f476fabf5d0e3e7fcb3e5217c542ee73.ppt

- Количество слайдов: 37

Chapter 11 Audit of Acquisition and Payment Cycle and Inventory Copyright © 2010 South-Western/Cengage Learning

Chapter 11 Audit of Acquisition and Payment Cycle and Inventory Copyright © 2010 South-Western/Cengage Learning

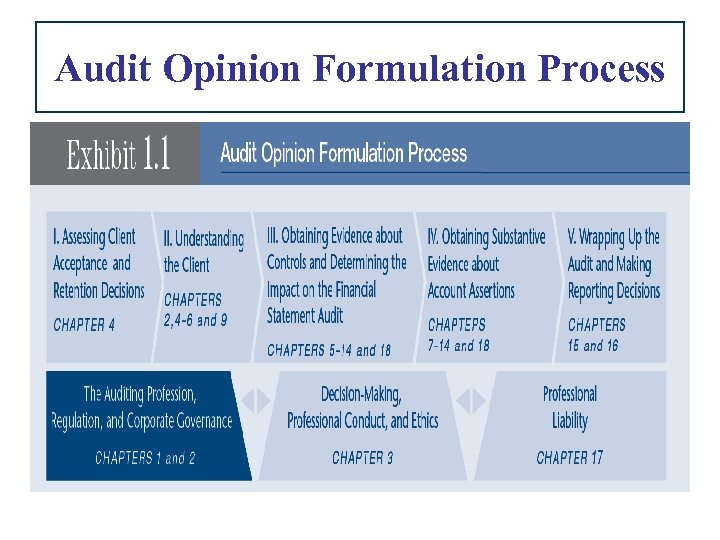

Audit Opinion Formulation Process

Audit Opinion Formulation Process

LO 1 Acquisition and Payment Cycle • The acquisition and payment cycle includes identifying products or services, purchasing, receiving, approving payments, and paying for goods and services received • Major accounts include inventory, cost of goods sold, accounts payable, and expenses • Acquisition and payment cycle consists of five distinct activities: – – – Requisition for goods or services Purchase of goods or services according to company policies Receipt of goods and services Approval of items for payment Cash disbursements

LO 1 Acquisition and Payment Cycle • The acquisition and payment cycle includes identifying products or services, purchasing, receiving, approving payments, and paying for goods and services received • Major accounts include inventory, cost of goods sold, accounts payable, and expenses • Acquisition and payment cycle consists of five distinct activities: – – – Requisition for goods or services Purchase of goods or services according to company policies Receipt of goods and services Approval of items for payment Cash disbursements

Automated Purchasing System • • Networked software system linking to vendors whose offerings and prices have been preapproved by appropriate management Automated purchasing system will perform the following beneficial tasks: – – – Apply preloaded specifications and materials lists to the system to start the process. Automatically flag invoices that don’t reconcile with purchase orders. Create change orders and variance purchase orders

Automated Purchasing System • • Networked software system linking to vendors whose offerings and prices have been preapproved by appropriate management Automated purchasing system will perform the following beneficial tasks: – – – Apply preloaded specifications and materials lists to the system to start the process. Automatically flag invoices that don’t reconcile with purchase orders. Create change orders and variance purchase orders

LO 2 Integrated Audit of the Acquisition and Payment Cycle • Phases I and II of the Audit Opinion Formulation Process – Continually update information on business risk – Analyze potential motivations to misstate accounts in the acquisition and payment cycle – Perform preliminary analytical procedures to determine if unexpected relationships exist in the accounts – Develop an understanding of the internal controls in the acquisition and payment cycle that are designed to address the risks identified in the three previous steps

LO 2 Integrated Audit of the Acquisition and Payment Cycle • Phases I and II of the Audit Opinion Formulation Process – Continually update information on business risk – Analyze potential motivations to misstate accounts in the acquisition and payment cycle – Perform preliminary analytical procedures to determine if unexpected relationships exist in the accounts – Develop an understanding of the internal controls in the acquisition and payment cycle that are designed to address the risks identified in the three previous steps

