86fd826c3789558da3d6257fca552503.ppt

- Количество слайдов: 25

Chapter 11: Externalities & Property Rights Part I

Chapter 11: Externalities & Property Rights Part I

Externality n An externality (or spillover) is a cost or benefit arising from an economic activity that falls on people who do not participate in that activity. n n Disposal of chemical wastes in a river (negative production externality) Proving a mathematical theorem (positive production externality) Consumption of Liquor (negative consumption externality) Consumption of education (positive consumption externality)

Externality n An externality (or spillover) is a cost or benefit arising from an economic activity that falls on people who do not participate in that activity. n n Disposal of chemical wastes in a river (negative production externality) Proving a mathematical theorem (positive production externality) Consumption of Liquor (negative consumption externality) Consumption of education (positive consumption externality)

How effective do the private resolve the problem of externalities n Consider a doctor whose ability to examine patients is disrupted by the noise of machinery operated by a confectioner (candy maker) in an adjacent building. n Historically, the economic and legal view is simple and clear: the confectioner’s noise is harming the doctor and should be restrained. n Challenge by Coase (1960): The confectioner’s noise does harm the doctor. But if we prevent the noise, we harm the confectioner.

How effective do the private resolve the problem of externalities n Consider a doctor whose ability to examine patients is disrupted by the noise of machinery operated by a confectioner (candy maker) in an adjacent building. n Historically, the economic and legal view is simple and clear: the confectioner’s noise is harming the doctor and should be restrained. n Challenge by Coase (1960): The confectioner’s noise does harm the doctor. But if we prevent the noise, we harm the confectioner.

The Coase Theorem n Suppose the damage inflicted to the doctor is 40, while the gain the confectioner receives from operating the shop is 60. When bargaining cost is low, the same efficient outcome prevails (the confectioner will keep on operating). n If confectioner is liable for his damage to the doctor, he will pay the doctor in order to harass him. If not, the confectioner will simply ignore the doctor and keep on operating. n Coase theorem states that: When the parties affected by externalities can negotiate costlessly with one another, the efficient outcome results no matter how the law assigns liability for damages. (In the absence of transaction cost, ownership does not matter. )

The Coase Theorem n Suppose the damage inflicted to the doctor is 40, while the gain the confectioner receives from operating the shop is 60. When bargaining cost is low, the same efficient outcome prevails (the confectioner will keep on operating). n If confectioner is liable for his damage to the doctor, he will pay the doctor in order to harass him. If not, the confectioner will simply ignore the doctor and keep on operating. n Coase theorem states that: When the parties affected by externalities can negotiate costlessly with one another, the efficient outcome results no matter how the law assigns liability for damages. (In the absence of transaction cost, ownership does not matter. )

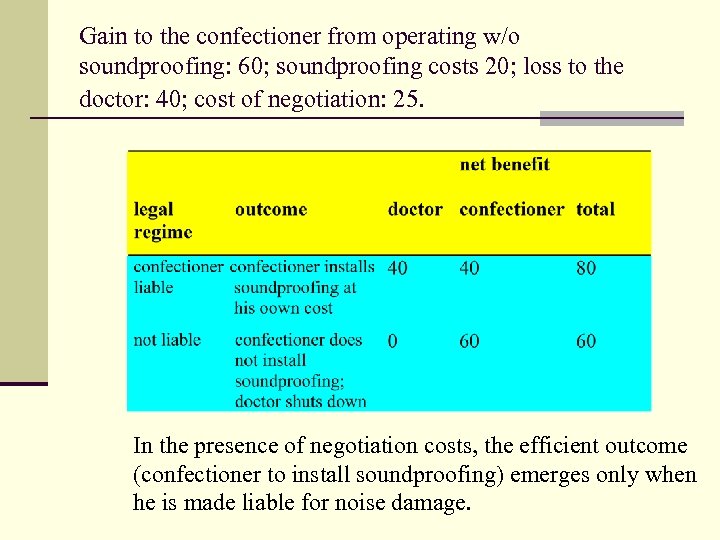

Gain to the confectioner from operating w/o soundproofing: 60; soundproofing costs 20; loss to the doctor: 40; cost of negotiation: 25. In the presence of negotiation costs, the efficient outcome (confectioner to install soundproofing) emerges only when he is made liable for noise damage.

