5ff771d9a2db092d908c091fa38871a9.ppt

- Количество слайдов: 99

Chapter 12 Pricing

Chapter 12 Pricing

Key issues 1. 2. 3. 4. 5. 6. why and how firms price discriminate perfect price discrimination quantity discrimination multimarket price discrimination two-part tariffs tie-in sales

Key issues 1. 2. 3. 4. 5. 6. why and how firms price discriminate perfect price discrimination quantity discrimination multimarket price discrimination two-part tariffs tie-in sales

Nonuniform pricing prices vary across customers or units • noncompetitive firms use nonuniform pricing to increase profits •

Nonuniform pricing prices vary across customers or units • noncompetitive firms use nonuniform pricing to increase profits •

Single-price firm • nondiscriminating firm faces a trade-off between charging maximum price to consumers who really want good • low enough price that less enthusiastic customers still buy • • as a result, single-price firm usually sets an intermediate price

Single-price firm • nondiscriminating firm faces a trade-off between charging maximum price to consumers who really want good • low enough price that less enthusiastic customers still buy • • as a result, single-price firm usually sets an intermediate price

Price-discriminating firm avoids this trade-off • earns a higher profit by charging • higher price to those willing to pay more than the uniform price: captures their consumer surplus • lower price to those not willing to pay as much as the uniform price: extra sales •

Price-discriminating firm avoids this trade-off • earns a higher profit by charging • higher price to those willing to pay more than the uniform price: captures their consumer surplus • lower price to those not willing to pay as much as the uniform price: extra sales •

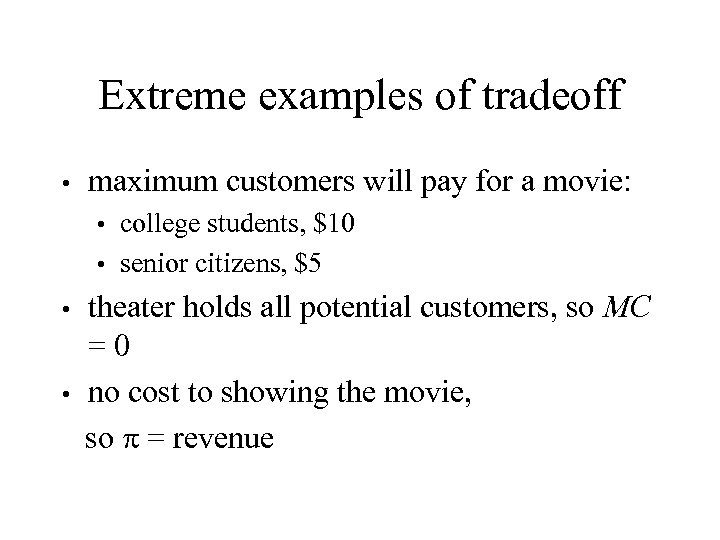

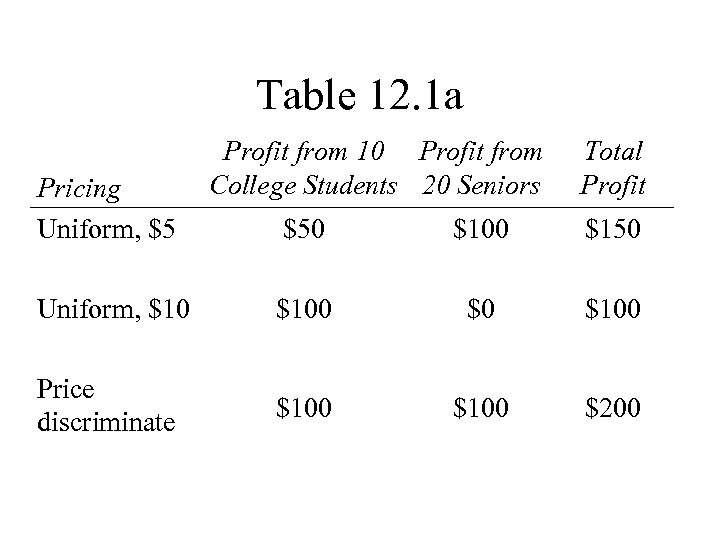

Extreme examples of tradeoff • maximum customers will pay for a movie: college students, $10 • senior citizens, $5 • theater holds all potential customers, so MC =0 • no cost to showing the movie, so = revenue •

Extreme examples of tradeoff • maximum customers will pay for a movie: college students, $10 • senior citizens, $5 • theater holds all potential customers, so MC =0 • no cost to showing the movie, so = revenue •

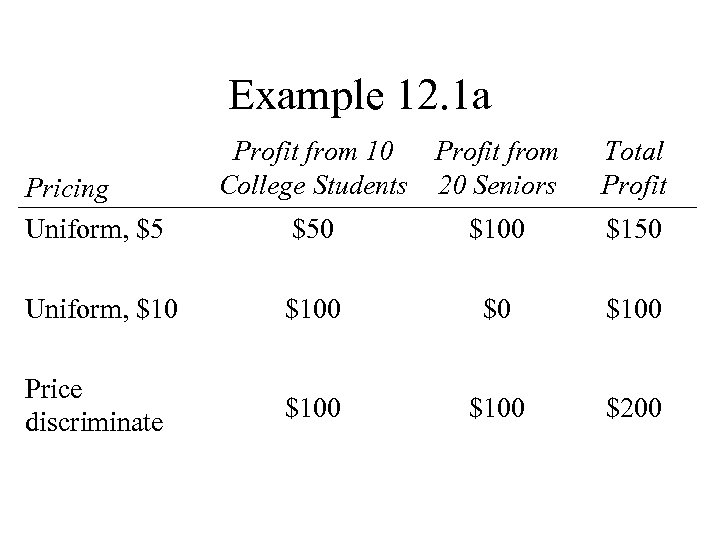

Example 12. 1 a Pricing Uniform, $5 Profit from 10 Profit from College Students 20 Seniors Total Profit $50 $100 $150 Uniform, $100 $0 $100 Price discriminate $100 $200

Example 12. 1 a Pricing Uniform, $5 Profit from 10 Profit from College Students 20 Seniors Total Profit $50 $100 $150 Uniform, $100 $0 $100 Price discriminate $100 $200

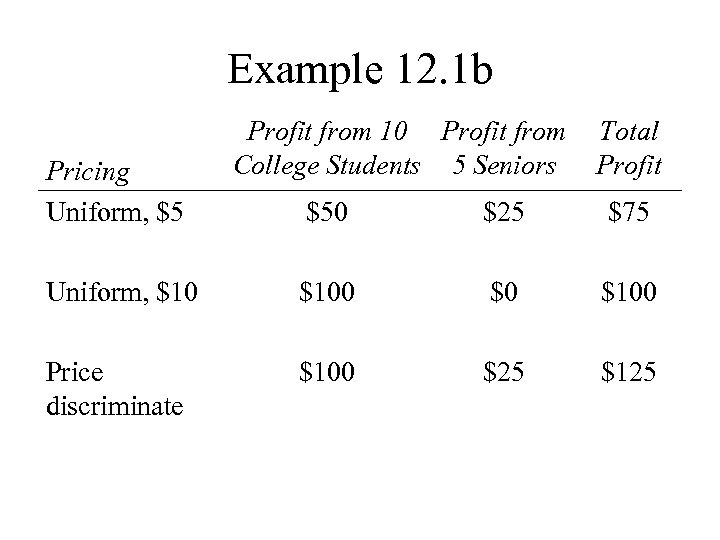

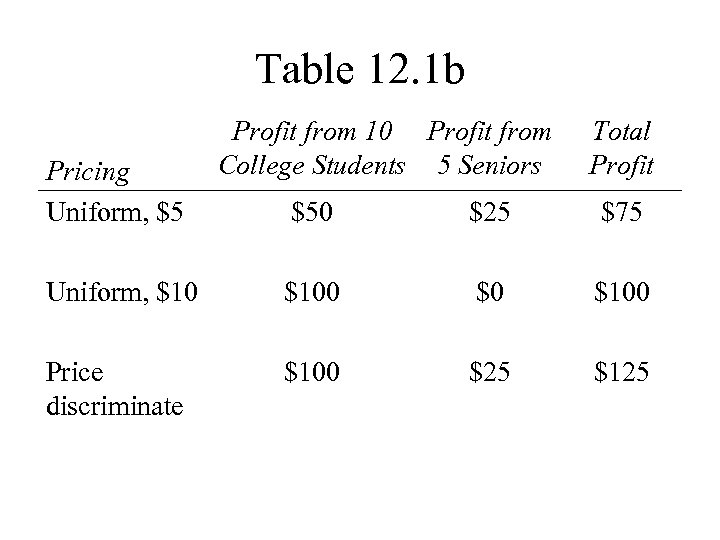

Example 12. 1 b Pricing Uniform, $5 Profit from 10 Profit from College Students 5 Seniors Total Profit $50 $25 $75 Uniform, $100 $0 $100 Price discriminate $100 $25 $125

