9a1084b6f7230e9b8e9953b4a9aadb8b.ppt

- Количество слайдов: 59

Chapter 10 Economic Fluctuations, Unemployment, and Inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -1

Chapter 10 Economic Fluctuations, Unemployment, and Inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -1

Chapter Objectives • • Examine the business cycle Consider various business cycle theories Show economic forecasting is done Measure the GDP gap Learn how the unemployment rate is computed Look at the types of unemployment Construct a consumer price index Consider theories of inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -2

Chapter Objectives • • Examine the business cycle Consider various business cycle theories Show economic forecasting is done Measure the GDP gap Learn how the unemployment rate is computed Look at the types of unemployment Construct a consumer price index Consider theories of inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -2

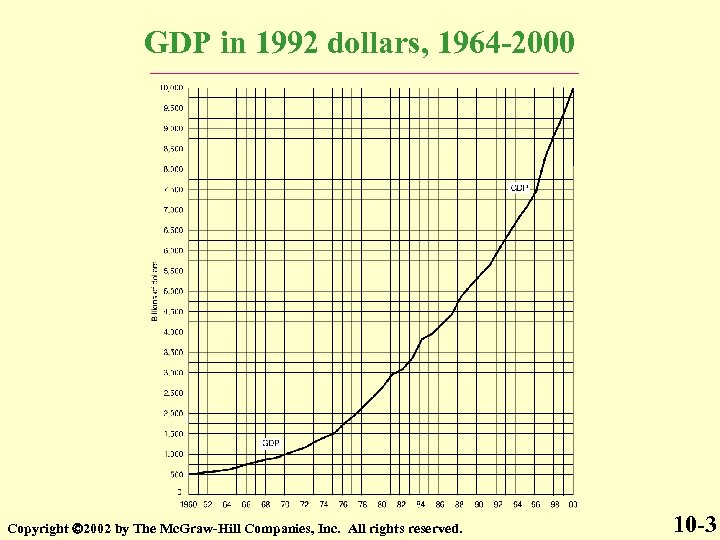

GDP in 1992 dollars, 1964 -2000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -3

GDP in 1992 dollars, 1964 -2000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -3

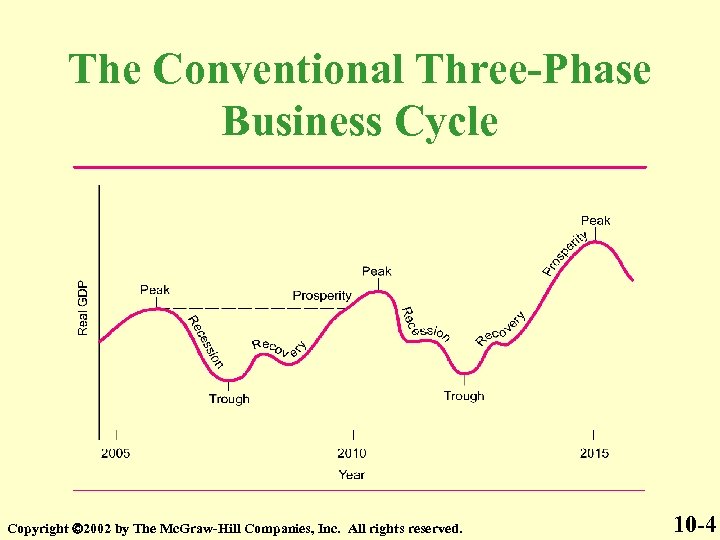

The Conventional Three-Phase Business Cycle Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -4

The Conventional Three-Phase Business Cycle Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -4

Business Cycle Theories • Endogenous theories – Innovation theory – Psychological theory – Inventory cycle theory – Monetary theory – Under-consumption theory • Exogenous theories – Sunspot theory – War theory Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -5

Business Cycle Theories • Endogenous theories – Innovation theory – Psychological theory – Inventory cycle theory – Monetary theory – Under-consumption theory • Exogenous theories – Sunspot theory – War theory Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -5

Business Cycle Forecasting • The Ten Leading Economic Indicators – 1. Average workweek of production workers in manufacturing – 2. Average initial weekly claims for state unemployment insurance – 3. New orders for consumer goods and materials – 4. Vendors performance (companies receiving slower deliveries from suppliers) – 5. New orders for capital goods Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -6

Business Cycle Forecasting • The Ten Leading Economic Indicators – 1. Average workweek of production workers in manufacturing – 2. Average initial weekly claims for state unemployment insurance – 3. New orders for consumer goods and materials – 4. Vendors performance (companies receiving slower deliveries from suppliers) – 5. New orders for capital goods Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -6

Business Cycle Forecasting (Continued) • The Ten Leading Economic Indicators – – 6. New building permits issued 7. Index of stock prices 8. Money supply 9. Spread between rates on 10 -year Treasury bonds and Federal funds – 10. Index of consumer expectations Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -7

Business Cycle Forecasting (Continued) • The Ten Leading Economic Indicators – – 6. New building permits issued 7. Index of stock prices 8. Money supply 9. Spread between rates on 10 -year Treasury bonds and Federal funds – 10. Index of consumer expectations Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -7

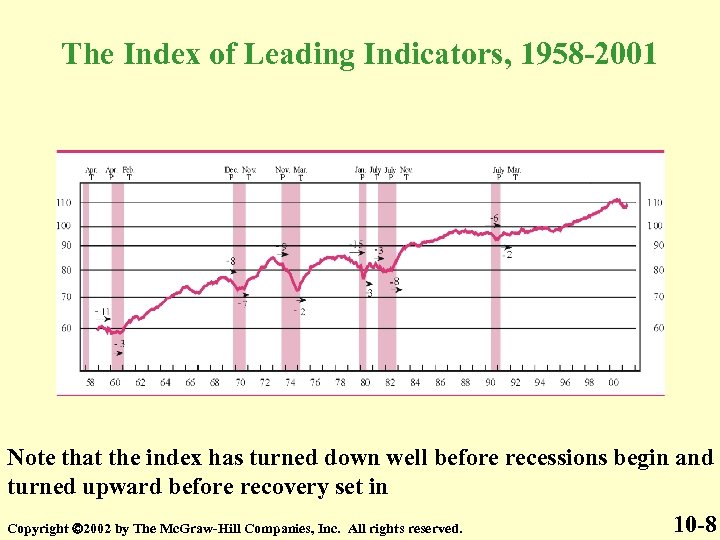

The Index of Leading Indicators, 1958 -2001 Note that the index has turned down well before recessions begin and turned upward before recovery set in Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -8

The Index of Leading Indicators, 1958 -2001 Note that the index has turned down well before recessions begin and turned upward before recovery set in Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -8

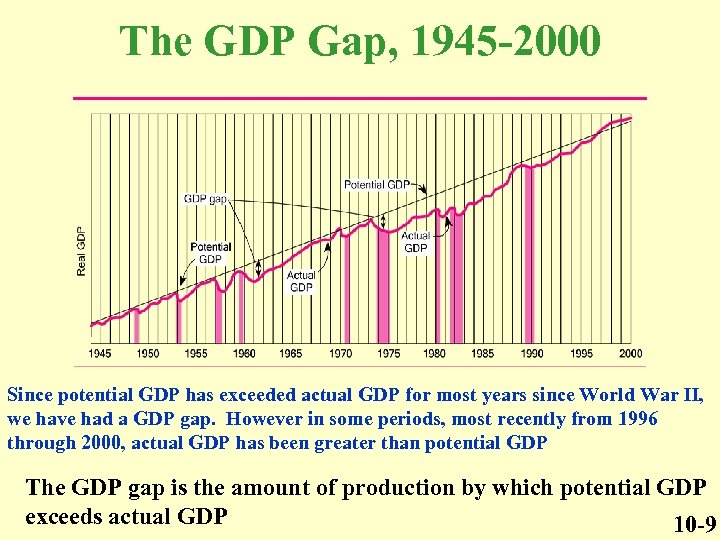

The GDP Gap, 1945 -2000 Since potential GDP has exceeded actual GDP for most years since World War II, we have had a GDP gap. However in some periods, most recently from 1996 through 2000, actual GDP has been greater than potential GDP The GDP gap is the amount of production by which potential GDP exceeds actual GDP 10 -9

