b962234de4b728dcfd409c2277c696bd.ppt

- Количество слайдов: 59

Chapter 13 Equity Valuation Mc. Graw-Hill/Irwin Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 13 Equity Valuation Mc. Graw-Hill/Irwin Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

13. 1 Valuation by Comparables 13 -2

13. 1 Valuation by Comparables 13 -2

Fundamental Stock Analysis: Models of Equity Valuation • Basic Types of Models – Balance Sheet Models – Dividend Discount Models – Price/Earnings Ratios – Free Cash Flow Models 13 -3

Fundamental Stock Analysis: Models of Equity Valuation • Basic Types of Models – Balance Sheet Models – Dividend Discount Models – Price/Earnings Ratios – Free Cash Flow Models 13 -3

Models of Equity Valuation • Valuation models using comparables – Look at the relationship between price and various determinants of value for similar firms • The internet provides a convenient way to access firm data. Some examples are: – EDGAR – Finance. yahoo. com 13 -4

Models of Equity Valuation • Valuation models using comparables – Look at the relationship between price and various determinants of value for similar firms • The internet provides a convenient way to access firm data. Some examples are: – EDGAR – Finance. yahoo. com 13 -4

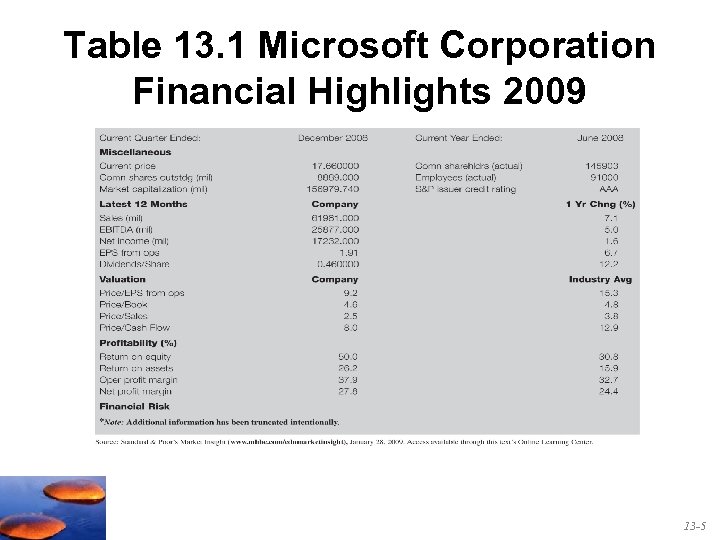

Table 13. 1 Microsoft Corporation Financial Highlights 2009 13 -5

Table 13. 1 Microsoft Corporation Financial Highlights 2009 13 -5

Valuation Methods • Book value – Value of common equity on the balance sheet – Based on historical values of assets and liabilities, which may not reflect current values – Some assets such as brand name or specialized skills are not on a balance sheet – Is book value a floor value for market value of equity? 13 -6

Valuation Methods • Book value – Value of common equity on the balance sheet – Based on historical values of assets and liabilities, which may not reflect current values – Some assets such as brand name or specialized skills are not on a balance sheet – Is book value a floor value for market value of equity? 13 -6

Valuation Methods • Market value – Current market value of assets minus current market value of liabilities • Market value of assets may be difficult to ascertain – Market value based on stock price – Better measure than book value of the worth of the stock to the investor. 13 -7

Valuation Methods • Market value – Current market value of assets minus current market value of liabilities • Market value of assets may be difficult to ascertain – Market value based on stock price – Better measure than book value of the worth of the stock to the investor. 13 -7

Valuation Methods (Other Measures) • Liquidation value – Net amount realized from sale of assets and paying off all debt – Firm becomes a takeover target if market value stock falls below this amount, so liquidation value may serve as floor to value 13 -8

Valuation Methods (Other Measures) • Liquidation value – Net amount realized from sale of assets and paying off all debt – Firm becomes a takeover target if market value stock falls below this amount, so liquidation value may serve as floor to value 13 -8

Valuation Methods (Other Measures) • Replacement cost – Replacement cost of the assets less the liabilities – May put a ceiling on market value in the long run because values above replacement cost will attract new entrants into the market. – Tobin’s Q = Market Value / Replacement Cost; should tend toward 1 over time. 13 -9

Valuation Methods (Other Measures) • Replacement cost – Replacement cost of the assets less the liabilities – May put a ceiling on market value in the long run because values above replacement cost will attract new entrants into the market. – Tobin’s Q = Market Value / Replacement Cost; should tend toward 1 over time. 13 -9

13. 2 Intrinsic Value Versus Market Price 13 -10

13. 2 Intrinsic Value Versus Market Price 13 -10

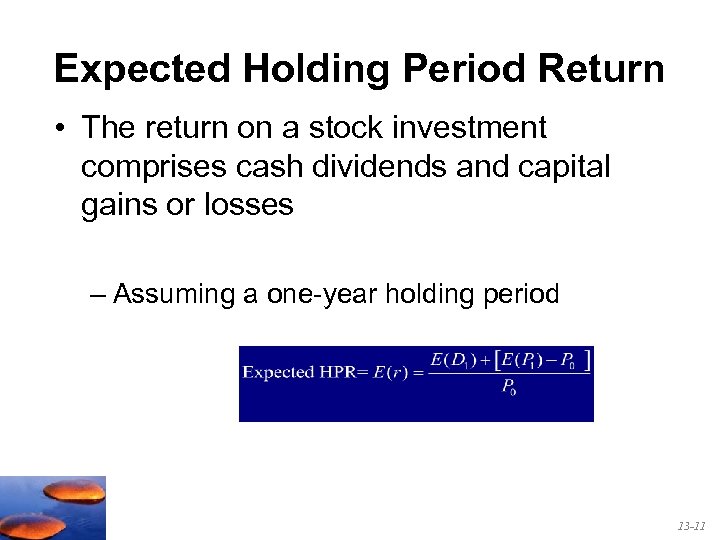

Expected Holding Period Return • The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period 13 -11

Expected Holding Period Return • The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period 13 -11

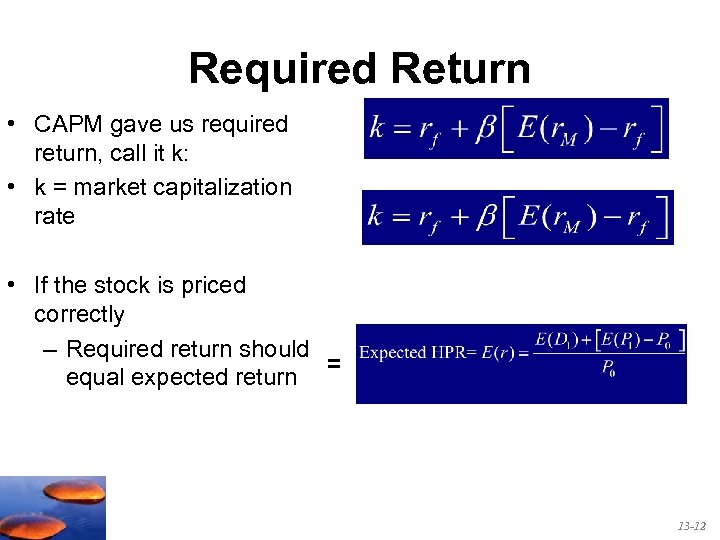

Required Return • CAPM gave us required return, call it k: • k = market capitalization rate • If the stock is priced correctly – Required return should = equal expected return 13 -12

Required Return • CAPM gave us required return, call it k: • k = market capitalization rate • If the stock is priced correctly – Required return should = equal expected return 13 -12

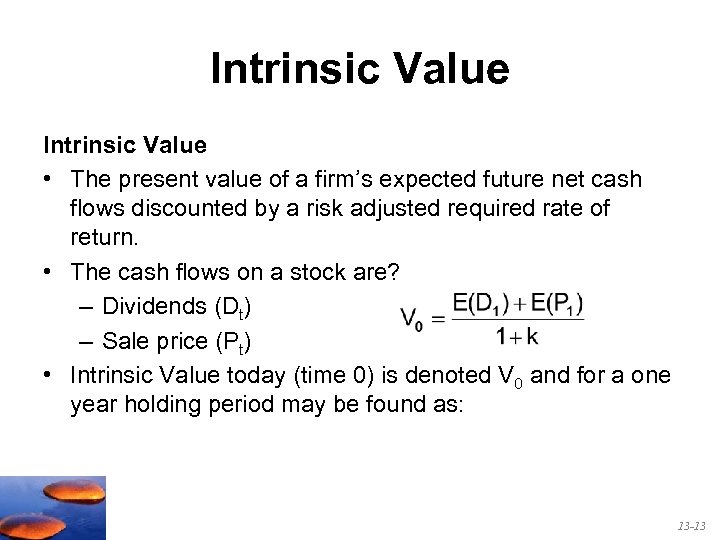

Intrinsic Value • The present value of a firm’s expected future net cash flows discounted by a risk adjusted required rate of return. • The cash flows on a stock are? – Dividends (Dt) – Sale price (Pt) • Intrinsic Value today (time 0) is denoted V 0 and for a one year holding period may be found as: 13 -13

