9f479c86ee5cf66208b15f400a7c941a.ppt

- Количество слайдов: 37

Chapter 10 Long-Term Liabilities Using Financial Accounting Information: The Alternative to Debits and Credits, 6/e by Gary A. Porter and Curtis L. Norton Copyright © 2009 South-Western, a part of Cengage Learning

Balance Sheet Classifications Current liabilities: Due within one year of the balance sheet date Long-term liabilities: Due beyond one year LO 1

Long-Term Liabilities v Bonds payable v Notes payable v Leases v Deferred taxes

Bonds Investor Borrower v Long-term borrowing arrangement v Interest paid at stated rate and times v Principal repaid at maturity date LO 2

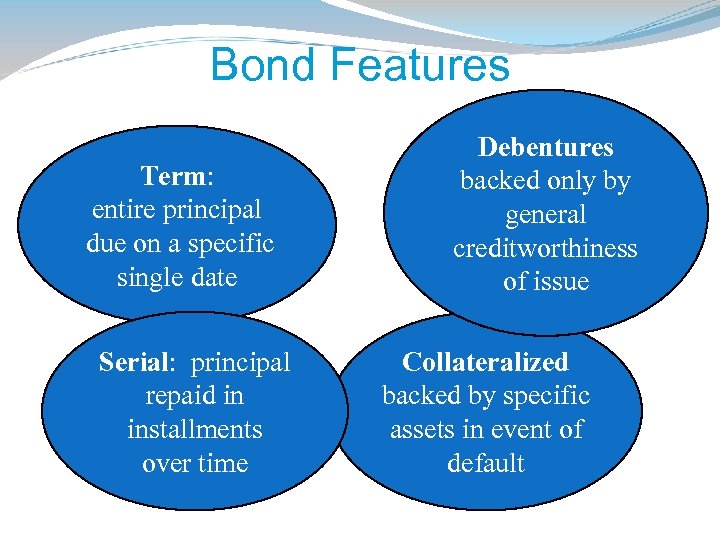

Bond Features Term: entire principal due on a specific single date Serial: principal repaid in installments over time Debentures backed only by general creditworthiness of issue Collateralized backed by specific assets in event of default

Bond Features Convertible into common stock Callable / Redeemable may be retired before maturity date

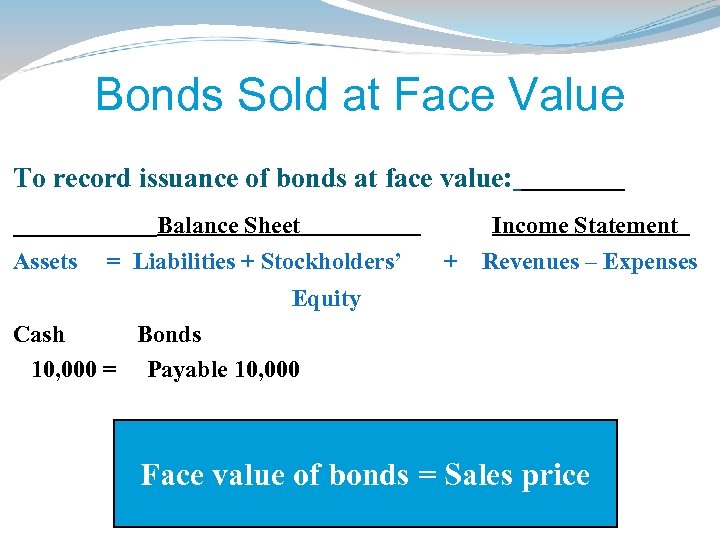

Bonds Sold at Face Value To record issuance of bonds at face value: Balance Sheet Assets = Liabilities + Stockholders’ Income Statement + Revenues – Expenses Equity Cash Bonds 10, 000 = Payable 10, 000 Face value of bonds = Sales price

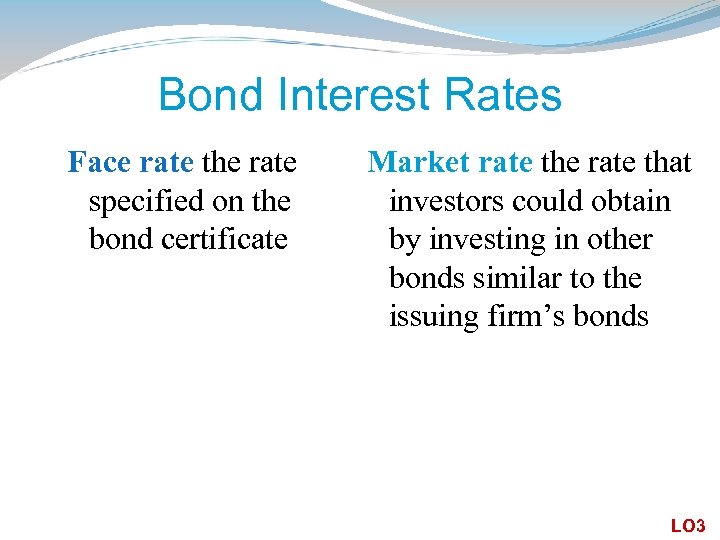

Bond Interest Rates Face rate the rate specified on the bond certificate Market rate the rate that investors could obtain by investing in other bonds similar to the issuing firm’s bonds LO 3

