7fad9a3bc8978528183a4a097f5aafcb.ppt

- Количество слайдов: 13

Chapter 15, Section 3 Analyzing and Recording Cash Payments What Do You Think? Why do you think the accounting department is responsible for making cash payments for a business? Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 0

Chapter 15, Section 3 Analyzing and Recording Cash Payments What Do You Think? Why do you think the accounting department is responsible for making cash payments for a business? Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 0

SECTION 15. 3 Analyzing and Recording Cash Payments Main Idea The accounting department is responsible for making the cash payments for the business. You Will Learn § the procedures for managing cash payments. § how to record the different types of cash payment transactions. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 1

SECTION 15. 3 Analyzing and Recording Cash Payments Main Idea The accounting department is responsible for making the cash payments for the business. You Will Learn § the procedures for managing cash payments. § how to record the different types of cash payment transactions. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 1

Analyzing and Recording Cash Payments SECTION 15. 3 Key Terms § § premium FOB destination FOB shipping point bankcard fee Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 2

Analyzing and Recording Cash Payments SECTION 15. 3 Key Terms § § premium FOB destination FOB shipping point bankcard fee Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 2

SECTION 15. 3 Analyzing and Recording Cash Payments Controls over Cash A business can manage cash payments by following these procedures: § Require proper authorization of all cash payments. § Write checks for all payments. § Use prenumbered checks. § Retain and account for voided checks. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 3

SECTION 15. 3 Analyzing and Recording Cash Payments Controls over Cash A business can manage cash payments by following these procedures: § Require proper authorization of all cash payments. § Write checks for all payments. § Use prenumbered checks. § Retain and account for voided checks. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 3

SECTION 15. 3 Analyzing and Recording Cash Payments Cash Payment Transactions Businesses buy needed items on account or with cash. This section discusses how to record several types of cash payment transactions. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 4

SECTION 15. 3 Analyzing and Recording Cash Payments Cash Payment Transactions Businesses buy needed items on account or with cash. This section discusses how to record several types of cash payment transactions. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 4

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchase of Insurance Businesses purchase insurance to protect against losses from theft, fire, and flood. An insurance premium is paid at the beginning of the covered period and is recorded in the Prepaid Insurance asset account. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 5

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchase of Insurance Businesses purchase insurance to protect against losses from theft, fire, and flood. An insurance premium is paid at the beginning of the covered period and is recorded in the Prepaid Insurance asset account. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 5

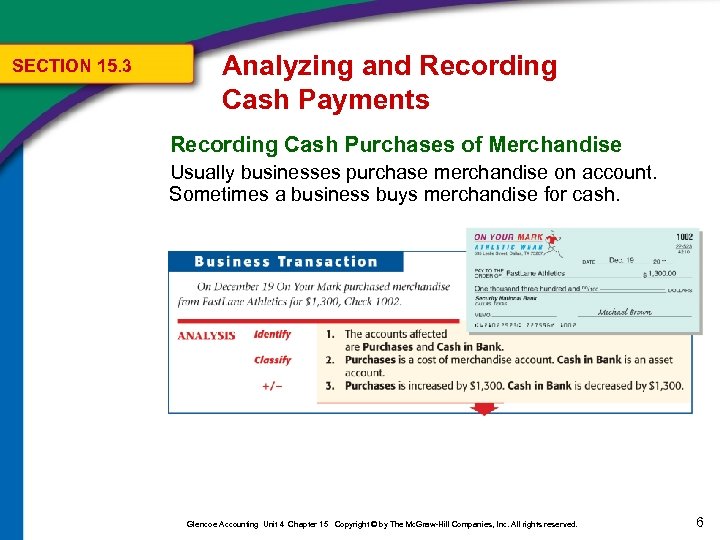

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchases of Merchandise Usually businesses purchase merchandise on account. Sometimes a business buys merchandise for cash. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 6

