865eafbcfc1111090abea10c4979eabe.ppt

- Количество слайдов: 53

Chapter 12 Contributed Capital Certificate of Stock Adapted from Financial Accounting 4 e by Porter and Norton 1

Equity Financing: Issue Stock Dividend flexibility l Ready markets l Often provides higher ROI than debt financing l Borrowing may not be feasible l ages ant sadv Di Adv 2

Equity Financing: Issue Stock Less control l Dividends not tax deductible l Hurts some financial ratios l Adv ant age s Dis adv a nta ges 3

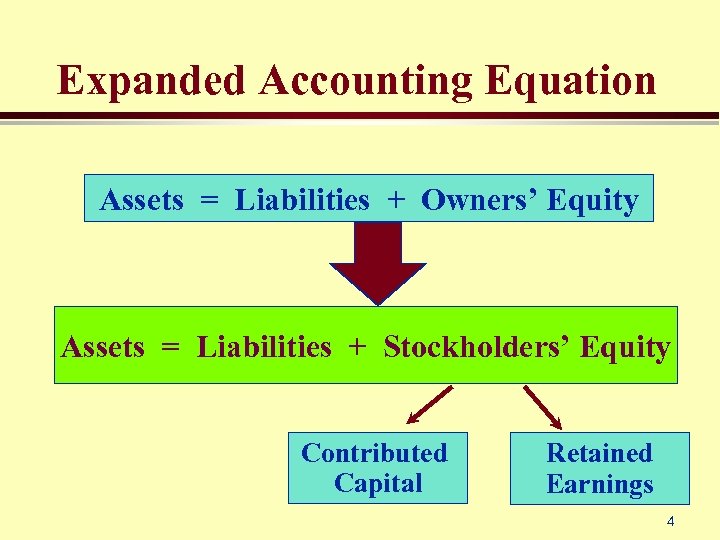

Expanded Accounting Equation Assets = Liabilities + Owners’ Equity Assets = Liabilities + Stockholders’ Equity Contributed Capital Retained Earnings 4

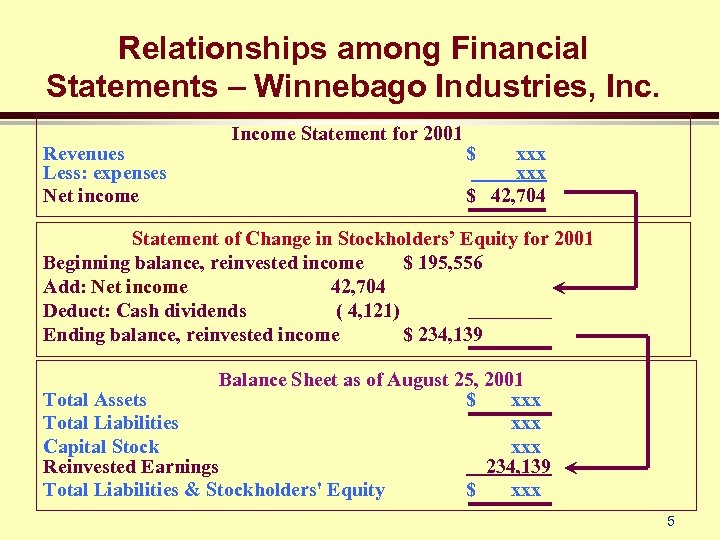

Relationships among Financial Statements – Winnebago Industries, Inc. Revenues Less: expenses Net income Income Statement for 2001 $ xxx $ 42, 704 Statement of Change in Stockholders’ Equity for 2001 Beginning balance, reinvested income $ 195, 556 Add: Net income 42, 704 Deduct: Cash dividends ( 4, 121) Ending balance, reinvested income $ 234, 139 Balance Sheet as of August 25, 2001 Total Assets $ xxx Total Liabilities xxx Capital Stock xxx Reinvested Earnings 234, 139 Total Liabilities & Stockholders' Equity $ xxx 5

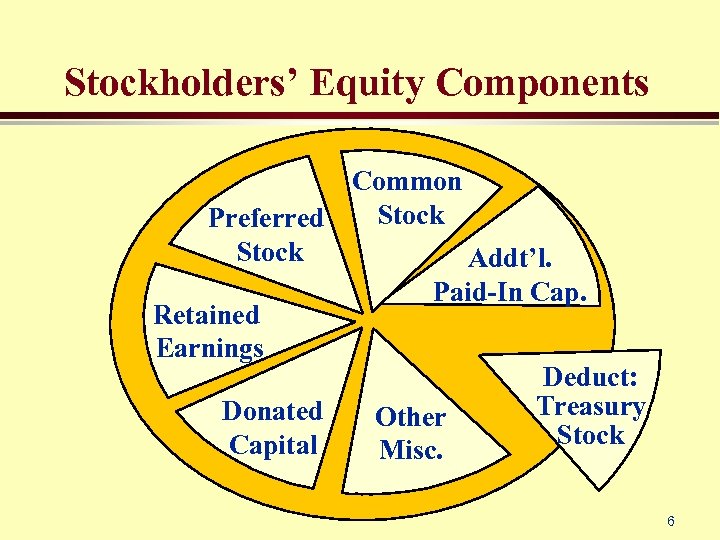

Stockholders’ Equity Components Common Stock Preferred Stock Addt’l. Paid-In Cap. Retained Earnings Deduct: Treasury Donated Other Stock Capital Misc. 6

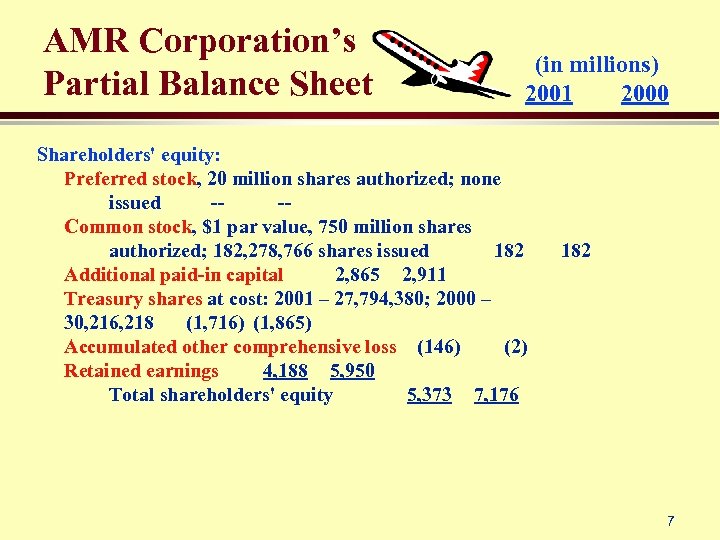

AMR Corporation’s Partial Balance Sheet (in millions) 2001 2000 Shareholders' equity: Preferred stock, 20 million shares authorized; none issued --Common stock, $1 par value, 750 million shares authorized; 182, 278, 766 shares issued 182 Additional paid-in capital 2, 865 2, 911 Treasury shares at cost: 2001 – 27, 794, 380; 2000 – 30, 216, 218 (1, 716) (1, 865) Accumulated other comprehensive loss (146) (2) Retained earnings 4, 188 5, 950 Total shareholders' equity 5, 373 7, 176 182 7

