fef98b9b59c982c4b00d8cb596c2652f.ppt

- Количество слайдов: 100

Chapter 12 Monopolistic Competition and Oligopoly Chapter 12 1

Chapter 12 Monopolistic Competition and Oligopoly Chapter 12 1

Topics to be Discussed n Monopolistic Competition n Oligopoly n Price Competition n Competition Versus Collusion: The Prisoners’ Dilemma Chapter 12 2

Topics to be Discussed n Monopolistic Competition n Oligopoly n Price Competition n Competition Versus Collusion: The Prisoners’ Dilemma Chapter 12 2

Topics to be Discussed n Implications of the Prisoners’ Dilemma for Oligopolistic Pricing n Cartels Chapter 12 3

Topics to be Discussed n Implications of the Prisoners’ Dilemma for Oligopolistic Pricing n Cartels Chapter 12 3

Monopolistic Competition n Characteristics 1) Many firms 2) Free entry and exit 3) Differentiated product Chapter 12 4

Monopolistic Competition n Characteristics 1) Many firms 2) Free entry and exit 3) Differentiated product Chapter 12 4

Monopolistic Competition n The amount of monopoly power depends on the degree of differentiation. n Examples of this very common market structure include: l Toothpaste l Soap l Cold remedies Chapter 12 5

Monopolistic Competition n The amount of monopoly power depends on the degree of differentiation. n Examples of this very common market structure include: l Toothpaste l Soap l Cold remedies Chapter 12 5

Monopolistic Competition n Toothpaste l Crest and monopoly power Procter & Gamble is the sole producer of Crest u Consumers can have a preference for Crest---taste, reputation, decay preventing efficacy u The greater the preference (differentiation) the higher the price. u Chapter 12 6

Monopolistic Competition n Toothpaste l Crest and monopoly power Procter & Gamble is the sole producer of Crest u Consumers can have a preference for Crest---taste, reputation, decay preventing efficacy u The greater the preference (differentiation) the higher the price. u Chapter 12 6

Monopolistic Competition n Question l Chapter 12 Does Procter & Gamble have much monopoly power in the market for Crest? 7

Monopolistic Competition n Question l Chapter 12 Does Procter & Gamble have much monopoly power in the market for Crest? 7

Monopolistic Competition n The Makings of Monopolistic Competition l Two u u Chapter 12 important characteristics Differentiated but highly substitutable products Free entry and exit 8

Monopolistic Competition n The Makings of Monopolistic Competition l Two u u Chapter 12 important characteristics Differentiated but highly substitutable products Free entry and exit 8

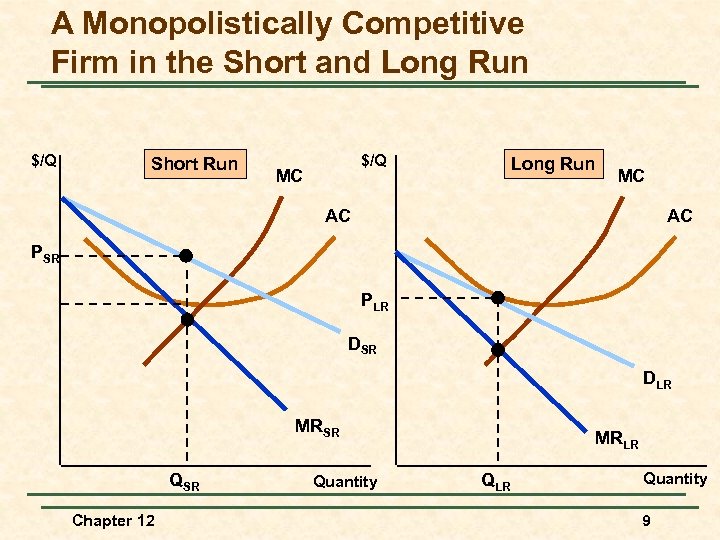

A Monopolistically Competitive Firm in the Short and Long Run $/Q Short Run $/Q MC Long Run MC AC AC PSR PLR DSR DLR MRSR QSR Chapter 12 Quantity MRLR Quantity 9

A Monopolistically Competitive Firm in the Short and Long Run $/Q Short Run $/Q MC Long Run MC AC AC PSR PLR DSR DLR MRSR QSR Chapter 12 Quantity MRLR Quantity 9

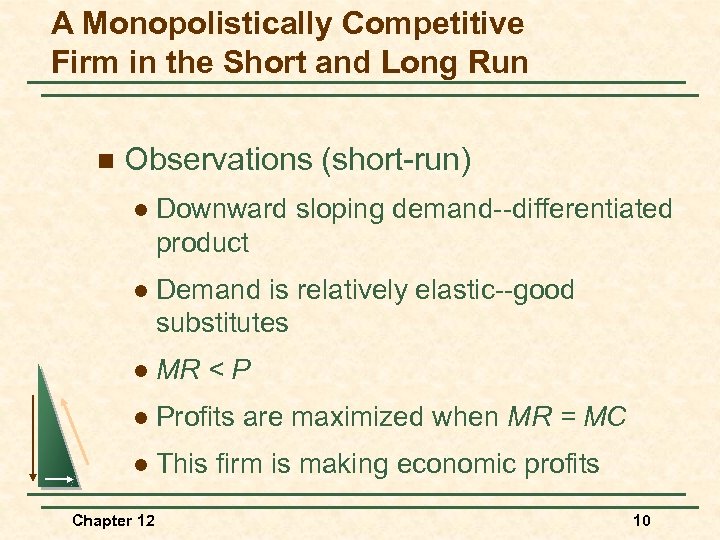

A Monopolistically Competitive Firm in the Short and Long Run n Observations (short-run) l Downward sloping demand--differentiated product l Demand is relatively elastic--good substitutes l MR < P l Profits are maximized when MR = MC l This firm is making economic profits Chapter 12 10

A Monopolistically Competitive Firm in the Short and Long Run n Observations (short-run) l Downward sloping demand--differentiated product l Demand is relatively elastic--good substitutes l MR < P l Profits are maximized when MR = MC l This firm is making economic profits Chapter 12 10

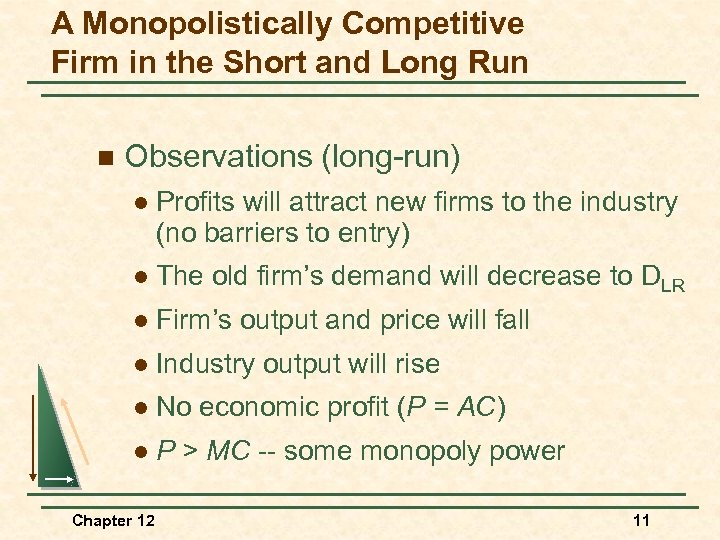

A Monopolistically Competitive Firm in the Short and Long Run n Observations (long-run) l Profits will attract new firms to the industry (no barriers to entry) l The old firm’s demand will decrease to DLR l Firm’s output and price will fall l Industry output will rise l No economic profit (P = AC) l P > MC -- some monopoly power Chapter 12 11

A Monopolistically Competitive Firm in the Short and Long Run n Observations (long-run) l Profits will attract new firms to the industry (no barriers to entry) l The old firm’s demand will decrease to DLR l Firm’s output and price will fall l Industry output will rise l No economic profit (P = AC) l P > MC -- some monopoly power Chapter 12 11

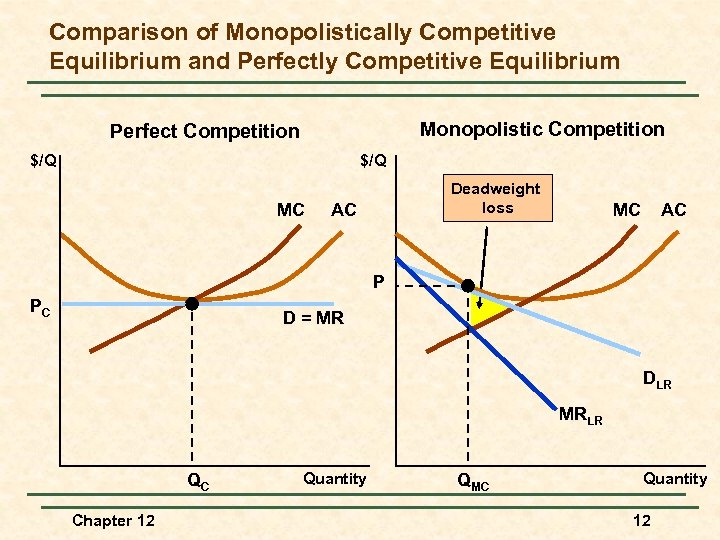

Comparison of Monopolistically Competitive Equilibrium and Perfectly Competitive Equilibrium Monopolistic Competition Perfect Competition $/Q MC Deadweight loss AC MC AC P PC D = MR DLR MRLR QC Chapter 12 Quantity QMC Quantity 12

Comparison of Monopolistically Competitive Equilibrium and Perfectly Competitive Equilibrium Monopolistic Competition Perfect Competition $/Q MC Deadweight loss AC MC AC P PC D = MR DLR MRLR QC Chapter 12 Quantity QMC Quantity 12

Monopolistic Competition n Monopolistic Competition and Economic Efficiency l The monopoly power (differentiation) yields a higher price than perfect competition. If price was lowered to the point where MC = D, consumer surplus would increase by the yellow triangle. Chapter 12 13

Monopolistic Competition n Monopolistic Competition and Economic Efficiency l The monopoly power (differentiation) yields a higher price than perfect competition. If price was lowered to the point where MC = D, consumer surplus would increase by the yellow triangle. Chapter 12 13

Monopolistic Competition n Monopolistic Competition and Economic Efficiency l With no economic profits in the long run, the firm is still not producing at minimum AC and excess capacity exists. Chapter 12 14

Monopolistic Competition n Monopolistic Competition and Economic Efficiency l With no economic profits in the long run, the firm is still not producing at minimum AC and excess capacity exists. Chapter 12 14

Monopolistic Competition n Questions 1) If the market became competitive, what would happen to output and price? 2) Should monopolistic competition be regulated? Chapter 12 15

Monopolistic Competition n Questions 1) If the market became competitive, what would happen to output and price? 2) Should monopolistic competition be regulated? Chapter 12 15

