ae2842b8be0cf1826369cc95ec37d3c2.ppt

- Количество слайдов: 61

Chapter 10: Externalities and Property Rights © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 1

Chapter 10: Externalities and Property Rights © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 1

Learning Objectives 1. Define negative and positive externalities and analyze their effect on resource allocations 2. Explain how the effects of externalities can be remedied 3. Compare and contrast the ways in which taxes and tradable permits can be used to reduce pollution 4. Discuss why the optimal amount of an externality is not zero 5. Characterize the tragedy of the commons and show private ownership is a way of preventing it 6. Define positional externalities and their effects Ø Show they can be remedied © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 2

Learning Objectives 1. Define negative and positive externalities and analyze their effect on resource allocations 2. Explain how the effects of externalities can be remedied 3. Compare and contrast the ways in which taxes and tradable permits can be used to reduce pollution 4. Discuss why the optimal amount of an externality is not zero 5. Characterize the tragedy of the commons and show private ownership is a way of preventing it 6. Define positional externalities and their effects Ø Show they can be remedied © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 2

External Costs and Benefits n External cost is a cost of an activity that is paid by people other than those who pursue the activity Ø Also called a negative externality n External benefit is a benefit of an activity received by a third party § Also called a positive externality n Externality an external cost or benefit of an activity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 3

External Costs and Benefits n External cost is a cost of an activity that is paid by people other than those who pursue the activity Ø Also called a negative externality n External benefit is a benefit of an activity received by a third party § Also called a positive externality n Externality an external cost or benefit of an activity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 3

Externalities n This chapter focuses on how externalities affect the allocation of resources n Adam Smith’s theory of invisible hand applies to an ideal market, in which externalities do not exist Ø In an ideal market, self-interested actions of individuals would lead to socially efficient outcomes n In the case of externalities, when the parties affected can easily negotiate with one another, the invisible hand will still produce an efficient outcome © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 4

Externalities n This chapter focuses on how externalities affect the allocation of resources n Adam Smith’s theory of invisible hand applies to an ideal market, in which externalities do not exist Ø In an ideal market, self-interested actions of individuals would lead to socially efficient outcomes n In the case of externalities, when the parties affected can easily negotiate with one another, the invisible hand will still produce an efficient outcome © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 4

Externalities Affect Resource Allocation n Externalities reduce economic efficiency Ø Solutions to externalities may be efficient Ø When efficient solutions to externalities are not possible, government intervention or other collective action may be used © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 5

Externalities Affect Resource Allocation n Externalities reduce economic efficiency Ø Solutions to externalities may be efficient Ø When efficient solutions to externalities are not possible, government intervention or other collective action may be used © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 5

Honeybee Keeper – Scenario 1 n Asal harvests and sells honey from her bees Ø Her neighbors grow apples Ø Bees pollinate their apple orchards n The bees provide a free service to the local farmers Ø Asal is giving away a service § No payments made to Asal § If Asal takes only her own costs and benefits into account in deciding how many hives to keep, will she keep the socially optimal number of hives? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 6

Honeybee Keeper – Scenario 1 n Asal harvests and sells honey from her bees Ø Her neighbors grow apples Ø Bees pollinate their apple orchards n The bees provide a free service to the local farmers Ø Asal is giving away a service § No payments made to Asal § If Asal takes only her own costs and benefits into account in deciding how many hives to keep, will she keep the socially optimal number of hives? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 6

Honeybee Keeper – Scenario 1 n The bees provide a free service to the local farmers Ø Since the orchard owners also benefit from additional hives, the total benefit of adding another hive at that point will be greater than its cost § Private costs are equal to private benefits • Asal, then, will keep too few hives § Social costs are less than social benefits When external benefits exist, maximizing private profits produces less than the social optimum © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 7

Honeybee Keeper – Scenario 1 n The bees provide a free service to the local farmers Ø Since the orchard owners also benefit from additional hives, the total benefit of adding another hive at that point will be greater than its cost § Private costs are equal to private benefits • Asal, then, will keep too few hives § Social costs are less than social benefits When external benefits exist, maximizing private profits produces less than the social optimum © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 7

Honeybee Keeper – Scenario 2 n Asal harvests and sells honey from her bees n Neighboring school and nursing homes are bothered by bee stings n The bees are a nuisance to the neighbors Ø Asal is not paying all the costs of her honeybees § Private costs are equal to private benefits • Social costs are greater than social benefits When external costs exist, maximizing private profits produces more than the social optimum © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 8

Honeybee Keeper – Scenario 2 n Asal harvests and sells honey from her bees n Neighboring school and nursing homes are bothered by bee stings n The bees are a nuisance to the neighbors Ø Asal is not paying all the costs of her honeybees § Private costs are equal to private benefits • Social costs are greater than social benefits When external costs exist, maximizing private profits produces more than the social optimum © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 8

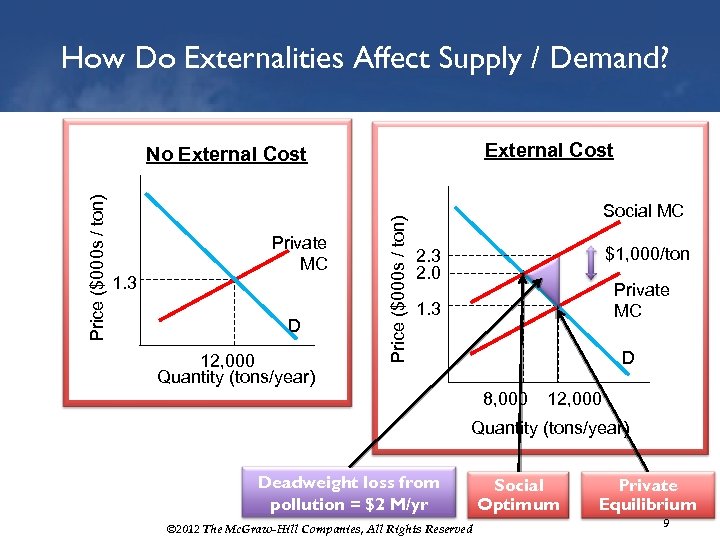

How Do Externalities Affect Supply / Demand? External Cost 1. 3 Private MC D 12, 000 Quantity (tons/year) Price ($000 s / ton) No External Cost Social MC $1, 000/ton 2. 3 2. 0 Private MC 1. 3 D 8, 000 12, 000 Quantity (tons/year) Deadweight loss from pollution = $2 M/yr © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Social Optimum Private Equilibrium 9

How Do Externalities Affect Supply / Demand? External Cost 1. 3 Private MC D 12, 000 Quantity (tons/year) Price ($000 s / ton) No External Cost Social MC $1, 000/ton 2. 3 2. 0 Private MC 1. 3 D 8, 000 12, 000 Quantity (tons/year) Deadweight loss from pollution = $2 M/yr © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Social Optimum Private Equilibrium 9

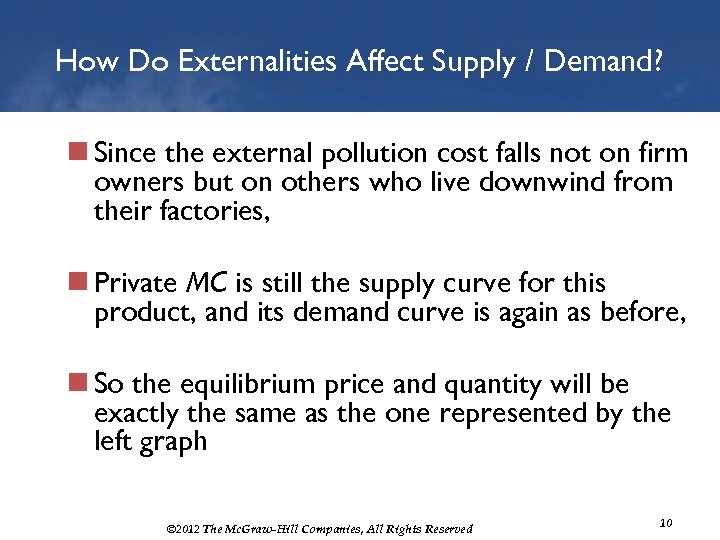

How Do Externalities Affect Supply / Demand? n Since the external pollution cost falls not on firm owners but on others who live downwind from their factories, n Private MC is still the supply curve for this product, and its demand curve is again as before, n So the equilibrium price and quantity will be exactly the same as the one represented by the left graph © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 10

How Do Externalities Affect Supply / Demand? n Since the external pollution cost falls not on firm owners but on others who live downwind from their factories, n Private MC is still the supply curve for this product, and its demand curve is again as before, n So the equilibrium price and quantity will be exactly the same as the one represented by the left graph © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 10

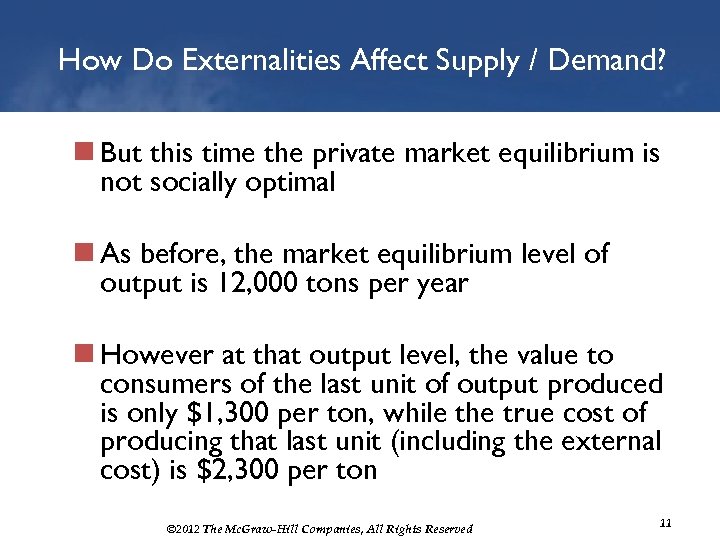

How Do Externalities Affect Supply / Demand? n But this time the private market equilibrium is not socially optimal n As before, the market equilibrium level of output is 12, 000 tons per year n However at that output level, the value to consumers of the last unit of output produced is only $1, 300 per ton, while the true cost of producing that last unit (including the external cost) is $2, 300 per ton © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 11

