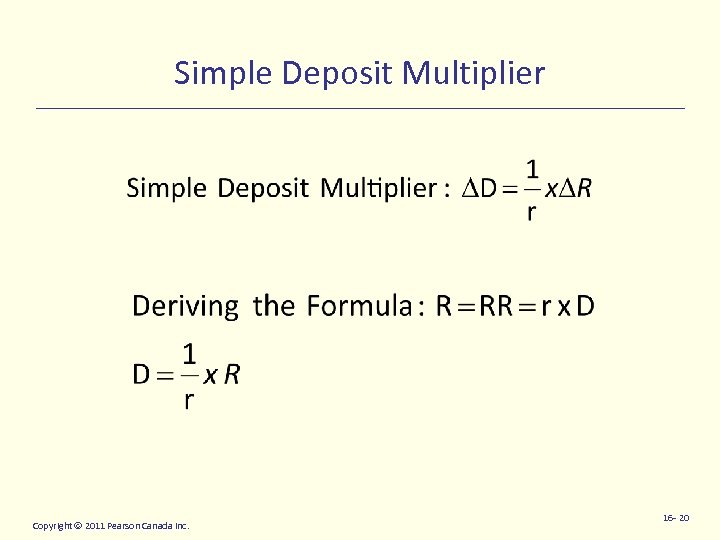

Simple Deposit Multiplier Copyright 2011 Pearson Canada Inc. 16 - 20

Simple Deposit Multiplier Copyright 2011 Pearson Canada Inc. 16 - 20

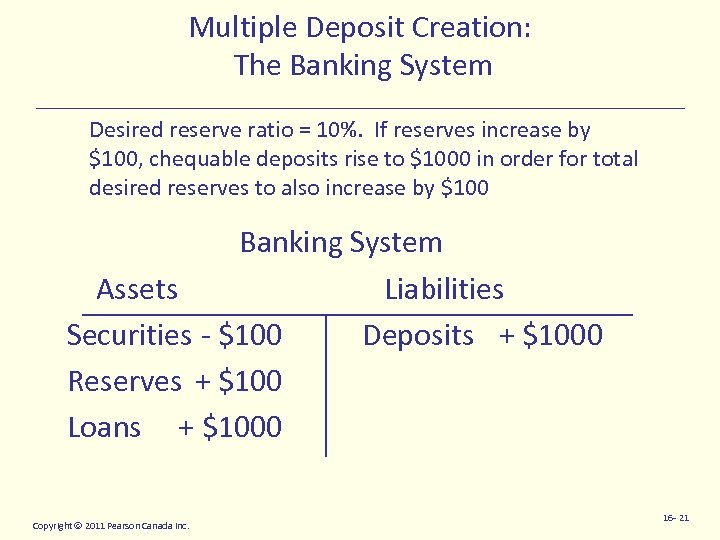

Multiple Deposit Creation: The Banking System Desired reserve ratio = 10%. If reserves increase by $100, chequable deposits rise to $1000 in order for total desired reserves to also increase by $100 Banking System Assets Liabilities Securities - $100 Deposits + $1000 Reserves + $100 Loans + $1000 Copyright 2011 Pearson Canada Inc. 16 - 21

Multiple Deposit Creation: The Banking System Desired reserve ratio = 10%. If reserves increase by $100, chequable deposits rise to $1000 in order for total desired reserves to also increase by $100 Banking System Assets Liabilities Securities - $100 Deposits + $1000 Reserves + $100 Loans + $1000 Copyright 2011 Pearson Canada Inc. 16 - 21

Critique of the Simple Model • Holding cash stops the process • Banks may not use all of their excess reserves to buy securities or make loans Copyright 2011 Pearson Canada Inc. 16 - 22

Critique of the Simple Model • Holding cash stops the process • Banks may not use all of their excess reserves to buy securities or make loans Copyright 2011 Pearson Canada Inc. 16 - 22

Factors that Determine the Money Supply • Changes in the Non-borrowed monetary base (MBn) - the money supply is positively related to the non-borrowed monetary base (MBn) • Changes in advances from the Bank of Canada - the money supply is positively related to the level of borrowed reserves (BR) from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 23

Factors that Determine the Money Supply • Changes in the Non-borrowed monetary base (MBn) - the money supply is positively related to the non-borrowed monetary base (MBn) • Changes in advances from the Bank of Canada - the money supply is positively related to the level of borrowed reserves (BR) from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 23

