997ab770d6e952661ead473ff32f3b52.ppt

- Количество слайдов: 33

CHAPTER 13 Cost Accounting and Reporting Systems 1

CHAPTER 13 Cost Accounting and Reporting Systems 1

Learning Objectives • • • Explain the role of cost accounting as it relates to financial and management accounting. Explain the strategic role cost management plays in the organisation’s value chain. Explain the difference between direct and indirect costs. Explain the difference between product and period costs. Explain the general operation of a product costing system. Calculate predetermined overhead application rates. Present a statement of cost of goods manufactured. Explain the difference between absorption and direct costing. Apply activity-based costing. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 2

Learning Objectives • • • Explain the role of cost accounting as it relates to financial and management accounting. Explain the strategic role cost management plays in the organisation’s value chain. Explain the difference between direct and indirect costs. Explain the difference between product and period costs. Explain the general operation of a product costing system. Calculate predetermined overhead application rates. Present a statement of cost of goods manufactured. Explain the difference between absorption and direct costing. Apply activity-based costing. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 2

Overview • Cost accounting is a subset of management accounting. • It relies on the accumulation and determination of product, process or service costs for the purposes of assigning these costs to a cost object. • Accurate cost information is necessary to help managers make pricing decisions and evaluate productivity and efficiency. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 3

Overview • Cost accounting is a subset of management accounting. • It relies on the accumulation and determination of product, process or service costs for the purposes of assigning these costs to a cost object. • Accurate cost information is necessary to help managers make pricing decisions and evaluate productivity and efficiency. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 3

Cost Accounting Financial accounting - focus on external reporting Cost accounting - focus on cost accumulation and assignment Management accounting - focus on internal reporting Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 4

Cost Accounting Financial accounting - focus on external reporting Cost accounting - focus on cost accumulation and assignment Management accounting - focus on internal reporting Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 4

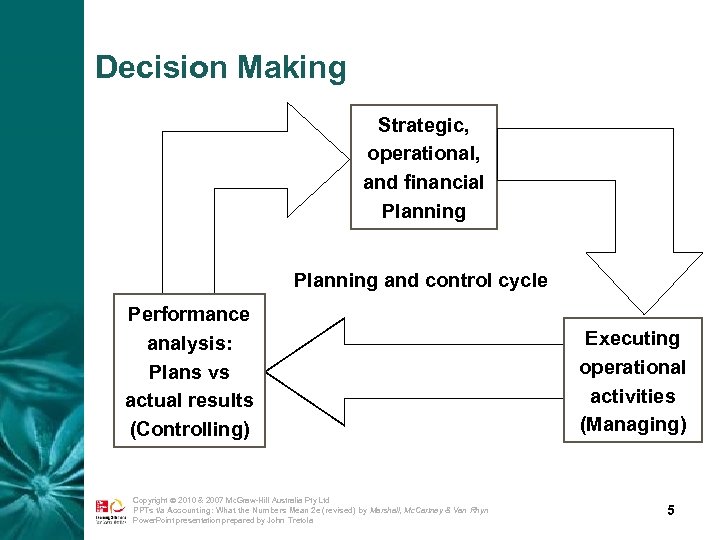

Decision Making Revisit plans Strategic, operational, and financial Planning Implement plans Planning and control cycle Performance analysis: Plans vs actual results (Controlling) Data collection and performance feedback Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Executing operational activities (Managing) 5

Decision Making Revisit plans Strategic, operational, and financial Planning Implement plans Planning and control cycle Performance analysis: Plans vs actual results (Controlling) Data collection and performance feedback Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Executing operational activities (Managing) 5

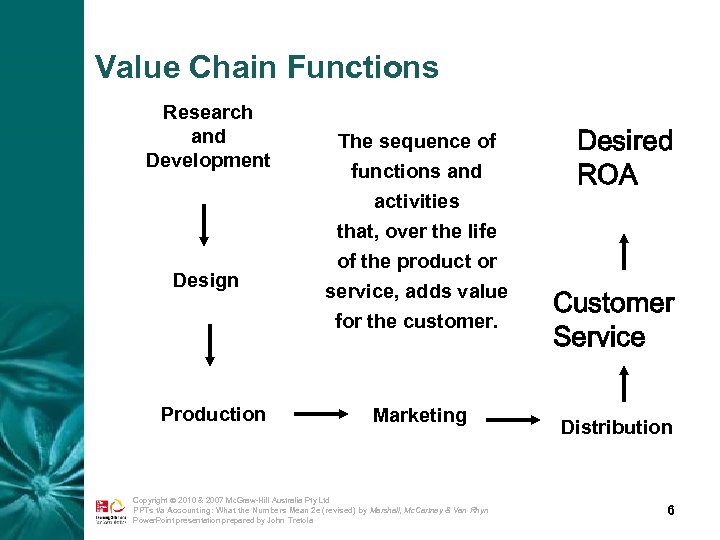

Value Chain Functions Research and Development Design Production The sequence of functions and activities that, over the life of the product or service, adds value for the customer. Marketing Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Desired ROA Customer Service Distribution 6

Value Chain Functions Research and Development Design Production The sequence of functions and activities that, over the life of the product or service, adds value for the customer. Marketing Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Desired ROA Customer Service Distribution 6

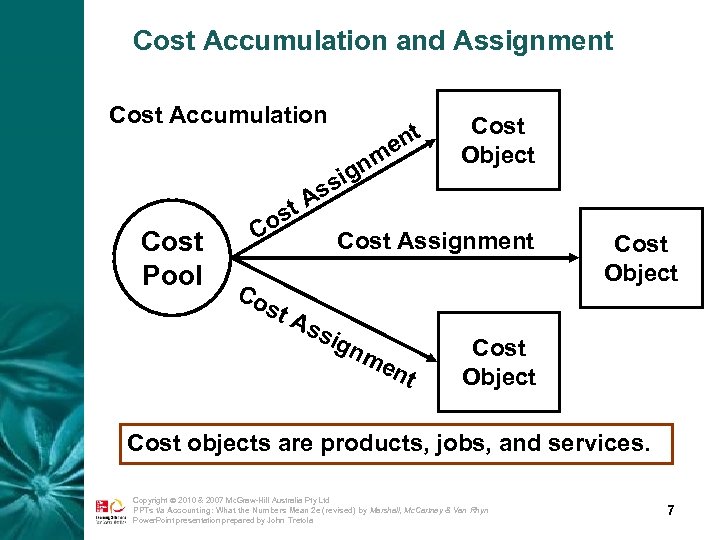

Cost Accumulation and Assignment Cost Accumulation nt e nm ig Cost Pool st Co Co st Cost Object ss A As Cost Assignment sig nm en t Cost Object Cost objects are products, jobs, and services. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 7

