e44749ddde3c2876ec2fa31cc2d24696.ppt

- Количество слайдов: 51

Chapter 11 Accounting for a Merchandising Business 1

10. 1 The Merchandising Business 2

The Merchandising Business Throughout the semester you have studies service businesses Businesses that sell a service rather than a product or good. A merchandising business is a business that buys goods and sells them at a profit. Wholesalers buy goods from manufacturers and sell to retailers. Retailers buy goods from wholesalers and manufacturers and sell to the public. 3

Merchandising Inventory Businesses that buy goods for the purpose of selling them at a profit are dealing in merchandise. The quantity of merchandise on hand is known as merchandise inventory 4

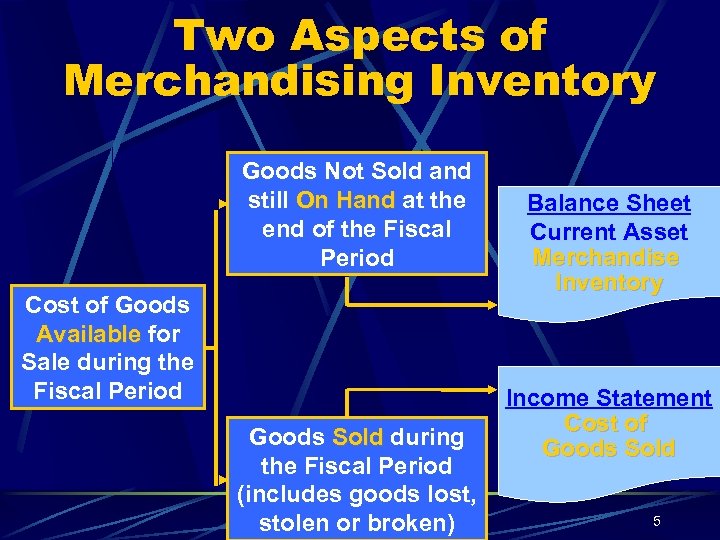

Two Aspects of Merchandising Inventory Goods Not Sold and still On Hand at the end of the Fiscal Period Cost of Goods Available for Sale during the Fiscal Period Goods Sold during the Fiscal Period (includes goods lost, stolen or broken) Balance Sheet Current Asset Merchandise Inventory Income Statement Cost of Goods Sold 5

Periodic Inventory System The periodic inventory system determines the cost of the inventory sold at the end of each fiscal period. No “up-to-date” inventory records are maintained throughout the accounting periods. It is the most common and least expensive inventory system. 6

The Inventory Cycle Merchandise moves in and out of the business in a regular pattern: There is inventory at the beginning of the accounting period. Merchandise is sold and continually moves out during the accounting period. Merchandise is periodically replaced by the purchase of new stock. The inventory at the end of the accounting period is more of less the same as at the beginning. 7

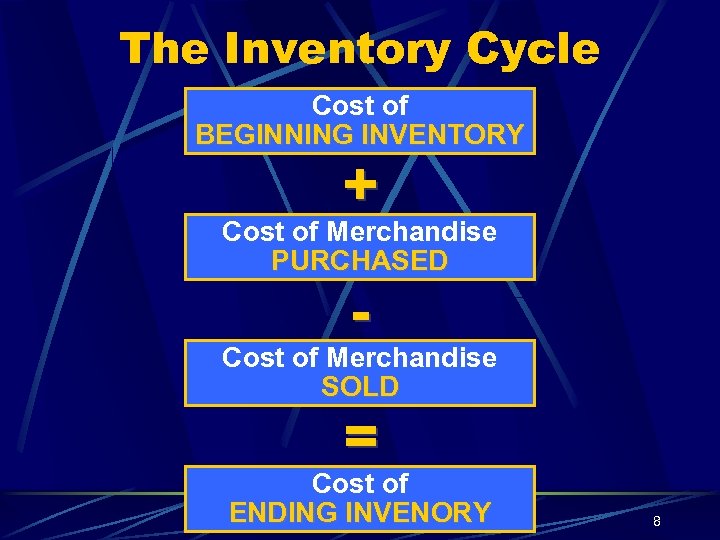

The Inventory Cycle Cost of BEGINNING INVENTORY + Cost of Merchandise PURCHASED - Cost of Merchandise SOLD = Cost of ENDING INVENORY 8

Merchandise Inventory and the Financial Statements Since no effort is made during the fiscal period to find out the cost of goods sold or the ending inventory, they must be determined in order to prepare the financial statements. When using the periodic inventory system, a physical inventory is necessary to count and value the ending inventory. Detailed procedures are followed to determine a value for the unsold merchandise inventory. 9

Merchandise Inventory and the Financial Statements The ending inventory figure is: Reported as a current asset on the balance sheet; Used to calculate the cost of goods sold figure for the income statement; and Used as the beginning inventory figure for the next accounting period. 10

Merchandise Inventory and the Financial Statements On the balance sheet, Ending Inventory is reported in the current assets section … after cash and accounts receivable. 11

