8a49565e0f082b59888d4d256d78e0df.ppt

- Количество слайдов: 25

Chapter 14 Tutorial Environmental Economics © 2000 South-Western College Publishing 1

Chapter 14 Tutorial Environmental Economics © 2000 South-Western College Publishing 1

1. Recently the city of New Orleans discovered chemical compounds in its drinking water. The source is the waste discharges of industrial plants upstream. This is an example of a. an external cost imposed on the citizens of New Orleans by the industrial plants upstream. b. a market failure where the market price of the output of these industrial plants does not fully reflect the social cost of producing these goods. c. an externality where the marginal social costs of producing these industrial goods differ from the marginal private costs. d. all of the above. 2

1. Recently the city of New Orleans discovered chemical compounds in its drinking water. The source is the waste discharges of industrial plants upstream. This is an example of a. an external cost imposed on the citizens of New Orleans by the industrial plants upstream. b. a market failure where the market price of the output of these industrial plants does not fully reflect the social cost of producing these goods. c. an externality where the marginal social costs of producing these industrial goods differ from the marginal private costs. d. all of the above. 2

1. D. The upstream firm is releasing chemicals into the water, an external cost to the citizens of New Orleans. The upstream firm is not including these costs when pricing its product; hence, the market price is too low. Marginal social costs would include the marginal private cost of the industrial product (their costs of labor, capital, materials, etc. ) and the external cost of the chemicals released into the water. Choices (a), (b), and (c)each are correct, so that all of the above is the correct choice. 3

1. D. The upstream firm is releasing chemicals into the water, an external cost to the citizens of New Orleans. The upstream firm is not including these costs when pricing its product; hence, the market price is too low. Marginal social costs would include the marginal private cost of the industrial product (their costs of labor, capital, materials, etc. ) and the external cost of the chemicals released into the water. Choices (a), (b), and (c)each are correct, so that all of the above is the correct choice. 3

2. A government policy that charges steel firms a fee per ton of steel produced (an effluent charge) where the fee is determined by the amount of pollutants discharged into the air or water will lead to a. a decrease in the market equilibrium quantity of steel produced. b. a decrease in the market equilibrium price of steel. c. an increase in the market equilibrium price of steel. d. the results in (a) and (b). e. the results in (a) and (c ). 4

2. A government policy that charges steel firms a fee per ton of steel produced (an effluent charge) where the fee is determined by the amount of pollutants discharged into the air or water will lead to a. a decrease in the market equilibrium quantity of steel produced. b. a decrease in the market equilibrium price of steel. c. an increase in the market equilibrium price of steel. d. the results in (a) and (b). e. the results in (a) and (c ). 4

2. E. Essentially, the government is employing an effluent tax to reduce pollution. The tax increases the cost of production. Supply decreases, leading to a higher price and smaller quantity. So choice (e), where (a) quantity decreases and (c)price increases, is the best choice. 5

2. E. Essentially, the government is employing an effluent tax to reduce pollution. The tax increases the cost of production. Supply decreases, leading to a higher price and smaller quantity. So choice (e), where (a) quantity decreases and (c)price increases, is the best choice. 5

3. Social costs are a. the full resource costs of an economic activity. b. usually less than private costs. c. the costs of an economic activity borne by the producer. d. all of the above. 6

3. Social costs are a. the full resource costs of an economic activity. b. usually less than private costs. c. the costs of an economic activity borne by the producer. d. all of the above. 6

3. A. Social costs include both private costs (the costs of the firm’s inputs, including labor, capital, land, etc. ) and external costs (the costs to third parties, such as pollution emitted by the producer). Social costs are at least as large as private costs. Producers will not consider external costs, which are a part of social costs, unless they are forced to do so by government or court. 7

3. A. Social costs include both private costs (the costs of the firm’s inputs, including labor, capital, land, etc. ) and external costs (the costs to third parties, such as pollution emitted by the producer). Social costs are at least as large as private costs. Producers will not consider external costs, which are a part of social costs, unless they are forced to do so by government or court. 7

4. As a general rule, if pollution costs are external, firms will produce a. too much of a polluting good. b. too little of a polluting good. c. an optimal amount of a polluting good. d. an amount that cannot be determined without additional information. 8

