695fc31c4fe309b71be9a3575e27189a.ppt

- Количество слайдов: 25

Chapter 16 Exporting, Importing, and Countertrade

Chapter 16 Exporting, Importing, and Countertrade

Why Export? Ø Exporting is a way to increase market size and profits Ø lower trade barriers under the WTO and regional economic agreements such as the EU and NAFTA make it easier than ever Ø Large firms often proactively seek new export opportunities, but many smaller firms export reactively Ø often intimidated by the complexities of exporting 16 -2

Why Export? Ø Exporting is a way to increase market size and profits Ø lower trade barriers under the WTO and regional economic agreements such as the EU and NAFTA make it easier than ever Ø Large firms often proactively seek new export opportunities, but many smaller firms export reactively Ø often intimidated by the complexities of exporting 16 -2

Why Export? Ø Exporting firms need to Ø Ø identify market opportunities deal with foreign exchange risk navigate import and export financing understand the challenges of doing business in a foreign market 16 -3

Why Export? Ø Exporting firms need to Ø Ø identify market opportunities deal with foreign exchange risk navigate import and export financing understand the challenges of doing business in a foreign market 16 -3

What Are the Pitfalls of Exporting? Ø Common pitfalls include Ø Ø Ø Ø poor market analysis poor understanding of competitive conditions a lack of customization for local markets a poor distribution program poorly executed promotional campaigns problems securing financing a general underestimation of the differences and expertise required foreign market penetration Ø an underestimation of the amount of paperwork and formalities involved 16 -4

What Are the Pitfalls of Exporting? Ø Common pitfalls include Ø Ø Ø Ø poor market analysis poor understanding of competitive conditions a lack of customization for local markets a poor distribution program poorly executed promotional campaigns problems securing financing a general underestimation of the differences and expertise required foreign market penetration Ø an underestimation of the amount of paperwork and formalities involved 16 -4

How Can Firms Improve Export Performance? Ø Many firms are unaware of export opportunities available Ø Firms need to collect information Ø Firms can get direct assistance from some countries and/or use an export management companies Ø both Germany and Japan have developed extensive institutional structures for promoting exports Ø Japanese exporters can use knowledge and contacts of sogo shosha - great trading houses Ø U. S. firms have far fewer resources available 16 -5

How Can Firms Improve Export Performance? Ø Many firms are unaware of export opportunities available Ø Firms need to collect information Ø Firms can get direct assistance from some countries and/or use an export management companies Ø both Germany and Japan have developed extensive institutional structures for promoting exports Ø Japanese exporters can use knowledge and contacts of sogo shosha - great trading houses Ø U. S. firms have far fewer resources available 16 -5

Where Can U. S. Firms Get Export Information? Ø The U. S. Department of Commerce Ø the most comprehensive source of export information for U. S. firms Ø The International Trade Administration and the United States and Commercial Service Agency Ø “best prospects” lists for firms Ø The Department of Commerce Ø organizes various trade events to help firms make foreign contacts and explore export opportunities Ø The Small Business Administration Ø Local and state governments 16 -6

Where Can U. S. Firms Get Export Information? Ø The U. S. Department of Commerce Ø the most comprehensive source of export information for U. S. firms Ø The International Trade Administration and the United States and Commercial Service Agency Ø “best prospects” lists for firms Ø The Department of Commerce Ø organizes various trade events to help firms make foreign contacts and explore export opportunities Ø The Small Business Administration Ø Local and state governments 16 -6

What Are Export Management Companies? Ø Export management companies (EMCs) are export specialists that act as the export marketing department or international department for client firms Ø Two types of assignments are common: 1. EMCs start export operations with the understanding that the firm will take over after they are established Ø not all EMCs are equal—some do a better job than others 16 -7

What Are Export Management Companies? Ø Export management companies (EMCs) are export specialists that act as the export marketing department or international department for client firms Ø Two types of assignments are common: 1. EMCs start export operations with the understanding that the firm will take over after they are established Ø not all EMCs are equal—some do a better job than others 16 -7

What Are Export Management Companies? 2. EMCs start services with the understanding that the EMC will have continuing responsibility for selling the firm’s products Ø but, firms that use EMCs may not develop their own export capabilities 16 -8

What Are Export Management Companies? 2. EMCs start services with the understanding that the EMC will have continuing responsibility for selling the firm’s products Ø but, firms that use EMCs may not develop their own export capabilities 16 -8

