8a89952ff9a2e13c7082679310ae20b4.ppt

- Количество слайдов: 113

Chapter 15 Investment, Time and Capital Markets

Chapter 15 Investment, Time and Capital Markets

Topics to be Discussed l Stocks Versus Flows l Present Discounted Value l The Value of a Bond l The Net Present Value Criterion for Capital Investment Decisions l Adjustments for Risk © 2005 Pearson Education, Inc. Chapter 15 2

Topics to be Discussed l Stocks Versus Flows l Present Discounted Value l The Value of a Bond l The Net Present Value Criterion for Capital Investment Decisions l Adjustments for Risk © 2005 Pearson Education, Inc. Chapter 15 2

Topics to be Discussed l Investment Decisions by Consumers l Investments in Human Capital l Intertemporal Production Decisions – Depletable Resources l How are Interest Rates Determined? © 2005 Pearson Education, Inc. Chapter 15 3

Topics to be Discussed l Investment Decisions by Consumers l Investments in Human Capital l Intertemporal Production Decisions – Depletable Resources l How are Interest Rates Determined? © 2005 Pearson Education, Inc. Chapter 15 3

Introduction l Markets for factors and output give a reasonably complete picture l Capital market are different m Capital is durable m It is an input that will contribute to output over a long period of time m Must compare the future value to current expenditures © 2005 Pearson Education, Inc. Chapter 15 4

Introduction l Markets for factors and output give a reasonably complete picture l Capital market are different m Capital is durable m It is an input that will contribute to output over a long period of time m Must compare the future value to current expenditures © 2005 Pearson Education, Inc. Chapter 15 4

Stocks Versus Flows l Stock m Capital is a stock measurement. l The amount of plant and equipment a company owns at a point in time l Flow m Variable inputs and outputs are flow measurements. l An © 2005 Pearson Education, Inc. amount needed or used per time period Chapter 15 5

Stocks Versus Flows l Stock m Capital is a stock measurement. l The amount of plant and equipment a company owns at a point in time l Flow m Variable inputs and outputs are flow measurements. l An © 2005 Pearson Education, Inc. amount needed or used per time period Chapter 15 5

Stocks Versus Flows l Profit is also a flow number l Must know what the capital stock will allow the firm to earn as a flow of profit m Was the investment a sound decision l Must be able to value today the expected profit flow over time m What © 2005 Pearson Education, Inc. is the flow of profit worth today? Chapter 15 6

Stocks Versus Flows l Profit is also a flow number l Must know what the capital stock will allow the firm to earn as a flow of profit m Was the investment a sound decision l Must be able to value today the expected profit flow over time m What © 2005 Pearson Education, Inc. is the flow of profit worth today? Chapter 15 6

Present Discounted Value (PDV) l Determining the value today of a future flow of income m The value of a future payment must be discounted for the time period and interest rate that could be earned. l Interest rate – rate at which one can borrow or lend money © 2005 Pearson Education, Inc. Chapter 15 7

Present Discounted Value (PDV) l Determining the value today of a future flow of income m The value of a future payment must be discounted for the time period and interest rate that could be earned. l Interest rate – rate at which one can borrow or lend money © 2005 Pearson Education, Inc. Chapter 15 7

Present Discounted Value (PDV) l Future Value (FV) m One dollar invested today should yield (1 + R) dollars a year from now m (1 + R) is the future value of the dollar today m What is the value today of getting $1 a year from now? m What is the present discounted value of the $1? © 2005 Pearson Education, Inc. Chapter 15 8

Present Discounted Value (PDV) l Future Value (FV) m One dollar invested today should yield (1 + R) dollars a year from now m (1 + R) is the future value of the dollar today m What is the value today of getting $1 a year from now? m What is the present discounted value of the $1? © 2005 Pearson Education, Inc. Chapter 15 8

Present Discounted Value (PDV) © 2005 Pearson Education, Inc. Chapter 15 9

Present Discounted Value (PDV) © 2005 Pearson Education, Inc. Chapter 15 9

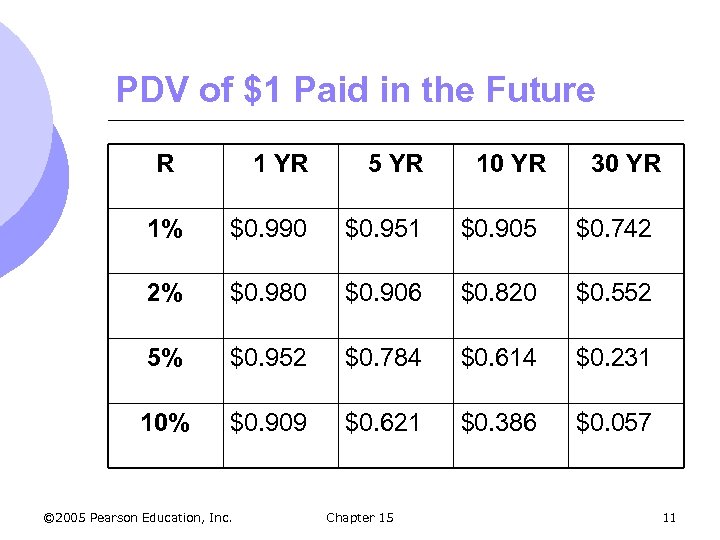

Present Discounted Value (PDV) l The interest rate impacts the PDV l The lower the interest rate, the less you have to invest to reach your goal in the future l We can see how different interest rates will give different future values © 2005 Pearson Education, Inc. Chapter 15 10

Present Discounted Value (PDV) l The interest rate impacts the PDV l The lower the interest rate, the less you have to invest to reach your goal in the future l We can see how different interest rates will give different future values © 2005 Pearson Education, Inc. Chapter 15 10

PDV of $1 Paid in the Future R 1 YR 5 YR 1% $0. 990 $0. 951 $0. 905 $0. 742 2% $0. 980 $0. 906 $0. 820 $0. 552 5% $0. 952 $0. 784 $0. 614 $0. 231 10% $0. 909 $0. 621 $0. 386 $0. 057 © 2005 Pearson Education, Inc. Chapter 15 10 YR 30 YR 11

PDV of $1 Paid in the Future R 1 YR 5 YR 1% $0. 990 $0. 951 $0. 905 $0. 742 2% $0. 980 $0. 906 $0. 820 $0. 552 5% $0. 952 $0. 784 $0. 614 $0. 231 10% $0. 909 $0. 621 $0. 386 $0. 057 © 2005 Pearson Education, Inc. Chapter 15 10 YR 30 YR 11

Valuing Payment Streams l Can determine a stream of payments over time l Choosing a payment stream depends upon the interest rate. l Given two streams, we can compute and add the present values of each year’s payment © 2005 Pearson Education, Inc. Chapter 15 12

Valuing Payment Streams l Can determine a stream of payments over time l Choosing a payment stream depends upon the interest rate. l Given two streams, we can compute and add the present values of each year’s payment © 2005 Pearson Education, Inc. Chapter 15 12

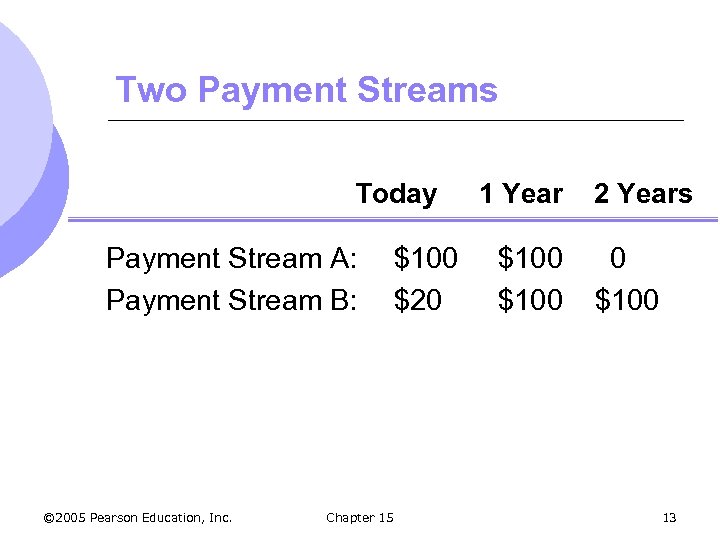

Two Payment Streams Today Payment Stream A: Payment Stream B: © 2005 Pearson Education, Inc. Chapter 15 $100 $20 1 Year $100 2 Years 0 $100 13

Two Payment Streams Today Payment Stream A: Payment Stream B: © 2005 Pearson Education, Inc. Chapter 15 $100 $20 1 Year $100 2 Years 0 $100 13

Two Payment Streams © 2005 Pearson Education, Inc. Chapter 15 14

Two Payment Streams © 2005 Pearson Education, Inc. Chapter 15 14

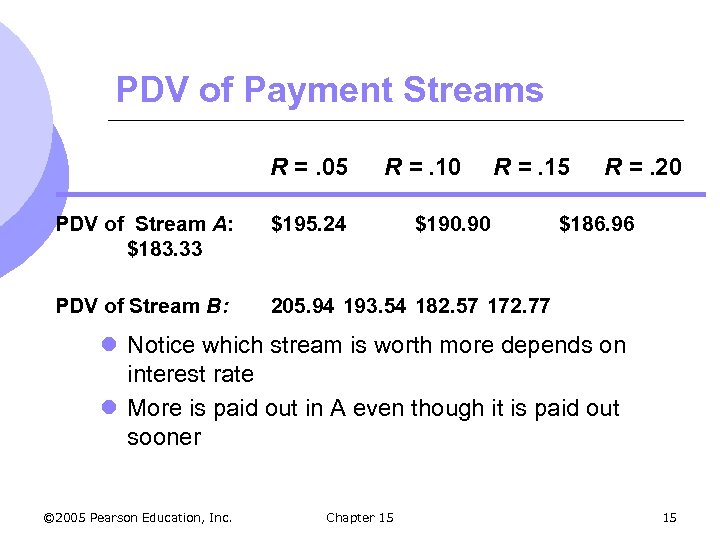

PDV of Payment Streams R =. 05 R =. 10 R =. 15 PDV of Stream A: $183. 33 $195. 24 $190. 90 PDV of Stream B: R =. 20 $186. 96 205. 94 193. 54 182. 57 172. 77 l Notice which stream is worth more depends on interest rate l More is paid out in A even though it is paid out sooner © 2005 Pearson Education, Inc. Chapter 15 15

PDV of Payment Streams R =. 05 R =. 10 R =. 15 PDV of Stream A: $183. 33 $195. 24 $190. 90 PDV of Stream B: R =. 20 $186. 96 205. 94 193. 54 182. 57 172. 77 l Notice which stream is worth more depends on interest rate l More is paid out in A even though it is paid out sooner © 2005 Pearson Education, Inc. Chapter 15 15

The Value of Lost Earnings l PDV can be used to determine the value of lost income from a disability or death. l Scenario m Harold Jennings died in an auto accident January 1, 1986 at 53 years of age. m Salary: $85, 000 m Retirement Age: 60 © 2005 Pearson Education, Inc. Chapter 15 16

The Value of Lost Earnings l PDV can be used to determine the value of lost income from a disability or death. l Scenario m Harold Jennings died in an auto accident January 1, 1986 at 53 years of age. m Salary: $85, 000 m Retirement Age: 60 © 2005 Pearson Education, Inc. Chapter 15 16

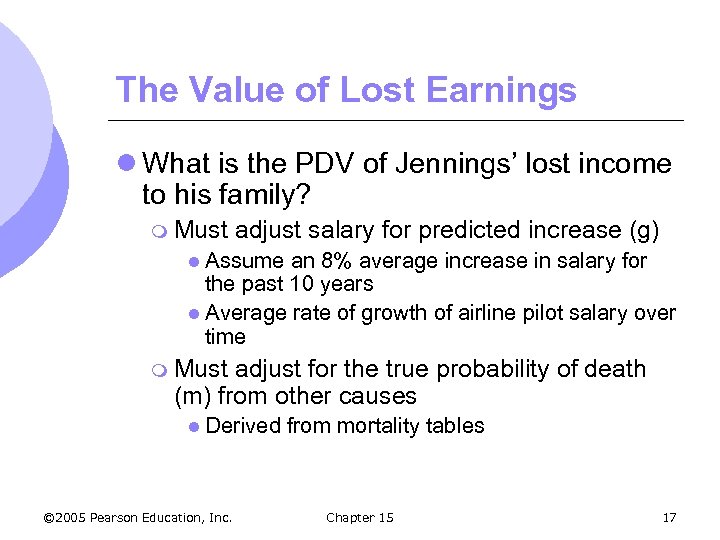

The Value of Lost Earnings l What is the PDV of Jennings’ lost income to his family? m Must adjust salary for predicted increase (g) l Assume an 8% average increase in salary for the past 10 years l Average rate of growth of airline pilot salary over time m Must adjust for the true probability of death (m) from other causes l Derived © 2005 Pearson Education, Inc. from mortality tables Chapter 15 17