Example 12. 1 b Pricing Uniform, $5 Profit from 10 Profit from College Students 5 Seniors Total Profit $50 $25 $75 Uniform, $100 $0 $100 Price discriminate $100 $25 $125

Broadway theaters increase their profits 5% by price discriminating rather than by setting uniform prices

Broadway theaters increase their profits 5% by price discriminating rather than by setting uniform prices

Geographic price discrimination • admission to Disneyland is $38 for out-ofstate adults and $28 for southern Californians • tuition at New York’s Fordham University is $4, 000 less for commuting first-year students than for others

Geographic price discrimination • admission to Disneyland is $38 for out-ofstate adults and $28 for southern Californians • tuition at New York’s Fordham University is $4, 000 less for commuting first-year students than for others

Successful price discrimination • • • requires that firm have market power consumers have different demand elasticities, and firm can identify how consumers differ firm must be able to prevent or limit resales to higher-price-paying customers by others

Successful price discrimination • • • requires that firm have market power consumers have different demand elasticities, and firm can identify how consumers differ firm must be able to prevent or limit resales to higher-price-paying customers by others

Preventing resales are difficult or impossible when transaction costs are high • resales are impossible for most services •

Preventing resales are difficult or impossible when transaction costs are high • resales are impossible for most services •

Prevent resales by raising transaction costs price-discriminating firms raise transaction costs to make resales difficult • applications: • U. C. Berkeley requires anyone with a student ticket to show a student picture ID • Nikon warranties cover only cameras sold in this country •

Prevent resales by raising transaction costs price-discriminating firms raise transaction costs to make resales difficult • applications: • U. C. Berkeley requires anyone with a student ticket to show a student picture ID • Nikon warranties cover only cameras sold in this country •

Prevent resales by vertically integrating VI: participate in more than one successive stage of the production and distribution chain for a good or service • VI into the low-price purchasers •

Prevent resales by vertically integrating VI: participate in more than one successive stage of the production and distribution chain for a good or service • VI into the low-price purchasers •

Prevent resales by government intervention governments require that milk producers charge higher price for fresh use than for processing (cheese, ice cream) and forbid resales • governments set tariffs limiting resales by making it expensive to import goods from lower-price countries • governments used trade laws to prevent sales of certain brand-name perfumes except by their manufacturers •

Prevent resales by government intervention governments require that milk producers charge higher price for fresh use than for processing (cheese, ice cream) and forbid resales • governments set tariffs limiting resales by making it expensive to import goods from lower-price countries • governments used trade laws to prevent sales of certain brand-name perfumes except by their manufacturers •

Flight of the Thunderbirds • 2002 production run of 25, 000 new Thunderbirds included only 2, 000 for Canada potential buyers are besieging Ford dealers in Canada • many hope to make a quick profit by reselling these cars in the United States • reselling is relatively easy and shipping costs are relatively low • • why a T-Bird south? Ford is price discriminating between U. S. and Canadian customers • at the end of 2001, Canadians were paying $56, 550 Cdn. (Thunderbird with the optional hardtop), while U. S. customers were spending up to $73, 000 Cdn. •

Flight of the Thunderbirds • 2002 production run of 25, 000 new Thunderbirds included only 2, 000 for Canada potential buyers are besieging Ford dealers in Canada • many hope to make a quick profit by reselling these cars in the United States • reselling is relatively easy and shipping costs are relatively low • • why a T-Bird south? Ford is price discriminating between U. S. and Canadian customers • at the end of 2001, Canadians were paying $56, 550 Cdn. (Thunderbird with the optional hardtop), while U. S. customers were spending up to $73, 000 Cdn. •

Thunderbirds (cont. ) • Canadian dealers try not to sell to buyers who will export the cars dealers have signed an agreement with Ford that explicitly prohibits moving vehicles to the United States • dealers try to prevent resales because otherwise Ford may cut off their Thunderbirds or remove their dealership license • one dealer said, “It’s got to the point that if we haven’t sold you a car in the past, or we don’t otherwise know you, we’re not selling you one. ” • nonetheless, many Thunderbirds were exported: e. Bay listed dozen of these cars on a typical day •

Thunderbirds (cont. ) • Canadian dealers try not to sell to buyers who will export the cars dealers have signed an agreement with Ford that explicitly prohibits moving vehicles to the United States • dealers try to prevent resales because otherwise Ford may cut off their Thunderbirds or remove their dealership license • one dealer said, “It’s got to the point that if we haven’t sold you a car in the past, or we don’t otherwise know you, we’re not selling you one. ” • nonetheless, many Thunderbirds were exported: e. Bay listed dozen of these cars on a typical day •

3 types of price discrimination • • • perfect price discrimination (first-degree): sell each unit for the most each customer is willing to pay quantity discrimination (second-degree): charges a different price for larger quantities than for smaller ones multimarket price discrimination (third-degree): charge groups of customers different prices

3 types of price discrimination • • • perfect price discrimination (first-degree): sell each unit for the most each customer is willing to pay quantity discrimination (second-degree): charges a different price for larger quantities than for smaller ones multimarket price discrimination (third-degree): charge groups of customers different prices

Perfect-price-discriminating monopoly has market power • can prevent resales • knows how much each customer is willing to pay for each unit purchase (all knowing) •

Perfect-price-discriminating monopoly has market power • can prevent resales • knows how much each customer is willing to pay for each unit purchase (all knowing) •

All-knowing monopoly sells each unit at its reservation price maximum price consumers will pay (captures all possible consumer surplus) • height of demand curve • MR is the same as its price (AR) •

All-knowing monopoly sells each unit at its reservation price maximum price consumers will pay (captures all possible consumer surplus) • height of demand curve • MR is the same as its price (AR) •

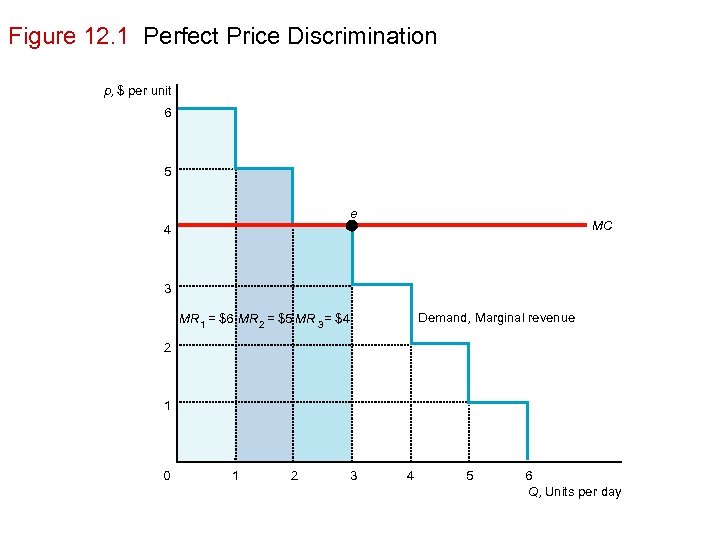

Figure 12. 1 Perfect Price Discrimination p, $ per unit 6 5 e MC 4 3 Demand, Marginal revenue MR 1 = $6 MR 2 = $5 MR 3 = $4 2 1 0 1 2 3 4 5 6 Q, Units per day

Figure 12. 1 Perfect Price Discrimination p, $ per unit 6 5 e MC 4 3 Demand, Marginal revenue MR 1 = $6 MR 2 = $5 MR 3 = $4 2 1 0 1 2 3 4 5 6 Q, Units per day

Perfect price discrimination properties perfect price discrimination is efficient • competition and a perfectly discriminating monopoly • sell the same quantity • maximize total welfare: W = CS + PS • have no deadweight loss • • consumers worse off (CS = 0) than with competition

Perfect price discrimination properties perfect price discrimination is efficient • competition and a perfectly discriminating monopoly • sell the same quantity • maximize total welfare: W = CS + PS • have no deadweight loss • • consumers worse off (CS = 0) than with competition

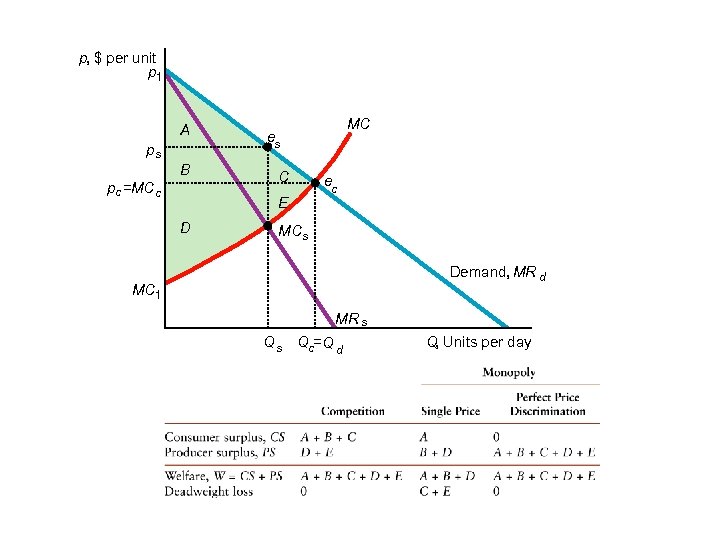

p, $ per unit p 1 A ps B pc =MC c C E D MC es ec MCs Demand, MR d MC 1 MR s Qc= Q d Q, Units per day

p, $ per unit p 1 A ps B pc =MC c C E D MC es ec MCs Demand, MR d MC 1 MR s Qc= Q d Q, Units per day