Contributed Capital l Common Stock » basic stock of corporation » has voting rights » represents ownership interest l Certificate of Stock Preferred Stock » optional » tailored to meet specific needs » provides dividend returns with less risk 8

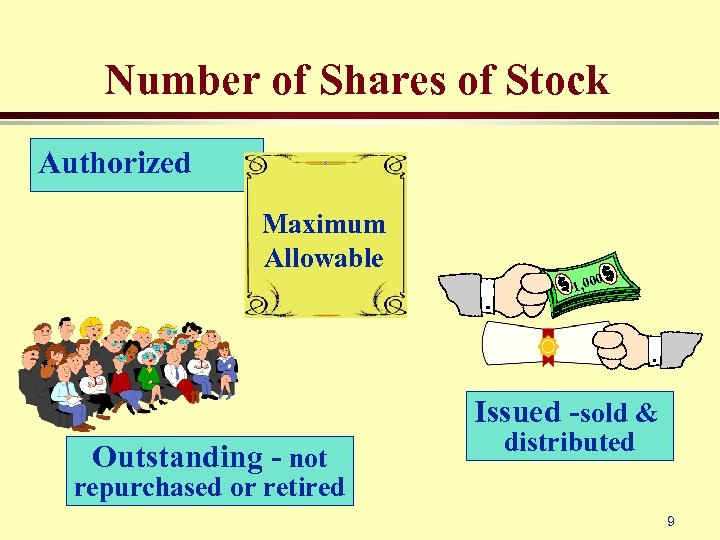

Number of Shares of Stock Authorized Maximum Allowable 0 1, 00 Issued -sold & Outstanding - not distributed repurchased or retired 9

Par Value “Legal capital” l Arbitrary amount stated on stock certificate l also called “stated value” l Certificate of Stock $1. 00 Par Value 10

Additional Paid-in Capital l Amount received in excess of par or stated value of stock Certificate of Stock $1. 00 Par Value 15 11

Retained Earnings Net income retained in business (not paid out as dividends) sinception l Reinvested in a variety of assets (not necessarily liquid) l 12

Preferred Stock Can tailor to specific needs of firm l Stated dividend rate l Often carries dividend preference over common stock l $100 par, 7% Preferred Stock 13

Preferred Stock Features Cumulative 1994 1995 1996 9 1 10 2 3 12 4 13 5 14 6 15 7 16 8 17 9 1 2 10 19 11 20 12 4 21 13 5 22 14 6 23 15 7 24 16 8 17 9 10 26 18 27 19 11 28 20 12 29 21 13 30 22 14 31 23 15 24 16 17 25 Participating 3 8 25 l 2 7 18 l 1 6 26 18 27 19 28 20 29 21 30 22 31 23 24 25 26 27 28 29 30 31 4 5 11 3 l Callable l Convertible Preferred Common 14

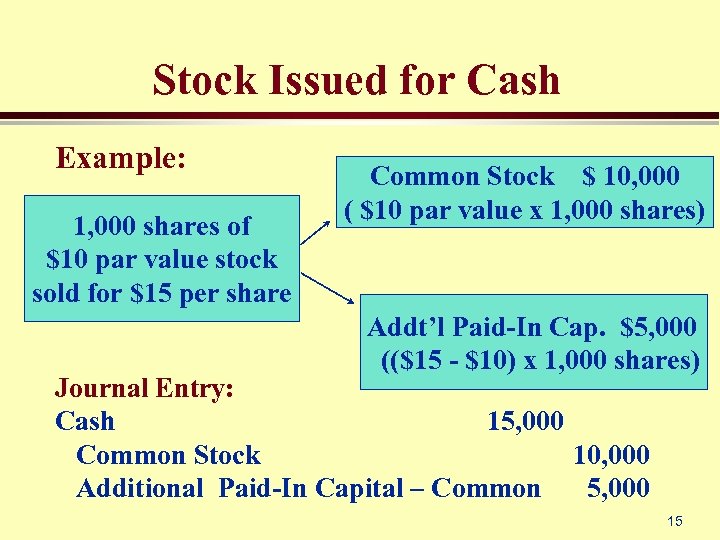

Stock Issued for Cash Example: 1, 000 shares of $10 par value stock sold for $15 per share Common Stock $ 10, 000 ( $10 par value x 1, 000 shares) Addt’l Paid-In Cap. $5, 000 (($15 - $10) x 1, 000 shares) Journal Entry: Cash 15, 000 Common Stock 10, 000 Additional Paid-In Capital – Common 5, 000 15

Stock Issued for Noncash Consideration l Record at fair market value of consideration given or received, whichever is more readily determinable Certificate of Stock Title to land, building, etc. 16

Treasury Stock Company buys back its own stock l Contra-equity account (debit balance) l Not outstanding (no voting rights) l Certificate of Stock 17

Reasons for Repurchasing Stock Provide for bonus or benefit plans l Maintain favorable market value l Improve financial ratios l Maintain control of ownership l Cash in on future price increases l 18

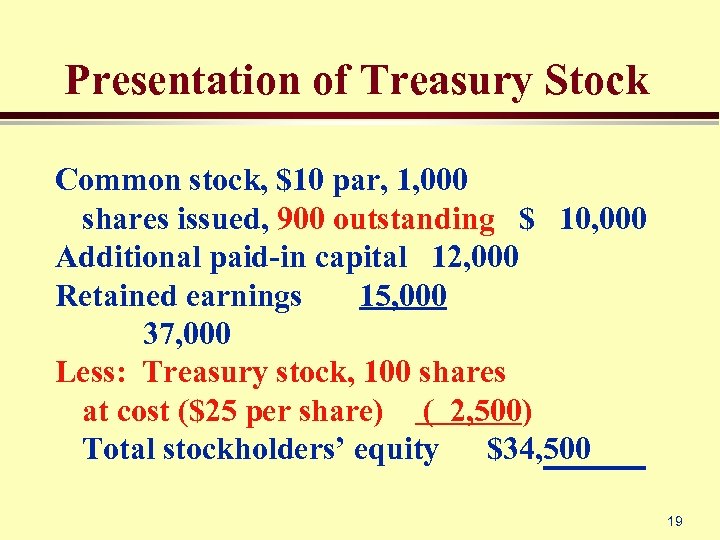

Presentation of Treasury Stock Common stock, $10 par, 1, 000 shares issued, 900 outstanding $ 10, 000 Additional paid-in capital 12, 000 Retained earnings 15, 000 37, 000 Less: Treasury stock, 100 shares at cost ($25 per share) ( 2, 500) Total stockholders’ equity $34, 500 19