Monopolistic Competition n Questions 3) What is the degree of monopoly power? 4) What is the benefit of product diversity? Chapter 12 16

Monopolistic Competition n Questions 3) What is the degree of monopoly power? 4) What is the benefit of product diversity? Chapter 12 16

Monopolistic Competition in the Market for Colas and Coffee n The markets for soft drinks and coffee illustrate the characteristics of monopolistic competition. Chapter 12 17

Monopolistic Competition in the Market for Colas and Coffee n The markets for soft drinks and coffee illustrate the characteristics of monopolistic competition. Chapter 12 17

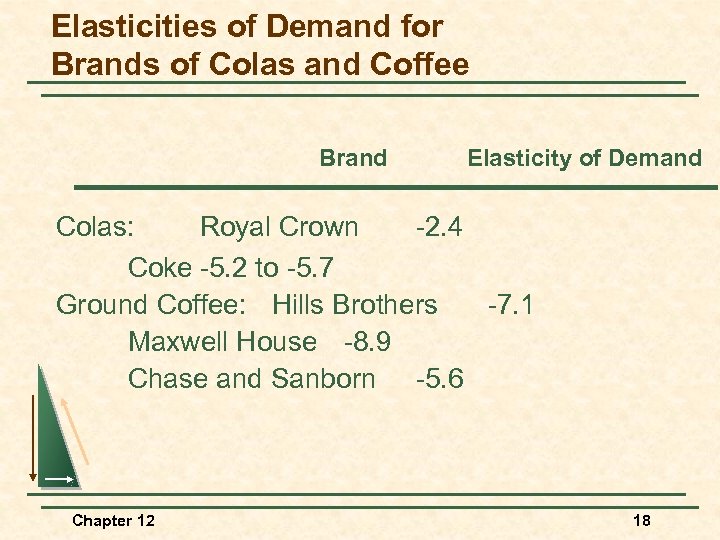

Elasticities of Demand for Brands of Colas and Coffee Brand Elasticity of Demand Colas: Royal Crown -2. 4 Coke -5. 2 to -5. 7 Ground Coffee: Hills Brothers -7. 1 Maxwell House -8. 9 Chase and Sanborn -5. 6 Chapter 12 18

Elasticities of Demand for Brands of Colas and Coffee Brand Elasticity of Demand Colas: Royal Crown -2. 4 Coke -5. 2 to -5. 7 Ground Coffee: Hills Brothers -7. 1 Maxwell House -8. 9 Chase and Sanborn -5. 6 Chapter 12 18

Elasticities of Demand for Brands of Colas and Coffee n Questions 1) Why is the demand for Royal Crown more price inelastic than for Coke? 2) Is there much monopoly power in these two markets? 3) Define the relationship between elasticity and monopoly power. Chapter 12 19

Elasticities of Demand for Brands of Colas and Coffee n Questions 1) Why is the demand for Royal Crown more price inelastic than for Coke? 2) Is there much monopoly power in these two markets? 3) Define the relationship between elasticity and monopoly power. Chapter 12 19

Oligopoly n Characteristics l Small number of firms l Product differentiation may or may not exist l Barriers to entry Chapter 12 20

Oligopoly n Characteristics l Small number of firms l Product differentiation may or may not exist l Barriers to entry Chapter 12 20

Oligopoly n Examples l Automobiles l Steel l Aluminum l Petrochemicals l Electrical equipment l Computers Chapter 12 21

Oligopoly n Examples l Automobiles l Steel l Aluminum l Petrochemicals l Electrical equipment l Computers Chapter 12 21

Oligopoly n The barriers to entry are: l Natural u u Patents u Technology u Chapter 12 Scale economies Name recognition 22

Oligopoly n The barriers to entry are: l Natural u u Patents u Technology u Chapter 12 Scale economies Name recognition 22

Oligopoly n The barriers to entry are: l Strategic action u u Chapter 12 Flooding the market Controlling an essential input 23

Oligopoly n The barriers to entry are: l Strategic action u u Chapter 12 Flooding the market Controlling an essential input 23

Oligopoly n Management Challenges l l n Strategic actions Rival behavior Question l Chapter 12 What are the possible rival responses to a 10% price cut by Ford? 24

Oligopoly n Management Challenges l l n Strategic actions Rival behavior Question l Chapter 12 What are the possible rival responses to a 10% price cut by Ford? 24

Oligopoly n Equilibrium in an Oligopolistic Market l In perfect competition, monopoly, and monopolistic competition the producers did not have to consider a rival’s response when choosing output and price. l In oligopoly the producers must consider the response of competitors when choosing output and price. Chapter 12 25

Oligopoly n Equilibrium in an Oligopolistic Market l In perfect competition, monopoly, and monopolistic competition the producers did not have to consider a rival’s response when choosing output and price. l In oligopoly the producers must consider the response of competitors when choosing output and price. Chapter 12 25

Oligopoly n Equilibrium in an Oligopolistic Market l Defining Equilibrium u u Chapter 12 Firms doing the best they can and have no incentive to change their output or price All firms assume competitors are taking rival decisions into account. 26

Oligopoly n Equilibrium in an Oligopolistic Market l Defining Equilibrium u u Chapter 12 Firms doing the best they can and have no incentive to change their output or price All firms assume competitors are taking rival decisions into account. 26

Oligopoly n Nash Equilibrium l Chapter 12 Each firm is doing the best it can given what its competitors are doing. 27

Oligopoly n Nash Equilibrium l Chapter 12 Each firm is doing the best it can given what its competitors are doing. 27

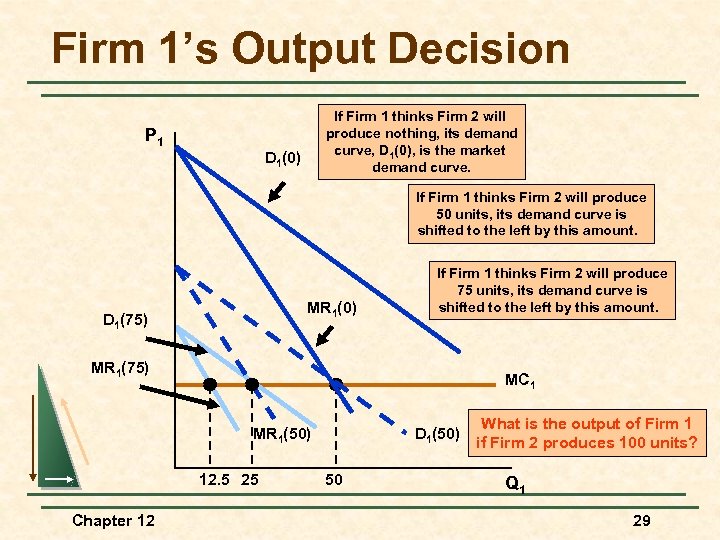

Oligopoly n The Cournot Model l Duopoly u Two firms competing with each other u Homogenous good u Chapter 12 The output of the other firm is assumed to be fixed 28

Oligopoly n The Cournot Model l Duopoly u Two firms competing with each other u Homogenous good u Chapter 12 The output of the other firm is assumed to be fixed 28

Firm 1’s Output Decision If Firm 1 thinks Firm 2 will produce nothing, its demand curve, D 1(0), is the market demand curve. P 1 D 1(0) If Firm 1 thinks Firm 2 will produce 50 units, its demand curve is shifted to the left by this amount. MR 1(0) D 1(75) If Firm 1 thinks Firm 2 will produce 75 units, its demand curve is shifted to the left by this amount. MR 1(75) MC 1 MR 1(50) 12. 5 25 Chapter 12 D 1(50) 50 What is the output of Firm 1 if Firm 2 produces 100 units? Q 1 29

Firm 1’s Output Decision If Firm 1 thinks Firm 2 will produce nothing, its demand curve, D 1(0), is the market demand curve. P 1 D 1(0) If Firm 1 thinks Firm 2 will produce 50 units, its demand curve is shifted to the left by this amount. MR 1(0) D 1(75) If Firm 1 thinks Firm 2 will produce 75 units, its demand curve is shifted to the left by this amount. MR 1(75) MC 1 MR 1(50) 12. 5 25 Chapter 12 D 1(50) 50 What is the output of Firm 1 if Firm 2 produces 100 units? Q 1 29

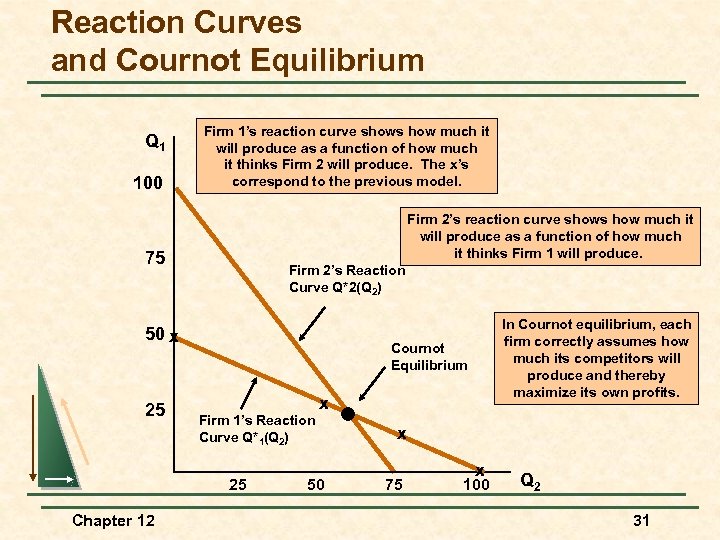

Oligopoly n The Reaction Curve l Chapter 12 A firm’s profit-maximizing output is a decreasing schedule of the expected output of Firm 2. 30

Oligopoly n The Reaction Curve l Chapter 12 A firm’s profit-maximizing output is a decreasing schedule of the expected output of Firm 2. 30

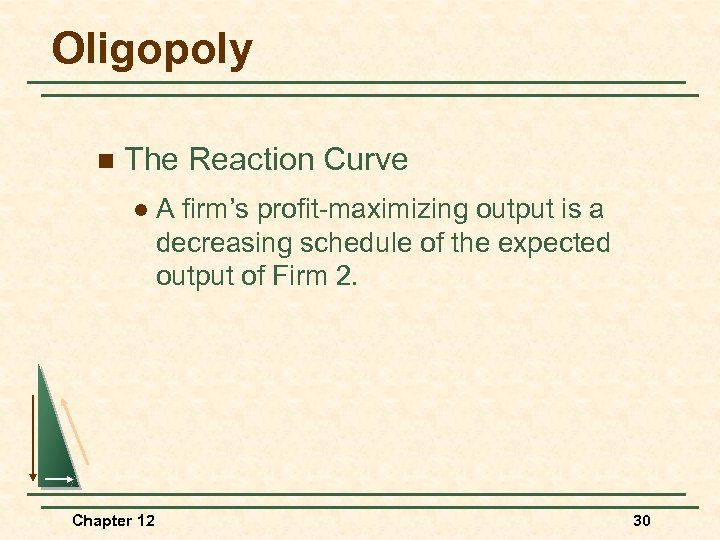

Reaction Curves and Cournot Equilibrium Q 1 100 Firm 1’s reaction curve shows how much it will produce as a function of how much it thinks Firm 2 will produce. The x’s correspond to the previous model. Firm 2’s reaction curve shows how much it will produce as a function of how much it thinks Firm 1 will produce. 75 Firm 2’s Reaction Curve Q*2(Q 2) 50 x 25 Cournot Equilibrium Firm 1’s Reaction Curve Q*1(Q 2) 25 Chapter 12 In Cournot equilibrium, each firm correctly assumes how much its competitors will produce and thereby maximize its own profits. x 50 x 75 x 100 Q 2 31

