9a4944afe4bf11f445ba6b354e1ad29e.ppt

- Количество слайдов: 46

Chapter 11 Pricing with Market Power

Chapter 11 Pricing with Market Power

Capturing Consumer Surplus l All pricing strategies we will examine are means of capturing consumer surplus and transferring it to the producer l Profit maximizing point of P* and Q* m. But some consumers will pay more than P* for a good. m. Some want to buy it if the price is less than P*. Chapter 11 2

Capturing Consumer Surplus l All pricing strategies we will examine are means of capturing consumer surplus and transferring it to the producer l Profit maximizing point of P* and Q* m. But some consumers will pay more than P* for a good. m. Some want to buy it if the price is less than P*. Chapter 11 2

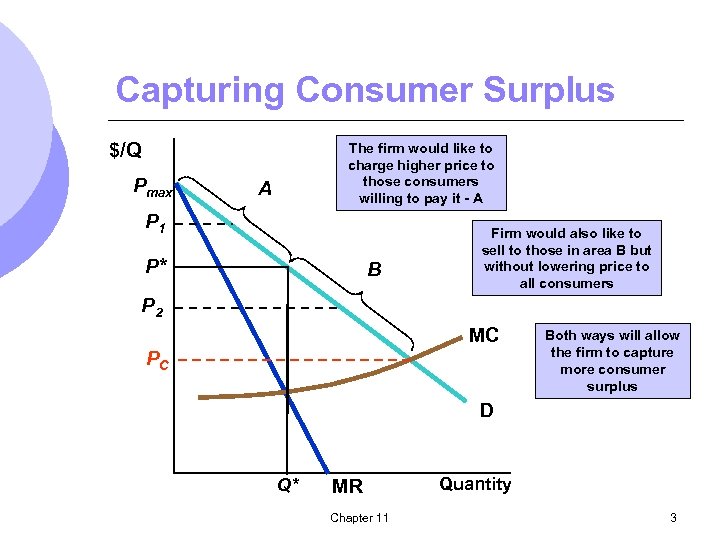

Capturing Consumer Surplus $/Q Pmax The firm would like to charge higher price to those consumers willing to pay it - A A P 1 P* B Firm would also like to sell to those in area B but without lowering price to all consumers P 2 MC PC Both ways will allow the firm to capture more consumer surplus D Q* MR Chapter 11 Quantity 3

Capturing Consumer Surplus $/Q Pmax The firm would like to charge higher price to those consumers willing to pay it - A A P 1 P* B Firm would also like to sell to those in area B but without lowering price to all consumers P 2 MC PC Both ways will allow the firm to capture more consumer surplus D Q* MR Chapter 11 Quantity 3

Capturing Consumer Surplus l Price discrimination is the practice of charging different prices to different consumers for similar goods. Chapter 11 4

Capturing Consumer Surplus l Price discrimination is the practice of charging different prices to different consumers for similar goods. Chapter 11 4

Price Discrimination l First Degree Price Discrimination m Charge a separate price to each customer: the maximum or reservation price they are willing to pay. l How can a firm profit m The firm produces Q* MR = MC m We can see the firms variable profit – the firm’s profit ignoring fixed costs l. Area between MR and MC m Consumer surplus area between demand Price Chapter 11 5

Price Discrimination l First Degree Price Discrimination m Charge a separate price to each customer: the maximum or reservation price they are willing to pay. l How can a firm profit m The firm produces Q* MR = MC m We can see the firms variable profit – the firm’s profit ignoring fixed costs l. Area between MR and MC m Consumer surplus area between demand Price Chapter 11 5

Price Discrimination l If the firm can perfectly price discriminate, each consumer is charged exactly what they are willing to pay. m. Incremental revenue is exactly the price at which each unit is sold – the demand curve m. Additional profit from producing and selling an incremental unit is now the difference between demand marginal cost Chapter 11 6

Price Discrimination l If the firm can perfectly price discriminate, each consumer is charged exactly what they are willing to pay. m. Incremental revenue is exactly the price at which each unit is sold – the demand curve m. Additional profit from producing and selling an incremental unit is now the difference between demand marginal cost Chapter 11 6

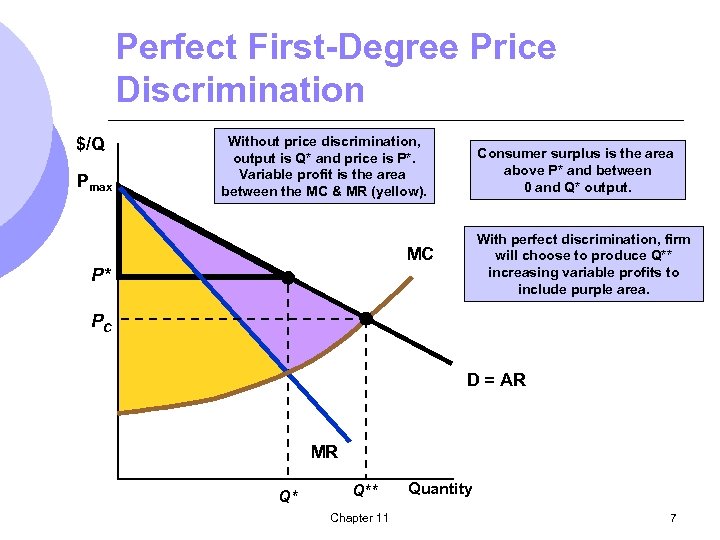

Perfect First-Degree Price Discrimination $/Q Pmax Without price discrimination, output is Q* and price is P*. Variable profit is the area between the MC & MR (yellow). Consumer surplus is the area above P* and between 0 and Q* output. With perfect discrimination, firm will choose to produce Q** increasing variable profits to include purple area. MC P* PC D = AR MR Q* Q** Chapter 11 Quantity 7

