ef25930da25209e57058faa01d327c98.ppt

- Количество слайдов: 41

Chapter 13 The Foreign Exchange Market

Chapter 13 The Foreign Exchange Market

Chapter Preview n We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: q Foreign Exchange Market q Exchange Rates in the Long Run q Exchange Rates in the Short Run q Explaining Changes in Exchange Rates 2

Chapter Preview n We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: q Foreign Exchange Market q Exchange Rates in the Long Run q Exchange Rates in the Short Run q Explaining Changes in Exchange Rates 2

13. 1 Foreign Exchange Market n Most countries of the world have their own currencies: the U. S. , France, Brazil, and India, just to name a few. n The trading of currencies and banks deposits is what makes up the foreign exchange market. 3

13. 1 Foreign Exchange Market n Most countries of the world have their own currencies: the U. S. , France, Brazil, and India, just to name a few. n The trading of currencies and banks deposits is what makes up the foreign exchange market. 3

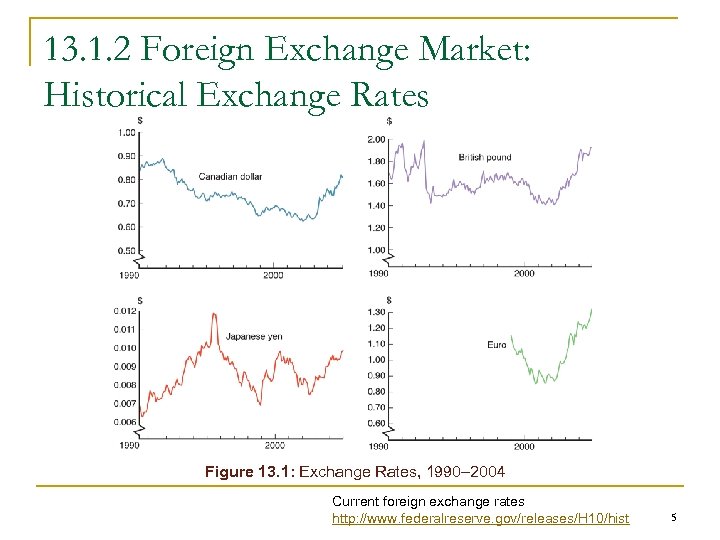

13. 1. 1 Foreign Exchange Market n The next slide shows exchange rates for four currencies from 1990 -2004. n Note the difference in rate fluctuations during the period. Which appears most volatile? The least? 4

13. 1. 1 Foreign Exchange Market n The next slide shows exchange rates for four currencies from 1990 -2004. n Note the difference in rate fluctuations during the period. Which appears most volatile? The least? 4

13. 1. 2 Foreign Exchange Market: Historical Exchange Rates Figure 13. 1: Exchange Rates, 1990– 2004 Current foreign exchange rates http: //www. federalreserve. gov/releases/H 10/hist 5

13. 1. 2 Foreign Exchange Market: Historical Exchange Rates Figure 13. 1: Exchange Rates, 1990– 2004 Current foreign exchange rates http: //www. federalreserve. gov/releases/H 10/hist 5

13. 1. 3 The Foreign Exchange Market n Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation 4. Depreciation 6

13. 1. 3 The Foreign Exchange Market n Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation 4. Depreciation 6

13. 1. 4 Foreign Exchange Market: Why Are Exchange Rates Important? n When the currency of your country appreciates relative to another country, your country's goods prices abroad and foreign goods prices in your country. 1. 2. Makes domestic businesses less competitive Benefits domestic consumers (you) 7

13. 1. 4 Foreign Exchange Market: Why Are Exchange Rates Important? n When the currency of your country appreciates relative to another country, your country's goods prices abroad and foreign goods prices in your country. 1. 2. Makes domestic businesses less competitive Benefits domestic consumers (you) 7

13. 1. 5 Foreign Exchange Market: How is Foreign Exchange Traded? n FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express (美国运通). 8

13. 1. 5 Foreign Exchange Market: How is Foreign Exchange Traded? n FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express (美国运通). 8

13. 2 Exchange Rates in the Long Run n Exchange rates are determined in markets by the interaction of supply and demand. n An important concept that drives the forces of supply and demand is the Law of One Price. 9

13. 2 Exchange Rates in the Long Run n Exchange rates are determined in markets by the interaction of supply and demand. n An important concept that drives the forces of supply and demand is the Law of One Price. 9

13. 2. 1 Exchange Rates in the Long Run: Law of One Price n The Law of One Price states that the price of an identical good will be the same throughout the world, regardless of which country produces it. n Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton 10

