b4aa549f6dd448d127620ea02cb3796f.ppt

- Количество слайдов: 90

Chapter 11 B. Partnerships. Sec. 751 etc. C 11 Chp 11 1 B Ptshp Sec 751 etc 2011 Edited 2011 0104 Howard Godfrey, Ph. D. , CPA Professor of Accounting Copyright 2011

Note to student: This chapter has some very important basic rules which are pretty simple and easy to learn, as well as some more complex rules. The key is to first learn the basic rules and then add the others as you can. If you are not careful, this chapter becomes overwhelming. You can avoid being overwhelmed by concentrating on the simple stuff and mastering it first. (Homework)

1. Determine the amount and character of gain or loss a partner recognizes in a nonliquidating partnership distribution. 2. Determine the partner’s basis of assets received in a nonliquidating partnership distribution. 3. Identify the partnership's Sec. 751 assets. 4. Determine the tax implications of a sale or a cash distribution when the partnership has Sec. 751 assets. 5. Determine the amount and character of gain or loss a partner recognizes in a liquidating partnership distribution. 6. Determine the partner’s basis of assets received in a liquidating distribution. 7. Determine the amount and character of the gain or loss recognized when a partner retires from a partnership or dies. 8. Determine whether a partnership is terminated for tax purposes. 9. Understand the effect of optional and mandatory basis adjustments. 10. Determine the appropriate reporting for the income of an electing large partnership.

Terminating Interest in a Partnership. Liquidating Distributions. Effects of Sec. 751 has the same impact for both liquidating and nonliquidating distributions. A step by step analysis of Sec. 751 on liquidating distributions is needed. 4

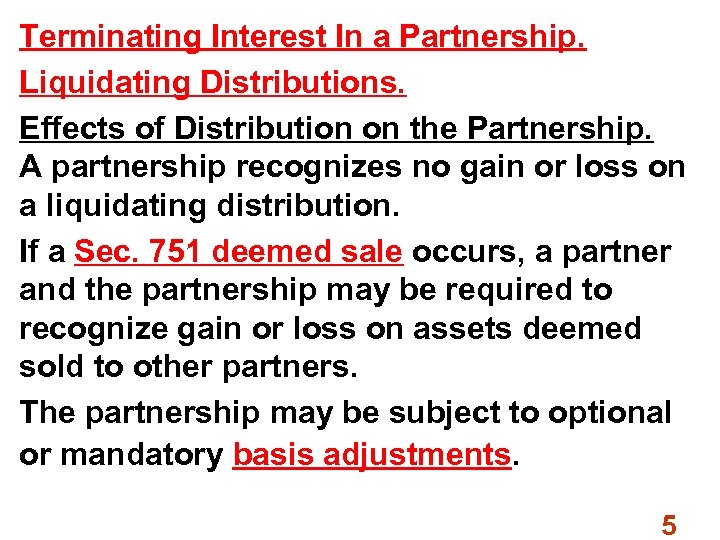

Terminating Interest In a Partnership. Liquidating Distributions. Effects of Distribution on the Partnership. A partnership recognizes no gain or loss on a liquidating distribution. If a Sec. 751 deemed sale occurs, a partner and the partnership may be required to recognize gain or loss on assets deemed sold to other partners. The partnership may be subject to optional or mandatory basis adjustments. 5

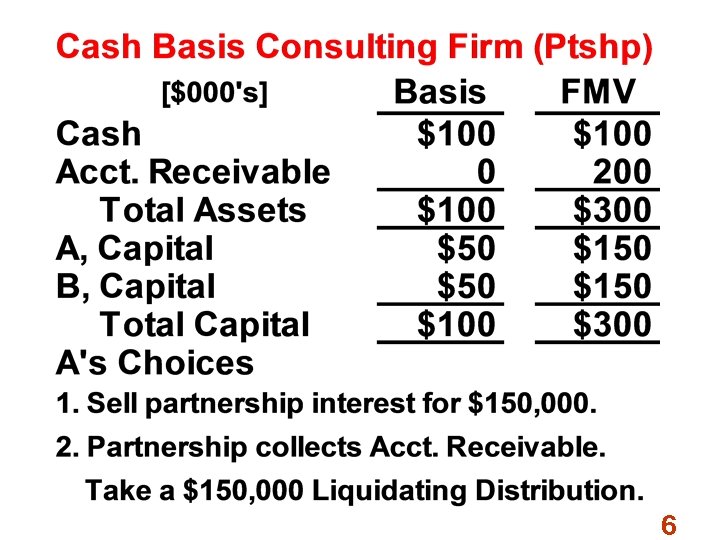

6

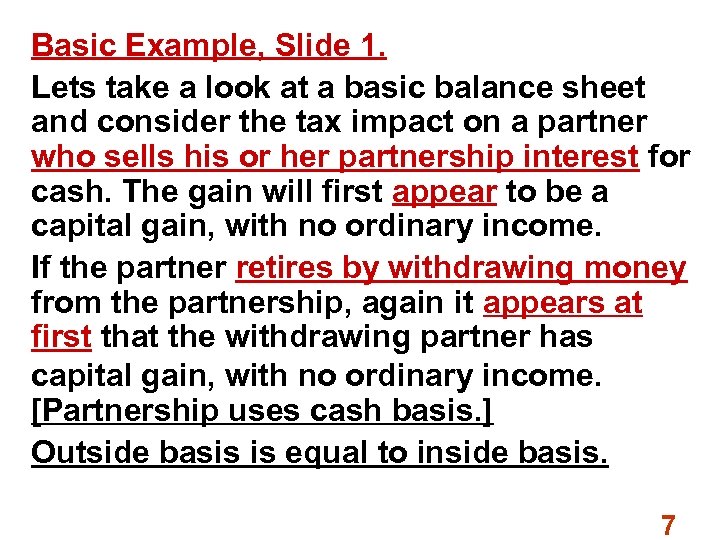

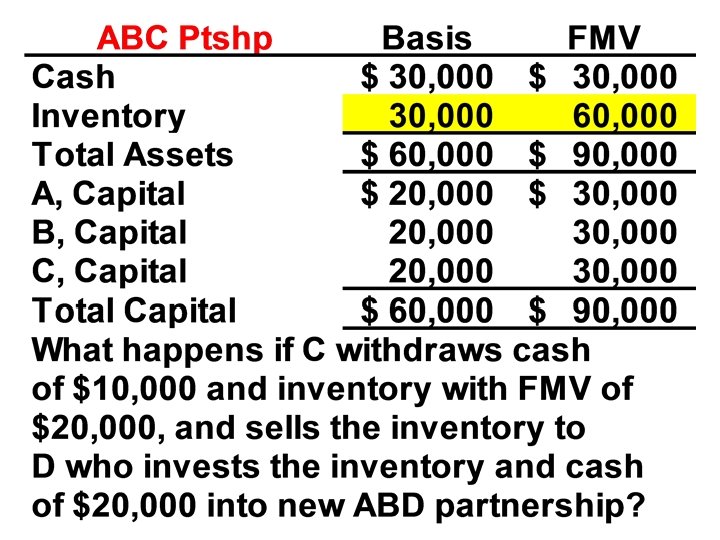

Basic Example, Slide 1. Lets take a look at a basic balance sheet and consider the tax impact on a partner who sells his or her partnership interest for cash. The gain will first appear to be a capital gain, with no ordinary income. If the partner retires by withdrawing money from the partnership, again it appears at first that the withdrawing partner has capital gain, with no ordinary income. [Partnership uses cash basis. ] Outside basis is equal to inside basis. 7

