b643c4436daea280236218e7eb29835d.ppt

- Количество слайдов: 40

Chapter 16: Capital Structure Objective To understand how a firm can create value through its capital structure decisions Copyright © Prentice Hall Inc. 2000. Author: Nick Bagley, bdella. Soft, Inc. 1

Chapter 16 Contents 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Internal Versus External Financing Equity Financing Debt Financing The Irrelevance of Capital Structure in a Frictionless Environment Creating Value Through Financing Decisions Reducing Costs Dealing with Conflicts of Interest Creating New Opportunities for Stakeholders Financing Decisions in Practice How to Evaluate Levered Investments 2

Internal versus External Financing Internal Financing arises from the operations of the firm. Example: A firm earns profits and reinvests them in new plant and equipment. ¡ External Financing occurs whenever the corporation’s managers must raise funds from outside lenders or investors. Example: A corporation issues bonds or stocks to finance the purchase of new plant and equipment. ¡ 3

Equity Financing ¡ ¡ 1. 2. 3. Equity is a claim to the residual that is left over after all debts have been paid. Three major types of equity claims: Common Stocks Stock Options Preferred Stock 4

Common Stocks Class A: has voting rights ¡ Class B: does not have voting rights ¡ Restricted Stock: often issued to the founders of a corporation, usually constrains them not to sell their shares for a certain number of years. ¡ 5

Stock Options Give their holders the right to buy common stock at a fixed exercise price in the future. ¡ Often managers and other employees of a corporation will receive part of their compensation in the form of stock option. ¡ 6

Preferred Stocks They carry a specified dividend that must be paid before the firm can pay any dividends to the holders of the common stock. ¡ They receive only their promised dividends and do not get to share in the residual value of the firm’s assets. ¡ 7

Debt Financing Corporate debt is a contractual obligation on the part of the corporation to make promised future payments in return for the resources provided to it. ¡ Loans and debt securities, such as bonds and mortgages ¡ Accounts payable, leases, pensions. ¡ 8

Secured Debt When a corporation borrows money, it promises to make a series of payments in the future. In some cases, the corporation pledges a particular asset (collateral) as security for that promise (secured debt). ¡ Example: An airline borrows money to finance the purchase of airplanes and pledges the airplanes as collateral for the loan. ¡ 9

Long-Term Leases Leasing an asset for a period of time that covers much of the asset’s useful life is similar to buying the asset and financing the purchasing with debt secured by the leased asset. ¡ Main difference: Who bears the risk associated with the residual market value of the leased asset at the end of the term of the lease. ¡ 10

Pension Liabilities ¡ Defined-contribution: each employee has an account into which the employer and usually the employee too make regular contributions. At retirement, the employee receives a benefit whose size depends on the accumulated value of the funds in the retirement account. 11

Pension Liabilities ¡ Defined-benefit: The employee’s pension benefit is determined by a formula that takes into account years of service for the employer and, in most cases, wages or salary. 12

Capital Structure in a Frictionless Environment (M&M) ¡ Modigliani and Miller (1958): In an economist’s idealized world of frictionless markets, the total market value of all the securities issued by a firm would be governed by the earning power and risk of its underlying real assets and would be independent of how the mix of securities issued to finance it was divided. 13

M&M Frictionless Environment No income taxes ¡ No transaction costs of issuing debt or equity securities ¡ Investors can borrow on the same terms as the firm ¡ The various stakeholders of the firm are able to costlessly resolve any conflicts of interest among themselves ¡ 14

Nodett and Somdett Two firms with identical assets differing only in their capital structure. ¡ Nodett: Only stocks ¡ Somdett: Bonds and stocks ¡ 15

Nodett EBIT=$10 million ¡ 1 million shares of common stocks ¡ Nodett pays out all $10 million as dividends to its shareholders ¡ Market capitalization rate on Nodett expected dividends=10% ¡ Nodett total value=$10 million/0. 1=$100 million ¡ 16

