dc2ceb57763a1d021b6f46976ca0ea9f.ppt

- Количество слайдов: 20

CHAPTER 13 FINANCIAL DECISION MAKING

CHAPTER 13 FINANCIAL DECISION MAKING

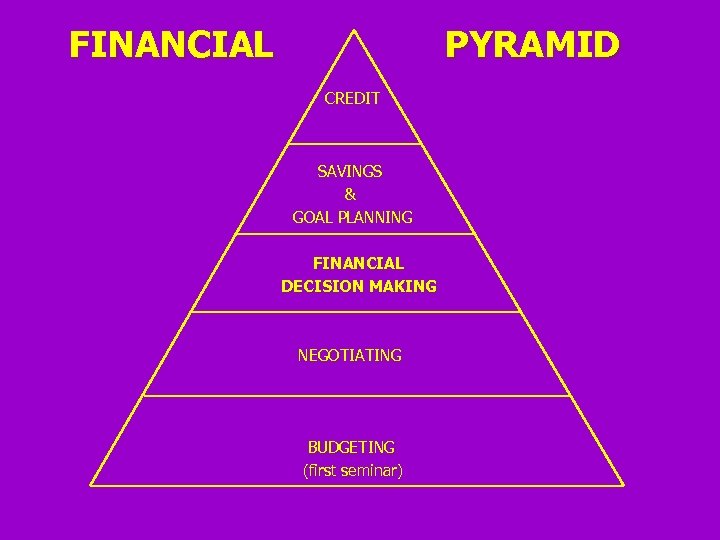

FINANCIAL PYRAMID CREDIT SAVINGS & GOAL PLANNING FINANCIAL DECISION MAKING NEGOTIATING BUDGETING (first seminar)

FINANCIAL PYRAMID CREDIT SAVINGS & GOAL PLANNING FINANCIAL DECISION MAKING NEGOTIATING BUDGETING (first seminar)

PRINCIPLES OF FINANCIAL DECISION MAKING n n n Thinking with your head, not your emotions. Determining which decision will provide the greatest amount of benefit. Know the length of benefit you are interested in maximizing. (short term, intermediate term or long term) Forgetting about lost cost! Calculating opportunity cost. Don’t use long term debt to pay off short term needs.

PRINCIPLES OF FINANCIAL DECISION MAKING n n n Thinking with your head, not your emotions. Determining which decision will provide the greatest amount of benefit. Know the length of benefit you are interested in maximizing. (short term, intermediate term or long term) Forgetting about lost cost! Calculating opportunity cost. Don’t use long term debt to pay off short term needs.

DECISION MAKING n HOW MANY MAJOR FINANCIAL DECISIONS WILL YOU MAKE IN YOUR LIFE? (AVG. ) 23

DECISION MAKING n HOW MANY MAJOR FINANCIAL DECISIONS WILL YOU MAKE IN YOUR LIFE? (AVG. ) 23

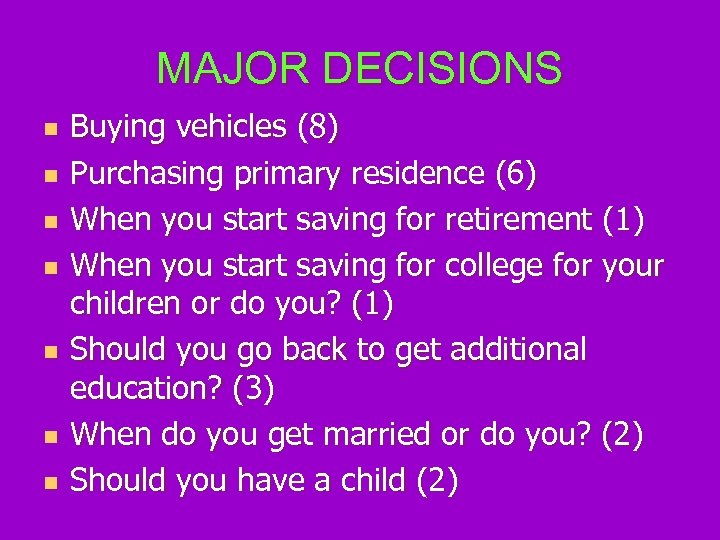

MAJOR DECISIONS n n n n Buying vehicles (8) Purchasing primary residence (6) When you start saving for retirement (1) When you start saving for college for your children or do you? (1) Should you go back to get additional education? (3) When do you get married or do you? (2) Should you have a child (2)

