c5e19f26bf315b73d6381b392e75475d.ppt

- Количество слайдов: 30

Chapter 15 Sourcing Equity Globally

The Goals of Chapter 15 • This chapter first introduces the sequence of strategies to source both equity and debt capital globally • It then describes issuing American depositary receipts (ADRs) or GDRs, which are the most important instruments of cross-border equity financing • In addition, the firms’ motives to acquire global equity are discussed, and the barrier for issuing global equity are analyzed as well • Finally, alternative instruments, including private placements or strategic alliances, to source equity in global markets are discussed 15 -2

Sourcing Equity Globally • A focus of this chapter is on how firms resident in less liquid or segmented markets attain the global cost of capital and availability of capital • To implement the goal of gaining access to global capital markets, a firm must begin by designing a strategy that will ultimately attract international investors • In addition to choose alternative paths to access global markets, this would also require some restructuring of the firm, improving the quality and level of its disclosure, and making its accounting and reporting standards more transparent to potential foreign investors 15 -3

Designing a Strategy to Source Equity Globally • Designing a capital sourcing strategy requires that management agree upon a long-run financial objective and then choose among alternative paths to get there • Often, this decision making process is aided by an early appointment of an investment bank as an official advisor to the firm – Investment bankers are in touch with potential foreign investors and know what they currently require, and can also help navigate the numerous institutional requirements and barriers that must be satisfied – Investment bankers usually prepare the required stock prospectus if an equity issue is desired, help to price the issue, and maintain the share price to prevent it from falling below its initial price after the issue date 15 -4

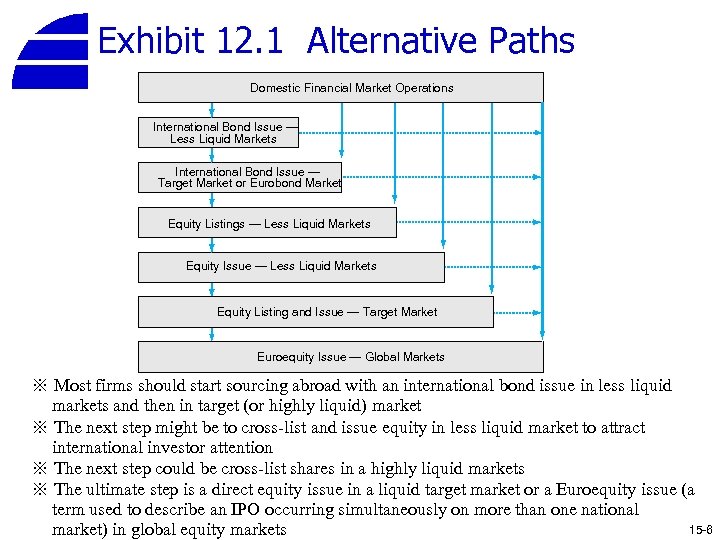

Designing a Strategy to Source Equity Globally • Alternative paths to globalize the cost and availability of capital are discussed as follows – Most firms raise their initial capital in their own domestic market – However, most firms that have only raised capital in their domestic market are not well known enough to attract foreign investors – Incremental steps to bridge this gap include conducting an international bond offering and/or cross-listing equity shares on more highly liquid foreign stock exchanges (see Exhibit 12. 1) 15 -5

Exhibit 12. 1 Alternative Paths Domestic Financial Market Operations International Bond Issue — Less Liquid Markets International Bond Issue — Target Market or Eurobond Market Equity Listings — Less Liquid Markets Equity Issue — Less Liquid Markets Equity Listing and Issue — Target Market Euroequity Issue — Global Markets ※ Most firms should start sourcing abroad with an international bond issue in less liquid markets and then in target (or highly liquid) market ※ The next step might be to cross-list and issue equity in less liquid market to attract international investor attention ※ The next step could be cross-list shares in a highly liquid markets ※ The ultimate step is a direct equity issue in a liquid target market or a Euroequity issue (a term used to describe an IPO occurring simultaneously on more than one national 15 -6 market) in global equity markets

