4fba65d9e9473d90b7b909558b9ed070.ppt

- Количество слайдов: 29

Chapter 15 Mc. Graw-Hill/Irwin Copyright © 2010 The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 15 Mc. Graw-Hill/Irwin Copyright © 2010 The Mc. Graw-Hill Companies, Inc. All rights reserved.

Capital 15 -

Capital 15 -

Chapter Outline • Financial Capital And Real Capital • The Demand For Real Capital • The Relationship Between The Rental Rate And The Interest Rate • The Criterion For Buying A Capital Good • Interest Rate Determination • Real Versus Nominal Interest Rates • The Market For Stocks And Bonds • The Anomaly Of The Investment Newsletter • Tax Policy And The Capital Market • Economic Rent • Peak-load Pricing • Exhaustible Resources As Inputs In Production 3

Chapter Outline • Financial Capital And Real Capital • The Demand For Real Capital • The Relationship Between The Rental Rate And The Interest Rate • The Criterion For Buying A Capital Good • Interest Rate Determination • Real Versus Nominal Interest Rates • The Market For Stocks And Bonds • The Anomaly Of The Investment Newsletter • Tax Policy And The Capital Market • Economic Rent • Peak-load Pricing • Exhaustible Resources As Inputs In Production 3

Financial Capital And Real Capital • Financial capital: money or some other paper asset that functions like money. • Real capital: productive equipment that generates a flow of services; also called physical capital. 4

Financial Capital And Real Capital • Financial capital: money or some other paper asset that functions like money. • Real capital: productive equipment that generates a flow of services; also called physical capital. 4

The Demand For Real Capital • If the firm can acquire the services of as much capital as it wishes at a constant rental rate of r/yr, it should employ capital up to the point at which its marginal revenue product (MRPK) is exactly equal to the rental rate. 5

The Demand For Real Capital • If the firm can acquire the services of as much capital as it wishes at a constant rental rate of r/yr, it should employ capital up to the point at which its marginal revenue product (MRPK) is exactly equal to the rental rate. 5

The Rental Rate And The Interest Rate • Technological obsolescence: the process by which a good loses value not because of physical depreciation, but because improvements in technology make substitute products more attractive. 6

The Rental Rate And The Interest Rate • Technological obsolescence: the process by which a good loses value not because of physical depreciation, but because improvements in technology make substitute products more attractive. 6

The Criterion For Buying A Capital Good • The machine will bolster the firm’s rate of production not only in the current period, but also in the future. • The firm should buy the machine if and only if PV is greater than or equal to PK. – Since PV is inversely related to the market rate of interest the firm that owns its capital will want to employ more of it the lower the market rate of interest is. 7

The Criterion For Buying A Capital Good • The machine will bolster the firm’s rate of production not only in the current period, but also in the future. • The firm should buy the machine if and only if PV is greater than or equal to PK. – Since PV is inversely related to the market rate of interest the firm that owns its capital will want to employ more of it the lower the market rate of interest is. 7

Interest Rate Determination • A firm’s demand for capital equipment depends on the rate of interest, the purchase price of capital, and the rates of technological and physical depreciation. – Interest rates are determined by the intersection of the supply and demand curves for loanable funds. 8

Interest Rate Determination • A firm’s demand for capital equipment depends on the rate of interest, the purchase price of capital, and the rates of technological and physical depreciation. – Interest rates are determined by the intersection of the supply and demand curves for loanable funds. 8

Figure 15. 1: Equilibrium in the Market for Loanable Funds 9

Figure 15. 1: Equilibrium in the Market for Loanable Funds 9

Real Versus Nominal Interest Rates • When banks expect the overall level of prices to rise, they will charge an interest premium to counteract the erosion of the real purchasing power of future loan payments. – The actual number that appears on the bank loan contract is called the nominal rate of interest. – The real rate of interest is given by: i = (n –q) / (1 + q) – n - nominal annual rate of interest (expressed as a fraction) – q - annual rate of inflation 10