Perfect First-Degree Price Discrimination $/Q Pmax Without price discrimination, output is Q* and price is P*. Variable profit is the area between the MC & MR (yellow). Consumer surplus is the area above P* and between 0 and Q* output. With perfect discrimination, firm will choose to produce Q** increasing variable profits to include purple area. MC P* PC D = AR MR Q* Q** Chapter 11 Quantity 7

First-Degree Price Discrimination l In practice perfect price discrimination is almost never possible l Firms can discriminate imperfectly m Can charge a few different prices based on some estimates of reservation prices Chapter 11 8

First-Degree Price Discrimination l In practice perfect price discrimination is almost never possible l Firms can discriminate imperfectly m Can charge a few different prices based on some estimates of reservation prices Chapter 11 8

First-Degree Price Discrimination l Examples of imperfect price discrimination where the seller has the ability to segregate the market to some extent and charge different prices for the same product: m. Lawyers, doctors, accountants m. Colleges and universities (differences in financial aid) Chapter 11 9

First-Degree Price Discrimination l Examples of imperfect price discrimination where the seller has the ability to segregate the market to some extent and charge different prices for the same product: m. Lawyers, doctors, accountants m. Colleges and universities (differences in financial aid) Chapter 11 9

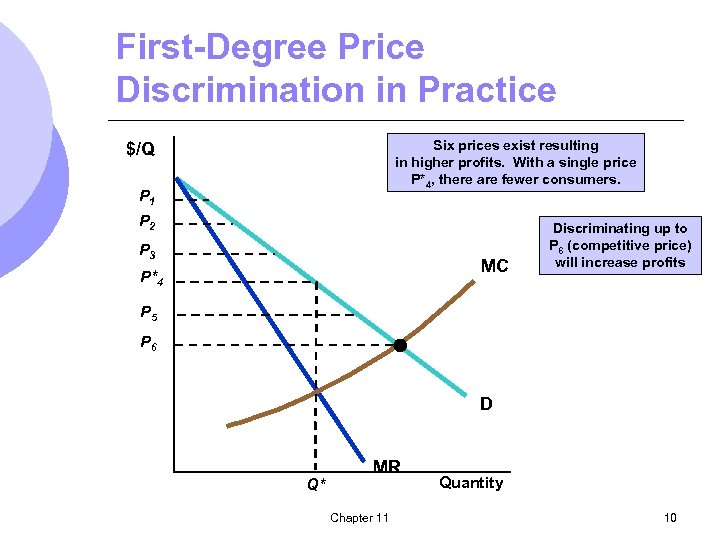

First-Degree Price Discrimination in Practice Six prices exist resulting in higher profits. With a single price P*4, there are fewer consumers. $/Q P 1 P 2 P 3 MC P*4 Discriminating up to P 6 (competitive price) will increase profits P 5 P 6 D Q* MR Chapter 11 Quantity 10

First-Degree Price Discrimination in Practice Six prices exist resulting in higher profits. With a single price P*4, there are fewer consumers. $/Q P 1 P 2 P 3 MC P*4 Discriminating up to P 6 (competitive price) will increase profits P 5 P 6 D Q* MR Chapter 11 Quantity 10

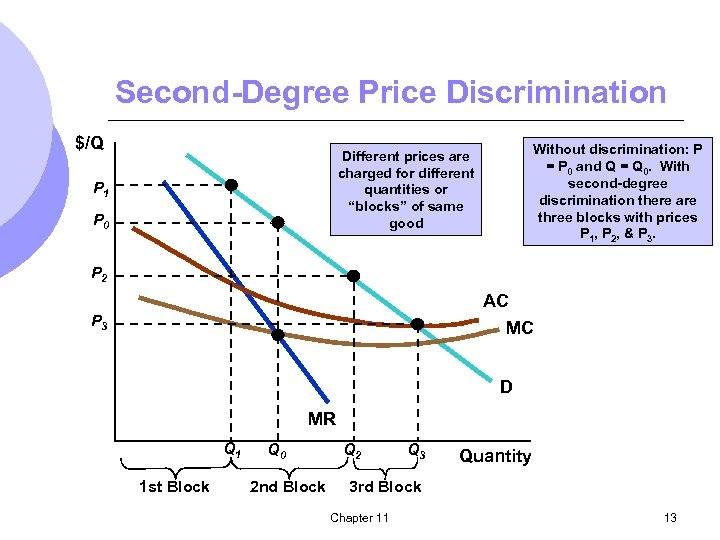

Second-Degree Price Discrimination l In some markets, consumers purchase many units of a good over time m. Demand for that good declines with increased consumption m. Firms can engage in second degree price discrimination l Practice of charging different prices per unit for different quantities of the same good or service Chapter 11 11

