d6e65ef8d532cff0d87052f47639df3c.ppt

- Количество слайдов: 46

CHAPTER 13 Equity Valuation Mc. Graw-Hill/Irwin © 2008 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

CHAPTER 13 Equity Valuation Mc. Graw-Hill/Irwin © 2008 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

13. 1 VALUATION BY COMPARABLES 13 -2

13. 1 VALUATION BY COMPARABLES 13 -2

Fundamental Stock Analysis: Models of Equity Valuation Basic Types of Models – Balance Sheet Models – Dividend Discount Models – Price/Earnings Ratios Estimating Growth Rates and Opportunities 13 -3

Fundamental Stock Analysis: Models of Equity Valuation Basic Types of Models – Balance Sheet Models – Dividend Discount Models – Price/Earnings Ratios Estimating Growth Rates and Opportunities 13 -3

Models of Equity Valuation models use comparables – Look at the relationship between price and various determinants of value for similar firms The internet provides a convenient way to access firm data. Some examples are: – EDGAR – Finance. yahoo. com 13 -4

Models of Equity Valuation models use comparables – Look at the relationship between price and various determinants of value for similar firms The internet provides a convenient way to access firm data. Some examples are: – EDGAR – Finance. yahoo. com 13 -4

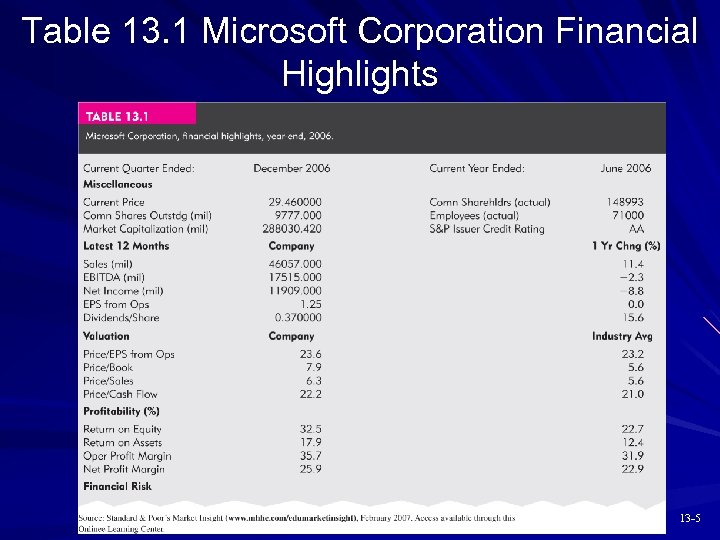

Table 13. 1 Microsoft Corporation Financial Highlights 13 -5

Table 13. 1 Microsoft Corporation Financial Highlights 13 -5

Valuation Methods Book value Market value Liquidation value Replacement cost 13 -6

Valuation Methods Book value Market value Liquidation value Replacement cost 13 -6

13. 2 INTRINSIC VALUE VERSUS MARKET PRICE 13 -7

13. 2 INTRINSIC VALUE VERSUS MARKET PRICE 13 -7

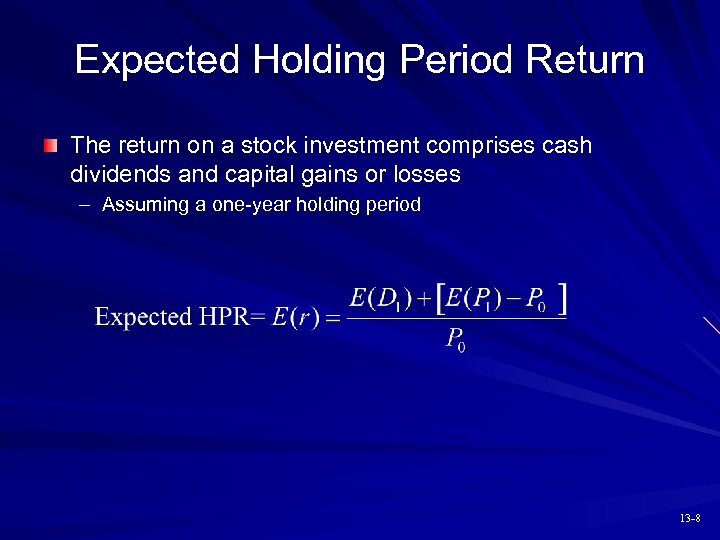

Expected Holding Period Return The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period 13 -8

Expected Holding Period Return The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period 13 -8

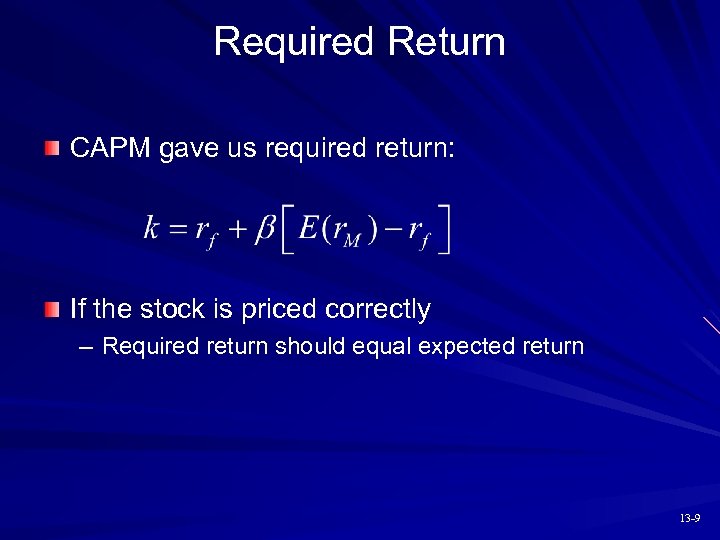

Required Return CAPM gave us required return: If the stock is priced correctly – Required return should equal expected return 13 -9

Required Return CAPM gave us required return: If the stock is priced correctly – Required return should equal expected return 13 -9