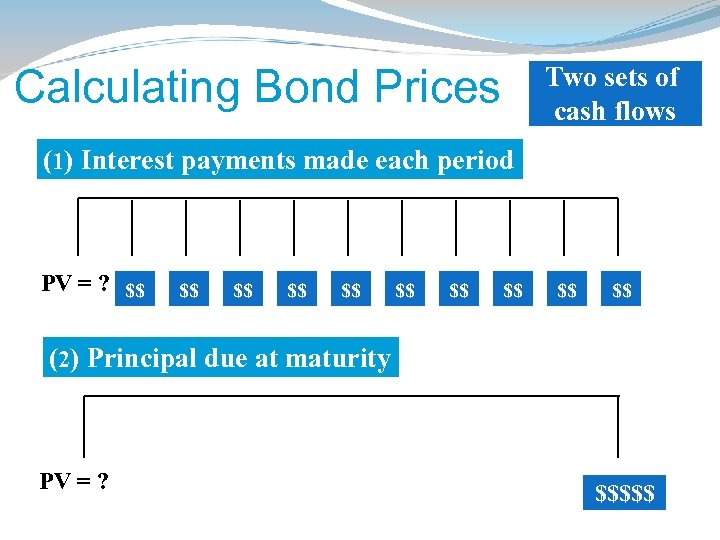

Calculating Bond Prices Two sets of cash flows (1) Interest payments made each period PV = ? $$ $$etc. $$ $$ $$ (2) Principal due at maturity PV = ? $$$$$

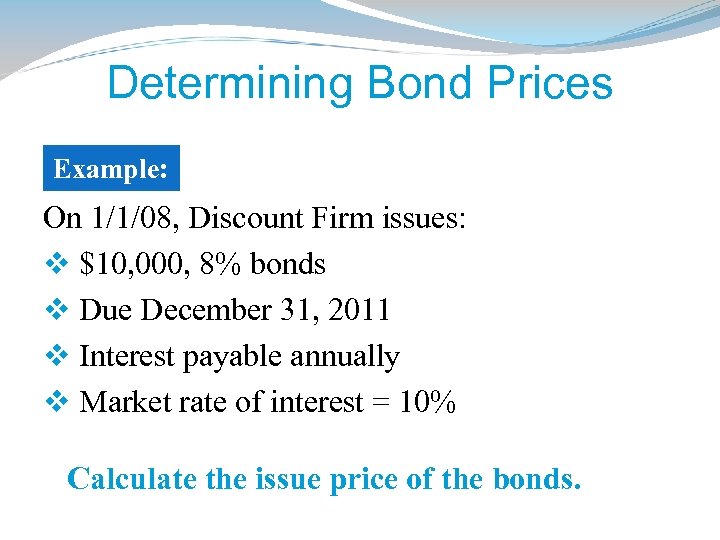

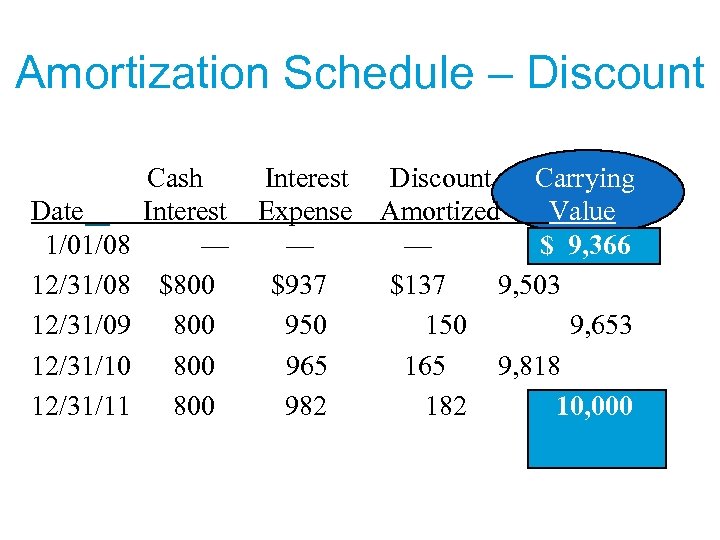

Determining Bond Prices Example: On 1/1/08, Discount Firm issues: v $10, 000, 8% bonds v Due December 31, 2011 v Interest payable annually v Market rate of interest = 10% Calculate the issue price of the bonds.