Intrinsic Value • The present value of a firm’s expected future net cash flows discounted by a risk adjusted required rate of return. • The cash flows on a stock are? – Dividends (Dt) – Sale price (Pt) • Intrinsic Value today (time 0) is denoted V 0 and for a one year holding period may be found as: 13 -13

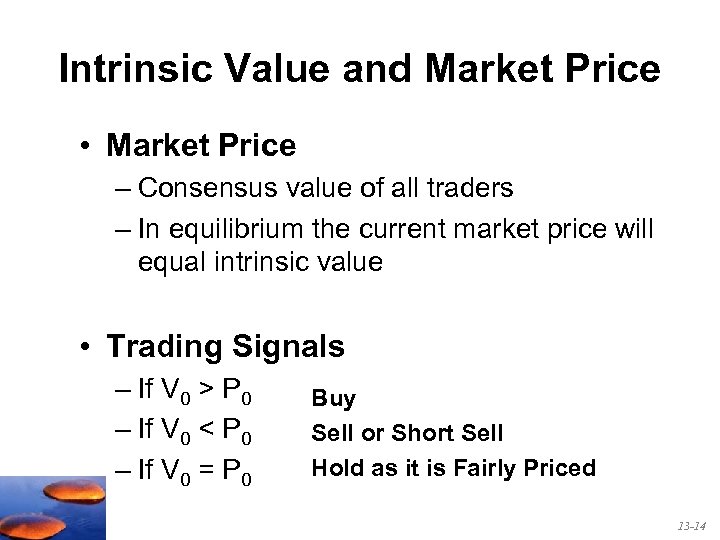

Intrinsic Value and Market Price • Market Price – Consensus value of all traders – In equilibrium the current market price will equal intrinsic value • Trading Signals – If V 0 > P 0 – If V 0 < P 0 – If V 0 = P 0 Buy Sell or Short Sell Hold as it is Fairly Priced 13 -14

Intrinsic Value and Market Price • Market Price – Consensus value of all traders – In equilibrium the current market price will equal intrinsic value • Trading Signals – If V 0 > P 0 – If V 0 < P 0 – If V 0 = P 0 Buy Sell or Short Sell Hold as it is Fairly Priced 13 -14

13. 3 Dividend Discount Models For now assume price = intrinsic value 13 -15

13. 3 Dividend Discount Models For now assume price = intrinsic value 13 -15

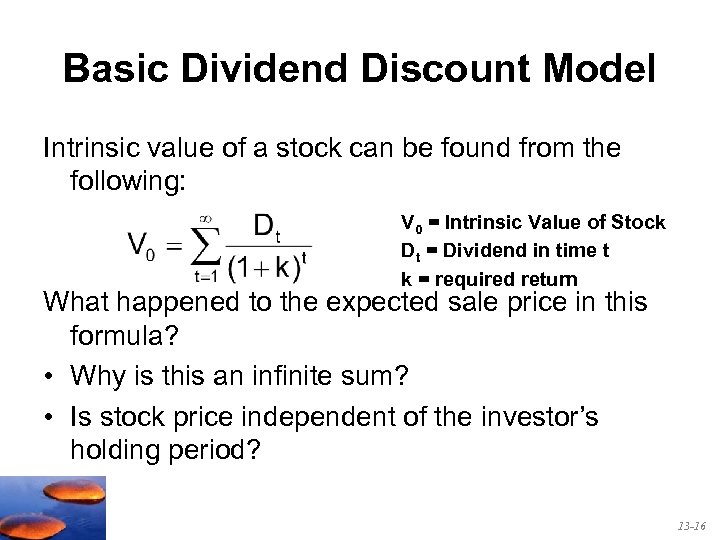

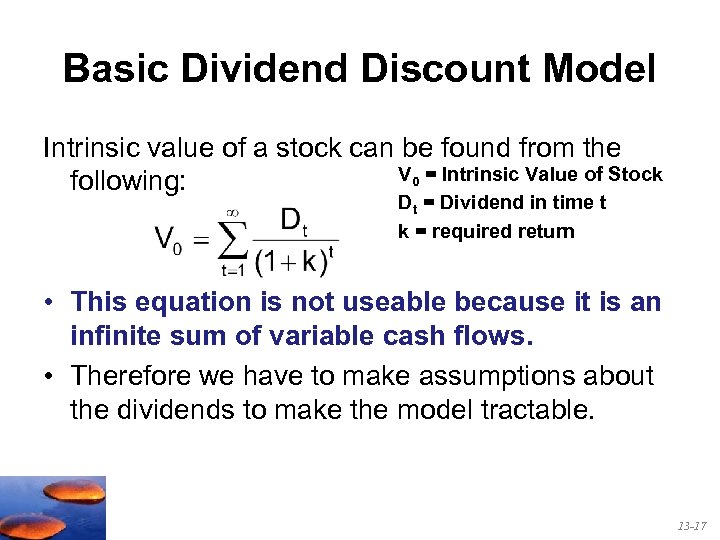

Basic Dividend Discount Model Intrinsic value of a stock can be found from the following: V 0 = Intrinsic Value of Stock Dt = Dividend in time t k = required return What happened to the expected sale price in this formula? • Why is this an infinite sum? • Is stock price independent of the investor’s holding period? 13 -16

Basic Dividend Discount Model Intrinsic value of a stock can be found from the following: V 0 = Intrinsic Value of Stock Dt = Dividend in time t k = required return What happened to the expected sale price in this formula? • Why is this an infinite sum? • Is stock price independent of the investor’s holding period? 13 -16

Basic Dividend Discount Model Intrinsic value of a stock can be found from the V 0 = Intrinsic Value of Stock following: Dt = Dividend in time t k = required return • This equation is not useable because it is an infinite sum of variable cash flows. • Therefore we have to make assumptions about the dividends to make the model tractable. 13 -17

Basic Dividend Discount Model Intrinsic value of a stock can be found from the V 0 = Intrinsic Value of Stock following: Dt = Dividend in time t k = required return • This equation is not useable because it is an infinite sum of variable cash flows. • Therefore we have to make assumptions about the dividends to make the model tractable. 13 -17

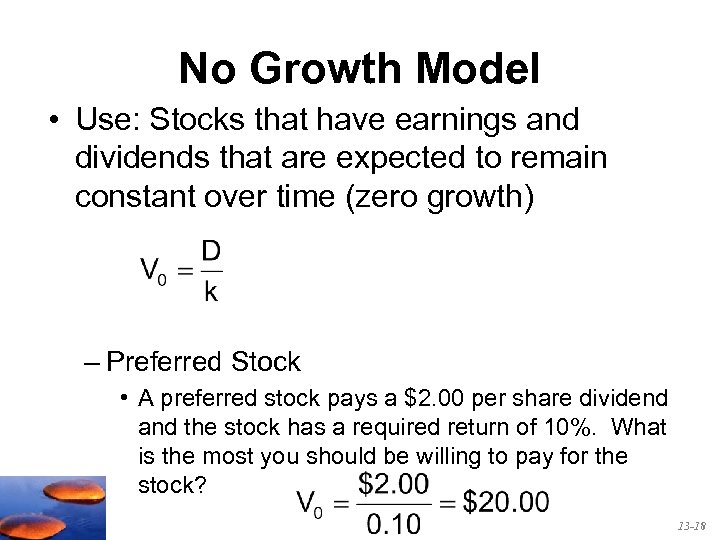

No Growth Model • Use: Stocks that have earnings and dividends that are expected to remain constant over time (zero growth) – Preferred Stock • A preferred stock pays a $2. 00 per share dividend and the stock has a required return of 10%. What is the most you should be willing to pay for the stock? 13 -18

No Growth Model • Use: Stocks that have earnings and dividends that are expected to remain constant over time (zero growth) – Preferred Stock • A preferred stock pays a $2. 00 per share dividend and the stock has a required return of 10%. What is the most you should be willing to pay for the stock? 13 -18

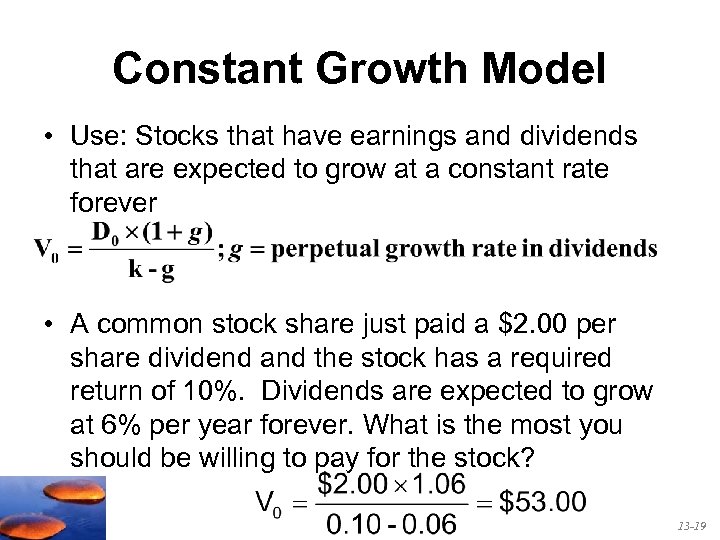

Constant Growth Model • Use: Stocks that have earnings and dividends that are expected to grow at a constant rate forever • A common stock share just paid a $2. 00 per share dividend and the stock has a required return of 10%. Dividends are expected to grow at 6% per year forever. What is the most you should be willing to pay for the stock? 13 -19