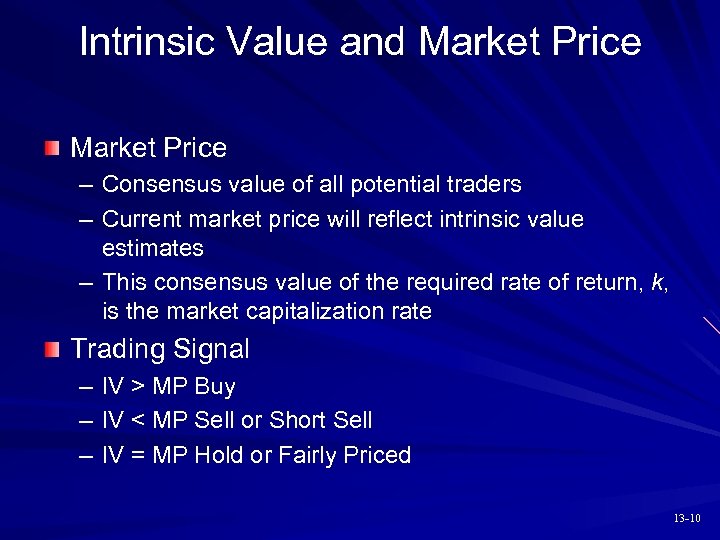

Intrinsic Value and Market Price – Consensus value of all potential traders – Current market price will reflect intrinsic value estimates – This consensus value of the required rate of return, k, is the market capitalization rate Trading Signal – IV > MP Buy – IV < MP Sell or Short Sell – IV = MP Hold or Fairly Priced 13 -10

Intrinsic Value and Market Price – Consensus value of all potential traders – Current market price will reflect intrinsic value estimates – This consensus value of the required rate of return, k, is the market capitalization rate Trading Signal – IV > MP Buy – IV < MP Sell or Short Sell – IV = MP Hold or Fairly Priced 13 -10

13. 3 DIVIDEND DISCOUNT MODELS 13 -11

13. 3 DIVIDEND DISCOUNT MODELS 13 -11

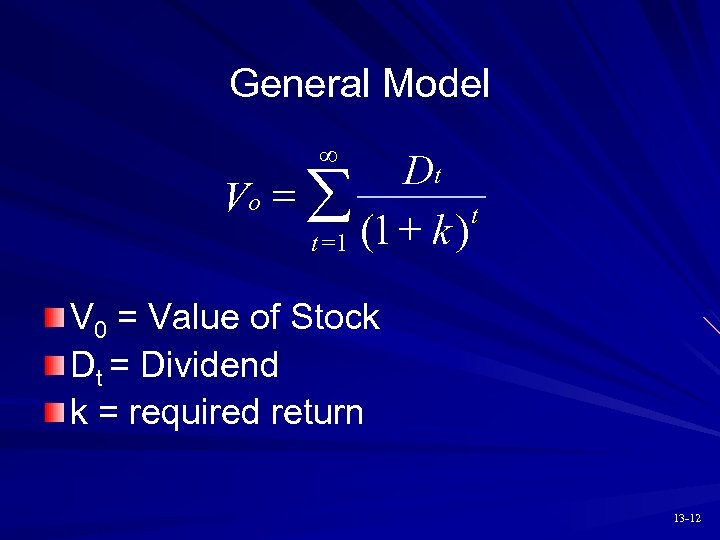

General Model ¥ Dt Vo = å t t = 1 (1 + k ) V 0 = Value of Stock Dt = Dividend k = required return 13 -12

General Model ¥ Dt Vo = å t t = 1 (1 + k ) V 0 = Value of Stock Dt = Dividend k = required return 13 -12

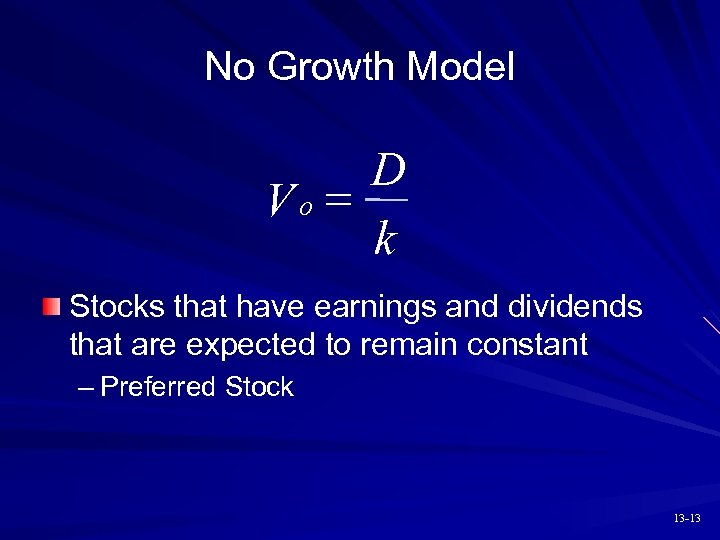

No Growth Model D Vo = k Stocks that have earnings and dividends that are expected to remain constant – Preferred Stock 13 -13

No Growth Model D Vo = k Stocks that have earnings and dividends that are expected to remain constant – Preferred Stock 13 -13

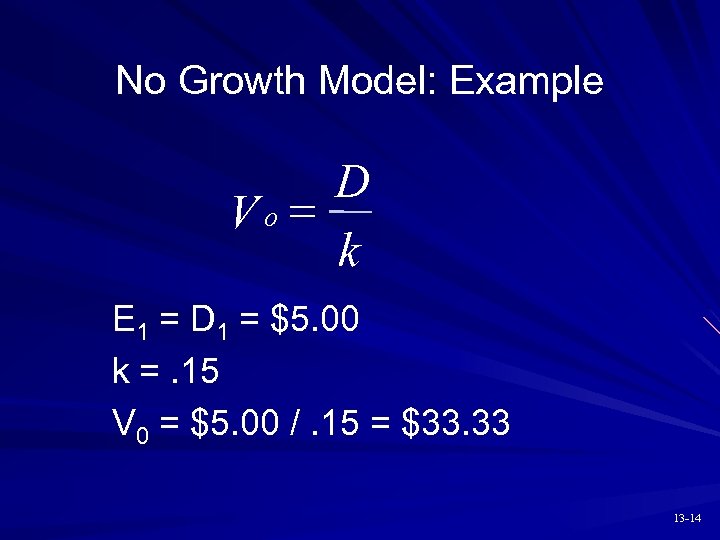

No Growth Model: Example D Vo = k E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33 13 -14

No Growth Model: Example D Vo = k E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33 13 -14