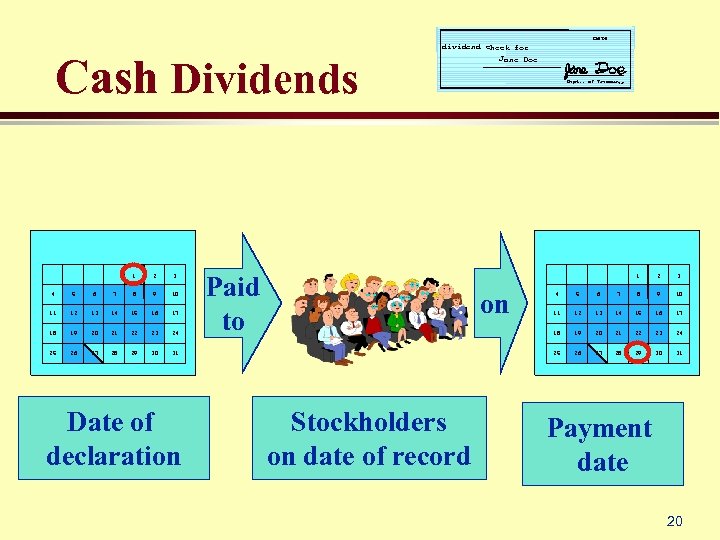

Date Cash Dividends 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 dividend check for Jane Doe Paid to 1 on 31 Date of declaration Dept. . of Treasurer 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Stockholders on date of record 4 26 27 28 29 30 31 Payment date 20

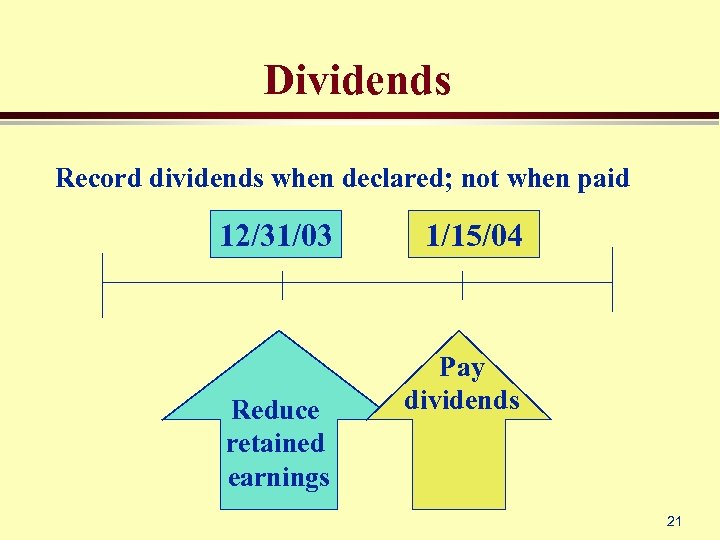

Dividends Record dividends when declared; not when paid 12/31/03 Reduce retained earnings 1/15/04 Pay dividends 21

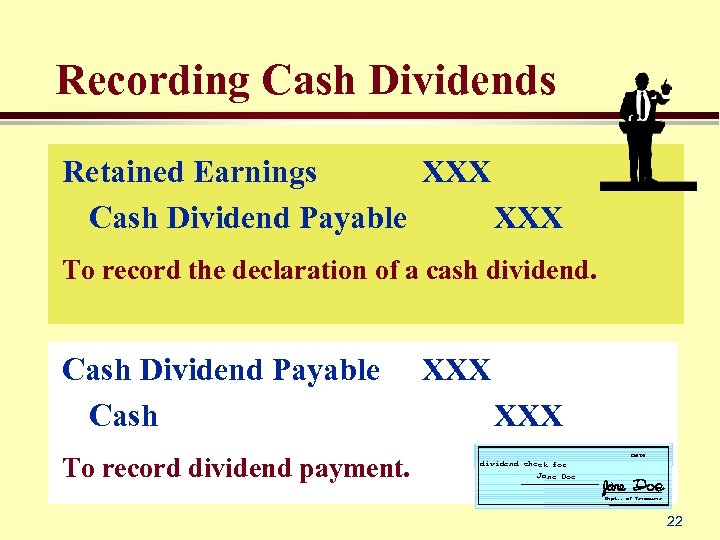

Recording Cash Dividends Retained Earnings XXX Cash Dividend Payable XXX To record the declaration of a cash dividend. Cash Dividend Payable Cash To record dividend payment. XXX Date dividend check for Jane Doe Dept. . of Treasurer 22

Dividend Requirements l Sufficient cash l Positive retained earnings 23

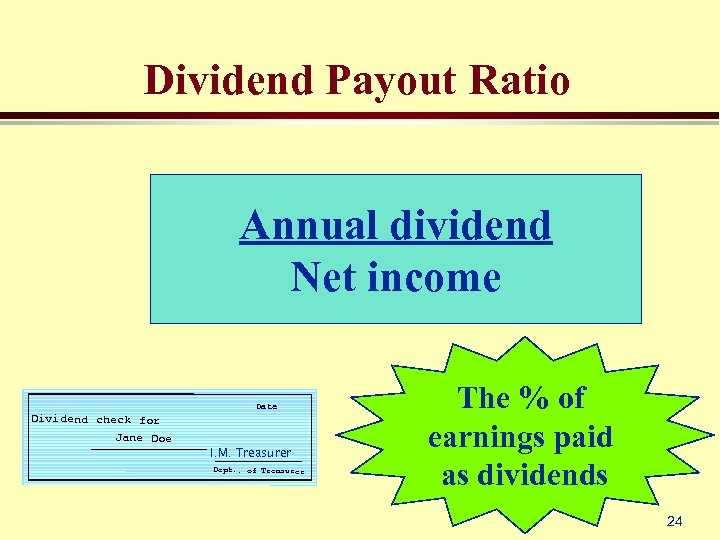

Dividend Payout Ratio Annual dividend Net income Date Dividend check for Jane Doe I. M. Treasurer Dept. . of Treasurer The % of earnings paid as dividends 24

