4e1d07f8374bb8604a4d0408296bdd5a.ppt

- Количество слайдов: 46

Chapter 12 FIXED-INCOME ANALYSIS

Chapter 12 FIXED-INCOME ANALYSIS

Chapter 12 Questions • What different bond yields are important to investors? • How are the following major yields on bonds computed: current yield, yield to maturity, yield to call, and compound realized (horizon) yield? • What factors affect the level of bond yields at a point in time? • What economic forces cause changes in the yields on bonds over time?

Chapter 12 Questions • What different bond yields are important to investors? • How are the following major yields on bonds computed: current yield, yield to maturity, yield to call, and compound realized (horizon) yield? • What factors affect the level of bond yields at a point in time? • What economic forces cause changes in the yields on bonds over time?

Chapter 12 Questions • When yields change, what characteristics of a bond cause differential price changes for individual bonds? • What do we mean by the duration of a bond, how is it computed, and what factors affect it? • What is modified duration and what is the relationship between a bond’s modified duration and its volatility?

Chapter 12 Questions • When yields change, what characteristics of a bond cause differential price changes for individual bonds? • What do we mean by the duration of a bond, how is it computed, and what factors affect it? • What is modified duration and what is the relationship between a bond’s modified duration and its volatility?

Chapter 12 Questions • What is the convexity for a bond, what factors affect it, and what is its effect on a bond’s volatility? • Under what conditions is it necessary to consider both modified duration and convexity when estimating a bond’s price volatility?

Chapter 12 Questions • What is the convexity for a bond, what factors affect it, and what is its effect on a bond’s volatility? • Under what conditions is it necessary to consider both modified duration and convexity when estimating a bond’s price volatility?

The Fundamentals of Bond Valuation • Like other financial assets, the value of a bond is the present value of its expected future cash flows: Vj = SCFt/(1+k)t

The Fundamentals of Bond Valuation • Like other financial assets, the value of a bond is the present value of its expected future cash flows: Vj = SCFt/(1+k)t

The Fundamentals of Bond Valuation • To incorporate the specifics of bonds: P = S(Ci/2)/(1+Ym/2)t + Pp /(1+Ym/2)2 n • This is the present value model where: – P is the current market price of the bond – n is the number of years to maturity – Ci is the annual coupon payment – Ym is the yield to maturity of the bond – Pp is the par value of the bond

The Fundamentals of Bond Valuation • To incorporate the specifics of bonds: P = S(Ci/2)/(1+Ym/2)t + Pp /(1+Ym/2)2 n • This is the present value model where: – P is the current market price of the bond – n is the number of years to maturity – Ci is the annual coupon payment – Ym is the yield to maturity of the bond – Pp is the par value of the bond

Bond Price/Yield Relationships • Bond prices change as yields change, and have the following relationships: – When yield is below the coupon rate, the bond will be priced at a premium to par value – When yield is above the coupon rate, the bond will be priced at a discount from its par value – The price-yield relationship is not a straight line, but rather convex (This is convexity) • As yields decline, prices increase at an increasing rate • As yield increase, prices fall at a declining rate

Bond Price/Yield Relationships • Bond prices change as yields change, and have the following relationships: – When yield is below the coupon rate, the bond will be priced at a premium to par value – When yield is above the coupon rate, the bond will be priced at a discount from its par value – The price-yield relationship is not a straight line, but rather convex (This is convexity) • As yields decline, prices increase at an increasing rate • As yield increase, prices fall at a declining rate

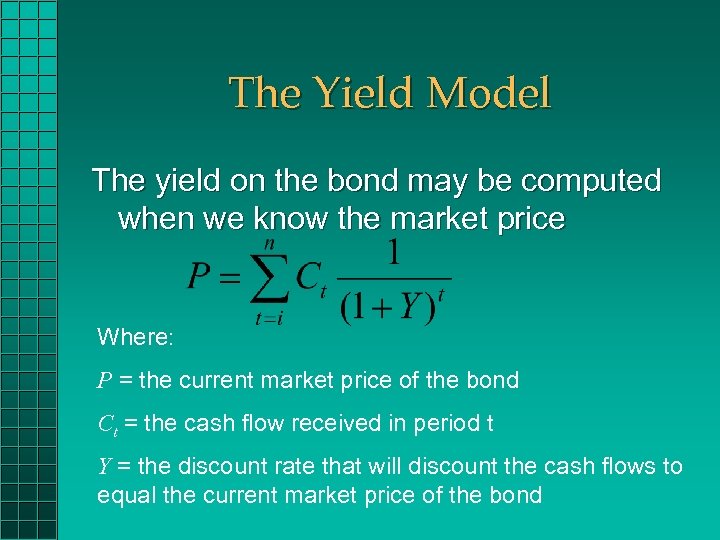

The Yield Model The yield on the bond may be computed when we know the market price Where: P = the current market price of the bond Ct = the cash flow received in period t Y = the discount rate that will discount the cash flows to equal the current market price of the bond

The Yield Model The yield on the bond may be computed when we know the market price Where: P = the current market price of the bond Ct = the cash flow received in period t Y = the discount rate that will discount the cash flows to equal the current market price of the bond