Reaction Curves and Cournot Equilibrium Q 1 100 Firm 1’s reaction curve shows how much it will produce as a function of how much it thinks Firm 2 will produce. The x’s correspond to the previous model. Firm 2’s reaction curve shows how much it will produce as a function of how much it thinks Firm 1 will produce. 75 Firm 2’s Reaction Curve Q*2(Q 2) 50 x 25 Cournot Equilibrium Firm 1’s Reaction Curve Q*1(Q 2) 25 Chapter 12 In Cournot equilibrium, each firm correctly assumes how much its competitors will produce and thereby maximize its own profits. x 50 x 75 x 100 Q 2 31

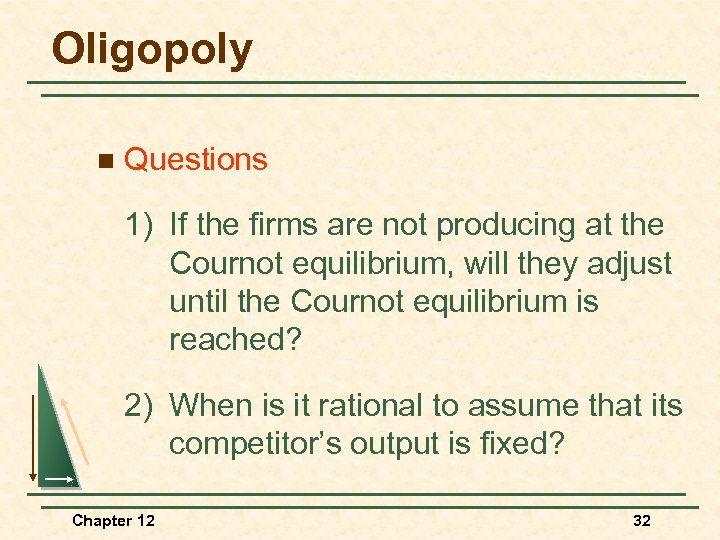

Oligopoly n Questions 1) If the firms are not producing at the Cournot equilibrium, will they adjust until the Cournot equilibrium is reached? 2) When is it rational to assume that its competitor’s output is fixed? Chapter 12 32

Oligopoly n Questions 1) If the firms are not producing at the Cournot equilibrium, will they adjust until the Cournot equilibrium is reached? 2) When is it rational to assume that its competitor’s output is fixed? Chapter 12 32

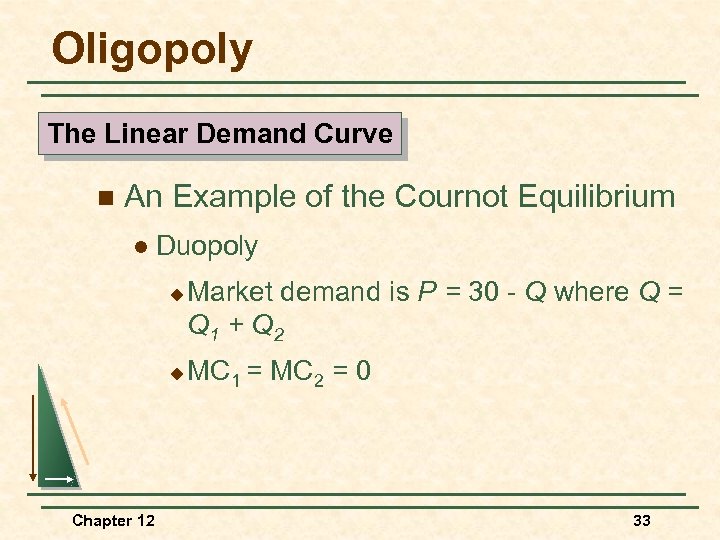

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium l Duopoly u u Chapter 12 Market demand is P = 30 - Q where Q = Q 1 + Q 2 MC 1 = MC 2 = 0 33

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium l Duopoly u u Chapter 12 Market demand is P = 30 - Q where Q = Q 1 + Q 2 MC 1 = MC 2 = 0 33

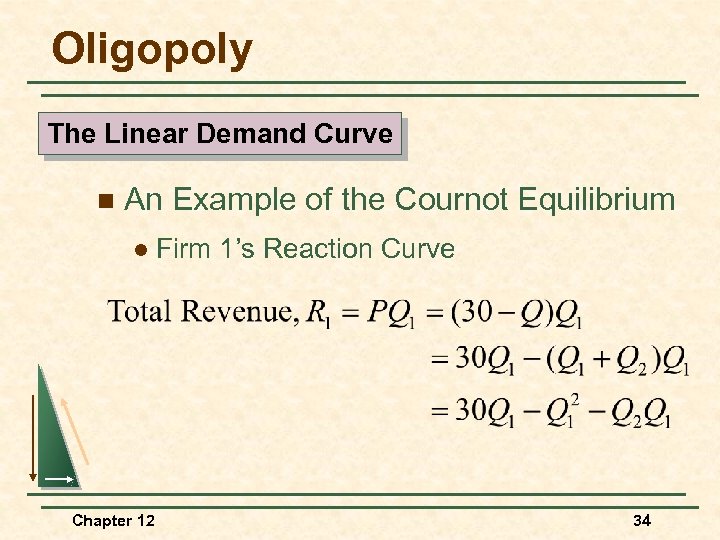

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium l Chapter 12 Firm 1’s Reaction Curve 34

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium l Chapter 12 Firm 1’s Reaction Curve 34

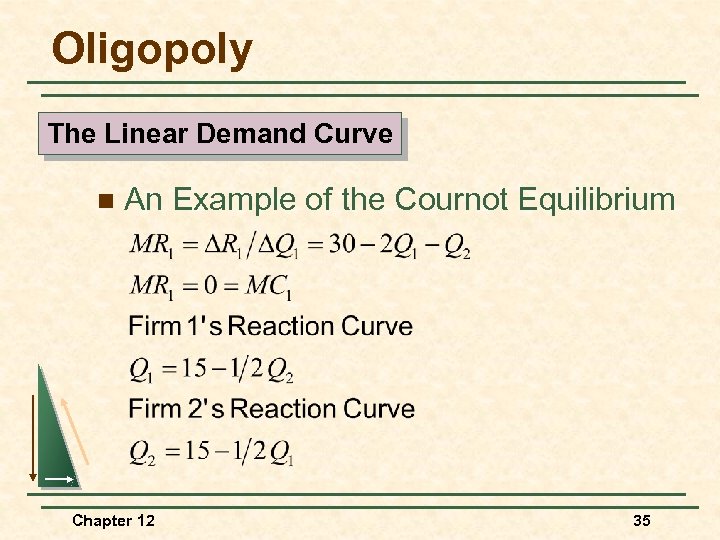

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium Chapter 12 35

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium Chapter 12 35

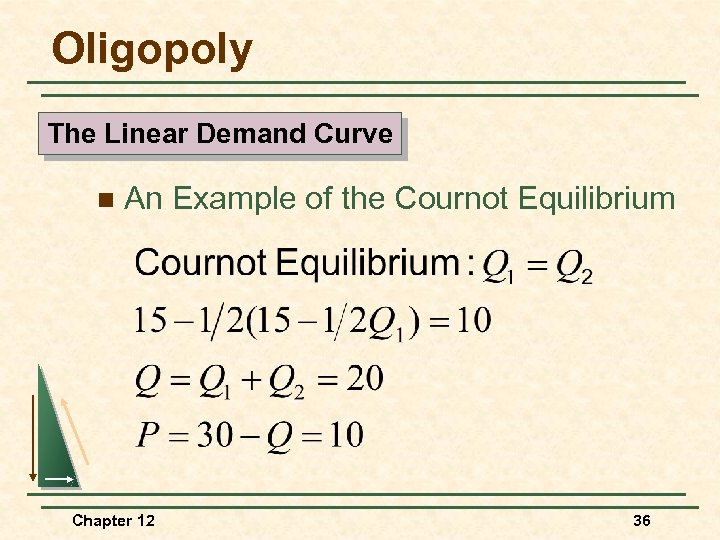

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium Chapter 12 36

Oligopoly The Linear Demand Curve n An Example of the Cournot Equilibrium Chapter 12 36

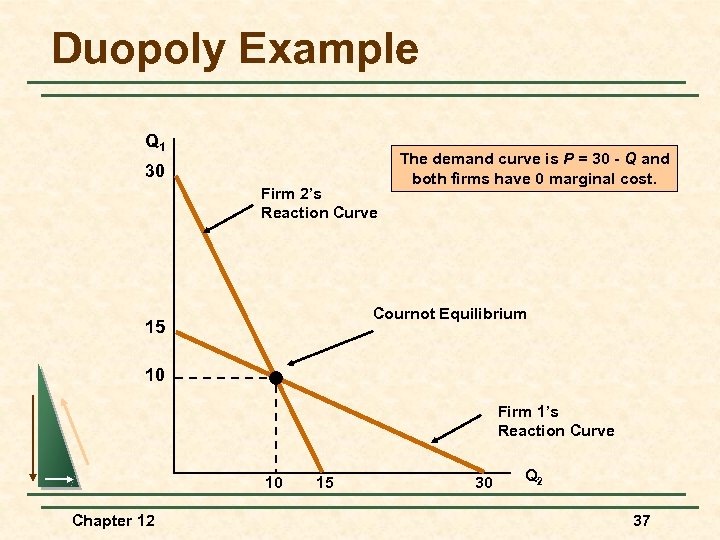

Duopoly Example Q 1 30 Firm 2’s Reaction Curve The demand curve is P = 30 - Q and both firms have 0 marginal cost. Cournot Equilibrium 15 10 Firm 1’s Reaction Curve 10 Chapter 12 15 30 Q 2 37

Duopoly Example Q 1 30 Firm 2’s Reaction Curve The demand curve is P = 30 - Q and both firms have 0 marginal cost. Cournot Equilibrium 15 10 Firm 1’s Reaction Curve 10 Chapter 12 15 30 Q 2 37

