6ec2c5ea0b5ba890fe682aa3c4257a71.ppt

- Количество слайдов: 27

Chapter 11 The “Order-to-Cash” Process: Part II, Revenue Collection (RC) Power. Point Presentation by Charlie Cook Copyright © 2004 South-Western. All rights reserved.

Chapter 11 The “Order-to-Cash” Process: Part II, Revenue Collection (RC) Power. Point Presentation by Charlie Cook Copyright © 2004 South-Western. All rights reserved.

Learning Objectives • To describe the business environment for the revenue collection (RC) process • To analyze the effect of enterprise systems and other technologies on the RC process • To describe the RC process logic, physical characteristics, and support of management decision making • To describe and analyze controls typically associated with the RC process Copyright © 2004 South-Western. All rights reserved. 2

Learning Objectives • To describe the business environment for the revenue collection (RC) process • To analyze the effect of enterprise systems and other technologies on the RC process • To describe the RC process logic, physical characteristics, and support of management decision making • To describe and analyze controls typically associated with the RC process Copyright © 2004 South-Western. All rights reserved. 2

Revenue Collection • The revenue collection process is designed to: Ø Support repetitive work of the credit department, cashier, and accounts receivable department. Ø Support problem-solving for financial managers. Ø Assist in preparation of reports. Ø Create information flows and data to support operations and management processes. Copyright © 2004 South-Western. All rights reserved. 3

Revenue Collection • The revenue collection process is designed to: Ø Support repetitive work of the credit department, cashier, and accounts receivable department. Ø Support problem-solving for financial managers. Ø Assist in preparation of reports. Ø Create information flows and data to support operations and management processes. Copyright © 2004 South-Western. All rights reserved. 3

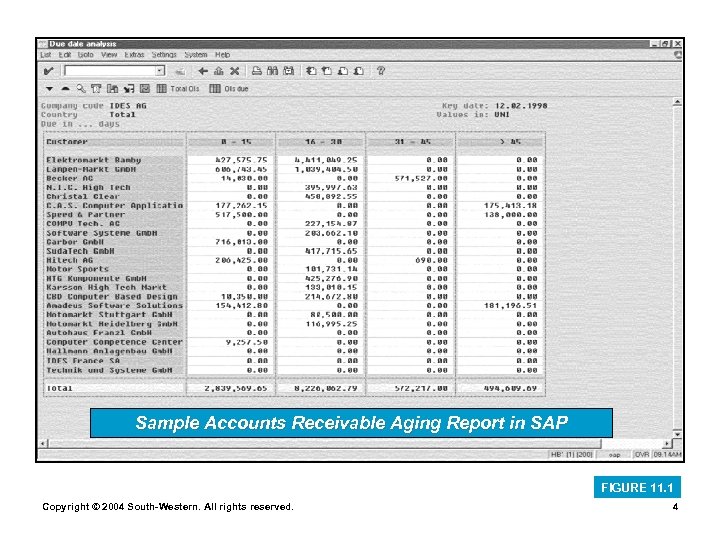

Sample Accounts Receivable Aging Report in SAP FIGURE 11. 1 Copyright © 2004 South-Western. All rights reserved. 4

Sample Accounts Receivable Aging Report in SAP FIGURE 11. 1 Copyright © 2004 South-Western. All rights reserved. 4

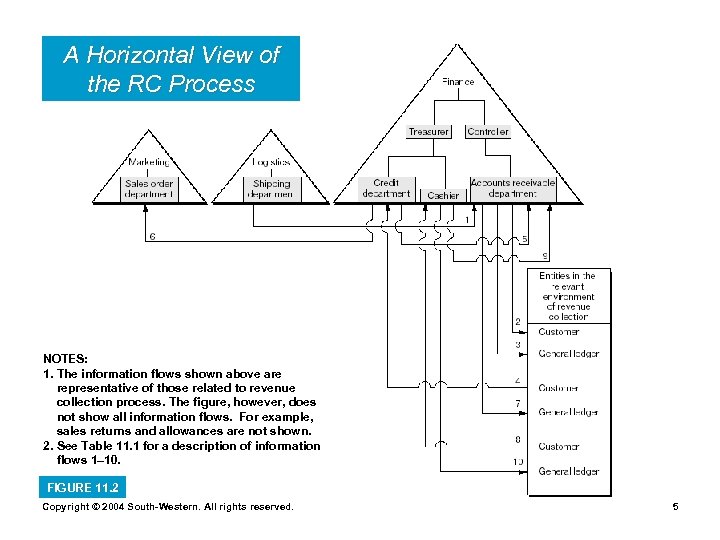

A Horizontal View of the RC Process NOTES: 1. The information flows shown above are representative of those related to revenue collection process. The figure, however, does not show all information flows. For example, sales returns and allowances are not shown. 2. See Table 11. 1 for a description of information flows 1– 10. FIGURE 11. 2 Copyright © 2004 South-Western. All rights reserved. 5