Factors that Determine the Money Supply II • Changes in the Desired Reserve Ratio, r – The money supply is negatively related to the desired reserve ratio • Changes in Currency Holdings – The money supply is negatively related to the currency holdings Copyright 2011 Pearson Canada Inc. 16 - 24

Factors that Determine the Money Supply II • Changes in the Desired Reserve Ratio, r – The money supply is negatively related to the desired reserve ratio • Changes in Currency Holdings – The money supply is negatively related to the currency holdings Copyright 2011 Pearson Canada Inc. 16 - 24

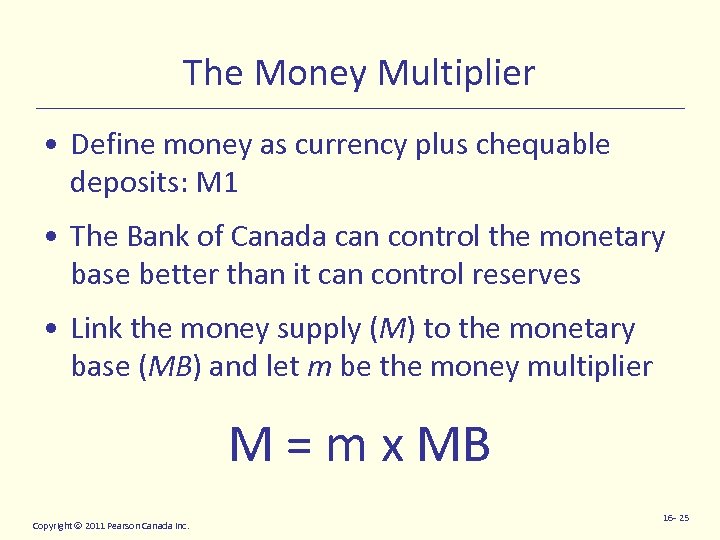

The Money Multiplier • Define money as currency plus chequable deposits: M 1 • The Bank of Canada can control the monetary base better than it can control reserves • Link the money supply (M) to the monetary base (MB) and let m be the money multiplier M = m x MB Copyright 2011 Pearson Canada Inc. 16 - 25

The Money Multiplier • Define money as currency plus chequable deposits: M 1 • The Bank of Canada can control the monetary base better than it can control reserves • Link the money supply (M) to the monetary base (MB) and let m be the money multiplier M = m x MB Copyright 2011 Pearson Canada Inc. 16 - 25

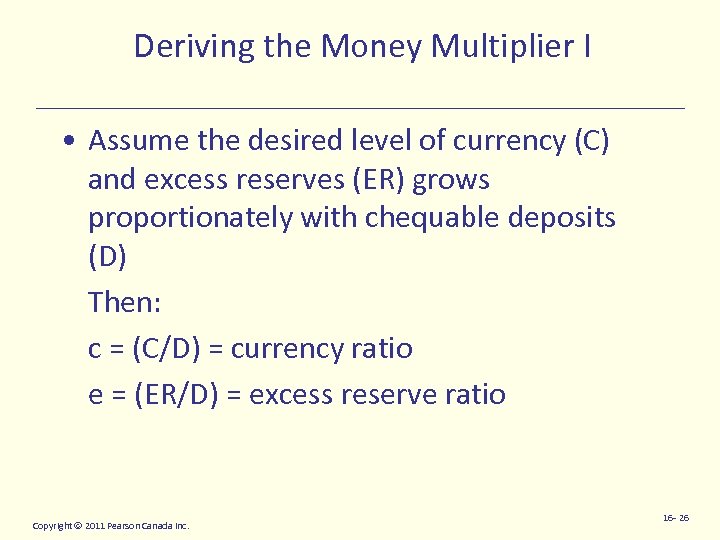

Deriving the Money Multiplier I • Assume the desired level of currency (C) and excess reserves (ER) grows proportionately with chequable deposits (D) Then: c = (C/D) = currency ratio e = (ER/D) = excess reserve ratio Copyright 2011 Pearson Canada Inc. 16 - 26

Deriving the Money Multiplier I • Assume the desired level of currency (C) and excess reserves (ER) grows proportionately with chequable deposits (D) Then: c = (C/D) = currency ratio e = (ER/D) = excess reserve ratio Copyright 2011 Pearson Canada Inc. 16 - 26

