1d2be2b8f0b8479d452fa032f222020f.ppt

- Количество слайдов: 81

Chapter 12 PRICE AND OUTPUT DETERMINATION UNDER OLIGOPOLY © 2013 Cengage Learning Gottheil — Principles of 1

Chapter 12 PRICE AND OUTPUT DETERMINATION UNDER OLIGOPOLY © 2013 Cengage Learning Gottheil — Principles of 1

Economic Principles The concentration ratio and the Herfindahl-Hirschman Index (HHI) Balanced and unbalanced oligopoly Horizontal, vertical and conglomerate mergers © 2013 Cengage Learning Gottheil — Principles of 2

Economic Principles The concentration ratio and the Herfindahl-Hirschman Index (HHI) Balanced and unbalanced oligopoly Horizontal, vertical and conglomerate mergers © 2013 Cengage Learning Gottheil — Principles of 2

Economic Principles Cartels Game theory Price leadership Kinked demand Brand multiplication Price discrimination © 2013 Cengage Learning Gottheil — Principles of 3

Economic Principles Cartels Game theory Price leadership Kinked demand Brand multiplication Price discrimination © 2013 Cengage Learning Gottheil — Principles of 3

Concentration Ratios For a vast number of US manufacturing industries, the competition among firms in the industry is essentially competition among the few— oligopoly. © 2013 Cengage Learning Gottheil — Principles of 4

Concentration Ratios For a vast number of US manufacturing industries, the competition among firms in the industry is essentially competition among the few— oligopoly. © 2013 Cengage Learning Gottheil — Principles of 4

Concentration Ratios An industry may consist of many firms, but if only a few of the many dominate the industry, then the industry is oligopolistic. © 2013 Cengage Learning Gottheil — Principles of 5

Concentration Ratios An industry may consist of many firms, but if only a few of the many dominate the industry, then the industry is oligopolistic. © 2013 Cengage Learning Gottheil — Principles of 5

Concentration Ratios Concentration ratio • A measure of market power. It is the ratio of total sales of the leading firms in an industry (usually four) to the industry’s total sales. © 2013 Cengage Learning Gottheil — Principles of 6

Concentration Ratios Concentration ratio • A measure of market power. It is the ratio of total sales of the leading firms in an industry (usually four) to the industry’s total sales. © 2013 Cengage Learning Gottheil — Principles of 6

Concentration Ratios A criterion for determining whether an industry is an oligopoly: four firms in an • If the leading industry account for 40 percent or more of total industry sales, then an industry is likely to be an oligopoly. © 2013 Cengage Learning Gottheil — Principles of 7

Concentration Ratios A criterion for determining whether an industry is an oligopoly: four firms in an • If the leading industry account for 40 percent or more of total industry sales, then an industry is likely to be an oligopoly. © 2013 Cengage Learning Gottheil — Principles of 7

Concentration Ratios Herfindahl-Hirschman index • A measure of industry concentration, calculated as the sum of the squares of the market shares held by each of the firms in the industry. © 2013 Cengage Learning Gottheil — Principles of 8

Concentration Ratios Herfindahl-Hirschman index • A measure of industry concentration, calculated as the sum of the squares of the market shares held by each of the firms in the industry. © 2013 Cengage Learning Gottheil — Principles of 8

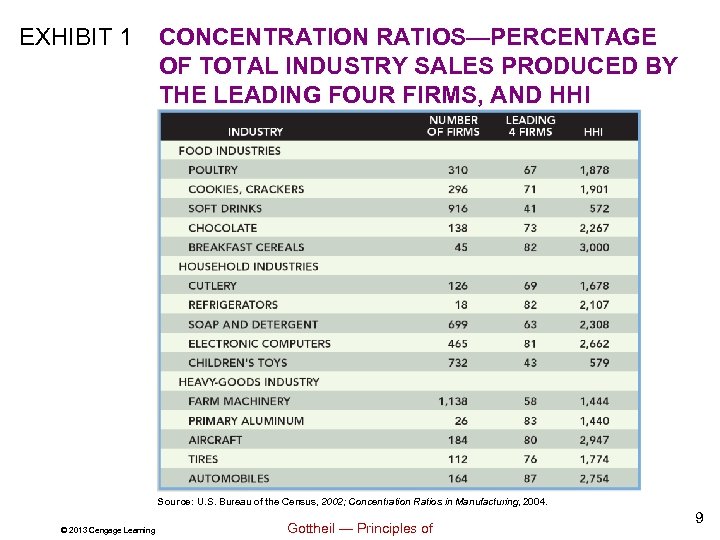

EXHIBIT 1 CONCENTRATION RATIOS—PERCENTAGE OF TOTAL INDUSTRY SALES PRODUCED BY THE LEADING FOUR FIRMS, AND HHI Source: U. S. Bureau of the Census, 2002; Concentration Ratios in Manufacturing, 2004. © 2013 Cengage Learning Gottheil — Principles of 9

EXHIBIT 1 CONCENTRATION RATIOS—PERCENTAGE OF TOTAL INDUSTRY SALES PRODUCED BY THE LEADING FOUR FIRMS, AND HHI Source: U. S. Bureau of the Census, 2002; Concentration Ratios in Manufacturing, 2004. © 2013 Cengage Learning Gottheil — Principles of 9

Exhibit 1: Concentration Ratios— Percentage of Total Industry Sales Produced by the Leading Four Firms, and HHI How many industries in Exhibit 1 have market shares greater than 50 percent at the four-firm level? • 13 of the 15 industries © 2013 Cengage Learning Gottheil — Principles of 10

Exhibit 1: Concentration Ratios— Percentage of Total Industry Sales Produced by the Leading Four Firms, and HHI How many industries in Exhibit 1 have market shares greater than 50 percent at the four-firm level? • 13 of the 15 industries © 2013 Cengage Learning Gottheil — Principles of 10

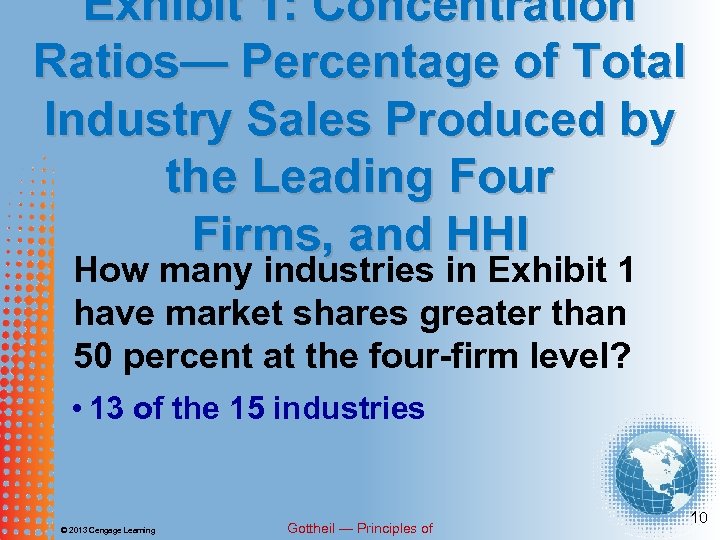

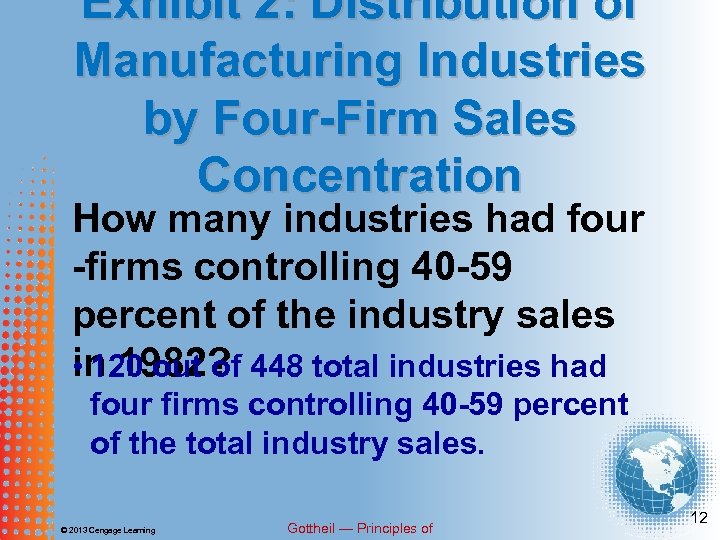

EXHIBIT 2 DISTRIBUTION OF MANUFACTURING INDUSTRIES BY FOUR-FIRM SALES CONCENTRATION Source: F. M. Scherer and David Ross, Industrial Market Structure and Economic Performance, Third Edition, Copyright © 1990 by Houghton Mifflin Company, Adapted with permission. © 2013 Cengage Learning Gottheil — Principles of 11