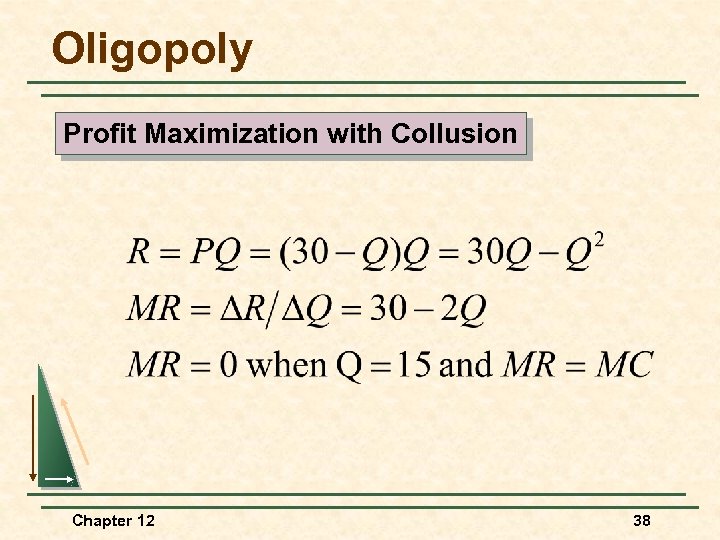

Oligopoly Profit Maximization with Collusion Chapter 12 38

Oligopoly Profit Maximization with Collusion Chapter 12 38

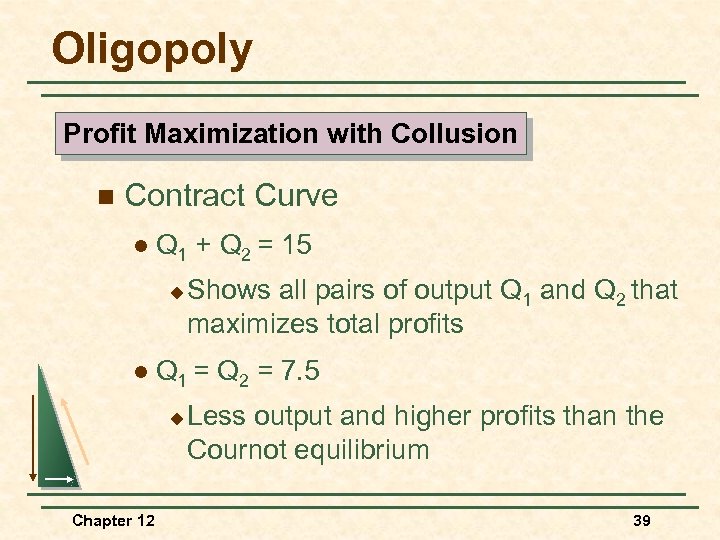

Oligopoly Profit Maximization with Collusion n Contract Curve l Q 1 + Q 2 = 15 u l Q 1 = Q 2 = 7. 5 u Chapter 12 Shows all pairs of output Q 1 and Q 2 that maximizes total profits Less output and higher profits than the Cournot equilibrium 39

Oligopoly Profit Maximization with Collusion n Contract Curve l Q 1 + Q 2 = 15 u l Q 1 = Q 2 = 7. 5 u Chapter 12 Shows all pairs of output Q 1 and Q 2 that maximizes total profits Less output and higher profits than the Cournot equilibrium 39

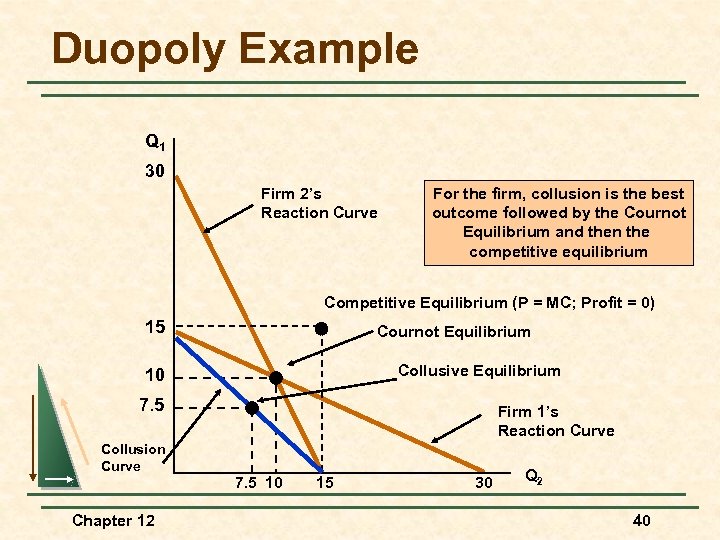

Duopoly Example Q 1 30 Firm 2’s Reaction Curve For the firm, collusion is the best outcome followed by the Cournot Equilibrium and then the competitive equilibrium Competitive Equilibrium (P = MC; Profit = 0) 15 Cournot Equilibrium Collusive Equilibrium 10 7. 5 Collusion Curve Chapter 12 Firm 1’s Reaction Curve 7. 5 10 15 30 Q 2 40

Duopoly Example Q 1 30 Firm 2’s Reaction Curve For the firm, collusion is the best outcome followed by the Cournot Equilibrium and then the competitive equilibrium Competitive Equilibrium (P = MC; Profit = 0) 15 Cournot Equilibrium Collusive Equilibrium 10 7. 5 Collusion Curve Chapter 12 Firm 1’s Reaction Curve 7. 5 10 15 30 Q 2 40

First Mover Advantage-The Stackelberg Model n Assumptions l One firm can set output first l MC = 0 l Market demand is P = 30 - Q where Q = total output l Firm 1 sets output first and Firm 2 then makes an output decision Chapter 12 41

First Mover Advantage-The Stackelberg Model n Assumptions l One firm can set output first l MC = 0 l Market demand is P = 30 - Q where Q = total output l Firm 1 sets output first and Firm 2 then makes an output decision Chapter 12 41

First Mover Advantage-The Stackelberg Model n Firm 1 l n Must consider the reaction of Firm 2 l Chapter 12 Takes Firm 1’s output as fixed and therefore determines output with the Cournot reaction curve: Q 2 = 15 - 1/2 Q 1 42

First Mover Advantage-The Stackelberg Model n Firm 1 l n Must consider the reaction of Firm 2 l Chapter 12 Takes Firm 1’s output as fixed and therefore determines output with the Cournot reaction curve: Q 2 = 15 - 1/2 Q 1 42

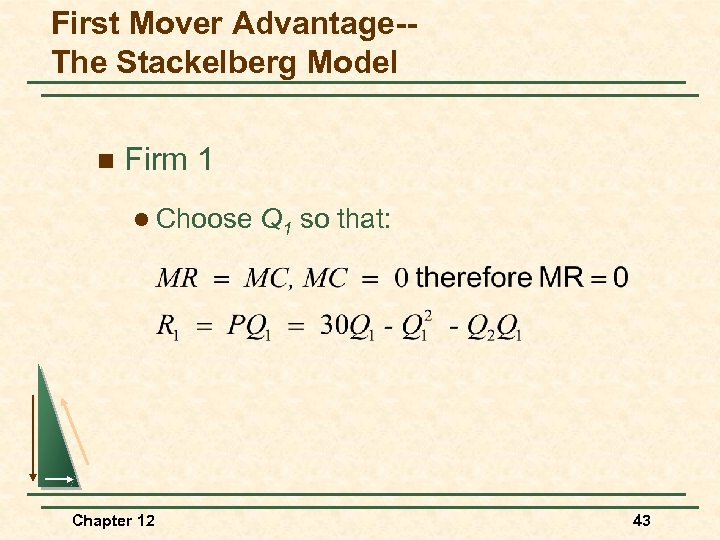

First Mover Advantage-The Stackelberg Model n Firm 1 l Choose Chapter 12 Q 1 so that: 43

First Mover Advantage-The Stackelberg Model n Firm 1 l Choose Chapter 12 Q 1 so that: 43

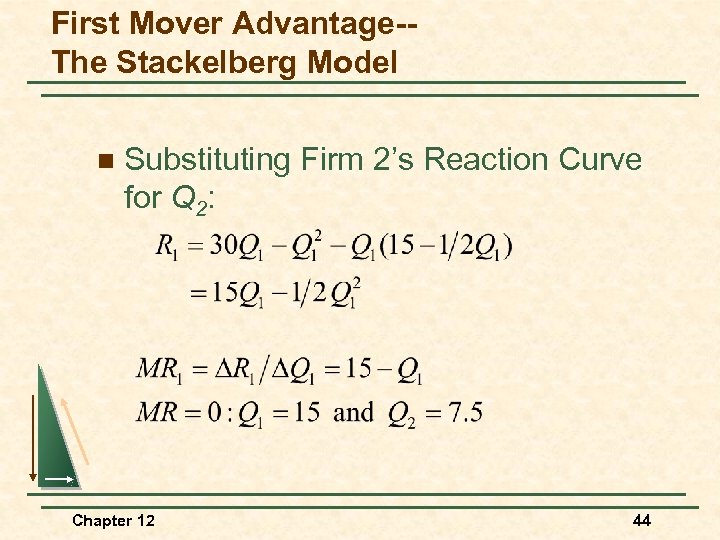

First Mover Advantage-The Stackelberg Model n Substituting Firm 2’s Reaction Curve for Q 2: Chapter 12 44

First Mover Advantage-The Stackelberg Model n Substituting Firm 2’s Reaction Curve for Q 2: Chapter 12 44

First Mover Advantage-The Stackelberg Model n Conclusion l l n Firm 1’s output is twice as large as firm 2’s Firm 1’s profit is twice as large as firm 2’s Questions l Why is it more profitable to be the first mover? l Which model (Cournot or Shackelberg) is more appropriate? Chapter 12 45

First Mover Advantage-The Stackelberg Model n Conclusion l l n Firm 1’s output is twice as large as firm 2’s Firm 1’s profit is twice as large as firm 2’s Questions l Why is it more profitable to be the first mover? l Which model (Cournot or Shackelberg) is more appropriate? Chapter 12 45

Price Competition n Competition in an oligopolistic industry may occur with price instead of output. n The Bertrand Model is used to illustrate price competition in an oligopolistic industry with homogenous goods. Chapter 12 46

Price Competition n Competition in an oligopolistic industry may occur with price instead of output. n The Bertrand Model is used to illustrate price competition in an oligopolistic industry with homogenous goods. Chapter 12 46

Price Competition Bertrand Model n Assumptions l Homogenous good l Market demand is P = 30 - Q where Q = Q 1 + Q 2 l MC = $3 for both firms and MC 1 = MC 2 = $3 Chapter 12 47

Price Competition Bertrand Model n Assumptions l Homogenous good l Market demand is P = 30 - Q where Q = Q 1 + Q 2 l MC = $3 for both firms and MC 1 = MC 2 = $3 Chapter 12 47

Price Competition Bertrand Model n Assumptions l The Cournot equilibrium: u l Chapter 12 Assume the firms compete with price, not quantity. 48

Price Competition Bertrand Model n Assumptions l The Cournot equilibrium: u l Chapter 12 Assume the firms compete with price, not quantity. 48

