759d89d9755de501677c154515edbdc7.ppt

- Количество слайдов: 101

Chapter 10 Market Power: Monopoly and Monopsony

Chapter 10 Market Power: Monopoly and Monopsony

Topics to be Discussed l Monopoly and Monopoly Power l Sources of Monopoly Power l The Social Costs of Monopoly Power l Monopsony and Monopsony Power l Limiting Market Power: The Antitrust Laws © 2005 Pearson Education, Inc. Chapter 10 2

Topics to be Discussed l Monopoly and Monopoly Power l Sources of Monopoly Power l The Social Costs of Monopoly Power l Monopsony and Monopsony Power l Limiting Market Power: The Antitrust Laws © 2005 Pearson Education, Inc. Chapter 10 2

Review of Perfect Competition l P = LMC = LRAC l Normal profits or zero economic profits in the long run l Large number of buyers and sellers l Homogenous product l Perfect information l Firm is a price taker © 2005 Pearson Education, Inc. Chapter 10 3

Review of Perfect Competition l P = LMC = LRAC l Normal profits or zero economic profits in the long run l Large number of buyers and sellers l Homogenous product l Perfect information l Firm is a price taker © 2005 Pearson Education, Inc. Chapter 10 3

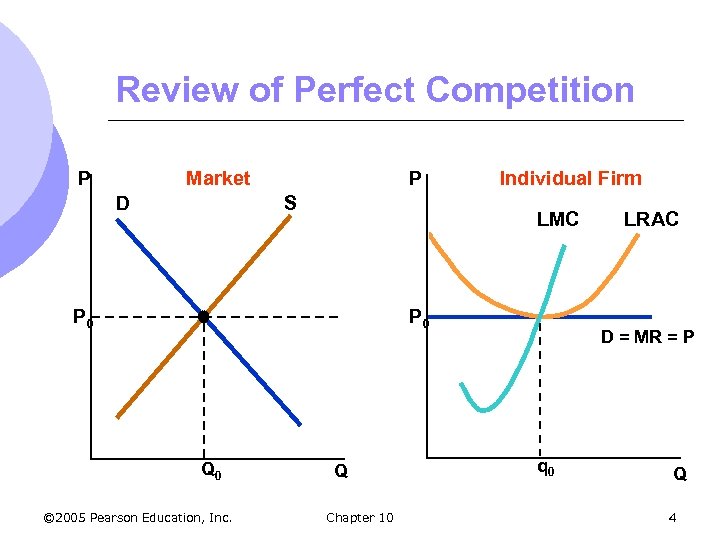

Review of Perfect Competition Market P D P S Individual Firm LMC P 0 Q 0 © 2005 Pearson Education, Inc. Q Chapter 10 LRAC D = MR = P q 0 Q 4

Review of Perfect Competition Market P D P S Individual Firm LMC P 0 Q 0 © 2005 Pearson Education, Inc. Q Chapter 10 LRAC D = MR = P q 0 Q 4

Monopoly l Monopoly 1. 2. 3. 4. One seller - many buyers One product (no good substitutes) Barriers to entry Price Maker © 2005 Pearson Education, Inc. Chapter 10 5

Monopoly l Monopoly 1. 2. 3. 4. One seller - many buyers One product (no good substitutes) Barriers to entry Price Maker © 2005 Pearson Education, Inc. Chapter 10 5

Monopoly l The monopolist is the supply-side of the market and has complete control over the amount offered for sale l Monopolist controls price but must consider consumer demand l Profits will be maximized at the level of output where marginal revenue equals marginal cost © 2005 Pearson Education, Inc. Chapter 10 6

Monopoly l The monopolist is the supply-side of the market and has complete control over the amount offered for sale l Monopolist controls price but must consider consumer demand l Profits will be maximized at the level of output where marginal revenue equals marginal cost © 2005 Pearson Education, Inc. Chapter 10 6

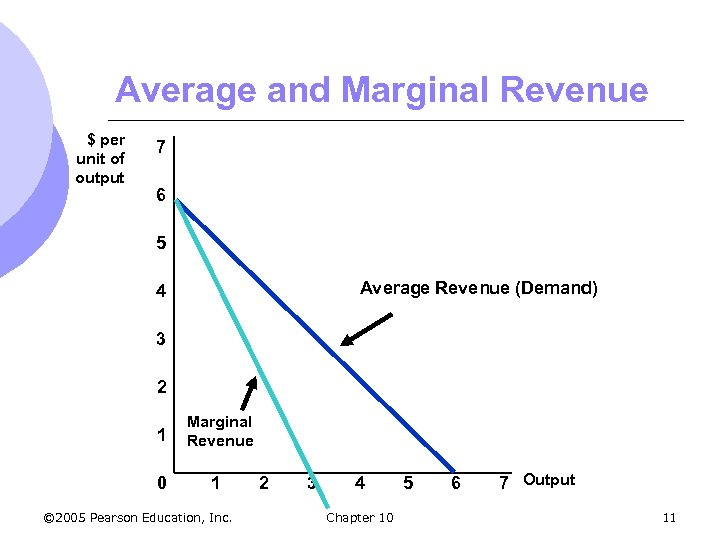

Average and Marginal Revenue l The monopolist’s average revenue, price received per unit sold, is the market demand curve l Monopolist also needs to find marginal revenue, change in revenue resulting from a unit change in output © 2005 Pearson Education, Inc. Chapter 10 7

Average and Marginal Revenue l The monopolist’s average revenue, price received per unit sold, is the market demand curve l Monopolist also needs to find marginal revenue, change in revenue resulting from a unit change in output © 2005 Pearson Education, Inc. Chapter 10 7

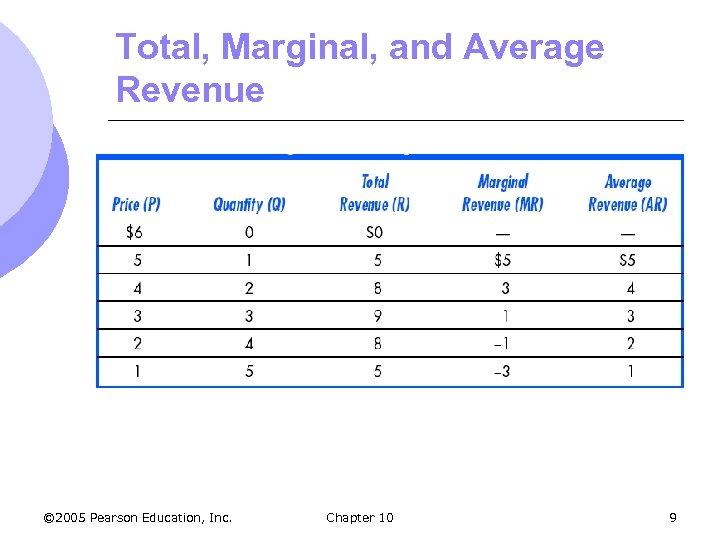

Average and Marginal Revenue l Finding Marginal Revenue m As the sole producer, the monopolist works with the market demand to determine output and price m An example can be used to show the relationship between average and marginal revenue m Assume a monopolist with demand: P=6 -Q © 2005 Pearson Education, Inc. Chapter 10 8

Average and Marginal Revenue l Finding Marginal Revenue m As the sole producer, the monopolist works with the market demand to determine output and price m An example can be used to show the relationship between average and marginal revenue m Assume a monopolist with demand: P=6 -Q © 2005 Pearson Education, Inc. Chapter 10 8

Total, Marginal, and Average Revenue © 2005 Pearson Education, Inc. Chapter 10 9

Total, Marginal, and Average Revenue © 2005 Pearson Education, Inc. Chapter 10 9

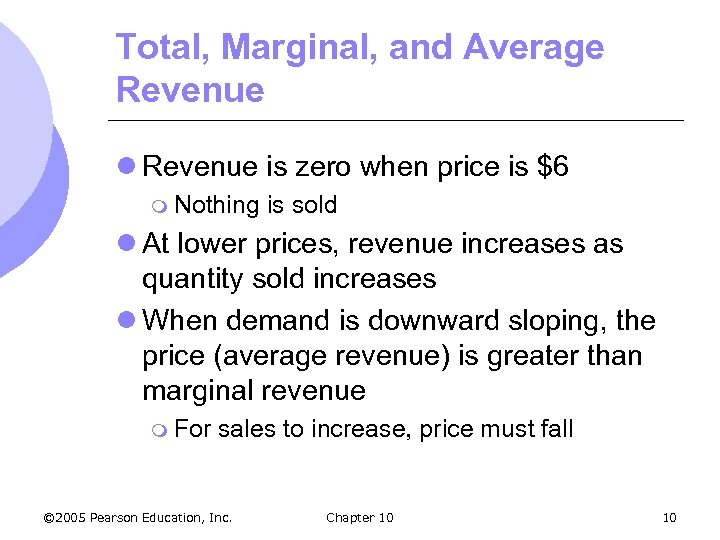

Total, Marginal, and Average Revenue l Revenue is zero when price is $6 m Nothing is sold l At lower prices, revenue increases as quantity sold increases l When demand is downward sloping, the price (average revenue) is greater than marginal revenue m For sales to increase, price must fall © 2005 Pearson Education, Inc. Chapter 10 10

Total, Marginal, and Average Revenue l Revenue is zero when price is $6 m Nothing is sold l At lower prices, revenue increases as quantity sold increases l When demand is downward sloping, the price (average revenue) is greater than marginal revenue m For sales to increase, price must fall © 2005 Pearson Education, Inc. Chapter 10 10

Average and Marginal Revenue $ per unit of output 7 6 5 Average Revenue (Demand) 4 3 2 1 Marginal Revenue 0 1 © 2005 Pearson Education, Inc. 2 3 4 Chapter 10 5 6 7 Output 11

Average and Marginal Revenue $ per unit of output 7 6 5 Average Revenue (Demand) 4 3 2 1 Marginal Revenue 0 1 © 2005 Pearson Education, Inc. 2 3 4 Chapter 10 5 6 7 Output 11

Monopoly l Observations 1. 2. 3. To increase sales the price must fall MR < P Compared to perfect competition No change in price to change sales l MR = P l © 2005 Pearson Education, Inc. Chapter 10 12

Monopoly l Observations 1. 2. 3. To increase sales the price must fall MR < P Compared to perfect competition No change in price to change sales l MR = P l © 2005 Pearson Education, Inc. Chapter 10 12

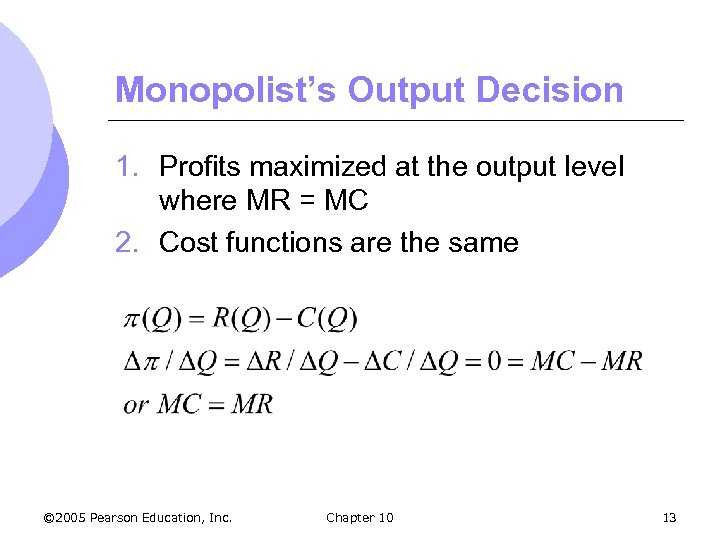

Monopolist’s Output Decision 1. Profits maximized at the output level where MR = MC 2. Cost functions are the same © 2005 Pearson Education, Inc. Chapter 10 13

Monopolist’s Output Decision 1. Profits maximized at the output level where MR = MC 2. Cost functions are the same © 2005 Pearson Education, Inc. Chapter 10 13

