a4d14e3de46ebb441d028084e724f02c.ppt

- Количество слайдов: 62

Chapter 13: Money, Banks, and the Federal Reserve System Today (Tuesday, April 7): 1. Money 1. Nature of money: (fiat vs. commodity money, double coincidence of wants) 2. Functions of money 3. Measurement of money 2. Banks 1. How banks make money 2. Reserve requirement and money multiplier 3. The Federal Reserve System 1. Monetary policy 2. The quantity theory of money

Money

What Is Money and Why Do We Need It? Money Assets that people are generally willing to accept in exchange for goods and services or for payment of debts. Asset Anything of value owned by a person or a firm. Fiat money Money, such as paper currency, that is authorized by a central bank or governmental body and that does not have to be exchanged by the central bank for gold or some other commodity money. Commodity money A good used as money that also has value independent of its use as money.

The Functions of Money Medium of Exchange Money serves as a medium of exchange when sellers are willing to accept it in exchange for goods or services. Unit of Account In a barter system, each good has many prices. Store of Value Money allows value to be stored easily: If you do not use all your accumulated Dinnars to buy goods and services today, you can hold the rest to use in the future. Standard of Deferred Payment Money is useful because it can serve as a standard of deferred payment in borrowing and lending.

Learning Objective 13. 1 What Is Money and Why Do We Need It? What Can Serve as Money? Five criteria make a good suitable to use as a medium of exchange: 1 The good must be acceptable to (that is, usable by) most people. 2 It should be of standardized quality so that any two units are identical. 3 It should be durable so that value is not lost by spoilage. 4 It should be valuable relative to its weight so that amounts large enough to be useful in trade can be easily transported. 5 The medium of exchange should be divisible because different goods are valued differently.

Learning Objective 13. 1 Making the Connection Money without a Government? The Strange Case of the Iraqi Dinar Many Iraqis continued to use currency with Saddam’s picture on it, even after he was forced from power.

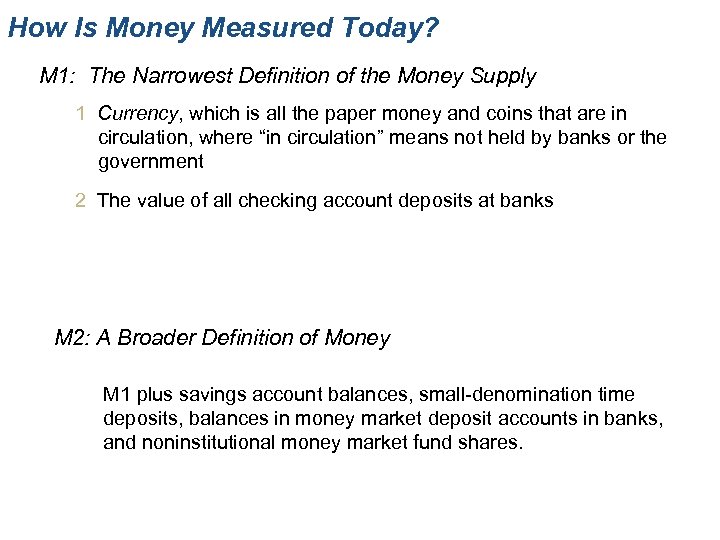

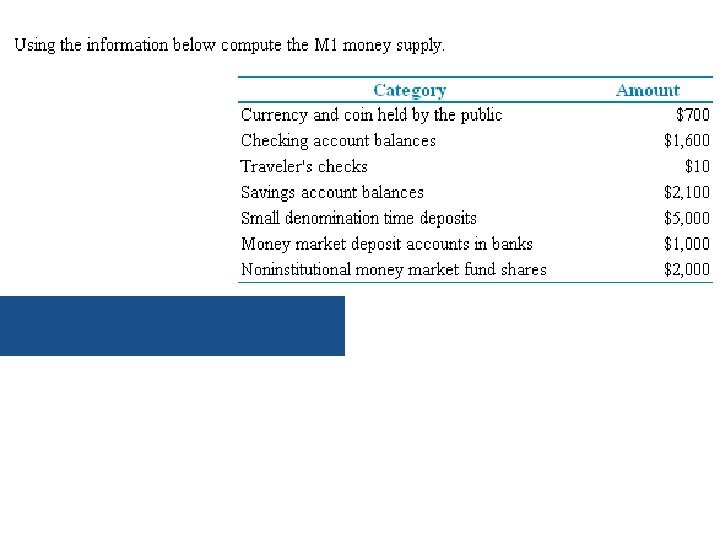

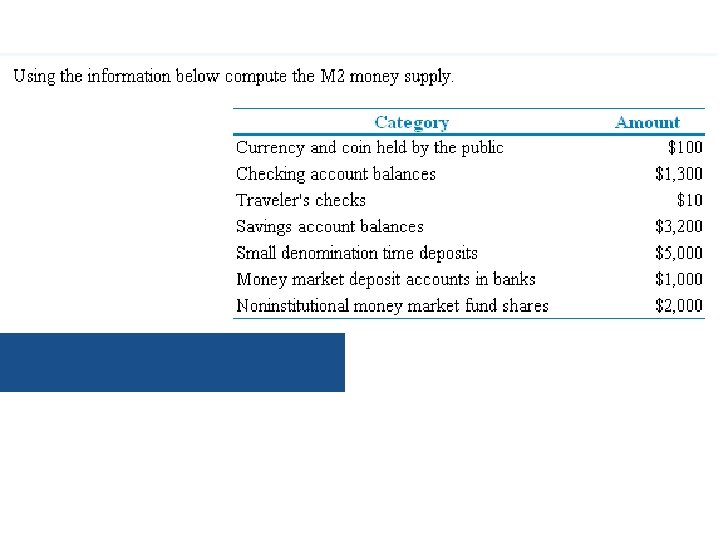

How Is Money Measured Today? M 1: The Narrowest Definition of the Money Supply 1 Currency, which is all the paper money and coins that are in circulation, where “in circulation” means not held by banks or the government 2 The value of all checking account deposits at banks M 2: A Broader Definition of Money M 1 plus savings account balances, small-denomination time deposits, balances in money market deposit accounts in banks, and noninstitutional money market fund shares.

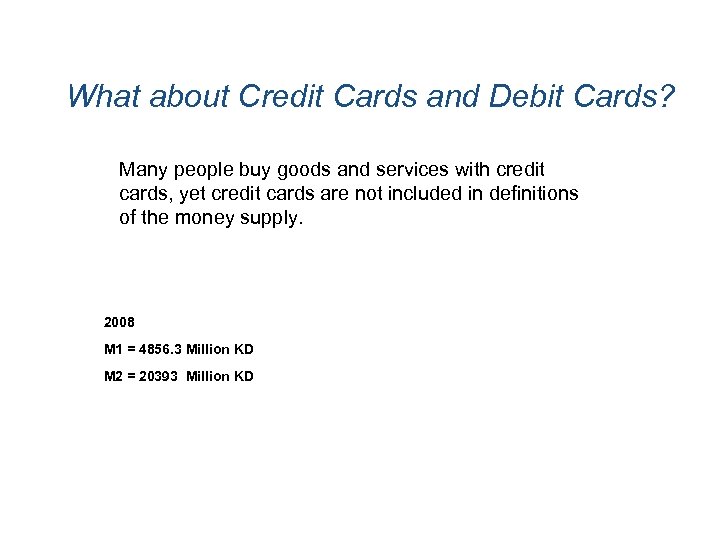

What about Credit Cards and Debit Cards? Many people buy goods and services with credit cards, yet credit cards are not included in definitions of the money supply. 2008 M 1 = 4856. 3 Million KD M 2 = 20393 Million KD