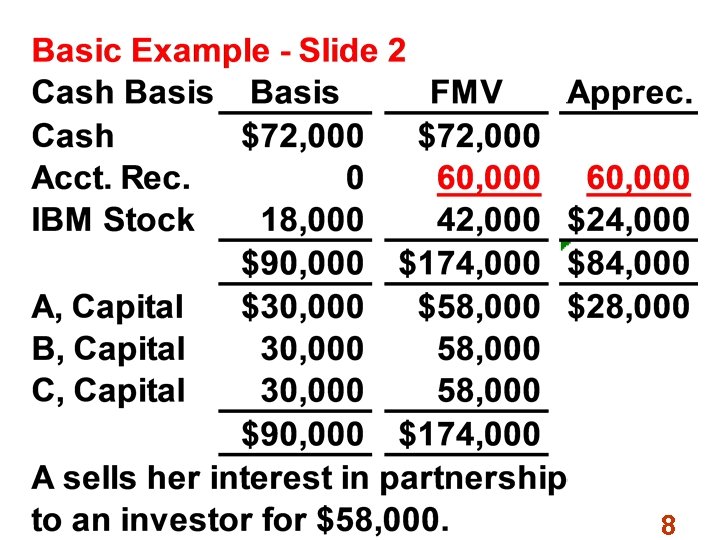

8

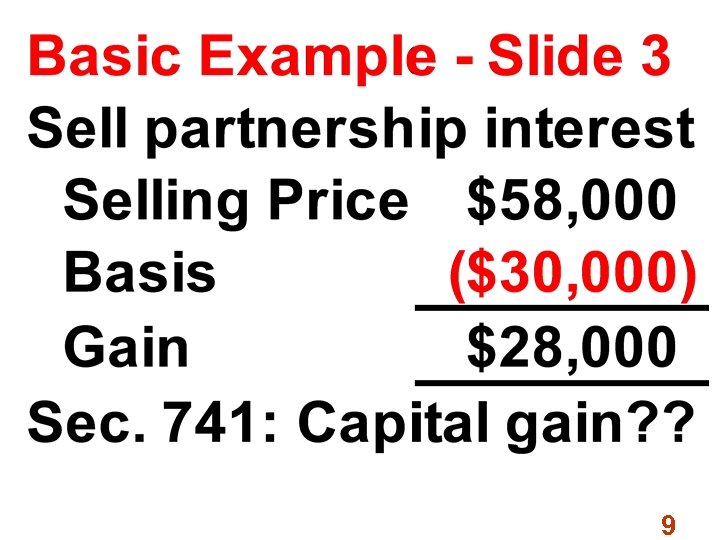

9

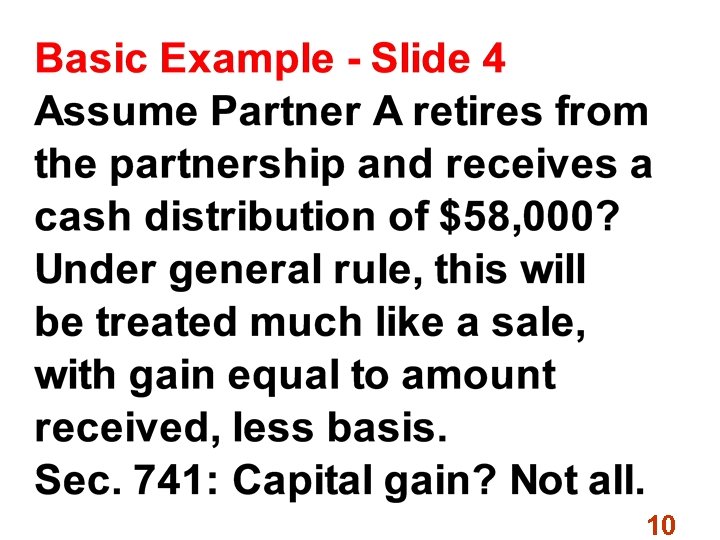

10

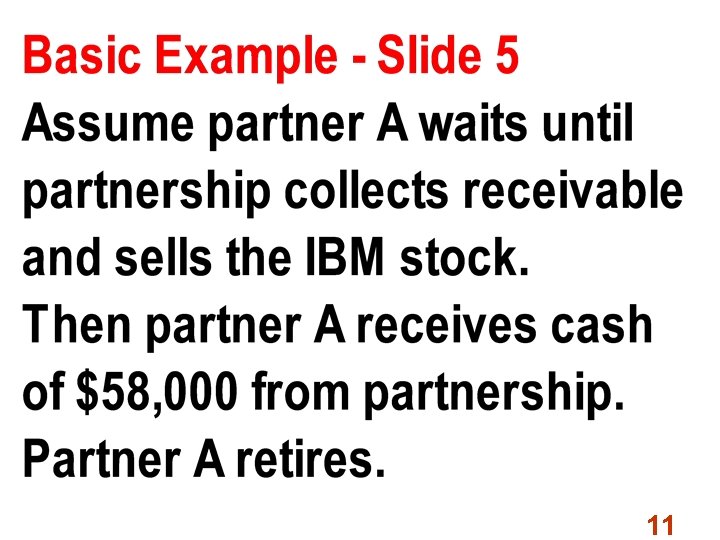

11

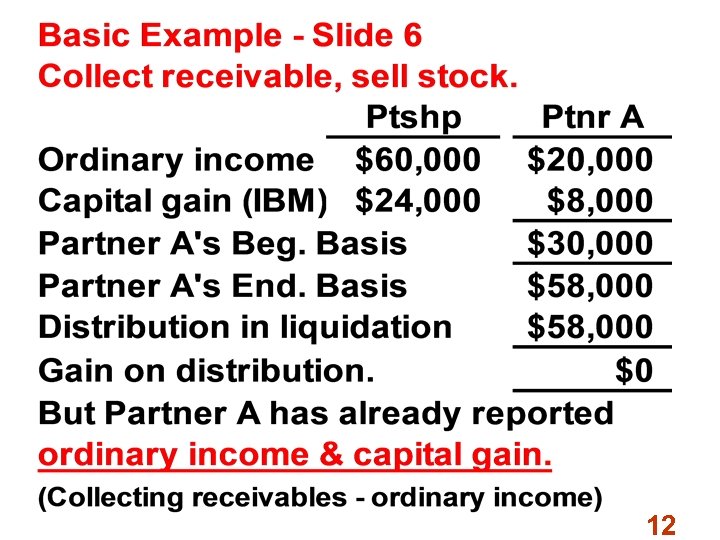

12

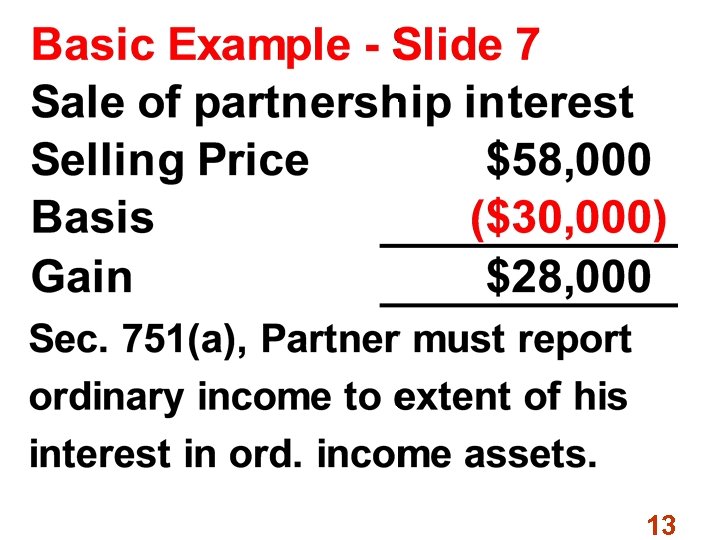

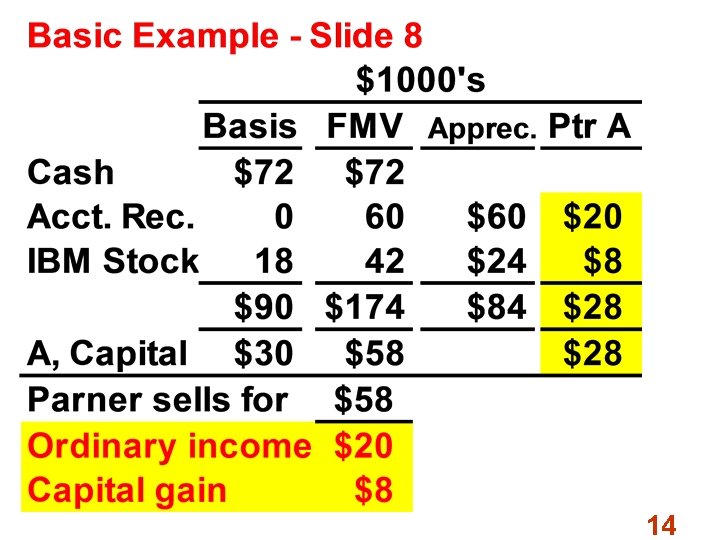

13

14

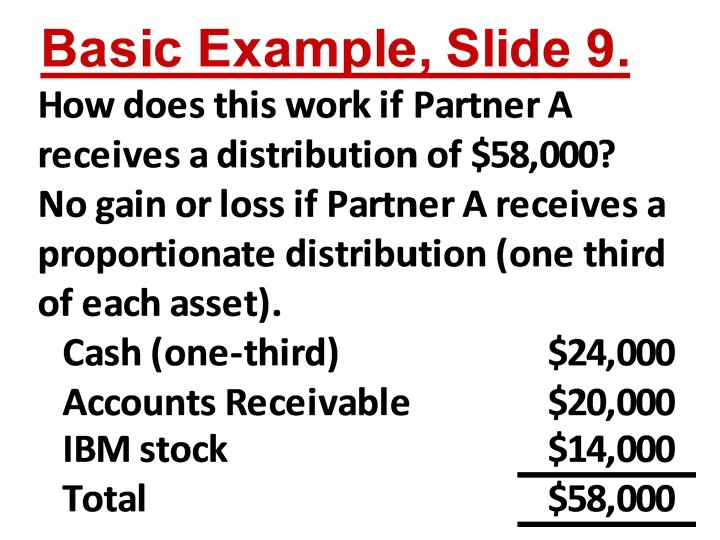

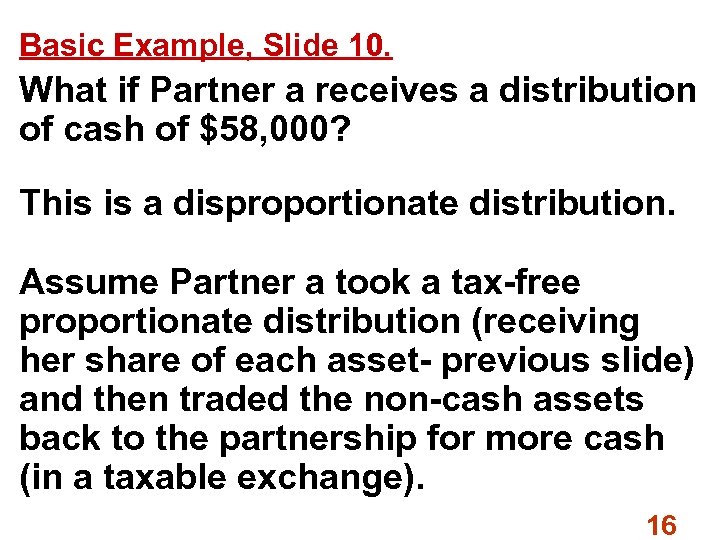

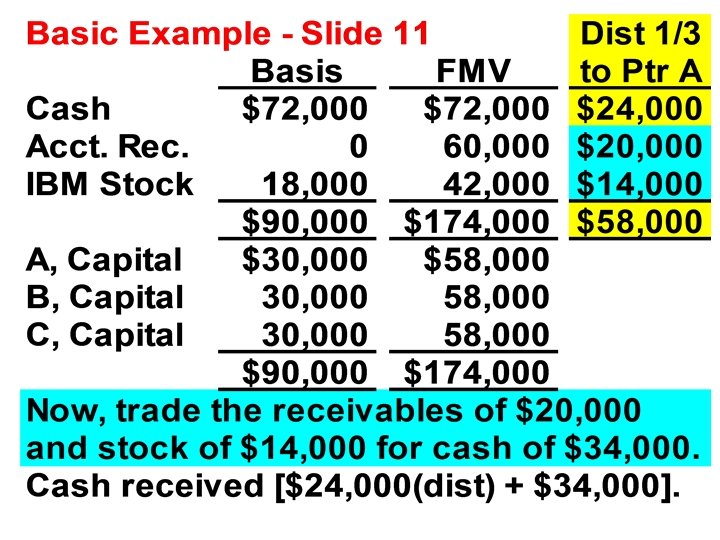

Basic Example, Slide 10. What if Partner a receives a distribution of cash of $58, 000? This is a disproportionate distribution. Assume Partner a took a tax free proportionate distribution (receiving her share of each asset previous slide) and then traded the non cash assets back to the partnership for more cash (in a taxable exchange). 16

