89bf2f3ec721fdb8d9a13dedbb9a9fef.ppt

- Количество слайдов: 23

Chapter 12 Buying and Selling Investments

What Are Sources of Investing Information? • • Magazines Newspapers Investor newsletters Annual reports • Company’s report to investors about the financial position of the company. • Prospectus • Legal document that offers securities or mutual fund shares for sale and includes detailed description of the securities. • Internet 12 -1 Researching Investments and Markets Slide 2

Key Figures for Comparing Firms • Stock Price: The amount investors are willing to pay for a share of ownership in the company • Number of Employees: Increases or decreases in number of employees can reflect growth or downsizing • Market Cap: Total value of a company in the stock market (total shares outstanding times price per share). This figure, along with revenue, indicates size of company. • Revenue: The amount of money received from business activities. • Net Income: The amount of money after deducting all the business expenses. • Profit Margin: The net income divided by revenue for the same period. “%” Slide 3

Key Figures for Comparing Firms • P/E Ratio: the price-earnings ratio compares the selling price of a company's common stock to the annual profits per share. Fast-growing or high risk companies may have higher P/E ratios than slow growing or low risk companies. This ratio is an important measure of the stocks value. • Current Ratio: measure of the company's ability to pay its current debts from current assets. It indicates a company's liquidity and financial strength. The current ratio is calculated by dividing the total assets by the total current liabilities. Slide 4

Interpreting P/E Ratio • • • N/A: A company with no earnings has an undefined P–E ratio. By convention, companies with losses (negative earnings) are usually treated as having an undefined P–E ratio, even though a negative P–E ratio can be mathematically determined. 0– 10: Either the stock is undervalued, or the company's earnings are thought to be in decline. Alternatively, current earnings may be substantially above historic trends or the company may have profited from selling assets. 10– 17: For many companies a P–E ratio in this range may be considered fair value. 17– 25: Either the stock is overvalued or the company's earnings have increased since the last earnings figure was published. The stock may also be a growth stock with earnings expected to increase substantially in the future. 25+: A company whose shares have a very high P/E may have high expected future growth in earnings, or this year's earnings may be considered exceptionally low, or the stock may be the subject of a speculative bubble.

What Professional Advice Is Available? • A stockbroker buys and sells securities on behalf of others. o o o Full-service brokers: qualified stockbroker who provides advice about what securities to buy and sell o Edward Jones Discount Broker: qualified stockbroker who buys and sells securities at a reduced commission but offers no advice. o Fidelity and E*Trade Online Brokers: Online services offered by brokerage firms. o TD Ameritrade 12 -1 Researching Investments and Markets Slide 6

What Professional Advice Is Available? • A financial planner helps people make investment decisions to meet goals. • Certified Financial Planner (CFP): has taken coursework and has passed an exam, indicating an expertise in developing financial plans for individuals. • Banks and credit unions sell securities that they endorse. 12 -1 Researching Investments and Markets Slide 7

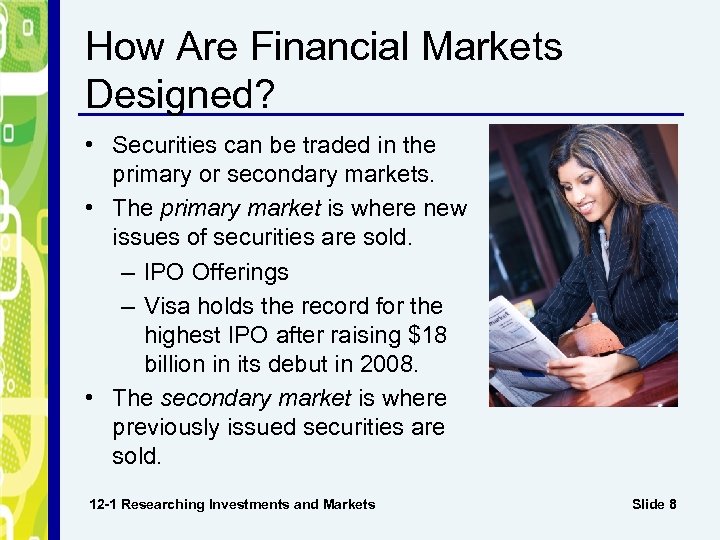

How Are Financial Markets Designed? • Securities can be traded in the primary or secondary markets. • The primary market is where new issues of securities are sold. – IPO Offerings – Visa holds the record for the highest IPO after raising $18 billion in its debut in 2008. • The secondary market is where previously issued securities are sold. 12 -1 Researching Investments and Markets Slide 8