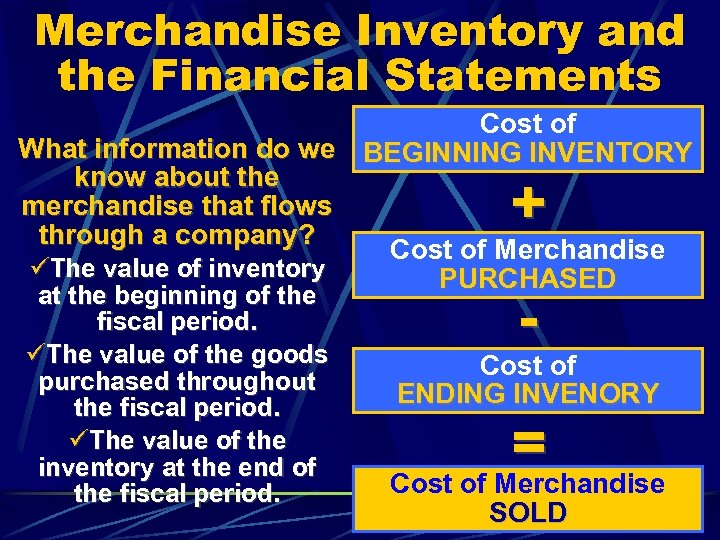

Merchandise Inventory and the Financial Statements Cost of What information do we BEGINNING INVENTORY know about the merchandise that flows through a company? Cost of Merchandise The value of inventory PURCHASED + at the beginning of the fiscal period. The value of the goods purchased throughout the fiscal period. The value of the inventory at the end of the fiscal period. - Cost of ENDING INVENORY = Cost of Merchandise SOLD 12

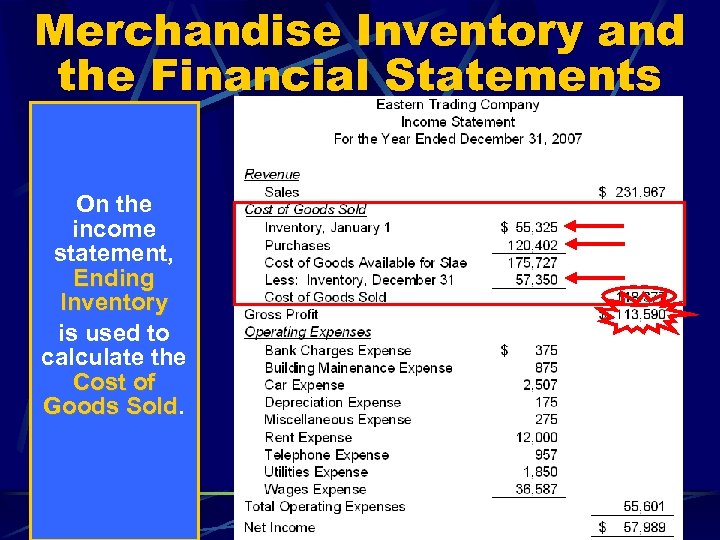

Merchandise Inventory and the Financial Statements On the income statement, Ending Inventory is used to calculate the Cost of Goods Sold 13

Limitations of the Periodic Inventory System Accurate financial statements cannot be generated unless a physical inventory is taken. Taking a physical inventory is time consuming and often interrupts business operations for a day or two. Easy to manage throughout the fiscal period. Well suited to small businesses that have to keep track a large number of different inventory items. Availability of cost effective computer technology has resulted in a move away from the periodic inventory system. 14

10. 2 Accounting Procedures for a Merchandising Business 15

Under the periodic inventory system, the merchandise inventory of a business is kept in two accounts: Merchandise Inventory … a current asset Purchases (or Purchases of Inventory for Resale) … an expense. 16

The Merchandise Inventory Account The balance in the Merchandise Inventory account shows the inventory figure as of the beginning of the accounting period. At the fiscal year end, the physical inventory counted is valued at cost price to arrive at the Merchandise Inventory used in the financial statements. At this point in time, the Merchandise Inventory account is adjusted to reflect the updated balance. 17

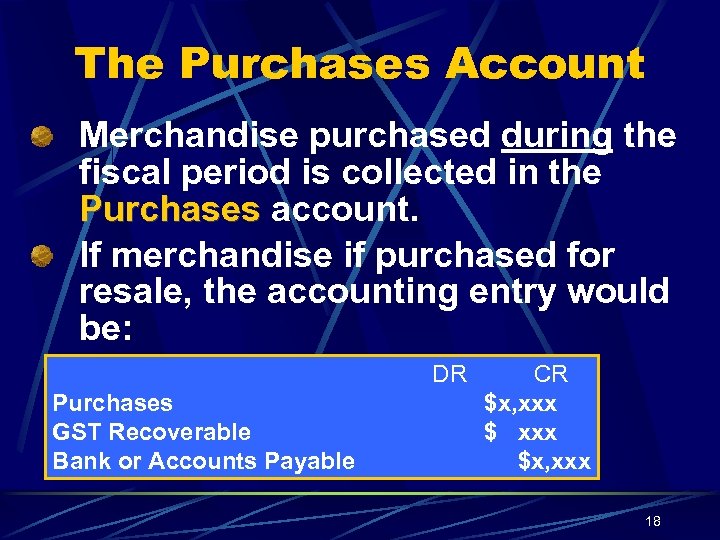

The Purchases Account Merchandise purchased during the fiscal period is collected in the Purchases account. If merchandise if purchased for resale, the accounting entry would be: DR Purchases GST Recoverable Bank or Accounts Payable CR $x, xxx 18

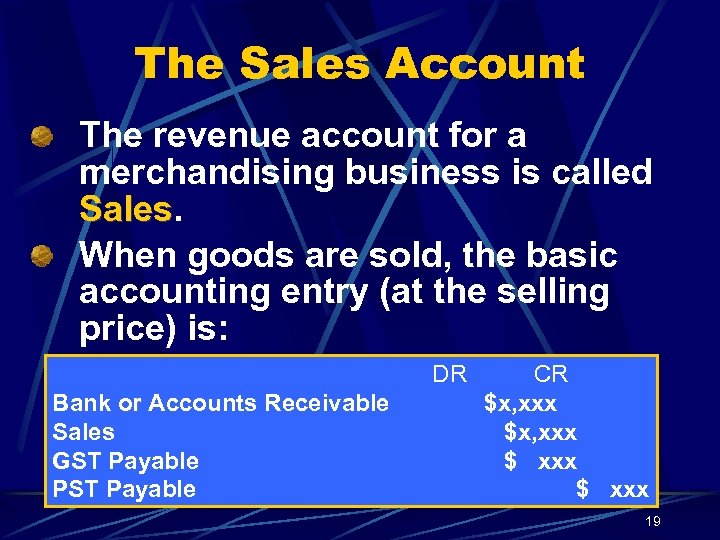

The Sales Account The revenue account for a merchandising business is called Sales When goods are sold, the basic accounting entry (at the selling price) is: DR Bank or Accounts Receivable Sales GST Payable PST Payable CR $x, xxx $ xxx 19