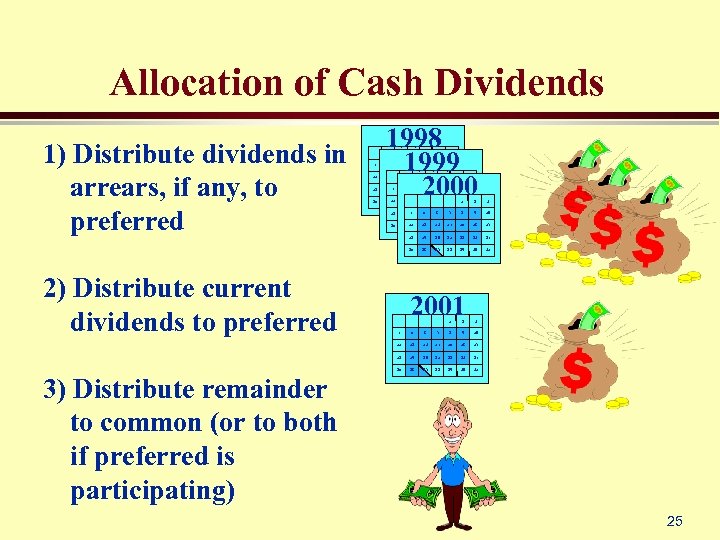

Allocation of Cash Dividends 1) Distribute dividends in arrears, if any, to preferred 1998 1999 2000 1 4 11 18 25 2 3 5 6 7 8 9 10 12 13 14 15 16 1 17 2 3 19 4 20 5 21 6 22 7 23 8 24 9 10 26 11 2712 28 13 29 14 30 15 31 16 1 17 2 3 24 9 10 26 11 2712 28 13 29 14 30 15 31 16 17 18 19 4 25 20 5 21 6 22 7 23 8 19 20 21 22 23 24 25 2) Distribute current dividends to preferred 18 26 27 28 29 30 31 2001 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 3) Distribute remainder to common (or to both if preferred is participating) 25

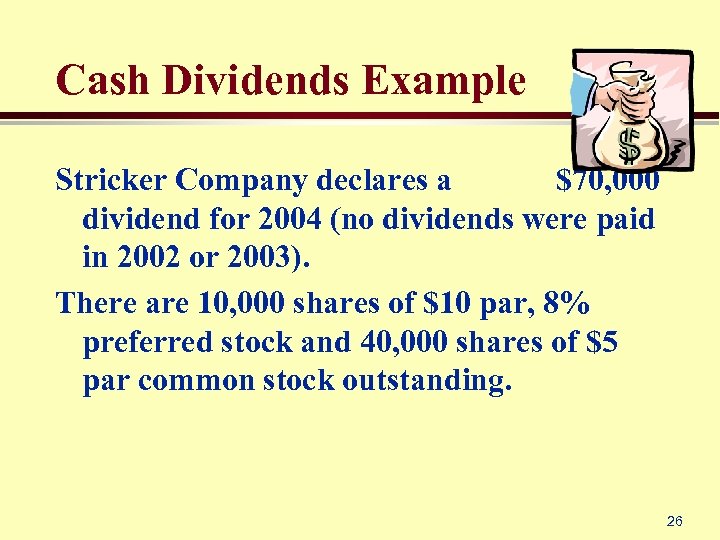

Cash Dividends Example Stricker Company declares a $70, 000 dividend for 2004 (no dividends were paid in 2002 or 2003). There are 10, 000 shares of $10 par, 8% preferred stock and 40, 000 shares of $5 par common stock outstanding. 26

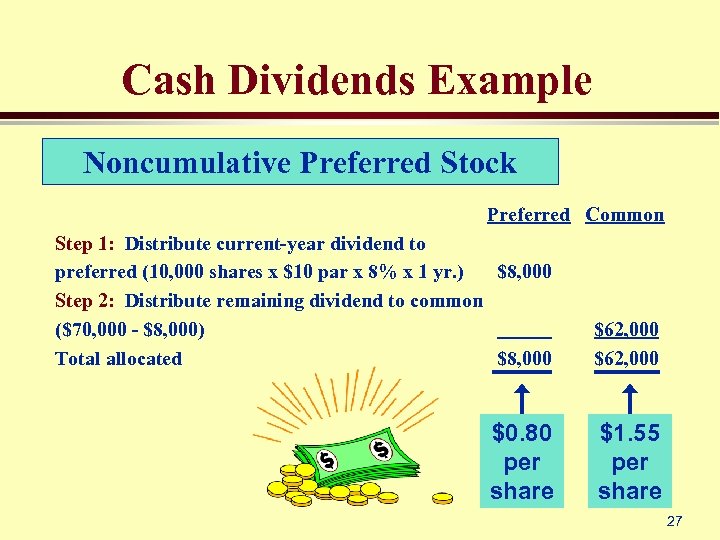

Cash Dividends Example Noncumulative Preferred Stock Preferred Common Step 1: Distribute current-year dividend to preferred (10, 000 shares x $10 par x 8% x 1 yr. ) $8, 000 Step 2: Distribute remaining dividend to common ($70, 000 - $8, 000) Total allocated $8, 000 $62, 000 $0. 80 per share $1. 55 per share 27

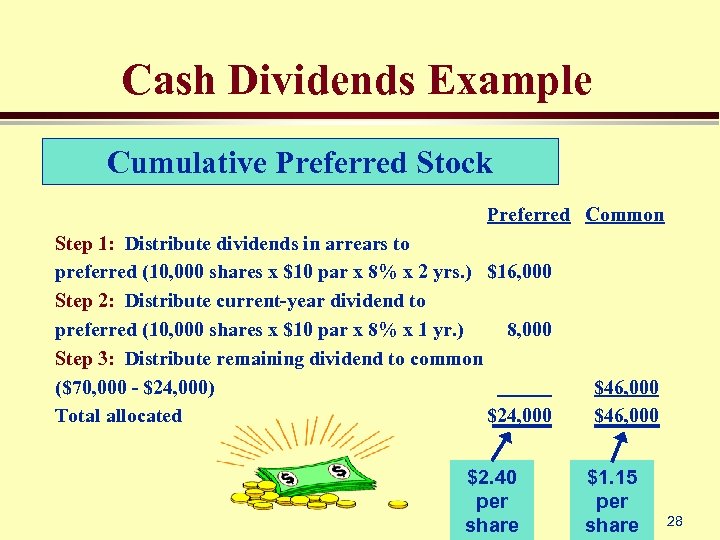

Cash Dividends Example Cumulative Preferred Stock Preferred Common Step 1: Distribute dividends in arrears to preferred (10, 000 shares x $10 par x 8% x 2 yrs. ) $16, 000 Step 2: Distribute current-year dividend to preferred (10, 000 shares x $10 par x 8% x 1 yr. ) 8, 000 Step 3: Distribute remaining dividend to common ($70, 000 - $24, 000) Total allocated $24, 000 $2. 40 per share $46, 000 $1. 15 per share 28