A Horizontal View of the RC Process NOTES: 1. The information flows shown above are representative of those related to revenue collection process. The figure, however, does not show all information flows. For example, sales returns and allowances are not shown. 2. See Table 11. 1 for a description of information flows 1– 10. FIGURE 11. 2 Copyright © 2004 South-Western. All rights reserved. 5

Horizontal Information Flows • Shipping informs accounting receivable (billing) of the shipment. • Accounts receivable sends invoice to customer. • Accounts receivable informs general ledger that invoice sent to customer. • Customer may default, sending message to credit department. • Credit changes customer credit limit; informs sales department to terminate sales to customer. Copyright © 2004 South-Western. All rights reserved. 6

Horizontal Information Flows • Shipping informs accounting receivable (billing) of the shipment. • Accounts receivable sends invoice to customer. • Accounts receivable informs general ledger that invoice sent to customer. • Customer may default, sending message to credit department. • Credit changes customer credit limit; informs sales department to terminate sales to customer. Copyright © 2004 South-Western. All rights reserved. 6

Horizontal Information Flows (cont’d) • Accounts receivable informs general ledger of write-off. • Customer makes payment on account. • Cashier informs accounts receivable of payment. • Cashier informs general ledger of payment. Copyright © 2004 South-Western. All rights reserved. 7

Horizontal Information Flows (cont’d) • Accounts receivable informs general ledger of write-off. • Customer makes payment on account. • Cashier informs accounts receivable of payment. • Cashier informs general ledger of payment. Copyright © 2004 South-Western. All rights reserved. 7

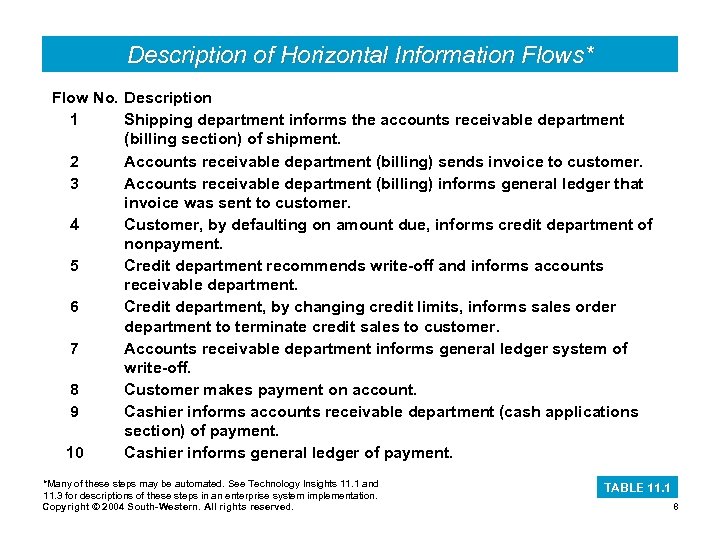

Description of Horizontal Information Flows* Flow No. Description 1 Shipping department informs the accounts receivable department (billing section) of shipment. 2 Accounts receivable department (billing) sends invoice to customer. 3 Accounts receivable department (billing) informs general ledger that invoice was sent to customer. 4 Customer, by defaulting on amount due, informs credit department of nonpayment. 5 Credit department recommends write-off and informs accounts receivable department. 6 Credit department, by changing credit limits, informs sales order department to terminate credit sales to customer. 7 Accounts receivable department informs general ledger system of write-off. 8 Customer makes payment on account. 9 Cashier informs accounts receivable department (cash applications section) of payment. 10 Cashier informs general ledger of payment. *Many of these steps may be automated. See Technology Insights 11. 1 and 11. 3 for descriptions of these steps in an enterprise system implementation. Copyright © 2004 South-Western. All rights reserved. TABLE 11. 1 8

Description of Horizontal Information Flows* Flow No. Description 1 Shipping department informs the accounts receivable department (billing section) of shipment. 2 Accounts receivable department (billing) sends invoice to customer. 3 Accounts receivable department (billing) informs general ledger that invoice was sent to customer. 4 Customer, by defaulting on amount due, informs credit department of nonpayment. 5 Credit department recommends write-off and informs accounts receivable department. 6 Credit department, by changing credit limits, informs sales order department to terminate credit sales to customer. 7 Accounts receivable department informs general ledger system of write-off. 8 Customer makes payment on account. 9 Cashier informs accounts receivable department (cash applications section) of payment. 10 Cashier informs general ledger of payment. *Many of these steps may be automated. See Technology Insights 11. 1 and 11. 3 for descriptions of these steps in an enterprise system implementation. Copyright © 2004 South-Western. All rights reserved. TABLE 11. 1 8