Amazon in 2000, Amazon revealed that it used “dynamic pricing”: gauges shopper’s desire and means, charges accordingly • example • a man ordered DVD of Julie Taymor’s “Titus” at $24. 49 • checks back next week and finds price is $26. 24 • removes cookie: price fell to $22. 74 • • after newspaper articles, Amazon announced it had dropped this policy

Amazon in 2000, Amazon revealed that it used “dynamic pricing”: gauges shopper’s desire and means, charges accordingly • example • a man ordered DVD of Julie Taymor’s “Titus” at $24. 49 • checks back next week and finds price is $26. 24 • removes cookie: price fell to $22. 74 • • after newspaper articles, Amazon announced it had dropped this policy

Botox revisited • how much more would Allergan earn from Botox if it could perfectly price discriminate?

Botox revisited • how much more would Allergan earn from Botox if it could perfectly price discriminate?

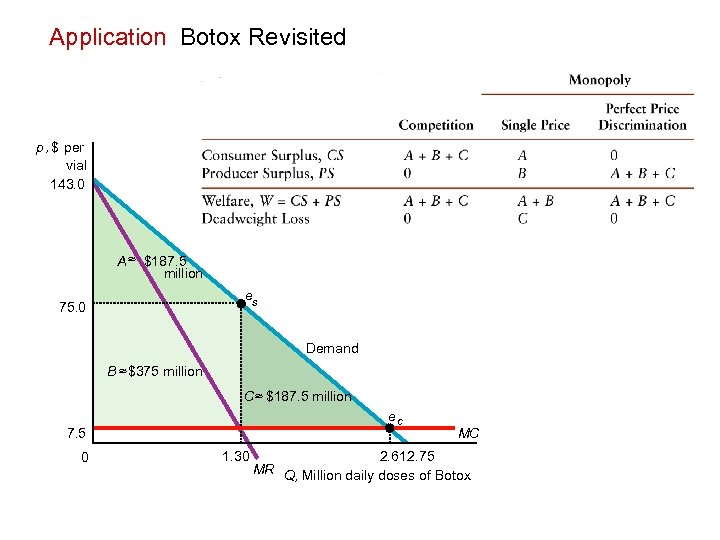

Application Botox Revisited p , $ per vial 143. 0 A ≈ $187. 5 million es 75. 0 Demand B ≈ $375 million C ≈ $187. 5 million ec 7. 5 0 1. 30 MC 2. 612. 75 MR Q, Million daily doses of Botox

Application Botox Revisited p , $ per vial 143. 0 A ≈ $187. 5 million es 75. 0 Demand B ≈ $375 million C ≈ $187. 5 million ec 7. 5 0 1. 30 MC 2. 612. 75 MR Q, Million daily doses of Botox

Solved problem How does welfare change if firm in Table 12. 1 goes from charging a single price to perfectly price discriminating?

Solved problem How does welfare change if firm in Table 12. 1 goes from charging a single price to perfectly price discriminating?

Table 12. 1 a Pricing Uniform, $5 Profit from 10 Profit from College Students 20 Seniors Total Profit $50 $100 $150 Uniform, $100 $0 $100 Price discriminate $100 $200

Table 12. 1 a Pricing Uniform, $5 Profit from 10 Profit from College Students 20 Seniors Total Profit $50 $100 $150 Uniform, $100 $0 $100 Price discriminate $100 $200

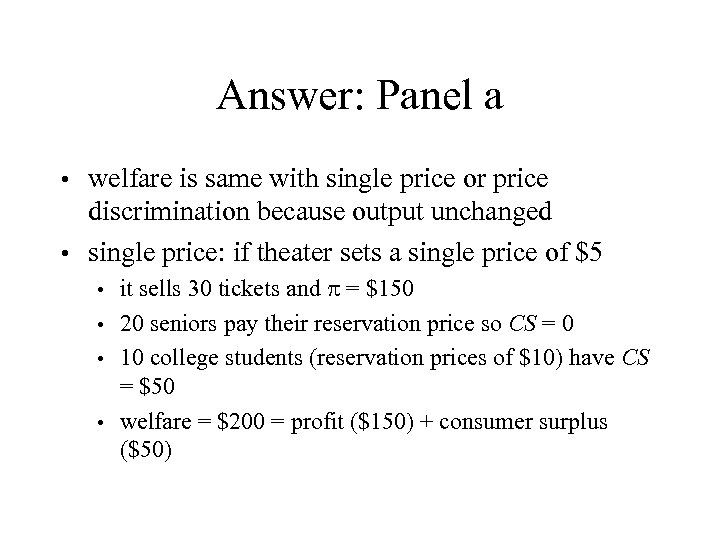

Answer: Panel a welfare is same with single price or price discrimination because output unchanged • single price: if theater sets a single price of $5 • it sells 30 tickets and = $150 • 20 seniors pay their reservation price so CS = 0 • 10 college students (reservation prices of $10) have CS = $50 • welfare = $200 = profit ($150) + consumer surplus ($50) •

Answer: Panel a welfare is same with single price or price discrimination because output unchanged • single price: if theater sets a single price of $5 • it sells 30 tickets and = $150 • 20 seniors pay their reservation price so CS = 0 • 10 college students (reservation prices of $10) have CS = $50 • welfare = $200 = profit ($150) + consumer surplus ($50) •

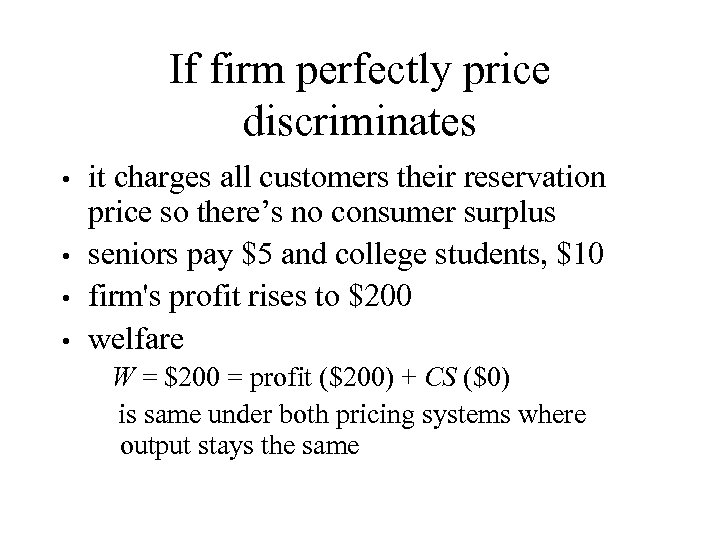

If firm perfectly price discriminates it charges all customers their reservation price so there’s no consumer surplus • seniors pay $5 and college students, $10 • firm's profit rises to $200 • welfare • W = $200 = profit ($200) + CS ($0) is same under both pricing systems where output stays the same

If firm perfectly price discriminates it charges all customers their reservation price so there’s no consumer surplus • seniors pay $5 and college students, $10 • firm's profit rises to $200 • welfare • W = $200 = profit ($200) + CS ($0) is same under both pricing systems where output stays the same

Table 12. 1 b Pricing Uniform, $5 Profit from 10 Profit from College Students 5 Seniors Total Profit $50 $25 $75 Uniform, $100 $0 $100 Price discriminate $100 $25 $125

Table 12. 1 b Pricing Uniform, $5 Profit from 10 Profit from College Students 5 Seniors Total Profit $50 $25 $75 Uniform, $100 $0 $100 Price discriminate $100 $25 $125

Answer: Panel b welfare is greater with perfect price discrimination where output increases • if theater sets single price of $10 • only college students attend and have CS = 0 • = $100 • W = $100 • • if it perfectly price discriminates: CS = 0 • =$125 • W = $125 •

Answer: Panel b welfare is greater with perfect price discrimination where output increases • if theater sets single price of $10 • only college students attend and have CS = 0 • = $100 • W = $100 • • if it perfectly price discriminates: CS = 0 • =$125 • W = $125 •

Quantity discrimination firm does not know which customers have highest reservation prices • firm might know most customers are willing to pay more for first unit (demand slopes down) • firm varies price each customer pays with number of units customer buys • price varies only with quantity: all customers pay the same price for a given quantity • note: not all quantity discounts are a form of price discrimination •

Quantity discrimination firm does not know which customers have highest reservation prices • firm might know most customers are willing to pay more for first unit (demand slopes down) • firm varies price each customer pays with number of units customer buys • price varies only with quantity: all customers pay the same price for a given quantity • note: not all quantity discounts are a form of price discrimination •