Depositary receipts • Depositary receipts (depositary shares) are negotiable (transferable) certificates issued by a bank to represent the underlying shares of stock, which are held in trust at a foreign custodian bank • Global depositary receipts (GDRs) refer to certificates traded outside the U. S. , and American depository receipts (ADRs) are certificates traded in the U. S. and denominated in U. S. dollars • In a word, ADRs are certificates traded in U. S. markets that represent ownership in shares of a foreign company (for example, ADRs of TSMC) 15 -7

Depositary receipts • Each ADR represents some multiple of the underlying foreign share, that allows for ADR pricing to resemble conventional U. S. share pricing between $20 and $50 per share, e. g. one ADR of TSMC can exchange for 5 shares of TSMC common stock • ADRs are registered, issued, and traded in the U. S. in the same manner as any share of stock – ADRs were created to make it easier foreign firms to satisfy U. S. security registration requirements – ADRs provides an easier way foreign firms to raise money in the U. S – On the other hands, ADRs provide the most common way for U. S. investors to invest in and trade the shares of foreign corporations 15 -8

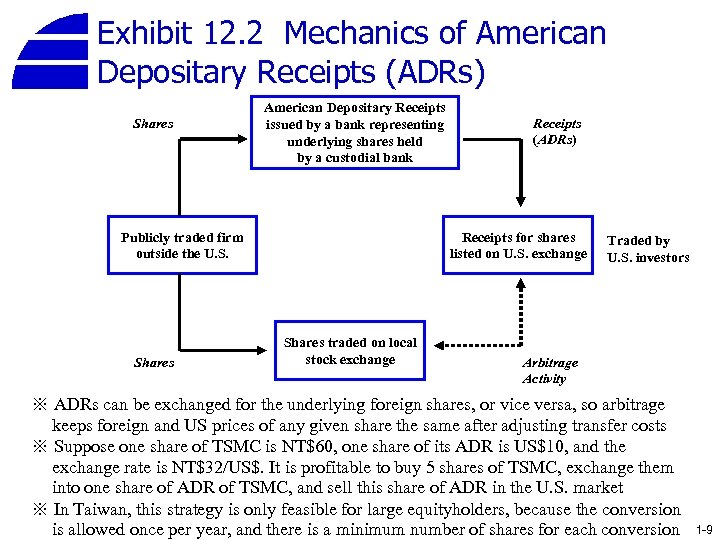

Exhibit 12. 2 Mechanics of American Depositary Receipts (ADRs) Shares American Depositary Receipts issued by a bank representing underlying shares held by a custodial bank Publicly traded firm outside the U. S. Shares Receipts (ADRs) Receipts for shares listed on U. S. exchange Shares traded on local stock exchange Traded by U. S. investors Arbitrage Activity ※ ADRs can be exchanged for the underlying foreign shares, or vice versa, so arbitrage keeps foreign and US prices of any given share the same after adjusting transfer costs ※ Suppose one share of TSMC is NT$60, one share of its ADR is US$10, and the exchange rate is NT$32/US$. It is profitable to buy 5 shares of TSMC, exchange them into one share of ADR of TSMC, and sell this share of ADR in the U. S. market ※ In Taiwan, this strategy is only feasible for large equityholders, because the conversion is allowed once per year, and there is a minimum number of shares for each conversion 1 -9