MAJOR DECISIONS n n n n Buying vehicles (8) Purchasing primary residence (6) When you start saving for retirement (1) When you start saving for college for your children or do you? (1) Should you go back to get additional education? (3) When do you get married or do you? (2) Should you have a child (2)

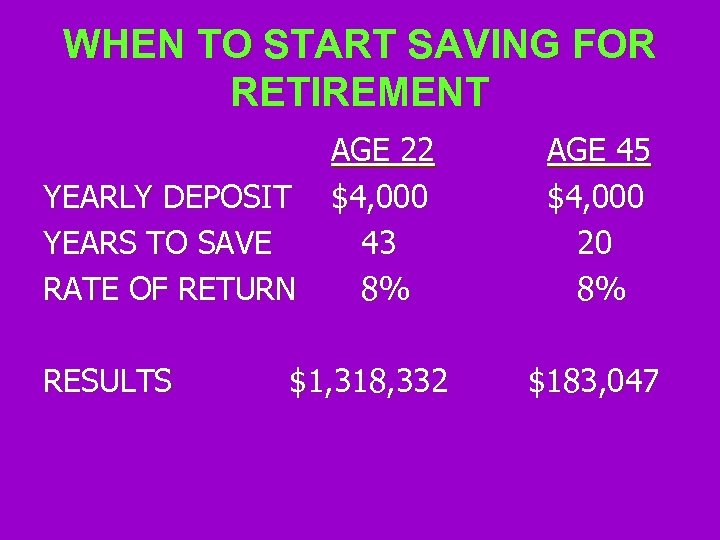

WHEN TO START SAVING FOR RETIREMENT YEARLY DEPOSIT YEARS TO SAVE RATE OF RETURN RESULTS AGE 22 $4, 000 43 8% $1, 318, 332 AGE 45 $4, 000 20 8% $183, 047

WHEN TO START SAVING FOR RETIREMENT YEARLY DEPOSIT YEARS TO SAVE RATE OF RETURN RESULTS AGE 22 $4, 000 43 8% $1, 318, 332 AGE 45 $4, 000 20 8% $183, 047

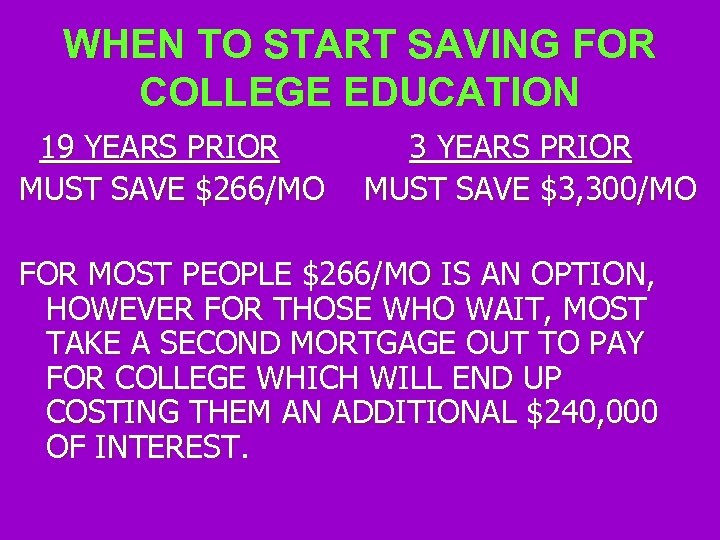

WHEN TO START SAVING FOR COLLEGE EDUCATION 19 YEARS PRIOR MUST SAVE $266/MO 3 YEARS PRIOR MUST SAVE $3, 300/MO FOR MOST PEOPLE $266/MO IS AN OPTION, HOWEVER FOR THOSE WHO WAIT, MOST TAKE A SECOND MORTGAGE OUT TO PAY FOR COLLEGE WHICH WILL END UP COSTING THEM AN ADDITIONAL $240, 000 OF INTEREST.

WHEN TO START SAVING FOR COLLEGE EDUCATION 19 YEARS PRIOR MUST SAVE $266/MO 3 YEARS PRIOR MUST SAVE $3, 300/MO FOR MOST PEOPLE $266/MO IS AN OPTION, HOWEVER FOR THOSE WHO WAIT, MOST TAKE A SECOND MORTGAGE OUT TO PAY FOR COLLEGE WHICH WILL END UP COSTING THEM AN ADDITIONAL $240, 000 OF INTEREST.