EXHIBIT 2 DISTRIBUTION OF MANUFACTURING INDUSTRIES BY FOUR-FIRM SALES CONCENTRATION Source: F. M. Scherer and David Ross, Industrial Market Structure and Economic Performance, Third Edition, Copyright © 1990 by Houghton Mifflin Company, Adapted with permission. © 2013 Cengage Learning Gottheil — Principles of 11

Exhibit 2: Distribution of Manufacturing Industries by Four-Firm Sales Concentration How many industries had four -firms controlling 40 -59 percent of the industry sales in 1982? 448 total industries had • 120 out of four firms controlling 40 -59 percent of the total industry sales. © 2013 Cengage Learning Gottheil — Principles of 12

Exhibit 2: Distribution of Manufacturing Industries by Four-Firm Sales Concentration How many industries had four -firms controlling 40 -59 percent of the industry sales in 1982? 448 total industries had • 120 out of four firms controlling 40 -59 percent of the total industry sales. © 2013 Cengage Learning Gottheil — Principles of 12

Oligopoly and Concentration Ratios Contrary to many people’s intuition, there is no convincing evidence that the share of industry sales controlled by the four leading firms in the US manufacturing economy is growing. © 2013 Cengage Learning Gottheil — Principles of 13

Oligopoly and Concentration Ratios Contrary to many people’s intuition, there is no convincing evidence that the share of industry sales controlled by the four leading firms in the US manufacturing economy is growing. © 2013 Cengage Learning Gottheil — Principles of 13

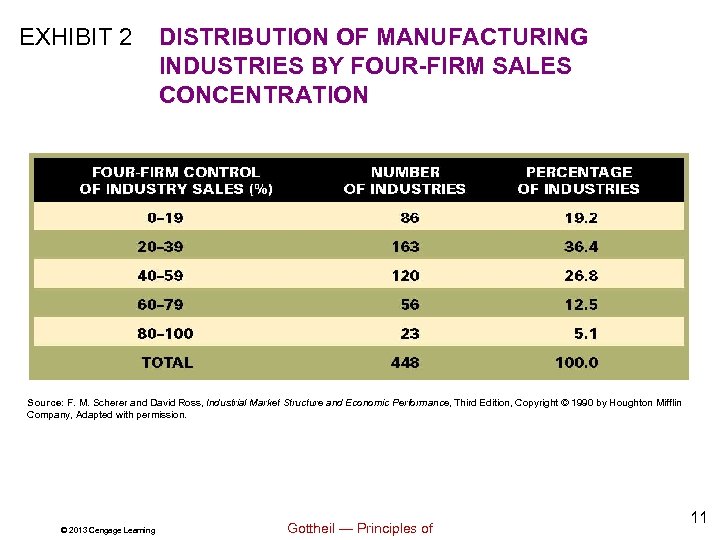

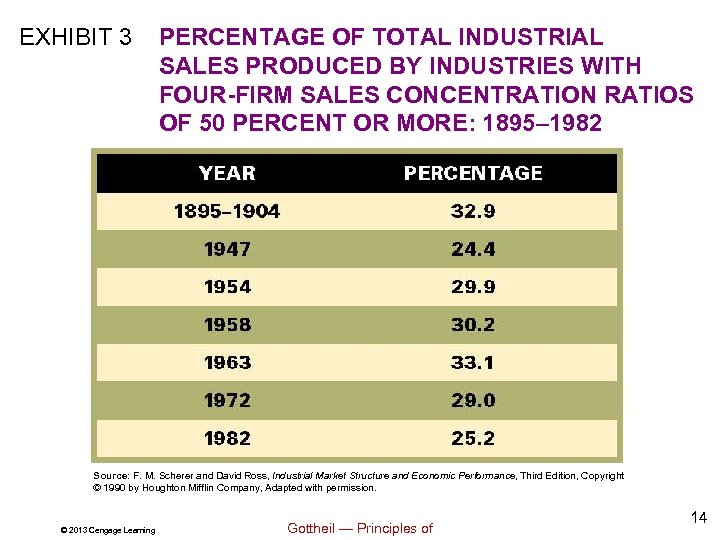

EXHIBIT 3 PERCENTAGE OF TOTAL INDUSTRIAL SALES PRODUCED BY INDUSTRIES WITH FOUR-FIRM SALES CONCENTRATION RATIOS OF 50 PERCENT OR MORE: 1895– 1982 Source: F. M. Scherer and David Ross, Industrial Market Structure and Economic Performance, Third Edition, Copyright © 1990 by Houghton Mifflin Company, Adapted with permission. © 2013 Cengage Learning Gottheil — Principles of 14

EXHIBIT 3 PERCENTAGE OF TOTAL INDUSTRIAL SALES PRODUCED BY INDUSTRIES WITH FOUR-FIRM SALES CONCENTRATION RATIOS OF 50 PERCENT OR MORE: 1895– 1982 Source: F. M. Scherer and David Ross, Industrial Market Structure and Economic Performance, Third Edition, Copyright © 1990 by Houghton Mifflin Company, Adapted with permission. © 2013 Cengage Learning Gottheil — Principles of 14

Exhibit 3: Percentage of Total Industrial Sales Produced by Industries with Four-Firm Sales Concentration Ratios of 50 Percent or More: 1895– 1982 What is the trend in the percentage of industrial sales produced by the largest four firms is a downward • Theresince 1963? trend in the percentage of industrial sales by the largest four firms from 1963 to 1982. © 2013 Cengage Learning Gottheil — Principles of 15

Exhibit 3: Percentage of Total Industrial Sales Produced by Industries with Four-Firm Sales Concentration Ratios of 50 Percent or More: 1895– 1982 What is the trend in the percentage of industrial sales produced by the largest four firms is a downward • Theresince 1963? trend in the percentage of industrial sales by the largest four firms from 1963 to 1982. © 2013 Cengage Learning Gottheil — Principles of 15

Oligopoly and Concentration Ratios Market power • A firm’s ability to select and control market price and output. © 2013 Cengage Learning Gottheil — Principles of 16

Oligopoly and Concentration Ratios Market power • A firm’s ability to select and control market price and output. © 2013 Cengage Learning Gottheil — Principles of 16

Oligopoly and Concentration Ratios Unbalanced oligopoly • An oligopoly in which the sales of the leading firms are distributed unevenly among them. © 2013 Cengage Learning Gottheil — Principles of 17

Oligopoly and Concentration Ratios Unbalanced oligopoly • An oligopoly in which the sales of the leading firms are distributed unevenly among them. © 2013 Cengage Learning Gottheil — Principles of 17

Oligopoly and Concentration Ratios Balanced oligopoly • An oligopoly in which the sales of the leading firms are distributed fairly evenly among them. © 2013 Cengage Learning Gottheil — Principles of 18

Oligopoly and Concentration Ratios Balanced oligopoly • An oligopoly in which the sales of the leading firms are distributed fairly evenly among them. © 2013 Cengage Learning Gottheil — Principles of 18

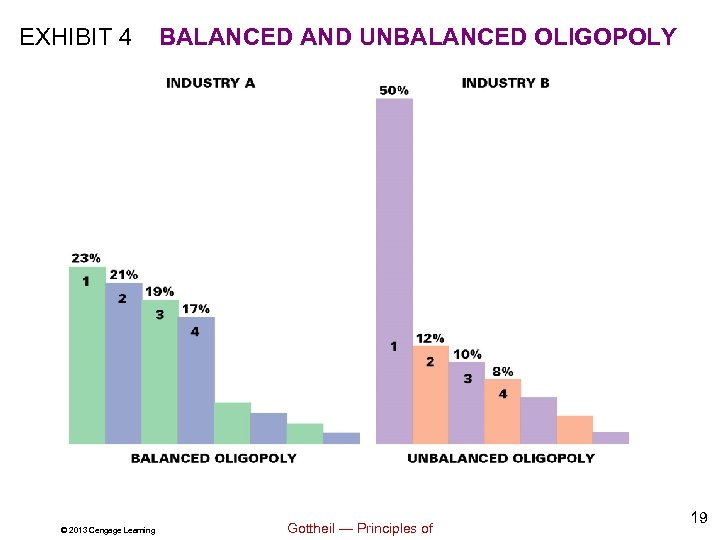

EXHIBIT 4 © 2013 Cengage Learning BALANCED AND UNBALANCED OLIGOPOLY Gottheil — Principles of 19

