16252d603f7e22f39fbd775bbc358f72.ppt

- Количество слайдов: 49

Chapter 11 Risk and Return!!!

Chapter 11 Risk and Return!!!

Key Concepts and Skills n n n Know how to calculate expected returns Understand the impact of diversification Understand the systematic risk principle Understand the security market line Understand the risk-return trade-off

Key Concepts and Skills n n n Know how to calculate expected returns Understand the impact of diversification Understand the systematic risk principle Understand the security market line Understand the risk-return trade-off

Chapter Outline n n n n Expected Returns and Variances Portfolios Announcements, Surprises, and Expected Returns Risk: Systematic and Unsystematic Diversification and Portfolio Risk Systematic Risk and Beta The Security Market Line The SML and the Cost of Capital: A Preview

Chapter Outline n n n n Expected Returns and Variances Portfolios Announcements, Surprises, and Expected Returns Risk: Systematic and Unsystematic Diversification and Portfolio Risk Systematic Risk and Beta The Security Market Line The SML and the Cost of Capital: A Preview

Expected Returns n n What expected returns are based on “Expected defined”

Expected Returns n n What expected returns are based on “Expected defined”

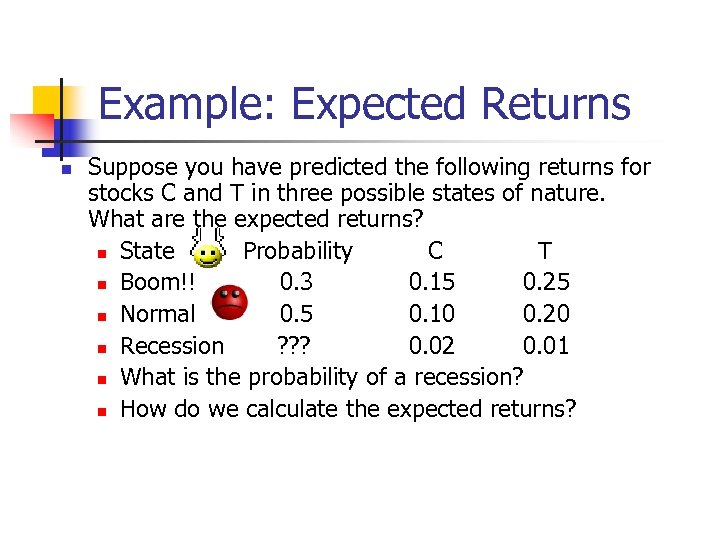

Example: Expected Returns n Suppose you have predicted the following returns for stocks C and T in three possible states of nature. What are the expected returns? n State Probability C T n Boom!! 0. 3 0. 15 0. 25 n Normal 0. 5 0. 10 0. 20 n Recession ? ? ? 0. 02 0. 01 n What is the probability of a recession? n How do we calculate the expected returns?

Example: Expected Returns n Suppose you have predicted the following returns for stocks C and T in three possible states of nature. What are the expected returns? n State Probability C T n Boom!! 0. 3 0. 15 0. 25 n Normal 0. 5 0. 10 0. 20 n Recession ? ? ? 0. 02 0. 01 n What is the probability of a recession? n How do we calculate the expected returns?

Risk Premium n n Risk-free rate of return is 6. 15% Calculate the risk premium n n n Formula = Stock C Stock T

Risk Premium n n Risk-free rate of return is 6. 15% Calculate the risk premium n n n Formula = Stock C Stock T

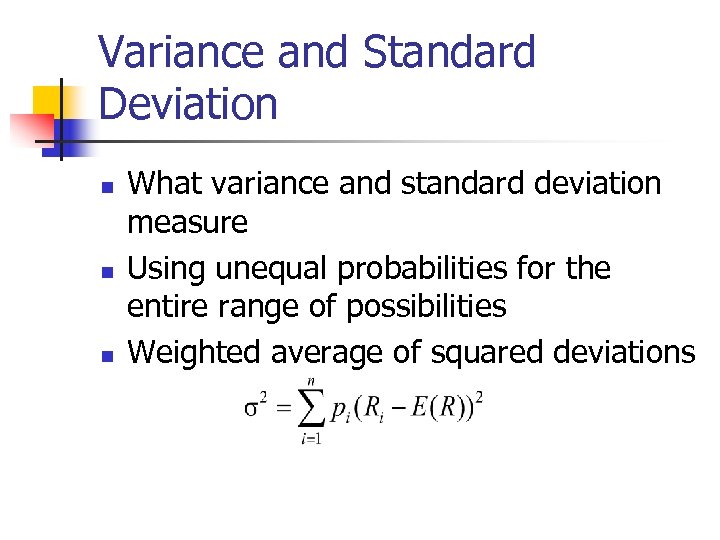

Variance and Standard Deviation n What variance and standard deviation measure Using unequal probabilities for the entire range of possibilities Weighted average of squared deviations

Variance and Standard Deviation n What variance and standard deviation measure Using unequal probabilities for the entire range of possibilities Weighted average of squared deviations