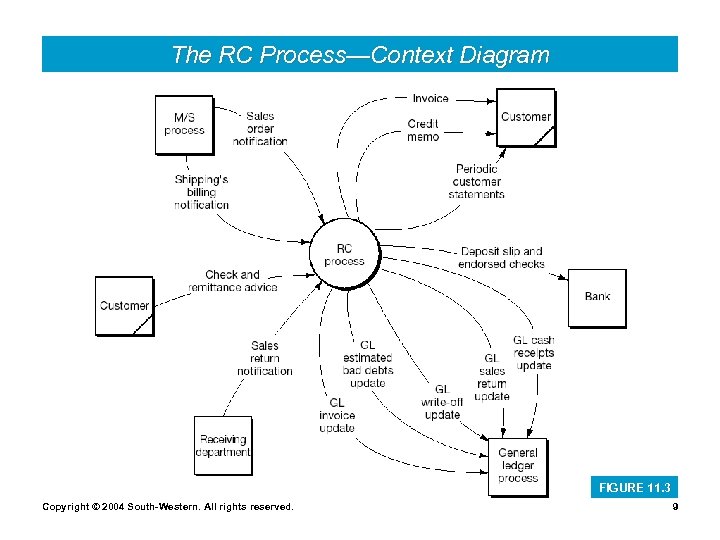

The RC Process—Context Diagram FIGURE 11. 3 Copyright © 2004 South-Western. All rights reserved. 9

The RC Process—Context Diagram FIGURE 11. 3 Copyright © 2004 South-Western. All rights reserved. 9

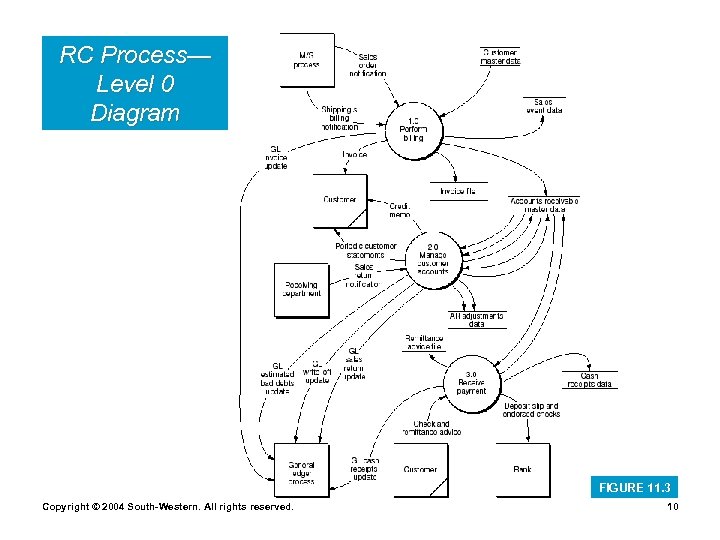

RC Process— Level 0 Diagram FIGURE 11. 3 Copyright © 2004 South-Western. All rights reserved. 10

RC Process— Level 0 Diagram FIGURE 11. 3 Copyright © 2004 South-Western. All rights reserved. 10

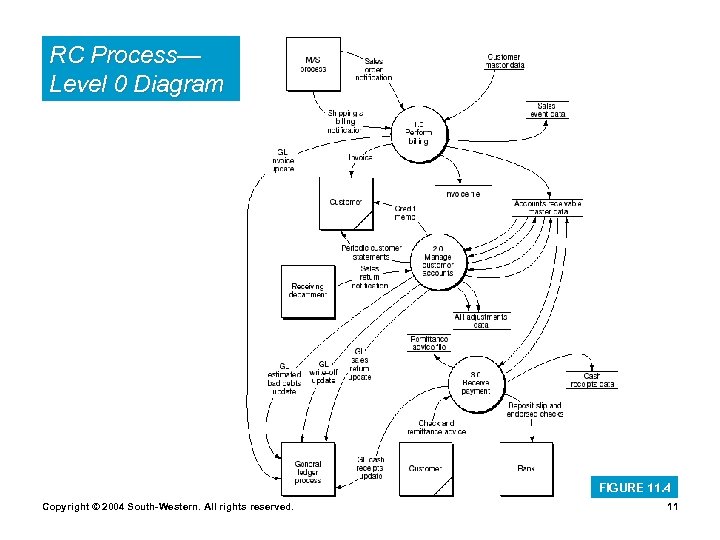

RC Process— Level 0 Diagram FIGURE 11. 4 Copyright © 2004 South-Western. All rights reserved. 11

RC Process— Level 0 Diagram FIGURE 11. 4 Copyright © 2004 South-Western. All rights reserved. 11