EXHIBIT 4 © 2013 Cengage Learning BALANCED AND UNBALANCED OLIGOPOLY Gottheil — Principles of 19

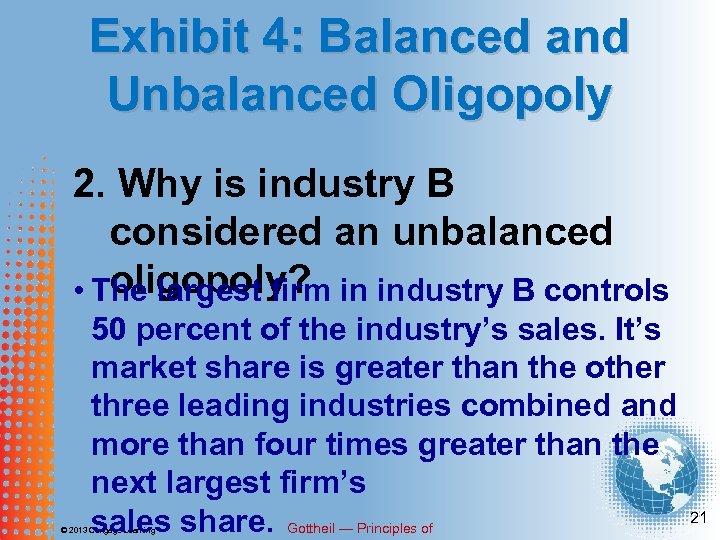

Exhibit 4: Balanced and Unbalanced Oligopoly 1. What percentage of their industry’s total sales do the leading four firms in Industry A leading four firms • The and B control? in both industry A and B control 80 percent of their industry’s sales. © 2013 Cengage Learning Gottheil — Principles of 20

Exhibit 4: Balanced and Unbalanced Oligopoly 1. What percentage of their industry’s total sales do the leading four firms in Industry A leading four firms • The and B control? in both industry A and B control 80 percent of their industry’s sales. © 2013 Cengage Learning Gottheil — Principles of 20

Exhibit 4: Balanced and Unbalanced Oligopoly 2. Why is industry B considered an unbalanced oligopoly? • The largest firm in industry B controls 50 percent of the industry’s sales. It’s market share is greater than the other three leading industries combined and more than four times greater than the next largest firm’s sales share. Gottheil — Principles of © 2013 Cengage Learning 21

Exhibit 4: Balanced and Unbalanced Oligopoly 2. Why is industry B considered an unbalanced oligopoly? • The largest firm in industry B controls 50 percent of the industry’s sales. It’s market share is greater than the other three leading industries combined and more than four times greater than the next largest firm’s sales share. Gottheil — Principles of © 2013 Cengage Learning 21

Oligopoly and Concentration Ratios • The dominance of oligopolies in industry is not unique to the U. S. • The concentration ratios for U. S. industries are similar to other modern industrialized economies. © 2013 Cengage Learning Gottheil — Principles of 22

Oligopoly and Concentration Ratios • The dominance of oligopolies in industry is not unique to the U. S. • The concentration ratios for U. S. industries are similar to other modern industrialized economies. © 2013 Cengage Learning Gottheil — Principles of 22

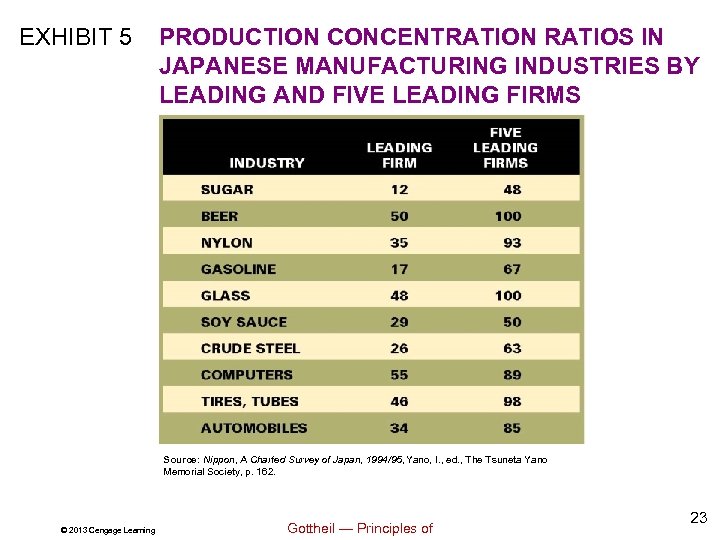

EXHIBIT 5 PRODUCTION CONCENTRATION RATIOS IN JAPANESE MANUFACTURING INDUSTRIES BY LEADING AND FIVE LEADING FIRMS Source: Nippon, A Charted Survey of Japan, 1994/95, Yano, I. , ed. , The Tsuneta Yano Memorial Society, p. 162. © 2013 Cengage Learning Gottheil — Principles of 23

EXHIBIT 5 PRODUCTION CONCENTRATION RATIOS IN JAPANESE MANUFACTURING INDUSTRIES BY LEADING AND FIVE LEADING FIRMS Source: Nippon, A Charted Survey of Japan, 1994/95, Yano, I. , ed. , The Tsuneta Yano Memorial Society, p. 162. © 2013 Cengage Learning Gottheil — Principles of 23

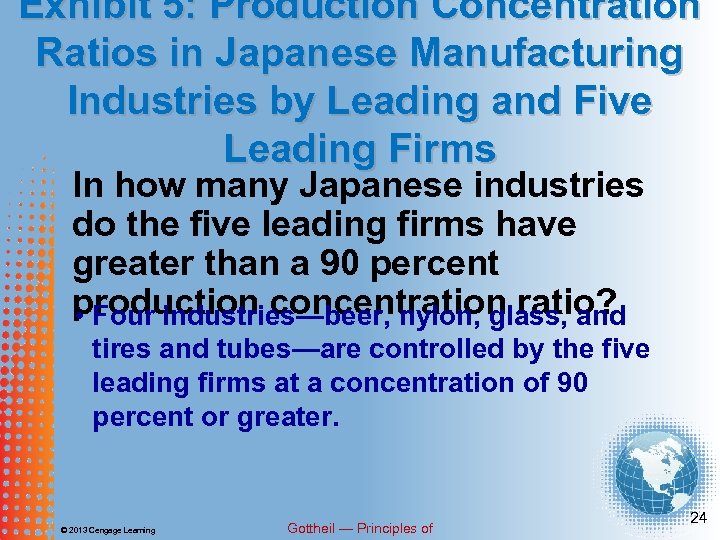

Exhibit 5: Production Concentration Ratios in Japanese Manufacturing Industries by Leading and Five Leading Firms In how many Japanese industries do the five leading firms have greater than a 90 percent production concentration ratio? • Four industries—beer, nylon, glass, and tires and tubes—are controlled by the five leading firms at a concentration of 90 percent or greater. © 2013 Cengage Learning Gottheil — Principles of 24

Exhibit 5: Production Concentration Ratios in Japanese Manufacturing Industries by Leading and Five Leading Firms In how many Japanese industries do the five leading firms have greater than a 90 percent production concentration ratio? • Four industries—beer, nylon, glass, and tires and tubes—are controlled by the five leading firms at a concentration of 90 percent or greater. © 2013 Cengage Learning Gottheil — Principles of 24

Concentrating the Concentration An oligopoly can build market power in two ways: • Reinvesting its profit and painstakingly expanding its production capacity. • Merging with and/or acquiring other firms. © 2013 Cengage Learning Gottheil — Principles of 25

Concentrating the Concentration An oligopoly can build market power in two ways: • Reinvesting its profit and painstakingly expanding its production capacity. • Merging with and/or acquiring other firms. © 2013 Cengage Learning Gottheil — Principles of 25

Concentrating the Concentration There are three reasons why firms merge: 1. To exercise greater market control. 2. To increase control over the supplies of their inputs or the buyers of their goods. 3. To expand diversify their asset holdings. © 2013 Cengage Learning Gottheil — Principles of 26

