3539a92caf4134467878619d13720a2b.ppt

- Количество слайдов: 21

Chapter 13 Corporate Governance in the Twenty-First Century

Chapter 13 Corporate Governance in the Twenty-First Century

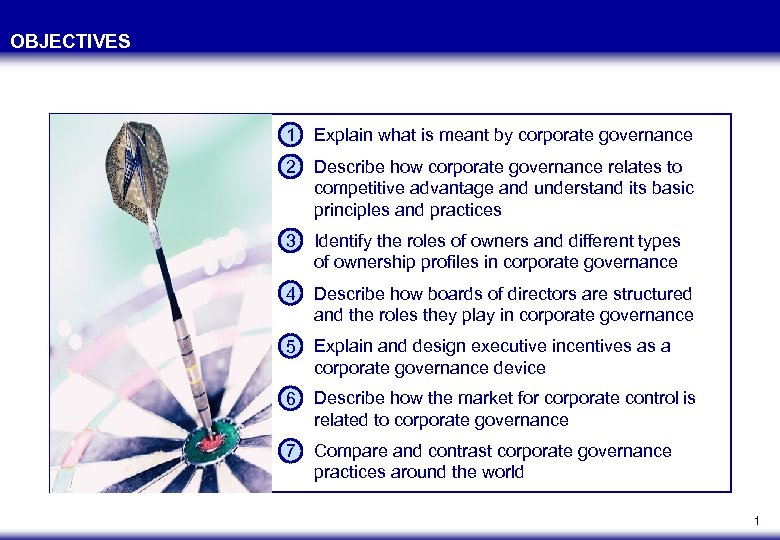

OBJECTIVES 1 Explain what is meant by corporate governance 2 Describe how corporate governance relates to competitive advantage and understand its basic principles and practices 3 Identify the roles of owners and different types of ownership profiles in corporate governance 4 Describe how boards of directors are structured and the roles they play in corporate governance 5 Explain and design executive incentives as a corporate governance device 6 Describe how the market for corporate control is related to corporate governance 7 Compare and contrast corporate governance practices around the world 1

OBJECTIVES 1 Explain what is meant by corporate governance 2 Describe how corporate governance relates to competitive advantage and understand its basic principles and practices 3 Identify the roles of owners and different types of ownership profiles in corporate governance 4 Describe how boards of directors are structured and the roles they play in corporate governance 5 Explain and design executive incentives as a corporate governance device 6 Describe how the market for corporate control is related to corporate governance 7 Compare and contrast corporate governance practices around the world 1

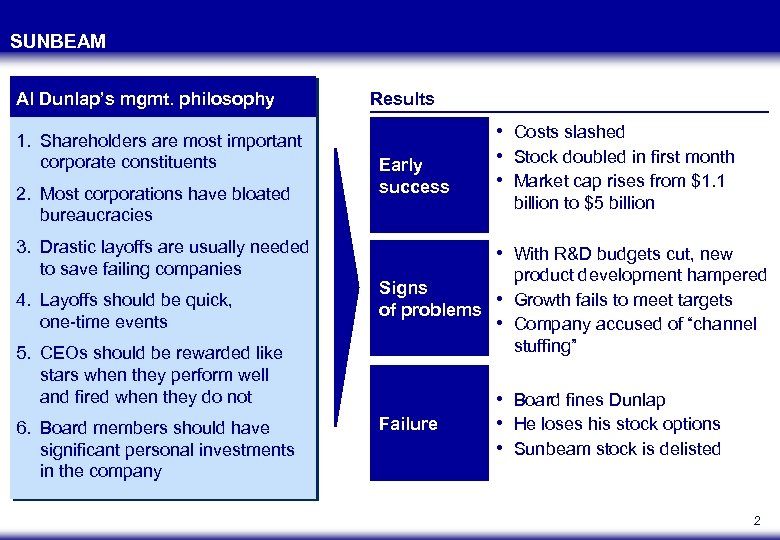

SUNBEAM Al Dunlap’s mgmt. philosophy 1. Shareholders are most important corporate constituents 2. Most corporations have bloated bureaucracies 3. Drastic layoffs are usually needed to save failing companies 4. Layoffs should be quick, one-time events Results Early success billion to $5 billion • With R&D budgets cut, new Signs of problems 5. CEOs should be rewarded like stars when they perform well and fired when they do not 6. Board members should have significant personal investments in the company • Costs slashed • Stock doubled in first month • Market cap rises from $1. 1 Failure • • product development hampered Growth fails to meet targets Company accused of “channel stuffing” • Board fines Dunlap • He loses his stock options • Sunbeam stock is delisted 2

