23e6ff2b09157a4a30aa12304c771351.ppt

- Количество слайдов: 14

chapter 13 Financial Derivatives

chapter 13 Financial Derivatives

Spot, Forward, and Futures Contracts • A spot contract is an agreement (at time 0) when the seller agrees to deliver an asset and the buyer agrees to pay for the asset immediately (now) • A forward contract is an agreement (at time 0) between a buyer and a seller that an asset will be exchanged for cash at some later date at a price agreed upon now • A futures contract is similar to a forward contract and is normally arranged through an organized exchange The main difference between a futures and a forward contract is that the price of a forward contract is fixed over the life of the contract, whereas futures contracts are marked-to-market daily Copyright © 2002 Pearson Education Canada Inc. 13 - 2

Spot, Forward, and Futures Contracts • A spot contract is an agreement (at time 0) when the seller agrees to deliver an asset and the buyer agrees to pay for the asset immediately (now) • A forward contract is an agreement (at time 0) between a buyer and a seller that an asset will be exchanged for cash at some later date at a price agreed upon now • A futures contract is similar to a forward contract and is normally arranged through an organized exchange The main difference between a futures and a forward contract is that the price of a forward contract is fixed over the life of the contract, whereas futures contracts are marked-to-market daily Copyright © 2002 Pearson Education Canada Inc. 13 - 2

Interest-Rate Forward Markets Long position = agree to buy securities at future date Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: requires information to screen good from bad risk Copyright © 2002 Pearson Education Canada Inc. 13 - 3

Interest-Rate Forward Markets Long position = agree to buy securities at future date Hedges by locking in future interest rate if funds coming in future Short position = agree to sell securities at future date Hedges by reducing price risk from change in interest rates if holding bonds Pros 1. Flexible Cons 1. Lack of liquidity: hard to find counterparty 2. Subject to default risk: requires information to screen good from bad risk Copyright © 2002 Pearson Education Canada Inc. 13 - 3

Financial Futures Markets Financial futures are classified as • Interest-rate futures • Stock index futures, and • Currency futures In Canada, financial futures are traded in • Montreal Exchange (which maintains active markets in short-term and long-term Canadian government bond futures), and • Toronto Futures Exchange (which maintains active markets in the Toronto 35 and Toronto 100 stock indexes futures) Copyright © 2002 Pearson Education Canada Inc. 13 - 4

Financial Futures Markets Financial futures are classified as • Interest-rate futures • Stock index futures, and • Currency futures In Canada, financial futures are traded in • Montreal Exchange (which maintains active markets in short-term and long-term Canadian government bond futures), and • Toronto Futures Exchange (which maintains active markets in the Toronto 35 and Toronto 100 stock indexes futures) Copyright © 2002 Pearson Education Canada Inc. 13 - 4

Widely Traded Interest-Rate Futures Contracts Copyright © 2002 Pearson Education Canada Inc. 13 - 5

Widely Traded Interest-Rate Futures Contracts Copyright © 2002 Pearson Education Canada Inc. 13 - 5

Interest Rate Futures Markets Interest Rate Futures Contract 1. Specifies delivery of type of security at future date 2. Arbitrage at expiration date, price of contract = price of the underlying asset delivered 3. i , long contract has loss, short contract has profit 4. Hedging similar to forwards Micro vs. macro hedge Traded on Exchanges: Global competition Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market: avoids default risk 4. Don’t have to deliver: netting Copyright © 2002 Pearson Education Canada Inc. 13 - 6

Interest Rate Futures Markets Interest Rate Futures Contract 1. Specifies delivery of type of security at future date 2. Arbitrage at expiration date, price of contract = price of the underlying asset delivered 3. i , long contract has loss, short contract has profit 4. Hedging similar to forwards Micro vs. macro hedge Traded on Exchanges: Global competition Success of Futures Over Forwards 1. Futures more liquid: standardized, can be traded again, delivery of range of securities 2. Delivery of range of securities prevents corner 3. Mark to market: avoids default risk 4. Don’t have to deliver: netting Copyright © 2002 Pearson Education Canada Inc. 13 - 6