Concentrating the Concentration There are three reasons why firms merge: 1. To exercise greater market control. 2. To increase control over the supplies of their inputs or the buyers of their goods. 3. To expand diversify their asset holdings. © 2013 Cengage Learning Gottheil — Principles of 26

Concentrating the Concentration There are three types of mergers: 1. Horizontal merger 2. Vertical merger 3. Conglomerate merger © 2013 Cengage Learning Gottheil — Principles of 27

Concentrating the Concentration There are three types of mergers: 1. Horizontal merger 2. Vertical merger 3. Conglomerate merger © 2013 Cengage Learning Gottheil — Principles of 27

Concentrating the Concentration Horizontal merger • A merger between firms producing the same good in the same industry. © 2013 Cengage Learning Gottheil — Principles of 28

Concentrating the Concentration Horizontal merger • A merger between firms producing the same good in the same industry. © 2013 Cengage Learning Gottheil — Principles of 28

Concentrating the Concentration A number of high-profile horizontal mergers occurred in the 1990 s. Mc. Donnell Douglas in the • Boeing and aircraft industry. • Staples and Office Depot in the office supply industry. • Union Pacific and Southern Pacific Rail in the railroad industry. © 2013 Cengage Learning Gottheil — Principles of 29

Concentrating the Concentration A number of high-profile horizontal mergers occurred in the 1990 s. Mc. Donnell Douglas in the • Boeing and aircraft industry. • Staples and Office Depot in the office supply industry. • Union Pacific and Southern Pacific Rail in the railroad industry. © 2013 Cengage Learning Gottheil — Principles of 29

Concentrating the Concentration Vertical merger • A merger between firms that have a supplier-purchaser relationship. © 2013 Cengage Learning Gottheil — Principles of 30

Concentrating the Concentration Vertical merger • A merger between firms that have a supplier-purchaser relationship. © 2013 Cengage Learning Gottheil — Principles of 30

Concentrating the Concentration An example of vertical merging is that of Anheuser. Busch. The firm has acquired malt plants, yeast plants, a cornprocessing plant, beer can factories, and a railway that ships freight by rail and truck. © 2013 Cengage Learning Gottheil — Principles of 31

Concentrating the Concentration An example of vertical merging is that of Anheuser. Busch. The firm has acquired malt plants, yeast plants, a cornprocessing plant, beer can factories, and a railway that ships freight by rail and truck. © 2013 Cengage Learning Gottheil — Principles of 31

Concentrating the Concentration Conglomerate merger • A merger between firms in unrelated industries. © 2013 Cengage Learning Gottheil — Principles of 32

Concentrating the Concentration Conglomerate merger • A merger between firms in unrelated industries. © 2013 Cengage Learning Gottheil — Principles of 32

Concentrating the Concentration The conglomerate merger is the most common type of merger. © 2013 Cengage Learning Gottheil — Principles of 33

Concentrating the Concentration The conglomerate merger is the most common type of merger. © 2013 Cengage Learning Gottheil — Principles of 33

Concentrating the Concentration • One reason for conglomerate mergers is the desire to diversify operations. • While horizontal and vertical mergers strengthen the firm’s position within the industry, the fate of the firm rests on the health of the industry. • Acquiring unrelated firms insures the conglomerate. Principles of against Gottheil — © 2013 Cengage Learning 34

Concentrating the Concentration • One reason for conglomerate mergers is the desire to diversify operations. • While horizontal and vertical mergers strengthen the firm’s position within the industry, the fate of the firm rests on the health of the industry. • Acquiring unrelated firms insures the conglomerate. Principles of against Gottheil — © 2013 Cengage Learning 34

Concentrating the Concentration Cartel • A group of firms that collude to limit competition in a market by negotiating and accepting agreedupon price and market shares. © 2013 Cengage Learning Gottheil — Principles of 35

Concentrating the Concentration Cartel • A group of firms that collude to limit competition in a market by negotiating and accepting agreedupon price and market shares. © 2013 Cengage Learning Gottheil — Principles of 35

Concentrating the Concentration Collusion • The practice of firms to negotiate price and market share decision that limit competition in a market. © 2013 Cengage Learning Gottheil — Principles of 36

Concentrating the Concentration Collusion • The practice of firms to negotiate price and market share decision that limit competition in a market. © 2013 Cengage Learning Gottheil — Principles of 36

Concentrating the Concentration Cartels are an example of a merger in which firms don’t have to actually buy each other’s assets, yet they enjoy the benefits of having market power. © 2013 Cengage Learning Gottheil — Principles of 37

Concentrating the Concentration Cartels are an example of a merger in which firms don’t have to actually buy each other’s assets, yet they enjoy the benefits of having market power. © 2013 Cengage Learning Gottheil — Principles of 37

Concentrating the Concentration • While cartels are illegal in the United States, it is difficult to prove collusion. • Some governments encourage cartels to form in their countries. OPEC is one example. © 2013 Cengage Learning Gottheil — Principles of 38

Concentrating the Concentration • While cartels are illegal in the United States, it is difficult to prove collusion. • Some governments encourage cartels to form in their countries. OPEC is one example. © 2013 Cengage Learning Gottheil — Principles of 38

Concentrating the Concentration Many studies support the contention that price and concentration ratios move in the same direction – an increase in one is associated with an increase in the other. © 2013 Cengage Learning Gottheil — Principles of 39

Concentrating the Concentration Many studies support the contention that price and concentration ratios move in the same direction – an increase in one is associated with an increase in the other. © 2013 Cengage Learning Gottheil — Principles of 39

Mergers without Merging Firms don’t have to merge or acquire each other to gain the advantages of merging. They can remain independent by creating a joint venture or joining a cartel. © 2013 Cengage Learning Gottheil — Principles of 40

Mergers without Merging Firms don’t have to merge or acquire each other to gain the advantages of merging. They can remain independent by creating a joint venture or joining a cartel. © 2013 Cengage Learning Gottheil — Principles of 40

Mergers without Merging Joint venture • A business arrangement in which two or more firms undertake a specific economic activity together. © 2013 Cengage Learning Gottheil — Principles of 41

Mergers without Merging Joint venture • A business arrangement in which two or more firms undertake a specific economic activity together. © 2013 Cengage Learning Gottheil — Principles of 41

Mergers without Merging Cartel • A group of firms that collude to limit competition in a market by negotiating and accepting agreed upon price and market shares. © 2013 Cengage Learning Gottheil — Principles of 42

Mergers without Merging Cartel • A group of firms that collude to limit competition in a market by negotiating and accepting agreed upon price and market shares. © 2013 Cengage Learning Gottheil — Principles of 42

Mergers without Merging Collusion • The practice of firms to negotiate price and market share decisions that limit competition in a market. © 2013 Cengage Learning Gottheil — Principles of 43

Mergers without Merging Collusion • The practice of firms to negotiate price and market share decisions that limit competition in a market. © 2013 Cengage Learning Gottheil — Principles of 43