Somdett Identical to Nodett in its investment and operating policies. ¡ Has issued bonds that have a face value of $40 million at an interest rate of 8% per year. ¡ The bonds are in perpetuity, default free. ¡ Somdett’s Net Earnings (available to shareholders)=EBIT -$3. 2 million ¡ 17

Somdett Total cash payments made to Somdett’s bondholders and stock holders: Somdett’s Total Payments = Somdett’s Net Earnings + Interest Payments Somdett’s Total Payments = EBIT $3. 2 million +$3. 2 million = EBIT ¡ 18

M&M Because Somdett offers exactly the same future cash flows as Nodett, the market value of Somdett should be $100 million, which is the same as Nodett’s. ¡ Bonds are riskfree thus they have a market value equal to their $40 million face value, thus the market value of shares is $60 million. 600, 00 shares, each $100. ¡ 19

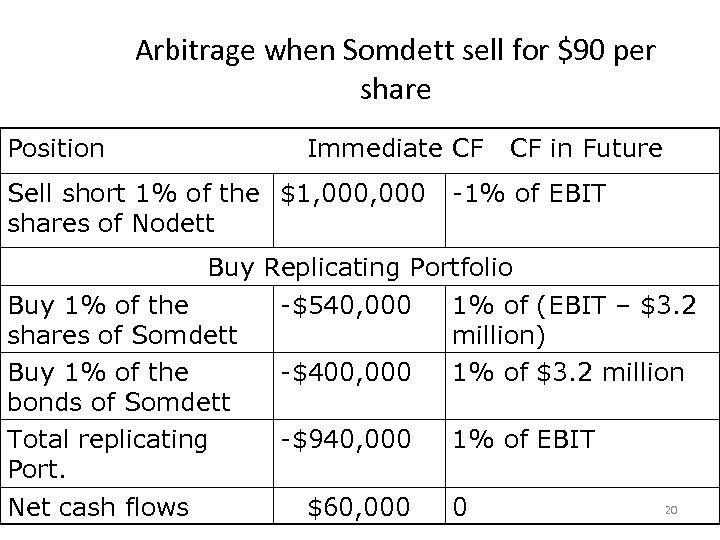

Arbitrage when Somdett sell for $90 per share Position Immediate CF Sell short 1% of the $1, 000 shares of Nodett CF in Future -1% of EBIT Buy Replicating Portfolio Buy 1% of the shares of Somdett Buy 1% of the bonds of Somdett Total replicating Port. Net cash flows -$540, 000 -$400, 000 1% of (EBIT – $3. 2 million) 1% of $3. 2 million -$940, 000 1% of EBIT $60, 000 0 20

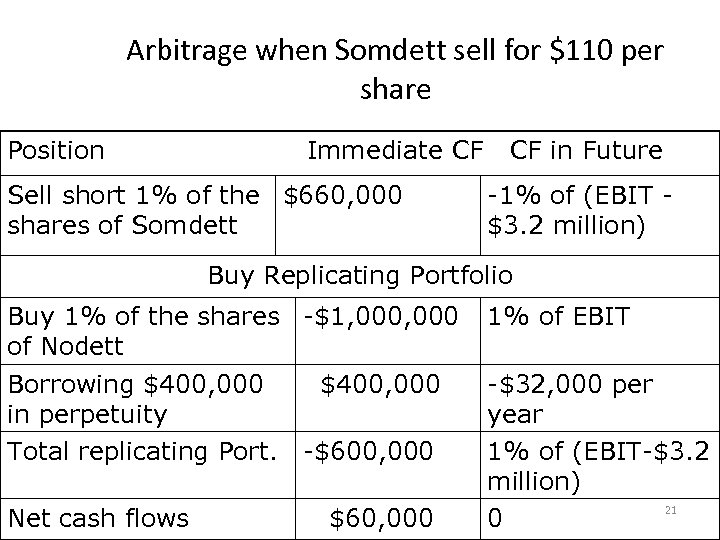

Arbitrage when Somdett sell for $110 per share Position Immediate CF Sell short 1% of the $660, 000 shares of Somdett CF in Future -1% of (EBIT $3. 2 million) Buy Replicating Portfolio Buy 1% of the shares -$1, 000 of Nodett Borrowing $400, 000 in perpetuity Total replicating Port. -$600, 000 Net cash flows $60, 000 1% of EBIT -$32, 000 per year 1% of (EBIT-$3. 2 million) 21 0