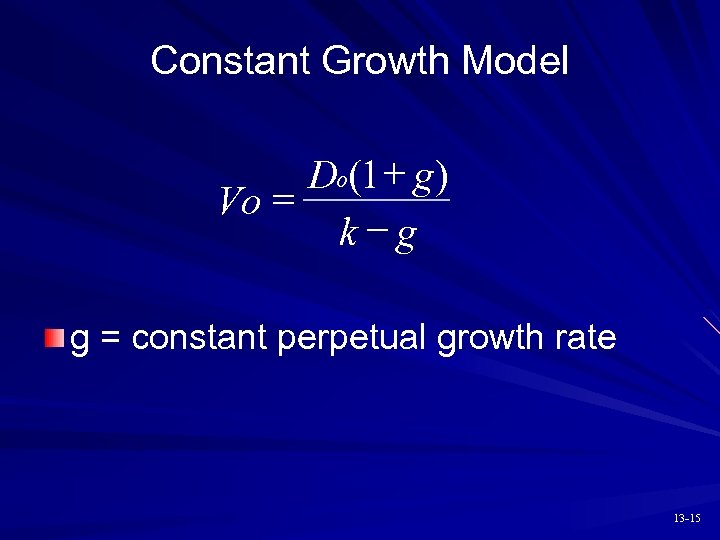

Constant Growth Model Do(1 + g) Vo = k-g g = constant perpetual growth rate 13 -15

Constant Growth Model Do(1 + g) Vo = k-g g = constant perpetual growth rate 13 -15

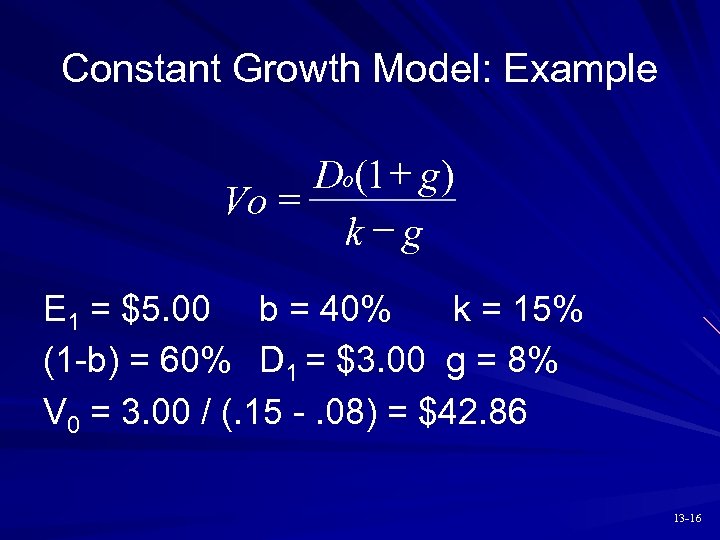

Constant Growth Model: Example Do(1 + g) Vo = k-g E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86 13 -16

Constant Growth Model: Example Do(1 + g) Vo = k-g E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86 13 -16

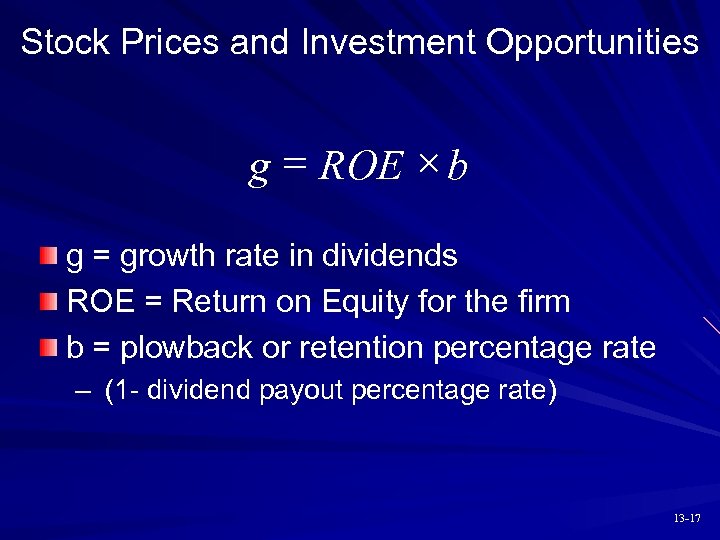

Stock Prices and Investment Opportunities g = ROE ´ b g = growth rate in dividends ROE = Return on Equity for the firm b = plowback or retention percentage rate – (1 - dividend payout percentage rate) 13 -17

Stock Prices and Investment Opportunities g = ROE ´ b g = growth rate in dividends ROE = Return on Equity for the firm b = plowback or retention percentage rate – (1 - dividend payout percentage rate) 13 -17