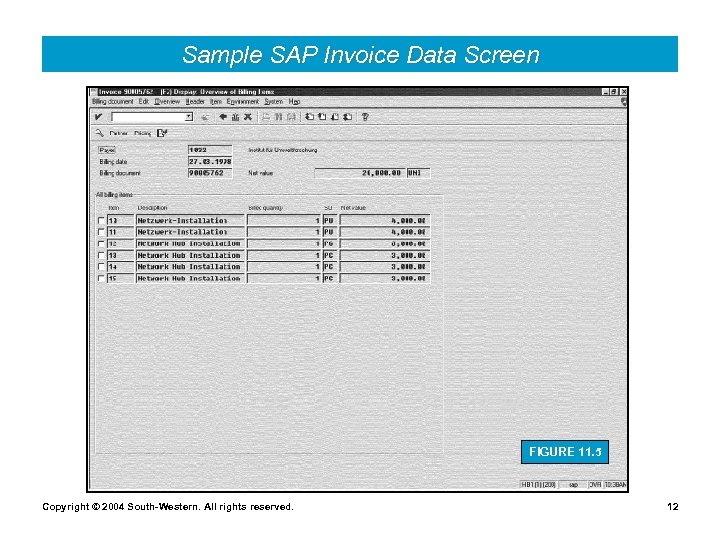

Sample SAP Invoice Data Screen FIGURE 11. 5 Copyright © 2004 South-Western. All rights reserved. 12

Sample SAP Invoice Data Screen FIGURE 11. 5 Copyright © 2004 South-Western. All rights reserved. 12

Logical Data Descriptions in RC • Accounts receivable (A/R) master data Ø Balance only: current balance, past due, finance charges. Ø Balance-forward: above fields + details of current charges; aging of past-due balances Ø Open-items: details of open invoices (invoices not yet paid); customer can pay by invoice. • Sales event data Ø One or more invoice records (details contained in invoice data). Copyright © 2004 South-Western. All rights reserved. 13

Logical Data Descriptions in RC • Accounts receivable (A/R) master data Ø Balance only: current balance, past due, finance charges. Ø Balance-forward: above fields + details of current charges; aging of past-due balances Ø Open-items: details of open invoices (invoices not yet paid); customer can pay by invoice. • Sales event data Ø One or more invoice records (details contained in invoice data). Copyright © 2004 South-Western. All rights reserved. 13

Logical Data Descriptions in RC (cont’d) • Invoice data - copies of invoice documents • A/R adjustments data Ø Write-offs, estimated doubtful accounts, sales returns, etc. Ø Journal voucher number, transaction code, authorization • Cash receipts data Ø Details of customer payments • Remittance advice data: copies of RAs. Copyright © 2004 South-Western. All rights reserved. 14

Logical Data Descriptions in RC (cont’d) • Invoice data - copies of invoice documents • A/R adjustments data Ø Write-offs, estimated doubtful accounts, sales returns, etc. Ø Journal voucher number, transaction code, authorization • Cash receipts data Ø Details of customer payments • Remittance advice data: copies of RAs. Copyright © 2004 South-Western. All rights reserved. 14

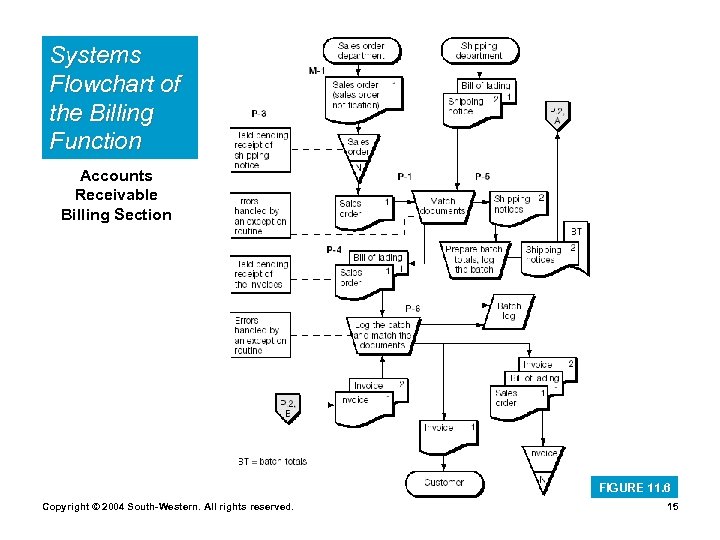

Systems Flowchart of the Billing Function Accounts Receivable Billing Section FIGURE 11. 6 Copyright © 2004 South-Western. All rights reserved. 15

Systems Flowchart of the Billing Function Accounts Receivable Billing Section FIGURE 11. 6 Copyright © 2004 South-Western. All rights reserved. 15

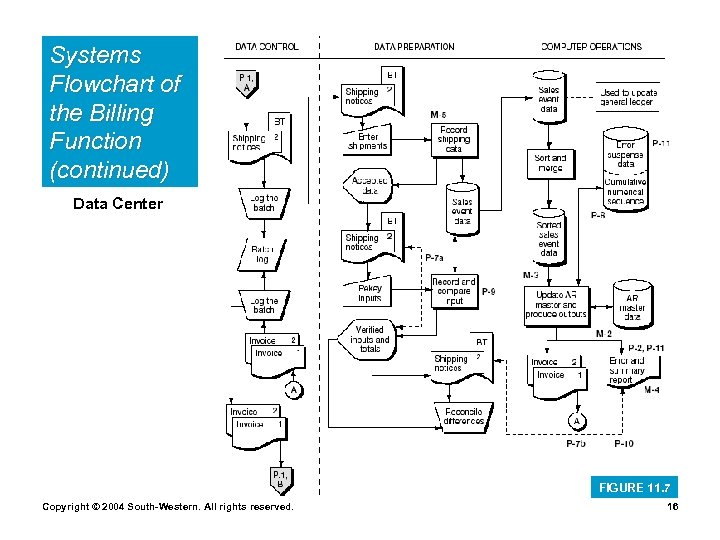

Systems Flowchart of the Billing Function (continued) Data Center FIGURE 11. 7 Copyright © 2004 South-Western. All rights reserved. 16

