f82e38294711b315058ce3e6f81ec1bc.ppt

- Количество слайдов: 35

Chapter 14 Bodie Kane Marcus Perrakis Ryan Security Analysis INVESTMENTS, Fourth Canadian Edition

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Chapter Summary w Objective: Introduction to fundamental stock analysis. This chapter introduces different types of valuation models and shows how economic conditions affect the results. n n Dividend discount models Price-Earnings ratios Other methods and issues Macroeconomic analysis

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Fundamental Analysis: Models of Equity Valuation w Basic Types of Models n n n Balance Sheet Models Dividend Discount Models Price/Earning Ratios w Estimating Growth Rates and Opportunities

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Intrinsic Value and Market Price w Intrinsic Value n n Self assigned Value Variety of models are used for estimation w Market Price n Consensus value of all potential traders w Trading Signal n n n IV > MP Buy IV < MP Sell or Short Sell IV = MP Hold or Fairly Priced

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: Introduction to fundamental stock analysis. This chapter introduces different types of valuation models and shows how economic conditions affect the results. n n Dividend discount models Price-Earnings ratios Other methods and issues Macroeconomic analysis

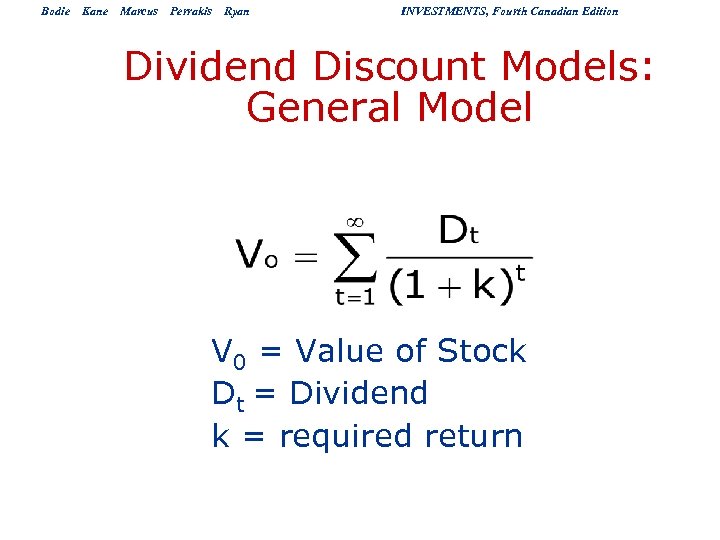

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Dividend Discount Models: General Model V 0 = Value of Stock Dt = Dividend k = required return

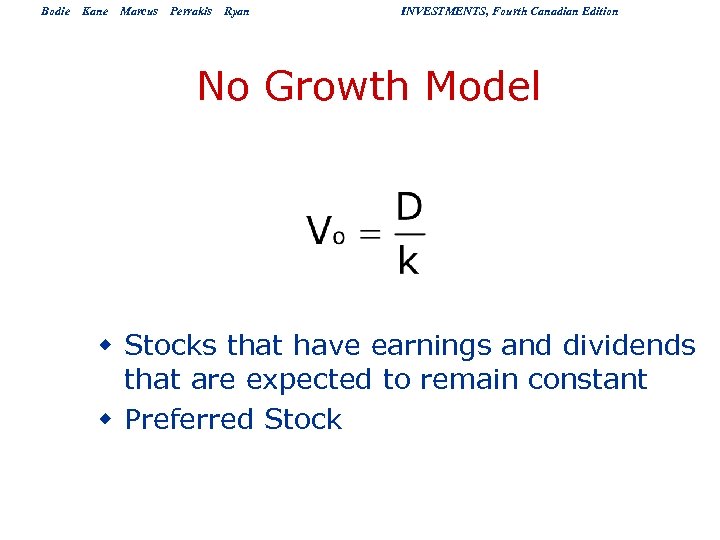

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition No Growth Model w Stocks that have earnings and dividends that are expected to remain constant w Preferred Stock