The Value of Lost Earnings l What is the PDV of Jennings’ lost income to his family? m Must adjust salary for predicted increase (g) l Assume an 8% average increase in salary for the past 10 years l Average rate of growth of airline pilot salary over time m Must adjust for the true probability of death (m) from other causes l Derived © 2005 Pearson Education, Inc. from mortality tables Chapter 15 17

The Value of Lost Earnings l Must adjust for the true probability of death (m) from other causes m Derived from mortality tables l Assume R = 9% – The rate on government bonds © 2005 Pearson Education, Inc. Chapter 15 18

The Value of Lost Earnings l Must adjust for the true probability of death (m) from other causes m Derived from mortality tables l Assume R = 9% – The rate on government bonds © 2005 Pearson Education, Inc. Chapter 15 18

The Value of Lost Earnings © 2005 Pearson Education, Inc. Chapter 15 19

The Value of Lost Earnings © 2005 Pearson Education, Inc. Chapter 15 19

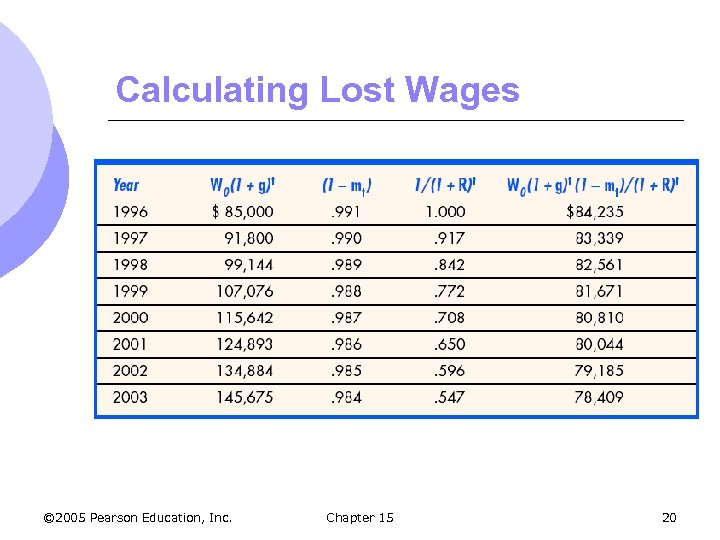

Calculating Lost Wages © 2005 Pearson Education, Inc. Chapter 15 20

Calculating Lost Wages © 2005 Pearson Education, Inc. Chapter 15 20

The Value of Lost Earnings l Finding PDV m The summation of column 4 will give the PDV of lost wages – $650, 252 m Jennings’ family could recover this amount as partial compensation for his death. © 2005 Pearson Education, Inc. Chapter 15 21

The Value of Lost Earnings l Finding PDV m The summation of column 4 will give the PDV of lost wages – $650, 252 m Jennings’ family could recover this amount as partial compensation for his death. © 2005 Pearson Education, Inc. Chapter 15 21

The Value of a Bond l A bond is a contract in which a borrower agrees to pay the bondholder (the lender) a stream of money l Example: A bond issued by a company make a “coupon” payment of $100 per year for the next 10 years and a final payment of $1000. m How much would you pay for this bond? m Present value of payment stream © 2005 Pearson Education, Inc. Chapter 15 22

The Value of a Bond l A bond is a contract in which a borrower agrees to pay the bondholder (the lender) a stream of money l Example: A bond issued by a company make a “coupon” payment of $100 per year for the next 10 years and a final payment of $1000. m How much would you pay for this bond? m Present value of payment stream © 2005 Pearson Education, Inc. Chapter 15 22

The Value of a Bond l Determining the Price of a Bond m Coupon Payments = $100/yr. for 10 yrs. m Principal Payment = $1, 000 in 10 yrs. © 2005 Pearson Education, Inc. Chapter 15 23

The Value of a Bond l Determining the Price of a Bond m Coupon Payments = $100/yr. for 10 yrs. m Principal Payment = $1, 000 in 10 yrs. © 2005 Pearson Education, Inc. Chapter 15 23

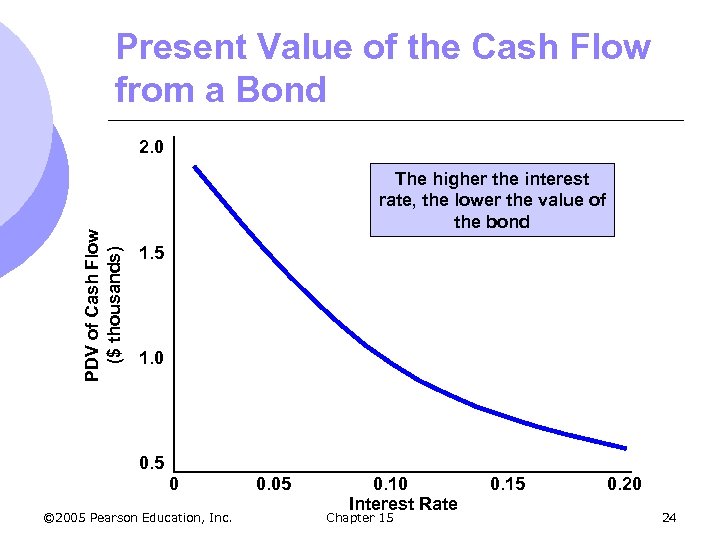

Present Value of the Cash Flow from a Bond PDV of Cash Flow ($ thousands) 2. 0 The higher the interest rate, the lower the value of the bond 1. 5 1. 0 0. 5 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate Chapter 15 0. 20 24

Present Value of the Cash Flow from a Bond PDV of Cash Flow ($ thousands) 2. 0 The higher the interest rate, the lower the value of the bond 1. 5 1. 0 0. 5 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate Chapter 15 0. 20 24

The Value of a Bond l Perpetuity is a bond that pays out a fixed amount of money each year forever. l Present value of a perpetuity is an infinite summation l Can express the value of a perpetuity by PDV = $100/R l In general, PDV = payment/R © 2005 Pearson Education, Inc. Chapter 15 25

The Value of a Bond l Perpetuity is a bond that pays out a fixed amount of money each year forever. l Present value of a perpetuity is an infinite summation l Can express the value of a perpetuity by PDV = $100/R l In general, PDV = payment/R © 2005 Pearson Education, Inc. Chapter 15 25

The Effective Yield on a Bond l Corporate and government bonds are often traded on the bond market l The price of the bond can be determined by looking at the market price m The value placed on it by buyers and sellers l To compare the bond with other investment options, can determine the interest rate consistent with that value © 2005 Pearson Education, Inc. Chapter 15 26

The Effective Yield on a Bond l Corporate and government bonds are often traded on the bond market l The price of the bond can be determined by looking at the market price m The value placed on it by buyers and sellers l To compare the bond with other investment options, can determine the interest rate consistent with that value © 2005 Pearson Education, Inc. Chapter 15 26

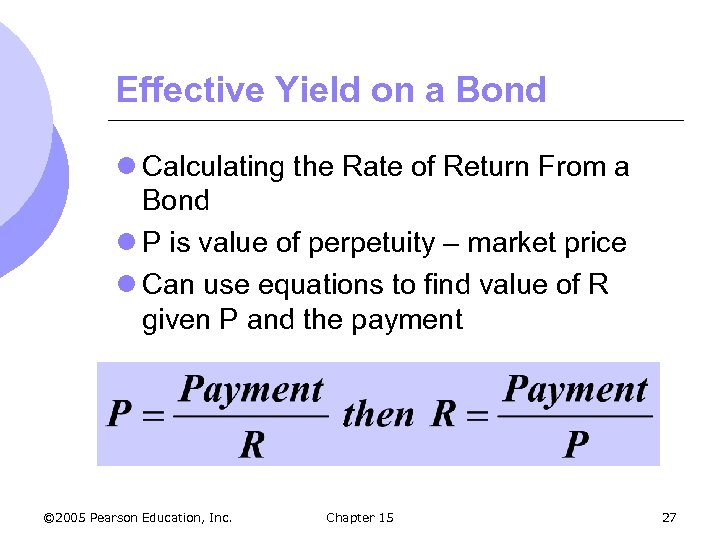

Effective Yield on a Bond l Calculating the Rate of Return From a Bond l P is value of perpetuity – market price l Can use equations to find value of R given P and the payment © 2005 Pearson Education, Inc. Chapter 15 27

Effective Yield on a Bond l Calculating the Rate of Return From a Bond l P is value of perpetuity – market price l Can use equations to find value of R given P and the payment © 2005 Pearson Education, Inc. Chapter 15 27

Effective Yield on a Bond l From previous example R = $100/$1000 = 0. 10 = 10% l The interest rate calculated here is the effective yield m Rate of return one received by investing in the bond © 2005 Pearson Education, Inc. Chapter 15 28

Effective Yield on a Bond l From previous example R = $100/$1000 = 0. 10 = 10% l The interest rate calculated here is the effective yield m Rate of return one received by investing in the bond © 2005 Pearson Education, Inc. Chapter 15 28

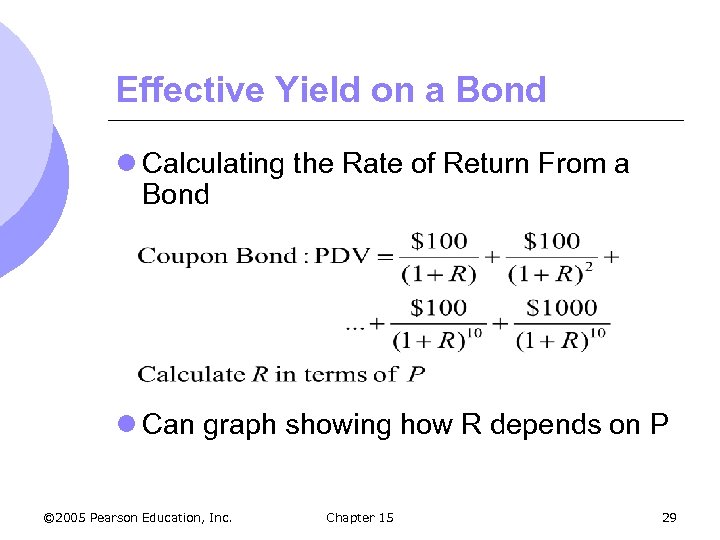

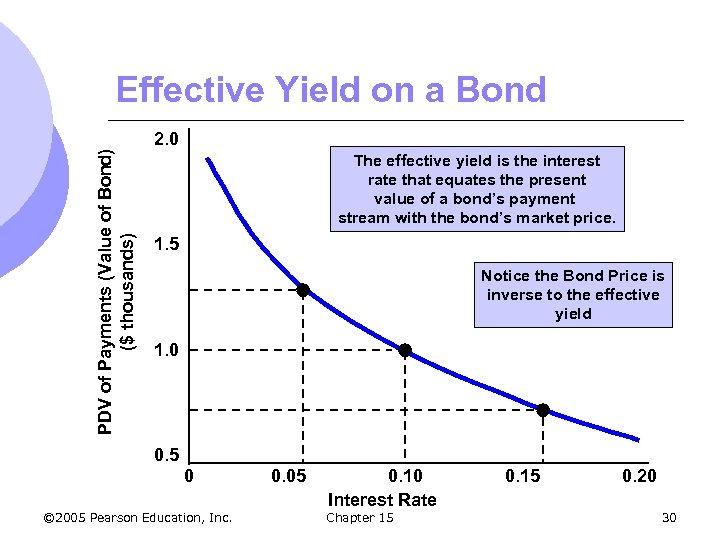

Effective Yield on a Bond l Calculating the Rate of Return From a Bond l Can graph showing how R depends on P © 2005 Pearson Education, Inc. Chapter 15 29

Effective Yield on a Bond l Calculating the Rate of Return From a Bond l Can graph showing how R depends on P © 2005 Pearson Education, Inc. Chapter 15 29

PDV of Payments (Value of Bond) ($ thousands) Effective Yield on a Bond 2. 0 The effective yield is the interest rate that equates the present value of a bond’s payment stream with the bond’s market price. 1. 5 Notice the Bond Price is inverse to the effective yield 1. 0 0. 5 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate Chapter 15 0. 20 30

PDV of Payments (Value of Bond) ($ thousands) Effective Yield on a Bond 2. 0 The effective yield is the interest rate that equates the present value of a bond’s payment stream with the bond’s market price. 1. 5 Notice the Bond Price is inverse to the effective yield 1. 0 0. 5 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate Chapter 15 0. 20 30

Effective Yield on a Bond l Yields vary on different bonds m EX: Corporate bonds yield more than government bonds m The degree of risk a bond holds is reflected in the yield l Riskier bonds have higher yields l Government unlikely to default l Some corporations more stable than others © 2005 Pearson Education, Inc. Chapter 15 31