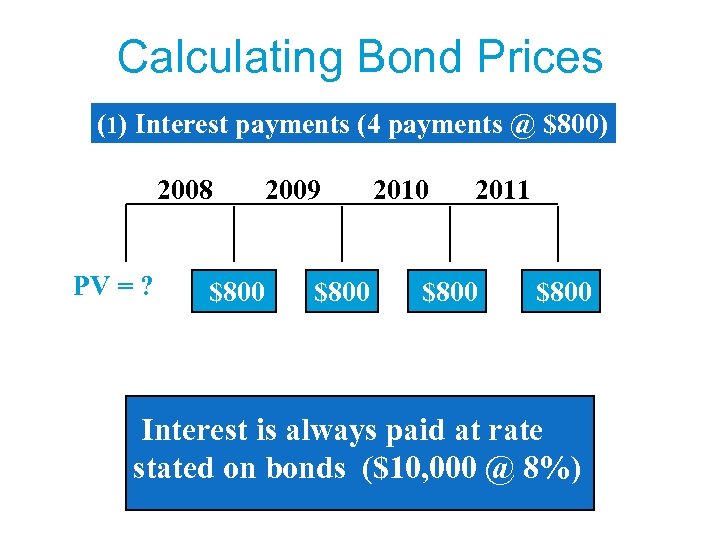

Calculating Bond Prices (1) Interest payments (4 payments @ $800) 2008 PV = ? $800 2009 $800 2011 $800 Interest is always paid at rate stated on bonds ($10, 000 @ 8%)

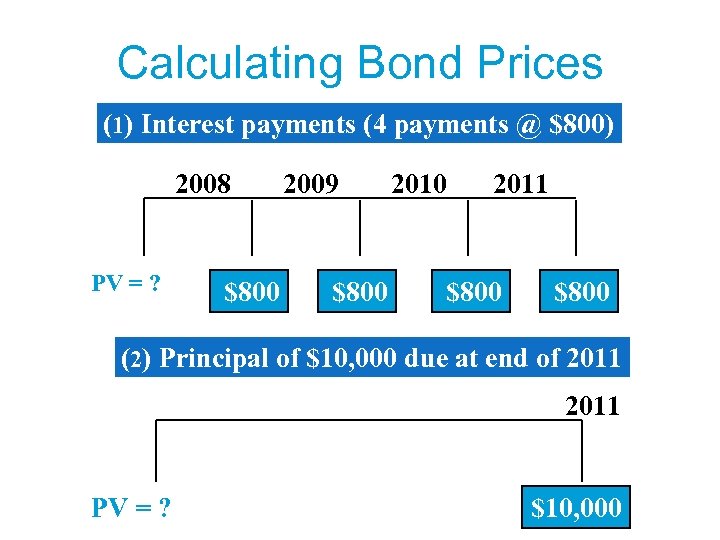

Calculating Bond Prices (1) Interest payments (4 payments @ $800) 2008 PV = ? $800 2009 $800 2011 $800 (2) Principal of $10, 000 due at end of 2011 PV = ? $10, 000

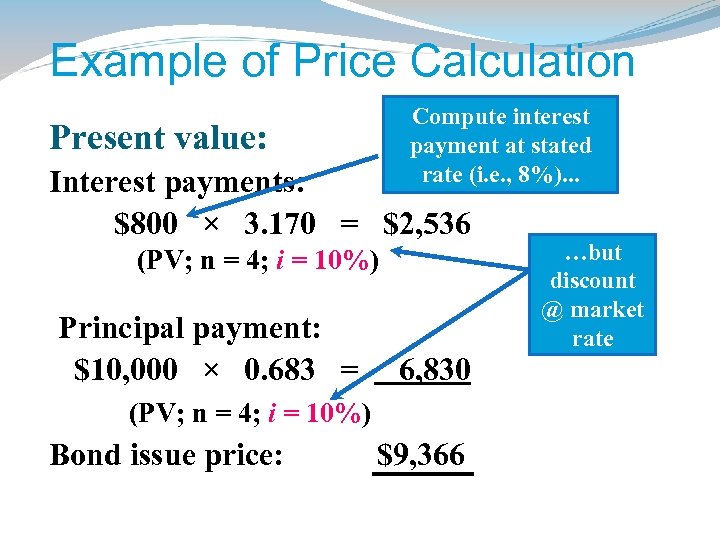

Example of Price Calculation Compute interest payment at stated rate (i. e. , 8%). . . Present value: Interest payments: $800 × 3. 170 = $2, 536 (PV; n = 4; i = 10%) Principal payment: $10, 000 × 0. 683 = 6, 830 (PV; n = 4; i = 10%) Bond issue price: $9, 366 …but discount @ market rate