The GDP Gap, 1945 -2000 Since potential GDP has exceeded actual GDP for most years since World War II, we have had a GDP gap. However in some periods, most recently from 1996 through 2000, actual GDP has been greater than potential GDP The GDP gap is the amount of production by which potential GDP exceeds actual GDP 10 -9

Unemployment • The problem – One of the most devastating experiences a person can have is to be out of work for a prolonged period – Discouraged workers are those who have given up looking for work and have simply dropped out of the labor force • The Bureau of Labor Statistics does not count discouraged workers as part of the labor force and thus as unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -10

Unemployment • The problem – One of the most devastating experiences a person can have is to be out of work for a prolonged period – Discouraged workers are those who have given up looking for work and have simply dropped out of the labor force • The Bureau of Labor Statistics does not count discouraged workers as part of the labor force and thus as unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -10

Unemployment • The liberal criticism – A person who worked one day last month is counted as employed – Someone who works part-time but who wants to work full-time is counted as employed – The true unemployment rate is higher than the official rate Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -11

Unemployment • The liberal criticism – A person who worked one day last month is counted as employed – Someone who works part-time but who wants to work full-time is counted as employed – The true unemployment rate is higher than the official rate Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -11

Unemployment • The conservative criticism – Some just go through the motions of looking for work to remain eligible for benefits and are not really looking for work – Huge numbers of Americans – as well as illegal immigrants are working in the underground economy • These people are employed off the books, do not report their income, and are not counted as employed by the bureau of labor statistics Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -12

Unemployment • The conservative criticism – Some just go through the motions of looking for work to remain eligible for benefits and are not really looking for work – Huge numbers of Americans – as well as illegal immigrants are working in the underground economy • These people are employed off the books, do not report their income, and are not counted as employed by the bureau of labor statistics Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -12

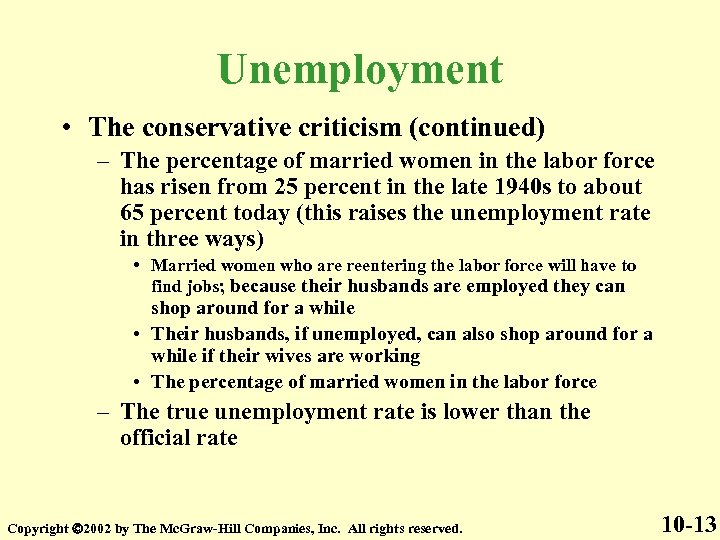

Unemployment • The conservative criticism (continued) – The percentage of married women in the labor force has risen from 25 percent in the late 1940 s to about 65 percent today (this raises the unemployment rate in three ways) • Married women who are reentering the labor force will have to find jobs; because their husbands are employed they can shop around for a while • Their husbands, if unemployed, can also shop around for a while if their wives are working • The percentage of married women in the labor force – The true unemployment rate is lower than the official rate Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -13

Unemployment • The conservative criticism (continued) – The percentage of married women in the labor force has risen from 25 percent in the late 1940 s to about 65 percent today (this raises the unemployment rate in three ways) • Married women who are reentering the labor force will have to find jobs; because their husbands are employed they can shop around for a while • Their husbands, if unemployed, can also shop around for a while if their wives are working • The percentage of married women in the labor force – The true unemployment rate is lower than the official rate Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -13

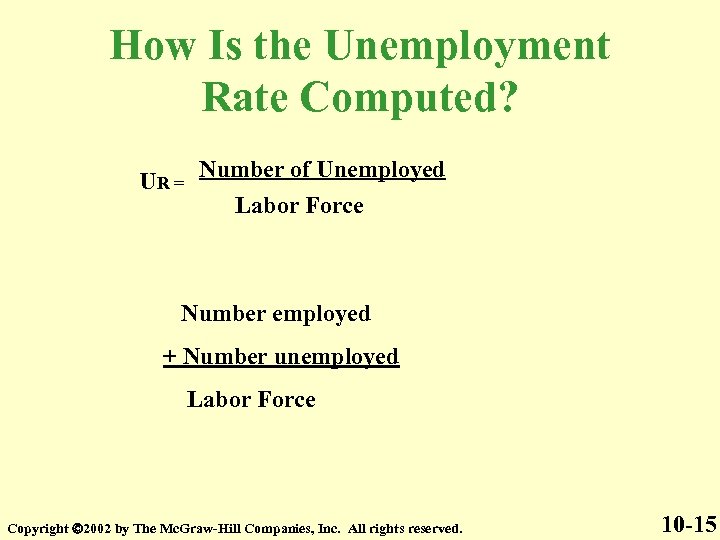

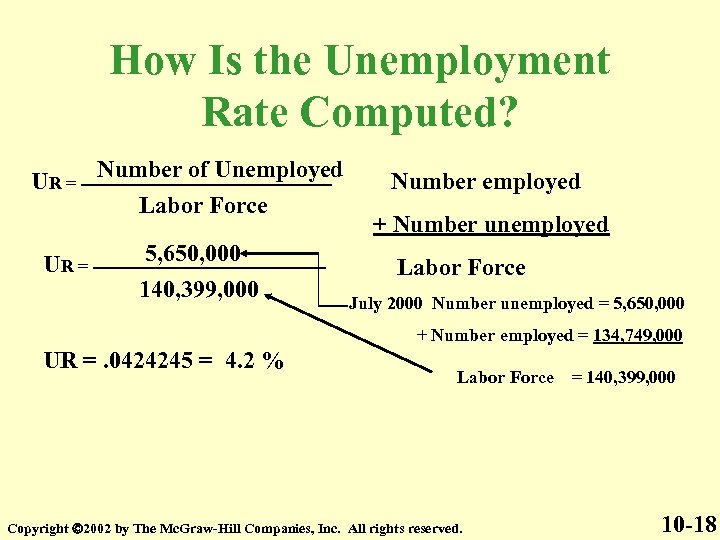

How Is the Unemployment Rate Computed? UR = Number of Unemployed Labor Force Number employed + Number unemployed Labor Force Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -15

How Is the Unemployment Rate Computed? UR = Number of Unemployed Labor Force Number employed + Number unemployed Labor Force Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -15

