099de68cde02538eb1ffddcf8b128d07.ppt

- Количество слайдов: 45

CHAPTER 10 EXCHANGE RATES, BUSINESS CYCLES, AND MACROECONOMIC POLICY IN THE OPEN ECONOMY

Part I Outline: I. Exchange Rates II. How Exchange Rates Are Determined III. The International Asset Market

I. Exchange Rates 1. Nominal Exchange Rates ( ) is the number of units of foreign currency that can be purchased with one unit of the domestic currency. Flexible-exchange-rate system: exchange rates are determined by conditions of supply and demand in the foreign exchange market. Fixed-exchange-rate system: exchange rates were set by the government.

2. Real Exchange Rate is the number of foreign goods that can be obtained in exchange for one domestic good: = the price of foreign goods, measured in the foreign currency = the price of domestic goods, measured in the domestic currency

3. Appreciation and Depreciation Type of Exchange rate Exchange Rate increases System “stronger” Flexible exchange rates Appreciation Fixed exchange rates Revaluation Exchange rate decreases “weaker” Depreciation Devaluation

4. Purchasing Power Parity “purchasing power parity” (PPP): (in the absence of transportation costs), the similar foreign and domestic goods should have the same price in terms of the same currency. Empirical evidence: PPP holds in the very long run, but not in the short run.

4. Purchasing Power Parity In the more general case: When is constant, “Relative purchasing power parity”: works well for high-inflation countries, but not low-inflation countries.

5. The Real Exchange Rate and Net Exports The real exchange rate is the price of domestic goods relative to foreign goods. It determines the demand for domestic goods both in home and foreign countries. real exchange rate net export

II. How Exchange Rate Are Determined Supply of dollars: (upward sloping) Why supply? (i) buy foreign goods and services (ii) buy foreign financial assets Demand for dollars: (downward sloping) Why demand? (i) buy Canadian goods and services (ii) buy Canadian financial assets

Macroeconomic Determinants of the Exchange Rate and Net Export Effects of Changes in Output Domestic income net export exchange rate (depreciation) Foreign income net export exchange rate (appreciation)

Macroeconomic Determinants of the Exchange Rate and Net Export Effects of Changes in Real Interest Rate Domestic real interest rate exchange rate (appreciation) net export (indirectly through Foreign real interest rate exchange rate (depreciation) net export (indirectly through ) )

III. The International Asset Market 1. Returns on Domestic and Foreign Assets Example: A Canadian saver has $100 to invest either in Canadian bonds or US bonds. Canadian bonds pay interest ; US bonds pay interest. Assume the two assets have the same risk and liquidity. Which bond should she buy? (Assume and )

General steps to calculate the gross nominal rate of return on foreign asset: Step 1: Convert home currency to foreign currency. Step 2: Earn interest on foreign asset. Step 3: Convert foreign currency to home currency. Expected gross nominal rate of return on foreign asset =

2. Interest Rate Parity The equilibrium condition in the international asset market: “nominal interest rate parity condition” In real term, “real interest rate parity condition”

Part II Outline: IV. The IS-LM Model for an Open Economy V. Macro Policy in a Small Open Economy with Flexible Exchange Rate VI. Fixed Exchange Rate

IV. The IS-LM Model for an Open Economy The LM curve and FE line are the same as in the closed economy; the IS curve will be modified. 3 main points about the IS curve in the open economy: i). downward sloping; ii). Factors shift IS curve in the closed economy shift IS in the open economy. iii). Factors that change NX also shift IS.

1. The Open-Economy IS Curve Goods Market Equilibrium: Closed economy: Open economy: Equivalently: The curve: slopes upward. The curve: slopes downward. Goods market equilibrium is given by the intersection of curve and curve

Numerical example: Given the following, derive the openeconomy IS curve:

2. Factors That Shift the IS Curve Factors that shift closed-economy IS curve up: shifts curve to the left shifts open-economy IS curve up e. g. : expected future output, wealth, , and effective tax rate on capital ,

Factors that shift the curve: i). Foreign output, ii). Foreign real interest rate, iii). Demand for domestic goods shifts open-economy IS curve up