Constant Growth Model • Use: Stocks that have earnings and dividends that are expected to grow at a constant rate forever • A common stock share just paid a $2. 00 per share dividend and the stock has a required return of 10%. Dividends are expected to grow at 6% per year forever. What is the most you should be willing to pay for the stock? 13 -19

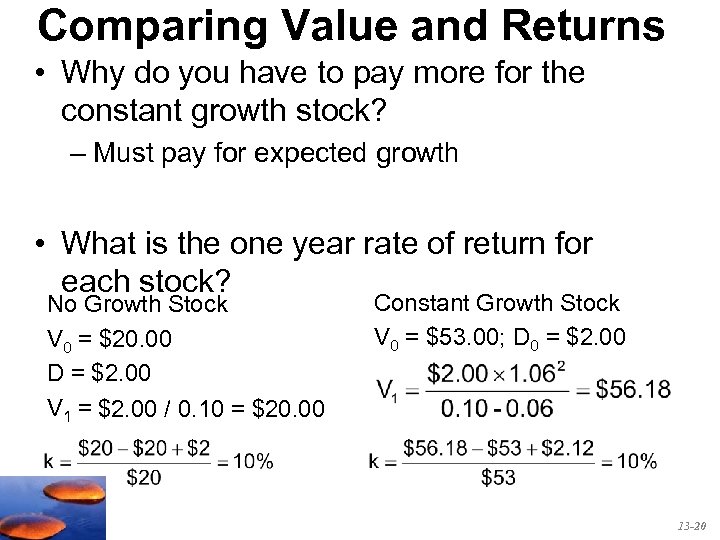

Comparing Value and Returns • Why do you have to pay more for the constant growth stock? – Must pay for expected growth • What is the one year rate of return for each stock? No Growth Stock V 0 = $20. 00 D = $2. 00 V 1 = $2. 00 / 0. 10 = $20. 00 Constant Growth Stock V 0 = $53. 00; D 0 = $2. 00 13 -20

Comparing Value and Returns • Why do you have to pay more for the constant growth stock? – Must pay for expected growth • What is the one year rate of return for each stock? No Growth Stock V 0 = $20. 00 D = $2. 00 V 1 = $2. 00 / 0. 10 = $20. 00 Constant Growth Stock V 0 = $53. 00; D 0 = $2. 00 13 -20

Comparing Value and Returns • Both stocks given an investor a pre-tax return of 10%. • Is one stock a better buy than the other? – Not if both are actually priced at their intrinsic value (ignoring taxes). 13 -21

Comparing Value and Returns • Both stocks given an investor a pre-tax return of 10%. • Is one stock a better buy than the other? – Not if both are actually priced at their intrinsic value (ignoring taxes). 13 -21

Stock Prices and Investment Opportunities • g = growth rate in dividends is a function of two variables: – ROE = Return on Equity for the firm – b = plowback or retention percentage rate • (1 - dividend payout percentage rate) • g increases if a firm increases its retention ratio and/or its ROE 13 -22

Stock Prices and Investment Opportunities • g = growth rate in dividends is a function of two variables: – ROE = Return on Equity for the firm – b = plowback or retention percentage rate • (1 - dividend payout percentage rate) • g increases if a firm increases its retention ratio and/or its ROE 13 -22

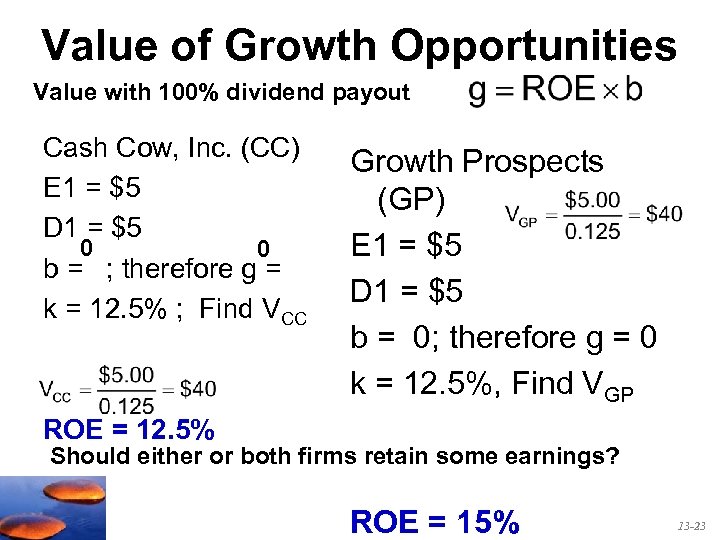

Value of Growth Opportunities Value with 100% dividend payout Cash Cow, Inc. (CC) E 1 = $5 D 1 = $5 0 0 b = ; therefore g = k = 12. 5% ; Find VCC Growth Prospects (GP) E 1 = $5 D 1 = $5 b = 0; therefore g = 0 k = 12. 5%, Find VGP ROE = 12. 5% Should either or both firms retain some earnings? ROE = 15% 13 -23

Value of Growth Opportunities Value with 100% dividend payout Cash Cow, Inc. (CC) E 1 = $5 D 1 = $5 0 0 b = ; therefore g = k = 12. 5% ; Find VCC Growth Prospects (GP) E 1 = $5 D 1 = $5 b = 0; therefore g = 0 k = 12. 5%, Find VGP ROE = 12. 5% Should either or both firms retain some earnings? ROE = 15% 13 -23

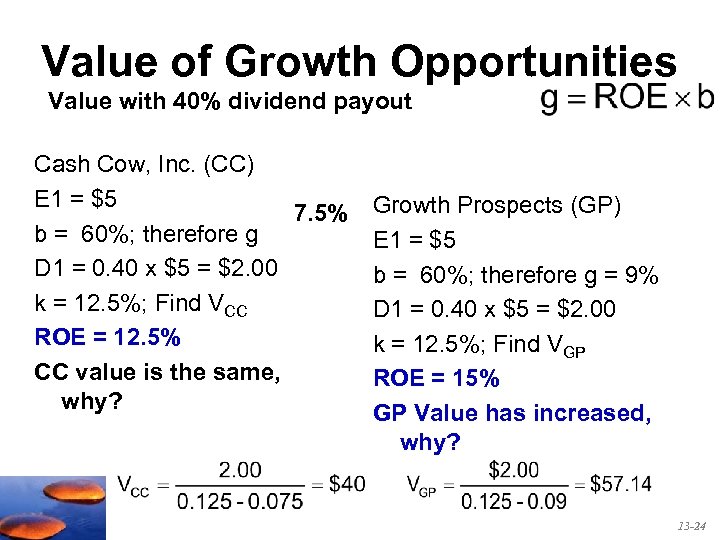

Value of Growth Opportunities Value with 40% dividend payout Cash Cow, Inc. (CC) E 1 = $5 7. 5% b = 60%; therefore g D 1 = 0. 40 x $5 = $2. 00 k = 12. 5%; Find VCC ROE = 12. 5% CC value is the same, why? Growth Prospects (GP) E 1 = $5 b = 60%; therefore g = 9% D 1 = 0. 40 x $5 = $2. 00 k = 12. 5%; Find VGP ROE = 15% GP Value has increased, why? 13 -24

Value of Growth Opportunities Value with 40% dividend payout Cash Cow, Inc. (CC) E 1 = $5 7. 5% b = 60%; therefore g D 1 = 0. 40 x $5 = $2. 00 k = 12. 5%; Find VCC ROE = 12. 5% CC value is the same, why? Growth Prospects (GP) E 1 = $5 b = 60%; therefore g = 9% D 1 = 0. 40 x $5 = $2. 00 k = 12. 5%; Find VGP ROE = 15% GP Value has increased, why? 13 -24

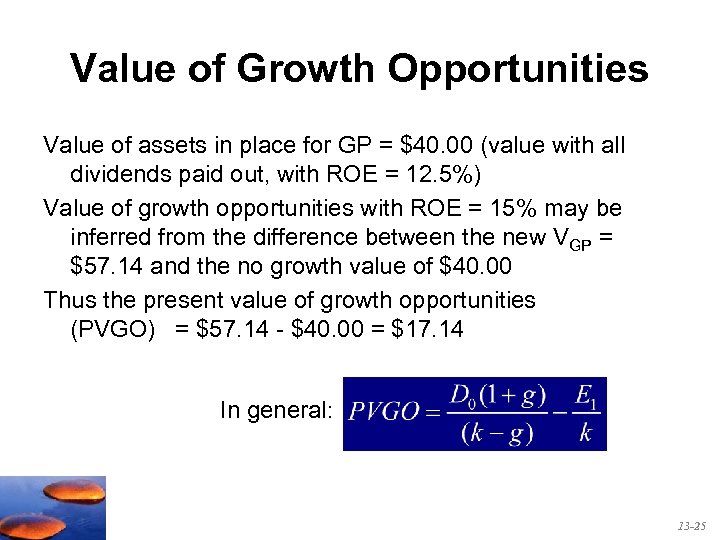

Value of Growth Opportunities Value of assets in place for GP = $40. 00 (value with all dividends paid out, with ROE = 12. 5%) Value of growth opportunities with ROE = 15% may be inferred from the difference between the new VGP = $57. 14 and the no growth value of $40. 00 Thus the present value of growth opportunities (PVGO) = $57. 14 - $40. 00 = $17. 14 In general: 13 -25