How Do Externalities Affect Supply / Demand? n But this time the private market equilibrium is not socially optimal n As before, the market equilibrium level of output is 12, 000 tons per year n However at that output level, the value to consumers of the last unit of output produced is only $1, 300 per ton, while the true cost of producing that last unit (including the external cost) is $2, 300 per ton © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 11

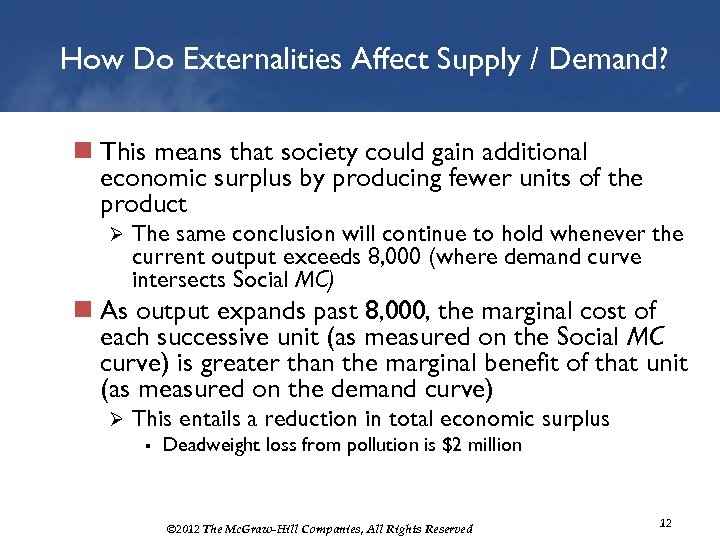

How Do Externalities Affect Supply / Demand? n This means that society could gain additional economic surplus by producing fewer units of the product Ø The same conclusion will continue to hold whenever the current output exceeds 8, 000 (where demand curve intersects Social MC) n As output expands past 8, 000, the marginal cost of each successive unit (as measured on the Social MC curve) is greater than the marginal benefit of that unit (as measured on the demand curve) Ø This entails a reduction in total economic surplus § Deadweight loss from pollution is $2 million © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 12

How Do Externalities Affect Supply / Demand? n This means that society could gain additional economic surplus by producing fewer units of the product Ø The same conclusion will continue to hold whenever the current output exceeds 8, 000 (where demand curve intersects Social MC) n As output expands past 8, 000, the marginal cost of each successive unit (as measured on the Social MC curve) is greater than the marginal benefit of that unit (as measured on the demand curve) Ø This entails a reduction in total economic surplus § Deadweight loss from pollution is $2 million © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 12

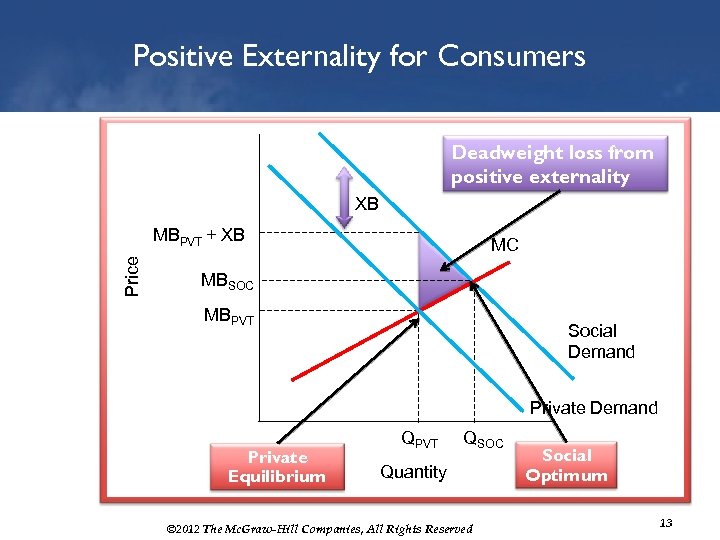

Positive Externality for Consumers Deadweight loss from positive externality XB Price MBPVT + XB MC MBSOC MBPVT Social Demand Private Equilibrium QPVT QSOC Quantity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Social Optimum 13

Positive Externality for Consumers Deadweight loss from positive externality XB Price MBPVT + XB MC MBSOC MBPVT Social Demand Private Equilibrium QPVT QSOC Quantity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Social Optimum 13

How Do Externalities Affect Supply / Demand? n To summarize, Ø Whether externalities are positive or negative distort the allocation of resources in efficient markets Ø When externalities are present, the individual pursuit of self-interest will not result in the largest possible economic surplus Ø The outcome is thus inefficient © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 14

How Do Externalities Affect Supply / Demand? n To summarize, Ø Whether externalities are positive or negative distort the allocation of resources in efficient markets Ø When externalities are present, the individual pursuit of self-interest will not result in the largest possible economic surplus Ø The outcome is thus inefficient © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 14

Effects of Externalities With externalities, private market outcomes do not achieve the largest possible economic surplus Cash is left on the table © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 15

Effects of Externalities With externalities, private market outcomes do not achieve the largest possible economic surplus Cash is left on the table © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 15

Remedying Externalities n With externalities, private market outcomes do not achieve the largest possible economic surplus Ø Cash is left on the table n For example, with monopolies, output is lower than with prefect competition Ø Introduction the market of coupons and rebates expands n With externalities, actions to capture the surplus are likely © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 16

Remedying Externalities n With externalities, private market outcomes do not achieve the largest possible economic surplus Ø Cash is left on the table n For example, with monopolies, output is lower than with prefect competition Ø Introduction the market of coupons and rebates expands n With externalities, actions to capture the surplus are likely © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 16

The Coase Theorem n To say that a situation is inefficient means that it can be rearranged in a way that would make at least some people better off without harming others n The existence of inefficiency means that there is cash on the table, which usually triggers a race to see who can capture it Ø For example, because monopoly pricing results in an inefficiently low output level, the potential for gain gave monopolists an incentive to make discounts available to price-sensitive buyers © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 17

The Coase Theorem n To say that a situation is inefficient means that it can be rearranged in a way that would make at least some people better off without harming others n The existence of inefficiency means that there is cash on the table, which usually triggers a race to see who can capture it Ø For example, because monopoly pricing results in an inefficiently low output level, the potential for gain gave monopolists an incentive to make discounts available to price-sensitive buyers © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 17

Fawaz the Polluter – Scenario 1 n Fawaz’s company dumps toxic waste in the river Ø Fawzi cannot fish the river Ø No one else is harmed n Fawaz could install a filter to remove the harm to Fawzi Ø Filter imposes costs on Fawaz benefits Fawzi n Parties do not communicate © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 18

Fawaz the Polluter – Scenario 1 n Fawaz’s company dumps toxic waste in the river Ø Fawzi cannot fish the river Ø No one else is harmed n Fawaz could install a filter to remove the harm to Fawzi Ø Filter imposes costs on Fawaz benefits Fawzi n Parties do not communicate © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 18

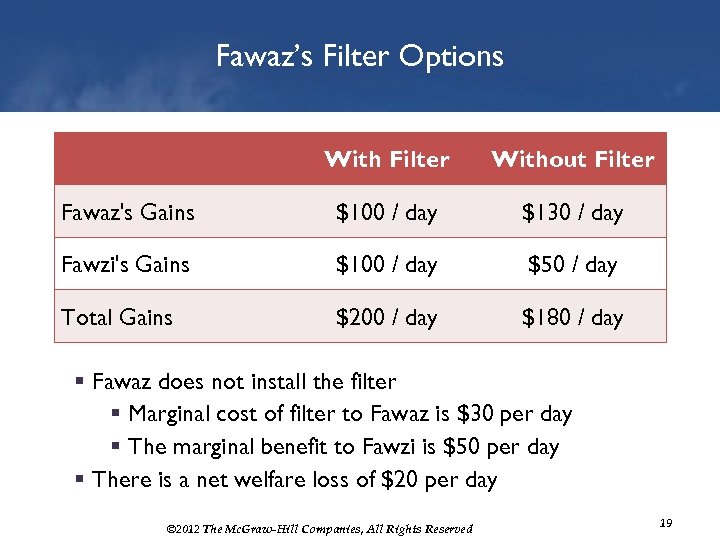

Fawaz’s Filter Options With Filter Without Filter Fawaz's Gains $100 / day $130 / day Fawzi's Gains $100 / day $50 / day Total Gains $200 / day $180 / day § Fawaz does not install the filter § Marginal cost of filter to Fawaz is $30 per day § The marginal benefit to Fawzi is $50 per day § There is a net welfare loss of $20 per day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 19

Fawaz’s Filter Options With Filter Without Filter Fawaz's Gains $100 / day $130 / day Fawzi's Gains $100 / day $50 / day Total Gains $200 / day $180 / day § Fawaz does not install the filter § Marginal cost of filter to Fawaz is $30 per day § The marginal benefit to Fawzi is $50 per day § There is a net welfare loss of $20 per day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 19

