b11a99669e21cc937c0e4669eef1574a.ppt

- Количество слайдов: 46

Chapter 10 Derivative Securities Markets

Chapter 10 Derivative Securities Markets

Chapter Outline Derivative Securities: Chapter Overview Forwards and Futures Options Regulation of Futures and Options Markets Swaps Caps, Floors and Collars International Aspects of Derivative Securities Markets

Chapter Outline Derivative Securities: Chapter Overview Forwards and Futures Options Regulation of Futures and Options Markets Swaps Caps, Floors and Collars International Aspects of Derivative Securities Markets

Derivative Securities a financial security whose payoff is linked to another, previously issued security Value changes with the change of the underlying derivatives have developed as the need to manage the risk of a given commodity or exposure grew

Derivative Securities a financial security whose payoff is linked to another, previously issued security Value changes with the change of the underlying derivatives have developed as the need to manage the risk of a given commodity or exposure grew

Derivative Securities Markets Derivative securities markets exist to trade derivatives, newest market First wave Second wave Third wave options stock index derivatives swaps

Derivative Securities Markets Derivative securities markets exist to trade derivatives, newest market First wave Second wave Third wave options stock index derivatives swaps

Banks are major players in derivative markets, particularly in certain OTC derivatives and in mortgage backed securities In addition to CME and CBT: open outcry, derivatives are now being traded on electronic exchanges

Banks are major players in derivative markets, particularly in certain OTC derivatives and in mortgage backed securities In addition to CME and CBT: open outcry, derivatives are now being traded on electronic exchanges

Forwards and Futures Spot Markets: A spot contract Forward Markets: A forward contract is a contract for future payment and delivery (beyond two or three days) Hedgers A forward rate agreement (FRA), ex…. custom arrangements Commercial banks, Investment banks, brokers-dealers, major players, making returns on spread for buy/sell underlying asset Becoming more standardized, computerized, OTC sec market

Forwards and Futures Spot Markets: A spot contract Forward Markets: A forward contract is a contract for future payment and delivery (beyond two or three days) Hedgers A forward rate agreement (FRA), ex…. custom arrangements Commercial banks, Investment banks, brokers-dealers, major players, making returns on spread for buy/sell underlying asset Becoming more standardized, computerized, OTC sec market

Futures Markets: Futures contracts are exchange traded (CME and the New York Futures Exchange). Difference with forwards… A buyer of a futures contract (long position) incurs the obligation to pay the extant futures price at the time the contract is purchased. A seller of a futures contract (short position) incurs the obligation to deliver the underlying commodity at contract maturity in exchange for receiving the futures price that was outstanding at the time the contract was enacted. Most futures contracts do not result in delivery; some do not even allow delivery, EFP: exchange for physical

Futures Markets: Futures contracts are exchange traded (CME and the New York Futures Exchange). Difference with forwards… A buyer of a futures contract (long position) incurs the obligation to pay the extant futures price at the time the contract is purchased. A seller of a futures contract (short position) incurs the obligation to deliver the underlying commodity at contract maturity in exchange for receiving the futures price that was outstanding at the time the contract was enacted. Most futures contracts do not result in delivery; some do not even allow delivery, EFP: exchange for physical

Types: commodity, currency, interest earning assets, index Purpose of the market: Price discovery Speculation hedging The clearinghouse Clearing member Open interest on a contract

Types: commodity, currency, interest earning assets, index Purpose of the market: Price discovery Speculation hedging The clearinghouse Clearing member Open interest on a contract

no cash is paid or received until contract maturity. initial margin requirement (IMR). The IMR is usually set at about 3%-5% of the face value maintenance margin requirement (usually about 75% of the IMR) marked to market daily

no cash is paid or received until contract maturity. initial margin requirement (IMR). The IMR is usually set at about 3%-5% of the face value maintenance margin requirement (usually about 75% of the IMR) marked to market daily

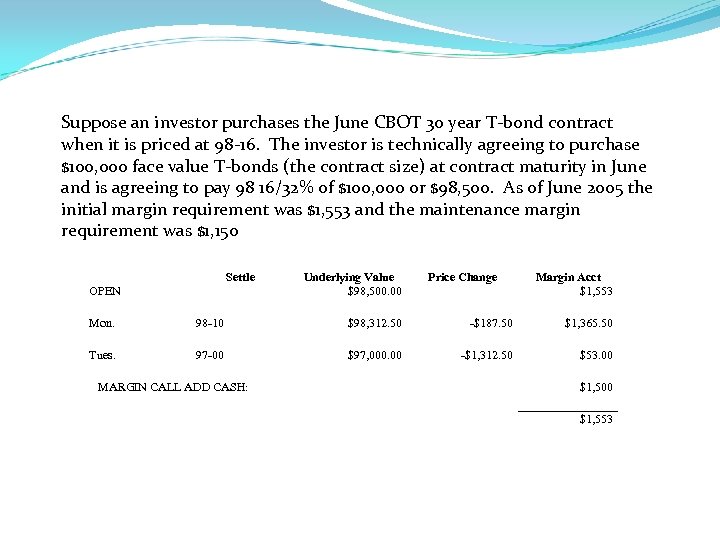

Suppose an investor purchases the June CBOT 30 year T-bond contract when it is priced at 98 -16. The investor is technically agreeing to purchase $100, 000 face value T-bonds (the contract size) at contract maturity in June and is agreeing to pay 98 16/32% of $100, 000 or $98, 500. As of June 2005 the initial margin requirement was $1, 553 and the maintenance margin requirement was $1, 150 Settle OPEN Underlying Value $98, 500. 00 Price Change Margin Acct $1, 553 Mon. 98 -10 $98, 312. 50 -$187. 50 $1, 365. 50 Tues. 97 -00 $97, 000. 00 -$1, 312. 50 $53. 00 MARGIN CALL ADD CASH: $1, 500 $1, 553