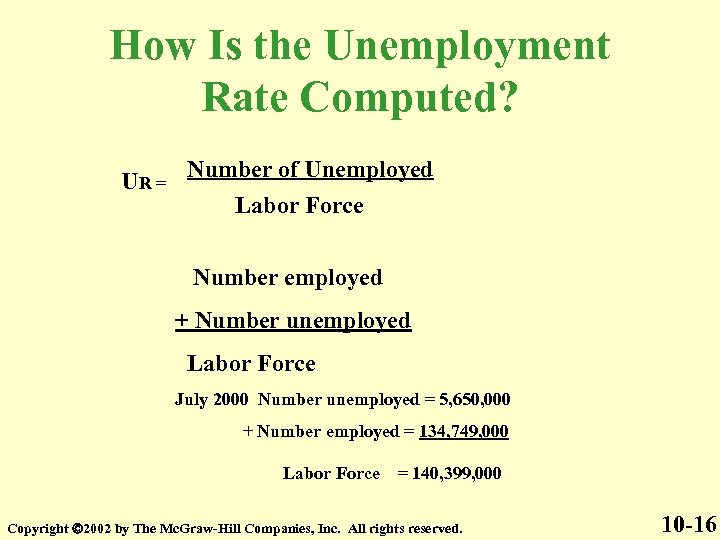

How Is the Unemployment Rate Computed? UR = Number of Unemployed Labor Force Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -16

How Is the Unemployment Rate Computed? UR = Number of Unemployed Labor Force Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -16

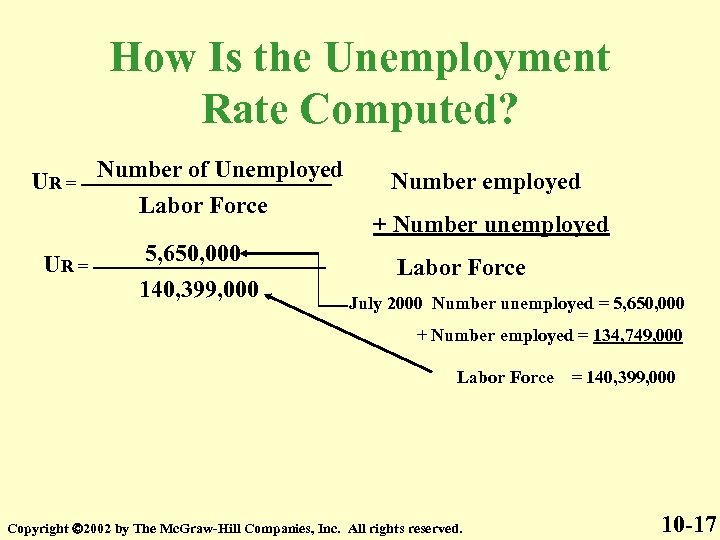

How Is the Unemployment Rate Computed? Number of Unemployed UR = ---------------------Labor Force 5, 650, 000 UR = -------------------140, 399, 000 Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -17

How Is the Unemployment Rate Computed? Number of Unemployed UR = ---------------------Labor Force 5, 650, 000 UR = -------------------140, 399, 000 Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -17

How Is the Unemployment Rate Computed? Number of Unemployed UR = ---------------------Labor Force 5, 650, 000 UR = -------------------140, 399, 000 Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 UR =. 0424245 = 4. 2 % Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -18

How Is the Unemployment Rate Computed? Number of Unemployed UR = ---------------------Labor Force 5, 650, 000 UR = -------------------140, 399, 000 Number employed + Number unemployed Labor Force July 2000 Number unemployed = 5, 650, 000 + Number employed = 134, 749, 000 UR =. 0424245 = 4. 2 % Labor Force = 140, 399, 000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -18

When It’s a Recession for Whites, It’s a Depression for Blacks • Historically, the unemployment rate for blacks has been double that of whites – During the 1981 -82 recession the unemployment rate for black teenagers topped 50 percent Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -19

When It’s a Recession for Whites, It’s a Depression for Blacks • Historically, the unemployment rate for blacks has been double that of whites – During the 1981 -82 recession the unemployment rate for black teenagers topped 50 percent Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -19

When It’s a Recession for Whites, It’s a Depression for Blacks – There have been major strides toward equality of economic opportunity since the mid-1960 s, but these strides have left in their wake a huge Black (and Hispanic) underclass • If you are Black or Hispanic, your chances of being poor are three times as great • If your are Black or Hispanic, your chances of being unemployed are twice as great Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -20

When It’s a Recession for Whites, It’s a Depression for Blacks – There have been major strides toward equality of economic opportunity since the mid-1960 s, but these strides have left in their wake a huge Black (and Hispanic) underclass • If you are Black or Hispanic, your chances of being poor are three times as great • If your are Black or Hispanic, your chances of being unemployed are twice as great Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -20

When It’s a Recession for Whites, It’s a Depression for Blacks • It appears that two things can be done to ease the economic burden of minority groups – Make greater efforts to end employment discrimination – Avoid recessions and keep the unemployment rate as low as possible Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -21

When It’s a Recession for Whites, It’s a Depression for Blacks • It appears that two things can be done to ease the economic burden of minority groups – Make greater efforts to end employment discrimination – Avoid recessions and keep the unemployment rate as low as possible Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -21

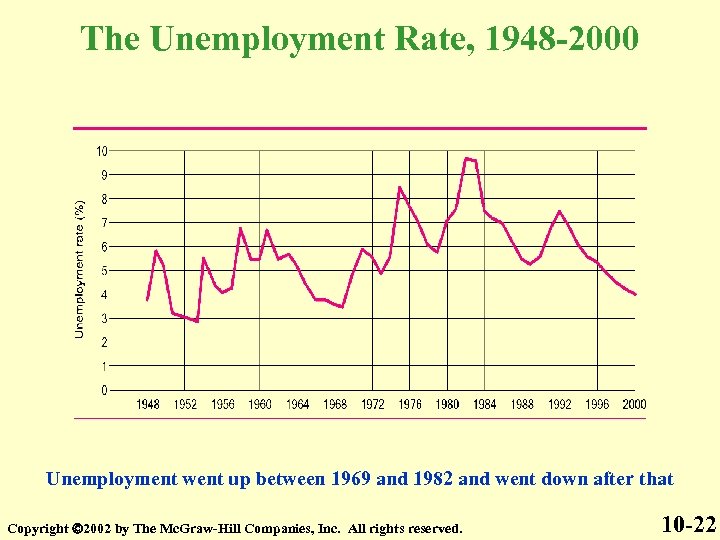

The Unemployment Rate, 1948 -2000 Unemployment went up between 1969 and 1982 and went down after that Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -22

The Unemployment Rate, 1948 -2000 Unemployment went up between 1969 and 1982 and went down after that Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -22

Types of Unemployment • Frictional unemployment • Structural unemployment • Cyclical unemployment Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -23

Types of Unemployment • Frictional unemployment • Structural unemployment • Cyclical unemployment Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -23

Frictional Unemployment • The frictionally unemployed are people who are between jobs or just entering or reentering the labor market – Usually weeks or months pass before positions are filled – At any given time, about 2 or 3 percent of the labor force is frictionally unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -24

Frictional Unemployment • The frictionally unemployed are people who are between jobs or just entering or reentering the labor market – Usually weeks or months pass before positions are filled – At any given time, about 2 or 3 percent of the labor force is frictionally unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -24

Structural Unemployment • A person who is out of work for a relatively long period of time, say, a couple of years, is structurally unemployed. Some examples are – Steelworkers and coal miners who are out of work because local steel plants and coal mines have closed – Clerical workers, typists, inventory control clerks who have been made obsolete by a computer system – People who are functionally illiterate and who are virtually shut of the labor force • One in five adult Americans is functionally illiterate • Our educational system turns out 1 million more functional illiterates every year – About 2 to 3 percent of our labor force is always structurally unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -25

Structural Unemployment • A person who is out of work for a relatively long period of time, say, a couple of years, is structurally unemployed. Some examples are – Steelworkers and coal miners who are out of work because local steel plants and coal mines have closed – Clerical workers, typists, inventory control clerks who have been made obsolete by a computer system – People who are functionally illiterate and who are virtually shut of the labor force • One in five adult Americans is functionally illiterate • Our educational system turns out 1 million more functional illiterates every year – About 2 to 3 percent of our labor force is always structurally unemployed Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -25

Cyclical Unemployment • Cyclical unemployment is anything above the sum of frictional and structural unemployment – Caused by the ups and downs in our economy known as the business cycle • Fluctuations in our unemployment rate are due to cyclical unemployment Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -26