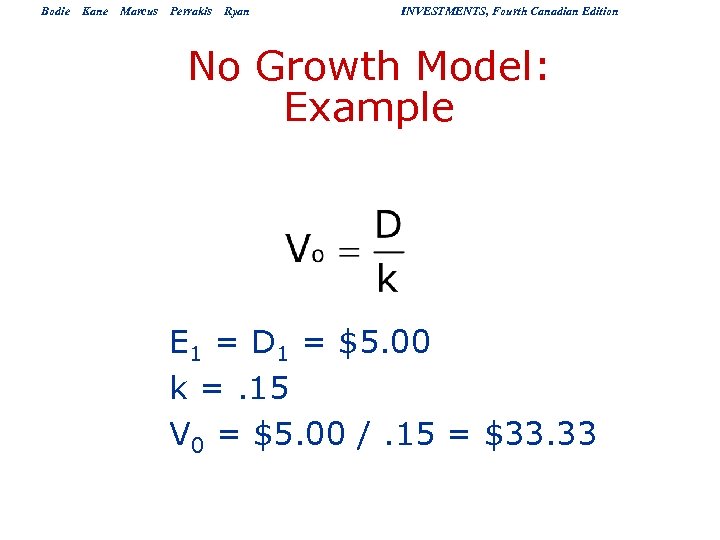

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition No Growth Model: Example E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33

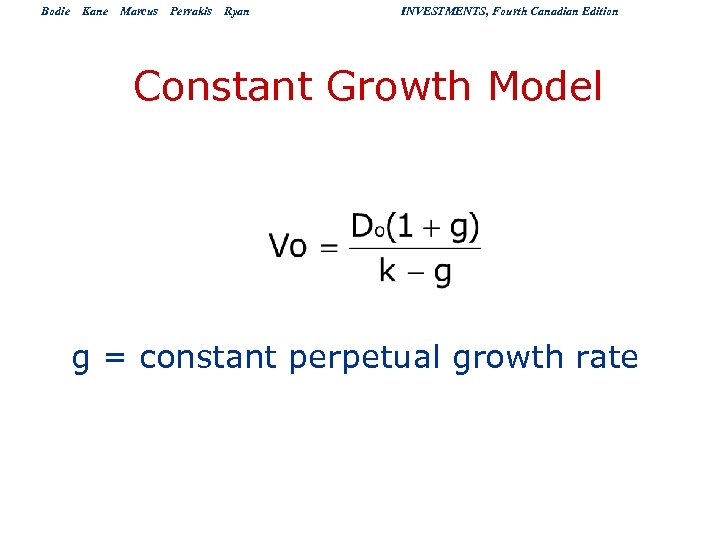

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Constant Growth Model g = constant perpetual growth rate

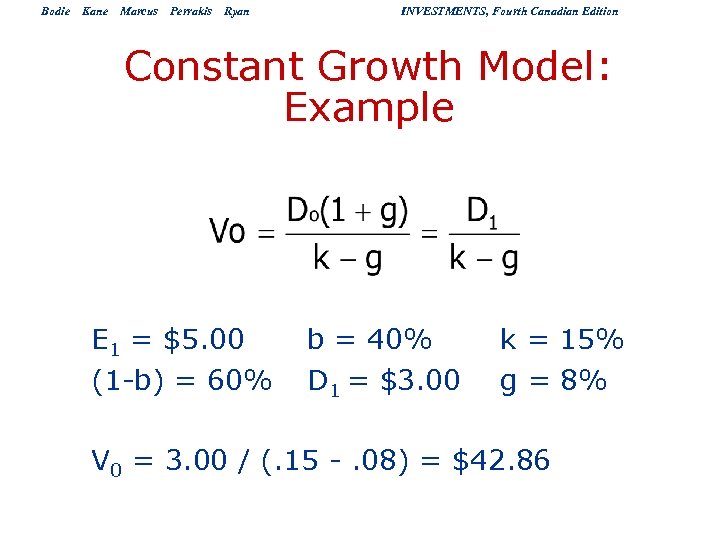

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Constant Growth Model: Example E 1 = $5. 00 (1 -b) = 60% b = 40% D 1 = $3. 00 k = 15% g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86