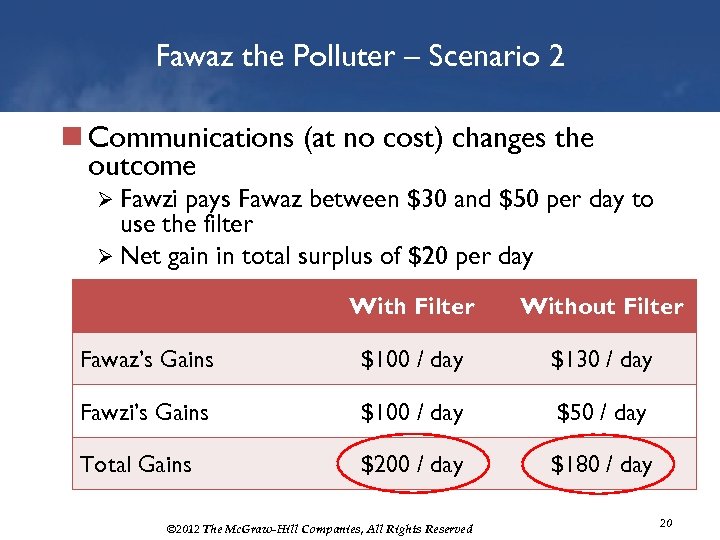

Fawaz the Polluter – Scenario 2 n Communications (at no cost) changes the outcome Ø Fawzi pays Fawaz between $30 and $50 per day to use the filter Ø Net gain in total surplus of $20 per day With Filter Without Filter Fawaz’s Gains $100 / day $130 / day Fawzi’s Gains $100 / day $50 / day Total Gains $200 / day $180 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 20

Fawaz the Polluter – Scenario 2 n Communications (at no cost) changes the outcome Ø Fawzi pays Fawaz between $30 and $50 per day to use the filter Ø Net gain in total surplus of $20 per day With Filter Without Filter Fawaz’s Gains $100 / day $130 / day Fawzi’s Gains $100 / day $50 / day Total Gains $200 / day $180 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 20

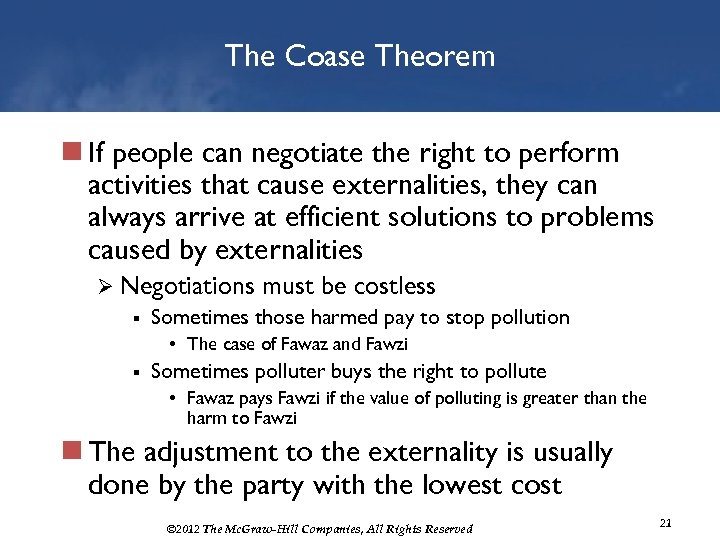

The Coase Theorem n If people can negotiate the right to perform activities that cause externalities, they can always arrive at efficient solutions to problems caused by externalities Ø Negotiations must be costless § Sometimes those harmed pay to stop pollution • The case of Fawaz and Fawzi § Sometimes polluter buys the right to pollute • Fawaz pays Fawzi if the value of polluting is greater than the harm to Fawzi n The adjustment to the externality is usually done by the party with the lowest cost © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 21

The Coase Theorem n If people can negotiate the right to perform activities that cause externalities, they can always arrive at efficient solutions to problems caused by externalities Ø Negotiations must be costless § Sometimes those harmed pay to stop pollution • The case of Fawaz and Fawzi § Sometimes polluter buys the right to pollute • Fawaz pays Fawzi if the value of polluting is greater than the harm to Fawzi n The adjustment to the externality is usually done by the party with the lowest cost © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 21

The Coase Theorem n Coase theorem if at no cost people can negotiate the purchase and sale of the right to perform activities that cause externalities, they can always arrive at efficient solutions to the problems caused by externalities © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 22

The Coase Theorem n Coase theorem if at no cost people can negotiate the purchase and sale of the right to perform activities that cause externalities, they can always arrive at efficient solutions to the problems caused by externalities © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 22

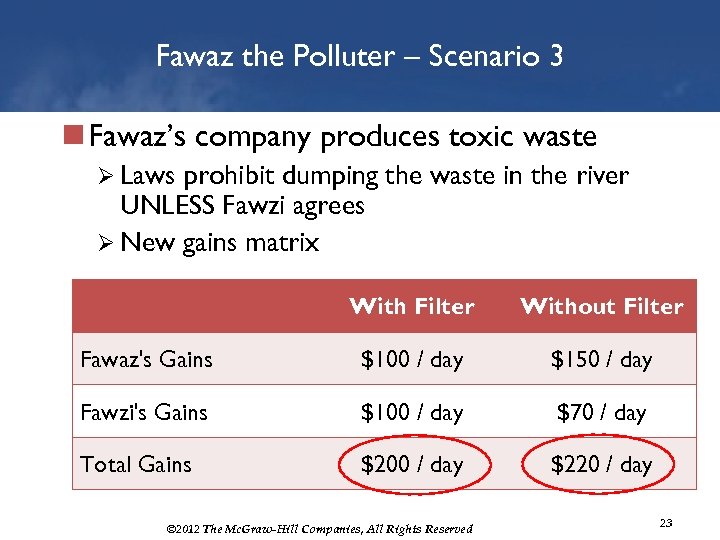

Fawaz the Polluter – Scenario 3 n Fawaz’s company produces toxic waste Ø Laws prohibit dumping the waste in the river UNLESS Fawzi agrees Ø New gains matrix With Filter Without Filter Fawaz's Gains $100 / day $150 / day Fawzi's Gains $100 / day $70 / day Total Gains $200 / day $220 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 23

Fawaz the Polluter – Scenario 3 n Fawaz’s company produces toxic waste Ø Laws prohibit dumping the waste in the river UNLESS Fawzi agrees Ø New gains matrix With Filter Without Filter Fawaz's Gains $100 / day $150 / day Fawzi's Gains $100 / day $70 / day Total Gains $200 / day $220 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 23

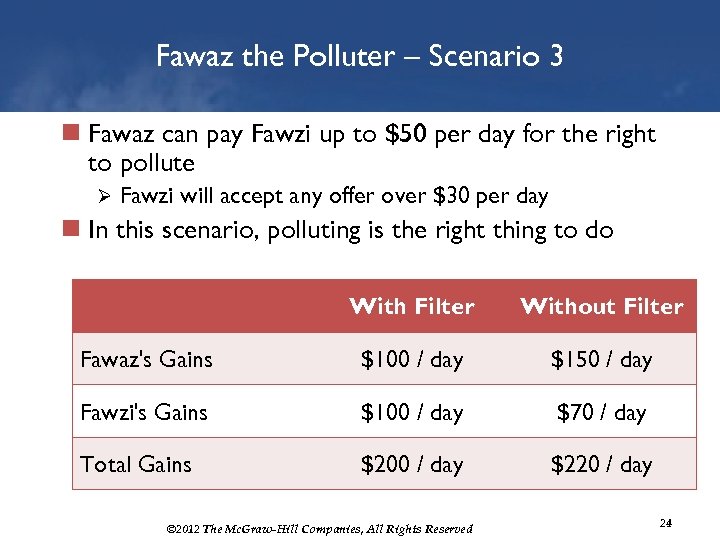

Fawaz the Polluter – Scenario 3 n Fawaz can pay Fawzi up to $50 per day for the right to pollute Ø Fawzi will accept any offer over $30 per day n In this scenario, polluting is the right thing to do With Filter Without Filter Fawaz's Gains $100 / day $150 / day Fawzi's Gains $100 / day $70 / day Total Gains $200 / day $220 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 24

Fawaz the Polluter – Scenario 3 n Fawaz can pay Fawzi up to $50 per day for the right to pollute Ø Fawzi will accept any offer over $30 per day n In this scenario, polluting is the right thing to do With Filter Without Filter Fawaz's Gains $100 / day $150 / day Fawzi's Gains $100 / day $70 / day Total Gains $200 / day $220 / day © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 24

Price Incentives and the Environment n Goods with negative externalities tend to be overproduced n Social objective is to reduce pollution by half from its unregulated level Ø The most efficient solution is one where the marginal cost of pollution abatement is the same for all polluters § Cost data are not available to government Ø One solution is to have all reduce pollution by the same proportion § Uneven distribution of costs © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 25

Price Incentives and the Environment n Goods with negative externalities tend to be overproduced n Social objective is to reduce pollution by half from its unregulated level Ø The most efficient solution is one where the marginal cost of pollution abatement is the same for all polluters § Cost data are not available to government Ø One solution is to have all reduce pollution by the same proportion § Uneven distribution of costs © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 25

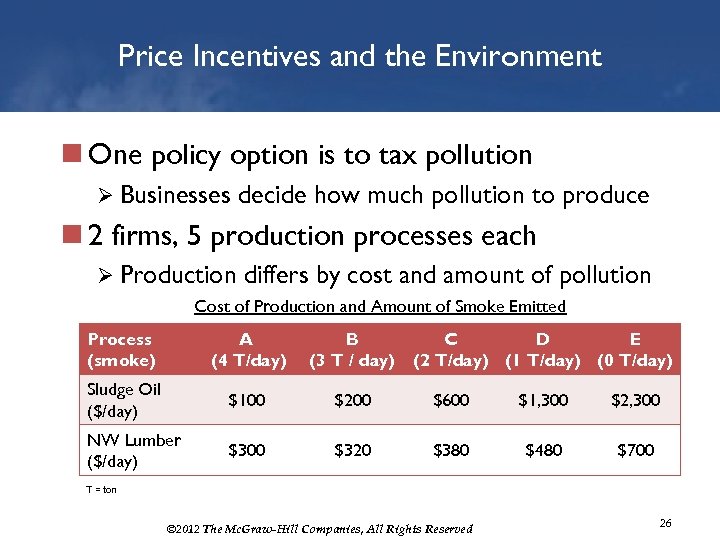

Price Incentives and the Environment n One policy option is to tax pollution Ø Businesses decide how much pollution to produce n 2 firms, 5 production processes each Ø Production differs by cost and amount of pollution Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 T = ton © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 26