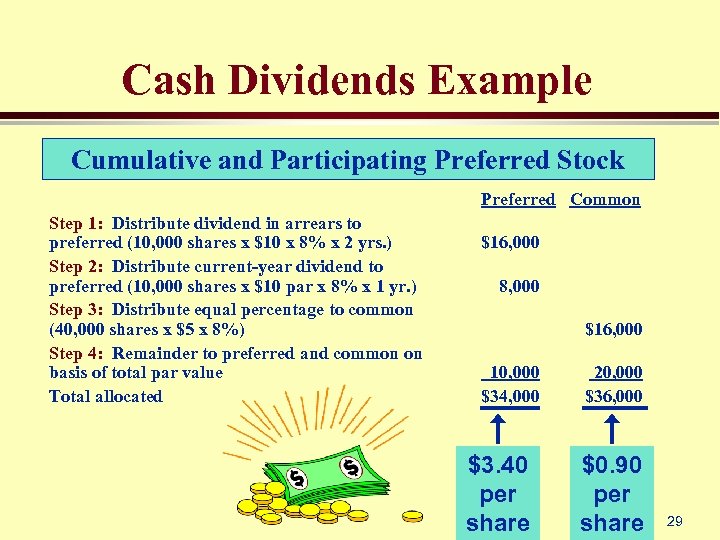

Cash Dividends Example Cumulative and Participating Preferred Stock Preferred Common Step 1: Distribute dividend in arrears to preferred (10, 000 shares x $10 x 8% x 2 yrs. ) Step 2: Distribute current-year dividend to preferred (10, 000 shares x $10 par x 8% x 1 yr. ) Step 3: Distribute equal percentage to common (40, 000 shares x $5 x 8%) Step 4: Remainder to preferred and common on basis of total par value Total allocated $16, 000 8, 000 $16, 000 10, 000 $34, 000 $3. 40 per share 20, 000 $36, 000 $0. 90 per share 29

Stock Dividends l l Issue of additional shares proportionately to existing stockholders Certificate of Stock Certificate of Stock Reasons: l insufficient cash l market price reduction l nontaxable to recipients 30

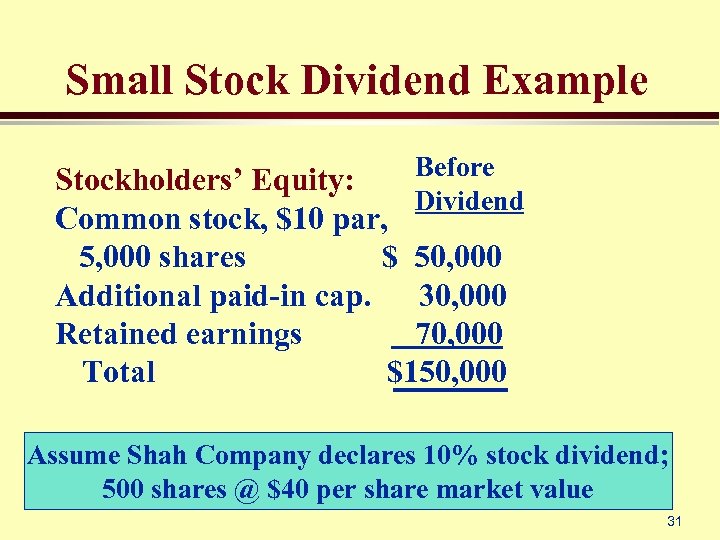

Small Stock Dividend Example Before Stockholders’ Equity: Dividend Common stock, $10 par, 5, 000 shares $ 50, 000 Additional paid-in cap. 30, 000 Retained earnings 70, 000 Total $150, 000 Assume Shah Company declares 10% stock dividend; 500 shares @ $40 per share market value 31

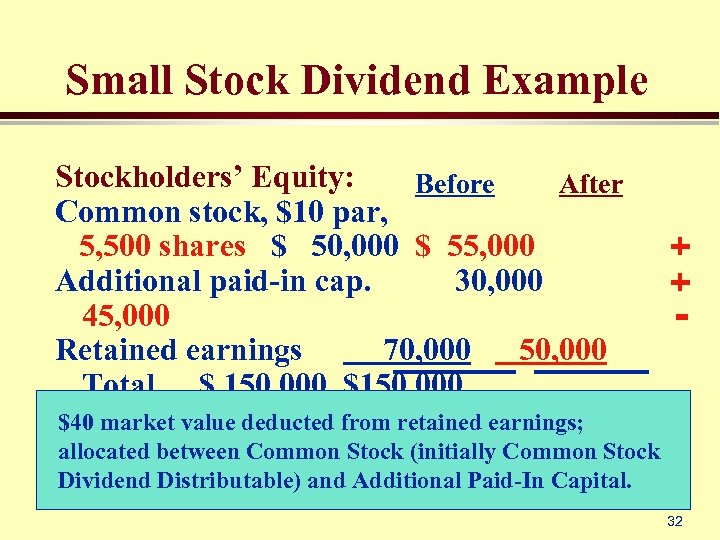

Small Stock Dividend Example Stockholders’ Equity: Before After Common stock, $10 par, 5, 500 shares $ 50, 000 $ 55, 000 Additional paid-in cap. 30, 000 45, 000 Retained earnings 70, 000 50, 000 Total $ 150, 000 $150, 000 + + - $40 market value deducted from retained earnings; allocated between Common Stock (initially Common Stock Dividend Distributable) and Additional Paid-In Capital. 32

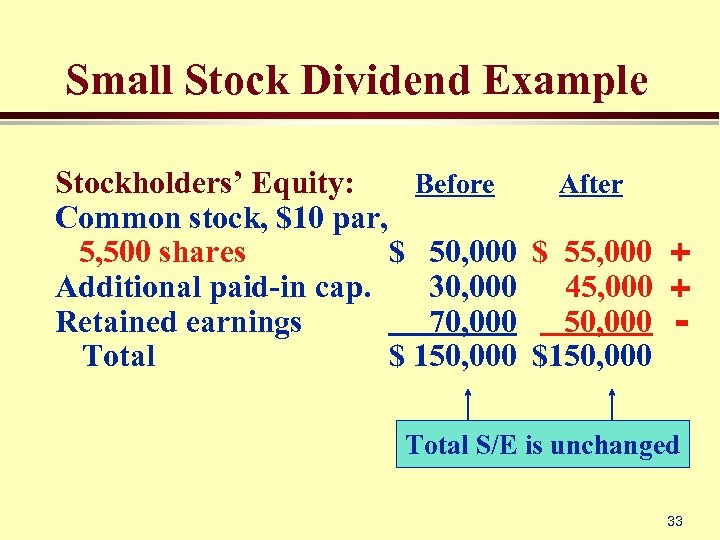

Small Stock Dividend Example Before After Stockholders’ Equity: Common stock, $10 par, 5, 500 shares $ 50, 000 $ 55, 000 + Additional paid-in cap. 30, 000 45, 000 + Retained earnings 70, 000 50, 000 Total $ 150, 000 $150, 000 Total S/E is unchanged 33

