bc702d254c04ff1fa953c12d199d023c.ppt

- Количество слайдов: 21

Chapter 14 Price Discrimination and Monopoly Practices 14. 1 © 2005 Pearson Education Canada Inc.

Chapter 14 Price Discrimination and Monopoly Practices 14. 1 © 2005 Pearson Education Canada Inc.

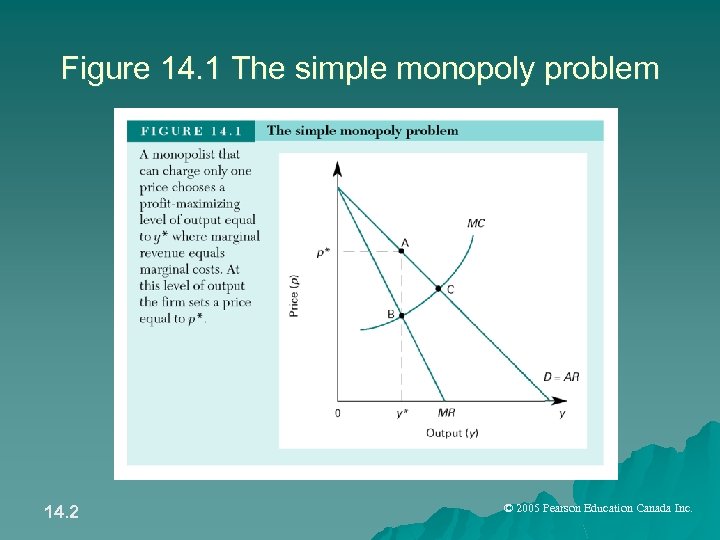

Figure 14. 1 The simple monopoly problem 14. 2 © 2005 Pearson Education Canada Inc.

Figure 14. 1 The simple monopoly problem 14. 2 © 2005 Pearson Education Canada Inc.

Price Discrimination and Market Segmentation u All price discrimination schemes share an underlying strategy to segment the market and to charge each segment a different price relative to its cost. u The monopolist’s goal is to turn consumer surplus into revenue. 14. 3 © 2005 Pearson Education Canada Inc.

Price Discrimination and Market Segmentation u All price discrimination schemes share an underlying strategy to segment the market and to charge each segment a different price relative to its cost. u The monopolist’s goal is to turn consumer surplus into revenue. 14. 3 © 2005 Pearson Education Canada Inc.

Price Discrimination Categories of price discrimination: 1. 2. 3. Perfect Price discrimination-successfully extracting the maximum possible profit from each customer and therefore the whole market. Ordinary Price Discrimination-identification of potential customer groups, charging each group a separate price. Multipart Pricing-charging different rates for different amounts (blocks) of a good or service. 14. 4 © 2005 Pearson Education Canada Inc.

Price Discrimination Categories of price discrimination: 1. 2. 3. Perfect Price discrimination-successfully extracting the maximum possible profit from each customer and therefore the whole market. Ordinary Price Discrimination-identification of potential customer groups, charging each group a separate price. Multipart Pricing-charging different rates for different amounts (blocks) of a good or service. 14. 4 © 2005 Pearson Education Canada Inc.

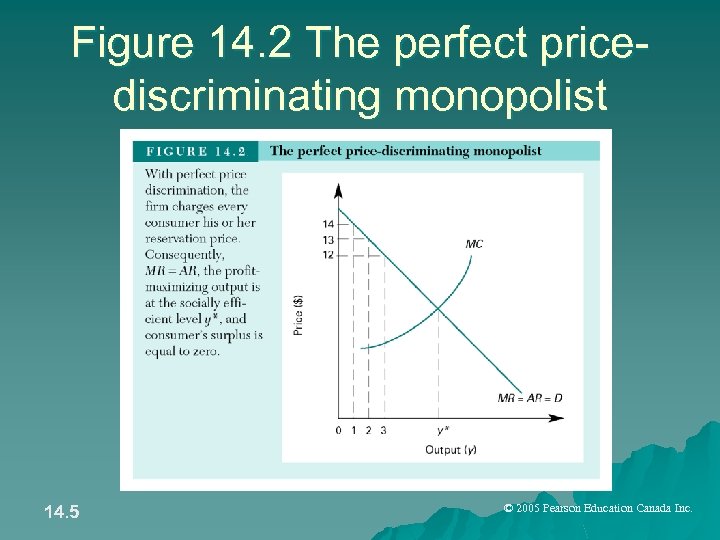

Figure 14. 2 The perfect pricediscriminating monopolist 14. 5 © 2005 Pearson Education Canada Inc.