Suppose an investor purchases the June CBOT 30 year T-bond contract when it is priced at 98 -16. The investor is technically agreeing to purchase $100, 000 face value T-bonds (the contract size) at contract maturity in June and is agreeing to pay 98 16/32% of $100, 000 or $98, 500. As of June 2005 the initial margin requirement was $1, 553 and the maintenance margin requirement was $1, 150 Settle OPEN Underlying Value $98, 500. 00 Price Change Margin Acct $1, 553 Mon. 98 -10 $98, 312. 50 -$187. 50 $1, 365. 50 Tues. 97 -00 $97, 000. 00 -$1, 312. 50 $53. 00 MARGIN CALL ADD CASH: $1, 500 $1, 553

The exchange (clearing corporation) guarantees payment for both parties in a futures contract Margin requirements, price limits, position limits and daily marking to market limit the risk to the exchange. If the underlying spot volatility increases, exchanges are quick to impose stricter requirements

The exchange (clearing corporation) guarantees payment for both parties in a futures contract Margin requirements, price limits, position limits and daily marking to market limit the risk to the exchange. If the underlying spot volatility increases, exchanges are quick to impose stricter requirements

Why delivery is not an issue on futures contracts I go long and default the pound futures contract F = futures price, S = spot price at time = 0 (today) or time = T at expiration. Suppose F 0=$110, 000 but at contract expiration ST = $108, 000 and I renege and refuse to pay $110, 000 to receive £ 62, 500 (contract size) when I could buy them in the spot for $108, 000. The seller of the pounds could sell the pound spot and receive $108, 000 and the seller has ALREADY gained $2, 000 from the daily marking to market. The net proceeds to the seller are $110, 000, the same as if no default occurred. I go short and default the Pound futures contract: F 0= $110, 000 but ST = $112, 000 and I renege and refuse to deliver £ 62, 500 in order to receive $110, 000 when I could receive $112, 000 in the spot. The buyer of the pounds could buy the pound spot and pay $112, 000 and (s)he (buyer) has ALREADY gained $2, 000 from the daily marking to market. Net cost to buyer $110, 000.

Why delivery is not an issue on futures contracts I go long and default the pound futures contract F = futures price, S = spot price at time = 0 (today) or time = T at expiration. Suppose F 0=$110, 000 but at contract expiration ST = $108, 000 and I renege and refuse to pay $110, 000 to receive £ 62, 500 (contract size) when I could buy them in the spot for $108, 000. The seller of the pounds could sell the pound spot and receive $108, 000 and the seller has ALREADY gained $2, 000 from the daily marking to market. The net proceeds to the seller are $110, 000, the same as if no default occurred. I go short and default the Pound futures contract: F 0= $110, 000 but ST = $112, 000 and I renege and refuse to deliver £ 62, 500 in order to receive $110, 000 when I could receive $112, 000 in the spot. The buyer of the pounds could buy the pound spot and pay $112, 000 and (s)he (buyer) has ALREADY gained $2, 000 from the daily marking to market. Net cost to buyer $110, 000.

standardized Interest rate contracts with the highest amount of open interest include the Eurodollar, Eurolibor, Short Sterling, T-note and T-bond contracts. The euro, yen and the S&P 500 contracts are among the highest in open interest for currency and stocks respectively. Futures trading uses an open outcry auction

standardized Interest rate contracts with the highest amount of open interest include the Eurodollar, Eurolibor, Short Sterling, T-note and T-bond contracts. The euro, yen and the S&P 500 contracts are among the highest in open interest for currency and stocks respectively. Futures trading uses an open outcry auction

Types of traders include Professional traders: similar to specialists, trade for their acct Position traders Day traders Scalpers floor brokers Either market or limit orders Long or short positions Clearinghouse clears the trade

Types of traders include Professional traders: similar to specialists, trade for their acct Position traders Day traders Scalpers floor brokers Either market or limit orders Long or short positions Clearinghouse clears the trade

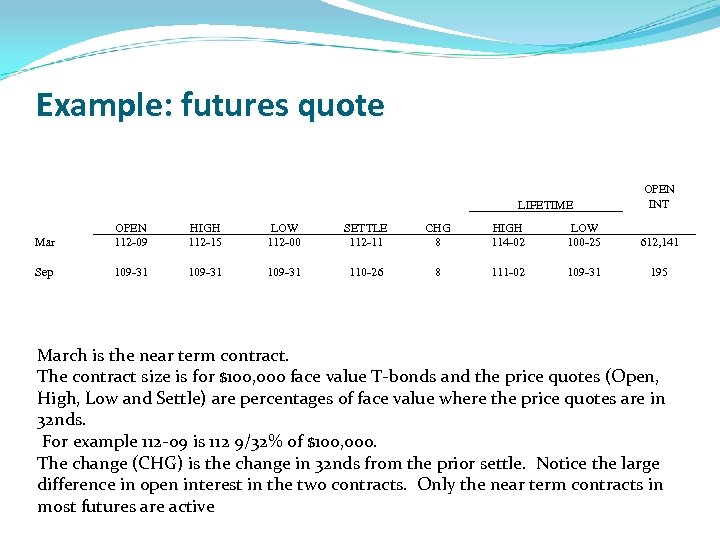

Example: futures quote LIFETIME OPEN INT Mar OPEN 112 -09 HIGH 112 -15 LOW 112 -00 SETTLE 112 -11 CHG 8 HIGH 114 -02 LOW 100 -25 612, 141 Sep 109 -31 110 -26 8 111 -02 109 -31 195 March is the near term contract. The contract size is for $100, 000 face value T-bonds and the price quotes (Open, High, Low and Settle) are percentages of face value where the price quotes are in 32 nds. For example 112 -09 is 112 9/32% of $100, 000. The change (CHG) is the change in 32 nds from the prior settle. Notice the large difference in open interest in the two contracts. Only the near term contracts in most futures are active

