Equity Valuation, Part 1.pptx

- Количество слайдов: 38

CHAPTER 13 Equity Valuation

CHAPTER 13 Equity Valuation

13. 1 How can we value a company?

13. 1 How can we value a company?

Fundamental Stock Analysis: Models of Equity Valuation • Basic Types of Models – Balance Sheet Models – Discounted Cash Flow Models – Valuation by comparables • Estimating Growth Rates and Opportunities

Fundamental Stock Analysis: Models of Equity Valuation • Basic Types of Models – Balance Sheet Models – Discounted Cash Flow Models – Valuation by comparables • Estimating Growth Rates and Opportunities

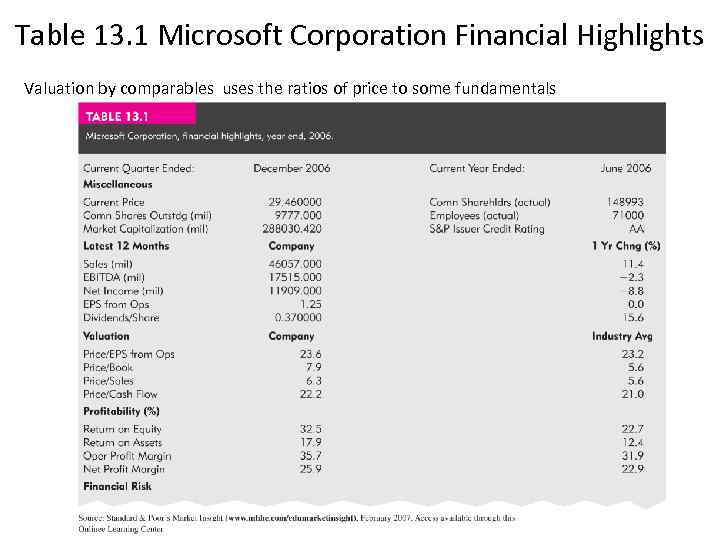

Table 13. 1 Microsoft Corporation Financial Highlights Valuation by comparables uses the ratios of price to some fundamentals

Table 13. 1 Microsoft Corporation Financial Highlights Valuation by comparables uses the ratios of price to some fundamentals

Balance Sheet Valuation Methods • Book value – The net worth of common equity according to a firm’s balance sheet. • Market value – based on current market capitalization of a company. • Liquidation value – Net amount that can be realized by selling the assets of a firm and paying off its debt. • Replacement cost – Some analysts believe the market value of the firm cannot get too far above its replacement cost because, if it did, competitors would try to replicate the firm. The competitive pressure of other similar firms entering the same industry would drive down the market value of all firms until they came into equality with replacement cost.

Balance Sheet Valuation Methods • Book value – The net worth of common equity according to a firm’s balance sheet. • Market value – based on current market capitalization of a company. • Liquidation value – Net amount that can be realized by selling the assets of a firm and paying off its debt. • Replacement cost – Some analysts believe the market value of the firm cannot get too far above its replacement cost because, if it did, competitors would try to replicate the firm. The competitive pressure of other similar firms entering the same industry would drive down the market value of all firms until they came into equality with replacement cost.

13. 2 INTRINSIC VALUE VERSUS MARKET PRICE

13. 2 INTRINSIC VALUE VERSUS MARKET PRICE

Intrinsic Value and Market Price • Market Price – Consensus value of all potential traders – Current market price will reflect intrinsic value estimates – This consensus value of the required rate of return, k, is the market capitalization rate • Trading Signal – IV > MP Buy – IV < MP Sell or Short Sell – IV = MP Hold or Fairly Priced

Intrinsic Value and Market Price • Market Price – Consensus value of all potential traders – Current market price will reflect intrinsic value estimates – This consensus value of the required rate of return, k, is the market capitalization rate • Trading Signal – IV > MP Buy – IV < MP Sell or Short Sell – IV = MP Hold or Fairly Priced

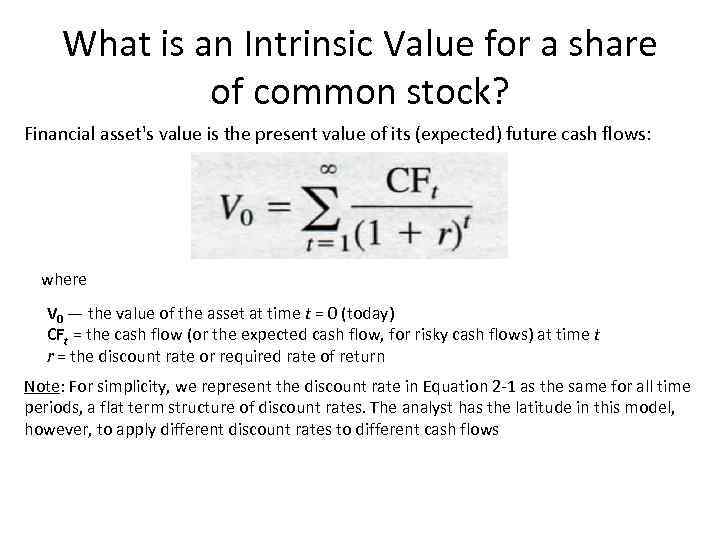

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows: where V 0 — the value of the asset at time t = 0 (today) CFt = the cash flow (or the expected cash flow, for risky cash flows) at time t r = the discount rate or required rate of return Note: For simplicity, we represent the discount rate in Equation 2 -1 as the same for all time periods, a flat term structure of discount rates. The analyst has the latitude in this model, however, to apply different discount rates to different cash flows