How Can Firms Reduce the Risks of Exporting? Ø To reduce the risks of exporting, firms should Ø hire an EMC or export consultant to identify opportunities and navigate paperwork and regulations Ø focus on one, or a few markets at first Ø enter a foreign market on a small scale in order to reduce the costs of any subsequent failures Ø recognize the time and managerial commitment involved Ø develop a good relationship with local distributors and customers Ø hire locals to help establish a presence in the market Ø be proactive Ø consider local production 16 -9

How Can Firms Reduce the Risks of Exporting? Ø To reduce the risks of exporting, firms should Ø hire an EMC or export consultant to identify opportunities and navigate paperwork and regulations Ø focus on one, or a few markets at first Ø enter a foreign market on a small scale in order to reduce the costs of any subsequent failures Ø recognize the time and managerial commitment involved Ø develop a good relationship with local distributors and customers Ø hire locals to help establish a presence in the market Ø be proactive Ø consider local production 16 -9

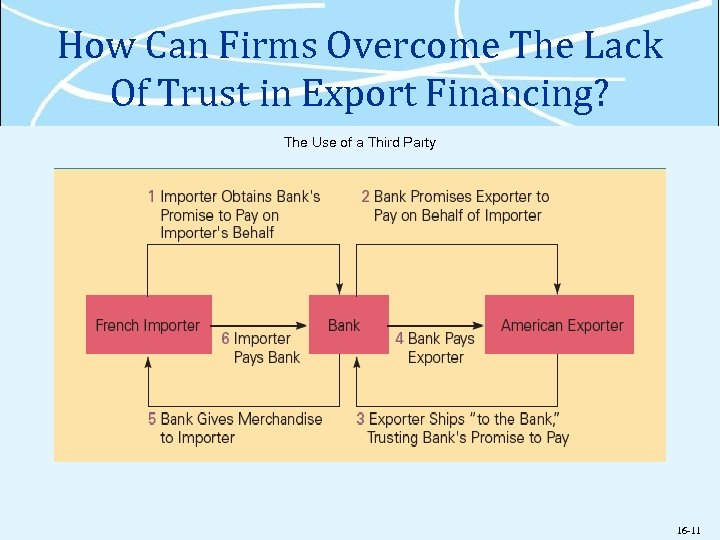

How Can Firms Overcome the Lack of Trust in Export Financing? Ø Because trade implies parties from different countries exchanging goods and payment the issue of trust is important Ø exporters prefer to receive payment prior to shipping goods, but importers prefer to receive goods prior to making payments Ø To get around this difference of preference, many international transactions are facilitated by a third party - normally a reputable bank Ø adds an element of trust to the relationship 16 -10

How Can Firms Overcome the Lack of Trust in Export Financing? Ø Because trade implies parties from different countries exchanging goods and payment the issue of trust is important Ø exporters prefer to receive payment prior to shipping goods, but importers prefer to receive goods prior to making payments Ø To get around this difference of preference, many international transactions are facilitated by a third party - normally a reputable bank Ø adds an element of trust to the relationship 16 -10

How Can Firms Overcome The Lack Of Trust in Export Financing? The Use of a Third Party 16 -11

How Can Firms Overcome The Lack Of Trust in Export Financing? The Use of a Third Party 16 -11

What Is a Letter of Credit? Ø A letter of credit is issued by a bank at the request of an importer Ø states the bank will pay a specified sum of money to a beneficiary, normally the exporter, on presentation of particular, specified documents Ø main advantage is that both parties are likely to trust a reputable bank even if they do not trust each other 16 -12

What Is a Letter of Credit? Ø A letter of credit is issued by a bank at the request of an importer Ø states the bank will pay a specified sum of money to a beneficiary, normally the exporter, on presentation of particular, specified documents Ø main advantage is that both parties are likely to trust a reputable bank even if they do not trust each other 16 -12

What Is a Draft? Ø A draft Ø an order written by an exporter instructing an importer, or an importer's agent, to pay a specified amount of money at a specified time Ø the instrument normally used in international commerce for payment Ø also called a bill of exchange 16 -13

What Is a Draft? Ø A draft Ø an order written by an exporter instructing an importer, or an importer's agent, to pay a specified amount of money at a specified time Ø the instrument normally used in international commerce for payment Ø also called a bill of exchange 16 -13