Nodett & Somdett, Expected Returns and Risks of the stock investments In the case of Nodett, the total risk of uncertain EBIT is spread among 1 million shares. ¡ In Somdett’s case the same total risk exposure is spread among only 600, 000 shares. ¡ Somdett’s stock, therefore, has a higher expected return and higher risk than Nodett’s stock. ¡ 22

Creating Value Through Financing Decisions Reducing Costs ¡ Dealing with Conflicts of Interest ¡ Creating New Opportunities for Stakeholders ¡ 23

Reducing Costs Taxes and Subsidies ¡ Costs of Financial Distress ¡ 24

Taxes and Subsidies ¡ A firm’s capital structure matters in the presence of corporate income taxes, because interest expense is deductible in computing a firm’s taxable income whereas dividends are not. Therefore, by using debt financing the firm can reduce the amount of its cash flow that must be paid to the government tax authority. 25

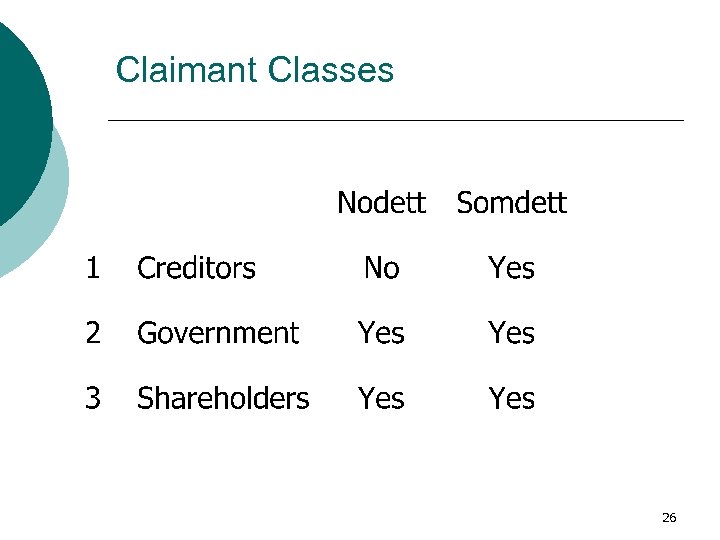

Claimant Classes 26

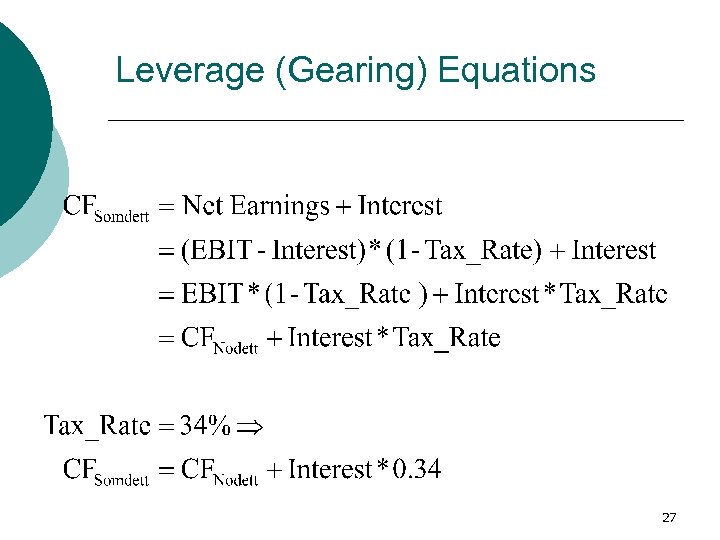