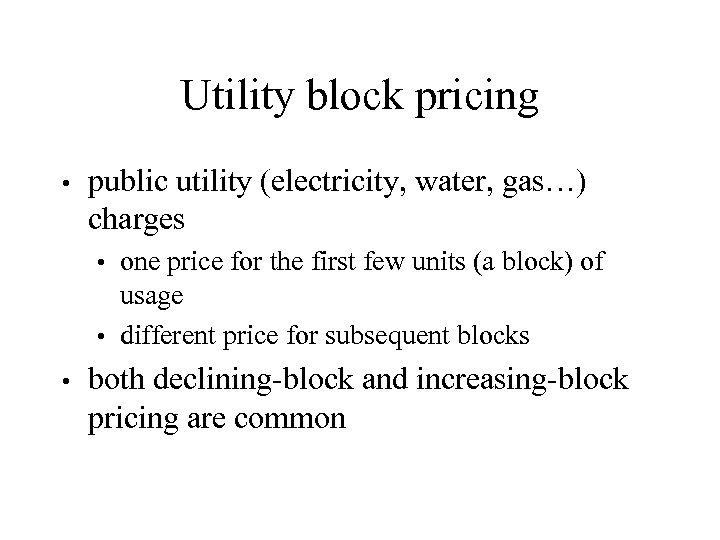

Utility block pricing • public utility (electricity, water, gas…) charges one price for the first few units (a block) of usage • different price for subsequent blocks • • both declining-block and increasing-block pricing are common

Utility block pricing • public utility (electricity, water, gas…) charges one price for the first few units (a block) of usage • different price for subsequent blocks • • both declining-block and increasing-block pricing are common

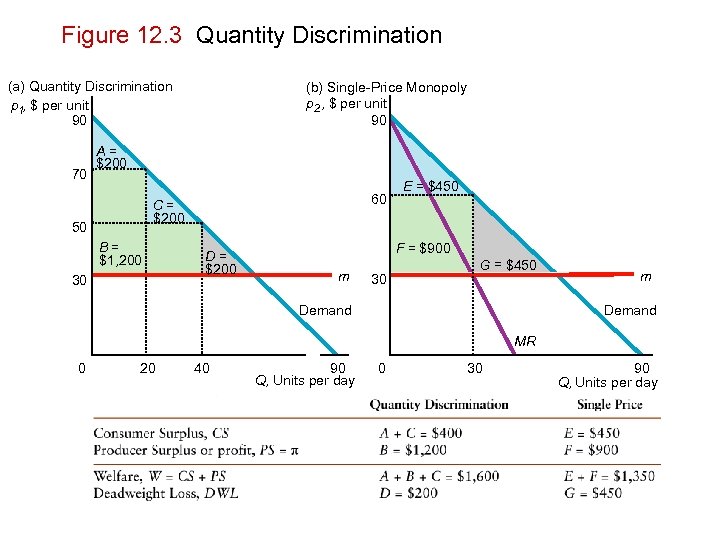

Figure 12. 3 Quantity Discrimination (a) Quantity Discrimination p 1, $ per unit 90 70 (b) Single-Price Monopoly p 2 , $ per unit 90 A= $200 60 C= $200 50 B= $1, 200 30 D= $200 E = $450 F = $900 m 30 G = $450 m Demand MR 0 20 40 90 Q, Units per day 0 30 90 Q, Units per day

Figure 12. 3 Quantity Discrimination (a) Quantity Discrimination p 1, $ per unit 90 70 (b) Single-Price Monopoly p 2 , $ per unit 90 A= $200 60 C= $200 50 B= $1, 200 30 D= $200 E = $450 F = $900 m 30 G = $450 m Demand MR 0 20 40 90 Q, Units per day 0 30 90 Q, Units per day

Multimarket price discrimination firm knows only which groups of customers are likely to have higher reservation prices than others • firm divides potential customers into two or more groups • firms set a different price for each group •

Multimarket price discrimination firm knows only which groups of customers are likely to have higher reservation prices than others • firm divides potential customers into two or more groups • firms set a different price for each group •

Theater senior citizens pay a lower price than younger adults at movie theaters • by admitting people as soon as they demonstrate their age and buy tickets, theater prevents resales •

Theater senior citizens pay a lower price than younger adults at movie theaters • by admitting people as soon as they demonstrate their age and buy tickets, theater prevents resales •

International price discrimination: Cars • even including shipping and customs, European price for BMW 750 IL • price is 13. 6% more from an American firm than imported from Europe

International price discrimination: Cars • even including shipping and customs, European price for BMW 750 IL • price is 13. 6% more from an American firm than imported from Europe

International price discrimination: Software Australia's Prices Surveillance Agency criticized American software industry for charging Australians 49% more than Americans, • then, Agency called for an end to import restrictions so that Australian retailers could import software directly •

International price discrimination: Software Australia's Prices Surveillance Agency criticized American software industry for charging Australians 49% more than Americans, • then, Agency called for an end to import restrictions so that Australian retailers could import software directly •

Price discriminating: 2 groups marginal cost = m • monopoly charges Group i members pi for Qi units • profit from Group i is i= pi. Qi – m. Qi •

Price discriminating: 2 groups marginal cost = m • monopoly charges Group i members pi for Qi units • profit from Group i is i= pi. Qi – m. Qi •

To maximize total profit monopoly sets its quantities so that marginal revenue for each group i, MRi, equals common marginal cost, m: MR 1 = m = MR 2. • example: Sony’s Aibo robot dog •

To maximize total profit monopoly sets its quantities so that marginal revenue for each group i, MRi, equals common marginal cost, m: MR 1 = m = MR 2. • example: Sony’s Aibo robot dog •

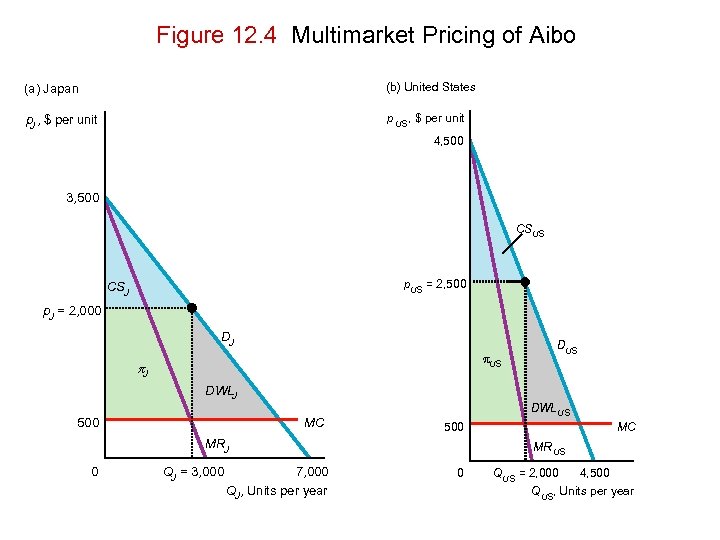

Figure 12. 4 Multimarket Pricing of Aibo (a) Japan (b) United States p , $ per unit J p US , $ per unit 4, 500 3, 500 CSUS p. US = 2, 500 CSJ p. J = 2, 000 DJ US p. J DWLJ 500 MC DWLUS 500 MRJ 0 QJ = 3, 000 7, 000 QJ, Units per year DUS MC MR US 0 QUS = 2, 000 4, 500 Q US, Units per year

Figure 12. 4 Multimarket Pricing of Aibo (a) Japan (b) United States p , $ per unit J p US , $ per unit 4, 500 3, 500 CSUS p. US = 2, 500 CSJ p. J = 2, 000 DJ US p. J DWLJ 500 MC DWLUS 500 MRJ 0 QJ = 3, 000 7, 000 QJ, Units per year DUS MC MR US 0 QUS = 2, 000 4, 500 Q US, Units per year

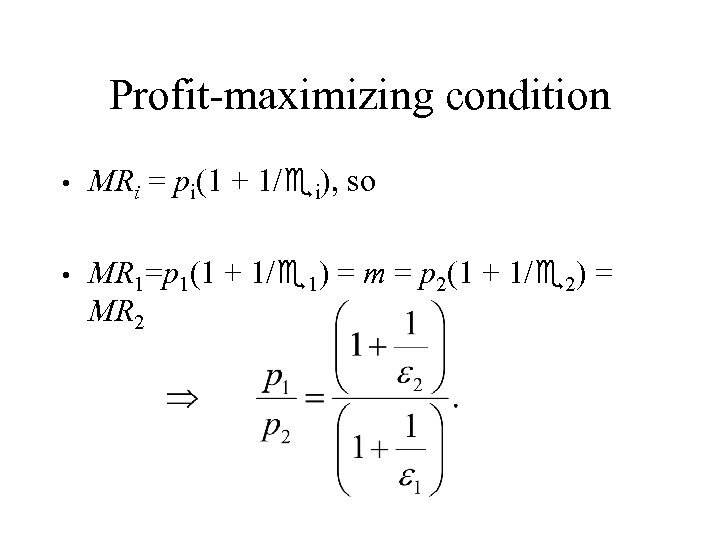

Profit-maximizing condition • MRi = pi(1 + 1/ i), so • MR 1=p 1(1 + 1/ 1) = m = p 2(1 + 1/ 2) = MR 2