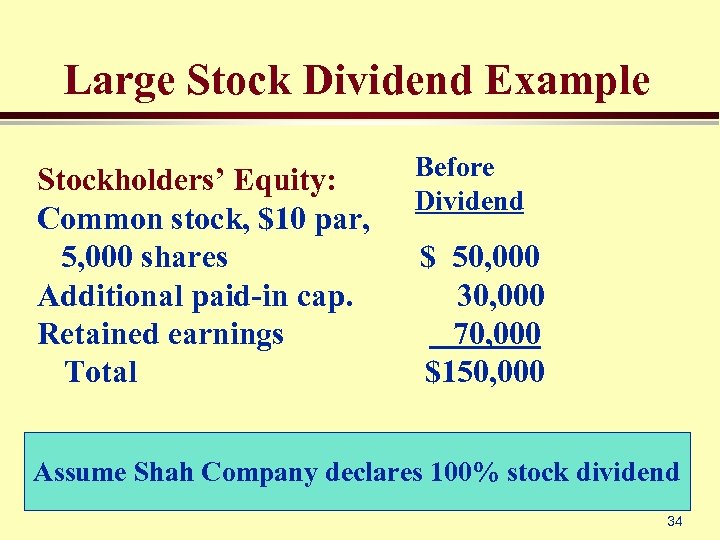

Large Stock Dividend Example Stockholders’ Equity: Common stock, $10 par, 5, 000 shares Additional paid-in cap. Retained earnings Total Before Dividend $ 50, 000 30, 000 70, 000 $150, 000 Assume Shah Company declares 100% stock dividend 34

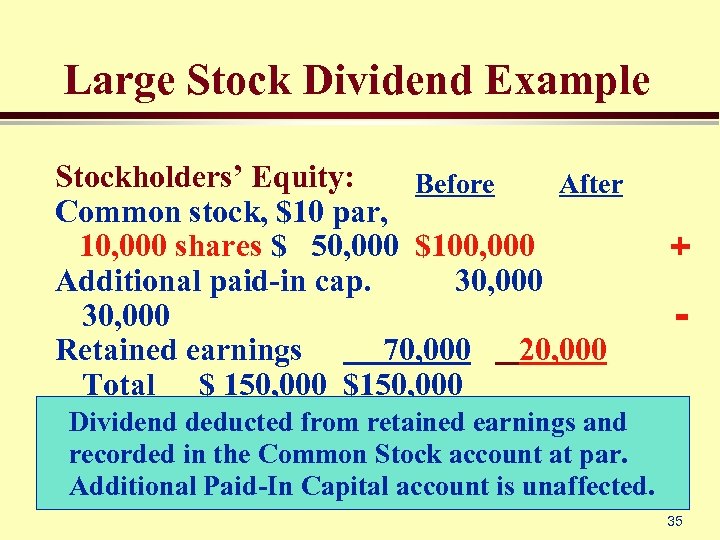

Large Stock Dividend Example Stockholders’ Equity: Before After Common stock, $10 par, 10, 000 shares $ 50, 000 $100, 000 Additional paid-in cap. 30, 000 Retained earnings 70, 000 20, 000 Total $ 150, 000 $150, 000 + - Dividend deducted from retained earnings and recorded in the Common Stock account at par. Additional Paid-In Capital account is unaffected. 35

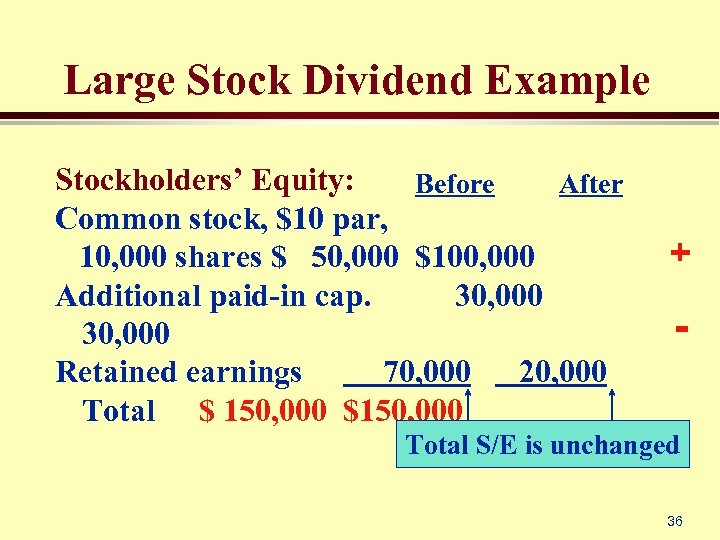

Large Stock Dividend Example Stockholders’ Equity: Before After Common stock, $10 par, 10, 000 shares $ 50, 000 $100, 000 Additional paid-in cap. 30, 000 Retained earnings 70, 000 20, 000 Total $ 150, 000 $150, 000 + - Total S/E is unchanged 36

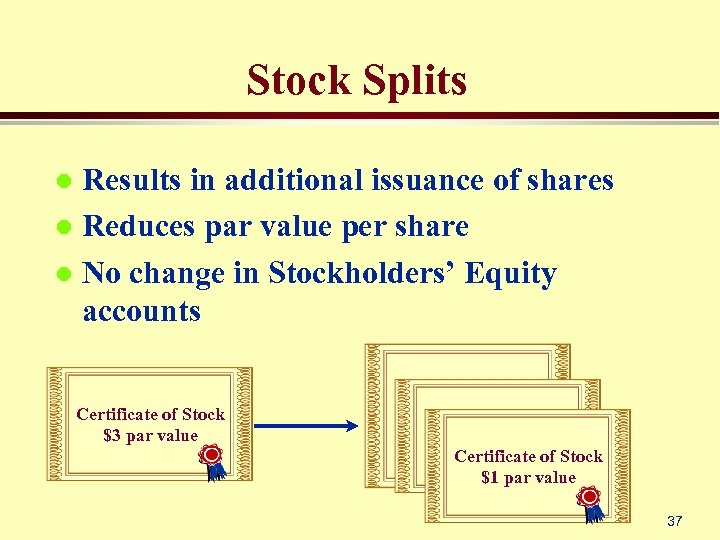

Stock Splits Results in additional issuance of shares l Reduces par value per share l No change in Stockholders’ Equity accounts l Certificate of Stock $3 par value Certificate of Stock $1 par value 37

Stock Splits l Not recorded in accounts l Splits reduce market value per share and make stock more affordable to a wider range of investors Disclose in notes 38

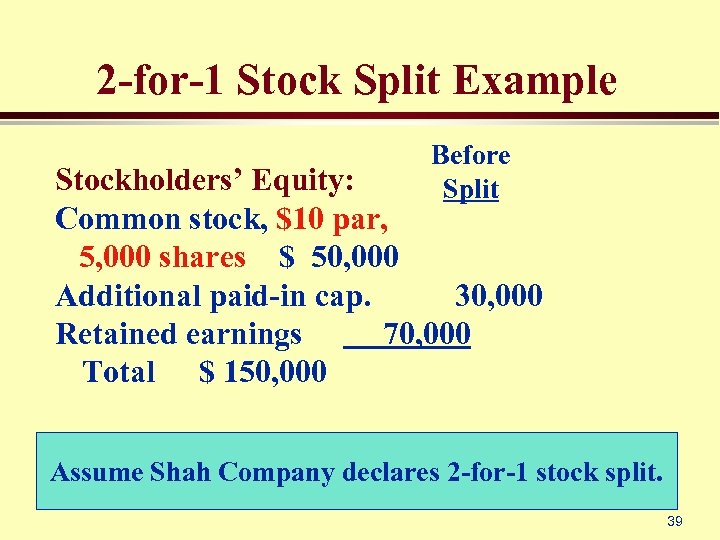

2 -for-1 Stock Split Example Before Split Stockholders’ Equity: Common stock, $10 par, 5, 000 shares $ 50, 000 Additional paid-in cap. 30, 000 Retained earnings 70, 000 Total $ 150, 000 Assume Shah Company declares 2 -for-1 stock split. 39