Figure 14. 2 The perfect pricediscriminating monopolist 14. 5 © 2005 Pearson Education Canada Inc.

Price Discrimination u To maximize revenue from the sale of a fixed quantity of output, allocate output so that marginal revenue is identical in all markets. 14. 6 © 2005 Pearson Education Canada Inc.

Price Discrimination u To maximize revenue from the sale of a fixed quantity of output, allocate output so that marginal revenue is identical in all markets. 14. 6 © 2005 Pearson Education Canada Inc.

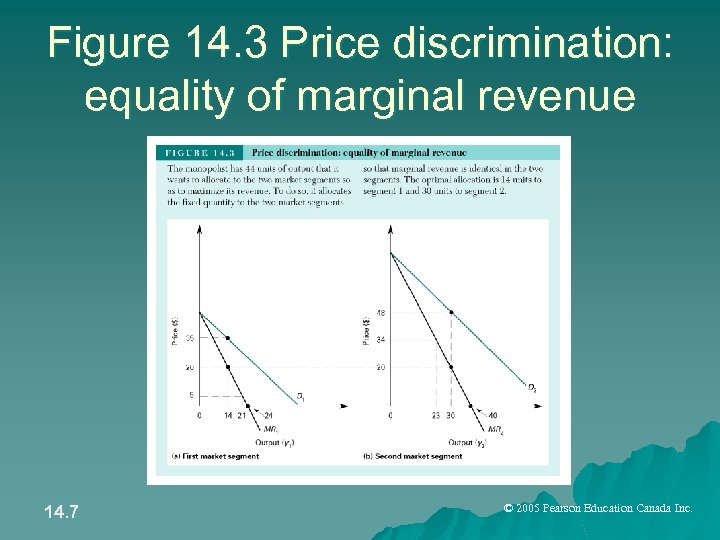

Figure 14. 3 Price discrimination: equality of marginal revenue 14. 7 © 2005 Pearson Education Canada Inc.

Figure 14. 3 Price discrimination: equality of marginal revenue 14. 7 © 2005 Pearson Education Canada Inc.

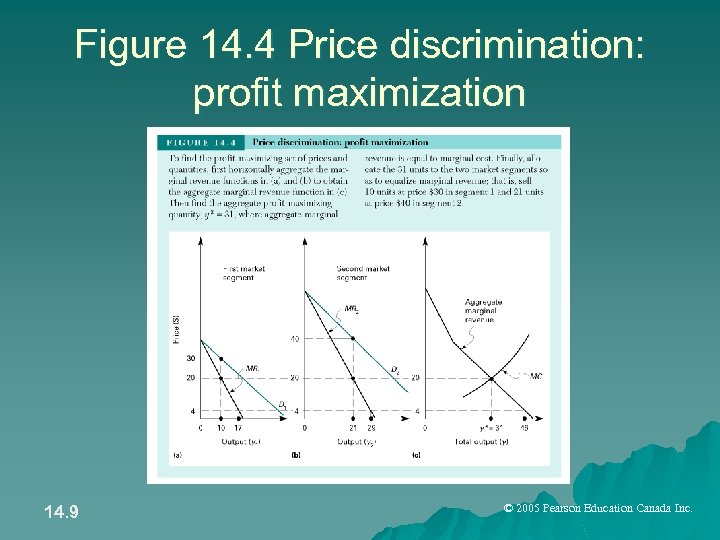

Price Discrimination u. A profit maximizing monopolist engaging in ordinary price discrimination will choose an aggregate output where (aggregate)MR=MC. u Output is allocated so MR is the same in all market segments. u Price is higher in the market segment with the lower price elasticity of demand. 14. 8 © 2005 Pearson Education Canada Inc.

Price Discrimination u. A profit maximizing monopolist engaging in ordinary price discrimination will choose an aggregate output where (aggregate)MR=MC. u Output is allocated so MR is the same in all market segments. u Price is higher in the market segment with the lower price elasticity of demand. 14. 8 © 2005 Pearson Education Canada Inc.