Banks

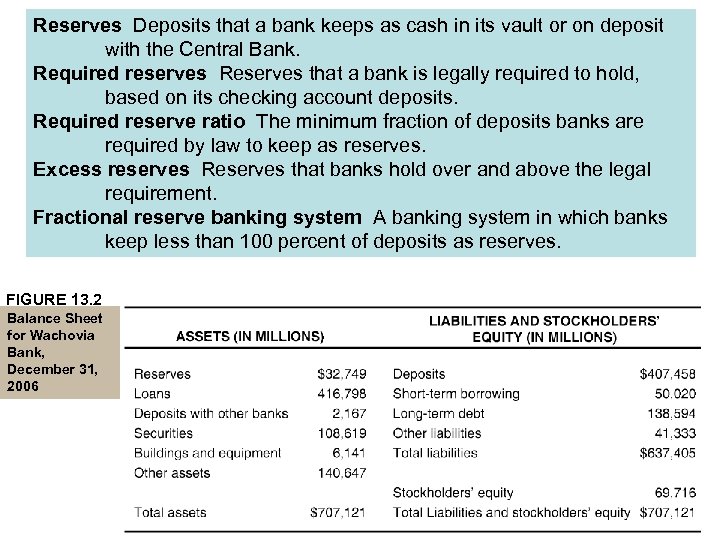

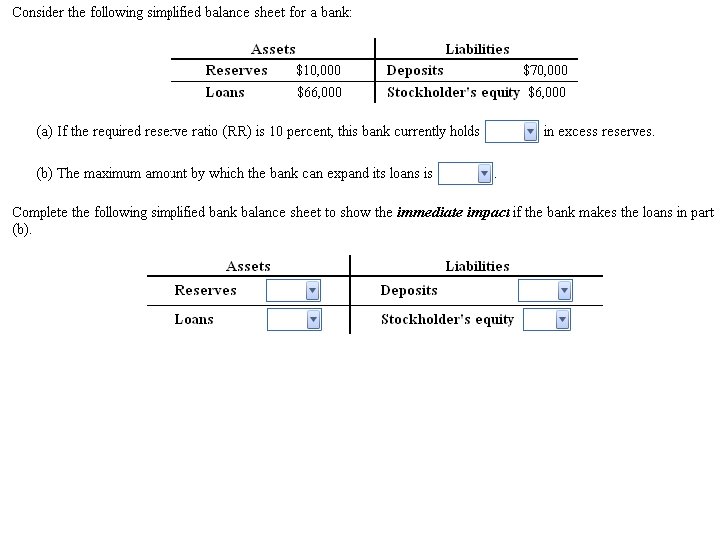

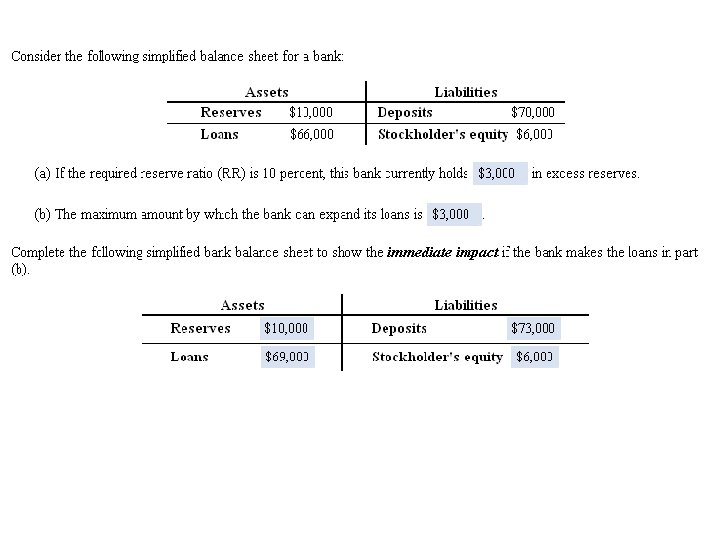

Reserves Deposits that a bank keeps as cash in its vault or on deposit with the Central Bank. Required reserves Reserves that a bank is legally required to hold, based on its checking account deposits. Required reserve ratio The minimum fraction of deposits banks are required by law to keep as reserves. Excess reserves Reserves that banks hold over and above the legal requirement. Fractional reserve banking system A banking system in which banks keep less than 100 percent of deposits as reserves. FIGURE 13. 2 Balance Sheet for Wachovia Bank, December 31, 2006