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchases of Merchandise Usually businesses purchase merchandise on account. Sometimes a business buys merchandise for cash. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 6

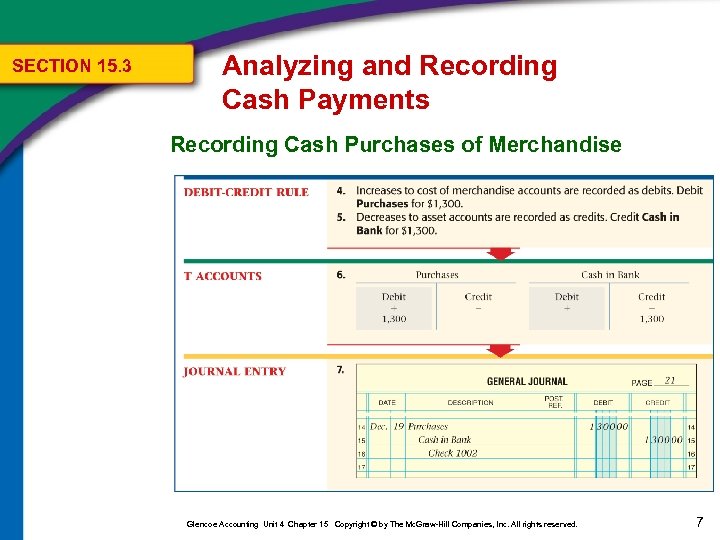

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchases of Merchandise Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 7

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Cash Purchases of Merchandise Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 7

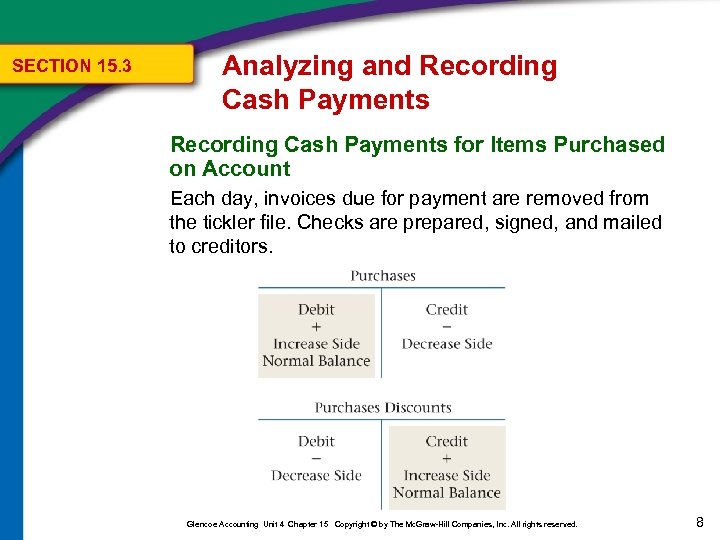

SECTION 15. 3 Analyzing and Recording Cash Payments for Items Purchased on Account Each day, invoices due for payment are removed from the tickler file. Checks are prepared, signed, and mailed to creditors. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 8

SECTION 15. 3 Analyzing and Recording Cash Payments for Items Purchased on Account Each day, invoices due for payment are removed from the tickler file. Checks are prepared, signed, and mailed to creditors. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 8