Effective Yield on a Bond l Yields vary on different bonds m EX: Corporate bonds yield more than government bonds m The degree of risk a bond holds is reflected in the yield l Riskier bonds have higher yields l Government unlikely to default l Some corporations more stable than others © 2005 Pearson Education, Inc. Chapter 15 31

The Yields on Corporate Bonds l In order to calculate corporate bond yields, the face value of the bond and the amount of the coupon payment must be known. l Assume m IBM and Lucent both issue bonds with a face value of $100 and make coupon payments every six months. © 2005 Pearson Education, Inc. Chapter 15 32

The Yields on Corporate Bonds l In order to calculate corporate bond yields, the face value of the bond and the amount of the coupon payment must be known. l Assume m IBM and Lucent both issue bonds with a face value of $100 and make coupon payments every six months. © 2005 Pearson Education, Inc. Chapter 15 32

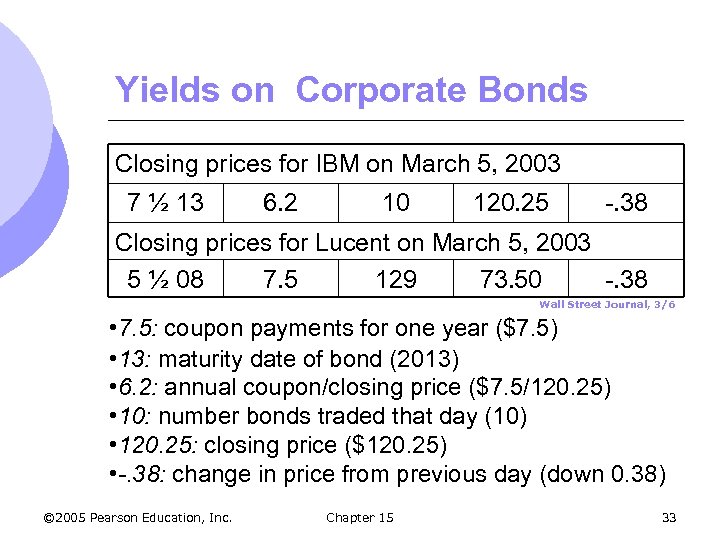

Yields on Corporate Bonds Closing prices for IBM on March 5, 2003 7 ½ 13 6. 2 10 120. 25 -. 38 Closing prices for Lucent on March 5, 2003 5 ½ 08 7. 5 129 73. 50 -. 38 Wall Street Journal, 3/6 • 7. 5: coupon payments for one year ($7. 5) • 13: maturity date of bond (2013) • 6. 2: annual coupon/closing price ($7. 5/120. 25) • 10: number bonds traded that day (10) • 120. 25: closing price ($120. 25) • -. 38: change in price from previous day (down 0. 38) © 2005 Pearson Education, Inc. Chapter 15 33

Yields on Corporate Bonds Closing prices for IBM on March 5, 2003 7 ½ 13 6. 2 10 120. 25 -. 38 Closing prices for Lucent on March 5, 2003 5 ½ 08 7. 5 129 73. 50 -. 38 Wall Street Journal, 3/6 • 7. 5: coupon payments for one year ($7. 5) • 13: maturity date of bond (2013) • 6. 2: annual coupon/closing price ($7. 5/120. 25) • 10: number bonds traded that day (10) • 120. 25: closing price ($120. 25) • -. 38: change in price from previous day (down 0. 38) © 2005 Pearson Education, Inc. Chapter 15 33

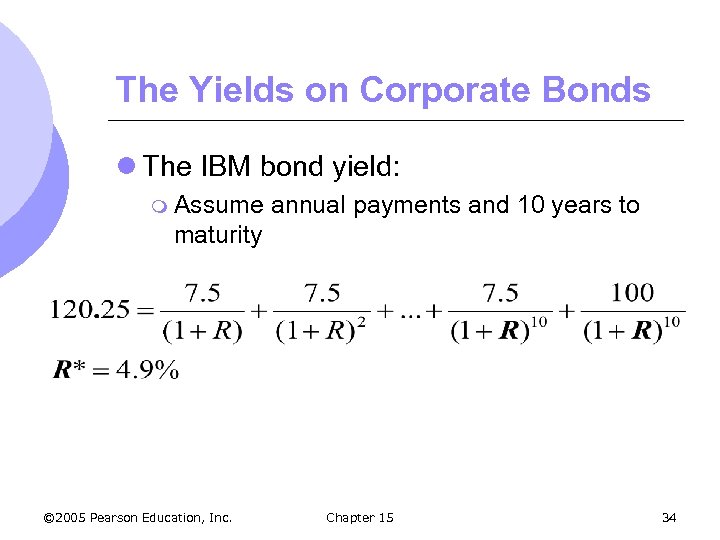

The Yields on Corporate Bonds l The IBM bond yield: m Assume annual payments and 10 years to maturity © 2005 Pearson Education, Inc. Chapter 15 34

The Yields on Corporate Bonds l The IBM bond yield: m Assume annual payments and 10 years to maturity © 2005 Pearson Education, Inc. Chapter 15 34

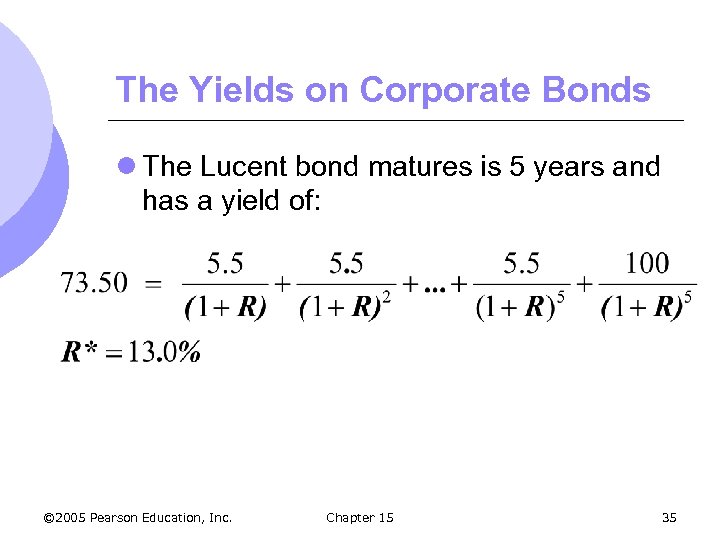

The Yields on Corporate Bonds l The Lucent bond matures is 5 years and has a yield of: © 2005 Pearson Education, Inc. Chapter 15 35

The Yields on Corporate Bonds l The Lucent bond matures is 5 years and has a yield of: © 2005 Pearson Education, Inc. Chapter 15 35

The Yields on Corporate Bonds l In 2003, Lucent had significant decline in revenue, laid off many workers and had an uncertain future l The more risky financial situation required a higher yield on the bonds to entice investors to buy © 2005 Pearson Education, Inc. Chapter 15 36

The Yields on Corporate Bonds l In 2003, Lucent had significant decline in revenue, laid off many workers and had an uncertain future l The more risky financial situation required a higher yield on the bonds to entice investors to buy © 2005 Pearson Education, Inc. Chapter 15 36

The Net Present Value Criterion for Capital Investment Decisions l Firms have to decide when and how much capital to invest in l Comparing the present value (PV) of the cash flows from the investment to the cost of the investment can give firm information needed to make worthwhile decisions. © 2005 Pearson Education, Inc. Chapter 15 37

The Net Present Value Criterion for Capital Investment Decisions l Firms have to decide when and how much capital to invest in l Comparing the present value (PV) of the cash flows from the investment to the cost of the investment can give firm information needed to make worthwhile decisions. © 2005 Pearson Education, Inc. Chapter 15 37

The Net Present Value Criterion for Capital Investment Decisions l NPV Criterion m Firms should invest if the present value of the expected future cash flows from an investment exceeds the cost of the investment. © 2005 Pearson Education, Inc. Chapter 15 38

The Net Present Value Criterion for Capital Investment Decisions l NPV Criterion m Firms should invest if the present value of the expected future cash flows from an investment exceeds the cost of the investment. © 2005 Pearson Education, Inc. Chapter 15 38

The Net Present Value Criterion for Capital Investment Decisions l © 2005 Pearson Education, Inc. Chapter 15 39

The Net Present Value Criterion for Capital Investment Decisions l © 2005 Pearson Education, Inc. Chapter 15 39

The Net Present Value Criterion for Capital Investment Decisions l Determining the Discount Rate m The firm must determine the opportunity cost of its money m The correct value of the discount rate should equal the rate that the firm could earn on a similar investment l One with same risk m We assume no risk for now so opportunity cost is what the firm could earn on a government bond © 2005 Pearson Education, Inc. Chapter 15 40

The Net Present Value Criterion for Capital Investment Decisions l Determining the Discount Rate m The firm must determine the opportunity cost of its money m The correct value of the discount rate should equal the rate that the firm could earn on a similar investment l One with same risk m We assume no risk for now so opportunity cost is what the firm could earn on a government bond © 2005 Pearson Education, Inc. Chapter 15 40

The Net Present Value Criterion for Capital Investment Decisions l The Electric Motor Factory (choosing to build a $10 million factory) m 8, 000 motors/ month for 20 yrs l Cost = $42. 50 each l Price = $52. 50/motor l Profit = $10/motor or $80, 000/month l Factory life is 20 years with a scrap value of $1 million m Should © 2005 Pearson Education, Inc. the company invest? Chapter 15 41

The Net Present Value Criterion for Capital Investment Decisions l The Electric Motor Factory (choosing to build a $10 million factory) m 8, 000 motors/ month for 20 yrs l Cost = $42. 50 each l Price = $52. 50/motor l Profit = $10/motor or $80, 000/month l Factory life is 20 years with a scrap value of $1 million m Should © 2005 Pearson Education, Inc. the company invest? Chapter 15 41

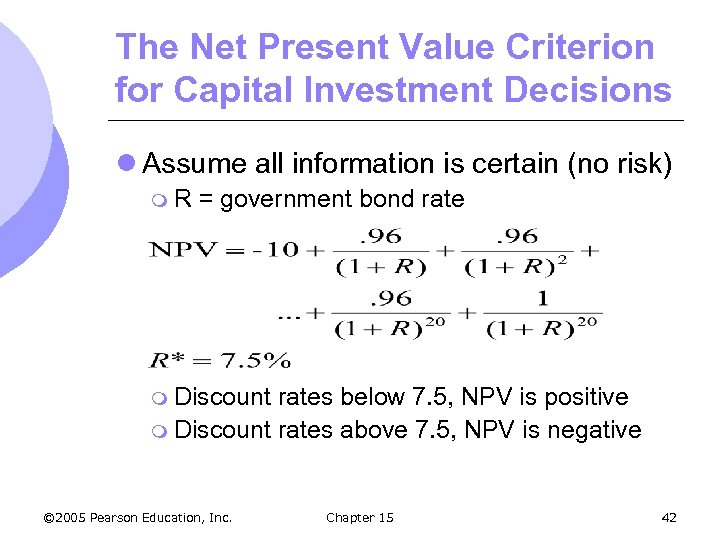

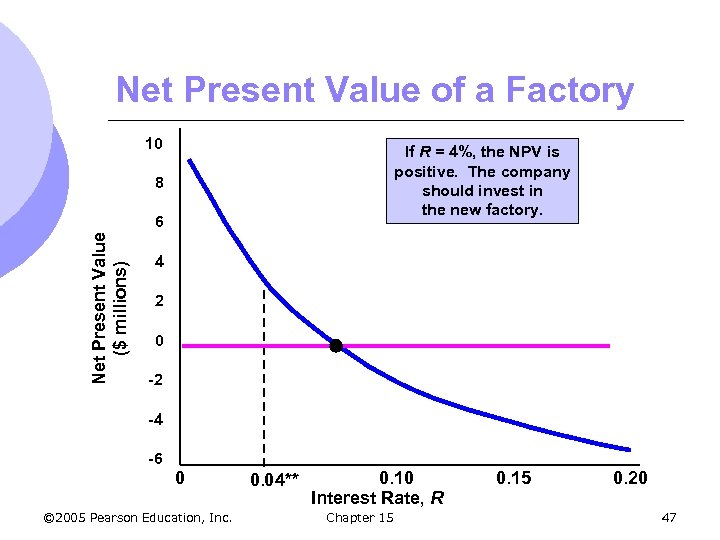

The Net Present Value Criterion for Capital Investment Decisions l Assume all information is certain (no risk) m. R = government bond rate m Discount rates below 7. 5, NPV is positive m Discount rates above 7. 5, NPV is negative © 2005 Pearson Education, Inc. Chapter 15 42

The Net Present Value Criterion for Capital Investment Decisions l Assume all information is certain (no risk) m. R = government bond rate m Discount rates below 7. 5, NPV is positive m Discount rates above 7. 5, NPV is negative © 2005 Pearson Education, Inc. Chapter 15 42