4. As a general rule, if pollution costs are external, firms will produce a. too much of a polluting good. b. too little of a polluting good. c. an optimal amount of a polluting good. d. an amount that cannot be determined without additional information. 8

4. A. Private firms will make their production decision using private costs. If there are external costs, social costs exceed private costs. If production decisions included external costs, supply would be smaller than when private costs alone are considered. So if external costs are ignored, the firm will produce too much, as compared to the social efficient level. 9

4. A. Private firms will make their production decision using private costs. If there are external costs, social costs exceed private costs. If production decisions included external costs, supply would be smaller than when private costs alone are considered. So if external costs are ignored, the firm will produce too much, as compared to the social efficient level. 9

5. Many economists would argue a. the optimal amount of pollution is greater than zero. b. all pollution should be eliminated. c. the market mechanism can handle pollution without any government intervention. d. central planning is the most efficient way to eliminate pollution. 10

5. Many economists would argue a. the optimal amount of pollution is greater than zero. b. all pollution should be eliminated. c. the market mechanism can handle pollution without any government intervention. d. central planning is the most efficient way to eliminate pollution. 10

5. A. The optimal amount of pollution is where marginal social cost equals marginal social benefit. This amount typically exceeds zero. The marginal cost of eliminating all pollution would likely be very high. For example, we would have to eliminate all cars. However, firms tend to ignore external costs such as pollution, in an unfettered market. While government is likely to be needed, pollution has actually been worse in centrally planned economies. 11

5. A. The optimal amount of pollution is where marginal social cost equals marginal social benefit. This amount typically exceeds zero. The marginal cost of eliminating all pollution would likely be very high. For example, we would have to eliminate all cars. However, firms tend to ignore external costs such as pollution, in an unfettered market. While government is likely to be needed, pollution has actually been worse in centrally planned economies. 11

6. Which of the following used marketable pollution permits as an incentive for reducing pollution? a. The 1970 Clean Air Act. b. The Comprehensive Environmental Response, Compensation, and Liability Act of 1980. c. The 1990 Clean Air Act amendments. d. The Water Quality and Improvement Act of 1970. 12

6. Which of the following used marketable pollution permits as an incentive for reducing pollution? a. The 1970 Clean Air Act. b. The Comprehensive Environmental Response, Compensation, and Liability Act of 1980. c. The 1990 Clean Air Act amendments. d. The Water Quality and Improvement Act of 1970. 12

6. C. The 1990 Clean Air Act was the first piece of federal legislation to introduce emissions trading. It introduced this approach for sulfur emissions, thought to contribute to acid rain. 13

6. C. The 1990 Clean Air Act was the first piece of federal legislation to introduce emissions trading. It introduced this approach for sulfur emissions, thought to contribute to acid rain. 13

7. The disposable diaper industry is perfectly competitive. Which of the following is true? a. Since the industry is perfectly competitive, price and quantity are at the socially efficient levels. b. Competitive price is higher and competitive quantity lower than the socially efficient point. c. Competitive price is higher and competitive quantity higher than the socially efficient point. d. Competitive price is lower and competitive quantity higher than the socially efficient point. 14

7. The disposable diaper industry is perfectly competitive. Which of the following is true? a. Since the industry is perfectly competitive, price and quantity are at the socially efficient levels. b. Competitive price is higher and competitive quantity lower than the socially efficient point. c. Competitive price is higher and competitive quantity higher than the socially efficient point. d. Competitive price is lower and competitive quantity higher than the socially efficient point. 14

7. D. Disposable diapers have an external cost, to the extent that they are not biodegradable and sit in landfills. Producers in a competitive market consider only private costs, ignoring disposal issues. Similarly, consumers just want to prevent leaks that affect them, but ignore leaks that affect landfills. So producers and consumers use private costs and benefits. Social costs are higher, so that social supply is smaller. The competitive price, based on private costs and benefits, is lower than the social cost. Competitive quantity is larger, given the larger supply, than the socially efficient quantity. 15

7. D. Disposable diapers have an external cost, to the extent that they are not biodegradable and sit in landfills. Producers in a competitive market consider only private costs, ignoring disposal issues. Similarly, consumers just want to prevent leaks that affect them, but ignore leaks that affect landfills. So producers and consumers use private costs and benefits. Social costs are higher, so that social supply is smaller. The competitive price, based on private costs and benefits, is lower than the social cost. Competitive quantity is larger, given the larger supply, than the socially efficient quantity. 15