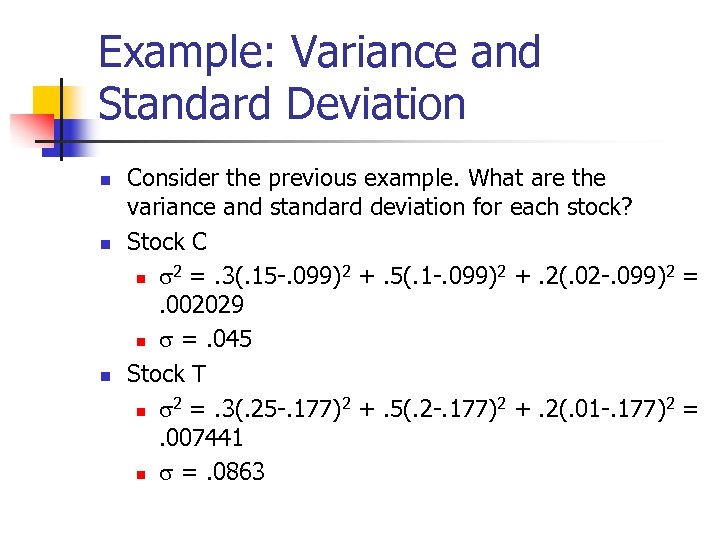

Example: Variance and Standard Deviation n Consider the previous example. What are the variance and standard deviation for each stock? Stock C 2 2 n =. 3(. 15 -. 099) +. 5(. 1 -. 099) +. 2(. 02 -. 099) =. 002029 n =. 045 Stock T 2 2 n =. 3(. 25 -. 177) +. 5(. 2 -. 177) +. 2(. 01 -. 177) =. 007441 n =. 0863

Example: Variance and Standard Deviation n Consider the previous example. What are the variance and standard deviation for each stock? Stock C 2 2 n =. 3(. 15 -. 099) +. 5(. 1 -. 099) +. 2(. 02 -. 099) =. 002029 n =. 045 Stock T 2 2 n =. 3(. 25 -. 177) +. 5(. 2 -. 177) +. 2(. 01 -. 177) =. 007441 n =. 0863

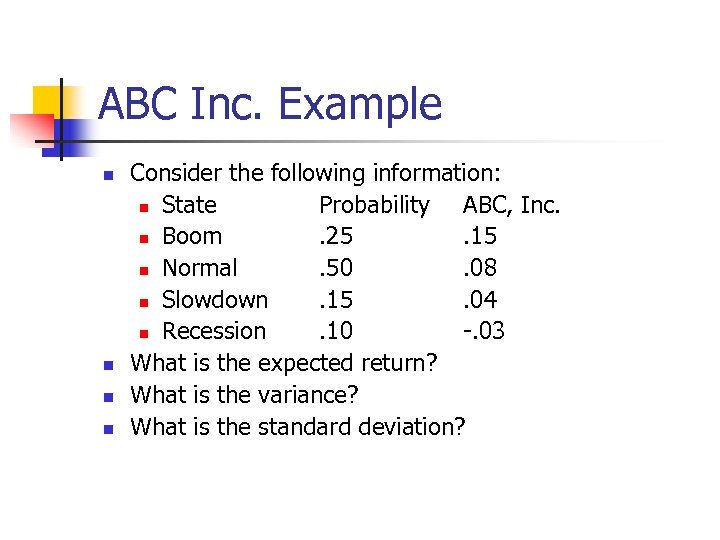

ABC Inc. Example n n Consider the following information: n State Probability ABC, Inc. n Boom. 25. 15 n Normal. 50. 08 n Slowdown. 15. 04 n Recession. 10 -. 03 What is the expected return? What is the variance? What is the standard deviation?

ABC Inc. Example n n Consider the following information: n State Probability ABC, Inc. n Boom. 25. 15 n Normal. 50. 08 n Slowdown. 15. 04 n Recession. 10 -. 03 What is the expected return? What is the variance? What is the standard deviation?

ABC Inc. calculations n n n Expected return Variance Standard deviation

ABC Inc. calculations n n n Expected return Variance Standard deviation

Portfolios n n n Portfolio defined How is an asset’s risk and return important? How the risk-return trade-off for a portfolio is measured

Portfolios n n n Portfolio defined How is an asset’s risk and return important? How the risk-return trade-off for a portfolio is measured

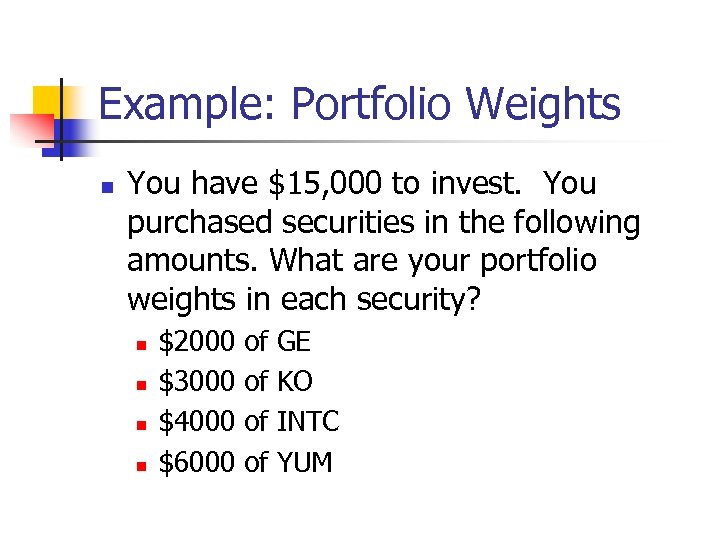

Example: Portfolio Weights n You have $15, 000 to invest. You purchased securities in the following amounts. What are your portfolio weights in each security? n n $2000 $3000 $4000 $6000 of of GE KO INTC YUM

Example: Portfolio Weights n You have $15, 000 to invest. You purchased securities in the following amounts. What are your portfolio weights in each security? n n $2000 $3000 $4000 $6000 of of GE KO INTC YUM

Portfolio weights calculation • • • GE: 2/15 =. 133 KO: 3/15 =. 2 INTC: 4/15 =. 267 YUM: 6/15 =. 4 This is easy!!!