Price Competition Bertrand Model n How will consumers respond to a price differential? (Hint: Consider homogeneity) l The Nash equilibrium: u P = MC; P 1 = P 2 = $3 u Q = 27; Q 1 & Q 2 = 13. 5 u Chapter 12 49

Price Competition Bertrand Model n How will consumers respond to a price differential? (Hint: Consider homogeneity) l The Nash equilibrium: u P = MC; P 1 = P 2 = $3 u Q = 27; Q 1 & Q 2 = 13. 5 u Chapter 12 49

Price Competition Bertrand Model n Why not charge a higher price to raise profits? n How does the Bertrand outcome compare to the Cournot outcome? n The Bertrand model demonstrates the importance of the strategic variable (price versus output). Chapter 12 50

Price Competition Bertrand Model n Why not charge a higher price to raise profits? n How does the Bertrand outcome compare to the Cournot outcome? n The Bertrand model demonstrates the importance of the strategic variable (price versus output). Chapter 12 50

Price Competition Bertrand Model n Criticisms l When firms produce a homogenous good, it is more natural to compete by setting quantities rather than prices. l Even if the firms do set prices and choose the same price, what share of total sales will go to each one? u Chapter 12 It may not be equally divided. 51

Price Competition Bertrand Model n Criticisms l When firms produce a homogenous good, it is more natural to compete by setting quantities rather than prices. l Even if the firms do set prices and choose the same price, what share of total sales will go to each one? u Chapter 12 It may not be equally divided. 51

Price Competition n Price Competition with Differentiated Products l Chapter 12 Market shares are now determined not just by prices, but by differences in the design, performance, and durability of each firm’s product. 52

Price Competition n Price Competition with Differentiated Products l Chapter 12 Market shares are now determined not just by prices, but by differences in the design, performance, and durability of each firm’s product. 52

Price Competition Differentiated Products n Assumptions l Duopoly l FC = $20 l VC = 0 Chapter 12 53

Price Competition Differentiated Products n Assumptions l Duopoly l FC = $20 l VC = 0 Chapter 12 53

Price Competition Differentiated Products n Assumptions l Firm 1’s demand is Q 1 = 12 - 2 P 1 + P 2 l Firm 2’s demand is Q 2 = 12 - 2 P 1 + P 1 u P 1 and P 2 are prices firms 1 and 2 charge respectively u Q 1 and Q 2 are the resulting quantities they sell Chapter 12 54

Price Competition Differentiated Products n Assumptions l Firm 1’s demand is Q 1 = 12 - 2 P 1 + P 2 l Firm 2’s demand is Q 2 = 12 - 2 P 1 + P 1 u P 1 and P 2 are prices firms 1 and 2 charge respectively u Q 1 and Q 2 are the resulting quantities they sell Chapter 12 54

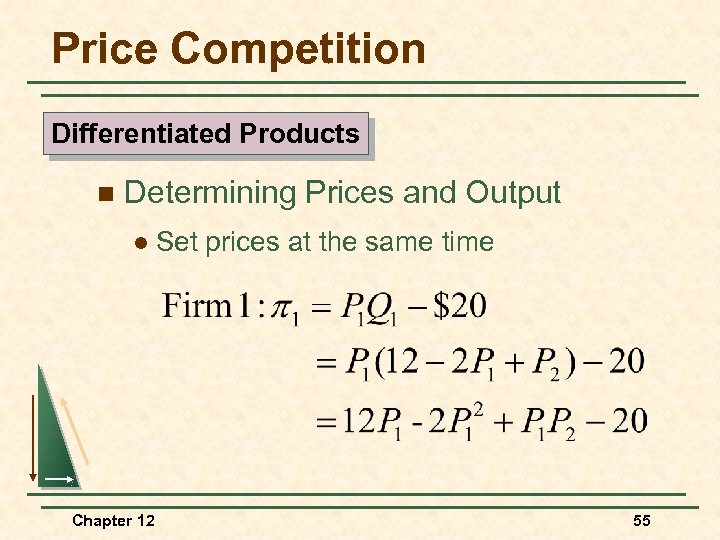

Price Competition Differentiated Products n Determining Prices and Output l Chapter 12 Set prices at the same time 55

Price Competition Differentiated Products n Determining Prices and Output l Chapter 12 Set prices at the same time 55

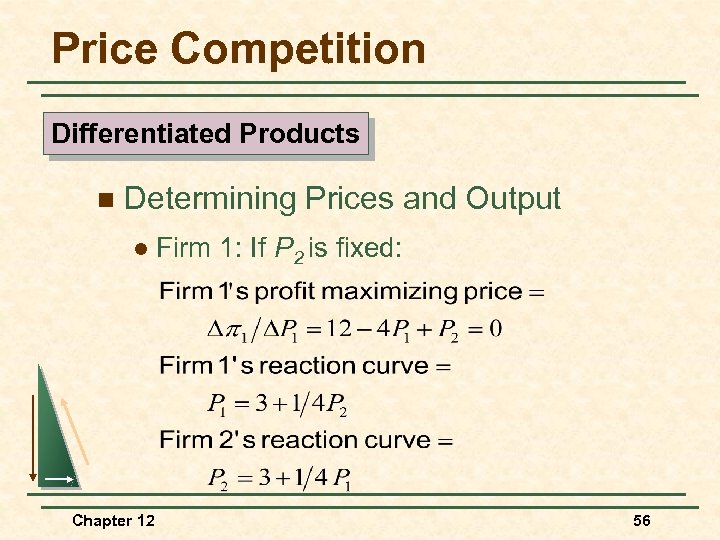

Price Competition Differentiated Products n Determining Prices and Output l Chapter 12 Firm 1: If P 2 is fixed: 56

Price Competition Differentiated Products n Determining Prices and Output l Chapter 12 Firm 1: If P 2 is fixed: 56

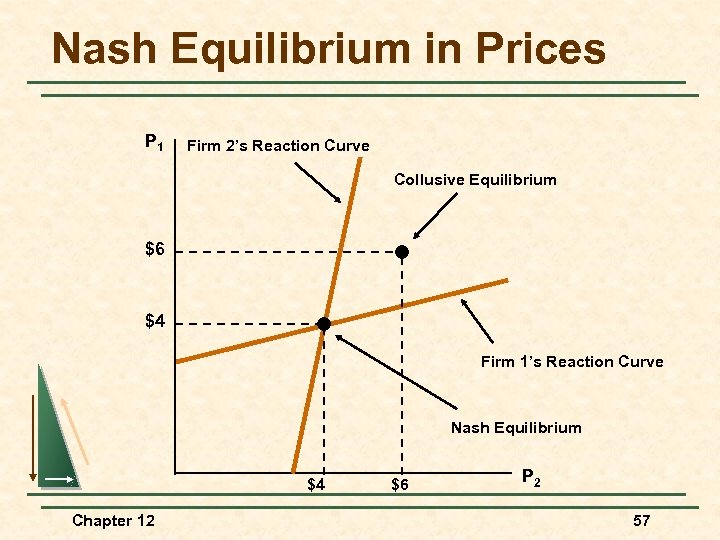

Nash Equilibrium in Prices P 1 Firm 2’s Reaction Curve Collusive Equilibrium $6 $4 Firm 1’s Reaction Curve Nash Equilibrium $4 Chapter 12 $6 P 2 57

Nash Equilibrium in Prices P 1 Firm 2’s Reaction Curve Collusive Equilibrium $6 $4 Firm 1’s Reaction Curve Nash Equilibrium $4 Chapter 12 $6 P 2 57

Nash Equilibrium in Prices n Does the Stackelberg model prediction for first mover hold when price is the variable instead of quantity? l Hint: Chapter 12 Would you want to set price first? 58

Nash Equilibrium in Prices n Does the Stackelberg model prediction for first mover hold when price is the variable instead of quantity? l Hint: Chapter 12 Would you want to set price first? 58

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 1) Procter & Gamble, Kao Soap, Ltd. , and Unilever, Ltd were entering the market for Gypsy Moth Tape. 2) All three would be choosing their prices at the same time. Chapter 12 59

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 1) Procter & Gamble, Kao Soap, Ltd. , and Unilever, Ltd were entering the market for Gypsy Moth Tape. 2) All three would be choosing their prices at the same time. Chapter 12 59

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 3) Procter & Gamble had to consider competitors prices when setting their price. 4) FC = $480, 000/month and VC = $1/unit for all firms Chapter 12 60

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 3) Procter & Gamble had to consider competitors prices when setting their price. 4) FC = $480, 000/month and VC = $1/unit for all firms Chapter 12 60

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 5) P&G’s demand curve was: Q = 3, 375 P-3. 5(PU). 25(PK). 25 u Chapter 12 Where P, PU , PK are P&G’s, Unilever’s, and Kao’s prices respectively 61

A Pricing Problem for Procter & Gamble Differentiated Products n Scenario 5) P&G’s demand curve was: Q = 3, 375 P-3. 5(PU). 25(PK). 25 u Chapter 12 Where P, PU , PK are P&G’s, Unilever’s, and Kao’s prices respectively 61

A Pricing Problem for Procter & Gamble Differentiated Products n Problem l Chapter 12 What price should P&G choose and what is the expected profit? 62

A Pricing Problem for Procter & Gamble Differentiated Products n Problem l Chapter 12 What price should P&G choose and what is the expected profit? 62

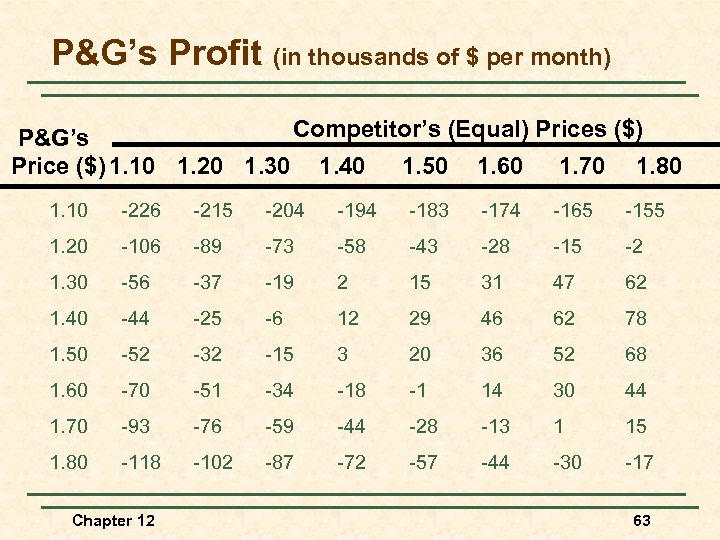

P&G’s Profit (in thousands of $ per month) Competitor’s (Equal) Prices ($) P&G’s Price ($) 1. 10 1. 20 1. 30 1. 40 1. 50 1. 60 1. 70 1. 80 1. 10 -226 -215 -204 -194 -183 -174 -165 -155 1. 20 -106 -89 -73 -58 -43 -28 -15 -2 1. 30 -56 -37 -19 2 15 31 47 62 1. 40 -44 -25 -6 12 29 46 62 78 1. 50 -52 -32 -15 3 20 36 52 68 1. 60 -70 -51 -34 -18 -1 14 30 44 1. 70 -93 -76 -59 -44 -28 -13 1 15 1. 80 -118 -102 -87 -72 -57 -44 -30 -17 Chapter 12 63