Second-Degree Price Discrimination l In some markets, consumers purchase many units of a good over time m. Demand for that good declines with increased consumption m. Firms can engage in second degree price discrimination l Practice of charging different prices per unit for different quantities of the same good or service Chapter 11 11

Second-Degree Price Discrimination l Quantity discounts are an example of second-degree price discrimination m. Ex: Buying in bulk like at Sam’s Club l Block pricing – the practice of charging different prices for different quantities of “blocks” of a good Chapter 11 12

Second-Degree Price Discrimination l Quantity discounts are an example of second-degree price discrimination m. Ex: Buying in bulk like at Sam’s Club l Block pricing – the practice of charging different prices for different quantities of “blocks” of a good Chapter 11 12

Second-Degree Price Discrimination $/Q Without discrimination: P = P 0 and Q = Q 0. With second-degree discrimination there are three blocks with prices P 1, P 2, & P 3. Different prices are charged for different quantities or “blocks” of same good P 1 P 0 P 2 AC MC P 3 D MR Q 1 1 st Block Q 0 2 nd Block Q 2 Q 3 Quantity 3 rd Block Chapter 11 13

Second-Degree Price Discrimination $/Q Without discrimination: P = P 0 and Q = Q 0. With second-degree discrimination there are three blocks with prices P 1, P 2, & P 3. Different prices are charged for different quantities or “blocks” of same good P 1 P 0 P 2 AC MC P 3 D MR Q 1 1 st Block Q 0 2 nd Block Q 2 Q 3 Quantity 3 rd Block Chapter 11 13

Third-Degree Price Discrimination l Practice of dividing consumers into two or more groups with separate demand curves and charging different prices to each group 1. Divides the market into two-groups. 2. Each group has its own demand function. Chapter 11 14

Third-Degree Price Discrimination l Practice of dividing consumers into two or more groups with separate demand curves and charging different prices to each group 1. Divides the market into two-groups. 2. Each group has its own demand function. Chapter 11 14

Price Discrimination l Third Degree Price Discrimination l Most common type of price discrimination. m. Examples: airlines, premium v. non-premium liquor, discounts to students and senior citizens, frozen v. canned vegetables. Chapter 11 15

Price Discrimination l Third Degree Price Discrimination l Most common type of price discrimination. m. Examples: airlines, premium v. non-premium liquor, discounts to students and senior citizens, frozen v. canned vegetables. Chapter 11 15

Third-Degree Price Discrimination l Some characteristic is used to divide the consumer groups l Typically elasticities of demand differ for the groups m. College students and senior citizens are not usually willing to pay as much as others because of lower incomes m. These groups are easily distinguishable with ID’s Chapter 11 16

Third-Degree Price Discrimination l Some characteristic is used to divide the consumer groups l Typically elasticities of demand differ for the groups m. College students and senior citizens are not usually willing to pay as much as others because of lower incomes m. These groups are easily distinguishable with ID’s Chapter 11 16

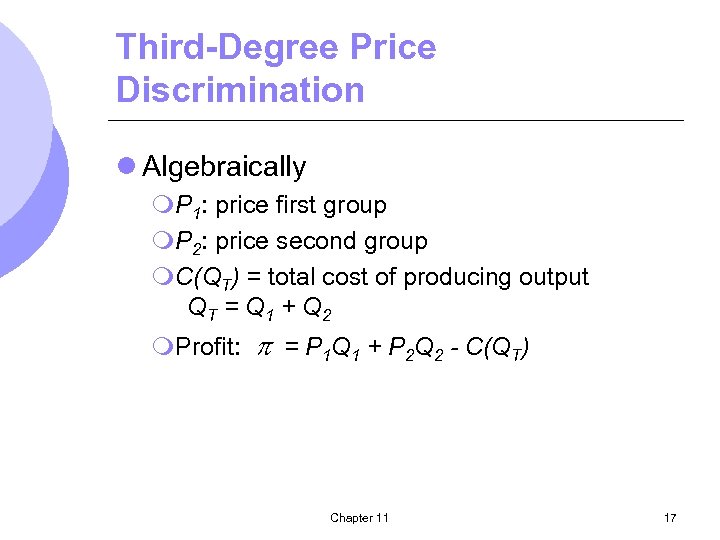

Third-Degree Price Discrimination l Algebraically m. P 1: price first group m. P 2: price second group m. C(QT) = total cost of producing output QT = Q 1 + Q 2 m. Profit: = P 1 Q 1 + P 2 Q 2 - C(QT) Chapter 11 17

Third-Degree Price Discrimination l Algebraically m. P 1: price first group m. P 2: price second group m. C(QT) = total cost of producing output QT = Q 1 + Q 2 m. Profit: = P 1 Q 1 + P 2 Q 2 - C(QT) Chapter 11 17