Cyclical Unemployment • Cyclical unemployment is anything above the sum of frictional and structural unemployment – Caused by the ups and downs in our economy known as the business cycle • Fluctuations in our unemployment rate are due to cyclical unemployment Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -26

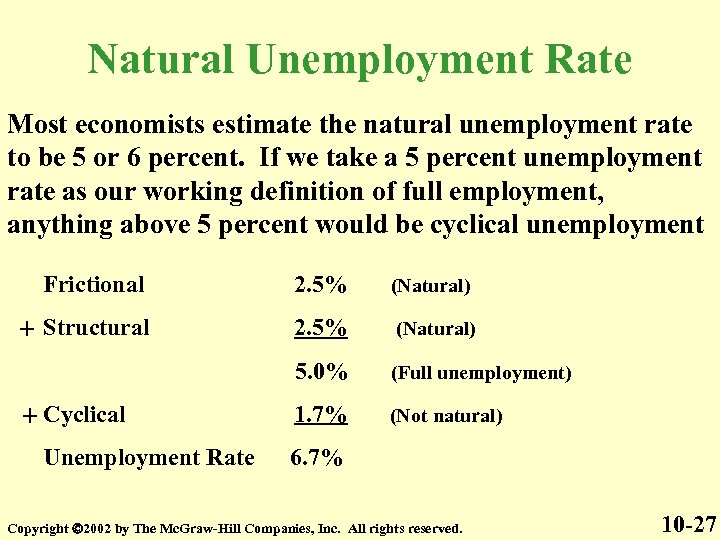

Natural Unemployment Rate Most economists estimate the natural unemployment rate to be 5 or 6 percent. If we take a 5 percent unemployment rate as our working definition of full employment, anything above 5 percent would be cyclical unemployment Frictional 2. 5% (Natural) + Structural 2. 5% (Natural) 5. 0% (Full unemployment) 1. 7% (Not natural) + Cyclical Unemployment Rate 6. 7% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -27

Natural Unemployment Rate Most economists estimate the natural unemployment rate to be 5 or 6 percent. If we take a 5 percent unemployment rate as our working definition of full employment, anything above 5 percent would be cyclical unemployment Frictional 2. 5% (Natural) + Structural 2. 5% (Natural) 5. 0% (Full unemployment) 1. 7% (Not natural) + Cyclical Unemployment Rate 6. 7% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -27

Natural Unemployment Rate • If it is increasingly difficult to find employees, employers will bid up wage rates, pushing up the rate of inflation • Once the unemployment rate falls below its natural rate, then inflationary wage pressure emerges Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -28

Natural Unemployment Rate • If it is increasingly difficult to find employees, employers will bid up wage rates, pushing up the rate of inflation • Once the unemployment rate falls below its natural rate, then inflationary wage pressure emerges Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -28

Inflation • Defining inflation – Generally, we consider inflation to be a sustained rise in the average price level over a period of years • When the overall price level is rising, the prices of some goods and services are going down [e. g. , TV prices in the 1970 s and the 1980 s, the price of VCRs, and more recently the price of cellular phones] – U. S. inflation has been persistent since World War II Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -29

Inflation • Defining inflation – Generally, we consider inflation to be a sustained rise in the average price level over a period of years • When the overall price level is rising, the prices of some goods and services are going down [e. g. , TV prices in the 1970 s and the 1980 s, the price of VCRs, and more recently the price of cellular phones] – U. S. inflation has been persistent since World War II Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -29

The Consumer Price Index (CPI) • The CPI, which measures changes in our cost of living, is reported near the middle of every month by the Bureau of Labor Statistics – The CPI is based on what it cost an average family to live Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -30

The Consumer Price Index (CPI) • The CPI, which measures changes in our cost of living, is reported near the middle of every month by the Bureau of Labor Statistics – The CPI is based on what it cost an average family to live Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -30

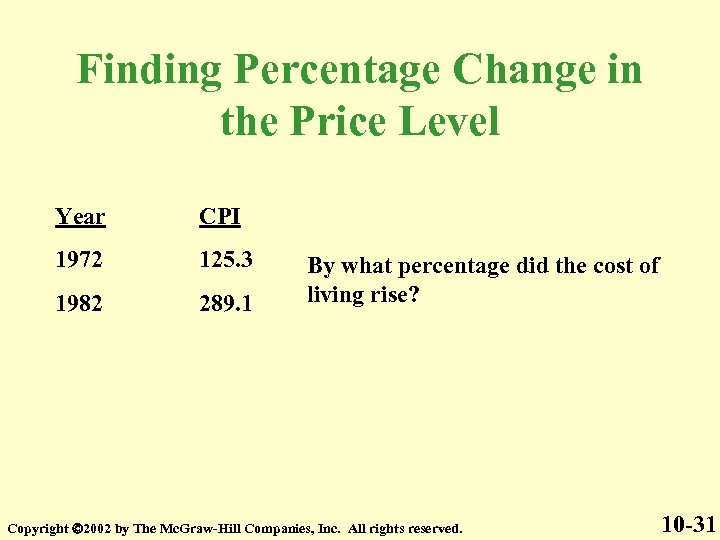

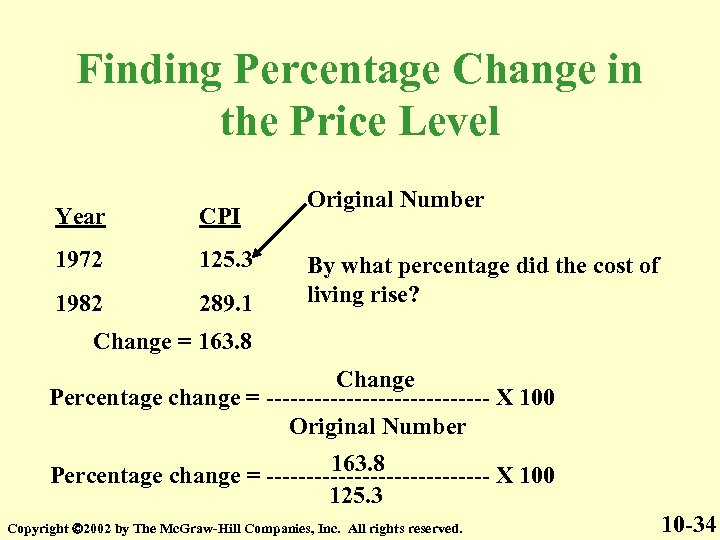

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 By what percentage did the cost of living rise? Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -31

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 By what percentage did the cost of living rise? Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -31

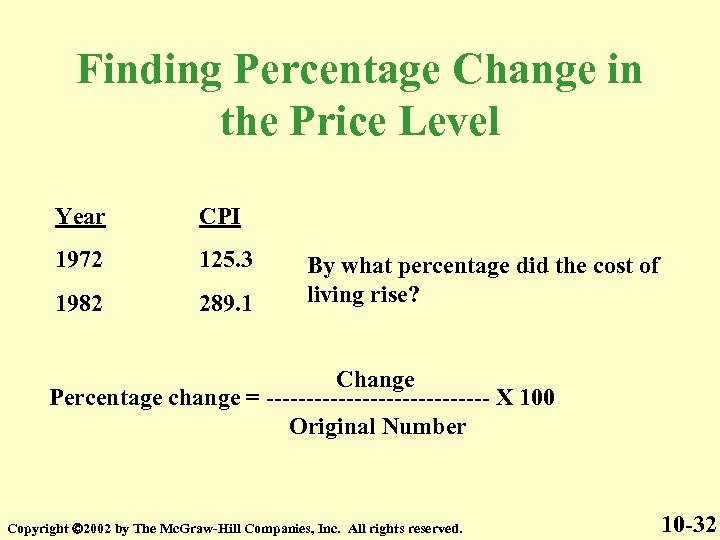

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 By what percentage did the cost of living rise? Change Percentage change = -------------- X 100 Original Number Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -32