Gain to the confectioner from operating w/o soundproofing: 60; soundproofing costs 20; loss to the doctor: 40; cost of negotiation: 25. In the presence of negotiation costs, the efficient outcome (confectioner to install soundproofing) emerges only when he is made liable for noise damage.

Is Coase theorem relevant? n Why the Coase theorem may not work in practice? Sunk costs--the one who initiates the negotiation will have some cost sunk upfront. n Transaction costs--costs of negotiating, writing and enforcing a contract. n Multiple parties--the issue may involve a large number of people, and reaching an arrangement among such a large number of people is prohibitively difficult. n

Is Coase theorem relevant? n Why the Coase theorem may not work in practice? Sunk costs--the one who initiates the negotiation will have some cost sunk upfront. n Transaction costs--costs of negotiating, writing and enforcing a contract. n Multiple parties--the issue may involve a large number of people, and reaching an arrangement among such a large number of people is prohibitively difficult. n

Some applications of the Coase theorem n why smoking in public is prohibited but in private is not? n why protecting freedom of speech when it could be wrongly used? n For a developer to build a hotel in the airspace above my land, he must first secure my permission. But the law permits commercial airliners to fly over my land without payment whenever they choose. Why this distinction?

Some applications of the Coase theorem n why smoking in public is prohibited but in private is not? n why protecting freedom of speech when it could be wrongly used? n For a developer to build a hotel in the airspace above my land, he must first secure my permission. But the law permits commercial airliners to fly over my land without payment whenever they choose. Why this distinction?

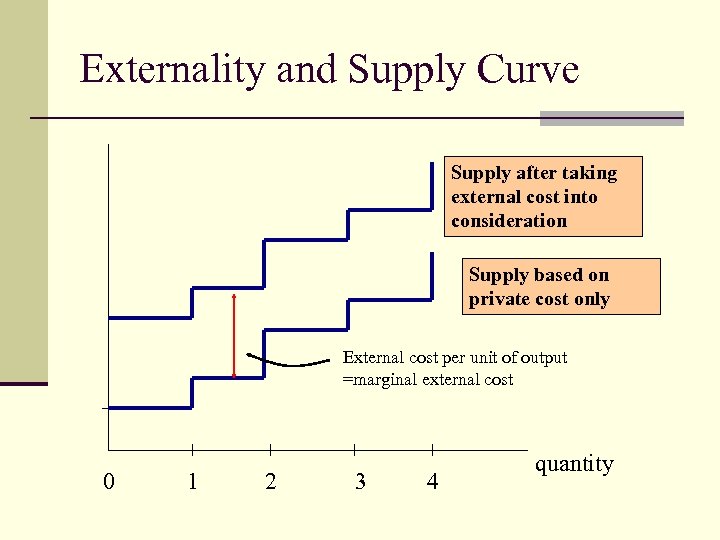

Externality and Supply Curve Supply after taking external cost into consideration Supply based on private cost only External cost per unit of output =marginal external cost 0 1 2 3 4 quantity

Externality and Supply Curve Supply after taking external cost into consideration Supply based on private cost only External cost per unit of output =marginal external cost 0 1 2 3 4 quantity