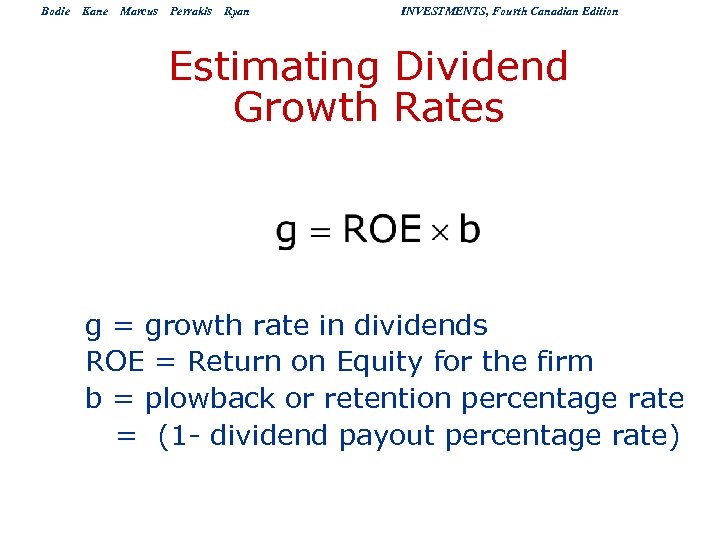

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Estimating Dividend Growth Rates g = growth rate in dividends ROE = Return on Equity for the firm b = plowback or retention percentage rate = (1 - dividend payout percentage rate)

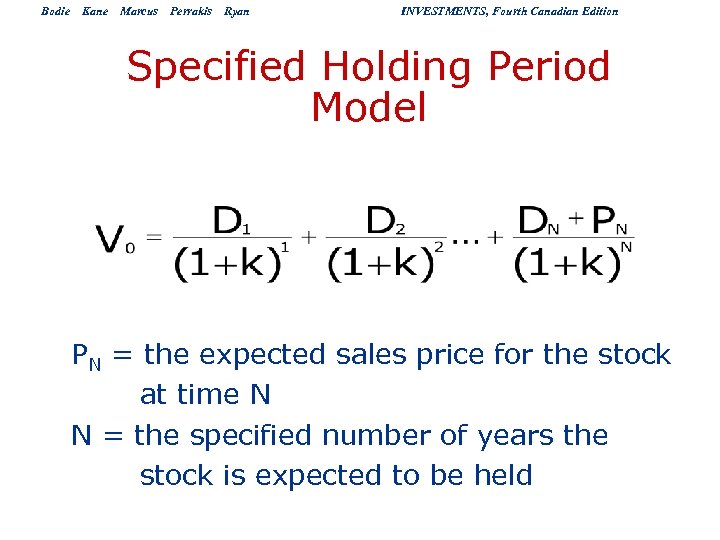

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Specified Holding Period Model PN = the expected sales price for the stock at time N N = the specified number of years the stock is expected to be held

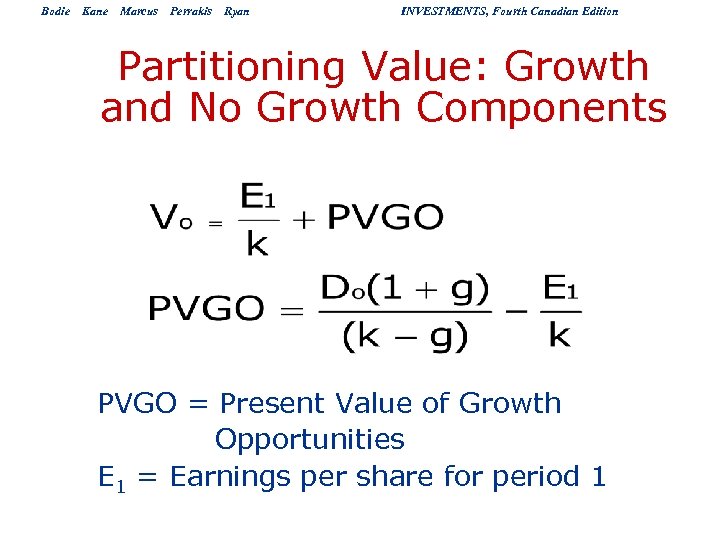

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Partitioning Value: Growth and No Growth Components PVGO = Present Value of Growth Opportunities E 1 = Earnings per share for period 1