V. Macro Policy under Flexible Exchange Rate 1. A Fiscal Expansion IS curve first shifts to the right IS curve then shifts to the left Overall effects: i). Fiscal policy is ineffective. ii). exchange rate and “net export crowding out”

2. A Monetary Expansion Short-run effects: LM and IS both shifts right , , (holding fixed) Long-run effects: . LM and IS both shifts left Overall effects: Money is neutral i). Real variables are unaffected ii). Nominal variables change proportionally

VI. Fixed Exchange Rates Fundamental value of the exchange rate the value that would be determined by the supply and demand in the foreign exchange markets. Overvalued exchange rate: fixed value > the fundamental value Undervalued exchange rate: fixed value < the fundamental value

How to deal with a situation with overvalued exchange rate? i). Devaluation: change the official value to the fundamental value ii). Restrict international transactions iii). Use official reserve assets to buy back its own currency Speculative run: investors expect overvalued currency will soon devalue, so they sell assets in that currency.

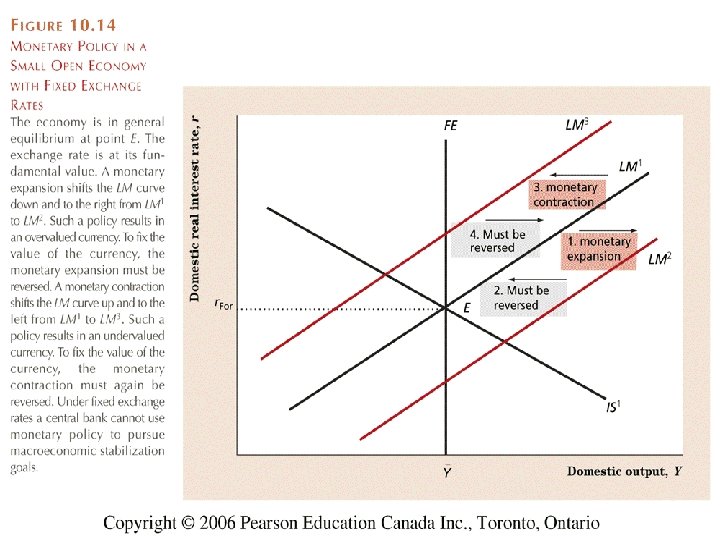

2. Monetary Policy and the Fixed Exchange Rate fundamental value of an overvalued exchange rate An overvalued exchange rate is not sustainable, so the monetary expansion eventually must be reversed. The relationship of the money supply to the fundamental value of : slopes downward.

2. Fiscal Policy and the Fixed Exchange Rate Short-run effects: IS and LM both shifts right , , (holding fixed) Long-run effects: . LM and IS both shifts left a) Fiscal expansion has no effect on b) Real exchange rate is increased. c) Net export is crowding out. .

VII. Choosing an Exchange Rate System Advantage of fixed exchange rates: i). Stable exchange rates promote trade. ii). Improve monetary policy “discipline” Disadvantage of fixed exchange rates: i). Unable to use monetary policy to deal with recession. ii). Lose monetary policy independence. iii). Vulnerable to speculative attacks.

Currency union – an alternative to fixed exchange rate – common monetary policy is controlled by a single institution. – 2 advantages over fixed exchange rates: i). With a single currency, trading cost is even less. ii). Using the common currency, speculative attacks can be avoided.

2. Self-Correcting Adjustment Closed Economy l Self-correcting mechanism: price adjustment. l When the intersection of IS and LM curves lies to the right of the FE line, price increases to shift LM curve up. l When the Intersection lies to the left of the FE line, price decreases to shift LM curve down.

Small Open Economy l Self-correcting mechanism: price adjustment & exchange rate adjustment l Under a flexible exchange rate system: I. Fiscal policy is ineffective, but many unexpected shocks that shift IS curve requires no stabilization policy response. II. Monetary policy is effective for stabilization purpose, but it has a magnified impact on output.

Small Open Economy l Under a fixed exchange rate system: I. Fiscal policy accompanied by a monetary expansion/contraction is effective for stabilization purpose, but it has larger impact on output. II. Monetary policy is ineffective, but factors that shift LM curve has no impact on output.

099de68cde02538eb1ffddcf8b128d07.ppt