20fab589cb21a9025bf21fe58b987a37.ppt

- Количество слайдов: 40

Chapter 12 The Foreign Exchange Market

Chapter 12 The Foreign Exchange Market

Chapter Preview • We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: – Foreign Exchange Market – Exchange Rates in the Long Run – Exchange Rates in the Short Run – Explaining Changes in Exchange Rates Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

Chapter Preview • We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: – Foreign Exchange Market – Exchange Rates in the Long Run – Exchange Rates in the Short Run – Explaining Changes in Exchange Rates Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

Foreign Exchange Market • Most countries of the world have their own currencies: the U. S. , France, Brazil, and India, just to name a few. • The trading of currencies and banks deposits is what makes up the foreign exchange market. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 3

Foreign Exchange Market • Most countries of the world have their own currencies: the U. S. , France, Brazil, and India, just to name a few. • The trading of currencies and banks deposits is what makes up the foreign exchange market. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 3

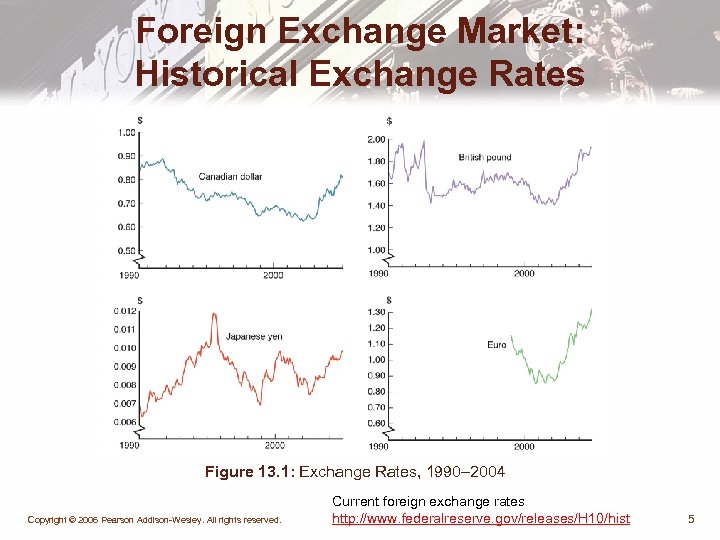

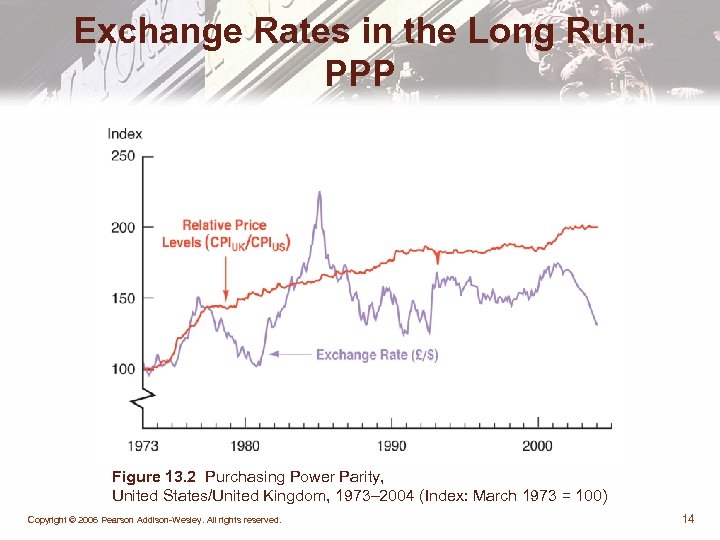

Foreign Exchange Market • The next slide shows exchange rates for four currencies from 1990 -2004. • Note the difference in rate fluctuations during the period. Which appears most volatile? The least? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

Foreign Exchange Market • The next slide shows exchange rates for four currencies from 1990 -2004. • Note the difference in rate fluctuations during the period. Which appears most volatile? The least? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

Foreign Exchange Market: Historical Exchange Rates Figure 13. 1: Exchange Rates, 1990– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Current foreign exchange rates http: //www. federalreserve. gov/releases/H 10/hist 5

Foreign Exchange Market: Historical Exchange Rates Figure 13. 1: Exchange Rates, 1990– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Current foreign exchange rates http: //www. federalreserve. gov/releases/H 10/hist 5