Integrated Audit of the Acquisition and Payment Cycle • Phases III and IV of the Audit Opinion Formulation Process – Determine the important controls that need to be tested – Develop a plan for testing internal controls and perform the tests of key controls in the acquisition and payment cycle – Analyze the results of the tests of controls – Perform planned substantive procedures based on the potential for misstatement and the information gathered

Integrated Audit of the Acquisition and Payment Cycle • Phases III and IV of the Audit Opinion Formulation Process – Determine the important controls that need to be tested – Develop a plan for testing internal controls and perform the tests of key controls in the acquisition and payment cycle – Analyze the results of the tests of controls – Perform planned substantive procedures based on the potential for misstatement and the information gathered

LO 3 Risks Related to the Acquisition and Payment Cycle • Acquisition cycle deals with receipt of all goods and services • Misstatements may occur just because of the volume of transactions • Frauds that have taken place include the following: – Employee theft of inventory – Employee schemes involving fictitious vendors as means to transfer payments to themselves – Executives misusing travel and entertainment accounts and charging them as company expense – Schemes to classify expenses as assets – Manipulation of “restructuring reserves” to manage future income

LO 3 Risks Related to the Acquisition and Payment Cycle • Acquisition cycle deals with receipt of all goods and services • Misstatements may occur just because of the volume of transactions • Frauds that have taken place include the following: – Employee theft of inventory – Employee schemes involving fictitious vendors as means to transfer payments to themselves – Executives misusing travel and entertainment accounts and charging them as company expense – Schemes to classify expenses as assets – Manipulation of “restructuring reserves” to manage future income

Risks Related to the Acquisition and Payment Cycle • Number of potential fraud indicators that affect the cycle include: – Inventory growing at a rate greater than sales – Expenses significantly above or below industry norms – Capital assets growing faster than the business and for which there are not strategic plans – Significant reduction of "reserves"

Risks Related to the Acquisition and Payment Cycle • Number of potential fraud indicators that affect the cycle include: – Inventory growing at a rate greater than sales – Expenses significantly above or below industry norms – Capital assets growing faster than the business and for which there are not strategic plans – Significant reduction of "reserves"

Risks Related to the Acquisition and Payment Cycle (continued) – Expense accounts that have significant credit entries – Travel and entertainment expense accounts that do not have documentation – Inadequate follow-up to auditor recommendations on needed controls – Payments made to senior officers in the form of loans that are subsequently forgiven.

Risks Related to the Acquisition and Payment Cycle (continued) – Expense accounts that have significant credit entries – Travel and entertainment expense accounts that do not have documentation – Inadequate follow-up to auditor recommendations on needed controls – Payments made to senior officers in the form of loans that are subsequently forgiven.

LO 4 Preliminary Analytical Procedures for Possible Misstatements • Analytical procedures to identify potential misstatements: – Calculate and analyze dollar and percentage change in inventory, cost of goods sold, and expense accounts – Compute and analyze ratios like inventory turnover and number of day's sales in inventory – Prepare common sized income statement to identify cost of good sold or expense accounts that are out of line • Auditor compares client analytics to past client performance, industry results, and auditor's expectations

LO 4 Preliminary Analytical Procedures for Possible Misstatements • Analytical procedures to identify potential misstatements: – Calculate and analyze dollar and percentage change in inventory, cost of goods sold, and expense accounts – Compute and analyze ratios like inventory turnover and number of day's sales in inventory – Prepare common sized income statement to identify cost of good sold or expense accounts that are out of line • Auditor compares client analytics to past client performance, industry results, and auditor's expectations

