22f258a1e844b2c336b3b988dd4b9cea.ppt

- Количество слайдов: 25

Chapter 14 Mortgage Default Insurance, Foreclosure, and Title Insurance

Chapter 14 Mortgage Default Insurance, Foreclosure, and Title Insurance

Chapter 14 Learning Objectives Understand how each of the three different default insurance plans VA, FHA, and private mortgage insurance - operate n Understand how state foreclosure laws differ n Understand the risk that is insured by title insurance n

Chapter 14 Learning Objectives Understand how each of the three different default insurance plans VA, FHA, and private mortgage insurance - operate n Understand how state foreclosure laws differ n Understand the risk that is insured by title insurance n

Mortgage Default Insurance Partial Coverage n Full Coverage n Self-Insurance n FHA Insurance n VA Insurance n Private Mortgage Insurance (PMI) n

Mortgage Default Insurance Partial Coverage n Full Coverage n Self-Insurance n FHA Insurance n VA Insurance n Private Mortgage Insurance (PMI) n

Department of Housing and Urban Development Insured energy efficient loans n Insured loans for rehabs n Insured loans for condos n Insured loans for disaster victims n Reverse Mortgages n FHA Loans n Sells foreclosed homes with FHA loans n

Department of Housing and Urban Development Insured energy efficient loans n Insured loans for rehabs n Insured loans for condos n Insured loans for disaster victims n Reverse Mortgages n FHA Loans n Sells foreclosed homes with FHA loans n

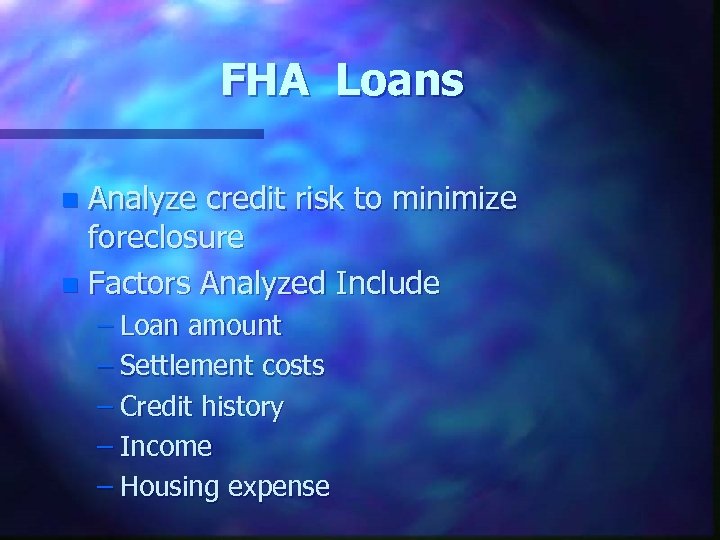

FHA Loans Analyze credit risk to minimize foreclosure n Factors Analyzed Include n – Loan amount – Settlement costs – Credit history – Income – Housing expense

FHA Loans Analyze credit risk to minimize foreclosure n Factors Analyzed Include n – Loan amount – Settlement costs – Credit history – Income – Housing expense

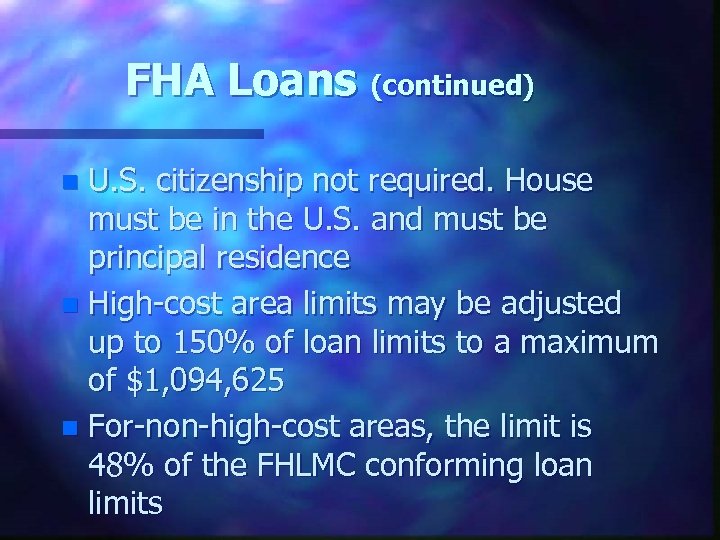

FHA Loans (continued) U. S. citizenship not required. House must be in the U. S. and must be principal residence n High-cost area limits may be adjusted up to 150% of loan limits to a maximum of $1, 094, 625 n For-non-high-cost areas, the limit is 48% of the FHLMC conforming loan limits n