Figure 14. 4 Price discrimination: profit maximization 14. 9 © 2005 Pearson Education Canada Inc.

Figure 14. 4 Price discrimination: profit maximization 14. 9 © 2005 Pearson Education Canada Inc.

Price Discrimination u 1. 2. 14. 10 Criteria For Price Discrimination: The market must be able to identify different price elasticities of demand segment the market accordingly. Re-sale must not be possible or cost effective in order to prevent arbitrage (profitable re-selling). © 2005 Pearson Education Canada Inc.

Price Discrimination u 1. 2. 14. 10 Criteria For Price Discrimination: The market must be able to identify different price elasticities of demand segment the market accordingly. Re-sale must not be possible or cost effective in order to prevent arbitrage (profitable re-selling). © 2005 Pearson Education Canada Inc.

Price Discrimination u Methods of market segmentation: - Direct identification (seniors must show ID to get discounts). - Self selection (advance booking on airlines, stay a Saturday night). - Intertemporal-charging higher prices when the good is first introduced and reducing prices through time. 14. 11 © 2005 Pearson Education Canada Inc.

Price Discrimination u Methods of market segmentation: - Direct identification (seniors must show ID to get discounts). - Self selection (advance booking on airlines, stay a Saturday night). - Intertemporal-charging higher prices when the good is first introduced and reducing prices through time. 14. 11 © 2005 Pearson Education Canada Inc.

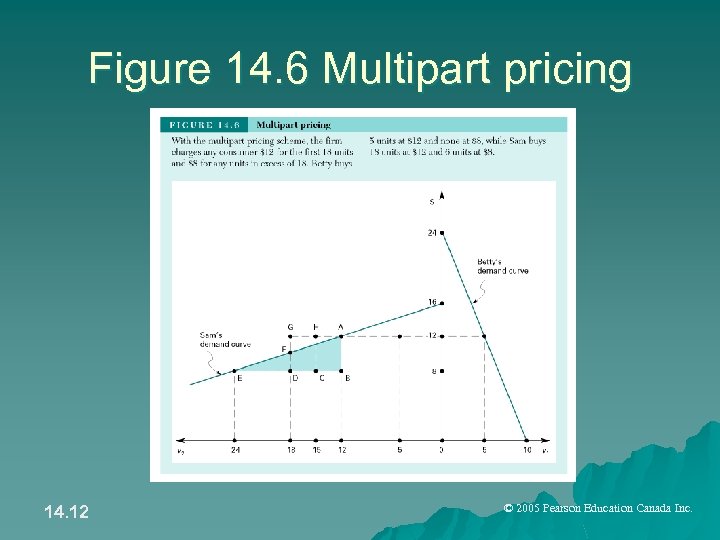

Figure 14. 6 Multipart pricing 14. 12 © 2005 Pearson Education Canada Inc.

Figure 14. 6 Multipart pricing 14. 12 © 2005 Pearson Education Canada Inc.

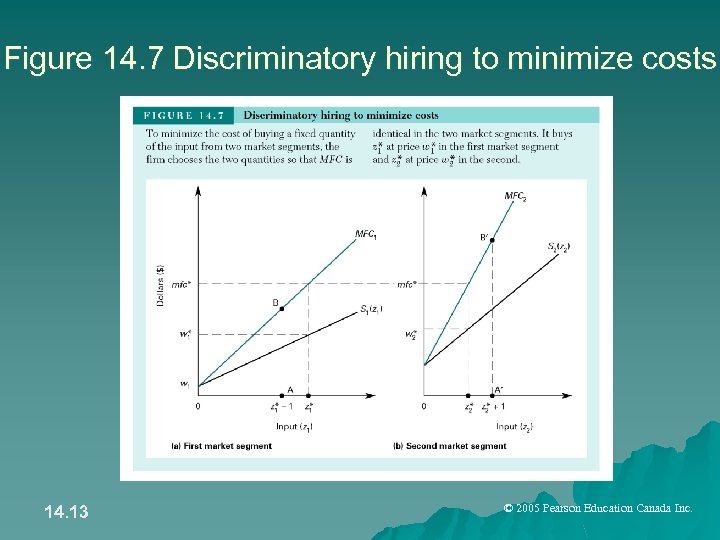

Figure 14. 7 Discriminatory hiring to minimize costs 14. 13 © 2005 Pearson Education Canada Inc.