The Foreign Exchange Market • Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation 4. Depreciation Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

The Foreign Exchange Market • Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation 4. Depreciation Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

Foreign Exchange Market: Why Are Exchange Rates Important? • When the currency of your country appreciates relative to another country, your country's goods prices abroad and foreign goods prices in your country. 1. Makes domestic businesses less competitive 2. Benefits domestic consumers (you) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

Foreign Exchange Market: Why Are Exchange Rates Important? • When the currency of your country appreciates relative to another country, your country's goods prices abroad and foreign goods prices in your country. 1. Makes domestic businesses less competitive 2. Benefits domestic consumers (you) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

Foreign Exchange Market: How is Foreign Exchange Traded? • FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

Foreign Exchange Market: How is Foreign Exchange Traded? • FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

Exchange Rates in the Long Run • Exchange rates are determined in markets by the interaction of supply and demand. • An important concept that drives the forces of supply and demand is the Law of One Price. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

Exchange Rates in the Long Run • Exchange rates are determined in markets by the interaction of supply and demand. • An important concept that drives the forces of supply and demand is the Law of One Price. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

Exchange Rates in the Long Run: Law of One Price • The Law of One Price states that the price of an identical good will be the same throughout the world, regardless of which country produces it. • Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 10

Exchange Rates in the Long Run: Law of One Price • The Law of One Price states that the price of an identical good will be the same throughout the world, regardless of which country produces it. • Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 10

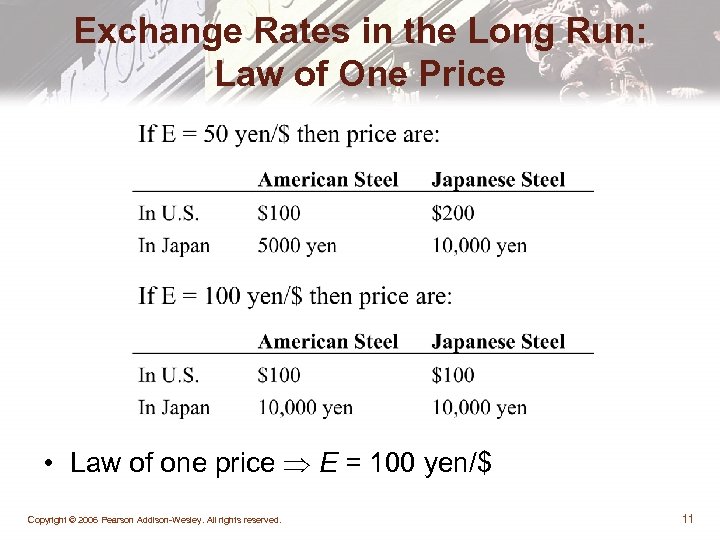

Exchange Rates in the Long Run: Law of One Price • Law of one price E = 100 yen/$ Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

Exchange Rates in the Long Run: Law of One Price • Law of one price E = 100 yen/$ Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