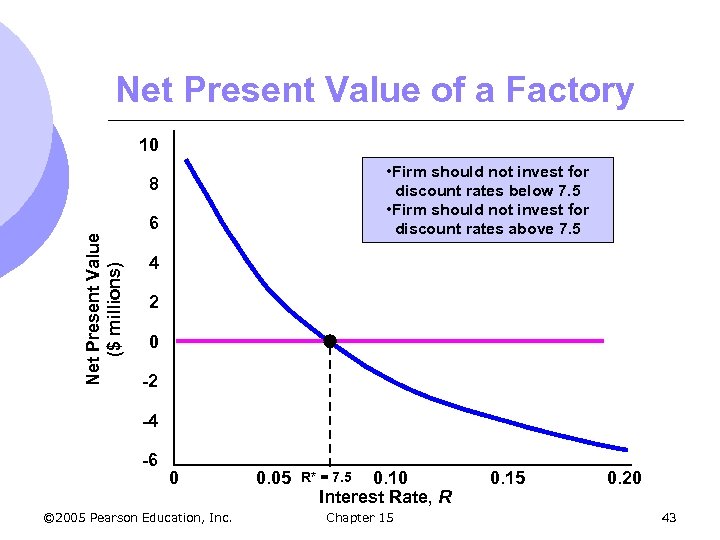

Net Present Value of a Factory 10 • Firm should not invest for discount rates below 7. 5 • Firm should not invest for discount rates above 7. 5 8 Net Present Value ($ millions) 6 4 2 0 -2 -4 -6 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate, R R* = 7. 5 Chapter 15 0. 20 43

Net Present Value of a Factory 10 • Firm should not invest for discount rates below 7. 5 • Firm should not invest for discount rates above 7. 5 8 Net Present Value ($ millions) 6 4 2 0 -2 -4 -6 0 © 2005 Pearson Education, Inc. 0. 05 0. 10 Interest Rate, R R* = 7. 5 Chapter 15 0. 20 43

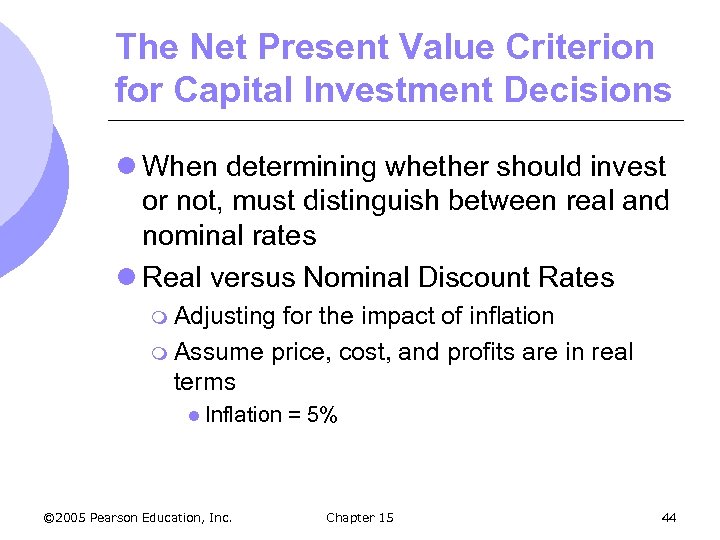

The Net Present Value Criterion for Capital Investment Decisions l When determining whether should invest or not, must distinguish between real and nominal rates l Real versus Nominal Discount Rates m Adjusting for the impact of inflation m Assume price, cost, and profits are in real terms l Inflation © 2005 Pearson Education, Inc. = 5% Chapter 15 44

The Net Present Value Criterion for Capital Investment Decisions l When determining whether should invest or not, must distinguish between real and nominal rates l Real versus Nominal Discount Rates m Adjusting for the impact of inflation m Assume price, cost, and profits are in real terms l Inflation © 2005 Pearson Education, Inc. = 5% Chapter 15 44

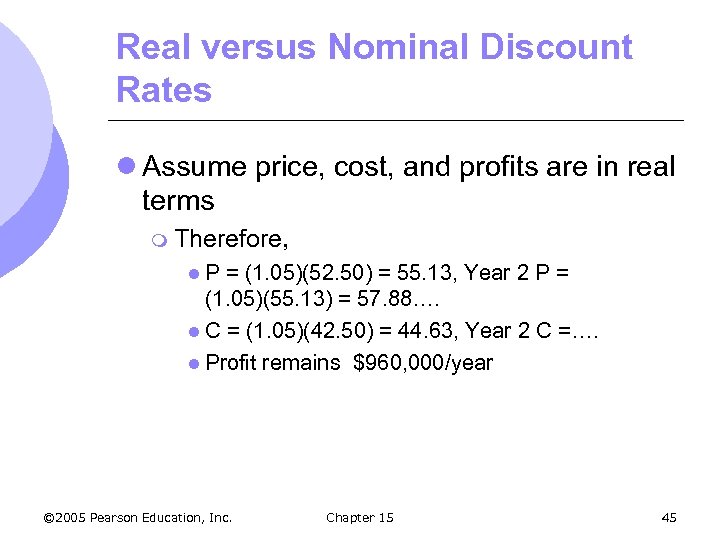

Real versus Nominal Discount Rates l Assume price, cost, and profits are in real terms m Therefore, l. P = (1. 05)(52. 50) = 55. 13, Year 2 P = (1. 05)(55. 13) = 57. 88…. l C = (1. 05)(42. 50) = 44. 63, Year 2 C =…. l Profit remains $960, 000/year © 2005 Pearson Education, Inc. Chapter 15 45

Real versus Nominal Discount Rates l Assume price, cost, and profits are in real terms m Therefore, l. P = (1. 05)(52. 50) = 55. 13, Year 2 P = (1. 05)(55. 13) = 57. 88…. l C = (1. 05)(42. 50) = 44. 63, Year 2 C =…. l Profit remains $960, 000/year © 2005 Pearson Education, Inc. Chapter 15 45

Real versus Nominal Discount Rates l If the cash flows are in real terms, then the discount rate must be in real terms as well m Opportunity cost of the investment so must include inflation here if doing it elsewhere m Real R = nominal R - inflation = 9% - 5% = 4% © 2005 Pearson Education, Inc. Chapter 15 46

Real versus Nominal Discount Rates l If the cash flows are in real terms, then the discount rate must be in real terms as well m Opportunity cost of the investment so must include inflation here if doing it elsewhere m Real R = nominal R - inflation = 9% - 5% = 4% © 2005 Pearson Education, Inc. Chapter 15 46

Net Present Value of a Factory 10 If R = 4%, the NPV is positive. The company should invest in the new factory. 8 Net Present Value ($ millions) 6 4 2 0 -2 -4 -6 0 © 2005 Pearson Education, Inc. 0. 04** 0. 10 Interest Rate, R Chapter 15 0. 20 47

Net Present Value of a Factory 10 If R = 4%, the NPV is positive. The company should invest in the new factory. 8 Net Present Value ($ millions) 6 4 2 0 -2 -4 -6 0 © 2005 Pearson Education, Inc. 0. 04** 0. 10 Interest Rate, R Chapter 15 0. 20 47

The Net Present Value Criterion for Capital Investment Decisions l Negative Future Cash Flows m Companies expect losses in certain situations l Take time to build demand l High up front costs that lower over time m Investment should be adjusted for construction time and losses. © 2005 Pearson Education, Inc. Chapter 15 48

The Net Present Value Criterion for Capital Investment Decisions l Negative Future Cash Flows m Companies expect losses in certain situations l Take time to build demand l High up front costs that lower over time m Investment should be adjusted for construction time and losses. © 2005 Pearson Education, Inc. Chapter 15 48

The Net Present Value Criterion for Capital Investment Decisions l Electric Motor Factory m Construction time is 1 year l $5 million expenditure today l $5 million expenditure next year m Expected to lose $1 million the first year and $0. 5 million the second year m Profit is $0. 96 million/yr. until year 20 m Scrap value is $1 million © 2005 Pearson Education, Inc. Chapter 15 49

The Net Present Value Criterion for Capital Investment Decisions l Electric Motor Factory m Construction time is 1 year l $5 million expenditure today l $5 million expenditure next year m Expected to lose $1 million the first year and $0. 5 million the second year m Profit is $0. 96 million/yr. until year 20 m Scrap value is $1 million © 2005 Pearson Education, Inc. Chapter 15 49

The Net Present Value Criterion for Capital Investment Decisions © 2005 Pearson Education, Inc. Chapter 15 50

The Net Present Value Criterion for Capital Investment Decisions © 2005 Pearson Education, Inc. Chapter 15 50

Adjustments for Risk l Determining the discount rate for an uncertain environment: m This can be done by increasing the discount rate by adding a risk-premium to the risk-free rate. l Amount of money that a risk-averse individual will pay to avoid taking a risk © 2005 Pearson Education, Inc. Chapter 15 51

Adjustments for Risk l Determining the discount rate for an uncertain environment: m This can be done by increasing the discount rate by adding a risk-premium to the risk-free rate. l Amount of money that a risk-averse individual will pay to avoid taking a risk © 2005 Pearson Education, Inc. Chapter 15 51

Diversifiable v. Nondiversifiable Risk l Diversifiable risk that can be eliminated by investing in many projects or by holding the stocks of many companies. l Nondiversifiable risk cannot be eliminated and should be entered into the risk premium. © 2005 Pearson Education, Inc. Chapter 15 52

Diversifiable v. Nondiversifiable Risk l Diversifiable risk that can be eliminated by investing in many projects or by holding the stocks of many companies. l Nondiversifiable risk cannot be eliminated and should be entered into the risk premium. © 2005 Pearson Education, Inc. Chapter 15 52

Diversifiable v. Nondiversifiable Risk l Diversifying spreads risk over many options m Invest in many types of investments – diversify portfolio m Firms invest in many different projects m No reward for assets that have only diversifiable risk – tend to earn return close to risk free return on average © 2005 Pearson Education, Inc. Chapter 15 53

Diversifiable v. Nondiversifiable Risk l Diversifying spreads risk over many options m Invest in many types of investments – diversify portfolio m Firms invest in many different projects m No reward for assets that have only diversifiable risk – tend to earn return close to risk free return on average © 2005 Pearson Education, Inc. Chapter 15 53

Diversifiable v. Nondiversifiable Risk l Some risk cannot be eliminated or avoided m Company profits depend on the economy – boom or recession m Future economic growth is uncertain so cannot eliminate all risk l Investors risk should be rewarded for bearing this m Opportunity cost of investing is higher – must include risk premium © 2005 Pearson Education, Inc. Chapter 15 54

Diversifiable v. Nondiversifiable Risk l Some risk cannot be eliminated or avoided m Company profits depend on the economy – boom or recession m Future economic growth is uncertain so cannot eliminate all risk l Investors risk should be rewarded for bearing this m Opportunity cost of investing is higher – must include risk premium © 2005 Pearson Education, Inc. Chapter 15 54

Diversifiable v. Nondiversifiable Risk l The Capital Asset Pricing Model (CAPM) m Model in which the risk premium for a capital investment depends on the correlation of the investment’s return with the return on the entire stock market m If you invest in a mutual fund, there is no diversifiable risk but there is nondiversifiable risk since stocks tend to move with economy. l Expected return on stock higher than risk free investment © 2005 Pearson Education, Inc. Chapter 15 55

Diversifiable v. Nondiversifiable Risk l The Capital Asset Pricing Model (CAPM) m Model in which the risk premium for a capital investment depends on the correlation of the investment’s return with the return on the entire stock market m If you invest in a mutual fund, there is no diversifiable risk but there is nondiversifiable risk since stocks tend to move with economy. l Expected return on stock higher than risk free investment © 2005 Pearson Education, Inc. Chapter 15 55

Capital Asset Pricing Model l Suppose you invest in the entire stock market (mutual fund) m rm = expected return of the stock market m rf = risk free rate m rm - rf = risk premium for nondiversifiable risk m Additional expected return you get for bearing the nondiversifiable risk of the stock market © 2005 Pearson Education, Inc. Chapter 15 56

Capital Asset Pricing Model l Suppose you invest in the entire stock market (mutual fund) m rm = expected return of the stock market m rf = risk free rate m rm - rf = risk premium for nondiversifiable risk m Additional expected return you get for bearing the nondiversifiable risk of the stock market © 2005 Pearson Education, Inc. Chapter 15 56

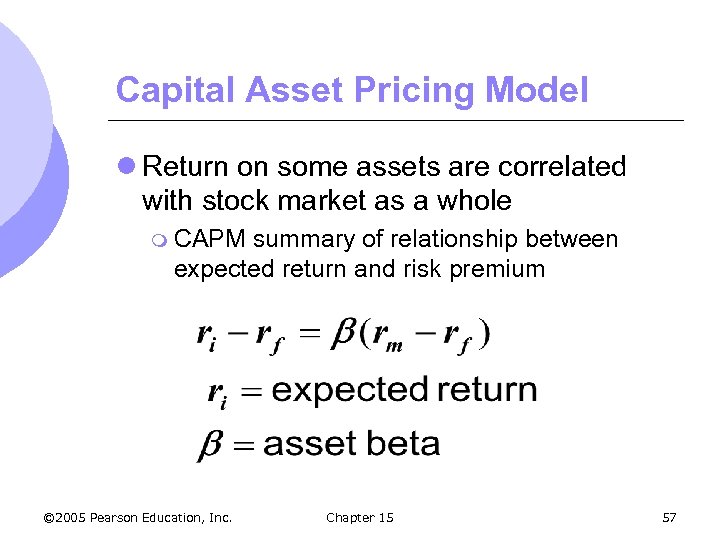

Capital Asset Pricing Model l Return on some assets are correlated with stock market as a whole m CAPM summary of relationship between expected return and risk premium © 2005 Pearson Education, Inc. Chapter 15 57