Cost Accumulation and Assignment Cost Accumulation nt e nm ig Cost Pool st Co Co st Cost Object ss A As Cost Assignment sig nm en t Cost Object Cost objects are products, jobs, and services. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 7

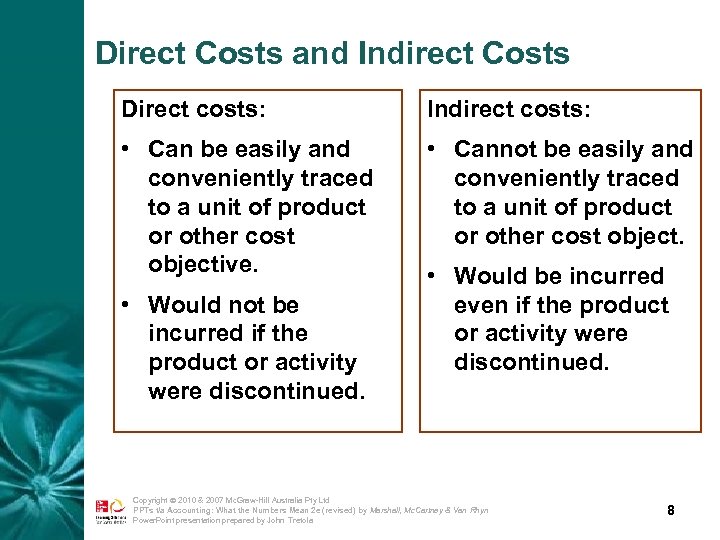

Direct Costs and Indirect Costs Direct costs: Indirect costs: • Can be easily and conveniently traced to a unit of product or other cost objective. • Cannot be easily and conveniently traced to a unit of product or other cost object. • Would not be incurred if the product or activity were discontinued. • Would be incurred even if the product or activity were discontinued. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 8

Direct Costs and Indirect Costs Direct costs: Indirect costs: • Can be easily and conveniently traced to a unit of product or other cost objective. • Cannot be easily and conveniently traced to a unit of product or other cost object. • Would not be incurred if the product or activity were discontinued. • Would be incurred even if the product or activity were discontinued. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 8

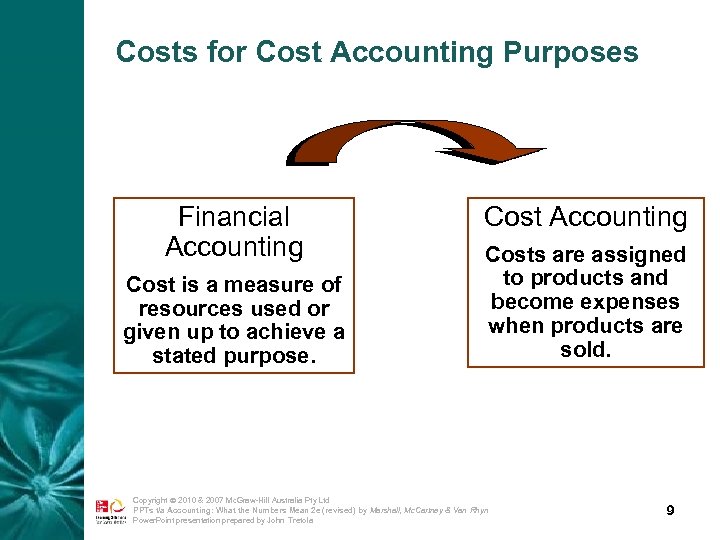

Costs for Cost Accounting Purposes Financial Accounting Cost is a measure of resources used or given up to achieve a stated purpose. Cost Accounting Costs are assigned to products and become expenses when products are sold. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 9

Costs for Cost Accounting Purposes Financial Accounting Cost is a measure of resources used or given up to achieve a stated purpose. Cost Accounting Costs are assigned to products and become expenses when products are sold. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 9

Costs for Cost Accounting Purposes Retailers. . . – buy finished goods – sell finished goods. Manufacturers. . . – buy raw materials – produce and sell finished goods. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 10

Costs for Cost Accounting Purposes Retailers. . . – buy finished goods – sell finished goods. Manufacturers. . . – buy raw materials – produce and sell finished goods. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 10

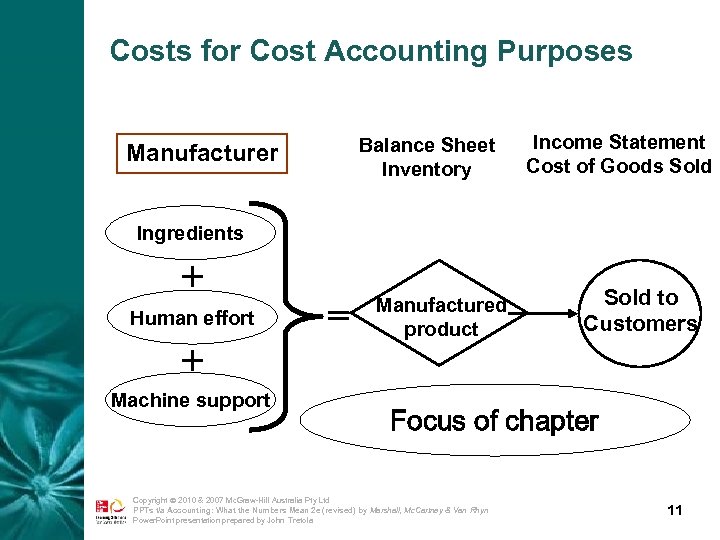

Costs for Cost Accounting Purposes Balance Sheet Inventory Manufacturer Income Statement Cost of Goods Sold Ingredients + Human effort + Machine support = Manufactured product Sold to Customers Focus of chapter Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 11