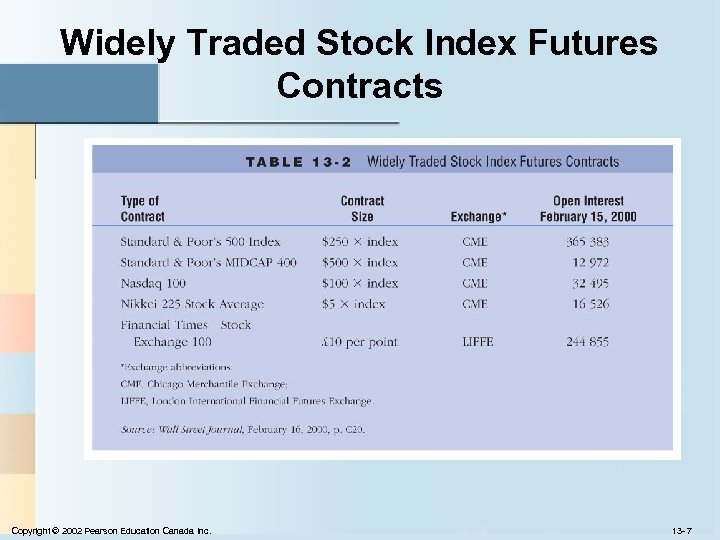

Widely Traded Stock Index Futures Contracts Copyright © 2002 Pearson Education Canada Inc. 13 - 7

Widely Traded Stock Index Futures Contracts Copyright © 2002 Pearson Education Canada Inc. 13 - 7

Currency Futures Hedging FX Risk Example: Customer due 20 million DM in two months, current DM = $0. 50 1. Forward agreeing to sell DM 20 million for $10 million, two months in future 2. Sell DM 20 million of futures Copyright © 2002 Pearson Education Canada Inc. 13 - 8

Currency Futures Hedging FX Risk Example: Customer due 20 million DM in two months, current DM = $0. 50 1. Forward agreeing to sell DM 20 million for $10 million, two months in future 2. Sell DM 20 million of futures Copyright © 2002 Pearson Education Canada Inc. 13 - 8

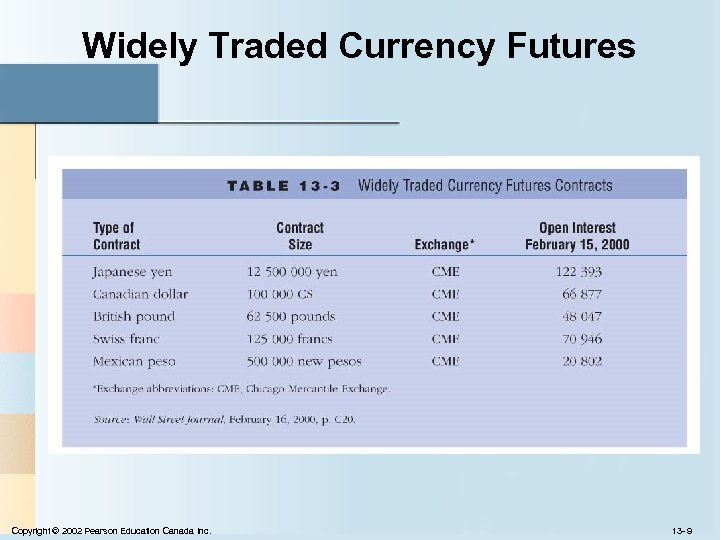

Widely Traded Currency Futures Copyright © 2002 Pearson Education Canada Inc. 13 - 9

Widely Traded Currency Futures Copyright © 2002 Pearson Education Canada Inc. 13 - 9

Options Contract Right to buy (call option) or sell (put option) instrument at exercise (strike) price up until expiration date (American) or on expiration date (European) Hedging with Options Buy same # of put option contracts as would sell of futures Disadvantage: pay premium Advantage: protected if i , gain if i Additional advantage if macro hedge: avoids accounting problems, no losses on option when i Copyright © 2002 Pearson Education Canada Inc. 13 - 10

Options Contract Right to buy (call option) or sell (put option) instrument at exercise (strike) price up until expiration date (American) or on expiration date (European) Hedging with Options Buy same # of put option contracts as would sell of futures Disadvantage: pay premium Advantage: protected if i , gain if i Additional advantage if macro hedge: avoids accounting problems, no losses on option when i Copyright © 2002 Pearson Education Canada Inc. 13 - 10