P&G’s Profit (in thousands of $ per month) Competitor’s (Equal) Prices ($) P&G’s Price ($) 1. 10 1. 20 1. 30 1. 40 1. 50 1. 60 1. 70 1. 80 1. 10 -226 -215 -204 -194 -183 -174 -165 -155 1. 20 -106 -89 -73 -58 -43 -28 -15 -2 1. 30 -56 -37 -19 2 15 31 47 62 1. 40 -44 -25 -6 12 29 46 62 78 1. 50 -52 -32 -15 3 20 36 52 68 1. 60 -70 -51 -34 -18 -1 14 30 44 1. 70 -93 -76 -59 -44 -28 -13 1 15 1. 80 -118 -102 -87 -72 -57 -44 -30 -17 Chapter 12 63

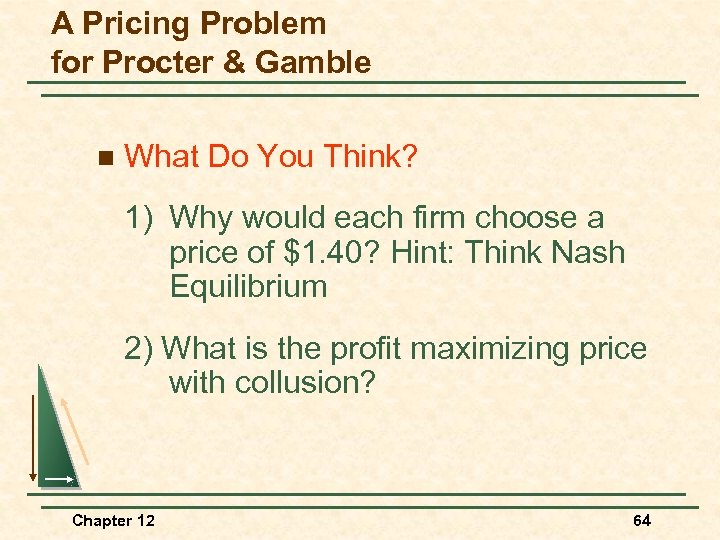

A Pricing Problem for Procter & Gamble n What Do You Think? 1) Why would each firm choose a price of $1. 40? Hint: Think Nash Equilibrium 2) What is the profit maximizing price with collusion? Chapter 12 64

A Pricing Problem for Procter & Gamble n What Do You Think? 1) Why would each firm choose a price of $1. 40? Hint: Think Nash Equilibrium 2) What is the profit maximizing price with collusion? Chapter 12 64

Competition Versus Collusion: The Prisoners’ Dilemma n Why wouldn’t each firm set the collusion price independently and earn the higher profits that occur with explicit collusion? Chapter 12 65

Competition Versus Collusion: The Prisoners’ Dilemma n Why wouldn’t each firm set the collusion price independently and earn the higher profits that occur with explicit collusion? Chapter 12 65

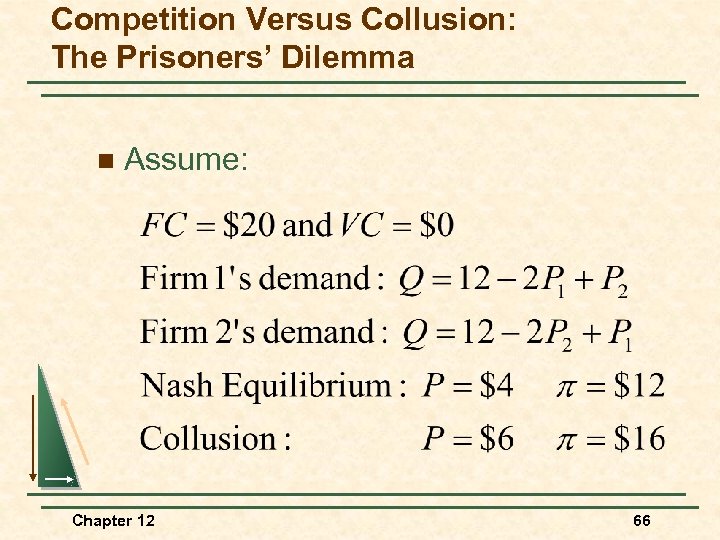

Competition Versus Collusion: The Prisoners’ Dilemma n Assume: Chapter 12 66

Competition Versus Collusion: The Prisoners’ Dilemma n Assume: Chapter 12 66

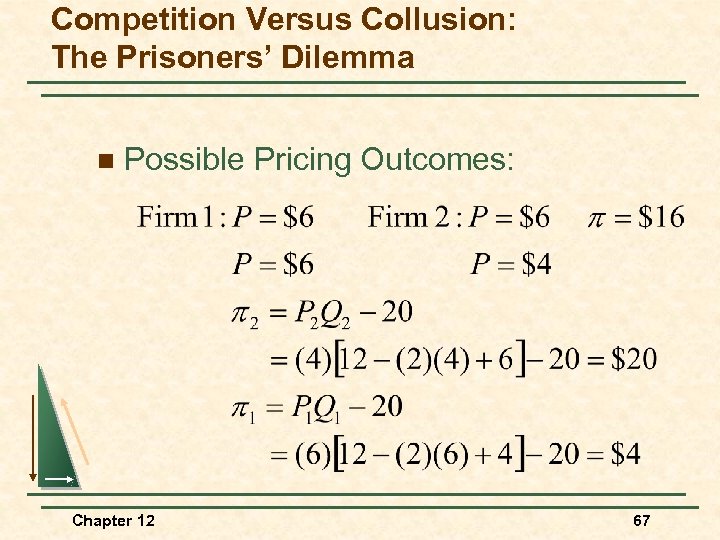

Competition Versus Collusion: The Prisoners’ Dilemma n Possible Pricing Outcomes: Chapter 12 67

Competition Versus Collusion: The Prisoners’ Dilemma n Possible Pricing Outcomes: Chapter 12 67

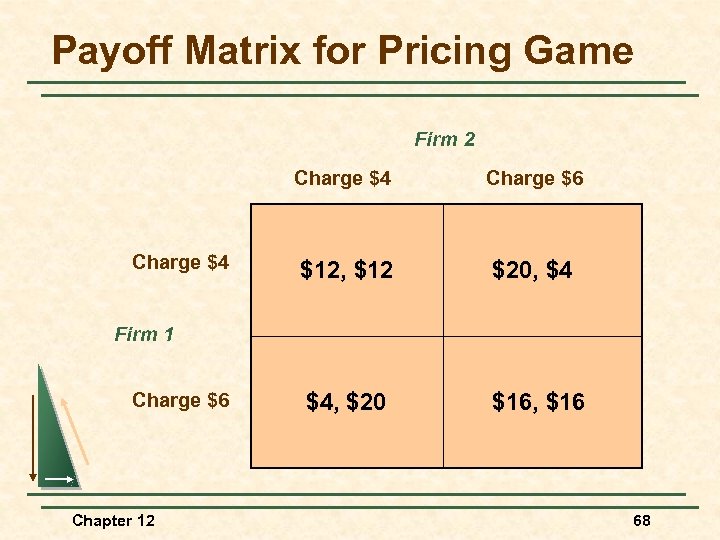

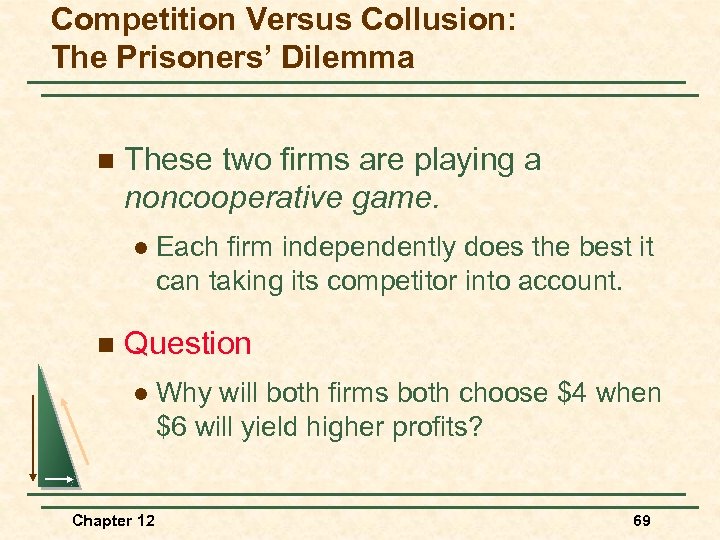

Payoff Matrix for Pricing Game Firm 2 Charge $4 Charge $6 $12, $12 $20, $4 $4, $20 $16, $16 Firm 1 Charge $6 Chapter 12 68

Payoff Matrix for Pricing Game Firm 2 Charge $4 Charge $6 $12, $12 $20, $4 $4, $20 $16, $16 Firm 1 Charge $6 Chapter 12 68

Competition Versus Collusion: The Prisoners’ Dilemma n These two firms are playing a noncooperative game. l n Each firm independently does the best it can taking its competitor into account. Question l Chapter 12 Why will both firms both choose $4 when $6 will yield higher profits? 69

Competition Versus Collusion: The Prisoners’ Dilemma n These two firms are playing a noncooperative game. l n Each firm independently does the best it can taking its competitor into account. Question l Chapter 12 Why will both firms both choose $4 when $6 will yield higher profits? 69

Competition Versus Collusion: The Prisoners’ Dilemma n An example in game theory, called the Prisoners’ Dilemma, illustrates the problem oligopolistic firms face. Chapter 12 70

Competition Versus Collusion: The Prisoners’ Dilemma n An example in game theory, called the Prisoners’ Dilemma, illustrates the problem oligopolistic firms face. Chapter 12 70

Competition Versus Collusion: The Prisoners’ Dilemma n Scenario l Two prisoners have been accused of collaborating in a crime. l They are in separate jail cells and cannot communicate. l Each has been asked to confess to the crime. Chapter 12 71

Competition Versus Collusion: The Prisoners’ Dilemma n Scenario l Two prisoners have been accused of collaborating in a crime. l They are in separate jail cells and cannot communicate. l Each has been asked to confess to the crime. Chapter 12 71