Figure 14. 7 Discriminatory hiring to minimize costs 14. 13 © 2005 Pearson Education Canada Inc.

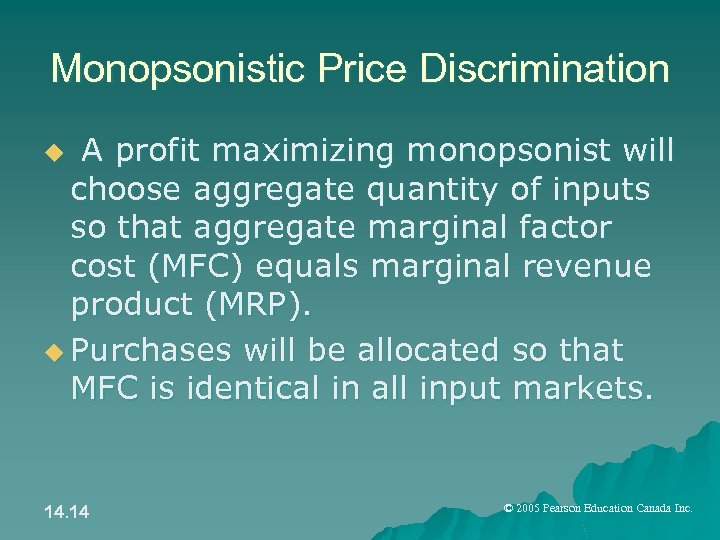

Monopsonistic Price Discrimination A profit maximizing monopsonist will choose aggregate quantity of inputs so that aggregate marginal factor cost (MFC) equals marginal revenue product (MRP). u Purchases will be allocated so that MFC is identical in all input markets. u 14. 14 © 2005 Pearson Education Canada Inc.

Monopsonistic Price Discrimination A profit maximizing monopsonist will choose aggregate quantity of inputs so that aggregate marginal factor cost (MFC) equals marginal revenue product (MRP). u Purchases will be allocated so that MFC is identical in all input markets. u 14. 14 © 2005 Pearson Education Canada Inc.

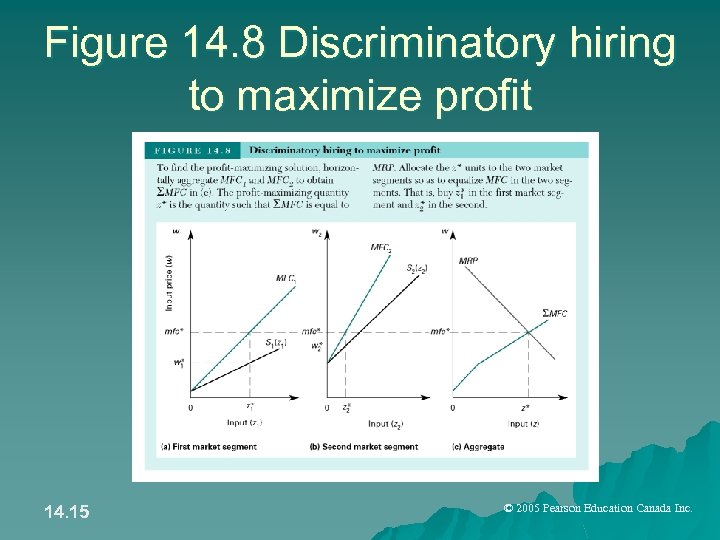

Figure 14. 8 Discriminatory hiring to maximize profit 14. 15 © 2005 Pearson Education Canada Inc.

Figure 14. 8 Discriminatory hiring to maximize profit 14. 15 © 2005 Pearson Education Canada Inc.