13. 2. 1 Exchange Rates in the Long Run: Law of One Price n The Law of One Price states that the price of an identical good will be the same throughout the world, regardless of which country produces it. n Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton 10

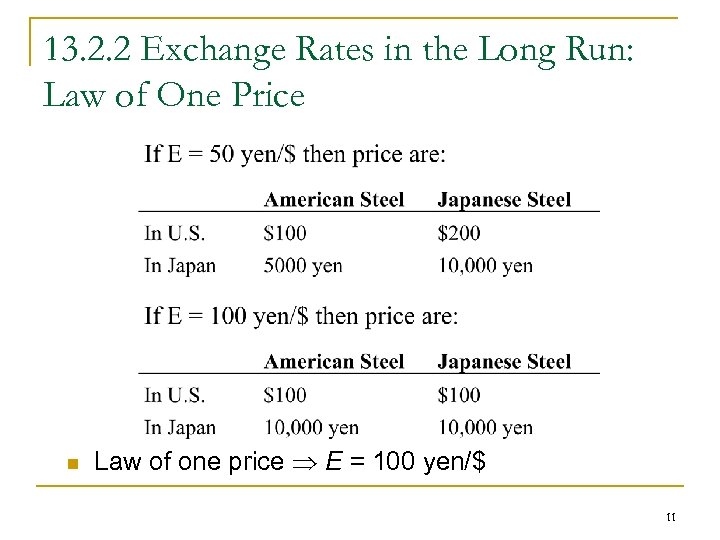

13. 2. 2 Exchange Rates in the Long Run: Law of One Price n Law of one price E = 100 yen/$ 11

13. 2. 2 Exchange Rates in the Long Run: Law of One Price n Law of one price E = 100 yen/$ 11

13. 2. 3 Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) n n The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. PPP Domestic price level 10%, domestic currency 10% q Application of law of one price to price levels q Works in long run, not short run 12

13. 2. 3 Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) n n The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. PPP Domestic price level 10%, domestic currency 10% q Application of law of one price to price levels q Works in long run, not short run 12

GDP rank (CIA) n https: //www. cia. gov/library/publications/theworld-factbook/rankorder/2001 rank. html 13

GDP rank (CIA) n https: //www. cia. gov/library/publications/theworld-factbook/rankorder/2001 rank. html 13

13. 2. 4 Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) n Problems with PPP 1. 2. All goods are not identical in both countries (i. e. , Toyota versus Chevy) Many goods and services are not traded (e. g. , haircuts, land, etc. ) 14

13. 2. 4 Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) n Problems with PPP 1. 2. All goods are not identical in both countries (i. e. , Toyota versus Chevy) Many goods and services are not traded (e. g. , haircuts, land, etc. ) 14

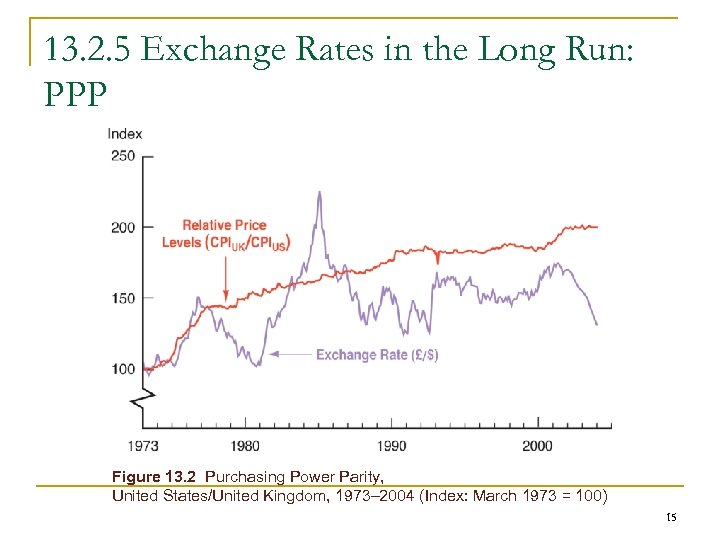

13. 2. 5 Exchange Rates in the Long Run: PPP Figure 13. 2 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100) 15

13. 2. 5 Exchange Rates in the Long Run: PPP Figure 13. 2 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100) 15

13. 2. 6 Factors Affecting Exchange Rates in Long Run Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate n The four major factors are: Relative price levels, Tariffs and quotas, Preferences for domestic v. foreign goods, Productivity. n 16

13. 2. 6 Factors Affecting Exchange Rates in Long Run Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate n The four major factors are: Relative price levels, Tariffs and quotas, Preferences for domestic v. foreign goods, Productivity. n 16