SUNBEAM Al Dunlap’s mgmt. philosophy 1. Shareholders are most important corporate constituents 2. Most corporations have bloated bureaucracies 3. Drastic layoffs are usually needed to save failing companies 4. Layoffs should be quick, one-time events Results Early success billion to $5 billion • With R&D budgets cut, new Signs of problems 5. CEOs should be rewarded like stars when they perform well and fired when they do not 6. Board members should have significant personal investments in the company • Costs slashed • Stock doubled in first month • Market cap rises from $1. 1 Failure • • product development hampered Growth fails to meet targets Company accused of “channel stuffing” • Board fines Dunlap • He loses his stock options • Sunbeam stock is delisted 2

CHAINSAW AL “The last dirty secret in the corporate world is how directors live off the fat of a business that is not their employer. I started a revolution by insisting that Scott directors be paid only in stock. ” - Al Dunlap 3

CHAINSAW AL “The last dirty secret in the corporate world is how directors live off the fat of a business that is not their employer. I started a revolution by insisting that Scott directors be paid only in stock. ” - Al Dunlap 3

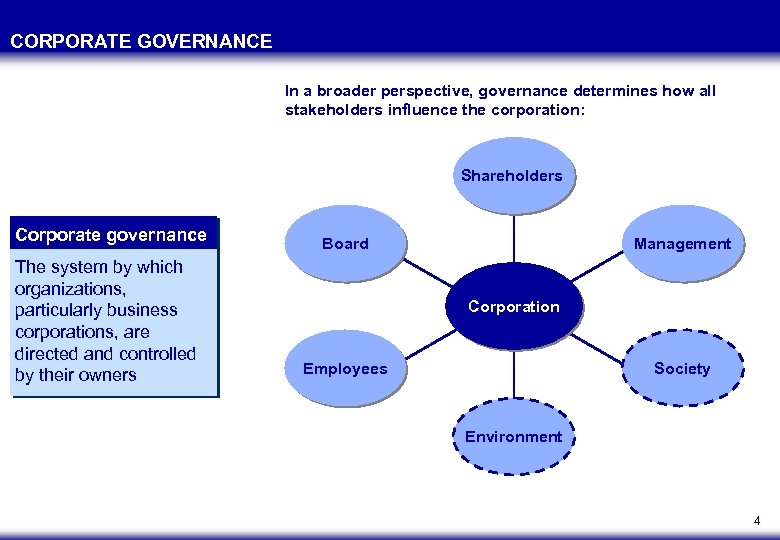

CORPORATE GOVERNANCE In a broader perspective, governance determines how all stakeholders influence the corporation: Shareholders Corporate governance The system by which organizations, particularly business corporations, are directed and controlled by their owners Board Management Corporation Employees Society Environment 4

CORPORATE GOVERNANCE In a broader perspective, governance determines how all stakeholders influence the corporation: Shareholders Corporate governance The system by which organizations, particularly business corporations, are directed and controlled by their owners Board Management Corporation Employees Society Environment 4

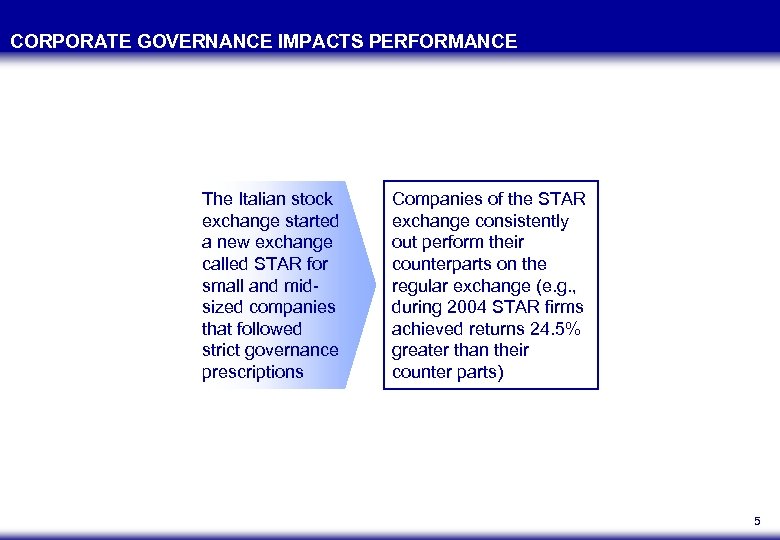

CORPORATE GOVERNANCE IMPACTS PERFORMANCE The Italian stock exchange started a new exchange called STAR for small and midsized companies that followed strict governance prescriptions Companies of the STAR exchange consistently out perform their counterparts on the regular exchange (e. g. , during 2004 STAR firms achieved returns 24. 5% greater than their counter parts) 5