Value of Growth Opportunities Value of assets in place for GP = $40. 00 (value with all dividends paid out, with ROE = 12. 5%) Value of growth opportunities with ROE = 15% may be inferred from the difference between the new VGP = $57. 14 and the no growth value of $40. 00 Thus the present value of growth opportunities (PVGO) = $57. 14 - $40. 00 = $17. 14 In general: 13 -25

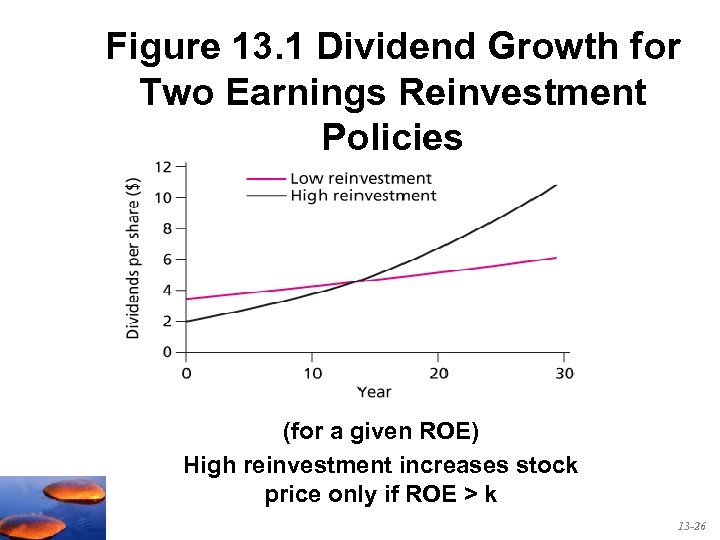

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies (for a given ROE) High reinvestment increases stock price only if ROE > k 13 -26

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies (for a given ROE) High reinvestment increases stock price only if ROE > k 13 -26

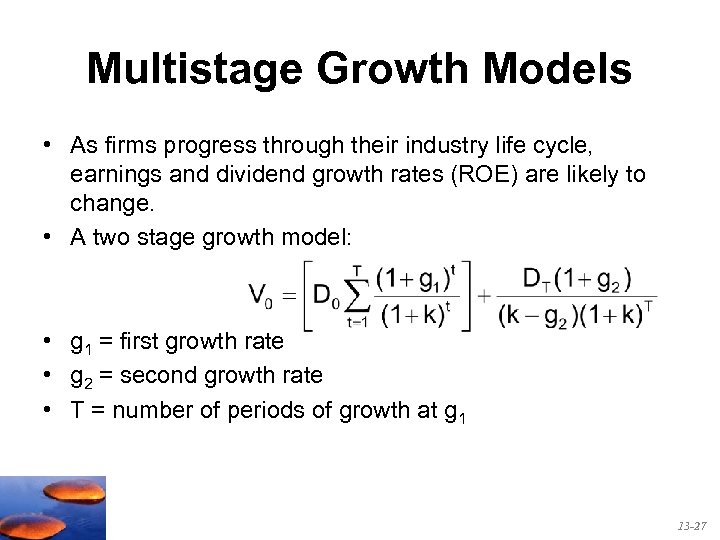

Multistage Growth Models • As firms progress through their industry life cycle, earnings and dividend growth rates (ROE) are likely to change. • A two stage growth model: • g 1 = first growth rate • g 2 = second growth rate • T = number of periods of growth at g 1 13 -27

Multistage Growth Models • As firms progress through their industry life cycle, earnings and dividend growth rates (ROE) are likely to change. • A two stage growth model: • g 1 = first growth rate • g 2 = second growth rate • T = number of periods of growth at g 1 13 -27

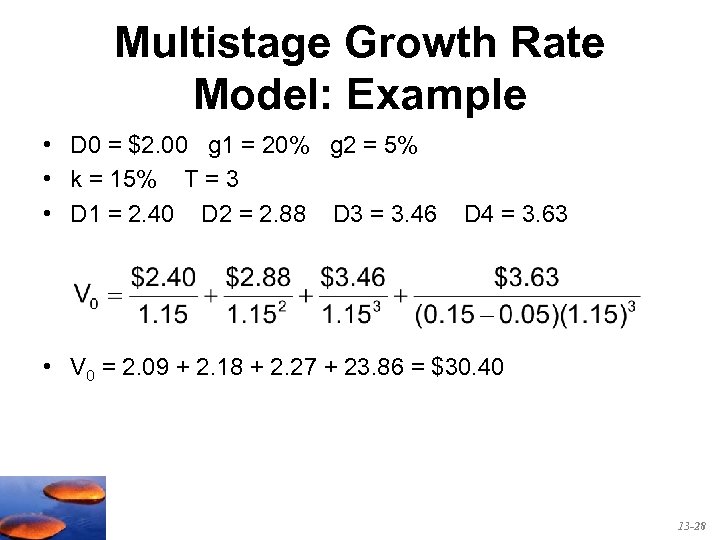

Multistage Growth Rate Model: Example • D 0 = $2. 00 g 1 = 20% g 2 = 5% • k = 15% T = 3 • D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 • V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 13 -28

Multistage Growth Rate Model: Example • D 0 = $2. 00 g 1 = 20% g 2 = 5% • k = 15% T = 3 • D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 • V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 13 -28

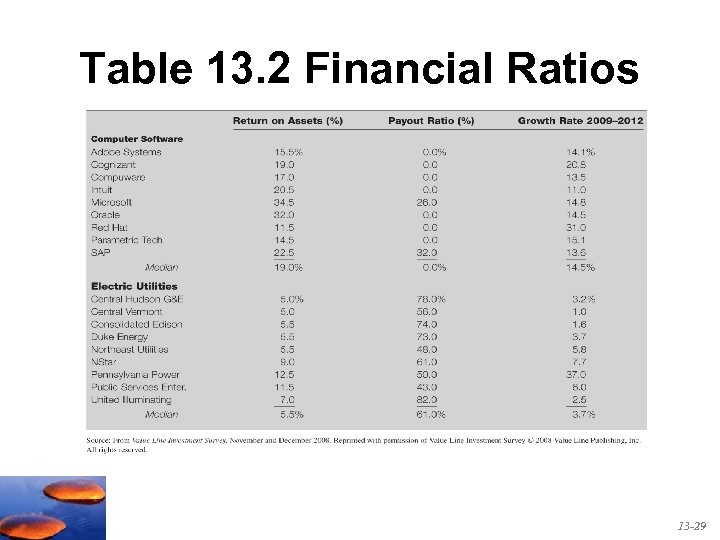

Table 13. 2 Financial Ratios 13 -29

Table 13. 2 Financial Ratios 13 -29

Figure 13. 2 Honda Motor 13 -30

Figure 13. 2 Honda Motor 13 -30

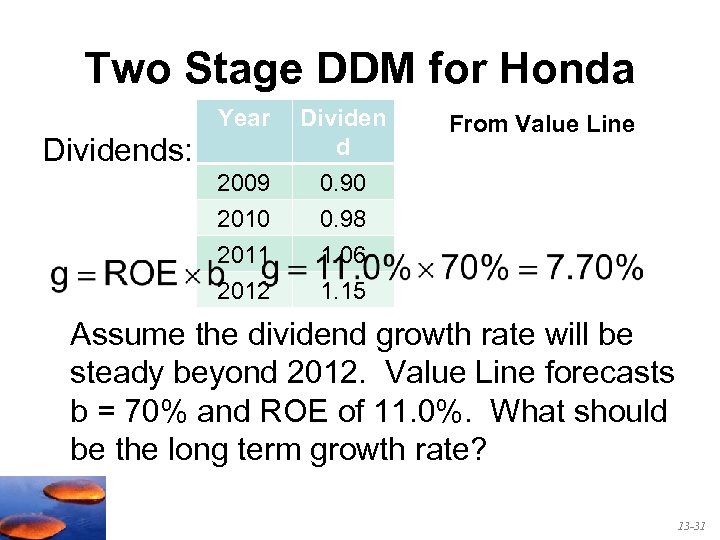

Two Stage DDM for Honda Year 2009 2010 Dividen d 0. 90 0. 98 2011 2012 1. 06 1. 15 Dividends: From Value Line Assume the dividend growth rate will be steady beyond 2012. Value Line forecasts b = 70% and ROE of 11. 0%. What should be the long term growth rate? 13 -31