Costs for Cost Accounting Purposes Balance Sheet Inventory Manufacturer Income Statement Cost of Goods Sold Ingredients + Human effort + Machine support = Manufactured product Sold to Customers Focus of chapter Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 11

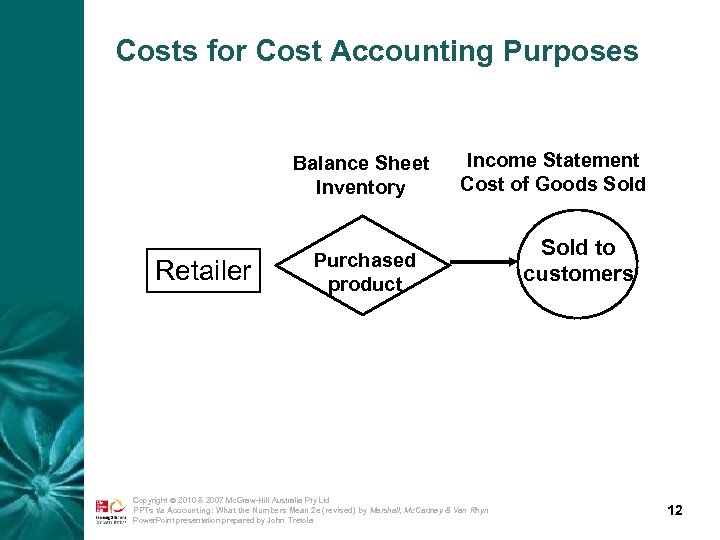

Costs for Cost Accounting Purposes Balance Sheet Inventory Retailer Income Statement Cost of Goods Sold Purchased product Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Sold to customers 12

Costs for Cost Accounting Purposes Balance Sheet Inventory Retailer Income Statement Cost of Goods Sold Purchased product Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Sold to customers 12

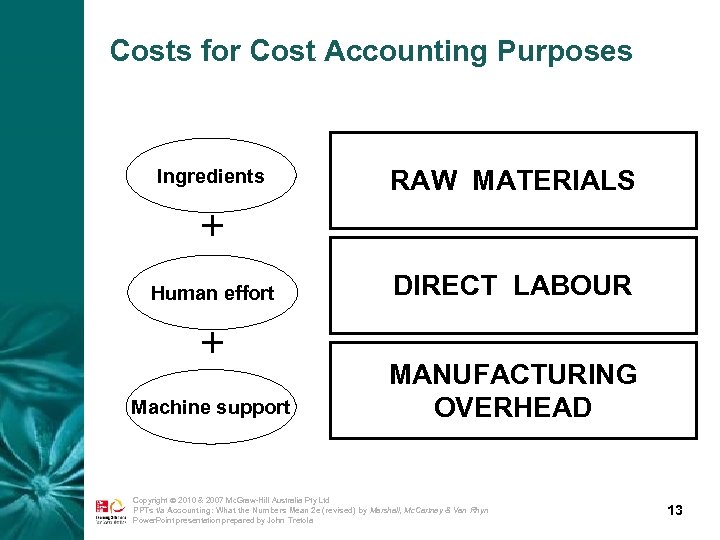

Costs for Cost Accounting Purposes Ingredients RAW MATERIALS + Human effort + Machine support DIRECT LABOUR MANUFACTURING OVERHEAD Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 13

Costs for Cost Accounting Purposes Ingredients RAW MATERIALS + Human effort + Machine support DIRECT LABOUR MANUFACTURING OVERHEAD Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 13

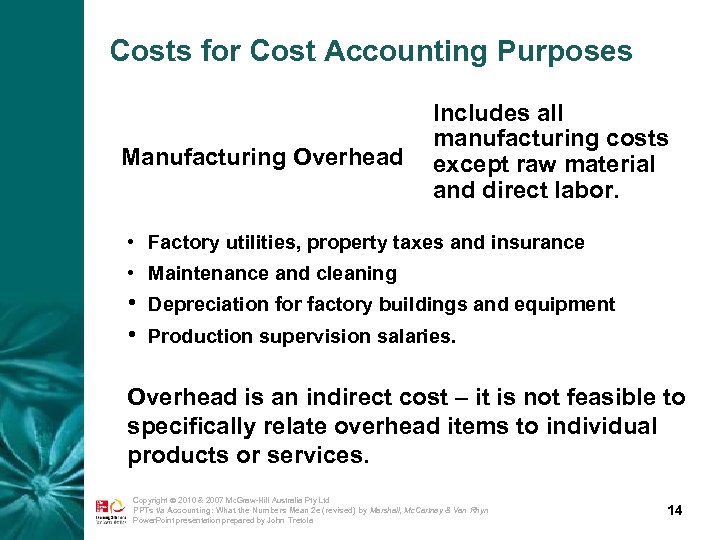

Costs for Cost Accounting Purposes Manufacturing Overhead Includes all manufacturing costs except raw material and direct labor. • Factory utilities, property taxes and insurance • Maintenance and cleaning • • Depreciation for factory buildings and equipment Production supervision salaries. Overhead is an indirect cost – it is not feasible to specifically relate overhead items to individual products or services. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 14

Costs for Cost Accounting Purposes Manufacturing Overhead Includes all manufacturing costs except raw material and direct labor. • Factory utilities, property taxes and insurance • Maintenance and cleaning • • Depreciation for factory buildings and equipment Production supervision salaries. Overhead is an indirect cost – it is not feasible to specifically relate overhead items to individual products or services. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 14

Costs for Cost Accounting Purposes Period Costs • Costs not included in inventory are reported on the income statement in the accounting period in which they are incurred. • Selling, general and administrative costs. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 15

Costs for Cost Accounting Purposes Period Costs • Costs not included in inventory are reported on the income statement in the accounting period in which they are incurred. • Selling, general and administrative costs. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 15