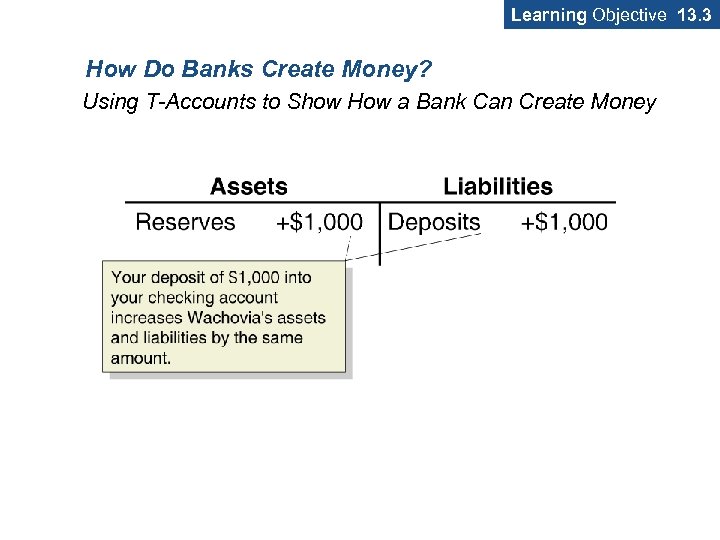

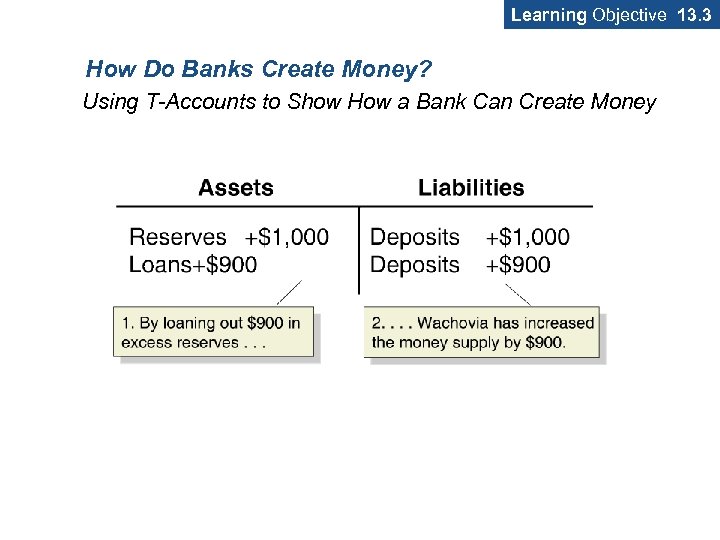

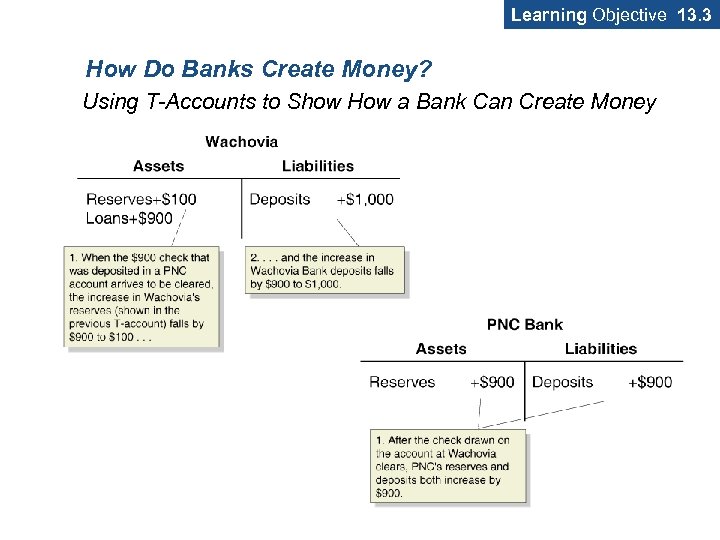

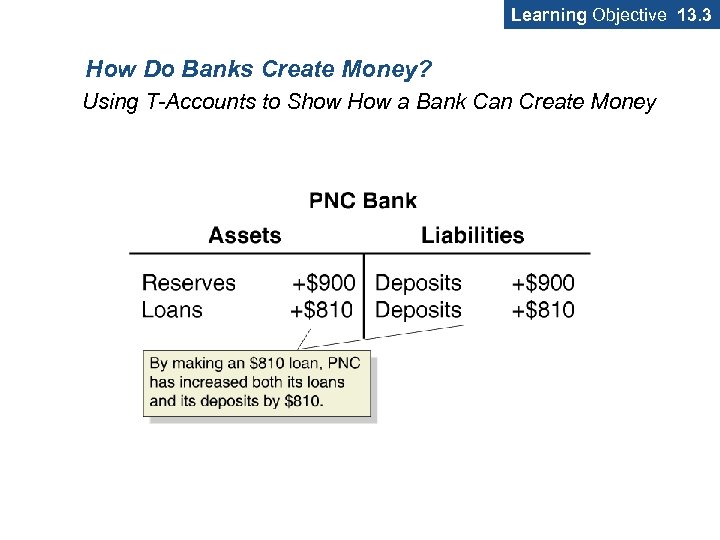

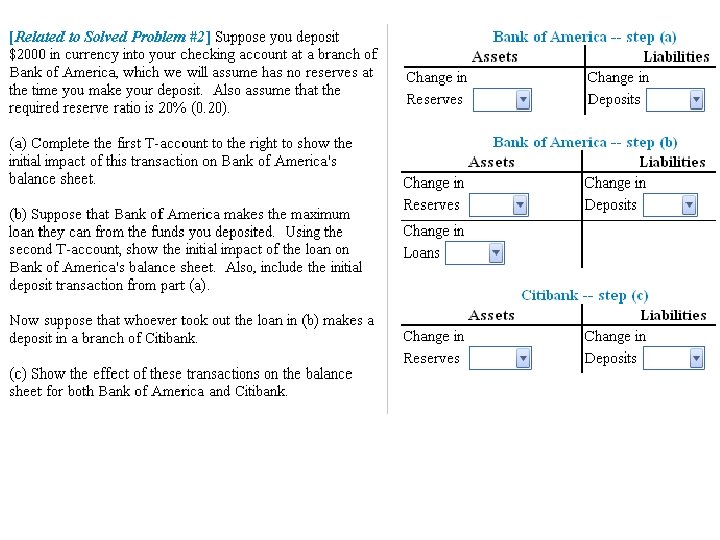

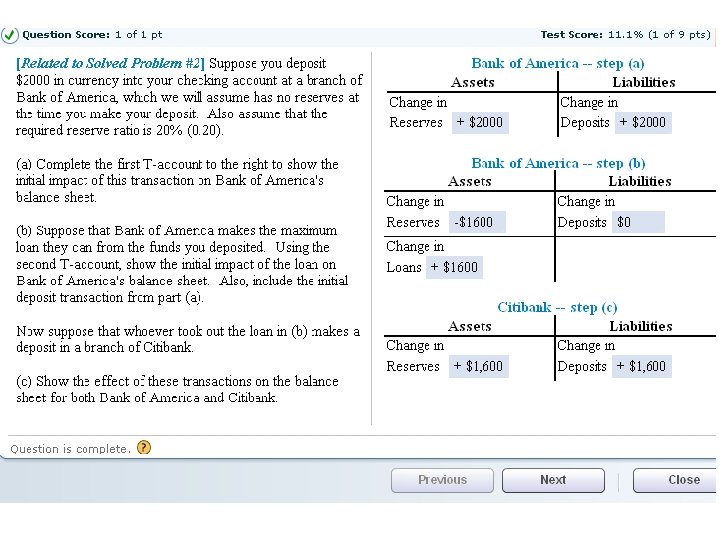

Learning Objective 13. 3 How Do Banks Create Money? Using T-Accounts to Show How a Bank Can Create Money

Learning Objective 13. 3 How Do Banks Create Money? Using T-Accounts to Show How a Bank Can Create Money

Learning Objective 13. 3 How Do Banks Create Money? Using T-Accounts to Show How a Bank Can Create Money

Learning Objective 13. 3 How Do Banks Create Money? Using T-Accounts to Show How a Bank Can Create Money

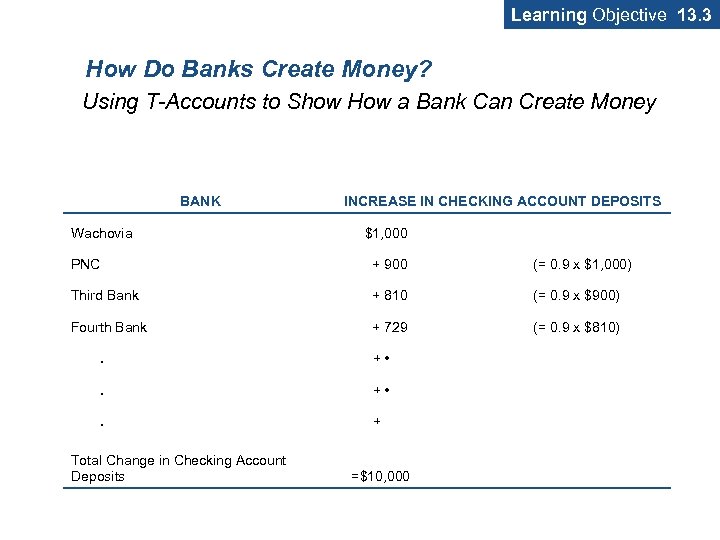

Learning Objective 13. 3 How Do Banks Create Money? Using T-Accounts to Show How a Bank Can Create Money BANK Wachovia INCREASE IN CHECKING ACCOUNT DEPOSITS $1, 000 PNC + 900 (= 0. 9 x $1, 000) Third Bank + 810 (= 0. 9 x $900) Fourth Bank + 729 (= 0. 9 x $810) . + • . + Total Change in Checking Account Deposits =$10, 000

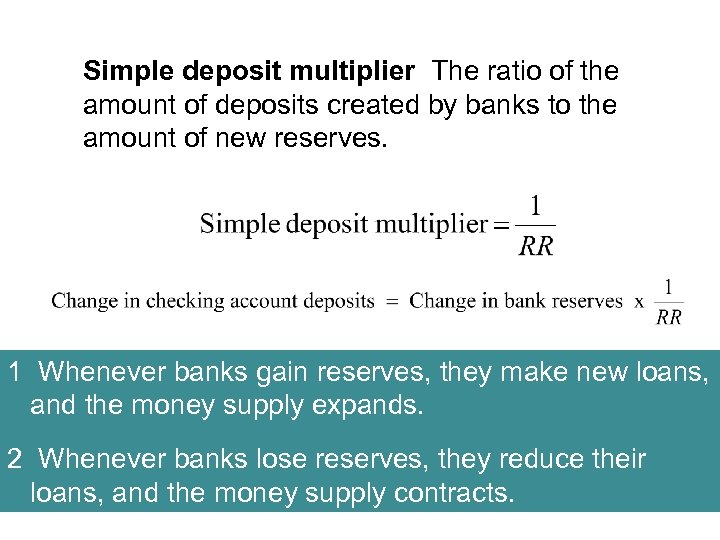

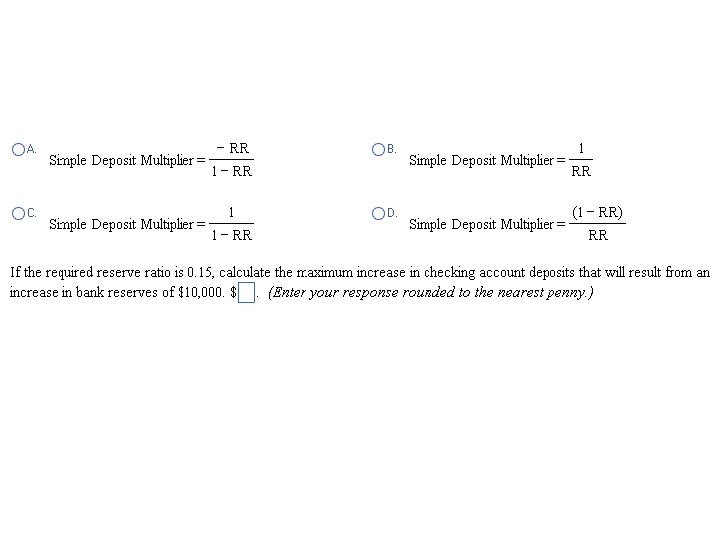

Simple deposit multiplier The ratio of the amount of deposits created by banks to the amount of new reserves. 1 Whenever banks gain reserves, they make new loans, and the money supply expands. 2 Whenever banks lose reserves, they reduce their loans, and the money supply contracts.

Making the The 2001 Bank Panic in Argentina Connection Bank run A situation in which many depositors simultaneously decide to withdraw money from a bank. Bank panic A situation in which many banks experience runs at the same time. The Argentine central bank was unable to stop the bank panic of 2001.