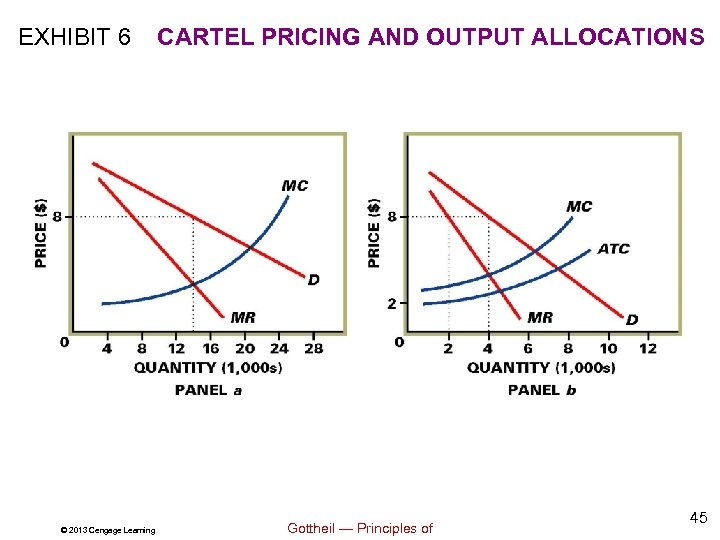

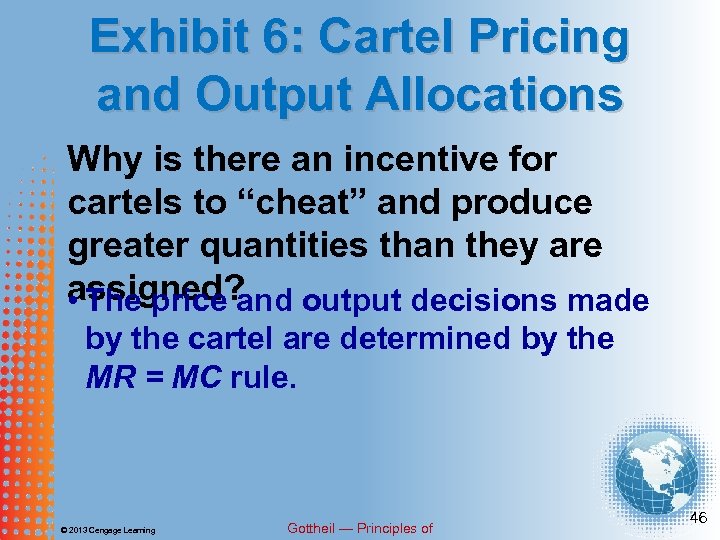

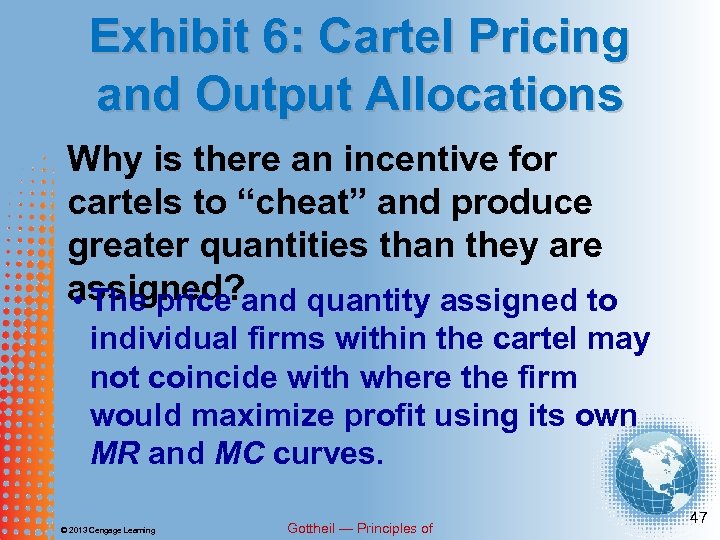

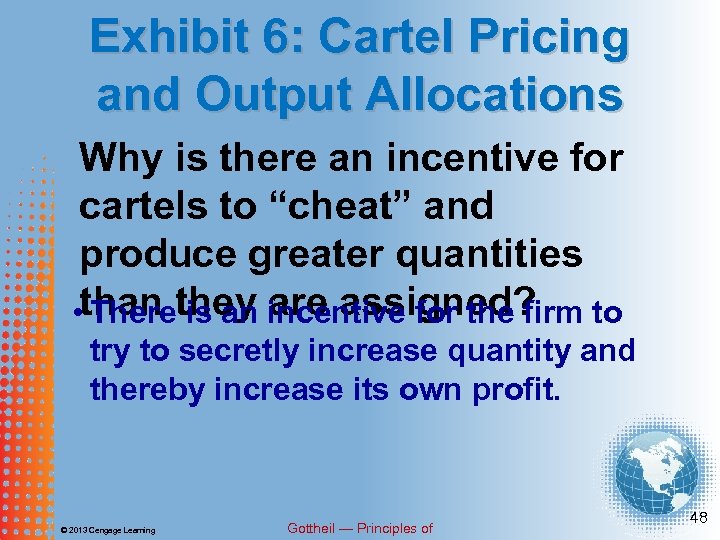

Cartel Pricing • A cartel determines price by acting as if it is a monopoly. • Price and quantity are determined using the MR = MC rule. © 2013 Cengage Learning Gottheil — Principles of 44

Cartel Pricing • A cartel determines price by acting as if it is a monopoly. • Price and quantity are determined using the MR = MC rule. © 2013 Cengage Learning Gottheil — Principles of 44

EXHIBIT 6 © 2013 Cengage Learning CARTEL PRICING AND OUTPUT ALLOCATIONS Gottheil — Principles of 45

EXHIBIT 6 © 2013 Cengage Learning CARTEL PRICING AND OUTPUT ALLOCATIONS Gottheil — Principles of 45

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities than they are assigned? • The price and output decisions made by the cartel are determined by the MR = MC rule. © 2013 Cengage Learning Gottheil — Principles of 46

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities than they are assigned? • The price and output decisions made by the cartel are determined by the MR = MC rule. © 2013 Cengage Learning Gottheil — Principles of 46

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities than they are assigned? and quantity assigned to • The price individual firms within the cartel may not coincide with where the firm would maximize profit using its own MR and MC curves. © 2013 Cengage Learning Gottheil — Principles of 47

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities than they are assigned? and quantity assigned to • The price individual firms within the cartel may not coincide with where the firm would maximize profit using its own MR and MC curves. © 2013 Cengage Learning Gottheil — Principles of 47

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities • than they incentive for the firm to There is an are assigned? try to secretly increase quantity and thereby increase its own profit. © 2013 Cengage Learning Gottheil — Principles of 48

Exhibit 6: Cartel Pricing and Output Allocations Why is there an incentive for cartels to “cheat” and produce greater quantities • than they incentive for the firm to There is an are assigned? try to secretly increase quantity and thereby increase its own profit. © 2013 Cengage Learning Gottheil — Principles of 48

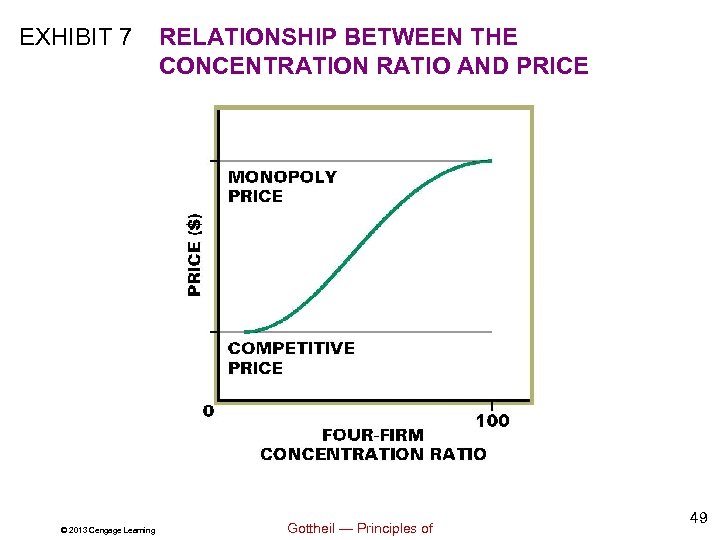

EXHIBIT 7 © 2013 Cengage Learning RELATIONSHIP BETWEEN THE CONCENTRATION RATIO AND PRICE Gottheil — Principles of 49

EXHIBIT 7 © 2013 Cengage Learning RELATIONSHIP BETWEEN THE CONCENTRATION RATIO AND PRICE Gottheil — Principles of 49

Exhibit 7: Relationship Between the Concentration Ratio and Price Where on the curve in Exhibit 7 does the concentration ratio have the strongest effect on price? is the strongest in the • The effect middle of the S-shaped curve. © 2013 Cengage Learning Gottheil — Principles of 50

Exhibit 7: Relationship Between the Concentration Ratio and Price Where on the curve in Exhibit 7 does the concentration ratio have the strongest effect on price? is the strongest in the • The effect middle of the S-shaped curve. © 2013 Cengage Learning Gottheil — Principles of 50

Theories of Oligopoly Pricing In monopoly, monopolistic competition and perfect competition, firms react only to the demand cost structures they face. Prices tend toward equilibrium. © 2013 Cengage Learning Gottheil — Principles of 51

Theories of Oligopoly Pricing In monopoly, monopolistic competition and perfect competition, firms react only to the demand cost structures they face. Prices tend toward equilibrium. © 2013 Cengage Learning Gottheil — Principles of 51