Example: futures quote LIFETIME OPEN INT Mar OPEN 112 -09 HIGH 112 -15 LOW 112 -00 SETTLE 112 -11 CHG 8 HIGH 114 -02 LOW 100 -25 612, 141 Sep 109 -31 110 -26 8 111 -02 109 -31 195 March is the near term contract. The contract size is for $100, 000 face value T-bonds and the price quotes (Open, High, Low and Settle) are percentages of face value where the price quotes are in 32 nds. For example 112 -09 is 112 9/32% of $100, 000. The change (CHG) is the change in 32 nds from the prior settle. Notice the large difference in open interest in the two contracts. Only the near term contracts in most futures are active

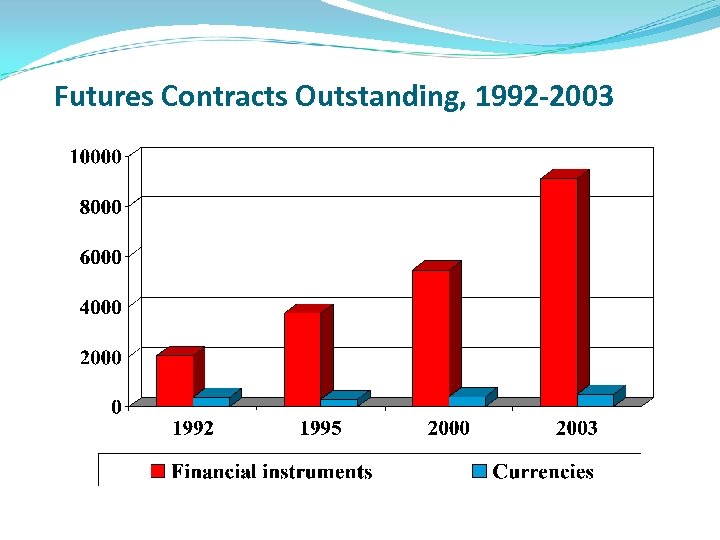

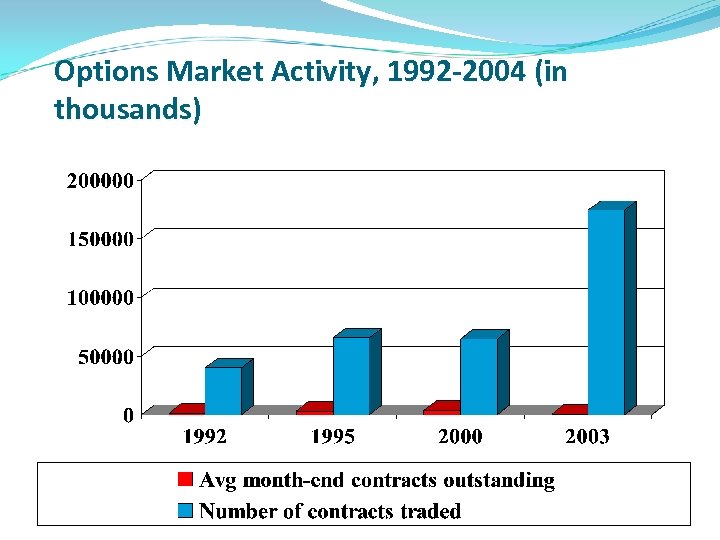

Futures Contracts Outstanding, 1992 -2003

Futures Contracts Outstanding, 1992 -2003

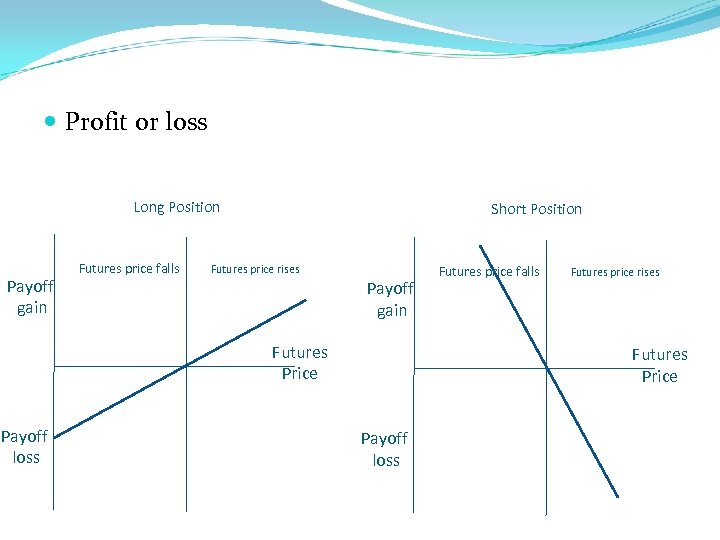

Profit or loss Long Position Payoff gain Futures price falls Short Position Futures price rises Payoff gain Futures Price Payoff loss Futures price falls Futures price rises Futures Price Payoff loss

Profit or loss Long Position Payoff gain Futures price falls Short Position Futures price rises Payoff gain Futures Price Payoff loss Futures price falls Futures price rises Futures Price Payoff loss

Options Unlike futures and forwards, options give the holder the right, but not the obligation, to either buy or sell the underlying commodity at a fixed price called the exercise or strike price, for a specified period American style options European options Cheaper and more volatile than security (gain) Option clearing corporation: matches/clears trades , takes margin payment on option