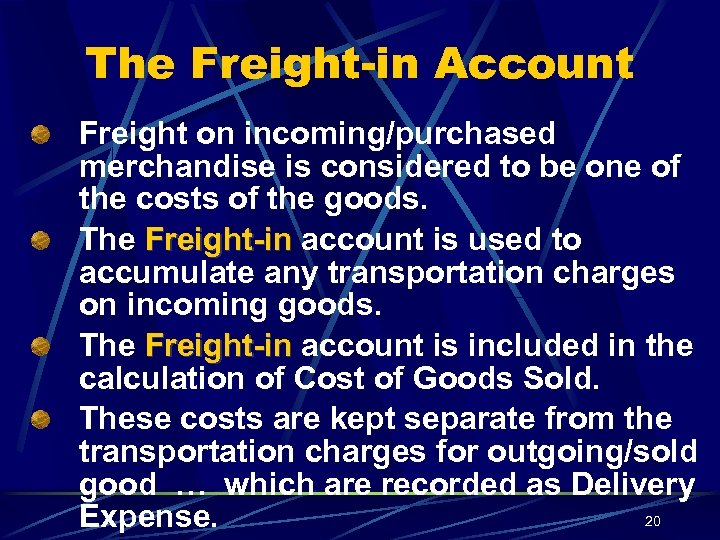

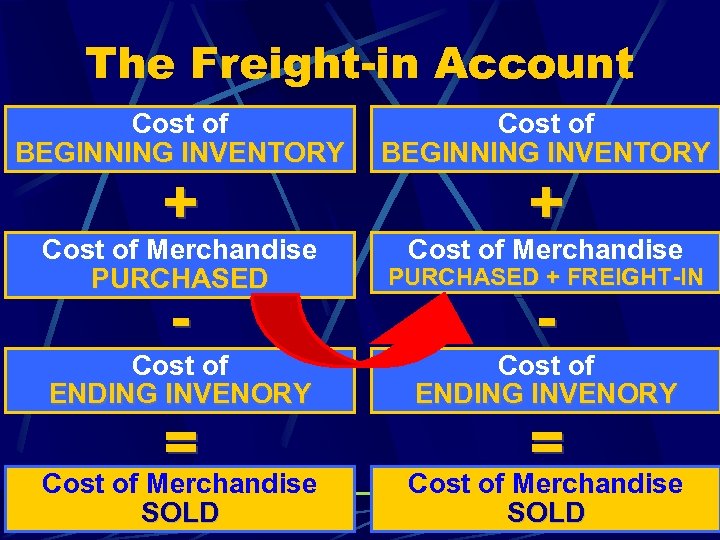

The Freight-in Account Freight on incoming/purchased merchandise is considered to be one of the costs of the goods. The Freight-in account is used to accumulate any transportation charges on incoming goods. The Freight-in account is included in the calculation of Cost of Goods Sold. These costs are kept separate from the transportation charges for outgoing/sold good … which are recorded as Delivery 20 Expense.

The Freight-in Account Cost of BEGINNING INVENTORY Cost of Merchandise PURCHASED + FREIGHT-IN Cost of ENDING INVENORY + - = Cost of Merchandise SOLD 21

10. 3 Worksheet for a Merchandising Business 22

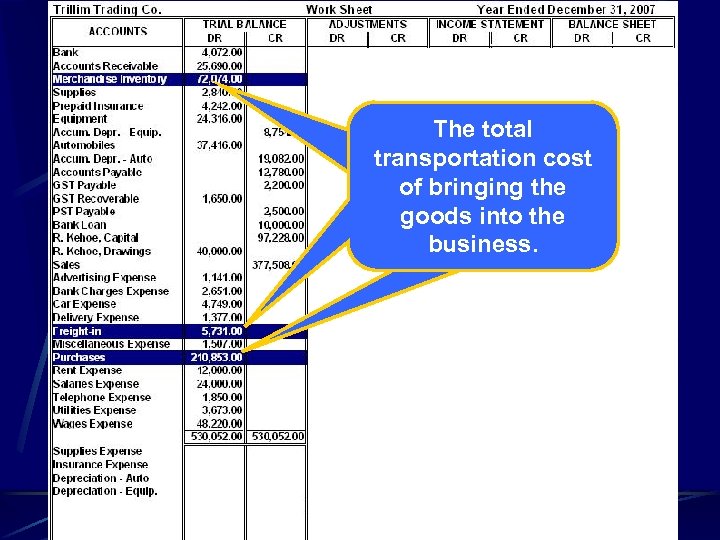

The value cost of all The total (at cost) of The total the merchandise on transportation cost merchandise inventory purchased ofhand at the bringing the beginning ofthe during the fiscal goods into the fiscal period. business. period. 23