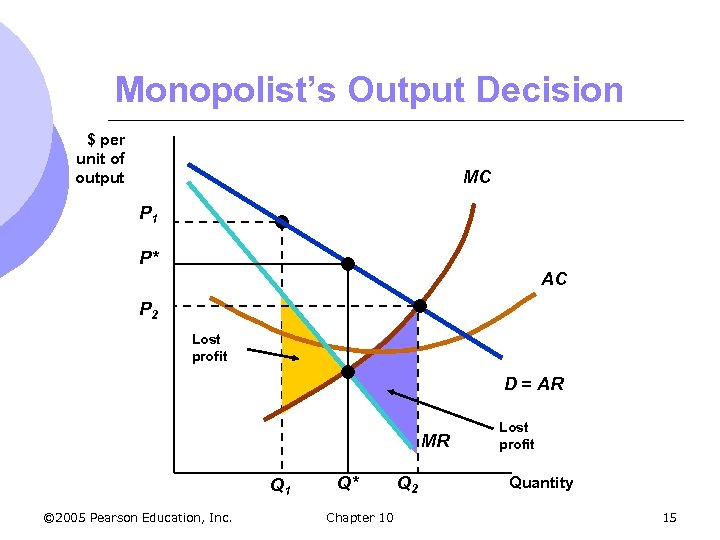

Monopolist’s Output Decision l At output levels below MR = MC, the decrease in revenue is greater than the decrease in cost (MR > MC) l At output levels above MR = MC, the increase in cost is greater than the decrease in revenue (MR < MC) © 2005 Pearson Education, Inc. Chapter 10 14

Monopolist’s Output Decision l At output levels below MR = MC, the decrease in revenue is greater than the decrease in cost (MR > MC) l At output levels above MR = MC, the increase in cost is greater than the decrease in revenue (MR < MC) © 2005 Pearson Education, Inc. Chapter 10 14

Monopolist’s Output Decision $ per unit of output MC P 1 P* AC P 2 Lost profit D = AR MR Q 1 © 2005 Pearson Education, Inc. Q* Chapter 10 Q 2 Lost profit Quantity 15

Monopolist’s Output Decision $ per unit of output MC P 1 P* AC P 2 Lost profit D = AR MR Q 1 © 2005 Pearson Education, Inc. Q* Chapter 10 Q 2 Lost profit Quantity 15

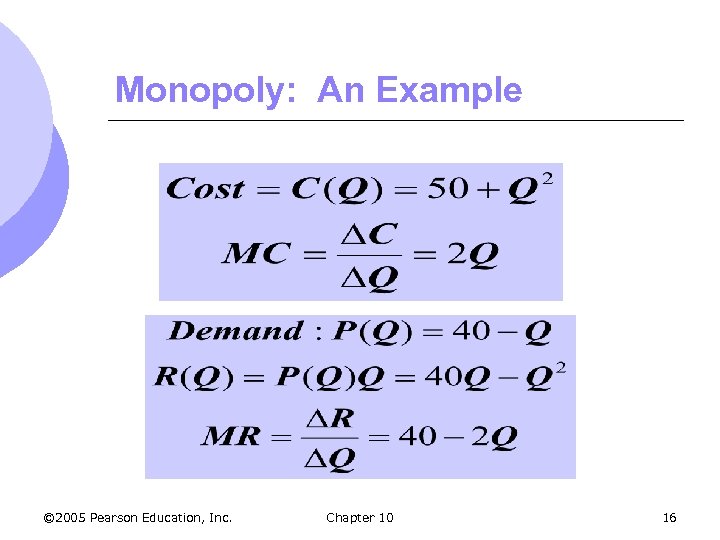

Monopoly: An Example © 2005 Pearson Education, Inc. Chapter 10 16

Monopoly: An Example © 2005 Pearson Education, Inc. Chapter 10 16

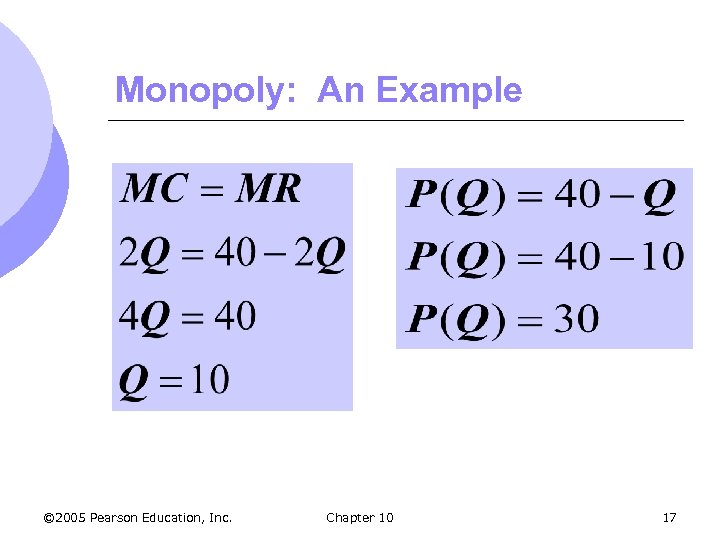

Monopoly: An Example © 2005 Pearson Education, Inc. Chapter 10 17

Monopoly: An Example © 2005 Pearson Education, Inc. Chapter 10 17

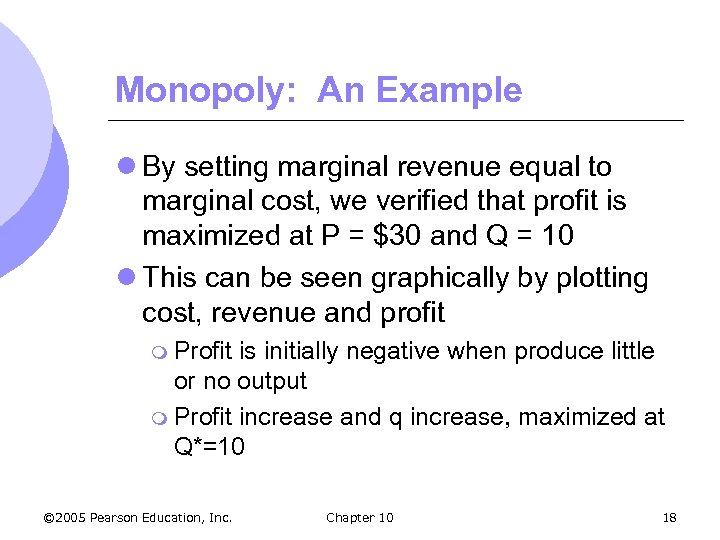

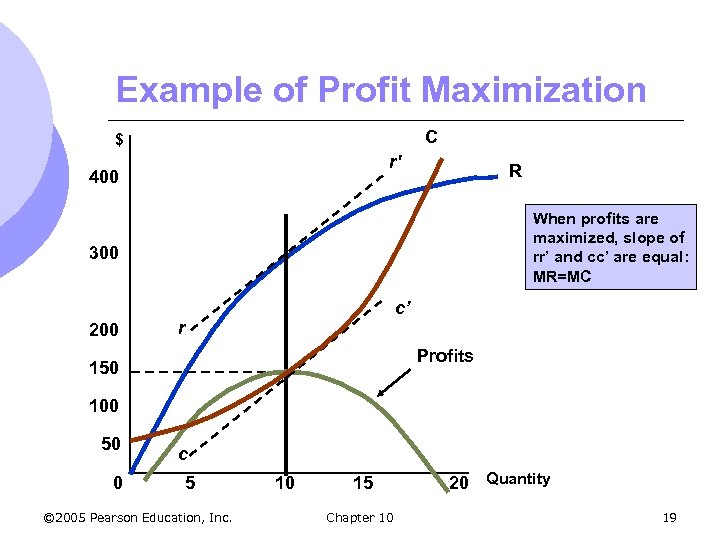

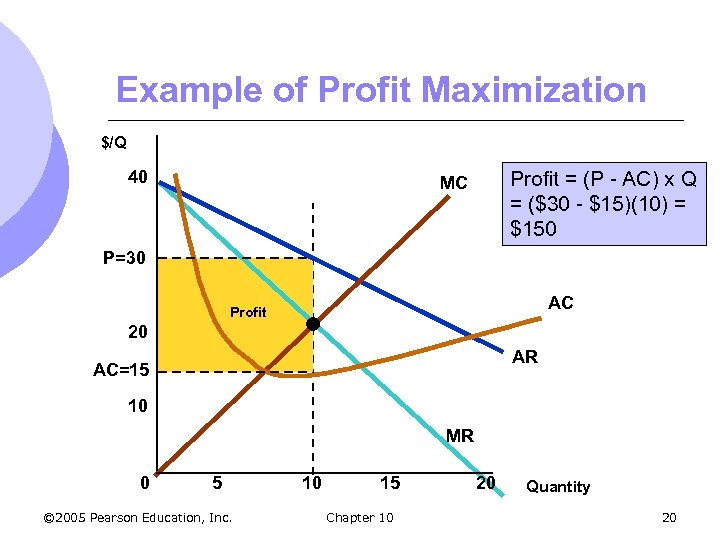

Monopoly: An Example l By setting marginal revenue equal to marginal cost, we verified that profit is maximized at P = $30 and Q = 10 l This can be seen graphically by plotting cost, revenue and profit m Profit is initially negative when produce little or no output m Profit increase and q increase, maximized at Q*=10 © 2005 Pearson Education, Inc. Chapter 10 18

Monopoly: An Example l By setting marginal revenue equal to marginal cost, we verified that profit is maximized at P = $30 and Q = 10 l This can be seen graphically by plotting cost, revenue and profit m Profit is initially negative when produce little or no output m Profit increase and q increase, maximized at Q*=10 © 2005 Pearson Education, Inc. Chapter 10 18

Example of Profit Maximization C $ r' 400 R When profits are maximized, slope of rr’ and cc’ are equal: MR=MC 300 c’ 200 r Profits 150 100 50 0 c 5 © 2005 Pearson Education, Inc. 10 15 Chapter 10 20 Quantity 19

Example of Profit Maximization C $ r' 400 R When profits are maximized, slope of rr’ and cc’ are equal: MR=MC 300 c’ 200 r Profits 150 100 50 0 c 5 © 2005 Pearson Education, Inc. 10 15 Chapter 10 20 Quantity 19

Example of Profit Maximization $/Q 40 Profit = (P - AC) x Q = ($30 - $15)(10) = $150 MC P=30 AC Profit 20 AR AC=15 10 MR 0 5 © 2005 Pearson Education, Inc. 10 15 Chapter 10 20 Quantity 20

Example of Profit Maximization $/Q 40 Profit = (P - AC) x Q = ($30 - $15)(10) = $150 MC P=30 AC Profit 20 AR AC=15 10 MR 0 5 © 2005 Pearson Education, Inc. 10 15 Chapter 10 20 Quantity 20

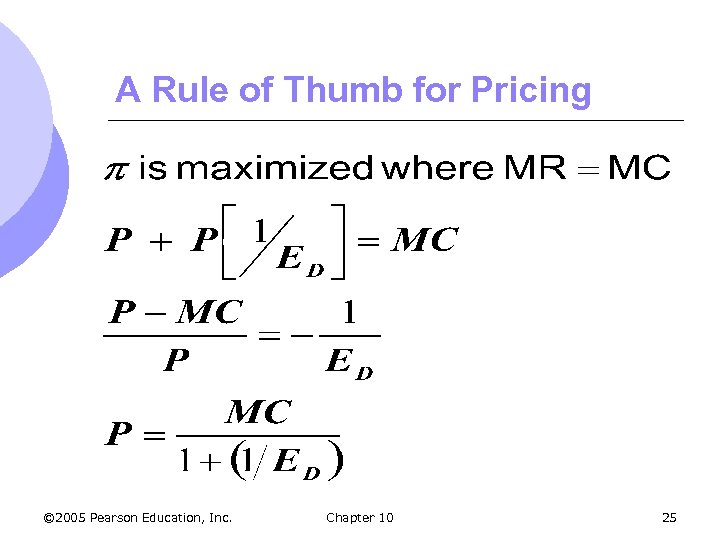

Monopoly l A Rule of Thumb for Pricing m We want to translate the condition that marginal revenue should equal marginal cost into a rule of thumb that can be more easily applied in practice m Looking at Marginal Revenue we can see that it has two components © 2005 Pearson Education, Inc. Chapter 10 21

Monopoly l A Rule of Thumb for Pricing m We want to translate the condition that marginal revenue should equal marginal cost into a rule of thumb that can be more easily applied in practice m Looking at Marginal Revenue we can see that it has two components © 2005 Pearson Education, Inc. Chapter 10 21