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 By what percentage did the cost of living rise? Change Percentage change = -------------- X 100 Original Number Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -32

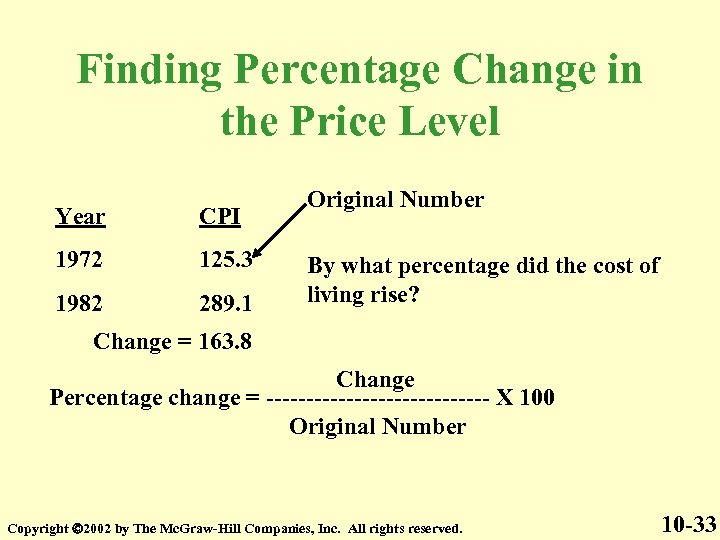

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -33

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -33

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number 163. 8 Percentage change = -------------- X 100 125. 3 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -34

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number 163. 8 Percentage change = -------------- X 100 125. 3 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -34

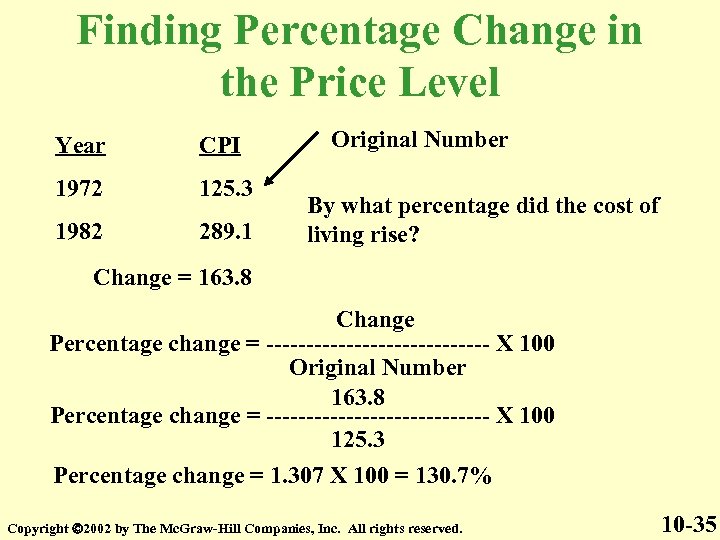

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number 163. 8 Percentage change = -------------- X 100 125. 3 Percentage change = 1. 307 X 100 = 130. 7% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -35

Finding Percentage Change in the Price Level Year CPI 1972 125. 3 1982 289. 1 Original Number By what percentage did the cost of living rise? Change = 163. 8 Change Percentage change = -------------- X 100 Original Number 163. 8 Percentage change = -------------- X 100 125. 3 Percentage change = 1. 307 X 100 = 130. 7% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -35

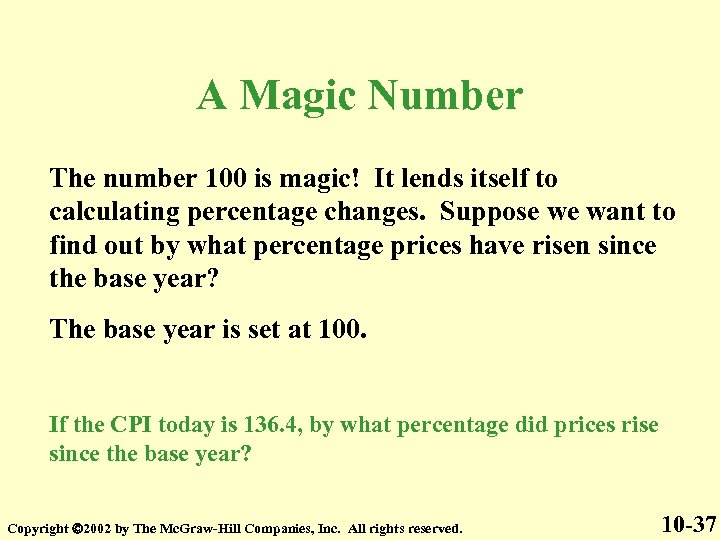

A Magic Number The number 100 is magic! It lends itself to calculating percentage changes. Suppose we want to find out by what percentage prices have risen since the base year? The base year is set at 100. If the CPI today is 136. 4, by what percentage did prices rise since the base year? Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -37

A Magic Number The number 100 is magic! It lends itself to calculating percentage changes. Suppose we want to find out by what percentage prices have risen since the base year? The base year is set at 100. If the CPI today is 136. 4, by what percentage did prices rise since the base year? Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -37

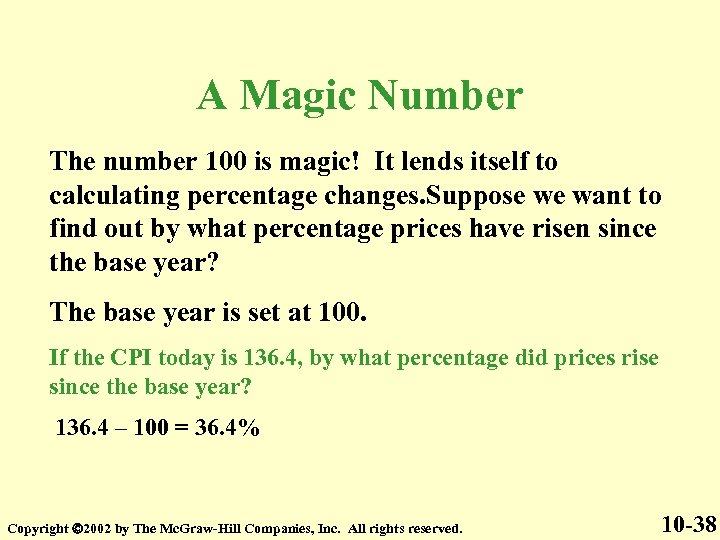

A Magic Number The number 100 is magic! It lends itself to calculating percentage changes. Suppose we want to find out by what percentage prices have risen since the base year? The base year is set at 100. If the CPI today is 136. 4, by what percentage did prices rise since the base year? 136. 4 – 100 = 36. 4% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -38

A Magic Number The number 100 is magic! It lends itself to calculating percentage changes. Suppose we want to find out by what percentage prices have risen since the base year? The base year is set at 100. If the CPI today is 136. 4, by what percentage did prices rise since the base year? 136. 4 – 100 = 36. 4% Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -38