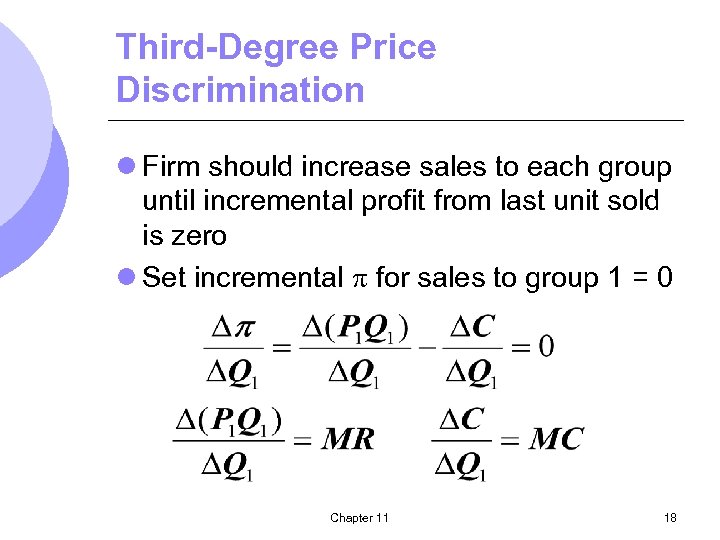

Third-Degree Price Discrimination l Firm should increase sales to each group until incremental profit from last unit sold is zero l Set incremental for sales to group 1 = 0 Chapter 11 18

Third-Degree Price Discrimination l Firm should increase sales to each group until incremental profit from last unit sold is zero l Set incremental for sales to group 1 = 0 Chapter 11 18

Third-Degree Price Discrimination l First group of consumers: m. MR 1= MC l Second group of customers: m. MR 2 = MC l Combining these conclusions gives m. MR 1 = MR 2 = MC Chapter 11 19

Third-Degree Price Discrimination l First group of consumers: m. MR 1= MC l Second group of customers: m. MR 2 = MC l Combining these conclusions gives m. MR 1 = MR 2 = MC Chapter 11 19

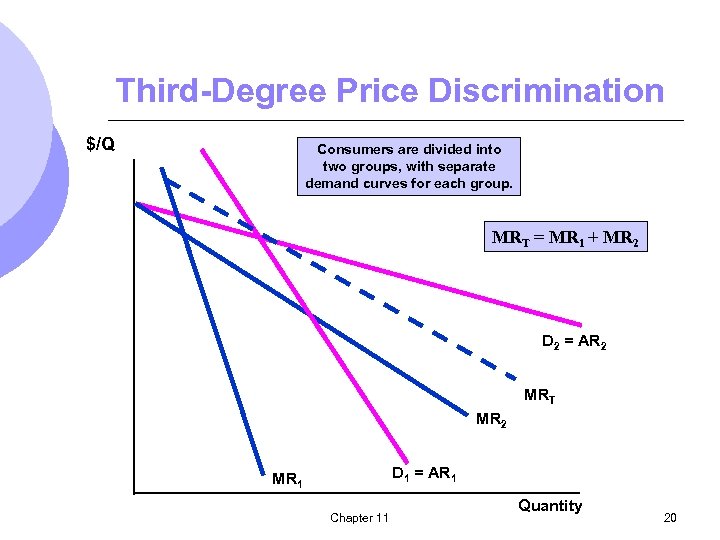

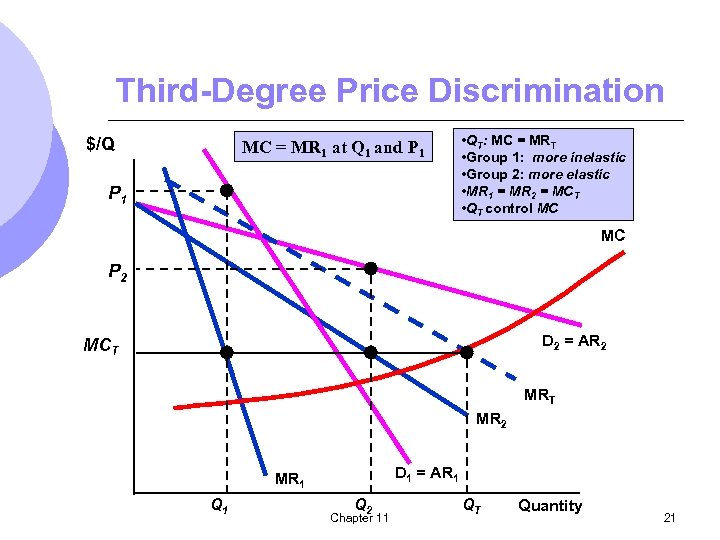

Third-Degree Price Discrimination $/Q Consumers are divided into two groups, with separate demand curves for each group. MRT = MR 1 + MR 2 D 2 = AR 2 MRT MR 2 D 1 = AR 1 MR 1 Chapter 11 Quantity 20

Third-Degree Price Discrimination $/Q Consumers are divided into two groups, with separate demand curves for each group. MRT = MR 1 + MR 2 D 2 = AR 2 MRT MR 2 D 1 = AR 1 MR 1 Chapter 11 Quantity 20