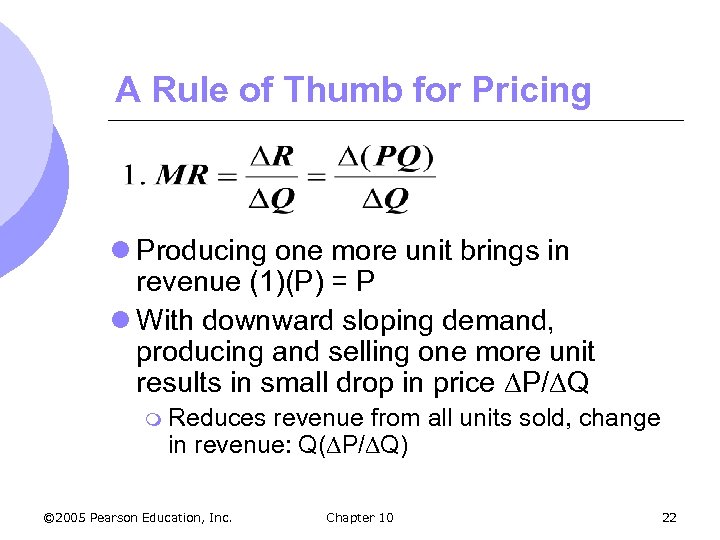

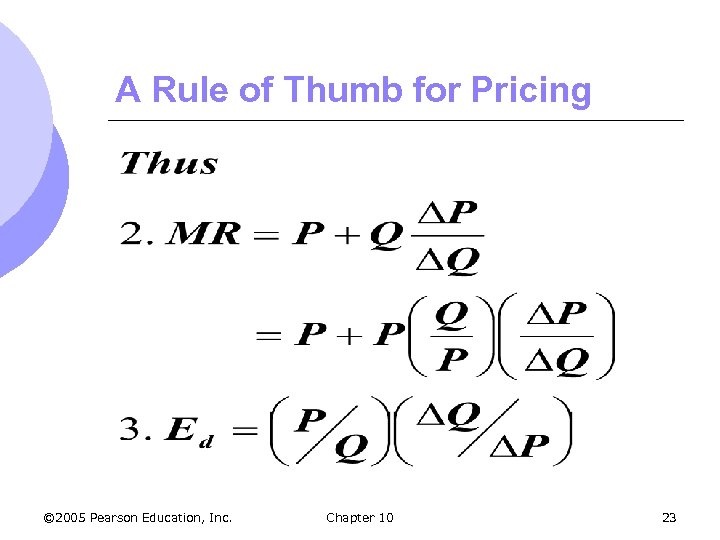

A Rule of Thumb for Pricing l Producing one more unit brings in revenue (1)(P) = P l With downward sloping demand, producing and selling one more unit results in small drop in price P/ Q m Reduces revenue from all units sold, change in revenue: Q( P/ Q) © 2005 Pearson Education, Inc. Chapter 10 22

A Rule of Thumb for Pricing l Producing one more unit brings in revenue (1)(P) = P l With downward sloping demand, producing and selling one more unit results in small drop in price P/ Q m Reduces revenue from all units sold, change in revenue: Q( P/ Q) © 2005 Pearson Education, Inc. Chapter 10 22

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 23

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 23

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 24

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 24

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 25

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 25

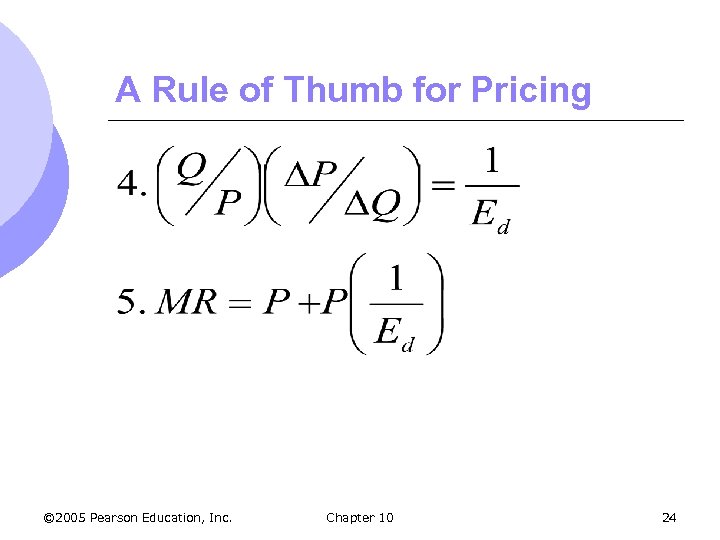

A Rule of Thumb for Pricing l (P – MC)/P is the markup over MC as a percentage of price l The markup should equal the inverse of the elasticity of demand l Price is expressed directly as the markup over marginal cost © 2005 Pearson Education, Inc. Chapter 10 26

A Rule of Thumb for Pricing l (P – MC)/P is the markup over MC as a percentage of price l The markup should equal the inverse of the elasticity of demand l Price is expressed directly as the markup over marginal cost © 2005 Pearson Education, Inc. Chapter 10 26

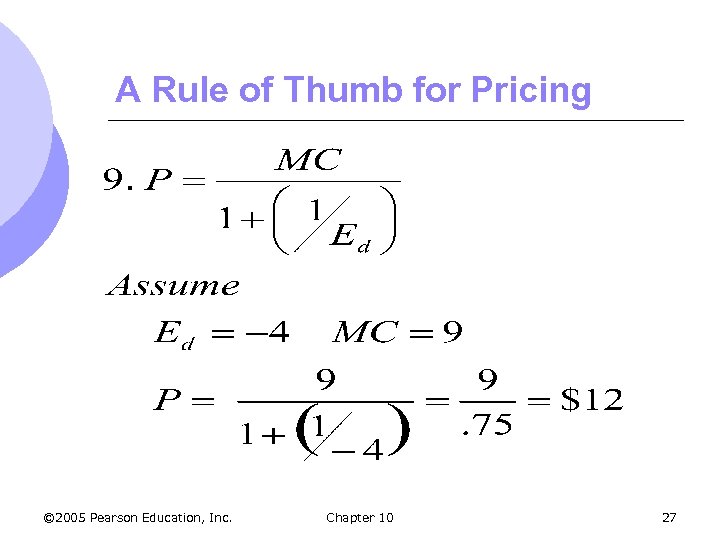

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 27

A Rule of Thumb for Pricing © 2005 Pearson Education, Inc. Chapter 10 27

Monopoly l Monopoly pricing compared to perfect competition pricing: m Monopoly l. P > MC l Price is larger than MC by an amount that depends inversely on the elasticity of demand m Perfect Competition l. P = MC l Demand is perfectly elastic, so P=MC © 2005 Pearson Education, Inc. Chapter 10 28

Monopoly l Monopoly pricing compared to perfect competition pricing: m Monopoly l. P > MC l Price is larger than MC by an amount that depends inversely on the elasticity of demand m Perfect Competition l. P = MC l Demand is perfectly elastic, so P=MC © 2005 Pearson Education, Inc. Chapter 10 28

Monopoly l If demand is very elastic, there is little benefit to being a monopolist l The larger the elasticity, the closer to a perfectly competitive market l Notice a monopolist will never produce a quantity in the inelastic portion of demand curve m In inelastic portion, can increase revenue by decreasing quantity and increasing price © 2005 Pearson Education, Inc. Chapter 10 29

Monopoly l If demand is very elastic, there is little benefit to being a monopolist l The larger the elasticity, the closer to a perfectly competitive market l Notice a monopolist will never produce a quantity in the inelastic portion of demand curve m In inelastic portion, can increase revenue by decreasing quantity and increasing price © 2005 Pearson Education, Inc. Chapter 10 29

Shifts in Demand l In perfect competition, the market supply curve is determined by marginal cost l For a monopoly, output is determined by marginal cost and the shape of the demand curve m There is no supply curve for monopolistic market © 2005 Pearson Education, Inc. Chapter 10 30

Shifts in Demand l In perfect competition, the market supply curve is determined by marginal cost l For a monopoly, output is determined by marginal cost and the shape of the demand curve m There is no supply curve for monopolistic market © 2005 Pearson Education, Inc. Chapter 10 30

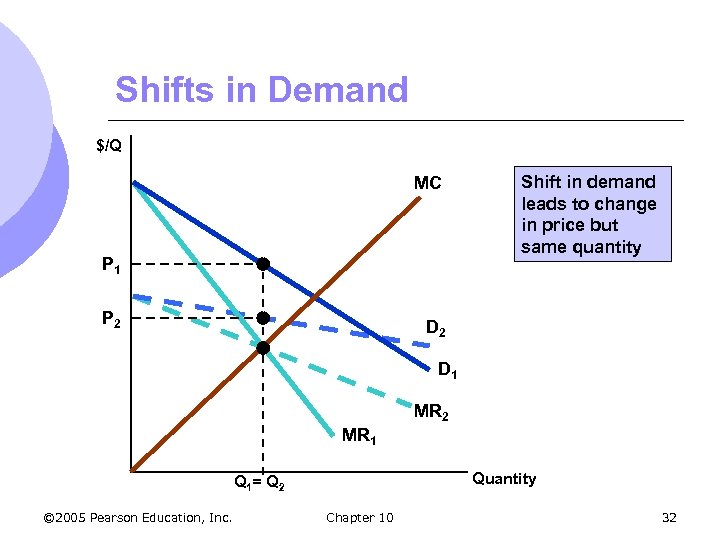

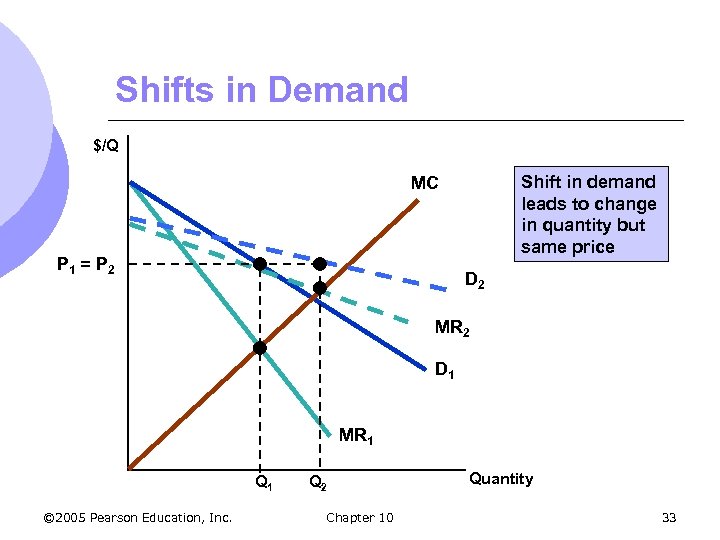

Shifts in Demand l Shifts in demand do not trace out price and quantity changes corresponding to a supply curve l Shifts in demand lead to m Changes in price with no change in output m Changes in output with no change in price m Changes in both price and quantity © 2005 Pearson Education, Inc. Chapter 10 31

Shifts in Demand l Shifts in demand do not trace out price and quantity changes corresponding to a supply curve l Shifts in demand lead to m Changes in price with no change in output m Changes in output with no change in price m Changes in both price and quantity © 2005 Pearson Education, Inc. Chapter 10 31

Shifts in Demand $/Q MC P 1 P 2 Shift in demand leads to change in price but same quantity D 2 D 1 MR 2 MR 1 Quantity Q 1= Q 2 © 2005 Pearson Education, Inc. Chapter 10 32

Shifts in Demand $/Q MC P 1 P 2 Shift in demand leads to change in price but same quantity D 2 D 1 MR 2 MR 1 Quantity Q 1= Q 2 © 2005 Pearson Education, Inc. Chapter 10 32

Shifts in Demand $/Q Shift in demand leads to change in quantity but same price MC P 1 = P 2 D 2 MR 2 D 1 MR 1 Q 1 © 2005 Pearson Education, Inc. Q 2 Chapter 10 Quantity 33

Shifts in Demand $/Q Shift in demand leads to change in quantity but same price MC P 1 = P 2 D 2 MR 2 D 1 MR 1 Q 1 © 2005 Pearson Education, Inc. Q 2 Chapter 10 Quantity 33

Monopoly l Shifts in demand usually cause a change in both price and quantity l Examples show monopolistic market differs from perfectly competitive market l Competitive market supplies specific quantity at every price m This relationship does not exist for a monopolistic market © 2005 Pearson Education, Inc. Chapter 10 34

