286318deac7474870c21e5c82eb025cc.ppt

- Количество слайдов: 34

Chapter 15 Options 1

Learning Objectives & Agenda o o Understand what are call and put options. Understand what are options contracts and how they can be used to reduce risk. Understand call-put parity. Understand what factors impact an option’s value. 2

Economic Benefits Provided by Options Derivative securities are instruments that derive their value from the value of other assets. Derivatives include options, futures, and swaps. Options and other derivative securities have several important economic functions: • Help bring about a more efficient allocation of risk; • Save transactions costs…sometimes it is cheaper to trade a derivative than the asset underlying it, and • Permit investment strategies that would not otherwise be possible. 3

Options and Option Terms o o Call Option: allows holder to buy an underlying asset at a specified price. Put Option: allows holder to sell an underlying asset at a specified price. n n n The specified price is called the exercise or strike price, and the option must be exercised by its expiration date. European options can only be exercised on the expiration date American options can be exercised at any time prior and up to the expiration date. 4

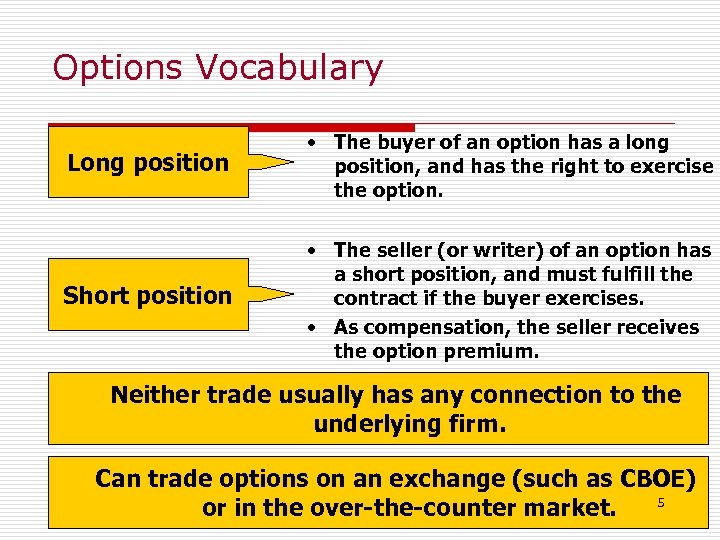

Options Vocabulary Long position • The buyer of an option has a long position, and has the right to exercise the option. Short position • The seller (or writer) of an option has a short position, and must fulfill the contract if the buyer exercises. • As compensation, the seller receives the option premium. Neither trade usually has any connection to the underlying firm. Can trade options on an exchange (such as CBOE) 5 or in the over-the-counter market.

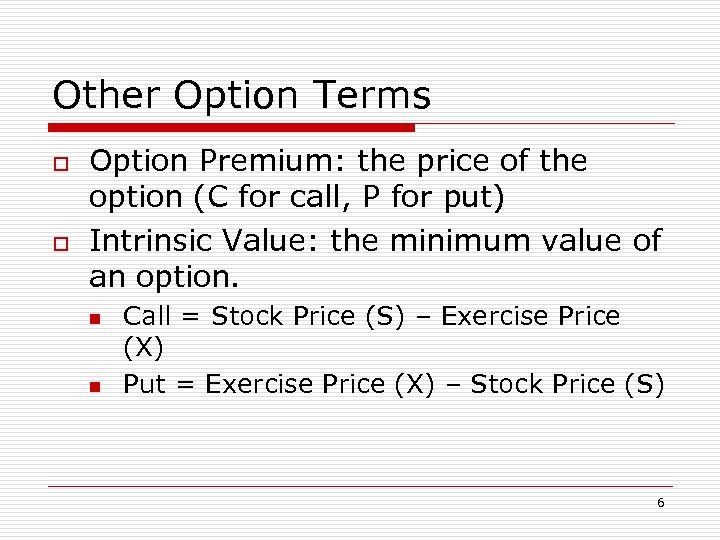

Other Option Terms o o Option Premium: the price of the option (C for call, P for put) Intrinsic Value: the minimum value of an option. n n Call = Stock Price (S) – Exercise Price (X) Put = Exercise Price (X) – Stock Price (S) 6

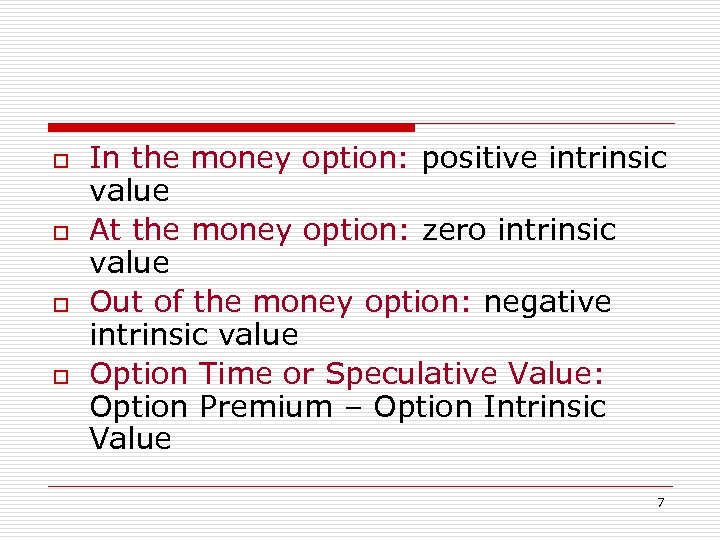

o o In the money option: positive intrinsic value At the money option: zero intrinsic value Out of the money option: negative intrinsic value Option Time or Speculative Value: Option Premium – Option Intrinsic Value 7