How Are Financial Markets Designed? • Securities exchanges are places for brokers to buy and sell securities for their clients. – NYSE is one of the largest security exchanges in the world – In an auction market, a stock is sold to the highest bidder. Both buyers and sellers compete with others for the best price. • Over-the-counter market is a network of dealers and brokers who buy and sell securities not listed on an exchange. – NASDAQ is an electronic marketplace for over-the counter stocks. – This system allows investors to buy and sell stock through their brokers. 12 -1 Researching Investments and Markets Slide 9

How Are Financial Markets Designed? • • Direct investing involves buying securities directly from a corporation. – No broker necessary – Buying US government savings bonds is a form of direct investing Reinvesting involves getting stock dividends instead of cash dividends. – Stock dividend: dividend paid in the form of new shares of stock. • A 10% stock dividend issues 10 new shares of stock for every 100 shares held. – By acquiring more shares, investors can continue to grow their wealth – Stock split: occurs when a company issues more stock to current shareholders in some proportion to the stock they already own. • Helps keep share prices low for investors. 12 -1 Researching Investments and Markets Slide 10

Focus On. . . Full Service or Discount Brokers? • Discount brokers: o Charge a smaller fee o May charge extra for information • Full service brokers: o Give sound investment advice for a higher fee • When making a choice, consider: services, fees, location of nearest brokerage office, minimum deposits, etc. 12 -1 Researching Investments and Markets Slide 11

How Are Stocks Bought and Sold? 1. Set up an account. • Choose your venue (fullservice broker, discount broker, bank, etc. ) • Provide identification. • Access your account online. • Make minimum or regular monthly deposit. 12 -2 Buying and Selling Securities Slide 12

How Are Stocks Bought and Sold? 2. Place transactions. • A market order is a request to buy or sell a stock at the current market price. • A limit order is a request to buy or sell a stock at a specific price. • A stop order is a request to sell a stock when it reaches a certain price. • A discretionary order allows the broker to buy or sell a stock to get the best price. 12 -2 Buying and Selling Securities Slide 13

How Do You Know When to Buy or Sell? • Set aside cash so you can buy and sell stock when you need to. • If you don’t have cash, you can use credit. o Selling short involves selling stock that has been borrowed from a broker and replacing it later. o Buying on margin involves borrowing money from your broker to buy stock. 12 -2 Buying and Selling Securities Slide 14

Buying Patterns • Buy and hold is a plan to purchase and keep stock for the long term. • Stock turning is making regular and systematic changes in stock ownership based on trends in the economy. • Watch-and-wait investing involves making a comparative analysis of securities periodically. 12 -2 Buying and Selling Securities Slide 15

Managing Costs • Type of Transaction – On the trading floor, stocks are traded in round lots or odd lots – Round lots: exactly 100 shares or multiples of 100 shares – Odd lots: fewer than 100 shares of stock – Thus, you can manage your costs of buying and selling by purchasing in round lots and avoiding the odd lot additional fee. • Using Discount Brokers – Using discount brokers will help reduce costs – However, buying in odd lots or trading an amount less than $1, 000 usually increases the fees.