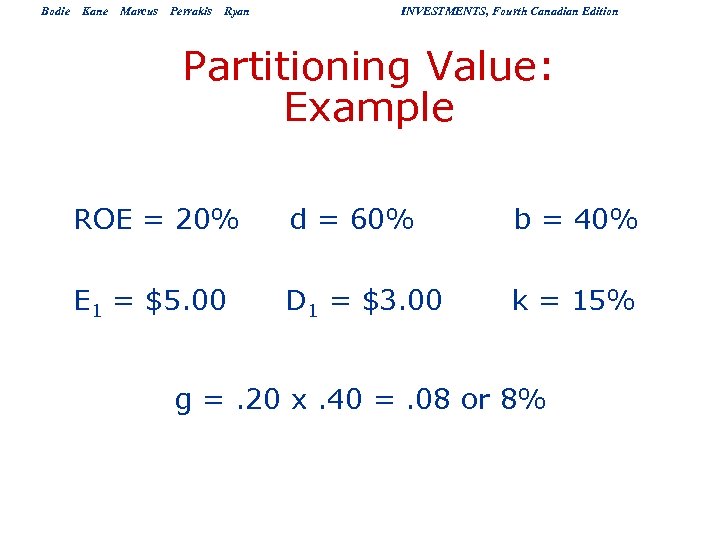

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Partitioning Value: Example ROE = 20% d = 60% b = 40% E 1 = $5. 00 D 1 = $3. 00 k = 15% g =. 20 x. 40 =. 08 or 8%

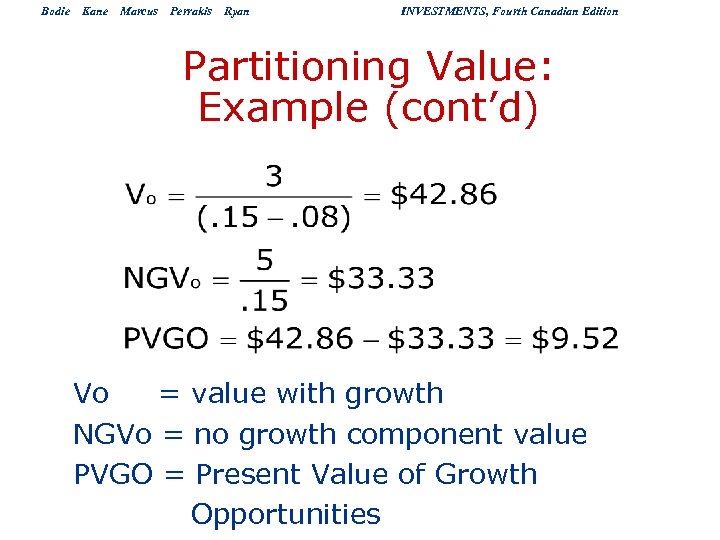

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Partitioning Value: Example (cont’d) Vo = value with growth NGVo = no growth component value PVGO = Present Value of Growth Opportunities

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: Introduction to fundamental stock analysis. This chapter introduces different types of valuation models and shows how economic conditions affect the results. n n Dividend discount models Price-Earnings ratios Other methods and issues Macroeconomic analysis

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Earnings, Growth and Price-Earnings Ratios w P/E Ratios are a function of two factors n n Required Rates of Return (k) Expected growth in Dividends w Uses n n Relative valuation Extensive Use in industry

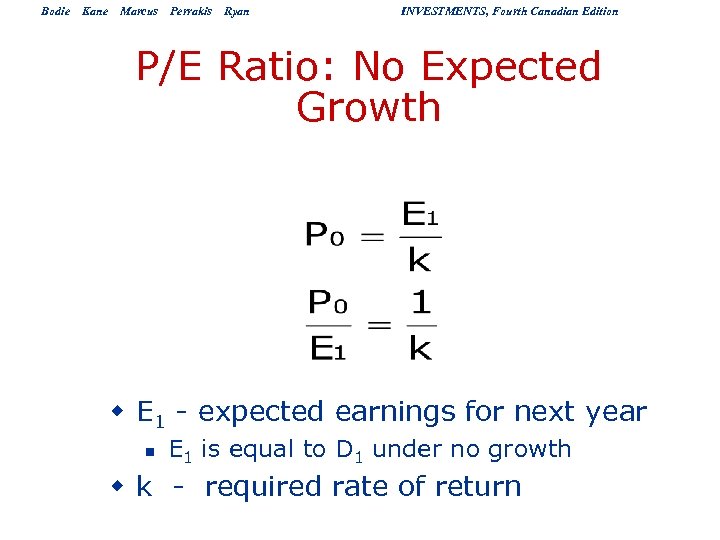

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition P/E Ratio: No Expected Growth w E 1 - expected earnings for next year n E 1 is equal to D 1 under no growth w k - required rate of return