Monopoly l Shifts in demand usually cause a change in both price and quantity l Examples show monopolistic market differs from perfectly competitive market l Competitive market supplies specific quantity at every price m This relationship does not exist for a monopolistic market © 2005 Pearson Education, Inc. Chapter 10 34

The Effect of a Tax l In competitive market, a per-unit tax causes price to rise by less than tax: burden is shared by producers and consumers l Under monopoly, price can sometimes rise by more than the amount of the tax l To determine the impact of a tax: mt = specific tax m MC = MC + t © 2005 Pearson Education, Inc. Chapter 10 35

The Effect of a Tax l In competitive market, a per-unit tax causes price to rise by less than tax: burden is shared by producers and consumers l Under monopoly, price can sometimes rise by more than the amount of the tax l To determine the impact of a tax: mt = specific tax m MC = MC + t © 2005 Pearson Education, Inc. Chapter 10 35

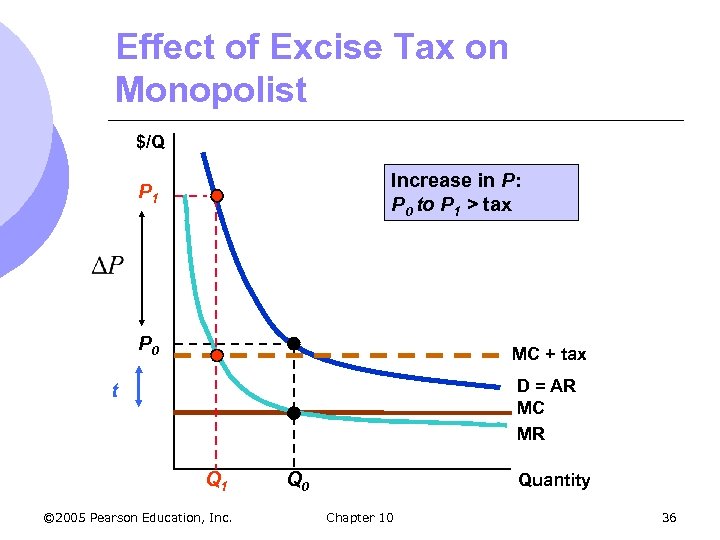

Effect of Excise Tax on Monopolist $/Q Increase in P: P 0 to P 1 > tax P 1 P 0 MC + tax D = AR MC MR t Q 1 © 2005 Pearson Education, Inc. Q 0 Quantity Chapter 10 36

Effect of Excise Tax on Monopolist $/Q Increase in P: P 0 to P 1 > tax P 1 P 0 MC + tax D = AR MC MR t Q 1 © 2005 Pearson Education, Inc. Q 0 Quantity Chapter 10 36

Effect of Excise Tax on Monopolist l The amount the price increases with implementation of a tax depends on elasticity of demand l Price may or may not increase by more than the tax l In a competitive market, the price cannot increase by more than tax l Profits for monopolist will fall with a tax © 2005 Pearson Education, Inc. Chapter 10 37

Effect of Excise Tax on Monopolist l The amount the price increases with implementation of a tax depends on elasticity of demand l Price may or may not increase by more than the tax l In a competitive market, the price cannot increase by more than tax l Profits for monopolist will fall with a tax © 2005 Pearson Education, Inc. Chapter 10 37

The Multi-plant Firm l For some firms, production takes place in more than one plant, each with different costs l Firm must determine how to distribute production between both plants 1. 2. Production should be split so that the MC in the plants is the same Output is chosen where MR=MC. Profit is therefore maximized when MR=MC at each plant. © 2005 Pearson Education, Inc. Chapter 10 38

The Multi-plant Firm l For some firms, production takes place in more than one plant, each with different costs l Firm must determine how to distribute production between both plants 1. 2. Production should be split so that the MC in the plants is the same Output is chosen where MR=MC. Profit is therefore maximized when MR=MC at each plant. © 2005 Pearson Education, Inc. Chapter 10 38

The Multi-plant Firm l We can show this algebraically: m Q 1 and C 1 is output and cost of production for Plant 1 m Q 2 and C 2 is output and cost of production for Plant 2 m QT = Q 1 + Q 2 is total output m Profit is then: = PQT – C 1(Q 1) – C 2(Q 2) © 2005 Pearson Education, Inc. Chapter 10 39

The Multi-plant Firm l We can show this algebraically: m Q 1 and C 1 is output and cost of production for Plant 1 m Q 2 and C 2 is output and cost of production for Plant 2 m QT = Q 1 + Q 2 is total output m Profit is then: = PQT – C 1(Q 1) – C 2(Q 2) © 2005 Pearson Education, Inc. Chapter 10 39

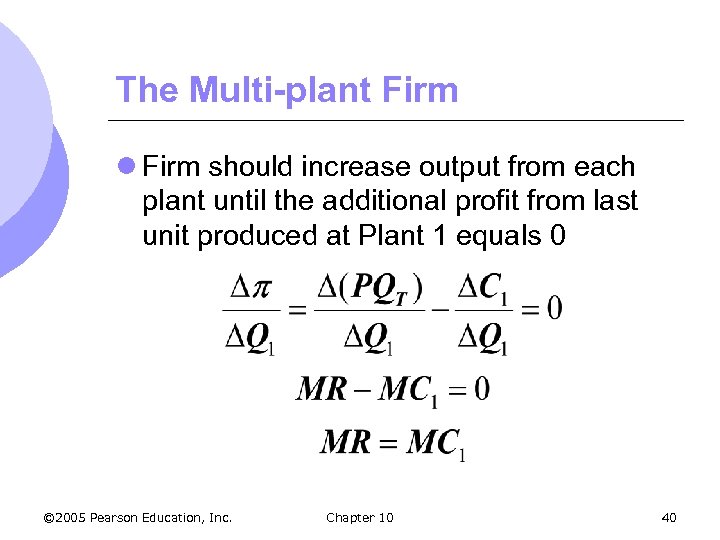

The Multi-plant Firm l Firm should increase output from each plant until the additional profit from last unit produced at Plant 1 equals 0 © 2005 Pearson Education, Inc. Chapter 10 40

The Multi-plant Firm l Firm should increase output from each plant until the additional profit from last unit produced at Plant 1 equals 0 © 2005 Pearson Education, Inc. Chapter 10 40

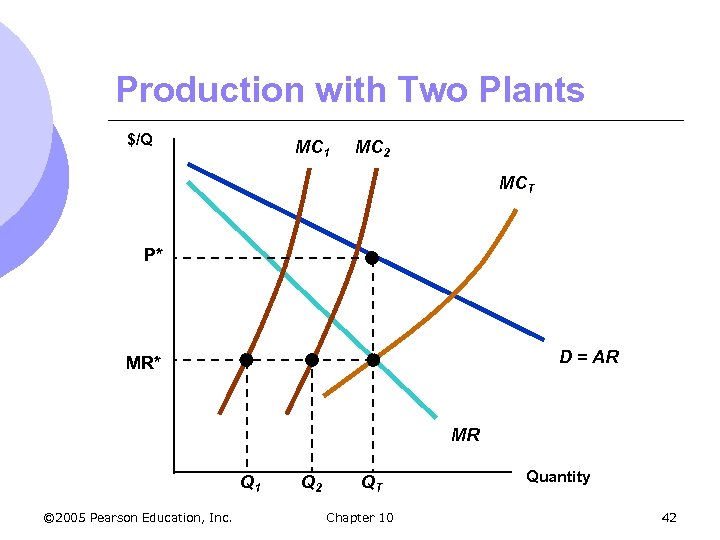

The Multi-plant Firm l We can show the same for Plant 2 l Therefore, we can see that the firm should choose to produce where MR = MC 1 = MC 2 l We can show this graphically m MR = MCT gives total output m This point shows the MR for each firm m Where MR crosses MC 1 and MC 2 shows the output for each firm © 2005 Pearson Education, Inc. Chapter 10 41

The Multi-plant Firm l We can show the same for Plant 2 l Therefore, we can see that the firm should choose to produce where MR = MC 1 = MC 2 l We can show this graphically m MR = MCT gives total output m This point shows the MR for each firm m Where MR crosses MC 1 and MC 2 shows the output for each firm © 2005 Pearson Education, Inc. Chapter 10 41

Production with Two Plants $/Q MC 1 MC 2 MCT P* D = AR MR* MR Q 1 © 2005 Pearson Education, Inc. Q 2 QT Chapter 10 Quantity 42

Production with Two Plants $/Q MC 1 MC 2 MCT P* D = AR MR* MR Q 1 © 2005 Pearson Education, Inc. Q 2 QT Chapter 10 Quantity 42

Monopoly Power l Pure monopoly is rare l However, a market with several firms, each facing a downward sloping demand curve, will produce so that price exceeds marginal cost l Firms often product similar goods that have some differences, thereby differentiating themselves from other firms © 2005 Pearson Education, Inc. Chapter 10 43

Monopoly Power l Pure monopoly is rare l However, a market with several firms, each facing a downward sloping demand curve, will produce so that price exceeds marginal cost l Firms often product similar goods that have some differences, thereby differentiating themselves from other firms © 2005 Pearson Education, Inc. Chapter 10 43

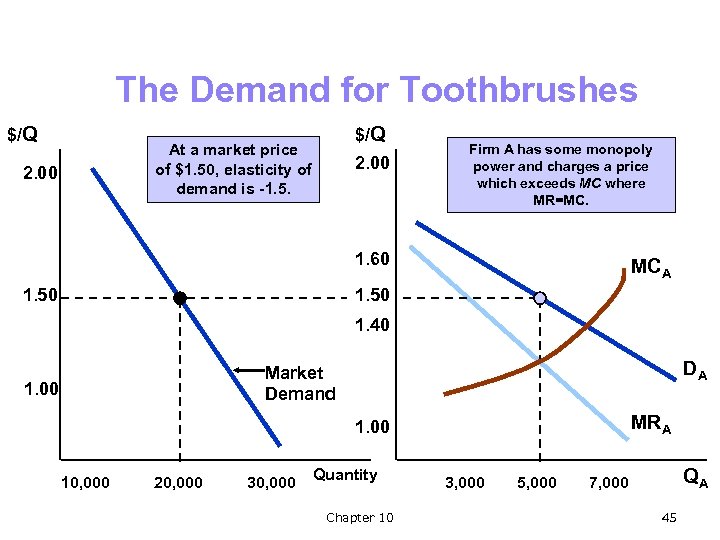

Monopoly Power: Example l Four firms share a market for 20, 000 toothbrushes at a price of $1. 50 l Profits maximizing quantity for each firm is where MR – MC l In our example that is 5000 units for Firm A, with a price of $1. 50, which is greater than marginal cost l Although Firm A is not a pure monopolist, they have monopoly power © 2005 Pearson Education, Inc. Chapter 10 44

Monopoly Power: Example l Four firms share a market for 20, 000 toothbrushes at a price of $1. 50 l Profits maximizing quantity for each firm is where MR – MC l In our example that is 5000 units for Firm A, with a price of $1. 50, which is greater than marginal cost l Although Firm A is not a pure monopolist, they have monopoly power © 2005 Pearson Education, Inc. Chapter 10 44

The Demand for Toothbrushes $/Q At a market price of $1. 50, elasticity of demand is -1. 5. 2. 00 Firm A has some monopoly power and charges a price which exceeds MC where MR=MC. 1. 60 1. 50 MCA 1. 50 1. 40 DA Market Demand 1. 00 MRA 1. 00 10, 000 20, 000 30, 000 Quantity Chapter 10 3, 000 5, 000 QA 7, 000 45

The Demand for Toothbrushes $/Q At a market price of $1. 50, elasticity of demand is -1. 5. 2. 00 Firm A has some monopoly power and charges a price which exceeds MC where MR=MC. 1. 60 1. 50 MCA 1. 50 1. 40 DA Market Demand 1. 00 MRA 1. 00 10, 000 20, 000 30, 000 Quantity Chapter 10 3, 000 5, 000 QA 7, 000 45

Measuring Monopoly Power l Our firm would have more monopoly power, of course, if it could get rid of the other firms m But the firm’s monopoly power might still be substantial l How can we measure monopoly power to compare firms? l What are the sources of monopoly power? m Why do some firms have more than others? © 2005 Pearson Education, Inc. Chapter 10 46