Capital Asset Pricing Model l Return on some assets are correlated with stock market as a whole m CAPM summary of relationship between expected return and risk premium © 2005 Pearson Education, Inc. Chapter 15 57

Adjustments for Risk l The asset beta, , measures the sensitivity of an asset’s return to market movements and, therefore, the asset’s nondiversifiable risk. m 2% rise in market resulting in a 2% rise in asset price means the beta is 2 m 1% rise in market resulting in a 1% rise in asset price, means beta is 1 m The larger the beta, the greater the expected return on the asset © 2005 Pearson Education, Inc. Chapter 15 58

Adjustments for Risk l The asset beta, , measures the sensitivity of an asset’s return to market movements and, therefore, the asset’s nondiversifiable risk. m 2% rise in market resulting in a 2% rise in asset price means the beta is 2 m 1% rise in market resulting in a 1% rise in asset price, means beta is 1 m The larger the beta, the greater the expected return on the asset © 2005 Pearson Education, Inc. Chapter 15 58

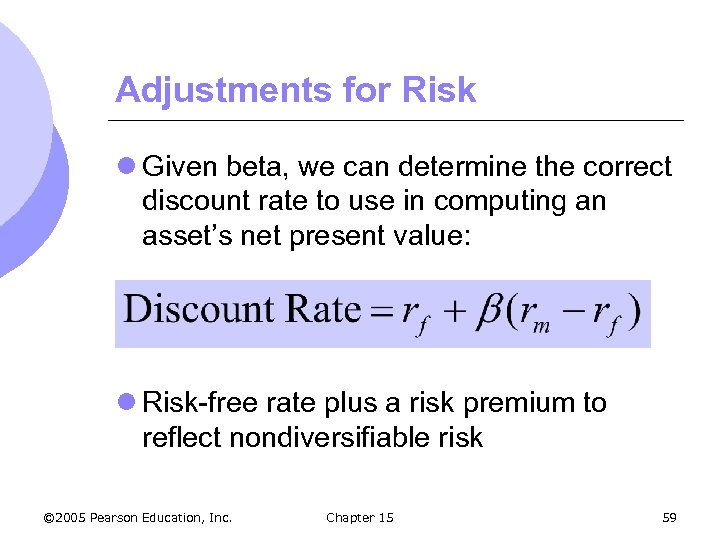

Adjustments for Risk l Given beta, we can determine the correct discount rate to use in computing an asset’s net present value: l Risk-free rate plus a risk premium to reflect nondiversifiable risk © 2005 Pearson Education, Inc. Chapter 15 59

Adjustments for Risk l Given beta, we can determine the correct discount rate to use in computing an asset’s net present value: l Risk-free rate plus a risk premium to reflect nondiversifiable risk © 2005 Pearson Education, Inc. Chapter 15 59

Determining Beta l For a stock, beta determined statistically l For a factory, determining beta is more difficult l Firms often use the company cost of capital as nominal discount rate m Weighted average of he expected return on a company’s stock and the interest rate that it pays for debt. m Can depend on level of nondiversifiable risk © 2005 Pearson Education, Inc. Chapter 15 60

Determining Beta l For a stock, beta determined statistically l For a factory, determining beta is more difficult l Firms often use the company cost of capital as nominal discount rate m Weighted average of he expected return on a company’s stock and the interest rate that it pays for debt. m Can depend on level of nondiversifiable risk © 2005 Pearson Education, Inc. Chapter 15 60

Investment Decisions by Consumers l Consumers face similar investment decisions when they purchase a durable good. m Compare flow of future benefits with the current purchase cost © 2005 Pearson Education, Inc. Chapter 15 61

Investment Decisions by Consumers l Consumers face similar investment decisions when they purchase a durable good. m Compare flow of future benefits with the current purchase cost © 2005 Pearson Education, Inc. Chapter 15 61

Investment Decisions by Consumers l Benefits and Costs of Buying a Car m If keep the car for 5 or 6 years have benefits that occur in the future m Must compare the future flow of net benefits from owning the car (having transportation minus cost of insurance, maintenance and gas) with the purchase price. © 2005 Pearson Education, Inc. Chapter 15 62

Investment Decisions by Consumers l Benefits and Costs of Buying a Car m If keep the car for 5 or 6 years have benefits that occur in the future m Must compare the future flow of net benefits from owning the car (having transportation minus cost of insurance, maintenance and gas) with the purchase price. © 2005 Pearson Education, Inc. Chapter 15 62

Benefits and Costs of Buying a Car m. S = dollar value of transportation services in dollars to a consumer m E = total operating cost/yr l Insurance, Maintenance, and Gas m Price of car is $20, 000 m Resale value of car is $4, 000 in 6 years l Decision to buy the car can be framed in net present value terms © 2005 Pearson Education, Inc. Chapter 15 63

Benefits and Costs of Buying a Car m. S = dollar value of transportation services in dollars to a consumer m E = total operating cost/yr l Insurance, Maintenance, and Gas m Price of car is $20, 000 m Resale value of car is $4, 000 in 6 years l Decision to buy the car can be framed in net present value terms © 2005 Pearson Education, Inc. Chapter 15 63

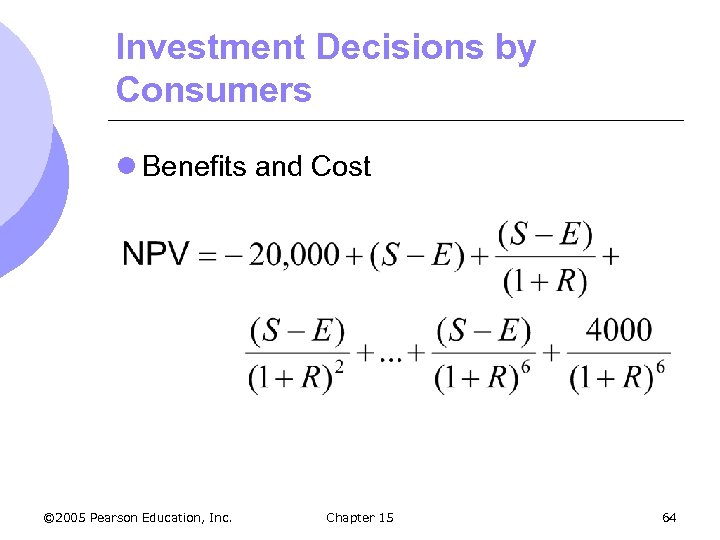

Investment Decisions by Consumers l Benefits and Cost © 2005 Pearson Education, Inc. Chapter 15 64

Investment Decisions by Consumers l Benefits and Cost © 2005 Pearson Education, Inc. Chapter 15 64

Investment Decisions by Consumers l Whether you should buy the car or not depends on discount rate m If have to borrow money, then use interest loan rate l When comparing to buy or lease, can use same calculation m High interest rate, often better to lease m Low interest rate, often better to buy © 2005 Pearson Education, Inc. Chapter 15 65

Investment Decisions by Consumers l Whether you should buy the car or not depends on discount rate m If have to borrow money, then use interest loan rate l When comparing to buy or lease, can use same calculation m High interest rate, often better to lease m Low interest rate, often better to buy © 2005 Pearson Education, Inc. Chapter 15 65

Choosing an Air Conditioner l When buying an air conditioner, must typically face a tradeoff between efficiency and cost m Efficiency – how much energy used to cool m Do you want to pay more now for lower long run costs or do you want to pay less now for higher long run costs © 2005 Pearson Education, Inc. Chapter 15 66

Choosing an Air Conditioner l When buying an air conditioner, must typically face a tradeoff between efficiency and cost m Efficiency – how much energy used to cool m Do you want to pay more now for lower long run costs or do you want to pay less now for higher long run costs © 2005 Pearson Education, Inc. Chapter 15 66

Choosing an Air Conditioner l Buying a new air conditioner involves making a trade-off. m Air Conditioner B l High price and more efficient m Both have the same cooling power m Assume an 8 year life © 2005 Pearson Education, Inc. Chapter 15 67

Choosing an Air Conditioner l Buying a new air conditioner involves making a trade-off. m Air Conditioner B l High price and more efficient m Both have the same cooling power m Assume an 8 year life © 2005 Pearson Education, Inc. Chapter 15 67

Choosing an Air Conditioner © 2005 Pearson Education, Inc. Chapter 15 68

Choosing an Air Conditioner © 2005 Pearson Education, Inc. Chapter 15 68

Choosing an Air Conditioner l Should you choose A or B? m Depends l If on the discount rate you borrow, the discount rate would be high m Probably choose a less expensive and inefficient unit l If you have plentiful cash, the discount rate would be low. m Probably © 2005 Pearson Education, Inc. choose the more expensive unit Chapter 15 69

Choosing an Air Conditioner l Should you choose A or B? m Depends l If on the discount rate you borrow, the discount rate would be high m Probably choose a less expensive and inefficient unit l If you have plentiful cash, the discount rate would be low. m Probably © 2005 Pearson Education, Inc. choose the more expensive unit Chapter 15 69

Investments in Human Capital l Individuals make choices on whether to invest in human capital m Do I finish college? m Do I go to graduate school? l Human capital is the knowledge, skills, and experience that make an individual more productive and thereby able to earn a higher income over a lifetime © 2005 Pearson Education, Inc. Chapter 15 70

Investments in Human Capital l Individuals make choices on whether to invest in human capital m Do I finish college? m Do I go to graduate school? l Human capital is the knowledge, skills, and experience that make an individual more productive and thereby able to earn a higher income over a lifetime © 2005 Pearson Education, Inc. Chapter 15 70

Investments in Human Capital l Typically the investment in human capital pays off in the future in terms of higher pay, better promotions, and/or more job opportunities l How does one decide to invest in human capital? m Can use the net present value rule from before © 2005 Pearson Education, Inc. Chapter 15 71

Investments in Human Capital l Typically the investment in human capital pays off in the future in terms of higher pay, better promotions, and/or more job opportunities l How does one decide to invest in human capital? m Can use the net present value rule from before © 2005 Pearson Education, Inc. Chapter 15 71

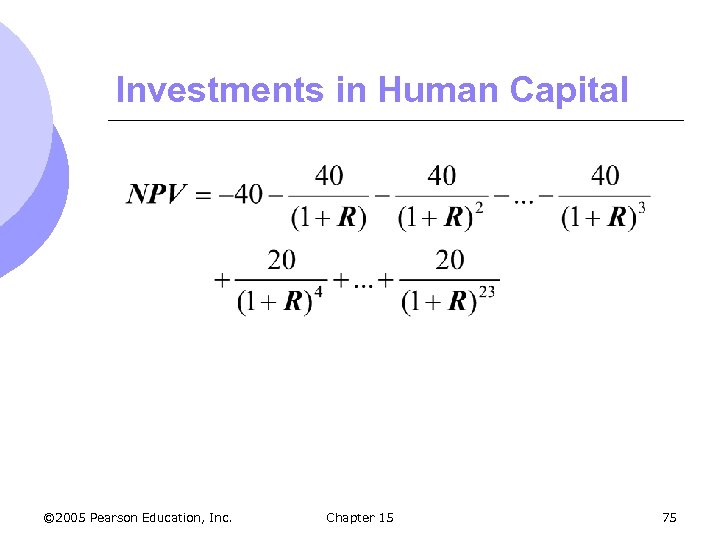

Investments in Human Capital l Suppose you are deciding to go to college for 4 years or skip college and go to work m Assume purely financial basis (ignore pleasure or pain from college) m Calculate net present value of costs and benefits of going to college © 2005 Pearson Education, Inc. Chapter 15 72

Investments in Human Capital l Suppose you are deciding to go to college for 4 years or skip college and go to work m Assume purely financial basis (ignore pleasure or pain from college) m Calculate net present value of costs and benefits of going to college © 2005 Pearson Education, Inc. Chapter 15 72

Investments in Human Capital l Major costs for college m Opportunity cost of lost wages – approximately $20, 000 per year m Costs for tuition, room and board, and related expenses – assume $20, 000 per year m Total economic costs of attending college are $40, 000 per year for 4 years © 2005 Pearson Education, Inc. Chapter 15 73