Portfolio weights calculation • • • GE: 2/15 =. 133 KO: 3/15 =. 2 INTC: 4/15 =. 267 YUM: 6/15 =. 4 This is easy!!!

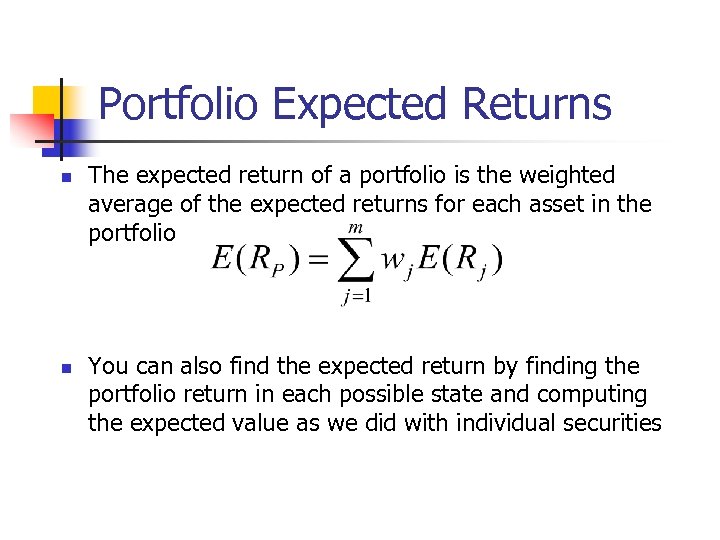

Portfolio Expected Returns n n The expected return of a portfolio is the weighted average of the expected returns for each asset in the portfolio You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities

Portfolio Expected Returns n n The expected return of a portfolio is the weighted average of the expected returns for each asset in the portfolio You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities

Example: Expected Portfolio Returns n Consider the portfolio weights computed previously. If the individual stocks have the following expected returns, what is the expected return for the portfolio? n GE: 19. 65% n KO: 8. 96% n INTC: 9. 67% n YUM: 8. 13% n Let’s calculate this!

Example: Expected Portfolio Returns n Consider the portfolio weights computed previously. If the individual stocks have the following expected returns, what is the expected return for the portfolio? n GE: 19. 65% n KO: 8. 96% n INTC: 9. 67% n YUM: 8. 13% n Let’s calculate this!

Portfolio Variance n n n Compute the portfolio return for each state: R P = w 1 R 1 + w 2 R 2 + … + wm R m Compute the expected portfolio return using the same formula as for an individual asset Compute the portfolio variance and standard deviation using the same formulas as for an individual asset

Portfolio Variance n n n Compute the portfolio return for each state: R P = w 1 R 1 + w 2 R 2 + … + wm R m Compute the expected portfolio return using the same formula as for an individual asset Compute the portfolio variance and standard deviation using the same formulas as for an individual asset

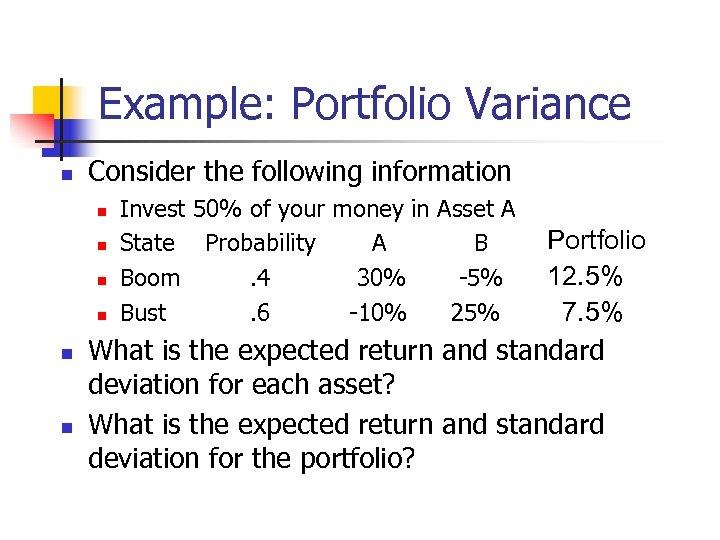

Example: Portfolio Variance n Consider the following information n Portfolio 12. 5% n 7. 5% n What is the expected return and standard deviation for each asset? What is the expected return and standard deviation for the portfolio? n n n Invest 50% of your money in Asset A State Probability A B Boom. 4 30% -5% Bust. 6 -10% 25%

Example: Portfolio Variance n Consider the following information n Portfolio 12. 5% n 7. 5% n What is the expected return and standard deviation for each asset? What is the expected return and standard deviation for the portfolio? n n n Invest 50% of your money in Asset A State Probability A B Boom. 4 30% -5% Bust. 6 -10% 25%