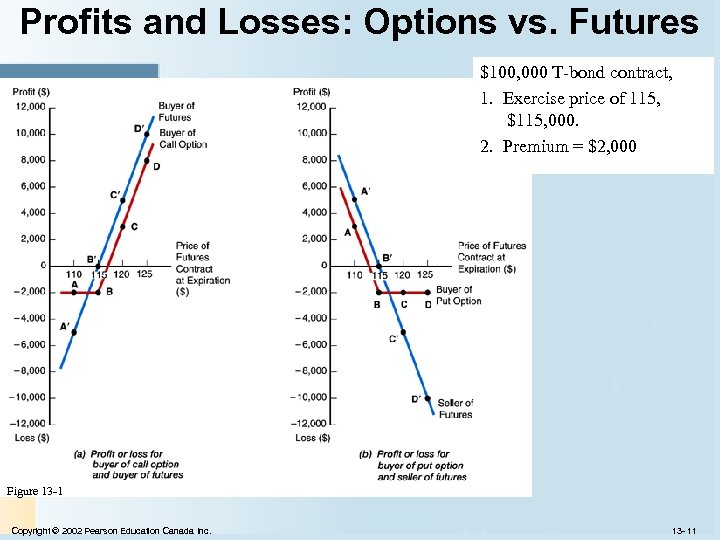

Profits and Losses: Options vs. Futures $100, 000 T-bond contract, 1. Exercise price of 115, $115, 000. 2. Premium = $2, 000 Figure 13 -1 Copyright © 2002 Pearson Education Canada Inc. 13 - 11

Profits and Losses: Options vs. Futures $100, 000 T-bond contract, 1. Exercise price of 115, $115, 000. 2. Premium = $2, 000 Figure 13 -1 Copyright © 2002 Pearson Education Canada Inc. 13 - 11

Factors Affecting Premium 1. Higher strike price lower premium on call options and higher premium on put options 2. Greater term to expiration higher premiums for both call and put options 3. Greater price volatility of underlying instrument higher premiums for both call and put options Copyright © 2002 Pearson Education Canada Inc. 13 - 12

Factors Affecting Premium 1. Higher strike price lower premium on call options and higher premium on put options 2. Greater term to expiration higher premiums for both call and put options 3. Greater price volatility of underlying instrument higher premiums for both call and put options Copyright © 2002 Pearson Education Canada Inc. 13 - 12

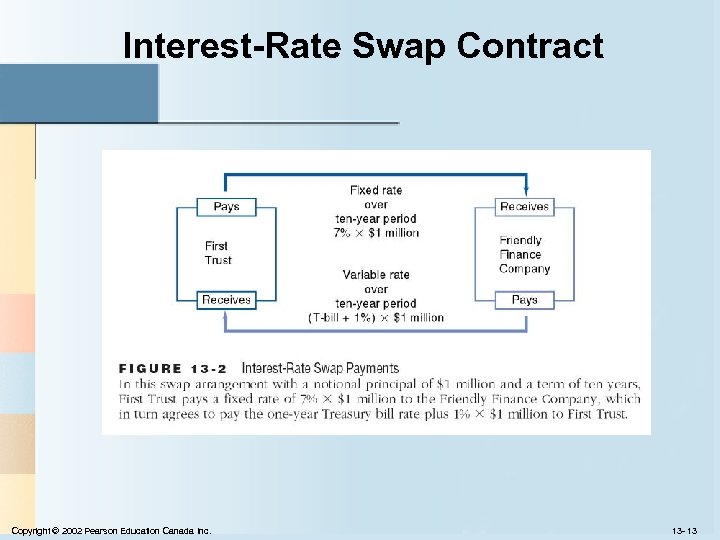

Interest-Rate Swap Contract Copyright © 2002 Pearson Education Canada Inc. 13 - 13

Interest-Rate Swap Contract Copyright © 2002 Pearson Education Canada Inc. 13 - 13

Hedging with Interest Rate Swaps Reduce interest-rate risk for both parties 1. Midwest converts $1 m of fixed rate assets to rate-sensitive assets, RSA , lowers GAP 2. Friendly Finance RSA , lowers GAP Advantages of swaps 1. Reduce risk, no change in balance-sheet 2. Longer term than futures or options Disadvantages of swaps 1. Lack of liquidity 2. Subject to default risk Financial intermediaries help reduce disadvantages of swaps Copyright © 2002 Pearson Education Canada Inc. 13 - 14

Hedging with Interest Rate Swaps Reduce interest-rate risk for both parties 1. Midwest converts $1 m of fixed rate assets to rate-sensitive assets, RSA , lowers GAP 2. Friendly Finance RSA , lowers GAP Advantages of swaps 1. Reduce risk, no change in balance-sheet 2. Longer term than futures or options Disadvantages of swaps 1. Lack of liquidity 2. Subject to default risk Financial intermediaries help reduce disadvantages of swaps Copyright © 2002 Pearson Education Canada Inc. 13 - 14