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows: where V 0 — the value of the asset at time t = 0 (today) CFt = the cash flow (or the expected cash flow, for risky cash flows) at time t r = the discount rate or required rate of return Note: For simplicity, we represent the discount rate in Equation 2 -1 as the same for all time periods, a flat term structure of discount rates. The analyst has the latitude in this model, however, to apply different discount rates to different cash flows

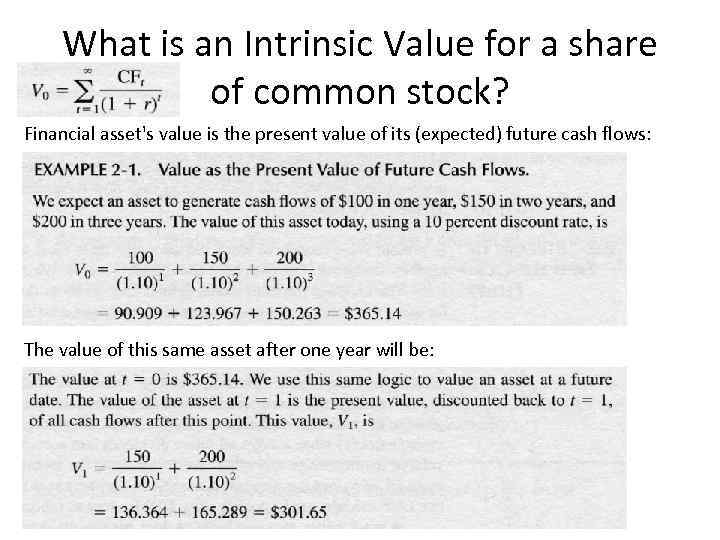

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows: The value of this same asset after one year will be:

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows: The value of this same asset after one year will be:

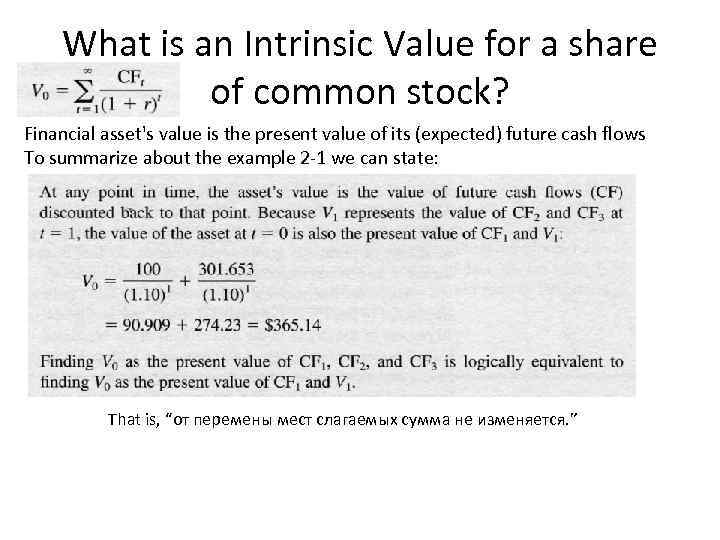

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows To summarize about the example 2 -1 we can state: That is, “от перемены мест слагаемых сумма не изменяется. ”

What is an Intrinsic Value for a share of common stock? Financial asset's value is the present value of its (expected) future cash flows To summarize about the example 2 -1 we can state: That is, “от перемены мест слагаемых сумма не изменяется. ”

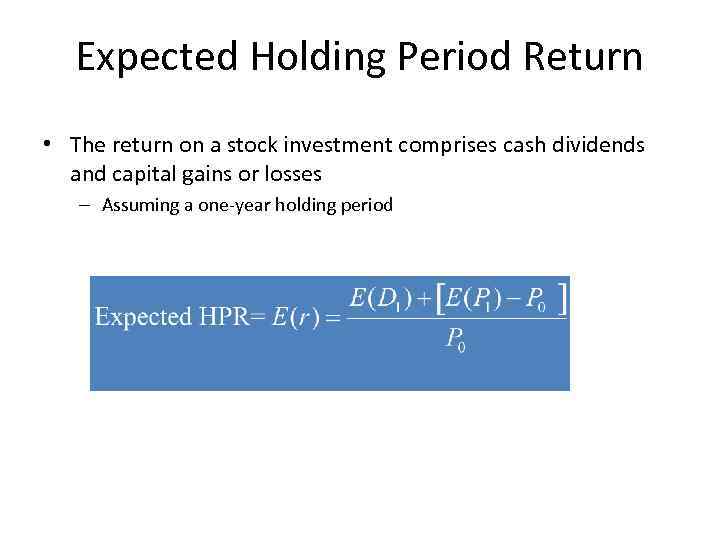

Expected Holding Period Return • The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period

Expected Holding Period Return • The return on a stock investment comprises cash dividends and capital gains or losses – Assuming a one-year holding period