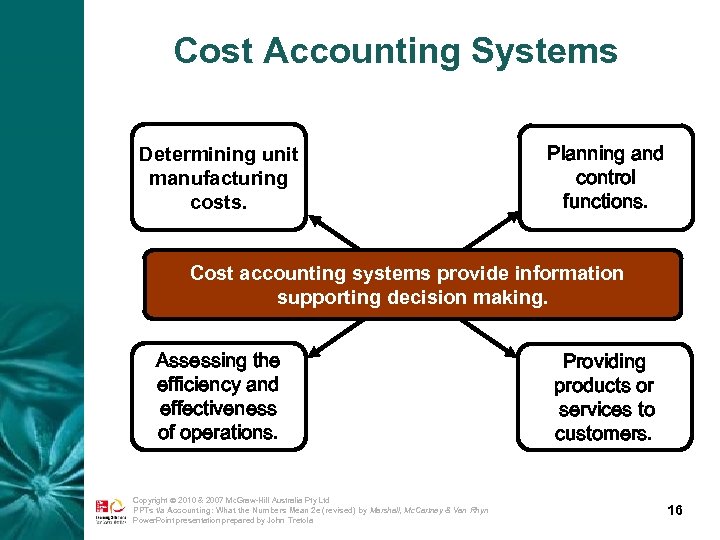

Cost Accounting Systems Determining unit manufacturing costs. Planning and control functions. Cost accounting systems provide information supporting decision making. Assessing the efficiency and effectiveness of operations. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Providing products or services to customers. 16

Cost Accounting Systems Determining unit manufacturing costs. Planning and control functions. Cost accounting systems provide information supporting decision making. Assessing the efficiency and effectiveness of operations. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Providing products or services to customers. 16

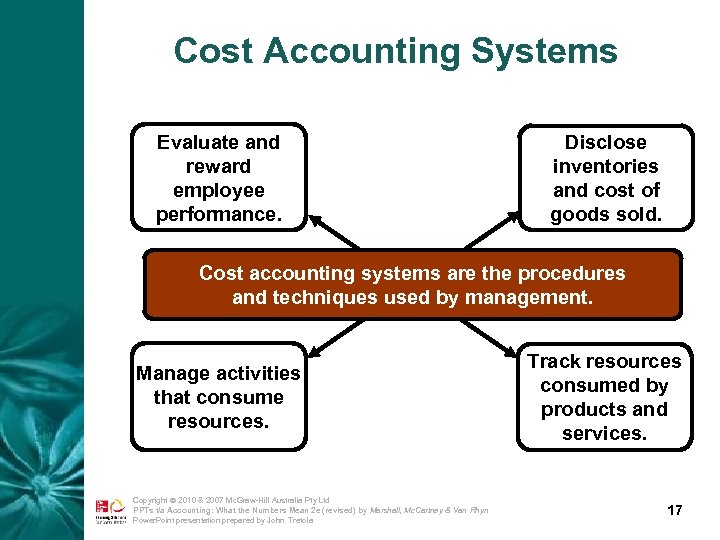

Cost Accounting Systems Evaluate and reward employee performance. Disclose inventories and cost of goods sold. Cost accounting systems are the procedures and techniques used by management. Manage activities that consume resources. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Track resources consumed by products and services. 17

Cost Accounting Systems Evaluate and reward employee performance. Disclose inventories and cost of goods sold. Cost accounting systems are the procedures and techniques used by management. Manage activities that consume resources. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Track resources consumed by products and services. 17

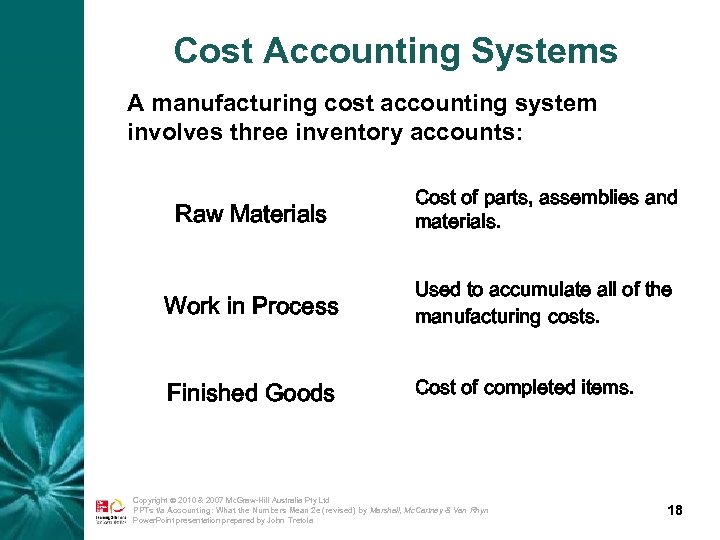

Cost Accounting Systems A manufacturing cost accounting system involves three inventory accounts: Raw Materials Cost of parts, assemblies and materials. Work in Process Used to accumulate all of the manufacturing costs. Finished Goods Cost of completed items. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 18

Cost Accounting Systems A manufacturing cost accounting system involves three inventory accounts: Raw Materials Cost of parts, assemblies and materials. Work in Process Used to accumulate all of the manufacturing costs. Finished Goods Cost of completed items. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 18