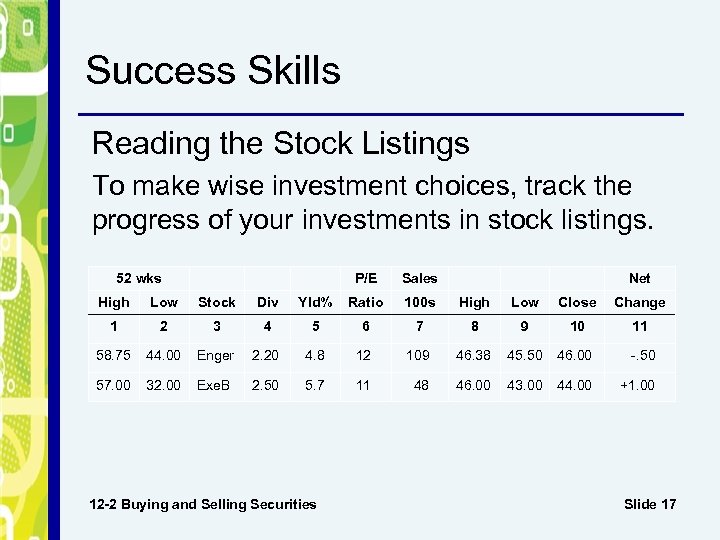

Success Skills Reading the Stock Listings To make wise investment choices, track the progress of your investments in stock listings. 52 wks P/E Sales Net High Low Stock Div Yld% Ratio 100 s High Low Close Change 1 2 3 4 5 6 7 8 9 10 11 58. 75 44. 00 Enger 2. 20 4. 8 12 109 46. 38 45. 50 46. 00 -. 50 57. 00 32. 00 Exe. B 2. 50 5. 7 11 48 46. 00 43. 00 44. 00 +1. 00 12 -2 Buying and Selling Securities Slide 17

What Regulatory Agencies Help Consumers? • Banks, brokerage companies, and other financial businesses are controlled by agencies created by Congress. • Agencies provide oversight to ensure that investors’ rights are protected. 12 -3 Regulatory Agencies and Laws Slide 18

What Regulatory Agencies Help Consumers? • • • Federal Deposit Insurance Corporation: created in 1933 as a response to the stock market crash of 1929. – Promotes public confidence in the banking system – Supervises banks and other financial institutions to maintain stable and sound banking system National Credit Union Administration – Similar to FDIC but for credit unions Commodity Futures Trading Commission: government agency that regulates commodity, futures, and options markets in the U. S. – Protects investors against manipulation, abusive trade actions, and fraud 12 -3 Regulatory Agencies and Laws Slide 19

What Regulatory Agencies Help Consumers? • • Securities and Exchange Commission: primary overseer and regulator of the U. S. securities markets. – Maintains fair and orderly markets and promote business growth. Department of the Treasury: government agency responsible for economic growth of the United States. – Maintains strong economy that creates growth and job opportunities Internal Revenue Service: helps taxpayers understand meet their tax responsibilities. – Seeks to ensure that those who owe taxes pay them The Fed: central bank of the United States – Sets monetary policy – Provides financial services to the U. S. government, financial institutions, and the public – Supervising and regulating the banking system – Keeps the country’s financial systems and markets stable 12 -3 Regulatory Agencies and Laws Slide 20

What Are Financial Reform Laws? • Sarbanes-Oxley (SOX) sets standards for public companies and accounting firms for the reporting of finances. o Created in response to financial scandals at large companies. o Requires improved financial reporting, audits, and accounting services. 12 -3 Regulatory Agencies and Laws Slide 21

Dodd-Frank Wall Street Reform • Wall Street Reform Act aims to create and maintain a stable financial system. o New consumer agency: agency sets o o o rules to prevent unfair practices related to consumer loans and credit cards Credit scores: allows consumers to get one free credit report a year. Interchange fees: cracks down on debit card “swipe fees” that retailers pay to banks when their customers buy products and services using debit cards Liar loans: lenders are now required to document borrowers income o Part of the collapse was due to mortgages being made to those who could not afford the payments o Income was undocumented 12 -3 Regulatory Agencies and Laws Slide 22

Dodd-Frank Wall Street Reform o Mortgage help: allows unemployed homeowners with good credit to take out lowinterest loans to help them avoid foreclosure. o New oversight: new ten-member oversight council consisting of financial regulators that will monitor financial firms and the financial system for problems o FDIC takeovers: FDIC new power to take over and liquidate giant financial firms in the same way it takes over banks whose failure would jeopardize the financial system. 12 -3 Regulatory Agencies and Laws Slide 23

89bf2f3ec721fdb8d9a13dedbb9a9fef.ppt