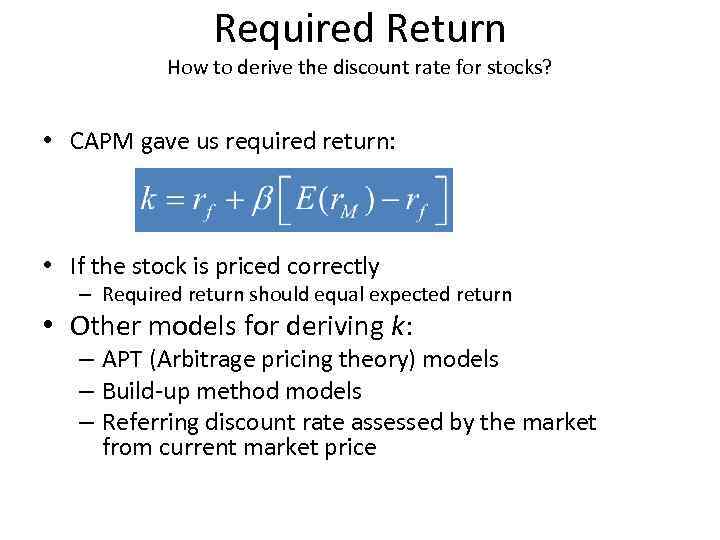

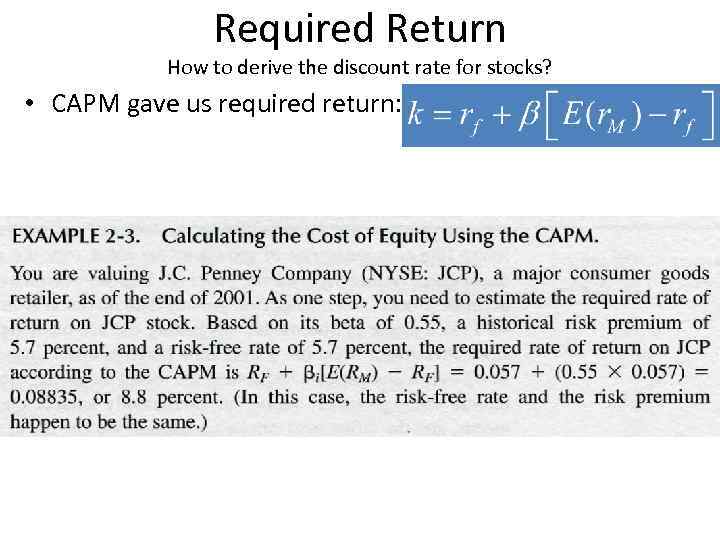

Required Return How to derive the discount rate for stocks? • CAPM gave us required return: • If the stock is priced correctly – Required return should equal expected return • Other models for deriving k: – APT (Arbitrage pricing theory) models – Build-up method models – Referring discount rate assessed by the market from current market price

Required Return How to derive the discount rate for stocks? • CAPM gave us required return: • If the stock is priced correctly – Required return should equal expected return • Other models for deriving k: – APT (Arbitrage pricing theory) models – Build-up method models – Referring discount rate assessed by the market from current market price

Required Return How to derive the discount rate for stocks? • CAPM gave us required return:

Required Return How to derive the discount rate for stocks? • CAPM gave us required return:

13. 3 DIVIDEND DISCOUNT MODELS

13. 3 DIVIDEND DISCOUNT MODELS

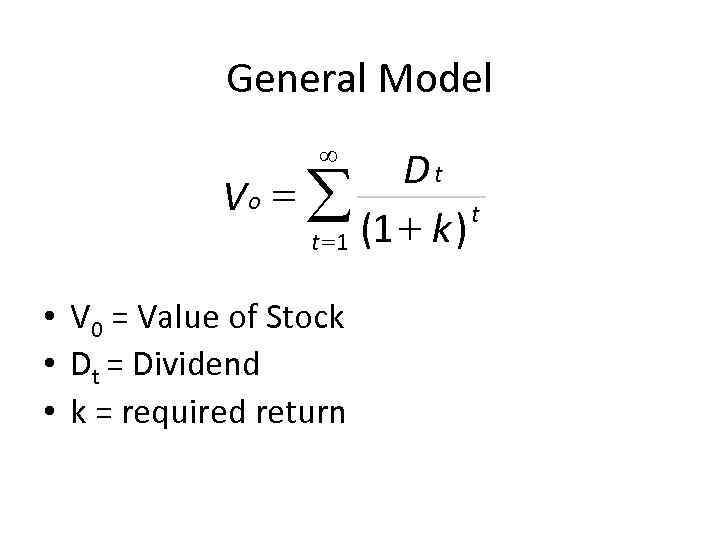

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • k = required return

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • k = required return

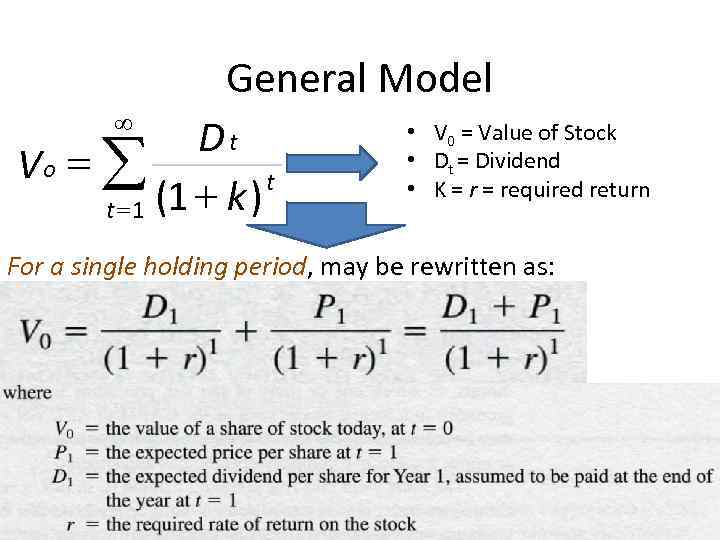

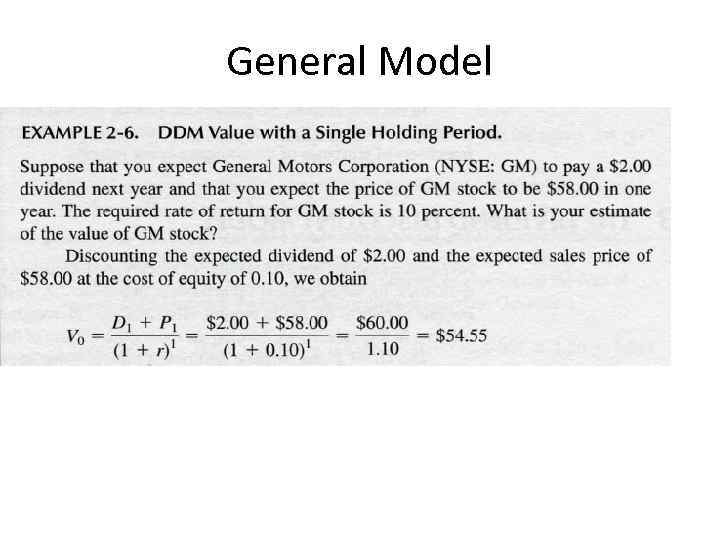

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • K = required return For a single holding period, may be rewritten as:

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • K = required return For a single holding period, may be rewritten as:

General Model

General Model

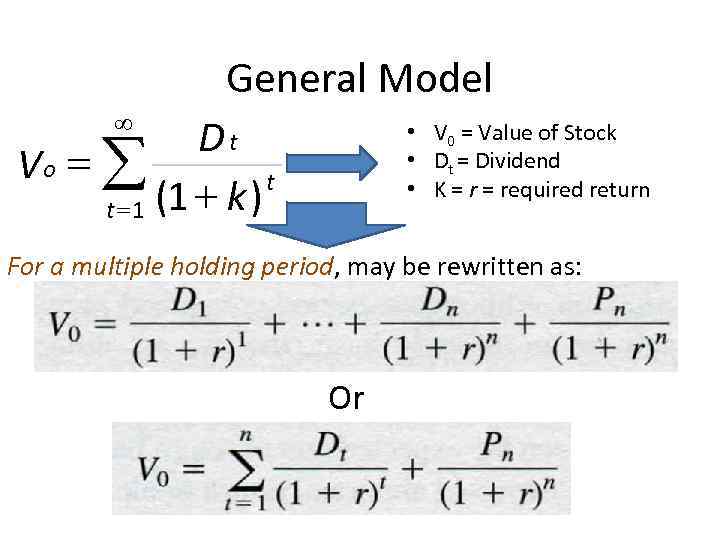

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • K = required return For a multiple holding period, may be rewritten as: Or

General Model ¥ Dt Vo = å t t = 1 (1 + k ) • V 0 = Value of Stock • Dt = Dividend • K = required return For a multiple holding period, may be rewritten as: Or

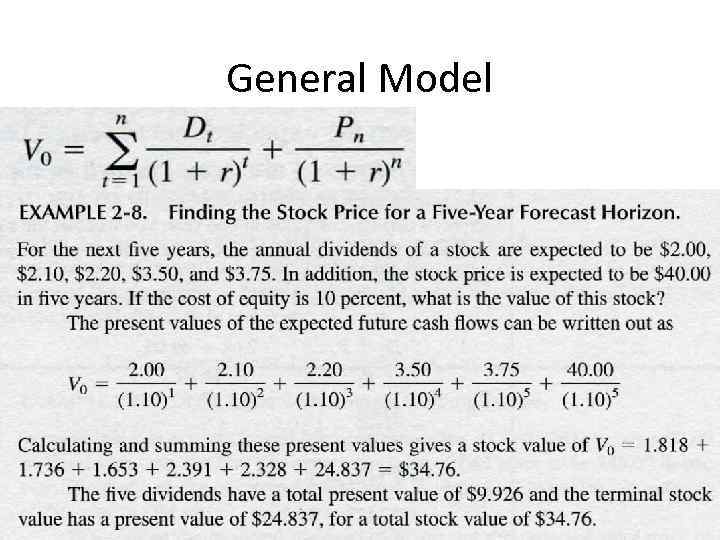

General Model

General Model

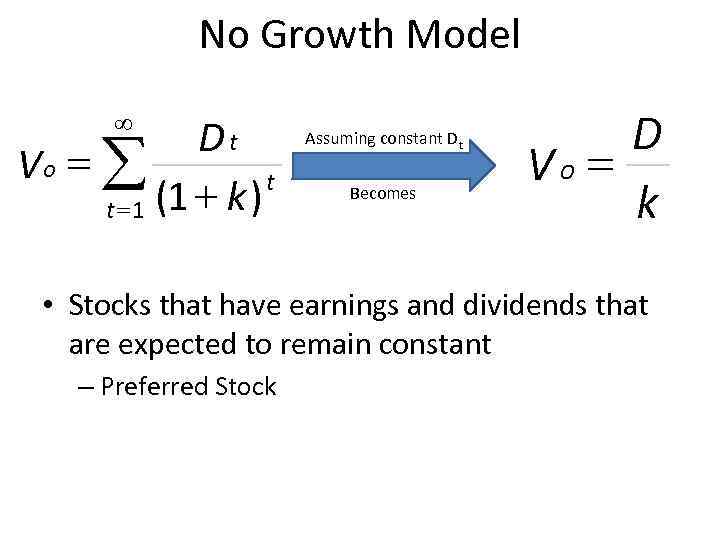

No Growth Model ¥ Dt Vo = å t t = 1 (1 + k ) Assuming constant Dt Becomes D Vo = k • Stocks that have earnings and dividends that are expected to remain constant – Preferred Stock

No Growth Model ¥ Dt Vo = å t t = 1 (1 + k ) Assuming constant Dt Becomes D Vo = k • Stocks that have earnings and dividends that are expected to remain constant – Preferred Stock