Profit-maximizing condition • MRi = pi(1 + 1/ i), so • MR 1=p 1(1 + 1/ 1) = m = p 2(1 + 1/ 2) = MR 2

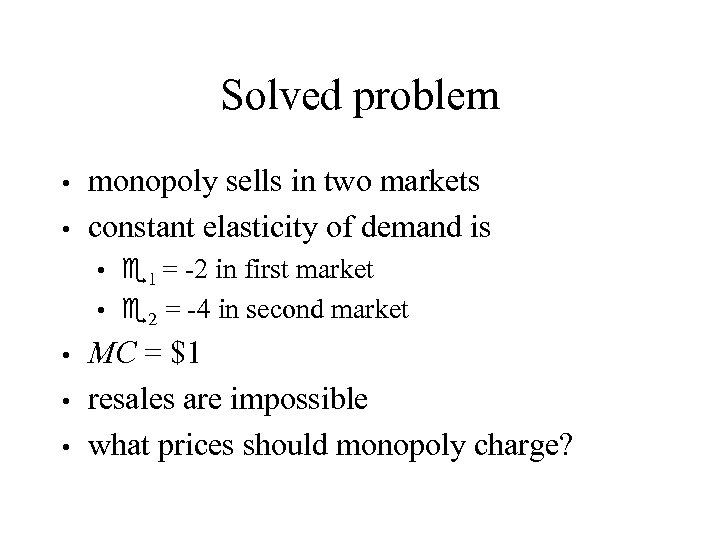

Solved problem monopoly sells in two markets • constant elasticity of demand is • 1 = -2 in first market • 2 = -4 in second market • MC = $1 • resales are impossible • what prices should monopoly charge? •

Solved problem monopoly sells in two markets • constant elasticity of demand is • 1 = -2 in first market • 2 = -4 in second market • MC = $1 • resales are impossible • what prices should monopoly charge? •

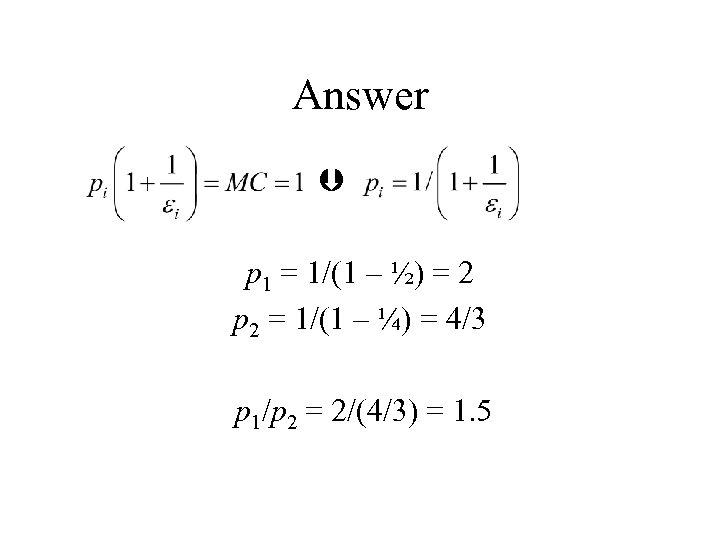

Answer p 1 = 1/(1 – ½) = 2 p 2 = 1/(1 – ¼) = 4/3 p 1/p 2 = 2/(4/3) = 1. 5

Answer p 1 = 1/(1 – ½) = 2 p 2 = 1/(1 – ¼) = 4/3 p 1/p 2 = 2/(4/3) = 1. 5

Coca-Cola Version 1 • a two-liter bottle of Coke costs 50% more in the U. K. than in EU nations (SF Chronicle, May 17, 2000: D 2) • if Coke’s marginal cost is the same for all European nations, how does the demand in the U. K. differ from that in the EU?

Coca-Cola Version 1 • a two-liter bottle of Coke costs 50% more in the U. K. than in EU nations (SF Chronicle, May 17, 2000: D 2) • if Coke’s marginal cost is the same for all European nations, how does the demand in the U. K. differ from that in the EU?

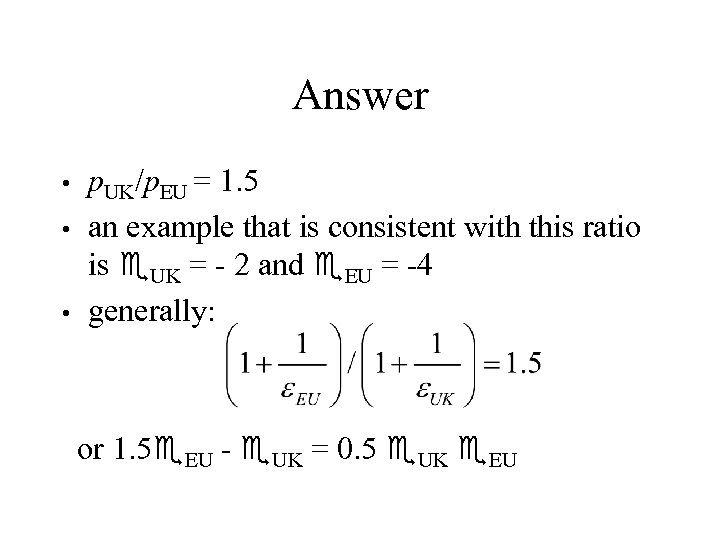

Answer p. UK/p. EU = 1. 5 • an example that is consistent with this ratio is UK = - 2 and EU = -4 • generally: • or 1. 5 EU - UK = 0. 5 UK EU

Answer p. UK/p. EU = 1. 5 • an example that is consistent with this ratio is UK = - 2 and EU = -4 • generally: • or 1. 5 EU - UK = 0. 5 UK EU

Generics and brand-name loyalty Why do prices of some brand-name pharmaceutical drugs rise when equivalent, generic brands enter the market?

Generics and brand-name loyalty Why do prices of some brand-name pharmaceutical drugs rise when equivalent, generic brands enter the market?

Entry of generics • generics enter when patent for profitable drug expires generics: 40% of U. S. pharmaceutical sales by volume • name-brand drugs with sales of about $20 billion went off patent by 1997 • • most states allow/require pharmacist to switch prescription from more expensive brand-name product to generic unless doctor or patient object

Entry of generics • generics enter when patent for profitable drug expires generics: 40% of U. S. pharmaceutical sales by volume • name-brand drugs with sales of about $20 billion went off patent by 1997 • • most states allow/require pharmacist to switch prescription from more expensive brand-name product to generic unless doctor or patient object

Price effects 18 major orally-administered drug products that faced generic competition 1983 -1987 on average for each drug, 17 generic brands entered and captured 35% of total sales in first year • price effects • brand-name drug prices rose an average of 7% • but average market price fell over 10% • because generic price was only 46% of brand-name price •

Price effects 18 major orally-administered drug products that faced generic competition 1983 -1987 on average for each drug, 17 generic brands entered and captured 35% of total sales in first year • price effects • brand-name drug prices rose an average of 7% • but average market price fell over 10% • because generic price was only 46% of brand-name price •

Explanation • customers with different demand elasticities some are price sensitive: willingly switch to less expensive generic drugs • others are unwilling to change brands • AARP survey found that people 65 and older are 15% less likely than people 45 to 64 to request generic versions of a drug from their doctor or pharmacist • • introduction of generics makes demand facing brand-name drug less elastic

Explanation • customers with different demand elasticities some are price sensitive: willingly switch to less expensive generic drugs • others are unwilling to change brands • AARP survey found that people 65 and older are 15% less likely than people 45 to 64 to request generic versions of a drug from their doctor or pharmacist • • introduction of generics makes demand facing brand-name drug less elastic

Identifying an individual’s group identify using observable characteristics of consumers price elasticities • identify consumers based on their actions: consumers self-select into a group •

Identifying an individual’s group identify using observable characteristics of consumers price elasticities • identify consumers based on their actions: consumers self-select into a group •

Why firms use self-identification each price discrimination method requires that, to receive a discount, consumers incur some cost, such as their time • otherwise, all consumers would get a discount • by spending extra time to obtain a discount, price-sensitive consumers differentiate themselves from others •

Why firms use self-identification each price discrimination method requires that, to receive a discount, consumers incur some cost, such as their time • otherwise, all consumers would get a discount • by spending extra time to obtain a discount, price-sensitive consumers differentiate themselves from others •

Getting consumers to identify themselves: Coupons self-selection: people who spend their time clipping coupons buy goods at lower prices than those who value their time more • coupon-using consumers paid $24 billion less than other consumers in the first half of 1990 s •

