ee57e7629ba0351d255d1c9762244331.ppt

- Количество слайдов: 20

Chapter 11 Input Demand: The Capital Market and the Investment Decision © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Chapter 11 Input Demand: The Capital Market and the Investment Decision © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital • One of the most important concepts in all of economics is the concept of capital. • In the labor and land markets, the labor and land are supplied directly to the demanders of these inputs…however, households often supply capital indirectly • Capital goods are those goods produced by the economic system that are used as inputs to produce other goods and services in the future. Hence they yield valuable productive services over time © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital • One of the most important concepts in all of economics is the concept of capital. • In the labor and land markets, the labor and land are supplied directly to the demanders of these inputs…however, households often supply capital indirectly • Capital goods are those goods produced by the economic system that are used as inputs to produce other goods and services in the future. Hence they yield valuable productive services over time © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital 1. Physical/ Tangible Capital 2. Social Capital 3. Intangible Capital © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital 1. Physical/ Tangible Capital 2. Social Capital 3. Intangible Capital © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

1. Tangible/ Physical Capital • Physical, or tangible, capital refers to the material things used as inputs in the production of future goods and services. • Major categories of physical capital: 1. Nonresidential structures- office buildings, power plants, factories, warehouses, etc 2. Durable equipment- machines, trucks, automobiles, etc 3. Residential structures 4. Inventories of inputs and outputs that firms keep in stock. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

1. Tangible/ Physical Capital • Physical, or tangible, capital refers to the material things used as inputs in the production of future goods and services. • Major categories of physical capital: 1. Nonresidential structures- office buildings, power plants, factories, warehouses, etc 2. Durable equipment- machines, trucks, automobiles, etc 3. Residential structures 4. Inventories of inputs and outputs that firms keep in stock. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

2. Social Capital • Social capital (also called infrastructure) is capital that provides services to the public. • Major categories of social capital: 1. Public works (roads and bridges) 2. Public services (police and fire protection) © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

2. Social Capital • Social capital (also called infrastructure) is capital that provides services to the public. • Major categories of social capital: 1. Public works (roads and bridges) 2. Public services (police and fire protection) © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

3. Intangible Capital • Nonmaterial things that contribute to the output of future goods and services are known as intangible capital. • For example, an advertising campaign to establish a brand name produces intangible capital called goodwill. • Human capital is a form of intangible capital that includes the skills and other knowledge that workers have or acquire through education and training. • Human capital yields valuable services to a firm over time. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

3. Intangible Capital • Nonmaterial things that contribute to the output of future goods and services are known as intangible capital. • For example, an advertising campaign to establish a brand name produces intangible capital called goodwill. • Human capital is a form of intangible capital that includes the skills and other knowledge that workers have or acquire through education and training. • Human capital yields valuable services to a firm over time. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Time Dimension • The most important dimension of capital is the fact that it exists through time- capital goods exist now and in future as well. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Time Dimension • The most important dimension of capital is the fact that it exists through time- capital goods exist now and in future as well. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Measuring Capital • Since capital comes in so many forms, hence it is impossible to measure it directly in physical terms. • Capital is measured as a stock value, i. e. , at a point of time • The measure of a firm’s capital stock is the current market value of its plant, equipment, inventories, and intangible assets. • When we speak of capital, we refer NOT to money or financial assets such as bonds or stocks, but to the firm’s physical plant, equipment, inventory, and intangible assets. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Measuring Capital • Since capital comes in so many forms, hence it is impossible to measure it directly in physical terms. • Capital is measured as a stock value, i. e. , at a point of time • The measure of a firm’s capital stock is the current market value of its plant, equipment, inventories, and intangible assets. • When we speak of capital, we refer NOT to money or financial assets such as bonds or stocks, but to the firm’s physical plant, equipment, inventory, and intangible assets. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Investment • Capital stocks are affected over time by 2 flows: investment and depreciation • Investment refers to new capital additions to a firm’s capital stock. • Although capital is measured at a given point in time (a stock), investment is measured over a period of time (a flow). • In economics, investing strictly refers only to increase in capital stock and not investments in bonds and shares. • The flow of investment increases the capital stock. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Investment • Capital stocks are affected over time by 2 flows: investment and depreciation • Investment refers to new capital additions to a firm’s capital stock. • Although capital is measured at a given point in time (a stock), investment is measured over a period of time (a flow). • In economics, investing strictly refers only to increase in capital stock and not investments in bonds and shares. • The flow of investment increases the capital stock. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