13. 2. 7 Factors Affecting Exchange Rates in Long Run n Relative price levels: a rise in relative price levels cause a country’s currency to depreciate. n Tariffs and quotas: increasing trade barriers causes a country’s currency to appreciate. 17

13. 2. 7 Factors Affecting Exchange Rates in Long Run n Relative price levels: a rise in relative price levels cause a country’s currency to depreciate. n Tariffs and quotas: increasing trade barriers causes a country’s currency to appreciate. 17

13. 2. 8 Factors Affecting Exchange Rates in Long Run n Preferences for domestic v. foreign goods: increased demand for a country’s good causes its currency to appreciate; increased demand for imports causes the domestic currency to depreciate. n Productivity: if a country is more productive relative to another, its currency appreciates. 18

13. 2. 8 Factors Affecting Exchange Rates in Long Run n Preferences for domestic v. foreign goods: increased demand for a country’s good causes its currency to appreciate; increased demand for imports causes the domestic currency to depreciate. n Productivity: if a country is more productive relative to another, its currency appreciates. 18

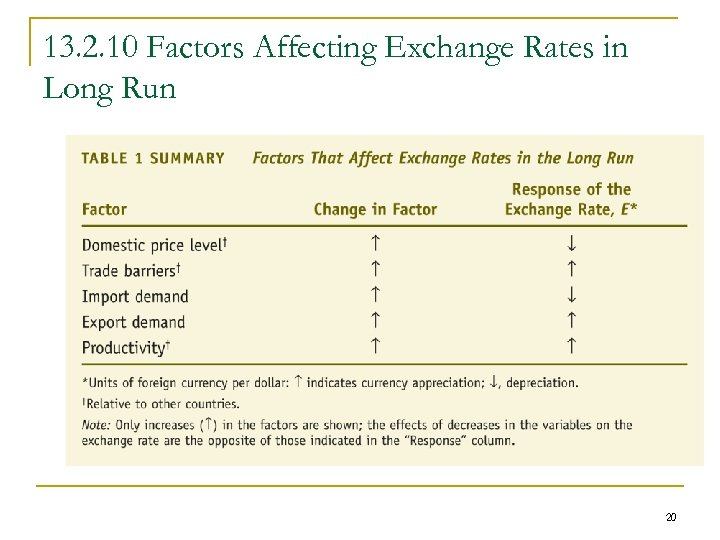

13. 2. 9 Factors Affecting Exchange Rates in Long Run n The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E, as units of foreign currency / 1 US dollar. 19

13. 2. 9 Factors Affecting Exchange Rates in Long Run n The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E, as units of foreign currency / 1 US dollar. 19

13. 2. 10 Factors Affecting Exchange Rates in Long Run 20

13. 2. 10 Factors Affecting Exchange Rates in Long Run 20

13. 3 Exchange Rates in the Short Run n In the short run, it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits. n Because of this, we will rely on the tools developed in Chapter 4 for the determinants of asset demand. 21

13. 3 Exchange Rates in the Short Run n In the short run, it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits. n Because of this, we will rely on the tools developed in Chapter 4 for the determinants of asset demand. 21

13. 3. 1 Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits n We will illustrate this with a simple example n Francois the Foreigner can deposit excess euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future exchange rates. 22

13. 3. 1 Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits n We will illustrate this with a simple example n Francois the Foreigner can deposit excess euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future exchange rates. 22

