cdf3cbbbc1d4de547d44572ea0045173.ppt

- Количество слайдов: 26

Chapter 16 Corporate Restructuring © 2000 South-Western College Publishing

Chapter 16 Corporate Restructuring © 2000 South-Western College Publishing

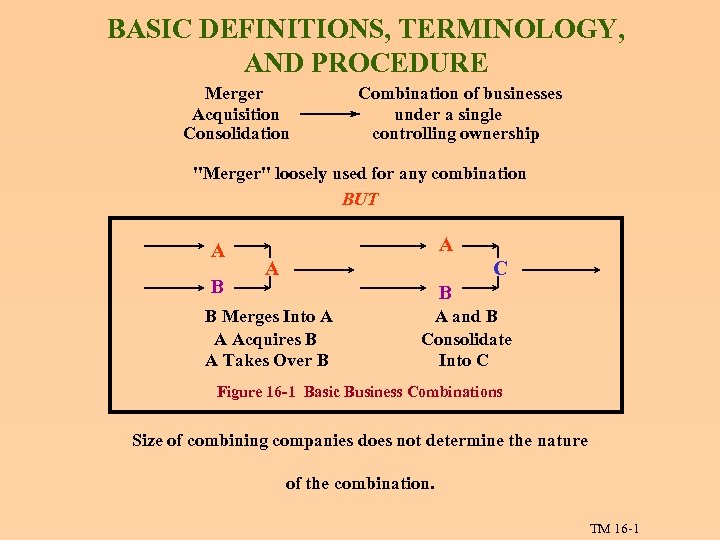

BASIC DEFINITIONS, TERMINOLOGY, AND PROCEDURE Merger Acquisition Consolidation Combination of businesses under a single controlling ownership "Merger" loosely used for any combination BUT A B A A C B B Merges Into A A Acquires B A Takes Over B A and B Consolidate Into C Figure 16 -1 Basic Business Combinations Size of combining companies does not determine the nature of the combination. TM 16 -1

BASIC DEFINITIONS, TERMINOLOGY, AND PROCEDURE Merger Acquisition Consolidation Combination of businesses under a single controlling ownership "Merger" loosely used for any combination BUT A B A A C B B Merges Into A A Acquires B A Takes Over B A and B Consolidate Into C Figure 16 -1 Basic Business Combinations Size of combining companies does not determine the nature of the combination. TM 16 -1

THE FRIENDLY MERGER PROCEDURE Acquirer's management contacts target's management and proposes a deal Target's management agrees and cooperates TM 16 -2 Slide 1 of 2

THE FRIENDLY MERGER PROCEDURE Acquirer's management contacts target's management and proposes a deal Target's management agrees and cooperates TM 16 -2 Slide 1 of 2

THE UNFRIENDLY OR HOSTILE PROCEDURE Acquiring firm makes a tender offer to the target's shareholders Offers a fixed price if accepted on enough shares to gain control Meanwhile, target's management likely contests with defensive measures Hostility is between the managements or boards of directors not the stockholders to whom the target is just an investment Why Unfriendly Mergers Are Unfriendly Price too low Managements of acquired companies lose power, often jobs TM 16 -2 Slide 2 of 2

THE UNFRIENDLY OR HOSTILE PROCEDURE Acquiring firm makes a tender offer to the target's shareholders Offers a fixed price if accepted on enough shares to gain control Meanwhile, target's management likely contests with defensive measures Hostility is between the managements or boards of directors not the stockholders to whom the target is just an investment Why Unfriendly Mergers Are Unfriendly Price too low Managements of acquired companies lose power, often jobs TM 16 -2 Slide 2 of 2

ECONOMIC CLASSIFICATION OF MERGERS Vertical Merger A firm acquires its suppliers or customers Horizontal Merger Between firms in the same kind of business usually as competitors Generally has the effect of reducing competition Conglomerate Merger Lines of business have nothing to do with one another THE ANTITRUST LAWS The U. S. is committed to a competitive economy Mergers concentrate economic power, and can reduce competitiveness Antitrust laws can prohibit mergers Judgment by Justice Department TM 16 -3