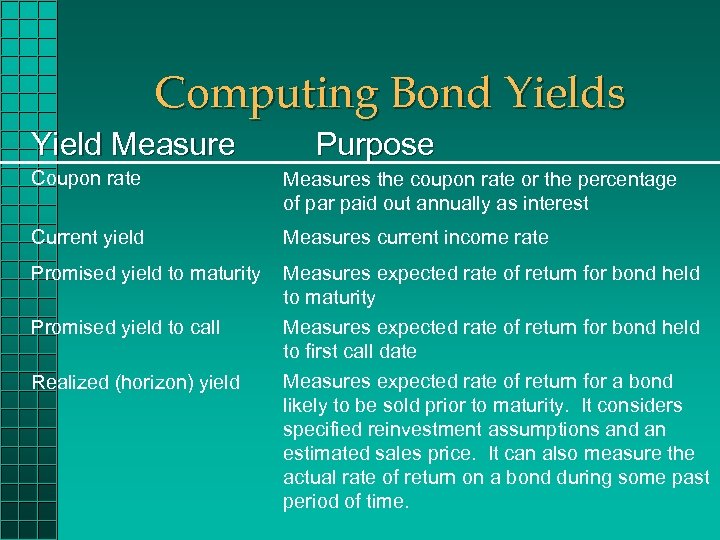

Computing Bond Yields Yield Measure Purpose Coupon rate Measures the coupon rate or the percentage of par paid out annually as interest Current yield Measures current income rate Promised yield to maturity Measures expected rate of return for bond held to first call date Measures expected rate of return for a bond likely to be sold prior to maturity. It considers specified reinvestment assumptions and an estimated sales price. It can also measure the actual rate of return on a bond during some past period of time. Promised yield to call Realized (horizon) yield

Computing Bond Yields Yield Measure Purpose Coupon rate Measures the coupon rate or the percentage of par paid out annually as interest Current yield Measures current income rate Promised yield to maturity Measures expected rate of return for bond held to first call date Measures expected rate of return for a bond likely to be sold prior to maturity. It considers specified reinvestment assumptions and an estimated sales price. It can also measure the actual rate of return on a bond during some past period of time. Promised yield to call Realized (horizon) yield

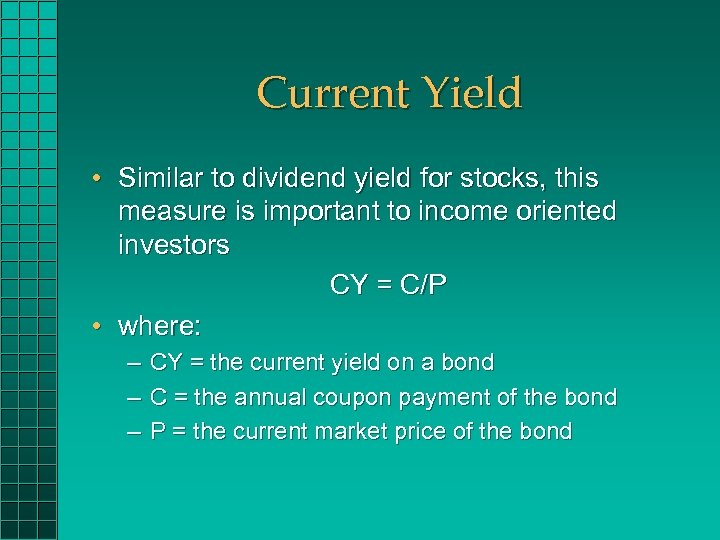

Current Yield • Similar to dividend yield for stocks, this measure is important to income oriented investors CY = C/P • where: – – – CY = the current yield on a bond C = the annual coupon payment of the bond P = the current market price of the bond

Current Yield • Similar to dividend yield for stocks, this measure is important to income oriented investors CY = C/P • where: – – – CY = the current yield on a bond C = the annual coupon payment of the bond P = the current market price of the bond

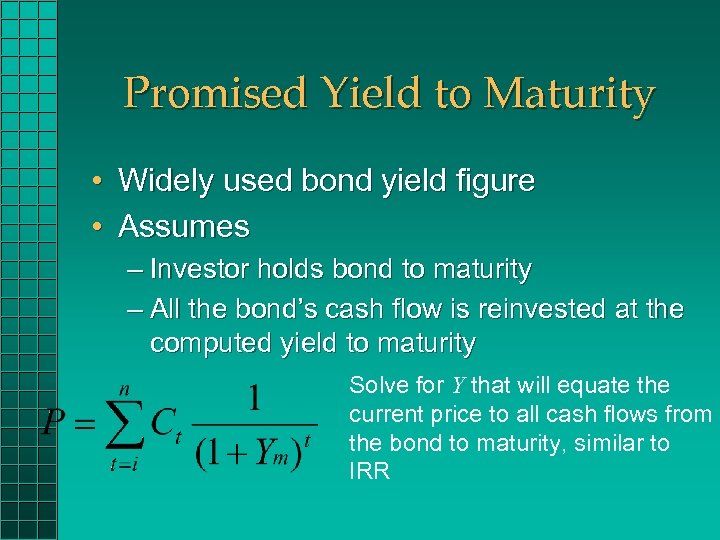

Promised Yield to Maturity • Widely used bond yield figure • Assumes – Investor holds bond to maturity – All the bond’s cash flow is reinvested at the computed yield to maturity Solve for Y that will equate the current price to all cash flows from the bond to maturity, similar to IRR