Systems Flowchart of the Billing Function (continued) Data Center FIGURE 11. 7 Copyright © 2004 South-Western. All rights reserved. 16

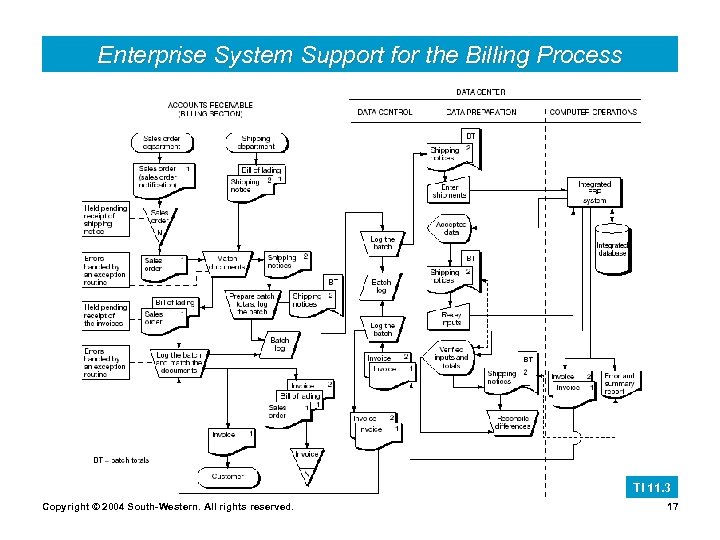

Enterprise System Support for the Billing Process TI 11. 3 Copyright © 2004 South-Western. All rights reserved. 17

Enterprise System Support for the Billing Process TI 11. 3 Copyright © 2004 South-Western. All rights reserved. 17

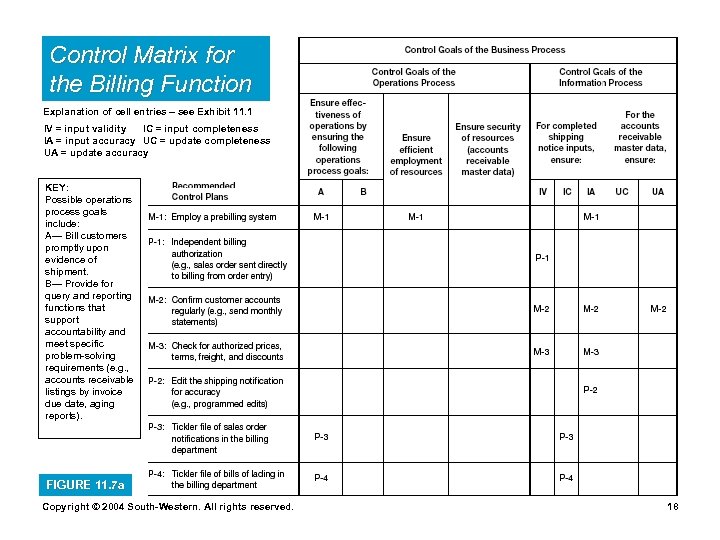

Control Matrix for the Billing Function Explanation of cell entries – see Exhibit 11. 1 IV = input validity IC = input completeness IA = input accuracy UC = update completeness UA = update accuracy KEY: Possible operations process goals include: A— Bill customers promptly upon evidence of shipment. B— Provide for query and reporting functions that support accountability and meet specific problem-solving requirements (e. g. , accounts receivable listings by invoice due date, aging reports). FIGURE 11. 7 a Copyright © 2004 South-Western. All rights reserved. 18

Control Matrix for the Billing Function Explanation of cell entries – see Exhibit 11. 1 IV = input validity IC = input completeness IA = input accuracy UC = update completeness UA = update accuracy KEY: Possible operations process goals include: A— Bill customers promptly upon evidence of shipment. B— Provide for query and reporting functions that support accountability and meet specific problem-solving requirements (e. g. , accounts receivable listings by invoice due date, aging reports). FIGURE 11. 7 a Copyright © 2004 South-Western. All rights reserved. 18