Measuring Monopoly Power l Our firm would have more monopoly power, of course, if it could get rid of the other firms m But the firm’s monopoly power might still be substantial l How can we measure monopoly power to compare firms? l What are the sources of monopoly power? m Why do some firms have more than others? © 2005 Pearson Education, Inc. Chapter 10 46

Measuring Monopoly Power l Could measure monopoly power by the extent to which price is greater than MC for each firm l Lerner’s Index of Monopoly Power m L = (P - MC)/P l. The larger the value of L (between 0 and 1) the greater the monopoly power m L is expressed in terms of Ed l. L = (P - MC)/P = -1/Ed l. Ed is elasticity of demand for a firm, not the market © 2005 Pearson Education, Inc. Chapter 10 47

Measuring Monopoly Power l Could measure monopoly power by the extent to which price is greater than MC for each firm l Lerner’s Index of Monopoly Power m L = (P - MC)/P l. The larger the value of L (between 0 and 1) the greater the monopoly power m L is expressed in terms of Ed l. L = (P - MC)/P = -1/Ed l. Ed is elasticity of demand for a firm, not the market © 2005 Pearson Education, Inc. Chapter 10 47

Monopoly Power l Monopoly power, however, does not guarantee profits l Profit depends on average cost relative to price l One firm may have more monopoly power but lower profits due to high average costs © 2005 Pearson Education, Inc. Chapter 10 48

Monopoly Power l Monopoly power, however, does not guarantee profits l Profit depends on average cost relative to price l One firm may have more monopoly power but lower profits due to high average costs © 2005 Pearson Education, Inc. Chapter 10 48

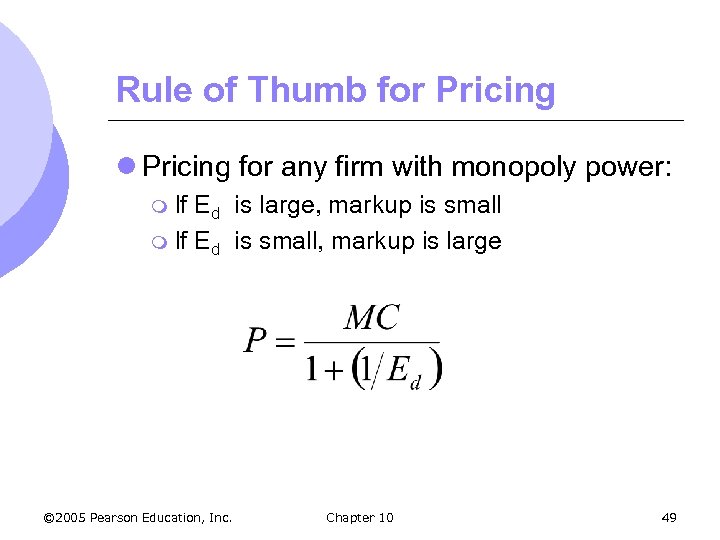

Rule of Thumb for Pricing l Pricing for any firm with monopoly power: m If Ed is large, markup is small m If Ed is small, markup is large © 2005 Pearson Education, Inc. Chapter 10 49

Rule of Thumb for Pricing l Pricing for any firm with monopoly power: m If Ed is large, markup is small m If Ed is small, markup is large © 2005 Pearson Education, Inc. Chapter 10 49

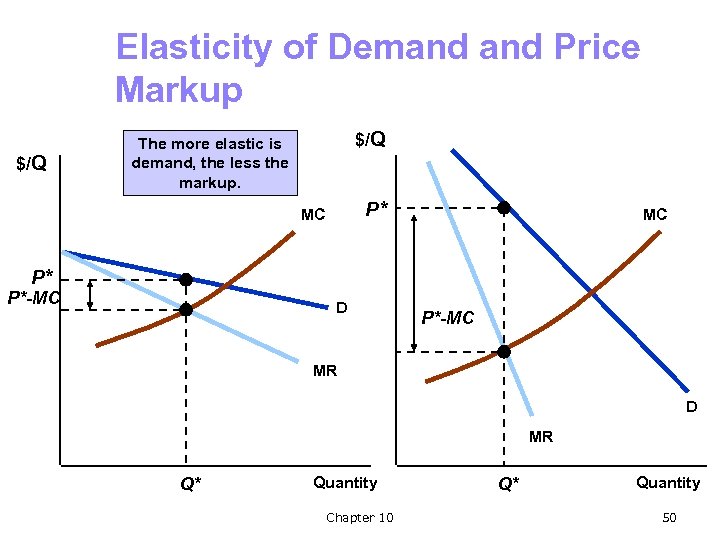

Elasticity of Demand Price Markup $/Q The more elastic is demand, the less the markup. P* MC MC P* P*-MC D P*-MC MR D MR Q* Quantity Chapter 10 Q* Quantity 50

Elasticity of Demand Price Markup $/Q The more elastic is demand, the less the markup. P* MC MC P* P*-MC D P*-MC MR D MR Q* Quantity Chapter 10 Q* Quantity 50

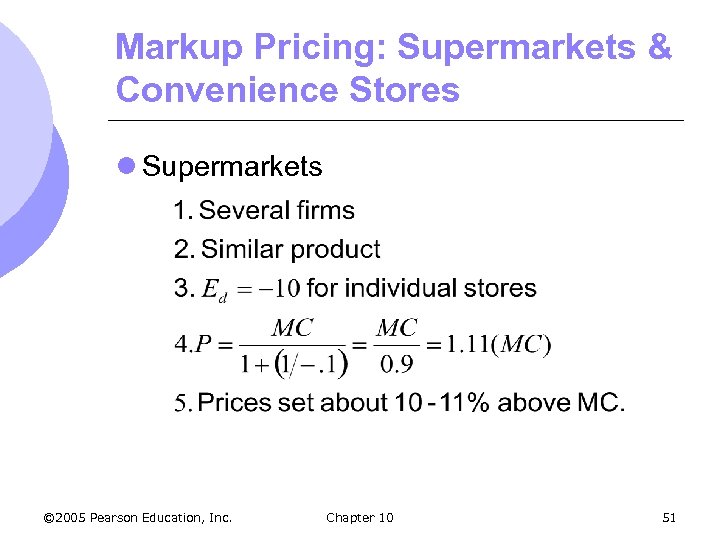

Markup Pricing: Supermarkets & Convenience Stores l Supermarkets © 2005 Pearson Education, Inc. Chapter 10 51

Markup Pricing: Supermarkets & Convenience Stores l Supermarkets © 2005 Pearson Education, Inc. Chapter 10 51

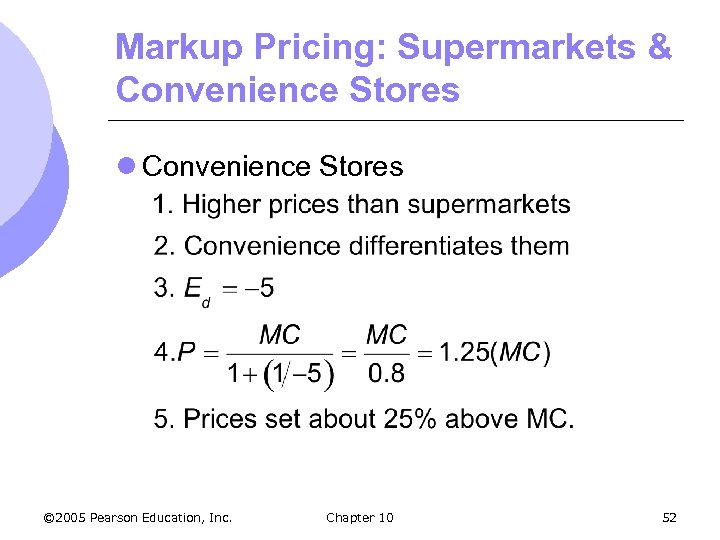

Markup Pricing: Supermarkets & Convenience Stores l Convenience Stores © 2005 Pearson Education, Inc. Chapter 10 52

Markup Pricing: Supermarkets & Convenience Stores l Convenience Stores © 2005 Pearson Education, Inc. Chapter 10 52

Markup Pricing: Supermarkets & Convenience Stores l Convenience stores have more monopoly power l Convenience stores do have higher profits than supermarkets, however m Volume is far smaller and average fixed costs are larger © 2005 Pearson Education, Inc. Chapter 10 53

Markup Pricing: Supermarkets & Convenience Stores l Convenience stores have more monopoly power l Convenience stores do have higher profits than supermarkets, however m Volume is far smaller and average fixed costs are larger © 2005 Pearson Education, Inc. Chapter 10 53

Sources of Monopoly Power l Why do some firms have considerable monopoly power, and others have little or none? l Monopoly power is determined by ability to set price higher than marginal cost l A firm’s monopoly power, therefore, is determined by the firm’s elasticity of demand © 2005 Pearson Education, Inc. Chapter 10 54

Sources of Monopoly Power l Why do some firms have considerable monopoly power, and others have little or none? l Monopoly power is determined by ability to set price higher than marginal cost l A firm’s monopoly power, therefore, is determined by the firm’s elasticity of demand © 2005 Pearson Education, Inc. Chapter 10 54

Sources of Monopoly Power l The less elastic the demand curve, the more monopoly power a firm has l The firm’s elasticity of demand is determined by: 1) Elasticity of market demand 2) Number of firms in market 3) The interaction among firms © 2005 Pearson Education, Inc. Chapter 10 55

Sources of Monopoly Power l The less elastic the demand curve, the more monopoly power a firm has l The firm’s elasticity of demand is determined by: 1) Elasticity of market demand 2) Number of firms in market 3) The interaction among firms © 2005 Pearson Education, Inc. Chapter 10 55

Elasticity of Market Demand l With one firm, their demand curve is market demand curve m Degree of monopoly power is determined completely by elasticity of market demand l With more firms, individual demand may differ from market demand m Demand for a firm’s product is more elastic than the market elasticity © 2005 Pearson Education, Inc. Chapter 10 56

Elasticity of Market Demand l With one firm, their demand curve is market demand curve m Degree of monopoly power is determined completely by elasticity of market demand l With more firms, individual demand may differ from market demand m Demand for a firm’s product is more elastic than the market elasticity © 2005 Pearson Education, Inc. Chapter 10 56

Number of Firms l The monopoly power of a firm falls as the number of firms increases; all else equal m More important are the number of firms with significant market share m Market is highly concentrated if only a few firms account for most of the sales l Firms would like to create barriers to entry to keep new firms out of market m Patent, scale © 2005 Pearson Education, Inc. copyrights, licenses, economies of Chapter 10 57

Number of Firms l The monopoly power of a firm falls as the number of firms increases; all else equal m More important are the number of firms with significant market share m Market is highly concentrated if only a few firms account for most of the sales l Firms would like to create barriers to entry to keep new firms out of market m Patent, scale © 2005 Pearson Education, Inc. copyrights, licenses, economies of Chapter 10 57

Interaction Among Firms l If firms are aggressive in gaining market share by, for example, undercutting the other firms, prices may reach close to competitive levels l If firms collude (violation of antitrust rules), could generate substantial monopoly power l Markets are dynamic and therefore, so is the concept of monopoly power © 2005 Pearson Education, Inc. Chapter 10 58

Interaction Among Firms l If firms are aggressive in gaining market share by, for example, undercutting the other firms, prices may reach close to competitive levels l If firms collude (violation of antitrust rules), could generate substantial monopoly power l Markets are dynamic and therefore, so is the concept of monopoly power © 2005 Pearson Education, Inc. Chapter 10 58