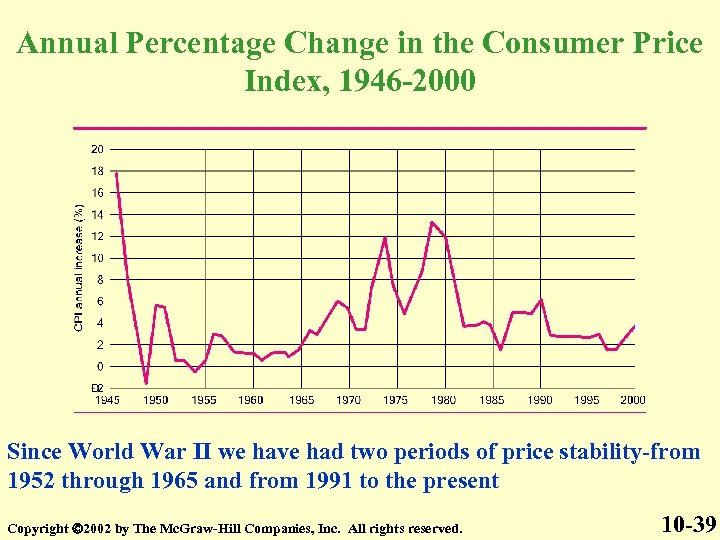

Annual Percentage Change in the Consumer Price Index, 1946 -2000 Since World War II we have had two periods of price stability-from 1952 through 1965 and from 1991 to the present Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -39

Annual Percentage Change in the Consumer Price Index, 1946 -2000 Since World War II we have had two periods of price stability-from 1952 through 1965 and from 1991 to the present Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -39

Inflation Seems Inevitable • It appears that it takes a recession to deflate “inflation” • Sir Frederick Keith-Ross (1957) – “Inflation is like sin; every government denounces it and every government practices it” Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -40

Inflation Seems Inevitable • It appears that it takes a recession to deflate “inflation” • Sir Frederick Keith-Ross (1957) – “Inflation is like sin; every government denounces it and every government practices it” Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -40

Deflation • Deflation is a decline in the general level of prices for a period of years – This is the OPPOSITE of inflation – This last occurred between 1929 -33 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -41

Deflation • Deflation is a decline in the general level of prices for a period of years – This is the OPPOSITE of inflation – This last occurred between 1929 -33 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -41

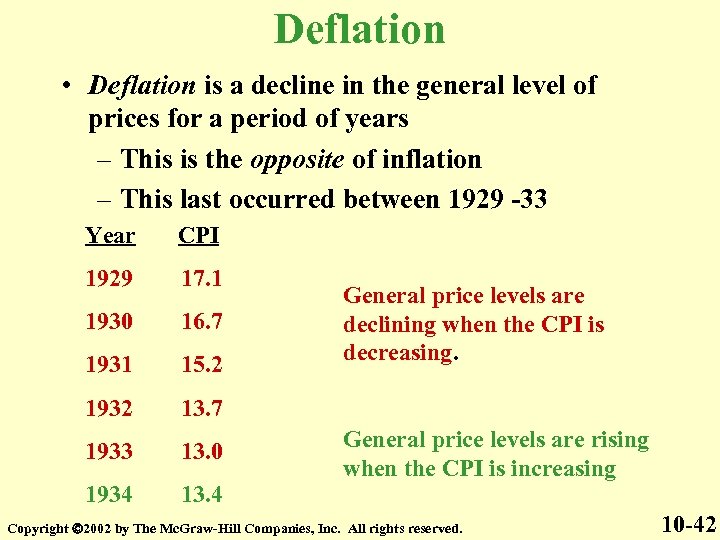

Deflation • Deflation is a decline in the general level of prices for a period of years – This is the opposite of inflation – This last occurred between 1929 -33 Year CPI 1929 17. 1 1930 16. 7 1931 15. 2 1932 13. 7 1933 13. 0 1934 13. 4 General price levels are declining when the CPI is decreasing. General price levels are rising when the CPI is increasing Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -42

Deflation • Deflation is a decline in the general level of prices for a period of years – This is the opposite of inflation – This last occurred between 1929 -33 Year CPI 1929 17. 1 1930 16. 7 1931 15. 2 1932 13. 7 1933 13. 0 1934 13. 4 General price levels are declining when the CPI is decreasing. General price levels are rising when the CPI is increasing Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -42

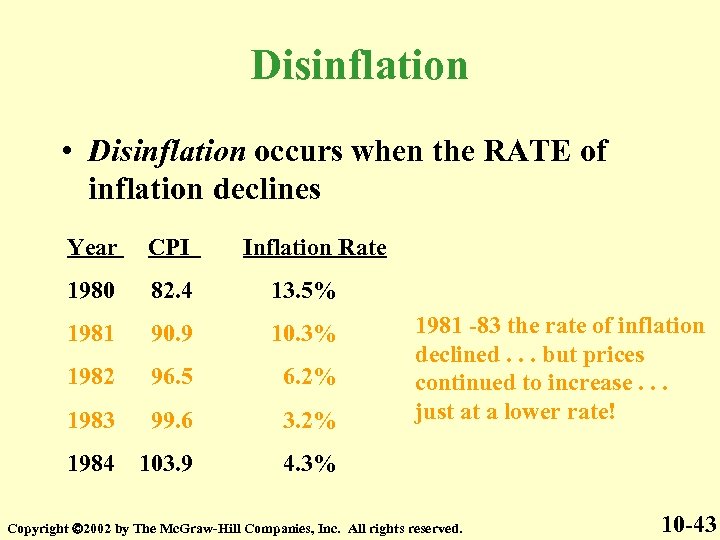

Disinflation • Disinflation occurs when the RATE of inflation declines Year CPI Inflation Rate 1980 82. 4 13. 5% 1981 90. 9 10. 3% 1982 96. 5 6. 2% 1983 99. 6 3. 2% 1984 103. 9 4. 3% 1981 -83 the rate of inflation declined. . . but prices continued to increase. . . just at a lower rate! Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -43

Disinflation • Disinflation occurs when the RATE of inflation declines Year CPI Inflation Rate 1980 82. 4 13. 5% 1981 90. 9 10. 3% 1982 96. 5 6. 2% 1983 99. 6 3. 2% 1984 103. 9 4. 3% 1981 -83 the rate of inflation declined. . . but prices continued to increase. . . just at a lower rate! Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -43

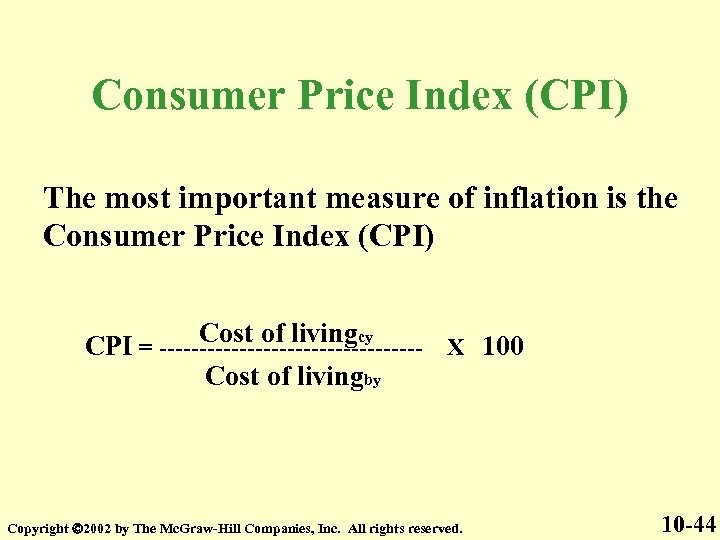

Consumer Price Index (CPI) The most important measure of inflation is the Consumer Price Index (CPI) Cost of livingcy CPI = ----------------- X 100 Cost of livingby Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -44

Consumer Price Index (CPI) The most important measure of inflation is the Consumer Price Index (CPI) Cost of livingcy CPI = ----------------- X 100 Cost of livingby Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -44