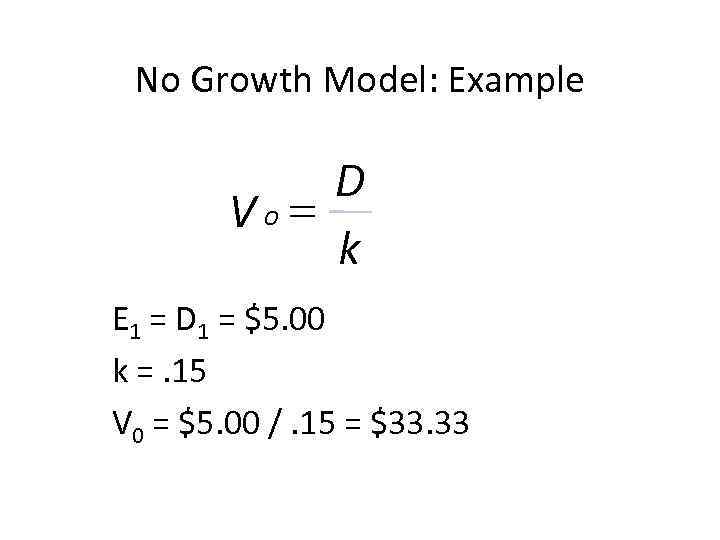

No Growth Model: Example D Vo= k E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33

No Growth Model: Example D Vo= k E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33

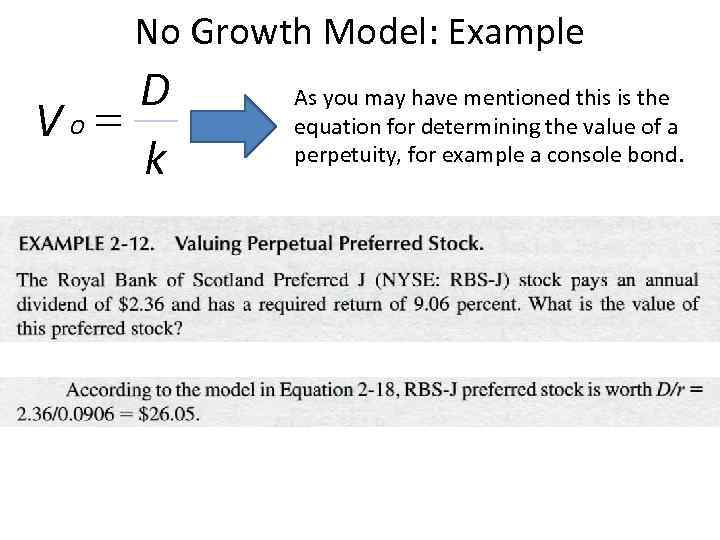

No Growth Model: Example D Vo= k As you may have mentioned this is the equation for determining the value of a perpetuity, for example a console bond.

No Growth Model: Example D Vo= k As you may have mentioned this is the equation for determining the value of a perpetuity, for example a console bond.

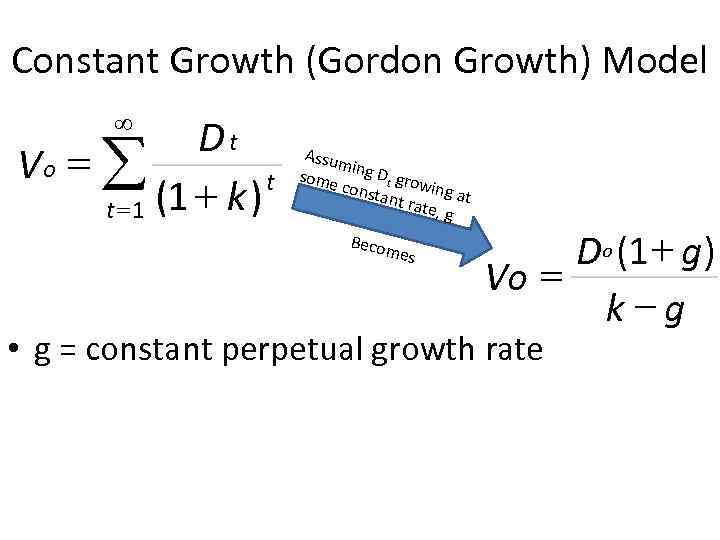

Constant Growth (Gordon Growth) Model ¥ Dt Vo = å t t = 1 (1 + k ) Assum some ing Dt grow const ant ra ing at te, g Becom es D o (1 + g) Vo = k-g • g = constant perpetual growth rate

Constant Growth (Gordon Growth) Model ¥ Dt Vo = å t t = 1 (1 + k ) Assum some ing Dt grow const ant ra ing at te, g Becom es D o (1 + g) Vo = k-g • g = constant perpetual growth rate

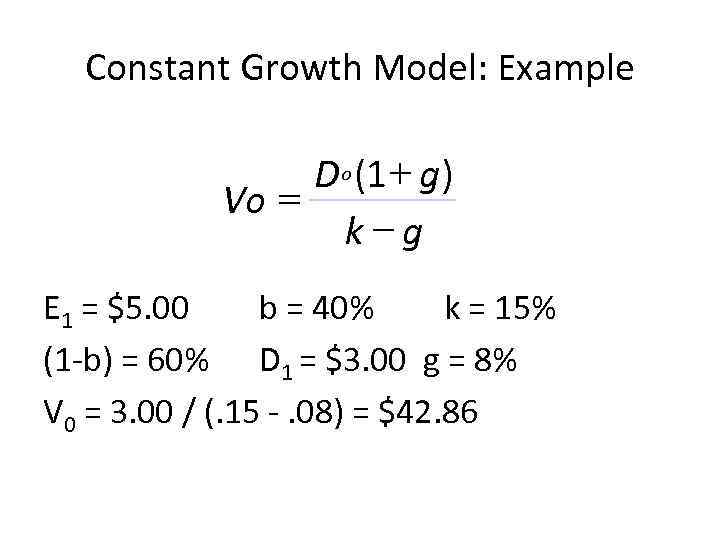

Constant Growth Model: Example D o (1 + g) Vo = k-g E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86

