2a49c358e1a25e35314feb2c8f823d25.ppt

- Количество слайдов: 26

Chapter 13 Subcultures and Consumer Behavior

Subculture A distinct cultural group that exists as an identifiable segment within a larger, more complex society. © 2000 Prentice Hall

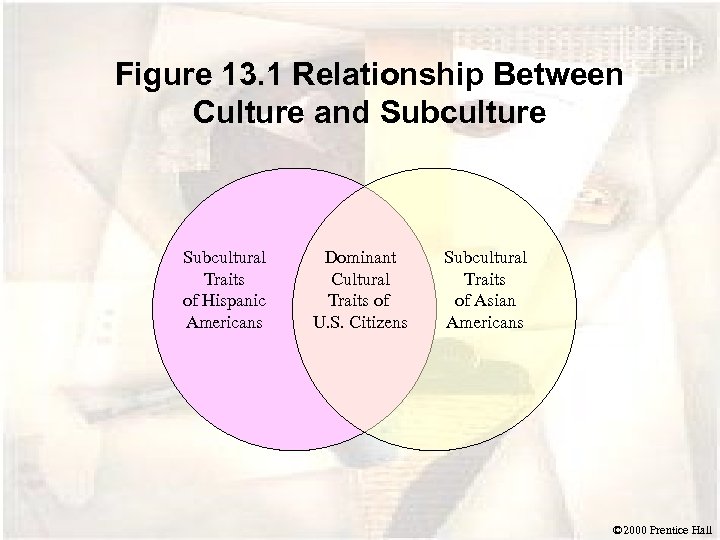

Figure 13. 1 Relationship Between Culture and Subculture Subcultural Traits of Hispanic Americans Dominant Cultural Traits of U. S. Citizens Subcultural Traits of Asian Americans © 2000 Prentice Hall

Table 13. 1 Examples of Major Subcultural Categories CATEGORIES Nationality Religion Geographic region Race Age Gender Occupation Social class EXAMPLES French, Puerto Rican, Korean Catholic, Hindu, Jew Southeastern, Midwestern, Eastern African-American, Caucasian, Asian-American Teens, Xers, middle age, elderly Female, Male Engineer, cook, plumber Lower, middle, upper © 2000 Prentice Hall