ECONOMIC CLASSIFICATION OF MERGERS Vertical Merger A firm acquires its suppliers or customers Horizontal Merger Between firms in the same kind of business usually as competitors Generally has the effect of reducing competition Conglomerate Merger Lines of business have nothing to do with one another THE ANTITRUST LAWS The U. S. is committed to a competitive economy Mergers concentrate economic power, and can reduce competitiveness Antitrust laws can prohibit mergers Judgment by Justice Department TM 16 -3

THE REASONS BEHIND MERGERS Synergies Growth Internal growth vs. external Diversification To Reduce Risk Similar to portfolio diversification Counterargument Economies of Scale Guaranteed Sources and Markets Acquiring Assets Cheaply TM 16 -4 Slide 1 of 2

THE REASONS BEHIND MERGERS Synergies Growth Internal growth vs. external Diversification To Reduce Risk Similar to portfolio diversification Counterargument Economies of Scale Guaranteed Sources and Markets Acquiring Assets Cheaply TM 16 -4 Slide 1 of 2

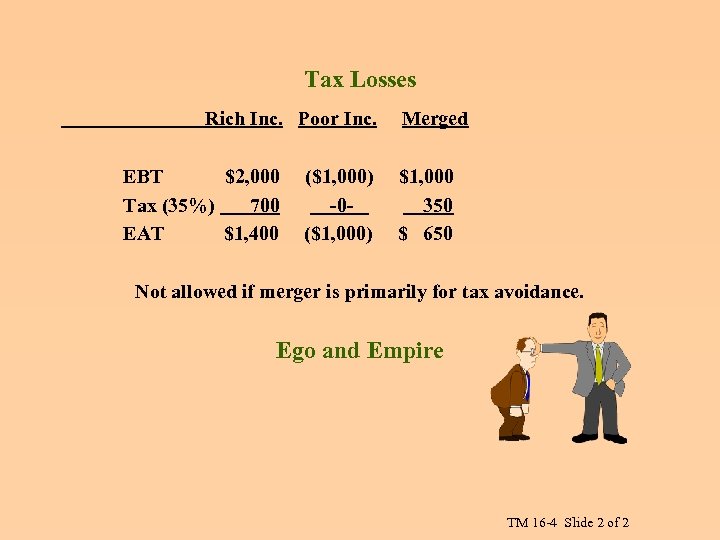

Tax Losses Rich Inc. Poor Inc. EBT $2, 000 Tax (35%) 700 EAT $1, 400 ($1, 000) -0($1, 000) Merged $1, 000 350 $ 650 Not allowed if merger is primarily for tax avoidance. Ego and Empire TM 16 -4 Slide 2 of 2

Tax Losses Rich Inc. Poor Inc. EBT $2, 000 Tax (35%) 700 EAT $1, 400 ($1, 000) -0($1, 000) Merged $1, 000 350 $ 650 Not allowed if merger is primarily for tax avoidance. Ego and Empire TM 16 -4 Slide 2 of 2

THE HISTORY OF MERGER ACTIVITY IN THE UNITED STATES Wave One, The Turn of the Century, 1897 -1904 Profound effect on the structure of American industry Largely horizontal and in primary industries Transformed the country from a nation of small companies into one of industrial giants Small companies absorbed using unfair and violent tactics Monopolistic abuses led to antitrust laws Wave Two, The Roaring Twenties, 1916 -1929 Horizontal mergers resulted in concentration into oligopolies Wave Three, The Swinging Sixties, 1965 -1969 Conglomerate mergers Financial phenomena EPS - P/E Little increase in concentration Many now undone TM 16 -5 Slide 1 of 2