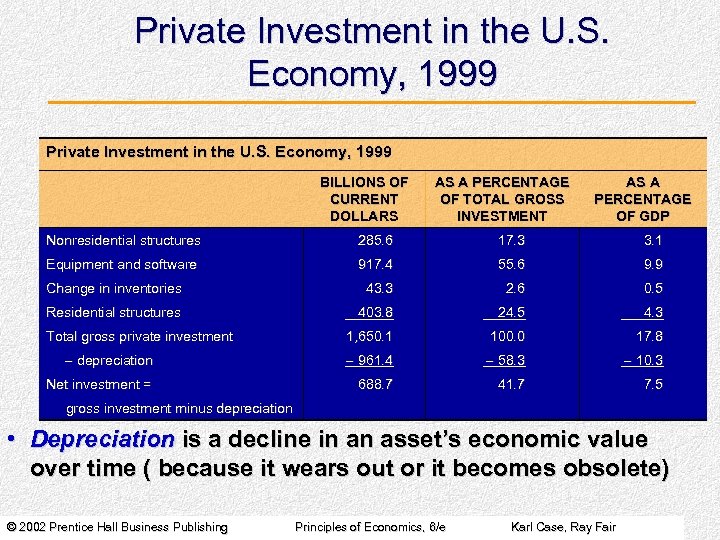

Private Investment in the U. S. Economy, 1999 BILLIONS OF CURRENT DOLLARS AS A PERCENTAGE OF TOTAL GROSS INVESTMENT AS A PERCENTAGE OF GDP Nonresidential structures 285. 6 17. 3 3. 1 Equipment and software 917. 4 55. 6 9. 9 Change in inventories 43. 3 2. 6 0. 5 Residential structures 403. 8 24. 5 4. 3 1, 650. 1 100. 0 17. 8 - depreciation - 961. 4 - 58. 3 - 10. 3 Net investment = 688. 7 41. 7 7. 5 Total gross private investment gross investment minus depreciation • Depreciation is a decline in an asset’s economic value over time ( because it wears out or it becomes obsolete) © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Private Investment in the U. S. Economy, 1999 BILLIONS OF CURRENT DOLLARS AS A PERCENTAGE OF TOTAL GROSS INVESTMENT AS A PERCENTAGE OF GDP Nonresidential structures 285. 6 17. 3 3. 1 Equipment and software 917. 4 55. 6 9. 9 Change in inventories 43. 3 2. 6 0. 5 Residential structures 403. 8 24. 5 4. 3 1, 650. 1 100. 0 17. 8 - depreciation - 961. 4 - 58. 3 - 10. 3 Net investment = 688. 7 41. 7 7. 5 Total gross private investment gross investment minus depreciation • Depreciation is a decline in an asset’s economic value over time ( because it wears out or it becomes obsolete) © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Capital Market • Where does capital come from? • How and why is it produced? • How much and what kind of capital is produced? • Who pays for it? • The capital market is a market in which households supply their savings to firms that demand funds to buy capital goods. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Capital Market • Where does capital come from? • How and why is it produced? • How much and what kind of capital is produced? • Who pays for it? • The capital market is a market in which households supply their savings to firms that demand funds to buy capital goods. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

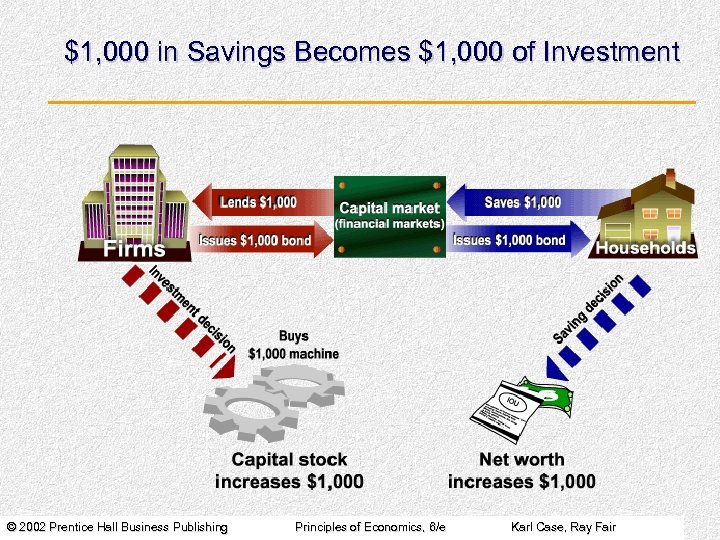

$1, 000 in Savings Becomes $1, 000 of Investment © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