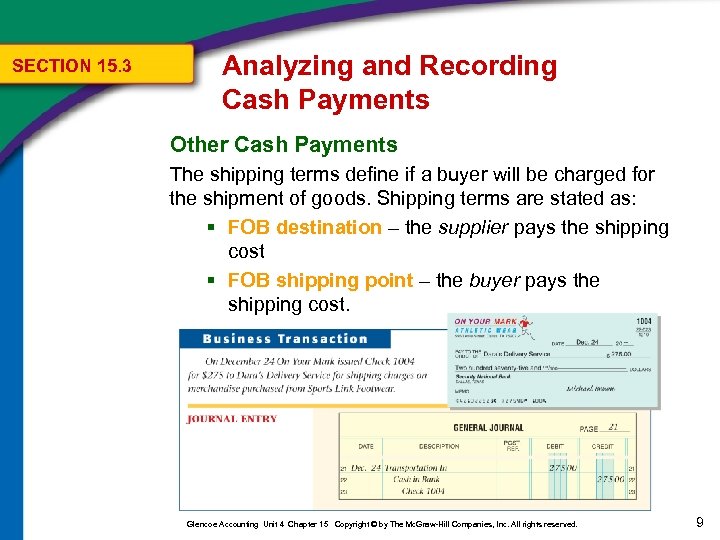

SECTION 15. 3 Analyzing and Recording Cash Payments Other Cash Payments The shipping terms define if a buyer will be charged for the shipment of goods. Shipping terms are stated as: § FOB destination – the supplier pays the shipping cost § FOB shipping point – the buyer pays the shipping cost. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 9

SECTION 15. 3 Analyzing and Recording Cash Payments Other Cash Payments The shipping terms define if a buyer will be charged for the shipment of goods. Shipping terms are stated as: § FOB destination – the supplier pays the shipping cost § FOB shipping point – the buyer pays the shipping cost. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 9

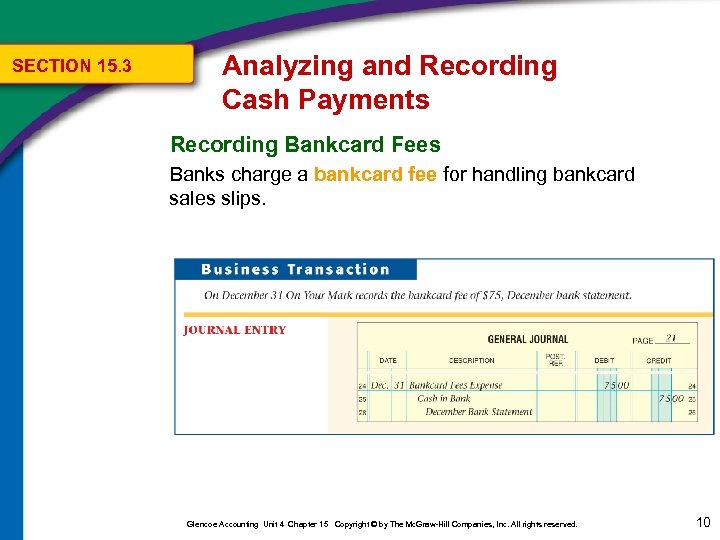

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Bankcard Fees Banks charge a bankcard fee for handling bankcard sales slips. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10

SECTION 15. 3 Analyzing and Recording Cash Payments Recording Bankcard Fees Banks charge a bankcard fee for handling bankcard sales slips. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10

SECTION 15. 3 Analyzing and Recording Cash Payments Key Terms Review § premium The amount paid for insurance. § FOB destination Shipping term specifying that the supplier pays the shipping cost to the buyer’s destination. § FOB shipping point Shipping term specifying that the buyer pays the shipping charge from the supplier’s shipping point. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 11

SECTION 15. 3 Analyzing and Recording Cash Payments Key Terms Review § premium The amount paid for insurance. § FOB destination Shipping term specifying that the supplier pays the shipping cost to the buyer’s destination. § FOB shipping point Shipping term specifying that the buyer pays the shipping charge from the supplier’s shipping point. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 11

SECTION 15. 3 Analyzing and Recording Cash Payments Key Terms Review § bankcard fee A fee charged for handling bankcard sales slips; usually based on the total amounts recorded on the sales slips processed. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 12

SECTION 15. 3 Analyzing and Recording Cash Payments Key Terms Review § bankcard fee A fee charged for handling bankcard sales slips; usually based on the total amounts recorded on the sales slips processed. Glencoe Accounting Unit 4 Chapter 15 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 12