Basic Example, Slide 12. Partner A has no gain or loss on the distribution to her of her share of each of the assets. Her basis in those assets is equal to the book value of those assets on the partnership books (because we assume her outside basis is equal to the inside basis). However, she is then treated as selling her receivable and her IBM stock to the partnership at FMV, in a taxable transaction. She will have ordinary income of $20, 000 and capital gain of $18, 000. [Same result that we saw earlier when she waited for the partnership to collect the receivables and sell the IBM stock. Then she took distribution from the partnership. ]

Basic Example, Slide 13. The net effect of Sec. 751 is to keep a partner from avoiding recognizing ordinary income (by converting that into capital gain via a sale of the partnership interest or receiving a distribution from the partnership. ) We pretend the withdrawing partner takes his or her share of all assets and then engages in a taxable exchange to get only the assets that partner wants. 19

Basic Example, Slide 14. Suppose Partner A retires and receives Cash $12, 000 IBM stock worth $42, 000 She chose to let the partnership keep her share of the receivables and part of her share of the cash. She sold her share of the receivables. Partnership used part of the IBM stock (amount above her share) to buy her share of receivable and part of her share of cash. 20

Basic Example, Slide 15. After the “pretend” proportionate distribution of assets to Partner A, all hypothetical exchanges of assets between Partner A and the partnership are fully taxable exchanges (for all parties). We have avoided including liabilities on the balance sheet because that adds complexity and our goal is to see the basics. 21

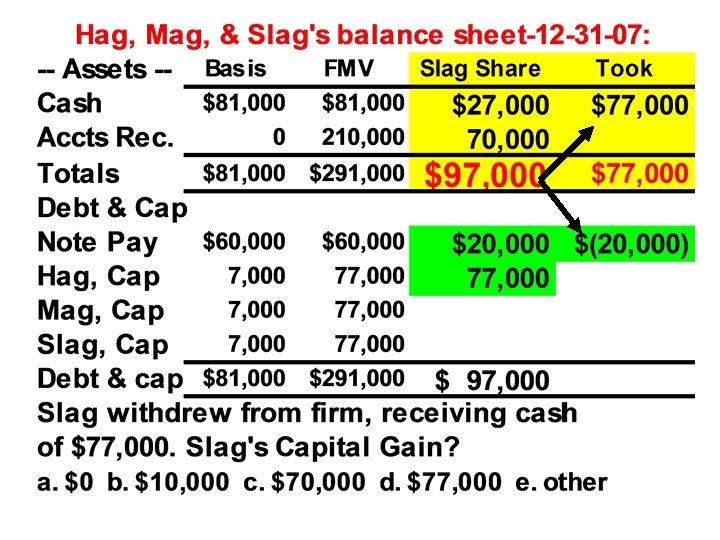

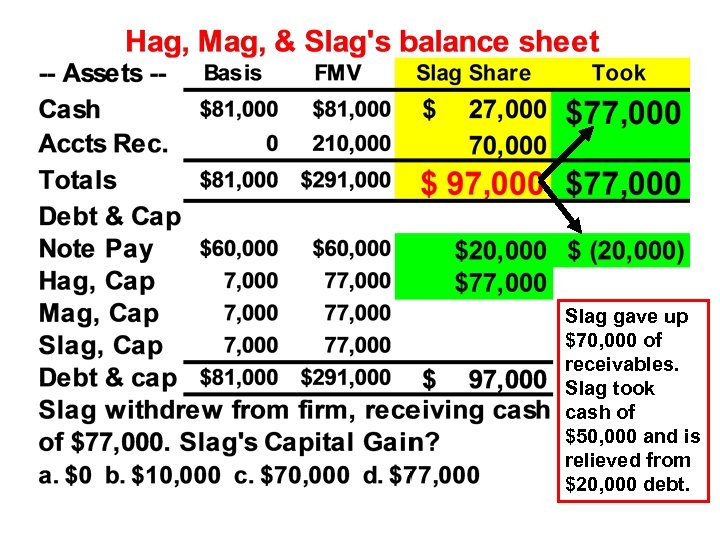

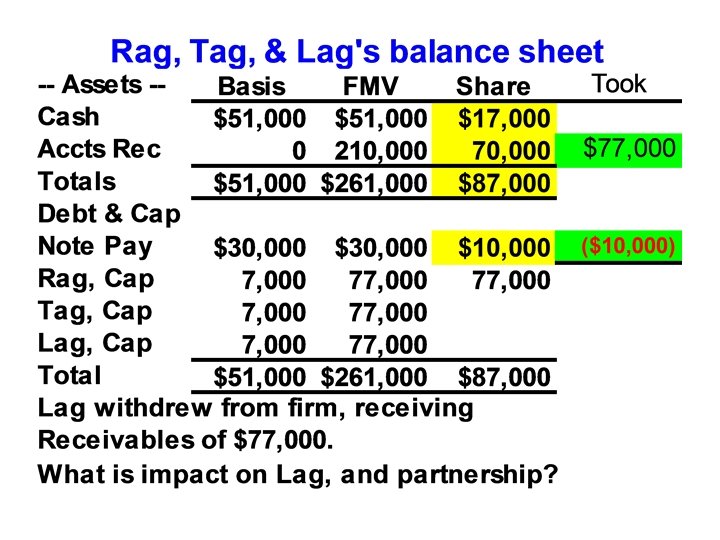

Slag gave up $70, 000 of receivables. Slag took cash of $50, 000 and is relieved from $20, 000 debt.

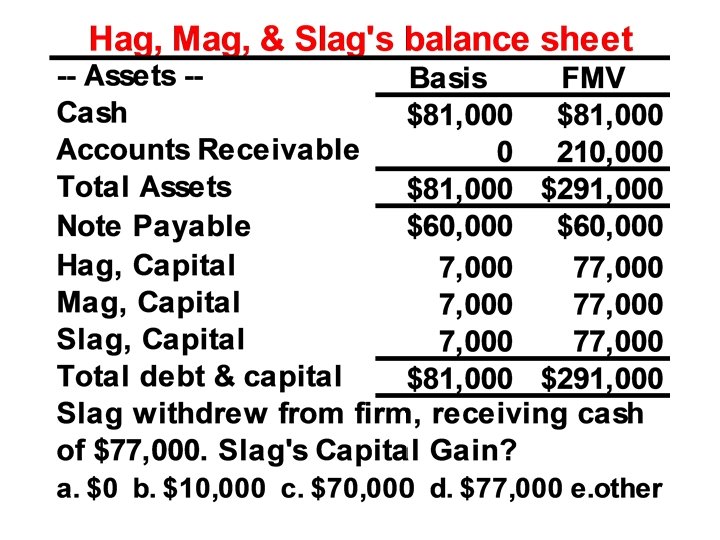

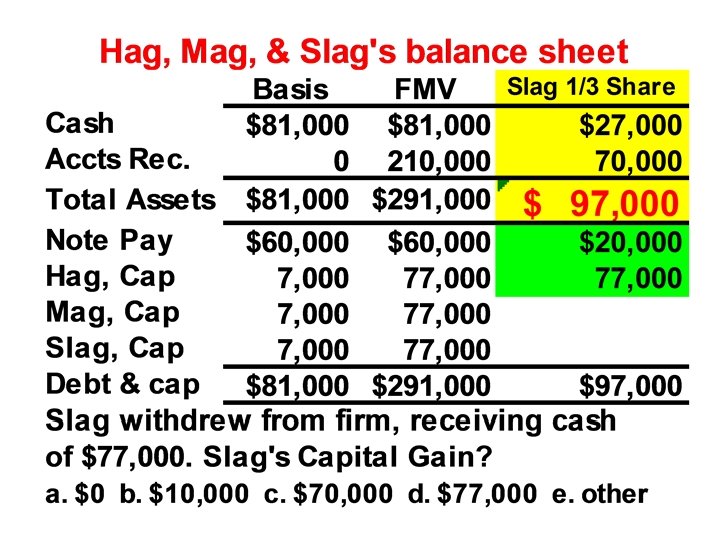

Hint for previous slide. What assets caused his capital to be worth more than the basis of the capital which was $7, 000? Are the Accounts Receivable classified as Sec. 751 Assets? Suppose Slag had withdrawn his one third of each asset, less $10, 000 to pay his share of debt. What additional dealing with the partnership would have been necessary to get him to the point of only having cash from the partnership? 26

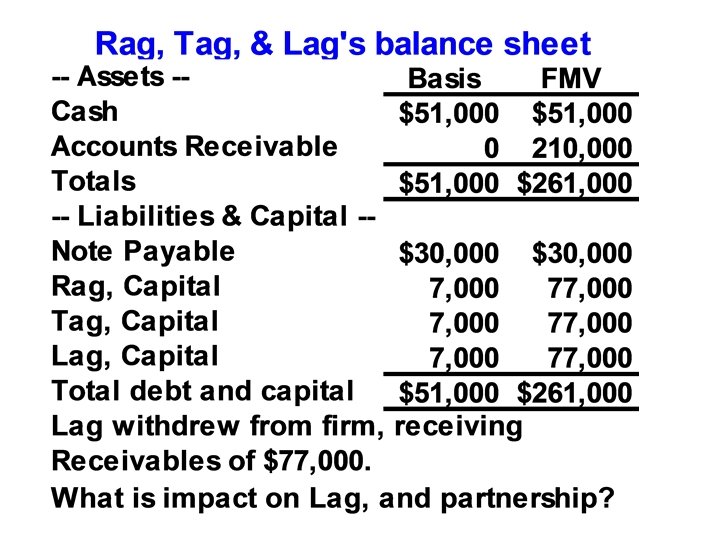

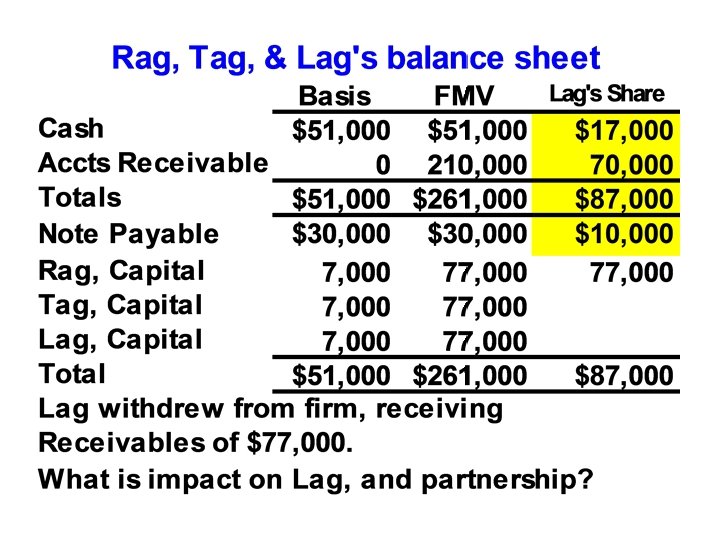

Hint for previous slide: Which party (parties) disposed of his (their) share(s) of unrealized receivables? 30