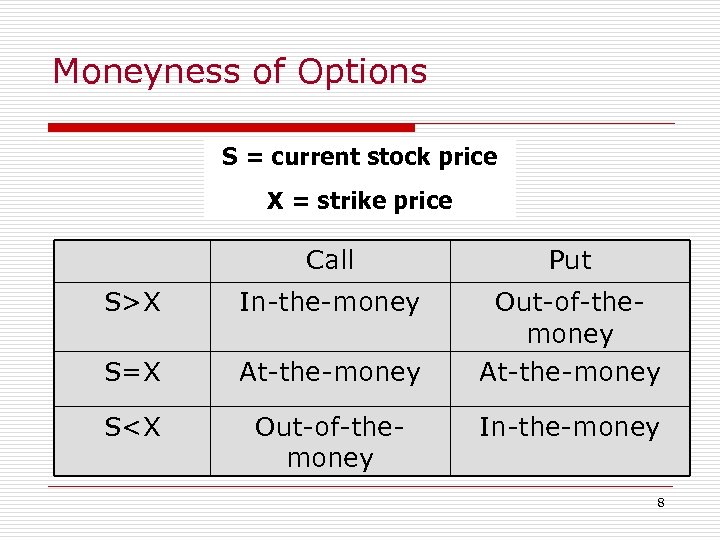

Moneyness of Options S = current stock price X = strike price Call Put S>X In-the-money S=X At-the-money Out-of-themoney At-the-money S<X Out-of-themoney In-the-money 8

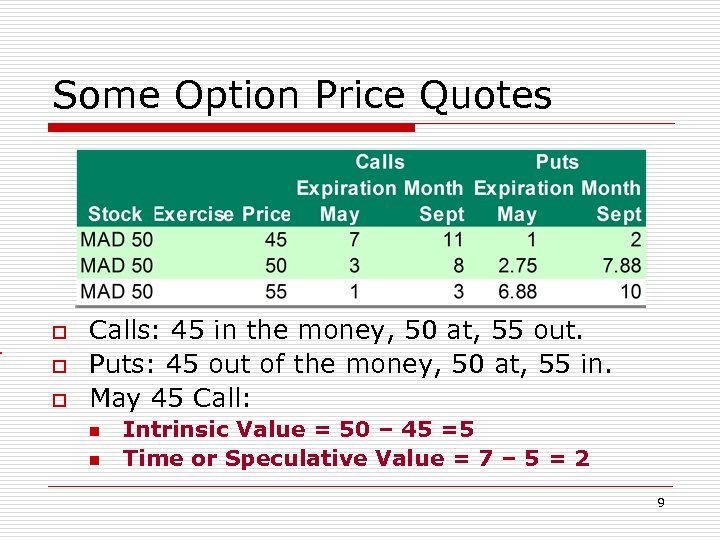

Some Option Price Quotes o o o Calls: 45 in the money, 50 at, 55 out. Puts: 45 out of the money, 50 at, 55 in. May 45 Call: n n Intrinsic Value = 50 – 45 =5 Time or Speculative Value = 7 – 5 = 2 9

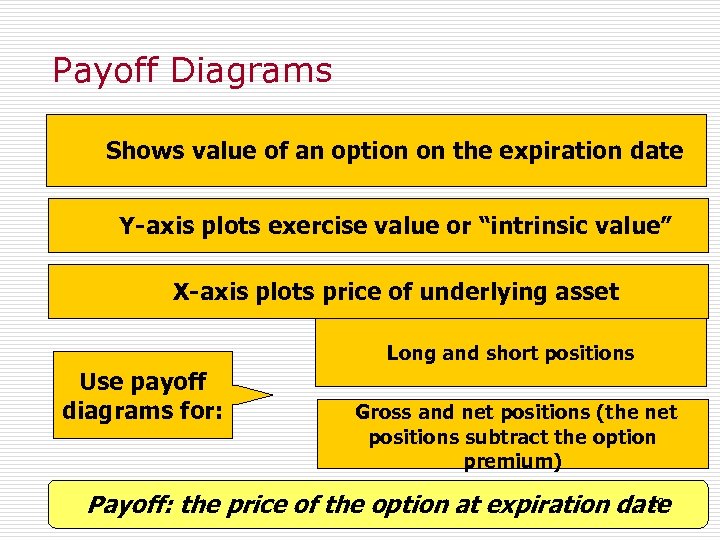

Payoff Diagrams Shows value of an option on the expiration date Y-axis plots exercise value or “intrinsic value” X-axis plots price of underlying asset Long and short positions Use payoff diagrams for: Gross and net positions (the net positions subtract the option premium) 10 Payoff: the price of the option at expiration date