LO 5 Linking Internal Controls and Financial Statement Assertions • Requisition of goods and services – Need identified – Pre-numbered requisition form completed and sent to purchasing • Purchase goods or services – Purchase order shows quantity and price of goods ordered, quality specifications, shipping terms – Purchase orders are pre-numbered to establish completeness

LO 5 Linking Internal Controls and Financial Statement Assertions • Requisition of goods and services – Need identified – Pre-numbered requisition form completed and sent to purchasing • Purchase goods or services – Purchase order shows quantity and price of goods ordered, quality specifications, shipping terms – Purchase orders are pre-numbered to establish completeness

Linking Internal Controls and Financial Statement Assertions (continued) – Purchase orders must be properly authorized – Many companies have separate purchasing department: • • Promotes efficiency and effectiveness Eliminates potential favoritism Reduces the opportunity for fraud Centralizes control in one function • Receipt of Goods and Services – Receiving department should ensure

Linking Internal Controls and Financial Statement Assertions (continued) – Purchase orders must be properly authorized – Many companies have separate purchasing department: • • Promotes efficiency and effectiveness Eliminates potential favoritism Reduces the opportunity for fraud Centralizes control in one function • Receipt of Goods and Services – Receiving department should ensure

Linking Internal Controls and Financial Statement Assertions (continued) • • Only authorized goods are received The goods meet order specifications An accurate count of goods received is taken All receipts of goods are recorded – Receiving reports are pre-numbered to establish completeness – Receiving department records quantity of goods received – Goods also inspected for quality – Receiving reports sent to accounting

Linking Internal Controls and Financial Statement Assertions (continued) • • Only authorized goods are received The goods meet order specifications An accurate count of goods received is taken All receipts of goods are recorded – Receiving reports are pre-numbered to establish completeness – Receiving department records quantity of goods received – Goods also inspected for quality – Receiving reports sent to accounting

Linking Internal Controls and Financial Statement Assertions (continued) • Approve payment – Accounting matches vendor invoice, purchase order, and receiving reports - If quality and quantity match, account payable is recorded – The match can occur as: • Traditional Manual Matching • Automated Matching • Cash disbursement

Linking Internal Controls and Financial Statement Assertions (continued) • Approve payment – Accounting matches vendor invoice, purchase order, and receiving reports - If quality and quantity match, account payable is recorded – The match can occur as: • Traditional Manual Matching • Automated Matching • Cash disbursement

Linking Internal Controls and Financial Statement Assertions (continued) – Supporting documentation is reviewed and approved for payment – Documents are marked "paid" to avoid duplicate payment

Linking Internal Controls and Financial Statement Assertions (continued) – Supporting documentation is reviewed and approved for payment – Documents are marked "paid" to avoid duplicate payment

Design, Perform and Analyze Results of Tests of Controls • The primary risk is that Accounts Payable and expenses will be understated • Therefore, controls related to the following are usually significant: – – Proper authorization Completeness of recording Timeliness of recording Correctness of valuation • Attribute sampling may be used to test control operation • The level of assessed control risk will impact the rigor of the subsequent substantive testing of Accounts Payable and expenses

Design, Perform and Analyze Results of Tests of Controls • The primary risk is that Accounts Payable and expenses will be understated • Therefore, controls related to the following are usually significant: – – Proper authorization Completeness of recording Timeliness of recording Correctness of valuation • Attribute sampling may be used to test control operation • The level of assessed control risk will impact the rigor of the subsequent substantive testing of Accounts Payable and expenses

LO 6 Substantive Tests of Accounts Payable • The auditor's main concern is that Accounts Payable will be understated • Therefore, emphasis is placed on testing the completeness assertion • Typical substantive tests include: – Analytical review of related accounts – Tests of subsequent disbursements – Reconcile vendor statements or confirm accounts payable

LO 6 Substantive Tests of Accounts Payable • The auditor's main concern is that Accounts Payable will be understated • Therefore, emphasis is placed on testing the completeness assertion • Typical substantive tests include: – Analytical review of related accounts – Tests of subsequent disbursements – Reconcile vendor statements or confirm accounts payable