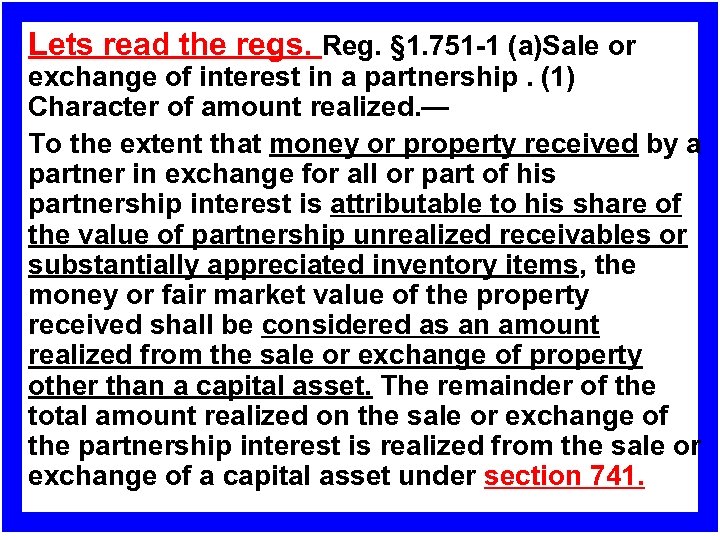

Lets read the regs. Reg. § 1. 751 1 (a)Sale or exchange of interest in a partnership. (1) Character of amount realized. — To the extent that money or property received by a partner in exchange for all or part of his partnership interest is attributable to his share of the value of partnership unrealized receivables or substantially appreciated inventory items, the money or fair market value of the property received shall be considered as an amount realized from the sale or exchange of property other than a capital asset. The remainder of the total amount realized on the sale or exchange of the partnership interest is realized from the sale or exchange of a capital asset under section 741.

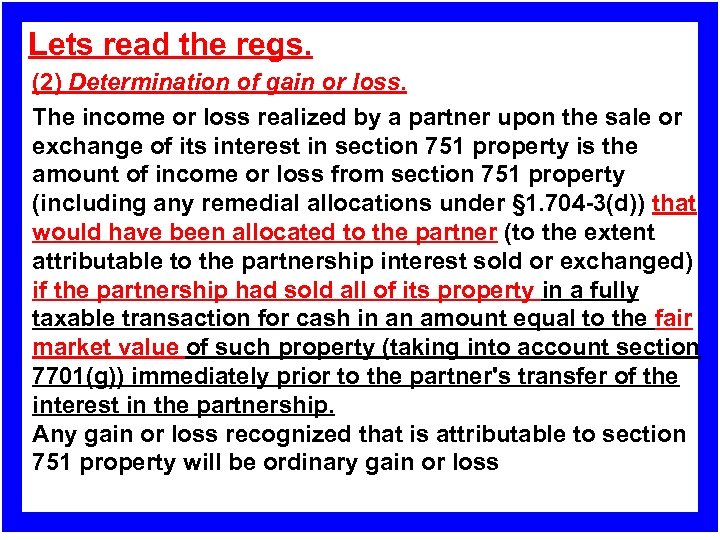

Lets read the regs. (2) Determination of gain or loss. The income or loss realized by a partner upon the sale or exchange of its interest in section 751 property is the amount of income or loss from section 751 property (including any remedial allocations under § 1. 704 3(d)) that would have been allocated to the partner (to the extent attributable to the partnership interest sold or exchanged) if the partnership had sold all of its property in a fully taxable transaction for cash in an amount equal to the fair market value of such property (taking into account section 7701(g)) immediately prior to the partner's transfer of the interest in the partnership. Any gain or loss recognized that is attributable to section 751 property will be ordinary gain or loss

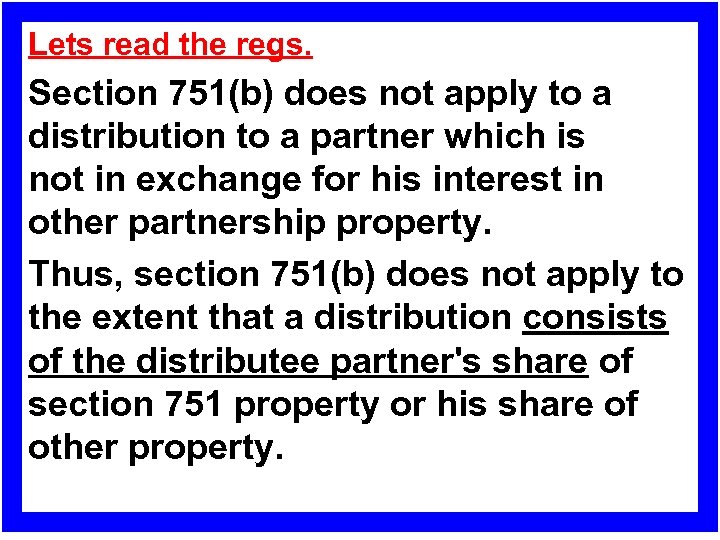

Lets read the regs. Section 751(b) does not apply to a distribution to a partner which is not in exchange for his interest in other partnership property. Thus, section 751(b) does not apply to the extent that a distribution consists of the distributee partner's share of section 751 property or his share of other property.

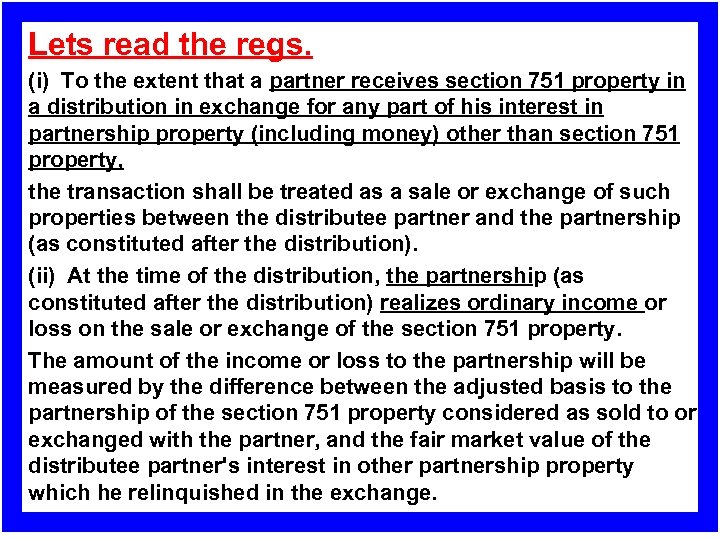

Lets read the regs. (i) To the extent that a partner receives section 751 property in a distribution in exchange for any part of his interest in partnership property (including money) other than section 751 property, the transaction shall be treated as a sale or exchange of such properties between the distributee partner and the partnership (as constituted after the distribution). (ii) At the time of the distribution, the partnership (as constituted after the distribution) realizes ordinary income or loss on the sale or exchange of the section 751 property. The amount of the income or loss to the partnership will be measured by the difference between the adjusted basis to the partnership of the section 751 property considered as sold to or exchanged with the partner, and the fair market value of the distributee partner's interest in other partnership property which he relinquished in the exchange.

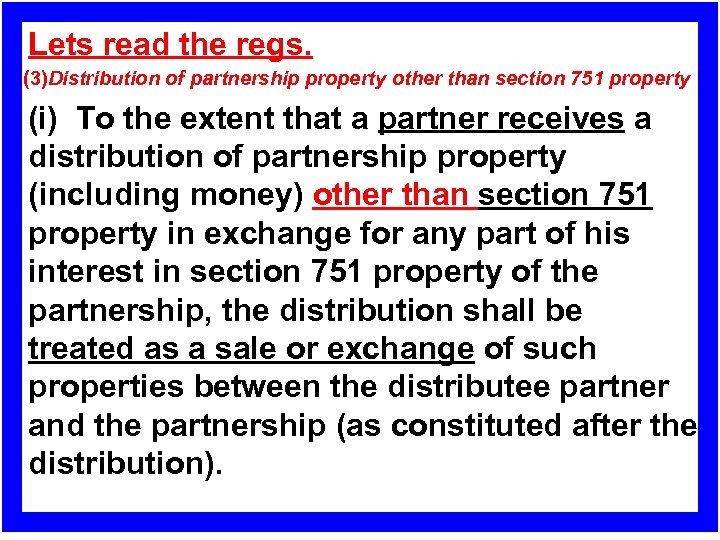

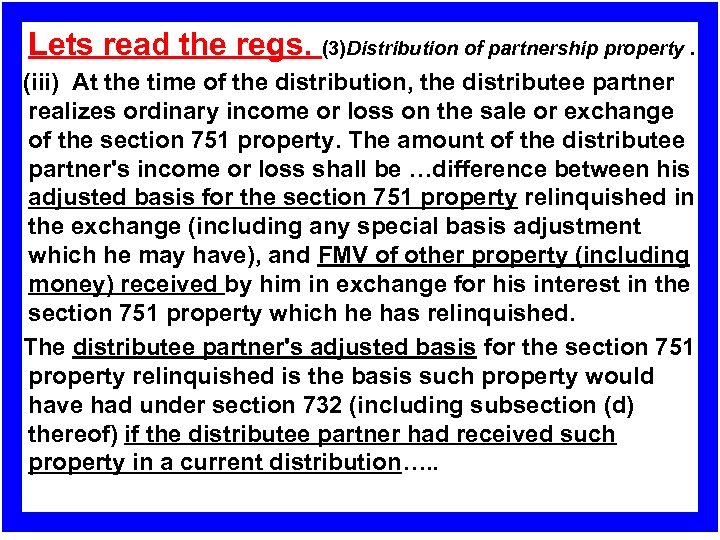

Lets read the regs. (3)Distribution of partnership property other than section 751 property (i) To the extent that a partner receives a distribution of partnership property (including money) other than section 751 property in exchange for any part of his interest in section 751 property of the partnership, the distribution shall be treated as a sale or exchange of such properties between the distributee partner and the partnership (as constituted after the distribution).

