db2cd169b4653a7e9ff83fec87d0de65.ppt

- Количество слайдов: 34

CHAPTER 13 Foreign operations

CHAPTER 13 Foreign operations

Contents q q q Stock exchange requirements Segment reporting Foreign currency transactions and foreign operations Primary translation – reporting foreign currency transactions in the functional currency Secondary translation – translating individual foreign currency financial statements in a group’s presentation currency Alternative accounting methods for secondary translation

Contents q q q Stock exchange requirements Segment reporting Foreign currency transactions and foreign operations Primary translation – reporting foreign currency transactions in the functional currency Secondary translation – translating individual foreign currency financial statements in a group’s presentation currency Alternative accounting methods for secondary translation

Stock exchange requirements q Stock exchange listing as a strategic issue Credibility v Public awareness v Financing flexibility v q q IFRS accepted by most stock exchanges IFRS not yet fully accepted in the US SEC requires reconciliation statement on net income and shareholders’ equity v IFRS/US GAAP convergence program (“Norwalk Agreement”) v

Stock exchange requirements q Stock exchange listing as a strategic issue Credibility v Public awareness v Financing flexibility v q q IFRS accepted by most stock exchanges IFRS not yet fully accepted in the US SEC requires reconciliation statement on net income and shareholders’ equity v IFRS/US GAAP convergence program (“Norwalk Agreement”) v

Segment reporting q q q Business and geographical segments may vary significantly in terms of rate of profitability, risks and growth oppportunities Segment reporting reflects a disaggregation of financial statement data by line of business and/or geographical area. IAS 14 Segment Reporting

Segment reporting q q q Business and geographical segments may vary significantly in terms of rate of profitability, risks and growth oppportunities Segment reporting reflects a disaggregation of financial statement data by line of business and/or geographical area. IAS 14 Segment Reporting

Reportable segments q Primary reporting format: the company has to identify the dominant source and nature of the risks and returns (business or geographical segments) v Analysis will concentrate on the primary format, with nonetheless some limited information on the other segmentation view

Reportable segments q Primary reporting format: the company has to identify the dominant source and nature of the risks and returns (business or geographical segments) v Analysis will concentrate on the primary format, with nonetheless some limited information on the other segmentation view

Reportable segments (cont. ) A segment is identified as a reportable segment if a majority of its revenue is earned from sales to external customers and a 10% threshold of total revenue, total results or total assets is satisfied q Reportable segments should account for at least 75% of total consolidated revenue q

Reportable segments (cont. ) A segment is identified as a reportable segment if a majority of its revenue is earned from sales to external customers and a 10% threshold of total revenue, total results or total assets is satisfied q Reportable segments should account for at least 75% of total consolidated revenue q

Segment information content q Segment information elements: Segment revenue § Segment expense § Segment assets § Segment liabilities § q Top-down approach: elements of consolidated financial statements are systematically disaggregated into segment disclosures v q Directly attributable elements and the relevant portion that can be allocated on a reasonable basis to the segment Some awkward links with consolidation procedures

Segment information content q Segment information elements: Segment revenue § Segment expense § Segment assets § Segment liabilities § q Top-down approach: elements of consolidated financial statements are systematically disaggregated into segment disclosures v q Directly attributable elements and the relevant portion that can be allocated on a reasonable basis to the segment Some awkward links with consolidation procedures

Foreign currency effects q Foreign currency issues affect two different areas 1. 2. q Translation of foreign currency transactions and related individual assets and liabilities which are denominated other than in the reporting currency (primary translation) Translation of the financial statements of foreign subsidiaries for inclusion in group financial statements (secondary translation) IAS 21 The Effects of Changes in Foreign Exchange Rates

Foreign currency effects q Foreign currency issues affect two different areas 1. 2. q Translation of foreign currency transactions and related individual assets and liabilities which are denominated other than in the reporting currency (primary translation) Translation of the financial statements of foreign subsidiaries for inclusion in group financial statements (secondary translation) IAS 21 The Effects of Changes in Foreign Exchange Rates

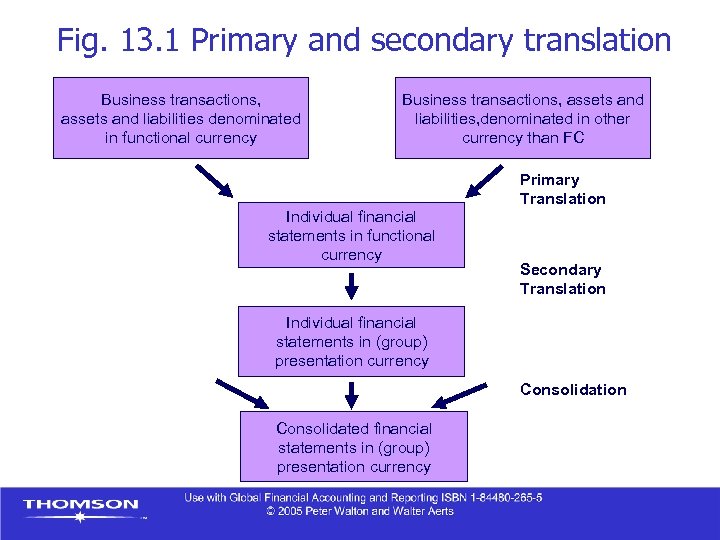

Fig. 13. 1 Primary and secondary translation Business transactions, assets and liabilities denominated in functional currency Business transactions, assets and liabilities, denominated in other currency than FC Individual financial statements in functional currency Primary Translation Secondary Translation Individual financial statements in (group) presentation currency Consolidation Consolidated financial statements in (group) presentation currency

Fig. 13. 1 Primary and secondary translation Business transactions, assets and liabilities denominated in functional currency Business transactions, assets and liabilities, denominated in other currency than FC Individual financial statements in functional currency Primary Translation Secondary Translation Individual financial statements in (group) presentation currency Consolidation Consolidated financial statements in (group) presentation currency

Functional currency q q q The functional currency concept is central in the translation requirements Functional currency is defined as “the currency of the primary economic environment in which the entity operates” (IAS 21, par. 8) It is determined separately for each individual entity within a group and may require considerable professional judgement

Functional currency q q q The functional currency concept is central in the translation requirements Functional currency is defined as “the currency of the primary economic environment in which the entity operates” (IAS 21, par. 8) It is determined separately for each individual entity within a group and may require considerable professional judgement

Foreign currency transactions q q q Foreign currency transactions are business transactions that are denominated or require settlement in a currency other than the functional currency of the company On initial recognition, the foreign currency transaction will be recorded in the functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction But which rate to use for subsequent measurement?