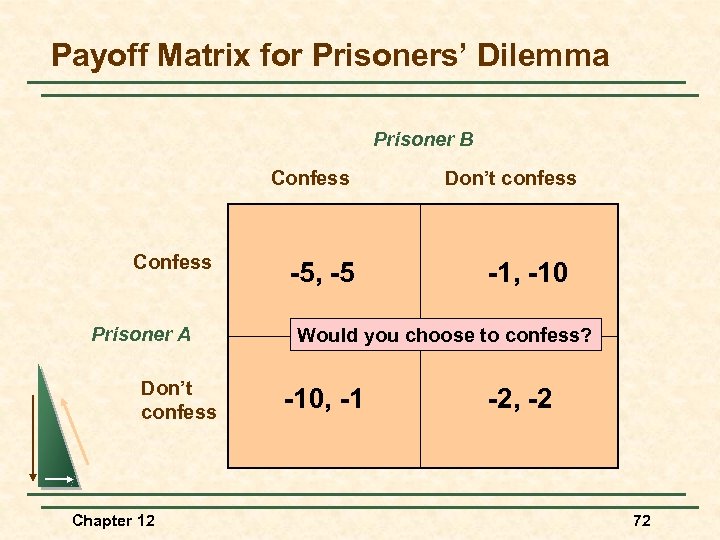

Payoff Matrix for Prisoners’ Dilemma Prisoner B Confess Prisoner A Don’t confess Chapter 12 -5, -5 Don’t confess -1, -10 Would you choose to confess? -10, -1 -2, -2 72

Payoff Matrix for Prisoners’ Dilemma Prisoner B Confess Prisoner A Don’t confess Chapter 12 -5, -5 Don’t confess -1, -10 Would you choose to confess? -10, -1 -2, -2 72

Payoff Matrix for the P & G Prisoners’ Dilemma n Conclusions: Oligipolistic Markets 1) Collusion will lead to greater profits 2) Explicit and implicit collusion is possible 3) Once collusion exists, the profit motive to break and lower price is significant Chapter 12 73

Payoff Matrix for the P & G Prisoners’ Dilemma n Conclusions: Oligipolistic Markets 1) Collusion will lead to greater profits 2) Explicit and implicit collusion is possible 3) Once collusion exists, the profit motive to break and lower price is significant Chapter 12 73

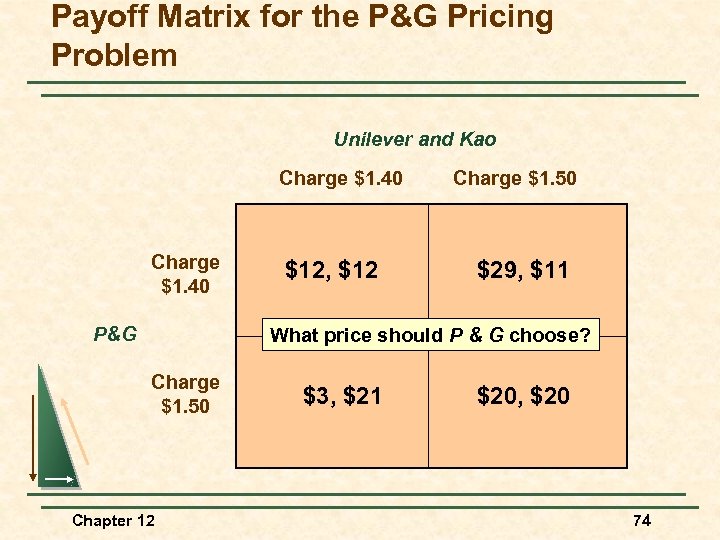

Payoff Matrix for the P&G Pricing Problem Unilever and Kao Charge $1. 40 P&G $12, $12 Charge $1. 50 $29, $11 What price should P & G choose? Charge $1. 50 Chapter 12 $3, $21 $20, $20 74

Payoff Matrix for the P&G Pricing Problem Unilever and Kao Charge $1. 40 P&G $12, $12 Charge $1. 50 $29, $11 What price should P & G choose? Charge $1. 50 Chapter 12 $3, $21 $20, $20 74

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing n Observations of Oligopoly Behavior 1) In some oligopoly markets, pricing behavior in time can create a predictable pricing environment and implied collusion may occur. Chapter 12 75

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing n Observations of Oligopoly Behavior 1) In some oligopoly markets, pricing behavior in time can create a predictable pricing environment and implied collusion may occur. Chapter 12 75

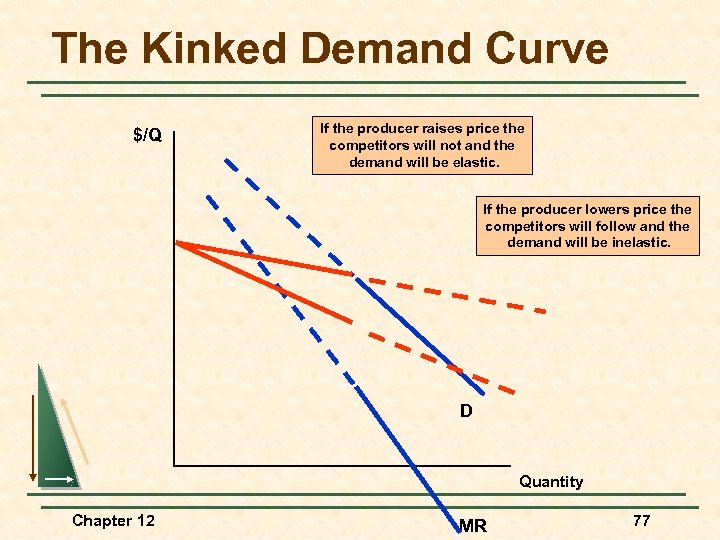

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing n Observations of Oligopoly Behavior 2) In other oligopoly markets, the firms are very aggressive and collusion is not possible. Firms are reluctant to change price because of the likely response of their competitors. u In this case prices tend to be relatively rigid. u Chapter 12 76

Implications of the Prisoners’ Dilemma for Oligipolistic Pricing n Observations of Oligopoly Behavior 2) In other oligopoly markets, the firms are very aggressive and collusion is not possible. Firms are reluctant to change price because of the likely response of their competitors. u In this case prices tend to be relatively rigid. u Chapter 12 76

The Kinked Demand Curve $/Q If the producer raises price the competitors will not and the demand will be elastic. If the producer lowers price the competitors will follow and the demand will be inelastic. D Quantity Chapter 12 MR 77

The Kinked Demand Curve $/Q If the producer raises price the competitors will not and the demand will be elastic. If the producer lowers price the competitors will follow and the demand will be inelastic. D Quantity Chapter 12 MR 77

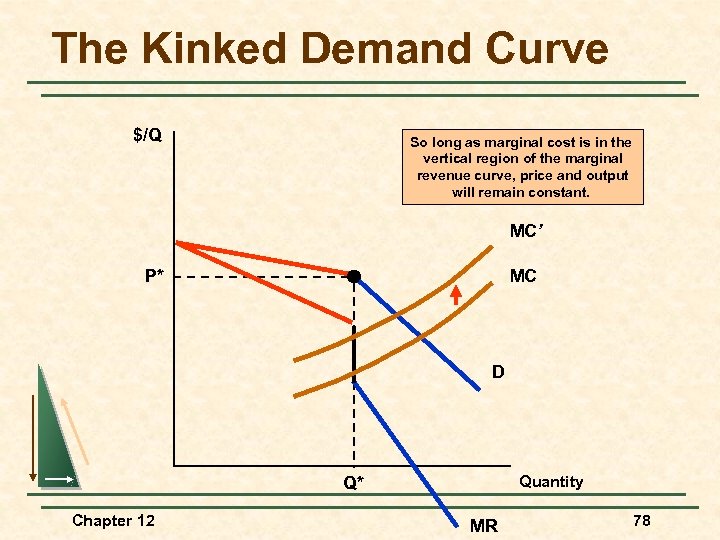

The Kinked Demand Curve $/Q So long as marginal cost is in the vertical region of the marginal revenue curve, price and output will remain constant. MC’ P* MC D Quantity Q* Chapter 12 MR 78

The Kinked Demand Curve $/Q So long as marginal cost is in the vertical region of the marginal revenue curve, price and output will remain constant. MC’ P* MC D Quantity Q* Chapter 12 MR 78

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing Price Signaling & Price Leadership n Price Signaling l Implicit collusion in which a firm announces a price increase in the hope that other firms will follow suit Chapter 12 79

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing Price Signaling & Price Leadership n Price Signaling l Implicit collusion in which a firm announces a price increase in the hope that other firms will follow suit Chapter 12 79

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing Price Signaling & Price Leadership n Price Leadership l Pattern of pricing in which one firm regularly announces price changes that other firms then match Chapter 12 80

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing Price Signaling & Price Leadership n Price Leadership l Pattern of pricing in which one firm regularly announces price changes that other firms then match Chapter 12 80

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing n The Dominant Firm Model l In some oligopolistic markets, one large firm has a major share of total sales, and a group of smaller firms supplies the remainder of the market. l The large firm might then act as the dominant firm, setting a price that maximized its own profits. Chapter 12 81

Implications of the Prisoners’ Dilemma for Oligopolistic Pricing n The Dominant Firm Model l In some oligopolistic markets, one large firm has a major share of total sales, and a group of smaller firms supplies the remainder of the market. l The large firm might then act as the dominant firm, setting a price that maximized its own profits. Chapter 12 81

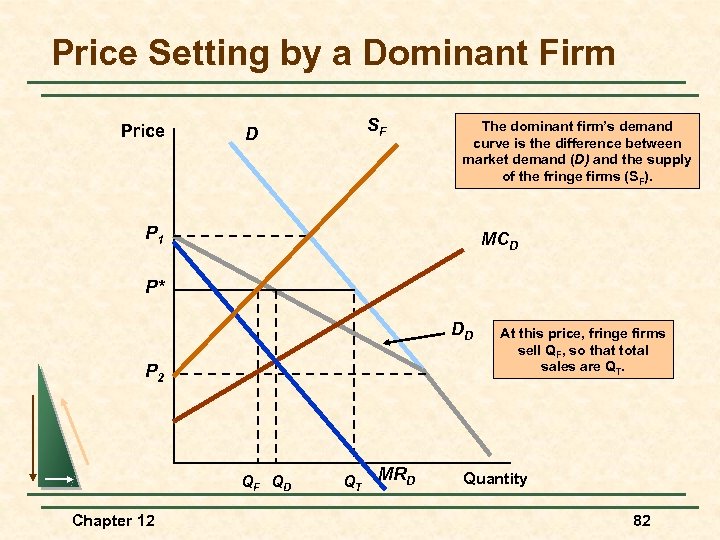

Price Setting by a Dominant Firm Price SF D The dominant firm’s demand curve is the difference between market demand (D) and the supply of the fringe firms (SF). P 1 MCD P* DD P 2 QF QD Chapter 12 QT MRD At this price, fringe firms sell QF, so that total sales are QT. Quantity 82

Price Setting by a Dominant Firm Price SF D The dominant firm’s demand curve is the difference between market demand (D) and the supply of the fringe firms (SF). P 1 MCD P* DD P 2 QF QD Chapter 12 QT MRD At this price, fringe firms sell QF, so that total sales are QT. Quantity 82