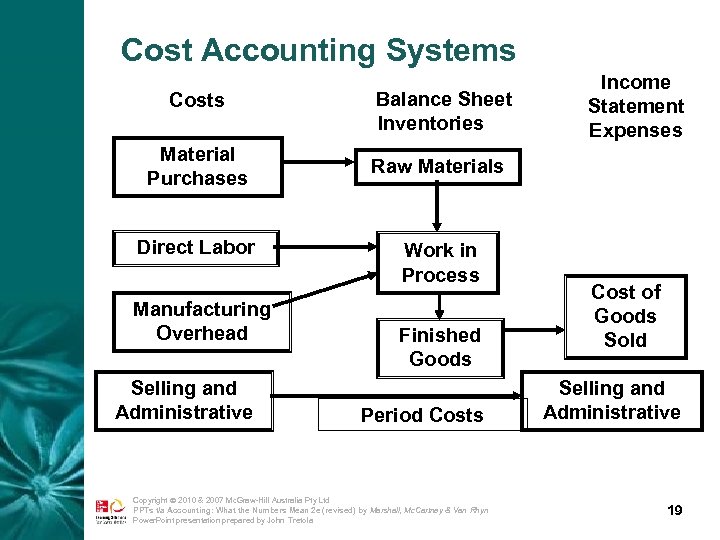

Cost Accounting Systems Costs Material Purchases Direct Labor Manufacturing Overhead Selling and Administrative Balance Sheet Inventories Income Statement Expenses Raw Materials Work in Process Finished Goods Period Costs Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Cost of Goods Sold Selling and Administrative 19

Cost Accounting Systems Costs Material Purchases Direct Labor Manufacturing Overhead Selling and Administrative Balance Sheet Inventories Income Statement Expenses Raw Materials Work in Process Finished Goods Period Costs Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Cost of Goods Sold Selling and Administrative 19

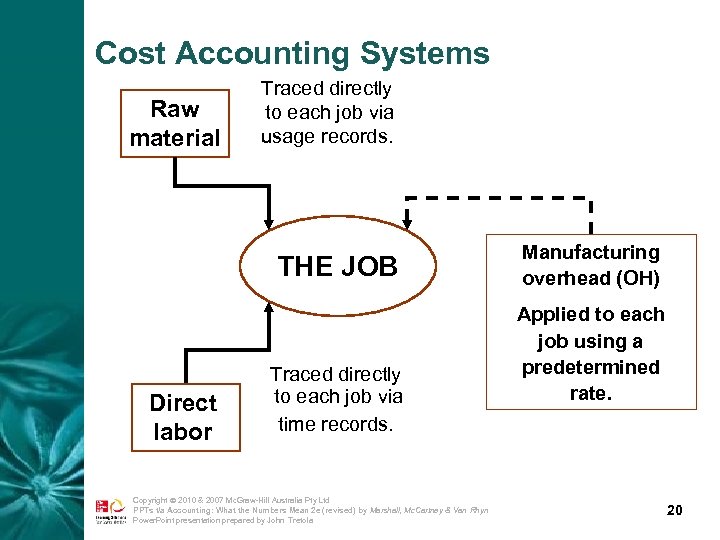

Cost Accounting Systems Raw material Traced directly to each job via usage records. THE JOB Direct labor Traced directly to each job via time records. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Manufacturing overhead (OH) Applied to each job using a predetermined rate. 20

Cost Accounting Systems Raw material Traced directly to each job via usage records. THE JOB Direct labor Traced directly to each job via time records. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Manufacturing overhead (OH) Applied to each job using a predetermined rate. 20

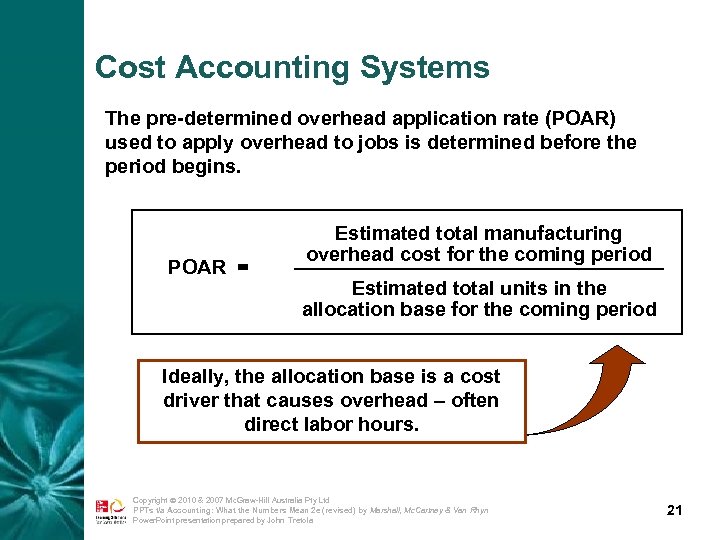

Cost Accounting Systems The pre-determined overhead application rate (POAR) used to apply overhead to jobs is determined before the period begins. POAR = Estimated total manufacturing overhead cost for the coming period Estimated total units in the allocation base for the coming period Ideally, the allocation base is a cost driver that causes overhead – often direct labor hours. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 21

Cost Accounting Systems The pre-determined overhead application rate (POAR) used to apply overhead to jobs is determined before the period begins. POAR = Estimated total manufacturing overhead cost for the coming period Estimated total units in the allocation base for the coming period Ideally, the allocation base is a cost driver that causes overhead – often direct labor hours. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 21

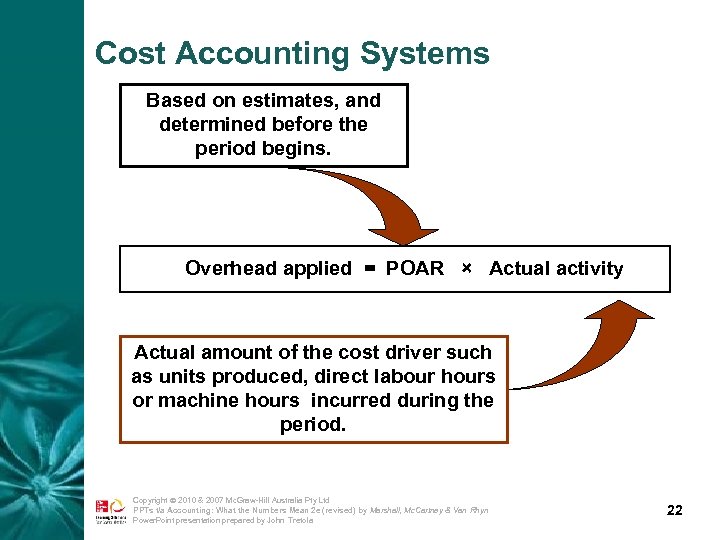

Cost Accounting Systems Based on estimates, and determined before the period begins. Overhead applied = POAR × Actual activity Actual amount of the cost driver such as units produced, direct labour hours or machine hours incurred during the period. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 22