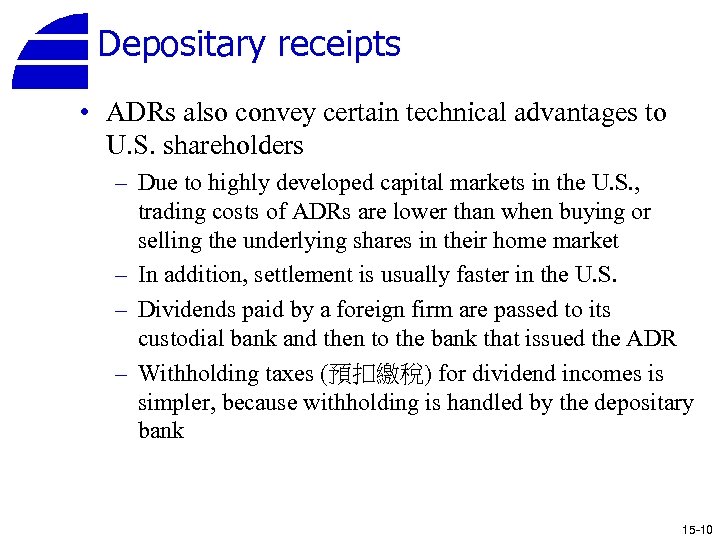

Depositary receipts • ADRs also convey certain technical advantages to U. S. shareholders – Due to highly developed capital markets in the U. S. , trading costs of ADRs are lower than when buying or selling the underlying shares in their home market – In addition, settlement is usually faster in the U. S. – Dividends paid by a foreign firm are passed to its custodial bank and then to the bank that issued the ADR – Withholding taxes (預扣繳稅) for dividend incomes is simpler, because withholding is handled by the depositary bank 15 -10

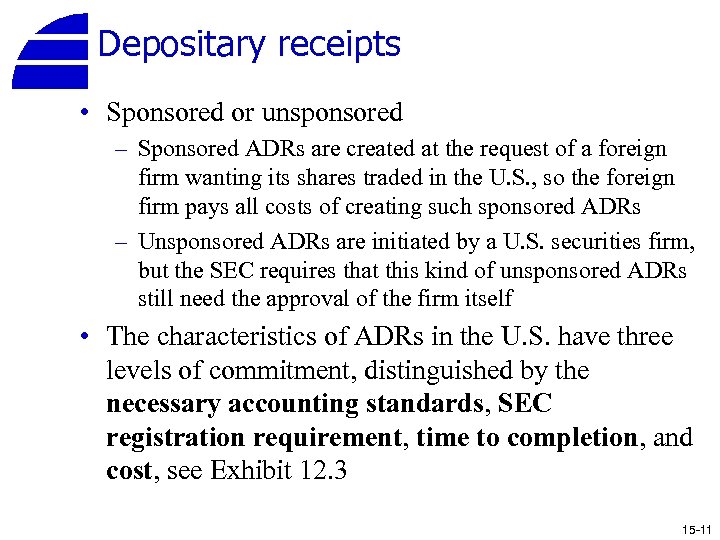

Depositary receipts • Sponsored or unsponsored – Sponsored ADRs are created at the request of a foreign firm wanting its shares traded in the U. S. , so the foreign firm pays all costs of creating such sponsored ADRs – Unsponsored ADRs are initiated by a U. S. securities firm, but the SEC requires that this kind of unsponsored ADRs still need the approval of the firm itself • The characteristics of ADRs in the U. S. have three levels of commitment, distinguished by the necessary accounting standards, SEC registration requirement, time to completion, and cost, see Exhibit 12. 3 15 -11

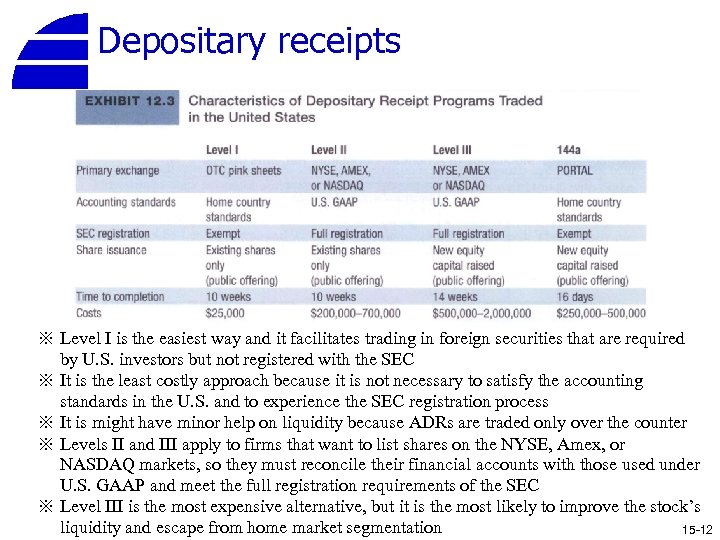

Depositary receipts ※ Level I is the easiest way and it facilitates trading in foreign securities that are required by U. S. investors but not registered with the SEC ※ It is the least costly approach because it is not necessary to satisfy the accounting standards in the U. S. and to experience the SEC registration process ※ It is might have minor help on liquidity because ADRs are traded only over the counter ※ Levels II and III apply to firms that want to list shares on the NYSE, Amex, or NASDAQ markets, so they must reconcile their financial accounts with those used under U. S. GAAP and meet the full registration requirements of the SEC ※ Level III is the most expensive alternative, but it is the most likely to improve the stock’s liquidity and escape from home market segmentation 15 -12