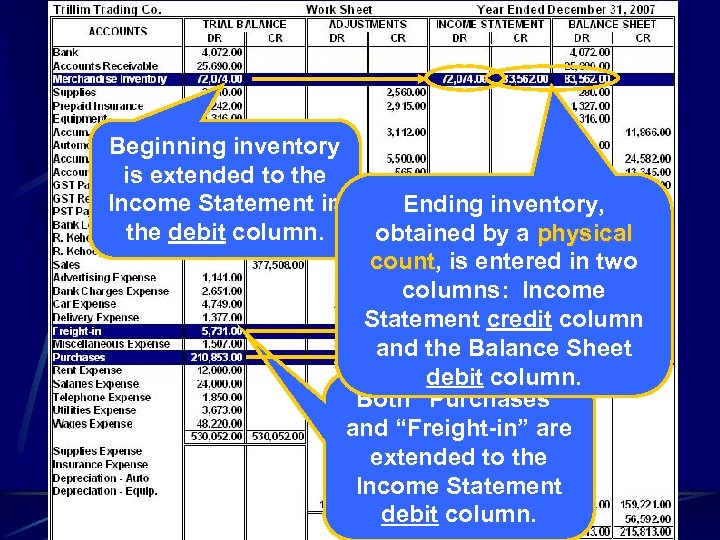

Beginning inventory is extended to the Income Statement in the debit column. Ending inventory, obtained by a physical count, is entered in two count columns: Income Statement credit column and the Balance Sheet debit column. Both “Purchases” and “Freight-in” are extended to the Income Statement debit column. 24

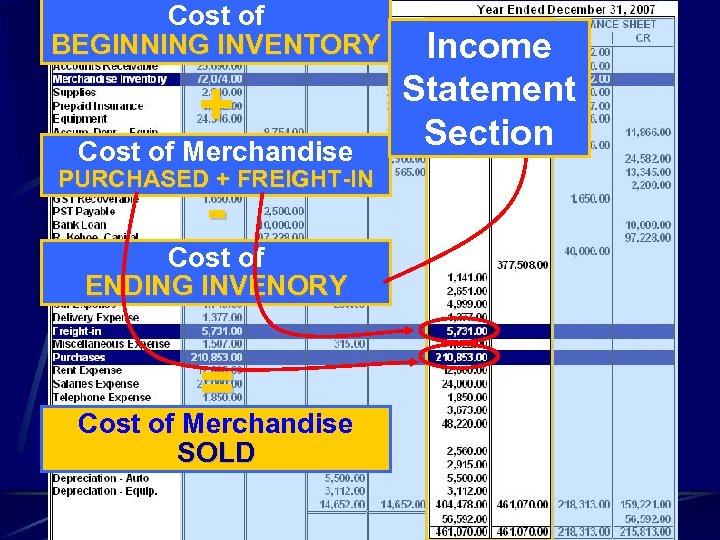

Cost of BEGINNING INVENTORY + Cost of Merchandise Income Statement Section PURCHASED + FREIGHT-IN - Cost of ENDING INVENORY = Cost of Merchandise SOLD 25

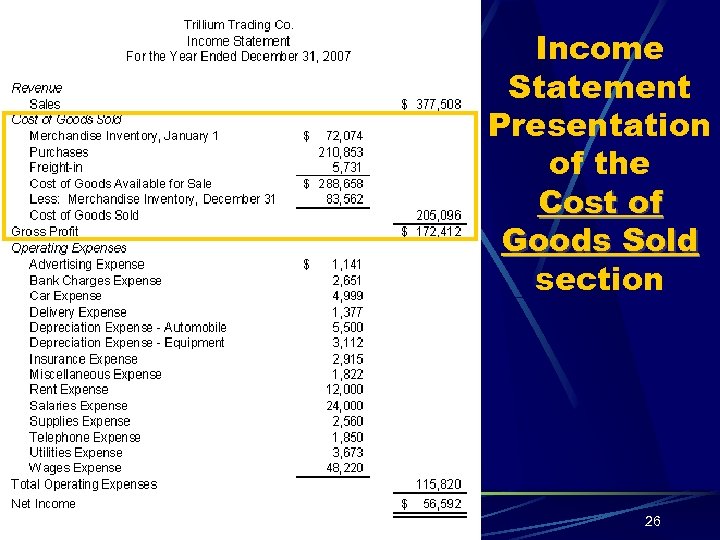

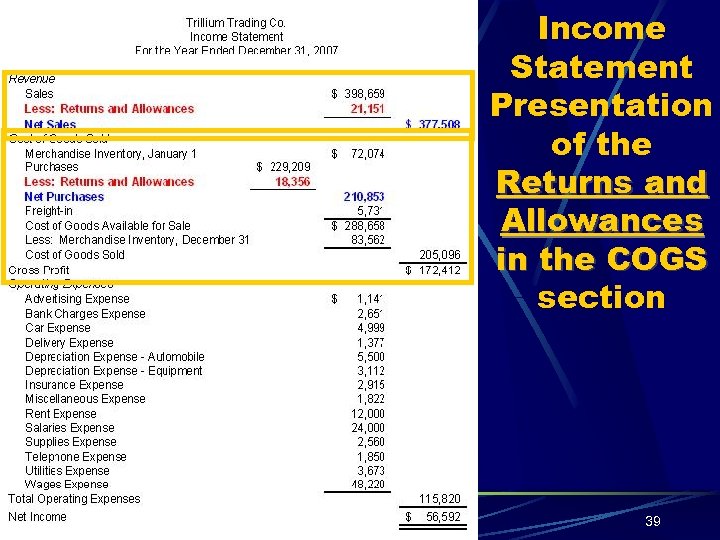

Income Statement Presentation of the Cost of Goods Sold section 26

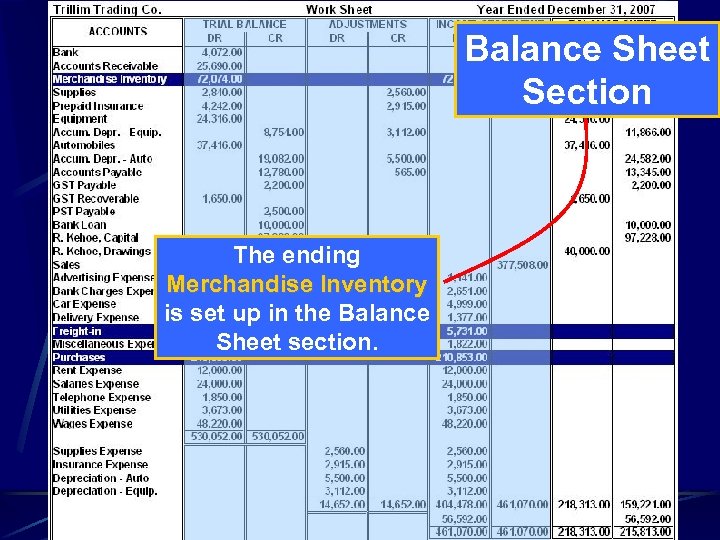

Balance Sheet Section The ending Merchandise Inventory is set up in the Balance Sheet section. 27