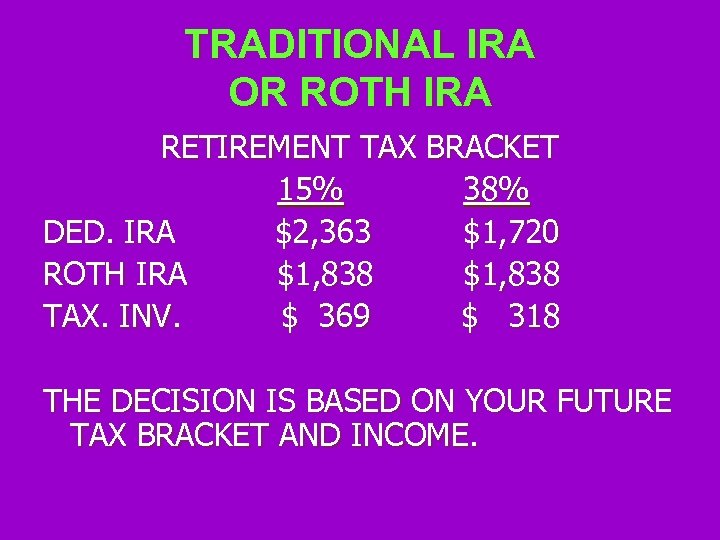

TRADITIONAL IRA OR ROTH IRA RETIREMENT TAX BRACKET 15% 38% DED. IRA $2, 363 $1, 720 ROTH IRA $1, 838 TAX. INV. $ 369 $ 318 THE DECISION IS BASED ON YOUR FUTURE TAX BRACKET AND INCOME.

TRADITIONAL IRA OR ROTH IRA RETIREMENT TAX BRACKET 15% 38% DED. IRA $2, 363 $1, 720 ROTH IRA $1, 838 TAX. INV. $ 369 $ 318 THE DECISION IS BASED ON YOUR FUTURE TAX BRACKET AND INCOME.

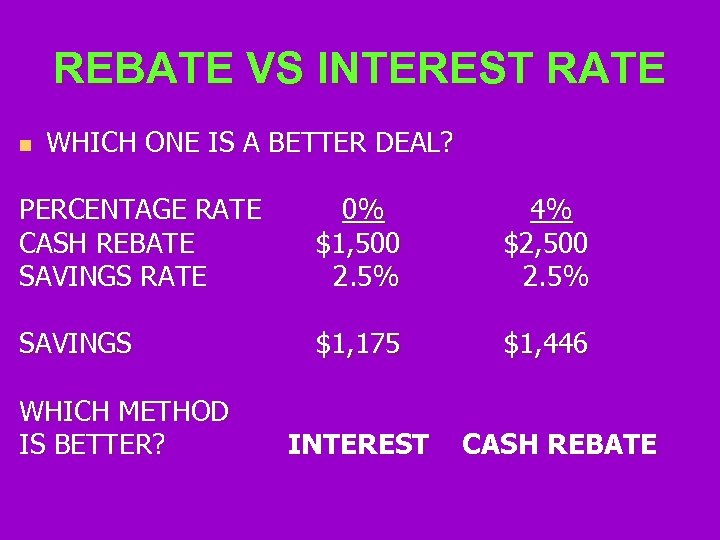

REBATE VS INTEREST RATE n WHICH ONE IS A BETTER DEAL? PERCENTAGE RATE CASH REBATE SAVINGS RATE 0% $1, 500 2. 5% 4% $2, 500 2. 5% SAVINGS $1, 175 $1, 446 WHICH METHOD IS BETTER? INTEREST CASH REBATE

REBATE VS INTEREST RATE n WHICH ONE IS A BETTER DEAL? PERCENTAGE RATE CASH REBATE SAVINGS RATE 0% $1, 500 2. 5% 4% $2, 500 2. 5% SAVINGS $1, 175 $1, 446 WHICH METHOD IS BETTER? INTEREST CASH REBATE