Depositary receipts • Rule 144 A – One type of directed issue with a long history as a source of both equity and debt is the private placement market – A private placement is the sale of a security to a small set of qualified institutional buyers (QIB) – QIB is an entity that owns and invests $100 million on a discretionary basis in securities of nonaffiliates, e. g. insurance companies, investment companies, pension fund etc. (Banks and savings and loans must satisfy an additional criterion of having a minimum net worth of $25 million) – Since the securities are not registered for sale to the public, OIBs have typically followed a “buy and hold” policy – The SEC approved Rule 144 A in 1990, which permits QIBs to trade privately place securities without the previous holding period restrictions and SEC registration 15 -13

Depositary receipts – The SEC also modified it Regulation S to permit foreign issuers to tap the U. S. private placement market through an SEC Rule 144 A issue, also without SEC registration – A screen-based automated trading system called PORTAL was established by National Association of Securities Dealers (NASD) to support the distribution of primary issues and to create a liquid secondary market for these unregistered private placements – Since SEC registration has been identified as the main barrier to foreign firms wishing to raise funds in the U. S. , SEC Rule 144 A placements are proving attractive to foreign issuers of both equity and debt securities 15 -14

Foreign Equity Listing and Issuance • The objectives of cross-listing shares on a welldeveloped foreign stock exchange: 1. Improve the liquidity of its existing shares and support a liquid secondary market for new equity issues in foreign markets 2. Increase its share price by overcoming mis-pricing in a segmented and illiquid home capital market 3. Increase the visibility and political acceptance 4. Create a secondary market for shares ※ We will explain the above objectives point by point in the following paragraphs 15 -15

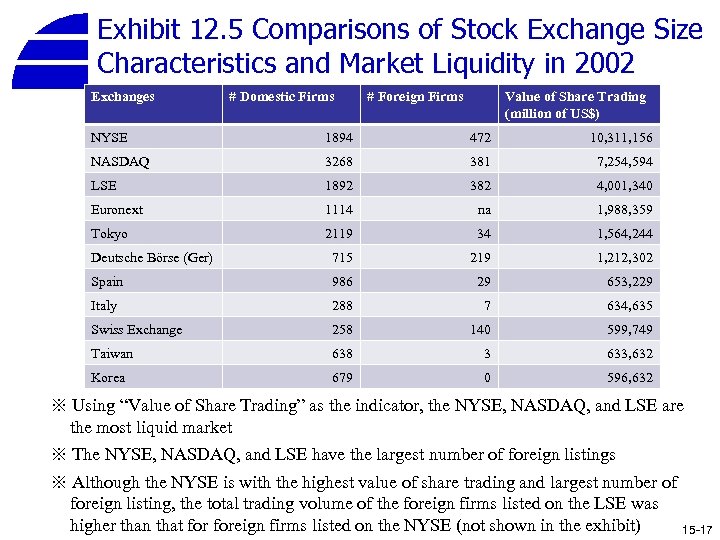

Foreign Equity Listing and Issuance 1. Improve the liquidity of its existing shares and support a liquid secondary market for new equity issues in foreign markets • Even though a firm’s shares are not listed on foreign exchanges, foreign investors can purchase the shares through brokerages (usually adopt the buy and hold strategy) • If the firm cross-list its shares on foreign exchanges, it creates a secondary market for existing shares, and encourages foreign investors who owns the shares to continue to trade these shares, thus improving secondary market liquidity • In addition, due to arbitrage transactions between the foreign and the home markets, it is also possible to enhance the liquidity of the stock shares in the home market • Compare the liquidity of selected stock exchanges in Exhibit 12. 5 15 -16

