Chapter 15 Capital Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

Chapter 15 Capital Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

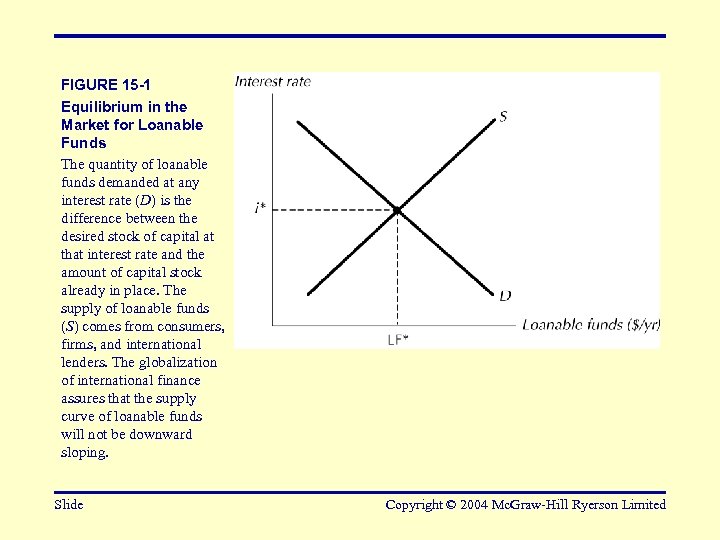

FIGURE 15 -1 Equilibrium in the Market for Loanable Funds The quantity of loanable funds demanded at any interest rate (D) is the difference between the desired stock of capital at that interest rate and the amount of capital stock already in place. The supply of loanable funds (S) comes from consumers, firms, and international lenders. The globalization of international finance assures that the supply curve of loanable funds will not be downward sloping. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

FIGURE 15 -1 Equilibrium in the Market for Loanable Funds The quantity of loanable funds demanded at any interest rate (D) is the difference between the desired stock of capital at that interest rate and the amount of capital stock already in place. The supply of loanable funds (S) comes from consumers, firms, and international lenders. The globalization of international finance assures that the supply curve of loanable funds will not be downward sloping. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

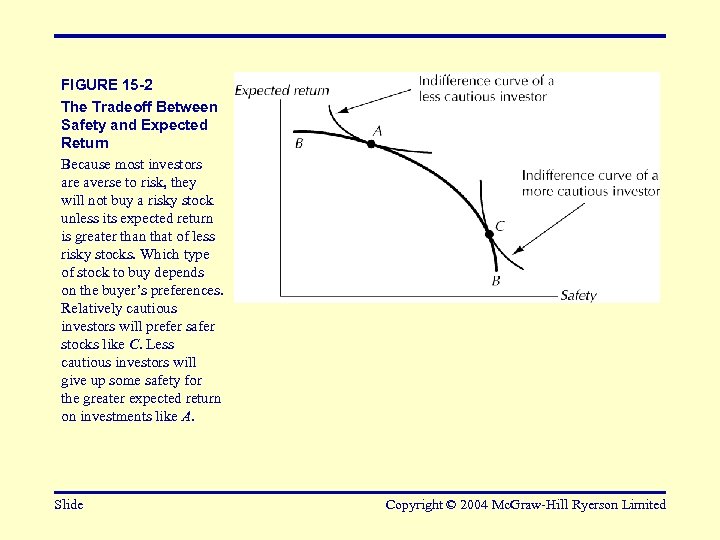

FIGURE 15 -2 The Tradeoff Between Safety and Expected Return Because most investors are averse to risk, they will not buy a risky stock unless its expected return is greater than that of less risky stocks. Which type of stock to buy depends on the buyer’s preferences. Relatively cautious investors will prefer safer stocks like C. Less cautious investors will give up some safety for the greater expected return on investments like A. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

FIGURE 15 -2 The Tradeoff Between Safety and Expected Return Because most investors are averse to risk, they will not buy a risky stock unless its expected return is greater than that of less risky stocks. Which type of stock to buy depends on the buyer’s preferences. Relatively cautious investors will prefer safer stocks like C. Less cautious investors will give up some safety for the greater expected return on investments like A. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

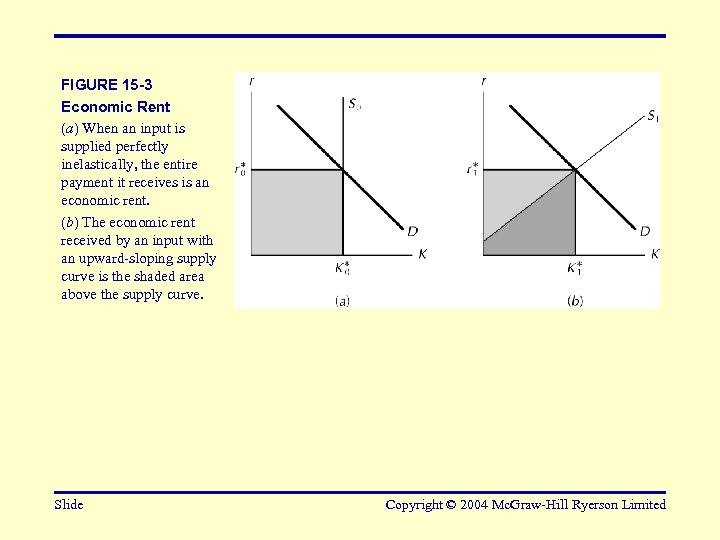

FIGURE 15 -3 Economic Rent (a) When an input is supplied perfectly inelastically, the entire payment it receives is an economic rent. (b) The economic rent received by an input with an upward-sloping supply curve is the shaded area above the supply curve. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

FIGURE 15 -3 Economic Rent (a) When an input is supplied perfectly inelastically, the entire payment it receives is an economic rent. (b) The economic rent received by an input with an upward-sloping supply curve is the shaded area above the supply curve. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

FIGURE 15 -4 The Effect of Peak. Load Pricing By charging higher prices during the peak hours (P = 12) and lower prices during the offpeak hours (P = 5), utilities give their customers an incentive to shift consumption onto off-peak hours. The resulting fall in peakperiod usage enables the utility to serve its customers with a significantly smaller stock of generating equipment. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited

FIGURE 15 -4 The Effect of Peak. Load Pricing By charging higher prices during the peak hours (P = 12) and lower prices during the offpeak hours (P = 5), utilities give their customers an incentive to shift consumption onto off-peak hours. The resulting fall in peakperiod usage enables the utility to serve its customers with a significantly smaller stock of generating equipment. Slide Copyright © 2004 Mc. Graw-Hill Ryerson Limited