Closing Entries for a Merchandising Business 28

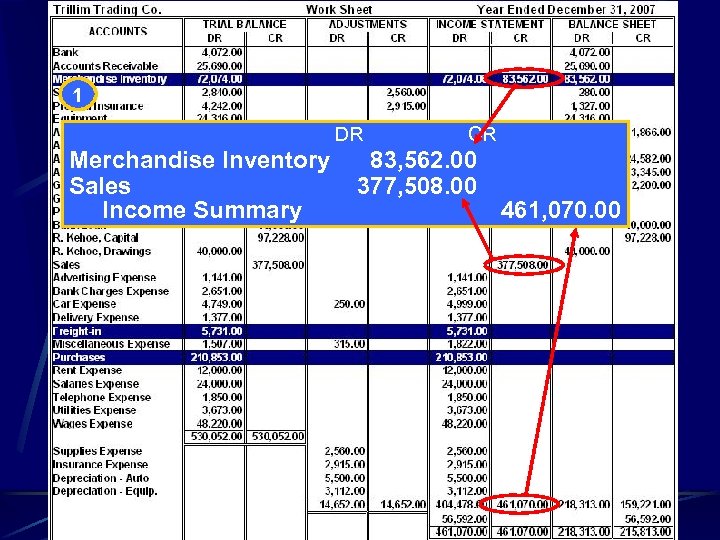

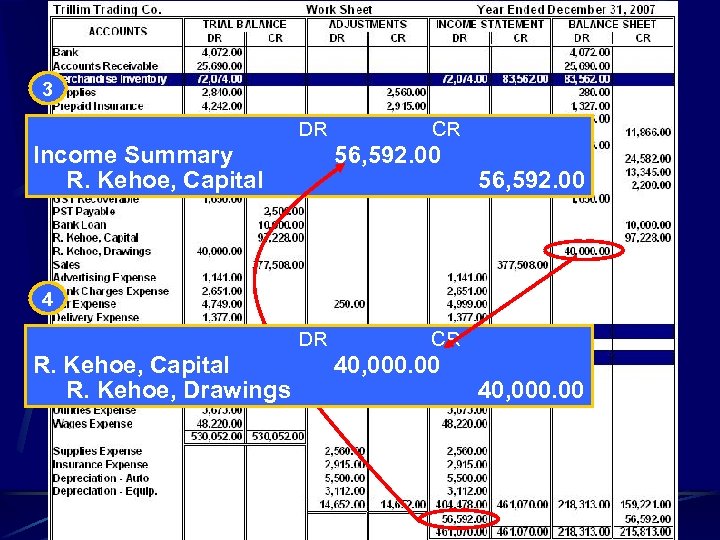

1 DR Merchandise Inventory Sales Income Summary CR 83, 562. 00 377, 508. 00 461, 070. 00 29

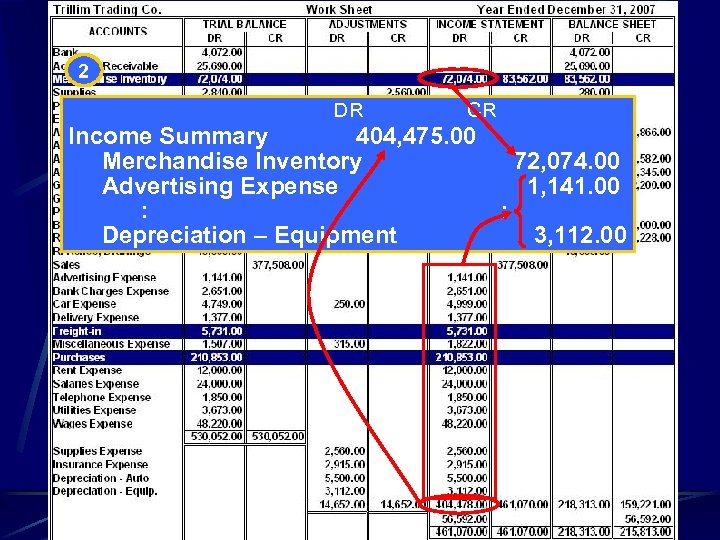

2 DR CR Income Summary 404, 475. 00 Merchandise Inventory 72, 074. 00 Advertising Expense 1, 141. 00 : : Depreciation – Equipment 3, 112. 00 30