Third-Degree Price Discrimination $/Q MC = MR 1 at Q 1 and P 1 • QT: MC = MRT • Group 1: more inelastic • Group 2: more elastic • MR 1 = MR 2 = MCT • QT control MC MC P 2 D 2 = AR 2 MCT MR 2 D 1 = AR 1 MR 1 Q 2 Chapter 11 QT Quantity 21

Third-Degree Price Discrimination $/Q MC = MR 1 at Q 1 and P 1 • QT: MC = MRT • Group 1: more inelastic • Group 2: more elastic • MR 1 = MR 2 = MCT • QT control MC MC P 2 D 2 = AR 2 MCT MR 2 D 1 = AR 1 MR 1 Q 2 Chapter 11 QT Quantity 21

The Economics of Coupons and Rebates l Those consumers who are more price elastic will tend to use the coupon/rebate more often when they purchase the product than those consumers with a less elastic demand. l Coupons and rebate programs allow firms to price discriminate. Chapter 11 22

The Economics of Coupons and Rebates l Those consumers who are more price elastic will tend to use the coupon/rebate more often when they purchase the product than those consumers with a less elastic demand. l Coupons and rebate programs allow firms to price discriminate. Chapter 11 22

Airline Fares l Differences in elasticities imply that some customers will pay a higher fare than others. l Business travelers have few choices and their demand is less elastic. l Casual travelers and families are more price sensitive and will therefore be choosier. Chapter 11 23

Airline Fares l Differences in elasticities imply that some customers will pay a higher fare than others. l Business travelers have few choices and their demand is less elastic. l Casual travelers and families are more price sensitive and will therefore be choosier. Chapter 11 23

Airline Fares l There are multiple fares for every route flown by airlines l They separate the market by setting various restrictions on the tickets. Chapter 11 24

Airline Fares l There are multiple fares for every route flown by airlines l They separate the market by setting various restrictions on the tickets. Chapter 11 24

Other Types of Price Discrimination l Intertemporal Price Discrimination m. Practice of separating consumers with different demand functions into different groups by charging different prices at different points in time m. Initial release of a product, the demand is inelastic l Hard back v. paperback book l New release movie l Technology Chapter 11 25

Other Types of Price Discrimination l Intertemporal Price Discrimination m. Practice of separating consumers with different demand functions into different groups by charging different prices at different points in time m. Initial release of a product, the demand is inelastic l Hard back v. paperback book l New release movie l Technology Chapter 11 25

Intertemporal Price Discrimination l Once this market has yielded a maximum profit, firms lower the price to appeal to a general market with a more elastic demand. l This can be seen graphically looking at two different groups of consumers – one willing to buy right now and one willing to wait. Chapter 11 26

Intertemporal Price Discrimination l Once this market has yielded a maximum profit, firms lower the price to appeal to a general market with a more elastic demand. l This can be seen graphically looking at two different groups of consumers – one willing to buy right now and one willing to wait. Chapter 11 26

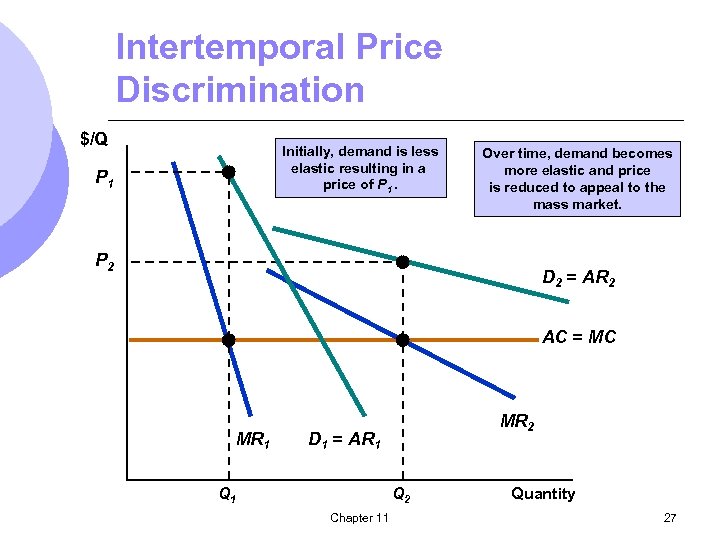

Intertemporal Price Discrimination $/Q Initially, demand is less elastic resulting in a price of P 1 Over time, demand becomes more elastic and price is reduced to appeal to the mass market. P 2 D 2 = AR 2 AC = MC MR 1 MR 2 D 1 = AR 1 Q 2 Chapter 11 Quantity 27

Intertemporal Price Discrimination $/Q Initially, demand is less elastic resulting in a price of P 1 Over time, demand becomes more elastic and price is reduced to appeal to the mass market. P 2 D 2 = AR 2 AC = MC MR 1 MR 2 D 1 = AR 1 Q 2 Chapter 11 Quantity 27

Other Types of Price Discrimination l Peak-Load Pricing m. Practice of charging higher prices during peak periods when capacity constraints cause marginal costs to be higher. l Demand for some products may peak at particular times. m. Rush hour traffic m. Electricity - late summer afternoons m. Ski resorts on weekends Chapter 11 28