Price Incentives and the Environment n One policy option is to tax pollution Ø Businesses decide how much pollution to produce n 2 firms, 5 production processes each Ø Production differs by cost and amount of pollution Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 T = ton © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 26

Price Incentives and the Environment n If there are no regulations, each firm produces at its lowest cost, production method A Ø Each firm produces 4 tons of smoke per day n Government wants to cut pollution by half Ø Option 1: Set maximum pollution limits Ø Option 2: Tax smoke at a rate of $T per ton § Determine T to reduce pollution by half n Each option has costs to society that must be considered © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 27

Price Incentives and the Environment n If there are no regulations, each firm produces at its lowest cost, production method A Ø Each firm produces 4 tons of smoke per day n Government wants to cut pollution by half Ø Option 1: Set maximum pollution limits Ø Option 2: Tax smoke at a rate of $T per ton § Determine T to reduce pollution by half n Each option has costs to society that must be considered © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 27

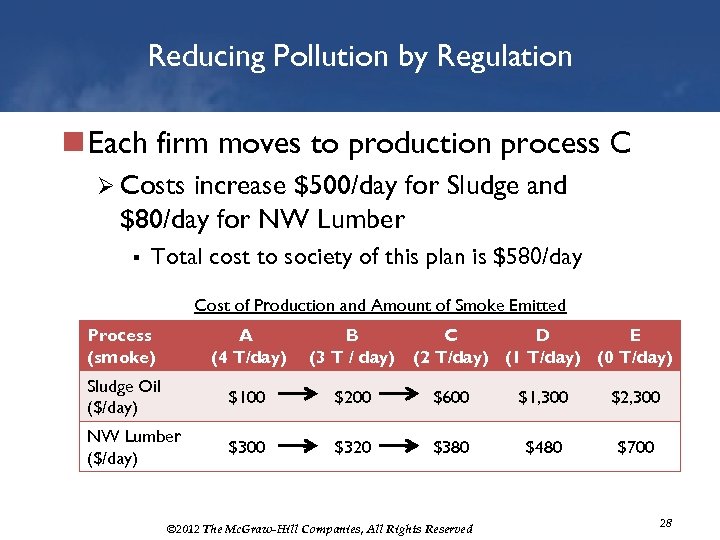

Reducing Pollution by Regulation n Each firm moves to production process C Ø Costs increase $500/day for Sludge and $80/day for NW Lumber § Total cost to society of this plan is $580/day Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 28

Reducing Pollution by Regulation n Each firm moves to production process C Ø Costs increase $500/day for Sludge and $80/day for NW Lumber § Total cost to society of this plan is $580/day Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 28

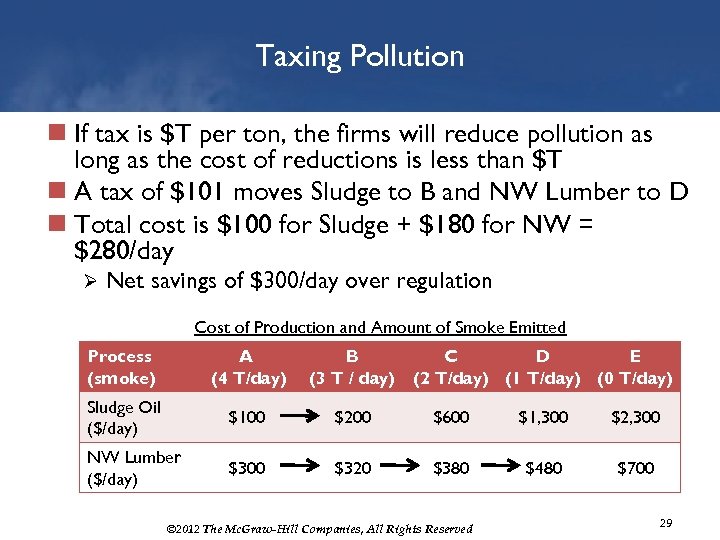

Taxing Pollution n If tax is $T per ton, the firms will reduce pollution as long as the cost of reductions is less than $T n A tax of $101 moves Sludge to B and NW Lumber to D n Total cost is $100 for Sludge + $180 for NW = $280/day Ø Net savings of $300/day over regulation Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 29

Taxing Pollution n If tax is $T per ton, the firms will reduce pollution as long as the cost of reductions is less than $T n A tax of $101 moves Sludge to B and NW Lumber to D n Total cost is $100 for Sludge + $180 for NW = $280/day Ø Net savings of $300/day over regulation Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 29

Price Incentives and the Environment n Taxing pollution concentrates pollution reduction in firms that can accomplish it at the least cost Cost – Benefit Principle Ø Cost of the last ton of smoke removed is the same for all firms Ø n It can be difficult to determine the optimal tax rate Set the tax too high and you get too little reduction Ø Set the tax too low and you get too much reduction Ø § Marginal cost exceeds marginal benefit to society © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 30

Price Incentives and the Environment n Taxing pollution concentrates pollution reduction in firms that can accomplish it at the least cost Cost – Benefit Principle Ø Cost of the last ton of smoke removed is the same for all firms Ø n It can be difficult to determine the optimal tax rate Set the tax too high and you get too little reduction Ø Set the tax too low and you get too much reduction Ø § Marginal cost exceeds marginal benefit to society © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 30

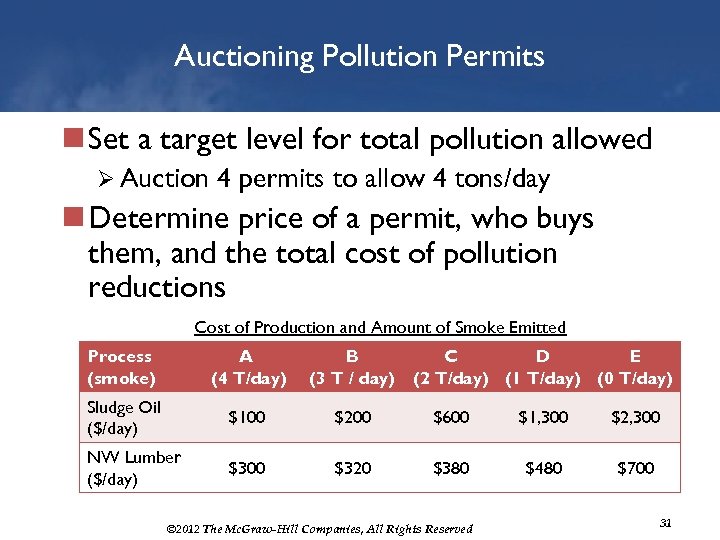

Auctioning Pollution Permits n Set a target level for total pollution allowed Ø Auction 4 permits to allow 4 tons/day n Determine price of a permit, who buys them, and the total cost of pollution reductions Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 31

Auctioning Pollution Permits n Set a target level for total pollution allowed Ø Auction 4 permits to allow 4 tons/day n Determine price of a permit, who buys them, and the total cost of pollution reductions Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 31

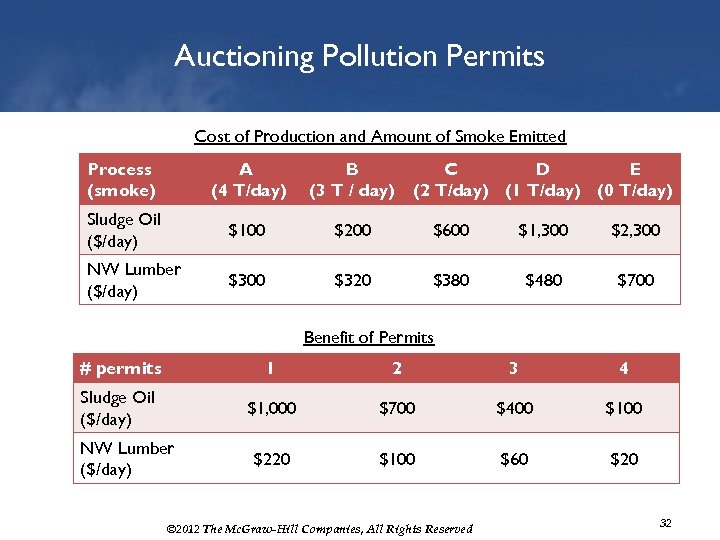

Auctioning Pollution Permits Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 Benefit of Permits # permits 1 2 3 4 Sludge Oil ($/day) $1, 000 $700 $400 $100 $220 $100 $60 $20 NW Lumber ($/day) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 32

Auctioning Pollution Permits Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 Benefit of Permits # permits 1 2 3 4 Sludge Oil ($/day) $1, 000 $700 $400 $100 $220 $100 $60 $20 NW Lumber ($/day) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 32