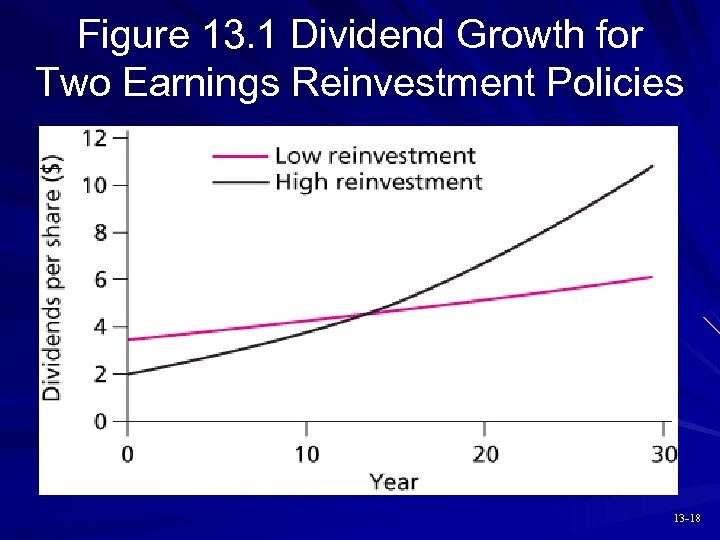

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies 13 -18

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies 13 -18

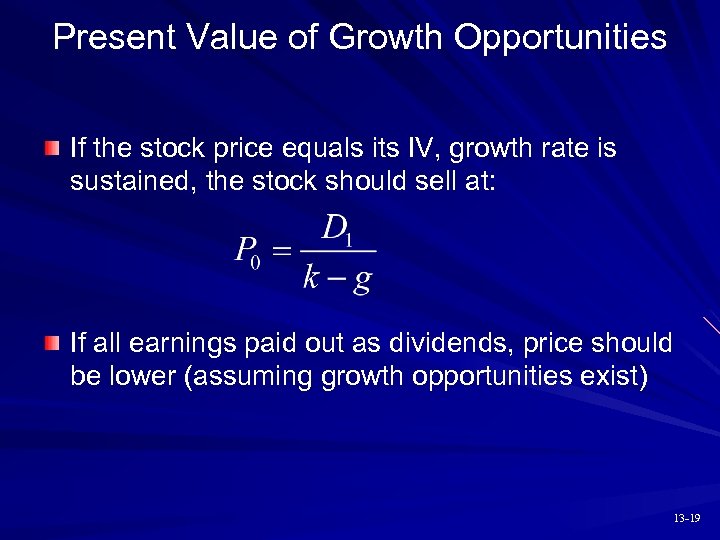

Present Value of Growth Opportunities If the stock price equals its IV, growth rate is sustained, the stock should sell at: If all earnings paid out as dividends, price should be lower (assuming growth opportunities exist) 13 -19

Present Value of Growth Opportunities If the stock price equals its IV, growth rate is sustained, the stock should sell at: If all earnings paid out as dividends, price should be lower (assuming growth opportunities exist) 13 -19

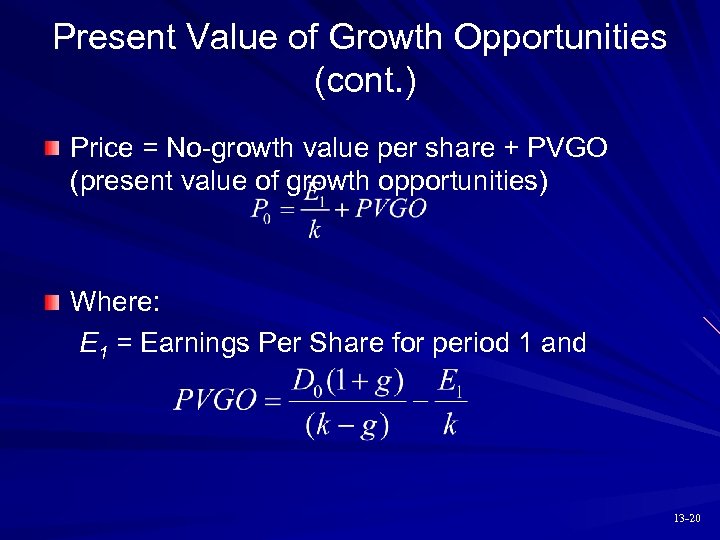

Present Value of Growth Opportunities (cont. ) Price = No-growth value per share + PVGO (present value of growth opportunities) Where: E 1 = Earnings Per Share for period 1 and 13 -20

Present Value of Growth Opportunities (cont. ) Price = No-growth value per share + PVGO (present value of growth opportunities) Where: E 1 = Earnings Per Share for period 1 and 13 -20

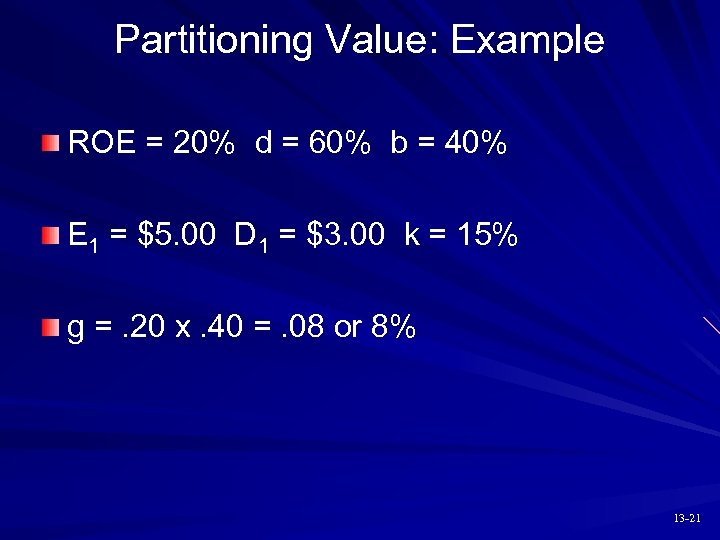

Partitioning Value: Example ROE = 20% d = 60% b = 40% E 1 = $5. 00 D 1 = $3. 00 k = 15% g =. 20 x. 40 =. 08 or 8% 13 -21

Partitioning Value: Example ROE = 20% d = 60% b = 40% E 1 = $5. 00 D 1 = $3. 00 k = 15% g =. 20 x. 40 =. 08 or 8% 13 -21

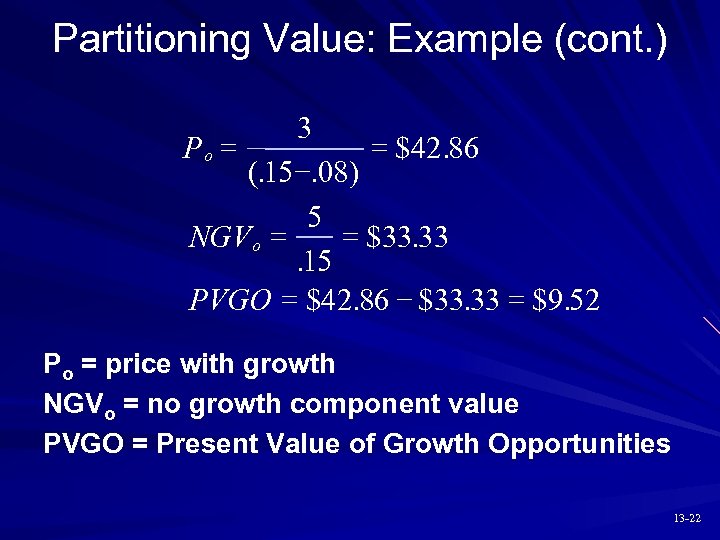

Partitioning Value: Example (cont. ) 3 = $42. 86 Po = (. 15 -. 08) 5 = $33. 33 NGV o =. 15 PVGO = $42. 86 - $33. 33 = $9. 52 Po = price with growth NGVo = no growth component value PVGO = Present Value of Growth Opportunities 13 -22