Options Unlike futures and forwards, options give the holder the right, but not the obligation, to either buy or sell the underlying commodity at a fixed price called the exercise or strike price, for a specified period American style options European options Cheaper and more volatile than security (gain) Option clearing corporation: matches/clears trades , takes margin payment on option

Options Use: Change risk of portfolio Tax purposes Enhance return Participants: Market maker Floor broker: represent brokerage firm Order book official: employee, facilitate trade, not trade for his own Scalpers: position trader Exchange official Some exchanges employ specialists instead of order book officials

Options Use: Change risk of portfolio Tax purposes Enhance return Participants: Market maker Floor broker: represent brokerage firm Order book official: employee, facilitate trade, not trade for his own Scalpers: position trader Exchange official Some exchanges employ specialists instead of order book officials

Call options: provide the right to buy the underlying commodity, option premium (C) , exercise or strike price (X). ‘in the money time value and intrinsic value C > Max (0, S-X) for a call prior to maturity Purchasing a call option… , writing a call … Buying a call …, writing a call is … not normally exercised prior to maturity unless the option is deep in the money Covered call/naked call

Call options: provide the right to buy the underlying commodity, option premium (C) , exercise or strike price (X). ‘in the money time value and intrinsic value C > Max (0, S-X) for a call prior to maturity Purchasing a call option… , writing a call … Buying a call …, writing a call is … not normally exercised prior to maturity unless the option is deep in the money Covered call/naked call

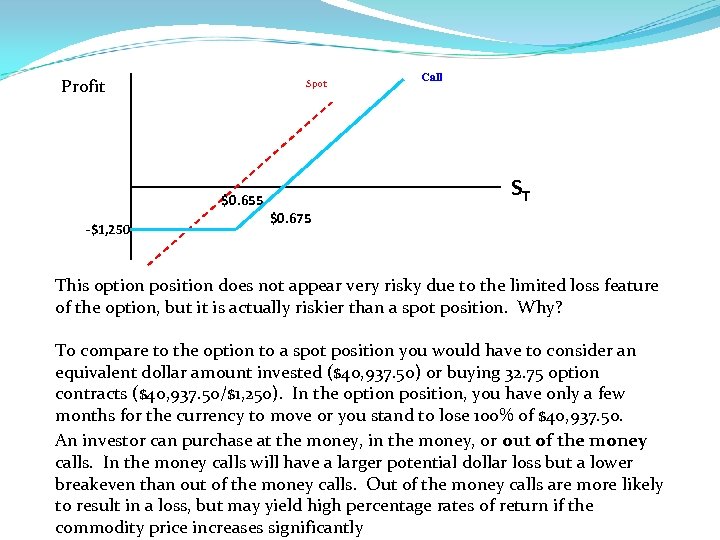

Comparing a call option with a spot position Suppose an at the money American style Swiss franc (Sfr) call option has the following terms: Exercise price 1 Sfr = $0. 655 Option Premium = 2¢/Sfr Contract size = 62, 500 Sfr Expiration = 90 days This option gives the buyer the right to purchase 62, 500 Sfr at any time within the next 90 days at an exercise (or strike) price of 62, 500 Sfr $0. 655/Sfr = $40, 937. 50. The price the option buyer must pay to obtain this right (the premium) is 62, 500 Sfr $. 02/Sfr = $1, 250. Assuming the buyer holds the option to just before expiration for simplicity, the investor’s profit diagram looks this:

Comparing a call option with a spot position Suppose an at the money American style Swiss franc (Sfr) call option has the following terms: Exercise price 1 Sfr = $0. 655 Option Premium = 2¢/Sfr Contract size = 62, 500 Sfr Expiration = 90 days This option gives the buyer the right to purchase 62, 500 Sfr at any time within the next 90 days at an exercise (or strike) price of 62, 500 Sfr $0. 655/Sfr = $40, 937. 50. The price the option buyer must pay to obtain this right (the premium) is 62, 500 Sfr $. 02/Sfr = $1, 250. Assuming the buyer holds the option to just before expiration for simplicity, the investor’s profit diagram looks this:

Profit Spot $0. 655 -$1, 250 Call ST $0. 675 This option position does not appear very risky due to the limited loss feature of the option, but it is actually riskier than a spot position. Why? To compare to the option to a spot position you would have to consider an equivalent dollar amount invested ($40, 937. 50) or buying 32. 75 option contracts ($40, 937. 50/$1, 250). In the option position, you have only a few months for the currency to move or you stand to lose 100% of $40, 937. 50. An investor can purchase at the money, in the money, or out of the money calls. In the money calls will have a larger potential dollar loss but a lower breakeven than out of the money calls. Out of the money calls are more likely to result in a loss, but may yield high percentage rates of return if the commodity price increases significantly

Profit Spot $0. 655 -$1, 250 Call ST $0. 675 This option position does not appear very risky due to the limited loss feature of the option, but it is actually riskier than a spot position. Why? To compare to the option to a spot position you would have to consider an equivalent dollar amount invested ($40, 937. 50) or buying 32. 75 option contracts ($40, 937. 50/$1, 250). In the option position, you have only a few months for the currency to move or you stand to lose 100% of $40, 937. 50. An investor can purchase at the money, in the money, or out of the money calls. In the money calls will have a larger potential dollar loss but a lower breakeven than out of the money calls. Out of the money calls are more likely to result in a loss, but may yield high percentage rates of return if the commodity price increases significantly

Buying a call on margin Stock price $105 Exercise $100 Call price $6 Call is in the money: You would sell the call and receive $600 Margin is 100% + 20% of stock price = $105+100*02+600=$2700 For out of the money call options: Margin is: sale proceeds + 20% of (stock price – amount option is out of the money) if negative then Margin is 100% of option proceeds + 10% of stock price