The Federal Reserve System

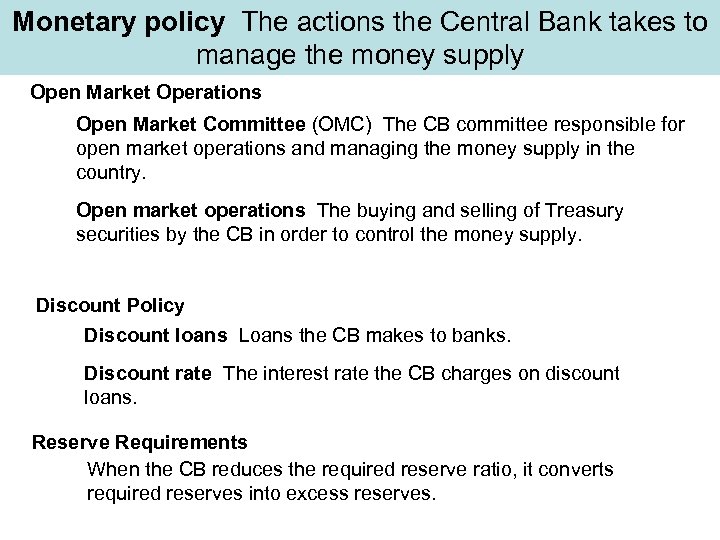

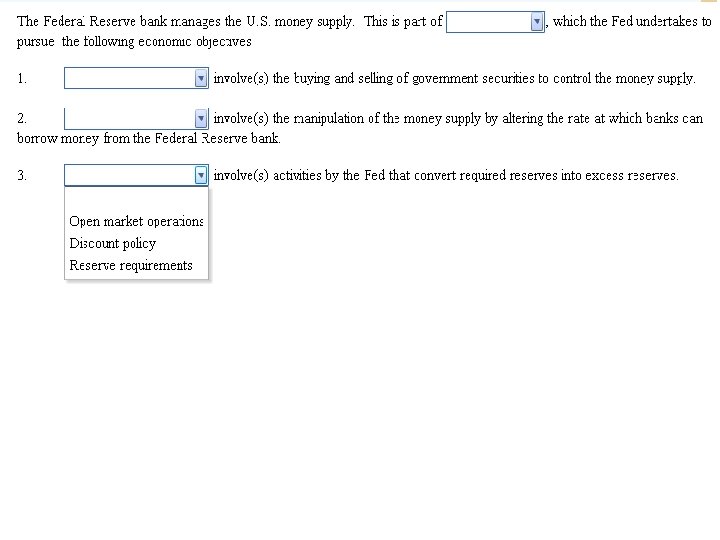

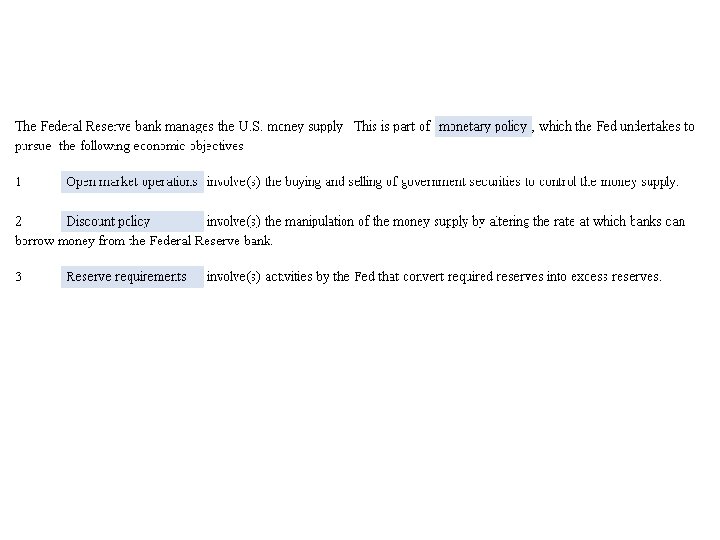

Monetary policy The actions the Central Bank takes to manage the money supply Open Market Operations Open Market Committee (OMC) The CB committee responsible for open market operations and managing the money supply in the country. Open market operations The buying and selling of Treasury securities by the CB in order to control the money supply. Discount Policy Discount loans Loans the CB makes to banks. Discount rate The interest rate the CB charges on discount loans. Reserve Requirements When the CB reduces the required reserve ratio, it converts required reserves into excess reserves.

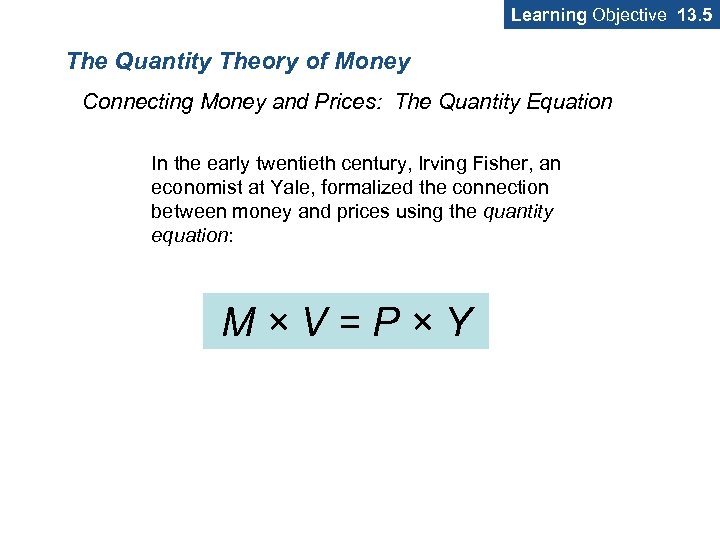

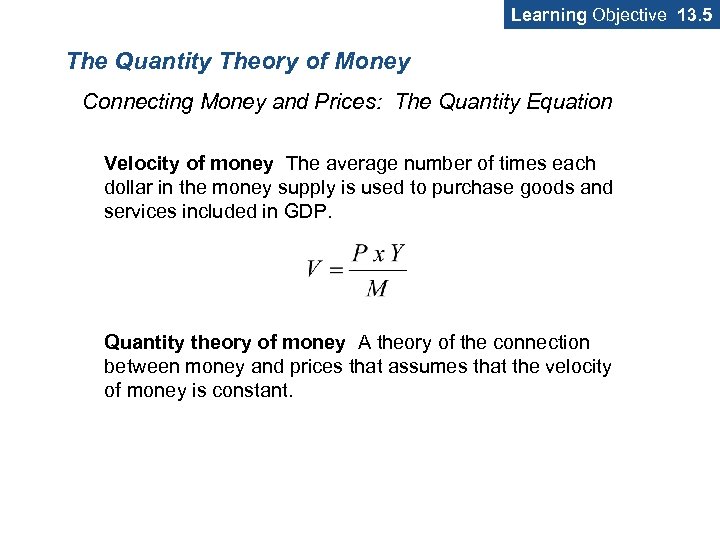

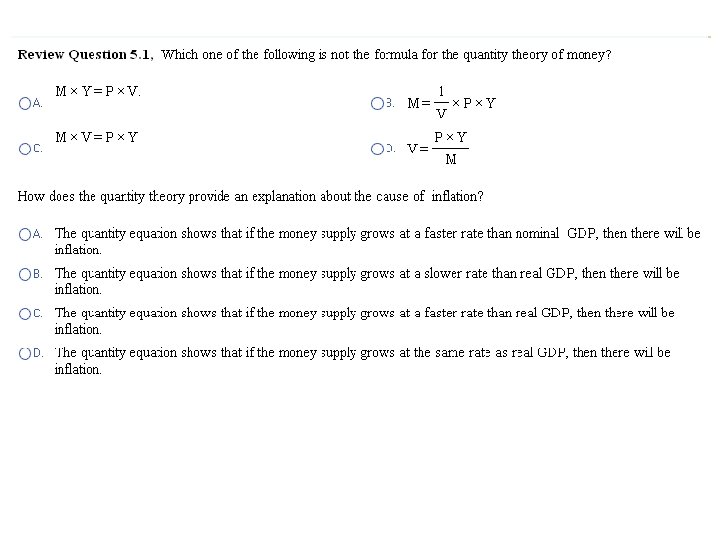

Learning Objective 13. 5 The Quantity Theory of Money Connecting Money and Prices: The Quantity Equation In the early twentieth century, Irving Fisher, an economist at Yale, formalized the connection between money and prices using the quantity equation: M×V=P×Y

Learning Objective 13. 5 The Quantity Theory of Money Connecting Money and Prices: The Quantity Equation Velocity of money The average number of times each dollar in the money supply is used to purchase goods and services included in GDP. Quantity theory of money A theory of the connection between money and prices that assumes that the velocity of money is constant.

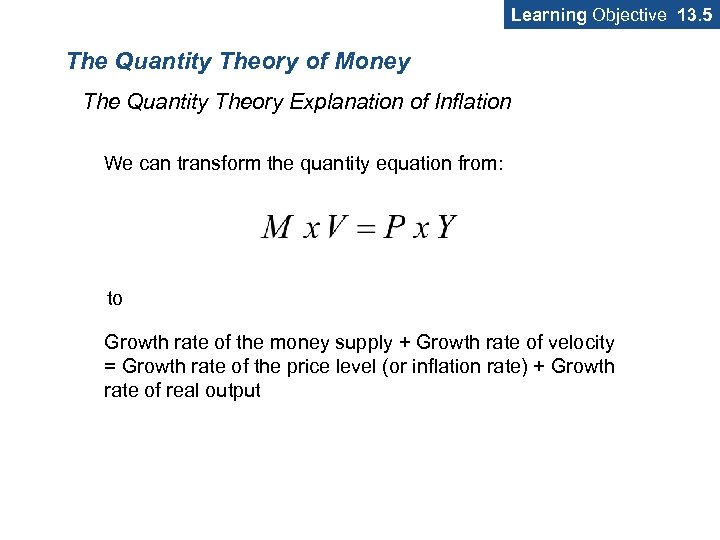

Learning Objective 13. 5 The Quantity Theory of Money The Quantity Theory Explanation of Inflation We can transform the quantity equation from: to Growth rate of the money supply + Growth rate of velocity = Growth rate of the price level (or inflation rate) + Growth rate of real output

Learning Objective 13. 5 The Quantity Theory of Money The Quantity Theory Explanation of Inflation The growth rate of the price level is just the inflation rate, so we can rewrite the quantity equation to help us understand the factors that determine inflation: Inflation rate = Growth rate of the money supply + Growth rate of velocity − Growth rate of real output If Irving Fisher was correct that velocity is constant, then the growth rate of velocity will be zero. This allows us to rewrite the equation one last time: Inflation rate = Growth rate of the money supply − Growth rate of real output

Learning Objective 13. 5 The Quantity Theory of Money The Quantity Theory Explanation of Inflation This equation leads to the following predictions: 1 If the money supply grows at a faster rate than real GDP, there will be inflation. 2 If the money supply grows at a slower rate than real GDP, there will be deflation. (Recall that deflation is a decline in the price level. ) 3 If the money supply grows at the same rate as real GDP, the price level will be stable, and there will be neither inflation nor deflation.