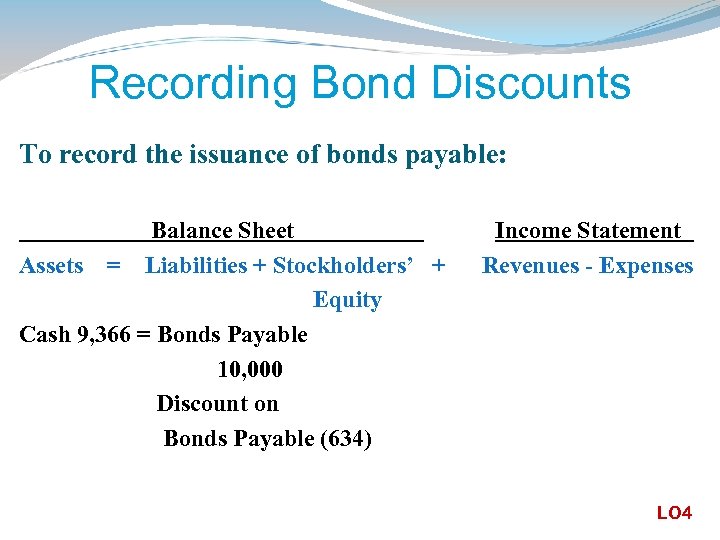

Recording Bond Discounts To record the issuance of bonds payable: Balance Sheet Assets = Liabilities + Stockholders’ + Equity Cash 9, 366 = Bonds Payable 10, 000 Discount on Bonds Payable (634) Income Statement Revenues - Expenses LO 4

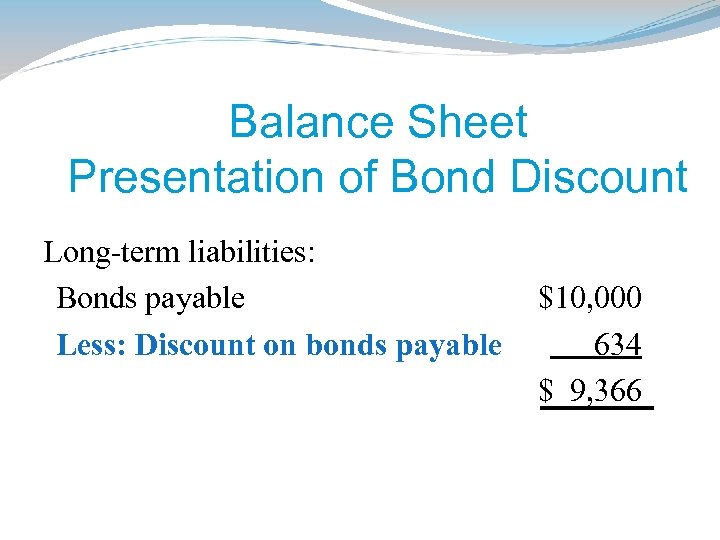

Balance Sheet Presentation of Bond Discount Long-term liabilities: Bonds payable Less: Discount on bonds payable $10, 000 634 $ 9, 366

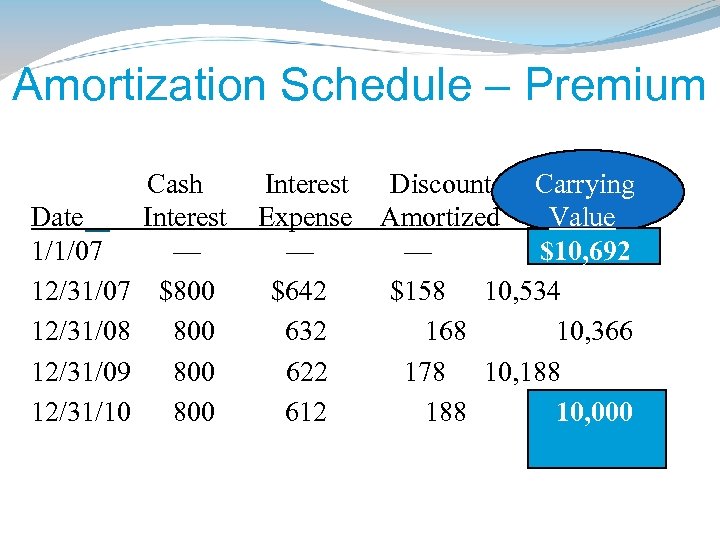

Determining Bond Prices Assume Premium Firm sells the same $10, 000, 8% bonds when the market rate on similar bonds is 6%.