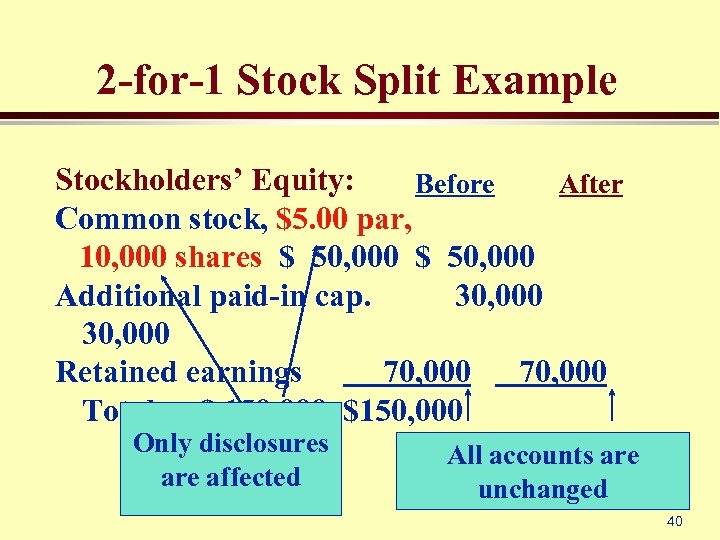

2 -for-1 Stock Split Example Stockholders’ Equity: Before After Common stock, $5. 00 par, 10, 000 shares $ 50, 000 Additional paid-in cap. 30, 000 Retained earnings 70, 000 Total $ 150, 000 $150, 000 Only disclosures are affected All accounts are unchanged 40

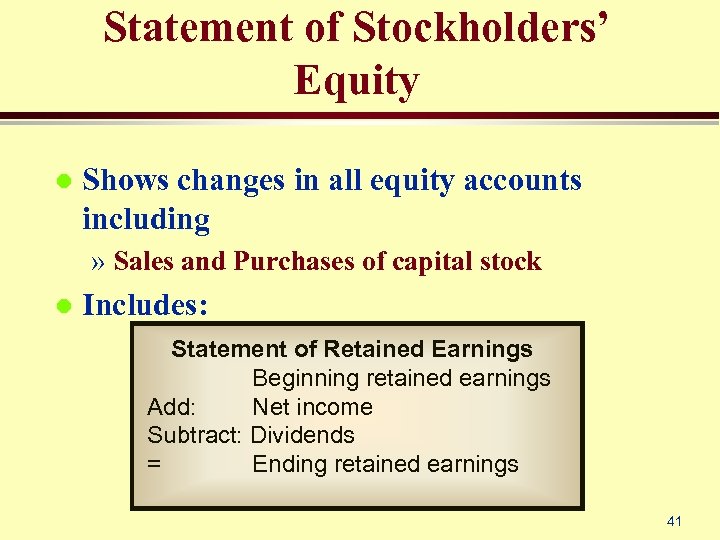

Statement of Stockholders’ Equity l Shows changes in all equity accounts including » Sales and Purchases of capital stock l Includes: Statement of Retained Earnings Beginning retained earnings Add: Net income Subtract: Dividends = Ending retained earnings 41

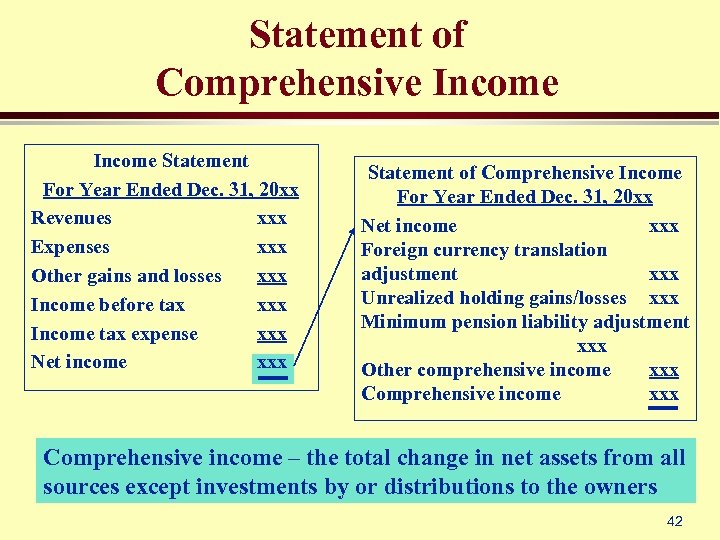

Statement of Comprehensive Income Statement For Year Ended Dec. 31, 20 xx Revenues xxx Expenses xxx Other gains and losses xxx Income before tax xxx Income tax expense xxx Net income xxx Statement of Comprehensive Income For Year Ended Dec. 31, 20 xx Net income xxx Foreign currency translation adjustment xxx Unrealized holding gains/losses xxx Minimum pension liability adjustment xxx Other comprehensive income xxx Comprehensive income – the total change in net assets from all sources except investments by or distributions to the owners 42

Analyzing Owners’ Equity l Book value per share » rights of each share to net assets of corporation l Market value per share » price at which stock is currently selling 43

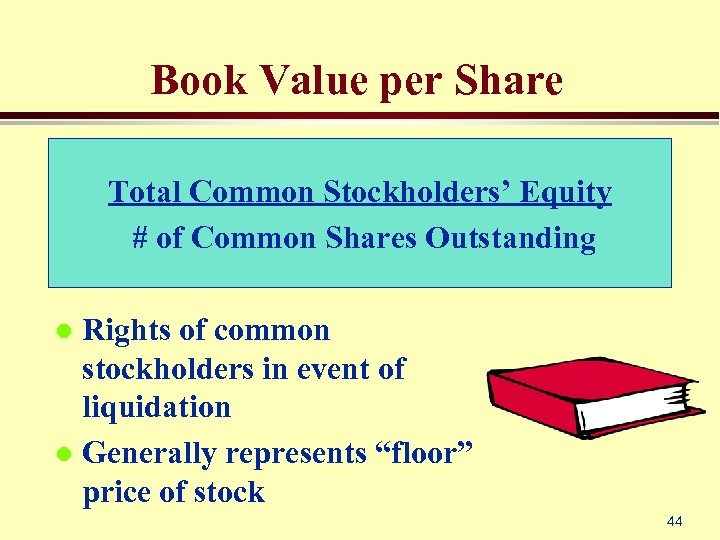

Book Value per Share Total Common Stockholders’ Equity # of Common Shares Outstanding Rights of common stockholders in event of liquidation l Generally represents “floor” price of stock l 44