FHA Loans (continued) U. S. citizenship not required. House must be in the U. S. and must be principal residence n High-cost area limits may be adjusted up to 150% of loan limits to a maximum of $1, 094, 625 n For-non-high-cost areas, the limit is 48% of the FHLMC conforming loan limits n

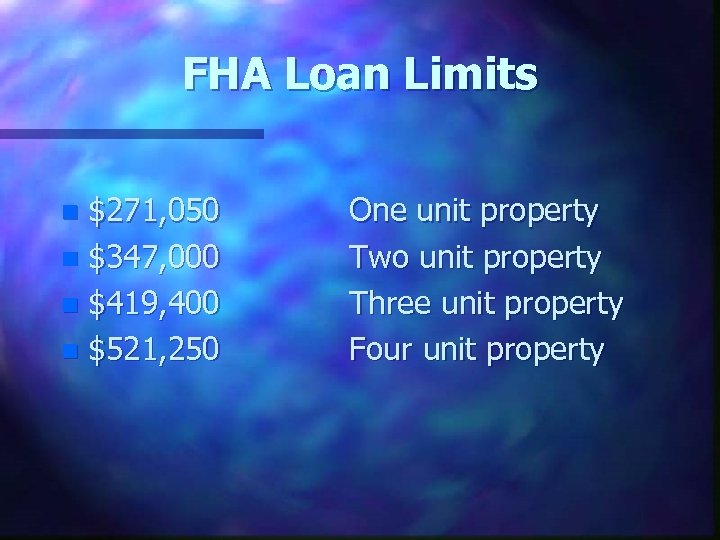

FHA Loan Limits $271, 050 n $347, 000 n $419, 400 n $521, 250 n One unit property Two unit property Three unit property Four unit property

FHA Loan Limits $271, 050 n $347, 000 n $419, 400 n $521, 250 n One unit property Two unit property Three unit property Four unit property

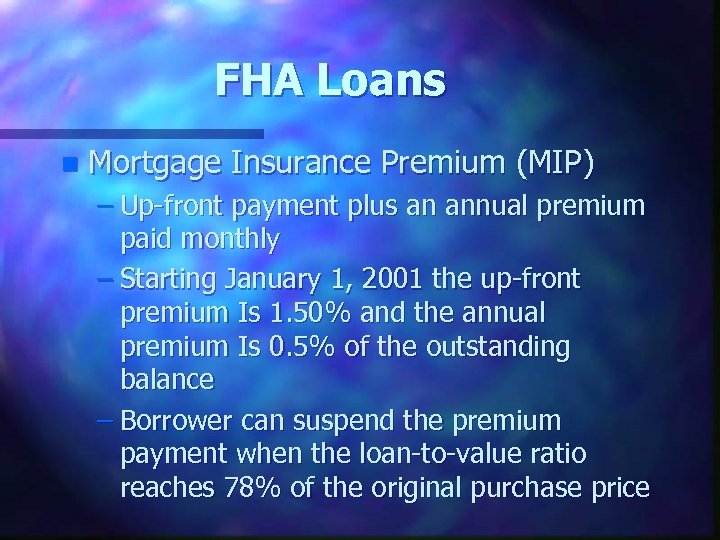

FHA Loans n Mortgage Insurance Premium (MIP) – Up-front payment plus an annual premium paid monthly – Starting January 1, 2001 the up-front premium Is 1. 50% and the annual premium Is 0. 5% of the outstanding balance – Borrower can suspend the premium payment when the loan-to-value ratio reaches 78% of the original purchase price

FHA Loans n Mortgage Insurance Premium (MIP) – Up-front payment plus an annual premium paid monthly – Starting January 1, 2001 the up-front premium Is 1. 50% and the annual premium Is 0. 5% of the outstanding balance – Borrower can suspend the premium payment when the loan-to-value ratio reaches 78% of the original purchase price