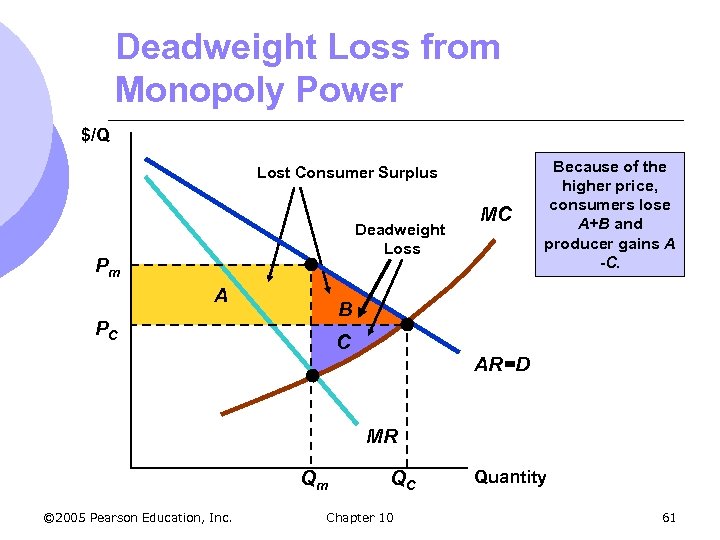

The Social Costs of Monopoly Power l Monopoly power results in higher prices and lower quantities l However, does monopoly power make consumers and producers in the aggregate better or worse off? l We can compare producer and consumer surplus when in a competitive market and in a monopolistic market © 2005 Pearson Education, Inc. Chapter 10 59

The Social Costs of Monopoly Power l Monopoly power results in higher prices and lower quantities l However, does monopoly power make consumers and producers in the aggregate better or worse off? l We can compare producer and consumer surplus when in a competitive market and in a monopolistic market © 2005 Pearson Education, Inc. Chapter 10 59

The Social Costs of Monopoly l Perfectly competitive firm will produce where MC = D PC and QC l Monopoly produces where MR = MC, getting their price from the demand curve PM and QM l There is a loss in consumer surplus when going from perfect competition to monopoly l A deadweight loss is also created with monopoly © 2005 Pearson Education, Inc. Chapter 10 60

The Social Costs of Monopoly l Perfectly competitive firm will produce where MC = D PC and QC l Monopoly produces where MR = MC, getting their price from the demand curve PM and QM l There is a loss in consumer surplus when going from perfect competition to monopoly l A deadweight loss is also created with monopoly © 2005 Pearson Education, Inc. Chapter 10 60

Deadweight Loss from Monopoly Power $/Q Lost Consumer Surplus Deadweight Loss Pm A MC Because of the higher price, consumers lose A+B and producer gains A -C. B PC C AR=D MR Qm © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 61

Deadweight Loss from Monopoly Power $/Q Lost Consumer Surplus Deadweight Loss Pm A MC Because of the higher price, consumers lose A+B and producer gains A -C. B PC C AR=D MR Qm © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 61

The Social Costs of Monopoly l Social cost of monopoly is likely to exceed the deadweight loss l Rent Seeking m Firms may spend to gain monopoly power l Lobbying l Advertising l Building © 2005 Pearson Education, Inc. excess capacity Chapter 10 62

The Social Costs of Monopoly l Social cost of monopoly is likely to exceed the deadweight loss l Rent Seeking m Firms may spend to gain monopoly power l Lobbying l Advertising l Building © 2005 Pearson Education, Inc. excess capacity Chapter 10 62

The Social Costs of Monopoly l The incentive to engage in monopoly practices is determined by the profit to be gained l The larger the transfer from consumers to the firm, the larger the social cost of monopoly © 2005 Pearson Education, Inc. Chapter 10 63

The Social Costs of Monopoly l The incentive to engage in monopoly practices is determined by the profit to be gained l The larger the transfer from consumers to the firm, the larger the social cost of monopoly © 2005 Pearson Education, Inc. Chapter 10 63

The Social Costs of Monopoly l Example m In 1996, Archer Daniels Midland (ADM) successfully lobbied for regulations requiring ethanol to be produced from corn m Although ethanol is the same whether produced from corn, potatoes, grain or anything else, ADM had a near monopoly on corn-based ethanol production © 2005 Pearson Education, Inc. Chapter 10 64

The Social Costs of Monopoly l Example m In 1996, Archer Daniels Midland (ADM) successfully lobbied for regulations requiring ethanol to be produced from corn m Although ethanol is the same whether produced from corn, potatoes, grain or anything else, ADM had a near monopoly on corn-based ethanol production © 2005 Pearson Education, Inc. Chapter 10 64

The Social Costs of Monopoly l Government can regulate monopoly power through price regulation m Recall that in competitive markets, price regulation creates a deadweight loss m Price regulation can eliminate deadweight loss with a monopoly m The effect of the regulation can be shown graphically © 2005 Pearson Education, Inc. Chapter 10 65

The Social Costs of Monopoly l Government can regulate monopoly power through price regulation m Recall that in competitive markets, price regulation creates a deadweight loss m Price regulation can eliminate deadweight loss with a monopoly m The effect of the regulation can be shown graphically © 2005 Pearson Education, Inc. Chapter 10 65

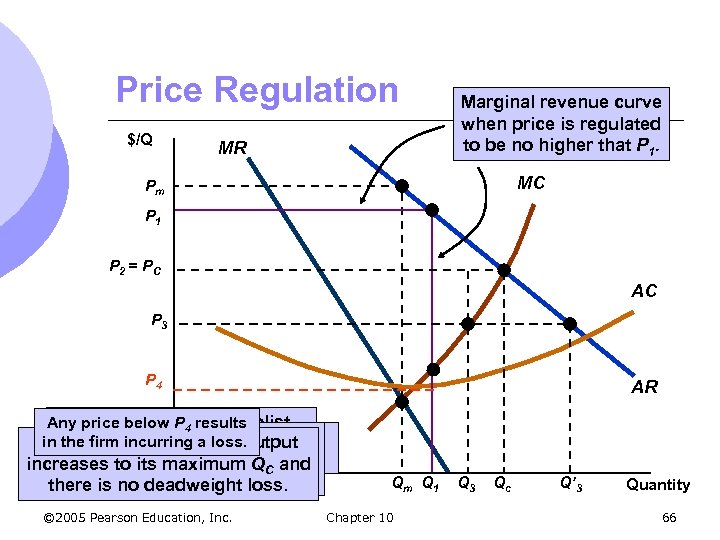

Price Regulation $/Q MR Marginal revenue curve when price is regulated to be no higher that P 1. MC Pm P 1 P 2 = P C AC P 3 P 4 AR Any price alone, P 4 monopolist If left below a results If price lowered to above Q 1 , For is incurring a P output inproduces Q levels loss. 3 output the firm is lowered to. CP If price output m and charges Pm. decreases its maximum and the to and shortage exists. increases originalaaverage QC and marginal revenue curves apply. there is no deadweight loss. © 2005 Pearson Education, Inc. Qm Q 1 Chapter 10 Q 3 Qc Q’ 3 Quantity 66

Price Regulation $/Q MR Marginal revenue curve when price is regulated to be no higher that P 1. MC Pm P 1 P 2 = P C AC P 3 P 4 AR Any price alone, P 4 monopolist If left below a results If price lowered to above Q 1 , For is incurring a P output inproduces Q levels loss. 3 output the firm is lowered to. CP If price output m and charges Pm. decreases its maximum and the to and shortage exists. increases originalaaverage QC and marginal revenue curves apply. there is no deadweight loss. © 2005 Pearson Education, Inc. Qm Q 1 Chapter 10 Q 3 Qc Q’ 3 Quantity 66

The Social Costs of Monopoly Power l Natural Monopoly m. A firm that can produce the entire output of an industry at a cost lower than what it would be if there were several firms m Usually arises when there are large economies of scale m We can show that splitting the market into two firms results in higher AC for each firm than when only one firm was producing © 2005 Pearson Education, Inc. Chapter 10 67

The Social Costs of Monopoly Power l Natural Monopoly m. A firm that can produce the entire output of an industry at a cost lower than what it would be if there were several firms m Usually arises when there are large economies of scale m We can show that splitting the market into two firms results in higher AC for each firm than when only one firm was producing © 2005 Pearson Education, Inc. Chapter 10 67

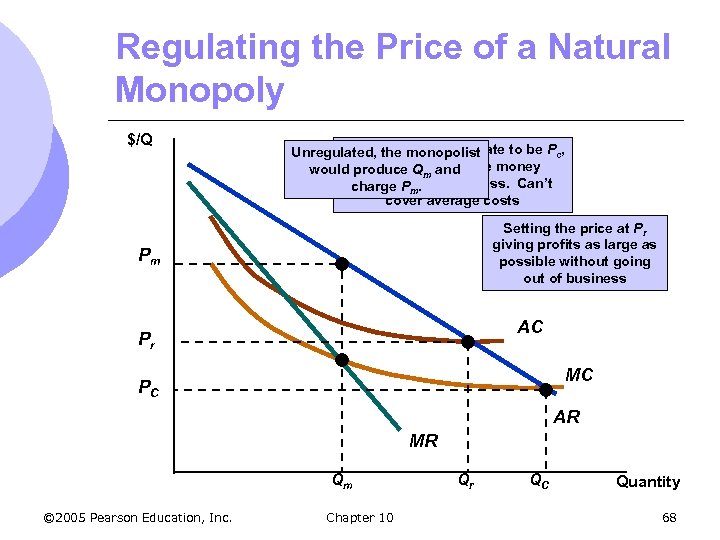

Regulating the Price of a Natural Monopoly $/Q If the monopolist Unregulated, price were regulate to be Pc, the firm would produce Qm and lose money and go out charge Pm. of business. Can’t cover average costs Setting the price at Pr giving profits as large as possible without going out of business Pm AC Pr MC PC AR MR Qm © 2005 Pearson Education, Inc. Chapter 10 Qr QC Quantity 68

Regulating the Price of a Natural Monopoly $/Q If the monopolist Unregulated, price were regulate to be Pc, the firm would produce Qm and lose money and go out charge Pm. of business. Can’t cover average costs Setting the price at Pr giving profits as large as possible without going out of business Pm AC Pr MC PC AR MR Qm © 2005 Pearson Education, Inc. Chapter 10 Qr QC Quantity 68

The Social Costs of Monopoly Power l Regulation in Practice m It is very difficult to estimate the firm's cost and demand functions because they change with evolving market conditions m An alternative pricing technique – rate-ofreturn regulation allows the firms to set a maximum price based on the expected rate or return that the firm will earn © 2005 Pearson Education, Inc. Chapter 10 69

The Social Costs of Monopoly Power l Regulation in Practice m It is very difficult to estimate the firm's cost and demand functions because they change with evolving market conditions m An alternative pricing technique – rate-ofreturn regulation allows the firms to set a maximum price based on the expected rate or return that the firm will earn © 2005 Pearson Education, Inc. Chapter 10 69

Regulation in Practice l There are problems, however, with rate of return regulation 1. 2. Firm’s capital stock is difficult to value “Fair” rate of return is based on actual cost of capital, that cost is based on regulatory behavior (and investor’s perception of allowed rates in the future) © 2005 Pearson Education, Inc. Chapter 10 70

Regulation in Practice l There are problems, however, with rate of return regulation 1. 2. Firm’s capital stock is difficult to value “Fair” rate of return is based on actual cost of capital, that cost is based on regulatory behavior (and investor’s perception of allowed rates in the future) © 2005 Pearson Education, Inc. Chapter 10 70

Regulation in Practice l Rate of return regulation leads to lags in regulatory response to changes in cost and other market conditions l Leads to long and expensive regulatory hearings l The hearing process creates a regulatory lag that may benefit producers (1950 s & ‘ 60 s) or consumers (1970 s & ‘ 80 s) © 2005 Pearson Education, Inc. Chapter 10 71

Regulation in Practice l Rate of return regulation leads to lags in regulatory response to changes in cost and other market conditions l Leads to long and expensive regulatory hearings l The hearing process creates a regulatory lag that may benefit producers (1950 s & ‘ 60 s) or consumers (1970 s & ‘ 80 s) © 2005 Pearson Education, Inc. Chapter 10 71

Regulation in Practice l Government may also set price caps based on firm’s variable costs, past prices, and possibly inflation and productivity growth l A firm is typically allowed to raise its price each year without approval from regulatory agency by amount equal to inflation minus expected productivity growth © 2005 Pearson Education, Inc. Chapter 10 72

Regulation in Practice l Government may also set price caps based on firm’s variable costs, past prices, and possibly inflation and productivity growth l A firm is typically allowed to raise its price each year without approval from regulatory agency by amount equal to inflation minus expected productivity growth © 2005 Pearson Education, Inc. Chapter 10 72

Monopsony l A monopsony is a market in which there is a single buyer l An oligopsony is a market with only a few buyers l Monopsony power is the ability of the buyer to affect the price of the good and pay less than the price that would exist in a competitive market © 2005 Pearson Education, Inc. Chapter 10 73