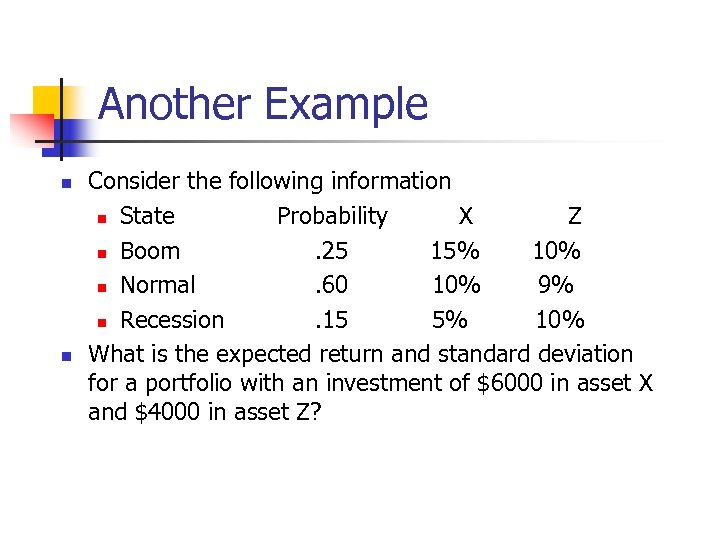

Another Example n n Consider the following information n State Probability X Z n Boom. 25 15% 10% n Normal. 60 10% 9% n Recession. 15 5% 10% What is the expected return and standard deviation for a portfolio with an investment of $6000 in asset X and $4000 in asset Z?

Another Example n n Consider the following information n State Probability X Z n Boom. 25 15% 10% n Normal. 60 10% 9% n Recession. 15 5% 10% What is the expected return and standard deviation for a portfolio with an investment of $6000 in asset X and $4000 in asset Z?

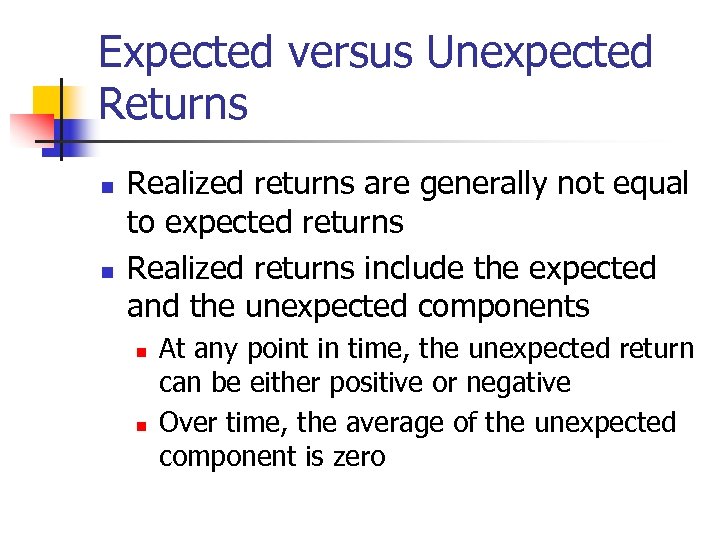

Expected versus Unexpected Returns n n Realized returns are generally not equal to expected returns Realized returns include the expected and the unexpected components n n At any point in time, the unexpected return can be either positive or negative Over time, the average of the unexpected component is zero

Expected versus Unexpected Returns n n Realized returns are generally not equal to expected returns Realized returns include the expected and the unexpected components n n At any point in time, the unexpected return can be either positive or negative Over time, the average of the unexpected component is zero

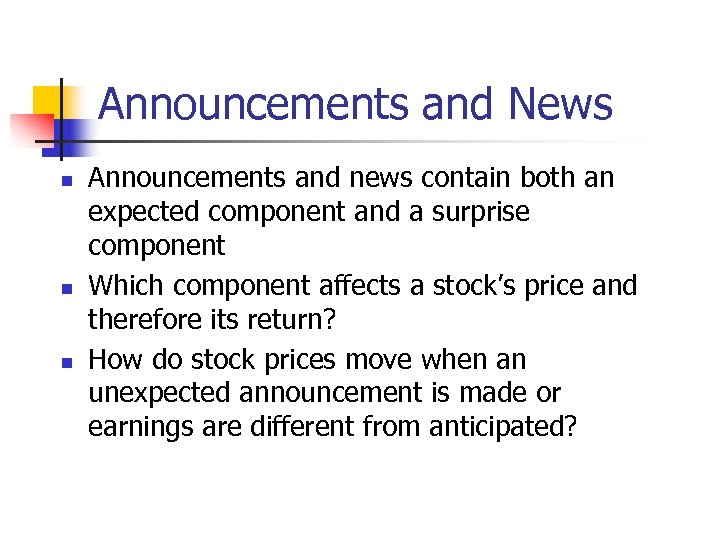

Announcements and News n n n Announcements and news contain both an expected component and a surprise component Which component affects a stock’s price and therefore its return? How do stock prices move when an unexpected announcement is made or earnings are different from anticipated?

Announcements and News n n n Announcements and news contain both an expected component and a surprise component Which component affects a stock’s price and therefore its return? How do stock prices move when an unexpected announcement is made or earnings are different from anticipated?