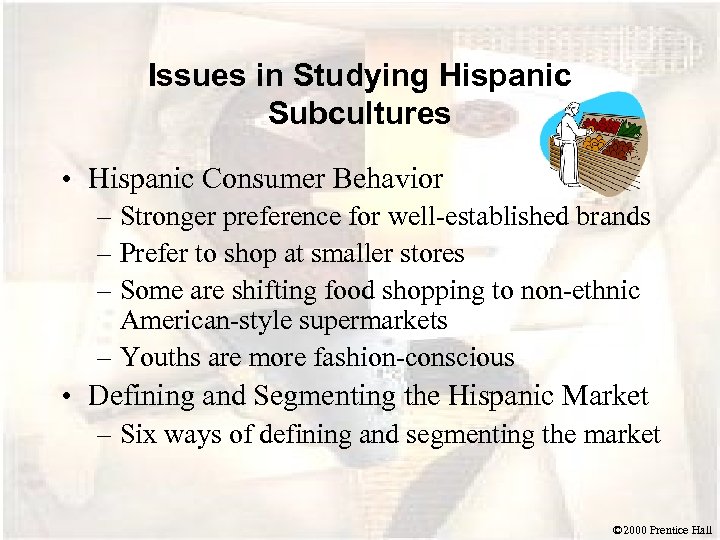

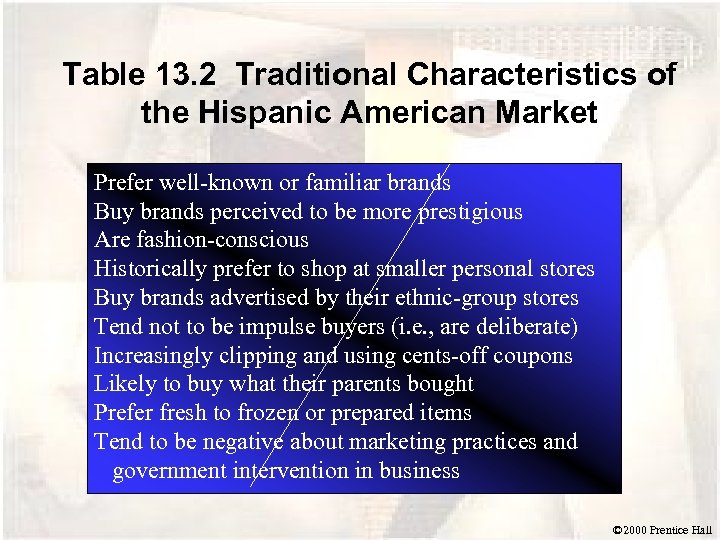

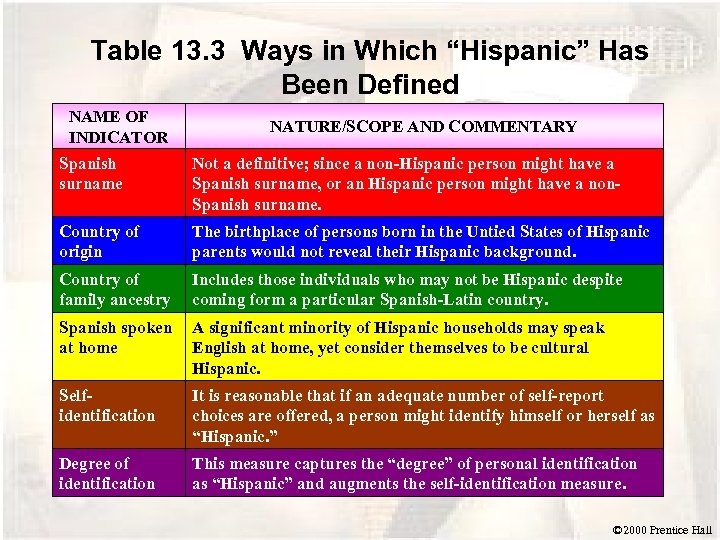

Issues in Studying Hispanic Subcultures • Hispanic Consumer Behavior – Stronger preference for well-established brands – Prefer to shop at smaller stores – Some are shifting food shopping to non-ethnic American-style supermarkets – Youths are more fashion-conscious • Defining and Segmenting the Hispanic Market – Six ways of defining and segmenting the market © 2000 Prentice Hall

Table 13. 2 Traditional Characteristics of the Hispanic American Market Prefer well-known or familiar brands Buy brands perceived to be more prestigious Are fashion-conscious Historically prefer to shop at smaller personal stores Buy brands advertised by their ethnic-group stores Tend not to be impulse buyers (i. e. , are deliberate) Increasingly clipping and using cents-off coupons Likely to buy what their parents bought Prefer fresh to frozen or prepared items Tend to be negative about marketing practices and government intervention in business © 2000 Prentice Hall

Table 13. 3 Ways in Which “Hispanic” Has Been Defined NAME OF INDICATOR NATURE/SCOPE AND COMMENTARY Spanish surname Not a definitive; since a non-Hispanic person might have a Spanish surname, or an Hispanic person might have a non. Spanish surname. Country of origin The birthplace of persons born in the Untied States of Hispanic parents would not reveal their Hispanic background. Country of family ancestry Includes those individuals who may not be Hispanic despite coming form a particular Spanish-Latin country. Spanish spoken at home A significant minority of Hispanic households may speak English at home, yet consider themselves to be cultural Hispanic. Selfidentification It is reasonable that if an adequate number of self-report choices are offered, a person might identify himself or herself as “Hispanic. ” Degree of identification This measure captures the “degree” of personal identification as “Hispanic” and augments the self-identification measure. © 2000 Prentice Hall