Theories of Oligopoly Pricing In oligopoly, firms are continually second guessing how the competition will respond to price decision they make. Prices are subject to fits of change. © 2013 Cengage Learning Gottheil — Principles of 52

Theories of Oligopoly Pricing In oligopoly, firms are continually second guessing how the competition will respond to price decision they make. Prices are subject to fits of change. © 2013 Cengage Learning Gottheil — Principles of 52

Theories of Oligopoly Pricing Game theory • A theory of strategy ascribed to the firms’ behavior in oligopoly. The firms’ behavior is mutually interdependent. © 2013 Cengage Learning Gottheil — Principles of 53

Theories of Oligopoly Pricing Game theory • A theory of strategy ascribed to the firms’ behavior in oligopoly. The firms’ behavior is mutually interdependent. © 2013 Cengage Learning Gottheil — Principles of 53

Theories of Oligopoly Pricing Nash equilibrium • A set of pricing strategies adopted by firms in which none can improve its payoff outcome, given the price strategies of the other firm or firms. © 2013 Cengage Learning Gottheil — Principles of 54

Theories of Oligopoly Pricing Nash equilibrium • A set of pricing strategies adopted by firms in which none can improve its payoff outcome, given the price strategies of the other firm or firms. © 2013 Cengage Learning Gottheil — Principles of 54

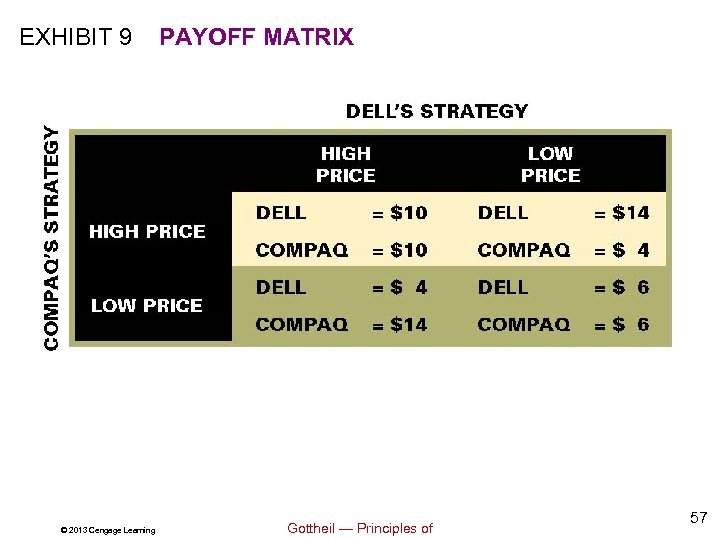

Theories of Oligopoly Pricing Payoff matrix • A table that matches the sets of gains (or losses) for competing firms when they choose, independently, various pricing options. © 2013 Cengage Learning Gottheil — Principles of 55

Theories of Oligopoly Pricing Payoff matrix • A table that matches the sets of gains (or losses) for competing firms when they choose, independently, various pricing options. © 2013 Cengage Learning Gottheil — Principles of 55

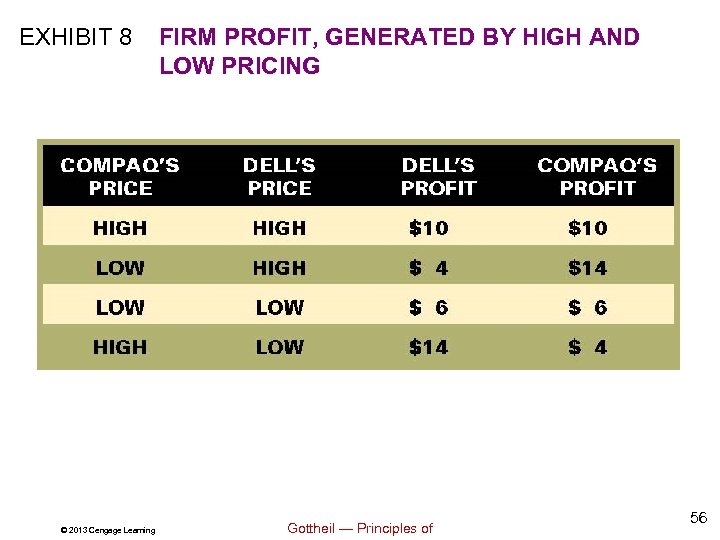

EXHIBIT 8 © 2013 Cengage Learning FIRM PROFIT, GENERATED BY HIGH AND LOW PRICING Gottheil — Principles of 56

EXHIBIT 8 © 2013 Cengage Learning FIRM PROFIT, GENERATED BY HIGH AND LOW PRICING Gottheil — Principles of 56

EXHIBIT 9 © 2013 Cengage Learning PAYOFF MATRIX Gottheil — Principles of 57

EXHIBIT 9 © 2013 Cengage Learning PAYOFF MATRIX Gottheil — Principles of 57

Exhibits 8 & 9: Firm Profit Generated by High and Low Pricing How does total profit change as Dell and Compaq change their prices? firms price high, total • When both profit is 20. When one firm prices high and the other prices low, total profit is 18. When both firms price low, total profit is 12. © 2013 Cengage Learning Gottheil — Principles of 58

Exhibits 8 & 9: Firm Profit Generated by High and Low Pricing How does total profit change as Dell and Compaq change their prices? firms price high, total • When both profit is 20. When one firm prices high and the other prices low, total profit is 18. When both firms price low, total profit is 12. © 2013 Cengage Learning Gottheil — Principles of 58

Theories of Oligopoly Pricing Price leadership • A firm whose price decisions are tacitly accepted and followed by other firms in the industry. The theory explains pricing in unbalanced oligopolies. © 2013 Cengage Learning Gottheil — Principles of 59

Theories of Oligopoly Pricing Price leadership • A firm whose price decisions are tacitly accepted and followed by other firms in the industry. The theory explains pricing in unbalanced oligopolies. © 2013 Cengage Learning Gottheil — Principles of 59

Theories of Oligopoly Pricing Tit-for-tat • A pricing strategy in game theory in which a firm chooses a price and will change its price to match whatever price the competing firm chooses. © 2013 Cengage Learning Gottheil — Principles of 60

Theories of Oligopoly Pricing Tit-for-tat • A pricing strategy in game theory in which a firm chooses a price and will change its price to match whatever price the competing firm chooses. © 2013 Cengage Learning Gottheil — Principles of 60

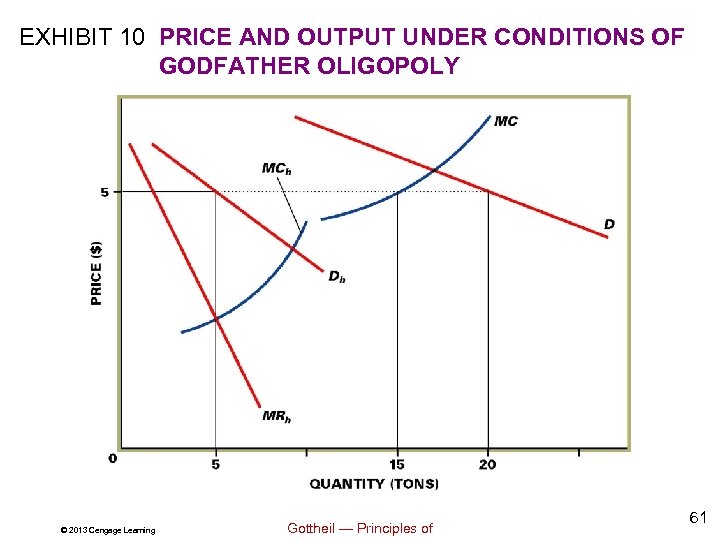

EXHIBIT 10 PRICE AND OUTPUT UNDER CONDITIONS OF GODFATHER OLIGOPOLY © 2013 Cengage Learning Gottheil — Principles of 61

EXHIBIT 10 PRICE AND OUTPUT UNDER CONDITIONS OF GODFATHER OLIGOPOLY © 2013 Cengage Learning Gottheil — Principles of 61