FHA Loans (continued) HUD does not regulate the contract interest rate or the amount of discount points paid by the borrower n A discharged veteran with a certificate of veteran status can finance 100% of the purchase price n

FHA Loans (continued) HUD does not regulate the contract interest rate or the amount of discount points paid by the borrower n A discharged veteran with a certificate of veteran status can finance 100% of the purchase price n

FHA Loans: Determining The Loan Amount n Price $50, 000 or Less: 98. 75% of the appraised value or sale price whichever is less n Price > $50, 000: 97. 75% of lesser of appraised value or sale price

FHA Loans: Determining The Loan Amount n Price $50, 000 or Less: 98. 75% of the appraised value or sale price whichever is less n Price > $50, 000: 97. 75% of lesser of appraised value or sale price

FHA Loans Loan-to-Value ratio is limited to 85% with family relationship n If the house goes from principal residence to rental, L/V must be reduced to 75% based on current appraisal n Payment/Income Ratios n – PITI 29% – PITI + Other Expenses 41%

FHA Loans Loan-to-Value ratio is limited to 85% with family relationship n If the house goes from principal residence to rental, L/V must be reduced to 75% based on current appraisal n Payment/Income Ratios n – PITI 29% – PITI + Other Expenses 41%

FHA Loans (continued) No mortgage assumptions after December, 1989 n Non-Qualifying assumptions before December 1986 n Will finance mobile homes n Offers Reverse Mortgages – 62 years old – Own home – Principal residence n

FHA Loans (continued) No mortgage assumptions after December, 1989 n Non-Qualifying assumptions before December 1986 n Will finance mobile homes n Offers Reverse Mortgages – 62 years old – Own home – Principal residence n

FHA Loans (continued) n Offers ARMs – TB Yield, 1/5 Caps, 2. 00 Margin In foreclosure, get an appraisal then decide whether to take title n Also offers graduated payment loans n

FHA Loans (continued) n Offers ARMs – TB Yield, 1/5 Caps, 2. 00 Margin In foreclosure, get an appraisal then decide whether to take title n Also offers graduated payment loans n

FHA Loans (continued) 3% equity investment required, does not have to be down payment n Can refinance up to 97% of the value n No credit history required n Mortgage refund- MIP is paid in full at closing. Refund time limit is 6 years from loan payoff n With a foreclosure, borrower must wait 3 years from date of claims payment n

FHA Loans (continued) 3% equity investment required, does not have to be down payment n Can refinance up to 97% of the value n No credit history required n Mortgage refund- MIP is paid in full at closing. Refund time limit is 6 years from loan payoff n With a foreclosure, borrower must wait 3 years from date of claims payment n

FHA Loans (continued) With Chapter 7 bankruptcy, borrower must wait two years n With Chapter 13 bankruptcy, borrower must be paying for one year and be in good standing n

FHA Loans (continued) With Chapter 7 bankruptcy, borrower must wait two years n With Chapter 13 bankruptcy, borrower must be paying for one year and be in good standing n

FHA Loans (continued) n FHA Streamline Refinancing – Less documentation – Existing FHA loan – Not delinquent – No equity cash out – W/O appraisal if new loan amount is not more than old loan and no costs are added in

FHA Loans (continued) n FHA Streamline Refinancing – Less documentation – Existing FHA loan – Not delinquent – No equity cash out – W/O appraisal if new loan amount is not more than old loan and no costs are added in

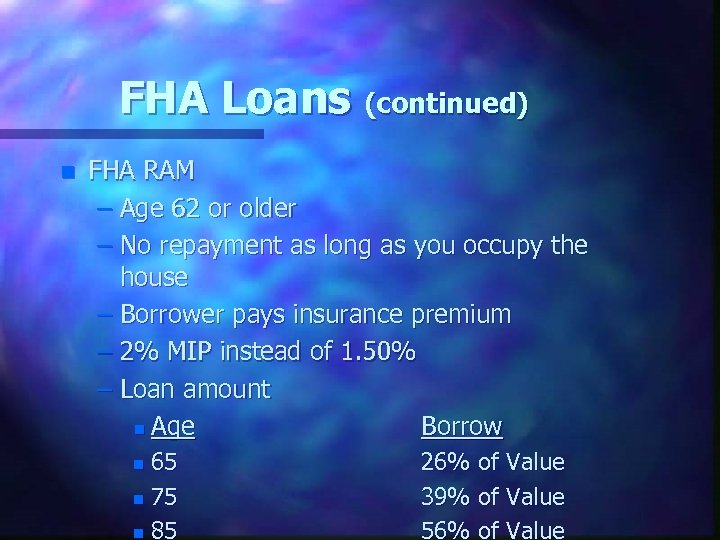

FHA Loans (continued) n FHA RAM – Age 62 or older – No repayment as long as you occupy the house – Borrower pays insurance premium – 2% MIP instead of 1. 50% – Loan amount n Age Borrow 65 n 75 n 85 n 26% of Value 39% of Value 56% of Value