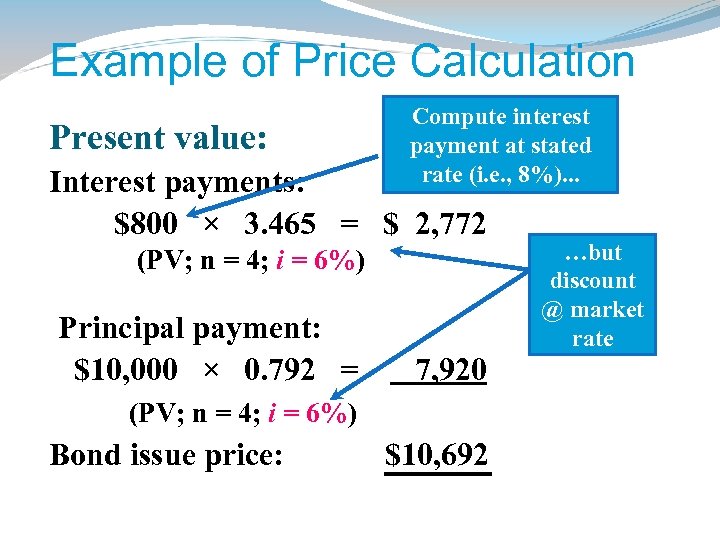

Example of Price Calculation Present value: Compute interest payment at stated rate (i. e. , 8%). . . Interest payments: $800 × 3. 465 = $ 2, 772 (PV; n = 4; i = 6%) Principal payment: $10, 000 × 0. 792 = 7, 920 (PV; n = 4; i = 6%) Bond issue price: $10, 692 …but discount @ market rate

Recording Bond Premiums To record the issuance of bonds payable: Balance Sheet Income Statement Assets = Liabilities + Stockholders’ + Revenues – Expenses Equity Cash = Bonds Payable 10, 692 10, 000 Premium on Bonds Payable 692

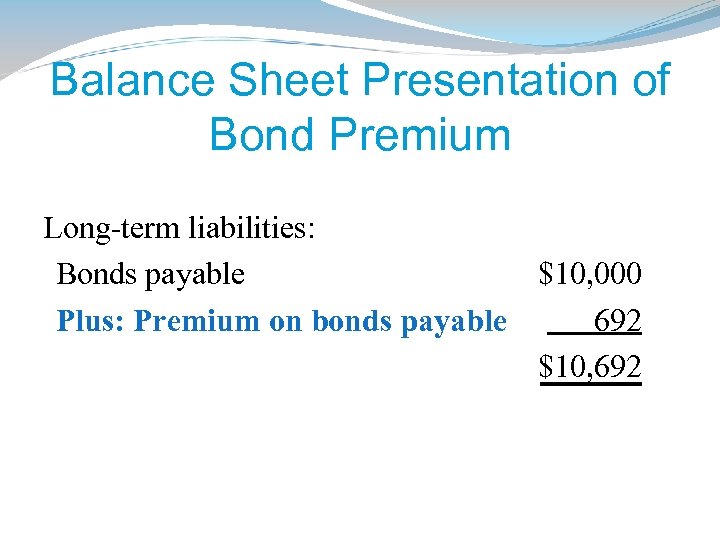

Balance Sheet Presentation of Bond Premium Long-term liabilities: Bonds payable $10, 000 Plus: Premium on bonds payable 692 $10, 692

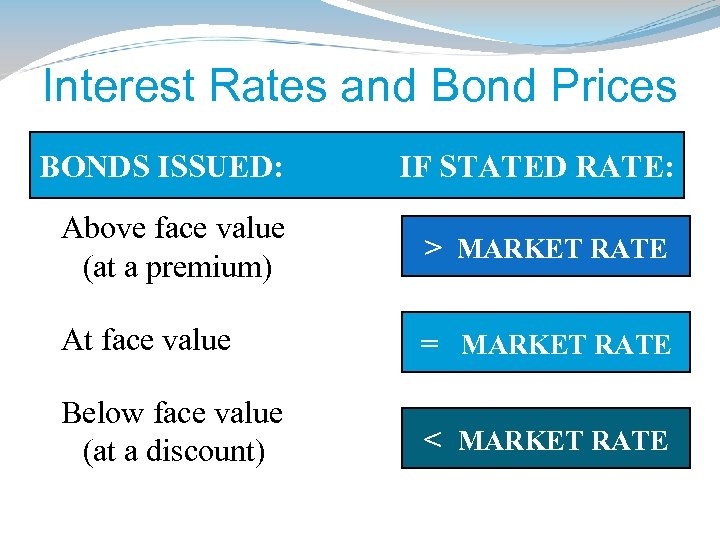

Interest Rates and Bond Prices BONDS ISSUED: IF STATED RATE: Above face value (at a premium) > MARKET RATE At face value = MARKET RATE Below face value (at a discount) < MARKET RATE