Foreign currency transactions q q q Foreign currency transactions are business transactions that are denominated or require settlement in a currency other than the functional currency of the company On initial recognition, the foreign currency transaction will be recorded in the functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction But which rate to use for subsequent measurement?

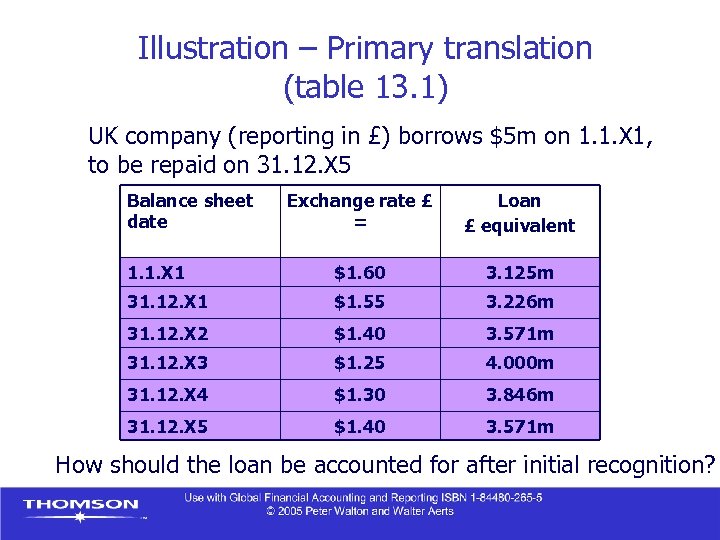

Illustration – Primary translation (table 13. 1) UK company (reporting in £) borrows $5 m on 1. 1. X 1, to be repaid on 31. 12. X 5 Balance sheet date Exchange rate £ = Loan £ equivalent 1. 1. X 1 $1. 60 3. 125 m 31. 12. X 1 $1. 55 3. 226 m 31. 12. X 2 $1. 40 3. 571 m 31. 12. X 3 $1. 25 4. 000 m 31. 12. X 4 $1. 30 3. 846 m 31. 12. X 5 $1. 40 3. 571 m How should the loan be accounted for after initial recognition?

Illustration – Primary translation (table 13. 1) UK company (reporting in £) borrows $5 m on 1. 1. X 1, to be repaid on 31. 12. X 5 Balance sheet date Exchange rate £ = Loan £ equivalent 1. 1. X 1 $1. 60 3. 125 m 31. 12. X 1 $1. 55 3. 226 m 31. 12. X 2 $1. 40 3. 571 m 31. 12. X 3 $1. 25 4. 000 m 31. 12. X 4 $1. 30 3. 846 m 31. 12. X 5 $1. 40 3. 571 m How should the loan be accounted for after initial recognition?

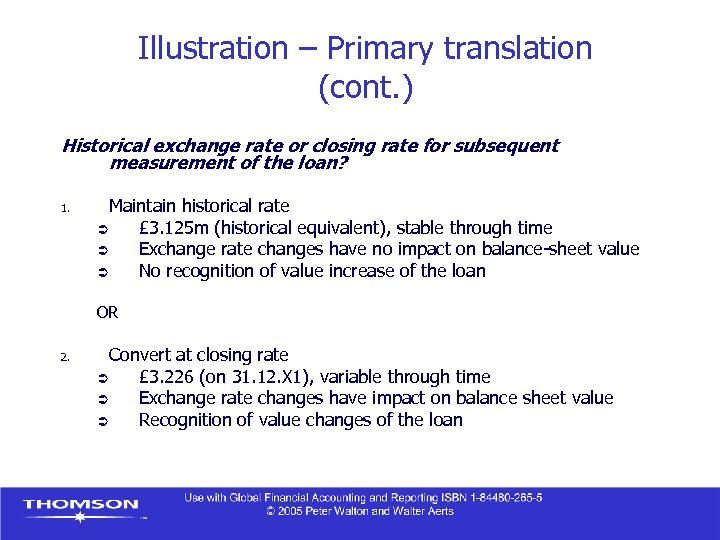

Illustration – Primary translation (cont. ) Historical exchange rate or closing rate for subsequent measurement of the loan? 1. Maintain historical rate Ü £ 3. 125 m (historical equivalent), stable through time Ü Exchange rate changes have no impact on balance-sheet value Ü No recognition of value increase of the loan OR 2. Convert at closing rate Ü £ 3. 226 (on 31. 12. X 1), variable through time Ü Exchange rate changes have impact on balance sheet value Ü Recognition of value changes of the loan

Illustration – Primary translation (cont. ) Historical exchange rate or closing rate for subsequent measurement of the loan? 1. Maintain historical rate Ü £ 3. 125 m (historical equivalent), stable through time Ü Exchange rate changes have no impact on balance-sheet value Ü No recognition of value increase of the loan OR 2. Convert at closing rate Ü £ 3. 226 (on 31. 12. X 1), variable through time Ü Exchange rate changes have impact on balance sheet value Ü Recognition of value changes of the loan

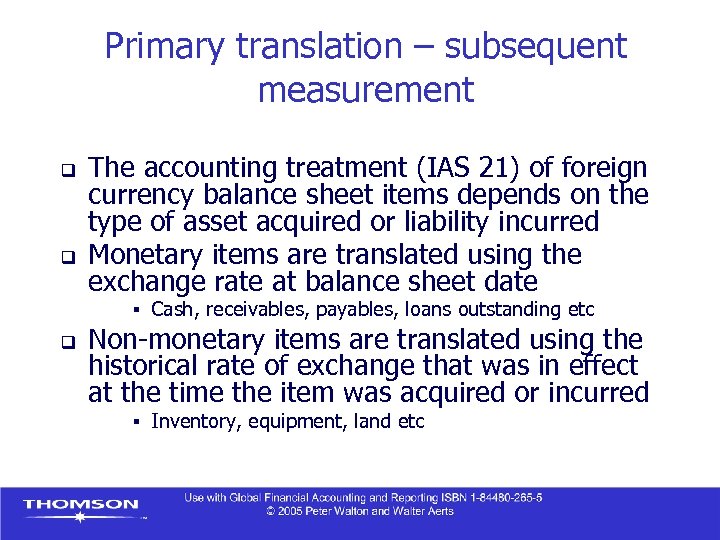

Primary translation – subsequent measurement q q The accounting treatment (IAS 21) of foreign currency balance sheet items depends on the type of asset acquired or liability incurred Monetary items are translated using the exchange rate at balance sheet date § q Cash, receivables, payables, loans outstanding etc Non-monetary items are translated using the historical rate of exchange that was in effect at the time the item was acquired or incurred § Inventory, equipment, land etc