Cost Accounting Systems Based on estimates, and determined before the period begins. Overhead applied = POAR × Actual activity Actual amount of the cost driver such as units produced, direct labour hours or machine hours incurred during the period. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 22

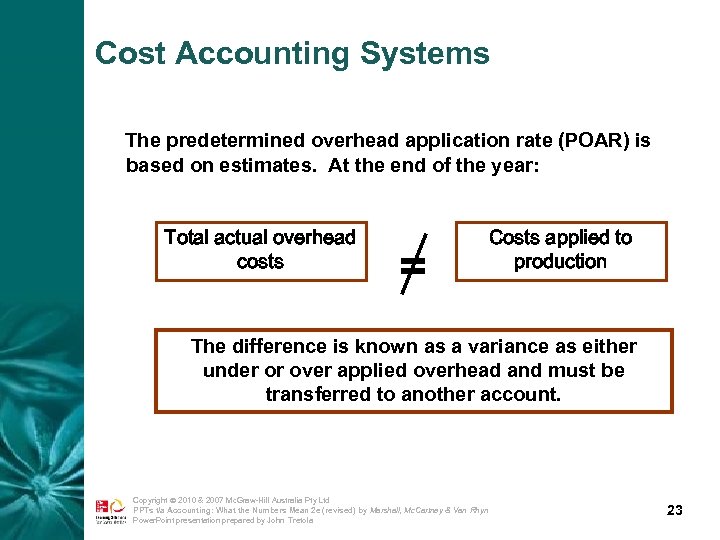

Cost Accounting Systems The predetermined overhead application rate (POAR) is based on estimates. At the end of the year: Total actual overhead costs = Costs applied to production The difference is known as a variance as either under or over applied overhead and must be transferred to another account. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 23

Cost Accounting Systems The predetermined overhead application rate (POAR) is based on estimates. At the end of the year: Total actual overhead costs = Costs applied to production The difference is known as a variance as either under or over applied overhead and must be transferred to another account. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 23

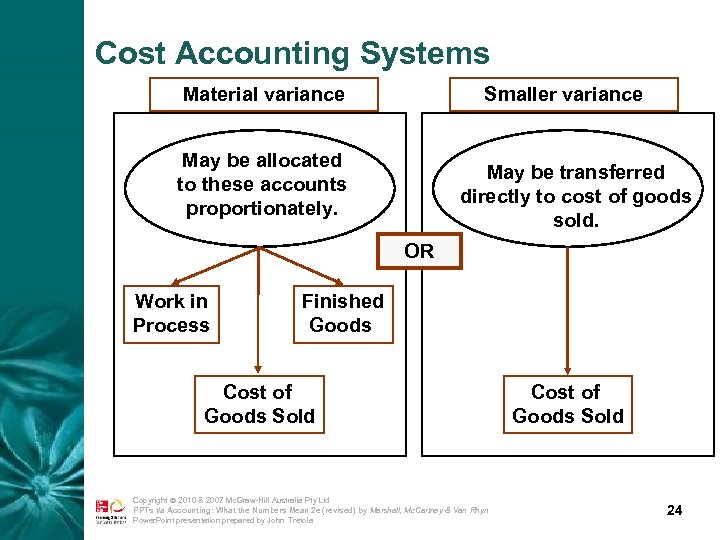

Cost Accounting Systems Material variance Smaller variance May be allocated to these accounts proportionately. May be transferred directly to cost of goods sold. OR Work in Process Finished Goods Cost of Goods Sold Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Cost of Goods Sold 24

Cost Accounting Systems Material variance Smaller variance May be allocated to these accounts proportionately. May be transferred directly to cost of goods sold. OR Work in Process Finished Goods Cost of Goods Sold Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola Cost of Goods Sold 24

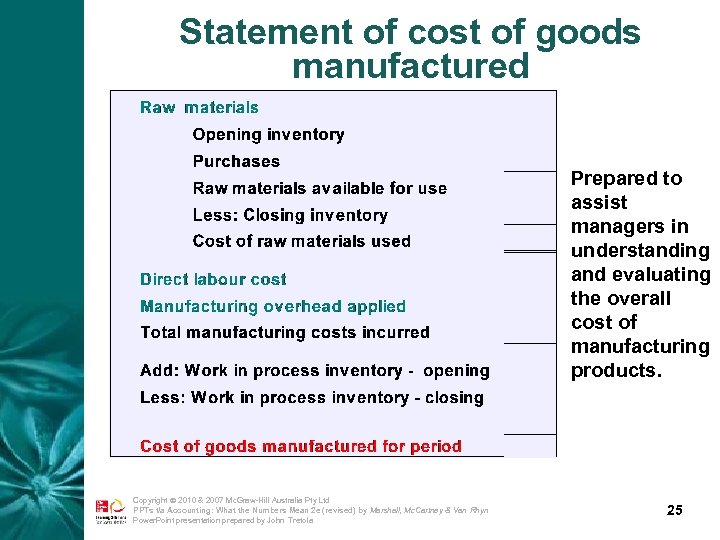

Statement of cost of goods manufactured Prepared to assist managers in understanding and evaluating the overall cost of manufacturing products. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 25

Statement of cost of goods manufactured Prepared to assist managers in understanding and evaluating the overall cost of manufacturing products. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 25