Constant Growth Model: Example D o (1 + g) Vo = k-g E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86

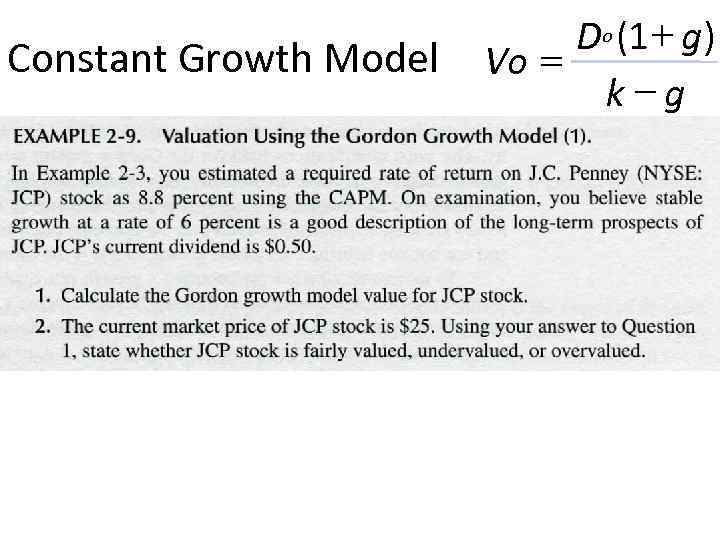

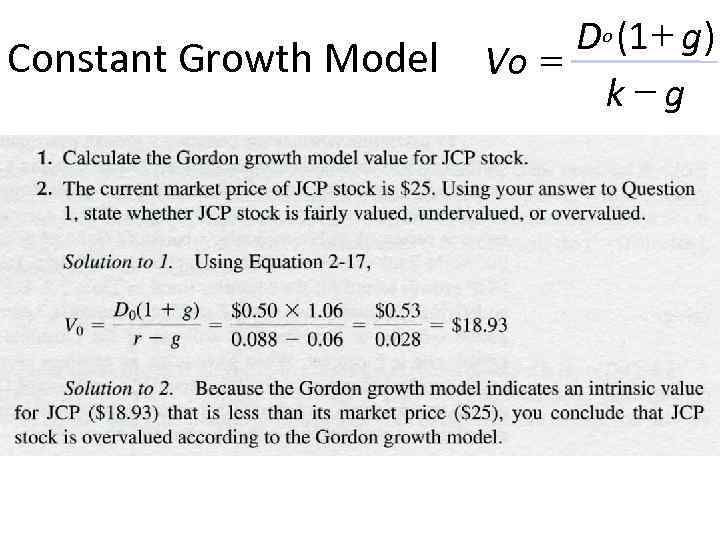

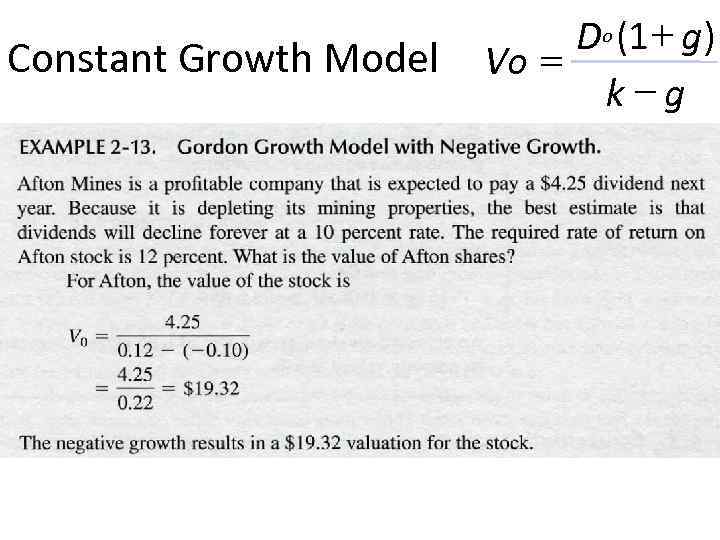

Constant Growth Model D o (1 + g) Vo = k-g

Constant Growth Model D o (1 + g) Vo = k-g

Constant Growth Model D o (1 + g) Vo = k-g

Constant Growth Model D o (1 + g) Vo = k-g

Constant Growth Model D o (1 + g) Vo = k-g

Constant Growth Model D o (1 + g) Vo = k-g

Stock Prices and Investment Opportunities g = ROE ´ b • g = growth rate in dividends • ROE = Return on Equity for the firm • b = plowback or retention percentage rate – (1 - dividend payout percentage rate)

Stock Prices and Investment Opportunities g = ROE ´ b • g = growth rate in dividends • ROE = Return on Equity for the firm • b = plowback or retention percentage rate – (1 - dividend payout percentage rate)