Analytical Review of Related Expense Accounts • Used to determine if accounting data indicates understatement of expenses • If understatement likely, auditor expands tests of accounts payable • Analytics used on clients with low control risk

Analytical Review of Related Expense Accounts • Used to determine if accounting data indicates understatement of expenses • If understatement likely, auditor expands tests of accounts payable • Analytics used on clients with low control risk

Testing Subsequent Disbursements • Auditor samples cash disbursements after the end of the year • Determines if disbursements are for audit year transactions by vouching back to source documents (purchase order, vendor invoice, receiving report) • If disbursement is for audit year transaction, auditor reprocesses the transaction to see if it was properly recorded as a payable

Testing Subsequent Disbursements • Auditor samples cash disbursements after the end of the year • Determines if disbursements are for audit year transactions by vouching back to source documents (purchase order, vendor invoice, receiving report) • If disbursement is for audit year transaction, auditor reprocesses the transaction to see if it was properly recorded as a payable

Reconciling Vendor Statements or Confirmations with Payables • Auditor requests vendors' monthly statements or sends confirmation to major vendors • Auditor reconciles vendor statement or confirmation with client balance in the accounts payable subsidiary ledger

Reconciling Vendor Statements or Confirmations with Payables • Auditor requests vendors' monthly statements or sends confirmation to major vendors • Auditor reconciles vendor statement or confirmation with client balance in the accounts payable subsidiary ledger

Substantive Tests of Expense Accounts • Auditing payables and cash disbursements provides indirect evidence about expense accounts • Additional analysis of selected expense accounts is usually merited • The auditor should consider management is more likely to – Understate rather than overstate expenses – Classify expenses as assets rather than vice versa

Substantive Tests of Expense Accounts • Auditing payables and cash disbursements provides indirect evidence about expense accounts • Additional analysis of selected expense accounts is usually merited • The auditor should consider management is more likely to – Understate rather than overstate expenses – Classify expenses as assets rather than vice versa

Substantive Tests of Expense Accounts (continued) • Substantive audit procedures include: – Detailed tests of transactions – Analytical review – Review of unusual entries

Substantive Tests of Expense Accounts (continued) • Substantive audit procedures include: – Detailed tests of transactions – Analytical review – Review of unusual entries

LO 7 Complexities Related to Inventory and Cost of Goods Sold • Audit of inventory is complicated by a number of factors including: – – – – Variety (diversity) of items High volume of activity Various (sometimes complex) valuation Difficulty in identifying obsolete or defective inventory Many frauds involve the inventory account Easily transportable making it subject to double counting May be stored at multiple locations, some may be remote May be returned by customers

LO 7 Complexities Related to Inventory and Cost of Goods Sold • Audit of inventory is complicated by a number of factors including: – – – – Variety (diversity) of items High volume of activity Various (sometimes complex) valuation Difficulty in identifying obsolete or defective inventory Many frauds involve the inventory account Easily transportable making it subject to double counting May be stored at multiple locations, some may be remote May be returned by customers

LO 8 Risks and Controls Related to Inventory and Cost of Goods Sold • Inventory and cost of goods sold accounts are prone to errors. • Inventory frauds are one of the most common frauds used by management to manage earnings and misrepresent the financial position of the company. • Exhibit 11. 6 indentifies some of the possible fraudulent schemes for manipulating inventory and cost of goods sold.

LO 8 Risks and Controls Related to Inventory and Cost of Goods Sold • Inventory and cost of goods sold accounts are prone to errors. • Inventory frauds are one of the most common frauds used by management to manage earnings and misrepresent the financial position of the company. • Exhibit 11. 6 indentifies some of the possible fraudulent schemes for manipulating inventory and cost of goods sold.