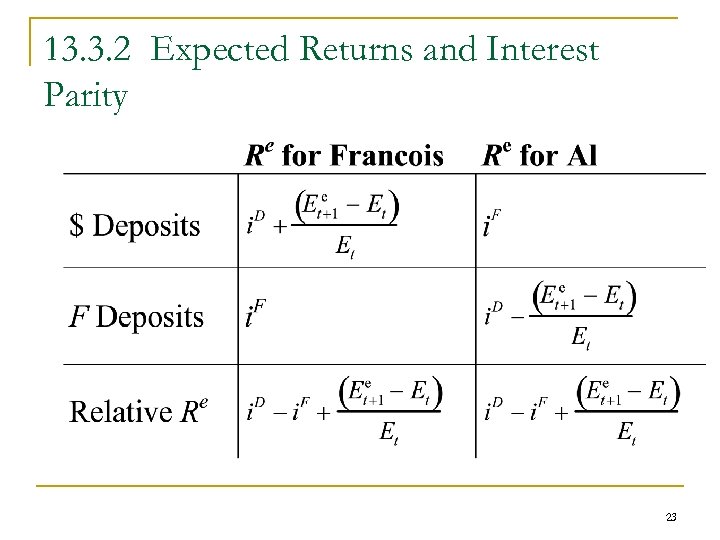

13. 3. 2 Expected Returns and Interest Parity 23

13. 3. 2 Expected Returns and Interest Parity 23

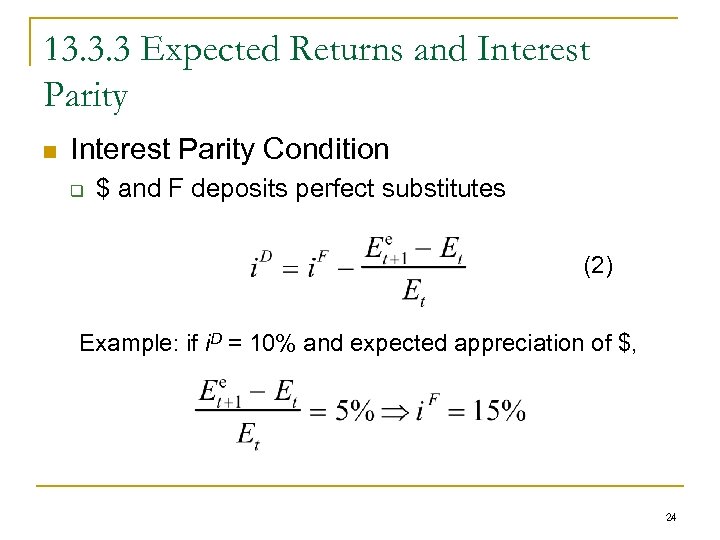

13. 3. 3 Expected Returns and Interest Parity n Interest Parity Condition q $ and F deposits perfect substitutes (2) Example: if i. D = 10% and expected appreciation of $, 24

13. 3. 3 Expected Returns and Interest Parity n Interest Parity Condition q $ and F deposits perfect substitutes (2) Example: if i. D = 10% and expected appreciation of $, 24

13. 3. 4 Expected Returns and Interest Parity n To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. n Next, we must determine the expected return in terms of dollars on dollar deposits, RD. 25

13. 3. 4 Expected Returns and Interest Parity n To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. n Next, we must determine the expected return in terms of dollars on dollar deposits, RD. 25

13. 3. 5 Deriving RF Curve Assume interest rate of euro i. F = 10%, the exchange rate of USD at (t+1) Eet+1 = 1 euro/$ n A: Et =0. 95, RF=0. 1 -(1. 0 -0. 95)/0. 95=0. 048=4. 8% n B: Et =1. 0, RF=0. 1 -(1. 0 -1. 0)/1. 0=0. 10=10. 0%% n C: Et =1. 05, RF=0. 1 -(1. 0 -1. 05)/1. 05=0. 148=14. 76% RF curve connects these points and is upward sloping because when Et is higher, the higher the future exchange rate of USD and therefore, expected return of F (in terms of interest rate), RF 26

13. 3. 5 Deriving RF Curve Assume interest rate of euro i. F = 10%, the exchange rate of USD at (t+1) Eet+1 = 1 euro/$ n A: Et =0. 95, RF=0. 1 -(1. 0 -0. 95)/0. 95=0. 048=4. 8% n B: Et =1. 0, RF=0. 1 -(1. 0 -1. 0)/1. 0=0. 10=10. 0%% n C: Et =1. 05, RF=0. 1 -(1. 0 -1. 05)/1. 05=0. 148=14. 76% RF curve connects these points and is upward sloping because when Et is higher, the higher the future exchange rate of USD and therefore, expected return of F (in terms of interest rate), RF 26

13. 3. 6 Deriving RD Curve n Deriving RD Curve q Points B, D, E, RD = 10%, so curve is vertical 27

13. 3. 6 Deriving RD Curve n Deriving RD Curve q Points B, D, E, RD = 10%, so curve is vertical 27