CORPORATE GOVERNANCE IMPACTS PERFORMANCE The Italian stock exchange started a new exchange called STAR for small and midsized companies that followed strict governance prescriptions Companies of the STAR exchange consistently out perform their counterparts on the regular exchange (e. g. , during 2004 STAR firms achieved returns 24. 5% greater than their counter parts) 5

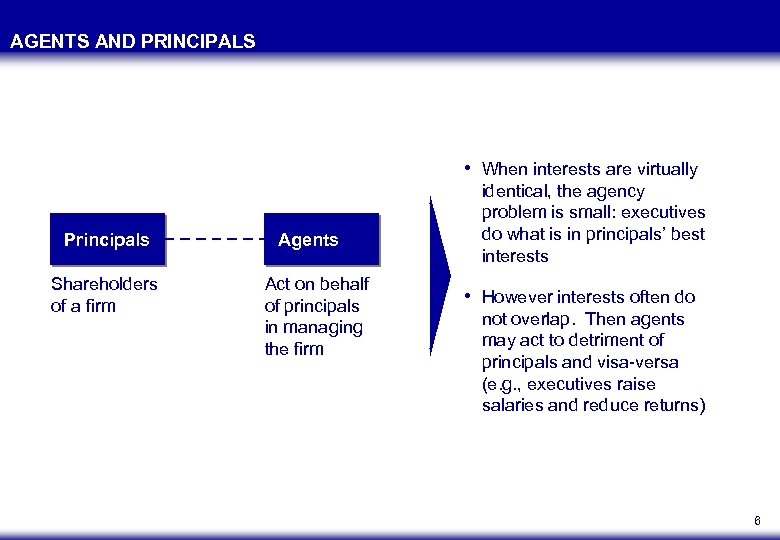

AGENTS AND PRINCIPALS • When interests are virtually Principals Shareholders of a firm Agents Act on behalf of principals in managing the firm identical, the agency problem is small: executives do what is in principals’ best interests • However interests often do not overlap. Then agents may act to detriment of principals and visa-versa (e. g. , executives raise salaries and reduce returns) 6

AGENTS AND PRINCIPALS • When interests are virtually Principals Shareholders of a firm Agents Act on behalf of principals in managing the firm identical, the agency problem is small: executives do what is in principals’ best interests • However interests often do not overlap. Then agents may act to detriment of principals and visa-versa (e. g. , executives raise salaries and reduce returns) 6

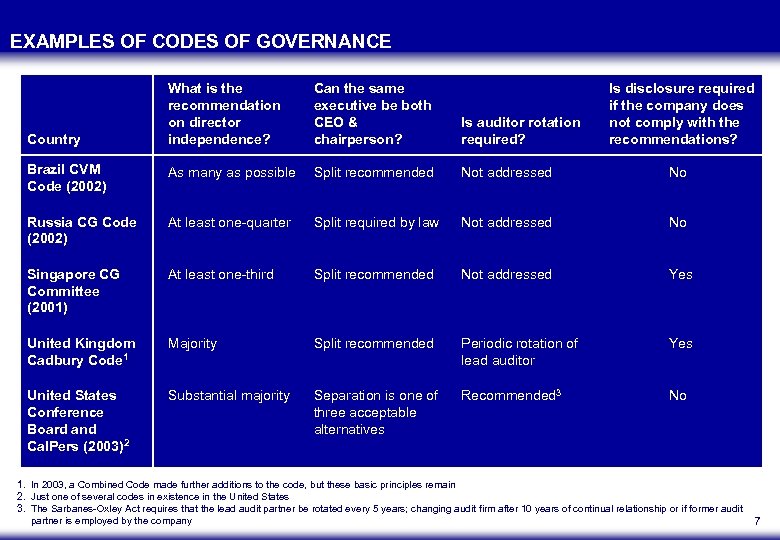

EXAMPLES OF CODES OF GOVERNANCE What is the recommendation on director independence? Can the same executive be both CEO & chairperson? Is auditor rotation required? Brazil CVM Code (2002) As many as possible Split recommended Not addressed No Russia CG Code (2002) At least one-quarter Split required by law Not addressed No Singapore CG Committee (2001) At least one-third Split recommended Not addressed Yes United Kingdom Cadbury Code 1 Majority Split recommended Periodic rotation of lead auditor Yes United States Conference Board and Cal. Pers (2003)2 Substantial majority Separation is one of three acceptable alternatives Recommended 3 No Country Is disclosure required if the company does not comply with the recommendations? 1. In 2003, a Combined Code made further additions to the code, but these basic principles remain 2. Just one of several codes in existence in the United States 3. The Sarbanes-Oxley Act requires that the lead audit partner be rotated every 5 years; changing audit firm after 10 years of continual relationship or if former audit partner is employed by the company 7