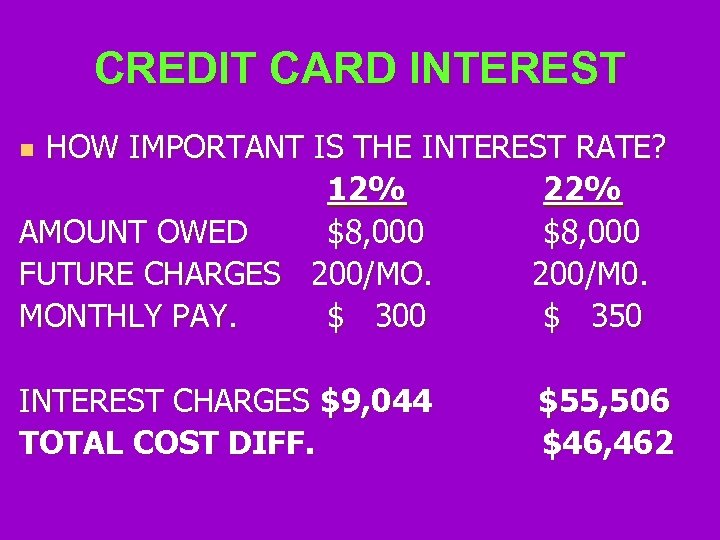

CREDIT CARD INTEREST HOW IMPORTANT IS THE INTEREST RATE? 12% 22% AMOUNT OWED $8, 000 FUTURE CHARGES 200/MO. 200/M 0. MONTHLY PAY. $ 300 $ 350 n INTEREST CHARGES $9, 044 TOTAL COST DIFF. $55, 506 $46, 462

CREDIT CARD INTEREST HOW IMPORTANT IS THE INTEREST RATE? 12% 22% AMOUNT OWED $8, 000 FUTURE CHARGES 200/MO. 200/M 0. MONTHLY PAY. $ 300 $ 350 n INTEREST CHARGES $9, 044 TOTAL COST DIFF. $55, 506 $46, 462

NEW OR USED VEHICLE? NEW AVG. PURCHASE PRICE $21, 000 AVG. MAINT. PER YEAR 2, 000 MONTHLY PAYMENT 400 TOTAL DEPRECIATION 18, 316 TOTAL INTEREST PAID (5%) 2, 777 USED $11, 000 3, 000 200 8, 886 1, 455 TOTAL COST (5 YEARS) $52, 093 $36, 341 (The used car will save you about $15, 000 plus investment return over a 5 year period. )

NEW OR USED VEHICLE? NEW AVG. PURCHASE PRICE $21, 000 AVG. MAINT. PER YEAR 2, 000 MONTHLY PAYMENT 400 TOTAL DEPRECIATION 18, 316 TOTAL INTEREST PAID (5%) 2, 777 USED $11, 000 3, 000 200 8, 886 1, 455 TOTAL COST (5 YEARS) $52, 093 $36, 341 (The used car will save you about $15, 000 plus investment return over a 5 year period. )

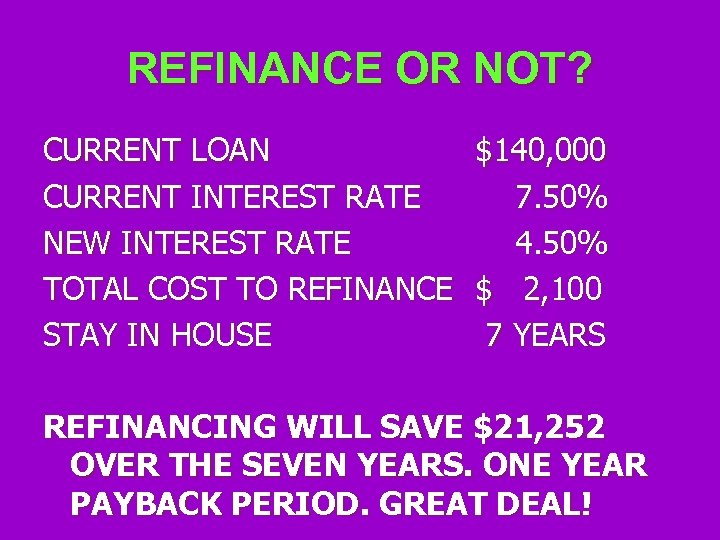

REFINANCE OR NOT? CURRENT LOAN CURRENT INTEREST RATE NEW INTEREST RATE TOTAL COST TO REFINANCE STAY IN HOUSE $140, 000 7. 50% 4. 50% $ 2, 100 7 YEARS REFINANCING WILL SAVE $21, 252 OVER THE SEVEN YEARS. ONE YEAR PAYBACK PERIOD. GREAT DEAL!

REFINANCE OR NOT? CURRENT LOAN CURRENT INTEREST RATE NEW INTEREST RATE TOTAL COST TO REFINANCE STAY IN HOUSE $140, 000 7. 50% 4. 50% $ 2, 100 7 YEARS REFINANCING WILL SAVE $21, 252 OVER THE SEVEN YEARS. ONE YEAR PAYBACK PERIOD. GREAT DEAL!