LO 9 Internal Controls for Inventory • A well-designed inventory control system should ensure: – All purchases are authorized – Accounting system ensures timely, accurate, and complete recording – Receipt of inventory properly accounted for – Costs properly identified and assigned to products – All products are systematically reviewed for obsolescence. – New products introduced only after market studies and quality control tests have been made – Management actively manages inventory – Long term contracts are closely monitored

LO 9 Internal Controls for Inventory • A well-designed inventory control system should ensure: – All purchases are authorized – Accounting system ensures timely, accurate, and complete recording – Receipt of inventory properly accounted for – Costs properly identified and assigned to products – All products are systematically reviewed for obsolescence. – New products introduced only after market studies and quality control tests have been made – Management actively manages inventory – Long term contracts are closely monitored

LO 10 Substantive Tests of Inventory and Cost of Goods Sold • • • Existence: observe year-end physical inventory Completeness: cutoff tests Rights: review long-term contracts, etc. Valuation: direct tests and analytics Disclosure: review GAAP

LO 10 Substantive Tests of Inventory and Cost of Goods Sold • • • Existence: observe year-end physical inventory Completeness: cutoff tests Rights: review long-term contracts, etc. Valuation: direct tests and analytics Disclosure: review GAAP

Procedures for Observing a Client's Physical Inventory • • Meet with client to discuss their plan to count inventory Review client's plans for counting and tagging inventory Review inventory counting procedures with audit personnel Determine whether specialists are needed to identify inventory items • Upon arriving at each site: – Meet with client, and obtain map and schedule of inventory count area – Obtain list of sequential tag numbers for each area – Observe procedures to shut down receipt or shipment of goods; obtain document numbers for last receipt and shipment for cutoff tests

Procedures for Observing a Client's Physical Inventory • • Meet with client to discuss their plan to count inventory Review client's plans for counting and tagging inventory Review inventory counting procedures with audit personnel Determine whether specialists are needed to identify inventory items • Upon arriving at each site: – Meet with client, and obtain map and schedule of inventory count area – Obtain list of sequential tag numbers for each area – Observe procedures to shut down receipt or shipment of goods; obtain document numbers for last receipt and shipment for cutoff tests

Procedures for Observing a Client's Physical Inventory • Observe the counting of inventory and note the following: – The first and last tag numbers in each section – Account for all tag numbers to prevent later insertion of additional inventory items • • Make selected test counts Items that appear obsolete or defective High-dollar value items in inventory Movement of inventory during counting process • Document conclusion as to quality of the inventory counting process

Procedures for Observing a Client's Physical Inventory • Observe the counting of inventory and note the following: – The first and last tag numbers in each section – Account for all tag numbers to prevent later insertion of additional inventory items • • Make selected test counts Items that appear obsolete or defective High-dollar value items in inventory Movement of inventory during counting process • Document conclusion as to quality of the inventory counting process

What does the auditor do after the inventory count? After the inventory count, the auditor should: • Trace the test counts to the client's inventory records • Trace the number of high-dollar items to the client's inventory records • Trace the obsolete or damaged inventory to the client's inventory records to see if the items have been written down

What does the auditor do after the inventory count? After the inventory count, the auditor should: • Trace the test counts to the client's inventory records • Trace the number of high-dollar items to the client's inventory records • Trace the obsolete or damaged inventory to the client's inventory records to see if the items have been written down

Counting Inventory Before or After Year-end • On occasion, it may not be feasible to count inventory at year-end • Acceptable to count inventory before or after yearend if: – Controls are strong – The opportunity and motivation to misstate inventory is low – Auditor can test the year-end balance using analytics and tests of transactions between the physical count and yearend (called the roll-forward or rollback period) – Auditor reviews intervening transactions for unusual activity

Counting Inventory Before or After Year-end • On occasion, it may not be feasible to count inventory at year-end • Acceptable to count inventory before or after yearend if: – Controls are strong – The opportunity and motivation to misstate inventory is low – Auditor can test the year-end balance using analytics and tests of transactions between the physical count and yearend (called the roll-forward or rollback period) – Auditor reviews intervening transactions for unusual activity