Real Versus Nominal Interest Rates • When banks expect the overall level of prices to rise, they will charge an interest premium to counteract the erosion of the real purchasing power of future loan payments. – The actual number that appears on the bank loan contract is called the nominal rate of interest. – The real rate of interest is given by: i = (n –q) / (1 + q) – n - nominal annual rate of interest (expressed as a fraction) – q - annual rate of inflation 10

The Market For Stocks And Bonds • A bond is essentially a promissory note issued by the firm. – The face value of the bond is the amount for which it was sold to the investor who bought it from the firm. – Short-term bonds: often promise to return their face value in full within 90 days. – Long-term bonds: reach maturity only after 30 years, and some have even longer lifetimes. 11

The Market For Stocks And Bonds • A bond is essentially a promissory note issued by the firm. – The face value of the bond is the amount for which it was sold to the investor who bought it from the firm. – Short-term bonds: often promise to return their face value in full within 90 days. – Long-term bonds: reach maturity only after 30 years, and some have even longer lifetimes. 11

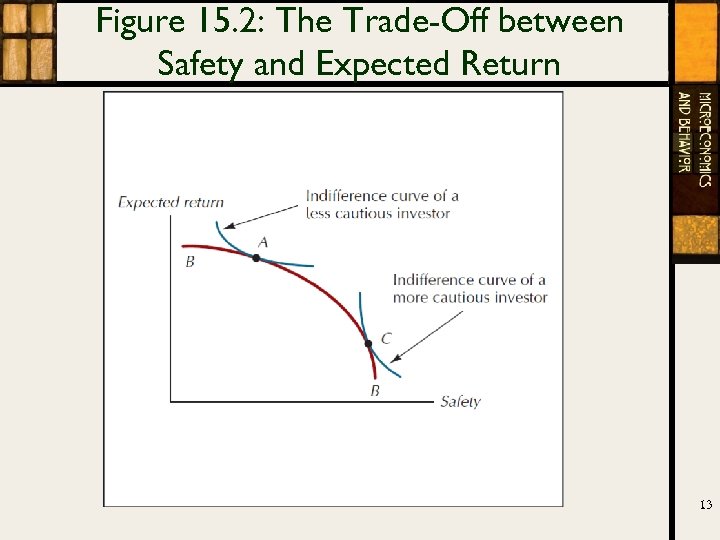

The Market For Stocks And Bonds • Perpetual bond: a bond that pays a fixed payment each year in perpetuity; also called a consol. • Risk premium: a payment differential necessary to compensate the supplier of a good or service for having to bear risk. 12

The Market For Stocks And Bonds • Perpetual bond: a bond that pays a fixed payment each year in perpetuity; also called a consol. • Risk premium: a payment differential necessary to compensate the supplier of a good or service for having to bear risk. 12

Figure 15. 2: The Trade-Off between Safety and Expected Return 13

Figure 15. 2: The Trade-Off between Safety and Expected Return 13

The Efficient Markets Hypothesis • Efficient stock market: the price of a stock embodies all available information that is relevant to its current and future earnings prospects. 14

The Efficient Markets Hypothesis • Efficient stock market: the price of a stock embodies all available information that is relevant to its current and future earnings prospects. 14

Tax Policy And The Capital Market • The interest earned on municipal bonds is exempted from the federal income tax. – The interest earned on federal government bonds, by contrast, is fully taxable, as is the interest on bonds issued by corporations. • Which kind of bond you should buy depends on the marginal rate at which your income is taxed. 15

Tax Policy And The Capital Market • The interest earned on municipal bonds is exempted from the federal income tax. – The interest earned on federal government bonds, by contrast, is fully taxable, as is the interest on bonds issued by corporations. • Which kind of bond you should buy depends on the marginal rate at which your income is taxed. 15