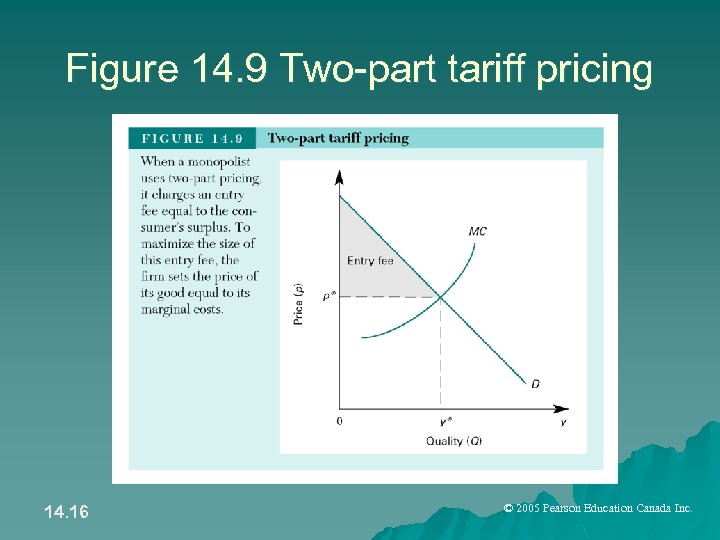

Figure 14. 9 Two-part tariff pricing 14. 16 © 2005 Pearson Education Canada Inc.

Figure 14. 9 Two-part tariff pricing 14. 16 © 2005 Pearson Education Canada Inc.

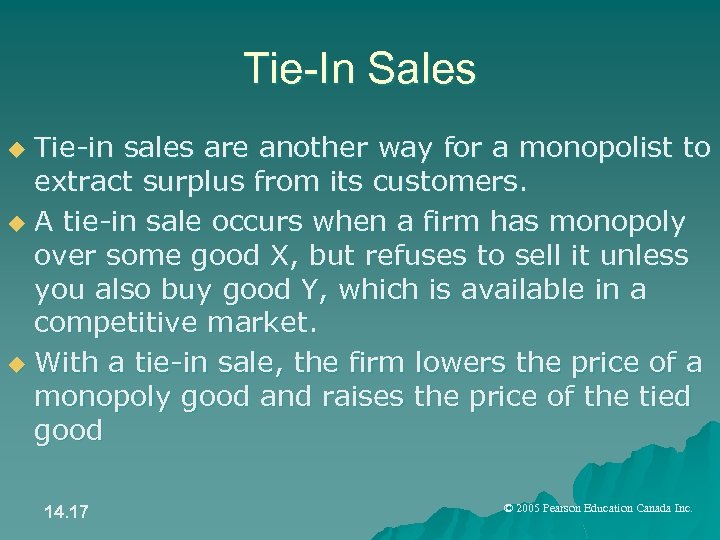

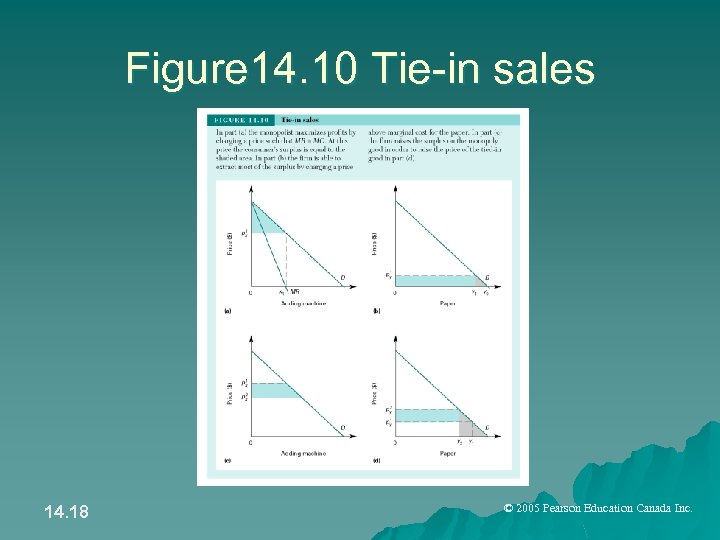

Tie-In Sales Tie-in sales are another way for a monopolist to extract surplus from its customers. u A tie-in sale occurs when a firm has monopoly over some good X, but refuses to sell it unless you also buy good Y, which is available in a competitive market. u With a tie-in sale, the firm lowers the price of a monopoly good and raises the price of the tied good u 14. 17 © 2005 Pearson Education Canada Inc.