EXAMPLES OF CODES OF GOVERNANCE What is the recommendation on director independence? Can the same executive be both CEO & chairperson? Is auditor rotation required? Brazil CVM Code (2002) As many as possible Split recommended Not addressed No Russia CG Code (2002) At least one-quarter Split required by law Not addressed No Singapore CG Committee (2001) At least one-third Split recommended Not addressed Yes United Kingdom Cadbury Code 1 Majority Split recommended Periodic rotation of lead auditor Yes United States Conference Board and Cal. Pers (2003)2 Substantial majority Separation is one of three acceptable alternatives Recommended 3 No Country Is disclosure required if the company does not comply with the recommendations? 1. In 2003, a Combined Code made further additions to the code, but these basic principles remain 2. Just one of several codes in existence in the United States 3. The Sarbanes-Oxley Act requires that the lead audit partner be rotated every 5 years; changing audit firm after 10 years of continual relationship or if former audit partner is employed by the company 7

INSTITUTIONAL ACTIVISM ON THE RISE Cal. PERS known for their institutional activism TIAA-CREF Corporate Governance Team 8

INSTITUTIONAL ACTIVISM ON THE RISE Cal. PERS known for their institutional activism TIAA-CREF Corporate Governance Team 8

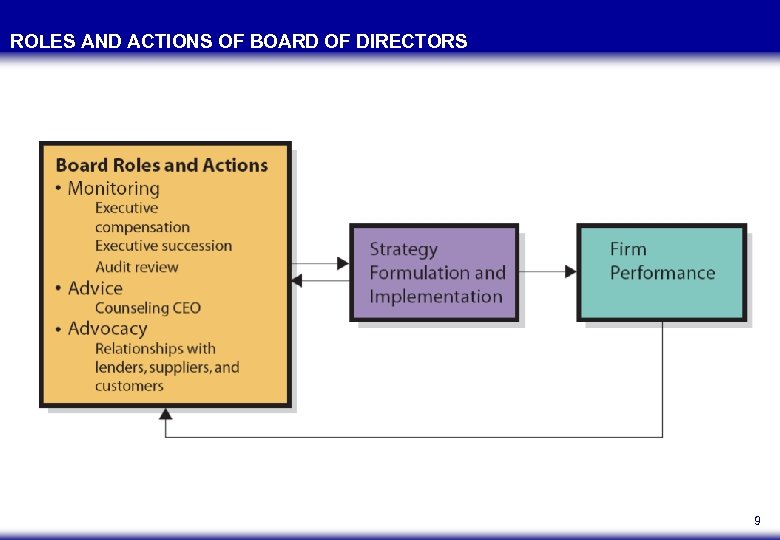

ROLES AND ACTIONS OF BOARD OF DIRECTORS 9

ROLES AND ACTIONS OF BOARD OF DIRECTORS 9

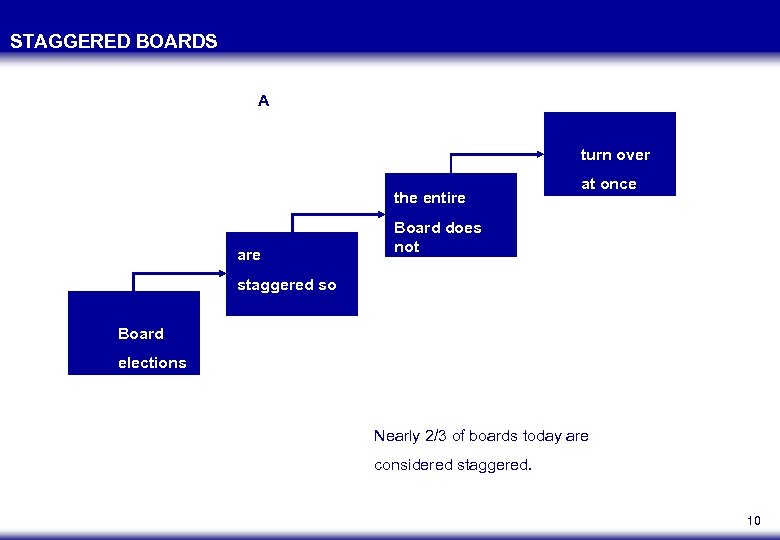

STAGGERED BOARDS A turn over the entire at once Board does not staggered so Board elections Nearly 2/3 of boards today are considered staggered. 10

STAGGERED BOARDS A turn over the entire at once Board does not staggered so Board elections Nearly 2/3 of boards today are considered staggered. 10

BOARD INVOLVEMENT Phantom boards have no involvement in the strategic management process of the firm. Active The public (and major stakeholders) have higher expectations for board involvement today. 11