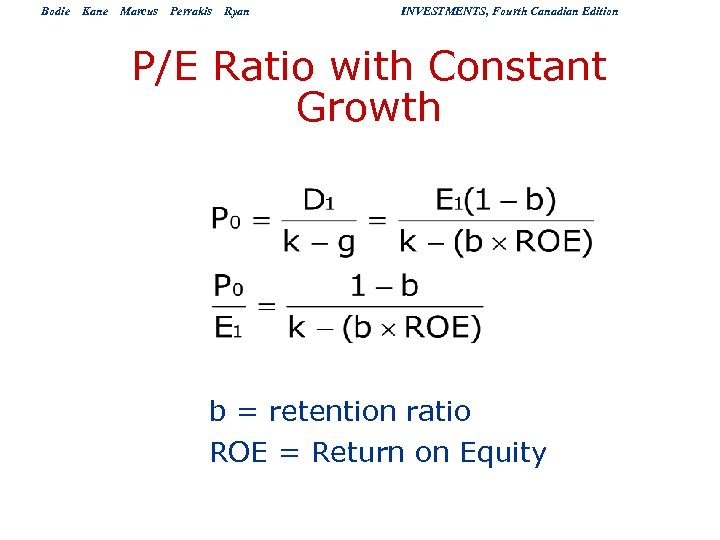

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition P/E Ratio with Constant Growth b = retention ratio ROE = Return on Equity

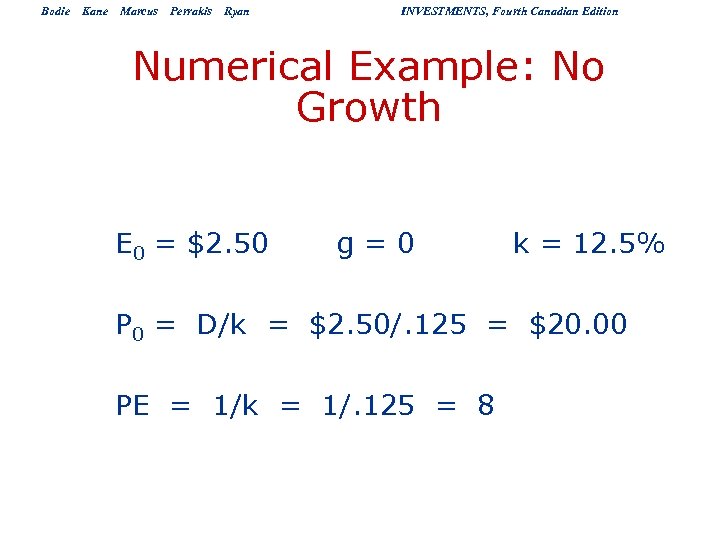

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Numerical Example: No Growth E 0 = $2. 50 g=0 k = 12. 5% P 0 = D/k = $2. 50/. 125 = $20. 00 PE = 1/k = 1/. 125 = 8

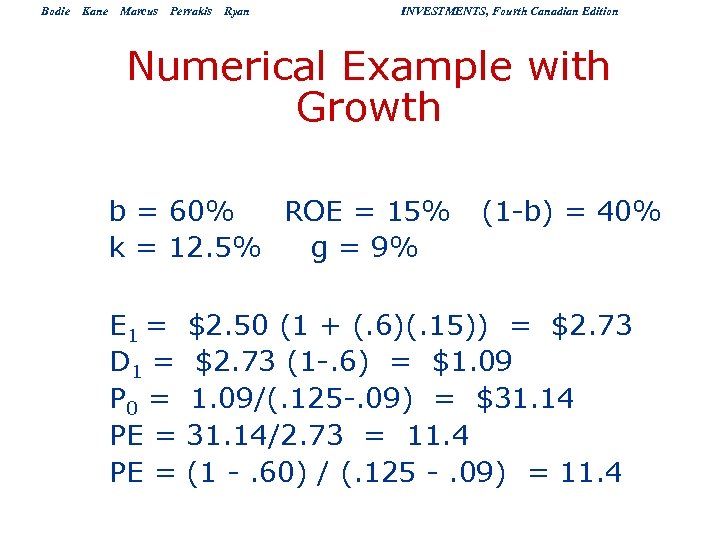

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Numerical Example with Growth b = 60% ROE = 15% k = 12. 5% g = 9% E 1 = D 1 = P 0 = PE = (1 -b) = 40% $2. 50 (1 + (. 6)(. 15)) = $2. 73 (1 -. 6) = $1. 09/(. 125 -. 09) = $31. 14/2. 73 = 11. 4 (1 -. 60) / (. 125 -. 09) = 11. 4