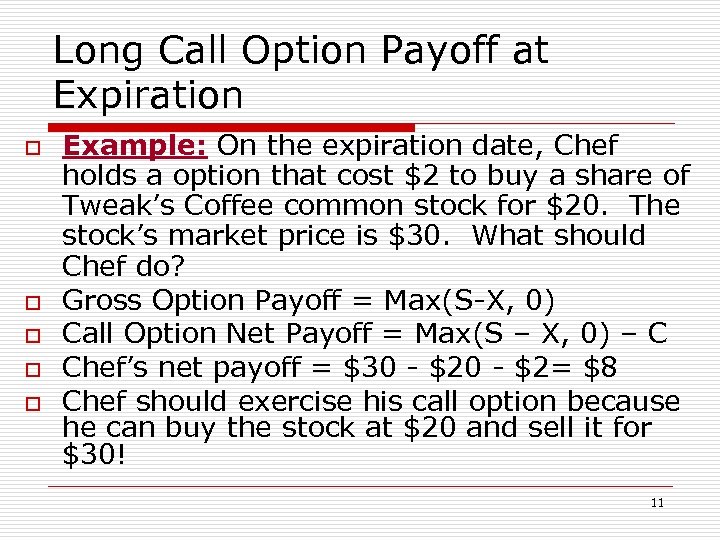

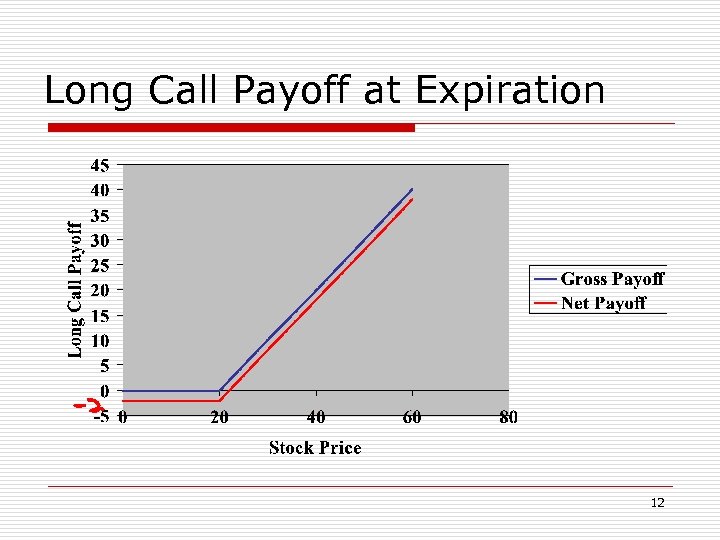

Long Call Option Payoff at Expiration o o o Example: On the expiration date, Chef holds a option that cost $2 to buy a share of Tweak’s Coffee common stock for $20. The stock’s market price is $30. What should Chef do? Gross Option Payoff = Max(S-X, 0) Call Option Net Payoff = Max(S – X, 0) – C Chef’s net payoff = $30 - $2= $8 Chef should exercise his call option because he can buy the stock at $20 and sell it for $30! 11

Long Call Payoff at Expiration 12

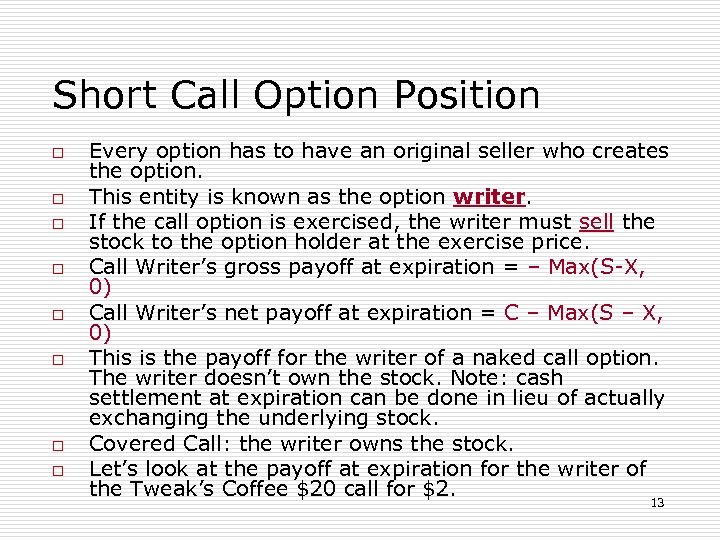

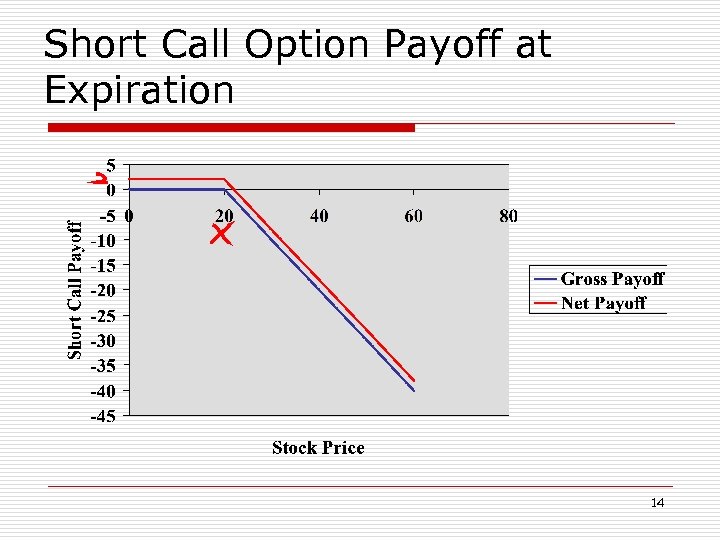

Short Call Option Position o o o o Every option has to have an original seller who creates the option. This entity is known as the option writer. If the call option is exercised, the writer must sell the stock to the option holder at the exercise price. Call Writer’s gross payoff at expiration = – Max(S-X, 0) Call Writer’s net payoff at expiration = C – Max(S – X, 0) This is the payoff for the writer of a naked call option. The writer doesn’t own the stock. Note: cash settlement at expiration can be done in lieu of actually exchanging the underlying stock. Covered Call: the writer owns the stock. Let’s look at the payoff at expiration for the writer of the Tweak’s Coffee $20 call for $2. 13