Promised Yield to Maturity • Widely used bond yield figure • Assumes – Investor holds bond to maturity – All the bond’s cash flow is reinvested at the computed yield to maturity Solve for Y that will equate the current price to all cash flows from the bond to maturity, similar to IRR

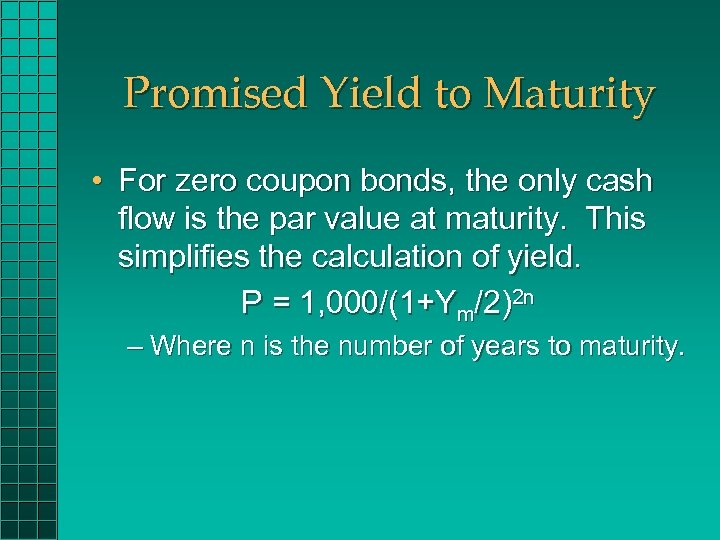

Promised Yield to Maturity • For zero coupon bonds, the only cash flow is the par value at maturity. This simplifies the calculation of yield. P = 1, 000/(1+Ym/2)2 n – Where n is the number of years to maturity.

Promised Yield to Maturity • For zero coupon bonds, the only cash flow is the par value at maturity. This simplifies the calculation of yield. P = 1, 000/(1+Ym/2)2 n – Where n is the number of years to maturity.

Promised Yield to Call • When a callable bond is likely to be called, yield to call is the more appropriate yield measure than yield to maturity – As a rule of thumb, when a callable bond is selling at a price equal to par value plus one year of interest, the value should be based on yield to call

Promised Yield to Call • When a callable bond is likely to be called, yield to call is the more appropriate yield measure than yield to maturity – As a rule of thumb, when a callable bond is selling at a price equal to par value plus one year of interest, the value should be based on yield to call

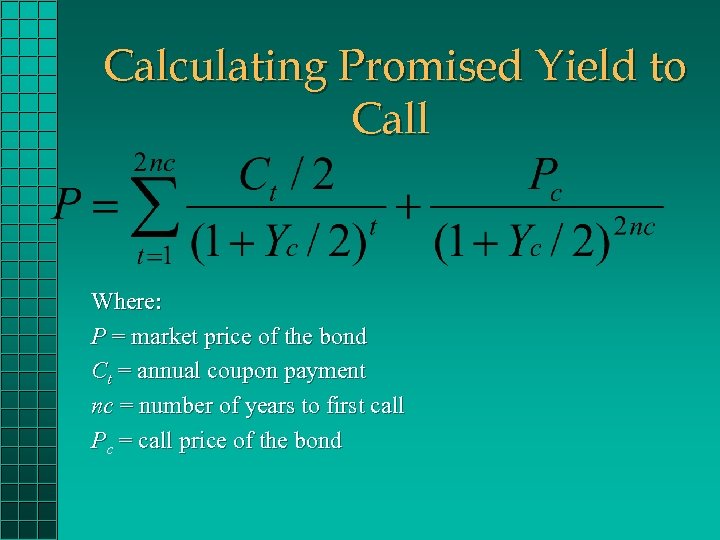

Calculating Promised Yield to Call Where: P = market price of the bond Ct = annual coupon payment nc = number of years to first call Pc = call price of the bond

Calculating Promised Yield to Call Where: P = market price of the bond Ct = annual coupon payment nc = number of years to first call Pc = call price of the bond

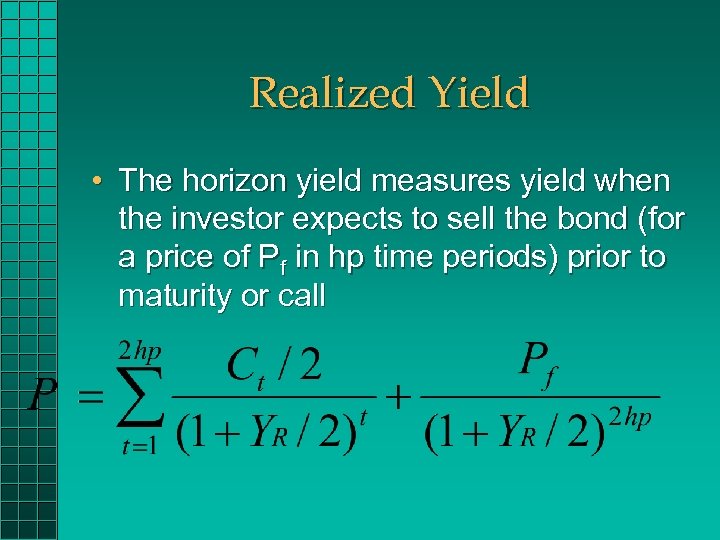

Realized Yield • The horizon yield measures yield when the investor expects to sell the bond (for a price of Pf in hp time periods) prior to maturity or call