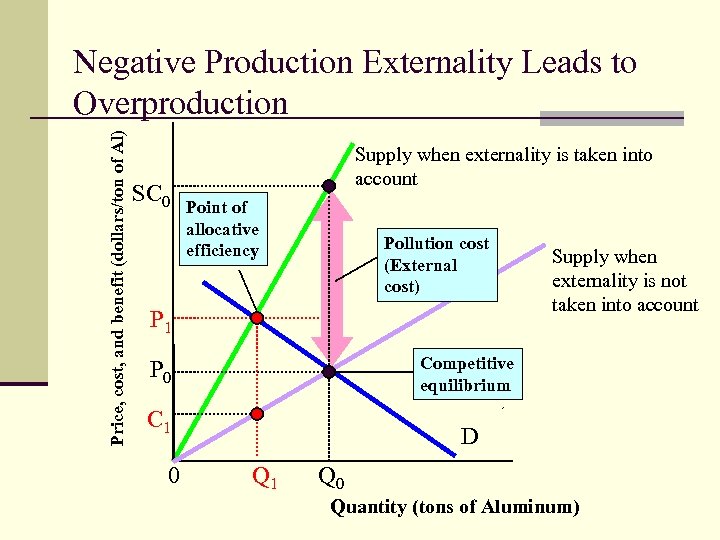

Price, cost, and benefit (dollars/ton of Al) Negative Production Externality Leads to Overproduction SC 0 Supply when externality is taken into account Point of allocative efficiency Pollution cost (External cost) P 1 Competitive equilibrium P 0 C 1 0 Supply when externality is not taken into account D Q 1 Q 0 Quantity (tons of Aluminum)

Price, cost, and benefit (dollars/ton of Al) Negative Production Externality Leads to Overproduction SC 0 Supply when externality is taken into account Point of allocative efficiency Pollution cost (External cost) P 1 Competitive equilibrium P 0 C 1 0 Supply when externality is not taken into account D Q 1 Q 0 Quantity (tons of Aluminum)

Public Policy on Externalities n Government has a wide range of measures to deal with negative production externalities (e. g. chemical waste) n Complete prohibition n Quantity Restriction n Pollution tax (Pigou tax) n Marketable Permits n Improvement in Pollution Abatement Technology

Public Policy on Externalities n Government has a wide range of measures to deal with negative production externalities (e. g. chemical waste) n Complete prohibition n Quantity Restriction n Pollution tax (Pigou tax) n Marketable Permits n Improvement in Pollution Abatement Technology

Quantity Restriction vs Pigou Tax n Suppose there are two firms A and B each releasing 600 tons of wastes into water each year. And the government wants to restrict to a total of 600 tons each year. It could restrict each firm to release up to 300 tons of waste a year. (quantity restriction) n Taxes can be used to provide incentives for firms A and B to cut back on its production that creates external costs. For instance, levy a pollution tax of $20 K/ton of waste. (Pigou tax)

Quantity Restriction vs Pigou Tax n Suppose there are two firms A and B each releasing 600 tons of wastes into water each year. And the government wants to restrict to a total of 600 tons each year. It could restrict each firm to release up to 300 tons of waste a year. (quantity restriction) n Taxes can be used to provide incentives for firms A and B to cut back on its production that creates external costs. For instance, levy a pollution tax of $20 K/ton of waste. (Pigou tax)

Quantity Restriction vs Pigou Tax n Suppose both measures can achieve the 600 tons target. Then which is better? n Most economists think that taxation is better than quantity restriction. n Suppose the cost of abatement for firm A is $10 K per ton and for firm B is $50 K per ton. n Then each reducing to 300 tons of wastes requires a total cost of $10 K x 300 + $50 K x 300 = $18 M.

Quantity Restriction vs Pigou Tax n Suppose both measures can achieve the 600 tons target. Then which is better? n Most economists think that taxation is better than quantity restriction. n Suppose the cost of abatement for firm A is $10 K per ton and for firm B is $50 K per ton. n Then each reducing to 300 tons of wastes requires a total cost of $10 K x 300 + $50 K x 300 = $18 M.

Quantity Restriction vs Pigou Tax n Clearly, the least costly way is to let firm A do all the abatement. Total cost = $10 K X 600 = $6 M. n To implement this outcome, the government can levy a pollution tax of $20 K per ton. Then firm A will do all the abatement.