Short Call Option Payoff at Expiration 14

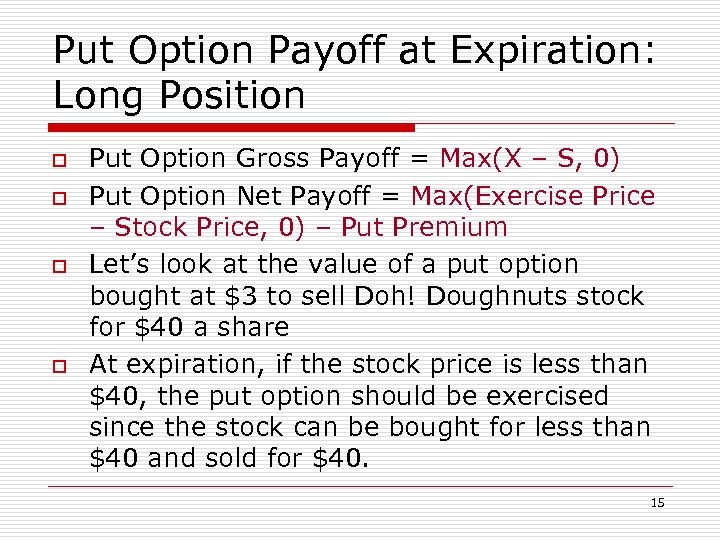

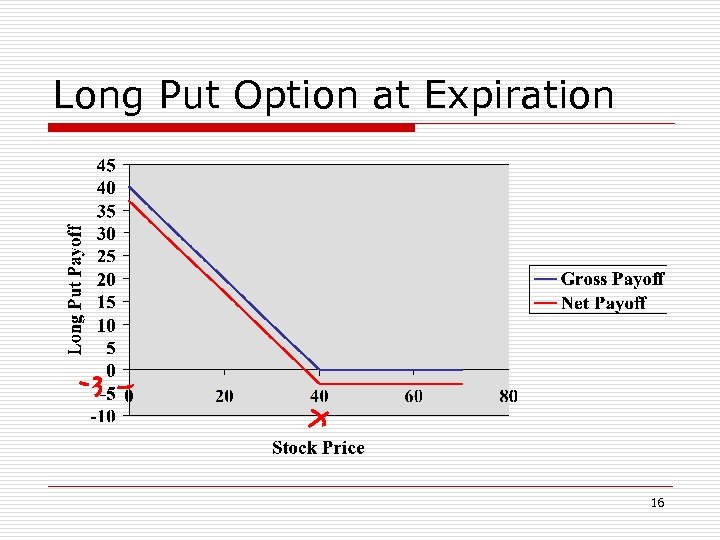

Put Option Payoff at Expiration: Long Position o o Put Option Gross Payoff = Max(X – S, 0) Put Option Net Payoff = Max(Exercise Price – Stock Price, 0) – Put Premium Let’s look at the value of a put option bought at $3 to sell Doh! Doughnuts stock for $40 a share At expiration, if the stock price is less than $40, the put option should be exercised since the stock can be bought for less than $40 and sold for $40. 15

Long Put Option at Expiration 16

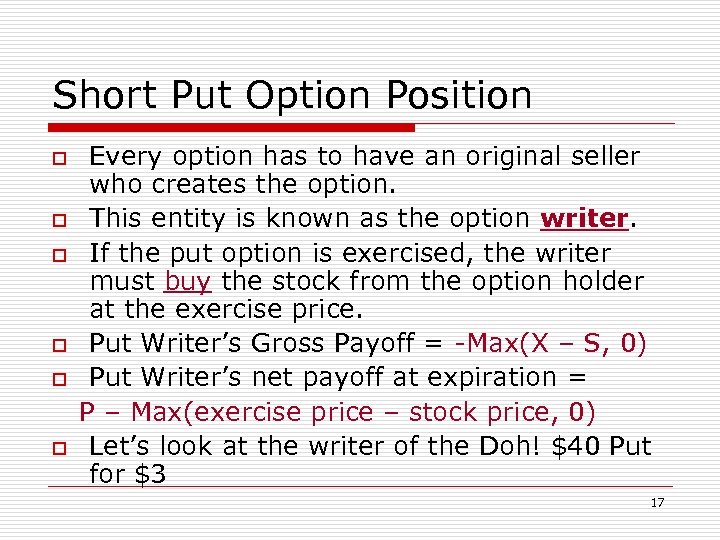

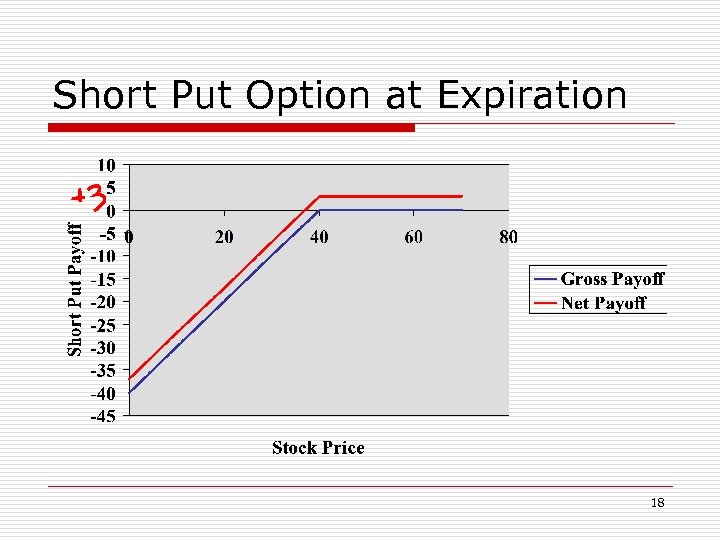

Short Put Option Position Every option has to have an original seller who creates the option. o This entity is known as the option writer. o If the put option is exercised, the writer must buy the stock from the option holder at the exercise price. o Put Writer’s Gross Payoff = -Max(X – S, 0) o Put Writer’s net payoff at expiration = P – Max(exercise price – stock price, 0) o Let’s look at the writer of the Doh! $40 Put for $3 o 17