3 DR Income Summary R. Kehoe, Capital CR 56, 592. 00 4 DR R. Kehoe, Capital R. Kehoe, Drawings CR 40, 000. 00 31

10. 4 Merchandising Returns and Allowances 32

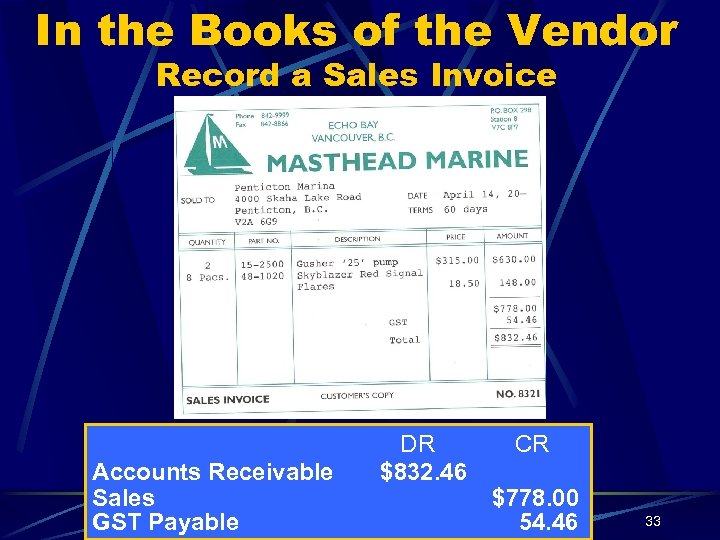

In the Books of the Vendor Record a Sales Invoice Accounts Receivable Sales GST Payable DR $832. 46 CR $778. 00 54. 46 33

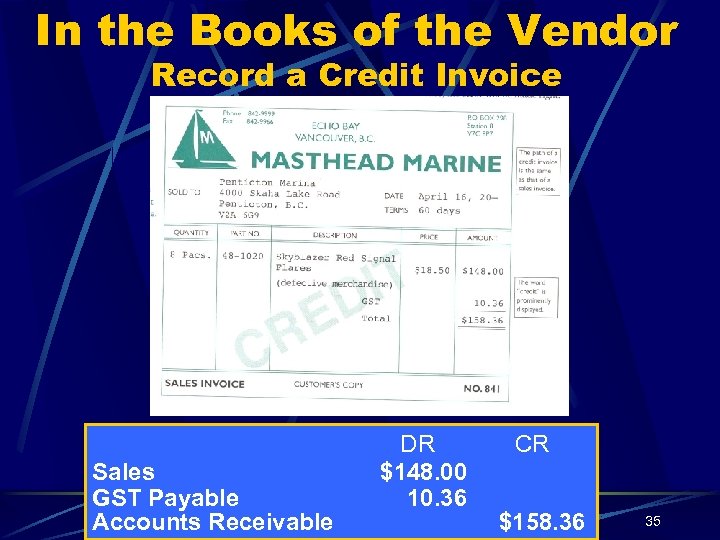

In the Books of the Vendor Occasionally, the vendor may need to issue a credit invoice to adjust, correct, or cancel a charge to a customer’s account. The credit invoice may be the result of: Defective goods that are returned; Less than satisfactory goods that are kept by the customer but require a reduced invoice price; or An error made on the sales invoice. 34

In the Books of the Vendor Record a Credit Invoice Sales GST Payable Accounts Receivable DR $148. 00 10. 36 CR $158. 36 35

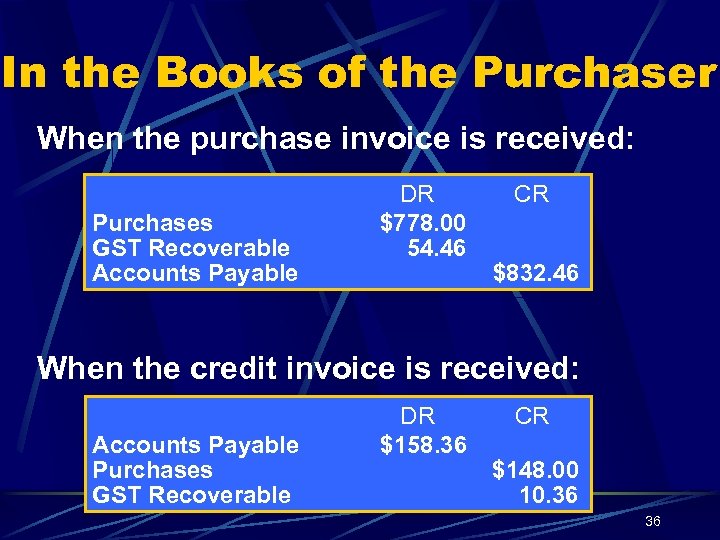

In the Books of the Purchaser When the purchase invoice is received: Purchases GST Recoverable Accounts Payable DR $778. 00 54. 46 CR $832. 46 When the credit invoice is received: Accounts Payable Purchases GST Recoverable DR $158. 36 CR $148. 00 10. 36 36

Sales Returns and Allowances Some companies prefer to track their Sales Returns and Allowances separate from the Sales account so that they can easily see the impact of returns. To accommodate this tracking process a separate ledger account is created. Sales Returns and Allowances is a contra -revenue account. 37

Purchases Returns and Allowances Some companies prefer to track their Purchases Returns and Allowances separate from the Purchases account so that they can easily see the impact of returns. To accommodate this tracking process a separate ledger account is created. Purchases Returns and Allowances is a contra-expense account. 38

Income Statement Presentation of the Returns and Allowances in the COGS section 39

10. 5 Sales Discounts 40

Terms of Sale C. O. D. – cash on delivery. On Account of Charge – full amount due when invoiced received … usually a “grace” period is provided. 30 Days or Net 30 – full amount due in 30 days from date of invoice. 60 Days or Net 60 2/10, n/30 – 2% discount if paid in 10 days, otherwise, full amount due in 30 days. 1/25, n/60 41