BOARD INVOLVEMENT Phantom boards have no involvement in the strategic management process of the firm. Active The public (and major stakeholders) have higher expectations for board involvement today. 11

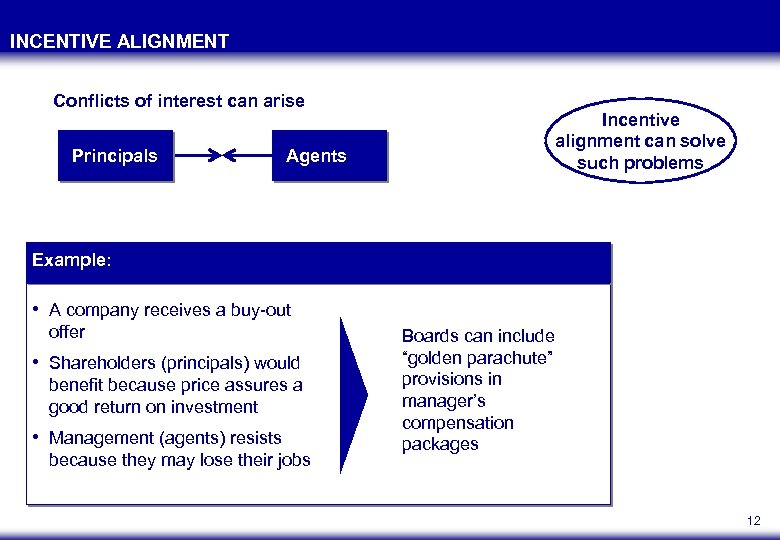

INCENTIVE ALIGNMENT Conflicts of interest can arise Principals Agents Incentive alignment can solve such problems Example: • A company receives a buy-out offer • Shareholders (principals) would benefit because price assures a good return on investment • Management (agents) resists because they may lose their jobs Boards can include “golden parachute” provisions in manager’s compensation packages 12

INCENTIVE ALIGNMENT Conflicts of interest can arise Principals Agents Incentive alignment can solve such problems Example: • A company receives a buy-out offer • Shareholders (principals) would benefit because price assures a good return on investment • Management (agents) resists because they may lose their jobs Boards can include “golden parachute” provisions in manager’s compensation packages 12

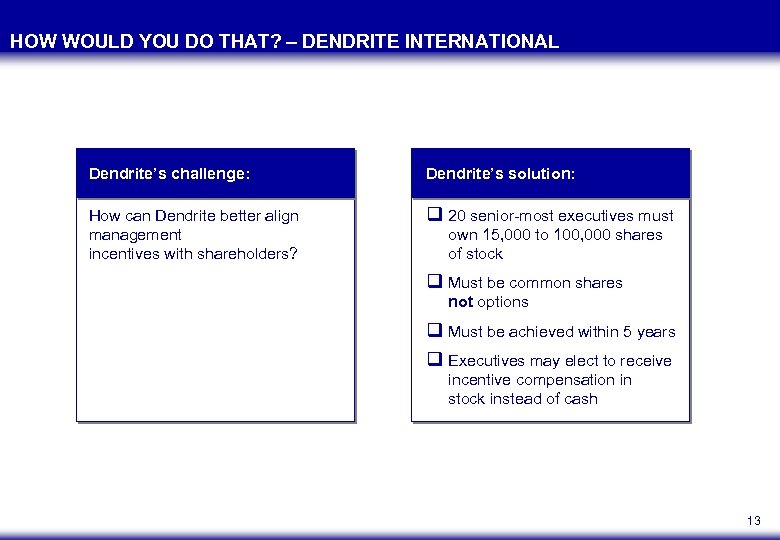

HOW WOULD YOU DO THAT? – DENDRITE INTERNATIONAL Dendrite’s challenge: Dendrite’s solution: How can Dendrite better align management incentives with shareholders? q 20 senior-most executives must own 15, 000 to 100, 000 shares of stock q Must be common shares not options q Must be achieved within 5 years q Executives may elect to receive incentive compensation in stock instead of cash 13

HOW WOULD YOU DO THAT? – DENDRITE INTERNATIONAL Dendrite’s challenge: Dendrite’s solution: How can Dendrite better align management incentives with shareholders? q 20 senior-most executives must own 15, 000 to 100, 000 shares of stock q Must be common shares not options q Must be achieved within 5 years q Executives may elect to receive incentive compensation in stock instead of cash 13