$1, 000 in Savings Becomes $1, 000 of Investment © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Bond Lending • A bond is a contract between a borrower and a lender, in which the borrower agrees to pay the loan at some time in the future, along with interest payments along the way. • In essence, households supply the capital demanded by a business firm. Presumably, the investment will generate added revenues that will facilitate the payment of interest to the household. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Bond Lending • A bond is a contract between a borrower and a lender, in which the borrower agrees to pay the loan at some time in the future, along with interest payments along the way. • In essence, households supply the capital demanded by a business firm. Presumably, the investment will generate added revenues that will facilitate the payment of interest to the household. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Financial Capital Market • The financial capital market is the part of the capital market in which savers and investors interact through intermediaries (like banks, insurance companies, etc) that stand between the lender and borrower. • However, at times the savings get transferred into investment even without an intermediary. E. g. when an entrepreneur uses his own savings to start his business © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

The Financial Capital Market • The financial capital market is the part of the capital market in which savers and investors interact through intermediaries (like banks, insurance companies, etc) that stand between the lender and borrower. • However, at times the savings get transferred into investment even without an intermediary. E. g. when an entrepreneur uses his own savings to start his business © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital Income: Interest and Profit Capital income is income earned on savings that have been put to use through financial capital markets. • Two most important forms of capital income are: 1. Interest is the payment made for the use of money. Interest is a reward for postponing consumption. 2. Profit is the excess of revenues over cost in a given period. Profit is a reward for innovation and risk taking. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Capital Income: Interest and Profit Capital income is income earned on savings that have been put to use through financial capital markets. • Two most important forms of capital income are: 1. Interest is the payment made for the use of money. Interest is a reward for postponing consumption. 2. Profit is the excess of revenues over cost in a given period. Profit is a reward for innovation and risk taking. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Interest • The interest rate is almost always expressed as an annual rate • It is usually agreed at the time of the loan/deposit being made • Interest rates may be adjustable/ floating rates OR fixed rates • A loans interest rate depends on a number of factors, the most important being risk © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Interest • The interest rate is almost always expressed as an annual rate • It is usually agreed at the time of the loan/deposit being made • Interest rates may be adjustable/ floating rates OR fixed rates • A loans interest rate depends on a number of factors, the most important being risk © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Profits • Profit is another word for Net Income • Profits belong to the owners of a firm • A share/ common stock/ common equity is a certificate that represents ownership of a share of business. • The owners of share called shareholders • When profits are paid directly to shareholders, it is called dividend • Accounting profit vs. Economic profits © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Profits • Profit is another word for Net Income • Profits belong to the owners of a firm • A share/ common stock/ common equity is a certificate that represents ownership of a share of business. • The owners of share called shareholders • When profits are paid directly to shareholders, it is called dividend • Accounting profit vs. Economic profits © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Functions of Interest and Profit Capital Income serves several functions: 1. Interest may function as an incentive to postpone gratification 2. Profits serve as a reward for innovation and risk taking © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Functions of Interest and Profit Capital Income serves several functions: 1. Interest may function as an incentive to postpone gratification 2. Profits serve as a reward for innovation and risk taking © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Forming Expectations • Decision makers must have expectations about what is going to happen in the future. • The investment process requires that the potential investor evaluate the expected flow of future productive services that an investment project will yield. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Forming Expectations • Decision makers must have expectations about what is going to happen in the future. • The investment process requires that the potential investor evaluate the expected flow of future productive services that an investment project will yield. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Present Value • The present value (PV), or present discounted value, of R dollars t years from now is: • Lower interest rates result in higher present values. The firm has to pay more now to purchase the same number of future dollars. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair

Present Value • The present value (PV), or present discounted value, of R dollars t years from now is: • Lower interest rates result in higher present values. The firm has to pay more now to purchase the same number of future dollars. © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray Fair