Realized Yield • The horizon yield measures yield when the investor expects to sell the bond (for a price of Pf in hp time periods) prior to maturity or call

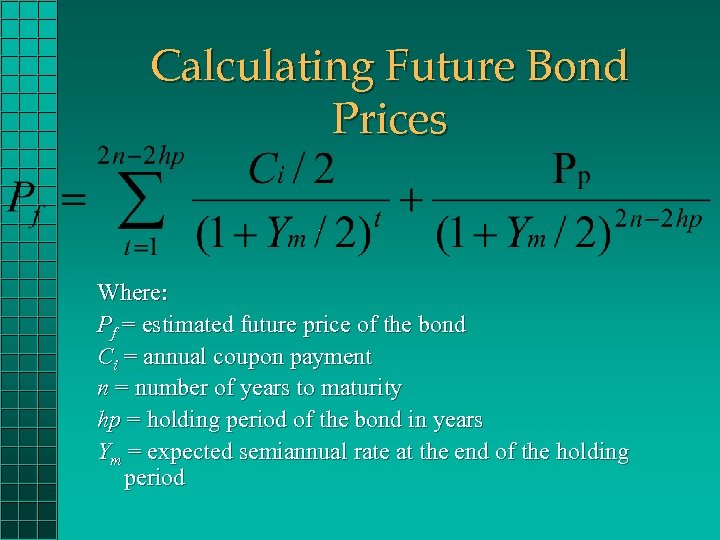

Calculating Future Bond Prices • Expected future bond prices are an important calculation in several instances: – When computing horizon yield, we need an estimated future selling price – When issues are quoted on a promised yield, as with municipals – For portfolio managers who frequently trade bonds

Calculating Future Bond Prices • Expected future bond prices are an important calculation in several instances: – When computing horizon yield, we need an estimated future selling price – When issues are quoted on a promised yield, as with municipals – For portfolio managers who frequently trade bonds

Calculating Future Bond Prices Where: Pf = estimated future price of the bond Ci = annual coupon payment n = number of years to maturity hp = holding period of the bond in years Ym = expected semiannual rate at the end of the holding period

Calculating Future Bond Prices Where: Pf = estimated future price of the bond Ci = annual coupon payment n = number of years to maturity hp = holding period of the bond in years Ym = expected semiannual rate at the end of the holding period

Adjusting for Differential Reinvestment Rates • The yield calculations implicitly assume reinvestment of early coupon payments at the calculated yield • If expectations are not consistent with this assumption, we can compound early cash flows at differential rates over the life of the bond and then find the yield based on an “Ending wealth” measure, which is calculated from the differential rates

Adjusting for Differential Reinvestment Rates • The yield calculations implicitly assume reinvestment of early coupon payments at the calculated yield • If expectations are not consistent with this assumption, we can compound early cash flows at differential rates over the life of the bond and then find the yield based on an “Ending wealth” measure, which is calculated from the differential rates

Yield Adjustments for Tax. Exempt Bonds • In order to compare taxable and taxexempt bonds on an “equal playing field” for an investor, we calculate the fully taxable equivalent yield (FTEY) for tax-free bonds based on their returns FTEY = Tax-Free Annual Return/(1 -T) • Where T is the investor’s marginal tax rate

Yield Adjustments for Tax. Exempt Bonds • In order to compare taxable and taxexempt bonds on an “equal playing field” for an investor, we calculate the fully taxable equivalent yield (FTEY) for tax-free bonds based on their returns FTEY = Tax-Free Annual Return/(1 -T) • Where T is the investor’s marginal tax rate

What Determines Interest Rates? • Inverse relationship with bond prices – Changes in interest rates have an impact on bond portfolios, in particular rising interest rates – It is therefore important to learn about what determines interest rates and to gain some insight as to forecasting future interest rates

What Determines Interest Rates? • Inverse relationship with bond prices – Changes in interest rates have an impact on bond portfolios, in particular rising interest rates – It is therefore important to learn about what determines interest rates and to gain some insight as to forecasting future interest rates

Forecasting interest rates • Interest rates are the cost of borrowing money, or the cost of “loanable funds” • Factors that affect the supply of loanable funds (through saving) and the demand for loanable funds (borrowing) affect interest rates – The goal is to monitor these factors, and to anticipate changes in interest rates and to be wellpositioned to either benefit from the forecast or at least be protected from adverse changes in rates

Forecasting interest rates • Interest rates are the cost of borrowing money, or the cost of “loanable funds” • Factors that affect the supply of loanable funds (through saving) and the demand for loanable funds (borrowing) affect interest rates – The goal is to monitor these factors, and to anticipate changes in interest rates and to be wellpositioned to either benefit from the forecast or at least be protected from adverse changes in rates

Determinants of Interest Rates • Nominal interest rates (i) can be broken down into the following components: i = RFR + I + RP where: – RFR = real risk-free rate of interest – I = expected rate of inflation – RP = risk premium • The key is to anticipate changes in any of these factors

Determinants of Interest Rates • Nominal interest rates (i) can be broken down into the following components: i = RFR + I + RP where: – RFR = real risk-free rate of interest – I = expected rate of inflation – RP = risk premium • The key is to anticipate changes in any of these factors