Partitioning Value: Example (cont. ) 3 = $42. 86 Po = (. 15 -. 08) 5 = $33. 33 NGV o =. 15 PVGO = $42. 86 - $33. 33 = $9. 52 Po = price with growth NGVo = no growth component value PVGO = Present Value of Growth Opportunities 13 -22

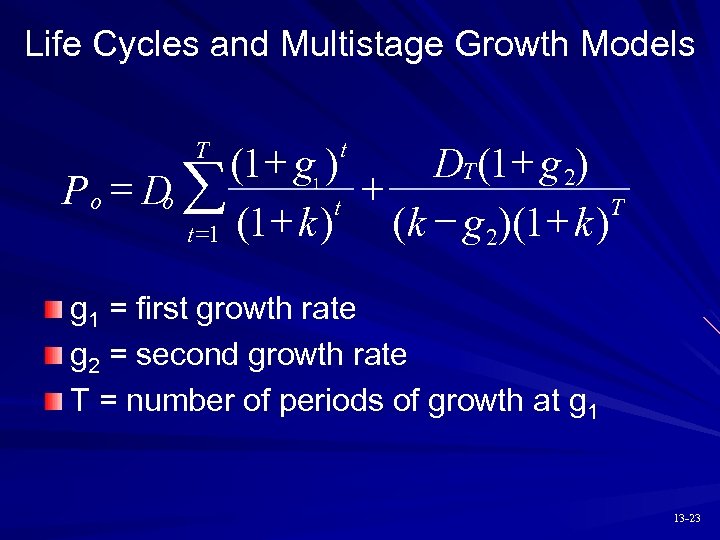

Life Cycles and Multistage Growth Models (1+ g ) DT (1+ g 2) + Po = D å o t T ( k - g 2)(1+ k ) t =1 (1 + k ) t T 1 g 1 = first growth rate g 2 = second growth rate T = number of periods of growth at g 1 13 -23

Life Cycles and Multistage Growth Models (1+ g ) DT (1+ g 2) + Po = D å o t T ( k - g 2)(1+ k ) t =1 (1 + k ) t T 1 g 1 = first growth rate g 2 = second growth rate T = number of periods of growth at g 1 13 -23

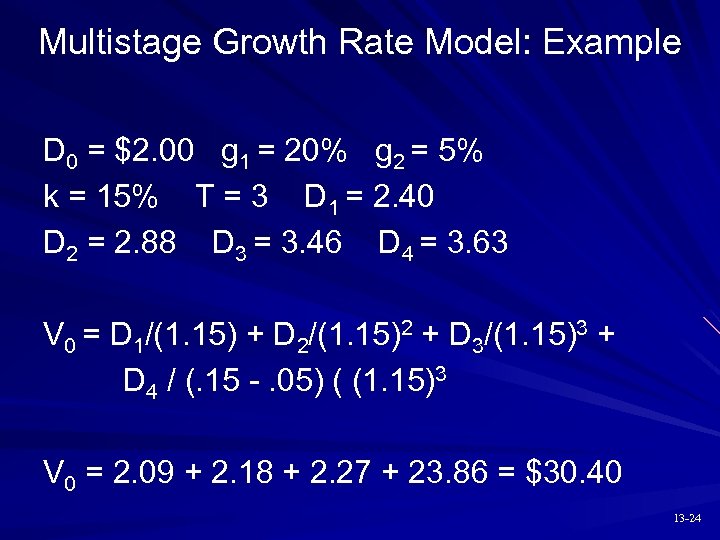

Multistage Growth Rate Model: Example D 0 = $2. 00 g 1 = 20% g 2 = 5% k = 15% T = 3 D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 V 0 = D 1/(1. 15) + D 2/(1. 15)2 + D 3/(1. 15)3 + D 4 / (. 15 -. 05) ( (1. 15)3 V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 13 -24

Multistage Growth Rate Model: Example D 0 = $2. 00 g 1 = 20% g 2 = 5% k = 15% T = 3 D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 V 0 = D 1/(1. 15) + D 2/(1. 15)2 + D 3/(1. 15)3 + D 4 / (. 15 -. 05) ( (1. 15)3 V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 13 -24

13. 4 PRICE-EARNINGS RATIOS 13 -25

13. 4 PRICE-EARNINGS RATIOS 13 -25

P/E Ratio and Growth Opportunities P/E Ratios are a function of two factors – Required Rates of Return (k) – Expected growth in Dividends Uses – Relative valuation – Extensive use in industry 13 -26

P/E Ratio and Growth Opportunities P/E Ratios are a function of two factors – Required Rates of Return (k) – Expected growth in Dividends Uses – Relative valuation – Extensive use in industry 13 -26

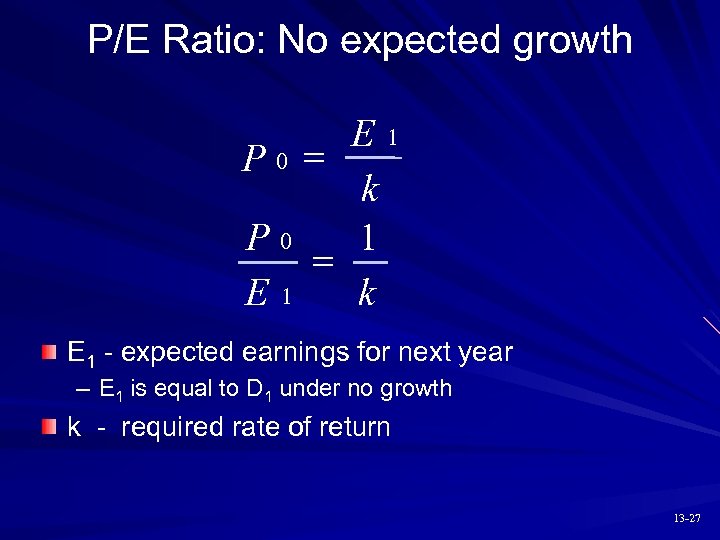

P/E Ratio: No expected growth E 1 P 0 = k P 0 1 = E 1 k E 1 - expected earnings for next year – E 1 is equal to D 1 under no growth k - required rate of return 13 -27

P/E Ratio: No expected growth E 1 P 0 = k P 0 1 = E 1 k E 1 - expected earnings for next year – E 1 is equal to D 1 under no growth k - required rate of return 13 -27