Efficient Markets n n n Efficient markets are a result of investors trading on the unexpected portion of announcements The easier it is to trade on surprises, the more efficient markets should be Efficient markets involve random price changes because we cannot predict surprises

Efficient Markets n n n Efficient markets are a result of investors trading on the unexpected portion of announcements The easier it is to trade on surprises, the more efficient markets should be Efficient markets involve random price changes because we cannot predict surprises

Systematic Risk n n Defined Several factors included in systematic risk

Systematic Risk n n Defined Several factors included in systematic risk

Unsystematic Risk n n n Defined Also known as unique risk and assetspecific risk Includes such things as labor strikes, part shortages, etc.

Unsystematic Risk n n n Defined Also known as unique risk and assetspecific risk Includes such things as labor strikes, part shortages, etc.

Returns n n n Total Return formula Unexpected return formula Total return formula 2

Returns n n n Total Return formula Unexpected return formula Total return formula 2

Diversification n n Portfolio diversification defined Diversification is not just holding a lot of assets For example, if you own 50 internet stocks, you are not diversified If you own 50 stocks in 20 different industries, are we diversified?

Diversification n n Portfolio diversification defined Diversification is not just holding a lot of assets For example, if you own 50 internet stocks, you are not diversified If you own 50 stocks in 20 different industries, are we diversified?

Are you diversified? n Yes!!!! And we’re happy!!!

Are you diversified? n Yes!!!! And we’re happy!!!

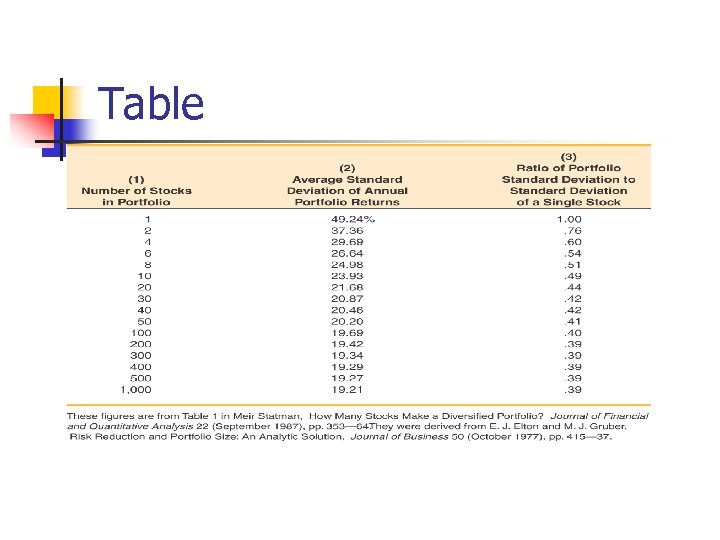

Table

Table

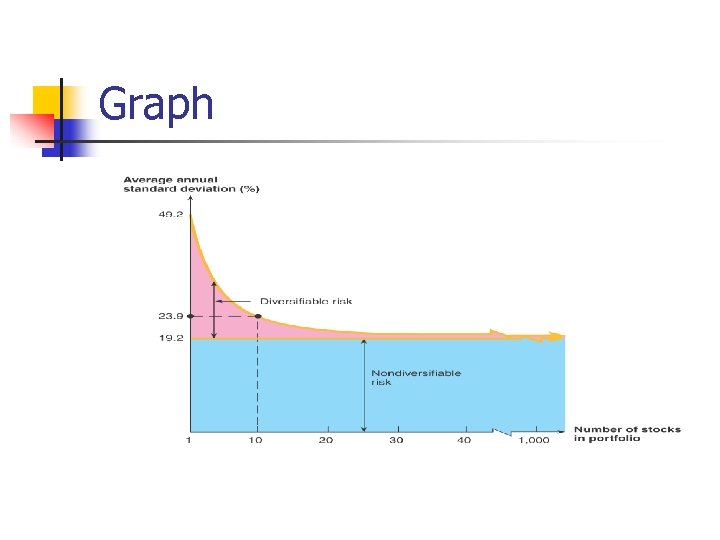

The Principle of Diversification n Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns How does diversification work? Nondiversifiable risk

The Principle of Diversification n Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns How does diversification work? Nondiversifiable risk

Graph

Graph

Diversifiable Risk n n Defined Examples n n Student at CSUS Driving Often considered the same as unsystematic, unique or asset-specific risk If we hold only one asset, or assets in the same industry, then we are exposing ourselves to risk that we could diversify away

Diversifiable Risk n n Defined Examples n n Student at CSUS Driving Often considered the same as unsystematic, unique or asset-specific risk If we hold only one asset, or assets in the same industry, then we are exposing ourselves to risk that we could diversify away

Total Risk n n Total risk = systematic risk + unsystematic risk The standard deviation of returns is a measure of total risk For well-diversified portfolios, unsystematic risk is very small Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk

Total Risk n n Total risk = systematic risk + unsystematic risk The standard deviation of returns is a measure of total risk For well-diversified portfolios, unsystematic risk is very small Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk

Systematic Risk Principle n n n There is a reward for bearing risk There is not a reward for bearing risk unnecessarily The expected return on a risky asset depends only on that asset’s systematic risk – why is this true?

Systematic Risk Principle n n n There is a reward for bearing risk There is not a reward for bearing risk unnecessarily The expected return on a risky asset depends only on that asset’s systematic risk – why is this true?