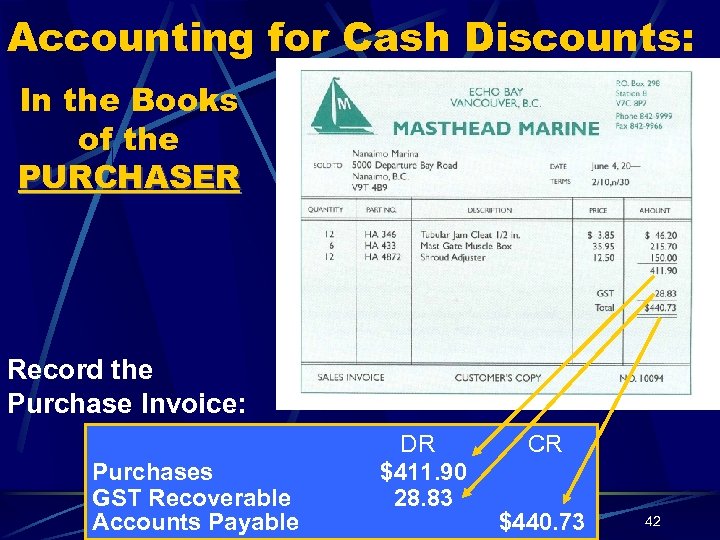

Accounting for Cash Discounts: In the Books of the PURCHASER Record the Purchase Invoice: Purchases GST Recoverable Accounts Payable DR $411. 90 28. 83 CR $440. 73 42

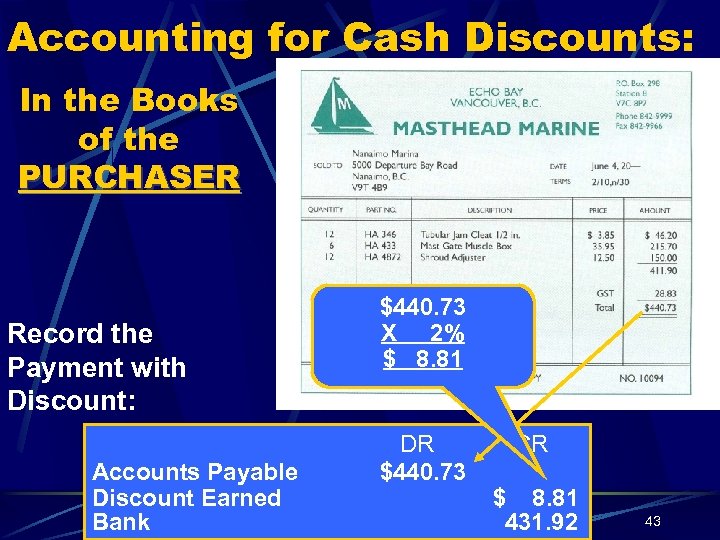

Accounting for Cash Discounts: In the Books of the PURCHASER Record the Payment with Discount: Accounts Payable Discount Earned Bank $440. 73 X 2% $ 8. 81 DR $440. 73 CR $ 8. 81 431. 92 43

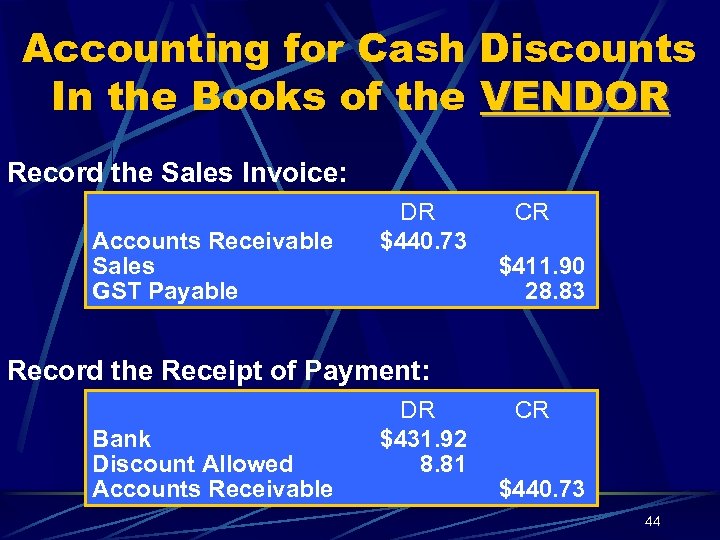

Accounting for Cash Discounts In the Books of the VENDOR Record the Sales Invoice: Accounts Receivable Sales GST Payable DR $440. 73 CR $411. 90 28. 83 Record the Receipt of Payment: Bank Discount Allowed Accounts Receivable DR $431. 92 8. 81 CR $440. 73 44

Income Statement Presentation of the Discounts Allowed and Discounts Earned in the COGS section 45

10. 7 Perpetual Inventory 46

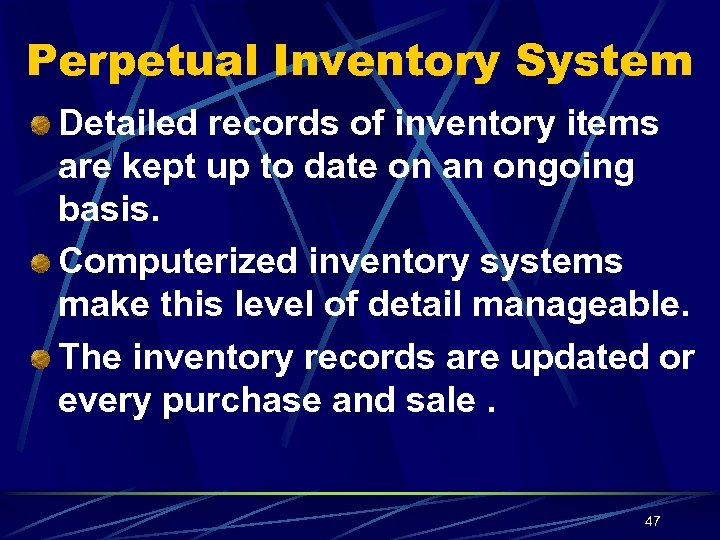

Perpetual Inventory System Detailed records of inventory items are kept up to date on an ongoing basis. Computerized inventory systems make this level of detail manageable. The inventory records are updated or every purchase and sale. 47