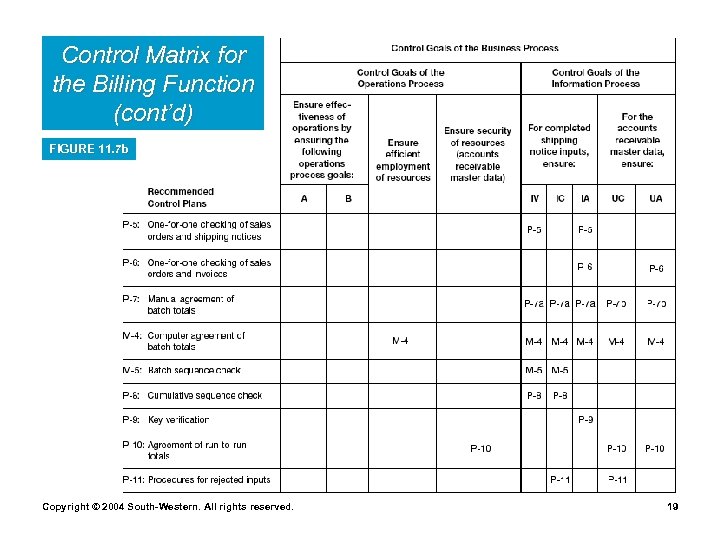

Control Matrix for the Billing Function (cont’d) FIGURE 11. 7 b Copyright © 2004 South-Western. All rights reserved. 19

Control Matrix for the Billing Function (cont’d) FIGURE 11. 7 b Copyright © 2004 South-Western. All rights reserved. 19

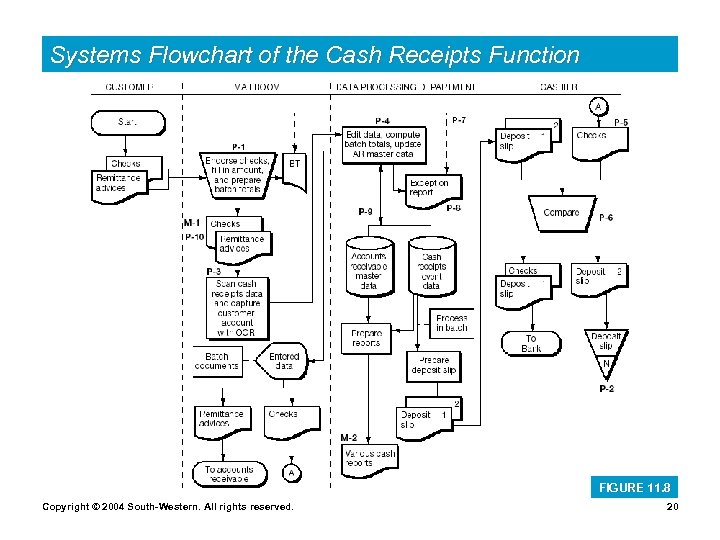

Systems Flowchart of the Cash Receipts Function FIGURE 11. 8 Copyright © 2004 South-Western. All rights reserved. 20

Systems Flowchart of the Cash Receipts Function FIGURE 11. 8 Copyright © 2004 South-Western. All rights reserved. 20

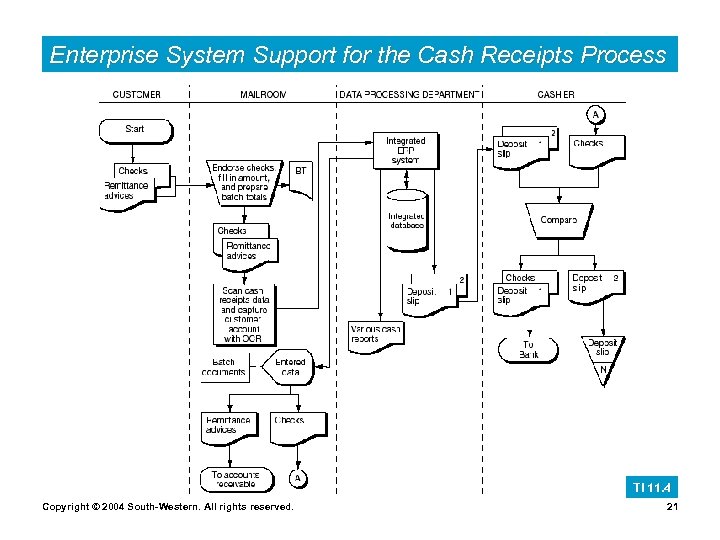

Enterprise System Support for the Cash Receipts Process TI 11. 4 Copyright © 2004 South-Western. All rights reserved. 21

Enterprise System Support for the Cash Receipts Process TI 11. 4 Copyright © 2004 South-Western. All rights reserved. 21