Determinants of Interest Rates • Alternatively, we can break down interest rate factors into two groups of effects: – Effect of economic factors • • real growth rate tightness or ease of capital market expected inflation supply and demand of loanable funds – Impact of bond characteristics • • credit quality term to maturity indenture provisions foreign bond risk (exchange rate risk and country risk)

Determinants of Interest Rates • Alternatively, we can break down interest rate factors into two groups of effects: – Effect of economic factors • • real growth rate tightness or ease of capital market expected inflation supply and demand of loanable funds – Impact of bond characteristics • • credit quality term to maturity indenture provisions foreign bond risk (exchange rate risk and country risk)

Determinants of Interest Rates Term structure of interest rates – One important source of interest rate variability is the time to maturity – The yield curve shows the relationship between bond yields and time to maturity at a point in time • Yield curve shapes – – – Rising curve (common) when rates are modest Declining curve when rates are relatively high Flat curves can happen any time Humped when high rates are expected to decline Note: usually relatively flat beyond 15 years

Determinants of Interest Rates Term structure of interest rates – One important source of interest rate variability is the time to maturity – The yield curve shows the relationship between bond yields and time to maturity at a point in time • Yield curve shapes – – – Rising curve (common) when rates are modest Declining curve when rates are relatively high Flat curves can happen any time Humped when high rates are expected to decline Note: usually relatively flat beyond 15 years

Determinants of Interest Rates Term Structure Theories (what explains the changing shape of the yield curve? ) • Expectations hypothesis – The shape of the yield curve depends on expected future interest rates and inflation rates – An upward-sloping curve indicates expectations of higher rates in the future – We can use this hypothesis to compute implied future (forward) interest rates – Yields of different maturities continually adjusting to estimates of future interest rates

Determinants of Interest Rates Term Structure Theories (what explains the changing shape of the yield curve? ) • Expectations hypothesis – The shape of the yield curve depends on expected future interest rates and inflation rates – An upward-sloping curve indicates expectations of higher rates in the future – We can use this hypothesis to compute implied future (forward) interest rates – Yields of different maturities continually adjusting to estimates of future interest rates

Determinants of Interest Rates Term Structure Theories • Liquidity preference hypothesis – Indicates that long term rates have to pay a premium over short term rates because: • Investors need a premium to compensate for the added price risk associated with long-term bonds • Borrowers are willing to pay higher rates on long-term debt to avoid refinancing risk – Works well in combination with the expectations hypothesis to explain the normal upward slope of the yield curve

Determinants of Interest Rates Term Structure Theories • Liquidity preference hypothesis – Indicates that long term rates have to pay a premium over short term rates because: • Investors need a premium to compensate for the added price risk associated with long-term bonds • Borrowers are willing to pay higher rates on long-term debt to avoid refinancing risk – Works well in combination with the expectations hypothesis to explain the normal upward slope of the yield curve

Determinants of Interest Rates Term Structure Theories • Segmented market hypothesis – Asserts that different investors, in particular institutions, have different maturity needs, so have “preferred habitats” along the yield curve – Interest rates in differentiated maturity markets are determined by unique supply and demand factors in those markets

Determinants of Interest Rates Term Structure Theories • Segmented market hypothesis – Asserts that different investors, in particular institutions, have different maturity needs, so have “preferred habitats” along the yield curve – Interest rates in differentiated maturity markets are determined by unique supply and demand factors in those markets

Determinants of Interest Rates • Term Structure and Trading – Knowledge of the term structure can aid in bond market trading strategies • For example, if the yield curve is sharply downward sloping, rates are likely to fall – lengthen bond maturities to take the most advantage of price appreciation as interest rates fall in the future

Determinants of Interest Rates • Term Structure and Trading – Knowledge of the term structure can aid in bond market trading strategies • For example, if the yield curve is sharply downward sloping, rates are likely to fall – lengthen bond maturities to take the most advantage of price appreciation as interest rates fall in the future

Determinants of Interest Rates Yield Spreads • Bond investing strategies can focus on predicting various changing yield spreads, which exist between: – Segments: government bonds, agency bonds, and corporate bonds – Sectors: prime-grade municipal bonds versus good-grade municipal bonds, AA utilities versus BBB utilities – Different coupons within a segment or sector – Maturities within a given market segment or sector

Determinants of Interest Rates Yield Spreads • Bond investing strategies can focus on predicting various changing yield spreads, which exist between: – Segments: government bonds, agency bonds, and corporate bonds – Sectors: prime-grade municipal bonds versus good-grade municipal bonds, AA utilities versus BBB utilities – Different coupons within a segment or sector – Maturities within a given market segment or sector

Bond Price Volatility • As interest rates and bond yields change, so do bond prices (that’s we we’ve been talking about interest rates!) • What determines how much a bond’s price will change as a result of changing yields (interest rates)? • Percentage Change = (EPB/BPB) – 1 – EPB = Ending Price of the Bond – BPB = Beginning Price of the Bond

Bond Price Volatility • As interest rates and bond yields change, so do bond prices (that’s we we’ve been talking about interest rates!) • What determines how much a bond’s price will change as a result of changing yields (interest rates)? • Percentage Change = (EPB/BPB) – 1 – EPB = Ending Price of the Bond – BPB = Beginning Price of the Bond

Determinants of Bond Price Volatility Four factors determine a bond’s price volatility to changing interest rates: 1. Par value 2. Coupon 3. Years to maturity 4. Prevailing level of market interest rate