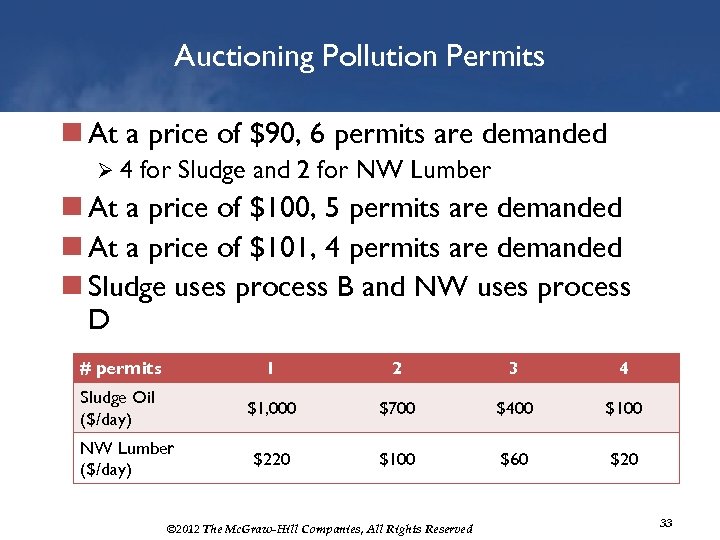

Auctioning Pollution Permits n At a price of $90, 6 permits are demanded Ø 4 for Sludge and 2 for NW Lumber n At a price of $100, 5 permits are demanded n At a price of $101, 4 permits are demanded n Sludge uses process B and NW uses process D # permits 1 2 3 4 Sludge Oil ($/day) $1, 000 $700 $400 $100 $220 $100 $60 $20 NW Lumber ($/day) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 33

Auctioning Pollution Permits n At a price of $90, 6 permits are demanded Ø 4 for Sludge and 2 for NW Lumber n At a price of $100, 5 permits are demanded n At a price of $101, 4 permits are demanded n Sludge uses process B and NW uses process D # permits 1 2 3 4 Sludge Oil ($/day) $1, 000 $700 $400 $100 $220 $100 $60 $20 NW Lumber ($/day) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 33

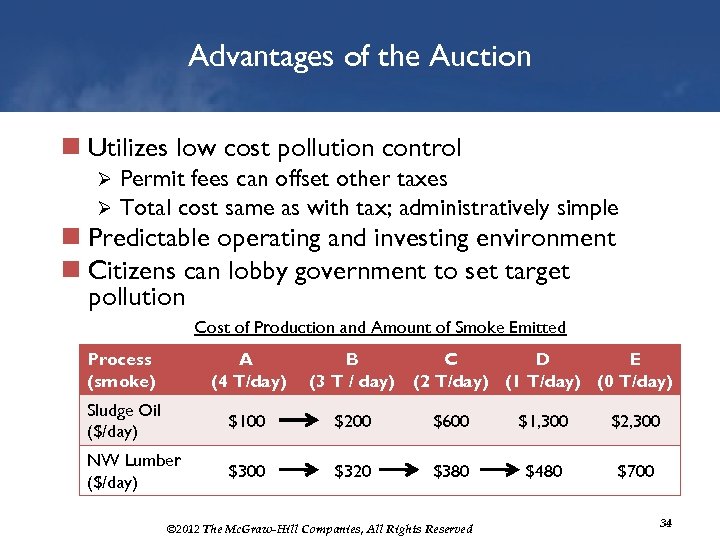

Advantages of the Auction n Utilizes low cost pollution control Ø Ø Permit fees can offset other taxes Total cost same as with tax; administratively simple n Predictable operating and investing environment n Citizens can lobby government to set target pollution Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 34

Advantages of the Auction n Utilizes low cost pollution control Ø Ø Permit fees can offset other taxes Total cost same as with tax; administratively simple n Predictable operating and investing environment n Citizens can lobby government to set target pollution Cost of Production and Amount of Smoke Emitted Process (smoke) A (4 T/day) B C D E (3 T / day) (2 T/day) (1 T/day) (0 T/day) Sludge Oil ($/day) $100 $200 $600 $1, 300 $2, 300 NW Lumber ($/day) $300 $320 $380 $480 $700 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 34

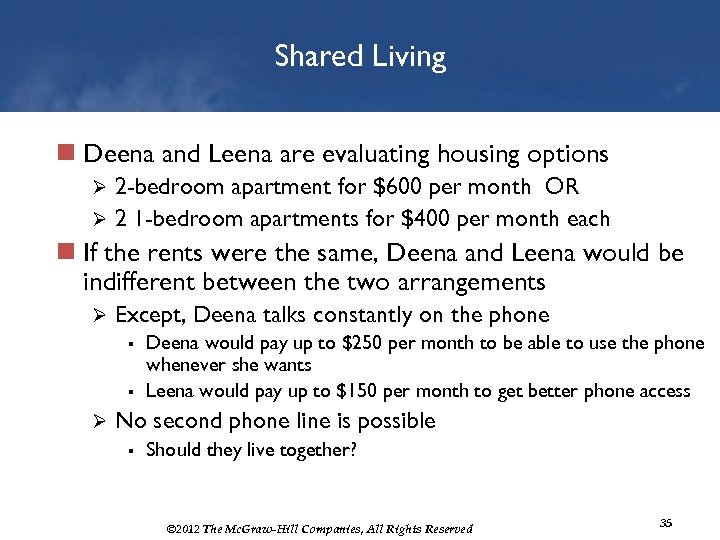

Shared Living n Deena and Leena are evaluating housing options 2 -bedroom apartment for $600 per month OR Ø 2 1 -bedroom apartments for $400 per month each Ø n If the rents were the same, Deena and Leena would be indifferent between the two arrangements Ø Except, Deena talks constantly on the phone § § Ø Deena would pay up to $250 per month to be able to use the phone whenever she wants Leena would pay up to $150 per month to get better phone access No second phone line is possible § Should they live together? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 35

Shared Living n Deena and Leena are evaluating housing options 2 -bedroom apartment for $600 per month OR Ø 2 1 -bedroom apartments for $400 per month each Ø n If the rents were the same, Deena and Leena would be indifferent between the two arrangements Ø Except, Deena talks constantly on the phone § § Ø Deena would pay up to $250 per month to be able to use the phone whenever she wants Leena would pay up to $150 per month to get better phone access No second phone line is possible § Should they live together? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 35

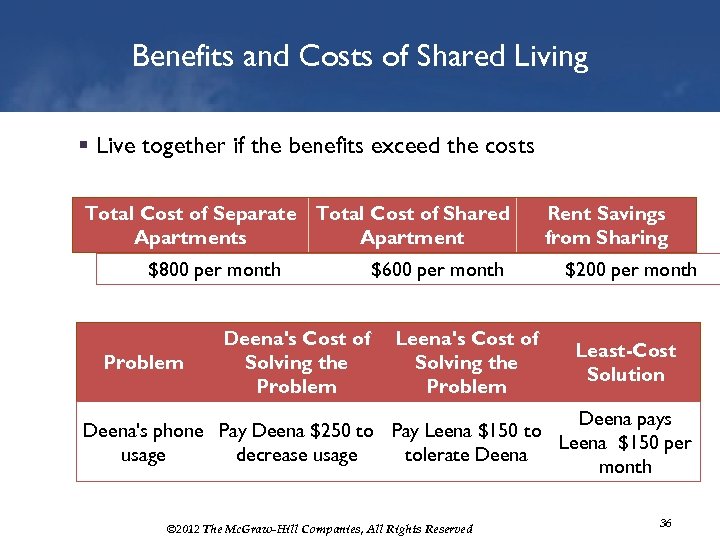

Benefits and Costs of Shared Living § Live together if the benefits exceed the costs Total Cost of Separate Total Cost of Shared Apartments Apartment $800 per month Problem Deena's Cost of Solving the Problem $600 per month Leena's Cost of Solving the Problem Rent Savings from Sharing $200 per month Least-Cost Solution Deena pays Deena's phone Pay Deena $250 to Pay Leena $150 to Leena $150 per usage decrease usage tolerate Deena month © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 36

Benefits and Costs of Shared Living § Live together if the benefits exceed the costs Total Cost of Separate Total Cost of Shared Apartments Apartment $800 per month Problem Deena's Cost of Solving the Problem $600 per month Leena's Cost of Solving the Problem Rent Savings from Sharing $200 per month Least-Cost Solution Deena pays Deena's phone Pay Deena $250 to Pay Leena $150 to Leena $150 per usage decrease usage tolerate Deena month © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 36

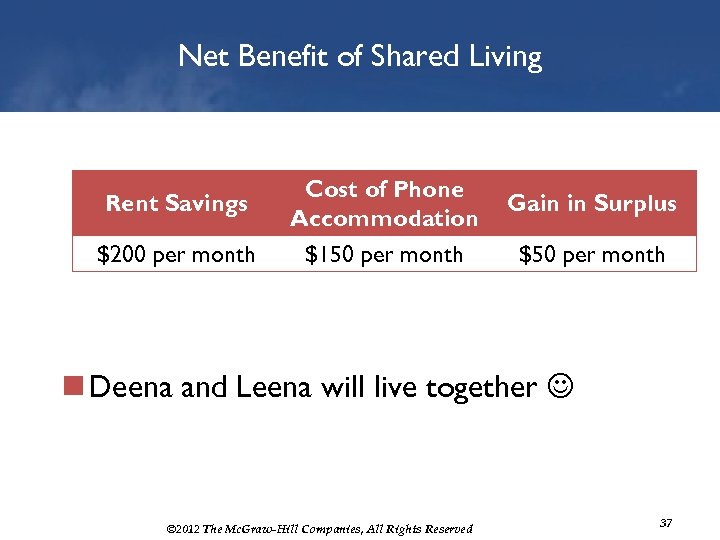

Net Benefit of Shared Living Rent Savings Cost of Phone Accommodation Gain in Surplus $200 per month $150 per month $50 per month n Deena and Leena will live together © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 37

Net Benefit of Shared Living Rent Savings Cost of Phone Accommodation Gain in Surplus $200 per month $150 per month $50 per month n Deena and Leena will live together © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 37

