d50f9fa53e0ecdb19de76176bf3d8cec.ppt

- Количество слайдов: 24

Chapter 12: Market Microstructure and Strategies

Chapter 12: Market Microstructure and Strategies

Chapter 12: Market Microstructure and Strategies Chapter Outline: • Market Microstructure • Stock Market Transactions. • How Trades Are Executed. • Regulations of Stock Trading. • International Stock Trading. 1 -

Chapter 12: Market Microstructure and Strategies Chapter Outline: • Market Microstructure • Stock Market Transactions. • How Trades Are Executed. • Regulations of Stock Trading. • International Stock Trading. 1 -

Market Microstructure • Market Microstructure is the process by which securities such as stocks are traded. • For a stock market to function properly, a structure is needed to: 1. Facilitate the placing of orders. 2. Speed the execution of the trades ordered. 3. Provide equal access to information for all investors.

Market Microstructure • Market Microstructure is the process by which securities such as stocks are traded. • For a stock market to function properly, a structure is needed to: 1. Facilitate the placing of orders. 2. Speed the execution of the trades ordered. 3. Provide equal access to information for all investors.

Market Microstructure • What is market microstructure? – Study of the process and outcomes of exchanging assets under explicit trading rules – Analysis of how specific trading mechanisms affect the price formation process. Trading mechanism: set of rules governing the exchange of financial assets (stocks, derivatives) or foreign currencies in a market. ⇒ specific intermediary, centralized location or electronic board, orders submitted, . . .

Market Microstructure • What is market microstructure? – Study of the process and outcomes of exchanging assets under explicit trading rules – Analysis of how specific trading mechanisms affect the price formation process. Trading mechanism: set of rules governing the exchange of financial assets (stocks, derivatives) or foreign currencies in a market. ⇒ specific intermediary, centralized location or electronic board, orders submitted, . . .

Market Microstructure • Why do we need market microstructure? Tries to answer how prices are formed in the economy!!!! – Two different lines of thought in the past: 1. The trading mechanism has no relevance at all for the determination of the equilibrium price (Rational Expectation Literature), 2. The trading mechanism is relevant (Walrasian Auctioneer).

Market Microstructure • Why do we need market microstructure? Tries to answer how prices are formed in the economy!!!! – Two different lines of thought in the past: 1. The trading mechanism has no relevance at all for the determination of the equilibrium price (Rational Expectation Literature), 2. The trading mechanism is relevant (Walrasian Auctioneer).

Organization of Financial Markets • Market player – Brokers: transmit orders for customers, act as conduits for the customers’ orders. Involved only in interdealer transactions (FX market) =⇒ pure match makers (connect dealers). – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). – Market makers: (specialists): quote price to buy or sell. Generally take a position in the security =⇒ dealer function.

Organization of Financial Markets • Market player – Brokers: transmit orders for customers, act as conduits for the customers’ orders. Involved only in interdealer transactions (FX market) =⇒ pure match makers (connect dealers). – Dealers: trade for their own account or also facilitate customer orders (broker/dealer). – Market makers: (specialists): quote price to buy or sell. Generally take a position in the security =⇒ dealer function.

Organization of Financial Markets • Orders: – Orders are instructions that traders give to the brokers and exchanges that arrange their trades. – They specify: • • security to be traded, how much to trade, whether to buy or sell, Terms – They may also specify: • their validity • their execution time • whether they can be partially filled or not – Orders affect the profit from trading, transaction costs, and the liquidity.

Organization of Financial Markets • Orders: – Orders are instructions that traders give to the brokers and exchanges that arrange their trades. – They specify: • • security to be traded, how much to trade, whether to buy or sell, Terms – They may also specify: • their validity • their execution time • whether they can be partially filled or not – Orders affect the profit from trading, transaction costs, and the liquidity.

Stock Market Transactions • Placing an Order. • Margin Trading. • Short Selling. • Investing in Stock Indexes.

Stock Market Transactions • Placing an Order. • Margin Trading. • Short Selling. • Investing in Stock Indexes.

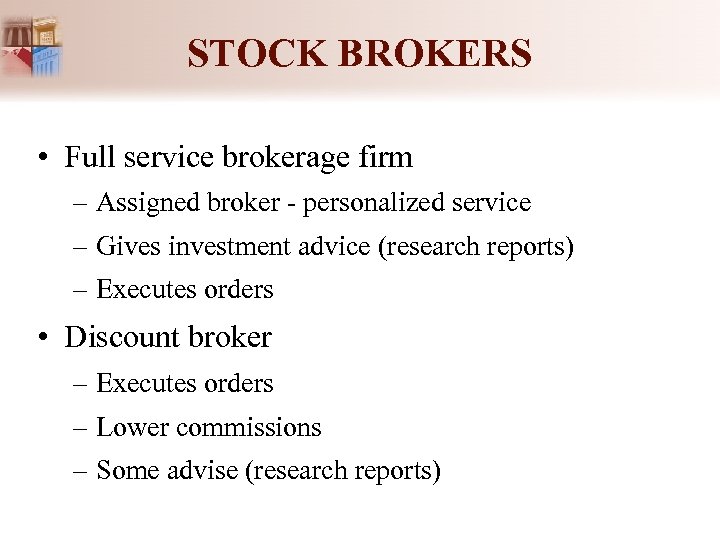

STOCK BROKERS • Full service brokerage firm – Assigned broker - personalized service – Gives investment advice (research reports) – Executes orders • Discount broker – Executes orders – Lower commissions – Some advise (research reports)