Determinants of Bond Price Volatility Four factors determine a bond’s price volatility to changing interest rates: 1. Par value 2. Coupon 3. Years to maturity 4. Prevailing level of market interest rate

Determinants of Bond Price Volatility Malkiel’s five bond relationships: 1. Bond prices move inversely to bond yields (interest rates) 2. For a given change in yields, longer maturity bonds post larger price changes, thus bond price volatility is directly related to maturity 3. Price volatility increases at a diminishing rate as term to maturity increases 4. Price movements resulting from equal absolute increases or decreases in yield are not symmetrical 5. Higher coupon issues show smaller percentage price fluctuation for a given change in yield, thus bond price volatility is inversely related to coupon

Determinants of Bond Price Volatility Malkiel’s five bond relationships: 1. Bond prices move inversely to bond yields (interest rates) 2. For a given change in yields, longer maturity bonds post larger price changes, thus bond price volatility is directly related to maturity 3. Price volatility increases at a diminishing rate as term to maturity increases 4. Price movements resulting from equal absolute increases or decreases in yield are not symmetrical 5. Higher coupon issues show smaller percentage price fluctuation for a given change in yield, thus bond price volatility is inversely related to coupon

Determinants of Bond Price Volatility • The maturity effect – The longer the time to maturity, the greater a bond’s price sensitivity – Price volatility increases at a decreasing rate with maturity • The coupon effect – The greater the coupon rate, the lower a bond’s price sensitivity

Determinants of Bond Price Volatility • The maturity effect – The longer the time to maturity, the greater a bond’s price sensitivity – Price volatility increases at a decreasing rate with maturity • The coupon effect – The greater the coupon rate, the lower a bond’s price sensitivity

Determinants of Bond Price Volatility • The yield level effect – For the same change in basis point yield, there is greater price sensitivity of lower yield bonds • Some trading implications – If our interest rate forecast is for lower rates, invest in bonds with the greatest price sensitivity, and do the opposite if we expect higher interest rates

Determinants of Bond Price Volatility • The yield level effect – For the same change in basis point yield, there is greater price sensitivity of lower yield bonds • Some trading implications – If our interest rate forecast is for lower rates, invest in bonds with the greatest price sensitivity, and do the opposite if we expect higher interest rates

Determinants of Bond Price Volatility • The Duration Measure – Since price volatility of a bond varies inversely with its coupon and directly with its term to maturity, it is necessary to determine the best combination of these two variables to achieve your objective – A composite measure considering both coupon and maturity would be beneficial, and that’s what this measure provides

Determinants of Bond Price Volatility • The Duration Measure – Since price volatility of a bond varies inversely with its coupon and directly with its term to maturity, it is necessary to determine the best combination of these two variables to achieve your objective – A composite measure considering both coupon and maturity would be beneficial, and that’s what this measure provides

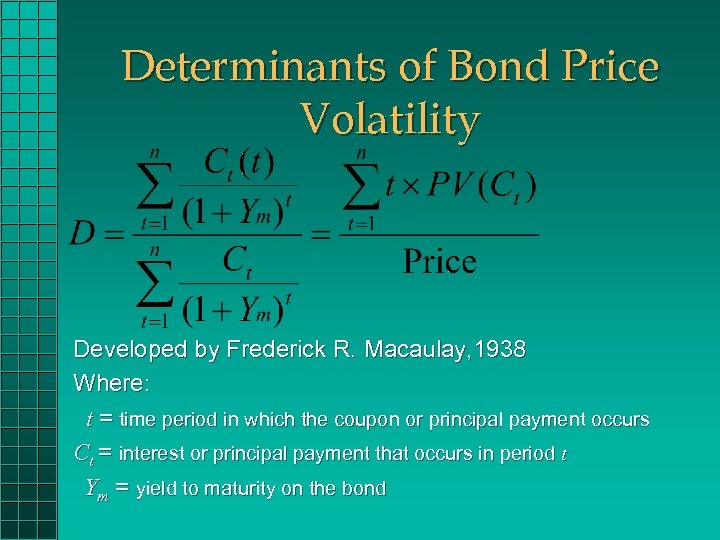

Determinants of Bond Price Volatility Developed by Frederick R. Macaulay, 1938 Where: t = time period in which the coupon or principal payment occurs Ct = interest or principal payment that occurs in period t Ym = yield to maturity on the bond

Determinants of Bond Price Volatility Developed by Frederick R. Macaulay, 1938 Where: t = time period in which the coupon or principal payment occurs Ct = interest or principal payment that occurs in period t Ym = yield to maturity on the bond

Determinants of Bond Price Volatility • Characteristics of Macaulay Duration – Duration of a bond with coupons is always less than its term to maturity because duration gives weight to these interim payments • A zero-coupon bond’s duration equals its maturity – There is an inverse relation between duration and the coupon rate – A positive relation between term to maturity and duration, but duration increases at a decreasing rate with maturity

Determinants of Bond Price Volatility • Characteristics of Macaulay Duration – Duration of a bond with coupons is always less than its term to maturity because duration gives weight to these interim payments • A zero-coupon bond’s duration equals its maturity – There is an inverse relation between duration and the coupon rate – A positive relation between term to maturity and duration, but duration increases at a decreasing rate with maturity

Determinants of Bond Price Volatility • Characteristics of Macaulay Duration – There is an inverse relation between YTM and duration – Sinking funds and call provisions can have a dramatic effect on a bond’s duration