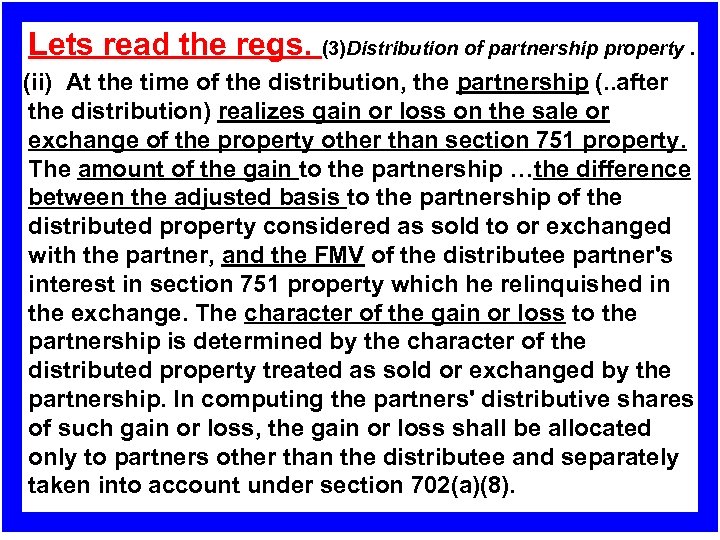

Lets read the regs. (3)Distribution of partnership property. (ii) At the time of the distribution, the partnership (. . after the distribution) realizes gain or loss on the sale or exchange of the property other than section 751 property. The amount of the gain to the partnership …the difference between the adjusted basis to the partnership of the distributed property considered as sold to or exchanged with the partner, and the FMV of the distributee partner's interest in section 751 property which he relinquished in the exchange. The character of the gain or loss to the partnership is determined by the character of the distributed property treated as sold or exchanged by the partnership. In computing the partners' distributive shares of such gain or loss, the gain or loss shall be allocated only to partners other than the distributee and separately taken into account under section 702(a)(8).

Lets read the regs. (3)Distribution of partnership property. (iii) At the time of the distribution, the distributee partner realizes ordinary income or loss on the sale or exchange of the section 751 property. The amount of the distributee partner's income or loss shall be …difference between his adjusted basis for the section 751 property relinquished in the exchange (including any special basis adjustment which he may have), and FMV of other property (including money) received by him in exchange for his interest in the section 751 property which he has relinquished. The distributee partner's adjusted basis for the section 751 property relinquished is the basis such property would have had under section 732 (including subsection (d) thereof) if the distributee partner had received such property in a current distribution…. .

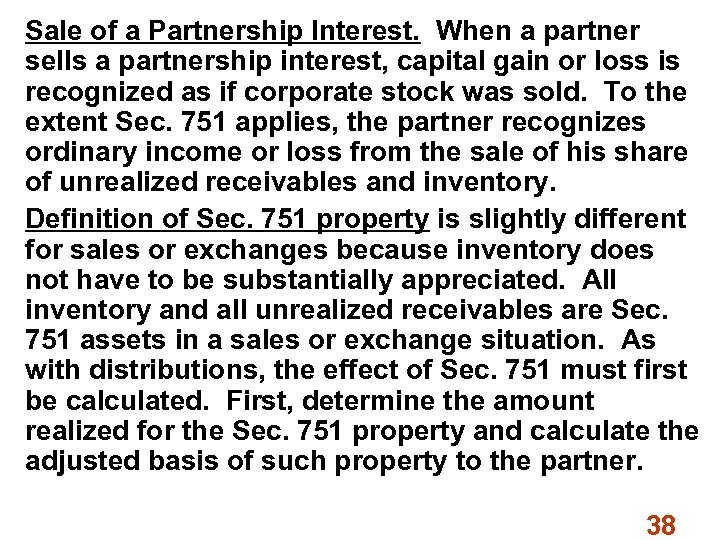

Sale of a Partnership Interest. When a partner sells a partnership interest, capital gain or loss is recognized as if corporate stock was sold. To the extent Sec. 751 applies, the partner recognizes ordinary income or loss from the sale of his share of unrealized receivables and inventory. Definition of Sec. 751 property is slightly different for sales or exchanges because inventory does not have to be substantially appreciated. All inventory and all unrealized receivables are Sec. 751 assets in a sales or exchange situation. As with distributions, the effect of Sec. 751 must first be calculated. First, determine the amount realized for the Sec. 751 property and calculate the adjusted basis of such property to the partner. 38

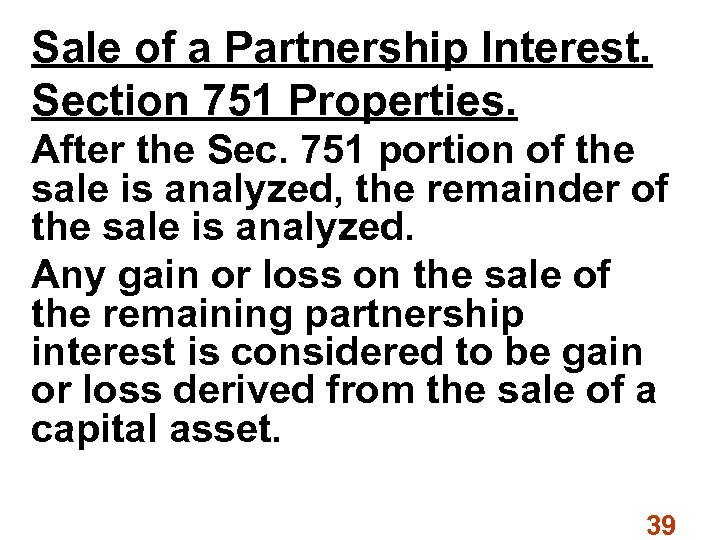

Sale of a Partnership Interest. Section 751 Properties. After the Sec. 751 portion of the sale is analyzed, the remainder of the sale is analyzed. Any gain or loss on the sale of the remaining partnership interest is considered to be gain or loss derived from the sale of a capital asset. 39

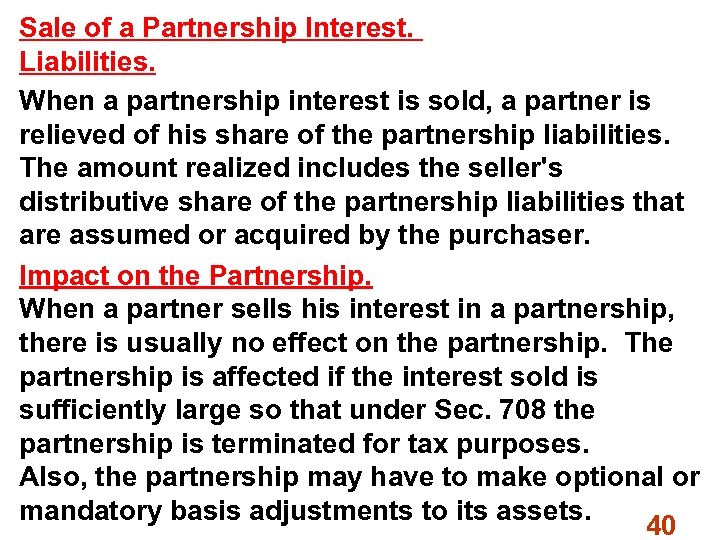

Sale of a Partnership Interest. Liabilities. When a partnership interest is sold, a partner is relieved of his share of the partnership liabilities. The amount realized includes the seller's distributive share of the partnership liabilities that are assumed or acquired by the purchaser. Impact on the Partnership. When a partner sells his interest in a partnership, there is usually no effect on the partnership. The partnership is affected if the interest sold is sufficiently large so that under Sec. 708 the partnership is terminated for tax purposes. Also, the partnership may have to make optional or mandatory basis adjustments to its assets. 40