Other Types of Price Discrimination l Peak-Load Pricing m. Practice of charging higher prices during peak periods when capacity constraints cause marginal costs to be higher. l Demand for some products may peak at particular times. m. Rush hour traffic m. Electricity - late summer afternoons m. Ski resorts on weekends Chapter 11 28

Peak-Load Pricing l Objective is to increase efficiency by charging customers close to marginal cost Chapter 11 29

Peak-Load Pricing l Objective is to increase efficiency by charging customers close to marginal cost Chapter 11 29

Peak-Load Pricing l With third-degree price discrimination, the MR for all markets was equal l MR is not equal for each market because one market does not impact the other market with peak-load pricing. m. Price and sales in each market are independent m. Ex: electricity, movie theaters Chapter 11 30

Peak-Load Pricing l With third-degree price discrimination, the MR for all markets was equal l MR is not equal for each market because one market does not impact the other market with peak-load pricing. m. Price and sales in each market are independent m. Ex: electricity, movie theaters Chapter 11 30

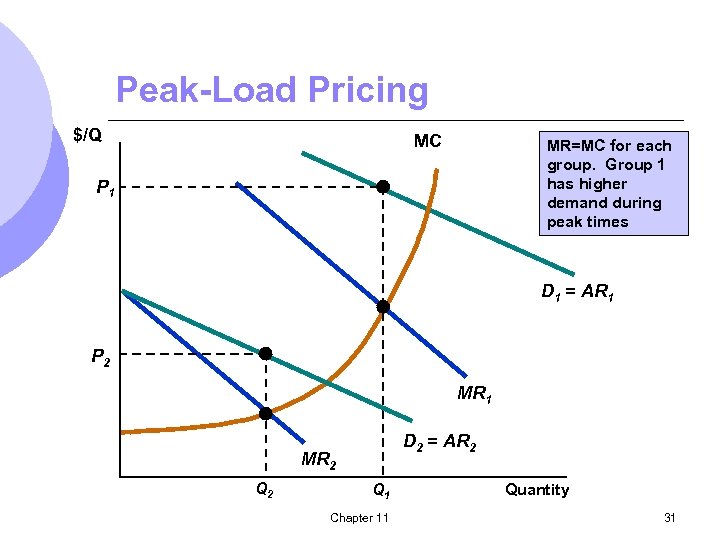

Peak-Load Pricing $/Q MC MR=MC for each group. Group 1 has higher demand during peak times P 1 D 1 = AR 1 P 2 MR 1 D 2 = AR 2 MR 2 Q 1 Chapter 11 Quantity 31

Peak-Load Pricing $/Q MC MR=MC for each group. Group 1 has higher demand during peak times P 1 D 1 = AR 1 P 2 MR 1 D 2 = AR 2 MR 2 Q 1 Chapter 11 Quantity 31

The Two-Part Tariff l Form of pricing in which consumers are charged both an entry and usage fee. l A fee is charged upfront for right to use/buy the product l An additional fee is charged for each unit the consumer wishes to consume Chapter 11 32

The Two-Part Tariff l Form of pricing in which consumers are charged both an entry and usage fee. l A fee is charged upfront for right to use/buy the product l An additional fee is charged for each unit the consumer wishes to consume Chapter 11 32

The Two-Part Tariff l Pricing decision is setting the entry fee (T) and the usage fee (P). l Choosing the trade-off between free-entry and high-use prices or high-entry and zero-use prices. l Single Consumer m. Assume firm knows consumer demand m. Firm wants to capture as much consumer surplus as possible Chapter 11 33

The Two-Part Tariff l Pricing decision is setting the entry fee (T) and the usage fee (P). l Choosing the trade-off between free-entry and high-use prices or high-entry and zero-use prices. l Single Consumer m. Assume firm knows consumer demand m. Firm wants to capture as much consumer surplus as possible Chapter 11 33

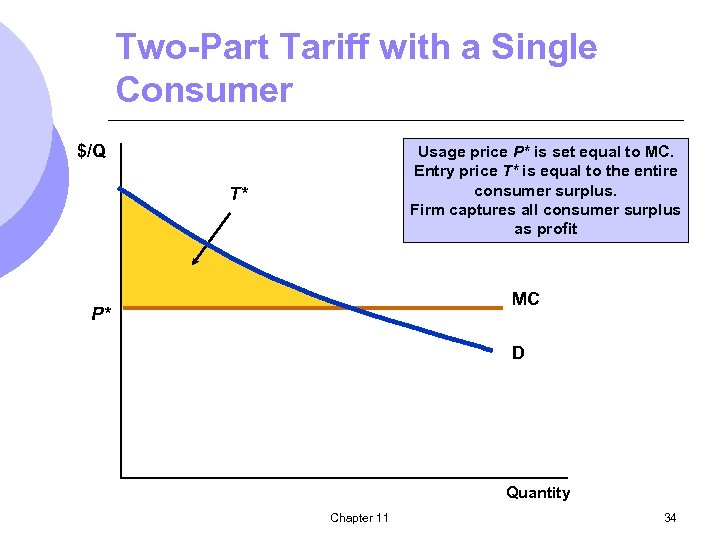

Two-Part Tariff with a Single Consumer $/Q Usage price P* is set equal to MC. Entry price T* is equal to the entire consumer surplus. Firm captures all consumer surplus as profit T* MC P* D Quantity Chapter 11 34