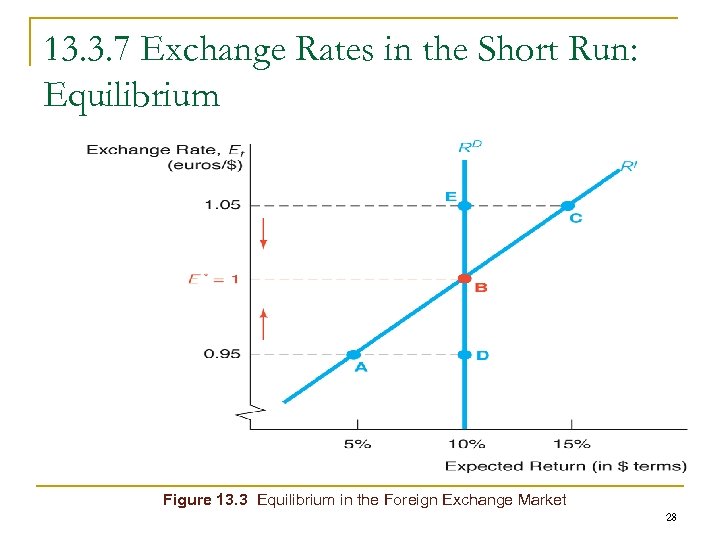

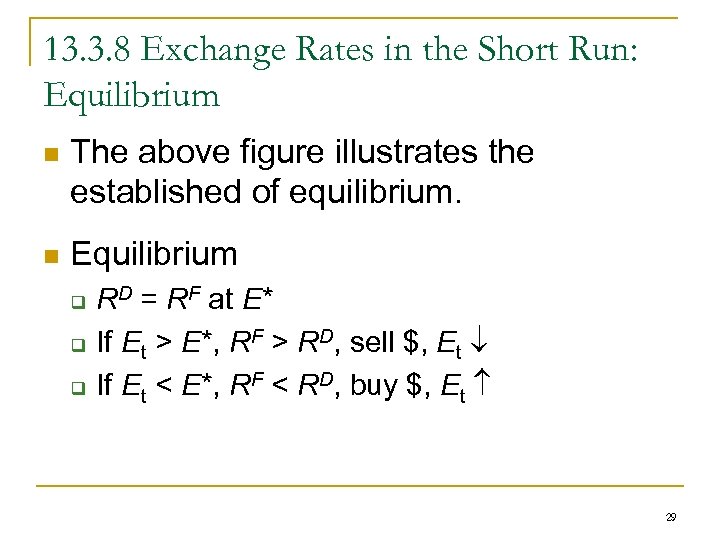

13. 3. 7 Exchange Rates in the Short Run: Equilibrium Figure 13. 3 Equilibrium in the Foreign Exchange Market 28

13. 3. 7 Exchange Rates in the Short Run: Equilibrium Figure 13. 3 Equilibrium in the Foreign Exchange Market 28

13. 3. 8 Exchange Rates in the Short Run: Equilibrium n The above figure illustrates the established of equilibrium. n Equilibrium q q q RD = RF at E* If Et > E*, RF > RD, sell $, Et If Et < E*, RF < RD, buy $, Et 29

13. 3. 8 Exchange Rates in the Short Run: Equilibrium n The above figure illustrates the established of equilibrium. n Equilibrium q q q RD = RF at E* If Et > E*, RF > RD, sell $, Et If Et < E*, RF < RD, buy $, Et 29

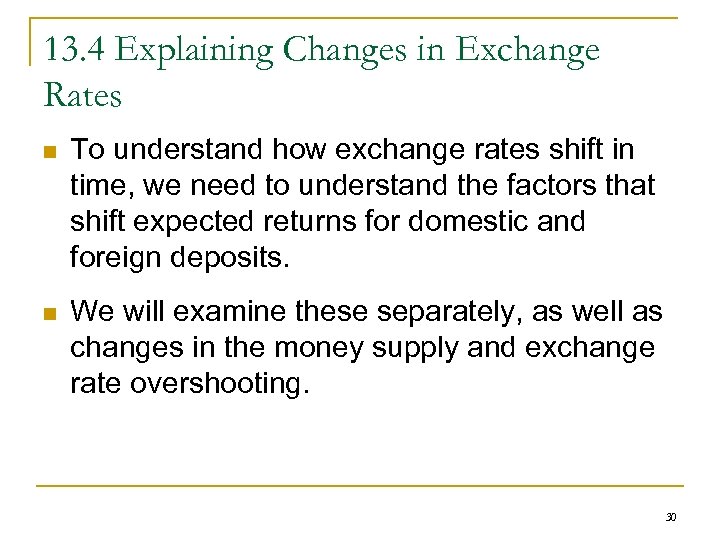

13. 4 Explaining Changes in Exchange Rates n To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. n We will examine these separately, as well as changes in the money supply and exchange rate overshooting. 30

13. 4 Explaining Changes in Exchange Rates n To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. n We will examine these separately, as well as changes in the money supply and exchange rate overshooting. 30