Cartels n Characteristics 1) Explicit agreements to set output and price 2) May not include all firms Chapter 12 83

Cartels n Characteristics 1) Explicit agreements to set output and price 2) May not include all firms Chapter 12 83

Cartels n Characteristics 3) Most often international l Chapter 12 Examples of successful cartels u OPEC u International Bauxite Association u Mercurio Europeo l Examples of unsuccessful cartels u Copper u Tin u Coffee u Tea u Cocoa 84

Cartels n Characteristics 3) Most often international l Chapter 12 Examples of successful cartels u OPEC u International Bauxite Association u Mercurio Europeo l Examples of unsuccessful cartels u Copper u Tin u Coffee u Tea u Cocoa 84

Cartels n Characteristics 4) Conditions for success u u Chapter 12 Competitive alternative sufficiently deters cheating Potential of monopoly power--inelastic demand 85

Cartels n Characteristics 4) Conditions for success u u Chapter 12 Competitive alternative sufficiently deters cheating Potential of monopoly power--inelastic demand 85

Cartels n Comparing OPEC to CIPEC l Chapter 12 Most cartels involve a portion of the market which then behaves as the dominant firm 86

Cartels n Comparing OPEC to CIPEC l Chapter 12 Most cartels involve a portion of the market which then behaves as the dominant firm 86

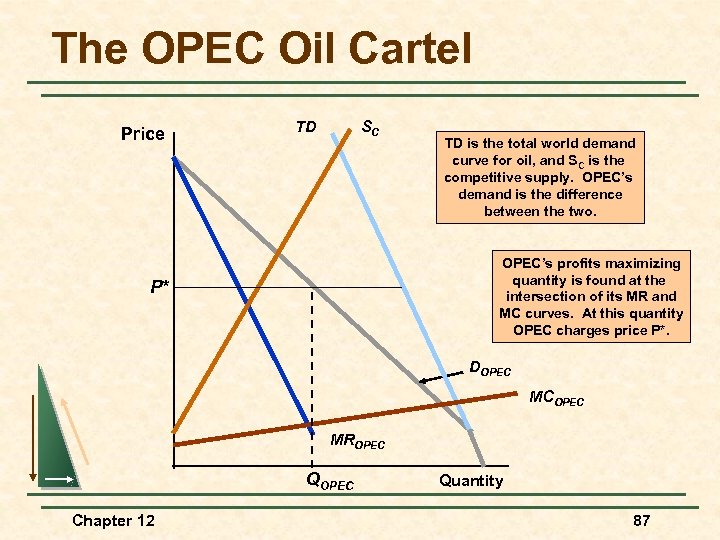

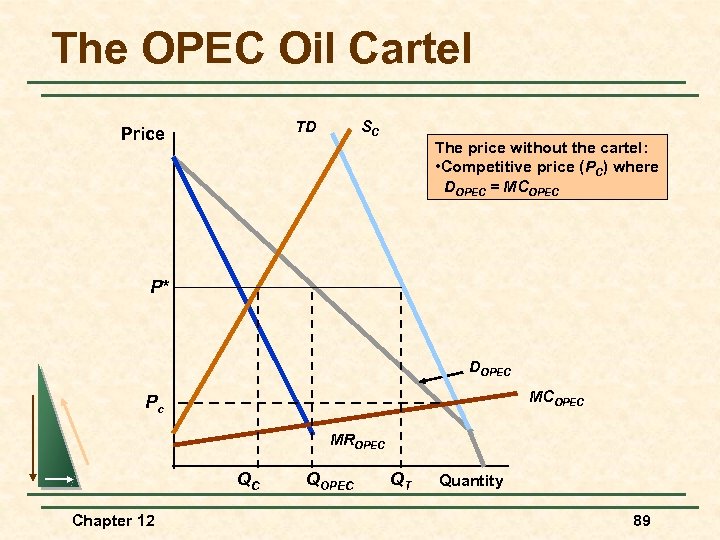

The OPEC Oil Cartel Price TD SC TD is the total world demand curve for oil, and SC is the competitive supply. OPEC’s demand is the difference between the two. OPEC’s profits maximizing quantity is found at the intersection of its MR and MC curves. At this quantity OPEC charges price P*. P* DOPEC MCOPEC MROPEC QOPEC Chapter 12 Quantity 87

The OPEC Oil Cartel Price TD SC TD is the total world demand curve for oil, and SC is the competitive supply. OPEC’s demand is the difference between the two. OPEC’s profits maximizing quantity is found at the intersection of its MR and MC curves. At this quantity OPEC charges price P*. P* DOPEC MCOPEC MROPEC QOPEC Chapter 12 Quantity 87

Cartels n About OPEC l Very low MC l TD is inelastic l Non-OPEC supply is inelastic l DOPEC is relatively inelastic Chapter 12 88

Cartels n About OPEC l Very low MC l TD is inelastic l Non-OPEC supply is inelastic l DOPEC is relatively inelastic Chapter 12 88

The OPEC Oil Cartel TD Price SC The price without the cartel: • Competitive price (PC) where DOPEC = MCOPEC P* DOPEC MCOPEC Pc MROPEC QC Chapter 12 QOPEC QT Quantity 89

The OPEC Oil Cartel TD Price SC The price without the cartel: • Competitive price (PC) where DOPEC = MCOPEC P* DOPEC MCOPEC Pc MROPEC QC Chapter 12 QOPEC QT Quantity 89

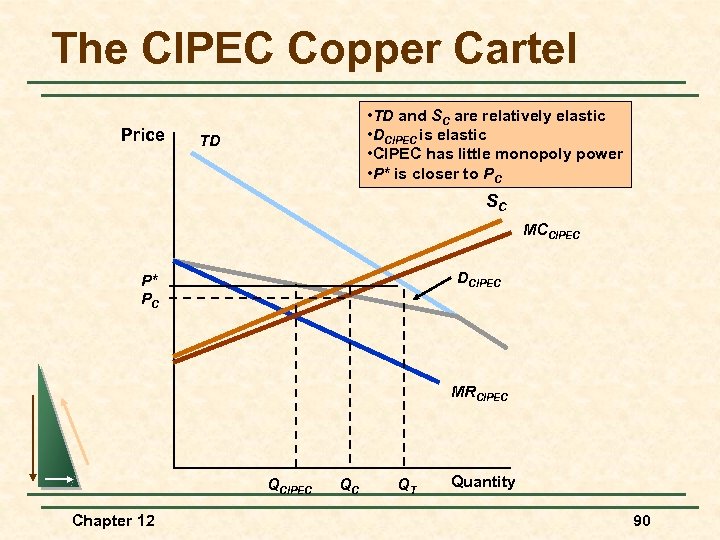

The CIPEC Copper Cartel Price • TD and SC are relatively elastic • DCIPEC is elastic • CIPEC has little monopoly power • P* is closer to PC TD SC MCCIPEC DCIPEC P* PC MRCIPEC QCIPEC Chapter 12 QC QT Quantity 90

The CIPEC Copper Cartel Price • TD and SC are relatively elastic • DCIPEC is elastic • CIPEC has little monopoly power • P* is closer to PC TD SC MCCIPEC DCIPEC P* PC MRCIPEC QCIPEC Chapter 12 QC QT Quantity 90

Cartels n Observations l To be successful: u u Chapter 12 Total demand must not be very price elastic Either the cartel must control nearly all of the world’s supply or the supply of noncartel producers must not be price elastic 91

Cartels n Observations l To be successful: u u Chapter 12 Total demand must not be very price elastic Either the cartel must control nearly all of the world’s supply or the supply of noncartel producers must not be price elastic 91

The Cartelization of Intercollegiate Athletics n Observations 1) Large number of firms (colleges) 2) Large number of consumers (fans) 3) Very high profits Chapter 12 92

The Cartelization of Intercollegiate Athletics n Observations 1) Large number of firms (colleges) 2) Large number of consumers (fans) 3) Very high profits Chapter 12 92

The Cartelization of Intercollegiate Athletics n Question l Chapter 12 How can we explain high profits in a competitive market? (Hint: Think cartel and the NCAA) 93

The Cartelization of Intercollegiate Athletics n Question l Chapter 12 How can we explain high profits in a competitive market? (Hint: Think cartel and the NCAA) 93

The Milk Cartel n 1990 s with less government support, the price of milk fluctuated more widely n In response, the government permitted six New England states to form a milk cartel (Northeast Interstate Dairy Compact -- NIDC) Chapter 12 94

The Milk Cartel n 1990 s with less government support, the price of milk fluctuated more widely n In response, the government permitted six New England states to form a milk cartel (Northeast Interstate Dairy Compact -- NIDC) Chapter 12 94

The Milk Cartel n 1999 legislation allowed dairy farmers in Northeastern states surrounding NIDC to join NIDC, 7 in 16 Southern states to form a new regional cartel. n Soy milk may become more popular. Chapter 12 95

The Milk Cartel n 1999 legislation allowed dairy farmers in Northeastern states surrounding NIDC to join NIDC, 7 in 16 Southern states to form a new regional cartel. n Soy milk may become more popular. Chapter 12 95

Summary n In a monopolistically competitive market, firms compete by selling differentiated products, which are highly substitutable. n In an oligopolistic market, only a few firms account for most or all of production. Chapter 12 96

Summary n In a monopolistically competitive market, firms compete by selling differentiated products, which are highly substitutable. n In an oligopolistic market, only a few firms account for most or all of production. Chapter 12 96

Summary n In the Cournot model of oligopoly, firms make their output decisions at the same time, each taking the other’s output as fixed. n In the Stackelberg model, one firm sets its output first. Chapter 12 97

Summary n In the Cournot model of oligopoly, firms make their output decisions at the same time, each taking the other’s output as fixed. n In the Stackelberg model, one firm sets its output first. Chapter 12 97

Summary n The Nash equilibrium concept can also be applied to markets in which firms produce substitute goods and compete by setting price. n Firms would earn higher profits by collusively agreeing to raise prices, but the antitrust laws usually prohibit this. Chapter 12 98

Summary n The Nash equilibrium concept can also be applied to markets in which firms produce substitute goods and compete by setting price. n Firms would earn higher profits by collusively agreeing to raise prices, but the antitrust laws usually prohibit this. Chapter 12 98

Summary n The Prisoners’ Dilemma creates price rigidity in oligopolistic markets. n Price leadership is a form of implicit collusion that sometimes gets around the Prisoners Dilemma. n In a cartel, producers explicitly collude in setting prices and output levels. Chapter 12 99

Summary n The Prisoners’ Dilemma creates price rigidity in oligopolistic markets. n Price leadership is a form of implicit collusion that sometimes gets around the Prisoners Dilemma. n In a cartel, producers explicitly collude in setting prices and output levels. Chapter 12 99

End of Chapter 12 Monopolistic Competition and Oligopoly Chapter 12 100

End of Chapter 12 Monopolistic Competition and Oligopoly Chapter 12 100