Quantity Restriction vs Pigou Tax n Clearly, the least costly way is to let firm A do all the abatement. Total cost = $10 K X 600 = $6 M. n To implement this outcome, the government can levy a pollution tax of $20 K per ton. Then firm A will do all the abatement.

Marketable Permits n Besides Pigou tax, government can also issue marketable permits to all involving firms. n e. g. Issue a permit to firm A and firm B, respectively, to allow each of them to release up to 300 tons of waste a year. Then firm B will buy a permit of 300 tons from firm A to release up to 600 tons of waste. n Market Environmentalism!!! Issuing marketable permits requires the least information on the part of government about the industry. n Currently used by the EU countries to control carbon dioxide release.

Marketable Permits n Besides Pigou tax, government can also issue marketable permits to all involving firms. n e. g. Issue a permit to firm A and firm B, respectively, to allow each of them to release up to 300 tons of waste a year. Then firm B will buy a permit of 300 tons from firm A to release up to 600 tons of waste. n Market Environmentalism!!! Issuing marketable permits requires the least information on the part of government about the industry. n Currently used by the EU countries to control carbon dioxide release.

Part II Public Goods and Common Resources

Part II Public Goods and Common Resources

Nonrivalry and Nonexcludability n Non-rivalry n A good is nonrival if the consumption by one person does not decrease the consumption by another n Non-excludability n A good is nonexcludable if it is impossible, or extremely costly, to prevent someone from benefiting from a good

Nonrivalry and Nonexcludability n Non-rivalry n A good is nonrival if the consumption by one person does not decrease the consumption by another n Non-excludability n A good is nonexcludable if it is impossible, or extremely costly, to prevent someone from benefiting from a good

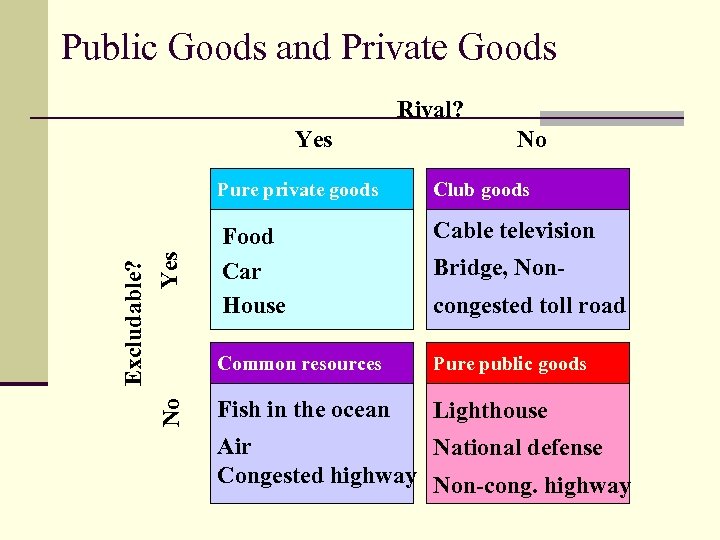

Public Goods and Private Goods Rival? Yes No Excludable? Yes No Pure private goods Club goods Food Car House Cable television Common resources Pure public goods Fish in the ocean Lighthouse Bridge, Noncongested toll road Air National defense Congested highway Non-cong. highway

Public Goods and Private Goods Rival? Yes No Excludable? Yes No Pure private goods Club goods Food Car House Cable television Common resources Pure public goods Fish in the ocean Lighthouse Bridge, Noncongested toll road Air National defense Congested highway Non-cong. highway

Common Resource n Fisheries--Many fisheries have common access such that anyone can fish and no one has a property right to a fish until it is caught. n Many species have been driven to extinction. The catch of Atlantic cod fell from about 4 million tons in the mid-60 s to about 1 million tons today due to overfishing. The tragedy of commons!