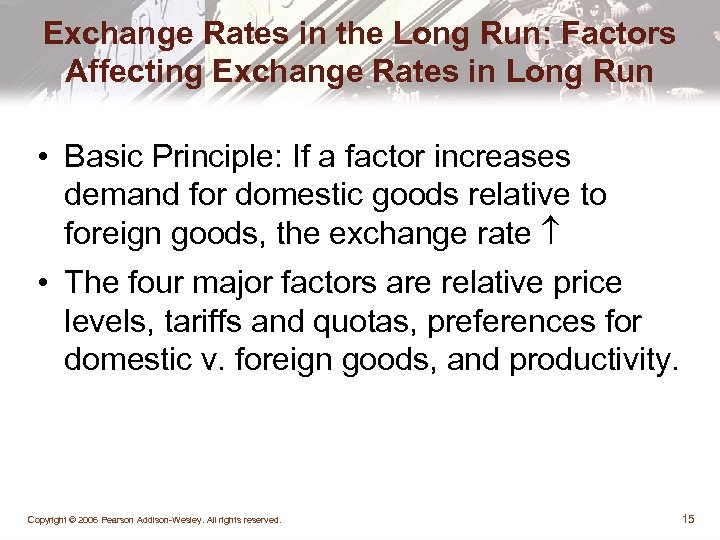

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) • The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. • PPP Domestic price level 10%, domestic currency 10% – Application of law of one price to price levels – Works in long run, not short run Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) • The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. • PPP Domestic price level 10%, domestic currency 10% – Application of law of one price to price levels – Works in long run, not short run Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) • Problems with PPP 1. All goods are not identical in both countries (i. e. , Toyota versus Chevy) 2. Many goods and services are not traded (e. g. , haircuts, land, etc. ) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) • Problems with PPP 1. All goods are not identical in both countries (i. e. , Toyota versus Chevy) 2. Many goods and services are not traded (e. g. , haircuts, land, etc. ) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13

Exchange Rates in the Long Run: PPP Figure 13. 2 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 14

Exchange Rates in the Long Run: PPP Figure 13. 2 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 14

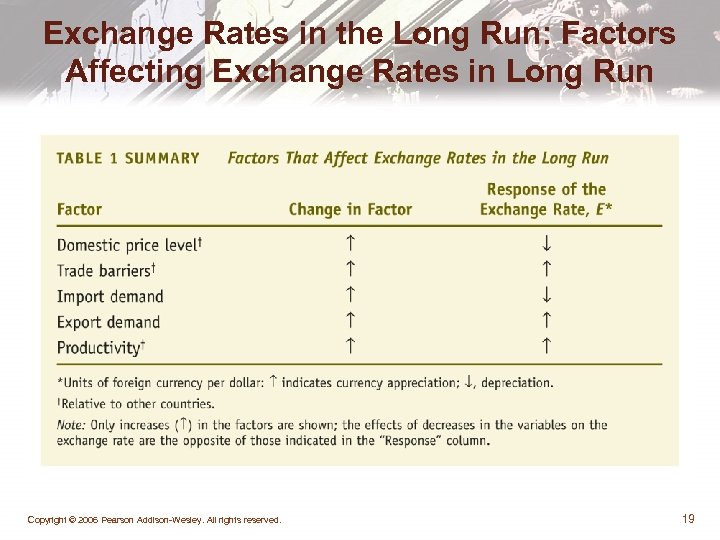

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate • The four major factors are relative price levels, tariffs and quotas, preferences for domestic v. foreign goods, and productivity. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 15

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate • The four major factors are relative price levels, tariffs and quotas, preferences for domestic v. foreign goods, and productivity. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 15

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Relative price levels: a rise in relative price levels cause a country’s currency to depreciate. • Tariffs and quotas: increasing trade barriers causes a country’s currency to appreciate. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 16

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Relative price levels: a rise in relative price levels cause a country’s currency to depreciate. • Tariffs and quotas: increasing trade barriers causes a country’s currency to appreciate. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 16

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Preferences for domestic v. foreign goods: increased demand for a country’s good causes its currency to appreciate; increased demand for imports causes the domestic currency to depreciate. • Productivity: if a country is more productive relative to another, its currency appreciates. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 17

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • Preferences for domestic v. foreign goods: increased demand for a country’s good causes its currency to appreciate; increased demand for imports causes the domestic currency to depreciate. • Productivity: if a country is more productive relative to another, its currency appreciates. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 17

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E, as units of foreign currency / 1 US dollar. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 18

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run • The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E, as units of foreign currency / 1 US dollar. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 18

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 19

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 19

Exchange Rates in the Short Run • In the short run, it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits. • Because of this, we will rely on the tools developed in Chapter 4 for the determinants of asset demand. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 20

Exchange Rates in the Short Run • In the short run, it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits. • Because of this, we will rely on the tools developed in Chapter 4 for the determinants of asset demand. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 20