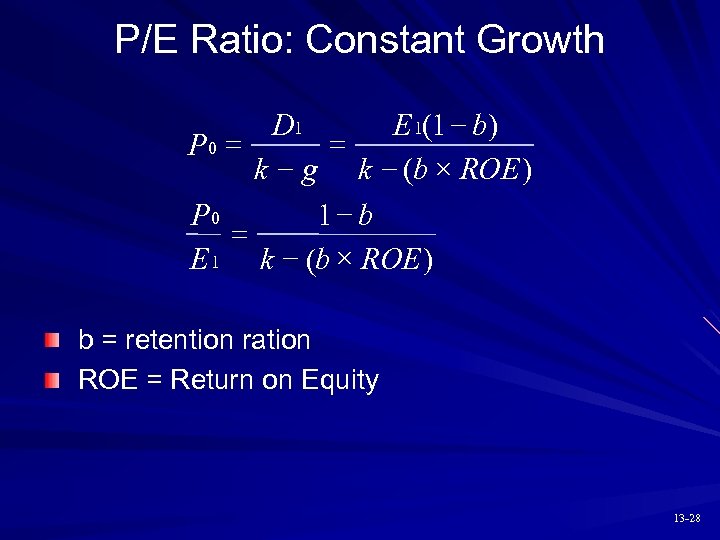

P/E Ratio: Constant Growth D 1 E 1(1 - b) = P 0 = k - g k - (b ´ ROE ) P 0 1 - b = E 1 k - (b ´ ROE ) b = retention ration ROE = Return on Equity 13 -28

P/E Ratio: Constant Growth D 1 E 1(1 - b) = P 0 = k - g k - (b ´ ROE ) P 0 1 - b = E 1 k - (b ´ ROE ) b = retention ration ROE = Return on Equity 13 -28

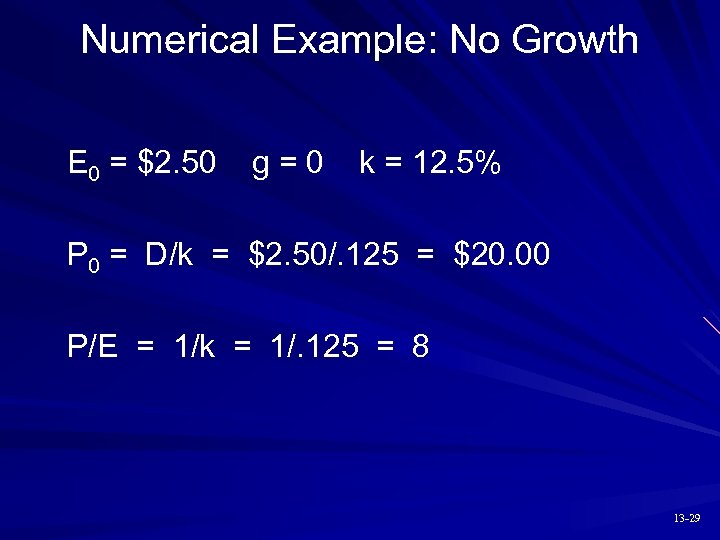

Numerical Example: No Growth E 0 = $2. 50 g=0 k = 12. 5% P 0 = D/k = $2. 50/. 125 = $20. 00 P/E = 1/k = 1/. 125 = 8 13 -29

Numerical Example: No Growth E 0 = $2. 50 g=0 k = 12. 5% P 0 = D/k = $2. 50/. 125 = $20. 00 P/E = 1/k = 1/. 125 = 8 13 -29

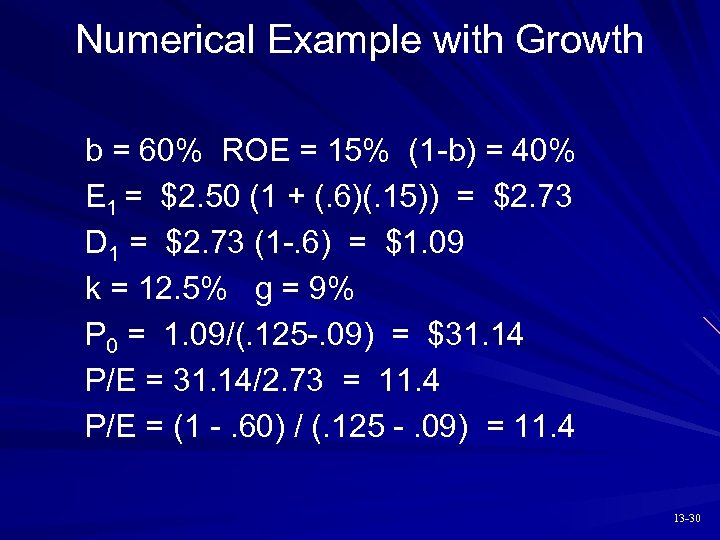

Numerical Example with Growth b = 60% ROE = 15% (1 -b) = 40% E 1 = $2. 50 (1 + (. 6)(. 15)) = $2. 73 D 1 = $2. 73 (1 -. 6) = $1. 09 k = 12. 5% g = 9% P 0 = 1. 09/(. 125 -. 09) = $31. 14 P/E = 31. 14/2. 73 = 11. 4 P/E = (1 -. 60) / (. 125 -. 09) = 11. 4 13 -30

Numerical Example with Growth b = 60% ROE = 15% (1 -b) = 40% E 1 = $2. 50 (1 + (. 6)(. 15)) = $2. 73 D 1 = $2. 73 (1 -. 6) = $1. 09 k = 12. 5% g = 9% P 0 = 1. 09/(. 125 -. 09) = $31. 14 P/E = 31. 14/2. 73 = 11. 4 P/E = (1 -. 60) / (. 125 -. 09) = 11. 4 13 -30

P/E Ratios and Stock Riskier stocks will have lower P/E multiples Riskier firms will have higher required rates of return (higher values of k) 13 -31

P/E Ratios and Stock Riskier stocks will have lower P/E multiples Riskier firms will have higher required rates of return (higher values of k) 13 -31

Pitfalls in Using P/E Ratios Flexibility in reporting makes choice of earnings difficult Pro forma earnings may give a better measure of operating earnings Problem of too much flexibility 13 -32

Pitfalls in Using P/E Ratios Flexibility in reporting makes choice of earnings difficult Pro forma earnings may give a better measure of operating earnings Problem of too much flexibility 13 -32