Determinants of Bond Price Volatility • Characteristics of Macaulay Duration – There is an inverse relation between YTM and duration – Sinking funds and call provisions can have a dramatic effect on a bond’s duration

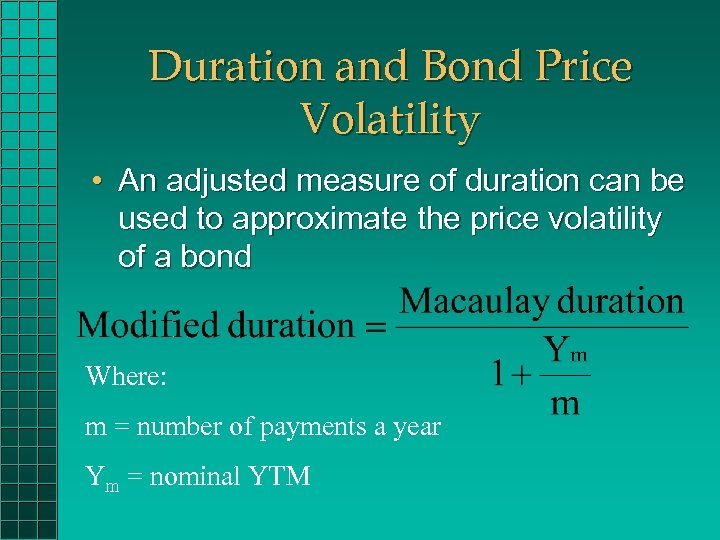

Duration and Bond Price Volatility • An adjusted measure of duration can be used to approximate the price volatility of a bond Where: m = number of payments a year Ym = nominal YTM

Duration and Bond Price Volatility • An adjusted measure of duration can be used to approximate the price volatility of a bond Where: m = number of payments a year Ym = nominal YTM

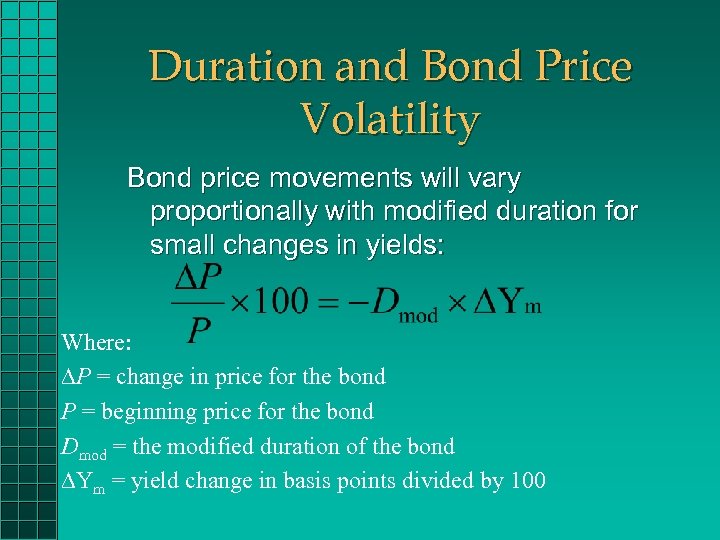

Duration and Bond Price Volatility Bond price movements will vary proportionally with modified duration for small changes in yields: Where: P = change in price for the bond P = beginning price for the bond Dmod = the modified duration of the bond Ym = yield change in basis points divided by 100

Duration and Bond Price Volatility Bond price movements will vary proportionally with modified duration for small changes in yields: Where: P = change in price for the bond P = beginning price for the bond Dmod = the modified duration of the bond Ym = yield change in basis points divided by 100

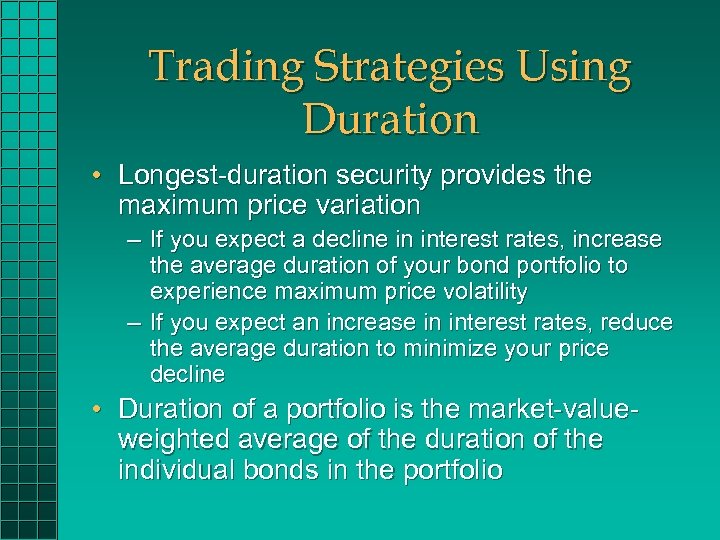

Trading Strategies Using Duration • Longest-duration security provides the maximum price variation – If you expect a decline in interest rates, increase the average duration of your bond portfolio to experience maximum price volatility – If you expect an increase in interest rates, reduce the average duration to minimize your price decline • Duration of a portfolio is the market-valueweighted average of the duration of the individual bonds in the portfolio