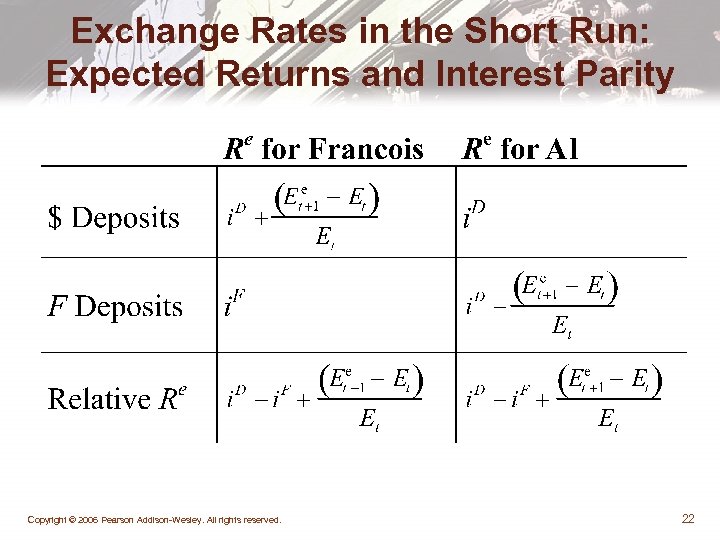

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits • We will illustrate this with a simple example • Francois the Foreigner can deposit excess euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future exchange rates. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 21

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits • We will illustrate this with a simple example • Francois the Foreigner can deposit excess euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future exchange rates. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 21

Exchange Rates in the Short Run: Expected Returns and Interest Parity Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 22

Exchange Rates in the Short Run: Expected Returns and Interest Parity Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 22

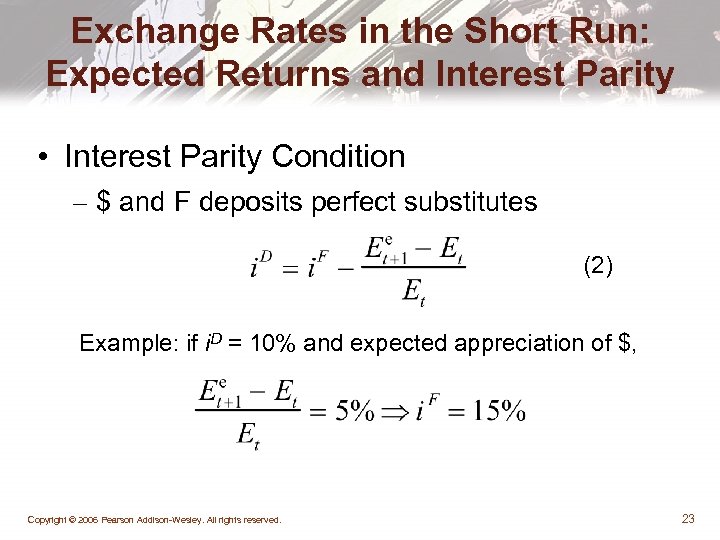

Exchange Rates in the Short Run: Expected Returns and Interest Parity • Interest Parity Condition – $ and F deposits perfect substitutes (2) Example: if i. D = 10% and expected appreciation of $, Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 23

Exchange Rates in the Short Run: Expected Returns and Interest Parity • Interest Parity Condition – $ and F deposits perfect substitutes (2) Example: if i. D = 10% and expected appreciation of $, Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 23

Exchange Rates in the Short Run: Expected Returns and Interest Parity • To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. • Next, we must determine the expected return in terms of dollars on dollar deposits, RD. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 24

Exchange Rates in the Short Run: Expected Returns and Interest Parity • To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. • Next, we must determine the expected return in terms of dollars on dollar deposits, RD. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 24

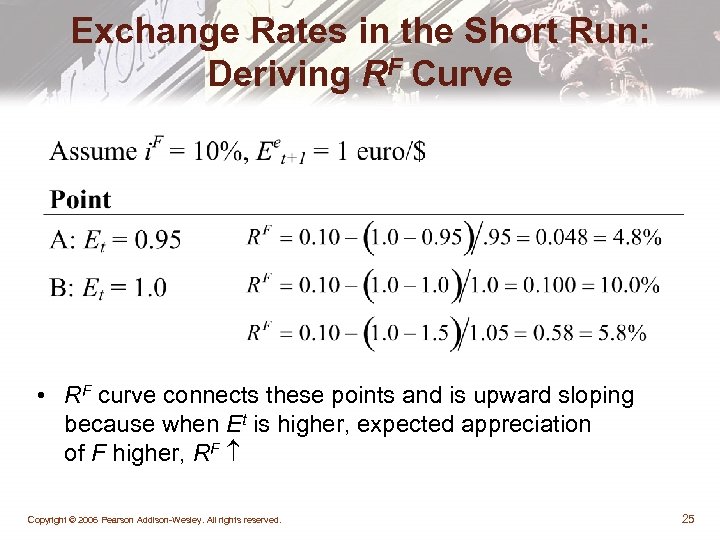

Exchange Rates in the Short Run: Deriving RF Curve • RF curve connects these points and is upward sloping because when Et is higher, expected appreciation of F higher, RF Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 25