THE HISTORY OF MERGER ACTIVITY IN THE UNITED STATES Wave One, The Turn of the Century, 1897 -1904 Profound effect on the structure of American industry Largely horizontal and in primary industries Transformed the country from a nation of small companies into one of industrial giants Small companies absorbed using unfair and violent tactics Monopolistic abuses led to antitrust laws Wave Two, The Roaring Twenties, 1916 -1929 Horizontal mergers resulted in concentration into oligopolies Wave Three, The Swinging Sixties, 1965 -1969 Conglomerate mergers Financial phenomena EPS - P/E Little increase in concentration Many now undone TM 16 -5 Slide 1 of 2

An Important Development During the 1970 s Prior to the 1970's reputable companies did not do hostile takeovers. Changed in 1974 with the acquisition of ESB, the world's largest maker of batteries, by International Nickel Company (Canadian) assisted by Morgan Stanley, a prestigious investment bank. The hostile takeover became an acceptable financial maneuver. TM 16 -5 Slide 2 of 2

An Important Development During the 1970 s Prior to the 1970's reputable companies did not do hostile takeovers. Changed in 1974 with the acquisition of ESB, the world's largest maker of batteries, by International Nickel Company (Canadian) assisted by Morgan Stanley, a prestigious investment bank. The hostile takeover became an acceptable financial maneuver. TM 16 -5 Slide 2 of 2

Wave Four, Bigger and Bigger, 1981 Distinguishing characteristics of the current wave of intense merger activity: Size Very large mergers involving leading firms are common Hostility Proportion of hostile actions has increased (still small), especially at large end The threat of hostile takeover now pervades corporate life TM 16 -6 Slide 1 of 2

Wave Four, Bigger and Bigger, 1981 Distinguishing characteristics of the current wave of intense merger activity: Size Very large mergers involving leading firms are common Hostility Proportion of hostile actions has increased (still small), especially at large end The threat of hostile takeover now pervades corporate life TM 16 -6 Slide 1 of 2

Raiders Financiers who mount hostile takeovers. Defenses A new field - Things the target of a hostile takeover can do to avoid losing control Advisors Investment bankers and lawyers instigate much of the current merger activity Financing Junk bonds developed by the now defunct investment bank of Drexel Burnham Lambert were a source of financing for takeovers TM 16 -6 Slide 2 of 2

Raiders Financiers who mount hostile takeovers. Defenses A new field - Things the target of a hostile takeover can do to avoid losing control Advisors Investment bankers and lawyers instigate much of the current merger activity Financing Junk bonds developed by the now defunct investment bank of Drexel Burnham Lambert were a source of financing for takeovers TM 16 -6 Slide 2 of 2

MERGER ANALYSIS AND THE PRICE PREMIUM What should an acquiring company be willing to pay for a particular target? A capital budgeting exercise based on a projection of cash flows the target will generate over the indefinite future The Appropriate Discount Rate The target's equity rate The Value to the Acquirer and the per Share Price NPV divided by shares of target's stock outstanding TM 16 -8 Slide 1 of 2

MERGER ANALYSIS AND THE PRICE PREMIUM What should an acquiring company be willing to pay for a particular target? A capital budgeting exercise based on a projection of cash flows the target will generate over the indefinite future The Appropriate Discount Rate The target's equity rate The Value to the Acquirer and the per Share Price NPV divided by shares of target's stock outstanding TM 16 -8 Slide 1 of 2

The Price Premium Price offered to the target's shareholders must always be higher than the stock's market price to induce a majority to sell. Excess over market is the premium. A major issue is choosing a premium that's high enough to attract a majority of shares but no higher. The Effect on Market Price Since a premium is virtually always paid, market price increases rapidly whenever a firm is in play. Insider Trading It is illegal to make a short term profit on price changes that result from the merger. TM 16 -8 Slide 2 of 2