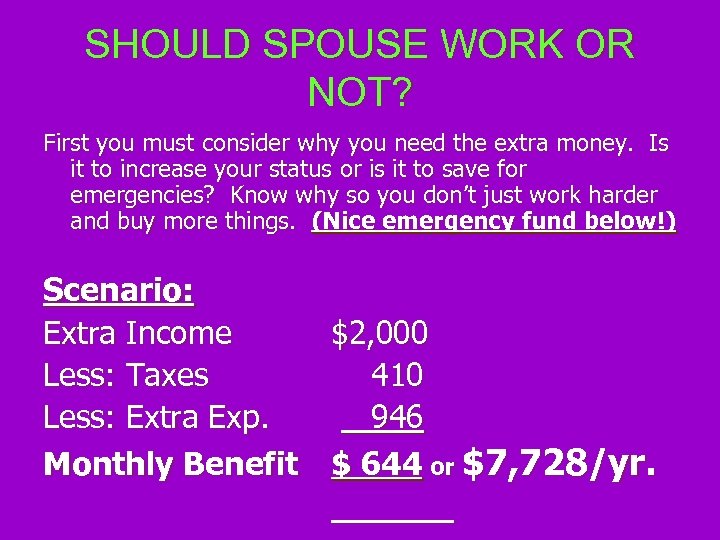

SHOULD SPOUSE WORK OR NOT? First you must consider why you need the extra money. Is it to increase your status or is it to save for emergencies? Know why so you don’t just work harder and buy more things. (Nice emergency fund below!) Scenario: Extra Income $2, 000 Less: Taxes 410 Less: Extra Exp. 946 Monthly Benefit $ 644 or $7, 728/yr. ______

SHOULD SPOUSE WORK OR NOT? First you must consider why you need the extra money. Is it to increase your status or is it to save for emergencies? Know why so you don’t just work harder and buy more things. (Nice emergency fund below!) Scenario: Extra Income $2, 000 Less: Taxes 410 Less: Extra Exp. 946 Monthly Benefit $ 644 or $7, 728/yr. ______

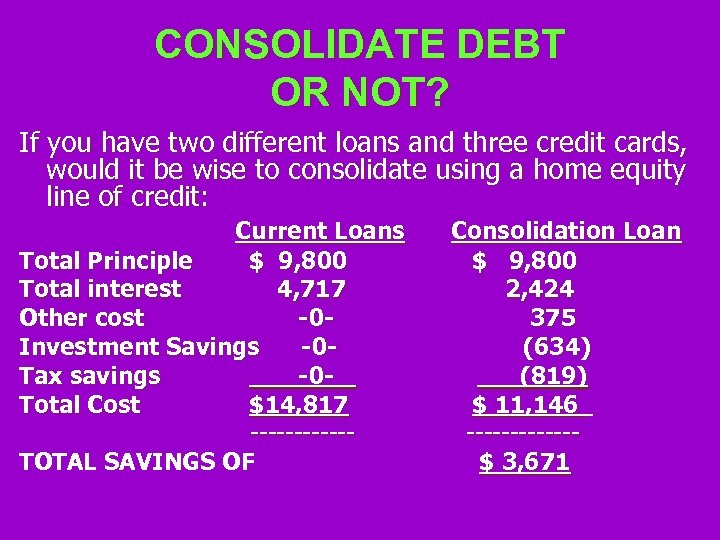

CONSOLIDATE DEBT OR NOT? If you have two different loans and three credit cards, would it be wise to consolidate using a home equity line of credit: Current Loans Total Principle $ 9, 800 Total interest 4, 717 Other cost -0 Investment Savings -0 Tax savings -0 Total Cost $14, 817 ------TOTAL SAVINGS OF Consolidation Loan $ 9, 800 2, 424 375 (634) (819) $ 11, 146 ------$ 3, 671

CONSOLIDATE DEBT OR NOT? If you have two different loans and three credit cards, would it be wise to consolidate using a home equity line of credit: Current Loans Total Principle $ 9, 800 Total interest 4, 717 Other cost -0 Investment Savings -0 Tax savings -0 Total Cost $14, 817 ------TOTAL SAVINGS OF Consolidation Loan $ 9, 800 2, 424 375 (634) (819) $ 11, 146 ------$ 3, 671