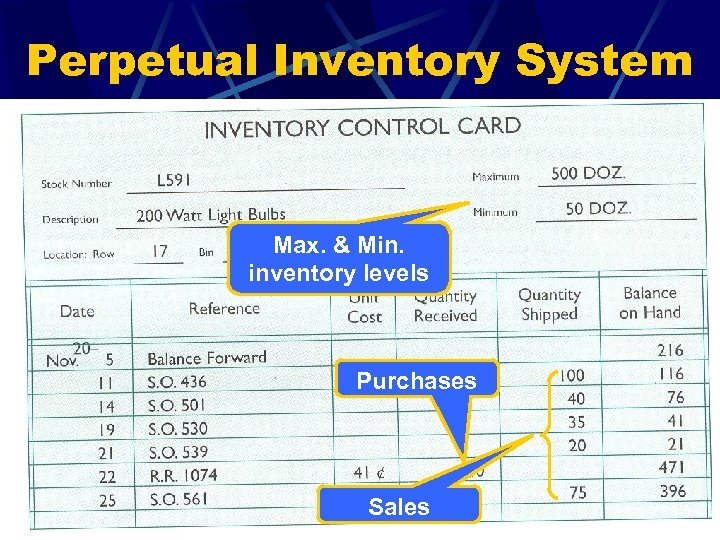

Perpetual Inventory System Max. & Min. inventory levels Purchases Sales 48

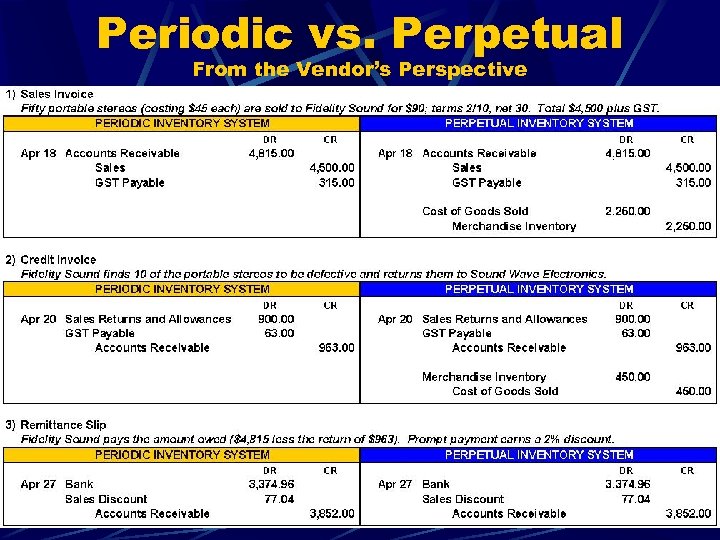

Periodic vs. Perpetual From the Vendor’s Perspective 49

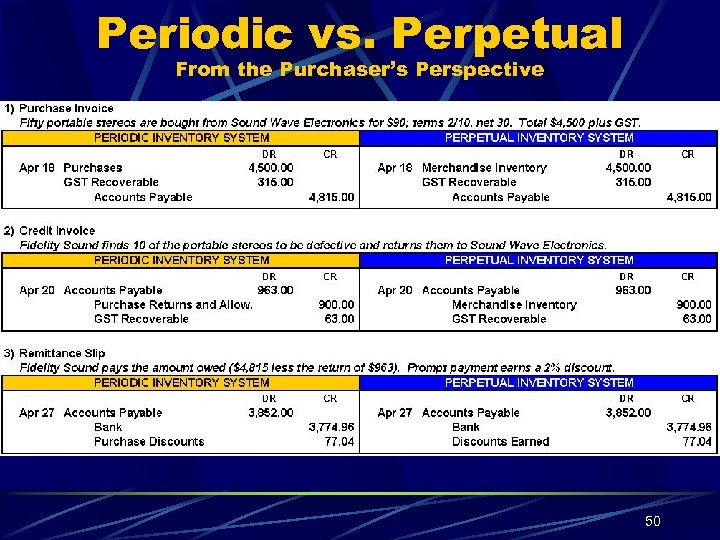

Periodic vs. Perpetual From the Purchaser’s Perspective 50

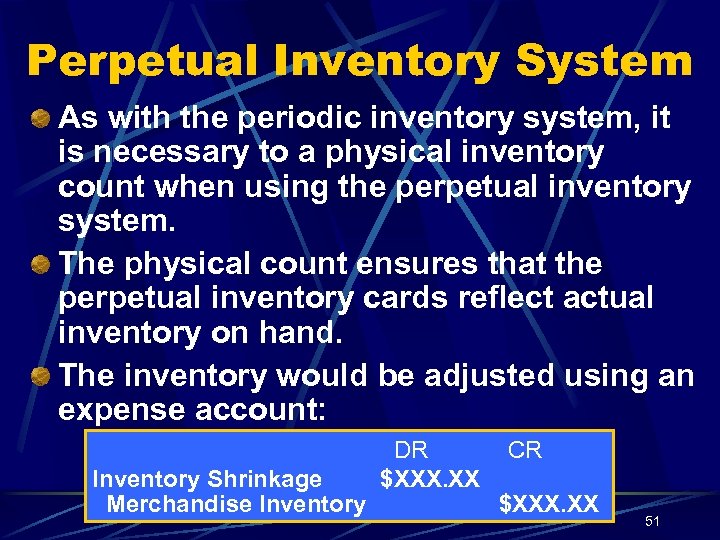

Perpetual Inventory System As with the periodic inventory system, it is necessary to a physical inventory count when using the perpetual inventory system. The physical count ensures that the perpetual inventory cards reflect actual inventory on hand. The inventory would be adjusted using an expense account: Inventory Shrinkage Merchandise Inventory DR $XXX. XX CR $XXX. XX 51

e44749ddde3c2876ec2fa31cc2d24696.ppt