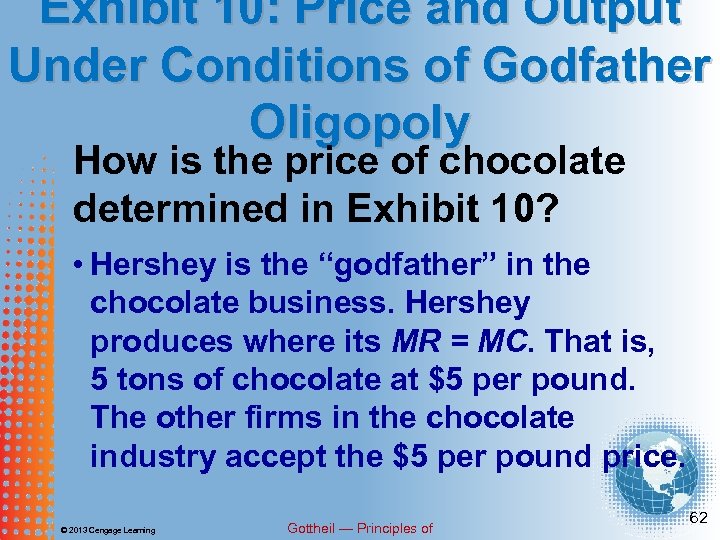

Exhibit 10: Price and Output Under Conditions of Godfather Oligopoly How is the price of chocolate determined in Exhibit 10? • Hershey is the “godfather” in the chocolate business. Hershey produces where its MR = MC. That is, 5 tons of chocolate at $5 per pound. The other firms in the chocolate industry accept the $5 per pound price. © 2013 Cengage Learning Gottheil — Principles of 62

Exhibit 10: Price and Output Under Conditions of Godfather Oligopoly How is the price of chocolate determined in Exhibit 10? • Hershey is the “godfather” in the chocolate business. Hershey produces where its MR = MC. That is, 5 tons of chocolate at $5 per pound. The other firms in the chocolate industry accept the $5 per pound price. © 2013 Cengage Learning Gottheil — Principles of 62

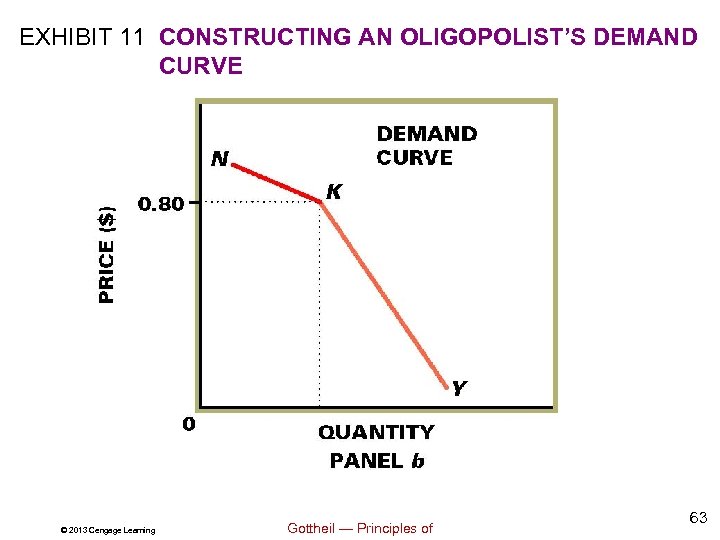

EXHIBIT 11 CONSTRUCTING AN OLIGOPOLIST’S DEMAND CURVE © 2013 Cengage Learning Gottheil — Principles of 63

EXHIBIT 11 CONSTRUCTING AN OLIGOPOLIST’S DEMAND CURVE © 2013 Cengage Learning Gottheil — Principles of 63

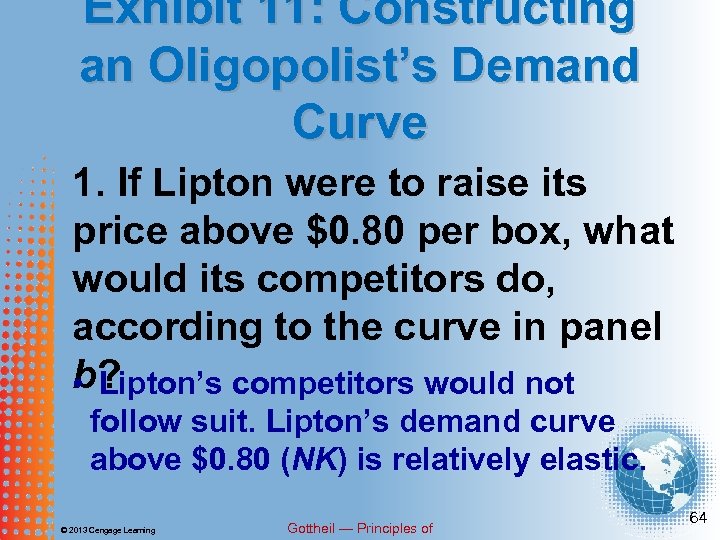

Exhibit 11: Constructing an Oligopolist’s Demand Curve 1. If Lipton were to raise its price above $0. 80 per box, what would its competitors do, according to the curve in panel b? • Lipton’s competitors would not follow suit. Lipton’s demand curve above $0. 80 (NK) is relatively elastic. © 2013 Cengage Learning Gottheil — Principles of 64

Exhibit 11: Constructing an Oligopolist’s Demand Curve 1. If Lipton were to raise its price above $0. 80 per box, what would its competitors do, according to the curve in panel b? • Lipton’s competitors would not follow suit. Lipton’s demand curve above $0. 80 (NK) is relatively elastic. © 2013 Cengage Learning Gottheil — Principles of 64

Exhibit 11: Constructing an Oligopolist’s Demand Curve 2. If Lipton were to lower its price below $0. 80 per box, then what would its competitors do? • Lipton’s competitors would feel compelled to follow suit. Lipton’s demand curve below $0. 80 (YK) is relatively inelastic. © 2013 Cengage Learning Gottheil — Principles of 65

Exhibit 11: Constructing an Oligopolist’s Demand Curve 2. If Lipton were to lower its price below $0. 80 per box, then what would its competitors do? • Lipton’s competitors would feel compelled to follow suit. Lipton’s demand curve below $0. 80 (YK) is relatively inelastic. © 2013 Cengage Learning Gottheil — Principles of 65

Theories of Oligopoly Pricing Kinked demand curve • The demand curve facing a firm in oligopoly; the curve is more elastic when the firm raises price than when it lowers price. © 2013 Cengage Learning Gottheil — Principles of 66

Theories of Oligopoly Pricing Kinked demand curve • The demand curve facing a firm in oligopoly; the curve is more elastic when the firm raises price than when it lowers price. © 2013 Cengage Learning Gottheil — Principles of 66

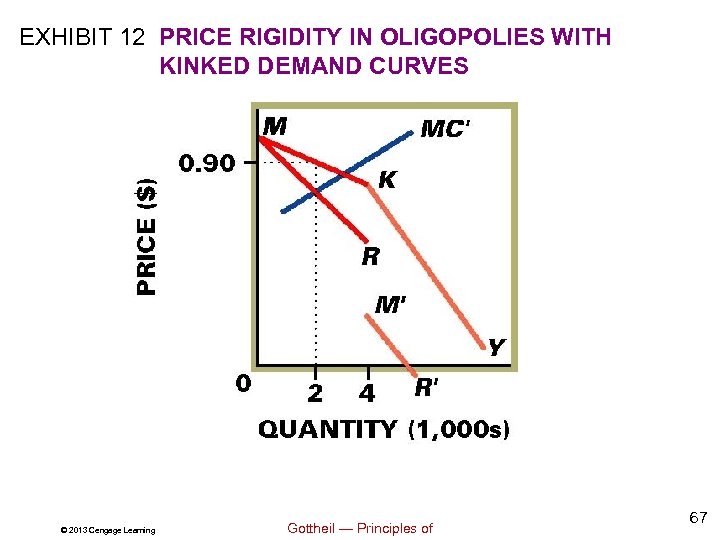

EXHIBIT 12 PRICE RIGIDITY IN OLIGOPOLIES WITH KINKED DEMAND CURVES © 2013 Cengage Learning Gottheil — Principles of 67

EXHIBIT 12 PRICE RIGIDITY IN OLIGOPOLIES WITH KINKED DEMAND CURVES © 2013 Cengage Learning Gottheil — Principles of 67

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves The marginal revenue curve associated with a kinked demand curve is: i. Continuous ii. Discontinuous © 2013 Cengage Learning Gottheil — Principles of 68

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves The marginal revenue curve associated with a kinked demand curve is: i. Continuous ii. Discontinuous © 2013 Cengage Learning Gottheil — Principles of 68