Tie-In Sales Tie-in sales are another way for a monopolist to extract surplus from its customers. u A tie-in sale occurs when a firm has monopoly over some good X, but refuses to sell it unless you also buy good Y, which is available in a competitive market. u With a tie-in sale, the firm lowers the price of a monopoly good and raises the price of the tied good u 14. 17 © 2005 Pearson Education Canada Inc.

Figure 14. 10 Tie-in sales 14. 18 © 2005 Pearson Education Canada Inc.

Figure 14. 10 Tie-in sales 14. 18 © 2005 Pearson Education Canada Inc.

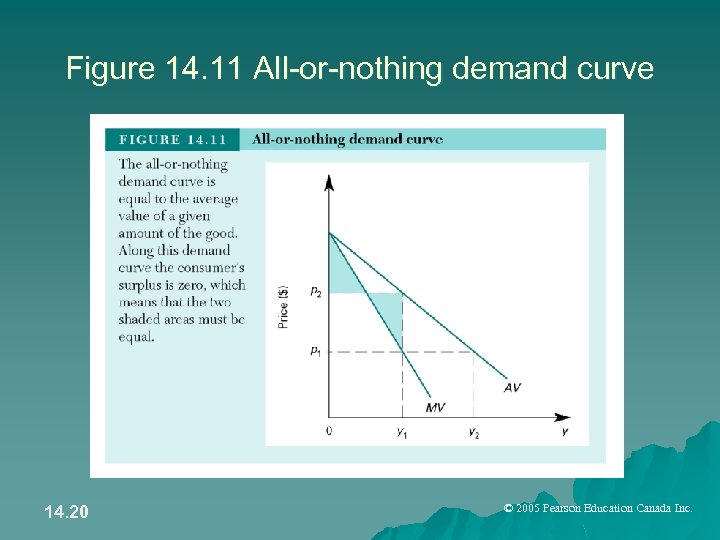

All-or-Nothing Demands and the Exploitation Effect u An ordinary demand curve shows the marginal value of a given quantity. u An all-or-nothing demand curve shows the average value of a given quantity. u When a consumer pays the average value for a good, rather than the marginal value, then the consumer surplus is zero. 14. 19 © 2005 Pearson Education Canada Inc.

All-or-Nothing Demands and the Exploitation Effect u An ordinary demand curve shows the marginal value of a given quantity. u An all-or-nothing demand curve shows the average value of a given quantity. u When a consumer pays the average value for a good, rather than the marginal value, then the consumer surplus is zero. 14. 19 © 2005 Pearson Education Canada Inc.

Figure 14. 11 All-or-nothing demand curve 14. 20 © 2005 Pearson Education Canada Inc.

Figure 14. 11 All-or-nothing demand curve 14. 20 © 2005 Pearson Education Canada Inc.

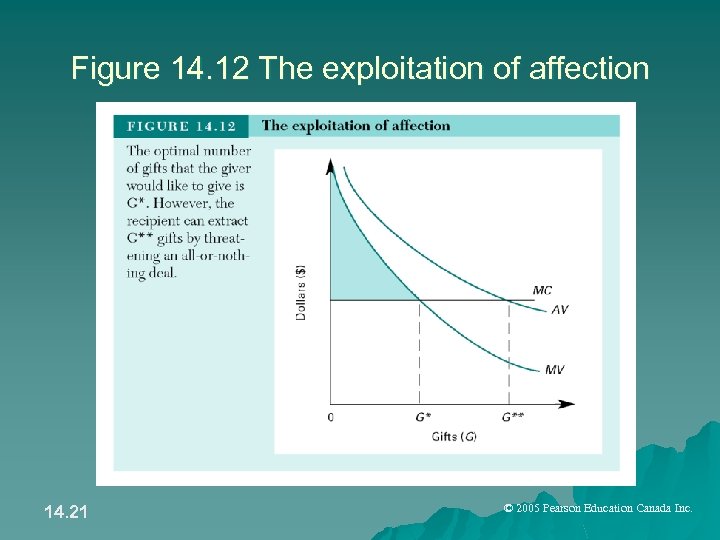

Figure 14. 12 The exploitation of affection 14. 21 © 2005 Pearson Education Canada Inc.

Figure 14. 12 The exploitation of affection 14. 21 © 2005 Pearson Education Canada Inc.