Buying a call on margin Stock price $105 Exercise $100 Call price $6 Call is in the money: You would sell the call and receive $600 Margin is 100% + 20% of stock price = $105+100*02+600=$2700 For out of the money call options: Margin is: sale proceeds + 20% of (stock price – amount option is out of the money) if negative then Margin is 100% of option proceeds + 10% of stock price

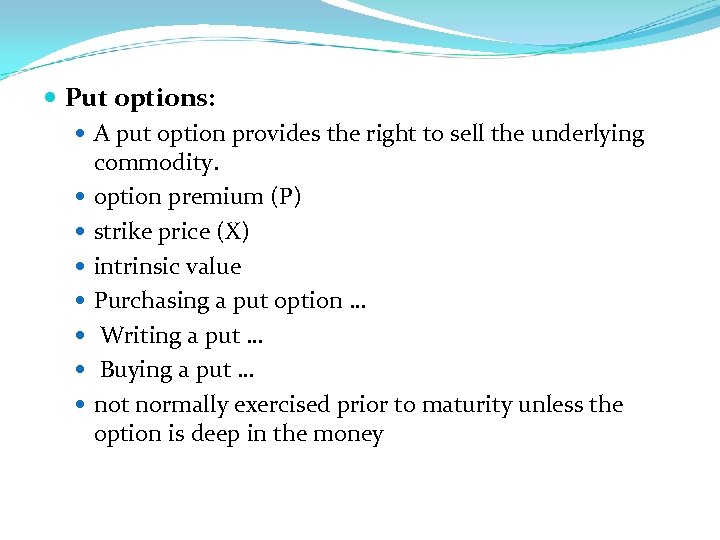

Put options: A put option provides the right to sell the underlying commodity. option premium (P) strike price (X) intrinsic value Purchasing a put option … Writing a put … Buying a put … not normally exercised prior to maturity unless the option is deep in the money

Put options: A put option provides the right to sell the underlying commodity. option premium (P) strike price (X) intrinsic value Purchasing a put option … Writing a put … Buying a put … not normally exercised prior to maturity unless the option is deep in the money

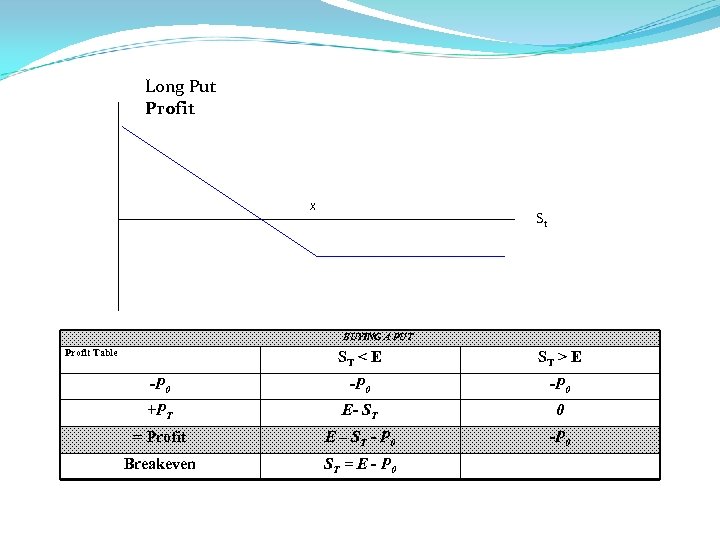

Long Put Profit X St BUYING A PUT Profit Table ST < E ST > E -P 0 +PT E- ST 0 = Profit E – S T - P 0 -P 0 Breakeven ST = E - P 0

Long Put Profit X St BUYING A PUT Profit Table ST < E ST > E -P 0 +PT E- ST 0 = Profit E – S T - P 0 -P 0 Breakeven ST = E - P 0

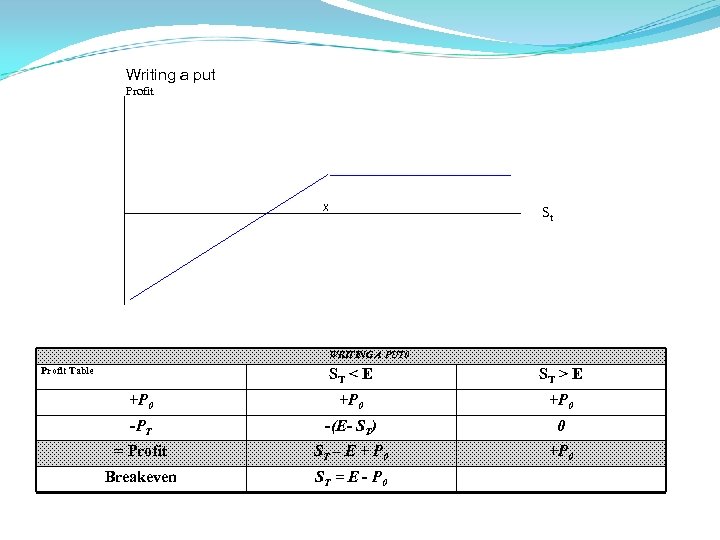

Writing a put Profit X St WRITING A PUT 0 Profit Table ST < E ST > E +P 0 -PT -(E- ST) 0 = Profit ST – E + P 0 +P 0 Breakeven ST = E - P 0

Writing a put Profit X St WRITING A PUT 0 Profit Table ST < E ST > E +P 0 -PT -(E- ST) 0 = Profit ST – E + P 0 +P 0 Breakeven ST = E - P 0

Option Values: The intrinsic value of a call option… The intrinsic value of a put option … time value

Option Values: The intrinsic value of a call option… The intrinsic value of a put option … time value