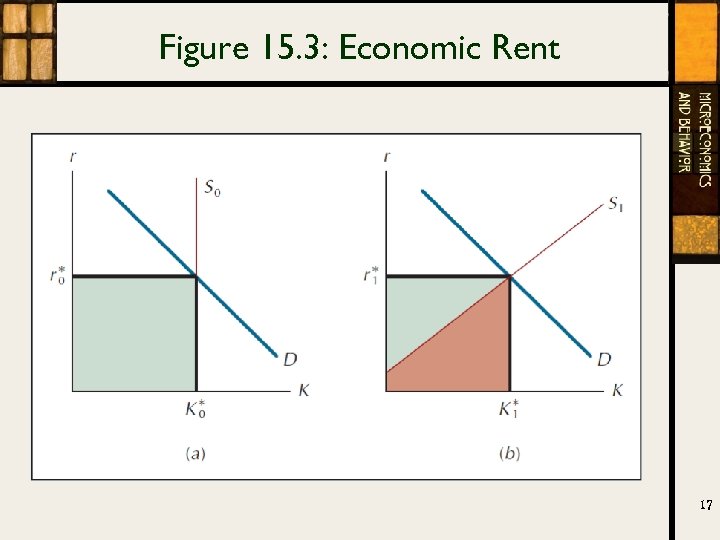

Economic Rent • Economic rent: the difference between what a factor of production is paid and the minimum amount necessary to induce it to remain in its current use. 16

Economic Rent • Economic rent: the difference between what a factor of production is paid and the minimum amount necessary to induce it to remain in its current use. 16

Figure 15. 3: Economic Rent 17

Figure 15. 3: Economic Rent 17

Peak-load Pricing • Peak-load pricing: the practice whereby higher prices are charged for goods or services during the periods in which they are consumed most intensively. 18

Peak-load Pricing • Peak-load pricing: the practice whereby higher prices are charged for goods or services during the periods in which they are consumed most intensively. 18

Figure 15. 4: The Effect of Peak-Load Pricing 19

Figure 15. 4: The Effect of Peak-Load Pricing 19

Exhaustible Resources As Inputs In Production • An exhaustible resource is one that cannot be replenished by people. • How does a competitive market allocate exhaustible resources? • The owner of an exhaustible resource has two options: – (1) he can hold the resource for the time being. • Opportunity cost is the interest that could have been earned had the resource been sold and the proceeds deposited in a bank (or used to purchase a stock or bond). – (2) he can sell it. 20

Exhaustible Resources As Inputs In Production • An exhaustible resource is one that cannot be replenished by people. • How does a competitive market allocate exhaustible resources? • The owner of an exhaustible resource has two options: – (1) he can hold the resource for the time being. • Opportunity cost is the interest that could have been earned had the resource been sold and the proceeds deposited in a bank (or used to purchase a stock or bond). – (2) he can sell it. 20