Short Put Option at Expiration 18

Uses of Options o Speculation: can get about the same dollar gain from the price movements of a stock with an option for a smaller investment leading to a much higher return. n o Downside: bigger chance of losing entire investment. Hedging: can use options to offset a position you have in the stock. n n Example, Protective Put or “portfolio insurance”: you buy a stock and buy a put which pays off if stock price falls. Downside of hedging: cost of the options reduces gains in stock price. 19

Portfolios of Options Look at payoff diagrams for combinations of options rather than just one Shows the range of potential strategies made possible by options Some positions can be a form of portfolio insurance. Some strategies allow investor to speculate on the volatility (or lack thereof) of a stock rather than betting on which direction it will move. 20

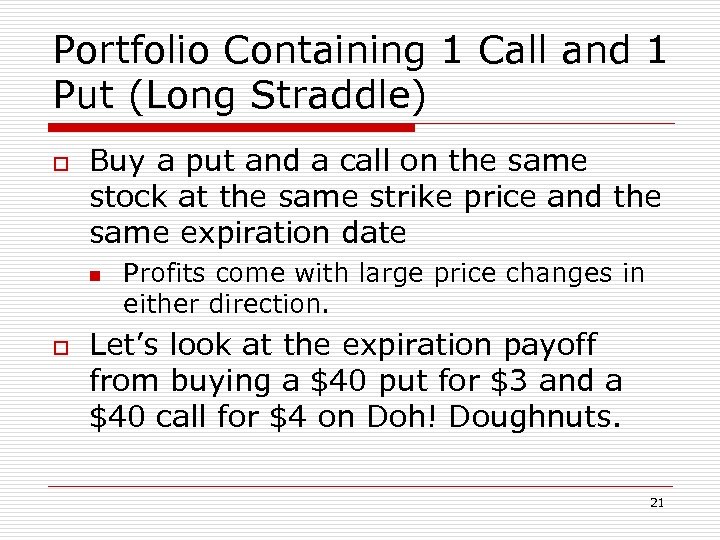

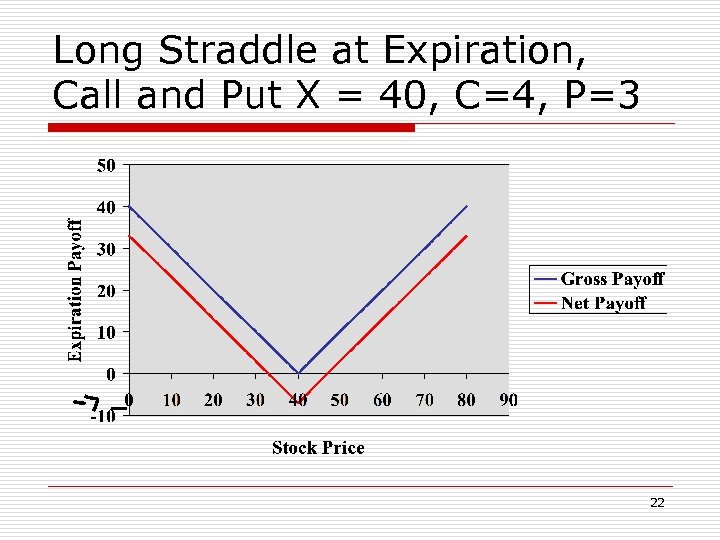

Portfolio Containing 1 Call and 1 Put (Long Straddle) o Buy a put and a call on the same stock at the same strike price and the same expiration date n o Profits come with large price changes in either direction. Let’s look at the expiration payoff from buying a $40 put for $3 and a $40 call for $4 on Doh! Doughnuts. 21