What Is a Draft? Ø A sight draft is payable on presentation to the drawee Ø A time draft allows for a delay in payment Ø normally 30, 60, 90, or 120 days Ø once a time draft has been “accepted” it becomes a negotiable instrument that can be sold at a discount from its face value 16 -14

What Is a Draft? Ø A sight draft is payable on presentation to the drawee Ø A time draft allows for a delay in payment Ø normally 30, 60, 90, or 120 days Ø once a time draft has been “accepted” it becomes a negotiable instrument that can be sold at a discount from its face value 16 -14

What Is a Bill of Lading? Ø The bill of lading is issued to the exporter by the common carrier transporting the merchandise Ø It serves three purposes 1. It is a receipt - merchandise described on document has been received by carrier 2. It is a contract - carrier is obligated to provide transportation service in return for a certain charge 3. It is a document of title - can be used to obtain payment or a written promise before the merchandise is released to the importer 16 -15

What Is a Bill of Lading? Ø The bill of lading is issued to the exporter by the common carrier transporting the merchandise Ø It serves three purposes 1. It is a receipt - merchandise described on document has been received by carrier 2. It is a contract - carrier is obligated to provide transportation service in return for a certain charge 3. It is a document of title - can be used to obtain payment or a written promise before the merchandise is released to the importer 16 -15

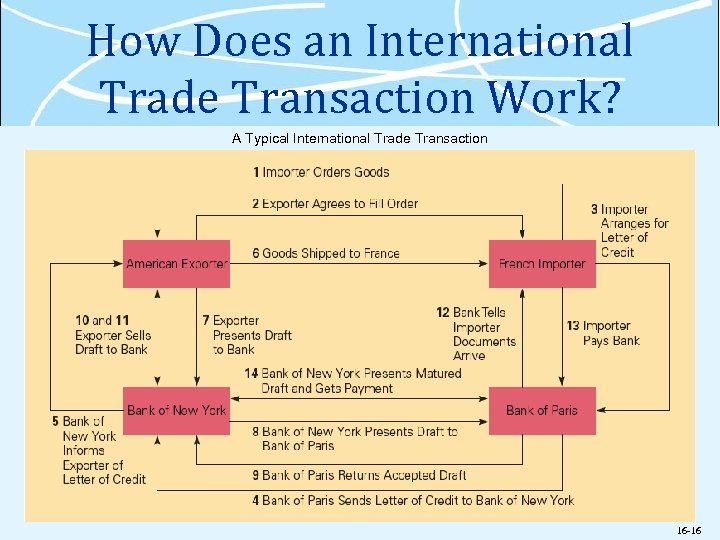

How Does an International Trade Transaction Work? A Typical International Trade Transaction 16 -16

How Does an International Trade Transaction Work? A Typical International Trade Transaction 16 -16

Where Can U. S. Firms Get Export Assistance? 1. Financing aid is available from the Export-Import Bank (Ex-Im Bank) Ø an independent agency of the U. S. government Ø provides financing aid to facilitate exports, imports, and the exchange of commodities between the U. S. and other countries Ø achieves its goals though loan and loan guarantee programs 16 -17

Where Can U. S. Firms Get Export Assistance? 1. Financing aid is available from the Export-Import Bank (Ex-Im Bank) Ø an independent agency of the U. S. government Ø provides financing aid to facilitate exports, imports, and the exchange of commodities between the U. S. and other countries Ø achieves its goals though loan and loan guarantee programs 16 -17

Where Can U. S. Firms Get Export Assistance? 2. Export credit insurance is available from the Foreign Credit Insurance Association (FCIA) Ø provides coverage against commercial risks and political risks Ø protects exporters against the risk that the importer will default on payment 16 -18

Where Can U. S. Firms Get Export Assistance? 2. Export credit insurance is available from the Foreign Credit Insurance Association (FCIA) Ø provides coverage against commercial risks and political risks Ø protects exporters against the risk that the importer will default on payment 16 -18

What Is Countertrade? Ø Countertrade - a range of barter-like agreements that facilitate the trade of goods and services for other goods and services when they cannot be traded for money Ø emerged as a means purchasing imports during the 1960 s when the USSR and the Communist states of Eastern Europe had nonconvertible currencies Ø grew in popularity in the 1980 s among many developing nations that lacked the foreign exchange reserves required to purchase necessary imports Ø notable increase after the 1997 Asian financial crisis 16 -19