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves The marginal revenue curve associated with a kinked demand curve is: i. Continuous ii. Discontinuous © 2013 Cengage Learning Gottheil — Principles of 69

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves The marginal revenue curve associated with a kinked demand curve is: i. Continuous ii. Discontinuous © 2013 Cengage Learning Gottheil — Principles of 69

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves As long as the MC curve crosses the gap created by the discontinuity in the MR curve, price will remain unchanged, as shown in panel b. © 2013 Cengage Learning Gottheil — Principles of 70

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves As long as the MC curve crosses the gap created by the discontinuity in the MR curve, price will remain unchanged, as shown in panel b. © 2013 Cengage Learning Gottheil — Principles of 70

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves If the MC curve cuts the MR curve above the gap, output will decrease and price will increase. This scenario is depicted in panel c. © 2013 Cengage Learning Gottheil — Principles of 71

Exhibit 12: Price Rigidity in Oligopolies with Kinked Demand Curves If the MC curve cuts the MR curve above the gap, output will decrease and price will increase. This scenario is depicted in panel c. © 2013 Cengage Learning Gottheil — Principles of 71

Brand Multiplication Brand multiplication • Variations on essentially one good that a firm produces in order to increase its market share. © 2013 Cengage Learning Gottheil — Principles of 72

Brand Multiplication Brand multiplication • Variations on essentially one good that a firm produces in order to increase its market share. © 2013 Cengage Learning Gottheil — Principles of 72

Brand Multiplication • A firm’s market share = (Number of brands) × (Brand market share). • As the number of brands in the industry increases, market share per brand diminishes. © 2013 Cengage Learning Gottheil — Principles of 73

Brand Multiplication • A firm’s market share = (Number of brands) × (Brand market share). • As the number of brands in the industry increases, market share per brand diminishes. © 2013 Cengage Learning Gottheil — Principles of 73

Price Discrimination Price discrimination • The practice of offering a specific good or service at different prices to different segments of the market. © 2013 Cengage Learning Gottheil — Principles of 74

Price Discrimination Price discrimination • The practice of offering a specific good or service at different prices to different segments of the market. © 2013 Cengage Learning Gottheil — Principles of 74

Price Discrimination • Oligopolists sometimes segment the market in order to charge consumers what they are willing to pay for a good or service. • Differences in airline ticket prices are a good example. © 2013 Cengage Learning Gottheil — Principles of 75

Price Discrimination • Oligopolists sometimes segment the market in order to charge consumers what they are willing to pay for a good or service. • Differences in airline ticket prices are a good example. © 2013 Cengage Learning Gottheil — Principles of 75

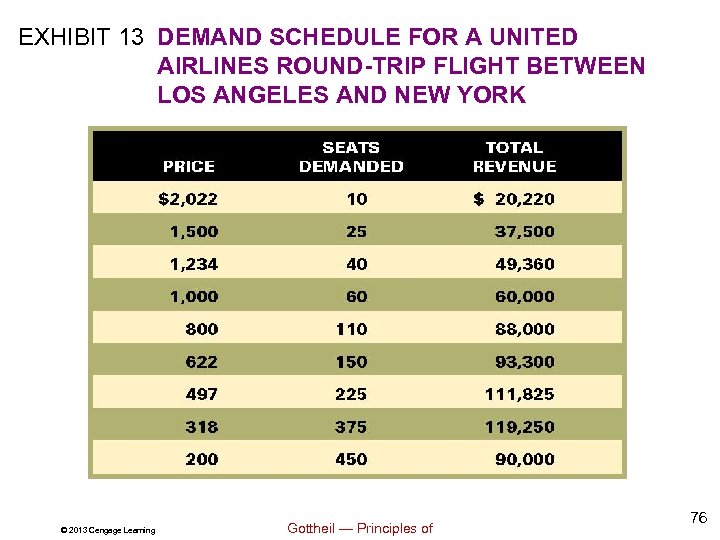

EXHIBIT 13 DEMAND SCHEDULE FOR A UNITED AIRLINES ROUND-TRIP FLIGHT BETWEEN LOS ANGELES AND NEW YORK © 2013 Cengage Learning Gottheil — Principles of 76

EXHIBIT 13 DEMAND SCHEDULE FOR A UNITED AIRLINES ROUND-TRIP FLIGHT BETWEEN LOS ANGELES AND NEW YORK © 2013 Cengage Learning Gottheil — Principles of 76

Exhibit 13: Demand Schedule for a United Airlines Round-Trip Flight Between LA and NY If United chose not to segment its market in Exhibit 13, what would be its total revenue? • The maximum total revenue for United would be achieved at a ticket price of $318 each, for a total of $119, 250. © 2013 Cengage Learning Gottheil — Principles of 77

Exhibit 13: Demand Schedule for a United Airlines Round-Trip Flight Between LA and NY If United chose not to segment its market in Exhibit 13, what would be its total revenue? • The maximum total revenue for United would be achieved at a ticket price of $318 each, for a total of $119, 250. © 2013 Cengage Learning Gottheil — Principles of 77

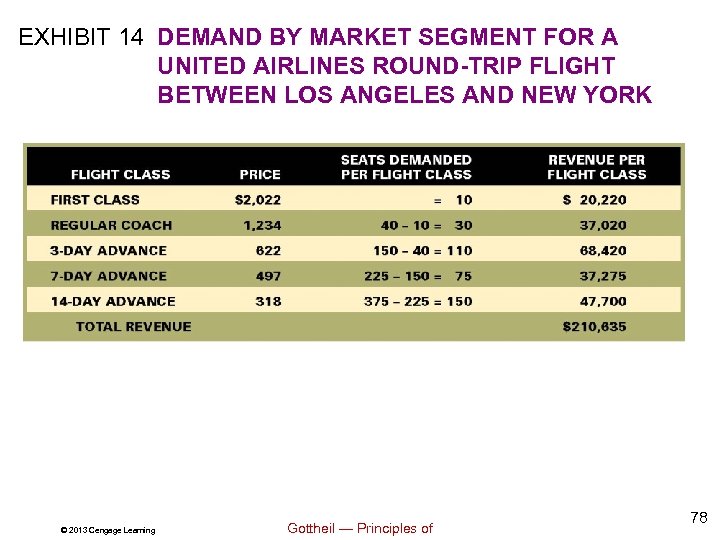

EXHIBIT 14 DEMAND BY MARKET SEGMENT FOR A UNITED AIRLINES ROUND-TRIP FLIGHT BETWEEN LOS ANGELES AND NEW YORK © 2013 Cengage Learning Gottheil — Principles of 78

EXHIBIT 14 DEMAND BY MARKET SEGMENT FOR A UNITED AIRLINES ROUND-TRIP FLIGHT BETWEEN LOS ANGELES AND NEW YORK © 2013 Cengage Learning Gottheil — Principles of 78

Exhibit 14: Demand by Market Segment for a United Airlines Round-Trip Flight Between LA and NY What is United’s total revenue when it segments its market into a multiple-fare system? • United’s total revenue is $210, 635. This is an increase of $91, 385 over the unsegmented market. © 2013 Cengage Learning Gottheil — Principles of 79

Exhibit 14: Demand by Market Segment for a United Airlines Round-Trip Flight Between LA and NY What is United’s total revenue when it segments its market into a multiple-fare system? • United’s total revenue is $210, 635. This is an increase of $91, 385 over the unsegmented market. © 2013 Cengage Learning Gottheil — Principles of 79

Price Discrimination • Price discrimination exists in virtually every market. • Some differences in price are not clear cases of price discrimination, however. © 2013 Cengage Learning Gottheil — Principles of 80

Price Discrimination • Price discrimination exists in virtually every market. • Some differences in price are not clear cases of price discrimination, however. © 2013 Cengage Learning Gottheil — Principles of 80

Why Oligopolists Sometimes Discriminate • For example, many would argue that upper balcony seats are not the same as front row seats at a concert. If the goods are different, then it is not necessarily price discrimination to charge more for the front row seats. © 2013 Cengage Learning Gottheil — Principles of 81

Why Oligopolists Sometimes Discriminate • For example, many would argue that upper balcony seats are not the same as front row seats at a concert. If the goods are different, then it is not necessarily price discrimination to charge more for the front row seats. © 2013 Cengage Learning Gottheil — Principles of 81