Investments in Human Capital l Major costs for college m Opportunity cost of lost wages – approximately $20, 000 per year m Costs for tuition, room and board, and related expenses – assume $20, 000 per year m Total economic costs of attending college are $40, 000 per year for 4 years © 2005 Pearson Education, Inc. Chapter 15 73

Investments in Human Capital l Benefits of college m Higher salary throughout working life l On average college grad earns $20, 000 higher than high school grad l Assume persists for 20 years l Can now calculate net present value of investing in a college education © 2005 Pearson Education, Inc. Chapter 15 74

Investments in Human Capital l Benefits of college m Higher salary throughout working life l On average college grad earns $20, 000 higher than high school grad l Assume persists for 20 years l Can now calculate net present value of investing in a college education © 2005 Pearson Education, Inc. Chapter 15 74

Investments in Human Capital © 2005 Pearson Education, Inc. Chapter 15 75

Investments in Human Capital © 2005 Pearson Education, Inc. Chapter 15 75

Investments in Human Capital l What discount rate should be used? m We are ignoring inflation so should use a real discount rate m About 5% would reflect opportunity cost of money for many households l Return of investing in other assets m This gives a NPV of about $66, 000 therefore investing in college is a good idea © 2005 Pearson Education, Inc. Chapter 15 76

Investments in Human Capital l What discount rate should be used? m We are ignoring inflation so should use a real discount rate m About 5% would reflect opportunity cost of money for many households l Return of investing in other assets m This gives a NPV of about $66, 000 therefore investing in college is a good idea © 2005 Pearson Education, Inc. Chapter 15 76

Investments in Human Capital l Although NPV is positive, it is not very large l Almost free entry system to attend college l Free entry markets tend to lead to zero economic profits © 2005 Pearson Education, Inc. Chapter 15 77

Investments in Human Capital l Although NPV is positive, it is not very large l Almost free entry system to attend college l Free entry markets tend to lead to zero economic profits © 2005 Pearson Education, Inc. Chapter 15 77

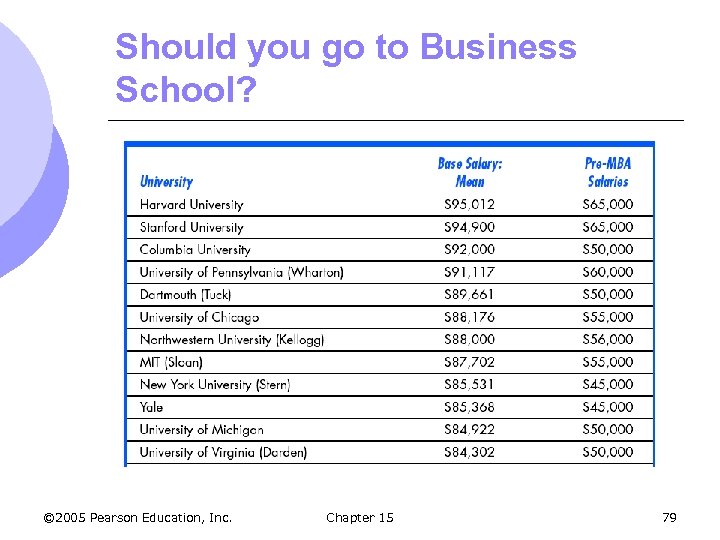

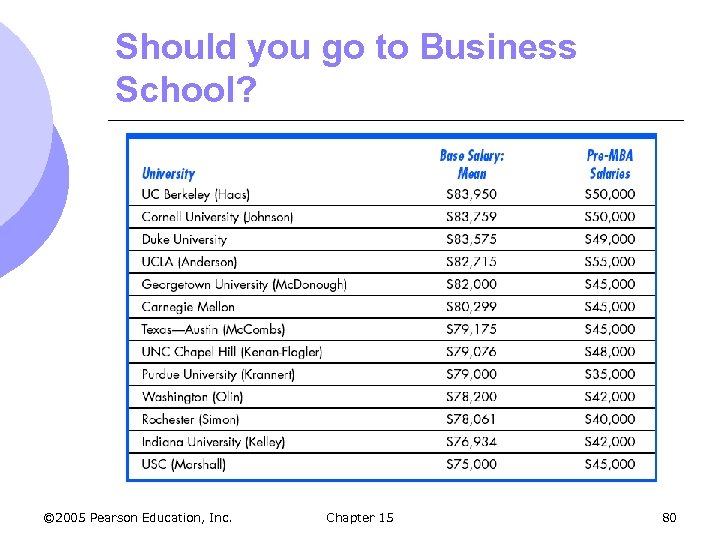

Should you go to Business School? l Getting an MBA often means a large increase in salary l Can see the typical change in salary from getting an MBA from top business schools l For US as a whole, average salary pre. MBA is about $45, 000 and obtaining the MBA increase by about $30, 000 © 2005 Pearson Education, Inc. Chapter 15 78

Should you go to Business School? l Getting an MBA often means a large increase in salary l Can see the typical change in salary from getting an MBA from top business schools l For US as a whole, average salary pre. MBA is about $45, 000 and obtaining the MBA increase by about $30, 000 © 2005 Pearson Education, Inc. Chapter 15 78

Should you go to Business School? © 2005 Pearson Education, Inc. Chapter 15 79

Should you go to Business School? © 2005 Pearson Education, Inc. Chapter 15 79

Should you go to Business School? © 2005 Pearson Education, Inc. Chapter 15 80

Should you go to Business School? © 2005 Pearson Education, Inc. Chapter 15 80

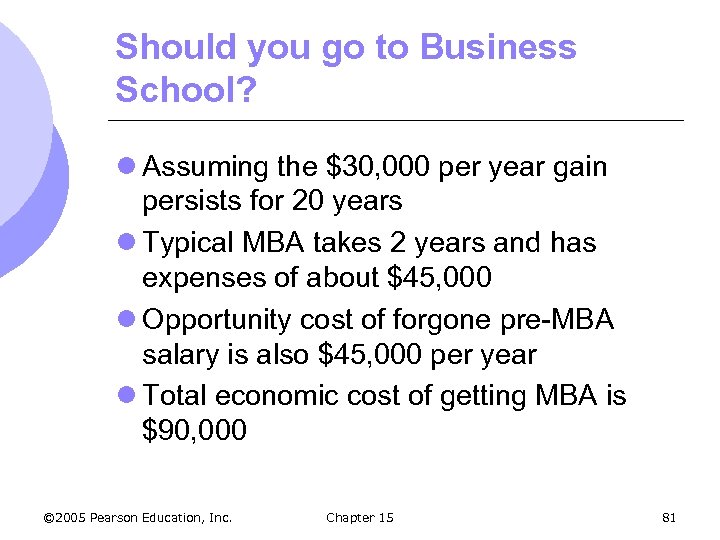

Should you go to Business School? l Assuming the $30, 000 per year gain persists for 20 years l Typical MBA takes 2 years and has expenses of about $45, 000 l Opportunity cost of forgone pre-MBA salary is also $45, 000 per year l Total economic cost of getting MBA is $90, 000 © 2005 Pearson Education, Inc. Chapter 15 81

Should you go to Business School? l Assuming the $30, 000 per year gain persists for 20 years l Typical MBA takes 2 years and has expenses of about $45, 000 l Opportunity cost of forgone pre-MBA salary is also $45, 000 per year l Total economic cost of getting MBA is $90, 000 © 2005 Pearson Education, Inc. Chapter 15 81

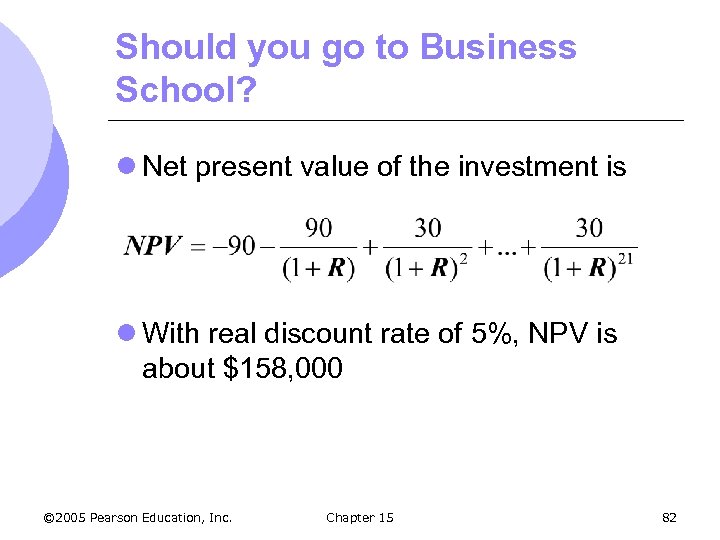

Should you go to Business School? l Net present value of the investment is l With real discount rate of 5%, NPV is about $158, 000 © 2005 Pearson Education, Inc. Chapter 15 82

Should you go to Business School? l Net present value of the investment is l With real discount rate of 5%, NPV is about $158, 000 © 2005 Pearson Education, Inc. Chapter 15 82

Should you go to Business School? l Why is payoff from MBA in table 15. 6 so much greater than from 4 -year undergrad degree? m Entry into many MBA programs, especially those listed in table, is highly selective and difficult m Many more people apply than are excepted so return remains high © 2005 Pearson Education, Inc. Chapter 15 83

Should you go to Business School? l Why is payoff from MBA in table 15. 6 so much greater than from 4 -year undergrad degree? m Entry into many MBA programs, especially those listed in table, is highly selective and difficult m Many more people apply than are excepted so return remains high © 2005 Pearson Education, Inc. Chapter 15 83

Should you go to Business School? l Financial decision is easy m Although costly, return is very high m But some find it more fun than others m Many not have undergraduate grades and test scores to go to business school m May find career you like better such as teaching or law © 2005 Pearson Education, Inc. Chapter 15 84

Should you go to Business School? l Financial decision is easy m Although costly, return is very high m But some find it more fun than others m Many not have undergraduate grades and test scores to go to business school m May find career you like better such as teaching or law © 2005 Pearson Education, Inc. Chapter 15 84

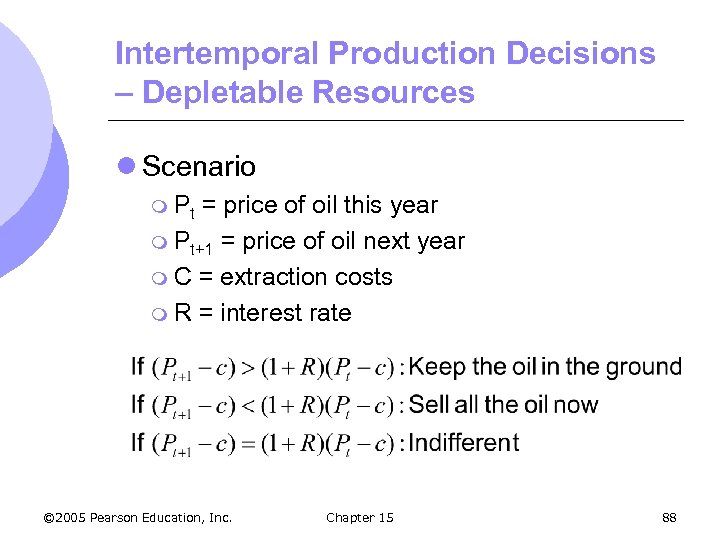

Intertemporal Production Decisions – Depletable Resources l Firms’ production decisions often have intertemporal aspects – production today affects sales or costs in the future. m Firms may gain experience which lowers future costs m Use of depletable resources – extract the resource today means less is available in the future l Must take these into account in decisions © 2005 Pearson Education, Inc. Chapter 15 85

Intertemporal Production Decisions – Depletable Resources l Firms’ production decisions often have intertemporal aspects – production today affects sales or costs in the future. m Firms may gain experience which lowers future costs m Use of depletable resources – extract the resource today means less is available in the future l Must take these into account in decisions © 2005 Pearson Education, Inc. Chapter 15 85

Intertemporal Production Decisions – Depletable Resources l Scenario m You are given an oil well containing 1000 barrels of oil. m MC and AC = $10/barrel m Should you produce the oil or save it? l If only look at extraction costs versus price, ignore important piece – opportunity cost l Decision depends on price today, but on how fast you expect the price to rise in future © 2005 Pearson Education, Inc. Chapter 15 86

Intertemporal Production Decisions – Depletable Resources l Scenario m You are given an oil well containing 1000 barrels of oil. m MC and AC = $10/barrel m Should you produce the oil or save it? l If only look at extraction costs versus price, ignore important piece – opportunity cost l Decision depends on price today, but on how fast you expect the price to rise in future © 2005 Pearson Education, Inc. Chapter 15 86

Intertemporal Production Decisions – Depletable Resources l If expect price of oil to rise slowly, might be better off extracting today l If expect price of oil to rise rapidly, better off waiting and extracting later l How fast must price rise to keep in ground? m Value must rise at least as fast as the rate of interest m Can show this mathematically © 2005 Pearson Education, Inc. Chapter 15 87