Long Straddle at Expiration, Call and Put X = 40, C=4, P=3 22

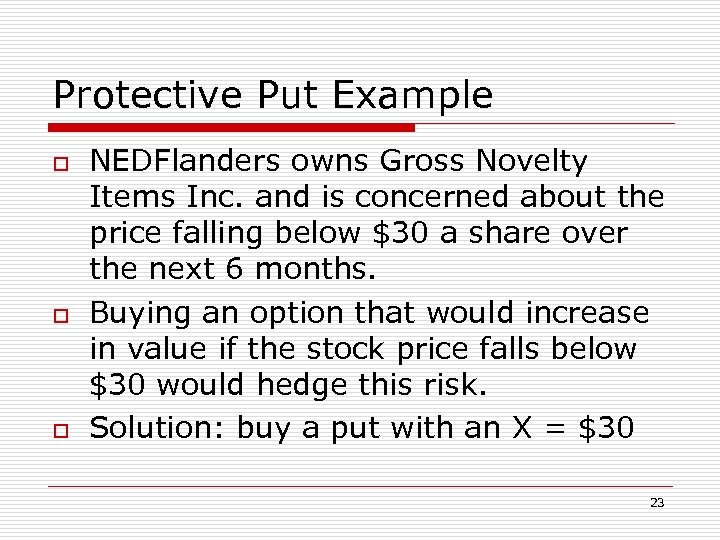

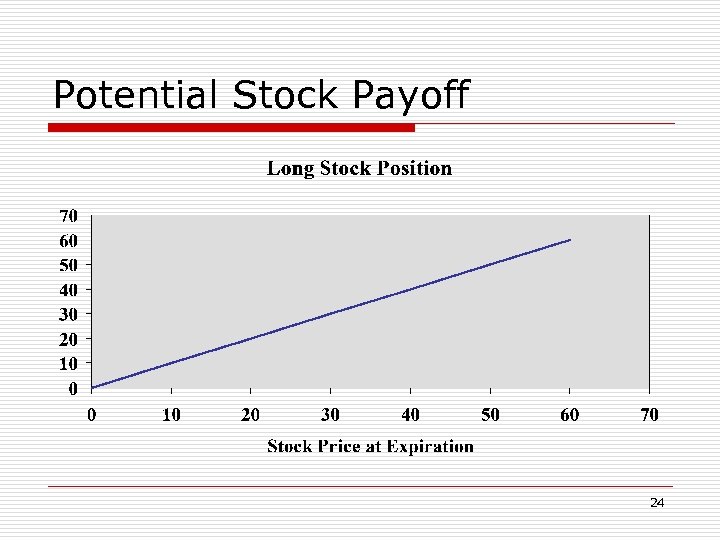

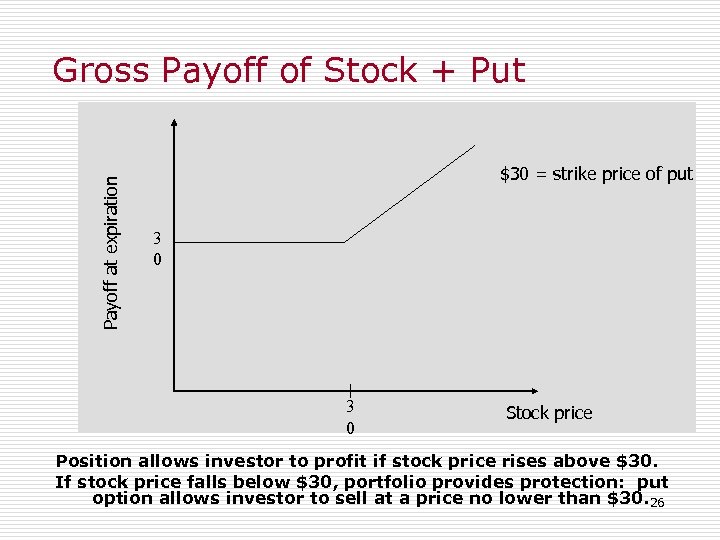

Protective Put Example o o o NEDFlanders owns Gross Novelty Items Inc. and is concerned about the price falling below $30 a share over the next 6 months. Buying an option that would increase in value if the stock price falls below $30 would hedge this risk. Solution: buy a put with an X = $30 23

Potential Stock Payoff 24

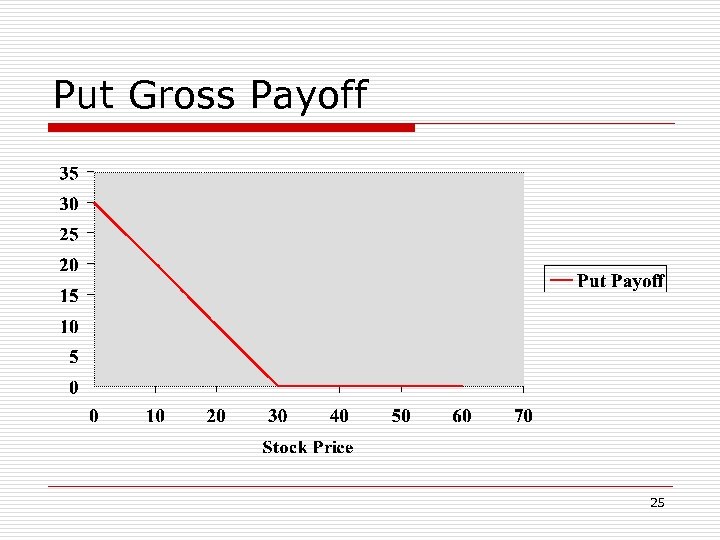

Put Gross Payoff 25

Payoff at expiration Gross Payoff of Stock + Put $30 = strike price of put 3 0 Stock price Position allows investor to profit if stock price rises above $30. If stock price falls below $30, portfolio provides protection: put option allows investor to sell at a price no lower than $30. 26

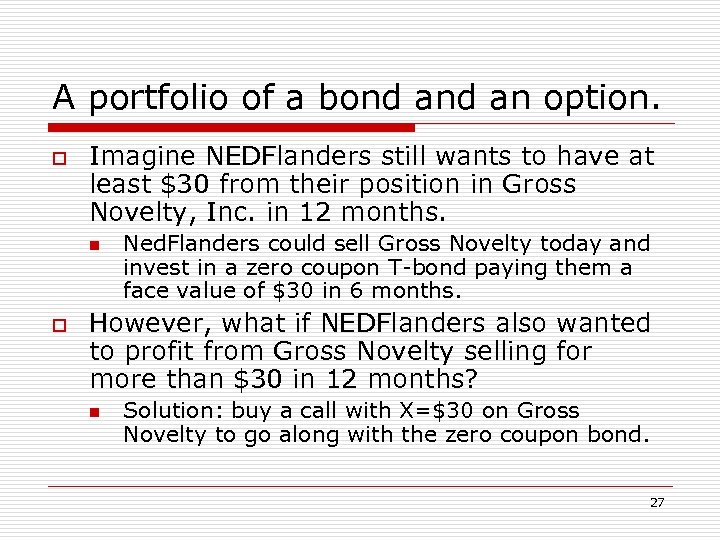

A portfolio of a bond an option. o Imagine NEDFlanders still wants to have at least $30 from their position in Gross Novelty, Inc. in 12 months. n o Ned. Flanders could sell Gross Novelty today and invest in a zero coupon T-bond paying them a face value of $30 in 6 months. However, what if NEDFlanders also wanted to profit from Gross Novelty selling for more than $30 in 12 months? n Solution: buy a call with X=$30 on Gross Novelty to go along with the zero coupon bond. 27