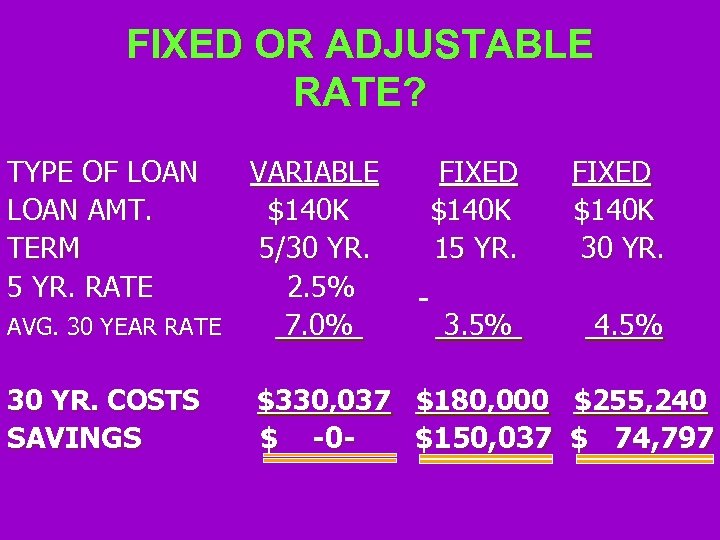

FIXED OR ADJUSTABLE RATE? TYPE OF LOAN AMT. TERM 5 YR. RATE VARIABLE $140 K 5/30 YR. 2. 5% AVG. 30 YEAR RATE 7. 0% 30 YR. COSTS SAVINGS FIXED $140 K 15 YR. FIXED $140 K 30 YR. 3. 5% 4. 5% $330, 037 $180, 000 $255, 240 $ -0$150, 037 $ 74, 797

FIXED OR ADJUSTABLE RATE? TYPE OF LOAN AMT. TERM 5 YR. RATE VARIABLE $140 K 5/30 YR. 2. 5% AVG. 30 YEAR RATE 7. 0% 30 YR. COSTS SAVINGS FIXED $140 K 15 YR. FIXED $140 K 30 YR. 3. 5% 4. 5% $330, 037 $180, 000 $255, 240 $ -0$150, 037 $ 74, 797

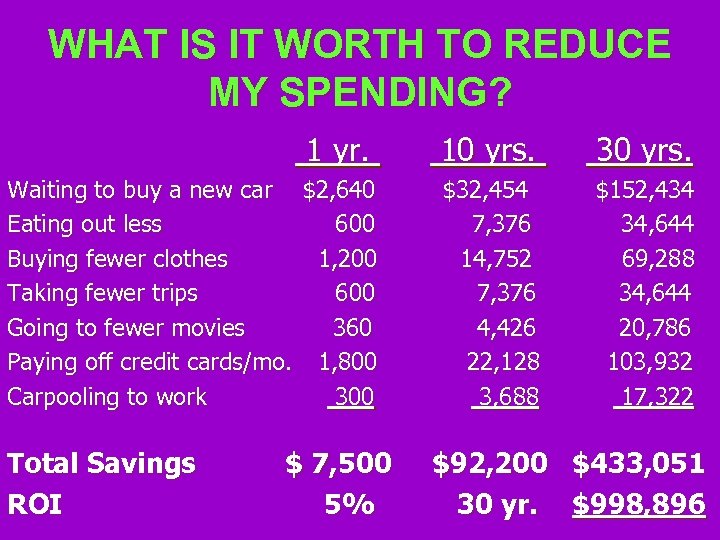

WHAT IS IT WORTH TO REDUCE MY SPENDING? 1 yr. 10 yrs. 30 yrs. Waiting to buy a new car $2, 640 Eating out less 600 Buying fewer clothes 1, 200 Taking fewer trips 600 Going to fewer movies 360 Paying off credit cards/mo. 1, 800 Carpooling to work 300 $32, 454 7, 376 14, 752 7, 376 4, 426 22, 128 3, 688 $152, 434 34, 644 69, 288 34, 644 20, 786 103, 932 17, 322 Total Savings ROI $ 7, 500 5% $92, 200 $433, 051 30 yr. $998, 896

WHAT IS IT WORTH TO REDUCE MY SPENDING? 1 yr. 10 yrs. 30 yrs. Waiting to buy a new car $2, 640 Eating out less 600 Buying fewer clothes 1, 200 Taking fewer trips 600 Going to fewer movies 360 Paying off credit cards/mo. 1, 800 Carpooling to work 300 $32, 454 7, 376 14, 752 7, 376 4, 426 22, 128 3, 688 $152, 434 34, 644 69, 288 34, 644 20, 786 103, 932 17, 322 Total Savings ROI $ 7, 500 5% $92, 200 $433, 051 30 yr. $998, 896