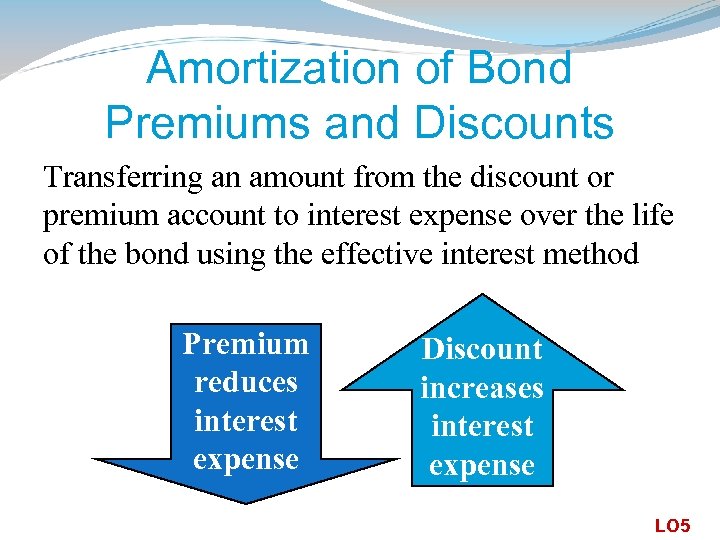

Amortization of Bond Premiums and Discounts Transferring an amount from the discount or premium account to interest expense over the life of the bond using the effective interest method Premium reduces interest expense Discount increases interest expense LO 5

Amortization Schedule – Discount Date 1/01/08 12/31/09 12/31/10 12/31/11 Cash Interest — $800 800 Interest Expense — $937 950 965 982 Discount Carrying Amortized Value — $ 9, 366 $137 9, 503 150 9, 653 165 9, 818 182 10, 000 (rounded)

Amortization Schedule – Premium Date 1/1/07 12/31/08 12/31/09 12/31/10 Cash Interest — $800 800 Interest Expense — $642 632 622 612 Discount Carrying Amortized Value — $10, 692 $158 10, 534 168 10, 366 178 10, 188 10, 000 (rounded)

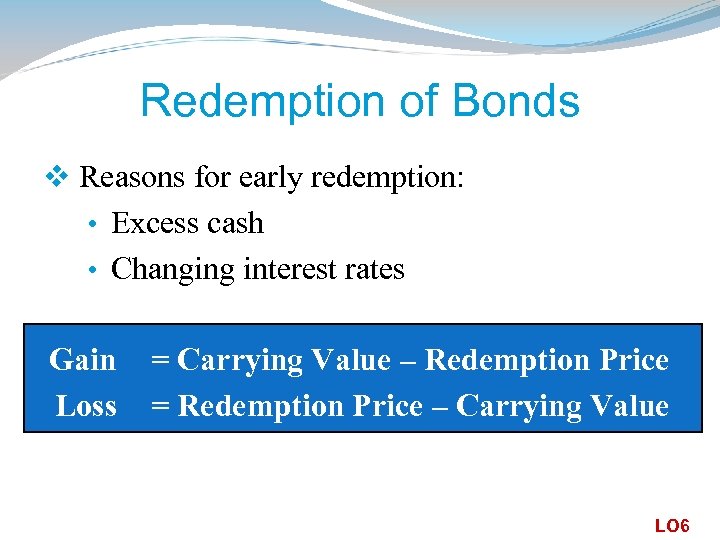

Redemption of Bonds v Reasons for early redemption: • Excess cash • Changing interest rates Gain Loss = Carrying Value – Redemption Price = Redemption Price – Carrying Value LO 6

Leases v Contractual arrangement v Grants right to use asset in exchange for payments v Form of financing Lessee Lessor LO 7

Capital Lease v Record as asset and corresponding liability (as if purchased through borrowings) v Depreciate asset over lease term v Separate payments into principal and interest components using the effective interest method

Criteria for Lease Capitalization Lease meets one or more: v Transfers ownership of property v Contains a bargain-purchase option v Term is > 75% of property’s life v Present value of payments is > 90% of property’s fair market value

Operating Leases v Record as rent (lease) expense each period v Disclose future lease obligations in financial statement notes OFFICE SPACE FOR LEASE

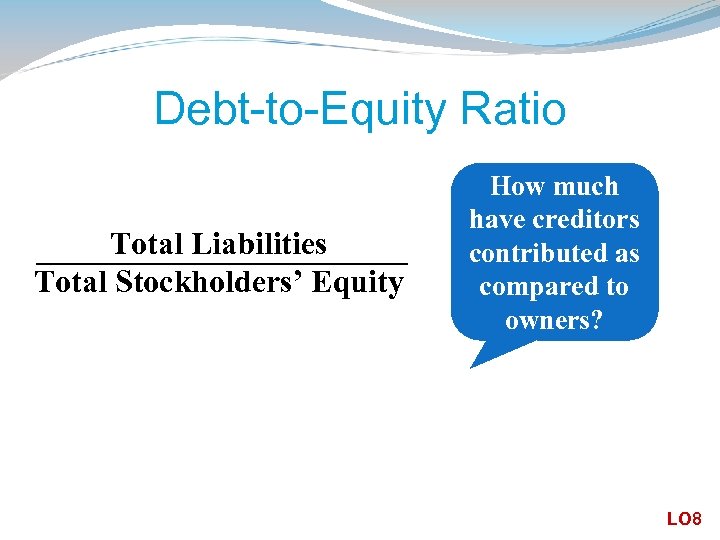

Debt-to-Equity Ratio Total Liabilities Total Stockholders’ Equity How much have creditors contributed as compared to owners? LO 8