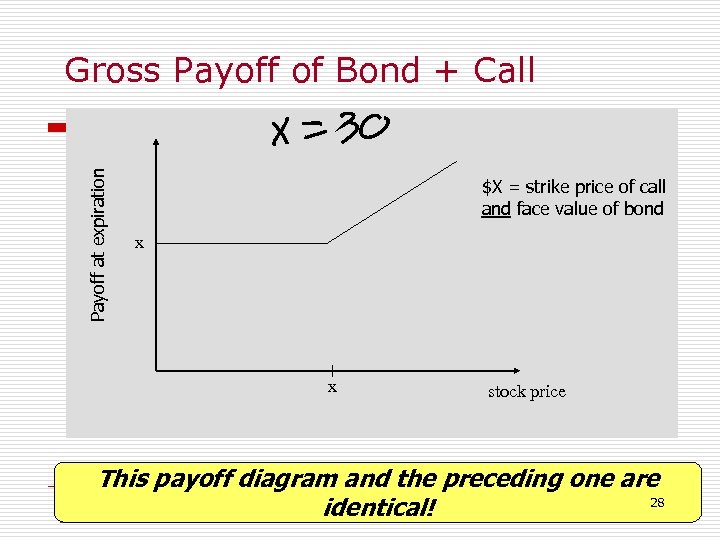

Payoff at expiration Gross Payoff of Bond + Call $X = strike price of call and face value of bond x x o o stock price The bond assures a minimum payoff of $X This payoff diagram and the preceding one are The call allows for a higher payoff if the stock price rises 28 identical!

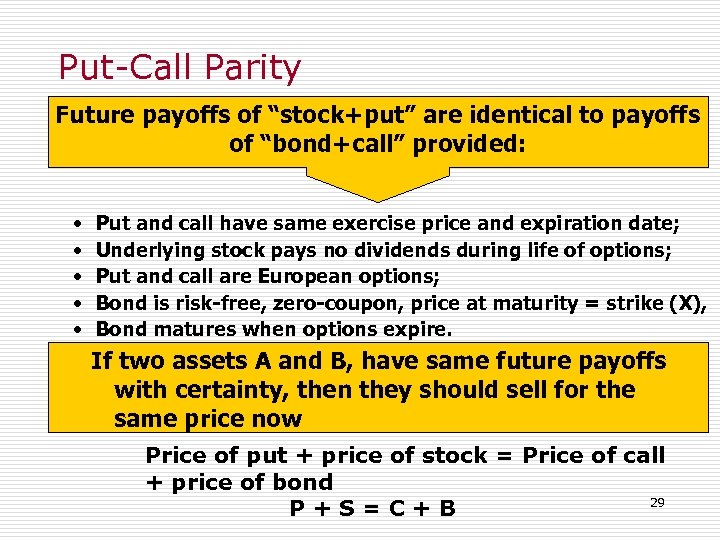

Put-Call Parity Future payoffs of “stock+put” are identical to payoffs of “bond+call” provided: • • • Put and call have same exercise price and expiration date; Underlying stock pays no dividends during life of options; Put and call are European options; Bond is risk-free, zero-coupon, price at maturity = strike (X), Bond matures when options expire. If two assets A and B, have same future payoffs with certainty, then they should sell for the same price now Price of put + price of stock = Price of call + price of bond 29 P+S=C+B

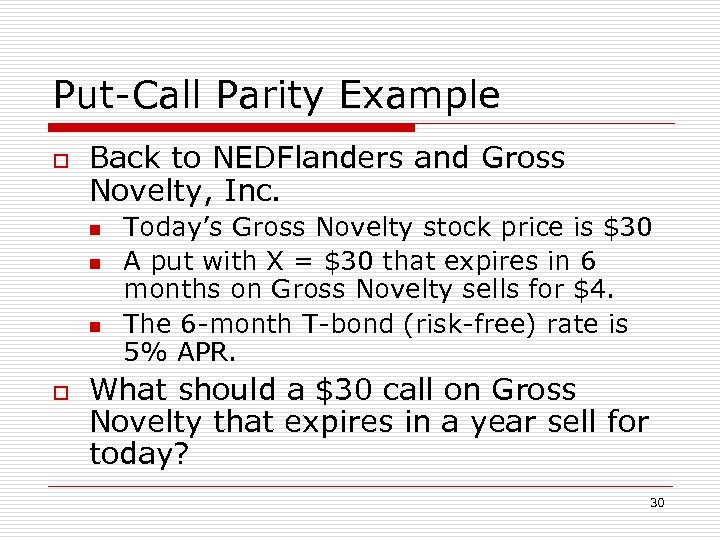

Put-Call Parity Example o Back to NEDFlanders and Gross Novelty, Inc. n n n o Today’s Gross Novelty stock price is $30 A put with X = $30 that expires in 6 months on Gross Novelty sells for $4. The 6 -month T-bond (risk-free) rate is 5% APR. What should a $30 call on Gross Novelty that expires in a year sell for today? 30