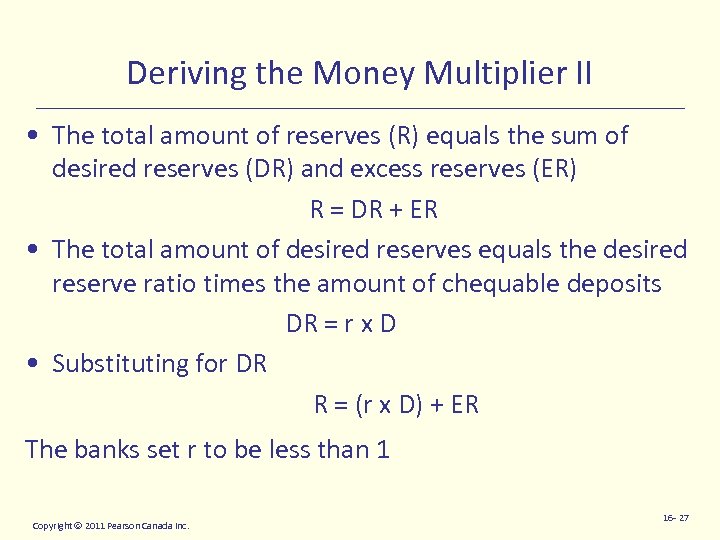

Deriving the Money Multiplier II • The total amount of reserves (R) equals the sum of desired reserves (DR) and excess reserves (ER) R = DR + ER • The total amount of desired reserves equals the desired reserve ratio times the amount of chequable deposits DR = r x D • Substituting for DR R = (r x D) + ER The banks set r to be less than 1 Copyright 2011 Pearson Canada Inc. 16 - 27

Deriving the Money Multiplier II • The total amount of reserves (R) equals the sum of desired reserves (DR) and excess reserves (ER) R = DR + ER • The total amount of desired reserves equals the desired reserve ratio times the amount of chequable deposits DR = r x D • Substituting for DR R = (r x D) + ER The banks set r to be less than 1 Copyright 2011 Pearson Canada Inc. 16 - 27

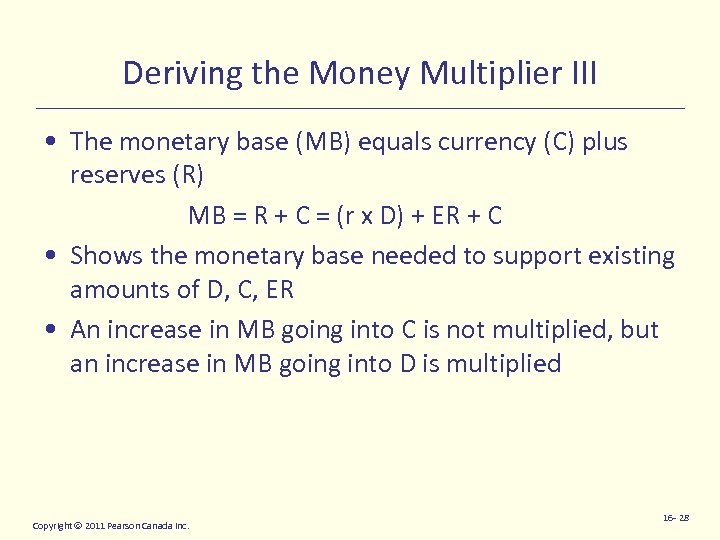

Deriving the Money Multiplier III • The monetary base (MB) equals currency (C) plus reserves (R) MB = R + C = (r x D) + ER + C • Shows the monetary base needed to support existing amounts of D, C, ER • An increase in MB going into C is not multiplied, but an increase in MB going into D is multiplied Copyright 2011 Pearson Canada Inc. 16 - 28

Deriving the Money Multiplier III • The monetary base (MB) equals currency (C) plus reserves (R) MB = R + C = (r x D) + ER + C • Shows the monetary base needed to support existing amounts of D, C, ER • An increase in MB going into C is not multiplied, but an increase in MB going into D is multiplied Copyright 2011 Pearson Canada Inc. 16 - 28