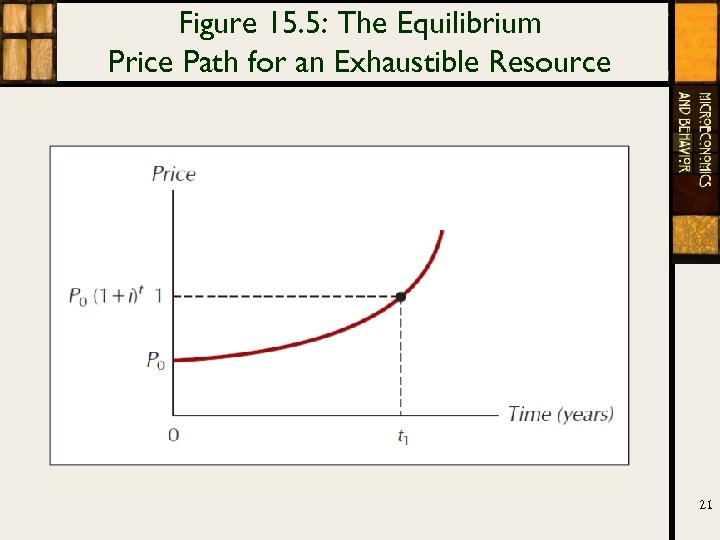

Figure 15. 5: The Equilibrium Price Path for an Exhaustible Resource 21

Figure 15. 5: The Equilibrium Price Path for an Exhaustible Resource 21

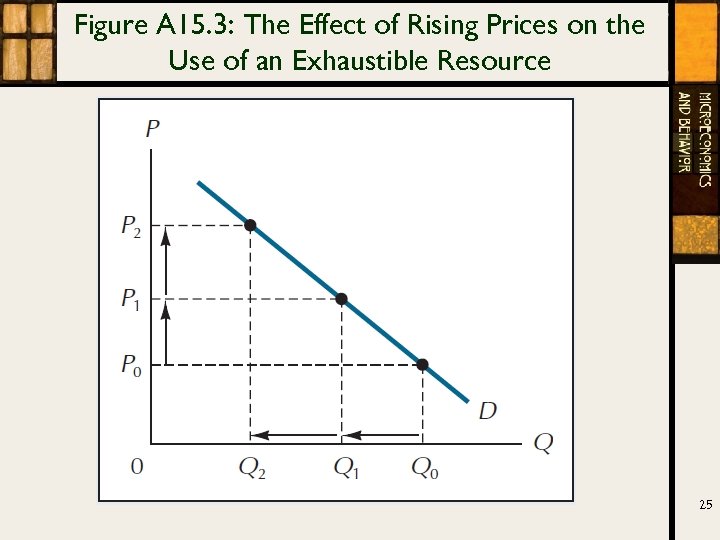

Exhaustible Resources As Inputs In Production • Because the demand curves for exhaustible resources are downward sloping the gradual rise in price will cause a gradual reduction in the quantity of the resource demanded. • Rising prices also stimulate the production of substitutes for the exhaustible resource. 22

Exhaustible Resources As Inputs In Production • Because the demand curves for exhaustible resources are downward sloping the gradual rise in price will cause a gradual reduction in the quantity of the resource demanded. • Rising prices also stimulate the production of substitutes for the exhaustible resource. 22

Figure A 15. 1: The Growth Curve for a Tree 23

Figure A 15. 1: The Growth Curve for a Tree 23

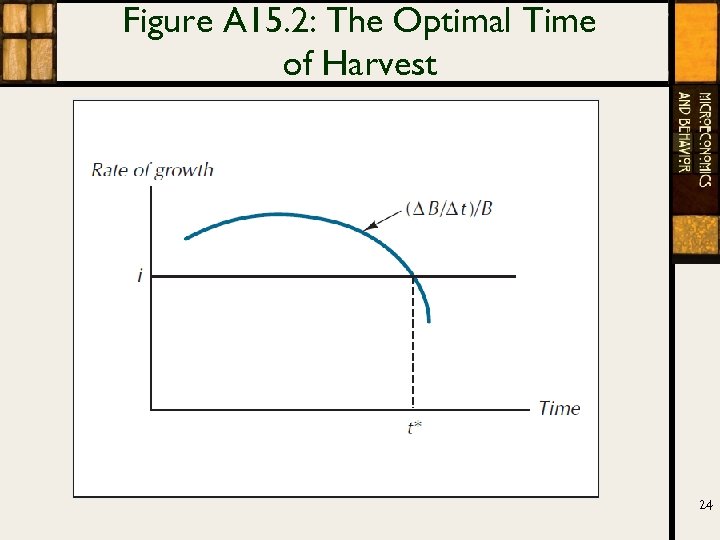

Figure A 15. 2: The Optimal Time of Harvest 24

Figure A 15. 2: The Optimal Time of Harvest 24

Figure A 15. 3: The Effect of Rising Prices on the Use of an Exhaustible Resource 25

Figure A 15. 3: The Effect of Rising Prices on the Use of an Exhaustible Resource 25