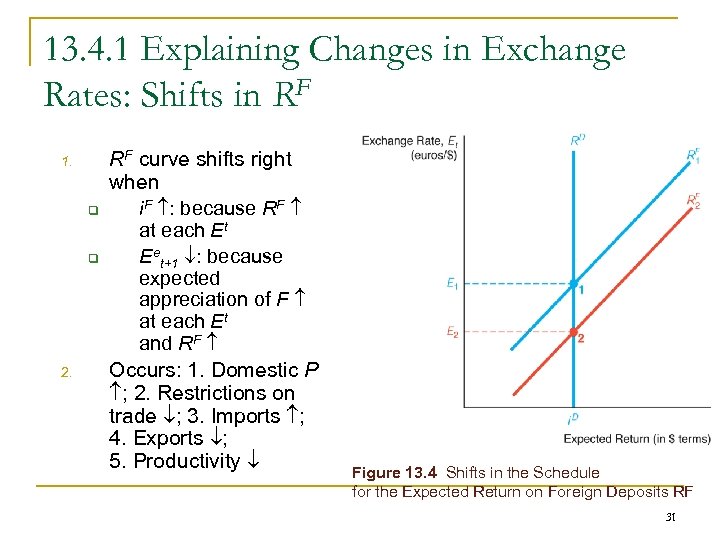

13. 4. 1 Explaining Changes in Exchange Rates: Shifts in RF 1. q q 2. RF curve shifts right when i. F : because RF at each Et Eet+1 : because expected appreciation of F at each Et and RF Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Figure 13. 4 Shifts in the Schedule for the Expected Return on Foreign Deposits RF 31

13. 4. 1 Explaining Changes in Exchange Rates: Shifts in RF 1. q q 2. RF curve shifts right when i. F : because RF at each Et Eet+1 : because expected appreciation of F at each Et and RF Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Figure 13. 4 Shifts in the Schedule for the Expected Return on Foreign Deposits RF 31

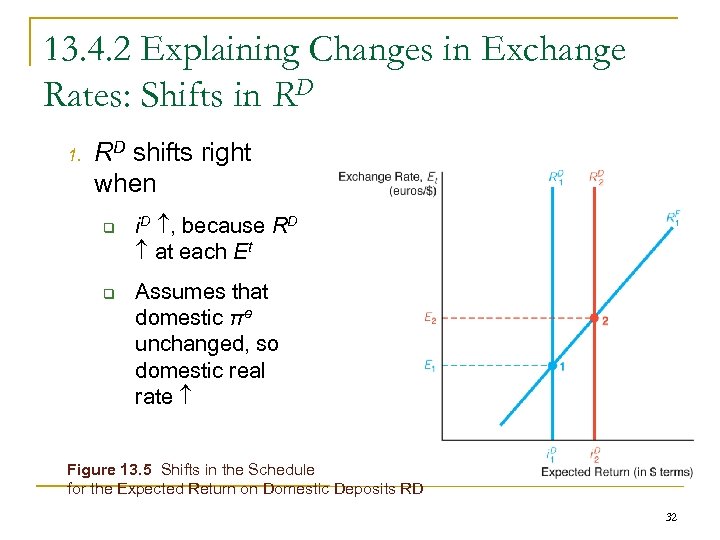

13. 4. 2 Explaining Changes in Exchange Rates: Shifts in RD 1. RD shifts right when q q i. D , because RD at each Et Assumes that domestic πe unchanged, so domestic real rate Figure 13. 5 Shifts in the Schedule for the Expected Return on Domestic Deposits RD 32

13. 4. 2 Explaining Changes in Exchange Rates: Shifts in RD 1. RD shifts right when q q i. D , because RD at each Et Assumes that domestic πe unchanged, so domestic real rate Figure 13. 5 Shifts in the Schedule for the Expected Return on Domestic Deposits RD 32