8. An example of the command-control approach to environmental policy is a. placing a tax on high-sulfur coal to reduce its use and the corresponding sulfur emissions (which contribute to acid rain). b. requiring electric utilities to install scrubbers to reduce sulfur dioxide emissions (which contribute to acid rain). c. allowing coal producers to buy and sell permits to allow sulfur emissions. d. allowing individuals to sue coal producers if sulfur emissions exceed government-set standard. 16

8. An example of the command-control approach to environmental policy is a. placing a tax on high-sulfur coal to reduce its use and the corresponding sulfur emissions (which contribute to acid rain). b. requiring electric utilities to install scrubbers to reduce sulfur dioxide emissions (which contribute to acid rain). c. allowing coal producers to buy and sell permits to allow sulfur emissions. d. allowing individuals to sue coal producers if sulfur emissions exceed government-set standard. 16

8. B. Command-control is a regulation whereby the government establishes a pollution target and dictates the method to achieve the target. An example is requiring scrubbers to reduce sulfur emissions. Sulfur emission permits and effluent taxes are example of incentive-based approaches. With taxes, for example, the firm can choose low-sulfur coal to avoid the tax. 17

8. B. Command-control is a regulation whereby the government establishes a pollution target and dictates the method to achieve the target. An example is requiring scrubbers to reduce sulfur emissions. Sulfur emission permits and effluent taxes are example of incentive-based approaches. With taxes, for example, the firm can choose low-sulfur coal to avoid the tax. 17

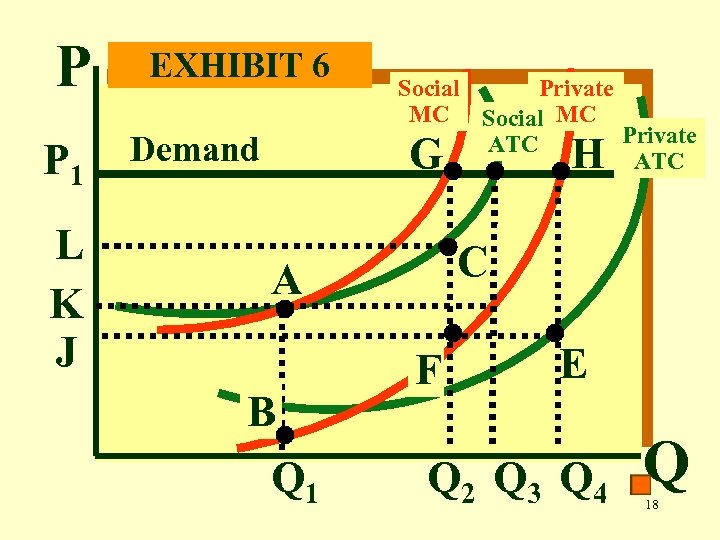

P P 1 L K J EXHIBIT 6 Social Private MC Social MC Private ATC G Demand C A B Q 1 H F E Q 2 Q 3 Q 4 Q 18

P P 1 L K J EXHIBIT 6 Social Private MC Social MC Private ATC G Demand C A B Q 1 H F E Q 2 Q 3 Q 4 Q 18

9. The profit-maximizing firm in Exhibit 6 creates water and air pollution as a consequence of producing its output of beef cattle. If pollution costs are borne by third parties, the firm will maximize economic profit by choosing to a. voluntarily incur costs to reduce its pollution. b. produce at output rate Q 3 c. produce at output rate Q 2 d. produce at output rate Q 4 D. The firm will produce at Q 4 where demand (MR) intersects Private MC. 19

9. The profit-maximizing firm in Exhibit 6 creates water and air pollution as a consequence of producing its output of beef cattle. If pollution costs are borne by third parties, the firm will maximize economic profit by choosing to a. voluntarily incur costs to reduce its pollution. b. produce at output rate Q 3 c. produce at output rate Q 2 d. produce at output rate Q 4 D. The firm will produce at Q 4 where demand (MR) intersects Private MC. 19

10. Use Exhibit 6 to complete the following: To maximize social welfare, the firm should produce at output rate a. Q 1 b. Q 2 c. Q 3 d. Q 4 B. The firm will produce at Q 2, where demand (MR) intersects Social MC. 20