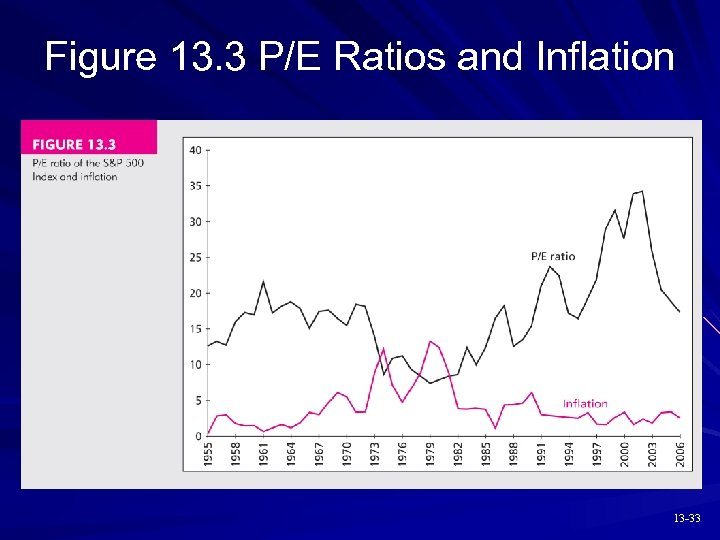

Figure 13. 3 P/E Ratios and Inflation 13 -33

Figure 13. 3 P/E Ratios and Inflation 13 -33

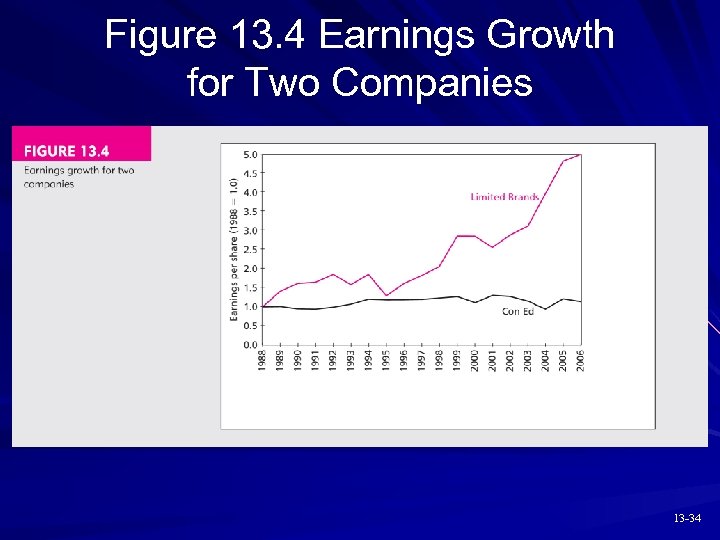

Figure 13. 4 Earnings Growth for Two Companies 13 -34

Figure 13. 4 Earnings Growth for Two Companies 13 -34

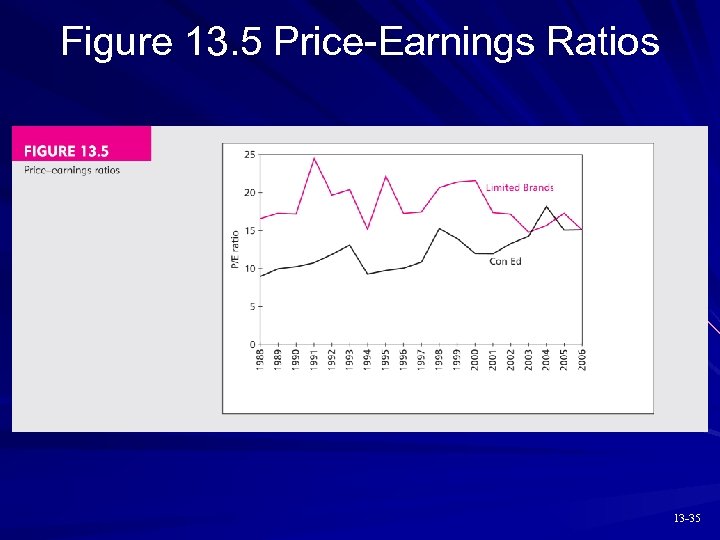

Figure 13. 5 Price-Earnings Ratios 13 -35

Figure 13. 5 Price-Earnings Ratios 13 -35

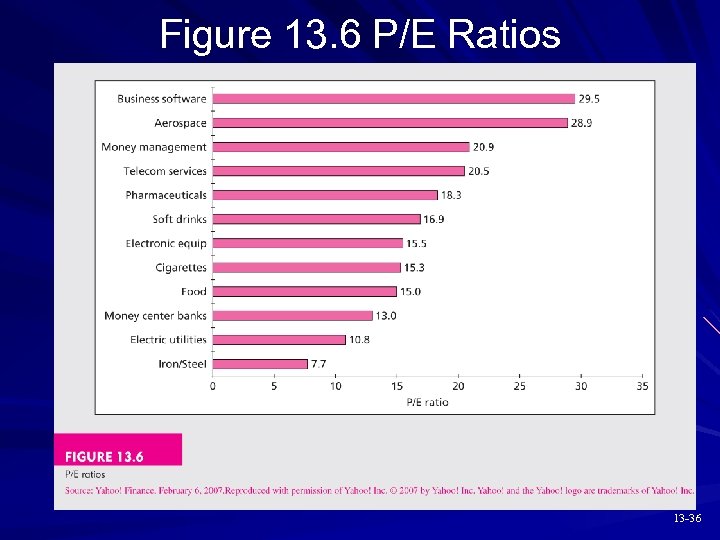

Figure 13. 6 P/E Ratios 13 -36

Figure 13. 6 P/E Ratios 13 -36

Other Comparative Valuation Ratios Price-to-book Price-to-cash flow Price-to-sales Be creative 13 -37

Other Comparative Valuation Ratios Price-to-book Price-to-cash flow Price-to-sales Be creative 13 -37