Exhibit 12. 5 Comparisons of Stock Exchange Size Characteristics and Market Liquidity in 2002 Exchanges # Domestic Firms # Foreign Firms Value of Share Trading (million of US$) NYSE 1894 472 10, 311, 156 NASDAQ 3268 381 7, 254, 594 LSE 1892 382 4, 001, 340 Euronext 1114 na 1, 988, 359 Tokyo 2119 34 1, 564, 244 Deutsche Börse (Ger) 715 219 1, 212, 302 Spain 986 29 653, 229 Italy 288 7 634, 635 Swiss Exchange 258 140 599, 749 Taiwan 638 3 633, 632 Korea 679 0 596, 632 ※ Using “Value of Share Trading” as the indicator, the NYSE, NASDAQ, and LSE are the most liquid market ※ The NYSE, NASDAQ, and LSE have the largest number of foreign listings ※ Although the NYSE is with the highest value of share trading and largest number of foreign listing, the total trading volume of the foreign firms listed on the LSE was higher than that foreign firms listed on the NYSE (not shown in the exhibit) 15 -17

Foreign Equity Listing and Issuance • Since the NYSE and LSE are two most important markets for cross-listing of foreign firms, the comparisons between these two exchanges are: – For both markets, liquidity in the most actively traded shares is similar, but the NYSE is a more liquid market for the less-popular shares – Transaction costs as measured by spreads are lower on the NYSE • The LSE spreads are roughly comparable to the spreads on NASDAQ – In term of fairness, the NYSE is superior, because orders are executed chronologically, whereas on the LSE, one has to shop from dealer to dealer 15 -18

Foreign Equity Listing and Issuance – Market-making activities and crisis management by specialists has been more effective in practice on the NYSE than on any other exchange, including LSE – The cost of listing, disclosure requirements, and required reporting frequency are less onerous on the LSE than on the NYSE • So, for those firms have trouble overcoming the barriers of crosslisting, the LSE is a better choice • For those firms that are willing to pay the price, a listing on the NYSE should improve the liquidity for their shares more than could be achieved with a similar listing elsewhere 15 -19

Foreign Equity Listing and Issuance 2. Increase its share price by overcoming mis-pricing in a segmented and illiquid home capital market • According to the international market segmentation hypothesis, the effect of cross-listing on a foreign stock exchange is more significant for firms resident in a more segmented home markets • Alexander, Eun, and Janakirmanan (1988) found a positive share price effect foreign firms that listed on the NYSE, AMEX, or NASDAQ from 1969 to 1982 • Sundaram and Logue (1996) found that share prices increased foreign firms that cross-listed their shares in ADR form on the NYSE and AMEX from 1982 to 1992 • Doidge, Karolyi, and Stulz (2004) found that at the end of 1997, foreign companies with shares cross-listed in the U. S. had Tobin’s q ratios that were 16. 5% higher than those of non-crosslisted firms from the same country 15 -20

Foreign Equity Listing and Issuance • The findings in Miller (1999) – Positive abnormal returns are found around the announcement date of a cross-listing in ADR form in the U. S. – Abnormal returns are largest for firms that list on major US exchanges such as NYSE or NASDAQ and smallest for firms that list on PORTAL – This study prove that the abnormal return from the combined effect of new equity issue and a cross-listing (Level III ADRs) is higher than the abnormal return for only cross-listed firms (Levels I and II) – Firms located in emerging markets have larger abnormal returns than those in developed markets – Foreign firms that enter US capital markets to raise new equity capital in a public offering experience a positive change in shareholder wealth. Those in a private offering experience a negative change in shareholder wealth • Even U. S. firms can benefit by issuing equity abroad as increased investor recognition and participation in the primary and secondary 15 -21 markets

Foreign Equity Listing and Issuance 3. Increase the visibility and political acceptance • Commercial objectives for MNEs’ listing in the foreign market where they have substantial physical operations are to enhance corporate image, advertise trademark and products, get better local press coverage, and become more familiar with the local financial community in order to raise working capital locally • Political objectives for MNEs’ listing in foreign markets might include the need to meet local equityholders’ requirement for a multinational firm’s foreign joint venture 4. Create a secondary market for shares • Shares can be used to compensate local management and employees in foreign subsidiaries, or shares can be used to acquire other firms through a share swap arrangement • Since the shares listed on foreign liquid exchanges creates a secondary market and let shares become more liquid and thus more valuable, the compensation or the acquisition becomes more attractive 15 -22