STOCK BROKERS • Full service brokerage firm – Assigned broker - personalized service – Gives investment advice (research reports) – Executes orders • Discount broker – Executes orders – Lower commissions – Some advise (research reports)

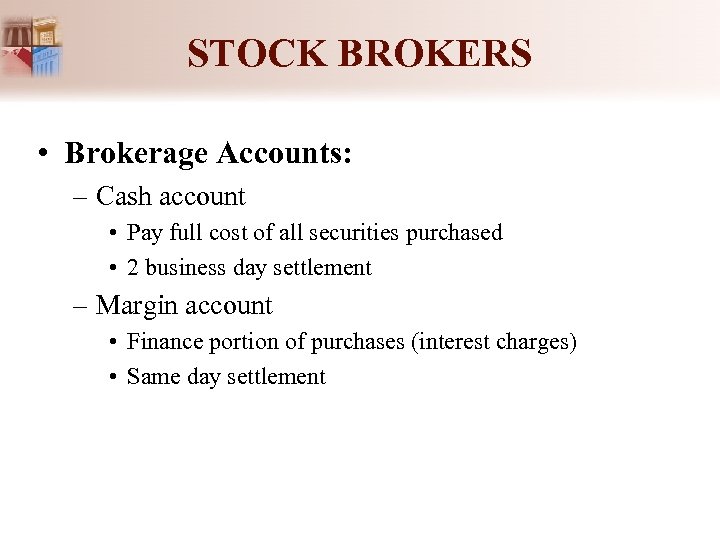

STOCK BROKERS • Brokerage Accounts: – Cash account • Pay full cost of all securities purchased • 2 business day settlement – Margin account • Finance portion of purchases (interest charges) • Same day settlement

STOCK BROKERS • Brokerage Accounts: – Cash account • Pay full cost of all securities purchased • 2 business day settlement – Margin account • Finance portion of purchases (interest charges) • Same day settlement

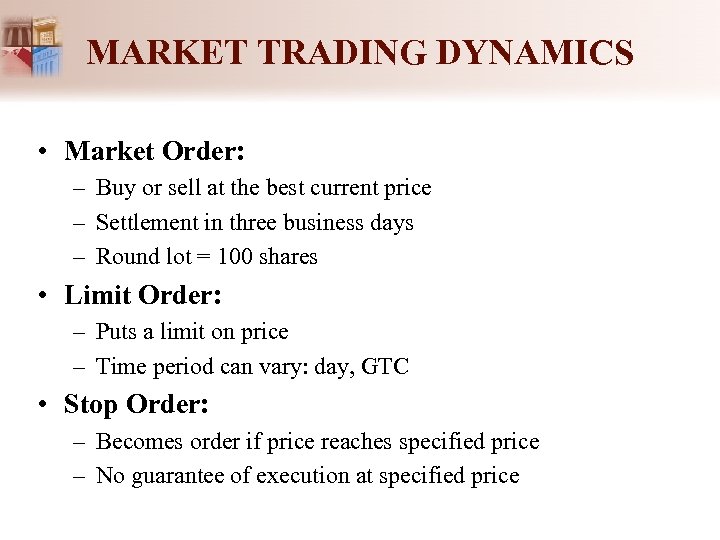

MARKET TRADING DYNAMICS • Market Order: – Buy or sell at the best current price – Settlement in three business days – Round lot = 100 shares • Limit Order: – Puts a limit on price – Time period can vary: day, GTC • Stop Order: – Becomes order if price reaches specified price – No guarantee of execution at specified price

MARKET TRADING DYNAMICS • Market Order: – Buy or sell at the best current price – Settlement in three business days – Round lot = 100 shares • Limit Order: – Puts a limit on price – Time period can vary: day, GTC • Stop Order: – Becomes order if price reaches specified price – No guarantee of execution at specified price