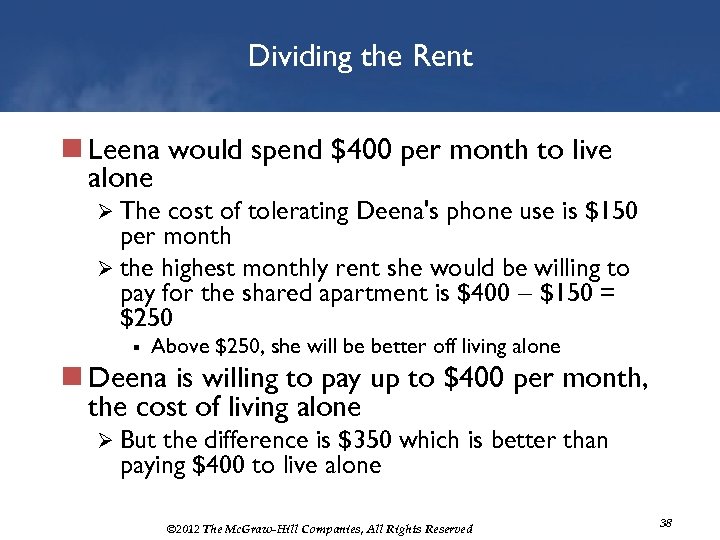

Dividing the Rent n Leena would spend $400 per month to live alone Ø The cost of tolerating Deena's phone use is $150 per month Ø the highest monthly rent she would be willing to pay for the shared apartment is $400 $150 = $250 § Above $250, she will be better off living alone n Deena is willing to pay up to $400 per month, the cost of living alone Ø But the difference is $350 which is better than paying $400 to live alone © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 38

Dividing the Rent n Leena would spend $400 per month to live alone Ø The cost of tolerating Deena's phone use is $150 per month Ø the highest monthly rent she would be willing to pay for the shared apartment is $400 $150 = $250 § Above $250, she will be better off living alone n Deena is willing to pay up to $400 per month, the cost of living alone Ø But the difference is $350 which is better than paying $400 to live alone © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 38

When Are Legal Remedies for Externalities Needed? n If negotiation is costless, the party with the lowest cost usually makes the adjustment Ø Private solution is generally adequate n When negotiation is not costless laws may be used to correct for externalities Ø The burden of the law can be placed on those who have the lowest cost © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 39

When Are Legal Remedies for Externalities Needed? n If negotiation is costless, the party with the lowest cost usually makes the adjustment Ø Private solution is generally adequate n When negotiation is not costless laws may be used to correct for externalities Ø The burden of the law can be placed on those who have the lowest cost © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 39

When Are Legal Remedies for Externalities Needed? n A motorist with a noisy muffler imposes costs on others Ø Yet we cannot flag him down and offer him a compensation payment to fix his muffler Ø In recognition of this difficulty, most governments simply require that cars have working mufflers § § A large share of laws is to solve problems caused by externalities The goal of such laws is to help people achieve the solutions they might have reached had they been able to negotiate with one another © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 40

When Are Legal Remedies for Externalities Needed? n A motorist with a noisy muffler imposes costs on others Ø Yet we cannot flag him down and offer him a compensation payment to fix his muffler Ø In recognition of this difficulty, most governments simply require that cars have working mufflers § § A large share of laws is to solve problems caused by externalities The goal of such laws is to help people achieve the solutions they might have reached had they been able to negotiate with one another © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 40

Examples of Legal Remedies for Externalities n Noise regulations (cars, parties, honking horns) n Most traffic and traffic-related laws Ø Car emission standards and inspections n Zoning laws n Building height and footprint regulations (sunshine laws) n Air and water pollution laws © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 41

Examples of Legal Remedies for Externalities n Noise regulations (cars, parties, honking horns) n Most traffic and traffic-related laws Ø Car emission standards and inspections n Zoning laws n Building height and footprint regulations (sunshine laws) n Air and water pollution laws © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 41

Three Cases Free Speech §Free speech laws recognize the value of open communications § Hard to identify speech that has a net cost §Some limitations § Yelling "fire" in a crowded theatre § Promote the violent overthrow of a government Planting Trees § Government subsidizes trees on private property § Decreases chances of flooding and landslides § Net reduction of CO 2 in the atmosphere Basic Research § Millions of dollars spent by federal government yearly § Externalities of new knowledge © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 42

Three Cases Free Speech §Free speech laws recognize the value of open communications § Hard to identify speech that has a net cost §Some limitations § Yelling "fire" in a crowded theatre § Promote the violent overthrow of a government Planting Trees § Government subsidizes trees on private property § Decreases chances of flooding and landslides § Net reduction of CO 2 in the atmosphere Basic Research § Millions of dollars spent by federal government yearly § Externalities of new knowledge © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 42

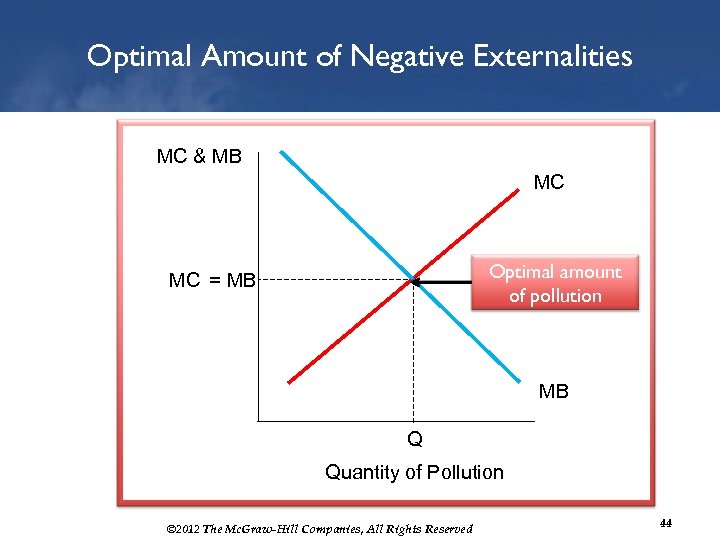

Optimal Amount of Negative Externalities n As pollution is reduced Ø The marginal benefit from its reduction tends to fall marginal cost from its reduction tends to increase n As a result, the marginal cost and marginal benefit curves almost always intersect at less than the maximum amount of pollution reduction Ø The intersection of the two curves marks the socially optimal level of pollution reduction § This implies the existence of a socially optimal level of pollution, and that level will almost always be greater than zero © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 43

Optimal Amount of Negative Externalities n As pollution is reduced Ø The marginal benefit from its reduction tends to fall marginal cost from its reduction tends to increase n As a result, the marginal cost and marginal benefit curves almost always intersect at less than the maximum amount of pollution reduction Ø The intersection of the two curves marks the socially optimal level of pollution reduction § This implies the existence of a socially optimal level of pollution, and that level will almost always be greater than zero © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 43

Optimal Amount of Negative Externalities MC & MB MC Optimal amount of pollution MC = MB MB Q Quantity of Pollution © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 44

Optimal Amount of Negative Externalities MC & MB MC Optimal amount of pollution MC = MB MB Q Quantity of Pollution © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 44

Optimal Amount of Negative Externalities n But to speak of a socially optimal level of pollution is not the same as saying that pollution is good Ø It is to recognize that society has an interest in cleaning up the environment, but only up to a certain point § Think of your apartment • You can spend the whole day cleaning • Or you can tolerate some amount of dirt © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 45

Optimal Amount of Negative Externalities n But to speak of a socially optimal level of pollution is not the same as saying that pollution is good Ø It is to recognize that society has an interest in cleaning up the environment, but only up to a certain point § Think of your apartment • You can spend the whole day cleaning • Or you can tolerate some amount of dirt © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 45

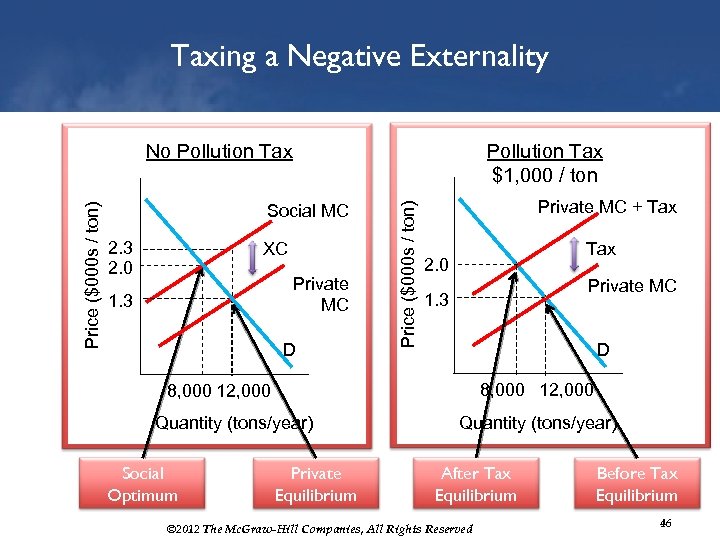

Taxing a Negative Externality Pollution Tax $1, 000 / ton Social MC 2. 3 2. 0 XC Private MC 1. 3 D Price ($000 s / ton) No Pollution Tax Private MC + Tax 2. 0 Private MC 1. 3 D 8, 000 12, 000 Quantity (tons/year) Social Optimum Private Equilibrium Quantity (tons/year) After Tax Equilibrium © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Before Tax Equilibrium 46

Taxing a Negative Externality Pollution Tax $1, 000 / ton Social MC 2. 3 2. 0 XC Private MC 1. 3 D Price ($000 s / ton) No Pollution Tax Private MC + Tax 2. 0 Private MC 1. 3 D 8, 000 12, 000 Quantity (tons/year) Social Optimum Private Equilibrium Quantity (tons/year) After Tax Equilibrium © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Before Tax Equilibrium 46