Two-Part Tariff with a Single Consumer $/Q Usage price P* is set equal to MC. Entry price T* is equal to the entire consumer surplus. Firm captures all consumer surplus as profit T* MC P* D Quantity Chapter 11 34

The Two-Part Tariff with Many Consumers l No exact way to determine P* and T*. l Must consider the trade-off between the entry fee T* and the use fee P*. m. Low entry fee: more entrants and more profit form sales of item m. As entry fee becomes smaller, number of entrants is larger and profit from entry fee will fall Chapter 11 35

The Two-Part Tariff with Many Consumers l No exact way to determine P* and T*. l Must consider the trade-off between the entry fee T* and the use fee P*. m. Low entry fee: more entrants and more profit form sales of item m. As entry fee becomes smaller, number of entrants is larger and profit from entry fee will fall Chapter 11 35

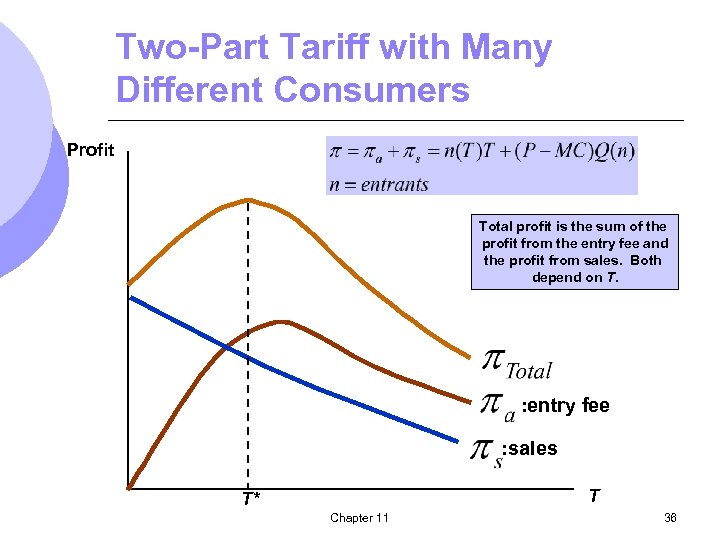

Two-Part Tariff with Many Different Consumers Profit Total profit is the sum of the profit from the entry fee and the profit from sales. Both depend on T. : entry fee : sales T T* Chapter 11 36

Two-Part Tariff with Many Different Consumers Profit Total profit is the sum of the profit from the entry fee and the profit from sales. Both depend on T. : entry fee : sales T T* Chapter 11 36

The Two-Part Tariff l Rule of Thumb m. Similar demand: Choose P close to MC and high T m. Dissimilar demand: Choose high P and low T. m. Ex: Disneyland in California and Disney world in Florida have a strategy of high entry fee and charge nothing for ride. Chapter 11 37

The Two-Part Tariff l Rule of Thumb m. Similar demand: Choose P close to MC and high T m. Dissimilar demand: Choose high P and low T. m. Ex: Disneyland in California and Disney world in Florida have a strategy of high entry fee and charge nothing for ride. Chapter 11 37

Bundling l Bundling is packaging two or more products to gain a pricing advantage. l Conditions necessary for bundling m. Heterogeneous customers m. Price discrimination is not possible m. Demands must be negatively correlated Chapter 11 38

Bundling l Bundling is packaging two or more products to gain a pricing advantage. l Conditions necessary for bundling m. Heterogeneous customers m. Price discrimination is not possible m. Demands must be negatively correlated Chapter 11 38

Bundling l When film company leased “Gone with the Wind” it required theaters to also lease “Getting Gertie’s Garter. ” l Why would a company do this? m. Company must be able to increase revenue. m. We can see the reservation prices for each theater and movie. Chapter 11 39

Bundling l When film company leased “Gone with the Wind” it required theaters to also lease “Getting Gertie’s Garter. ” l Why would a company do this? m. Company must be able to increase revenue. m. We can see the reservation prices for each theater and movie. Chapter 11 39

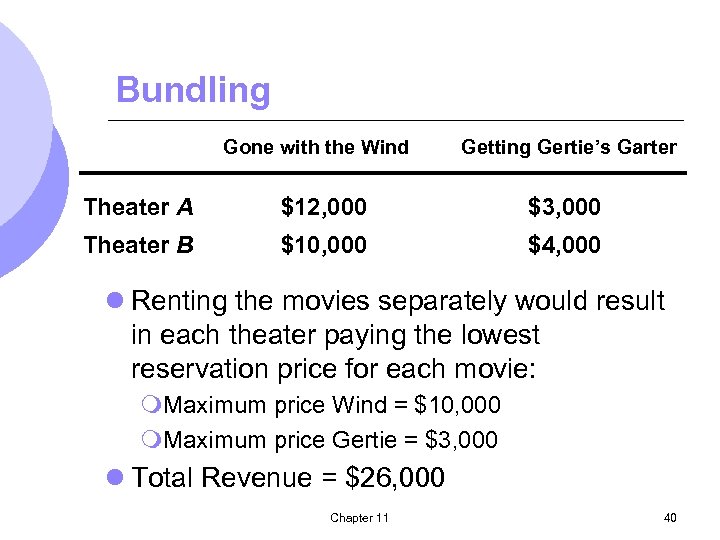

Bundling Gone with the Wind Getting Gertie’s Garter Theater A $12, 000 $3, 000 Theater B $10, 000 $4, 000 l Renting the movies separately would result in each theater paying the lowest reservation price for each movie: m. Maximum price Wind = $10, 000 m. Maximum price Gertie = $3, 000 l Total Revenue = $26, 000 Chapter 11 40