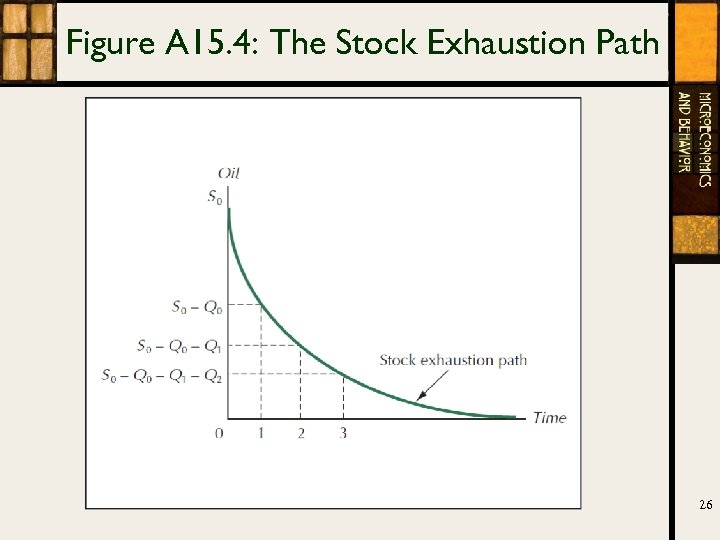

Figure A 15. 4: The Stock Exhaustion Path 26

Figure A 15. 4: The Stock Exhaustion Path 26

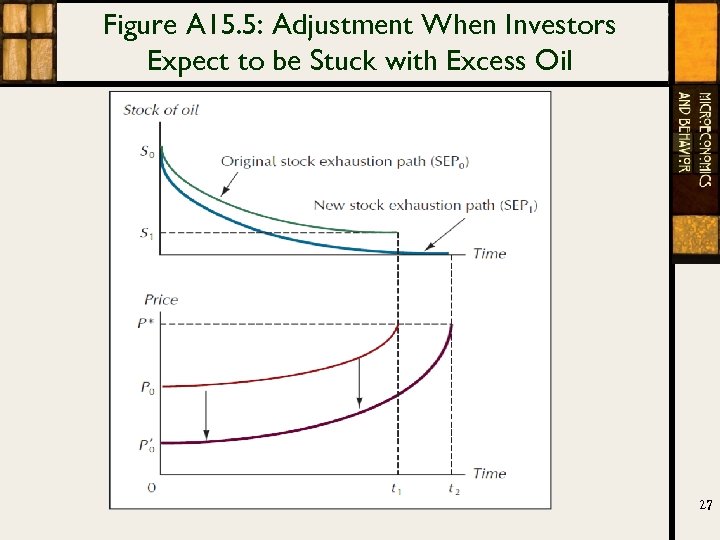

Figure A 15. 5: Adjustment When Investors Expect to be Stuck with Excess Oil 27

Figure A 15. 5: Adjustment When Investors Expect to be Stuck with Excess Oil 27

Figure A 15. 6: Adjustment When Investors Expect Oil to Run Out Too Soon 28

Figure A 15. 6: Adjustment When Investors Expect Oil to Run Out Too Soon 28

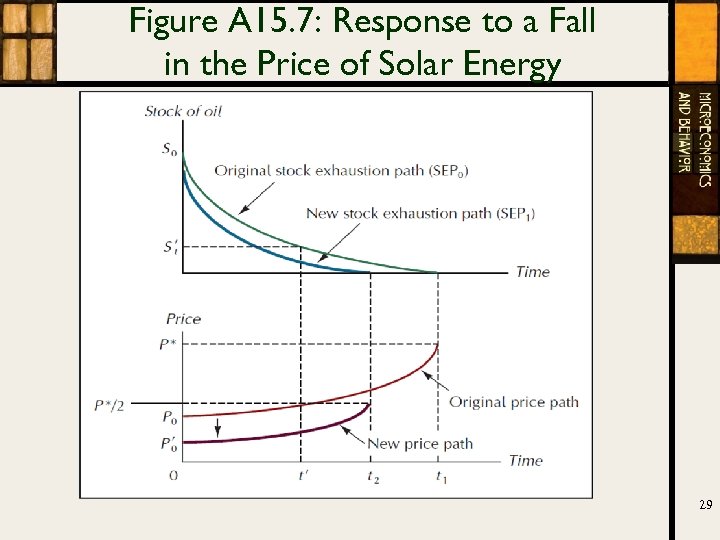

Figure A 15. 7: Response to a Fall in the Price of Solar Energy 29

Figure A 15. 7: Response to a Fall in the Price of Solar Energy 29