Trading Strategies Using Duration • Longest-duration security provides the maximum price variation – If you expect a decline in interest rates, increase the average duration of your bond portfolio to experience maximum price volatility – If you expect an increase in interest rates, reduce the average duration to minimize your price decline • Duration of a portfolio is the market-valueweighted average of the duration of the individual bonds in the portfolio

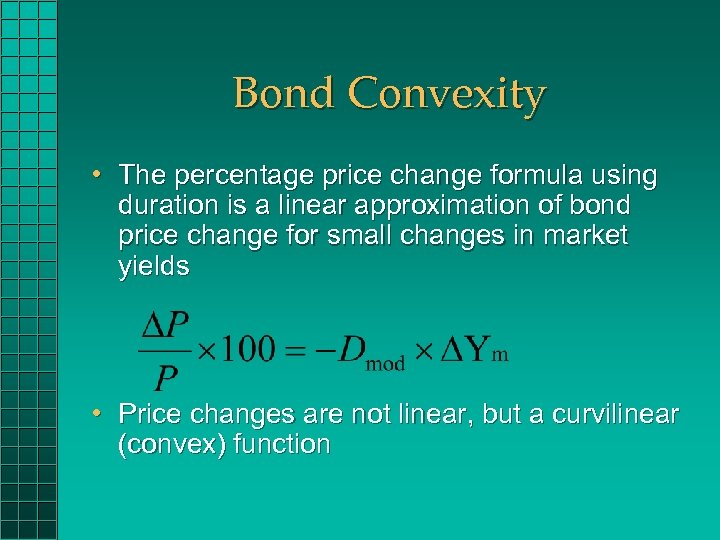

Bond Convexity • The percentage price change formula using duration is a linear approximation of bond price change for small changes in market yields • Price changes are not linear, but a curvilinear (convex) function

Bond Convexity • The percentage price change formula using duration is a linear approximation of bond price change for small changes in market yields • Price changes are not linear, but a curvilinear (convex) function

Bond Convexity • The graph of prices relative to yields is not a straight line, but a curvilinear relationship – This can be applied to a single bond, a portfolio of bonds, or any stream of future cash flows • The convex price-yield relationship will differ among bonds or other cash flow streams depending on the coupon and maturity – The convexity of the price-yield relationship declines slower as the yield increases • Modified duration is the percentage change in price for a nominal change in yield

Bond Convexity • The graph of prices relative to yields is not a straight line, but a curvilinear relationship – This can be applied to a single bond, a portfolio of bonds, or any stream of future cash flows • The convex price-yield relationship will differ among bonds or other cash flow streams depending on the coupon and maturity – The convexity of the price-yield relationship declines slower as the yield increases • Modified duration is the percentage change in price for a nominal change in yield

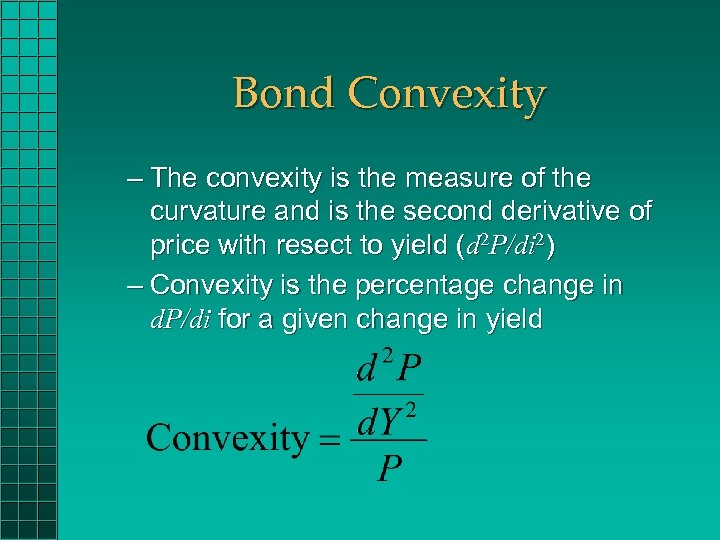

Bond Convexity – The convexity is the measure of the curvature and is the second derivative of price with resect to yield (d 2 P/di 2) – Convexity is the percentage change in d. P/di for a given change in yield

Bond Convexity – The convexity is the measure of the curvature and is the second derivative of price with resect to yield (d 2 P/di 2) – Convexity is the percentage change in d. P/di for a given change in yield

Bond Convexity • Determinants of Convexity – Inverse relationship between coupon and convexity – Direct relationship between maturity and convexity – Inverse relationship between yield and convexity

Bond Convexity • Determinants of Convexity – Inverse relationship between coupon and convexity – Direct relationship between maturity and convexity – Inverse relationship between yield and convexity

Modified Duration-Convexity Effects • Changes in a bond’s price resulting from a change in yield are due to: – Bond’s modified duration – Bond’s convexity • Relative effect of these two factors depends on the characteristics of the bond (its convexity) and the size of the yield change • Convexity is desirable – Greater price appreciation if interest rates fall, smaller price drop if interest rates rise

Modified Duration-Convexity Effects • Changes in a bond’s price resulting from a change in yield are due to: – Bond’s modified duration – Bond’s convexity • Relative effect of these two factors depends on the characteristics of the bond (its convexity) and the size of the yield change • Convexity is desirable – Greater price appreciation if interest rates fall, smaller price drop if interest rates rise