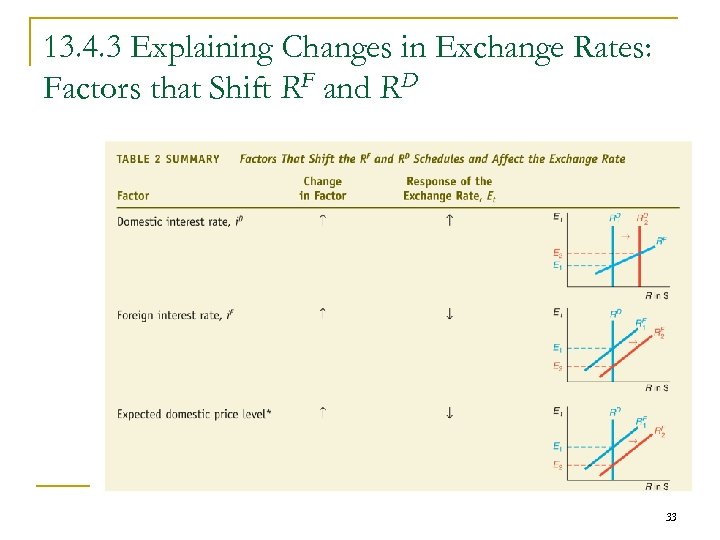

13. 4. 3 Explaining Changes in Exchange Rates: Factors that Shift RF and RD 33

13. 4. 3 Explaining Changes in Exchange Rates: Factors that Shift RF and RD 33

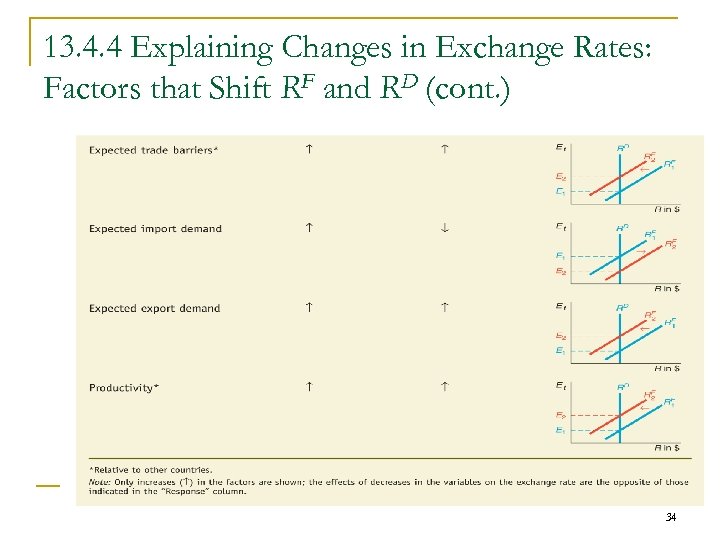

13. 4. 4 Explaining Changes in Exchange Rates: Factors that Shift RF and RD (cont. ) 34

13. 4. 4 Explaining Changes in Exchange Rates: Factors that Shift RF and RD (cont. ) 34

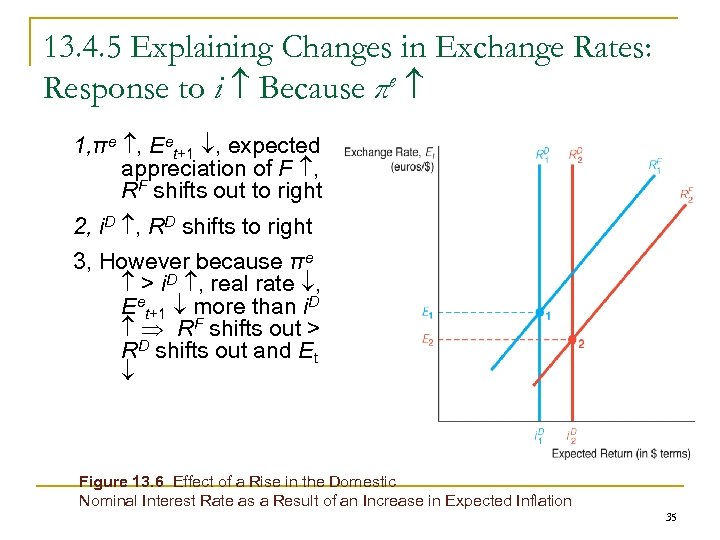

13. 4. 5 Explaining Changes in Exchange Rates: Response to i Because πe 1, πe , Eet+1 , expected appreciation of F , RF shifts out to right 2, i. D , RD shifts to right 3, However because πe > i. D , real rate , Eet+1 more than i. D RF shifts out > RD shifts out and Et Figure 13. 6 Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation 35

13. 4. 5 Explaining Changes in Exchange Rates: Response to i Because πe 1, πe , Eet+1 , expected appreciation of F , RF shifts out to right 2, i. D , RD shifts to right 3, However because πe > i. D , real rate , Eet+1 more than i. D RF shifts out > RD shifts out and Et Figure 13. 6 Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation 35