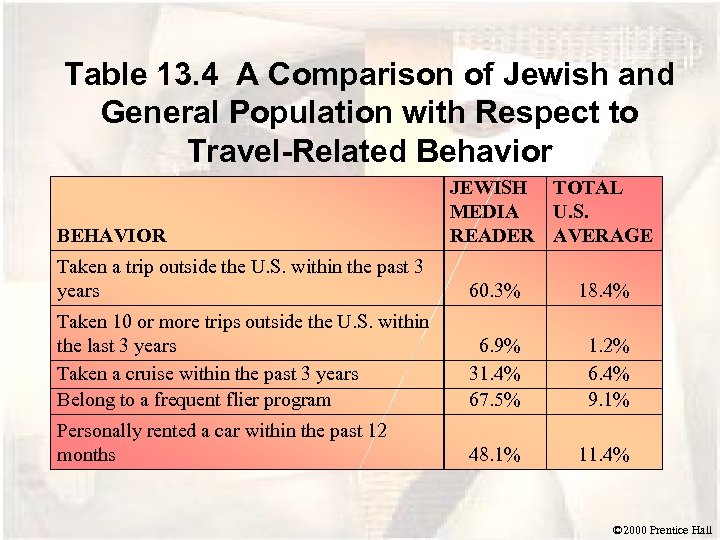

Table 13. 4 A Comparison of Jewish and General Population with Respect to Travel-Related Behavior BEHAVIOR JEWISH TOTAL MEDIA U. S. READER AVERAGE Taken a trip outside the U. S. within the past 3 years 60. 3% 18. 4% Taken 10 or more trips outside the U. S. within the last 3 years Taken a cruise within the past 3 years Belong to a frequent flier program 6. 9% 31. 4% 67. 5% 1. 2% 6. 4% 9. 1% Personally rented a car within the past 12 months 48. 1% 11. 4% © 2000 Prentice Hall

Table 13. 5 Product Purchase/Usage by Leading Metropolitan Market PRODUCT PURCHASE/USAGE Own Rollerblades/in-line skates New domestic car HIGHEST PURCHASE/ USAGE Detroit LOWEST PURCHASE/ USAGE Dallas San Francisco New imported car Have life insurance Drink Scotch whiskey Purchased men’s jeans Have a bowling ball Washington, D. C. Cleveland Dallas Cleveland Detroit Use eyeliner Use artificial sweeteners Used cough syrup (past 6 months) Popcorn (past 6 months) Lottery tickets (past 12 months) Dallas Philadelphia Dallas-Fort Worth San Francisco Chicago Washington, D. C. Detroit New York Cleveland Washington, D. C. Detroit San Francisco Cleveland New York Boston © 2000 Prentice Hall

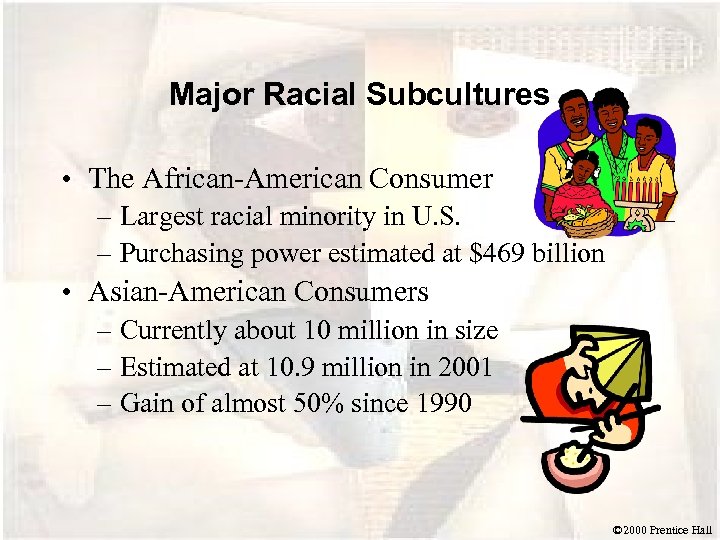

Major Racial Subcultures • The African-American Consumer – Largest racial minority in U. S. – Purchasing power estimated at $469 billion • Asian-American Consumers – Currently about 10 million in size – Estimated at 10. 9 million in 2001 – Gain of almost 50% since 1990 © 2000 Prentice Hall