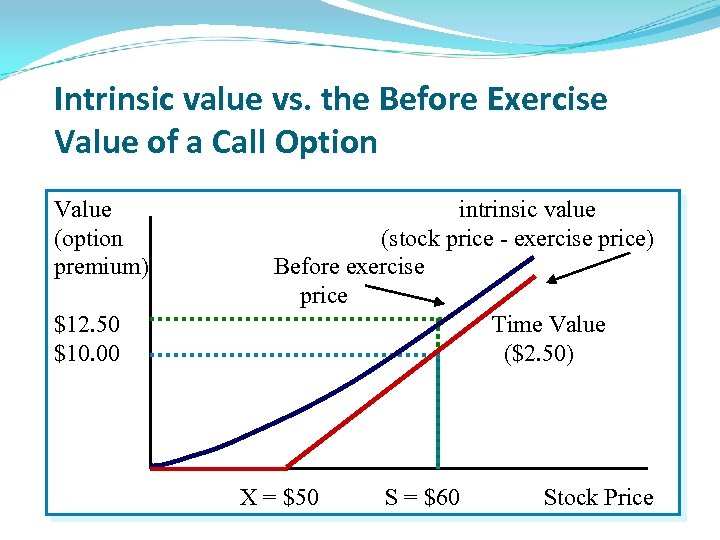

Intrinsic value vs. the Before Exercise Value of a Call Option Value (option premium) $12. 50 $10. 00 intrinsic value (stock price - exercise price) Before exercise price Time Value ($2. 50) X = $50 S = $60 Stock Price

Intrinsic value vs. the Before Exercise Value of a Call Option Value (option premium) $12. 50 $10. 00 intrinsic value (stock price - exercise price) Before exercise price Time Value ($2. 50) X = $50 S = $60 Stock Price

Other variables include: Risk free rate (Rf Time to expiration

Other variables include: Risk free rate (Rf Time to expiration

Option Markets: From modest beginnings in 1973 with the Chicago Board Options Exchange (CBOE), the world’s first market dedicated to options, option trading has grown worldwide. In the U. S. open outcry auctions, 2000, the CBOE introduced hand held computers Who can transact on the floor, how? Options on individual common stocks and stock indexes are popular today for both hedgers and speculators (multiplier)

Option Markets: From modest beginnings in 1973 with the Chicago Board Options Exchange (CBOE), the world’s first market dedicated to options, option trading has grown worldwide. In the U. S. open outcry auctions, 2000, the CBOE introduced hand held computers Who can transact on the floor, how? Options on individual common stocks and stock indexes are popular today for both hedgers and speculators (multiplier)

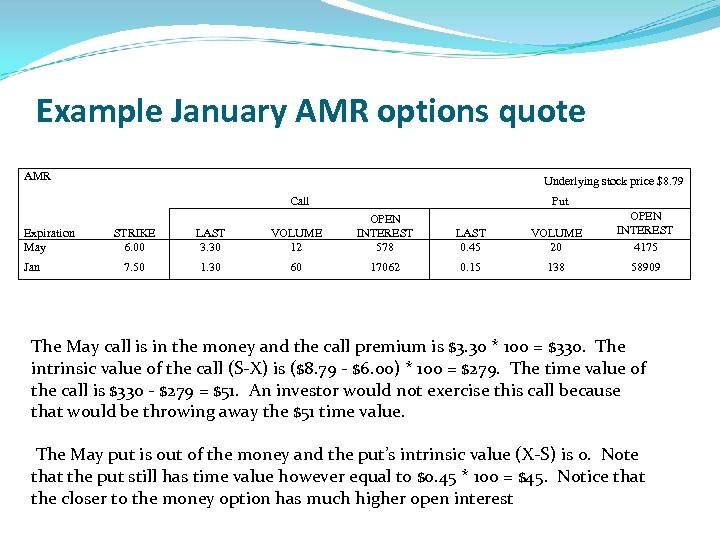

Example January AMR options quote AMR Underlying stock price $8. 79 Call Expiration May Jan Put STRIKE 6. 00 LAST 3. 30 VOLUME 12 OPEN INTEREST 578 7. 50 1. 30 60 17062 LAST 0. 45 VOLUME 20 OPEN INTEREST 4175 0. 15 138 58909 The May call is in the money and the call premium is $3. 30 * 100 = $330. The intrinsic value of the call (S-X) is ($8. 79 - $6. 00) * 100 = $279. The time value of the call is $330 - $279 = $51. An investor would not exercise this call because that would be throwing away the $51 time value. The May put is out of the money and the put’s intrinsic value (X-S) is 0. Note that the put still has time value however equal to $0. 45 * 100 = $45. Notice that the closer to the money option has much higher open interest

Example January AMR options quote AMR Underlying stock price $8. 79 Call Expiration May Jan Put STRIKE 6. 00 LAST 3. 30 VOLUME 12 OPEN INTEREST 578 7. 50 1. 30 60 17062 LAST 0. 45 VOLUME 20 OPEN INTEREST 4175 0. 15 138 58909 The May call is in the money and the call premium is $3. 30 * 100 = $330. The intrinsic value of the call (S-X) is ($8. 79 - $6. 00) * 100 = $279. The time value of the call is $330 - $279 = $51. An investor would not exercise this call because that would be throwing away the $51 time value. The May put is out of the money and the put’s intrinsic value (X-S) is 0. Note that the put still has time value however equal to $0. 45 * 100 = $45. Notice that the closer to the money option has much higher open interest

Example: Stock Index to hedge stock portfolio Portfolio: $2. 15 million S&P 500 currently 1, 075. 0 Expects a decline Long put option on index Multiplier 500 Option price: 1, 075 * 500 = $537, 000 Buy: 2. 15/0. 537 = 4 put options S&P dropped 15% to 913. 75, portfolio now $1, 827, 500, loss $322, 500 Offset loss through option: intrinsic value (1, 075913. 75)*500*4=$322, 500