What Is Countertrade? Ø Countertrade - a range of barter-like agreements that facilitate the trade of goods and services for other goods and services when they cannot be traded for money Ø emerged as a means purchasing imports during the 1960 s when the USSR and the Communist states of Eastern Europe had nonconvertible currencies Ø grew in popularity in the 1980 s among many developing nations that lacked the foreign exchange reserves required to purchase necessary imports Ø notable increase after the 1997 Asian financial crisis 16 -19

What Are the Forms of Countertrade? Ø There are five distinct versions of countertrade 1. Barter - a direct exchange of goods and/or services between two parties without a cash transaction Ø the most restrictive countertrade arrangement Ø used primarily for one-time-only deals in transactions with trading partners who are not creditworthy or trustworthy 16 -20

What Are the Forms of Countertrade? Ø There are five distinct versions of countertrade 1. Barter - a direct exchange of goods and/or services between two parties without a cash transaction Ø the most restrictive countertrade arrangement Ø used primarily for one-time-only deals in transactions with trading partners who are not creditworthy or trustworthy 16 -20

What Are the Forms of Countertrade? 2. Counterpurchase - a reciprocal buying agreement Ø occurs when a firm agrees to purchase a certain amount of materials back from a country to which a sale is made 3. Offset - similar to counterpurchase - one party agrees to purchase goods and services with a specified percentage of the proceeds from the original sale Ø difference is that this party can fulfill the obligation with any firm in the country to which the sale is being made 16 -21

What Are the Forms of Countertrade? 2. Counterpurchase - a reciprocal buying agreement Ø occurs when a firm agrees to purchase a certain amount of materials back from a country to which a sale is made 3. Offset - similar to counterpurchase - one party agrees to purchase goods and services with a specified percentage of the proceeds from the original sale Ø difference is that this party can fulfill the obligation with any firm in the country to which the sale is being made 16 -21

What Are the Forms of Countertrade? 4. A buyback occurs when a firm builds a plant in a country or supplies technology, equipment, training, or other services to the country Ø agrees to take a certain percentage of the plant’s output as a partial payment for the contract 16 -22

What Are the Forms of Countertrade? 4. A buyback occurs when a firm builds a plant in a country or supplies technology, equipment, training, or other services to the country Ø agrees to take a certain percentage of the plant’s output as a partial payment for the contract 16 -22

What Are the Forms of Countertrade? 5. Switch trading - the use of a specialized thirdparty trading house in a countertrade arrangement Ø when a firm enters a counterpurchase or offset agreement with a country, it often ends up with counterpurchase credits which can be used to purchase goods from that country Ø switch trading occurs when a third-party trading house buys the firm’s counterpurchase credits and sells them to another firm that can better use them 16 -23

What Are the Forms of Countertrade? 5. Switch trading - the use of a specialized thirdparty trading house in a countertrade arrangement Ø when a firm enters a counterpurchase or offset agreement with a country, it often ends up with counterpurchase credits which can be used to purchase goods from that country Ø switch trading occurs when a third-party trading house buys the firm’s counterpurchase credits and sells them to another firm that can better use them 16 -23

What Are the Pros of Countertrade? Ø Countertrade is attractive because Ø it gives a firm a way to finance an export deal when other means are not available Ø it give a firm a competitive edge over a firm that is unwilling to enter a countertrade agreement Ø Countertrade arrangements may be required by the government of a country to which a firm is exporting goods or services 16 -24

What Are the Pros of Countertrade? Ø Countertrade is attractive because Ø it gives a firm a way to finance an export deal when other means are not available Ø it give a firm a competitive edge over a firm that is unwilling to enter a countertrade agreement Ø Countertrade arrangements may be required by the government of a country to which a firm is exporting goods or services 16 -24

What Are the Cons of Countertrade? Ø Countertrade is unattractive because Ø it may involve the exchange of unusable or poorquality goods that the firm cannot dispose of profitably Ø it requires the firm to establish an in-house trading department to handle countertrade deals Ø Countertrade is most attractive to large, diverse multinational enterprises that can use their worldwide network of contacts to dispose of goods acquired in countertrade deals Ø sogo shosha 16 -25

What Are the Cons of Countertrade? Ø Countertrade is unattractive because Ø it may involve the exchange of unusable or poorquality goods that the firm cannot dispose of profitably Ø it requires the firm to establish an in-house trading department to handle countertrade deals Ø Countertrade is most attractive to large, diverse multinational enterprises that can use their worldwide network of contacts to dispose of goods acquired in countertrade deals Ø sogo shosha 16 -25