Barriers to Cross-Listing and Selling Equity Abroad • There are serveral barriers to cross-listing and/or selling equity abroad – The most serious barriers for U. S. markets includes the commitment to providing full, transparent, and regular disclosure of operating results and balance sheets as well as a continuous program of investor relations – One of the U. S. school of thought is that the worldwide trend toward requiring fuller, more transparent, and more standardized financial disclosure of operating results and balance sheet positions may have the desirable effect of lowering the cost of equity capital – The other school of thought is that the U. S. level of required disclosure is an onerous, costly burden, which chases away many potential firms, thereby narrowing the choice of securities available to U. S. investors 15 -23

Alternative Instruments to Source Equity in Global Markets • Alternative instruments to source equity in global markets are summarized as follows: – Sale of a directed public share issue to investors in a target market – Sale of a Euroequity public issue to investors in more than one market (foreign and domestic markets) – Private placements under SEC Rule 144 A – Sale of shares to private equity funds – Sale of shares to a foreign firm as part of a strategic alliance 15 -24

Alternative Instruments to Source Equity in Global Markets • Sale of directed public share issues – A directed public share issue is defined as one that is targeted at investors in a single country and underwritten in whole or in part by investment institutions from that country – The U. S. share issue by Novo in 1981 is a good example of successful directed share issue. In fact, issuing ADR is also a kind of directed public share issue – The issue might or might not be denominated in the currency of the target market – The shares might or might not be cross-listed on a stock exchange in the target market (with crosslisting, the liquidity for shares can be improved) 15 -25

Alternative Instruments to Source Equity in Global Markets • Sale of Euroequity public issues – The gradual integration of the world’s capital markets and increased international portfolio investment has spawned the emergence of a very viable Euroequity market – Today, a firm can issue equity underwritten and distributed in multiple foreign equity markets, sometimes simultaneously with distribution in the domestic market – The “Euro” market (a generic term for international securities issues originating and being sold anywhere in the world), was created by the same financial institutions that had previously created an infrastructure for the Euronote and Eurobond markets – Euroequity public issues are usually applied to privatizations of government-owned enterprises because most of the firms are very large 15 -26

Alternative Instruments to Source Equity in Global Markets – Euroequity public issues for privatizations of governmentowned enterprises are popular with international portfolio investors, because most of the firms are with excellent credit ratings and profitable quasi-government monopolies at the time of privatization – Megginson, Nash, and Randenborgh (1994) studied the privatization cases from 1961 to 1990, and they found that the privatized firm showed strong performance improvements, e. g. the firms increased real sales, raised capital investment level, improved efficiency and profitability, lowered debt levels, and increased dividend payments 15 -27

Alternative Instruments to Source Equity in Global Markets • Private placement under SEC rule 144 A – Please refer to Slides 12. 13 and 12. 14 • Sales of shares to private equity funds – Private equity funds (私募基金) are usually limited partnerships of institutional and wealthy individual investors that raise their capital in large capital markets – Private equity funds invest in mature, profitable, and small firms located in emerging markets (usually these firm is too small to conduct a globalization strategy) – The investment objective is to help these firms to restructure and modernize in order to face increasing competition and the growth of new technologies – Private equity funds may be content with the improved profitability of the firm through better management or 15 -28 harvest the investment via mergers with other firms

Alternative Instruments to Source Equity in Global Markets – Private equity funds operate in many countries, invest in many industry sectors, and often have a longer time horizon for exiting – Private equity funds differ from traditional venture capital funds (創投基金) • Venture capital funds typically invest in high technology startups with the goal of exiting the investment with an initial public offering (IPO) in highly liquid markets • Very little venture capital is available in emerging markets, partly because it would be difficult to exit with an IPO in an illiquid market 15 -29

Alternative Instruments to Source Equity in Global Markets • Sale of shares to a foreign firm as part of a strategic alliance – Strategic alliance are normally formed by firms that expect to gain synergies from one or more of the following joint efforts: • They might share the cost of developing technology or pursue complementary marketing activities • They might gain economies of scale or scope or a variety of other commercial advantage • The strategic alliance may bring financial assistance between firms, i. e. helping a financially weak firm to lower its cost of capital through attractively priced debt or equity financing 15 -30

c5e19f26bf315b73d6381b392e75475d.ppt