Example: Stock Index to hedge stock portfolio Portfolio: $2. 15 million S&P 500 currently 1, 075. 0 Expects a decline Long put option on index Multiplier 500 Option price: 1, 075 * 500 = $537, 000 Buy: 2. 15/0. 537 = 4 put options S&P dropped 15% to 913. 75, portfolio now $1, 827, 500, loss $322, 500 Offset loss through option: intrinsic value (1, 075913. 75)*500*4=$322, 500

Options exist on futures contracts as well. Options on futures are popular The futures contract is typically more liquid than the underlying spot and more information about supply and demand for futures may be available than can be easily found for the underlying commodity or security. The Philadelphia Options Exchange offers several popular currency options contracts. Options are available for the Euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

Options exist on futures contracts as well. Options on futures are popular The futures contract is typically more liquid than the underlying spot and more information about supply and demand for futures may be available than can be easily found for the underlying commodity or security. The Philadelphia Options Exchange offers several popular currency options contracts. Options are available for the Euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc.

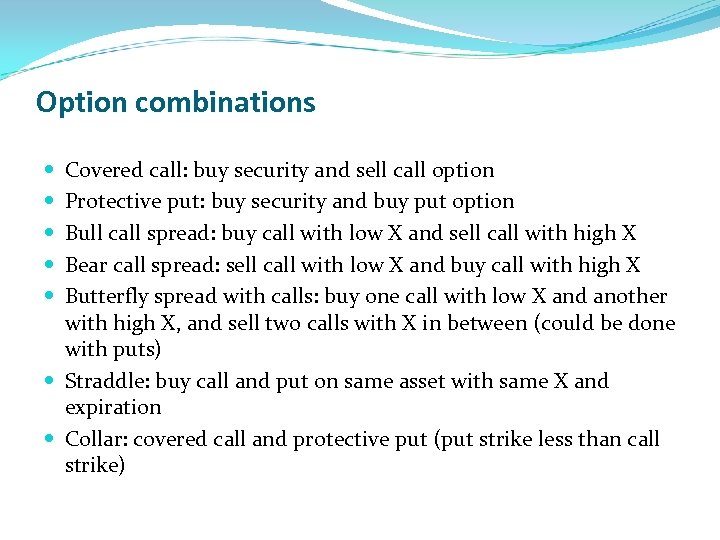

Options Market Activity, 1992 -2004 (in thousands)

Options Market Activity, 1992 -2004 (in thousands)

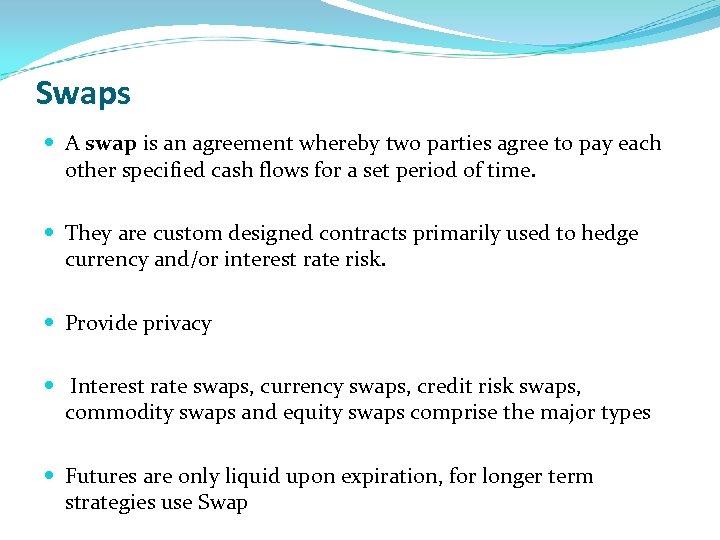

Option combinations Covered call: buy security and sell call option Protective put: buy security and buy put option Bull call spread: buy call with low X and sell call with high X Bear call spread: sell call with low X and buy call with high X Butterfly spread with calls: buy one call with low X and another with high X, and sell two calls with X in between (could be done with puts) Straddle: buy call and put on same asset with same X and expiration Collar: covered call and protective put (put strike less than call strike)

Option combinations Covered call: buy security and sell call option Protective put: buy security and buy put option Bull call spread: buy call with low X and sell call with high X Bear call spread: sell call with low X and buy call with high X Butterfly spread with calls: buy one call with low X and another with high X, and sell two calls with X in between (could be done with puts) Straddle: buy call and put on same asset with same X and expiration Collar: covered call and protective put (put strike less than call strike)

Regulation of Futures and Options Markets The Commodity Futures Trade Commission (CFTC) The Securities Exchange Commission (SEC) Neither party directly regulates OTC derivatives.

Regulation of Futures and Options Markets The Commodity Futures Trade Commission (CFTC) The Securities Exchange Commission (SEC) Neither party directly regulates OTC derivatives.