Two Stage DDM for Honda Year 2009 2010 Dividen d 0. 90 0. 98 2011 2012 1. 06 1. 15 Dividends: From Value Line Assume the dividend growth rate will be steady beyond 2012. Value Line forecasts b = 70% and ROE of 11. 0%. What should be the long term growth rate? 13 -31

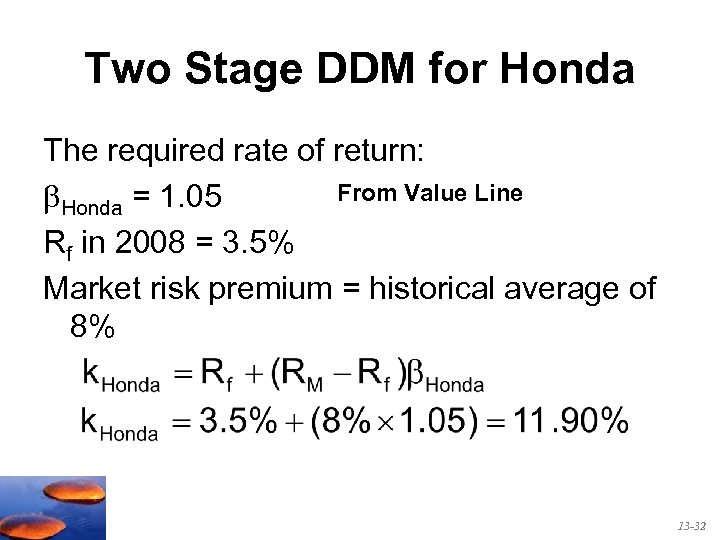

Two Stage DDM for Honda The required rate of return: From Value Line Honda = 1. 05 Rf in 2008 = 3. 5% Market risk premium = historical average of 8% 13 -32

Two Stage DDM for Honda The required rate of return: From Value Line Honda = 1. 05 Rf in 2008 = 3. 5% Market risk premium = historical average of 8% 13 -32

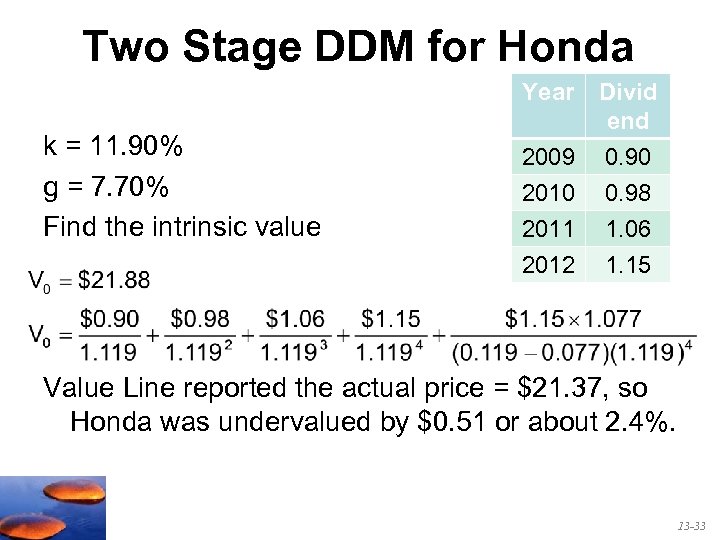

Two Stage DDM for Honda Year k = 11. 90% g = 7. 70% Find the intrinsic value Divid end 2009 0. 90 2010 0. 98 2011 2012 1. 06 1. 15 Value Line reported the actual price = $21. 37, so Honda was undervalued by $0. 51 or about 2. 4%. 13 -33

Two Stage DDM for Honda Year k = 11. 90% g = 7. 70% Find the intrinsic value Divid end 2009 0. 90 2010 0. 98 2011 2012 1. 06 1. 15 Value Line reported the actual price = $21. 37, so Honda was undervalued by $0. 51 or about 2. 4%. 13 -33

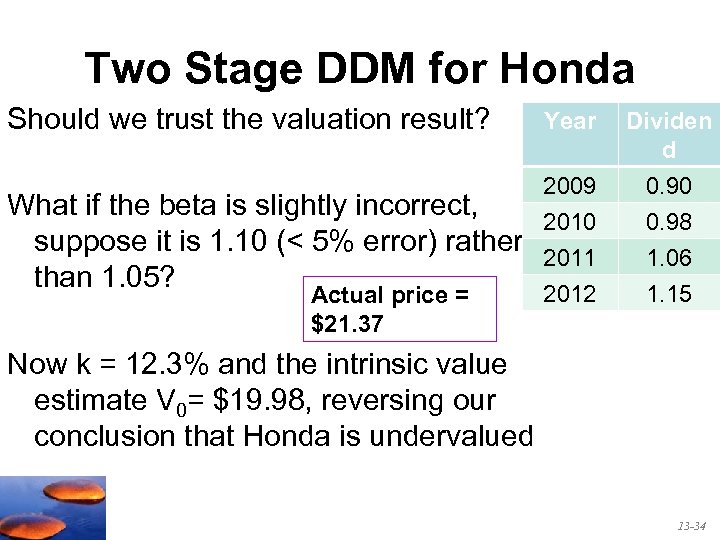

Two Stage DDM for Honda Should we trust the valuation result? What if the beta is slightly incorrect, suppose it is 1. 10 (< 5% error) rather than 1. 05? Actual price = $21. 37 Year 2009 2010 Dividen d 0. 90 0. 98 2011 2012 1. 06 1. 15 Now k = 12. 3% and the intrinsic value estimate V 0= $19. 98, reversing our conclusion that Honda is undervalued 13 -34

Two Stage DDM for Honda Should we trust the valuation result? What if the beta is slightly incorrect, suppose it is 1. 10 (< 5% error) rather than 1. 05? Actual price = $21. 37 Year 2009 2010 Dividen d 0. 90 0. 98 2011 2012 1. 06 1. 15 Now k = 12. 3% and the intrinsic value estimate V 0= $19. 98, reversing our conclusion that Honda is undervalued 13 -34

13. 4 Price-Earnings (P/E) Ratios 13 -35

13. 4 Price-Earnings (P/E) Ratios 13 -35

P/E Ratio and Growth Opportunities • P/E Ratios are a function of two factors – Required Rates of Return (k) (inverse relationship) – Expected Growth in Dividends (direct relationship) • Uses – Estimate intrinsic value of stocks • Conceptually equivalent to the constant growth DDM – Extensively used by analysts and investors 13 -36

P/E Ratio and Growth Opportunities • P/E Ratios are a function of two factors – Required Rates of Return (k) (inverse relationship) – Expected Growth in Dividends (direct relationship) • Uses – Estimate intrinsic value of stocks • Conceptually equivalent to the constant growth DDM – Extensively used by analysts and investors 13 -36

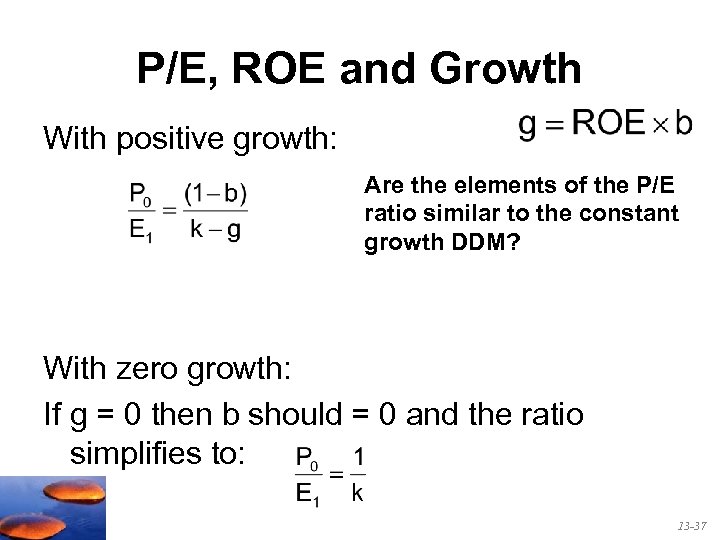

P/E, ROE and Growth With positive growth: Are the elements of the P/E ratio similar to the constant growth DDM? With zero growth: If g = 0 then b should = 0 and the ratio simplifies to: 13 -37

P/E, ROE and Growth With positive growth: Are the elements of the P/E ratio similar to the constant growth DDM? With zero growth: If g = 0 then b should = 0 and the ratio simplifies to: 13 -37