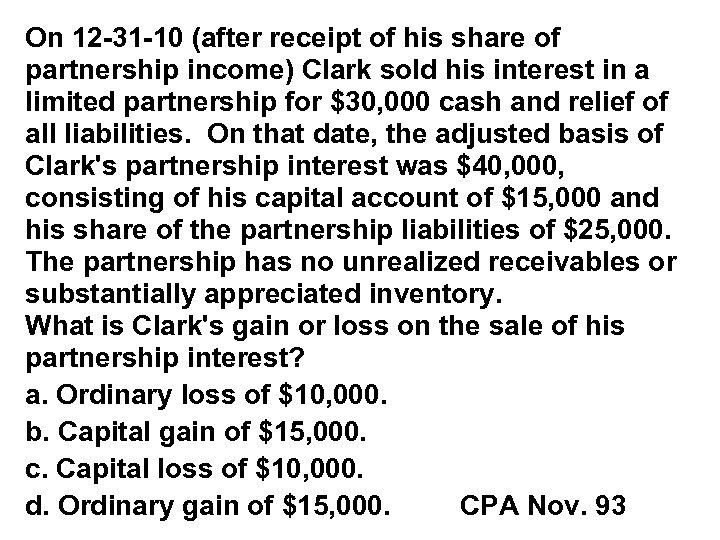

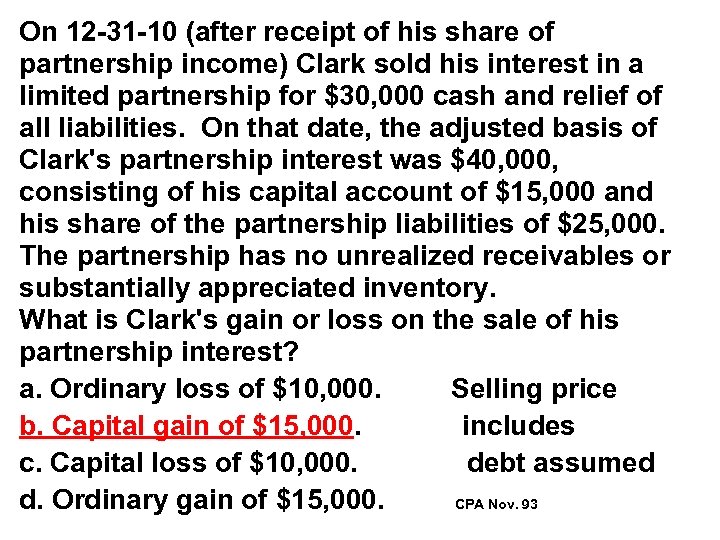

On 12 31 10 (after receipt of his share of partnership income) Clark sold his interest in a limited partnership for $30, 000 cash and relief of all liabilities. On that date, the adjusted basis of Clark's partnership interest was $40, 000, consisting of his capital account of $15, 000 and his share of the partnership liabilities of $25, 000. The partnership has no unrealized receivables or substantially appreciated inventory. What is Clark's gain or loss on the sale of his partnership interest? a. Ordinary loss of $10, 000. b. Capital gain of $15, 000. c. Capital loss of $10, 000. d. Ordinary gain of $15, 000. CPA Nov. 93

On 12 31 10 (after receipt of his share of partnership income) Clark sold his interest in a limited partnership for $30, 000 cash and relief of all liabilities. On that date, the adjusted basis of Clark's partnership interest was $40, 000, consisting of his capital account of $15, 000 and his share of the partnership liabilities of $25, 000. The partnership has no unrealized receivables or substantially appreciated inventory. What is Clark's gain or loss on the sale of his partnership interest? a. Ordinary loss of $10, 000. Selling price b. Capital gain of $15, 000. includes c. Capital loss of $10, 000. debt assumed d. Ordinary gain of $15, 000. CPA Nov. 93

Sec. 741 C. G.

Sec. 751 Ord

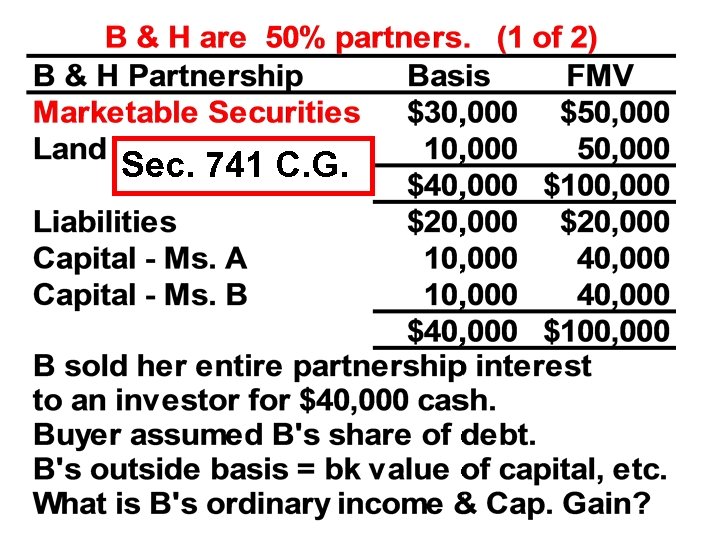

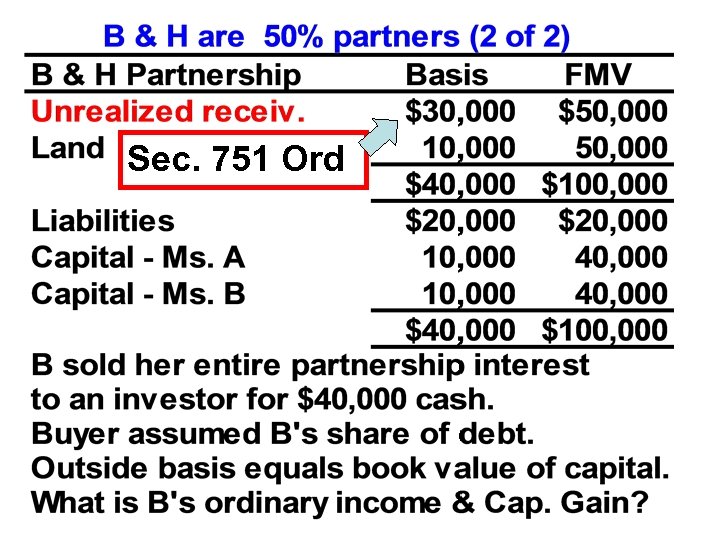

Preceding slide You pretend the partnership sold its assets just before Ms. B actually sold her partnership interest. She reports 751 gain on the hypothetical sale by the partnership.

7. Determine the amount and character of the gain or loss recognized when a partner retires from a partnership or dies.

Retirement or Death of a Partner. If a partner dies or retires from a partnership, that partner's interest can be sold either to an outsider or to one or more existing partners. Frequently, however, a partner or a deceased partner's assignee departs from the partnership in return for payments made by the partnership itself. These payments are made in exchange for the former partner's interest in partnership property and other payments.

Payments for Partnership Property. The valuation of a retiring partner's interest in the partnership properties by the partners in an arm's length transaction is generally accepted by the IRS. The payments are taxed under the liquidating distribution rules with two exceptions. These two exceptions, for unrealized receivables and goodwill not provided for in the partnership agreement made to general partners in a service partnership, are taxed as ordinary income. The remaining payments are likely to generate no gain or capital gain, except to the extent they are for substantially appreciated inventory. These property payments are not deductible by the partnership. If the retiring or deceased partner was a general partner and the partnership is a service partnership, payments made for unrealized receivables and goodwill are not considered payments for property absent a provision for goodwill. These payments will be considered "other payments. " 48

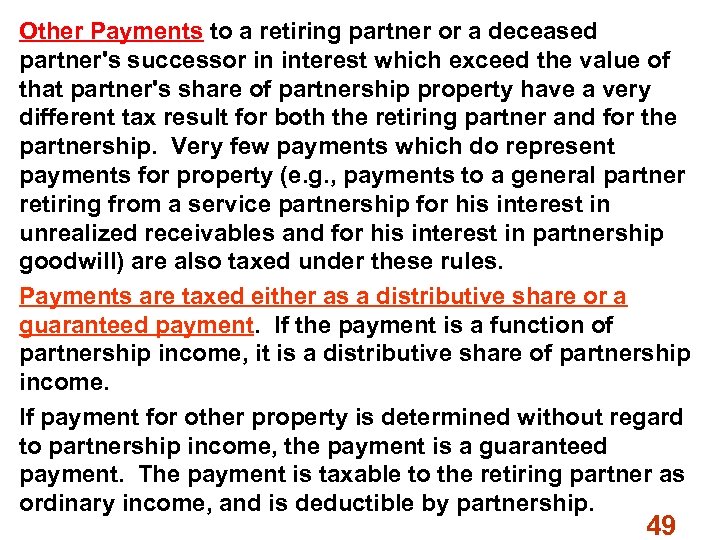

Other Payments to a retiring partner or a deceased partner's successor in interest which exceed the value of that partner's share of partnership property have a very different tax result for both the retiring partner and for the partnership. Very few payments which do represent payments for property (e. g. , payments to a general partner retiring from a service partnership for his interest in unrealized receivables and for his interest in partnership goodwill) are also taxed under these rules. Payments are taxed either as a distributive share or a guaranteed payment. If the payment is a function of partnership income, it is a distributive share of partnership income. If payment for other property is determined without regard to partnership income, the payment is a guaranteed payment. The payment is taxable to the retiring partner as ordinary income, and is deductible by partnership. 49

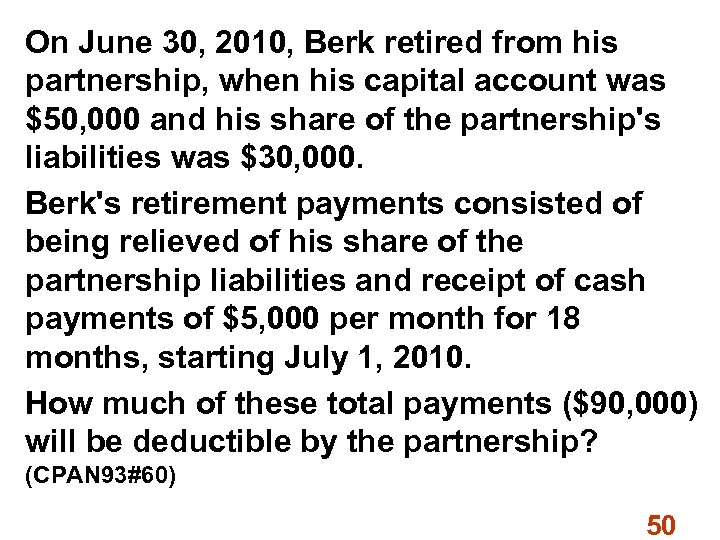

On June 30, 2010, Berk retired from his partnership, when his capital account was $50, 000 and his share of the partnership's liabilities was $30, 000. Berk's retirement payments consisted of being relieved of his share of the partnership liabilities and receipt of cash payments of $5, 000 per month for 18 months, starting July 1, 2010. How much of these total payments ($90, 000) will be deductible by the partnership? (CPAN 93#60) 50