The Price Premium Price offered to the target's shareholders must always be higher than the stock's market price to induce a majority to sell. Excess over market is the premium. A major issue is choosing a premium that's high enough to attract a majority of shares but no higher. The Effect on Market Price Since a premium is virtually always paid, market price increases rapidly whenever a firm is in play. Insider Trading It is illegal to make a short term profit on price changes that result from the merger. TM 16 -8 Slide 2 of 2

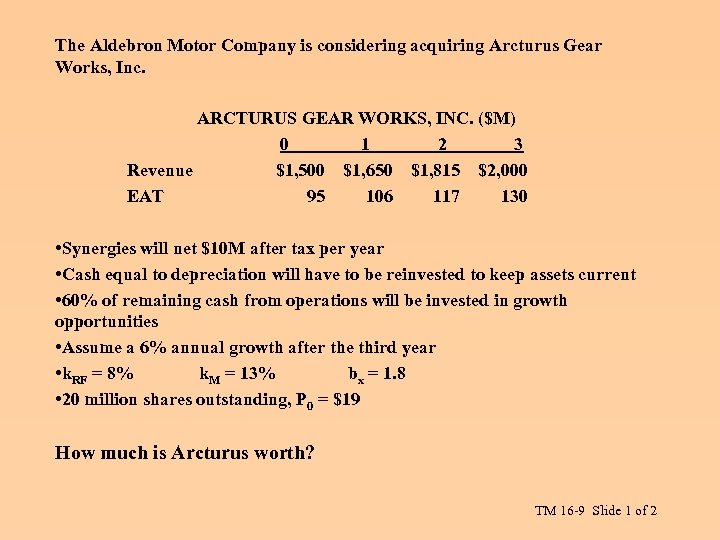

The Aldebron Motor Company is considering acquiring Arcturus Gear Works, Inc. ARCTURUS GEAR WORKS, INC. ($M) 0 1 2 3 Revenue $1, 500 $1, 650 $1, 815 $2, 000 EAT 95 106 117 130 • Synergies will net $10 M after tax per year • Cash equal to depreciation will have to be reinvested to keep assets current • 60% of remaining cash from operations will be invested in growth opportunities • Assume a 6% annual growth after the third year • k. RF = 8% k. M = 13% bx = 1. 8 • 20 million shares outstanding, P 0 = $19 How much is Arcturus worth? TM 16 -9 Slide 1 of 2

The Aldebron Motor Company is considering acquiring Arcturus Gear Works, Inc. ARCTURUS GEAR WORKS, INC. ($M) 0 1 2 3 Revenue $1, 500 $1, 650 $1, 815 $2, 000 EAT 95 106 117 130 • Synergies will net $10 M after tax per year • Cash equal to depreciation will have to be reinvested to keep assets current • 60% of remaining cash from operations will be invested in growth opportunities • Assume a 6% annual growth after the third year • k. RF = 8% k. M = 13% bx = 1. 8 • 20 million shares outstanding, P 0 = $19 How much is Arcturus worth? TM 16 -9 Slide 1 of 2