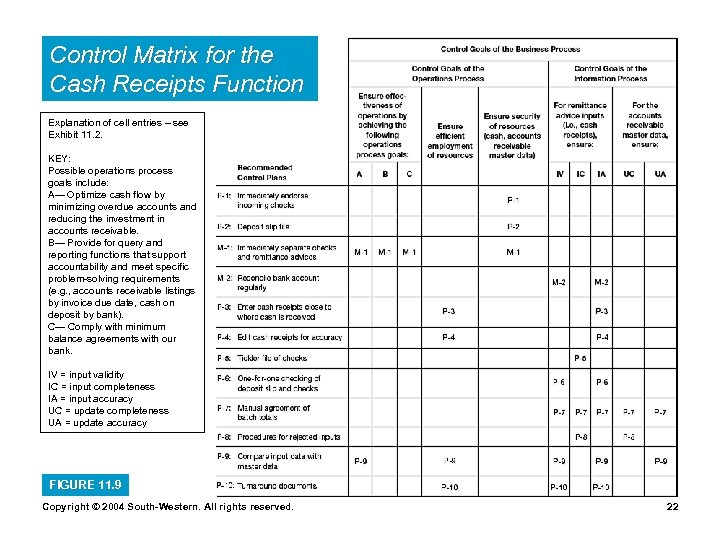

Control Matrix for the Cash Receipts Function Explanation of cell entries – see Exhibit 11. 2. KEY: Possible operations process goals include: A— Optimize cash flow by minimizing overdue accounts and reducing the investment in accounts receivable. B— Provide for query and reporting functions that support accountability and meet specific problem-solving requirements (e. g. , accounts receivable listings by invoice due date, cash on deposit by bank). C— Comply with minimum balance agreements with our bank. IV = input validity IC = input completeness IA = input accuracy UC = update completeness UA = update accuracy FIGURE 11. 9 Copyright © 2004 South-Western. All rights reserved. 22

Control Matrix for the Cash Receipts Function Explanation of cell entries – see Exhibit 11. 2. KEY: Possible operations process goals include: A— Optimize cash flow by minimizing overdue accounts and reducing the investment in accounts receivable. B— Provide for query and reporting functions that support accountability and meet specific problem-solving requirements (e. g. , accounts receivable listings by invoice due date, cash on deposit by bank). C— Comply with minimum balance agreements with our bank. IV = input validity IC = input completeness IA = input accuracy UC = update completeness UA = update accuracy FIGURE 11. 9 Copyright © 2004 South-Western. All rights reserved. 22

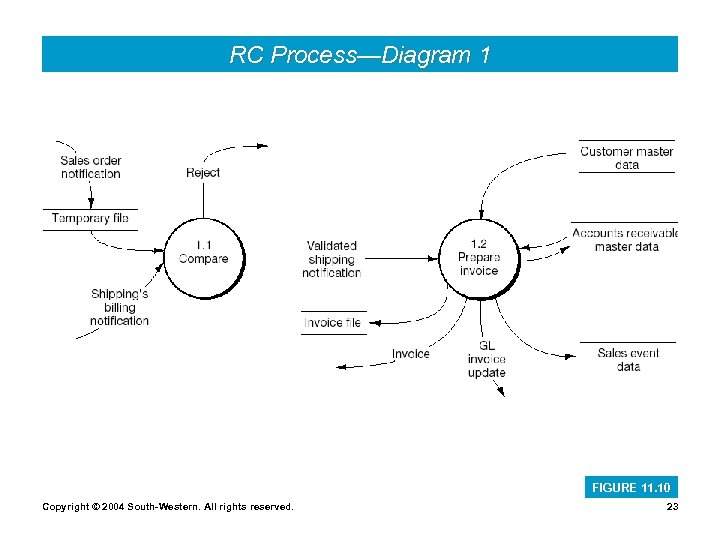

RC Process—Diagram 1 FIGURE 11. 10 Copyright © 2004 South-Western. All rights reserved. 23

RC Process—Diagram 1 FIGURE 11. 10 Copyright © 2004 South-Western. All rights reserved. 23

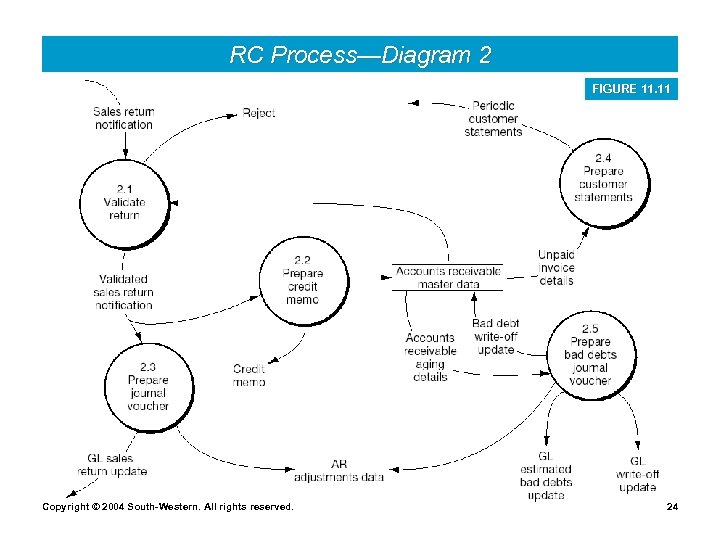

RC Process—Diagram 2 FIGURE 11. 11 Copyright © 2004 South-Western. All rights reserved. 24