Getting consumers to identify themselves: Coupons self-selection: people who spend their time clipping coupons buy goods at lower prices than those who value their time more • coupon-using consumers paid $24 billion less than other consumers in the first half of 1990 s •

Airline tickets and hotel rooms self-selection (business vs. vacation travelers): cheap fares require advanced purchase and staying over a Saturday night • Sheraton and other hotel chains offer discounts for rooms booked 14 days in advance for the same reason •

Airline tickets and hotel rooms self-selection (business vs. vacation travelers): cheap fares require advanced purchase and staying over a Saturday night • Sheraton and other hotel chains offer discounts for rooms booked 14 days in advance for the same reason •

Reverse Auctions priceline. com uses a name-your-own-price or reverse-auction to identify price sensitive customers • a customer enters a relatively low price bid for a good or service, such as airline tickets • merchants decide whether to accept that bid or not •

Reverse Auctions priceline. com uses a name-your-own-price or reverse-auction to identify price sensitive customers • a customer enters a relatively low price bid for a good or service, such as airline tickets • merchants decide whether to accept that bid or not •

Why priceline works • to keep their less price-sensitive customers from using this method, airlines force successful Priceline bidders to be flexible: • • • to fly at off hours to make one or more connection to accept any type of aircraft when bidding on groceries, a customer must list “two or more brands you like. ” • as Jay Walker, Priceline’s founder said, “The manufacturers would rather not give you a discount, of course, but if you prove that you’re willing to switch brands, they’re willing to pay to keep you. ” •

Why priceline works • to keep their less price-sensitive customers from using this method, airlines force successful Priceline bidders to be flexible: • • • to fly at off hours to make one or more connection to accept any type of aircraft when bidding on groceries, a customer must list “two or more brands you like. ” • as Jay Walker, Priceline’s founder said, “The manufacturers would rather not give you a discount, of course, but if you prove that you’re willing to switch brands, they’re willing to pay to keep you. ” •

Welfare effects of multimarket price discrimination results in inefficient production and consumption • welfare under multimarket price discrimination is lower than under competition or perfect price discrimination • welfare may be lower or higher with multimarket price discrimination than with a single-price monopoly •

Welfare effects of multimarket price discrimination results in inefficient production and consumption • welfare under multimarket price discrimination is lower than under competition or perfect price discrimination • welfare may be lower or higher with multimarket price discrimination than with a single-price monopoly •

Gray markets producers of recordings, books, sunglasses, and shampoo, price discriminate by selling these goods for higher prices in U. S. than in foreign markets • if the price differential is great enough, some goods are reimported into U. S. and sold in a $130 billion-a-year "gray market" by discounters (Costco, Target, Wal-Mart) •

Gray markets producers of recordings, books, sunglasses, and shampoo, price discriminate by selling these goods for higher prices in U. S. than in foreign markets • if the price differential is great enough, some goods are reimported into U. S. and sold in a $130 billion-a-year "gray market" by discounters (Costco, Target, Wal-Mart) •

Gray markets (cont. ) • 1995 federal court decision: copyright owners has exclusive right to control marketing • can prevent reimportation • • 1998 Supreme Court decision reversed: discount retailers had the legal right to sell copyrighted U. S. goods in U. S. • once sold, "lawfully made" copies can be resold without the permission of copyright holder • reduces firms ability to price discriminate •

Gray markets (cont. ) • 1995 federal court decision: copyright owners has exclusive right to control marketing • can prevent reimportation • • 1998 Supreme Court decision reversed: discount retailers had the legal right to sell copyrighted U. S. goods in U. S. • once sold, "lawfully made" copies can be resold without the permission of copyright holder • reduces firms ability to price discriminate •

Other forms of nonlinear pricing two-part tariffs • tie-in sales • both are second-degree price discrimination schemes where the average price per unit varies with the number of units consumers buy

Other forms of nonlinear pricing two-part tariffs • tie-in sales • both are second-degree price discrimination schemes where the average price per unit varies with the number of units consumers buy

Two-part tariff • firm charges a consumer lump-sum fee (first tariff) for right to buy any units • constant price (second tariff) on each unit purchased • • because of lump-sum fee, consumers pay more, the fewer units they buy

Two-part tariff • firm charges a consumer lump-sum fee (first tariff) for right to buy any units • constant price (second tariff) on each unit purchased • • because of lump-sum fee, consumers pay more, the fewer units they buy

Two-part tariff examples telephone service: monthly connection fee, price per minute of use • car rental firms: charge per-day, price per mile •

Two-part tariff examples telephone service: monthly connection fee, price per minute of use • car rental firms: charge per-day, price per mile •

Personal seat license Carolina Panthers introduced the PSL in 1993, and at least 11 NFL teams used a PSL by 2002 • over $700 million has been raised by the PSL portion of this two-part tariff • Raiders football season tickets: “personal seat license” at $250 -$4, 000 (right to buy season tickets for next 11 years), tickets $40 -$60 each •

Personal seat license Carolina Panthers introduced the PSL in 1993, and at least 11 NFL teams used a PSL by 2002 • over $700 million has been raised by the PSL portion of this two-part tariff • Raiders football season tickets: “personal seat license” at $250 -$4, 000 (right to buy season tickets for next 11 years), tickets $40 -$60 each •

Two-part tariff with identical consumers monopoly that knows its customers' demand curve can set a two-part tariff that has same properties as perfect-price-discriminating equilibrium

Two-part tariff with identical consumers monopoly that knows its customers' demand curve can set a two-part tariff that has same properties as perfect-price-discriminating equilibrium

Two-part tariff with nonidentical consumers suppose two customers - Consumer 1 and Consumer 2 - with demand curves, D 1 and D 2 • consider two cases, monopoly • knows customers’ demand curves and can charge them different prices • cannot distinguish between types of customers or cannot charge consumers different prices •

Two-part tariff with nonidentical consumers suppose two customers - Consumer 1 and Consumer 2 - with demand curves, D 1 and D 2 • consider two cases, monopoly • knows customers’ demand curves and can charge them different prices • cannot distinguish between types of customers or cannot charge consumers different prices •

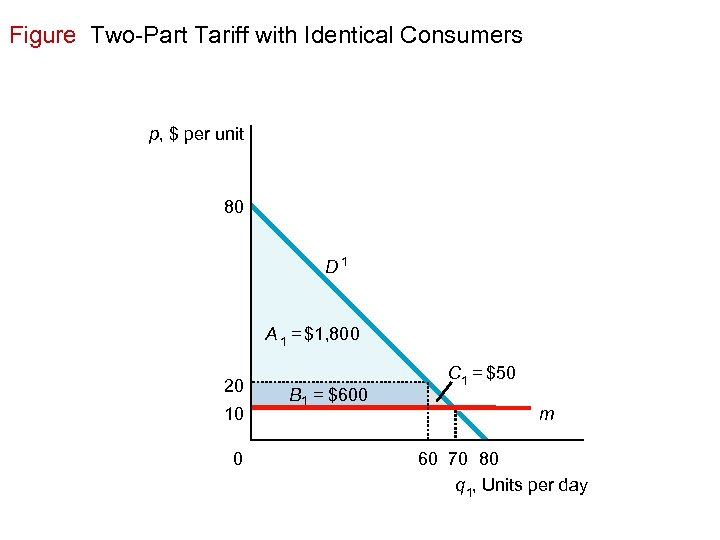

Can distinguish/discriminate monopoly knows customers’ demand curves; can charge them different prices • monopoly charges each customer p = MC = m = $10/unit • thus, makes no profit per unit but sells number of units that maximizes potential CS • monopoly sets lump-sum fees = potential CS • A 1 + B 1 + C 1 = $2, 450 to Consumer 1 • A 2 + B 2 + C 2 = $4, 050 to Consumer 2 • monopoly's total profit= $6, 500 •

Can distinguish/discriminate monopoly knows customers’ demand curves; can charge them different prices • monopoly charges each customer p = MC = m = $10/unit • thus, makes no profit per unit but sells number of units that maximizes potential CS • monopoly sets lump-sum fees = potential CS • A 1 + B 1 + C 1 = $2, 450 to Consumer 1 • A 2 + B 2 + C 2 = $4, 050 to Consumer 2 • monopoly's total profit= $6, 500 •

Figure Two-Part Tariff with Identical Consumers p, $ per unit 80 D 1 A 1 = $1, 800 20 10 0 B 1 = $600 C 1 = $50 m 60 70 80 q 1, Units per day

Figure Two-Part Tariff with Identical Consumers p, $ per unit 80 D 1 A 1 = $1, 800 20 10 0 B 1 = $600 C 1 = $50 m 60 70 80 q 1, Units per day

Cannot distinguish/discriminate monopoly cannot distinguish between types of customers or cannot charge them different prices • monopoly has to charge each consumer the same lump-sum fee and same p • due to legal restrictions, telephone company charges all residential customers same monthly fee and same fee per call, even though company knows that consumers' demands vary •