Primary translation – subsequent measurement q q The accounting treatment (IAS 21) of foreign currency balance sheet items depends on the type of asset acquired or liability incurred Monetary items are translated using the exchange rate at balance sheet date § q Cash, receivables, payables, loans outstanding etc Non-monetary items are translated using the historical rate of exchange that was in effect at the time the item was acquired or incurred § Inventory, equipment, land etc

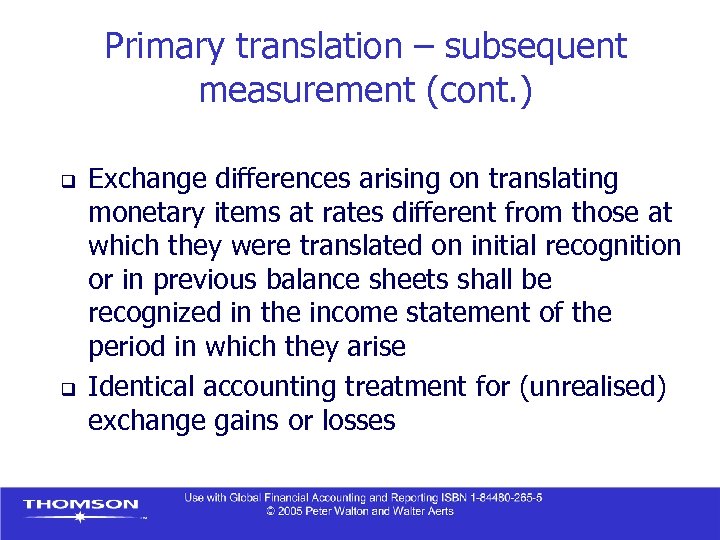

Primary translation – subsequent measurement (cont. ) q q Exchange differences arising on translating monetary items at rates different from those at which they were translated on initial recognition or in previous balance sheets shall be recognized in the income statement of the period in which they arise Identical accounting treatment for (unrealised) exchange gains or losses

Primary translation – subsequent measurement (cont. ) q q Exchange differences arising on translating monetary items at rates different from those at which they were translated on initial recognition or in previous balance sheets shall be recognized in the income statement of the period in which they arise Identical accounting treatment for (unrealised) exchange gains or losses

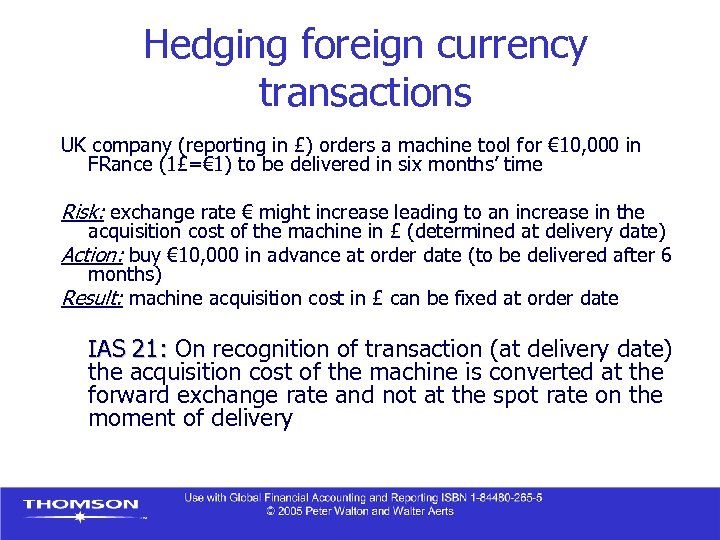

Hedging foreign currency transactions UK company (reporting in £) orders a machine tool for € 10, 000 in FRance (1£=€ 1) to be delivered in six months’ time Risk: exchange rate € might increase leading to an increase in the acquisition cost of the machine in £ (determined at delivery date) Action: buy € 10, 000 in advance at order date (to be delivered after 6 months) Result: machine acquisition cost in £ can be fixed at order date IAS 21: On recognition of transaction (at delivery date) IAS 21: the acquisition cost of the machine is converted at the forward exchange rate and not at the spot rate on the moment of delivery

Hedging foreign currency transactions UK company (reporting in £) orders a machine tool for € 10, 000 in FRance (1£=€ 1) to be delivered in six months’ time Risk: exchange rate € might increase leading to an increase in the acquisition cost of the machine in £ (determined at delivery date) Action: buy € 10, 000 in advance at order date (to be delivered after 6 months) Result: machine acquisition cost in £ can be fixed at order date IAS 21: On recognition of transaction (at delivery date) IAS 21: the acquisition cost of the machine is converted at the forward exchange rate and not at the spot rate on the moment of delivery

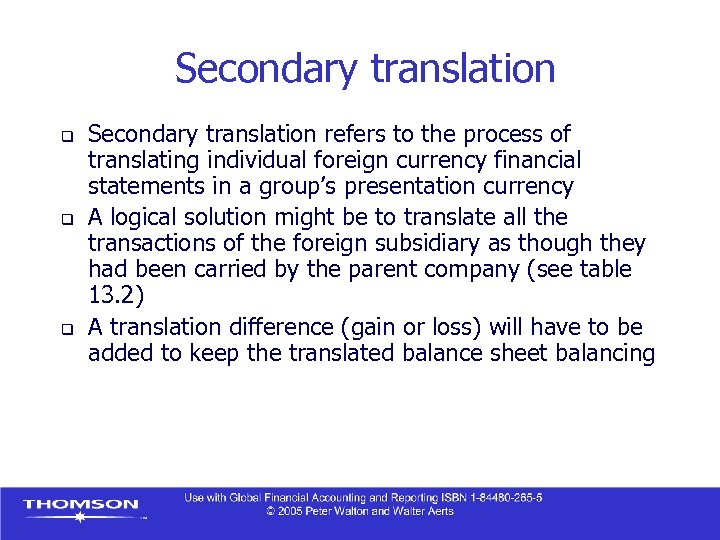

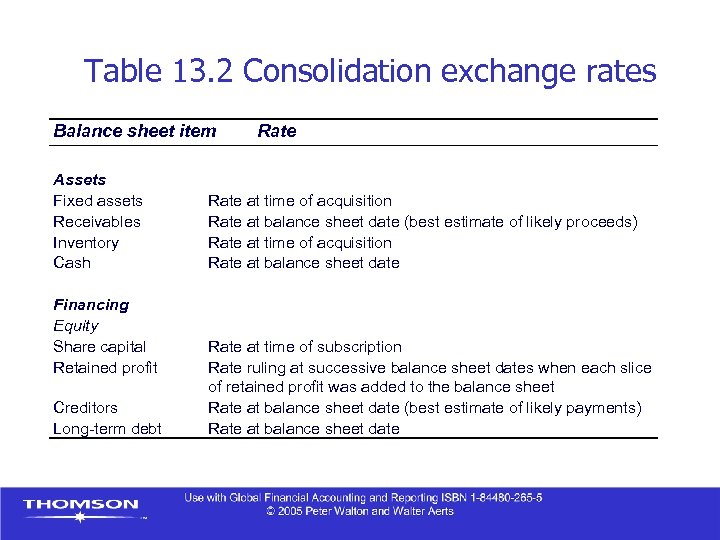

Secondary translation q q q Secondary translation refers to the process of translating individual foreign currency financial statements in a group’s presentation currency A logical solution might be to translate all the transactions of the foreign subsidiary as though they had been carried by the parent company (see table 13. 2) A translation difference (gain or loss) will have to be added to keep the translated balance sheet balancing