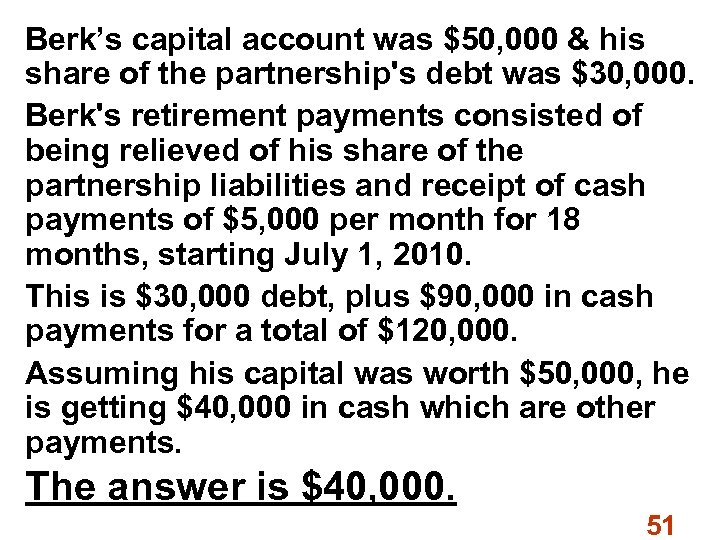

Berk’s capital account was $50, 000 & his share of the partnership's debt was $30, 000. Berk's retirement payments consisted of being relieved of his share of the partnership liabilities and receipt of cash payments of $5, 000 per month for 18 months, starting July 1, 2010. This is $30, 000 debt, plus $90, 000 in cash payments for a total of $120, 000. Assuming his capital was worth $50, 000, he is getting $40, 000 in cash which are other payments. The answer is $40, 000. 51

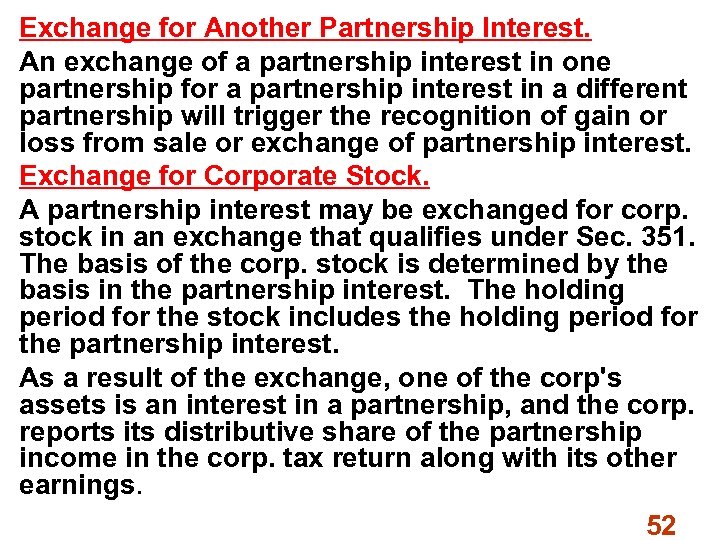

Exchange for Another Partnership Interest. An exchange of a partnership interest in one partnership for a partnership interest in a different partnership will trigger the recognition of gain or loss from sale or exchange of partnership interest. Exchange for Corporate Stock. A partnership interest may be exchanged for corp. stock in an exchange that qualifies under Sec. 351. The basis of the corp. stock is determined by the basis in the partnership interest. The holding period for the stock includes the holding period for the partnership interest. As a result of the exchange, one of the corp's assets is an interest in a partnership, and the corp. reports its distributive share of the partnership income in the corp. tax return along with its other earnings. 52

Exchange of a Partnership Interest. Incorporation. When a partnership becomes extremely profitable or when limited liability is important, the entire partnership may choose to incorporate. Normally the transaction can be structured under Sec. 351 and be partially or totally tax exempt. There are three ways a partnership can choose to incorporate. These methods may have different tax consequences. See additional slides near end of this file. 53

Income Recognition & Transfers of a Partnership Interest. Partnership year closes with respect to any partner who sells or exchanges his entire interest in a partnership or any partner whose interest in the partnership is liquidated. The year closes on date of sale or exchange, or the final payment in the case of a liquidation. As a result, that partner's share of all items earned by the partnership must be reported in the partner's tax year that includes the transaction date. A partner's tax year now closes on the date of death. The partner's final return will include all partnership income up to the date of death. 54

8. Determine whether a partnership has terminated for tax purposes.

Events Causing a Termination to Occur. Only two conditions terminate a partnership. These are discussed below: No Business Operated as Partnership. If no partner continues to operate any business, financial operation, or venture of a partnership through the same or another partnership, the original partnership terminates. To avoid termination, a partnership must maintain both partners and business activity. Sale or Exchange of at Least a 50% Interest. A partnership terminates if there is a sale or exchange of at least 50% of the total interests in both partnership capital and profits within a 12 month period. 56

Effects of Termination. When a partnership terminates, its tax year is closed, requiring the partners to report their share of partnership earnings for the short period partnership tax year. This may cause a bunching of income, particularly if the partnership is on a fiscal year. 57

Liquidating Distributions & Contributions. When a termination occurs, a pro rata liquidating distribution is deemed to have been made to all partners. Gain or loss is recognized by the partners under the liquidating distribution rules. The basis of assets deemed distributed must be adjusted as they would be in an actual liquidating distribution. If the partnership is terminated because of a greater than 50% change in ownership, the business of the partnership will likely continue. In that case, a deemed contribution of property to the new partnership must follow the deemed distribution. Changes in Accounting Methods. Termination of the partnership will end all partnership elections. New elections must be made for the partnership tax year and accounting methods. 58

Cobb, Danver & Evans each owned a one third interest in the capital and profits of their calendar year partnership. On September 18, 2009, Cobb and Danver sold their partnership interests to Frank, and immediately withdrew from all participation in the partnership. On March 15, 2010, Cobb and Danver received full payment from Frank for the sale of their partnership interests. For tax purposes, the partnership a. Terminated on September 18, 2009. b. Terminated on December 31, 2009. c. Terminated on March 15, 2010. d. Did not terminate. (CPAN 93#58). 59

Mergers & Consolidations. When two or more partnership's merge, an old partnership, whose partners own more than 50% of the profits and capital interests of the new partnership, is considered to be continued as the new partnership. The new partnership continues with the tax year and accounting methods and elections of the old partnership. All the other old partnerships are considered terminated. When two or more partnerships meet the more than 50% of profits and capital interests requirement, the partnership that is considered contributing the greater dollar value of assets to the new partnership is considered the continuing partnership. If no partnership contributed the requisite amount, all of the partnerships terminate and the new entity can make its own tax year and accounting method elections.

Division of a Partnership. When a partnership is divided into two or more partnerships, any of the new partnerships whose partners own collectively more than 50% of the profits and capital interest in the old partnership are considered a continuation of the old partnership. The new partnership(s) are bound by the accounting method and tax year elections of the continuing partnership. 61

9. Understand the effect of optional and mandatory basis adjustments.

Optional & Mandatory Basis Adjustments Partnership can adjust basis of its property when a: 1. partner sells or exchanges his or her interest in the partnership, 2. partner transfers upon the partner’s death, or 3. partnership makes a property distribution to a partner.

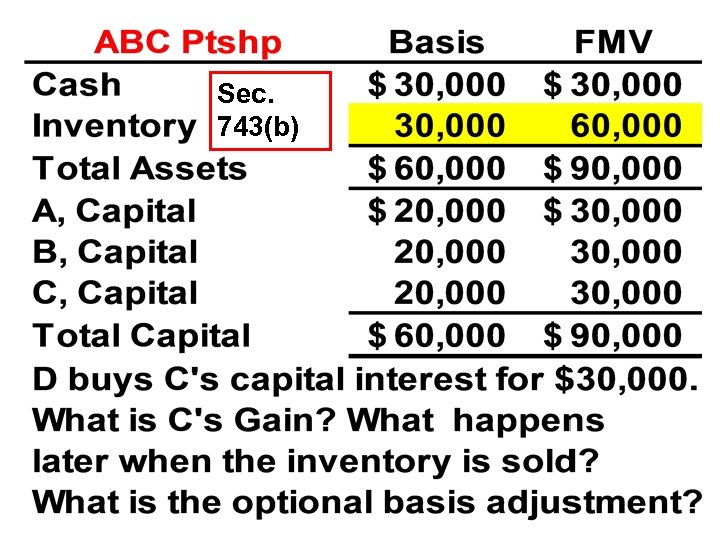

Basis Adjustments on Transfers. If an incoming partner buys a partnership interest from an existing partner, the new partner’s basis in the partnership interest equals the purchase price plus the new partner’s share of partnership debt. The new partner’s basis in the partnership is likely to be different from his or her share of basis of the underlying assets in the partnership. With an election under Sec. 754, Sec 743 mandates a basis adjustment equal to the difference between the transferee partner’s basis in the partnership and the transferee partner’s share of basis of partnership assets. This adjustment belongs only to transferee partner & eliminates inequities of different inside & outside basis.

Sec. 743(b)

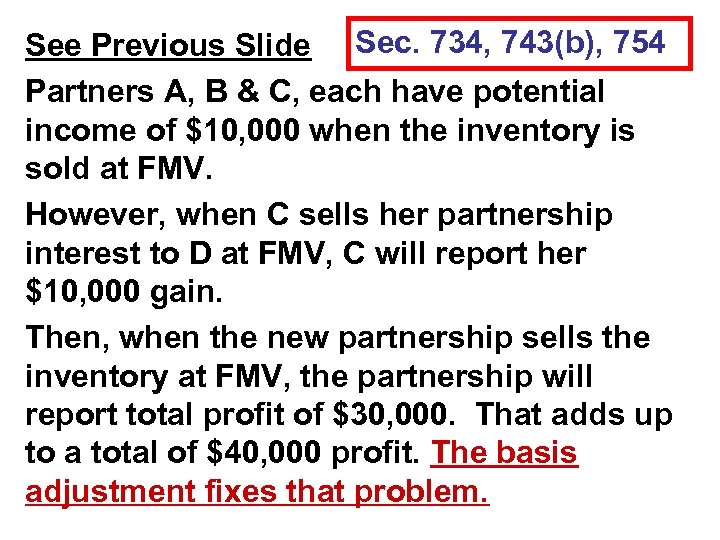

See Previous Slide Sec. 734, 743(b), 754 Partners A, B & C, each have potential income of $10, 000 when the inventory is sold at FMV. However, when C sells her partnership interest to D at FMV, C will report her $10, 000 gain. Then, when the new partnership sells the inventory at FMV, the partnership will report total profit of $30, 000. That adds up to a total of $40, 000 profit. The basis adjustment fixes that problem.