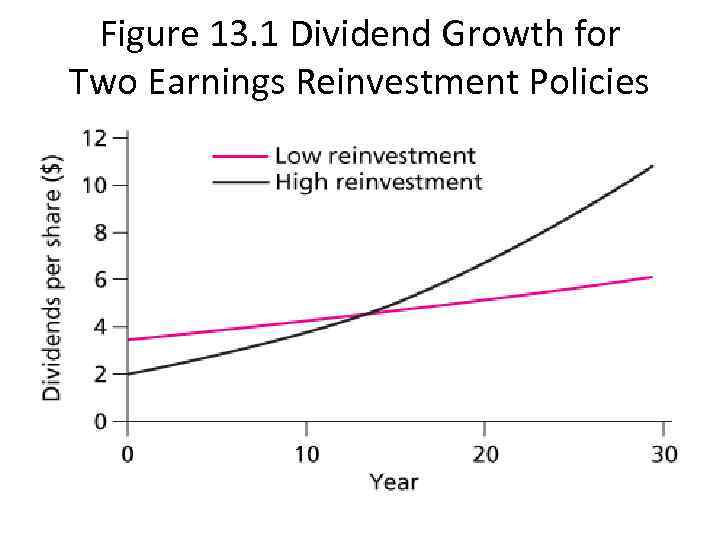

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies

Figure 13. 1 Dividend Growth for Two Earnings Reinvestment Policies

When can we use GGM 1. Stable earnings. Future earnings of a company should follow stable historical growth record. We should anticipate that earnings will be stable. This can be tested by viewing historical figures of ROE, it should be stable. 2. Stable dividends. Dividends should bear an understandable and consistent relationship to earnings, as evidenced by stable dividend payout ratio. 3. Expected earnings should grow at a rate equal or lower than the economy’s nominal growth rate (we can estimate economy’s nominal growth rate by expected nominal GDP rate, which is equal to real GDP plus expected long-run inflation). When forecasting an earnings growth rate far above than the economy’s nominal growth rate, analysts should use a multistage DDM in which the final-stage growth rate reflects a growth rate that is more plausible relative to the economy’s nominal growth rate, rather than using GGM.

When can we use GGM 1. Stable earnings. Future earnings of a company should follow stable historical growth record. We should anticipate that earnings will be stable. This can be tested by viewing historical figures of ROE, it should be stable. 2. Stable dividends. Dividends should bear an understandable and consistent relationship to earnings, as evidenced by stable dividend payout ratio. 3. Expected earnings should grow at a rate equal or lower than the economy’s nominal growth rate (we can estimate economy’s nominal growth rate by expected nominal GDP rate, which is equal to real GDP plus expected long-run inflation). When forecasting an earnings growth rate far above than the economy’s nominal growth rate, analysts should use a multistage DDM in which the final-stage growth rate reflects a growth rate that is more plausible relative to the economy’s nominal growth rate, rather than using GGM.