Exchange Rates in the Short Run: Deriving RF Curve • RF curve connects these points and is upward sloping because when Et is higher, expected appreciation of F higher, RF Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 25

Exchange Rates in the Short Run: Deriving RD Curve • Deriving RD Curve – Points B, D, E, RD = 10%, so curve is vertical Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 26

Exchange Rates in the Short Run: Deriving RD Curve • Deriving RD Curve – Points B, D, E, RD = 10%, so curve is vertical Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 26

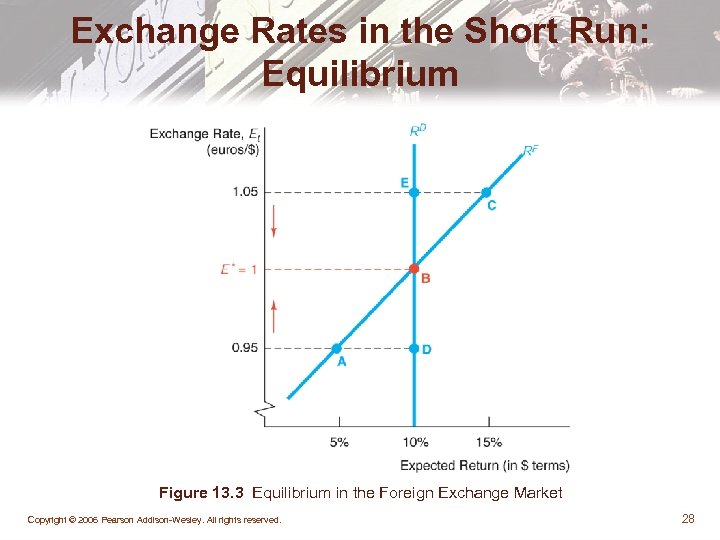

Exchange Rates in the Short Run: Equilibrium • Equilibrium – RD = RF at E* – If Et > E*, RF > RD, sell $, Et – If Et < E*, RF < RD, buy $, Et • The following figure illustrates this. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 27

Exchange Rates in the Short Run: Equilibrium • Equilibrium – RD = RF at E* – If Et > E*, RF > RD, sell $, Et – If Et < E*, RF < RD, buy $, Et • The following figure illustrates this. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 27

Exchange Rates in the Short Run: Equilibrium Figure 13. 3 Equilibrium in the Foreign Exchange Market Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 28

Exchange Rates in the Short Run: Equilibrium Figure 13. 3 Equilibrium in the Foreign Exchange Market Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 28

Explaining Changes in Exchange Rates • To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. • We will examine these separately, as well as changes in the money supply and exchange rate overshooting. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 29

Explaining Changes in Exchange Rates • To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. • We will examine these separately, as well as changes in the money supply and exchange rate overshooting. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 29

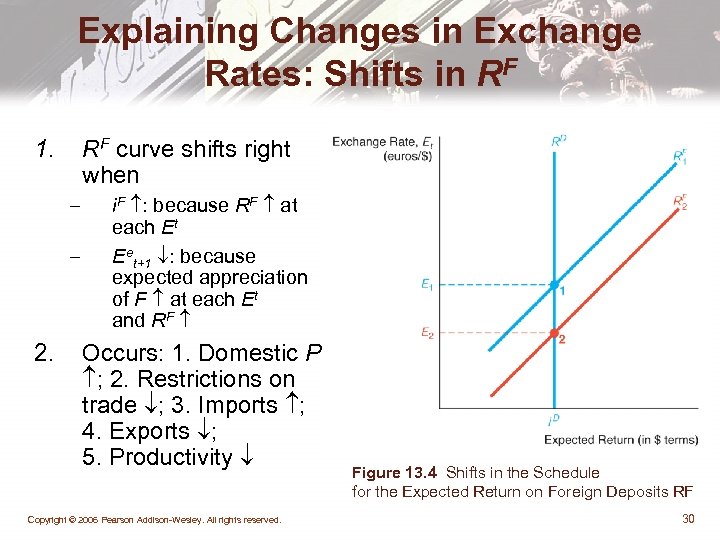

Explaining Changes in Exchange Rates: Shifts in RF 1. RF curve shifts right when – – 2. i. F : because RF at each Et Eet+1 : because expected appreciation of F at each Et and RF Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Figure 13. 4 Shifts in the Schedule for the Expected Return on Foreign Deposits RF 30