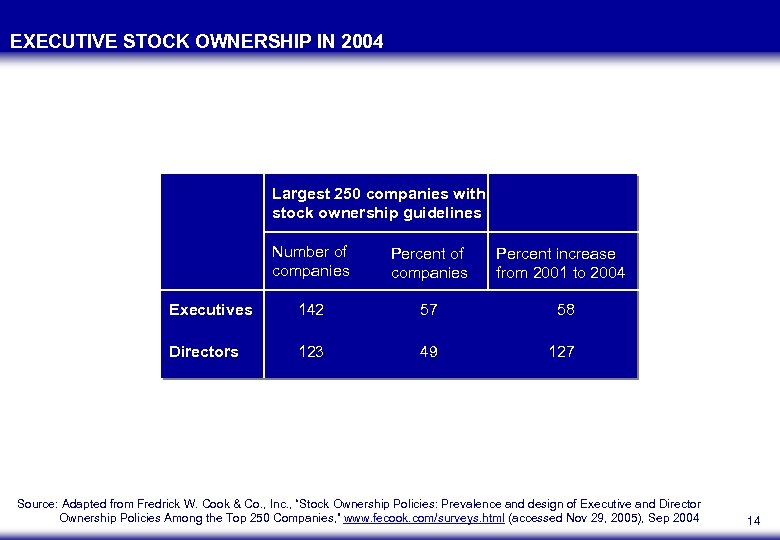

EXECUTIVE STOCK OWNERSHIP IN 2004 Largest 250 companies with stock ownership guidelines Number of companies Percent increase from 2001 to 2004 Executives 142 57 58 Directors 123 49 127 Source: Adapted from Fredrick W. Cook & Co. , Inc. , “Stock Ownership Policies: Prevalence and design of Executive and Director Ownership Policies Among the Top 250 Companies, ” www. fecook. com/surveys. html (accessed Nov 29, 2005), Sep 2004 14

EXECUTIVE STOCK OWNERSHIP IN 2004 Largest 250 companies with stock ownership guidelines Number of companies Percent increase from 2001 to 2004 Executives 142 57 58 Directors 123 49 127 Source: Adapted from Fredrick W. Cook & Co. , Inc. , “Stock Ownership Policies: Prevalence and design of Executive and Director Ownership Policies Among the Top 250 Companies, ” www. fecook. com/surveys. html (accessed Nov 29, 2005), Sep 2004 14

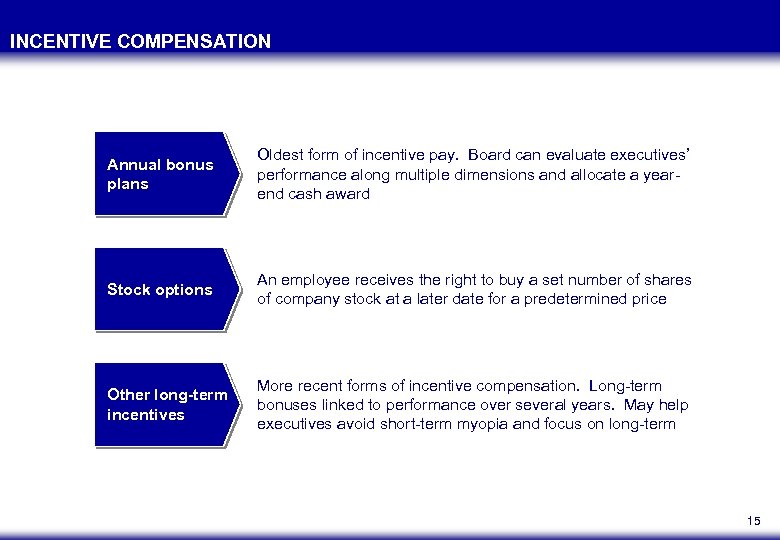

INCENTIVE COMPENSATION Annual bonus plans Oldest form of incentive pay. Board can evaluate executives’ performance along multiple dimensions and allocate a yearend cash award Stock options An employee receives the right to buy a set number of shares of company stock at a later date for a predetermined price Other long-term incentives More recent forms of incentive compensation. Long-term bonuses linked to performance over several years. May help executives avoid short-term myopia and focus on long-term 15

INCENTIVE COMPENSATION Annual bonus plans Oldest form of incentive pay. Board can evaluate executives’ performance along multiple dimensions and allocate a yearend cash award Stock options An employee receives the right to buy a set number of shares of company stock at a later date for a predetermined price Other long-term incentives More recent forms of incentive compensation. Long-term bonuses linked to performance over several years. May help executives avoid short-term myopia and focus on long-term 15