Learning Objective 13. 5 The Quantity Theory of Money High Rates of Inflation Very high rates of inflation—in excess of hundreds or thousands of percentage points per year—are known as hyperinflation. Economies suffering from high inflation usually also suffer from very slow growth, if not severe recession.

Making the Connection The German Hyperinflation of the Early 1920 s During the hyperinflation of the 1920 s, people in Germany used paper currency to light their stoves.

Recall, there are many policies that can applied to change a GDP gap or to generally change the real GDP and the price level. One of these policies is the Fiscal Policy. The other policy is monetary policy. Monetary policy: policy by the central Bank to adjust and control the quantity of money in circulation (money supply) through different tools to influence GDP growth, the general price level and other macroeconomics variables.

To understand the operation of the monetary policy, we need to understand the definition and function of money, commercial banks, and the central bank.

To understand the operation of the monetary policy, we need to understand the definition and function of money, commercial banks, and the central bank. First: Money Q: What is money ? Money: anything that is generally accepted as a means of payment (in the exchange of goods & services)

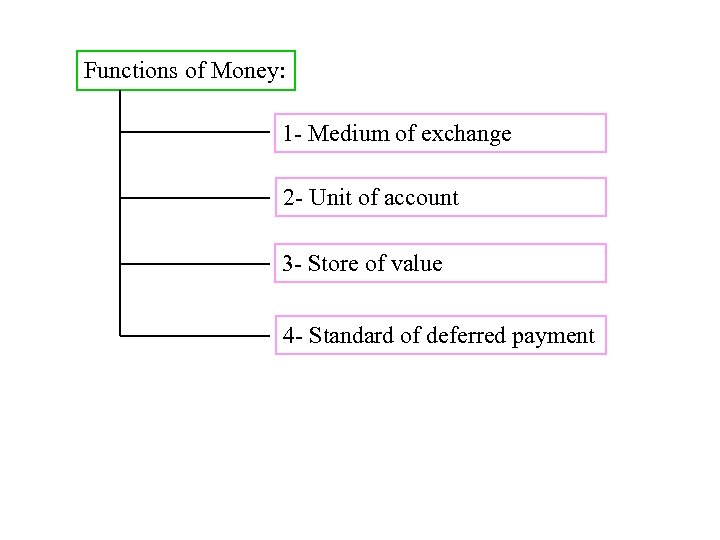

Functions of Money: 1 - Medium of exchange 2 - Unit of account 3 - Store of value 4 - Standard of deferred payment

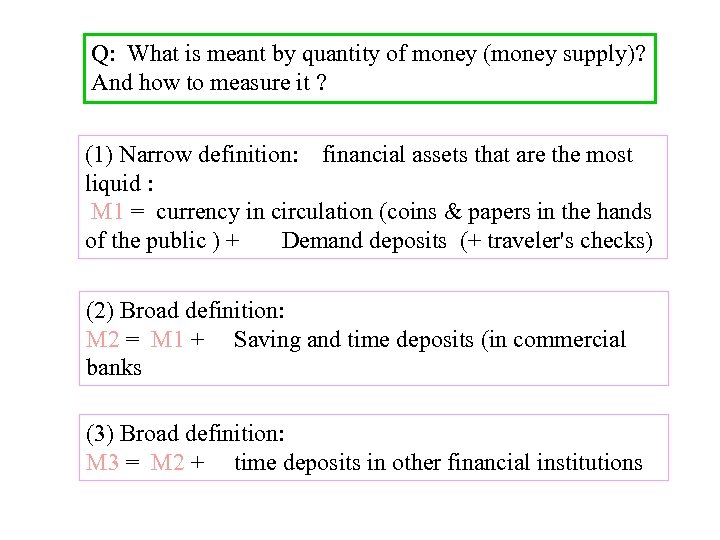

Q: What is meant by quantity of money (money supply)? And how to measure it ? (1) Narrow definition: financial assets that are the most liquid : M 1 = currency in circulation (coins & papers in the hands of the public ) + Demand deposits (+ traveler's checks) (2) Broad definition: M 2 = M 1 + Saving and time deposits (in commercial banks (3) Broad definition: M 3 = M 2 + time deposits in other financial institutions

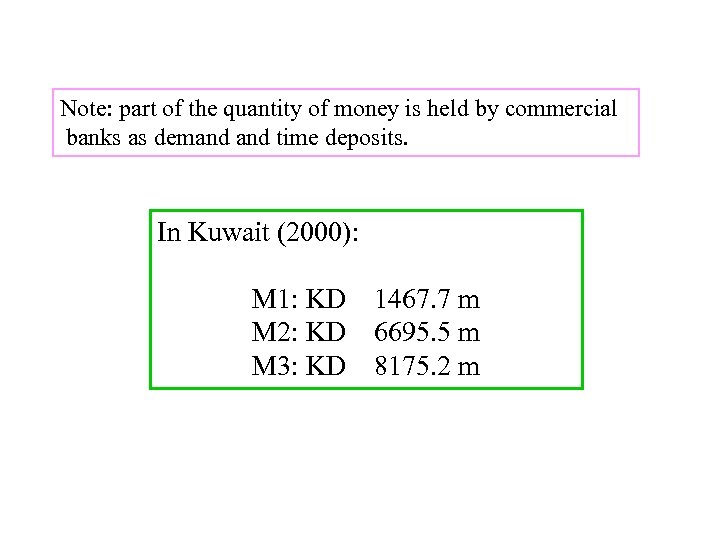

Note: part of the quantity of money is held by commercial banks as demand time deposits. In Kuwait (2000): M 1: KD M 2: KD M 3: KD 1467. 7 m 6695. 5 m 8175. 2 m

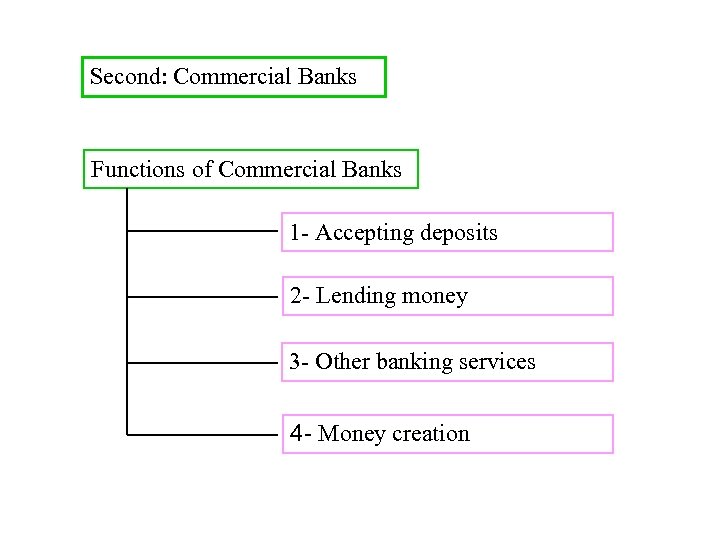

Second: Commercial Banks Functions of Commercial Banks 1 - Accepting deposits 2 - Lending money 3 - Other banking services 4 - Money creation

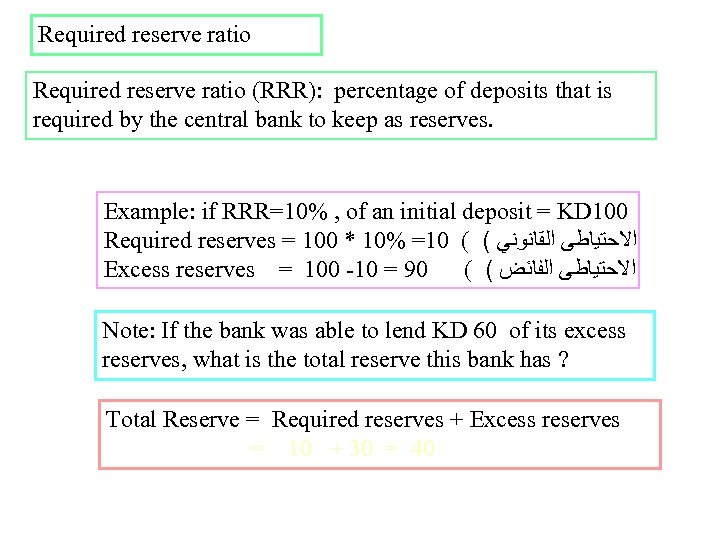

Required reserve ratio (RRR): percentage of deposits that is required by the central bank to keep as reserves. Example: if RRR=10% , of an initial deposit = KD 100 Required reserves = 100 * 10% =10 ( ( ﺍﻻﺣﺘﻴﺎﻃﻰ ﺍﻟﻘﺎﻧﻮﻧﻲ Excess reserves = 100 -10 = 90 ( ( ﺍﻻﺣﺘﻴﺎﻃﻰ ﺍﻟﻔﺎﺋﺾ Note: If the bank was able to lend KD 60 of its excess reserves, what is the total reserve this bank has ? Total Reserve = Required reserves + Excess reserves = 10 + 30 = 40