Measuring Systematic Risk n n n How do we measure systematic risk? The beta coefficient What does beta tell us? n A beta of 1 n A beta < 1 n A beta > 1

Measuring Systematic Risk n n n How do we measure systematic risk? The beta coefficient What does beta tell us? n A beta of 1 n A beta < 1 n A beta > 1

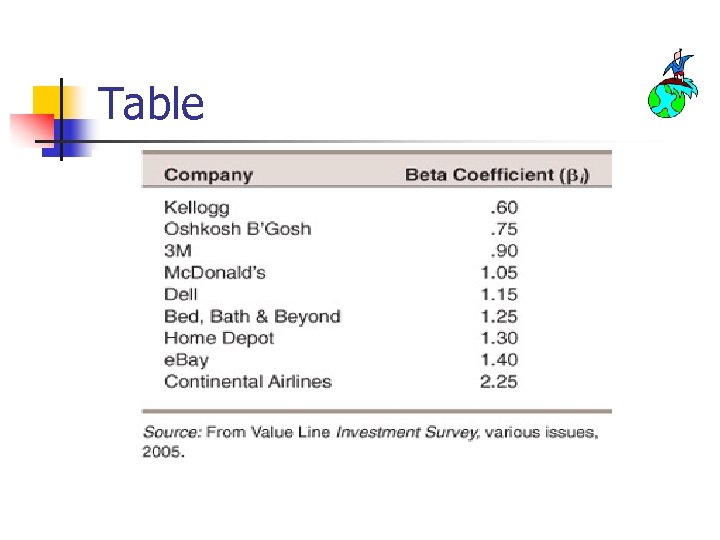

Table

Table

Work the Web Example n n n Many sites provide betas for companies Yahoo! Finance provides beta, plus a lot of other information under its profile link Click on the web surfer to go to Yahoo! Finance n Enter a ticker symbol and get a basic quote n Click on key statistics n Beta is reported under stock price history

Work the Web Example n n n Many sites provide betas for companies Yahoo! Finance provides beta, plus a lot of other information under its profile link Click on the web surfer to go to Yahoo! Finance n Enter a ticker symbol and get a basic quote n Click on key statistics n Beta is reported under stock price history

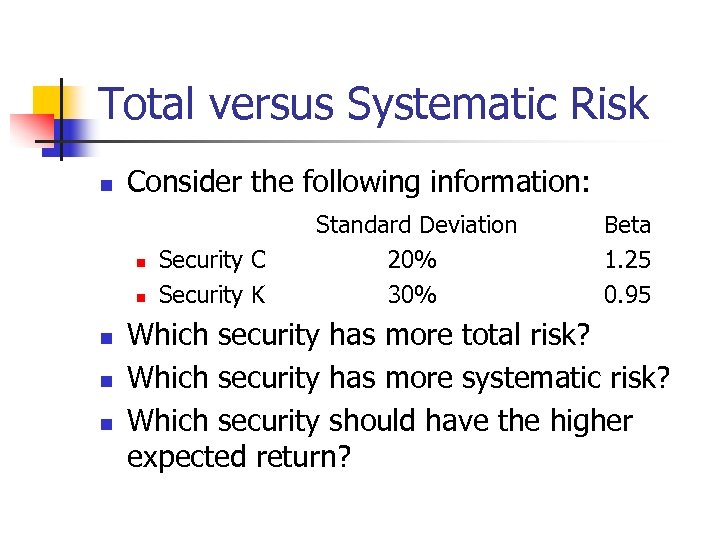

Total versus Systematic Risk n Consider the following information: n n n Security C Security K Standard Deviation 20% 30% Beta 1. 25 0. 95 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return?

Total versus Systematic Risk n Consider the following information: n n n Security C Security K Standard Deviation 20% 30% Beta 1. 25 0. 95 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return?

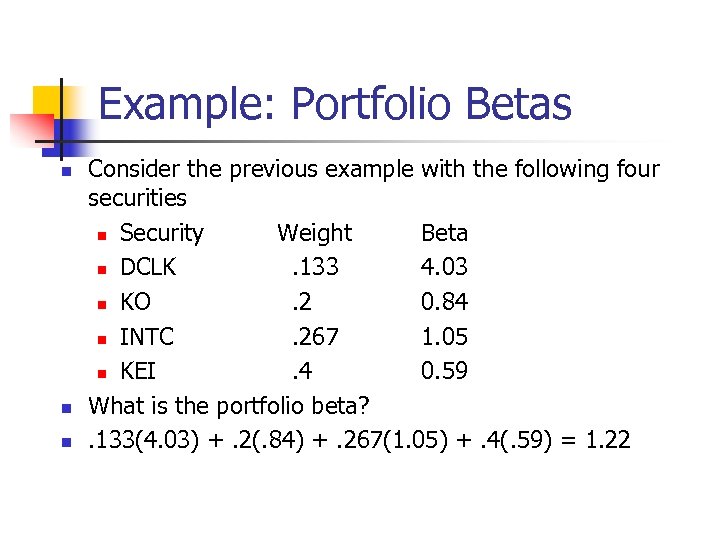

Example: Portfolio Betas n n n Consider the previous example with the following four securities n Security Weight Beta n DCLK. 133 4. 03 n KO. 2 0. 84 n INTC. 267 1. 05 n KEI. 4 0. 59 What is the portfolio beta? . 133(4. 03) +. 2(. 84) +. 267(1. 05) +. 4(. 59) = 1. 22

Example: Portfolio Betas n n n Consider the previous example with the following four securities n Security Weight Beta n DCLK. 133 4. 03 n KO. 2 0. 84 n INTC. 267 1. 05 n KEI. 4 0. 59 What is the portfolio beta? . 133(4. 03) +. 2(. 84) +. 267(1. 05) +. 4(. 59) = 1. 22

Beta and the Risk Premium n n n Remember that the risk premium = expected return – risk-free rate The higher the beta, the ? ? ? the risk premium should be Can we define the relationship between the risk premium and beta so that we can estimate the expected return? n YES!