Leverage (Gearing) Equations 27

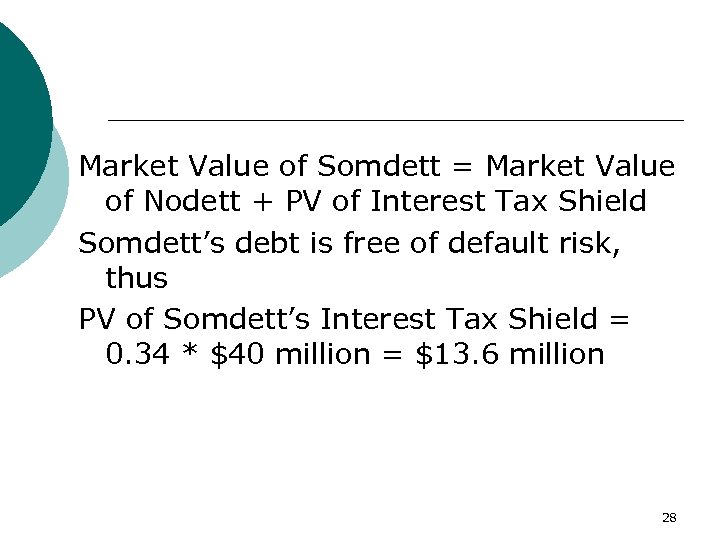

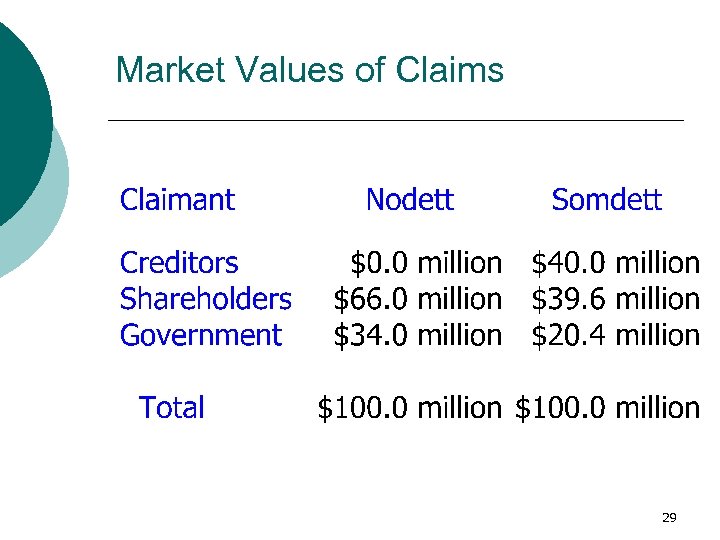

Market Value of Somdett = Market Value of Nodett + PV of Interest Tax Shield Somdett’s debt is free of default risk, thus PV of Somdett’s Interest Tax Shield = 0. 34 * $40 million = $13. 6 million 28

Market Values of Claims 29

Question ¡ If Nodett Corporation ( with 1 million shares) were to announce an issue of $40 million of debt to be used to repurchase and retire common stock, what would be the effect on its share price? After the stock repurchase how many shares of stock would be outstanding? 30

Answer ¡ In this case the stock price would rise to reflect the $13. 6 million present value of the interest tax shield. The value of the 1 million shares would rise from $66 million to $79. 6 million of $79. 6 per share. The number of shares repurchased and retired would be 502, 513 shares ($40 million/$79. 6), thus leaving 497, 487 shares outstanding. 31