Explaining Changes in Exchange Rates: Shifts in RF 1. RF curve shifts right when – – 2. i. F : because RF at each Et Eet+1 : because expected appreciation of F at each Et and RF Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Figure 13. 4 Shifts in the Schedule for the Expected Return on Foreign Deposits RF 30

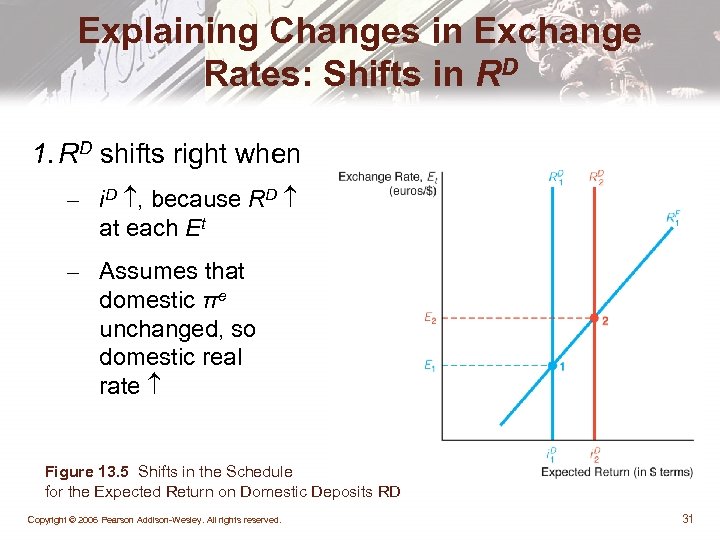

Explaining Changes in Exchange Rates: Shifts in RD 1. RD shifts right when – i. D , because RD at each Et – Assumes that domestic πe unchanged, so domestic real rate Figure 13. 5 Shifts in the Schedule for the Expected Return on Domestic Deposits RD Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 31

Explaining Changes in Exchange Rates: Shifts in RD 1. RD shifts right when – i. D , because RD at each Et – Assumes that domestic πe unchanged, so domestic real rate Figure 13. 5 Shifts in the Schedule for the Expected Return on Domestic Deposits RD Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 31