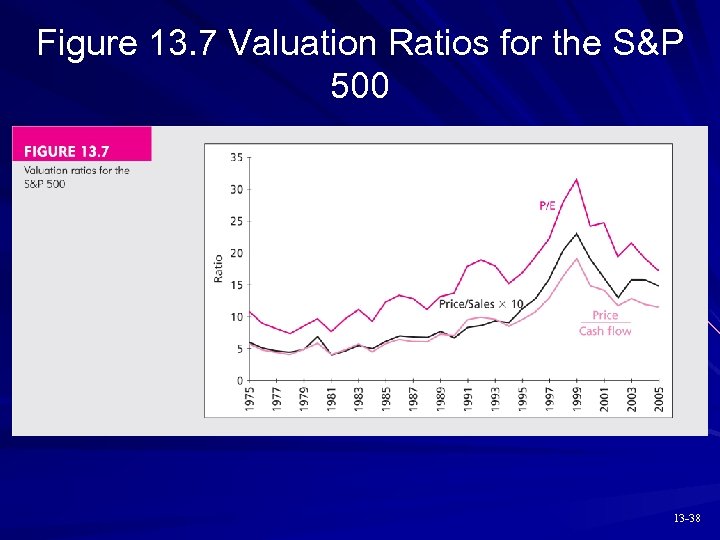

Figure 13. 7 Valuation Ratios for the S&P 500 13 -38

Figure 13. 7 Valuation Ratios for the S&P 500 13 -38

13. 5 FREE CASH FLOW VALUATION APPROACHES 13 -39

13. 5 FREE CASH FLOW VALUATION APPROACHES 13 -39

Free Cash Flow One approach is to discount the free cash flow for the firm (FCFF) at the weightedaverage cost of capital – Subtract existing value of debt – FCFF = EBIT (1 - tc) + Depreciation – Capital expenditures – Increase in NWC where: EBIT = earnings before interest and taxes tc = the corporate tax rate NWC = net working capital 13 -40

Free Cash Flow One approach is to discount the free cash flow for the firm (FCFF) at the weightedaverage cost of capital – Subtract existing value of debt – FCFF = EBIT (1 - tc) + Depreciation – Capital expenditures – Increase in NWC where: EBIT = earnings before interest and taxes tc = the corporate tax rate NWC = net working capital 13 -40

Free Cash Flow (cont. ) Another approach focuses on the free cash flow to the equity holders (FCFE) and discounts the cash flows directly at the cost of equity FCFE = FCFF – Interest expense (1 - tc) + Increases in net debt 13 -41

Free Cash Flow (cont. ) Another approach focuses on the free cash flow to the equity holders (FCFE) and discounts the cash flows directly at the cost of equity FCFE = FCFF – Interest expense (1 - tc) + Increases in net debt 13 -41

Comparing the Valuation Models Free cash flow approach should provide same estimate of IV as the dividend growth model In practice the two approaches may differ substantially – Simplifying assumptions are used 13 -42

Comparing the Valuation Models Free cash flow approach should provide same estimate of IV as the dividend growth model In practice the two approaches may differ substantially – Simplifying assumptions are used 13 -42

13. 6 THE AGGREGATE STOCK MARKET 13 -43

13. 6 THE AGGREGATE STOCK MARKET 13 -43

Earnings Multiplier Approach Forecast corporate profits for the coming period Derive an estimate for the aggregate P/E ratio using long-term interest rates Product of the two forecasts is the estimate of the end-of-period level of the market 13 -44

Earnings Multiplier Approach Forecast corporate profits for the coming period Derive an estimate for the aggregate P/E ratio using long-term interest rates Product of the two forecasts is the estimate of the end-of-period level of the market 13 -44

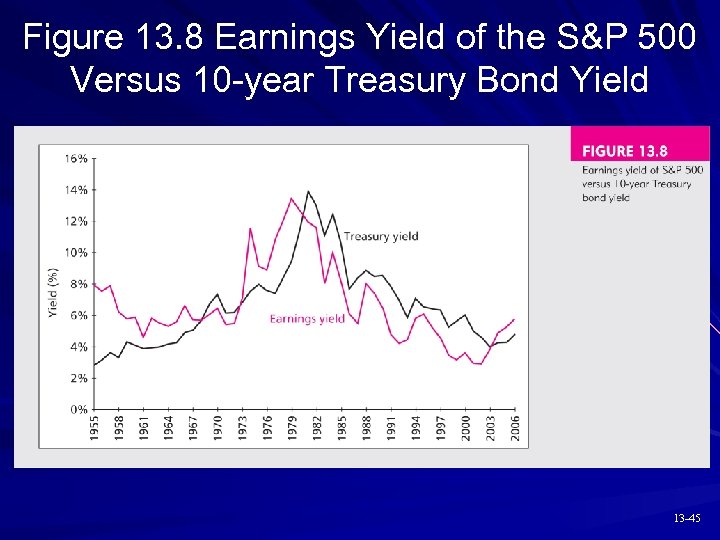

Figure 13. 8 Earnings Yield of the S&P 500 Versus 10 -year Treasury Bond Yield 13 -45

Figure 13. 8 Earnings Yield of the S&P 500 Versus 10 -year Treasury Bond Yield 13 -45

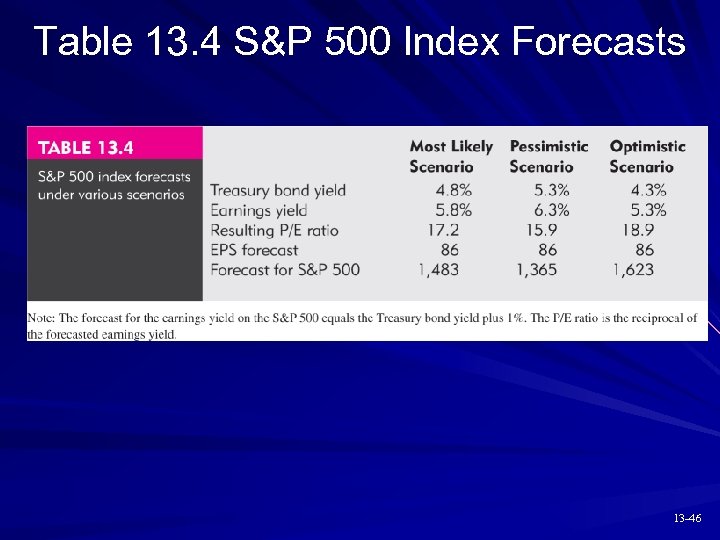

Table 13. 4 S&P 500 Index Forecasts 13 -46

Table 13. 4 S&P 500 Index Forecasts 13 -46