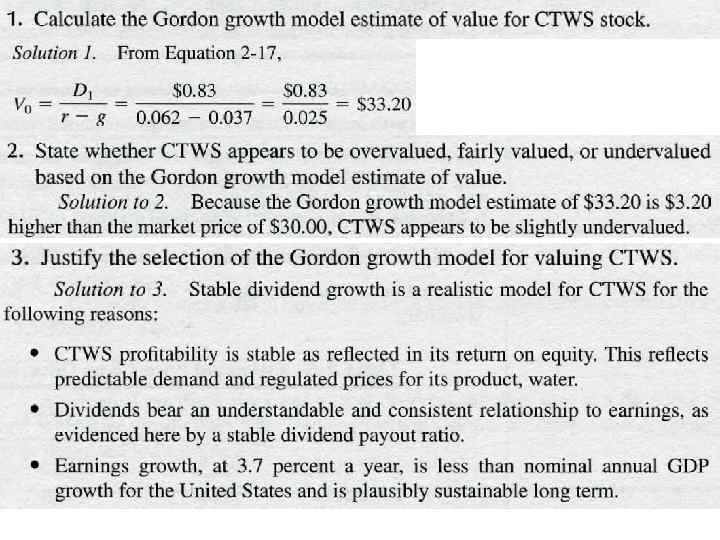

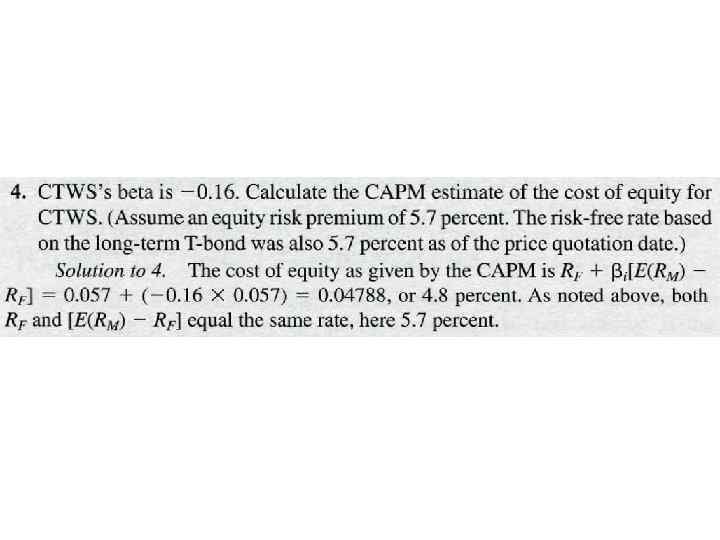

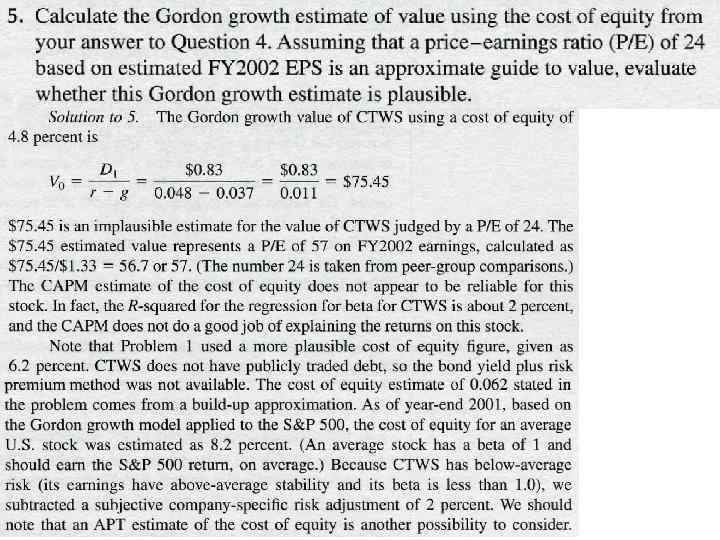

EXAMPLE 2 -10. Valuation Using the Gordon Growth Model (2) As an analyst for a U. S. domestic equity-income mutual fund, you are evaluating Connecticut Water Service, Inc. (Nasdaq NMS: CTWS) for possible inclusion in the approved list of investments. Not all countries have traded water utility stocks. In the United States, about 85 percent of the population gets its water from government entities. A group of investor-owned water utilities, however, also supplies water to the public. CTWS is the parent company of three regulated water utility companies serving Connecticut and Massachusetts. Because CTWS operates in a regulated industry providing an important staple to a stable population, you are confident that its future earnings growth should follow its stable historical growth record. CTWS's return on equity has consistently come in close to the historical median ROE for U. S. businesses of 12. 2 percent, reflecting die regulated prices for its product. Estimated FY 2001 and FY 2002 EPS are $1. 27 and $1. 33 according to First Call/Thomson Financial, reflecting 4. 7 percent growth. CTWS has a current dividend rate of $0. 81. Although CTWS's dividend payout ratio has been relatively stable (73 percent in 2000, 77 percent in 1999, 75 percent in 1998, 77 percent in 1997, and 78 percent in 1996), you conclude that CTWS has not followed an exact fixed-payout dividend policy. CTWS has been conservative in reflecting earnings growth in increased dividends. Your forecast of dividends for FY 2002 is $0. 83 your nominal annual GDP growth estimate is 4 percent. . Compared with a mean dividend payout ratio of 76 percent from 1996 -2000, you expect a long-term average dividend payout ratio of 70 percent going forward. You anticipate a 3. 7 percent long-term dividend growth rate. A recent price for CTWS is $30. 00. You estimate CTWS's cost of equity at 6. 2 percent.

EXAMPLE 2 -10. Valuation Using the Gordon Growth Model (2) As an analyst for a U. S. domestic equity-income mutual fund, you are evaluating Connecticut Water Service, Inc. (Nasdaq NMS: CTWS) for possible inclusion in the approved list of investments. Not all countries have traded water utility stocks. In the United States, about 85 percent of the population gets its water from government entities. A group of investor-owned water utilities, however, also supplies water to the public. CTWS is the parent company of three regulated water utility companies serving Connecticut and Massachusetts. Because CTWS operates in a regulated industry providing an important staple to a stable population, you are confident that its future earnings growth should follow its stable historical growth record. CTWS's return on equity has consistently come in close to the historical median ROE for U. S. businesses of 12. 2 percent, reflecting die regulated prices for its product. Estimated FY 2001 and FY 2002 EPS are $1. 27 and $1. 33 according to First Call/Thomson Financial, reflecting 4. 7 percent growth. CTWS has a current dividend rate of $0. 81. Although CTWS's dividend payout ratio has been relatively stable (73 percent in 2000, 77 percent in 1999, 75 percent in 1998, 77 percent in 1997, and 78 percent in 1996), you conclude that CTWS has not followed an exact fixed-payout dividend policy. CTWS has been conservative in reflecting earnings growth in increased dividends. Your forecast of dividends for FY 2002 is $0. 83 your nominal annual GDP growth estimate is 4 percent. . Compared with a mean dividend payout ratio of 76 percent from 1996 -2000, you expect a long-term average dividend payout ratio of 70 percent going forward. You anticipate a 3. 7 percent long-term dividend growth rate. A recent price for CTWS is $30. 00. You estimate CTWS's cost of equity at 6. 2 percent.

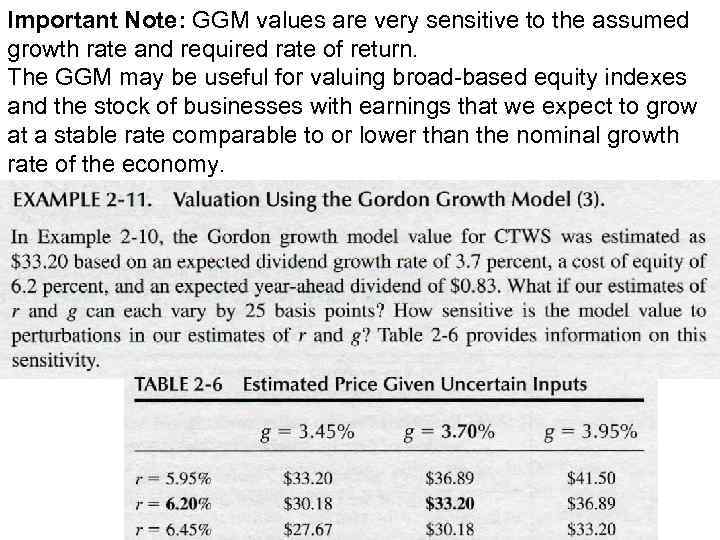

Important Note: GGM values are very sensitive to the assumed growth rate and required rate of return. The GGM may be useful for valuing broad-based equity indexes and the stock of businesses with earnings that we expect to grow at a stable rate comparable to or lower than the nominal growth rate of the economy.

Important Note: GGM values are very sensitive to the assumed growth rate and required rate of return. The GGM may be useful for valuing broad-based equity indexes and the stock of businesses with earnings that we expect to grow at a stable rate comparable to or lower than the nominal growth rate of the economy.