FHA Loans (continued) n FHA RAM – Age 62 or older – No repayment as long as you occupy the house – Borrower pays insurance premium – 2% MIP instead of 1. 50% – Loan amount n Age Borrow 65 n 75 n 85 n 26% of Value 39% of Value 56% of Value

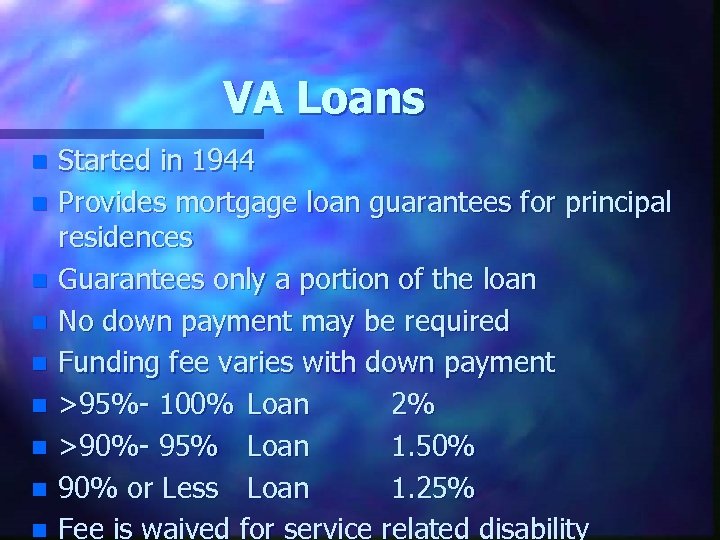

VA Loans n n n n n Started in 1944 Provides mortgage loan guarantees for principal residences Guarantees only a portion of the loan No down payment may be required Funding fee varies with down payment >95%- 100% Loan 2% >90%- 95% Loan 1. 50% 90% or Less Loan 1. 25% Fee is waived for service related disability

VA Loans n n n n n Started in 1944 Provides mortgage loan guarantees for principal residences Guarantees only a portion of the loan No down payment may be required Funding fee varies with down payment >95%- 100% Loan 2% >90%- 95% Loan 1. 50% 90% or Less Loan 1. 25% Fee is waived for service related disability

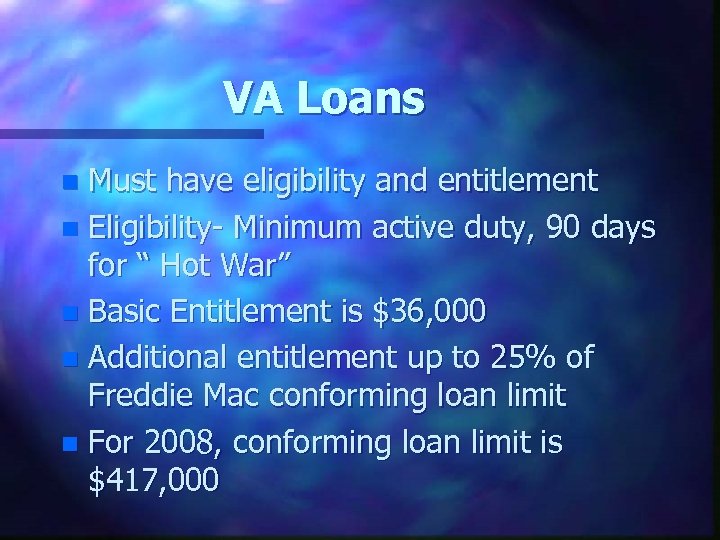

VA Loans Must have eligibility and entitlement n Eligibility- Minimum active duty, 90 days for “ Hot War” n Basic Entitlement is $36, 000 n Additional entitlement up to 25% of Freddie Mac conforming loan limit n For 2008, conforming loan limit is $417, 000 n