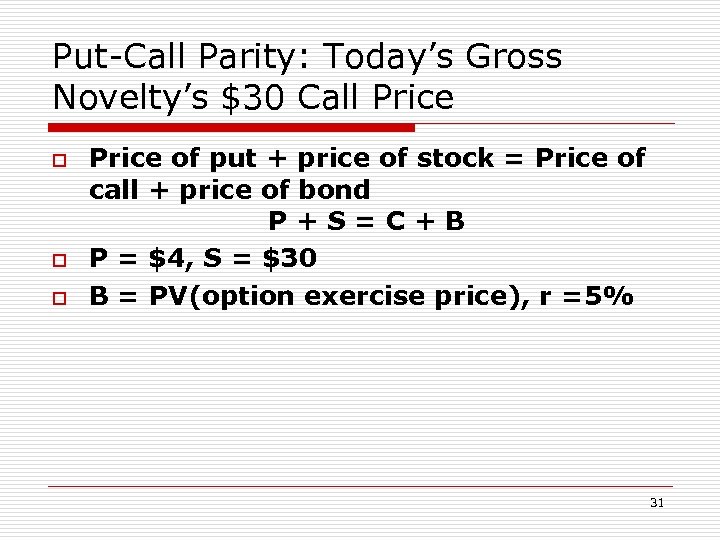

Put-Call Parity: Today’s Gross Novelty’s $30 Call Price o o o Price of put + price of stock = Price of call + price of bond P+S=C+B P = $4, S = $30 B = PV(option exercise price), r =5% 31

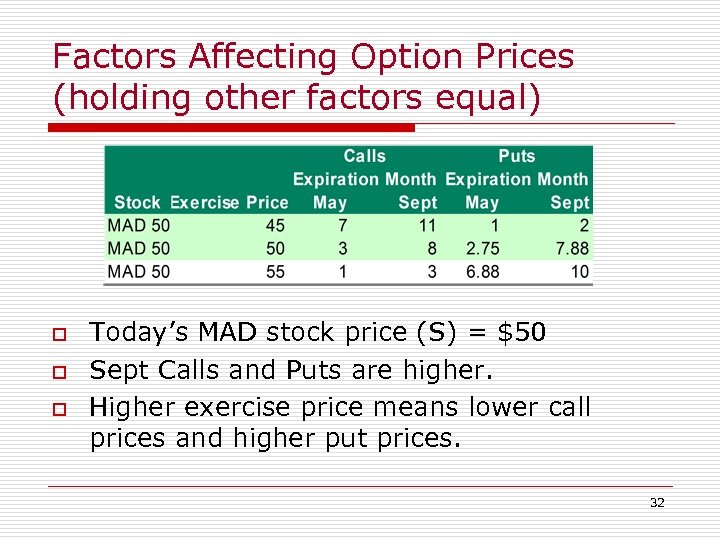

Factors Affecting Option Prices (holding other factors equal) o o o Today’s MAD stock price (S) = $50 Sept Calls and Puts are higher. Higher exercise price means lower call prices and higher put prices. 32

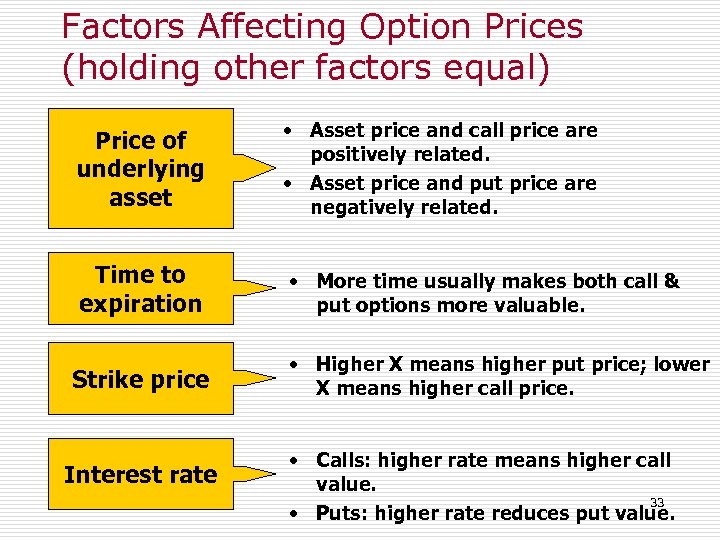

Factors Affecting Option Prices (holding other factors equal) Price of underlying asset • Asset price and call price are positively related. • Asset price and put price are negatively related. Time to expiration • More time usually makes both call & put options more valuable. Strike price Interest rate • Higher X means higher put price; lower X means higher call price. • Calls: higher rate means higher call value. 33 • Puts: higher rate reduces put value.

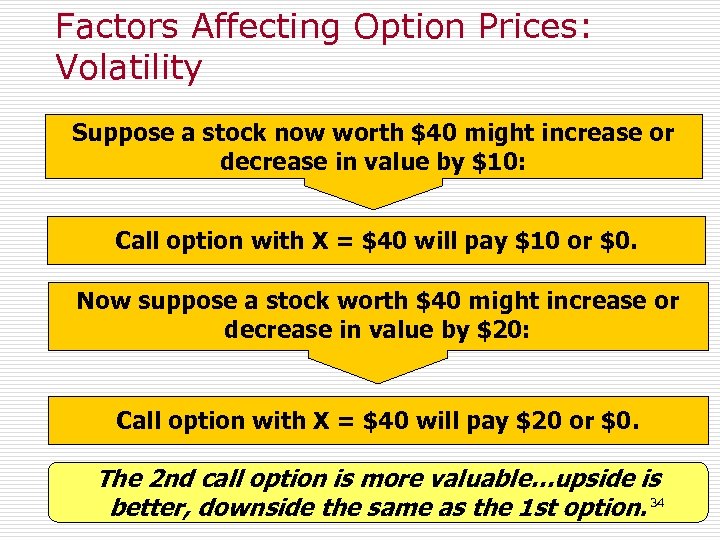

Factors Affecting Option Prices: Volatility Suppose a stock now worth $40 might increase or decrease in value by $10: Call option with X = $40 will pay $10 or $0. Now suppose a stock worth $40 might increase or decrease in value by $20: Call option with X = $40 will pay $20 or $0. The 2 nd call option is more valuable…upside is better, downside the same as the 1 st option. 34

286318deac7474870c21e5c82eb025cc.ppt