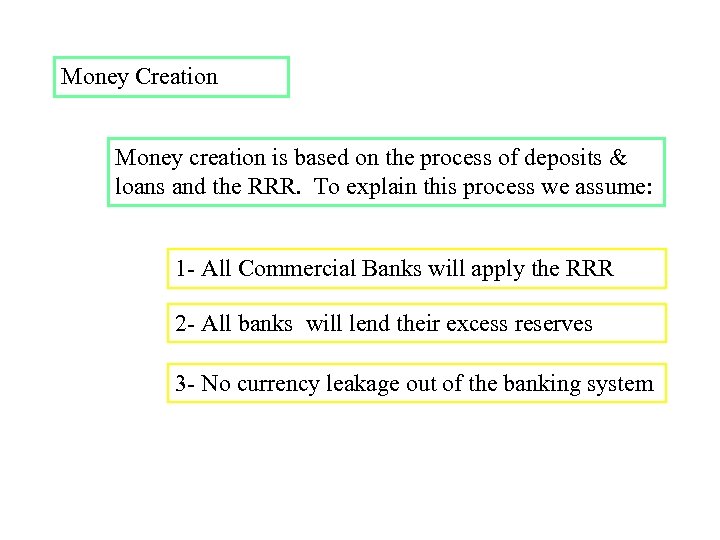

Money Creation Money creation is based on the process of deposits & loans and the RRR. To explain this process we assume: 1 - All Commercial Banks will apply the RRR 2 - All banks will lend their excess reserves 3 - No currency leakage out of the banking system

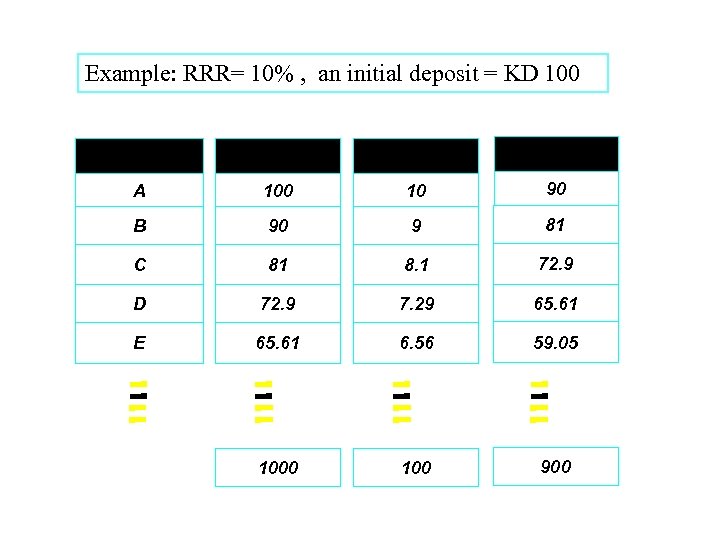

Example: RRR= 10% , an initial deposit = KD 100 Bank Deposits Required Reserves Excess Reserve A 100 10 90 B 90 9 81 C 81 8. 1 72. 9 D 72. 9 7. 29 65. 61 E 65. 61 6. 56 59. 05 1000 100 900

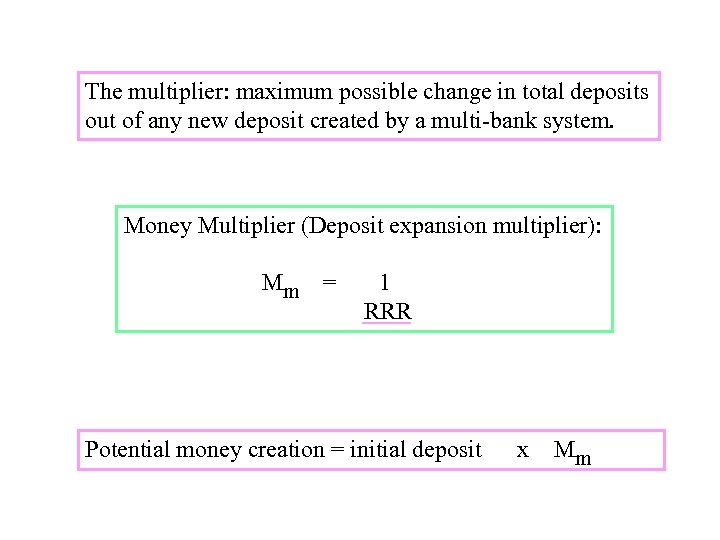

The multiplier: maximum possible change in total deposits out of any new deposit created by a multi-bank system. Money Multiplier (Deposit expansion multiplier): Mm = 1 RRR Potential money creation = initial deposit x Mm

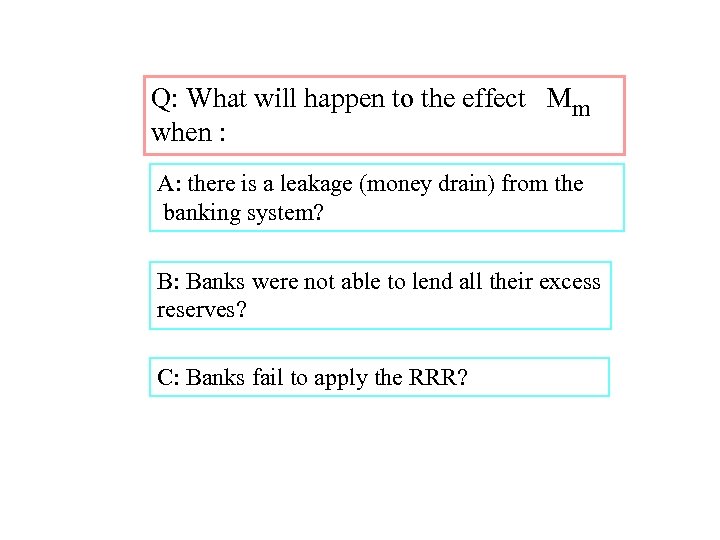

Q: What will happen to the effect Mm when : A: there is a leakage (money drain) from the banking system? B: Banks were not able to lend all their excess reserves? C: Banks fail to apply the RRR?

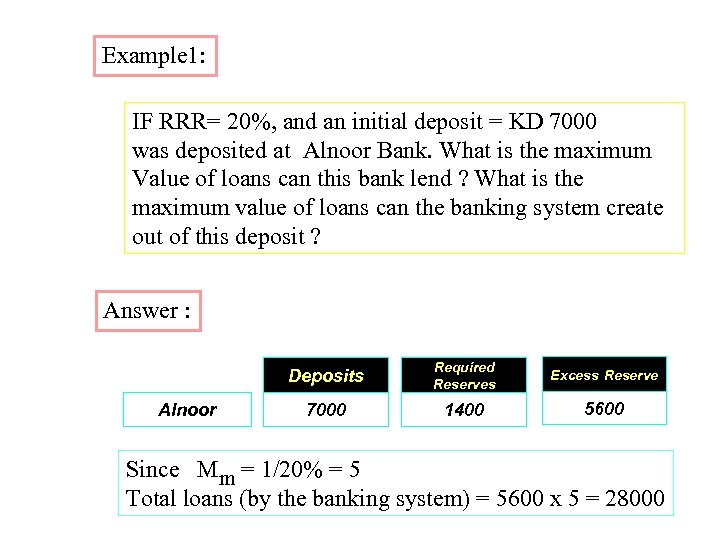

Example 1: IF RRR= 20%, and an initial deposit = KD 7000 was deposited at Alnoor Bank. What is the maximum Value of loans can this bank lend ? What is the maximum value of loans can the banking system create out of this deposit ? Answer : Deposits Alnoor Required Reserves Excess Reserve 7000 1400 5600 Since Mm = 1/20% = 5 Total loans (by the banking system) = 5600 x 5 = 28000

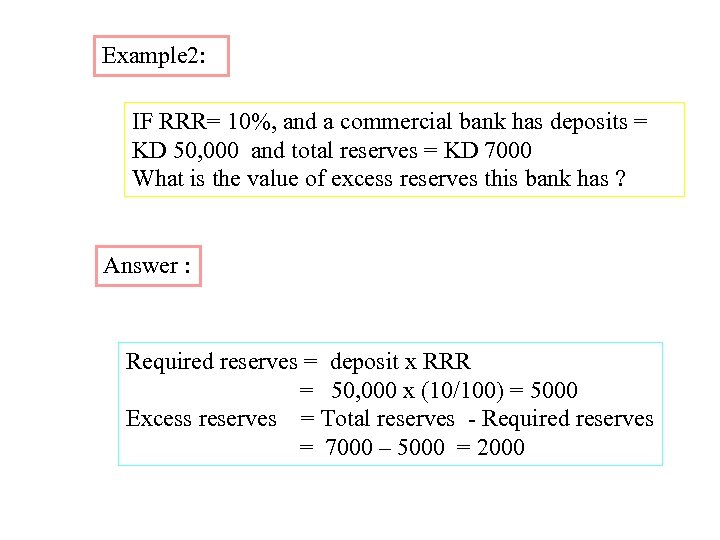

Example 2: IF RRR= 10%, and a commercial bank has deposits = KD 50, 000 and total reserves = KD 7000 What is the value of excess reserves this bank has ? Answer : Required reserves = deposit x RRR = 50, 000 x (10/100) = 5000 Excess reserves = Total reserves - Required reserves = 7000 – 5000 = 2000