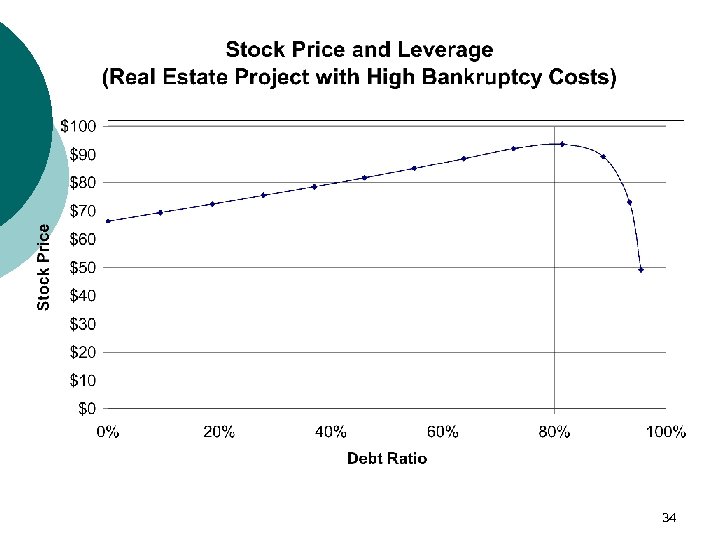

Costs of Financial Distress As the proportion of debt in a firm’s capital structure increases, so too does the likelihood that it might default on that debt should future cash flow be less than expected. ¡ Firms that are in imminent danger of defaulting on their debt obligations are said to be in financial distress. ¡ 32

Costs of Financial Distress These costs include the time and effort of the firm’s managers in avoiding bankruptcy and fees paid to lawyers. ¡ Taking the costs of financial distress into consideration as well as the tax savings associated with higher levels of debt financing produces a trade-off. ¡ 33

34

Dealing with Conflicts of Interest Incentive Problems: Free Cash Flow ¡ Conflicts between Shareholders and Creditors ¡ 35

Incentive Problems: Free Cash Flow ¡ Debt forces management to distribute cash to the firm’s debtholders in the form of prescheduled payments of interest and principle. Issuing debt to repurchase shares can, therefore, be a way of creating value for the shareholders by reducing the amount of free cash flow available to managers. 36

Conflicts between Shareholders and Creditors Managers acting in the best interests of shareholders will choose to undertake more volatile investments that have the effect of increasing the wealth of shareholders at the expense of the debtholders. ¡ Because creditors are aware of the matter, they will limit their lending in the first place. ¡ 37

Creating New Opportunities for Stakeholders Capital structure can create value by creating opportunities for some of the firm’s stakeholders that otherwise would be available to them at greater cost or not at all. ¡ Example: The use of pension promises as a form of corporate financing. ¡ 38

39

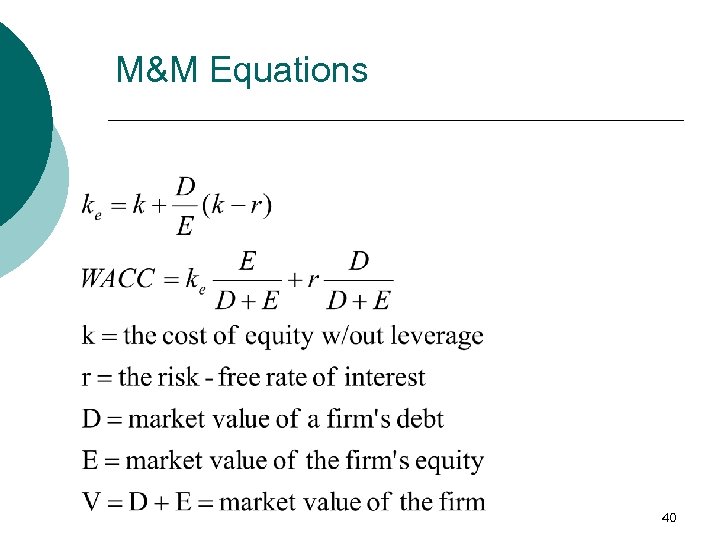

M&M Equations 40

b643c4436daea280236218e7eb29835d.ppt