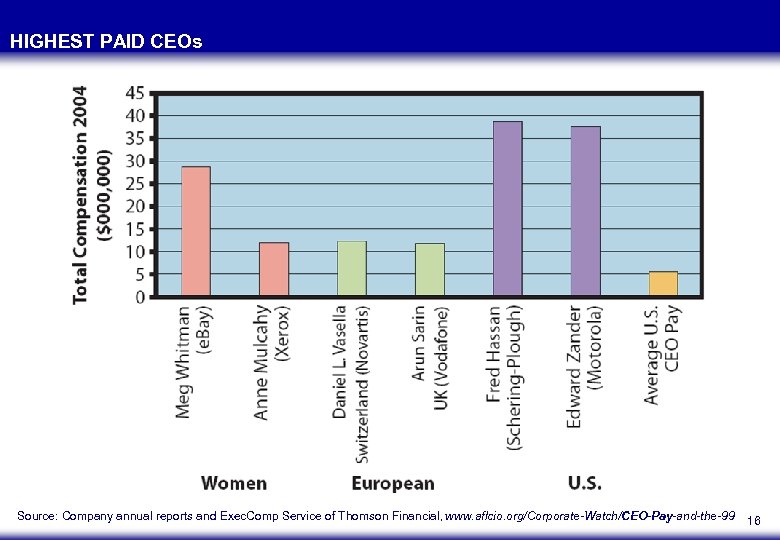

HIGHEST PAID CEOs Source: Company annual reports and Exec. Comp Service of Thomson Financial, www. aflcio. org/Corporate-Watch/CEO-Pay-and-the-99 16

HIGHEST PAID CEOs Source: Company annual reports and Exec. Comp Service of Thomson Financial, www. aflcio. org/Corporate-Watch/CEO-Pay-and-the-99 16

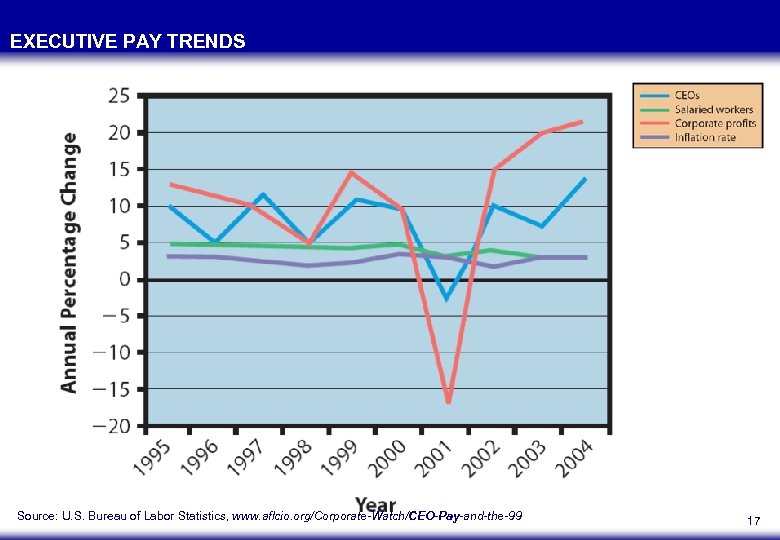

EXECUTIVE PAY TRENDS Source: U. S. Bureau of Labor Statistics, www. aflcio. org/Corporate-Watch/CEO-Pay-and-the-99 17

EXECUTIVE PAY TRENDS Source: U. S. Bureau of Labor Statistics, www. aflcio. org/Corporate-Watch/CEO-Pay-and-the-99 17

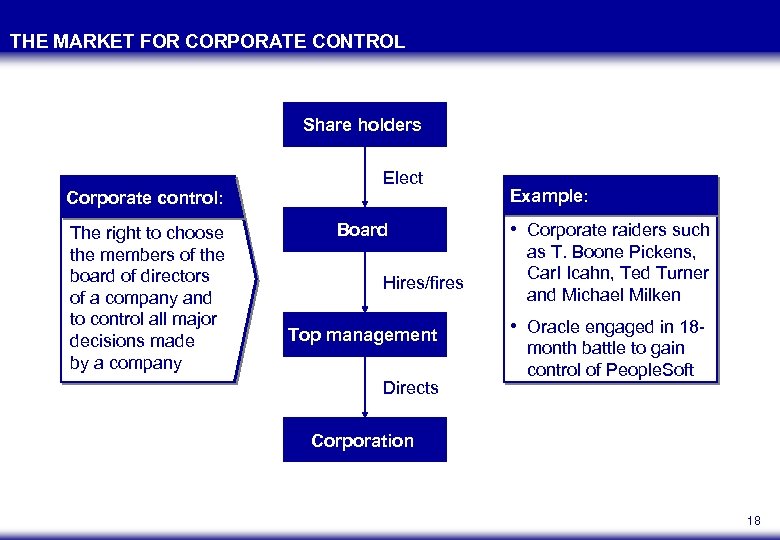

THE MARKET FOR CORPORATE CONTROL Share holders Corporate control: The right to choose the members of the board of directors of a company and to control all major decisions made by a company Elect Board Hires/fires Top management Directs Example: • Corporate raiders such as T. Boone Pickens, Car. I Icahn, Ted Turner and Michael Milken • Oracle engaged in 18 month battle to gain control of People. Soft Corporation 18