Secondary translation q q q Secondary translation refers to the process of translating individual foreign currency financial statements in a group’s presentation currency A logical solution might be to translate all the transactions of the foreign subsidiary as though they had been carried by the parent company (see table 13. 2) A translation difference (gain or loss) will have to be added to keep the translated balance sheet balancing

Table 13. 2 Consolidation exchange rates Balance sheet item Assets Fixed assets Receivables Inventory Cash Financing Equity Share capital Retained profit Creditors Long-term debt Rate at time of acquisition Rate at balance sheet date (best estimate of likely proceeds) Rate at time of acquisition Rate at balance sheet date Rate at time of subscription Rate ruling at successive balance sheet dates when each slice of retained profit was added to the balance sheet Rate at balance sheet date (best estimate of likely payments) Rate at balance sheet date

Table 13. 2 Consolidation exchange rates Balance sheet item Assets Fixed assets Receivables Inventory Cash Financing Equity Share capital Retained profit Creditors Long-term debt Rate at time of acquisition Rate at balance sheet date (best estimate of likely proceeds) Rate at time of acquisition Rate at balance sheet date Rate at time of subscription Rate ruling at successive balance sheet dates when each slice of retained profit was added to the balance sheet Rate at balance sheet date (best estimate of likely payments) Rate at balance sheet date

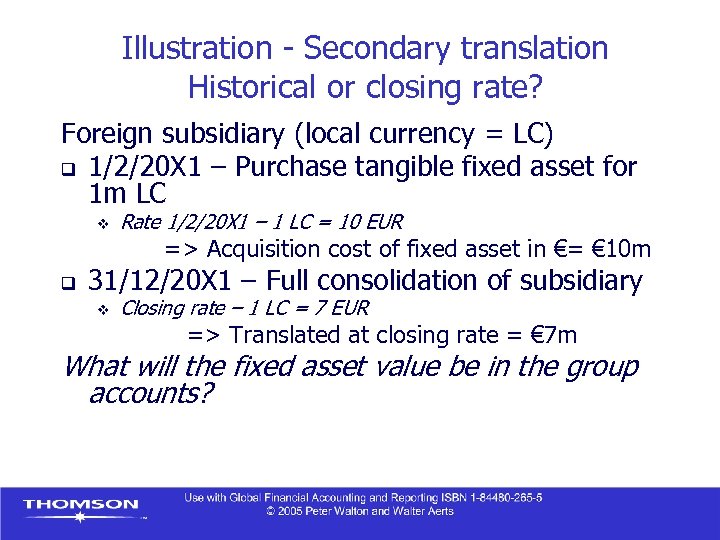

Illustration - Secondary translation Historical or closing rate? Foreign subsidiary (local currency = LC) q 1/2/20 X 1 – Purchase tangible fixed asset for 1 m LC v Rate 1/2/20 X 1 – 1 LC = 10 EUR => Acquisition cost of fixed asset in €= € 10 m q 31/12/20 X 1 – Full consolidation of subsidiary v Closing rate – 1 LC = 7 EUR => Translated at closing rate = € 7 m What will the fixed asset value be in the group accounts?

Illustration - Secondary translation Historical or closing rate? Foreign subsidiary (local currency = LC) q 1/2/20 X 1 – Purchase tangible fixed asset for 1 m LC v Rate 1/2/20 X 1 – 1 LC = 10 EUR => Acquisition cost of fixed asset in €= € 10 m q 31/12/20 X 1 – Full consolidation of subsidiary v Closing rate – 1 LC = 7 EUR => Translated at closing rate = € 7 m What will the fixed asset value be in the group accounts?

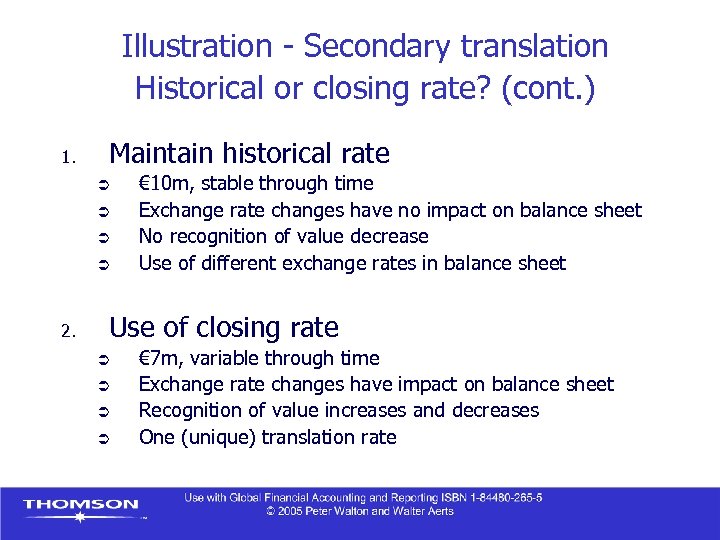

Illustration - Secondary translation Historical or closing rate? (cont. ) 1. Maintain historical rate Ü Ü 2. € 10 m, stable through time Exchange rate changes have no impact on balance sheet No recognition of value decrease Use of different exchange rates in balance sheet Use of closing rate Ü Ü € 7 m, variable through time Exchange rate changes have impact on balance sheet Recognition of value increases and decreases One (unique) translation rate

Illustration - Secondary translation Historical or closing rate? (cont. ) 1. Maintain historical rate Ü Ü 2. € 10 m, stable through time Exchange rate changes have no impact on balance sheet No recognition of value decrease Use of different exchange rates in balance sheet Use of closing rate Ü Ü € 7 m, variable through time Exchange rate changes have impact on balance sheet Recognition of value increases and decreases One (unique) translation rate