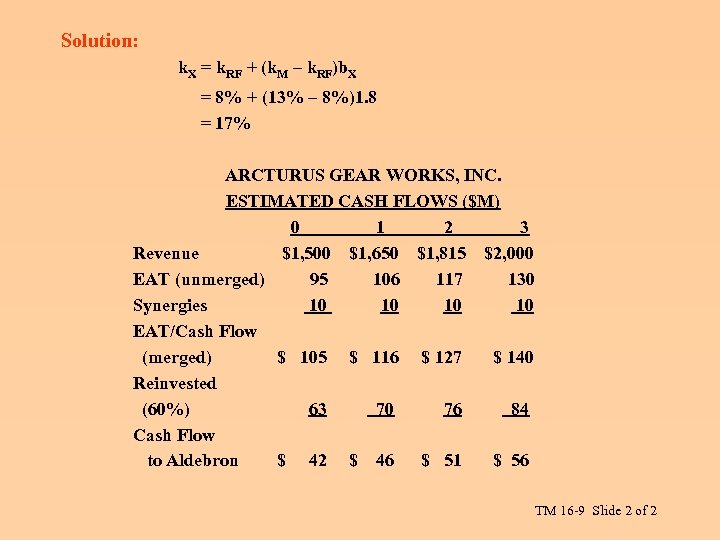

Solution: k. X = k. RF + (k. M – k. RF)b. X = 8% + (13% – 8%)1. 8 = 17% ARCTURUS GEAR WORKS, INC. ESTIMATED CASH FLOWS ($M) 0 1 2 3 Revenue $1, 500 $1, 650 $1, 815 $2, 000 EAT (unmerged) 95 106 117 130 Synergies 10 10 EAT/Cash Flow (merged) $ 105 $ 116 $ 127 $ 140 Reinvested (60%) 63 70 76 84 Cash Flow to Aldebron $ 42 $ 46 $ 51 $ 56 TM 16 -9 Slide 2 of 2

Solution: k. X = k. RF + (k. M – k. RF)b. X = 8% + (13% – 8%)1. 8 = 17% ARCTURUS GEAR WORKS, INC. ESTIMATED CASH FLOWS ($M) 0 1 2 3 Revenue $1, 500 $1, 650 $1, 815 $2, 000 EAT (unmerged) 95 106 117 130 Synergies 10 10 EAT/Cash Flow (merged) $ 105 $ 116 $ 127 $ 140 Reinvested (60%) 63 70 76 84 Cash Flow to Aldebron $ 42 $ 46 $ 51 $ 56 TM 16 -9 Slide 2 of 2

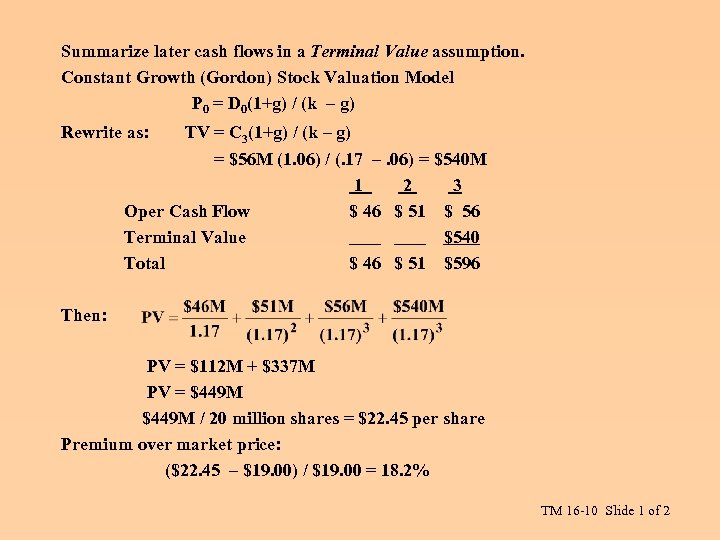

Summarize later cash flows in a Terminal Value assumption. Constant Growth (Gordon) Stock Valuation Model P 0 = D 0(1+g) / (k – g) Rewrite as: TV = C 3(1+g) / (k – g) = $56 M (1. 06) / (. 17 –. 06) = $540 M 1 2 3 Oper Cash Flow $ 46 $ 51 $ 56 Terminal Value $540 Total $ 46 $ 51 $596 Then: PV = $112 M + $337 M PV = $449 M / 20 million shares = $22. 45 per share Premium over market price: ($22. 45 – $19. 00) / $19. 00 = 18. 2% TM 16 -10 Slide 1 of 2