Beta and the Risk Premium n n n Remember that the risk premium = expected return – risk-free rate The higher the beta, the ? ? ? the risk premium should be Can we define the relationship between the risk premium and beta so that we can estimate the expected return? n YES!

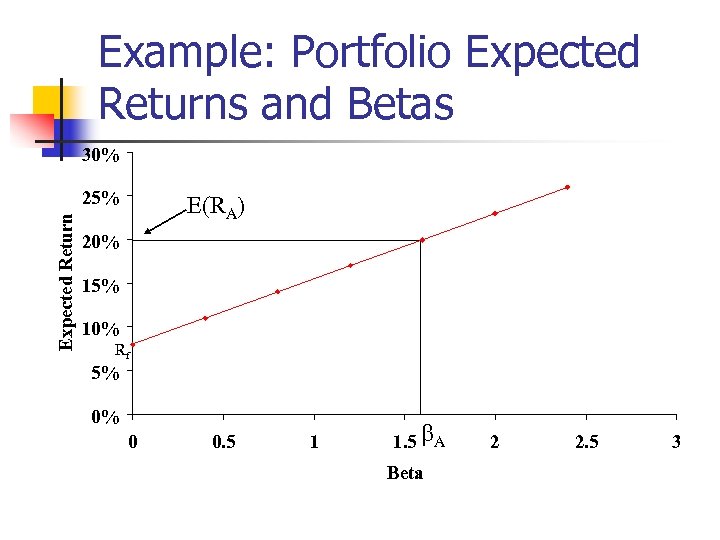

Example: Portfolio Expected Returns and Betas 30% Expected Return 25% E(RA) 20% 15% 10% Rf 5% 0% 0 0. 5 1 1. 5 A Beta 2 2. 5 3

Example: Portfolio Expected Returns and Betas 30% Expected Return 25% E(RA) 20% 15% 10% Rf 5% 0% 0 0. 5 1 1. 5 A Beta 2 2. 5 3

Reward-to-Risk Ratio: Definition and Example n The reward-to-risk ratio is the slope of the line illustrated in the previous example n Slope = (E(RA) – Rf) / ( A – 0) n Reward-to-risk ratio for previous example = (20 – 8) / (1. 6 – 0) = 7. 5

Reward-to-Risk Ratio: Definition and Example n The reward-to-risk ratio is the slope of the line illustrated in the previous example n Slope = (E(RA) – Rf) / ( A – 0) n Reward-to-risk ratio for previous example = (20 – 8) / (1. 6 – 0) = 7. 5

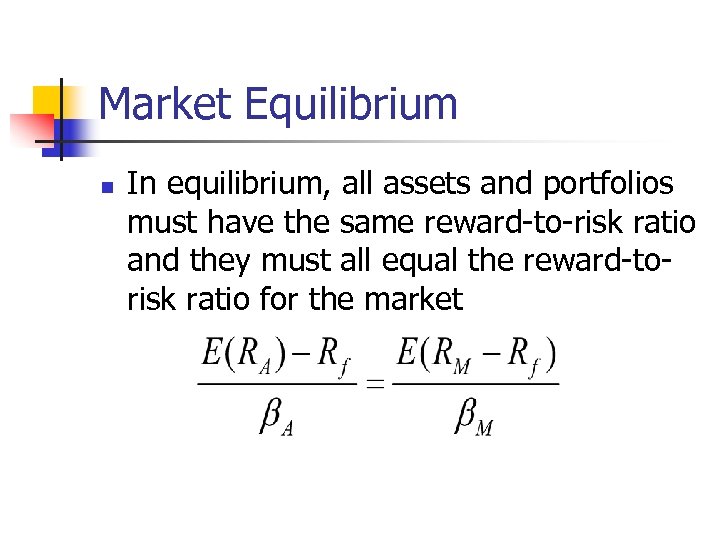

Market Equilibrium n In equilibrium, all assets and portfolios must have the same reward-to-risk ratio and they must all equal the reward-torisk ratio for the market

Market Equilibrium n In equilibrium, all assets and portfolios must have the same reward-to-risk ratio and they must all equal the reward-torisk ratio for the market