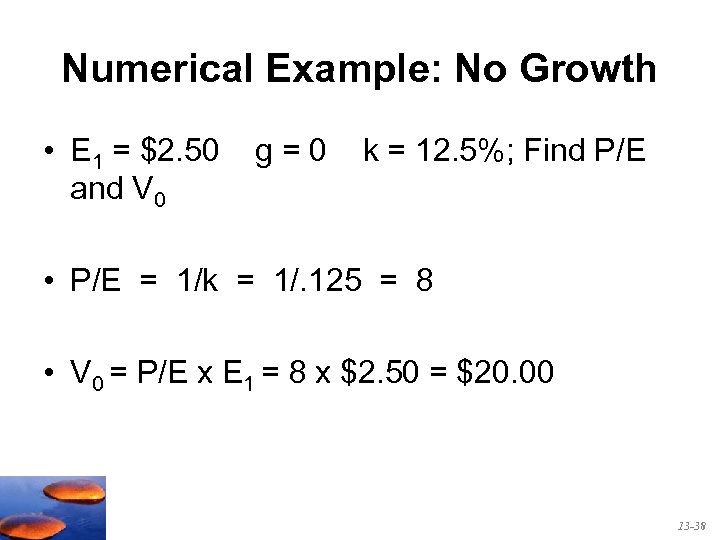

Numerical Example: No Growth • E 1 = $2. 50 and V 0 g=0 k = 12. 5%; Find P/E • P/E = 1/k = 1/. 125 = 8 • V 0 = P/E x E 1 = 8 x $2. 50 = $20. 00 13 -38

Numerical Example: No Growth • E 1 = $2. 50 and V 0 g=0 k = 12. 5%; Find P/E • P/E = 1/k = 1/. 125 = 8 • V 0 = P/E x E 1 = 8 x $2. 50 = $20. 00 13 -38

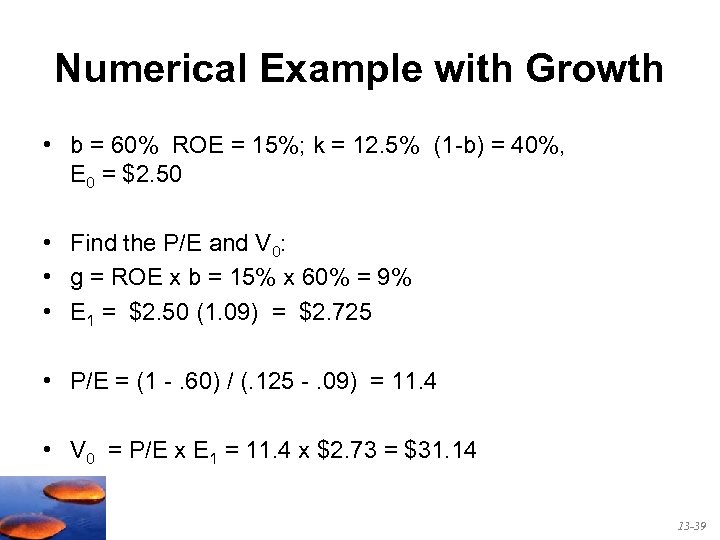

Numerical Example with Growth • b = 60% ROE = 15%; k = 12. 5% (1 -b) = 40%, E 0 = $2. 50 • Find the P/E and V 0: • g = ROE x b = 15% x 60% = 9% • E 1 = $2. 50 (1. 09) = $2. 725 • P/E = (1 -. 60) / (. 125 -. 09) = 11. 4 • V 0 = P/E x E 1 = 11. 4 x $2. 73 = $31. 14 13 -39

Numerical Example with Growth • b = 60% ROE = 15%; k = 12. 5% (1 -b) = 40%, E 0 = $2. 50 • Find the P/E and V 0: • g = ROE x b = 15% x 60% = 9% • E 1 = $2. 50 (1. 09) = $2. 725 • P/E = (1 -. 60) / (. 125 -. 09) = 11. 4 • V 0 = P/E x E 1 = 11. 4 x $2. 73 = $31. 14 13 -39

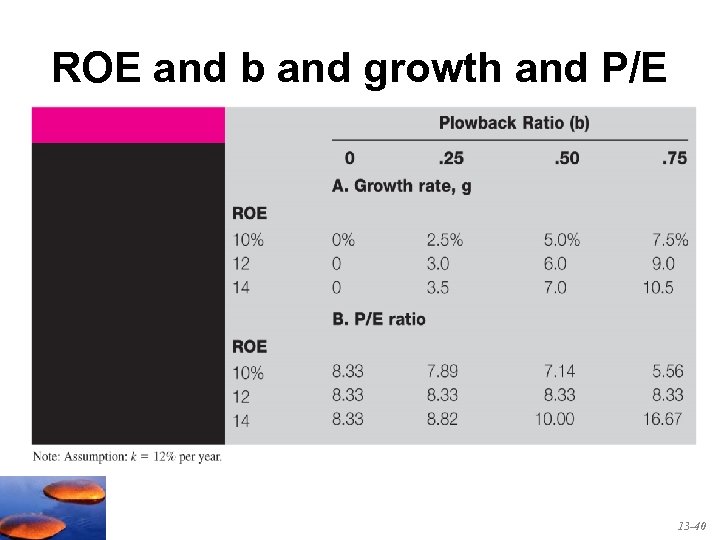

ROE and b and growth and P/E 13 -40

ROE and b and growth and P/E 13 -40

P/E Ratios and Stock Risk • Riskier firms will have higher required rates of return (higher values of k) • Riskier stocks will have lower P/E multiples 13 -41

P/E Ratios and Stock Risk • Riskier firms will have higher required rates of return (higher values of k) • Riskier stocks will have lower P/E multiples 13 -41

Pitfalls in Using P/E Ratios • Earnings management is a serious problem, • P/E should be calculated using pro forma earnings, • A high P/E implies high expected growth, but not necessarily high stock returns, • Simplistic, assumes the future P/E will not be lower than the current P/E. If expected growth in earnings fails to materialize the P/E will fall and investors may incur large losses. 13 -42

Pitfalls in Using P/E Ratios • Earnings management is a serious problem, • P/E should be calculated using pro forma earnings, • A high P/E implies high expected growth, but not necessarily high stock returns, • Simplistic, assumes the future P/E will not be lower than the current P/E. If expected growth in earnings fails to materialize the P/E will fall and investors may incur large losses. 13 -42