Summarize later cash flows in a Terminal Value assumption. Constant Growth (Gordon) Stock Valuation Model P 0 = D 0(1+g) / (k – g) Rewrite as: TV = C 3(1+g) / (k – g) = $56 M (1. 06) / (. 17 –. 06) = $540 M 1 2 3 Oper Cash Flow $ 46 $ 51 $ 56 Terminal Value $540 Total $ 46 $ 51 $596 Then: PV = $112 M + $337 M PV = $449 M / 20 million shares = $22. 45 per share Premium over market price: ($22. 45 – $19. 00) / $19. 00 = 18. 2% TM 16 -10 Slide 1 of 2

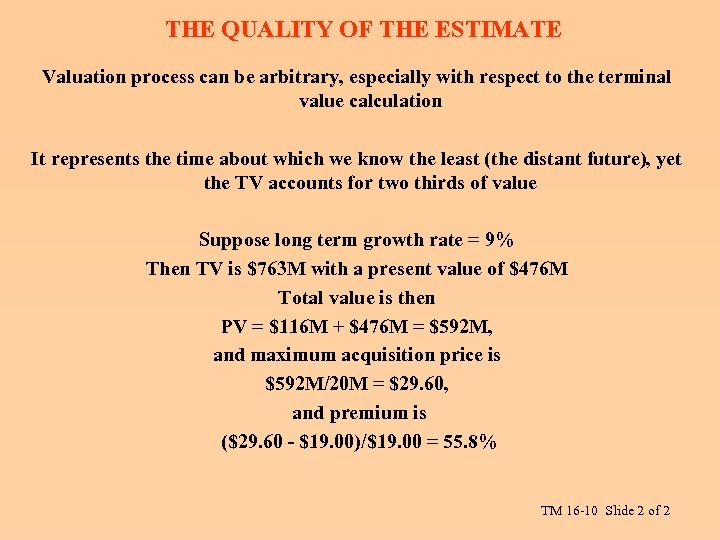

THE QUALITY OF THE ESTIMATE Valuation process can be arbitrary, especially with respect to the terminal value calculation It represents the time about which we know the least (the distant future), yet the TV accounts for two thirds of value Suppose long term growth rate = 9% Then TV is $763 M with a present value of $476 M Total value is then PV = $116 M + $476 M = $592 M, and maximum acquisition price is $592 M/20 M = $29. 60, and premium is ($29. 60 - $19. 00)/$19. 00 = 55. 8% TM 16 -10 Slide 2 of 2

THE QUALITY OF THE ESTIMATE Valuation process can be arbitrary, especially with respect to the terminal value calculation It represents the time about which we know the least (the distant future), yet the TV accounts for two thirds of value Suppose long term growth rate = 9% Then TV is $763 M with a present value of $476 M Total value is then PV = $116 M + $476 M = $592 M, and maximum acquisition price is $592 M/20 M = $29. 60, and premium is ($29. 60 - $19. 00)/$19. 00 = 55. 8% TM 16 -10 Slide 2 of 2

The Junk Bond Market In the 1980 s, investment bankers helped raise debt money for acquisitions through low quality, high yield "junk bonds. " The Capital Structure Argument To Justify High Premiums More leverage can sometimes increase value. TM 16 -11

The Junk Bond Market In the 1980 s, investment bankers helped raise debt money for acquisitions through low quality, high yield "junk bonds. " The Capital Structure Argument To Justify High Premiums More leverage can sometimes increase value. TM 16 -11

DEFENSIVE TACTICS Things managements of target companies can do to prevent or stop acquisitions TACTICS AFTER A TAKEOVER IS UNDERWAY Challenge the Price is too low because stock is temporarily undervalued Raise Antitrust Issues Approach Justice Department claiming merger is anticompetitive Issue Debt and Repurchase Shares Drives up stock price and weakens capital structure Seek A White Knight Find an alternative acquirer with a better reputation Greenmail Buy out potential acquirer above market price TM 16 -12 Slide 1 of 2