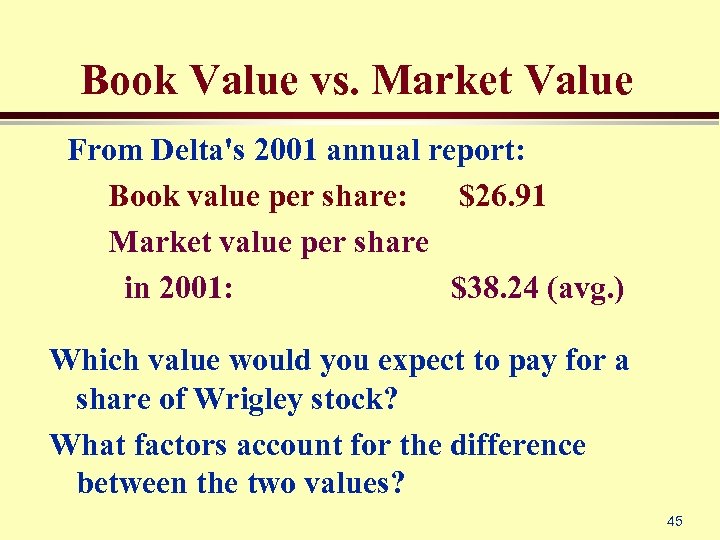

Book Value vs. Market Value From Delta's 2001 annual report: Book value per share: $26. 91 Market value per share in 2001: $38. 24 (avg. ) Which value would you expect to pay for a share of Wrigley stock? What factors account for the difference between the two values? 45

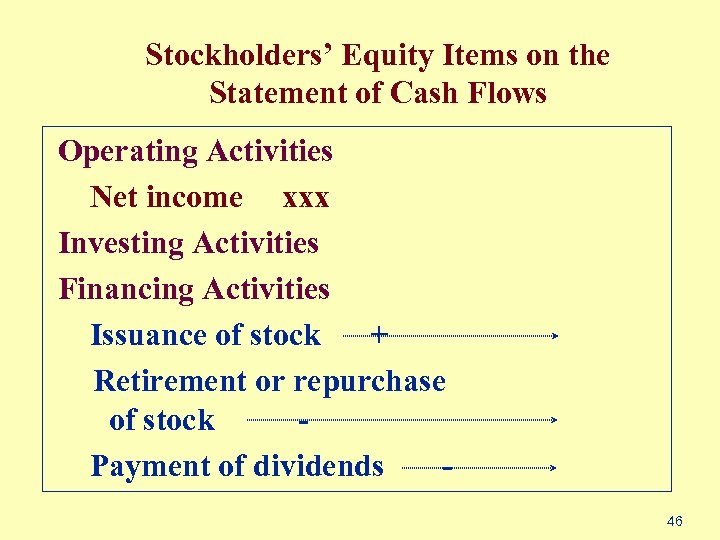

Stockholders’ Equity Items on the Statement of Cash Flows Operating Activities Net income xxx Investing Activities Financing Activities Issuance of stock + Retirement or repurchase of stock Payment of dividends 46

Appendix Accounting Tools: Unincorporated Businesses 47

Sole Proprietorships Not a separate legal entity so owner has unlimited liability l Must keep personal and business records separate l Business income is declared on the owner’s personal tax return and taxed at personal tax rate l 48

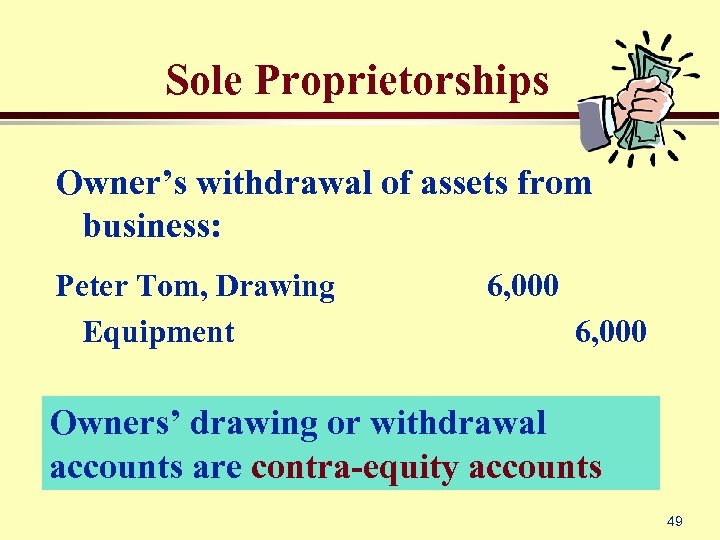

Sole Proprietorships Owner’s withdrawal of assets from business: Peter Tom, Drawing Equipment 6, 000 Owners’ drawing or withdrawal accounts are contra-equity accounts 49

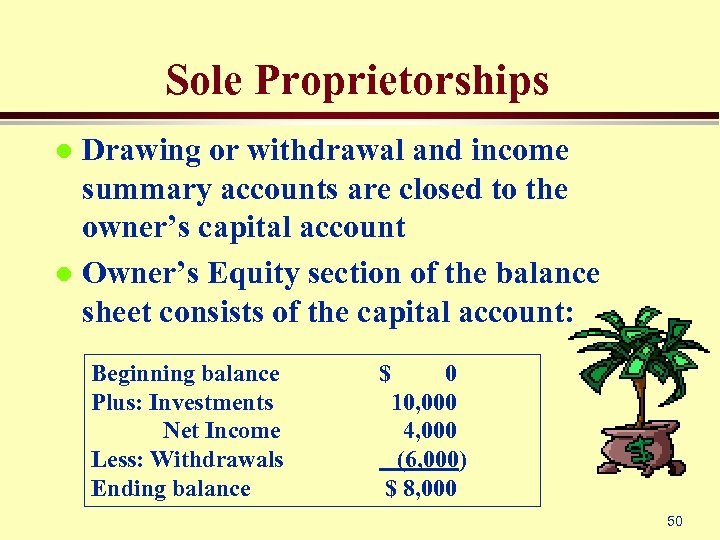

Sole Proprietorships Drawing or withdrawal and income summary accounts are closed to the owner’s capital account l Owner’s Equity section of the balance sheet consists of the capital account: l Beginning balance Plus: Investments Net Income Less: Withdrawals Ending balance $ 0 10, 000 4, 000 (6, 000) $ 8, 000 50

Partnerships Unlimited liability l Limited life – partnership agreements can and do end l Not taxed as a separate entity l 51

Partnerships Distribution of income: l Equal distribution l Stated ratio l Other allocation » For example, based on salaries, interest on invested capital, and a stated ratio 52

End of Chapter 12 Certificate of Stock 53

865eafbcfc1111090abea10c4979eabe.ppt