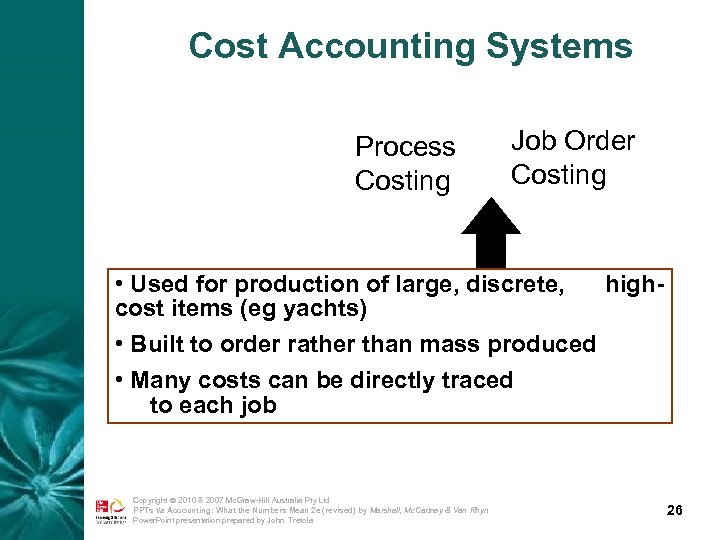

Cost Accounting Systems Process Costing Job Order Costing • Used for production of large, discrete, highcost items (eg yachts) • Built to order rather than mass produced • Many costs can be directly traced to each job Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 26

Cost Accounting Systems Process Costing Job Order Costing • Used for production of large, discrete, highcost items (eg yachts) • Built to order rather than mass produced • Many costs can be directly traced to each job Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 26

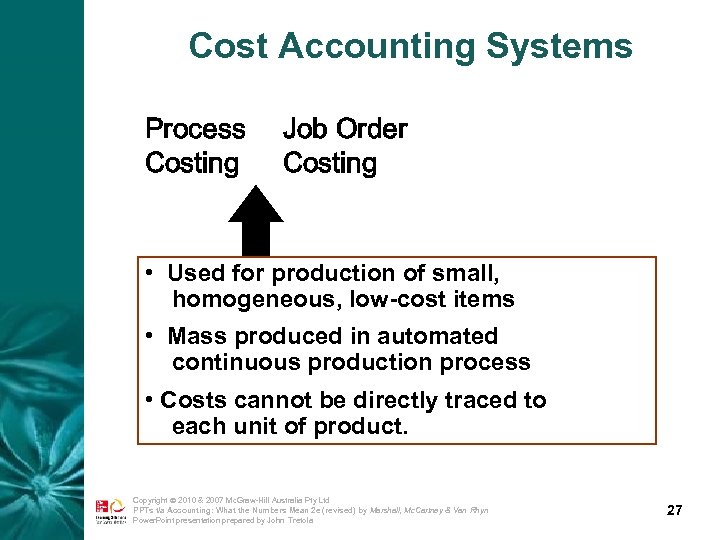

Cost Accounting Systems Process Costing Job Order Costing • Used for production of small, homogeneous, low-cost items • Mass produced in automated continuous production process • Costs cannot be directly traced to each unit of product. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 27

Cost Accounting Systems Process Costing Job Order Costing • Used for production of small, homogeneous, low-cost items • Mass produced in automated continuous production process • Costs cannot be directly traced to each unit of product. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 27

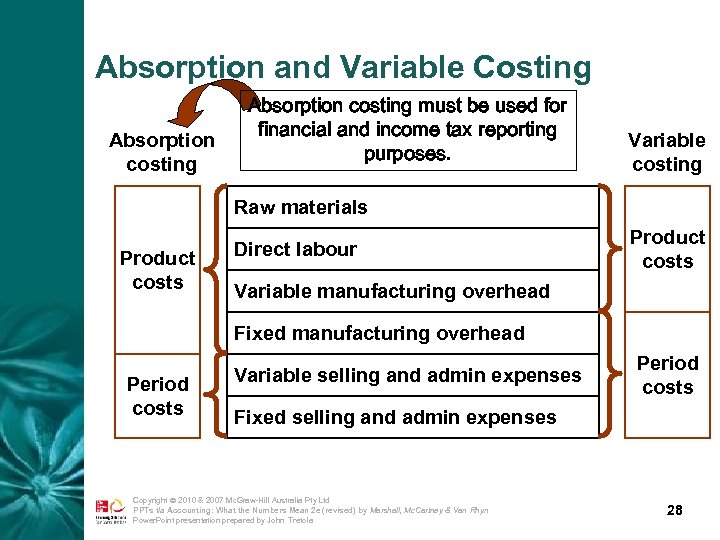

Absorption and Variable Costing Absorption costing must be used for financial and income tax reporting purposes. Variable costing Raw materials Product costs Direct labour Product costs Variable manufacturing overhead Fixed manufacturing overhead Period costs Variable selling and admin expenses Period costs Fixed selling and admin expenses Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 28

Absorption and Variable Costing Absorption costing must be used for financial and income tax reporting purposes. Variable costing Raw materials Product costs Direct labour Product costs Variable manufacturing overhead Fixed manufacturing overhead Period costs Variable selling and admin expenses Period costs Fixed selling and admin expenses Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 28

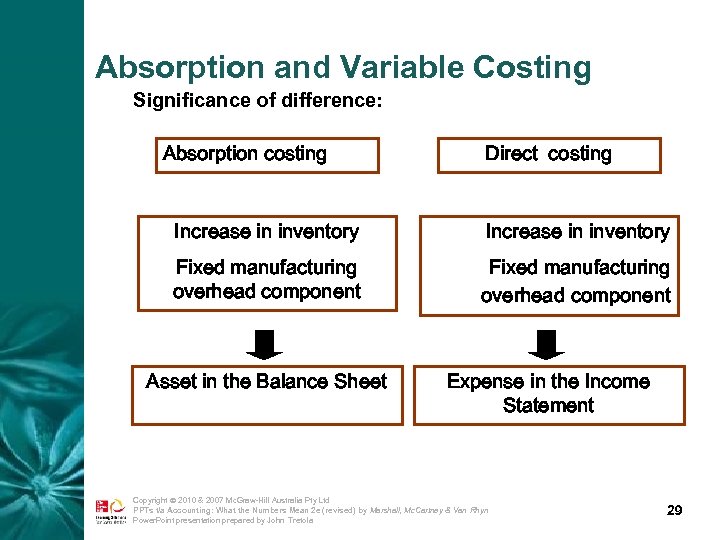

Absorption and Variable Costing Significance of difference: Absorption costing Direct costing Increase in inventory Fixed manufacturing overhead component Asset in the Balance Sheet Expense in the Income Statement Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 29