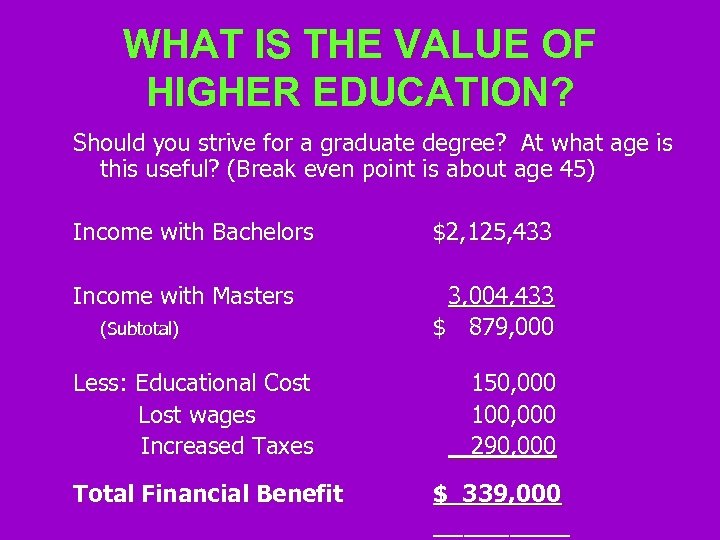

WHAT IS THE VALUE OF HIGHER EDUCATION? Should you strive for a graduate degree? At what age is this useful? (Break even point is about age 45) Income with Bachelors $2, 125, 433 Income with Masters 3, 004, 433 $ 879, 000 (Subtotal) Less: Educational Cost Lost wages Increased Taxes Total Financial Benefit 150, 000 100, 000 290, 000 $ 339, 000 _____

WHAT IS THE VALUE OF HIGHER EDUCATION? Should you strive for a graduate degree? At what age is this useful? (Break even point is about age 45) Income with Bachelors $2, 125, 433 Income with Masters 3, 004, 433 $ 879, 000 (Subtotal) Less: Educational Cost Lost wages Increased Taxes Total Financial Benefit 150, 000 100, 000 290, 000 $ 339, 000 _____

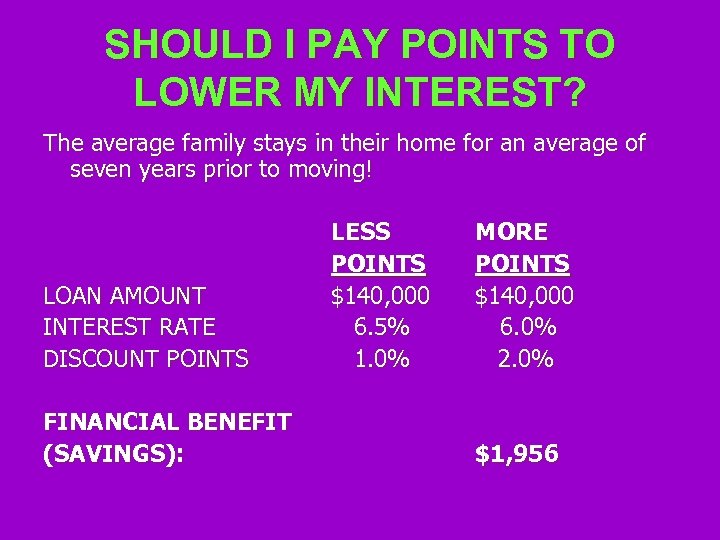

SHOULD I PAY POINTS TO LOWER MY INTEREST? The average family stays in their home for an average of seven years prior to moving! LOAN AMOUNT INTEREST RATE DISCOUNT POINTS FINANCIAL BENEFIT (SAVINGS): LESS POINTS $140, 000 6. 5% 1. 0% MORE POINTS $140, 000 6. 0% 2. 0% $1, 956

SHOULD I PAY POINTS TO LOWER MY INTEREST? The average family stays in their home for an average of seven years prior to moving! LOAN AMOUNT INTEREST RATE DISCOUNT POINTS FINANCIAL BENEFIT (SAVINGS): LESS POINTS $140, 000 6. 5% 1. 0% MORE POINTS $140, 000 6. 0% 2. 0% $1, 956