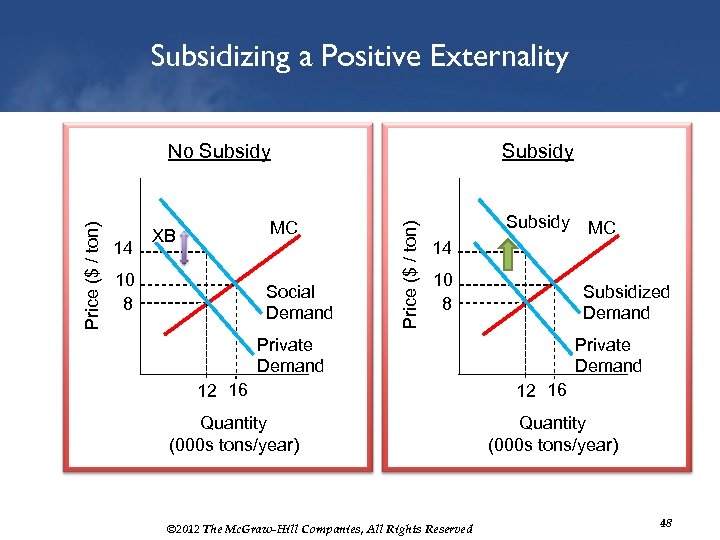

Taxing a Negative Externality n Critics insist that taxes always reduce economic efficiency Ø This tax actually makes the economy more efficient Ø The tax forces producers to take explicit account of the fact that each additional unit of output they produce imposes an external cost of $1, 000 on the rest of society n Similar reasoning suggests that a subsidy to producers can serve to counteract misallocations that result from positive externalities © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 47

Taxing a Negative Externality n Critics insist that taxes always reduce economic efficiency Ø This tax actually makes the economy more efficient Ø The tax forces producers to take explicit account of the fact that each additional unit of output they produce imposes an external cost of $1, 000 on the rest of society n Similar reasoning suggests that a subsidy to producers can serve to counteract misallocations that result from positive externalities © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 47

Subsidizing a Positive Externality 14 MC XB 10 8 Social Demand Subsidy Price ($ / ton) No Subsidy 14 10 8 Subsidized Demand Private Demand 12 16 Quantity (000 s tons/year) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved MC Private Demand 12 16 Quantity (000 s tons/year) 48

Subsidizing a Positive Externality 14 MC XB 10 8 Social Demand Subsidy Price ($ / ton) No Subsidy 14 10 8 Subsidized Demand Private Demand 12 16 Quantity (000 s tons/year) © 2012 The Mc. Graw-Hill Companies, All Rights Reserved MC Private Demand 12 16 Quantity (000 s tons/year) 48

Property Rights and the Tragedy of The Commons n People who grow up in industrialized nations tend to take the institution of private property for granted Ø Our intuitive sense is that people have the right to own any property they acquire by lawful means and to do with that property as they see fit n When use of a communally owned resource has no price, the costs of using it are not considered Ø Use of the property will increase until MB = 0 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 49

Property Rights and the Tragedy of The Commons n People who grow up in industrialized nations tend to take the institution of private property for granted Ø Our intuitive sense is that people have the right to own any property they acquire by lawful means and to do with that property as they see fit n When use of a communally owned resource has no price, the costs of using it are not considered Ø Use of the property will increase until MB = 0 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 49

The Tragedy of The Commons n Suppose 5 villagers own land suitable for grazing Ø Each can spend $100 for either a steer or invest in a risk-free market that pays 13% § § Steers graze on the commons for 1 year before being sold in year 2 Value of the steer in year 2 depends the weight it gained which depends on herd size Ø Villagers make sequential decisions © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 50

The Tragedy of The Commons n Suppose 5 villagers own land suitable for grazing Ø Each can spend $100 for either a steer or invest in a risk-free market that pays 13% § § Steers graze on the commons for 1 year before being sold in year 2 Value of the steer in year 2 depends the weight it gained which depends on herd size Ø Villagers make sequential decisions © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 50

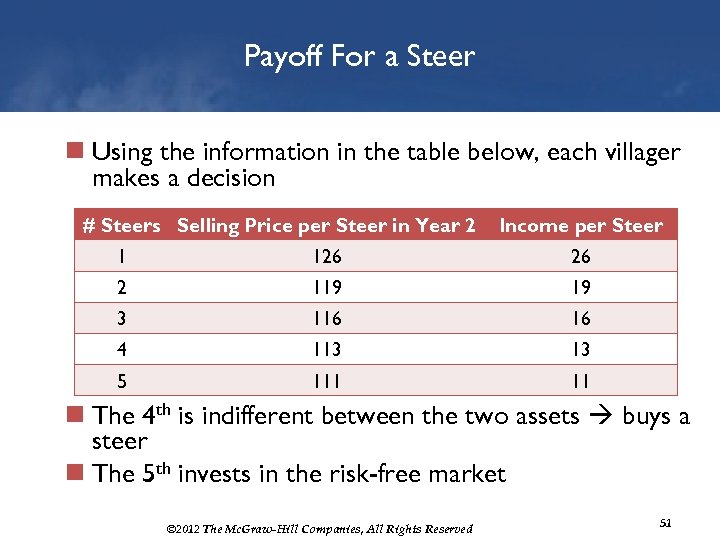

Payoff For a Steer n Using the information in the table below, each villager makes a decision # Steers Selling Price per Steer in Year 2 Income per Steer 1 126 26 2 119 19 3 116 16 4 113 13 5 111 11 n The 4 th is indifferent between the two assets buys a steer n The 5 th invests in the risk-free market © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 51

Payoff For a Steer n Using the information in the table below, each villager makes a decision # Steers Selling Price per Steer in Year 2 Income per Steer 1 126 26 2 119 19 3 116 16 4 113 13 5 111 11 n The 4 th is indifferent between the two assets buys a steer n The 5 th invests in the risk-free market © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 51

The Tragedy of The Commons n Since the first 4 villagers will send their steer to graze, their income becomes 4 * 13 = $52 n The 5 th villager will invest in a risk-free market and earn $13 Ø Total income of the village is $65 n Has Adam Smith’s invisible hand produced the most efficient allocation of these villagers’ resources? Ø It has not since their total village income is $65—precisely the same as it would have been had the possibility of cattle raising not existed n What if now villagers make their decision as a group? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 52

The Tragedy of The Commons n Since the first 4 villagers will send their steer to graze, their income becomes 4 * 13 = $52 n The 5 th villager will invest in a risk-free market and earn $13 Ø Total income of the village is $65 n Has Adam Smith’s invisible hand produced the most efficient allocation of these villagers’ resources? Ø It has not since their total village income is $65—precisely the same as it would have been had the possibility of cattle raising not existed n What if now villagers make their decision as a group? © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 52

What the Villagers Did n This time the villagers’ goal is to maximize the income received by the group as a whole n Net income from the risk-free investment after one year is $13 § Buy a steer only if its marginal benefit is at least $13 n First villager buys a steer and all others invest in the risk-free market. Total net income is 26 + (4) (13) = $78 § A net gain of $13 compared to the first scenario © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 53

What the Villagers Did n This time the villagers’ goal is to maximize the income received by the group as a whole n Net income from the risk-free investment after one year is $13 § Buy a steer only if its marginal benefit is at least $13 n First villager buys a steer and all others invest in the risk-free market. Total net income is 26 + (4) (13) = $78 § A net gain of $13 compared to the first scenario © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 53

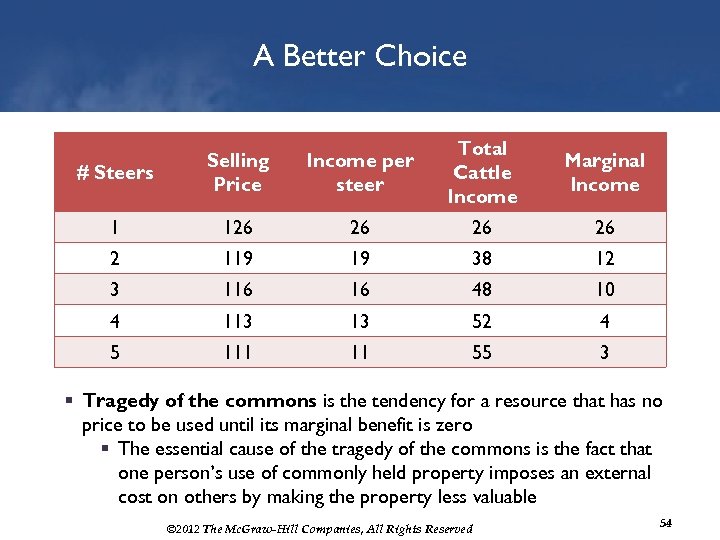

A Better Choice # Steers Selling Price Income per steer Total Cattle Income Marginal Income 1 126 26 2 119 19 38 12 3 116 16 48 10 4 113 13 52 4 5 111 11 55 3 § Tragedy of the commons is the tendency for a resource that has no price to be used until its marginal benefit is zero § The essential cause of the tragedy of the commons is the fact that one person’s use of commonly held property imposes an external cost on others by making the property less valuable © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 54

A Better Choice # Steers Selling Price Income per steer Total Cattle Income Marginal Income 1 126 26 2 119 19 38 12 3 116 16 48 10 4 113 13 52 4 5 111 11 55 3 § Tragedy of the commons is the tendency for a resource that has no price to be used until its marginal benefit is zero § The essential cause of the tragedy of the commons is the fact that one person’s use of commonly held property imposes an external cost on others by making the property less valuable © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 54

The Effect of Private Ownership n The villagers decide to auction off the rights to the commons Ø Auction makes the highest bidder consider the opportunity cost of grazing additional steers Ø Villagers can borrow and lend at 13% Ø One steer is the optimal number income of $26 n Winning bidder pays $100 for the right to use the commons § Since its use generates an income of $26 per year, or $13 more than the opportunity cost of your investment in the steer, the most you would pay is $100 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 55