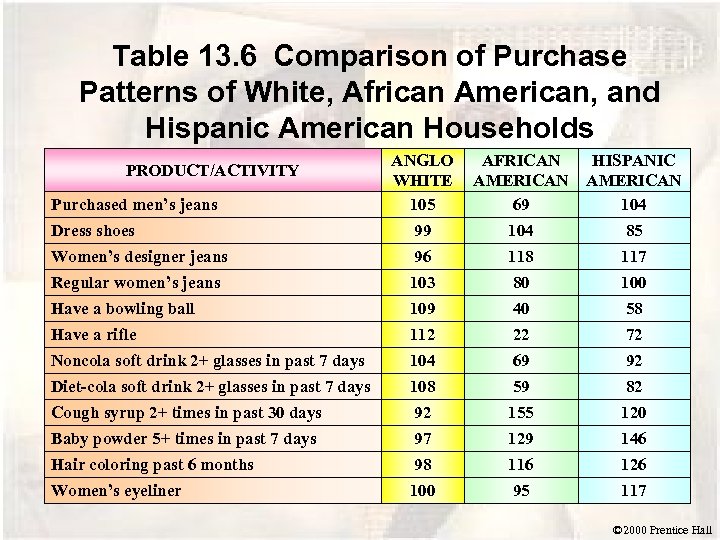

Table 13. 6 Comparison of Purchase Patterns of White, African American, and Hispanic American Households ANGLO WHITE 105 AFRICAN AMERICAN 69 HISPANIC AMERICAN 104 Dress shoes 99 104 85 Women’s designer jeans 96 118 117 Regular women’s jeans 103 80 100 Have a bowling ball 109 40 58 Have a rifle 112 22 72 Noncola soft drink 2+ glasses in past 7 days 104 69 92 Diet-cola soft drink 2+ glasses in past 7 days 108 59 82 Cough syrup 2+ times in past 30 days 92 155 120 Baby powder 5+ times in past 7 days 97 129 146 Hair coloring past 6 months 98 116 126 Women’s eyeliner 100 95 117 PRODUCT/ACTIVITY Purchased men’s jeans © 2000 Prentice Hall

Reaching the African-American Audience • Two Alternate Strategies – Running all the advertising in general mass media – Running additional advertising at special advertising in selected media directed exclusively to African-Americans © 2000 Prentice Hall

Asian-American Consumers • Where Are the Asian-Americans? – Largely urban • Asian-Americans As Consumers – Buying power of $110 billion annually – Brand loyal customers – Frequently male-oriented consumer decisions – Attracted to retailers who welcome Asian-American patronage © 2000 Prentice Hall

Age Subcultures Age subgroupings of the population. © 2000 Prentice Hall

Major Age Subcultures Generation X Market Baby Boomer Market Seniors Market © 2000 Prentice Hall

Generation X The 18 - to 29 -year-old post baby boomer segment (also referred to as Xers or busters). © 2000 Prentice Hall

Baby Boomers Individuals born between 1946 and 1964 (approximately 45% of the adult population). © 2000 Prentice Hall

Seniors Generally older consumers. Consist of subcultures including the 50 -plus market and the “elderly consumers” market. © 2000 Prentice Hall

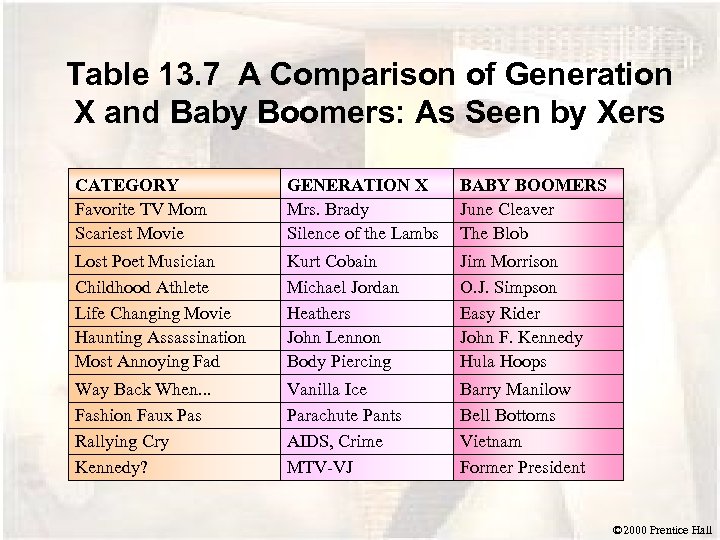

Table 13. 7 A Comparison of Generation X and Baby Boomers: As Seen by Xers CATEGORY Favorite TV Mom Scariest Movie GENERATION X Mrs. Brady Silence of the Lambs BABY BOOMERS June Cleaver The Blob Lost Poet Musician Childhood Athlete Life Changing Movie Haunting Assassination Most Annoying Fad Kurt Cobain Michael Jordan Heathers John Lennon Body Piercing Jim Morrison O. J. Simpson Easy Rider John F. Kennedy Hula Hoops Way Back When. . . Fashion Faux Pas Rallying Cry Kennedy? Vanilla Ice Parachute Pants AIDS, Crime MTV-VJ Barry Manilow Bell Bottoms Vietnam Former President © 2000 Prentice Hall

Issues in Understanding Older Consumer • Defining “Older” in Older Consumer • Segmenting the Elderly Market • Shopping Experiences of the Older Consumer © 2000 Prentice Hall