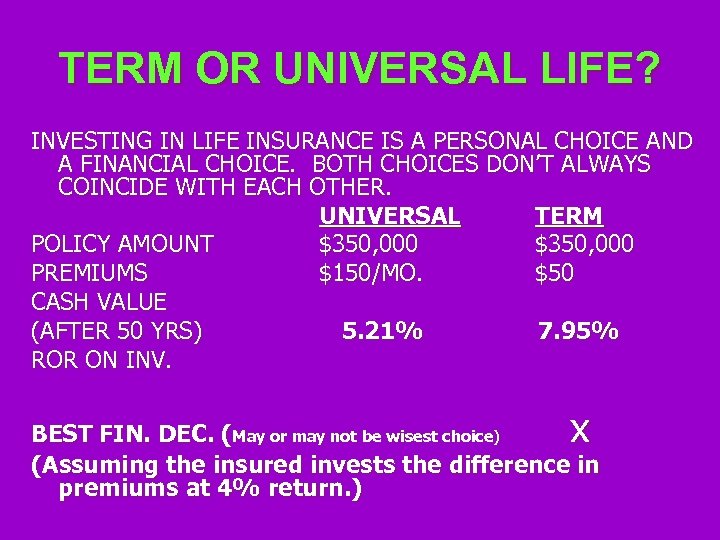

TERM OR UNIVERSAL LIFE? INVESTING IN LIFE INSURANCE IS A PERSONAL CHOICE AND A FINANCIAL CHOICE. BOTH CHOICES DON’T ALWAYS COINCIDE WITH EACH OTHER. UNIVERSAL TERM POLICY AMOUNT $350, 000 PREMIUMS $150/MO. $50 CASH VALUE (AFTER 50 YRS) 5. 21% 7. 95% ROR ON INV. x BEST FIN. DEC. (May or may not be wisest choice) (Assuming the insured invests the difference in premiums at 4% return. )

TERM OR UNIVERSAL LIFE? INVESTING IN LIFE INSURANCE IS A PERSONAL CHOICE AND A FINANCIAL CHOICE. BOTH CHOICES DON’T ALWAYS COINCIDE WITH EACH OTHER. UNIVERSAL TERM POLICY AMOUNT $350, 000 PREMIUMS $150/MO. $50 CASH VALUE (AFTER 50 YRS) 5. 21% 7. 95% ROR ON INV. x BEST FIN. DEC. (May or may not be wisest choice) (Assuming the insured invests the difference in premiums at 4% return. )

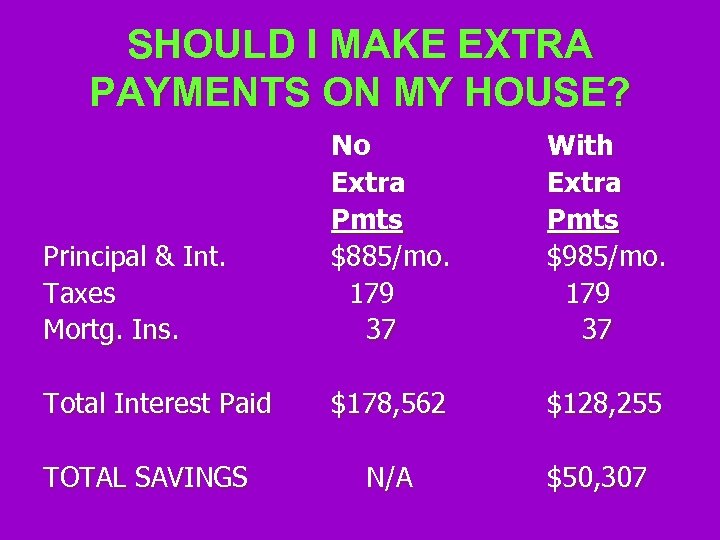

SHOULD I MAKE EXTRA PAYMENTS ON MY HOUSE? Principal & Int. Taxes Mortg. Ins. No Extra Pmts $885/mo. 179 37 With Extra Pmts $985/mo. 179 37 Total Interest Paid $178, 562 $128, 255 N/A $50, 307 TOTAL SAVINGS

SHOULD I MAKE EXTRA PAYMENTS ON MY HOUSE? Principal & Int. Taxes Mortg. Ins. No Extra Pmts $885/mo. 179 37 With Extra Pmts $985/mo. 179 37 Total Interest Paid $178, 562 $128, 255 N/A $50, 307 TOTAL SAVINGS