VA Loans Must have eligibility and entitlement n Eligibility- Minimum active duty, 90 days for “ Hot War” n Basic Entitlement is $36, 000 n Additional entitlement up to 25% of Freddie Mac conforming loan limit n For 2008, conforming loan limit is $417, 000 n

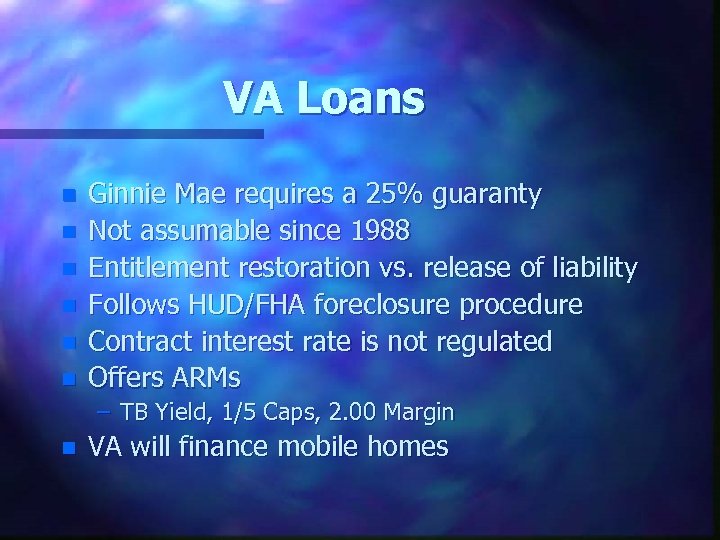

VA Loans n n n Ginnie Mae requires a 25% guaranty Not assumable since 1988 Entitlement restoration vs. release of liability Follows HUD/FHA foreclosure procedure Contract interest rate is not regulated Offers ARMs – TB Yield, 1/5 Caps, 2. 00 Margin n VA will finance mobile homes

VA Loans n n n Ginnie Mae requires a 25% guaranty Not assumable since 1988 Entitlement restoration vs. release of liability Follows HUD/FHA foreclosure procedure Contract interest rate is not regulated Offers ARMs – TB Yield, 1/5 Caps, 2. 00 Margin n VA will finance mobile homes

Private Mortgage Insurance (PMI) Private insurers n Insures top portion of loan n Pay claim and take title or just pay losses n Homeowners Protection Act Of 1998 requires lenders to cancel PMI automatically when L/V is 78% n After July 29, 1999 can be cancelled at 80% L/V of original property value n

Private Mortgage Insurance (PMI) Private insurers n Insures top portion of loan n Pay claim and take title or just pay losses n Homeowners Protection Act Of 1998 requires lenders to cancel PMI automatically when L/V is 78% n After July 29, 1999 can be cancelled at 80% L/V of original property value n

PMI n Other requirements for cancellation: – No payment more than 30 days late in last 12 months – No payment more than 60 days late in last 24 months – Property value has not declined – Protects conventional mortgages and cannot be required with 80% or less L/V ratio

PMI n Other requirements for cancellation: – No payment more than 30 days late in last 12 months – No payment more than 60 days late in last 24 months – Property value has not declined – Protects conventional mortgages and cannot be required with 80% or less L/V ratio

PMI n Some borrowers do “ Piggyback” loans called 80 -10 -10 s to avoid PMI 80% First Mortgage 10% Second Mortgage 10% Down Payment

PMI n Some borrowers do “ Piggyback” loans called 80 -10 -10 s to avoid PMI 80% First Mortgage 10% Second Mortgage 10% Down Payment

Foreclosure Laws n n Judicial Foreclosure – Court judgment against borrower allowed in all states Power of Sale – Foreclosure proceeds without a court order Usually with the deed-of-trust Equitable Right of Redemption – Redeem the property before the sale Statutory Right of Redemption – Redeem the property after the sale

Foreclosure Laws n n Judicial Foreclosure – Court judgment against borrower allowed in all states Power of Sale – Foreclosure proceeds without a court order Usually with the deed-of-trust Equitable Right of Redemption – Redeem the property before the sale Statutory Right of Redemption – Redeem the property after the sale

Title Insurance Insures Good Title n Title Search n

Title Insurance Insures Good Title n Title Search n