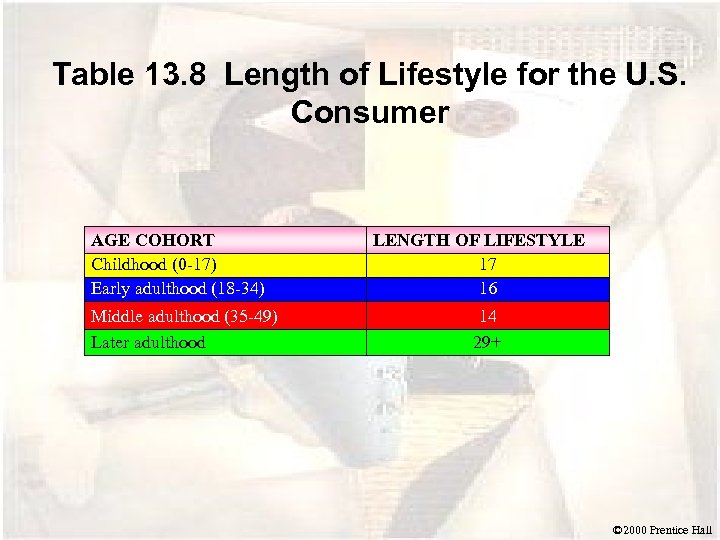

Table 13. 8 Length of Lifestyle for the U. S. Consumer AGE COHORT Childhood (0 -17) Early adulthood (18 -34) Middle adulthood (35 -49) Later adulthood LENGTH OF LIFESTYLE 17 16 14 29+ © 2000 Prentice Hall

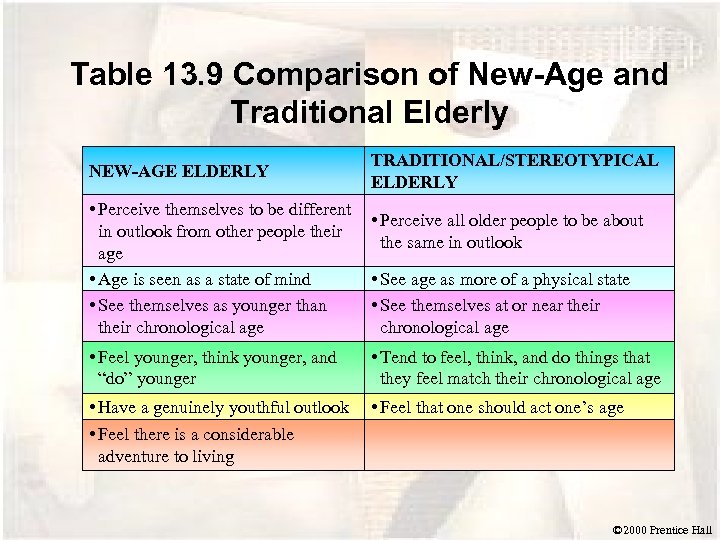

Table 13. 9 Comparison of New-Age and Traditional Elderly NEW-AGE ELDERLY • Perceive themselves to be different in outlook from other people their age • Age is seen as a state of mind • See themselves as younger than their chronological age TRADITIONAL/STEREOTYPICAL ELDERLY • Perceive all older people to be about the same in outlook • See age as more of a physical state • See themselves at or near their chronological age • Feel younger, think younger, and “do” younger • Tend to feel, think, and do things that they feel match their chronological age • Have a genuinely youthful outlook • Feel there is a considerable adventure to living • Feel that one should act one’s age © 2000 Prentice Hall