Monopsony l A monopsony is a market in which there is a single buyer l An oligopsony is a market with only a few buyers l Monopsony power is the ability of the buyer to affect the price of the good and pay less than the price that would exist in a competitive market © 2005 Pearson Education, Inc. Chapter 10 73

Monopsony l Typically choose to buy until the benefit from last unit equals that unit’s cost l Marginal value is the additional benefit derived from purchasing one more unit of a good m Demand curve – downward sloping l Marginal expenditure is the additional cost of buying one more unit of a good m Depends © 2005 Pearson Education, Inc. on buying power Chapter 10 74

Monopsony l Typically choose to buy until the benefit from last unit equals that unit’s cost l Marginal value is the additional benefit derived from purchasing one more unit of a good m Demand curve – downward sloping l Marginal expenditure is the additional cost of buying one more unit of a good m Depends © 2005 Pearson Education, Inc. on buying power Chapter 10 74

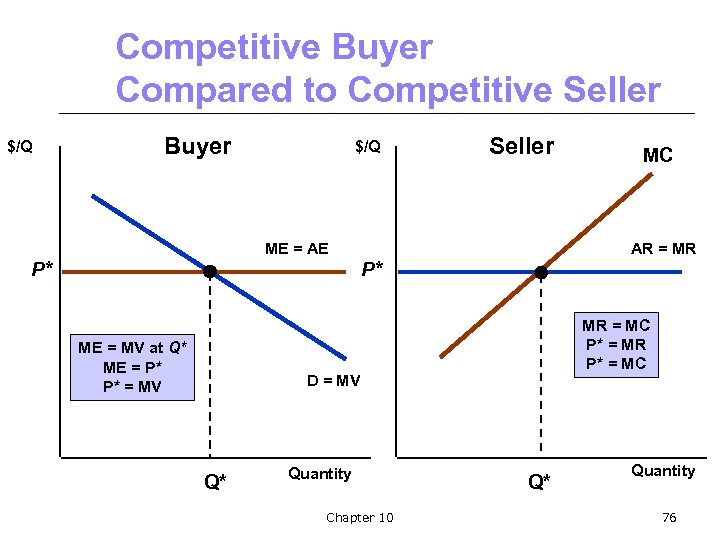

Monopsony l Competitive Buyer m Price taker m P = Marginal expenditure = Average expenditure m D = Marginal value l Graphically can compare competitive buyer to competitive seller © 2005 Pearson Education, Inc. Chapter 10 75

Monopsony l Competitive Buyer m Price taker m P = Marginal expenditure = Average expenditure m D = Marginal value l Graphically can compare competitive buyer to competitive seller © 2005 Pearson Education, Inc. Chapter 10 75

Competitive Buyer Compared to Competitive Seller $/Q Buyer $/Q Seller ME = AE P* MC AR = MR P* ME = MV at Q* ME = P* P* = MV MR = MC P* = MR P* = MC D = MV Q* Quantity Chapter 10 Q* Quantity 76

Competitive Buyer Compared to Competitive Seller $/Q Buyer $/Q Seller ME = AE P* MC AR = MR P* ME = MV at Q* ME = P* P* = MV MR = MC P* = MR P* = MC D = MV Q* Quantity Chapter 10 Q* Quantity 76

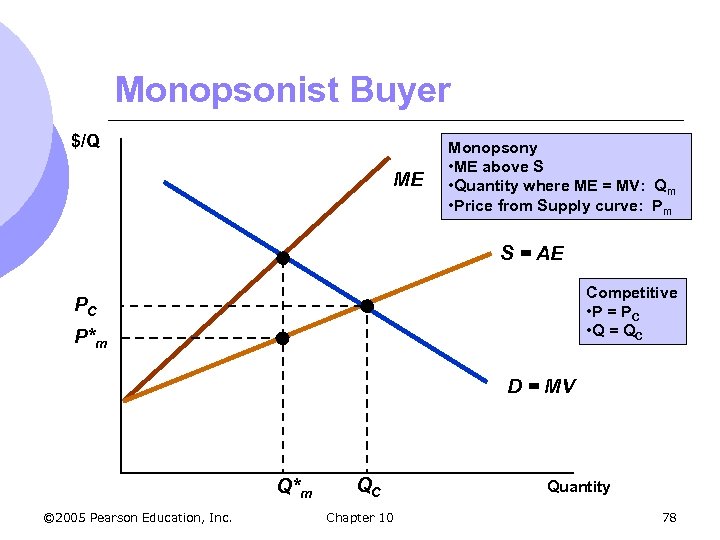

Monopsonist Buyer l Buyer will buy until value from last unit equals expenditure on that unit l The market supply curve is not the marginal expenditure curve m m Market supply shows how much must pay per unit as a function of total units purchased Supply curve is average expenditure curve Upward sloping supply implies the marginal expenditure curve must lie above it Decision to buy extra unit raises price paid for all units © 2005 Pearson Education, Inc. Chapter 10 77

Monopsonist Buyer l Buyer will buy until value from last unit equals expenditure on that unit l The market supply curve is not the marginal expenditure curve m m Market supply shows how much must pay per unit as a function of total units purchased Supply curve is average expenditure curve Upward sloping supply implies the marginal expenditure curve must lie above it Decision to buy extra unit raises price paid for all units © 2005 Pearson Education, Inc. Chapter 10 77

Monopsonist Buyer $/Q ME Monopsony • ME above S • Quantity where ME = MV: Qm • Price from Supply curve: Pm S = AE Competitive • P = P C • Q = Q C PC P*m D = MV Q*m © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 78

Monopsonist Buyer $/Q ME Monopsony • ME above S • Quantity where ME = MV: Qm • Price from Supply curve: Pm S = AE Competitive • P = P C • Q = Q C PC P*m D = MV Q*m © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 78

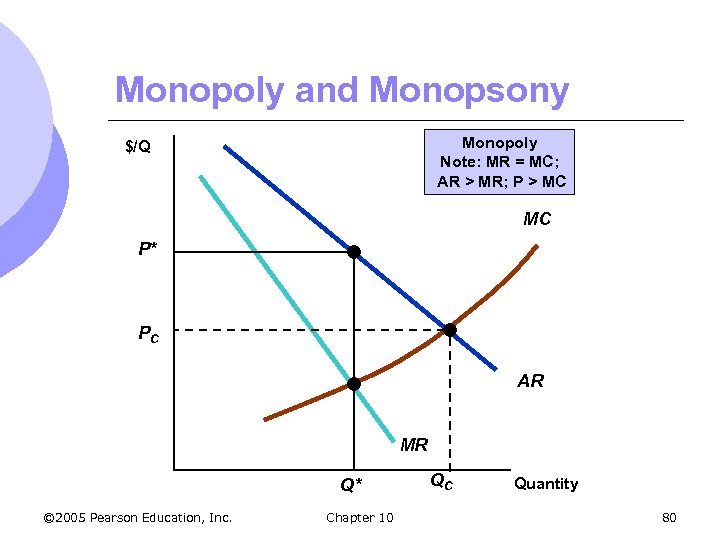

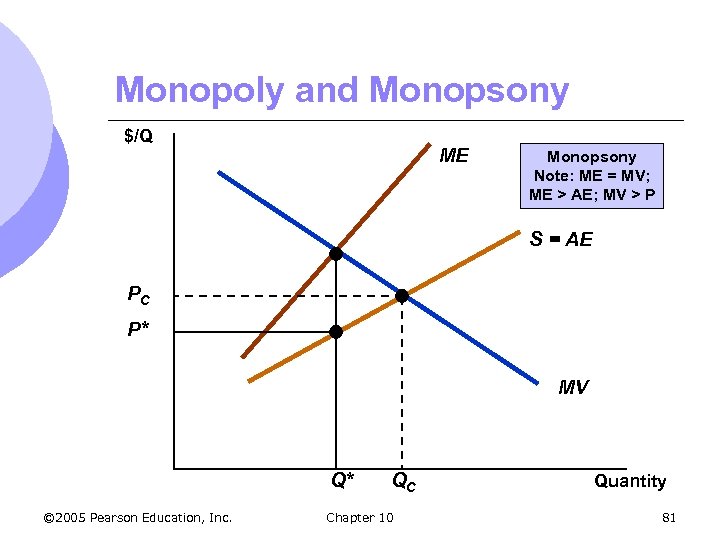

Monopoly and Monopsony l Monopsony is easier to understand if we compare to monopoly l We can see this graphically l Monopolist m m m Can charge price above MC because faces downward sloping demand (average revenue) MR < AR MR = MC gives quantity less than competitive market and price that is higher © 2005 Pearson Education, Inc. Chapter 10 79

Monopoly and Monopsony l Monopsony is easier to understand if we compare to monopoly l We can see this graphically l Monopolist m m m Can charge price above MC because faces downward sloping demand (average revenue) MR < AR MR = MC gives quantity less than competitive market and price that is higher © 2005 Pearson Education, Inc. Chapter 10 79

Monopoly and Monopsony Monopoly Note: MR = MC; AR > MR; P > MC $/Q MC P* PC AR MR Q* © 2005 Pearson Education, Inc. Chapter 10 QC Quantity 80

Monopoly and Monopsony Monopoly Note: MR = MC; AR > MR; P > MC $/Q MC P* PC AR MR Q* © 2005 Pearson Education, Inc. Chapter 10 QC Quantity 80

Monopoly and Monopsony $/Q ME Monopsony Note: ME = MV; ME > AE; MV > P S = AE PC P* MV Q* © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 81

Monopoly and Monopsony $/Q ME Monopsony Note: ME = MV; ME > AE; MV > P S = AE PC P* MV Q* © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 81

Monopoly and Monopsony l Monopoly l Monopsony MR < P m P > MC m Qm < Q C m Pm > P C ME > P m P < MV m Qm < Q C m Pm < P C m © 2005 Pearson Education, Inc. m Chapter 10 82

Monopoly and Monopsony l Monopoly l Monopsony MR < P m P > MC m Qm < Q C m Pm > P C ME > P m P < MV m Qm < Q C m Pm < P C m © 2005 Pearson Education, Inc. m Chapter 10 82

Monopsony Power l More common than pure monopsony are a few firms competing among themselves as buyers so that each firm has some monopsony power m Automobile industry l Monopsony power gives them the ability to pay a price that is less than marginal value © 2005 Pearson Education, Inc. Chapter 10 83

Monopsony Power l More common than pure monopsony are a few firms competing among themselves as buyers so that each firm has some monopsony power m Automobile industry l Monopsony power gives them the ability to pay a price that is less than marginal value © 2005 Pearson Education, Inc. Chapter 10 83

Monopsony Power l The degree of monopsony power depends on three factors: 1. Number of buyers l 2. The fewer the number of buyers, the less elastic the supply and the greater the monopsony power Interaction Among Buyers l The less the buyers compete, the greater the monopsony power © 2005 Pearson Education, Inc. Chapter 10 84

Monopsony Power l The degree of monopsony power depends on three factors: 1. Number of buyers l 2. The fewer the number of buyers, the less elastic the supply and the greater the monopsony power Interaction Among Buyers l The less the buyers compete, the greater the monopsony power © 2005 Pearson Education, Inc. Chapter 10 84

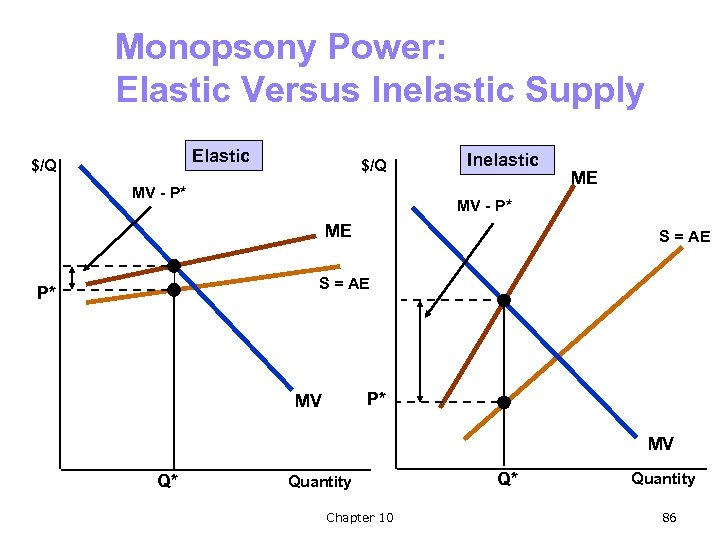

Monopsony Power l The degree of monopsony power depends on three factors (cont’d): 3. Elasticity of market supply Extent to which price is marked down below MV depends on elasticity of supply facing buyer l If supply is very elastic, markdown will be small l The more inelastic the supply, the more monopsony power l © 2005 Pearson Education, Inc. Chapter 10 85