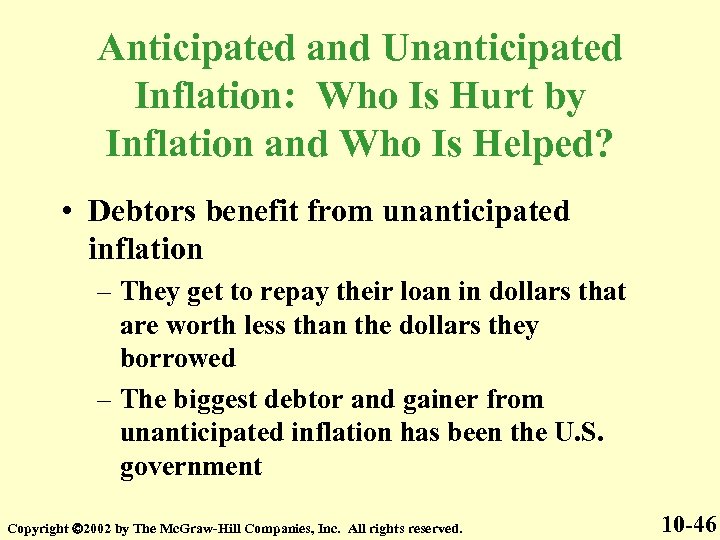

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • Debtors benefit from unanticipated inflation – They get to repay their loan in dollars that are worth less than the dollars they borrowed – The biggest debtor and gainer from unanticipated inflation has been the U. S. government Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -46

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • Debtors benefit from unanticipated inflation – They get to repay their loan in dollars that are worth less than the dollars they borrowed – The biggest debtor and gainer from unanticipated inflation has been the U. S. government Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -46

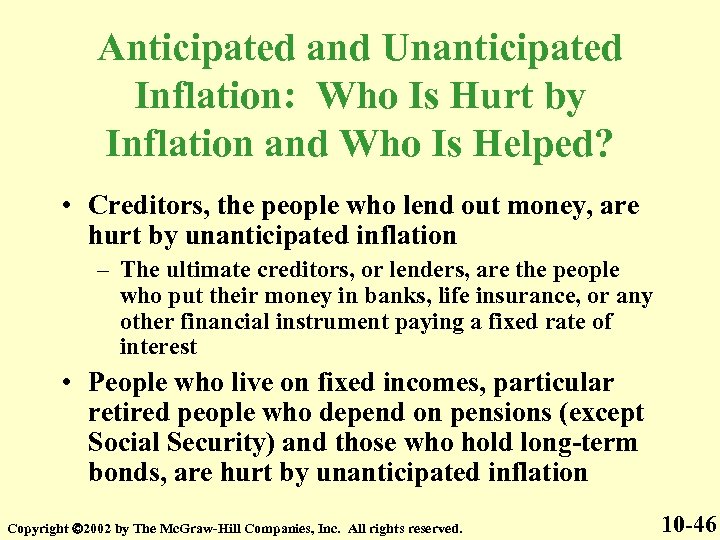

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • Creditors, the people who lend out money, are hurt by unanticipated inflation – The ultimate creditors, or lenders, are the people who put their money in banks, life insurance, or any other financial instrument paying a fixed rate of interest • People who live on fixed incomes, particular retired people who depend on pensions (except Social Security) and those who hold long-term bonds, are hurt by unanticipated inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -46

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • Creditors, the people who lend out money, are hurt by unanticipated inflation – The ultimate creditors, or lenders, are the people who put their money in banks, life insurance, or any other financial instrument paying a fixed rate of interest • People who live on fixed incomes, particular retired people who depend on pensions (except Social Security) and those who hold long-term bonds, are hurt by unanticipated inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -46

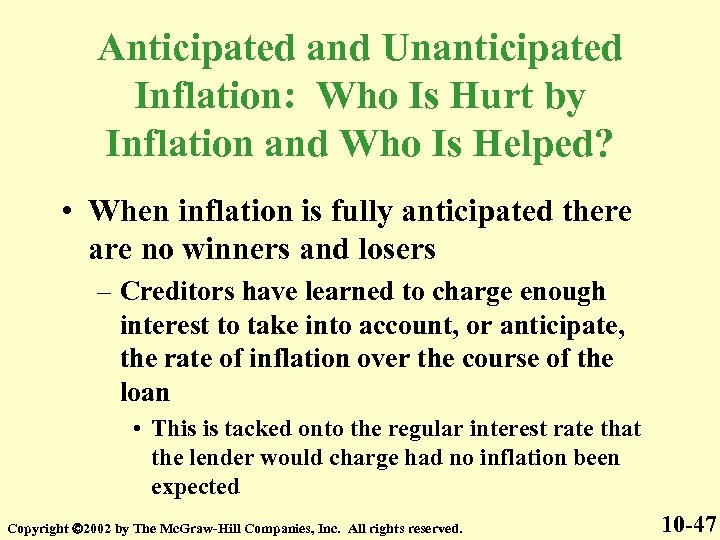

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • When inflation is fully anticipated there are no winners and losers – Creditors have learned to charge enough interest to take into account, or anticipate, the rate of inflation over the course of the loan • This is tacked onto the regular interest rate that the lender would charge had no inflation been expected Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -47

Anticipated and Unanticipated Inflation: Who Is Hurt by Inflation and Who Is Helped? • When inflation is fully anticipated there are no winners and losers – Creditors have learned to charge enough interest to take into account, or anticipate, the rate of inflation over the course of the loan • This is tacked onto the regular interest rate that the lender would charge had no inflation been expected Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -47

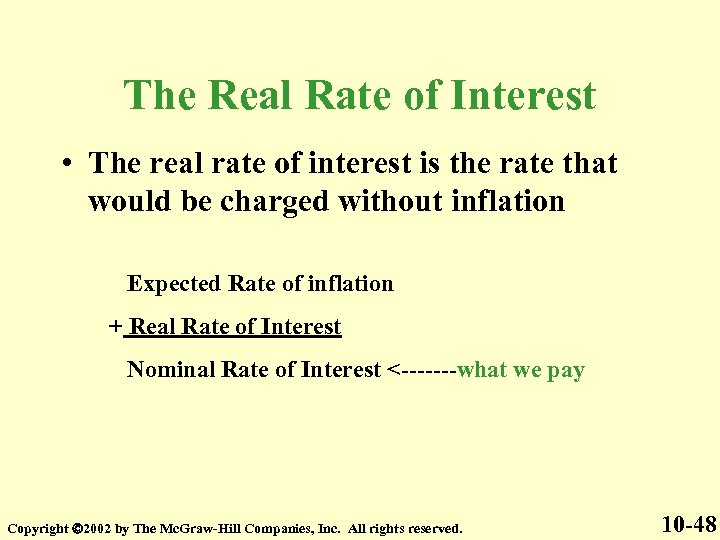

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest <-------what we pay Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -48

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest <-------what we pay Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -48