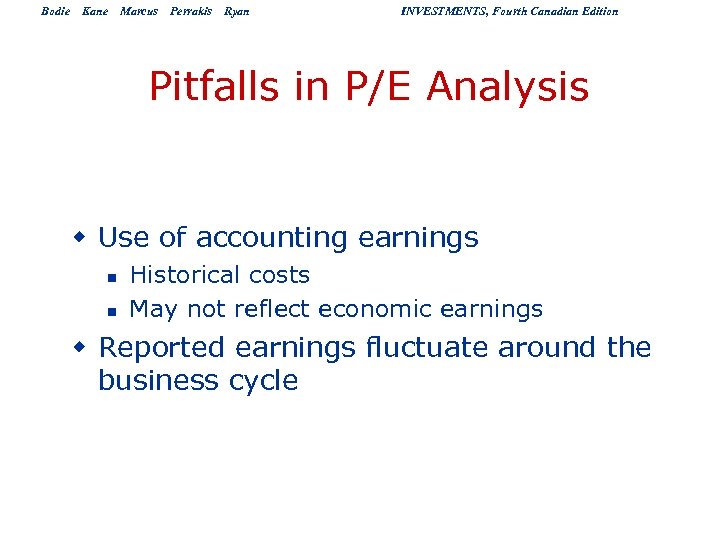

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Pitfalls in P/E Analysis w Use of accounting earnings n n Historical costs May not reflect economic earnings w Reported earnings fluctuate around the business cycle

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: Introduction to fundamental stock analysis. This chapter introduces different types of valuation models and shows how economic conditions affect the results. n n Dividend discount models Price-Earnings ratios Other methods and issues Macroeconomic analysis

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Other Valuation Ratios w Price-to-Book w Price-to-Cash-Flow w Price-to-Sales

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition The Free Cash-Flow Approach w Fundamental idea: the intrinsic value of a firm is the present value of all its net cash-flows to shareholders w Estimate the value of the firm as a whole n It equals the present value of cash-flows, assuming all-equity financing plus the net present value of tax shields created by using debt; w Derive the value of equity by subtracting the market value of all non-equity claims

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Inflation and Equity Valuation w Inflation has an impact on equity valuations w Historical costs underestimate economic costs w Empirical research shows that inflation has an adverse effect on equity values n Research shows that real rates of return are lower with high rates of inflation

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Potential Causes of Lower Equity Values with Inflation w Shocks cause expectation of lower earnings by market participants w Returns are viewed as being riskier with higher rates of inflation w Real dividends are lower because of taxes

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Growth or Value Investing w Growth Investing – picking companies that are considered to have superior growth prospects w Value Investing – choosing companies for which fundamental analysis reveals unrecognized value w The Graham technique

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: Introduction to fundamental stock analysis. This chapter introduces different types of valuation models and shows how economic conditions affect the results. n n Dividend discount models Price-Earnings ratios Other methods and issues Macroeconomic analysis

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Global Economic Considerations w Performance in countries and regions is highly variable w Political risk w Exchange rate risk n n n Sales Profits Stock returns

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Key Economic Variables w w w Gross domestic product (GDP) Unemployment rates Interest rates & inflation International measures Consumer sentiment

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Government Policy w Fiscal Policy - Government spending and taxing actions w Monetary Policy - manipulation of the money supply to influence economic activity w Tools of monetary policy n n n Open market operations Discount rate Reserve requirements

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Demand Supply Shocks w Demand shock - an event that affects demand for goods and services in the economy n n Tax rate cut Increases in government spending w Supply shock - an event that influences production capacity or production costs n n Commodity price changes Educational level of economic participants

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Business Cycles w Business Cycle n n Peak Trough w Industry relationship to business cycles n n Cyclical Defensive

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Cyclical Indicators w Leading Indicators - tend to rise and fall in advance of the economy. Examples: n n Average work week New orders - durables Residential construction Stock Prices w Lagging Indicators - indicators that tend to follow the lag economic performance

f82e38294711b315058ce3e6f81ec1bc.ppt