Bundling Gone with the Wind Getting Gertie’s Garter Theater A $12, 000 $3, 000 Theater B $10, 000 $4, 000 l Renting the movies separately would result in each theater paying the lowest reservation price for each movie: m. Maximum price Wind = $10, 000 m. Maximum price Gertie = $3, 000 l Total Revenue = $26, 000 Chapter 11 40

Bundling l If the movies are bundled: m. Theater A will pay $15, 000 for both m. Theater B will pay $14, 000 for both l If each were charged the lower of the two prices, total revenue will be $28, 000. l The movie company will gain more revenue ($2000) by bundling the movie Chapter 11 41

Bundling l If the movies are bundled: m. Theater A will pay $15, 000 for both m. Theater B will pay $14, 000 for both l If each were charged the lower of the two prices, total revenue will be $28, 000. l The movie company will gain more revenue ($2000) by bundling the movie Chapter 11 41

Relative Valuations l More profitable to bundle because relative valuation of two films are reversed l Demands are negatively correlated m. A pays more for Wind ($12, 000) than B ($10, 000). m. B pays more for Gertie ($4, 000) than A ($3, 000). Chapter 11 42

Relative Valuations l More profitable to bundle because relative valuation of two films are reversed l Demands are negatively correlated m. A pays more for Wind ($12, 000) than B ($10, 000). m. B pays more for Gertie ($4, 000) than A ($3, 000). Chapter 11 42

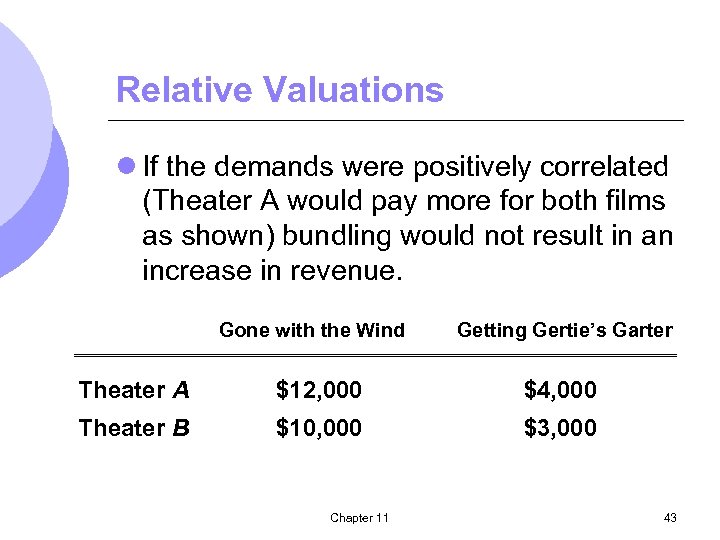

Relative Valuations l If the demands were positively correlated (Theater A would pay more for both films as shown) bundling would not result in an increase in revenue. Gone with the Wind Getting Gertie’s Garter Theater A $12, 000 $4, 000 Theater B $10, 000 $3, 000 Chapter 11 43

Relative Valuations l If the demands were positively correlated (Theater A would pay more for both films as shown) bundling would not result in an increase in revenue. Gone with the Wind Getting Gertie’s Garter Theater A $12, 000 $4, 000 Theater B $10, 000 $3, 000 Chapter 11 43

Bundling l If the movies are bundled: m. Theater A will pay $16, 000 for both m. Theater B will pay $13, 000 for both l If each were charged the lower of the two prices, total revenue will be $26, 000, the same as by selling the films separately. Chapter 11 44

Bundling l If the movies are bundled: m. Theater A will pay $16, 000 for both m. Theater B will pay $13, 000 for both l If each were charged the lower of the two prices, total revenue will be $26, 000, the same as by selling the films separately. Chapter 11 44

Bundling in Practice l Car purchasing m. Bundles of options such as electric locks with air conditioning l Vacation Travel m. Bundling hotel with air fare l Cable television m. Premium channels bundled together Chapter 11 45

Bundling in Practice l Car purchasing m. Bundles of options such as electric locks with air conditioning l Vacation Travel m. Bundling hotel with air fare l Cable television m. Premium channels bundled together Chapter 11 45

Tying l Practice of requiring a customer to purchase one good in order to purchase another. m. Xerox machines and the paper m. IBM mainframe and computer cards l Allows firm to meter demand practice price discrimination more effectively. Chapter 11 46

Tying l Practice of requiring a customer to purchase one good in order to purchase another. m. Xerox machines and the paper m. IBM mainframe and computer cards l Allows firm to meter demand practice price discrimination more effectively. Chapter 11 46