Common Resource n Fisheries--Many fisheries have common access such that anyone can fish and no one has a property right to a fish until it is caught. n Many species have been driven to extinction. The catch of Atlantic cod fell from about 4 million tons in the mid-60 s to about 1 million tons today due to overfishing. The tragedy of commons!

Case: Easter Island: tragedy of commons? n Easter Island is a small Pacific island over 3, 200 km from the coast of Chile, with a population of 2. 1 k. n Viewed as a major archaeological and anthropological mystery.

Case: Easter Island: tragedy of commons? n Easter Island is a small Pacific island over 3, 200 km from the coast of Chile, with a population of 2. 1 k. n Viewed as a major archaeological and anthropological mystery.

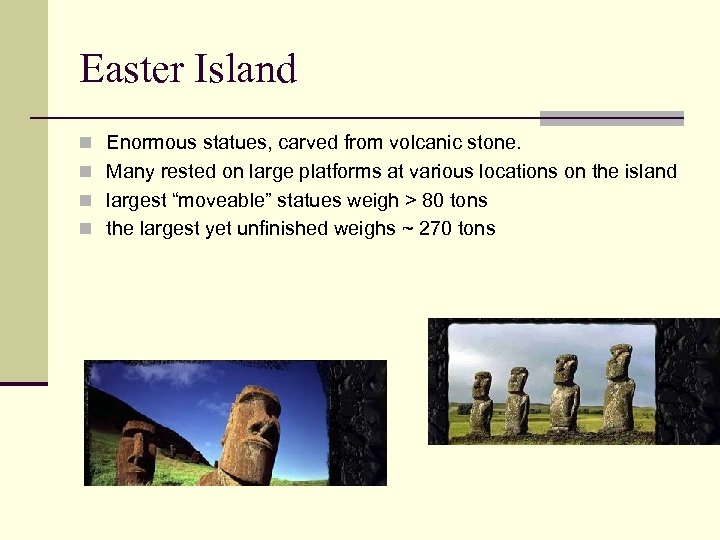

Easter Island n Enormous statues, carved from volcanic stone. n Many rested on large platforms at various locations on the island n largest “moveable” statues weigh > 80 tons n the largest yet unfinished weighs ~ 270 tons

Easter Island n Enormous statues, carved from volcanic stone. n Many rested on large platforms at various locations on the island n largest “moveable” statues weigh > 80 tons n the largest yet unfinished weighs ~ 270 tons

Easter Island n the culture seemed too poor to support a large artisan class n the statues were moved substantial distances; the population too small to move the larger statues n the island had no trees suitable for making tools such as levers, rollers, rope and wooden sleds n Conclusion: rising wealth and rising population, followed by decline.

Easter Island n the culture seemed too poor to support a large artisan class n the statues were moved substantial distances; the population too small to move the larger statues n the island had no trees suitable for making tools such as levers, rollers, rope and wooden sleds n Conclusion: rising wealth and rising population, followed by decline.

Easter Island: Brander & Taylor (1998, AER) n To explain: the cyclical overshooting on Easter Island vs the monotonic behavior on the major Polynesian islands n All else the same: no a priori reason to believe difference in demographics, tastes, or technology. n The only variable: nature of resource. palm tree on Easter Island is a very slow-growing palm (40 to 60 years to yield fruit). It grows nowhere else in Polynesia, and probably the only palm that can live in Easter Island’s relatively cool climate.

Easter Island: Brander & Taylor (1998, AER) n To explain: the cyclical overshooting on Easter Island vs the monotonic behavior on the major Polynesian islands n All else the same: no a priori reason to believe difference in demographics, tastes, or technology. n The only variable: nature of resource. palm tree on Easter Island is a very slow-growing palm (40 to 60 years to yield fruit). It grows nowhere else in Polynesia, and probably the only palm that can live in Easter Island’s relatively cool climate.