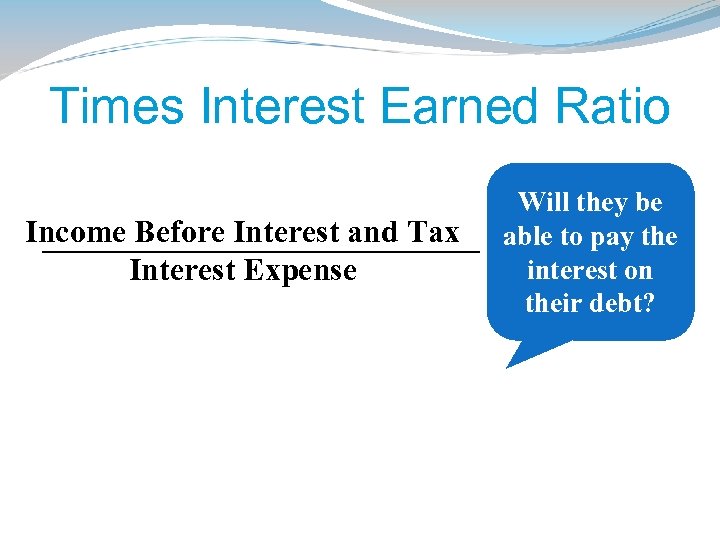

Times Interest Earned Ratio Income Before Interest and Tax Interest Expense Will they be able to pay the interest on their debt?

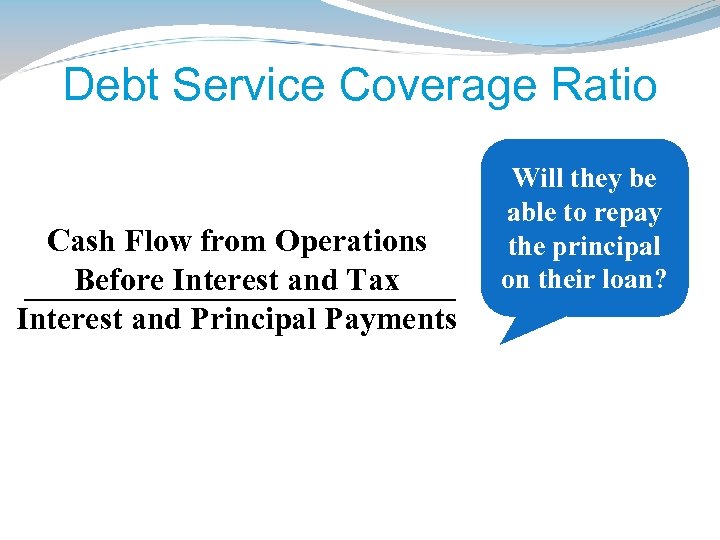

Debt Service Coverage Ratio Cash Flow from Operations Before Interest and Tax Interest and Principal Payments Will they be able to repay the principal on their loan?

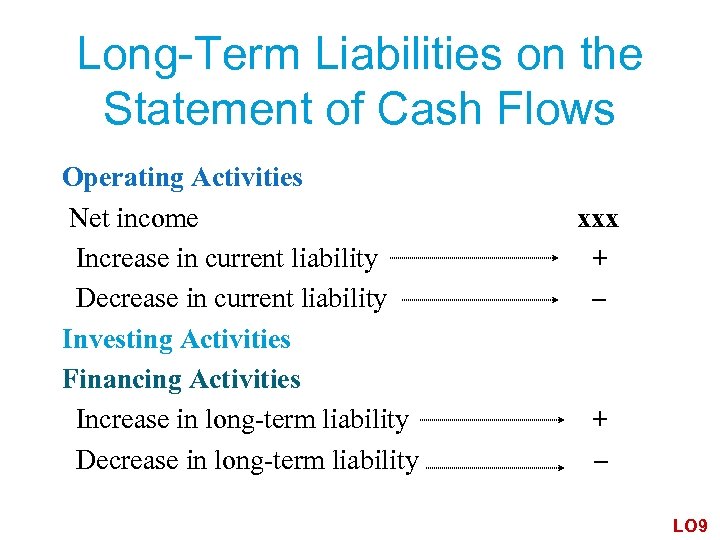

Long-Term Liabilities on the Statement of Cash Flows Operating Activities Net income Increase in current liability Decrease in current liability Investing Activities Financing Activities Increase in long-term liability Decrease in long-term liability xxx + – LO 9