Completeness • Inventory cutoff tests: – Obtain information on last items shipped and received at year-end – Compare this information to transactions recorded in the sales and purchases journal – Determine if transaction is recorded in correct accounting period • Auditor should also inquire about any inventory out on consignment or stored in a public warehouse • Tracing test counts and number of high-dollar items to the client's inventory records tests completeness (as well as existence)

Completeness • Inventory cutoff tests: – Obtain information on last items shipped and received at year-end – Compare this information to transactions recorded in the sales and purchases journal – Determine if transaction is recorded in correct accounting period • Auditor should also inquire about any inventory out on consignment or stored in a public warehouse • Tracing test counts and number of high-dollar items to the client's inventory records tests completeness (as well as existence)

Allowance for Returns • In most situations, expected returns of inventory are not material • However, some companies provide return guarantees and expect significant returns • Management can use previous experience, updated for current economic conditions, to develop estimates of returns

Allowance for Returns • In most situations, expected returns of inventory are not material • However, some companies provide return guarantees and expect significant returns • Management can use previous experience, updated for current economic conditions, to develop estimates of returns

Rights • Most of the work regarding ownership of inventory is performed during the auditor's testing of purchases • Auditor should also review long-term contracts to determine obligations • Inquiry should be made about inventory on consignment

Rights • Most of the work regarding ownership of inventory is performed during the auditor's testing of purchases • Auditor should also review long-term contracts to determine obligations • Inquiry should be made about inventory on consignment

Inventory Valuation • Most complex assertion related to inventory because of the: – Volume of transactions – Diversity of products – Variety of costing methods – Difficulty in estimating net realizable value of products

Inventory Valuation • Most complex assertion related to inventory because of the: – Volume of transactions – Diversity of products – Variety of costing methods – Difficulty in estimating net realizable value of products

Inventory Valuation (continued) • Auditor uses direct tests and analytics to assess inventory valuation: – Direct tests include verifying cost by reviewing vendor invoices – Auditor usually examines current market data and other conditions that might indicate inventory obsolescence – Management inquiry and review of industry publications can help the auditor identify obsolete units – Analytics, like inventory turnover or day's sales in inventory, may identify slow-moving inventory which may need to be written down – Auditor looks for obsolete units during the counting of inventory; these units need to be written down

Inventory Valuation (continued) • Auditor uses direct tests and analytics to assess inventory valuation: – Direct tests include verifying cost by reviewing vendor invoices – Auditor usually examines current market data and other conditions that might indicate inventory obsolescence – Management inquiry and review of industry publications can help the auditor identify obsolete units – Analytics, like inventory turnover or day's sales in inventory, may identify slow-moving inventory which may need to be written down – Auditor looks for obsolete units during the counting of inventory; these units need to be written down

Appropriate Disclosure • Auditor reviews client disclosure for compliance with GAAP – Disclosure should include: • Costing method(s) used • Frequency of accounting • Inventory pledged as collateral • Any other unusual circumstance

Appropriate Disclosure • Auditor reviews client disclosure for compliance with GAAP – Disclosure should include: • Costing method(s) used • Frequency of accounting • Inventory pledged as collateral • Any other unusual circumstance

Cost of Goods Sold • Audit of cost of goods sold can be direct tied to the audit of inventory • If beginning and ending inventories have been verified and acquisitions have been tested, cost of goods sold can be direct calculated • Auditor should also apply analytics to cost of goods sold to see if there any significant variations - either overall or by product line

Cost of Goods Sold • Audit of cost of goods sold can be direct tied to the audit of inventory • If beginning and ending inventories have been verified and acquisitions have been tested, cost of goods sold can be direct calculated • Auditor should also apply analytics to cost of goods sold to see if there any significant variations - either overall or by product line