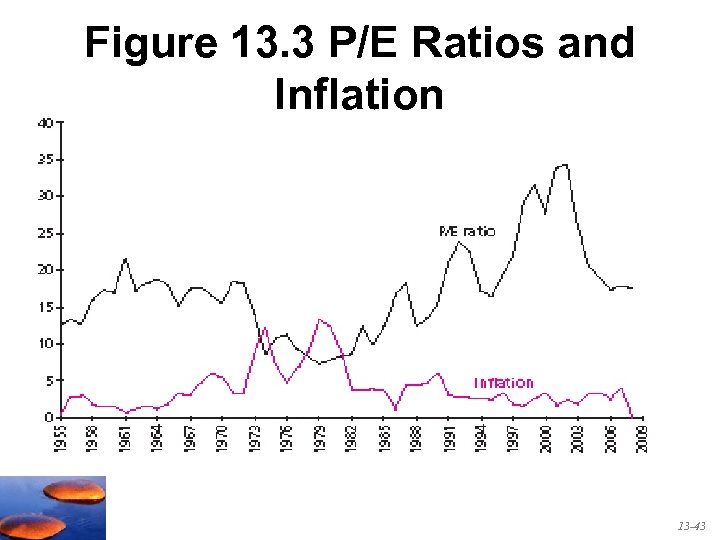

Figure 13. 3 P/E Ratios and Inflation 13 -43

Figure 13. 3 P/E Ratios and Inflation 13 -43

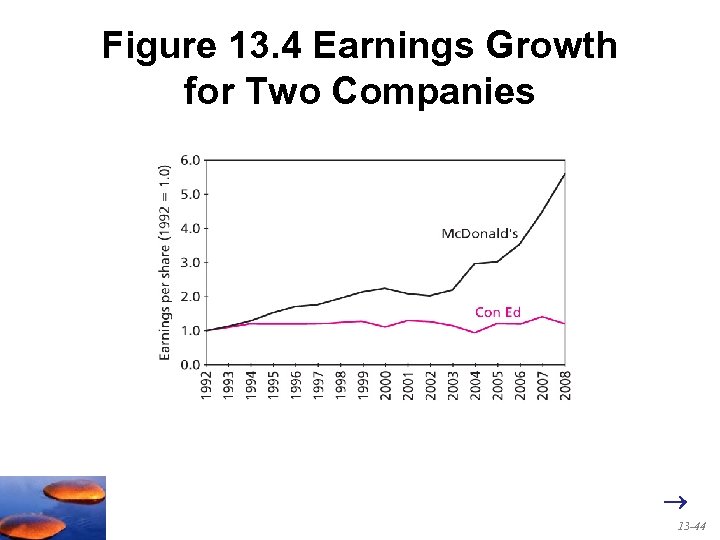

Figure 13. 4 Earnings Growth for Two Companies 13 -44

Figure 13. 4 Earnings Growth for Two Companies 13 -44

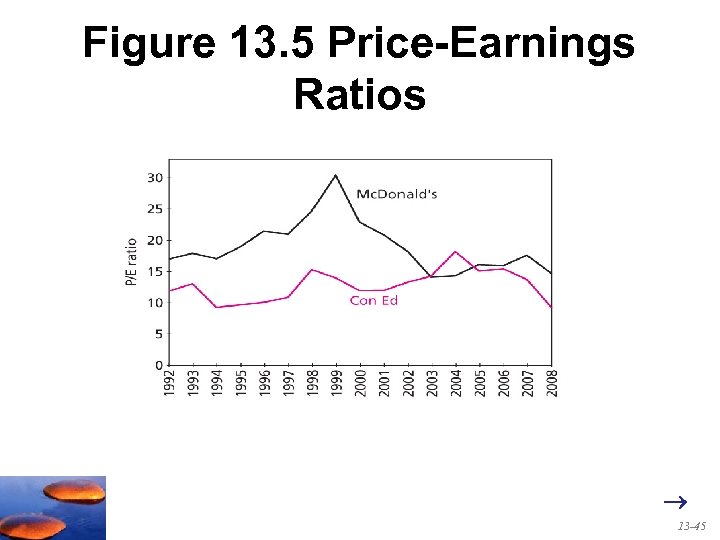

Figure 13. 5 Price-Earnings Ratios 13 -45

Figure 13. 5 Price-Earnings Ratios 13 -45

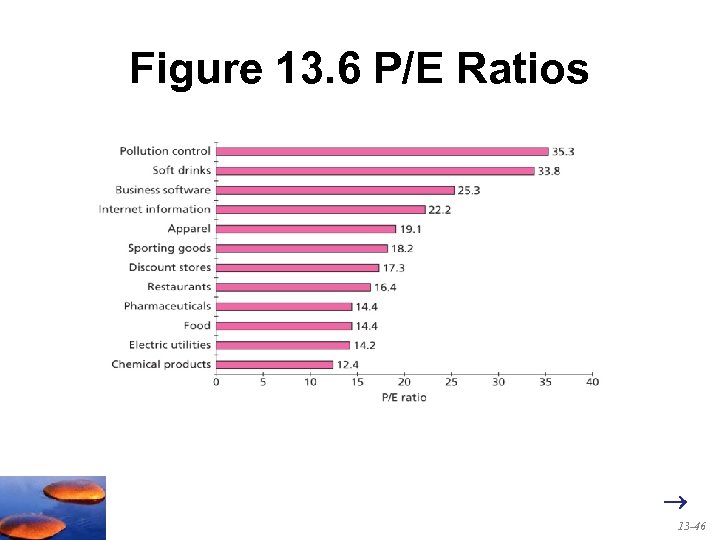

Figure 13. 6 P/E Ratios 13 -46

Figure 13. 6 P/E Ratios 13 -46

Other Comparative Valuation Ratios • Price-to-book – High ratio indicates a large premium over book value, and a ‘floor’ value that is often far below market price • Price-to-cash flow – P/Cash Flow instead of P/E; less subject to accounting manipulation • Price-to-sales – Useful for firms with low or negative earnings in early growth stage • Be creative 13 -47

Other Comparative Valuation Ratios • Price-to-book – High ratio indicates a large premium over book value, and a ‘floor’ value that is often far below market price • Price-to-cash flow – P/Cash Flow instead of P/E; less subject to accounting manipulation • Price-to-sales – Useful for firms with low or negative earnings in early growth stage • Be creative 13 -47

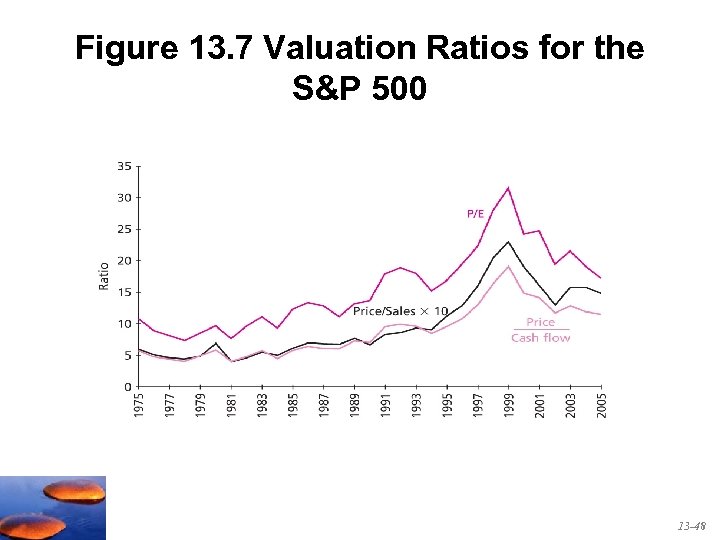

Figure 13. 7 Valuation Ratios for the S&P 500 13 -48

Figure 13. 7 Valuation Ratios for the S&P 500 13 -48

13. 5 Free Cash Flow Valuation Approaches 13 -49

13. 5 Free Cash Flow Valuation Approaches 13 -49

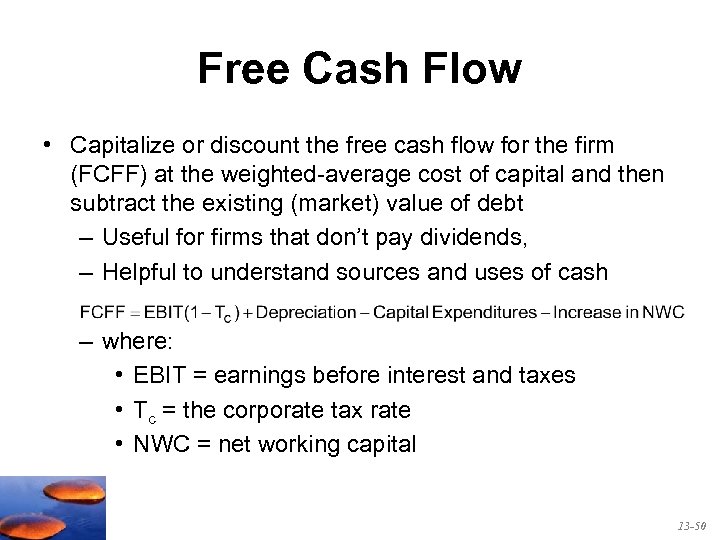

Free Cash Flow • Capitalize or discount the free cash flow for the firm (FCFF) at the weighted-average cost of capital and then subtract the existing (market) value of debt – Useful for firms that don’t pay dividends, – Helpful to understand sources and uses of cash – where: • EBIT = earnings before interest and taxes • Tc = the corporate tax rate • NWC = net working capital 13 -50

Free Cash Flow • Capitalize or discount the free cash flow for the firm (FCFF) at the weighted-average cost of capital and then subtract the existing (market) value of debt – Useful for firms that don’t pay dividends, – Helpful to understand sources and uses of cash – where: • EBIT = earnings before interest and taxes • Tc = the corporate tax rate • NWC = net working capital 13 -50

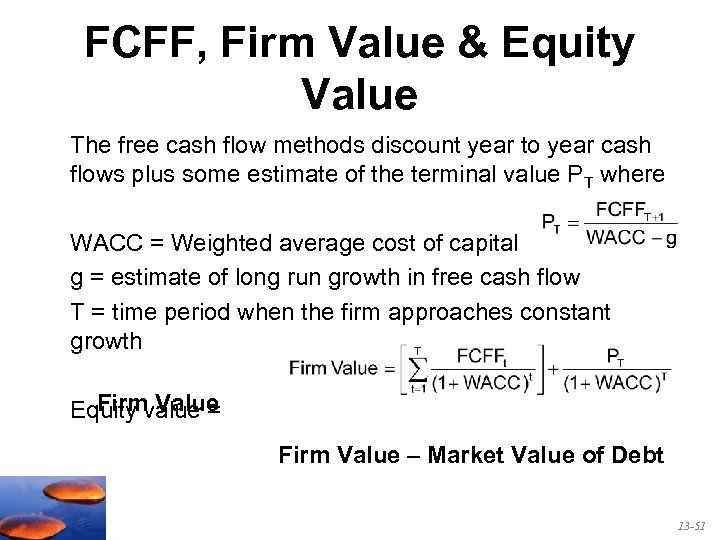

FCFF, Firm Value & Equity Value The free cash flow methods discount year to year cash flows plus some estimate of the terminal value PT where WACC = Weighted average cost of capital g = estimate of long run growth in free cash flow T = time period when the firm approaches constant growth Firm Value Equity value = Firm Value – Market Value of Debt 13 -51

FCFF, Firm Value & Equity Value The free cash flow methods discount year to year cash flows plus some estimate of the terminal value PT where WACC = Weighted average cost of capital g = estimate of long run growth in free cash flow T = time period when the firm approaches constant growth Firm Value Equity value = Firm Value – Market Value of Debt 13 -51