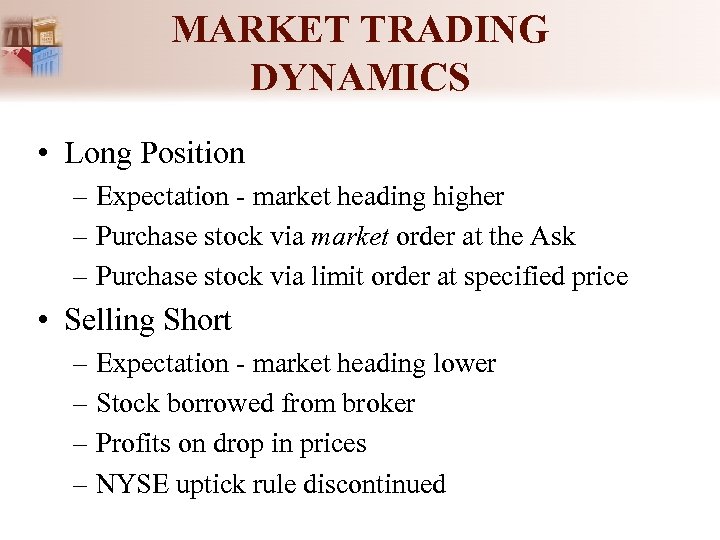

MARKET TRADING DYNAMICS • Long Position – Expectation - market heading higher – Purchase stock via market order at the Ask – Purchase stock via limit order at specified price • Selling Short – Expectation - market heading lower – Stock borrowed from broker – Profits on drop in prices – NYSE uptick rule discontinued

MARKET TRADING DYNAMICS • Long Position – Expectation - market heading higher – Purchase stock via market order at the Ask – Purchase stock via limit order at specified price • Selling Short – Expectation - market heading lower – Stock borrowed from broker – Profits on drop in prices – NYSE uptick rule discontinued

Margin Trading • Margin Requirements. • Maintenance Margin. • Margin Calls. • Impact on Losses and Returns.

Margin Trading • Margin Requirements. • Maintenance Margin. • Margin Calls. • Impact on Losses and Returns.

Short Selling • What is a short Selling? • How speculators make profits in short selling? • Measuring the Short Position of a Stock. • Using a stop-Buy Order to Offset Short Selling.

Short Selling • What is a short Selling? • How speculators make profits in short selling? • Measuring the Short Position of a Stock. • Using a stop-Buy Order to Offset Short Selling.

Investing in Stock Indexes • What is Stock Indexes? • Why investing in Stock Indexes became very poplar? • Exchange Traded Funds (ETFs), are funds that are designed to mimic particular stock indexes and are traded on a stock exchange.

Investing in Stock Indexes • What is Stock Indexes? • Why investing in Stock Indexes became very poplar? • Exchange Traded Funds (ETFs), are funds that are designed to mimic particular stock indexes and are traded on a stock exchange.

Investing in Stock Indexes Comparison of ETFs with Mutual Funds: • Similarities: 1. Adjustment of stock price. 2. Payment of dividends. 3. Lower management fees.

Investing in Stock Indexes Comparison of ETFs with Mutual Funds: • Similarities: 1. Adjustment of stock price. 2. Payment of dividends. 3. Lower management fees.

Investing in Stock Indexes Comparison of ETFs with Mutual Funds: • Differences: 1. Traded throughout the day. 2. Purchased on margin. 3. Can be sold short.

Investing in Stock Indexes Comparison of ETFs with Mutual Funds: • Differences: 1. Traded throughout the day. 2. Purchased on margin. 3. Can be sold short.

Investing in Stock Indexes Types of ETFs: • Cube. • Spider. • Sector Spider • Diamond.

Investing in Stock Indexes Types of ETFs: • Cube. • Spider. • Sector Spider • Diamond.

How Trades Are Executed. • Floor Brokers. • Specialists. • Making a Market. • Market Makers on the NASDAQ.

How Trades Are Executed. • Floor Brokers. • Specialists. • Making a Market. • Market Makers on the NASDAQ.

How Trades Are Executed. Effect of the Spread on Transaction Costs: 1. Order Cost. 2. Inventory Cost. 3. Competition. 4. Volume. 5. Risk.

How Trades Are Executed. Effect of the Spread on Transaction Costs: 1. Order Cost. 2. Inventory Cost. 3. Competition. 4. Volume. 5. Risk.

Electric Communication Network (ECNs) • What is ECNs? • Program Trading: • Impact of Program Trading on Stock Volatility: • Collars Applied to Program Trading:

Electric Communication Network (ECNs) • What is ECNs? • Program Trading: • Impact of Program Trading on Stock Volatility: • Collars Applied to Program Trading:

Regulations of Stock Trading • Circuit Breakers: • Trading Halts: • SEC Oversight of Corporate Disclosure: Fair Disclosure (FD).

Regulations of Stock Trading • Circuit Breakers: • Trading Halts: • SEC Oversight of Corporate Disclosure: Fair Disclosure (FD).

Barriers to International Stock Trading • Transaction Costs: • Information Costs: • Exchange Rate Costs:

Barriers to International Stock Trading • Transaction Costs: • Information Costs: • Exchange Rate Costs:

End of Chapter 12

End of Chapter 12