Cannot distinguish/discriminate monopoly cannot distinguish between types of customers or cannot charge them different prices • monopoly has to charge each consumer the same lump-sum fee and same p • due to legal restrictions, telephone company charges all residential customers same monthly fee and same fee per call, even though company knows that consumers' demands vary •

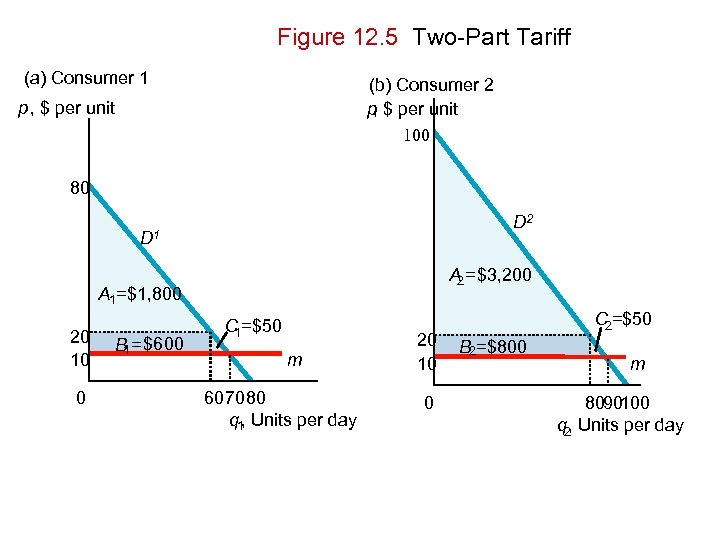

Figure 12. 5 Two-Part Tariff (a) Consumer 1 (b) Consumer 2 p $ per unit , 100 p , $ per unit 80 D 2 D 1 A = $3, 200 2 A 1=$1, 800 20 10 0 B 1= $600 C =$50 1 m 607080 q 1, Units per day 20 10 0 C 2=$50 B 2=$800 m 8090100 q 2, Units per day

Figure 12. 5 Two-Part Tariff (a) Consumer 1 (b) Consumer 2 p $ per unit , 100 p , $ per unit 80 D 2 D 1 A = $3, 200 2 A 1=$1, 800 20 10 0 B 1= $600 C =$50 1 m 607080 q 1, Units per day 20 10 0 C 2=$50 B 2=$800 m 8090100 q 2, Units per day

Monopoly doesn’t capture all CS • monopoly charges lump-sum fee equal to potential CS 1 or CS 2 because CS 2 > CS 1 both customers buy if lumpsum fee = CS 1 • Consumer 2 buys if monopoly charges lumpsum fee = CS 2 • • in Figure 12. 5, monopoly maximizes its profit by setting lower lump-sum fee and charging p = $20 > MC

Monopoly doesn’t capture all CS • monopoly charges lump-sum fee equal to potential CS 1 or CS 2 because CS 2 > CS 1 both customers buy if lumpsum fee = CS 1 • Consumer 2 buys if monopoly charges lumpsum fee = CS 2 • • in Figure 12. 5, monopoly maximizes its profit by setting lower lump-sum fee and charging p = $20 > MC

Why is price > marginal cost? by raising its price, monopoly earns more per unit from both types of customers but lowers its customers’ potential CS • if monopoly can capture each customer's potential CS by charging different lumpsum fees, it sets p = MC •

Why is price > marginal cost? by raising its price, monopoly earns more per unit from both types of customers but lowers its customers’ potential CS • if monopoly can capture each customer's potential CS by charging different lumpsum fees, it sets p = MC •

Tie-in sales customers can buy one product only if they purchase another product as well • most tie-in sales increase efficiency by lowering transaction costs •

Tie-in sales customers can buy one product only if they purchase another product as well • most tie-in sales increase efficiency by lowering transaction costs •

2 forms of tie-in sales requirements tie-in sale: customers who buy one product from a firm must purchase all units of another product from that firm (copiers/toner or service) • bundling (or a package tie-in sale): two goods are combined so that customers cannot buy either good separately (shoes/shoelaces) •

2 forms of tie-in sales requirements tie-in sale: customers who buy one product from a firm must purchase all units of another product from that firm (copiers/toner or service) • bundling (or a package tie-in sale): two goods are combined so that customers cannot buy either good separately (shoes/shoelaces) •

Requirement tie-in sales firm cannot tell which customers are going to use its product most (highest willing to pay) • firms uses requirement tie-in sale to identify heavy users •

Requirement tie-in sales firm cannot tell which customers are going to use its product most (highest willing to pay) • firms uses requirement tie-in sale to identify heavy users •

IBM requirement tie 1930 s: IBM produced card punch machines, sorters, and tabulating machines that computed using punched cards • IBM leased (rather than sold) punch machines; lease would terminate if customer used non-IBM card • by leasing, IBM avoided resale problems and forced customers to buy cards from it •

IBM requirement tie 1930 s: IBM produced card punch machines, sorters, and tabulating machines that computed using punched cards • IBM leased (rather than sold) punch machines; lease would terminate if customer used non-IBM card • by leasing, IBM avoided resale problems and forced customers to buy cards from it •

Bundling bundling allows firms that can't directly price discriminate to charge customers different prices • profitability of bundling depends on customers’ tastes and ability to prevent resales •

Bundling bundling allows firms that can't directly price discriminate to charge customers different prices • profitability of bundling depends on customers’ tastes and ability to prevent resales •

Selling Raiders' season tickets suppose stadium can hold all potential customers, so MC = 0 for selling one more ticket • should Raiders bundle tickets for preseason (“exhibition”) and regular-season games, or sell separately? •

Selling Raiders' season tickets suppose stadium can hold all potential customers, so MC = 0 for selling one more ticket • should Raiders bundle tickets for preseason (“exhibition”) and regular-season games, or sell separately? •

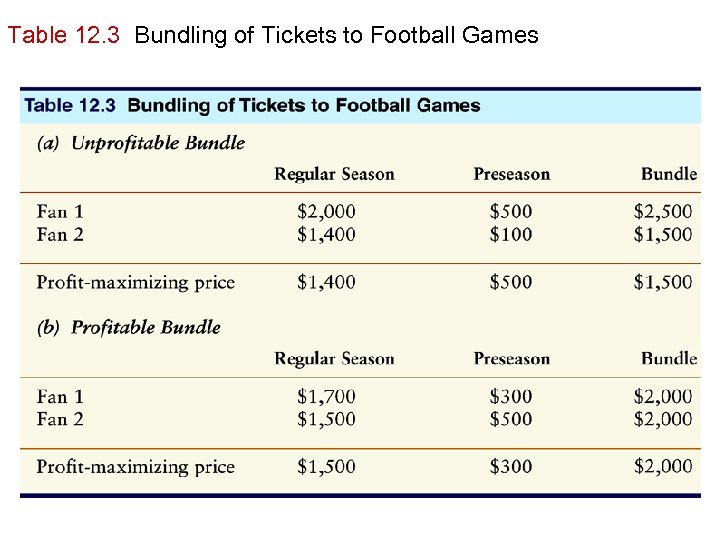

Table 12. 3 Bundling of Tickets to Football Games

Table 12. 3 Bundling of Tickets to Football Games

When bundling increases profit • bundling likely to increase profit if consumers' demands are negatively correlated: • consumers who value one good much more than other customers value other good less • • here, bundling pays only if customers willing to pay relatively more for regular-season tickets are not willing to pay as much as others for preseason tickets and vice versa

When bundling increases profit • bundling likely to increase profit if consumers' demands are negatively correlated: • consumers who value one good much more than other customers value other good less • • here, bundling pays only if customers willing to pay relatively more for regular-season tickets are not willing to pay as much as others for preseason tickets and vice versa

Supreme Court on tie-in sales Kodak was prohibited by the Supreme Court from using certain tie-in sales in 1992 • Kodak sells photocopiers and Kodak parts and service to its customers • Kodak refused to supply some parts to independent repair firms - effectively forcing customers to buy those parts and associated service from Kodak •

Supreme Court on tie-in sales Kodak was prohibited by the Supreme Court from using certain tie-in sales in 1992 • Kodak sells photocopiers and Kodak parts and service to its customers • Kodak refused to supply some parts to independent repair firms - effectively forcing customers to buy those parts and associated service from Kodak •

Charge and response company was charged with illegally tying sale of its photocopiers with its parts and service • Kodak argued that • case should be dismissed because both sides agreed Kodak faced substantial competition in initial sale of photocopiers • customers would not buy from Kodak if they knew that they would be overcharged on repair parts and service • because Kodak didn't have market power in copier market, it couldn't price discriminate or extend its market power to another market •

Charge and response company was charged with illegally tying sale of its photocopiers with its parts and service • Kodak argued that • case should be dismissed because both sides agreed Kodak faced substantial competition in initial sale of photocopiers • customers would not buy from Kodak if they knew that they would be overcharged on repair parts and service • because Kodak didn't have market power in copier market, it couldn't price discriminate or extend its market power to another market •