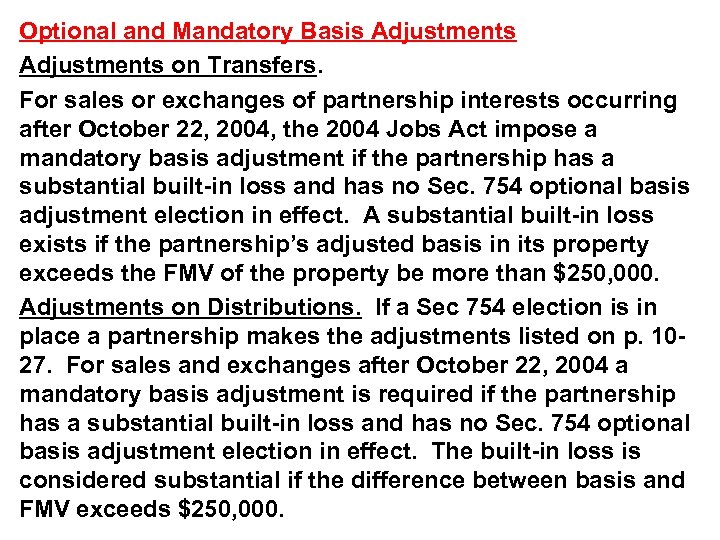

Optional and Mandatory Basis Adjustments on Transfers. For sales or exchanges of partnership interests occurring after October 22, 2004, the 2004 Jobs Act impose a mandatory basis adjustment if the partnership has a substantial built in loss and has no Sec. 754 optional basis adjustment election in effect. A substantial built in loss exists if the partnership’s adjusted basis in its property exceeds the FMV of the property be more than $250, 000. Adjustments on Distributions. If a Sec 754 election is in place a partnership makes the adjustments listed on p. 10 27. For sales and exchanges after October 22, 2004 a mandatory basis adjustment is required if the partnership has a substantial built in loss and has no Sec. 754 optional basis adjustment election in effect. The built in loss is considered substantial if the difference between basis and FMV exceeds $250, 000.

Special Forms of Partnerships Limited partnerships are discussed in the beginning sections of Chapter 10. Here, we examine a series of special partnership forms, including tax shelters that are organized as limited partnerships, publicly traded partnerships, limited liability companies and limited liability partnerships and electing large partnerships. Tax Shelters and Limited Partners. Prior to the 1986 Tax Act, limited partnerships were the primary vehicle for tax shelter investments. The passive loss rules have changed this. Limited partnerships that generate passive income are now becoming popular investment vehicles. 69

Publicly Traded Partnerships. A publicly traded partnership which meets req. of Sec. 7704 is taxed as a corp instead to being taxed as a partnership under Subchapter K unless they are grandfathered by being in existence on December 17, 1987, and have not added a substantial new line of business since the date they are grandfathered, or earn primarily qualifying income. A publicly traded partnership is a partnership whose interests are either traded on an established securities exchange or are traded on a secondary market or the equivalent thereof. The Taxpayer Relief Act of 1997 added an election which will allow the grandfathered partnerships to continue to be taxed as partnerships after the original 10 year window and until the election is revoked. In order to elect to be taxed as a partnership, the publicly traded partnership must agree to pay a 3. 5% annual tax on gross income from the active conduct of any trade or business. The election may be revoked by the partnership, but once revoked, cannot be reinstated.

Special Forms of Partnerships Limited Liability Companies (LLCs). The limited liability company (LLC) combines the legal and tax benefits of the partnership and S corporation forms of doing business. All 50 states have adopted limited liability company rules or are considering them. The LLC business form combines the advantage of limited liability for all its owners with the possibility of achieving the conduit treatment and the flexibility of being taxed as a partnership. 71

Limited Liability Partnerships (LLPs). Many states have added limited liability partnerships (LLP) to the list of business forms, which can be formed. Most LLPs are service partnerships. Under state laws, the primary difference between a general partnership and a limited liability partnership in a limited liability partnership, a partner is not liable for damages due to failures in the work of other partners or of people supervised by other partners. This feature is one reason why the Big 4 (and other large accounting firms) have converted to this status. Like a general or limited partnership, this business form is a partnership for tax purposes except under very unusual circumstances. 72

10. Determine the appropriate reporting for the income of an electing large partnership.

Electing Large Partnerships. “Large partnerships" may elect to be taxed under a simplified reporting arrangement. The partnership reports income under a simplified reporting scheme, is subject to different rules about when the partnership terminates, and is subject to a different system of audits. The election is irrevocable without IRS permission. Electing Large Partnership Taxable Income. The calculation of Electing Large Partnership taxable income includes separately stated income and other income. The items which must be separately stated are very different from a regular partnership. There will be much less separate reporting of items, so that most items of income and expense will be determined at the partnership level and will flow through as partnership income. 74

Electing Large Partnerships. Separately Stated Large Partnership Items. Limits on the charitable contribution and Sec. 179 expense list are applied at the partnership level rather than the individual partner level. Three limits still apply at the partner level, itemized deductions, at risk losses and passive activity losses. Termination of the Partnership. An Electing Large Partnership terminates only if its partners cease to conduct any business, financial operation or venture in a partnership form. 75

Electing Large Partnership Audits. Electing Large Partnerships are not subject to the partnership audit rules but are subject to a much more restrictive set of partnership audit procedures. All partners must report all items of partnership income, gain, loss or deduction in the way the partnership reports the item. Deviations from that partnership reporting will be "corrected" by the IRS just like a math mistake is corrected. 76

Liquidating Distribution or Sale to Partners. When a partner withdraws from a partnership, the transaction can be structured as either a liquidating distribution or a sale of the partnership interest to the remaining partners. The difference in form can create a number of different tax consequences even though the transactions achieve substantially the same result. Because of these tax implications, partners should make their choice only after careful consideration. 77

B. P. Citron 1 A limited partner in a motion picture partnership was entitled an abandonment loss equal to his basis for his partnership interest. At a meeting of all partners, the taxpayer stated that he would have nothing further to do with the partnership or the X rated film that the general partner wanted to produce. The partners voted to dissolve, and the general partner later filed the final partnership return. 78

B. P. Citron 2 These facts constituted an overt & affirmative act of abandonment by taxpayer to the general partner and all limited partners, who were the only parties in interest since the partnership had no creditors. The loss was found to be ordinary, and not capital, since no sale or exchange took place. 79

B. P. Citron 3 However, the court stated that abandonment could be deemed as a sale if the partner's share of partnership liabilities was decreased; in this case, the partnership had no outstanding liabilities. B. P. Citron, 97 TC 200, Dec. 47, 513. 80

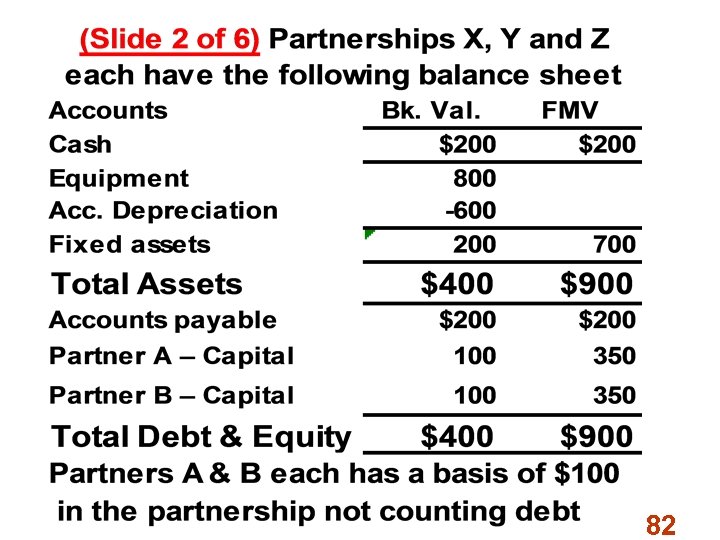

Incorporating a Partnership Slide 1 of 6. The three situations below involve partnerships X, Y, and Z, respectively. Each partnership used the accrual method of accounting. The liabilities of each partnership did not exceed the adjusted basis of its assets. Partnerships X, Y and Z each have the balance sheet shown on the next slide Numbers added by Instructor. 81

82

Slide 3 of 6 Situation 1 – Partnership X transferred all of its assets to newly formed Corporation R in exchange for all the outstanding stock of R and the assumption by R of X's liabilities. X then terminated by distributing all the stock of R to X's partners in proportion to their partnership interests. 83

Slide 4 of 6 Situation 2 – Partnership Y distributed all of its assets and liabilities to its partners in proportion to their partnership interests in a transaction that constituted a termination of Y under section 708(b)(1)(A) of the Code. The partners then transferred all the assets received from Y to newly formed Corp S in exchange for all the outstanding stock of T and the assumption by S of Y's liabilities that had been assumed by the partners. 84

Slide 5 of 6 Situation 3 – Partners of Z The partners of Z transferred their partnership interests in Z to newly formed Corporation T in exchange for all the outstanding stock of T. This exchange terminated Z and all of its assets and liabilities became assets and liabilities of T. 85

Slide 6 of 6 Will the three methods of incorporating the partnership all involve tax deferral? See Rev. Rul. 84 111 posted on the web page. 86

Liability Allocations Explain the difference in recourse and nonrecourse liabilities when distinguishing between general and limited partners. Assume the partnership has $100, 000 of recourse liabilities and $60, 000 of nonrecourse liabilities. It has one general partner, Matt, who has a 20% interest in income and loss, and two limited partners, each of whom has a 40% interest in income and loss. Illustrate the difference in allocation of liabilities to the three partners. 87

Liability Allocations-1 Recourse debt increase the basis of general partners only based on the loss sharing ratio. Nonrecourse debt increase the basis of both general and limited partners based on their profit sharing ratio. The $100, 000 of recourse liabilities will be allocated entirely to Matt as the only general partner and his basis will increase by the $100, 000 allocated liability. 88

Liability Allocations-2 The $60, 000 of nonrecourse debt will be allocated as follows: $12, 000 (20% x $60, 000) to Matt, bringing his total allocated debt to $112, 000; $24, 000 (40% x $60, 000) to each of the two limited partners. 89

The End 90

b4aa549f6dd448d127620ea02cb3796f.ppt