THE MARKET FOR CORPORATE CONTROL Share holders Corporate control: The right to choose the members of the board of directors of a company and to control all major decisions made by a company Elect Board Hires/fires Top management Directs Example: • Corporate raiders such as T. Boone Pickens, Car. I Icahn, Ted Turner and Michael Milken • Oracle engaged in 18 month battle to gain control of People. Soft Corporation 18

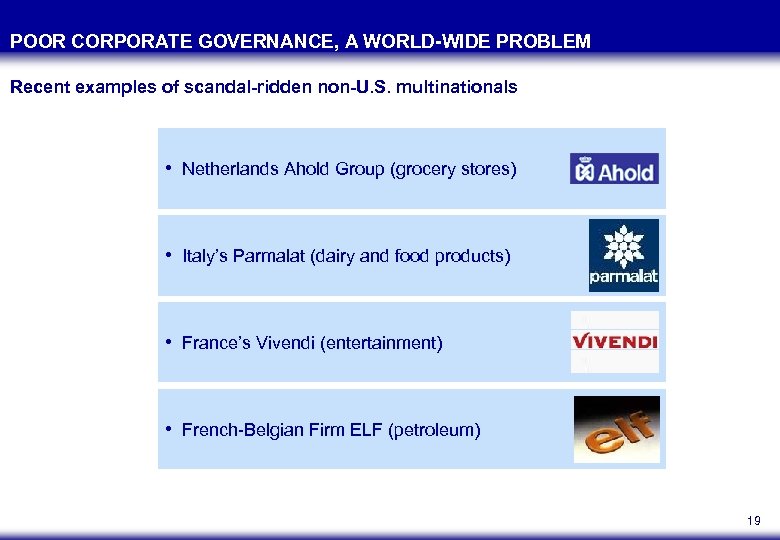

POOR CORPORATE GOVERNANCE, A WORLD-WIDE PROBLEM Recent examples of scandal-ridden non-U. S. multinationals • Netherlands Ahold Group (grocery stores) • Italy’s Parmalat (dairy and food products) • France’s Vivendi (entertainment) • French-Belgian Firm ELF (petroleum) 19

POOR CORPORATE GOVERNANCE, A WORLD-WIDE PROBLEM Recent examples of scandal-ridden non-U. S. multinationals • Netherlands Ahold Group (grocery stores) • Italy’s Parmalat (dairy and food products) • France’s Vivendi (entertainment) • French-Belgian Firm ELF (petroleum) 19

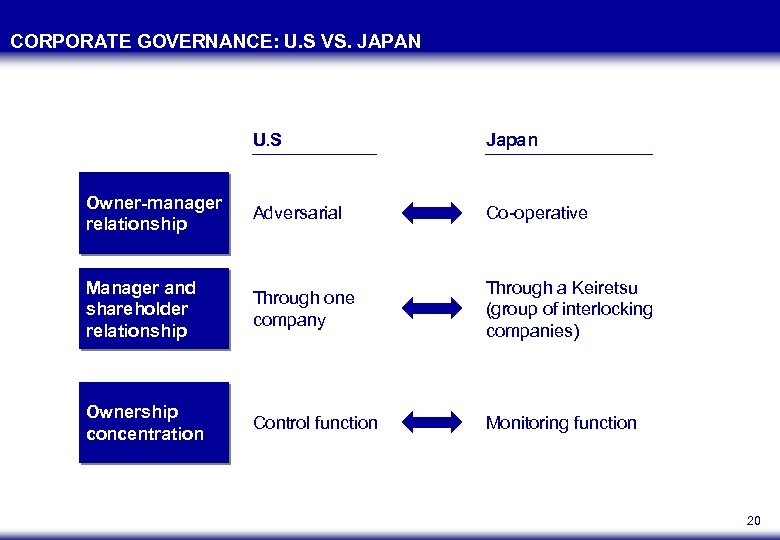

CORPORATE GOVERNANCE: U. S VS. JAPAN U. S Japan Owner-manager relationship Adversarial Co-operative Manager and shareholder relationship Through one company Through a Keiretsu (group of interlocking companies) Ownership concentration Control function Monitoring function 20

CORPORATE GOVERNANCE: U. S VS. JAPAN U. S Japan Owner-manager relationship Adversarial Co-operative Manager and shareholder relationship Through one company Through a Keiretsu (group of interlocking companies) Ownership concentration Control function Monitoring function 20