Intertemporal Production Decisions – Depletable Resources l If expect price of oil to rise slowly, might be better off extracting today l If expect price of oil to rise rapidly, better off waiting and extracting later l How fast must price rise to keep in ground? m Value must rise at least as fast as the rate of interest m Can show this mathematically © 2005 Pearson Education, Inc. Chapter 15 87

Intertemporal Production Decisions – Depletable Resources l Scenario m Pt = price of oil this year m Pt+1 = price of oil next year m C = extraction costs m R = interest rate © 2005 Pearson Education, Inc. Chapter 15 88

Intertemporal Production Decisions – Depletable Resources l Scenario m Pt = price of oil this year m Pt+1 = price of oil next year m C = extraction costs m R = interest rate © 2005 Pearson Education, Inc. Chapter 15 88

Intertemporal Production Decisions – Depletable Resources l Do not produce if you expect its price less its extraction cost to rise faster than the rate of interest. l Extract and sell all of it if you expect price less cost to rise at less than the rate of interest. l But, how fast will the price of oil rise? © 2005 Pearson Education, Inc. Chapter 15 89

Intertemporal Production Decisions – Depletable Resources l Do not produce if you expect its price less its extraction cost to rise faster than the rate of interest. l Extract and sell all of it if you expect price less cost to rise at less than the rate of interest. l But, how fast will the price of oil rise? © 2005 Pearson Education, Inc. Chapter 15 89

The Behavior of Market Price l If OPEC cartel didn’t exist, could estimate oil prices by production decisions of producers. l To maximize return, producers will follow production rule stated previously m Price minus marginal cost must rise at exactly the rate of interest m Why? © 2005 Pearson Education, Inc. Chapter 15 90

The Behavior of Market Price l If OPEC cartel didn’t exist, could estimate oil prices by production decisions of producers. l To maximize return, producers will follow production rule stated previously m Price minus marginal cost must rise at exactly the rate of interest m Why? © 2005 Pearson Education, Inc. Chapter 15 90

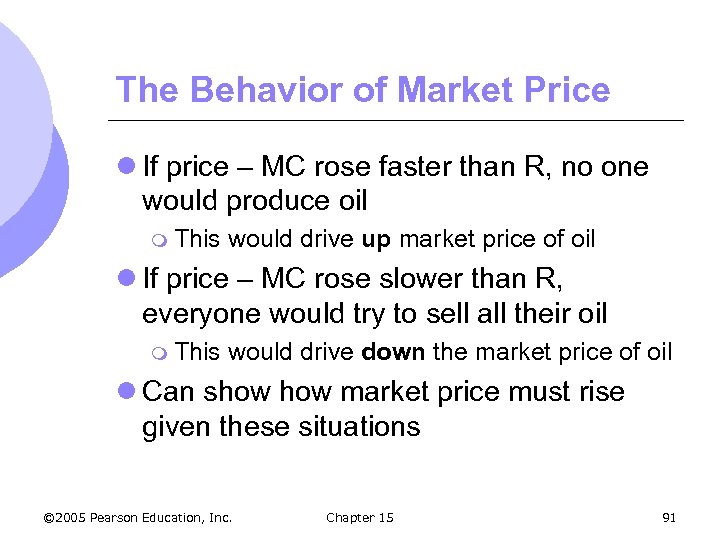

The Behavior of Market Price l If price – MC rose faster than R, no one would produce oil m This would drive up market price of oil l If price – MC rose slower than R, everyone would try to sell all their oil m This would drive down the market price of oil l Can show market price must rise given these situations © 2005 Pearson Education, Inc. Chapter 15 91

The Behavior of Market Price l If price – MC rose faster than R, no one would produce oil m This would drive up market price of oil l If price – MC rose slower than R, everyone would try to sell all their oil m This would drive down the market price of oil l Can show market price must rise given these situations © 2005 Pearson Education, Inc. Chapter 15 91

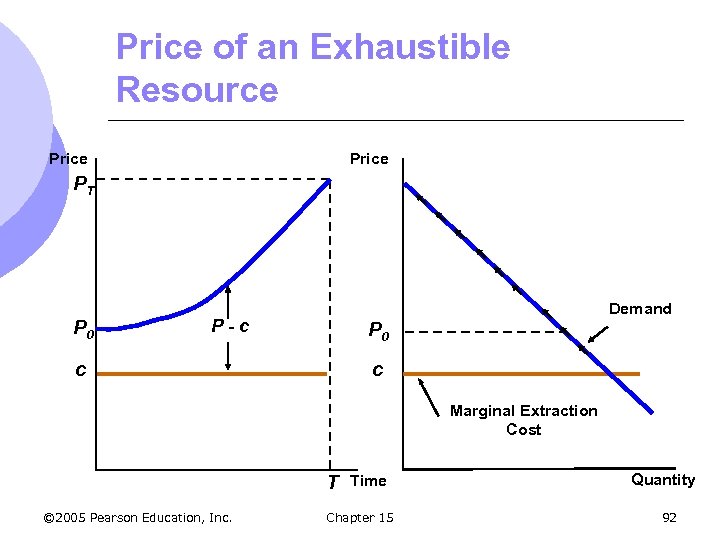

Price of an Exhaustible Resource Price PT P 0 Demand P-c P 0 c c Marginal Extraction Cost T © 2005 Pearson Education, Inc. Time Chapter 15 Quantity 92

Price of an Exhaustible Resource Price PT P 0 Demand P-c P 0 c c Marginal Extraction Cost T © 2005 Pearson Education, Inc. Time Chapter 15 Quantity 92

Price of an Exhaustible Resource l Notice P > MC m Is this a contradiction to the competitive rule that P = MC? l Total marginal cost must include extraction costs AND opportunity cost m User cost of production l Opportunity cost of producing and selling a unit today making it unavailable for production and sale in the future © 2005 Pearson Education, Inc. Chapter 15 93

Price of an Exhaustible Resource l Notice P > MC m Is this a contradiction to the competitive rule that P = MC? l Total marginal cost must include extraction costs AND opportunity cost m User cost of production l Opportunity cost of producing and selling a unit today making it unavailable for production and sale in the future © 2005 Pearson Education, Inc. Chapter 15 93

Price of an Exhaustible Resource l P = MC m MC = extraction cost + user cost m User cost = P - marginal extraction cost l User cost rises over time m As resource remaining in ground becomes scarcer, opportunity cost of depleting another unit becomes higher © 2005 Pearson Education, Inc. Chapter 15 94

Price of an Exhaustible Resource l P = MC m MC = extraction cost + user cost m User cost = P - marginal extraction cost l User cost rises over time m As resource remaining in ground becomes scarcer, opportunity cost of depleting another unit becomes higher © 2005 Pearson Education, Inc. Chapter 15 94

Resource Production by a Monopolist l How would a monopolist choose their rate of production? m Value of unit is marginal revenue minus marginal cost m They will produce so that marginal revenue less marginal cost rises at exactly the rate of interest, or (MRt+1 – c) = (1 + R)(MRt – c) © 2005 Pearson Education, Inc. Chapter 15 95

Resource Production by a Monopolist l How would a monopolist choose their rate of production? m Value of unit is marginal revenue minus marginal cost m They will produce so that marginal revenue less marginal cost rises at exactly the rate of interest, or (MRt+1 – c) = (1 + R)(MRt – c) © 2005 Pearson Education, Inc. Chapter 15 95

Resource Production by a Monopolist l For a monopolist with a downward sloping demand, price is greater than MR l (MR – MC) < (P – MC) l The monopolist is more conservationist than a competitive industry. m They start out charging a higher price and deplete the resources more slowly. © 2005 Pearson Education, Inc. Chapter 15 96

Resource Production by a Monopolist l For a monopolist with a downward sloping demand, price is greater than MR l (MR – MC) < (P – MC) l The monopolist is more conservationist than a competitive industry. m They start out charging a higher price and deplete the resources more slowly. © 2005 Pearson Education, Inc. Chapter 15 96

How Depletable Are Depletable Resources? l For some resources such as oil, natural gas and helium, in ground reserves are only equal to about 50 – 100 years of current consumption m User cost is significant part of market price l For resources like coal and iron, reserves are close to thousands of year of current consumption m User © 2005 Pearson Education, Inc. cost is very small Chapter 15 97

How Depletable Are Depletable Resources? l For some resources such as oil, natural gas and helium, in ground reserves are only equal to about 50 – 100 years of current consumption m User cost is significant part of market price l For resources like coal and iron, reserves are close to thousands of year of current consumption m User © 2005 Pearson Education, Inc. cost is very small Chapter 15 97

How Depletable Are Depletable Resources? l Can estimate user cost from geological information about existing and potential reserves l Also need to know demand curve and likely factors shifting it over time l In competitive market, determine user cost from economic rent earned by owners of resource bearing lands © 2005 Pearson Education, Inc. Chapter 15 98

How Depletable Are Depletable Resources? l Can estimate user cost from geological information about existing and potential reserves l Also need to know demand curve and likely factors shifting it over time l In competitive market, determine user cost from economic rent earned by owners of resource bearing lands © 2005 Pearson Education, Inc. Chapter 15 98

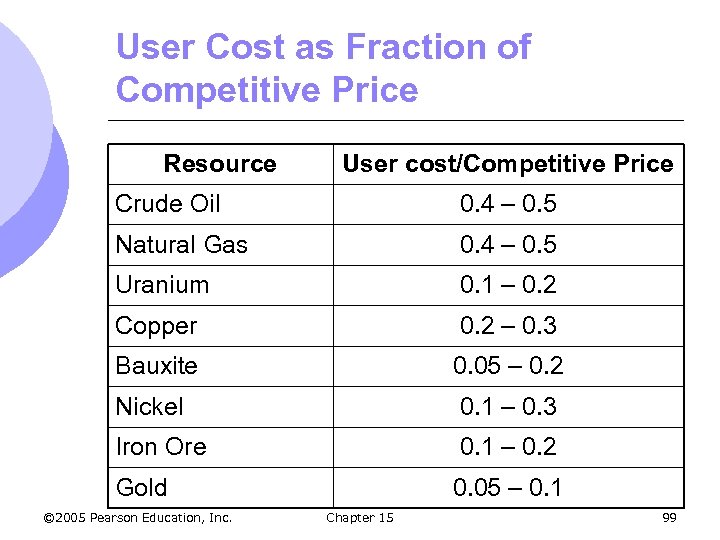

User Cost as Fraction of Competitive Price Resource User cost/Competitive Price Crude Oil 0. 4 – 0. 5 Natural Gas 0. 4 – 0. 5 Uranium 0. 1 – 0. 2 Copper 0. 2 – 0. 3 Bauxite 0. 05 – 0. 2 Nickel 0. 1 – 0. 3 Iron Ore 0. 1 – 0. 2 Gold 0. 05 – 0. 1 © 2005 Pearson Education, Inc. Chapter 15 99

User Cost as Fraction of Competitive Price Resource User cost/Competitive Price Crude Oil 0. 4 – 0. 5 Natural Gas 0. 4 – 0. 5 Uranium 0. 1 – 0. 2 Copper 0. 2 – 0. 3 Bauxite 0. 05 – 0. 2 Nickel 0. 1 – 0. 3 Iron Ore 0. 1 – 0. 2 Gold 0. 05 – 0. 1 © 2005 Pearson Education, Inc. Chapter 15 99

How Depletable Are Depletable Resources? l Notice that only crude oil and natural gas have a user cost as a substantial component of price l Of the sharp price fluctuations, user cost has almost nothing to do with them m Oil prices change from OPEC and conflict in Persian Gulf l Resource depletion has not had much effect on prices of those resources © 2005 Pearson Education, Inc. Chapter 15 100

How Depletable Are Depletable Resources? l Notice that only crude oil and natural gas have a user cost as a substantial component of price l Of the sharp price fluctuations, user cost has almost nothing to do with them m Oil prices change from OPEC and conflict in Persian Gulf l Resource depletion has not had much effect on prices of those resources © 2005 Pearson Education, Inc. Chapter 15 100

How Are Interest Rates Determined? l The interest rate is the price that borrowers pay lenders to use their funds. m Determined by supply and demand for loanable funds. m Supply of loanable funds comes from household savings m Demand for loanable funds comes from l Household consuming more than income l Firms wanting to make capital investments © 2005 Pearson Education, Inc. Chapter 15 101

How Are Interest Rates Determined? l The interest rate is the price that borrowers pay lenders to use their funds. m Determined by supply and demand for loanable funds. m Supply of loanable funds comes from household savings m Demand for loanable funds comes from l Household consuming more than income l Firms wanting to make capital investments © 2005 Pearson Education, Inc. Chapter 15 101

How are Interest Rates Determined? l For households, the higher the interest rate, the greater the cost of consuming m Less willing to borrow m Demand is declining function of interest rate l Firms invest in project when NPV > 0 m Higher interest rate means lower NPV m Demand is downward sloping l Total demand for loanable funds is sum of household demand firm demand © 2005 Pearson Education, Inc. Chapter 15 102