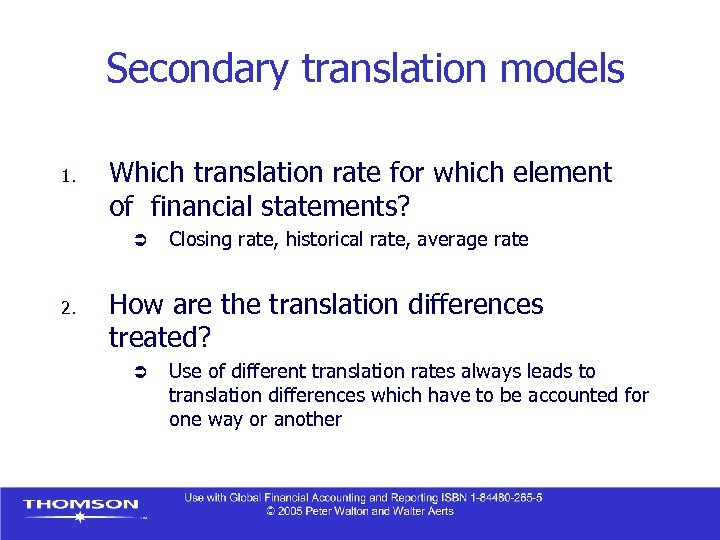

Secondary translation models 1. Which translation rate for which element of financial statements? Ü 2. Closing rate, historical rate, average rate How are the translation differences treated? Ü Use of different translation rates always leads to translation differences which have to be accounted for one way or another

Secondary translation models 1. Which translation rate for which element of financial statements? Ü 2. Closing rate, historical rate, average rate How are the translation differences treated? Ü Use of different translation rates always leads to translation differences which have to be accounted for one way or another

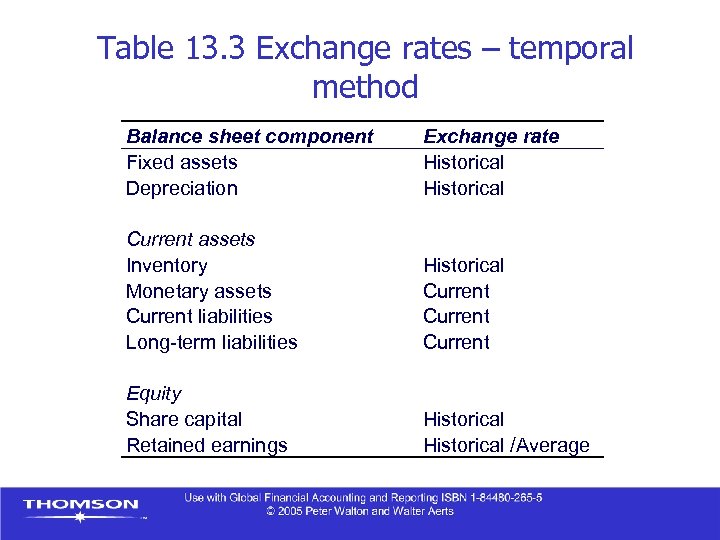

Table 13. 3 Exchange rates – temporal method Balance sheet component Fixed assets Depreciation Exchange rate Historical Current assets Inventory Monetary assets Current liabilities Long-term liabilities Historical Current Equity Share capital Retained earnings Historical /Average

Table 13. 3 Exchange rates – temporal method Balance sheet component Fixed assets Depreciation Exchange rate Historical Current assets Inventory Monetary assets Current liabilities Long-term liabilities Historical Current Equity Share capital Retained earnings Historical /Average

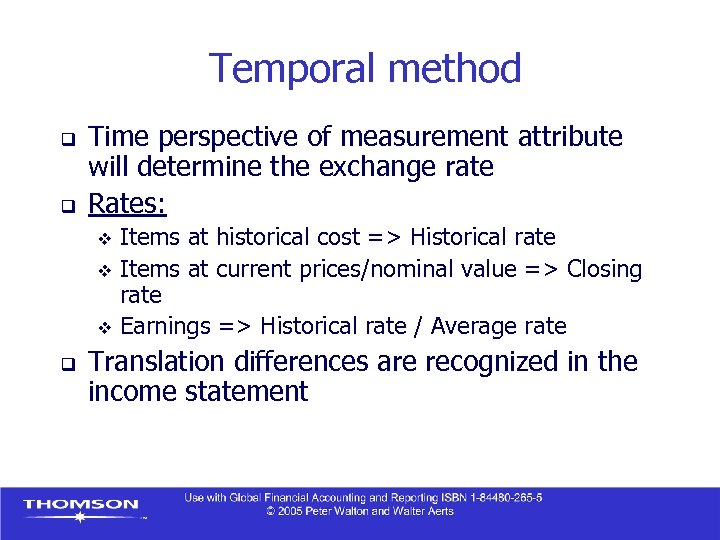

Temporal method q q Time perspective of measurement attribute will determine the exchange rate Rates: Items at historical cost => Historical rate v Items at current prices/nominal value => Closing rate v Earnings => Historical rate / Average rate v q Translation differences are recognized in the income statement

Temporal method q q Time perspective of measurement attribute will determine the exchange rate Rates: Items at historical cost => Historical rate v Items at current prices/nominal value => Closing rate v Earnings => Historical rate / Average rate v q Translation differences are recognized in the income statement

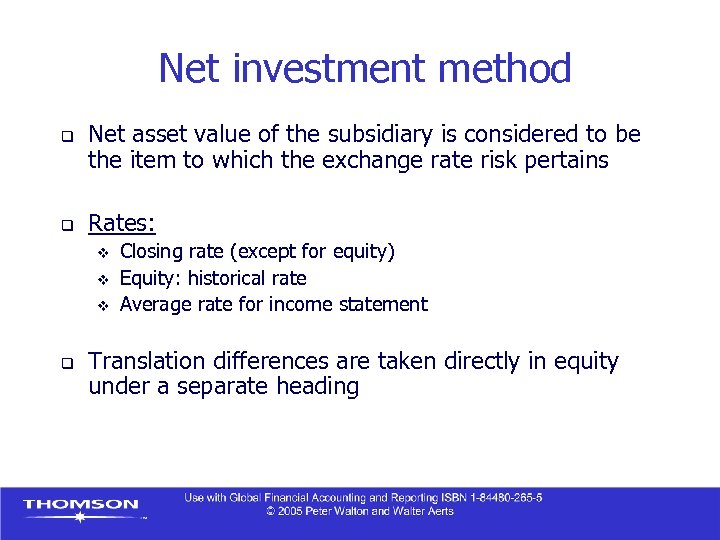

Net investment method q q Net asset value of the subsidiary is considered to be the item to which the exchange rate risk pertains Rates: v v v q Closing rate (except for equity) Equity: historical rate Average rate for income statement Translation differences are taken directly in equity under a separate heading