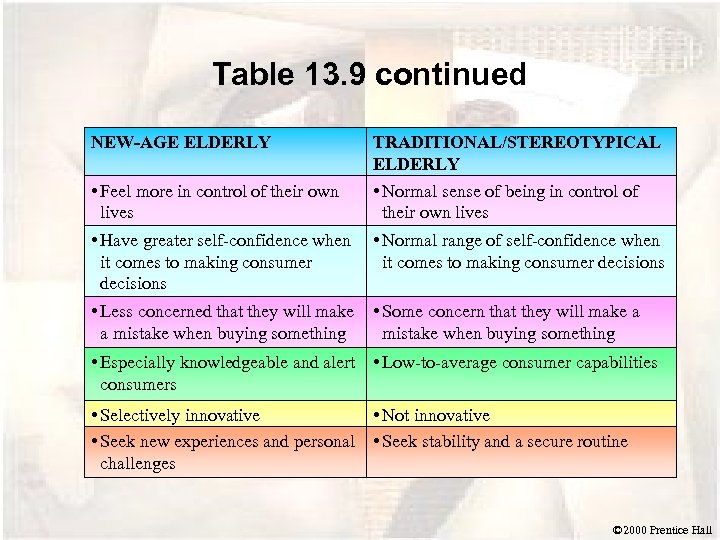

Table 13. 9 continued NEW-AGE ELDERLY • Feel more in control of their own lives • Have greater self-confidence when it comes to making consumer decisions • Less concerned that they will make a mistake when buying something TRADITIONAL/STEREOTYPICAL ELDERLY • Normal sense of being in control of their own lives • Normal range of self-confidence when it comes to making consumer decisions • Some concern that they will make a mistake when buying something • Especially knowledgeable and alert • Low-to-average consumer capabilities consumers • Selectively innovative • Not innovative • Seek new experiences and personal • Seek stability and a secure routine challenges © 2000 Prentice Hall

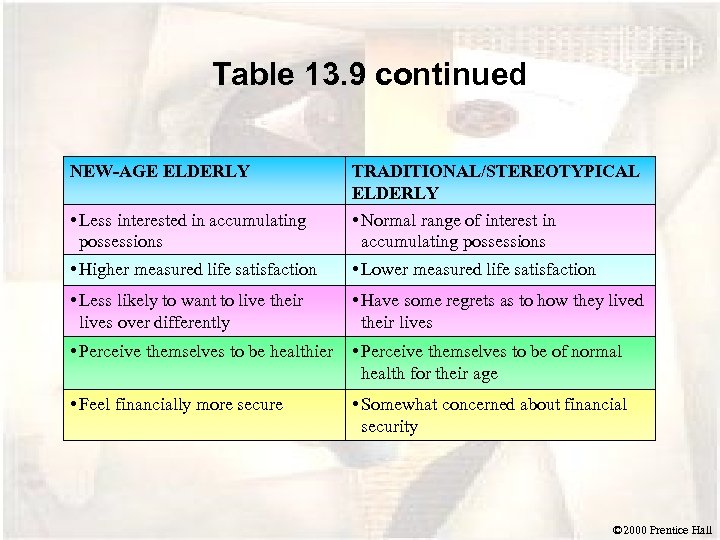

Table 13. 9 continued NEW-AGE ELDERLY • Less interested in accumulating possessions • Higher measured life satisfaction TRADITIONAL/STEREOTYPICAL ELDERLY • Normal range of interest in accumulating possessions • Lower measured life satisfaction • Less likely to want to live their lives over differently • Have some regrets as to how they lived their lives • Perceive themselves to be healthier • Perceive themselves to be of normal health for their age • Feel financially more secure • Somewhat concerned about financial security © 2000 Prentice Hall

Issues in Understanding Sex as a Subculture • Sex Roles and Consumer Behavior – Masculine vs. Feminine Traits • The Working Woman – Segmentation Issues – Shopping Patterns © 2000 Prentice Hall

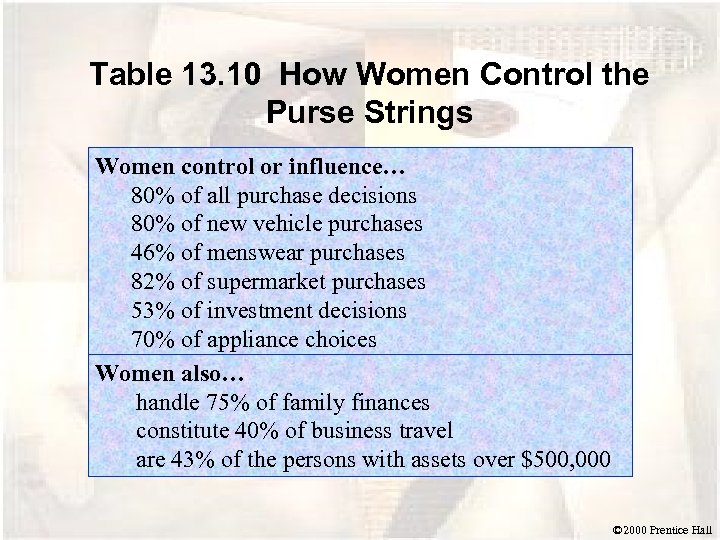

Table 13. 10 How Women Control the Purse Strings Women control or influence… 80% of all purchase decisions 80% of new vehicle purchases 46% of menswear purchases 82% of supermarket purchases 53% of investment decisions 70% of appliance choices Women also… handle 75% of family finances constitute 40% of business travel are 43% of the persons with assets over $500, 000 © 2000 Prentice Hall

2a49c358e1a25e35314feb2c8f823d25.ppt