How are Interest Rates Determined? l For households, the higher the interest rate, the greater the cost of consuming m Less willing to borrow m Demand is declining function of interest rate l Firms invest in project when NPV > 0 m Higher interest rate means lower NPV m Demand is downward sloping l Total demand for loanable funds is sum of household demand firm demand © 2005 Pearson Education, Inc. Chapter 15 102

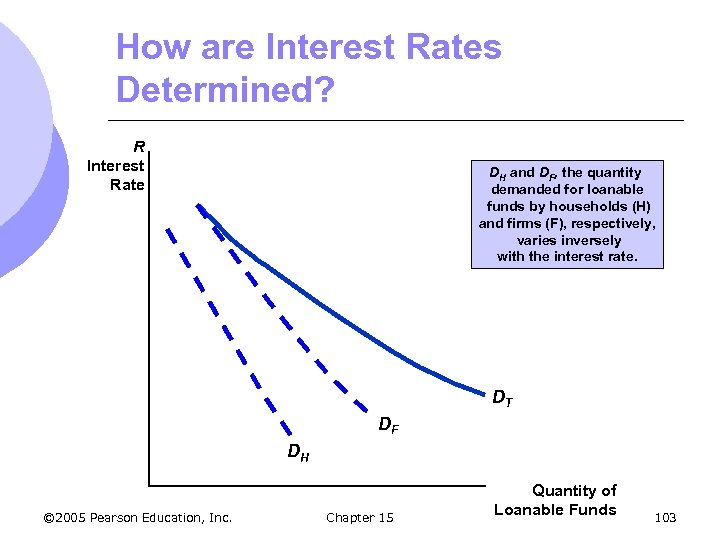

How are Interest Rates Determined? R Interest Rate DH and DF, the quantity demanded for loanable funds by households (H) and firms (F), respectively, varies inversely with the interest rate. DT DF DH © 2005 Pearson Education, Inc. Chapter 15 Quantity of Loanable Funds 103

How are Interest Rates Determined? R Interest Rate DH and DF, the quantity demanded for loanable funds by households (H) and firms (F), respectively, varies inversely with the interest rate. DT DF DH © 2005 Pearson Education, Inc. Chapter 15 Quantity of Loanable Funds 103

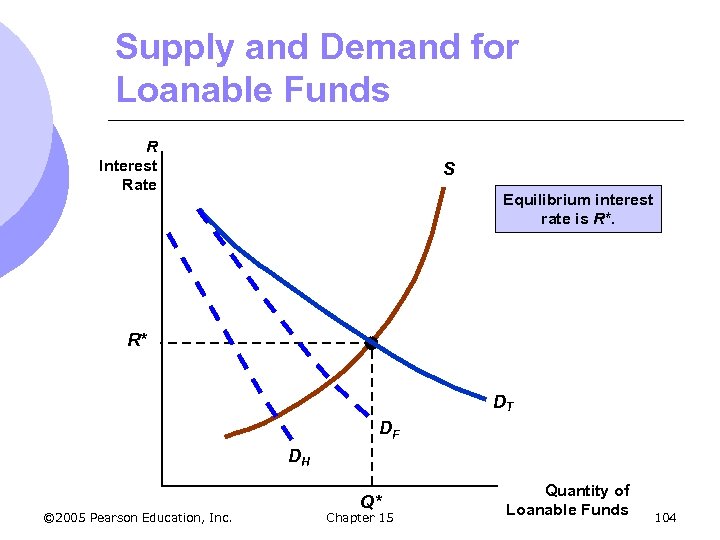

Supply and Demand for Loanable Funds R Interest Rate S Equilibrium interest rate is R*. R* DT DF DH © 2005 Pearson Education, Inc. Q* Chapter 15 Quantity of Loanable Funds 104

Supply and Demand for Loanable Funds R Interest Rate S Equilibrium interest rate is R*. R* DT DF DH © 2005 Pearson Education, Inc. Q* Chapter 15 Quantity of Loanable Funds 104

How are Interest Rates Determined? l The supply and demand for loanable funds, determines the equilibrium interest rate m If recession hits, NPV of projects will fall, firms will invest less, and demand for loanable funds will fall l DF and DT will fall causing interest rate to fall m If government has to borrow money, demand will increase and R also increases m FED shifts supply of loanable funds as well © 2005 Pearson Education, Inc. Chapter 15 105

How are Interest Rates Determined? l The supply and demand for loanable funds, determines the equilibrium interest rate m If recession hits, NPV of projects will fall, firms will invest less, and demand for loanable funds will fall l DF and DT will fall causing interest rate to fall m If government has to borrow money, demand will increase and R also increases m FED shifts supply of loanable funds as well © 2005 Pearson Education, Inc. Chapter 15 105

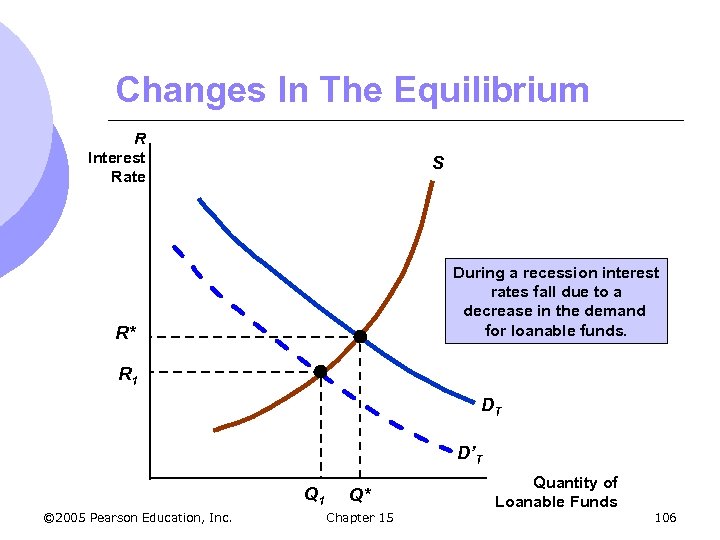

Changes In The Equilibrium R Interest Rate S During a recession interest rates fall due to a decrease in the demand for loanable funds. R* R 1 DT D’T Q 1 © 2005 Pearson Education, Inc. Q* Chapter 15 Quantity of Loanable Funds 106

Changes In The Equilibrium R Interest Rate S During a recession interest rates fall due to a decrease in the demand for loanable funds. R* R 1 DT D’T Q 1 © 2005 Pearson Education, Inc. Q* Chapter 15 Quantity of Loanable Funds 106

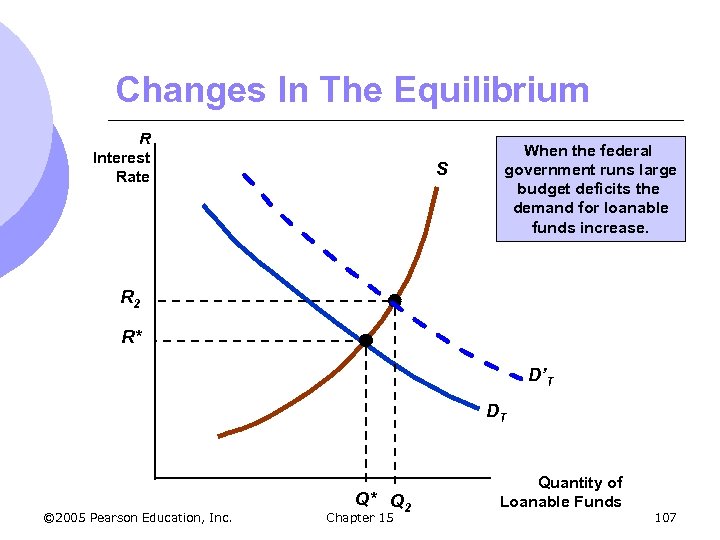

Changes In The Equilibrium R Interest Rate S When the federal government runs large budget deficits the demand for loanable funds increase. R 2 R* D’T DT © 2005 Pearson Education, Inc. Q* Q 2 Chapter 15 Quantity of Loanable Funds 107

Changes In The Equilibrium R Interest Rate S When the federal government runs large budget deficits the demand for loanable funds increase. R 2 R* D’T DT © 2005 Pearson Education, Inc. Q* Q 2 Chapter 15 Quantity of Loanable Funds 107

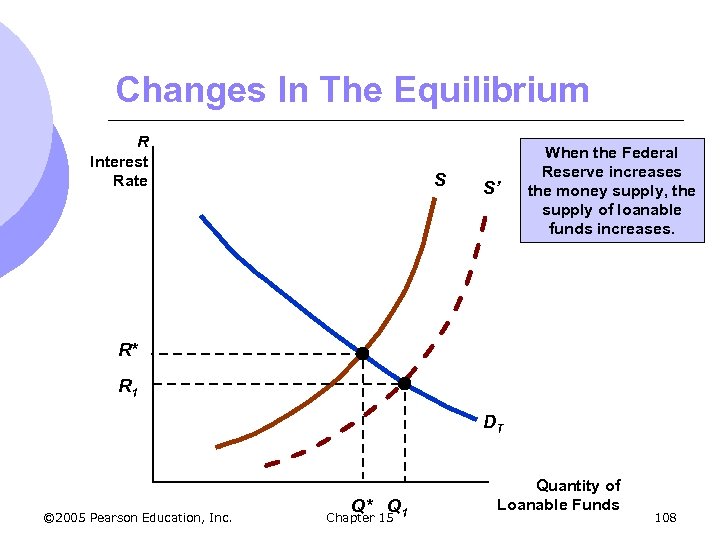

Changes In The Equilibrium R Interest Rate S S’ When the Federal Reserve increases the money supply, the supply of loanable funds increases. R* R 1 DT © 2005 Pearson Education, Inc. Q* Q Chapter 15 1 Quantity of Loanable Funds 108

Changes In The Equilibrium R Interest Rate S S’ When the Federal Reserve increases the money supply, the supply of loanable funds increases. R* R 1 DT © 2005 Pearson Education, Inc. Q* Q Chapter 15 1 Quantity of Loanable Funds 108

A Variety of Interest Rates 1. Treasury Bill Rate m m m Short term (1 yr or less) bond issued by US government Pure discount bond – no coupon payments Short-term, risk-free rate 2. Treasury Bond Rate m m Longer term bond, typically 10 -30 yrs Rates depend on maturity of bond © 2005 Pearson Education, Inc. Chapter 15 109

A Variety of Interest Rates 1. Treasury Bill Rate m m m Short term (1 yr or less) bond issued by US government Pure discount bond – no coupon payments Short-term, risk-free rate 2. Treasury Bond Rate m m Longer term bond, typically 10 -30 yrs Rates depend on maturity of bond © 2005 Pearson Education, Inc. Chapter 15 109

A Variety of Interest Rates 3. Discount Rate m Rate Federal Reserve charges commercial banks for short period loans, called discounts 4. Federal Funds Rate m m Interest rate banks charge one another for overnight loans of federal funds Banks with excess reserves may loan them to banks with reserve deficiencies © 2005 Pearson Education, Inc. Chapter 15 110

A Variety of Interest Rates 3. Discount Rate m Rate Federal Reserve charges commercial banks for short period loans, called discounts 4. Federal Funds Rate m m Interest rate banks charge one another for overnight loans of federal funds Banks with excess reserves may loan them to banks with reserve deficiencies © 2005 Pearson Education, Inc. Chapter 15 110

A Variety of Interest Rates 5. Commercial Paper Rate m m Short-term (6 months or less) discount bonds used by high-quality corporate borrowers Slightly riskier than treasury bills, so rate less than 1% higher than Treasury bill rate © 2005 Pearson Education, Inc. Chapter 15 111

A Variety of Interest Rates 5. Commercial Paper Rate m m Short-term (6 months or less) discount bonds used by high-quality corporate borrowers Slightly riskier than treasury bills, so rate less than 1% higher than Treasury bill rate © 2005 Pearson Education, Inc. Chapter 15 111

A Variety of Interest Rates 6. Prime Rate m m m Sometimes called the reference rate Rate large banks post as a reference point for short-term loans to biggest corporate borrowers Does not fluctuate form day to day © 2005 Pearson Education, Inc. Chapter 15 112

A Variety of Interest Rates 6. Prime Rate m m m Sometimes called the reference rate Rate large banks post as a reference point for short-term loans to biggest corporate borrowers Does not fluctuate form day to day © 2005 Pearson Education, Inc. Chapter 15 112

A Variety of Interest Rates 7. Corporate Bond Rate m Long term (typically 20 yrs) corporate bonds with different risks l m m High grade, medium grade, etc Average yields indicate how much corporations are paying for long term debt Vary considerably © 2005 Pearson Education, Inc. Chapter 15 113

A Variety of Interest Rates 7. Corporate Bond Rate m Long term (typically 20 yrs) corporate bonds with different risks l m m High grade, medium grade, etc Average yields indicate how much corporations are paying for long term debt Vary considerably © 2005 Pearson Education, Inc. Chapter 15 113