Net investment method q q Net asset value of the subsidiary is considered to be the item to which the exchange rate risk pertains Rates: v v v q Closing rate (except for equity) Equity: historical rate Average rate for income statement Translation differences are taken directly in equity under a separate heading

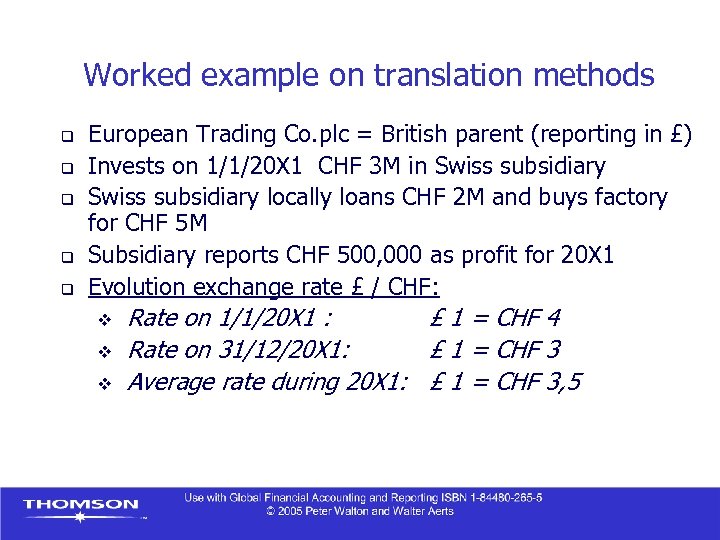

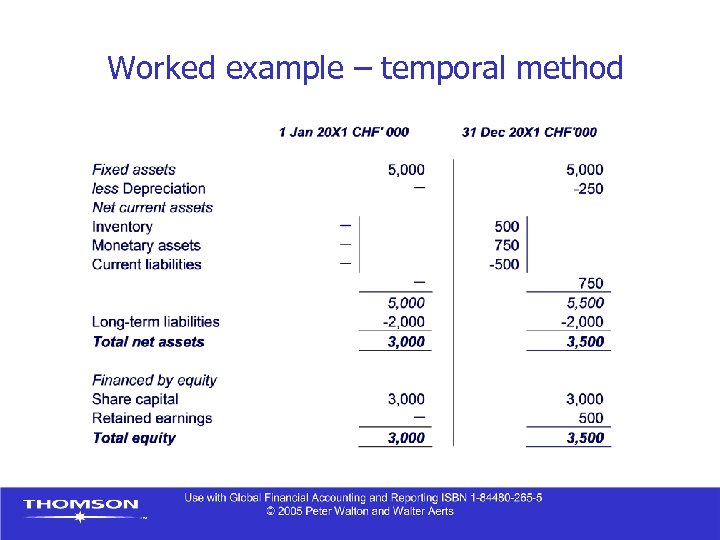

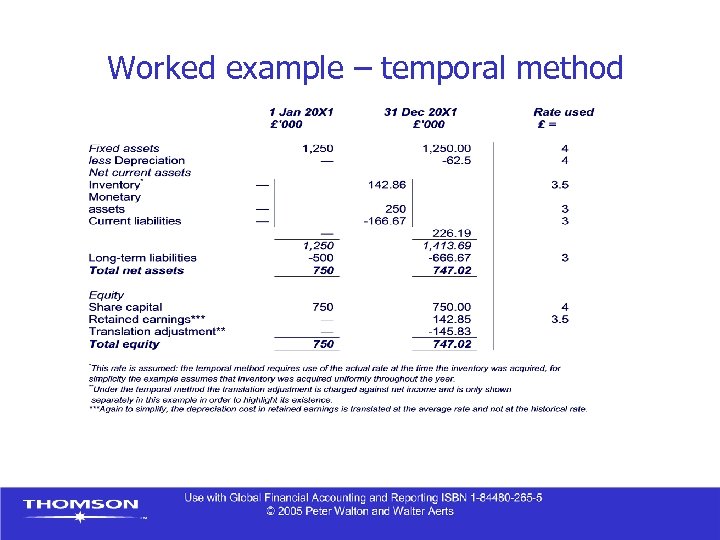

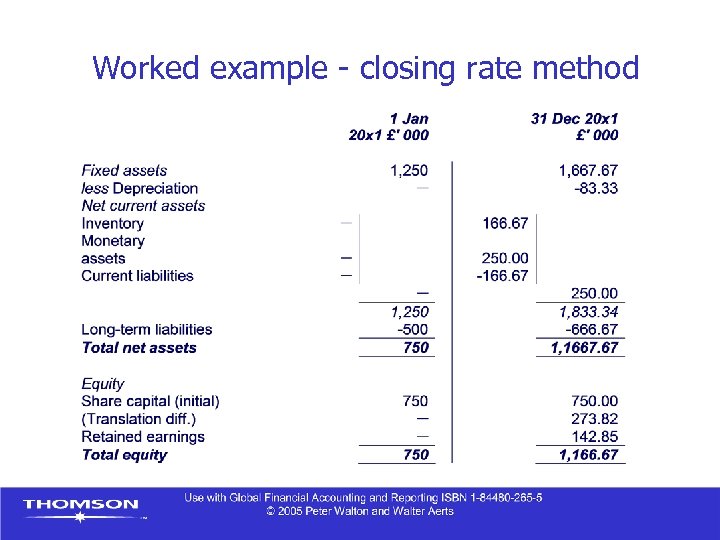

Worked example on translation methods q q q European Trading Co. plc = British parent (reporting in £) Invests on 1/1/20 X 1 CHF 3 M in Swiss subsidiary locally loans CHF 2 M and buys factory for CHF 5 M Subsidiary reports CHF 500, 000 as profit for 20 X 1 Evolution exchange rate £ / CHF: v Rate on 1/1/20 X 1 : £ 1 = CHF 4 v v Rate on 31/12/20 X 1: £ 1 = CHF 3 Average rate during 20 X 1: £ 1 = CHF 3, 5

Worked example on translation methods q q q European Trading Co. plc = British parent (reporting in £) Invests on 1/1/20 X 1 CHF 3 M in Swiss subsidiary locally loans CHF 2 M and buys factory for CHF 5 M Subsidiary reports CHF 500, 000 as profit for 20 X 1 Evolution exchange rate £ / CHF: v Rate on 1/1/20 X 1 : £ 1 = CHF 4 v v Rate on 31/12/20 X 1: £ 1 = CHF 3 Average rate during 20 X 1: £ 1 = CHF 3, 5