The Effect of Private Ownership n The villagers decide to auction off the rights to the commons Ø Auction makes the highest bidder consider the opportunity cost of grazing additional steers Ø Villagers can borrow and lend at 13% Ø One steer is the optimal number income of $26 n Winning bidder pays $100 for the right to use the commons § Since its use generates an income of $26 per year, or $13 more than the opportunity cost of your investment in the steer, the most you would pay is $100 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 55

The Effect of Private Ownership n The winning bidder starts the year Ø Spends $100 in savings to buy a year-old steer Ø Borrows $100 at 13% to get control of commons n The winning bidder ends the year Ø Sells § § § the steer for $126 Gets original $100 back $13 opportunity cost of buying a steer $13 interest on loan for the commons n Economic surplus of the village is (4 x $13) + $26 = $78 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 56

The Effect of Private Ownership n The winning bidder starts the year Ø Spends $100 in savings to buy a year-old steer Ø Borrows $100 at 13% to get control of commons n The winning bidder ends the year Ø Sells § § § the steer for $126 Gets original $100 back $13 opportunity cost of buying a steer $13 interest on loan for the commons n Economic surplus of the village is (4 x $13) + $26 = $78 © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 56

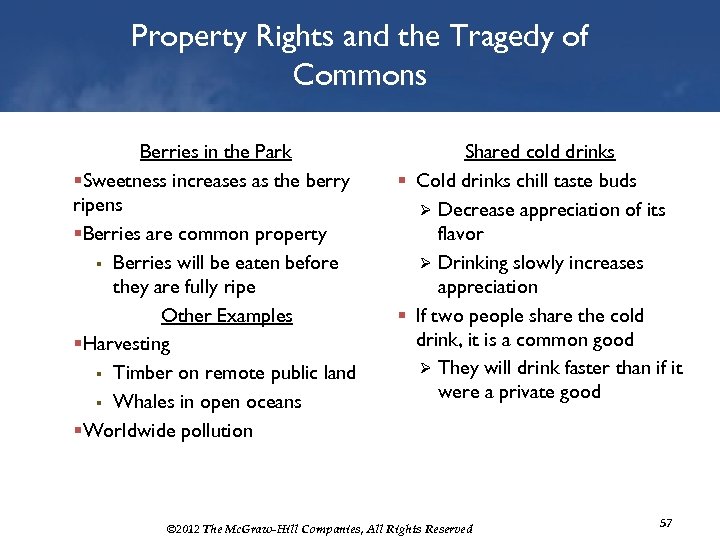

Property Rights and the Tragedy of Commons Berries in the Park §Sweetness increases as the berry ripens §Berries are common property § Berries will be eaten before they are fully ripe Other Examples §Harvesting § Timber on remote public land § Whales in open oceans §Worldwide pollution Shared cold drinks § Cold drinks chill taste buds Ø Decrease appreciation of its flavor Ø Drinking slowly increases appreciation § If two people share the cold drink, it is a common good Ø They will drink faster than if it were a private good © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 57

Property Rights and the Tragedy of Commons Berries in the Park §Sweetness increases as the berry ripens §Berries are common property § Berries will be eaten before they are fully ripe Other Examples §Harvesting § Timber on remote public land § Whales in open oceans §Worldwide pollution Shared cold drinks § Cold drinks chill taste buds Ø Decrease appreciation of its flavor Ø Drinking slowly increases appreciation § If two people share the cold drink, it is a common good Ø They will drink faster than if it were a private good © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 57

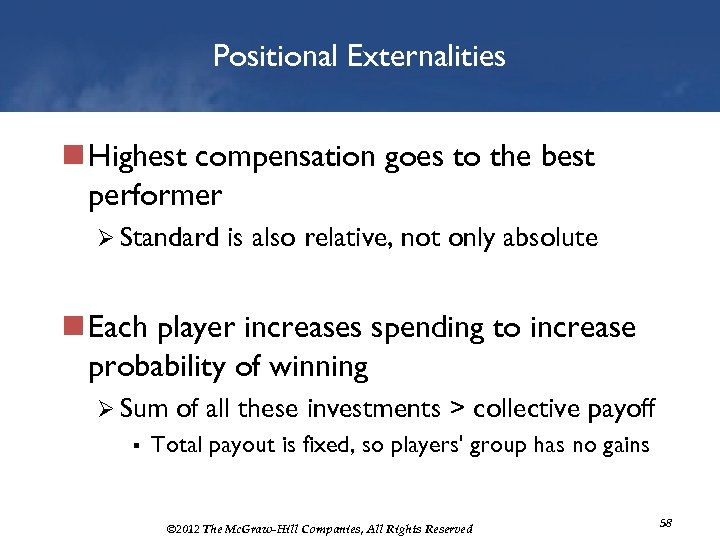

Positional Externalities n Highest compensation goes to the best performer Ø Standard is also relative, not only absolute n Each player increases spending to increase probability of winning Ø Sum § of all these investments > collective payoff Total payout is fixed, so players' group has no gains © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 58

Positional Externalities n Highest compensation goes to the best performer Ø Standard is also relative, not only absolute n Each player increases spending to increase probability of winning Ø Sum § of all these investments > collective payoff Total payout is fixed, so players' group has no gains © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 58

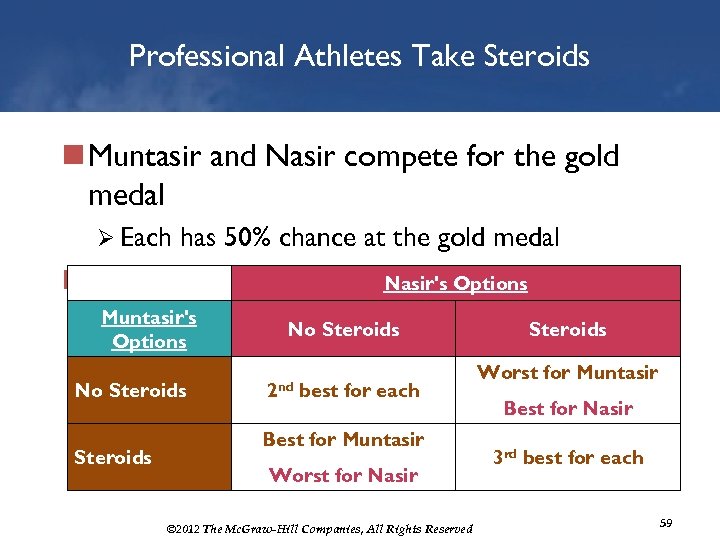

Professional Athletes Take Steroids n Muntasir and Nasir compete for the gold medal Ø Each has 50% chance at the gold medal Nasir's Options n Muntasir and Nasir have a Prisoner's Muntasir's Dilemma No Steroids Options No Steroids 2 nd best for each Best for Muntasir Worst for Nasir © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Worst for Muntasir Best for Nasir 3 rd best for each 59

Professional Athletes Take Steroids n Muntasir and Nasir compete for the gold medal Ø Each has 50% chance at the gold medal Nasir's Options n Muntasir and Nasir have a Prisoner's Muntasir's Dilemma No Steroids Options No Steroids 2 nd best for each Best for Muntasir Worst for Nasir © 2012 The Mc. Graw-Hill Companies, All Rights Reserved Worst for Muntasir Best for Nasir 3 rd best for each 59

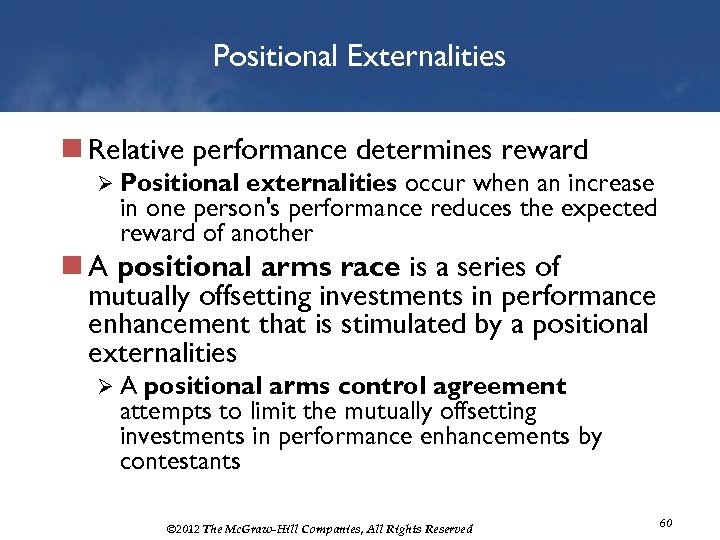

Positional Externalities n Relative performance determines reward Ø Positional externalities occur when an increase in one person's performance reduces the expected reward of another n A positional arms race is a series of mutually offsetting investments in performance enhancement that is stimulated by a positional externalities ØA positional arms control agreement attempts to limit the mutually offsetting investments in performance enhancements by contestants © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 60

Positional Externalities n Relative performance determines reward Ø Positional externalities occur when an increase in one person's performance reduces the expected reward of another n A positional arms race is a series of mutually offsetting investments in performance enhancement that is stimulated by a positional externalities ØA positional arms control agreement attempts to limit the mutually offsetting investments in performance enhancements by contestants © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 60

Examples of Positional Arms Control Agreements n Campaign spending limits n Roster limits n Arbitration agreements n Mandatory starting dates for kindergarten n Nerd norms n Fashion norms n Norms of taste n Norms against vanity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 61

Examples of Positional Arms Control Agreements n Campaign spending limits n Roster limits n Arbitration agreements n Mandatory starting dates for kindergarten n Nerd norms n Fashion norms n Norms of taste n Norms against vanity © 2012 The Mc. Graw-Hill Companies, All Rights Reserved 61