The Money Multiplier in Terms of the Currency Ratio • • MB = (C x D) + (r x D) = (c + r) x D D = 1/(c+r) x MB M=C+D M = (c x D) + D = (1 + C)D M = (1+c)/(1+r) x MB M = (1+c)/(1+r) While there is a multiple expansion of deposits, there is no such expansion for currency Copyright 2011 Pearson Canada Inc. 16 - 29

The Money Multiplier in Terms of the Currency Ratio • • MB = (C x D) + (r x D) = (c + r) x D D = 1/(c+r) x MB M=C+D M = (c x D) + D = (1 + C)D M = (1+c)/(1+r) x MB M = (1+c)/(1+r) While there is a multiple expansion of deposits, there is no such expansion for currency Copyright 2011 Pearson Canada Inc. 16 - 29

Money Supply Response to Changes in the Factors Split the monetary base into two components M = m x (MBn + BR) • The money supply is positively related to both the non-borrowed monetary base MBn and to the level of borrowed reserves, BR, from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 30

Money Supply Response to Changes in the Factors Split the monetary base into two components M = m x (MBn + BR) • The money supply is positively related to both the non-borrowed monetary base MBn and to the level of borrowed reserves, BR, from the Bank of Canada Copyright 2011 Pearson Canada Inc. 16 - 30

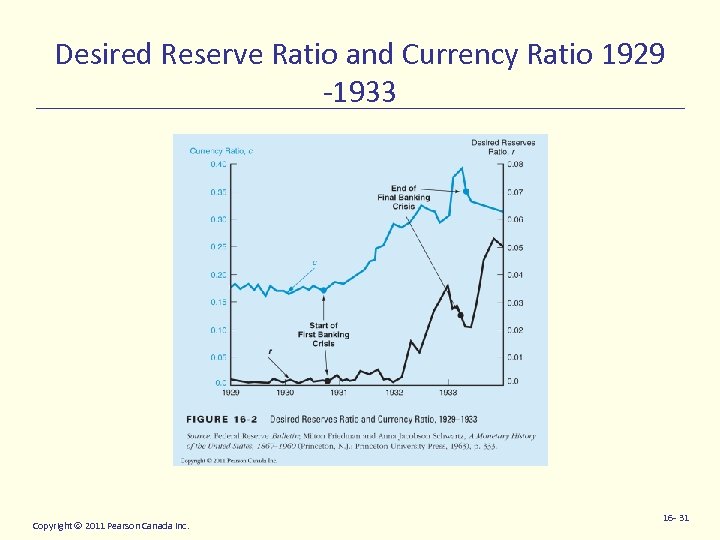

Desired Reserve Ratio and Currency Ratio 1929 -1933 Copyright 2011 Pearson Canada Inc. 16 - 31

Desired Reserve Ratio and Currency Ratio 1929 -1933 Copyright 2011 Pearson Canada Inc. 16 - 31

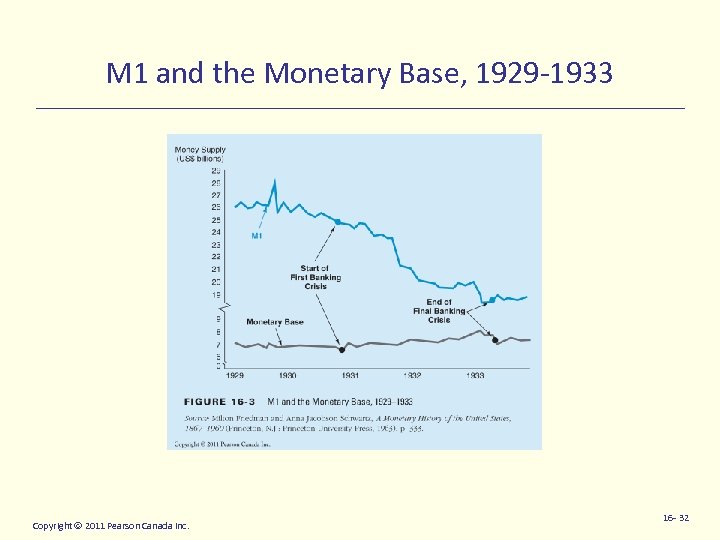

M 1 and the Monetary Base, 1929 -1933 Copyright 2011 Pearson Canada Inc. 16 - 32

M 1 and the Monetary Base, 1929 -1933 Copyright 2011 Pearson Canada Inc. 16 - 32