DEFENSIVE TACTICS Things managements of target companies can do to prevent or stop acquisitions TACTICS AFTER A TAKEOVER IS UNDERWAY Challenge the Price is too low because stock is temporarily undervalued Raise Antitrust Issues Approach Justice Department claiming merger is anticompetitive Issue Debt and Repurchase Shares Drives up stock price and weakens capital structure Seek A White Knight Find an alternative acquirer with a better reputation Greenmail Buy out potential acquirer above market price TM 16 -12 Slide 1 of 2

TACTICS IN ANTICIPATION OF A TAKEOVER Written Into Corporate Bylaws Staggered Election of Directors Delays acquirer's ability to take control Require Approval by a Supermajority of Stockholders Makes approval more difficult Poison Pills Make it prohibitively expensive for outsiders to take control Acquirer commits financial suicide by swallowing target along with its poison pill Golden Parachutes Exorbitant severance packages for senior management if fired after a takeover Accelerated Debt Principal amounts due if taken over. Share Rights Plans (SRP's) Current shareholders given right to buy shares in merged company at reduced price TM 16 -12 Slide 2 of 2

TACTICS IN ANTICIPATION OF A TAKEOVER Written Into Corporate Bylaws Staggered Election of Directors Delays acquirer's ability to take control Require Approval by a Supermajority of Stockholders Makes approval more difficult Poison Pills Make it prohibitively expensive for outsiders to take control Acquirer commits financial suicide by swallowing target along with its poison pill Golden Parachutes Exorbitant severance packages for senior management if fired after a takeover Accelerated Debt Principal amounts due if taken over. Share Rights Plans (SRP's) Current shareholders given right to buy shares in merged company at reduced price TM 16 -12 Slide 2 of 2

LEVERAGED BUYOUTS (LBOs) A publicly held company's stock purchased by investors in a negotiated deal or a tender offer Company becomes privately held Investors are frequently the firm's management Leverage is usually asset based Very risky because of high debt and interest burden LBO is a takeover but not a merger PROXY FIGHTS Proxy - a legal document giving one person the right to act for another on a certain issue Directors usually elected by proxy Competing groups fight for seats on the board by soliciting proxies from stockholders TM 16 -13

LEVERAGED BUYOUTS (LBOs) A publicly held company's stock purchased by investors in a negotiated deal or a tender offer Company becomes privately held Investors are frequently the firm's management Leverage is usually asset based Very risky because of high debt and interest burden LBO is a takeover but not a merger PROXY FIGHTS Proxy - a legal document giving one person the right to act for another on a certain issue Directors usually elected by proxy Competing groups fight for seats on the board by soliciting proxies from stockholders TM 16 -13

DIVESTITURES Reasons for Divestitures Cash Strategic Fit Poor Performance METHODS OF DIVESTING OPERATIONS Sale for Cash and/or Securities A friendly acquisition or an LBO Spin-off Two parts of a firm are strategically incompatible, but there's no desire to get rid of either Set up operation as a separate corporation Give a share of new firm for every share of old firm held Liquidation Close business and sell off assets Usually a last resort TM 16 -14

DIVESTITURES Reasons for Divestitures Cash Strategic Fit Poor Performance METHODS OF DIVESTING OPERATIONS Sale for Cash and/or Securities A friendly acquisition or an LBO Spin-off Two parts of a firm are strategically incompatible, but there's no desire to get rid of either Set up operation as a separate corporation Give a share of new firm for every share of old firm held Liquidation Close business and sell off assets Usually a last resort TM 16 -14

BANKRUPTCY AND THE REORGANIZATION OF FAILED BUSINESSES Economic failure - business is unable to provide an adequate return to its owners An issue between a business and its owners Commercial failure - a business can't pay its debts Such a firm is insolvent An issue between a business and its creditors A commercial failure faces bankruptcy A commercial failure is usually economic failure as well An economic failure may not involve commercial failure TM 16 -15 Slide 1 of 2