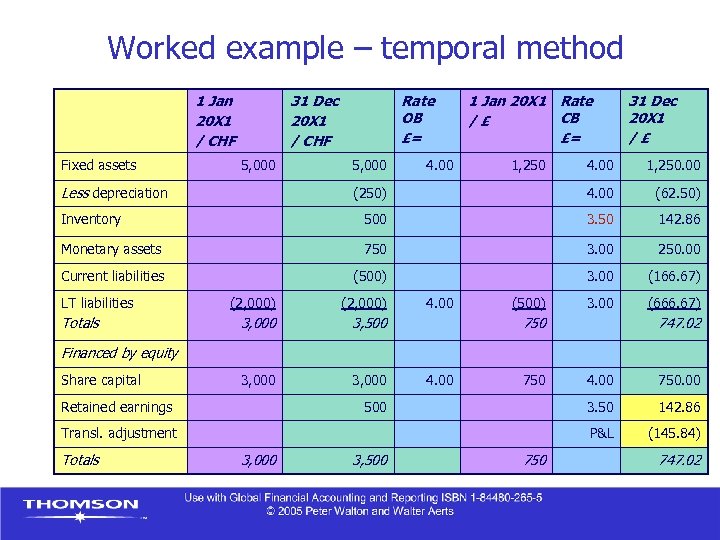

Worked example – temporal method

Worked example – temporal method

Worked example – temporal method

Worked example – temporal method

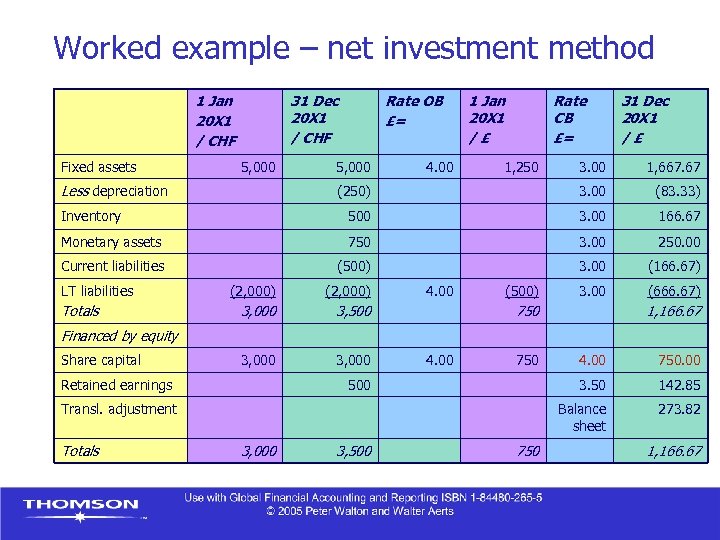

Worked example - closing rate method

Worked example - closing rate method

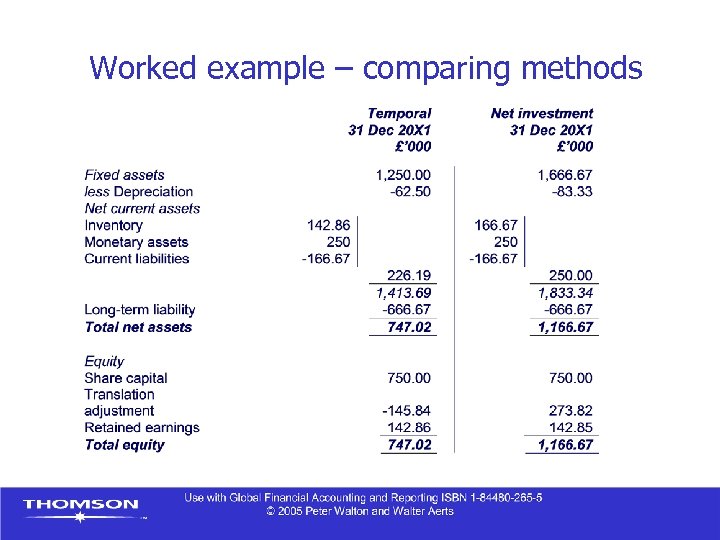

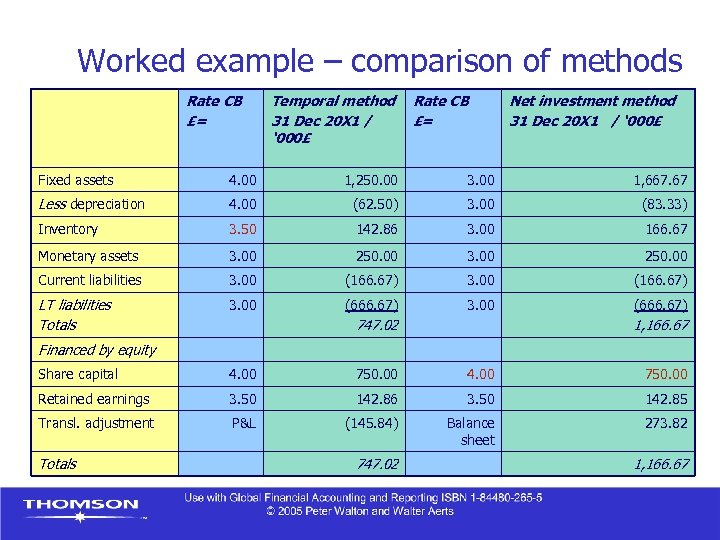

Worked example – comparing methods

Worked example – comparing methods

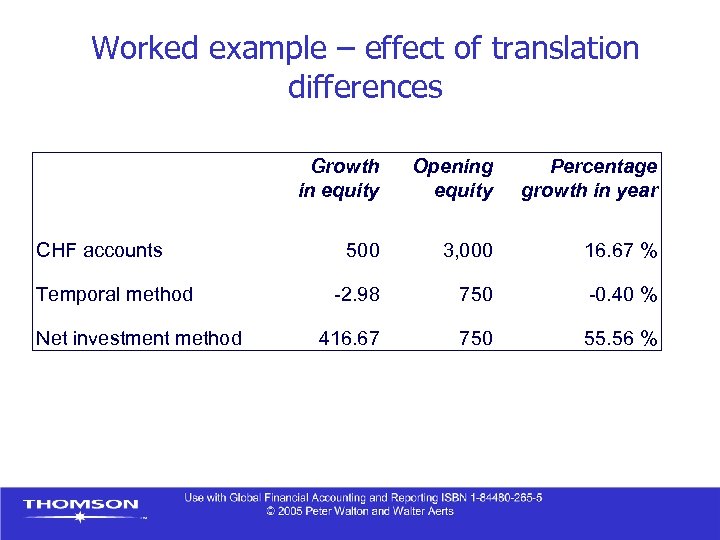

Worked example – effect of translation differences Growth in equity CHF accounts Temporal method Net investment method Opening equity Percentage growth in year 500 3, 000 16. 67 % -2. 98 750 -0. 40 % 416. 67 750 55. 56 %