RC Process—Diagram 2 FIGURE 11. 11 Copyright © 2004 South-Western. All rights reserved. 24

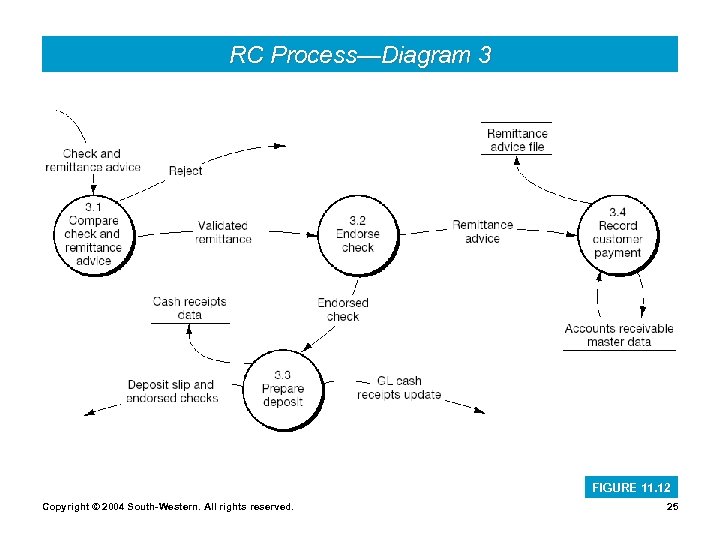

RC Process—Diagram 3 FIGURE 11. 12 Copyright © 2004 South-Western. All rights reserved. 25

RC Process—Diagram 3 FIGURE 11. 12 Copyright © 2004 South-Western. All rights reserved. 25

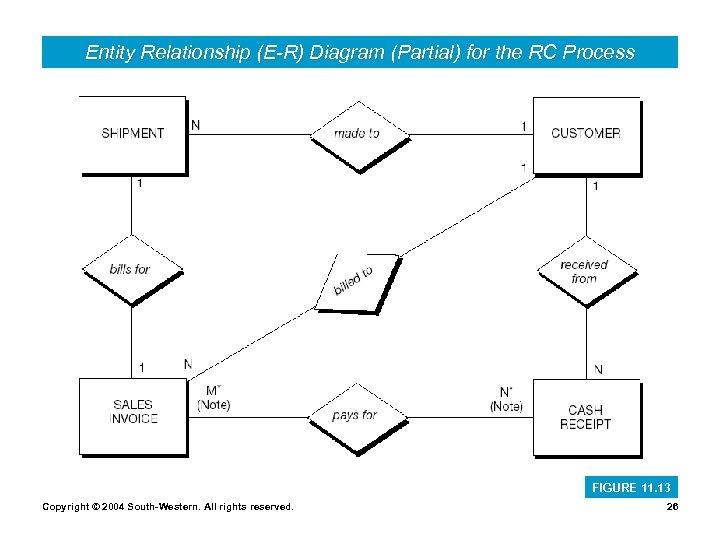

Entity Relationship (E-R) Diagram (Partial) for the RC Process FIGURE 11. 13 Copyright © 2004 South-Western. All rights reserved. 26

Entity Relationship (E-R) Diagram (Partial) for the RC Process FIGURE 11. 13 Copyright © 2004 South-Western. All rights reserved. 26

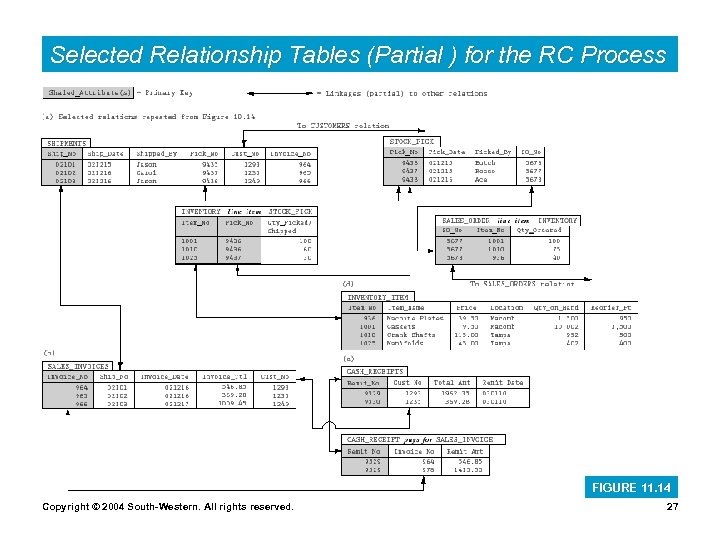

Selected Relationship Tables (Partial ) for the RC Process FIGURE 11. 14 Copyright © 2004 South-Western. All rights reserved. 27

Selected Relationship Tables (Partial ) for the RC Process FIGURE 11. 14 Copyright © 2004 South-Western. All rights reserved. 27