Appendix Accounting Tools: Other Liabilities

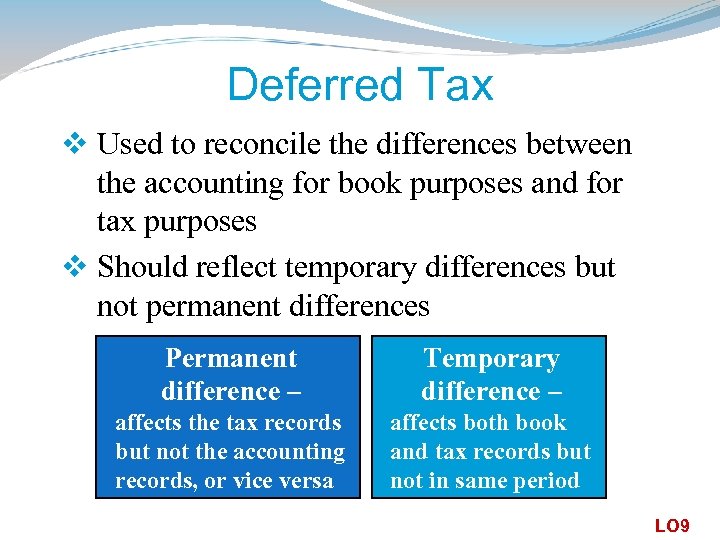

Deferred Tax v Used to reconcile the differences between the accounting for book purposes and for tax purposes v Should reflect temporary differences but not permanent differences Permanent difference – Temporary difference – affects the tax records but not the accounting records, or vice versa affects both book and tax records but not in same period LO 9

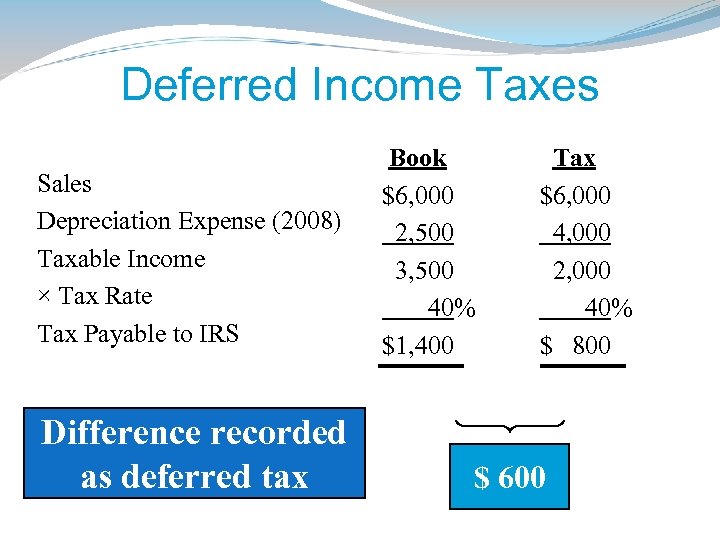

Deferred Income Taxes Sales Depreciation Expense (2008) Taxable Income × Tax Rate Tax Payable to IRS Difference recorded as deferred tax Book $6, 000 2, 500 3, 500 40% $1, 400 Tax $6, 000 4, 000 2, 000 40% $ 800 $ 600

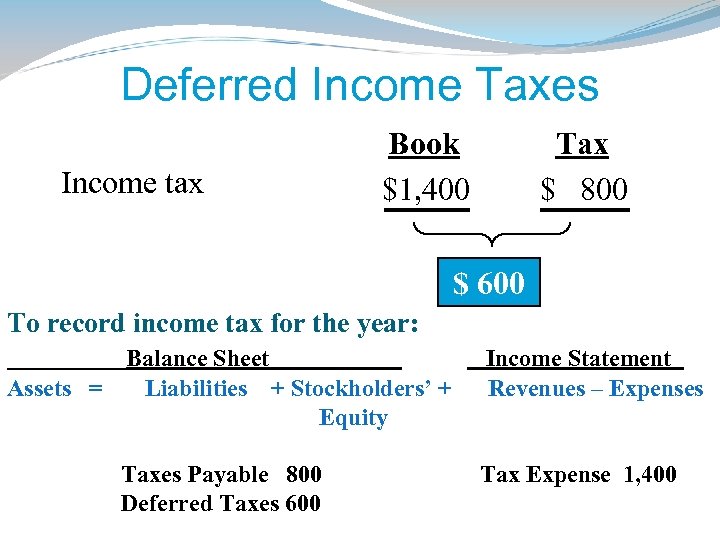

Deferred Income Taxes Income tax Book $1, 400 Tax $ 800 $ 600 To record income tax for the year: Balance Sheet Assets = Liabilities + Stockholders’ + Equity Taxes Payable 800 Deferred Taxes 600 Income Statement Revenues – Expenses Tax Expense 1, 400

End of Chapter 10

9f479c86ee5cf66208b15f400a7c941a.ppt