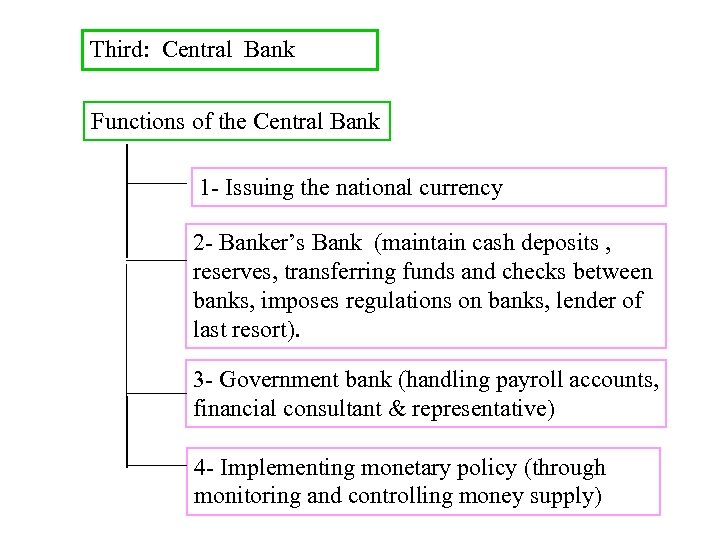

Third: Central Bank Functions of the Central Bank 1 - Issuing the national currency 2 - Banker’s Bank (maintain cash deposits , reserves, transferring funds and checks between banks, imposes regulations on banks, lender of last resort). 3 - Government bank (handling payroll accounts, financial consultant & representative) 4 - Implementing monetary policy (through monitoring and controlling money supply)

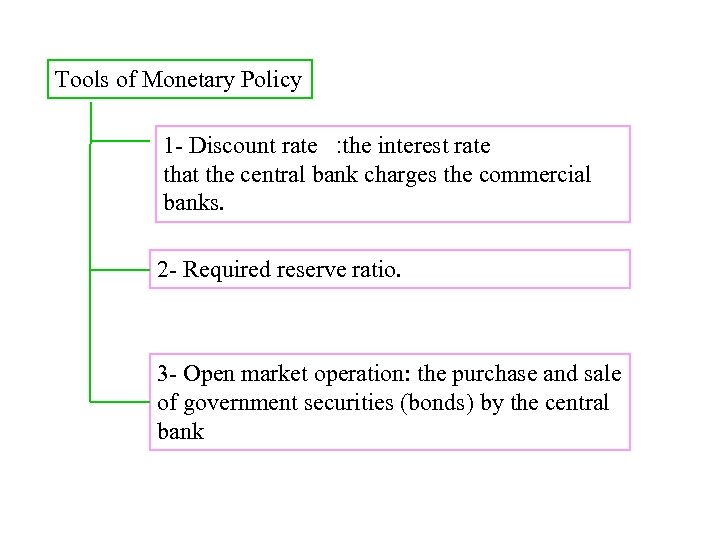

Tools of Monetary Policy 1 - Discount rate : the interest rate that the central bank charges the commercial banks. 2 - Required reserve ratio. 3 - Open market operation: the purchase and sale of government securities (bonds) by the central bank

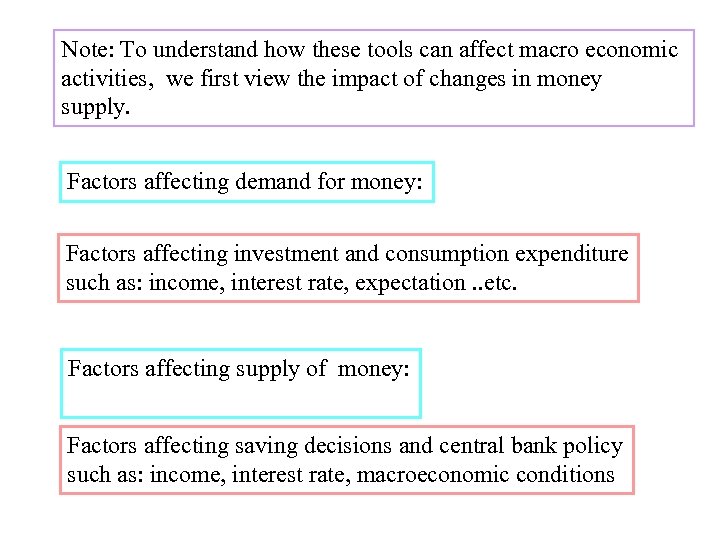

Note: To understand how these tools can affect macro economic activities, we first view the impact of changes in money supply. Factors affecting demand for money: Factors affecting investment and consumption expenditure such as: income, interest rate, expectation. . etc. Factors affecting supply of money: Factors affecting saving decisions and central bank policy such as: income, interest rate, macroeconomic conditions

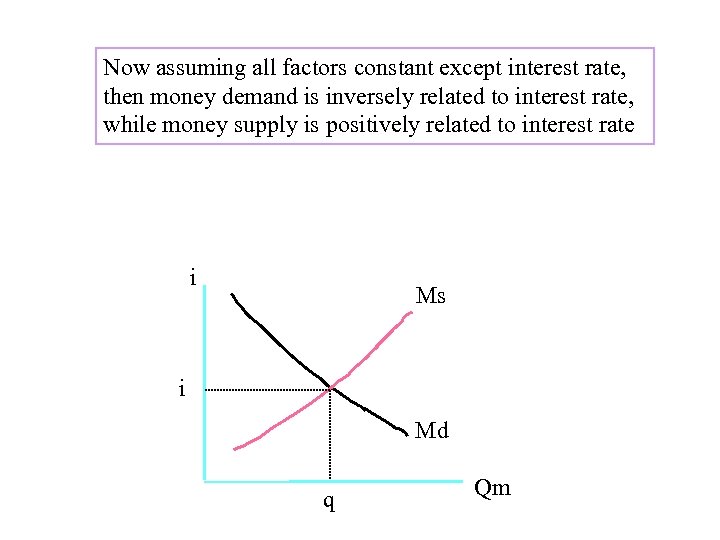

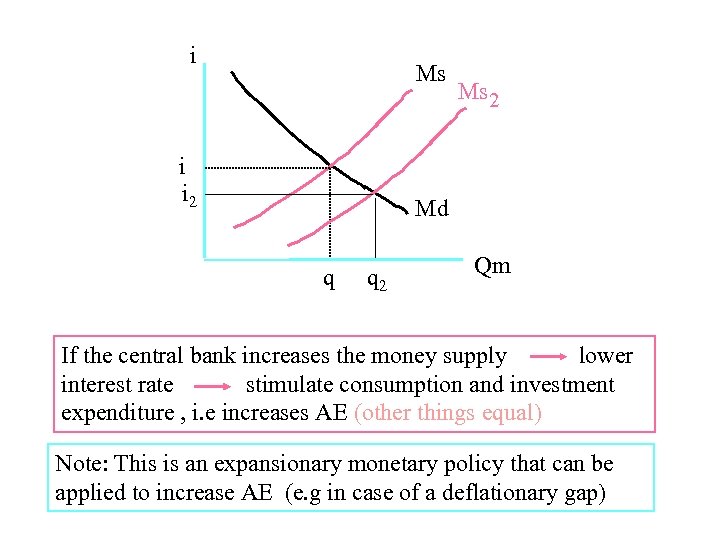

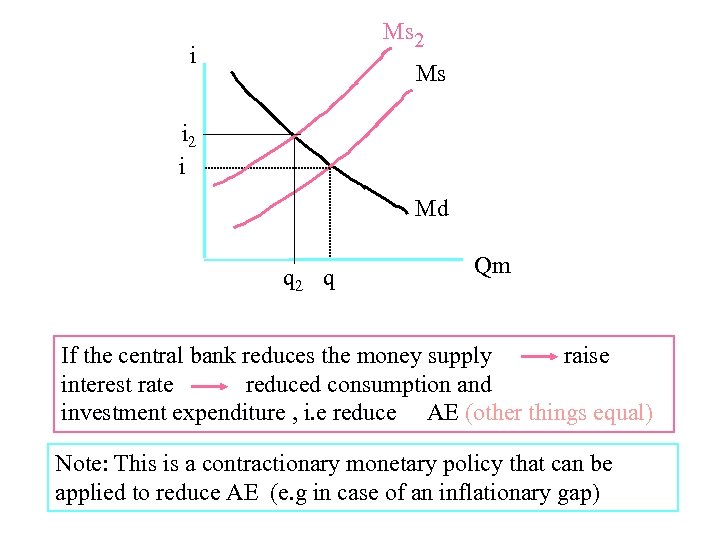

Now assuming all factors constant except interest rate, then money demand is inversely related to interest rate, while money supply is positively related to interest rate i Ms i Md q Qm

i Ms i i 2 Ms 2 Md q q 2 Qm If the central bank increases the money supply lower interest rate stimulate consumption and investment expenditure , i. e increases AE (other things equal) Note: This is an expansionary monetary policy that can be applied to increase AE (e. g in case of a deflationary gap)