Supreme Court rejects Kodak consumers may be uninformed (can’t forecast repair cost) • even if Kodak lacks market power in photocopiers, it’s a monopoly supplier of its unique repair parts • factual investigation needed to determine if consumers are ignorant and have to be protected • (Court did not explain consumer benefit if Kodak forced to sell repair parts to independent repair shops at prices set by Kodak) •

Supreme Court rejects Kodak consumers may be uninformed (can’t forecast repair cost) • even if Kodak lacks market power in photocopiers, it’s a monopoly supplier of its unique repair parts • factual investigation needed to determine if consumers are ignorant and have to be protected • (Court did not explain consumer benefit if Kodak forced to sell repair parts to independent repair shops at prices set by Kodak) •

1. Why and how firms price discriminate • to successfully price discriminate a firm needs market power • to know which customers will pay more for each unit of output • to prevent resales • • firm earns a higher profit from price discrimination than uniform pricing because it captures some or all of the CS of customers who are willing to pay more than uniform price • sells to some people who won’t buy at uniform price •

1. Why and how firms price discriminate • to successfully price discriminate a firm needs market power • to know which customers will pay more for each unit of output • to prevent resales • • firm earns a higher profit from price discrimination than uniform pricing because it captures some or all of the CS of customers who are willing to pay more than uniform price • sells to some people who won’t buy at uniform price •

2. Perfect price discrimination to perfectly price discriminate, firm must know maximum amount each customer is willing to pay for each unit of output. • perfectly price discriminating firm captures all potential consumer surplus • sells efficient (competitive) level of output • compared to competition • welfare is same • consumers are worse off • firms are better off •

2. Perfect price discrimination to perfectly price discriminate, firm must know maximum amount each customer is willing to pay for each unit of output. • perfectly price discriminating firm captures all potential consumer surplus • sells efficient (competitive) level of output • compared to competition • welfare is same • consumers are worse off • firms are better off •

3. Quantity discrimination some firms charge customers different prices depending on how many units they purchase • doing so raises their profits •

3. Quantity discrimination some firms charge customers different prices depending on how many units they purchase • doing so raises their profits •

4. Multimarket price discrimination firm does not have enough information to perfectly price discriminate but knows relative elasticities of demand of groups of customers • firm charges each group a price in proportion to its elasticity of demand • welfare under multimarket price discrimination is • < under competition/perfect price discrimination • > or < under single-price monopoly •

4. Multimarket price discrimination firm does not have enough information to perfectly price discriminate but knows relative elasticities of demand of groups of customers • firm charges each group a price in proportion to its elasticity of demand • welfare under multimarket price discrimination is • < under competition/perfect price discrimination • > or < under single-price monopoly •

5. Two-part tariffs by charging consumers a fee for the right to buy and a price per unit, firms may earn higher profits than from charging only for each unit sold • if a firm knows demand curves of its customers, it can use two-part tariffs (instead of perfectly price discriminating) to capture all consumer surplus •

5. Two-part tariffs by charging consumers a fee for the right to buy and a price per unit, firms may earn higher profits than from charging only for each unit sold • if a firm knows demand curves of its customers, it can use two-part tariffs (instead of perfectly price discriminating) to capture all consumer surplus •

6. Tie-in sales firm may increase its profit by using a tie-in sale: customers can buy one product only if they also purchase another one • requirement tie-in sale: customers who buy one good must make all of their purchases of another good or service from that firm • bundling (package tie-in sale): firm sells only a bundle of two goods together • prices differ across customers under both types of tie-in sales •

6. Tie-in sales firm may increase its profit by using a tie-in sale: customers can buy one product only if they also purchase another one • requirement tie-in sale: customers who buy one good must make all of their purchases of another good or service from that firm • bundling (package tie-in sale): firm sells only a bundle of two goods together • prices differ across customers under both types of tie-in sales •

Docking Their Pay • 2002 dispute between the International Longshore and Warehouse Union (ILWU) • shipping companies, represented by the Pacific Maritime Association • led to the closure of 29 west coast ports for 12 days and significant damage to U. S. and foreign economies • these docks handle about $300 billion worth of goods per year •

Docking Their Pay • 2002 dispute between the International Longshore and Warehouse Union (ILWU) • shipping companies, represented by the Pacific Maritime Association • led to the closure of 29 west coast ports for 12 days and significant damage to U. S. and foreign economies • these docks handle about $300 billion worth of goods per year •

Lockout shippers locked out 10, 500 union workers • lockout: an action by the employers that causes a work stoppage similar to what would happen if the union called a strike •

Lockout shippers locked out 10, 500 union workers • lockout: an action by the employers that causes a work stoppage similar to what would happen if the union called a strike •

Damages • by one estimate, the shutdown inflicted up to $2 billion a day in damages of the U. S. economy revenues fell 80% at West Coast Trucking • one of Hawaii’s largest moving companies declared bankruptcy as a consequence • Singapore’s Neptune Orient Lines said that the shutdown cost it $1 million a day • • Had the shutdown lasted longer, vast amounts of food and other perishables waiting to be shipped would have spoiled.

Damages • by one estimate, the shutdown inflicted up to $2 billion a day in damages of the U. S. economy revenues fell 80% at West Coast Trucking • one of Hawaii’s largest moving companies declared bankruptcy as a consequence • Singapore’s Neptune Orient Lines said that the shutdown cost it $1 million a day • • Had the shutdown lasted longer, vast amounts of food and other perishables waiting to be shipped would have spoiled.

Why these events were triggered by the expiration of a union contract • dispute had more to do with employment issues than wages •

Why these events were triggered by the expiration of a union contract • dispute had more to do with employment issues than wages •

Background number of dock workers has shrunk over the years as firms have used automation to become more efficient • 10, 500 registered union workers averaged at least $80, 000 (some estimates set the figure at $100, 000) a year with benefits and other perks worth about $42, 000 under the previous contract •

Background number of dock workers has shrunk over the years as firms have used automation to become more efficient • 10, 500 registered union workers averaged at least $80, 000 (some estimates set the figure at $100, 000) a year with benefits and other perks worth about $42, 000 under the previous contract •

Offer Pacific Maritime Association negotiators had offered $1 billion worth of new pension benefits— lifetime benefits of $50, 000 a year • higher salaries of $114, 500 a year for longshore workers and $137, 500 for marine clerks • health care plan with no deductibles •

Offer Pacific Maritime Association negotiators had offered $1 billion worth of new pension benefits— lifetime benefits of $50, 000 a year • higher salaries of $114, 500 a year for longshore workers and $137, 500 for marine clerks • health care plan with no deductibles •

Union Concerns use of new technologies • potential loss of 400 longshore positions • wanted guarantees that new clerical positions would be filled by their union members •

Union Concerns use of new technologies • potential loss of 400 longshore positions • wanted guarantees that new clerical positions would be filled by their union members •

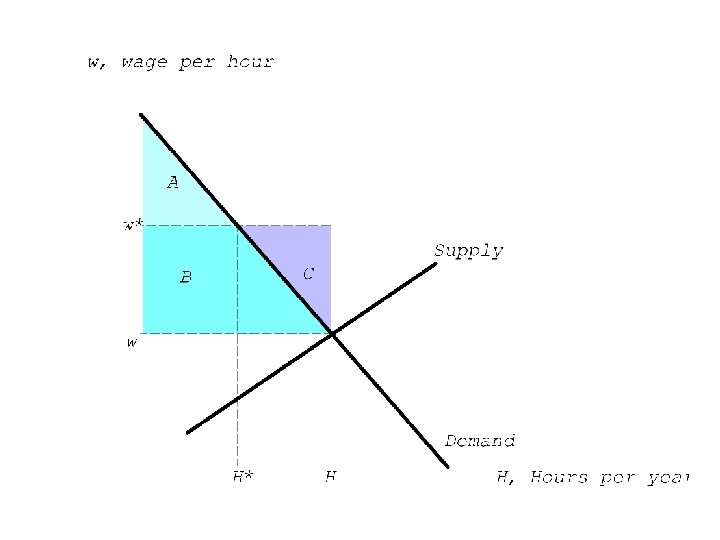

Take-it-or-leave it Traditionally, longshore unions offered employers a take-it-or-leave-it choice: • union specified both a wage and a minimum number of hours of work that the employers had to provide • 1975 U. S. Department of Labor study found 2/3 of transportation union contracts (excluding railroads and airplanes) had wage-employment compared to only 11% of union contracts in all industries •

Take-it-or-leave it Traditionally, longshore unions offered employers a take-it-or-leave-it choice: • union specified both a wage and a minimum number of hours of work that the employers had to provide • 1975 U. S. Department of Labor study found 2/3 of transportation union contracts (excluding railroads and airplanes) had wage-employment compared to only 11% of union contracts in all industries •

Task Compare equilibrium where a union specifies both wages and hours of work to the perfect price discrimination equilibrium

Task Compare equilibrium where a union specifies both wages and hours of work to the perfect price discrimination equilibrium