10. Use Exhibit 6 to complete the following: To maximize social welfare, the firm should produce at output rate a. Q 1 b. Q 2 c. Q 3 d. Q 4 B. The firm will produce at Q 2, where demand (MR) intersects Social MC. 20

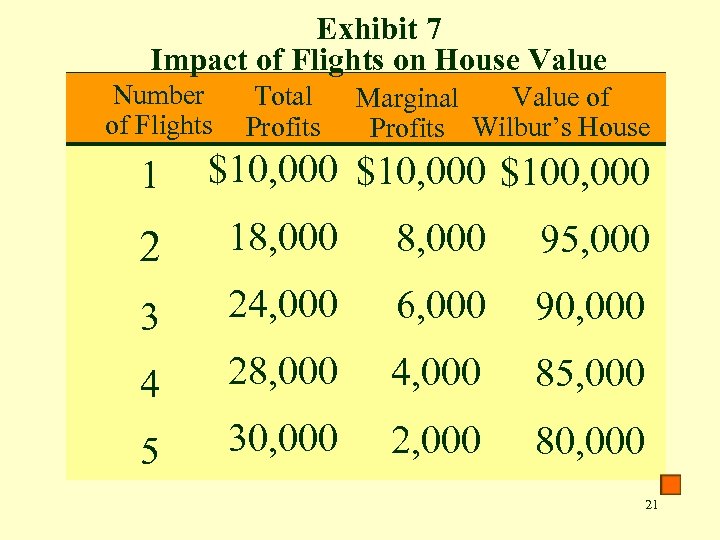

Exhibit 7 Impact of Flights on House Value Number of Flights 1 Total Profits Value of Marginal Profits Wilbur’s House $10, 000 $100, 000 2 18, 000 95, 000 3 24, 000 6, 000 90, 000 4 28, 000 4, 000 85, 000 5 30, 000 2, 000 80, 000 21

Exhibit 7 Impact of Flights on House Value Number of Flights 1 Total Profits Value of Marginal Profits Wilbur’s House $10, 000 $100, 000 2 18, 000 95, 000 3 24, 000 6, 000 90, 000 4 28, 000 4, 000 85, 000 5 30, 000 2, 000 80, 000 21

11. As shown in Exhibit 7, if Orville has the property right to fly over Wilbur’s house, but Wilbur is allowed to negotiate with Orville on the number of flights, what will be the number of flights? a. 2. b. 3. c. 4. d. 5. C. At 4 flights, marginal profits for Orville is $4, 000 and the value of Wilbur’s property goes down by $5, 000. 22

11. As shown in Exhibit 7, if Orville has the property right to fly over Wilbur’s house, but Wilbur is allowed to negotiate with Orville on the number of flights, what will be the number of flights? a. 2. b. 3. c. 4. d. 5. C. At 4 flights, marginal profits for Orville is $4, 000 and the value of Wilbur’s property goes down by $5, 000. 22

12. As shown in Exhibit 7, Wilbur has the property right to have no planes flying over his house, but Orville is allowed to negotiate with Wilbur, what will be the number of flights? a. 2. b. 3. c. 4. d. 5. B. At 3 flights, marginal profits for Orville is $6, 000 and the value of Wilbur’s property goes down by $5, 000. 23

12. As shown in Exhibit 7, Wilbur has the property right to have no planes flying over his house, but Orville is allowed to negotiate with Wilbur, what will be the number of flights? a. 2. b. 3. c. 4. d. 5. B. At 3 flights, marginal profits for Orville is $6, 000 and the value of Wilbur’s property goes down by $5, 000. 23

13. As shown in Exhibit 7, at the socially efficient number of flights, what will be the market value of Orville’s house? a. $100, 000. b. $95, 000. c. $90, 000. d. $85, 000. C. At 3 flights, this is the last number of flights that the marginal profits are greater than the marginal costs (ie. the amount that Orville’s house declines in value) 24

13. As shown in Exhibit 7, at the socially efficient number of flights, what will be the market value of Orville’s house? a. $100, 000. b. $95, 000. c. $90, 000. d. $85, 000. C. At 3 flights, this is the last number of flights that the marginal profits are greater than the marginal costs (ie. the amount that Orville’s house declines in value) 24

END 25

END 25