Easter Island: Brander & Taylor n The two most common large palms in Polynesia are the Cocos (cononut palm) and the Pritchardia (Fuji fan palm). Neither of these palms can grow on Easter Island, and both are fast-growing trees that reach fruit-growing age in approximately 7 to 10 years.

Easter Island: Brander & Taylor n The two most common large palms in Polynesia are the Cocos (cononut palm) and the Pritchardia (Fuji fan palm). Neither of these palms can grow on Easter Island, and both are fast-growing trees that reach fruit-growing age in approximately 7 to 10 years.

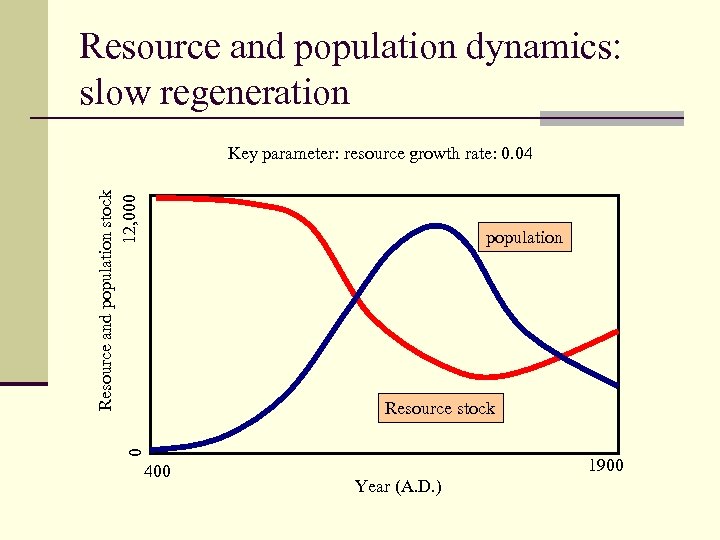

Resource and population dynamics: slow regeneration Resource and population stock 12, 000 Key parameter: resource growth rate: 0. 04 population 0 Resource stock 400 1900 Year (A. D. )

Resource and population dynamics: slow regeneration Resource and population stock 12, 000 Key parameter: resource growth rate: 0. 04 population 0 Resource stock 400 1900 Year (A. D. )

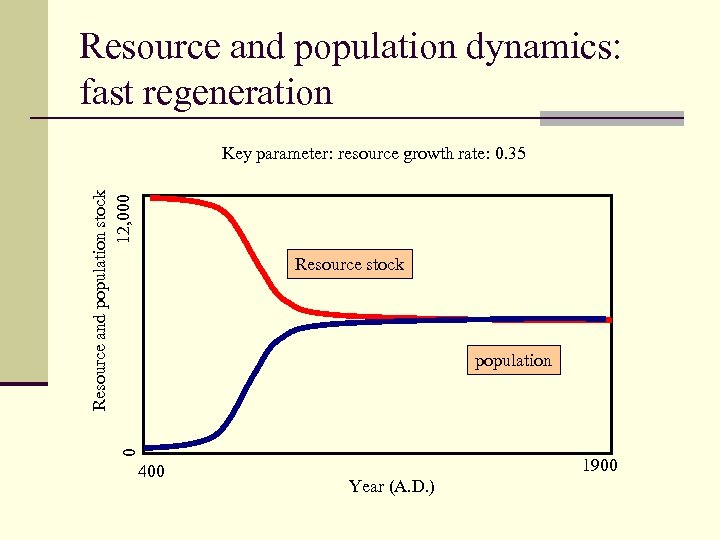

Resource and population dynamics: fast regeneration Resource and population stock 12, 000 Key parameter: resource growth rate: 0. 35 Resource stock 0 population 400 1900 Year (A. D. )

Resource and population dynamics: fast regeneration Resource and population stock 12, 000 Key parameter: resource growth rate: 0. 35 Resource stock 0 population 400 1900 Year (A. D. )