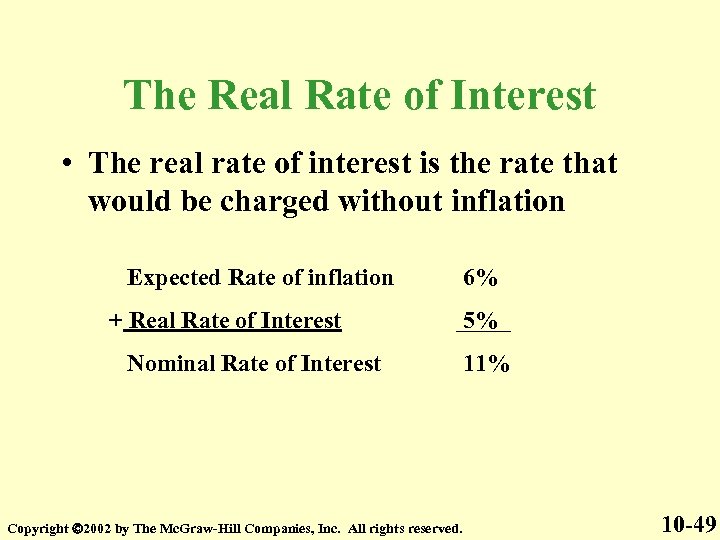

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 6% 5% 11% 10 -49

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 6% 5% 11% 10 -49

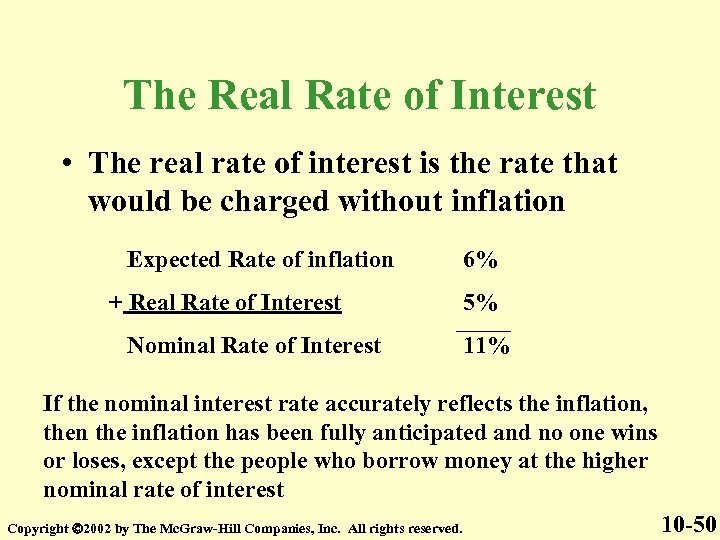

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest 6% 5% 11% If the nominal interest rate accurately reflects the inflation, then the inflation has been fully anticipated and no one wins or loses, except the people who borrow money at the higher nominal rate of interest Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -50

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest 6% 5% 11% If the nominal interest rate accurately reflects the inflation, then the inflation has been fully anticipated and no one wins or loses, except the people who borrow money at the higher nominal rate of interest Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -50

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest 6% 5% 11% But if the rate of inflation keeps growing – even if it is correctly anticipated – our economy will be in big trouble Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -51

The Real Rate of Interest • The real rate of interest is the rate that would be charged without inflation Expected Rate of inflation + Real Rate of Interest Nominal Rate of Interest 6% 5% 11% But if the rate of inflation keeps growing – even if it is correctly anticipated – our economy will be in big trouble Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -51

Theories of the Causes of Inflation • Demand-Pull Inflation • Cost-Push inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -52

Theories of the Causes of Inflation • Demand-Pull Inflation • Cost-Push inflation Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -52

Demand-Pull Inflation • When there is excessive demand for goods and services, we have demand-pull inflation – This occurs when people are willing and able to buy more output than our economy can produce because our economy is already operating at full capacity Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -53

Demand-Pull Inflation • When there is excessive demand for goods and services, we have demand-pull inflation – This occurs when people are willing and able to buy more output than our economy can produce because our economy is already operating at full capacity Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -53

Demand-Pull Inflation • Demand-pull inflation is often summed up as “too many dollars chasing too few goods” – Just where did all of this money come from”? Milton Friedman, a Nobel laureate in economics, suspects the seven governors of the Federal Reserve System, which controls the rate of growth of the money supply Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -54

Demand-Pull Inflation • Demand-pull inflation is often summed up as “too many dollars chasing too few goods” – Just where did all of this money come from”? Milton Friedman, a Nobel laureate in economics, suspects the seven governors of the Federal Reserve System, which controls the rate of growth of the money supply Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -54

Cost-Push Inflation • There are three variants of cost-push inflation – The wage-price spiral – Profit-push inflation – Supply-side cost shocks Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -55

Cost-Push Inflation • There are three variants of cost-push inflation – The wage-price spiral – Profit-push inflation – Supply-side cost shocks Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -55

Cost-Push Inflation: The Wage. Price Spiral – Wages constitute nearly two-thirds of the cost of doing business – Whenever workers receive a significant wage increase, this increase is passed along to consumers in the form of higher prices – Higher prices raise everyone’s cost of living, engendering further wage increases Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -56

Cost-Push Inflation: The Wage. Price Spiral – Wages constitute nearly two-thirds of the cost of doing business – Whenever workers receive a significant wage increase, this increase is passed along to consumers in the form of higher prices – Higher prices raise everyone’s cost of living, engendering further wage increases Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -56

Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing them on to their customers Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -57

Cost-Push Inflation: Profit Push – Because just a handful of firms dominate many industries, they have the power to administer prices rather than accept the dictates of the market forces of supply and demand – To the degree that they are able, these firms will respond to any rise in cost by passing them on to their customers Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -57

Cost-Push Inflation: Supply. Side Cost Shocks – Finally, we have supply-side shocks, most prominently the oil price shocks of 1973 -74 and 1979 • OPEC nations raised the price of oil • When the price of oil rises, the cost of making many other things rise as well – Cost increases are quickly translated into price increases Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -58

Cost-Push Inflation: Supply. Side Cost Shocks – Finally, we have supply-side shocks, most prominently the oil price shocks of 1973 -74 and 1979 • OPEC nations raised the price of oil • When the price of oil rises, the cost of making many other things rise as well – Cost increases are quickly translated into price increases Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -58

Inflation as a Psychological Process • If people believe prices will rise, they will act in a way that keeps prices rising • To break the back of inflationary psychology, policymakers need to bring down the rate of inflation for a sufficiently long period of time for people to actually expect price stability • This happened in the recent past only after successive recessions have “wrung” inflation out of the economy Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -59

Inflation as a Psychological Process • If people believe prices will rise, they will act in a way that keeps prices rising • To break the back of inflationary psychology, policymakers need to bring down the rate of inflation for a sufficiently long period of time for people to actually expect price stability • This happened in the recent past only after successive recessions have “wrung” inflation out of the economy Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -59

Creeping Inflation and Hyperinflation • Inflation is a relative term – Creeping inflation in one country would be hyperinflation in another • Once we cross the line between creeping inflation and hyperinflation—which keeps shifting—we run into trouble – It becomes increasingly difficult to conduct normal economic affairs – Prices are raised constantly – It becomes impossible to enter into long-term contracts – No one is sure what the government might do Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -60

Creeping Inflation and Hyperinflation • Inflation is a relative term – Creeping inflation in one country would be hyperinflation in another • Once we cross the line between creeping inflation and hyperinflation—which keeps shifting—we run into trouble – It becomes increasingly difficult to conduct normal economic affairs – Prices are raised constantly – It becomes impossible to enter into long-term contracts – No one is sure what the government might do Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -60

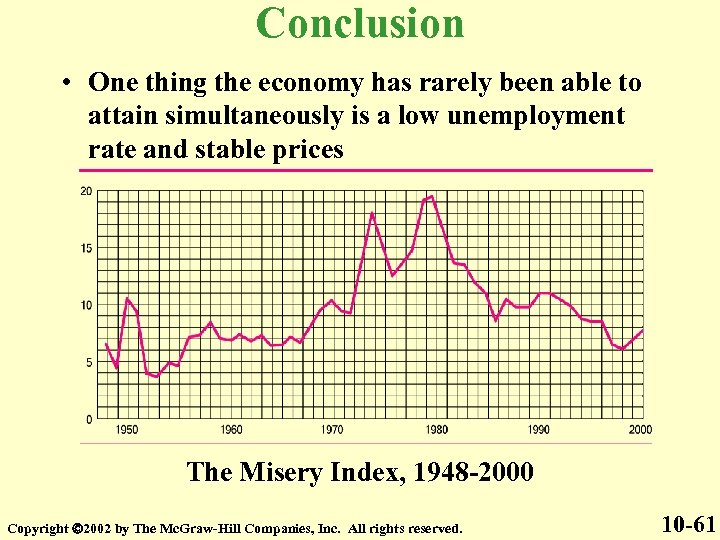

Conclusion • One thing the economy has rarely been able to attain simultaneously is a low unemployment rate and stable prices The Misery Index, 1948 -2000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -61

Conclusion • One thing the economy has rarely been able to attain simultaneously is a low unemployment rate and stable prices The Misery Index, 1948 -2000 Copyright 2002 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10 -61