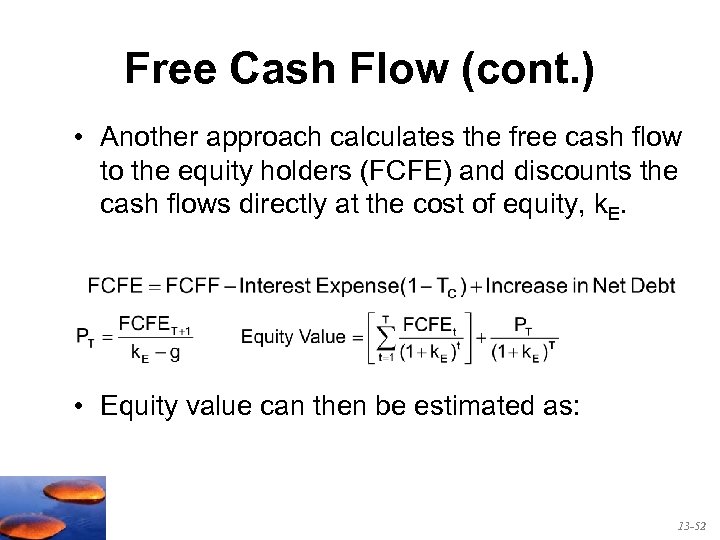

Free Cash Flow (cont. ) • Another approach calculates the free cash flow to the equity holders (FCFE) and discounts the cash flows directly at the cost of equity, k. E. • Equity value can then be estimated as: 13 -52

Free Cash Flow (cont. ) • Another approach calculates the free cash flow to the equity holders (FCFE) and discounts the cash flows directly at the cost of equity, k. E. • Equity value can then be estimated as: 13 -52

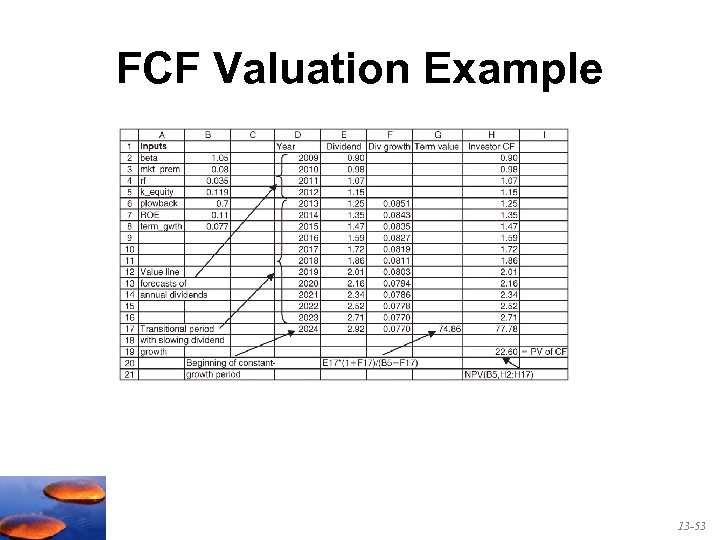

FCF Valuation Example 13 -53

FCF Valuation Example 13 -53

Comparing the Valuation Models • In theory free cash flow approaches should provide the same estimate of intrinsic value as the dividend growth model • In practice the various approaches often differ substantially – Simplifying assumptions are used in all models – The models establish ranges of likely intrinsic value – Using multiple models forces rigorous thinking about the inputs 13 -54

Comparing the Valuation Models • In theory free cash flow approaches should provide the same estimate of intrinsic value as the dividend growth model • In practice the various approaches often differ substantially – Simplifying assumptions are used in all models – The models establish ranges of likely intrinsic value – Using multiple models forces rigorous thinking about the inputs 13 -54

13. 6 The Aggregate Stock Market 13 -55

13. 6 The Aggregate Stock Market 13 -55

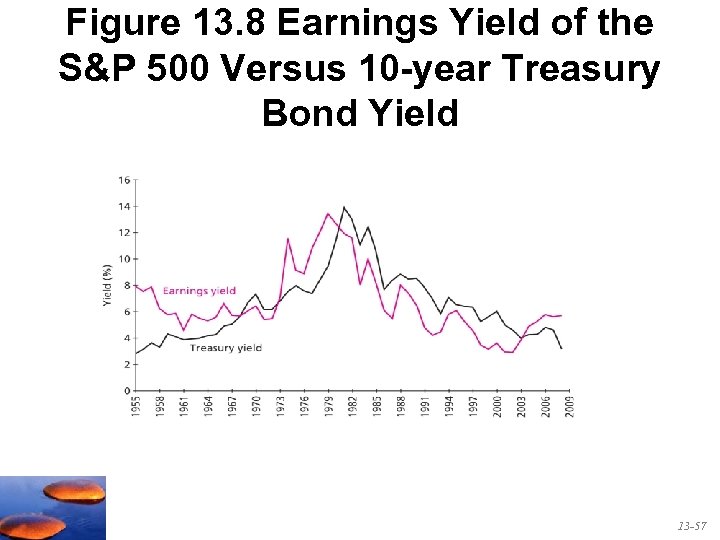

Earnings Multiplier Approach 1. Forecast corporate profits for the coming period for an index such as the S&P 500. 2. Derive an estimate for the aggregate P/E ratio using long-term interest rates – Based on the relationship between the ‘earnings yield’ or E/P ratio for the S&P 500 and the yield on 10 year Treasuries 3. Product of the two forecasts is the estimate of the endof-period level of the market 13 -56

Earnings Multiplier Approach 1. Forecast corporate profits for the coming period for an index such as the S&P 500. 2. Derive an estimate for the aggregate P/E ratio using long-term interest rates – Based on the relationship between the ‘earnings yield’ or E/P ratio for the S&P 500 and the yield on 10 year Treasuries 3. Product of the two forecasts is the estimate of the endof-period level of the market 13 -56

Figure 13. 8 Earnings Yield of the S&P 500 Versus 10 -year Treasury Bond Yield 13 -57

Figure 13. 8 Earnings Yield of the S&P 500 Versus 10 -year Treasury Bond Yield 13 -57

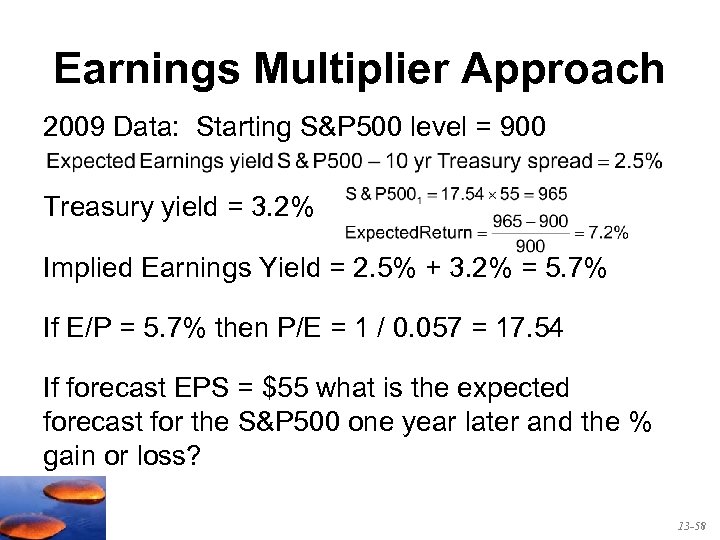

Earnings Multiplier Approach 2009 Data: Starting S&P 500 level = 900 Treasury yield = 3. 2% Implied Earnings Yield = 2. 5% + 3. 2% = 5. 7% If E/P = 5. 7% then P/E = 1 / 0. 057 = 17. 54 If forecast EPS = $55 what is the expected forecast for the S&P 500 one year later and the % gain or loss? 13 -58

Earnings Multiplier Approach 2009 Data: Starting S&P 500 level = 900 Treasury yield = 3. 2% Implied Earnings Yield = 2. 5% + 3. 2% = 5. 7% If E/P = 5. 7% then P/E = 1 / 0. 057 = 17. 54 If forecast EPS = $55 what is the expected forecast for the S&P 500 one year later and the % gain or loss? 13 -58

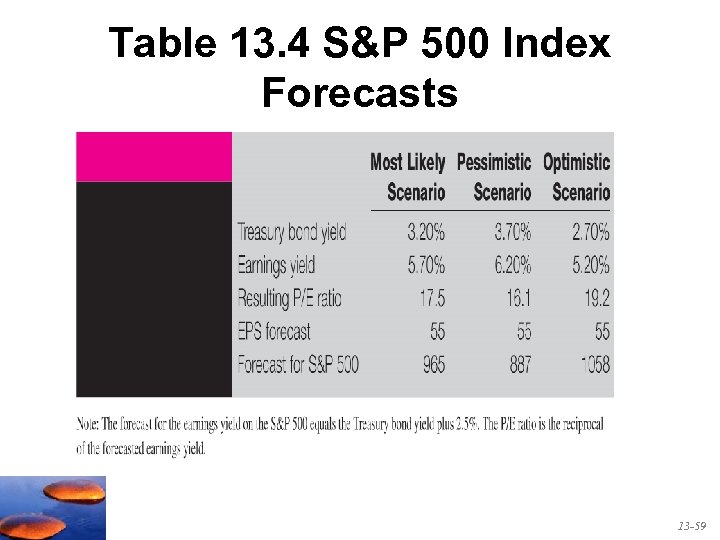

Table 13. 4 S&P 500 Index Forecasts 13 -59

Table 13. 4 S&P 500 Index Forecasts 13 -59