Absorption and Variable Costing Significance of difference: Absorption costing Direct costing Increase in inventory Fixed manufacturing overhead component Asset in the Balance Sheet Expense in the Income Statement Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 29

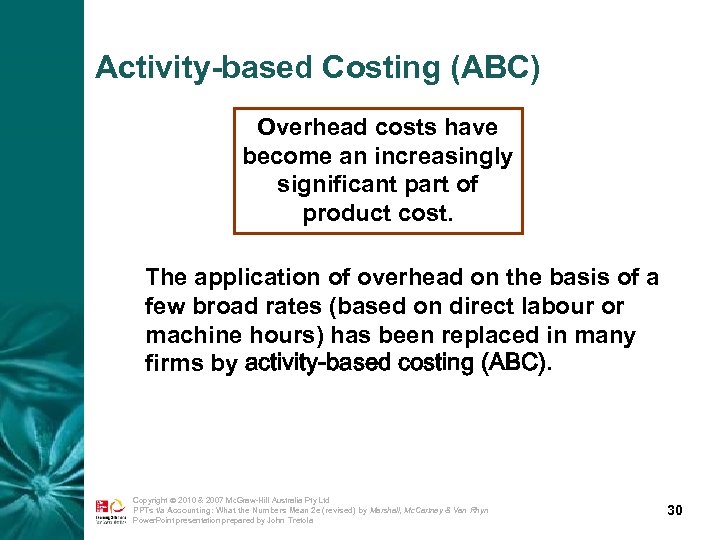

Activity-based Costing (ABC) Overhead costs have become an increasingly significant part of product cost. The application of overhead on the basis of a few broad rates (based on direct labour or machine hours) has been replaced in many firms by activity-based costing (ABC). Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 30

Activity-based Costing (ABC) Overhead costs have become an increasingly significant part of product cost. The application of overhead on the basis of a few broad rates (based on direct labour or machine hours) has been replaced in many firms by activity-based costing (ABC). Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 30

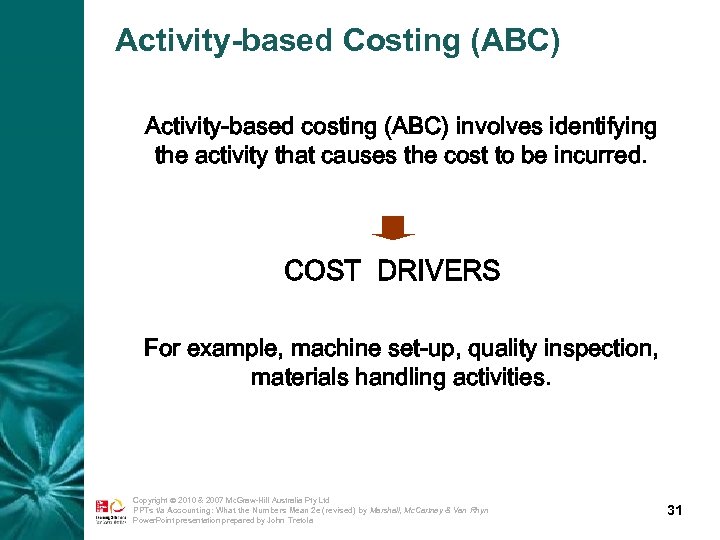

Activity-based Costing (ABC) Activity-based costing (ABC) involves identifying the activity that causes the cost to be incurred. COST DRIVERS For example, machine set-up, quality inspection, materials handling activities. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 31

Activity-based Costing (ABC) Activity-based costing (ABC) involves identifying the activity that causes the cost to be incurred. COST DRIVERS For example, machine set-up, quality inspection, materials handling activities. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 31

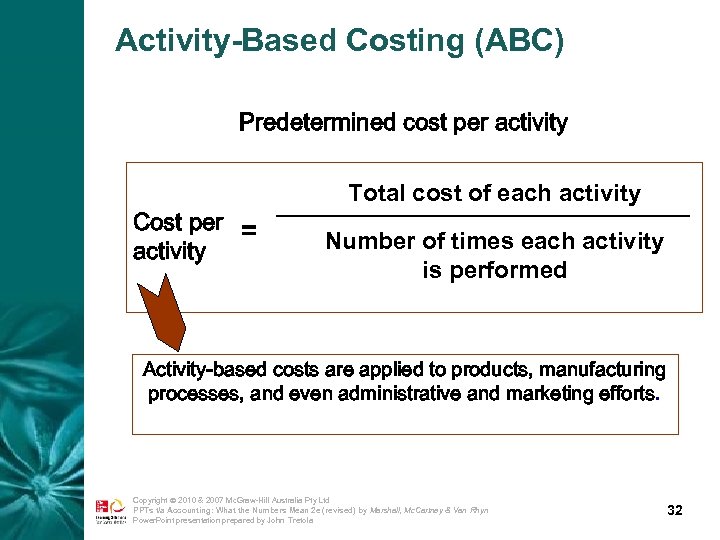

Activity-Based Costing (ABC) Predetermined cost per activity Cost per = activity Total cost of each activity Number of times each activity is performed Activity-based costs are applied to products, manufacturing processes, and even administrative and marketing efforts. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 32

Activity-Based Costing (ABC) Predetermined cost per activity Cost per = activity Total cost of each activity Number of times each activity is performed Activity-based costs are applied to products, manufacturing processes, and even administrative and marketing efforts. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 32

The Benefits of ABC • More clearly focuses on the activities causing costs. • More accurate product costs for: – pricing decisions – product elimination decisions – managing activities that cause costs. • Benefits should always be compared to costs of implementation. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 33

The Benefits of ABC • More clearly focuses on the activities causing costs. • More accurate product costs for: – pricing decisions – product elimination decisions – managing activities that cause costs. • Benefits should always be compared to costs of implementation. Copyright 2010 & 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Accounting: What the Numbers Mean 2 e (revised) by Marshall, Mc. Cartney & Van Rhyn Power. Point presentation prepared by John Tretola 33