BANKRUPTCY AND THE REORGANIZATION OF FAILED BUSINESSES Economic failure - business is unable to provide an adequate return to its owners An issue between a business and its owners Commercial failure - a business can't pay its debts Such a firm is insolvent An issue between a business and its creditors A commercial failure faces bankruptcy A commercial failure is usually economic failure as well An economic failure may not involve commercial failure TM 16 -15 Slide 1 of 2

BANKRUPTCY A legal proceeding which protects a failing firm from its creditors so it can stay in business until a solution is worked out The solution generally involves either: A reorganization under the supervision and protection of the court, which involves a restructuring of debt and a plan to pay everyone off as fairly as possible, Or A liquidation of the firm's assets to pay creditors. A firm "comes out of bankruptcy" after a reorganization in which its creditors agree to a settlement of their claims. Voluntary or Involuntary The court may appoint a trustee to oversee operations during bankruptcy proceedings. TM 16 -15 Slide 2 of 2

BANKRUPTCY A legal proceeding which protects a failing firm from its creditors so it can stay in business until a solution is worked out The solution generally involves either: A reorganization under the supervision and protection of the court, which involves a restructuring of debt and a plan to pay everyone off as fairly as possible, Or A liquidation of the firm's assets to pay creditors. A firm "comes out of bankruptcy" after a reorganization in which its creditors agree to a settlement of their claims. Voluntary or Involuntary The court may appoint a trustee to oversee operations during bankruptcy proceedings. TM 16 -15 Slide 2 of 2

BANKRUPTCY PROCEDURES Reorganization Business plan under which firm can continue to operate and pay off its debts Judged on fairness and feasibility Fairness implies the priorities in the bankruptcy laws A reorganization plan must be approved by bankruptcy court, creditors, and stockholders Debt Restructuring The heart of most reorganization plans is a restructuring of the firm's debt to make payments easier. Extension - More time to repay Composition - Creditors settle for less Conversion of debt into equity Liquidation Value of assets is more than the operating value of firm Sell off assets using the proceeds to pay off as many debts as possible Can be administratively complex TM 16 -16 Slide 1 of 2

BANKRUPTCY PROCEDURES Reorganization Business plan under which firm can continue to operate and pay off its debts Judged on fairness and feasibility Fairness implies the priorities in the bankruptcy laws A reorganization plan must be approved by bankruptcy court, creditors, and stockholders Debt Restructuring The heart of most reorganization plans is a restructuring of the firm's debt to make payments easier. Extension - More time to repay Composition - Creditors settle for less Conversion of debt into equity Liquidation Value of assets is more than the operating value of firm Sell off assets using the proceeds to pay off as many debts as possible Can be administratively complex TM 16 -16 Slide 1 of 2

Distribution Priorities All claimants are not equal in the eyes of the law Secured Debt paid from sale of related assets Priorities for Payment of General Claims 1. Administrative expenses of the bankruptcy proceedings. 2. Certain business expenses incurred after the bankruptcy petition is filed. 3. Unpaid wages up to $2, 000 per employee. 4. Certain unpaid contributions to employee benefit plans. 5. Certain customer deposits up to $900 per individual. 6. Unpaid taxes. 7. Unsecured creditors. 8. Preferred stockholders. 9. Common stockholders. TM 16 -16 Slide 2 of 2

Distribution Priorities All claimants are not equal in the eyes of the law Secured Debt paid from sale of related assets Priorities for Payment of General Claims 1. Administrative expenses of the bankruptcy proceedings. 2. Certain business expenses incurred after the bankruptcy petition is filed. 3. Unpaid wages up to $2, 000 per employee. 4. Certain unpaid contributions to employee benefit plans. 5. Certain customer deposits up to $900 per individual. 6. Unpaid taxes. 7. Unsecured creditors. 8. Preferred stockholders. 9. Common stockholders. TM 16 -16 Slide 2 of 2