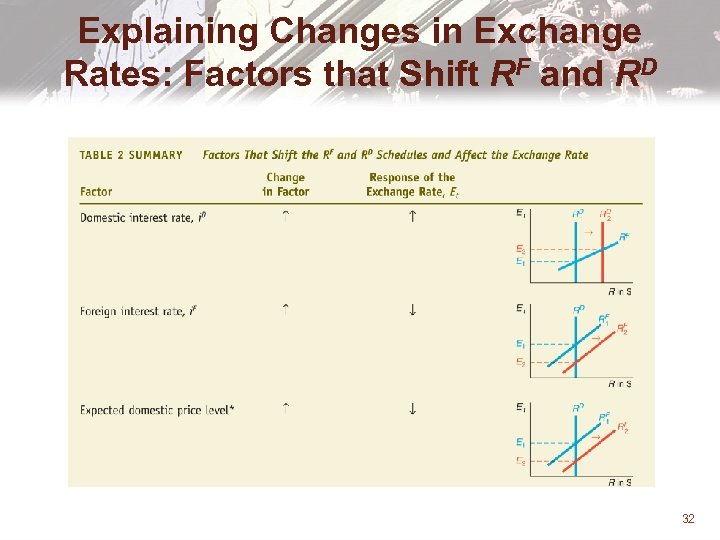

Explaining Changes in Exchange Rates: Factors that Shift RF and RD 32

Explaining Changes in Exchange Rates: Factors that Shift RF and RD 32

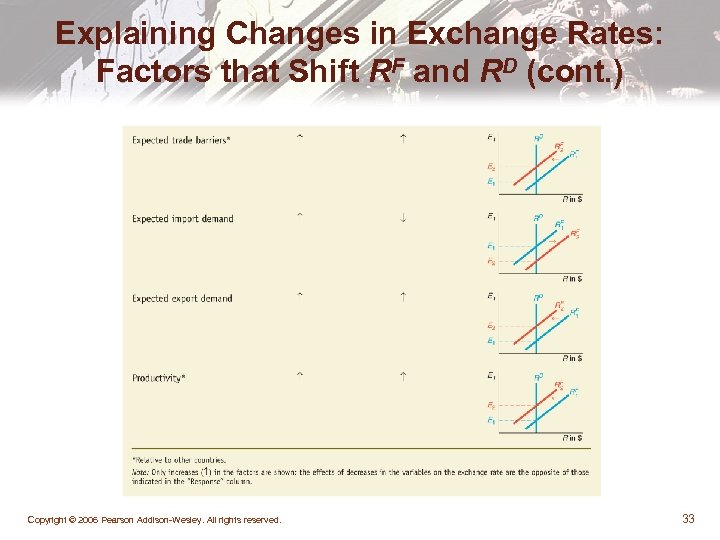

Explaining Changes in Exchange Rates: Factors that Shift RF and RD (cont. ) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 33

Explaining Changes in Exchange Rates: Factors that Shift RF and RD (cont. ) Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 33

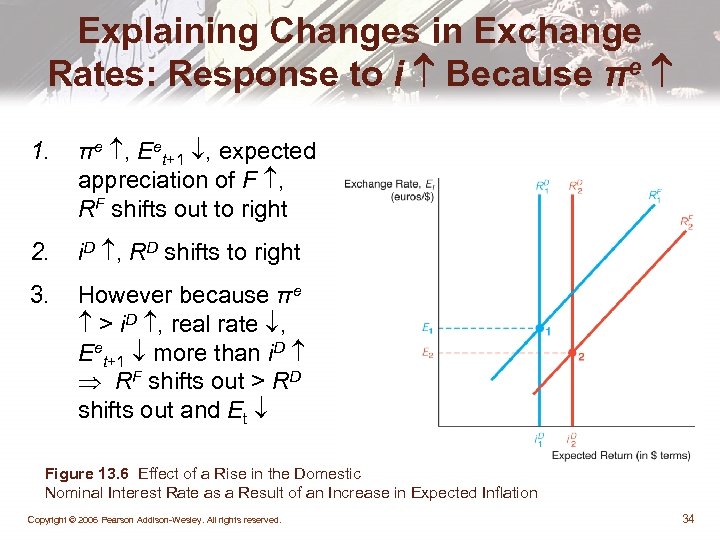

Explaining Changes in Exchange Rates: Response to i Because πe 1. πe , Eet+1 , expected appreciation of F , RF shifts out to right 2. i. D , RD shifts to right 3. However because πe > i. D , real rate , Eet+1 more than i. D RF shifts out > RD shifts out and Et Figure 13. 6 Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 34

Explaining Changes in Exchange Rates: Response to i Because πe 1. πe , Eet+1 , expected appreciation of F , RF shifts out to right 2. i. D , RD shifts to right 3. However because πe > i. D , real rate , Eet+1 more than i. D RF shifts out > RD shifts out and Et Figure 13. 6 Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 34