Monopsony Power l The degree of monopsony power depends on three factors (cont’d): 3. Elasticity of market supply Extent to which price is marked down below MV depends on elasticity of supply facing buyer l If supply is very elastic, markdown will be small l The more inelastic the supply, the more monopsony power l © 2005 Pearson Education, Inc. Chapter 10 85

Monopsony Power: Elastic Versus Inelastic Supply Elastic $/Q MV - P* Inelastic ME MV - P* ME S = AE P* P* MV MV Q* Quantity Chapter 10 Q* Quantity 86

Monopsony Power: Elastic Versus Inelastic Supply Elastic $/Q MV - P* Inelastic ME MV - P* ME S = AE P* P* MV MV Q* Quantity Chapter 10 Q* Quantity 86

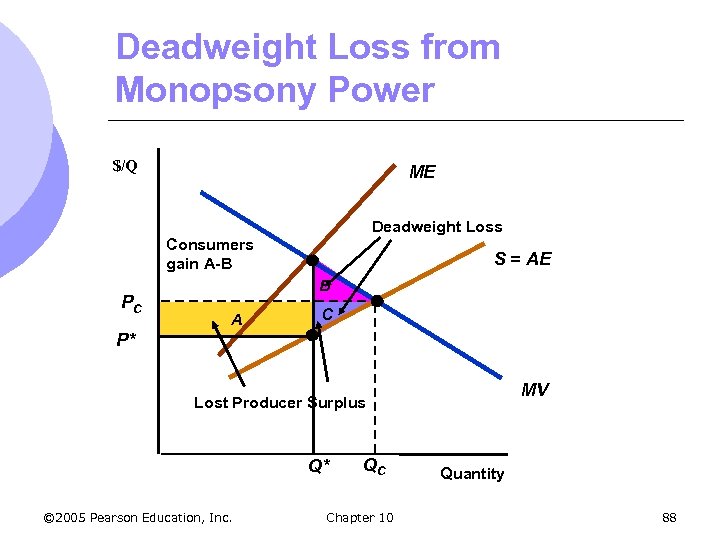

Social Costs of Monopsony Power l Since monopsony power gives lower prices and lower quantities purchased, we would expect sellers to be worse off and buyers better off l We can show the effects of monopsony power using producer and consumer surplus compared to competitive market m m For sole monopsonist, quantity is where ME = MV and price is from demand For competitive market, quantity and price where S=D © 2005 Pearson Education, Inc. Chapter 10 87

Social Costs of Monopsony Power l Since monopsony power gives lower prices and lower quantities purchased, we would expect sellers to be worse off and buyers better off l We can show the effects of monopsony power using producer and consumer surplus compared to competitive market m m For sole monopsonist, quantity is where ME = MV and price is from demand For competitive market, quantity and price where S=D © 2005 Pearson Education, Inc. Chapter 10 87

Deadweight Loss from Monopsony Power $/Q ME Deadweight Loss Consumers gain A-B PC S = AE B A C P* MV Lost Producer Surplus Q* © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 88

Deadweight Loss from Monopsony Power $/Q ME Deadweight Loss Consumers gain A-B PC S = AE B A C P* MV Lost Producer Surplus Q* © 2005 Pearson Education, Inc. QC Chapter 10 Quantity 88

Monopsony Power l Bilateral Monopoly m Market where there is only one buyer and one seller m Bilateral monopoly is rare, however, markets with a small number of sellers with monopoly power selling to a market with few buyers with monopsony power is more common m Even with bargaining, in general, monopsony and monopoly power will counteract each other © 2005 Pearson Education, Inc. Chapter 10 89

Monopsony Power l Bilateral Monopoly m Market where there is only one buyer and one seller m Bilateral monopoly is rare, however, markets with a small number of sellers with monopoly power selling to a market with few buyers with monopsony power is more common m Even with bargaining, in general, monopsony and monopoly power will counteract each other © 2005 Pearson Education, Inc. Chapter 10 89

Limiting Market Power: The Antitrust Laws l Market power harms some players in the market – buyer or seller l Market power reduces output, leading to deadweight loss l Excessive market power could raise problems of equity and fairness © 2005 Pearson Education, Inc. Chapter 10 90

Limiting Market Power: The Antitrust Laws l Market power harms some players in the market – buyer or seller l Market power reduces output, leading to deadweight loss l Excessive market power could raise problems of equity and fairness © 2005 Pearson Education, Inc. Chapter 10 90

Limiting Market Power: The Antitrust Laws l What can we do to limit market power and keep it from being used anticompetitively? m Tax away monopoly profits and redistribute to consumers l Difficult to measure and find all those who lost m Direct price regulation of natural monopolies m Keep firms from acquiring excessive market power l Antitrust © 2005 Pearson Education, Inc. laws Chapter 10 91

Limiting Market Power: The Antitrust Laws l What can we do to limit market power and keep it from being used anticompetitively? m Tax away monopoly profits and redistribute to consumers l Difficult to measure and find all those who lost m Direct price regulation of natural monopolies m Keep firms from acquiring excessive market power l Antitrust © 2005 Pearson Education, Inc. laws Chapter 10 91

The Antitrust Laws l Rules and regulations designed to promote a competitive economy by: m Prohibiting actions that restrain or are likely to restrain competition m Restricting the forms of allowable market structures l Monopoly power arises in a number of ways, each of which is covered by the antitrust laws © 2005 Pearson Education, Inc. Chapter 10 92

The Antitrust Laws l Rules and regulations designed to promote a competitive economy by: m Prohibiting actions that restrain or are likely to restrain competition m Restricting the forms of allowable market structures l Monopoly power arises in a number of ways, each of which is covered by the antitrust laws © 2005 Pearson Education, Inc. Chapter 10 92

Limiting Market Power: The Antitrust Laws l Sherman Act (1890) – Section 1 m Prohibits contracts, combinations, or conspiracies in restraint of trade l Explicit agreement to restrict output or fix prices l Implicit collusion through parallel conduct m Form of implicit collusion in which one firm consistently follows actions of another m Example l In 1999, four of the world’s largest drug and chemical companies were found guilty of fixing prices of vitamins sold in US © 2005 Pearson Education, Inc. Chapter 10 93

Limiting Market Power: The Antitrust Laws l Sherman Act (1890) – Section 1 m Prohibits contracts, combinations, or conspiracies in restraint of trade l Explicit agreement to restrict output or fix prices l Implicit collusion through parallel conduct m Form of implicit collusion in which one firm consistently follows actions of another m Example l In 1999, four of the world’s largest drug and chemical companies were found guilty of fixing prices of vitamins sold in US © 2005 Pearson Education, Inc. Chapter 10 93

Limiting Market Power: The Antitrust Laws l Sherman Act (1890) – Section 2 m Makes it illegal to monopolize or attempt to monopolize a market and prohibits conspiracies that result in monopolization l Clayton Act (1914) 1. Makes it unlawful to require a buyer or lessor not to buy from a competitor © 2005 Pearson Education, Inc. Chapter 10 94

Limiting Market Power: The Antitrust Laws l Sherman Act (1890) – Section 2 m Makes it illegal to monopolize or attempt to monopolize a market and prohibits conspiracies that result in monopolization l Clayton Act (1914) 1. Makes it unlawful to require a buyer or lessor not to buy from a competitor © 2005 Pearson Education, Inc. Chapter 10 94

Limiting Market Power: The Antitrust Laws l Clayton Act (1914) 2. Prohibits predatory pricing l 3. The practice of pricing to drive current competitors out of business and to discourage new entrants in a market so that a firm can enjoy higher future profits Prohibits mergers and acquisitions if they “substantially lessen competition” or “tend to create a monopoly” © 2005 Pearson Education, Inc. Chapter 10 95

Limiting Market Power: The Antitrust Laws l Clayton Act (1914) 2. Prohibits predatory pricing l 3. The practice of pricing to drive current competitors out of business and to discourage new entrants in a market so that a firm can enjoy higher future profits Prohibits mergers and acquisitions if they “substantially lessen competition” or “tend to create a monopoly” © 2005 Pearson Education, Inc. Chapter 10 95

Limiting Market Power: The Antitrust Laws l Robinson-Patman Act (1936) m Amendment to the Clayton Act m Prohibits price discrimination if it causes buyers to suffer economic damages and competition is reduced © 2005 Pearson Education, Inc. Chapter 10 96

Limiting Market Power: The Antitrust Laws l Robinson-Patman Act (1936) m Amendment to the Clayton Act m Prohibits price discrimination if it causes buyers to suffer economic damages and competition is reduced © 2005 Pearson Education, Inc. Chapter 10 96

Limiting Market Power: The Antitrust Laws l Federal Trade Commission Act (1914, amended 1938, 1973, 1975) 1. 2. Created the Federal Trade Commission (FTC) Supplements the Sherman and Clayton Acts by fostering competition through a set of prohibitions against unfair and anticompetitive practices l Prohibitions against deceptive advertising, labeling, agreements with retailer to exclude competing brands © 2005 Pearson Education, Inc. Chapter 10 97

Limiting Market Power: The Antitrust Laws l Federal Trade Commission Act (1914, amended 1938, 1973, 1975) 1. 2. Created the Federal Trade Commission (FTC) Supplements the Sherman and Clayton Acts by fostering competition through a set of prohibitions against unfair and anticompetitive practices l Prohibitions against deceptive advertising, labeling, agreements with retailer to exclude competing brands © 2005 Pearson Education, Inc. Chapter 10 97

Enforcement of Antitrust Laws Antitrust laws are enforced three ways: 1. Antitrust Division of the Department of Justice m m A part of the executive branch – the administration can influence enforcement Fines levied on businesses; fines and imprisonment levied on individuals © 2005 Pearson Education, Inc. Chapter 10 98

Enforcement of Antitrust Laws Antitrust laws are enforced three ways: 1. Antitrust Division of the Department of Justice m m A part of the executive branch – the administration can influence enforcement Fines levied on businesses; fines and imprisonment levied on individuals © 2005 Pearson Education, Inc. Chapter 10 98

Enforcement of Antitrust Laws 2. Federal Trade Commission m Enforces through voluntary understanding or formal commission order 3. Private Proceedings m m Can sue for treble damages (threefold damages) Individuals or companies can also ask for injunctions to force wrongdoers to cease anticompetitive actions © 2005 Pearson Education, Inc. Chapter 10 99

Enforcement of Antitrust Laws 2. Federal Trade Commission m Enforces through voluntary understanding or formal commission order 3. Private Proceedings m m Can sue for treble damages (threefold damages) Individuals or companies can also ask for injunctions to force wrongdoers to cease anticompetitive actions © 2005 Pearson Education, Inc. Chapter 10 99

Enforcement of Antitrust Laws l US antitrust laws are stricter and more far reaching than the rest of the world m Some have claimed this has hindered US competing in international markets l With growth of European Union, methods of antitrust enforcement have evolved m Similar to US laws with some procedural and substantive differences m Europe only imposes civil penalties © 2005 Pearson Education, Inc. Chapter 10 100

Enforcement of Antitrust Laws l US antitrust laws are stricter and more far reaching than the rest of the world m Some have claimed this has hindered US competing in international markets l With growth of European Union, methods of antitrust enforcement have evolved m Similar to US laws with some procedural and substantive differences m Europe only imposes civil penalties © 2005 Pearson Education, Inc. Chapter 10 100

Limiting Market Power: The Antitrust Laws l Two Examples m American Airlines l Early 80’s president and CEO accused of attempting to price fix m Microsoft l Monopoly power l Predatory actions l Collusion © 2005 Pearson Education, Inc. Chapter 10 101

Limiting Market Power: The Antitrust Laws l Two Examples m American Airlines l Early 80’s president and CEO accused of attempting to price fix m Microsoft l Monopoly power l Predatory actions l Collusion © 2005 Pearson Education, Inc. Chapter 10 101