Worked example – effect of translation differences Growth in equity CHF accounts Temporal method Net investment method Opening equity Percentage growth in year 500 3, 000 16. 67 % -2. 98 750 -0. 40 % 416. 67 750 55. 56 %

Worked example – temporal method 1 Jan 20 X 1 / CHF Fixed assets 31 Dec 20 X 1 / CHF 5, 000 Rate OB £= 1, 250. 00 (250) 4. 00 (62. 50) Inventory 500 3. 50 142. 86 Monetary assets 750 3. 00 250. 00 Current liabilities (500) 3. 00 (166. 67) 3. 00 (666. 67) LT liabilities Totals (2, 000) 3, 000 3, 500 3, 000 4. 00 1, 250 31 Dec 20 X 1 /£ 4. 00 Less depreciation 5, 000 1 Jan 20 X 1 Rate CB /£ £= (500) 750 747. 02 Financed by equity Share capital 750 Transl. adjustment Totals 3, 000 3, 500 750. 00 3. 50 500 4. 00 142. 86 P&L Retained earnings 4. 00 (145. 84) 747. 02

Worked example – temporal method 1 Jan 20 X 1 / CHF Fixed assets 31 Dec 20 X 1 / CHF 5, 000 Rate OB £= 1, 250. 00 (250) 4. 00 (62. 50) Inventory 500 3. 50 142. 86 Monetary assets 750 3. 00 250. 00 Current liabilities (500) 3. 00 (166. 67) 3. 00 (666. 67) LT liabilities Totals (2, 000) 3, 000 3, 500 3, 000 4. 00 1, 250 31 Dec 20 X 1 /£ 4. 00 Less depreciation 5, 000 1 Jan 20 X 1 Rate CB /£ £= (500) 750 747. 02 Financed by equity Share capital 750 Transl. adjustment Totals 3, 000 3, 500 750. 00 3. 50 500 4. 00 142. 86 P&L Retained earnings 4. 00 (145. 84) 747. 02

Worked example – net investment method 1 Jan 20 X 1 / CHF Fixed assets 31 Dec 20 X 1 / CHF 5, 000 Rate OB £= (250) 3. 00 (83. 33) Inventory 500 3. 00 166. 67 Monetary assets 750 3. 00 250. 00 Current liabilities (500) 3. 00 (166. 67) 3. 00 (666. 67) Totals (2, 000) 3, 000 3, 500 3, 000 4. 00 1, 250 31 Dec 20 X 1 /£ 1, 667. 67 LT liabilities 4. 00 Rate CB £= 3. 00 Less depreciation 5, 000 1 Jan 20 X 1 /£ (500) 750 1, 166. 67 Financed by equity Share capital Retained earnings 4. 00 750 Transl. adjustment Totals 750. 00 3. 50 500 4. 00 142. 85 Balance sheet 3, 000 3, 500 750 273. 82 1, 166. 67

Worked example – net investment method 1 Jan 20 X 1 / CHF Fixed assets 31 Dec 20 X 1 / CHF 5, 000 Rate OB £= (250) 3. 00 (83. 33) Inventory 500 3. 00 166. 67 Monetary assets 750 3. 00 250. 00 Current liabilities (500) 3. 00 (166. 67) 3. 00 (666. 67) Totals (2, 000) 3, 000 3, 500 3, 000 4. 00 1, 250 31 Dec 20 X 1 /£ 1, 667. 67 LT liabilities 4. 00 Rate CB £= 3. 00 Less depreciation 5, 000 1 Jan 20 X 1 /£ (500) 750 1, 166. 67 Financed by equity Share capital Retained earnings 4. 00 750 Transl. adjustment Totals 750. 00 3. 50 500 4. 00 142. 85 Balance sheet 3, 000 3, 500 750 273. 82 1, 166. 67

Worked example – comparison of methods Rate CB £= Temporal method 31 Dec 20 X 1 / ‘ 000£ Rate CB £= Net investment method 31 Dec 20 X 1 / ‘ 000£ Fixed assets 4. 00 1, 250. 00 3. 00 1, 667. 67 Less depreciation 4. 00 (62. 50) 3. 00 (83. 33) Inventory 3. 50 142. 86 3. 00 166. 67 Monetary assets 3. 00 250. 00 Current liabilities 3. 00 (166. 67) LT liabilities Totals 3. 00 (666. 67) 747. 02 1, 166. 67 Financed by equity Share capital 4. 00 750. 00 Retained earnings 3. 50 142. 86 3. 50 142. 85 Transl. adjustment P&L (145. 84) Totals 747. 02 Balance sheet 273. 82 1, 166. 67

Worked example – comparison of methods Rate CB £= Temporal method 31 Dec 20 X 1 / ‘ 000£ Rate CB £= Net investment method 31 Dec 20 X 1 / ‘ 000£ Fixed assets 4. 00 1, 250. 00 3. 00 1, 667. 67 Less depreciation 4. 00 (62. 50) 3. 00 (83. 33) Inventory 3. 50 142. 86 3. 00 166. 67 Monetary assets 3. 00 250. 00 Current liabilities 3. 00 (166. 67) LT liabilities Totals 3. 00 (666. 67) 747. 02 1, 166. 67 Financed by equity Share capital 4. 00 750. 00 Retained earnings 3. 50 142. 86 3. 50 142. 85 Transl. adjustment P&L (145. 84) Totals 747. 02 Balance sheet 273. 82 1, 166. 67

Functional currency and type of foreign operation q q q IAS 21 sets the functional currency of a foreign subsidiary which is heavily integrated with the operations of the parent and for which the temporal method is more appropriate, equal to the functional currency of the parent IAS 21 only refers to the closing rate method as the method to be used whan translating foreign currency financial statements to the presentation currency of the group The translation difference (under the net investment method) is treated as a direct adjustment to equity

Functional currency and type of foreign operation q q q IAS 21 sets the functional currency of a foreign subsidiary which is heavily integrated with the operations of the parent and for which the temporal method is more appropriate, equal to the functional currency of the parent IAS 21 only refers to the closing rate method as the method to be used whan translating foreign currency financial statements to the presentation currency of the group The translation difference (under the net investment method) is treated as a direct adjustment to equity