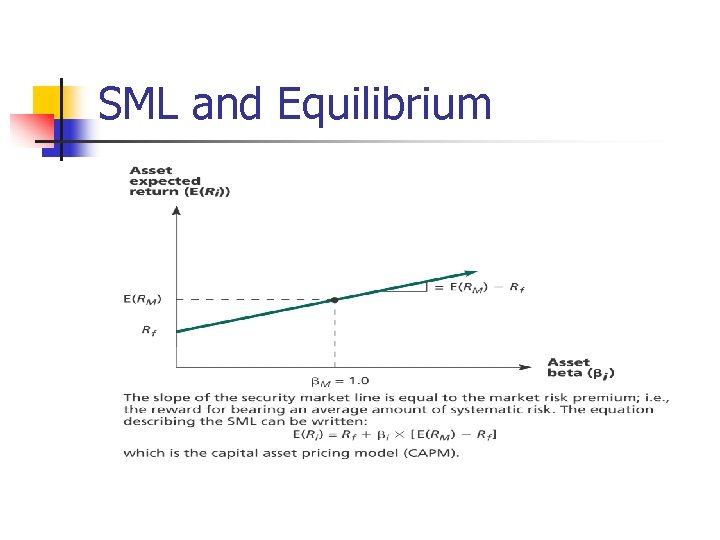

Security Market Line n n The security market line (SML) is the representation of market equilibrium The slope of the SML is the reward-to-risk ratio: (E(RM) – Rf) / M But since the beta for the market is ALWAYS equal to one, the slope can be rewritten Slope = E(RM) – Rf = market risk premium

Security Market Line n n The security market line (SML) is the representation of market equilibrium The slope of the SML is the reward-to-risk ratio: (E(RM) – Rf) / M But since the beta for the market is ALWAYS equal to one, the slope can be rewritten Slope = E(RM) – Rf = market risk premium

Capital Asset Pricing Model n n The capital asset pricing model (CAPM) defines the relationship between risk and return E(RA) = Rf + A(E(RM) – Rf) If we know an asset’s systematic risk, we can use the CAPM to determine its expected return This is true whether we are talking about financial assets or physical assets

Capital Asset Pricing Model n n The capital asset pricing model (CAPM) defines the relationship between risk and return E(RA) = Rf + A(E(RM) – Rf) If we know an asset’s systematic risk, we can use the CAPM to determine its expected return This is true whether we are talking about financial assets or physical assets

Factors Affecting Expected Return n Pure time value of money – measured by the risk-free rate Reward for bearing systematic risk – measured by the market risk premium Amount of systematic risk – measured by beta

Factors Affecting Expected Return n Pure time value of money – measured by the risk-free rate Reward for bearing systematic risk – measured by the market risk premium Amount of systematic risk – measured by beta

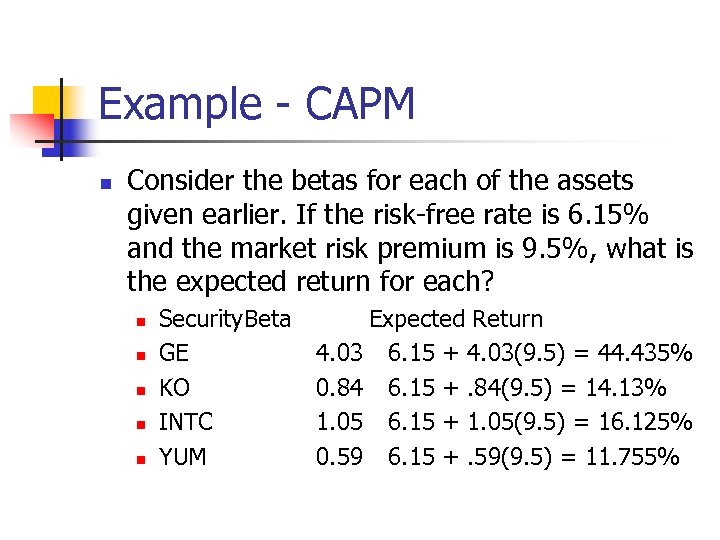

Example - CAPM n Consider the betas for each of the assets given earlier. If the risk-free rate is 6. 15% and the market risk premium is 9. 5%, what is the expected return for each? n n n Security. Beta GE KO INTC YUM Expected Return 4. 03 6. 15 + 4. 03(9. 5) = 44. 435% 0. 84 6. 15 +. 84(9. 5) = 14. 13% 1. 05 6. 15 + 1. 05(9. 5) = 16. 125% 0. 59 6. 15 +. 59(9. 5) = 11. 755%

Example - CAPM n Consider the betas for each of the assets given earlier. If the risk-free rate is 6. 15% and the market risk premium is 9. 5%, what is the expected return for each? n n n Security. Beta GE KO INTC YUM Expected Return 4. 03 6. 15 + 4. 03(9. 5) = 44. 435% 0. 84 6. 15 +. 84(9. 5) = 14. 13% 1. 05 6. 15 + 1. 05(9. 5) = 16. 125% 0. 59 6. 15 +. 59(9. 5) = 11. 755%

SML and Equilibrium

SML and Equilibrium

Quick Quiz n n n How do you compute the expected return and standard deviation for an individual asset? For a portfolio? What is the difference between systematic and unsystematic risk? What type of risk is relevant for determining the expected return?

Quick Quiz n n n How do you compute the expected return and standard deviation for an individual asset? For a portfolio? What is the difference between systematic and unsystematic risk? What type of risk is relevant for determining the expected return?

Quick Quiz (continued) n Consider an asset with a beta of 1. 2, a risk-free rate of 5% and a market return of 13%. n n What is the reward-to-risk ratio in equilibrium? What is the expected return on the asset?

Quick Quiz (continued) n Consider an asset with a beta of 1. 2, a risk-free rate of 5% and a market return of 13%. n n What is the reward-to-risk ratio in equilibrium? What is the expected return on the asset?

End of Chapter 11! n Yeah!

End of Chapter 11! n Yeah!