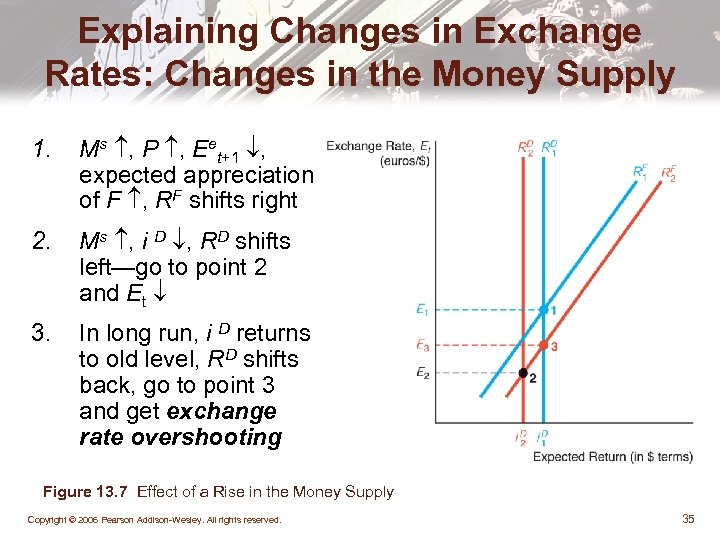

Explaining Changes in Exchange Rates: Changes in the Money Supply 1. Ms , P , Eet+1 , expected appreciation of F , RF shifts right 2. Ms , i D , RD shifts left—go to point 2 and Et 3. In long run, i D returns to old level, RD shifts back, go to point 3 and get exchange rate overshooting Figure 13. 7 Effect of a Rise in the Money Supply Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 35

Explaining Changes in Exchange Rates: Changes in the Money Supply 1. Ms , P , Eet+1 , expected appreciation of F , RF shifts right 2. Ms , i D , RD shifts left—go to point 2 and Et 3. In long run, i D returns to old level, RD shifts back, go to point 3 and get exchange rate overshooting Figure 13. 7 Effect of a Rise in the Money Supply Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 35

Case: Why are Exchange Rates So Volatile • Expectations of Eet+1 fluctuate • Exchange rate overshooting Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 36

Case: Why are Exchange Rates So Volatile • Expectations of Eet+1 fluctuate • Exchange rate overshooting Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 36

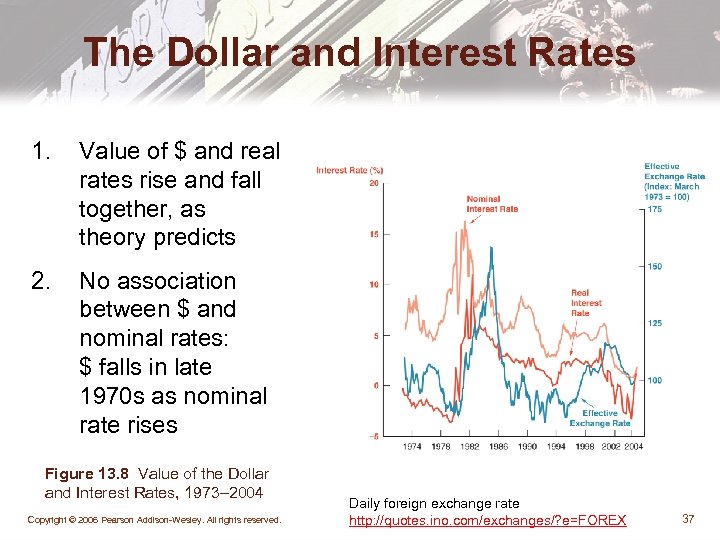

The Dollar and Interest Rates 1. Value of $ and real rates rise and fall together, as theory predicts 2. No association between $ and nominal rates: $ falls in late 1970 s as nominal rate rises Figure 13. 8 Value of the Dollar and Interest Rates, 1973– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX 37

The Dollar and Interest Rates 1. Value of $ and real rates rise and fall together, as theory predicts 2. No association between $ and nominal rates: $ falls in late 1970 s as nominal rate rises Figure 13. 8 Value of the Dollar and Interest Rates, 1973– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX 37

The Practicing Manger: Profiting from FX Forecasts • Forecasters look at factors discussed here • FX forecasts affect financial institutions managers' decisions • If forecast yen appreciate, yen depreciate, – Sell franc assets, buy euro assets – Make more euros loans, less yen loans – FX traders sell yen, buy euros Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 38

The Practicing Manger: Profiting from FX Forecasts • Forecasters look at factors discussed here • FX forecasts affect financial institutions managers' decisions • If forecast yen appreciate, yen depreciate, – Sell franc assets, buy euro assets – Make more euros loans, less yen loans – FX traders sell yen, buy euros Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 38

Chapter Summary • Foreign Exchange Market: the market for deposits in one currency versus deposits in another. • Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 39

Chapter Summary • Foreign Exchange Market: the market for deposits in one currency versus deposits in another. • Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 39

Chapter Summary (cont. ) • Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. • Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 40

Chapter Summary (cont. ) • Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. • Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 40