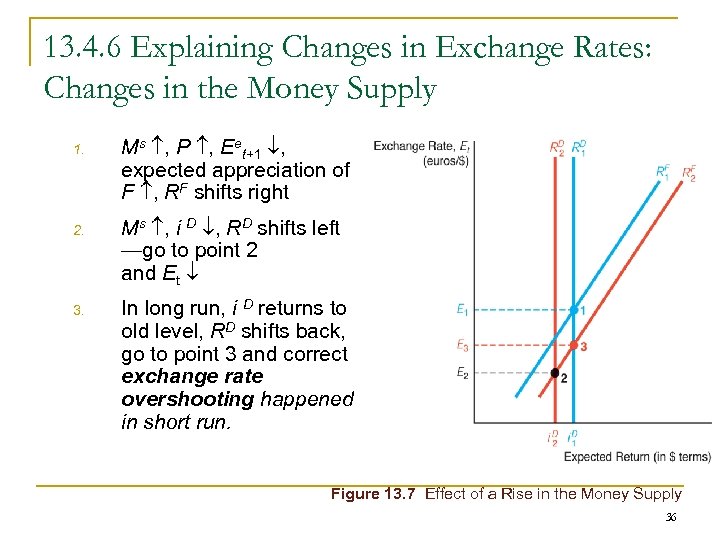

13. 4. 6 Explaining Changes in Exchange Rates: Changes in the Money Supply 1. 2. 3. Ms , P , Eet+1 , expected appreciation of F , RF shifts right Ms , i D , RD shifts left —go to point 2 and Et In long run, i D returns to old level, RD shifts back, go to point 3 and correct exchange rate overshooting happened in short run. Figure 13. 7 Effect of a Rise in the Money Supply 36

13. 4. 6 Explaining Changes in Exchange Rates: Changes in the Money Supply 1. 2. 3. Ms , P , Eet+1 , expected appreciation of F , RF shifts right Ms , i D , RD shifts left —go to point 2 and Et In long run, i D returns to old level, RD shifts back, go to point 3 and correct exchange rate overshooting happened in short run. Figure 13. 7 Effect of a Rise in the Money Supply 36

13. 4. 7 Case: Why are Exchange Rates So Volatile (p 339) n Expectations of any variables change would cause market reaction and make the rates fluctuate all the time; n The exchange rate overshooting makes the fluctuation more volatile. 37

13. 4. 7 Case: Why are Exchange Rates So Volatile (p 339) n Expectations of any variables change would cause market reaction and make the rates fluctuate all the time; n The exchange rate overshooting makes the fluctuation more volatile. 37

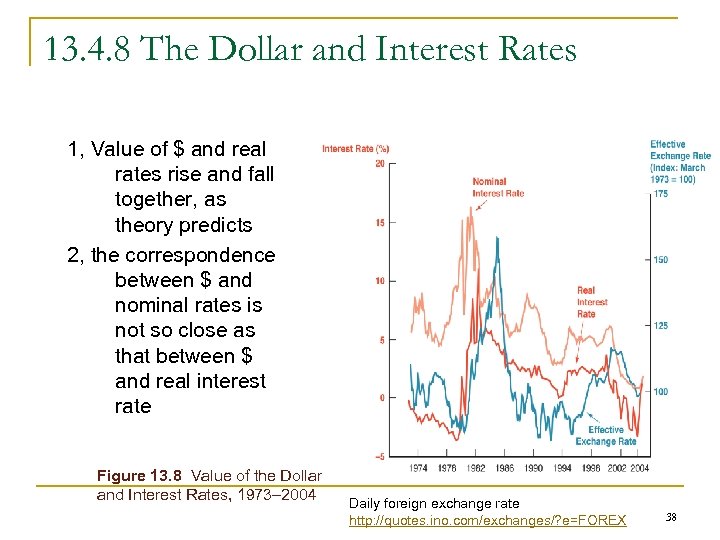

13. 4. 8 The Dollar and Interest Rates 1, Value of $ and real rates rise and fall together, as theory predicts 2, the correspondence between $ and nominal rates is not so close as that between $ and real interest rate Figure 13. 8 Value of the Dollar and Interest Rates, 1973– 2004 Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX 38

13. 4. 8 The Dollar and Interest Rates 1, Value of $ and real rates rise and fall together, as theory predicts 2, the correspondence between $ and nominal rates is not so close as that between $ and real interest rate Figure 13. 8 Value of the Dollar and Interest Rates, 1973– 2004 Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX 38

13. 4. 9 The Practicing Manger: Profiting from FX Forecasts n n n Forecasters look at factors discussed here FX forecasts affect financial institutions managers' decisions If forecast yen appreciate, q q q Buy yen; Buy yen asset; Borrow more in other currencies and less in yen currency. 39

13. 4. 9 The Practicing Manger: Profiting from FX Forecasts n n n Forecasters look at factors discussed here FX forecasts affect financial institutions managers' decisions If forecast yen appreciate, q q q Buy yen; Buy yen asset; Borrow more in other currencies and less in yen currency. 39

Chapter Summary n Foreign Exchange Market: the market for deposits in one currency versus deposits in another. n Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed. 40

Chapter Summary n Foreign Exchange Market: the market for deposits in one currency versus deposits in another. n Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed. 40

Chapter Summary (cont. ) n Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. n Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored. 41

Chapter Summary (cont. ) n Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. n Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored. 41