Ms 2 i Ms i 2 i Md q 2 q Qm If the central bank reduces the money supply raise interest rate reduced consumption and investment expenditure , i. e reduce AE (other things equal) Note: This is a contractionary monetary policy that can be applied to reduce AE (e. g in case of an inflationary gap)

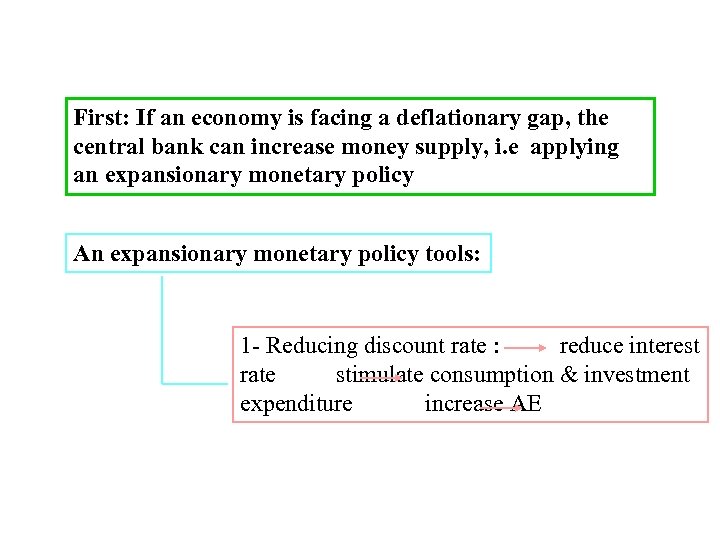

First: If an economy is facing a deflationary gap, the central bank can increase money supply, i. e applying an expansionary monetary policy An expansionary monetary policy tools: 1 - Reducing discount rate : reduce interest rate stimulate consumption & investment expenditure increase AE

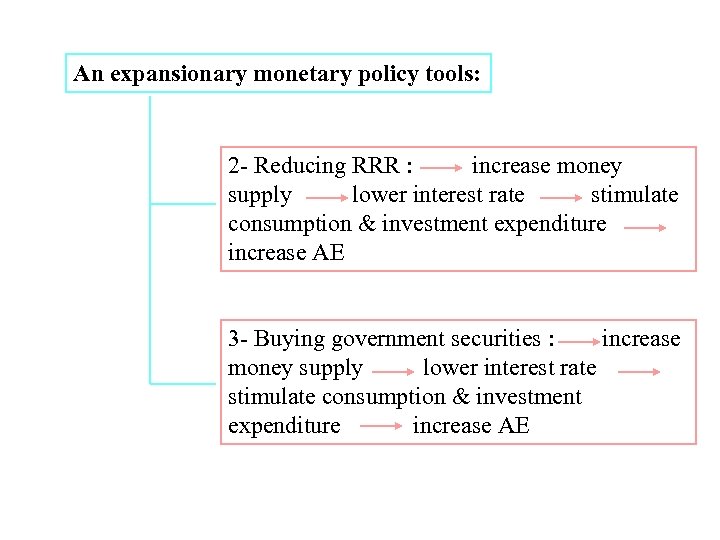

An expansionary monetary policy tools: 2 - Reducing RRR : increase money supply lower interest rate stimulate consumption & investment expenditure increase AE 3 - Buying government securities : increase money supply lower interest rate stimulate consumption & investment expenditure increase AE

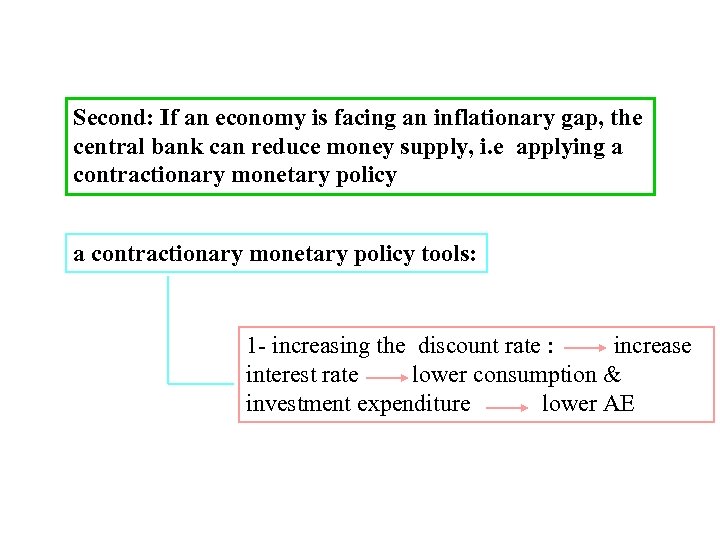

Second: If an economy is facing an inflationary gap, the central bank can reduce money supply, i. e applying a contractionary monetary policy tools: 1 - increasing the discount rate : increase interest rate lower consumption & investment expenditure lower AE

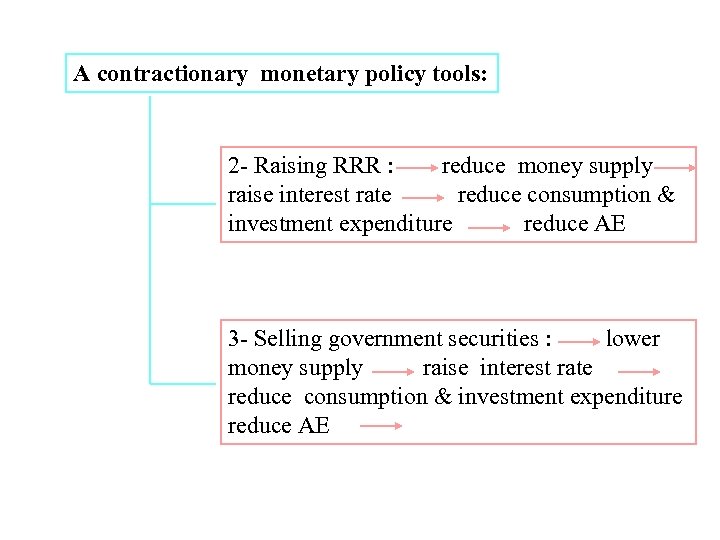

A contractionary monetary policy tools: 2 - Raising RRR : reduce money supply raise interest rate reduce consumption & investment expenditure reduce AE 3 - Selling government securities : lower money supply raise interest rate reduce consumption & investment expenditure reduce AE

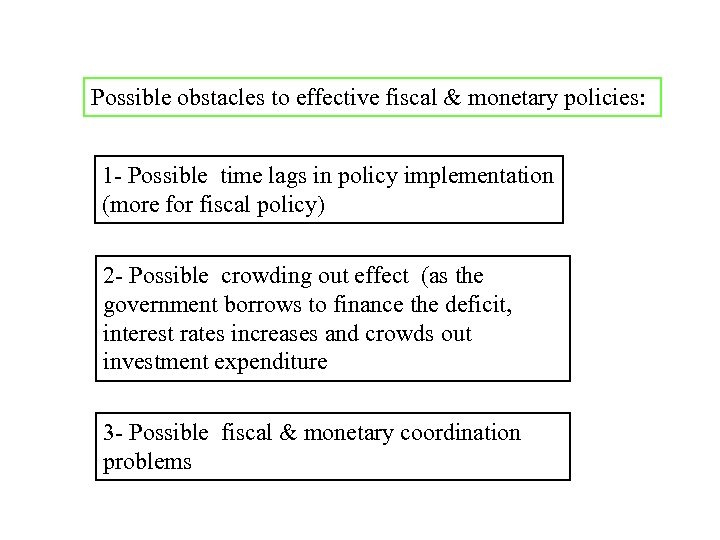

Possible obstacles to effective fiscal & monetary policies: 1 - Possible time lags in policy implementation (more for fiscal policy) 2 - Possible crowding out effect (as the government borrows to finance the deficit, interest rates increases and crowds out investment expenditure 3 - Possible fiscal & monetary coordination problems

4 - Lack of full control over some domestic and international economic variables. (e. g lack of control over international money movement, investors & consumers expectations, social & political changes) 5 - Limitations of accurate economic forecasting of dynamic economic variables. Q: What policies should be applied in case of stagflation?

a4d14e3de46ebb441d028084e724f02c.ppt