Swaps A swap is an agreement whereby two parties agree to pay each other specified cash flows for a set period of time. They are custom designed contracts primarily used to hedge currency and/or interest rate risk. Provide privacy Interest rate swaps, currency swaps, credit risk swaps, commodity swaps and equity swaps comprise the major types Futures are only liquid upon expiration, for longer term strategies use Swap

Swaps A swap is an agreement whereby two parties agree to pay each other specified cash flows for a set period of time. They are custom designed contracts primarily used to hedge currency and/or interest rate risk. Provide privacy Interest rate swaps, currency swaps, credit risk swaps, commodity swaps and equity swaps comprise the major types Futures are only liquid upon expiration, for longer term strategies use Swap

Interest Rate Swaps: plain vanilla interest rate swap Swap maturities swap buyer, swap seller. notional principal

Interest Rate Swaps: plain vanilla interest rate swap Swap maturities swap buyer, swap seller. notional principal

An institution that has too many rate sensitive liabilities relative to its holdings of rate sensitive assets. . . Credit risk exposure on a swap

An institution that has too many rate sensitive liabilities relative to its holdings of rate sensitive assets. . . Credit risk exposure on a swap

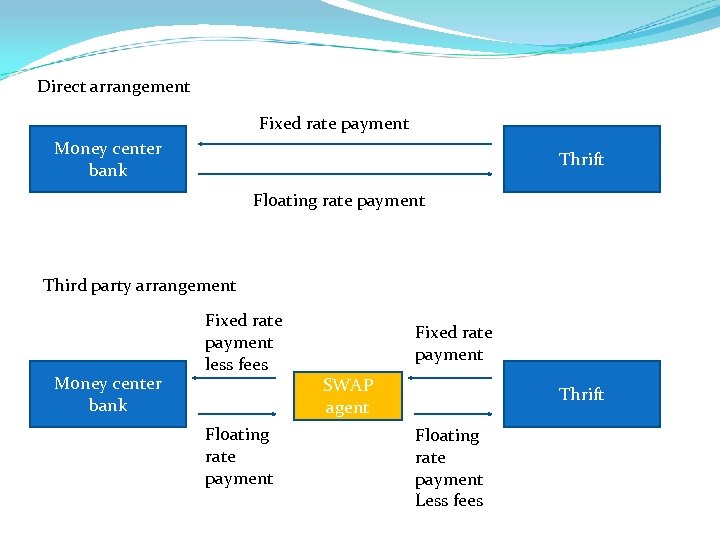

Direct arrangement Fixed rate payment Money center bank Thrift Floating rate payment Third party arrangement Money center bank Fixed rate payment less fees Floating rate payment Fixed rate payment SWAP agent Thrift Floating rate payment Less fees

Direct arrangement Fixed rate payment Money center bank Thrift Floating rate payment Third party arrangement Money center bank Fixed rate payment less fees Floating rate payment Fixed rate payment SWAP agent Thrift Floating rate payment Less fees

Currency Swaps: Currency swaps may be used to hedge mismatches in the currency of a FI’s assets and liabilities or other commitments Fixed for fixed currency swaps Fixed for floating currency swaps

Currency Swaps: Currency swaps may be used to hedge mismatches in the currency of a FI’s assets and liabilities or other commitments Fixed for fixed currency swaps Fixed for floating currency swaps

Example U. S. firm might have a British subsidiary that is earning pounds. Suppose the subsidiary is not well known and cannot procure pound financing at an acceptable cost, so the parent arranges variable rate dollar loans. The U. S. parent is now at risk if the pound declines because a depreciating pound will make repaying the dollar loans more expensive. Moreover, the loans are variable rate and cannot be fully hedged with forward contracts because of the changing outflow amounts. The parent may arrange a swap with a counterparty where the British subsidiary agrees to pay a fixed rate of interest (and principle when due) in pound sterling in exchange for receiving a dollar denominated variable rate of interest (and principle).

Example U. S. firm might have a British subsidiary that is earning pounds. Suppose the subsidiary is not well known and cannot procure pound financing at an acceptable cost, so the parent arranges variable rate dollar loans. The U. S. parent is now at risk if the pound declines because a depreciating pound will make repaying the dollar loans more expensive. Moreover, the loans are variable rate and cannot be fully hedged with forward contracts because of the changing outflow amounts. The parent may arrange a swap with a counterparty where the British subsidiary agrees to pay a fixed rate of interest (and principle when due) in pound sterling in exchange for receiving a dollar denominated variable rate of interest (and principle).

Swap Markets: Swap dealers greatly facilitate the market for swaps. Swap dealers usually guarantee payments on both sides of the swap (for a fee), min cost of finding counterparty Dealers book their own swaps and keep a ‘swap book’ to facilitate management of their net payment obligations. Swap brokers

Swap Markets: Swap dealers greatly facilitate the market for swaps. Swap dealers usually guarantee payments on both sides of the swap (for a fee), min cost of finding counterparty Dealers book their own swaps and keep a ‘swap book’ to facilitate management of their net payment obligations. Swap brokers

Swap Markets: Regulators have worried that the swap market is largely unregulated and some of the specific terms of swap agreements may not be publicly available. Since the swap market involves U. S. banks, swap market activities are indirectly regulated through the normal bank regulatory process. The Basle accord also specifies capital requirements to offset the risks associated with swaps ISDA: codes and standards, spokesgroup for regulatory issues, promotes dev of risk mgmt practices for SWAP dealers

Swap Markets: Regulators have worried that the swap market is largely unregulated and some of the specific terms of swap agreements may not be publicly available. Since the swap market involves U. S. banks, swap market activities are indirectly regulated through the normal bank regulatory process. The Basle accord also specifies capital requirements to offset the risks associated with swaps ISDA: codes and standards, spokesgroup for regulatory issues, promotes dev of risk mgmt practices for SWAP dealers

Caps, Floors and Collars Caps, floors and collars are options on interest rates. The majority of these contracts have between 1 and 5 years, although some have longer expirations. Cap: A cap is an OTC call option on interest rates. Floor: A floor is an OTC put option on interest rates. Collar: A collar is a simultaneous position in a cap and a floor.

Caps, Floors and Collars Caps, floors and collars are options on interest rates. The majority of these contracts have between 1 and 5 years, although some have longer expirations. Cap: A cap is an OTC call option on interest rates. Floor: A floor is an OTC put option on interest rates. Collar: A collar is a simultaneous position in a cap and a floor.

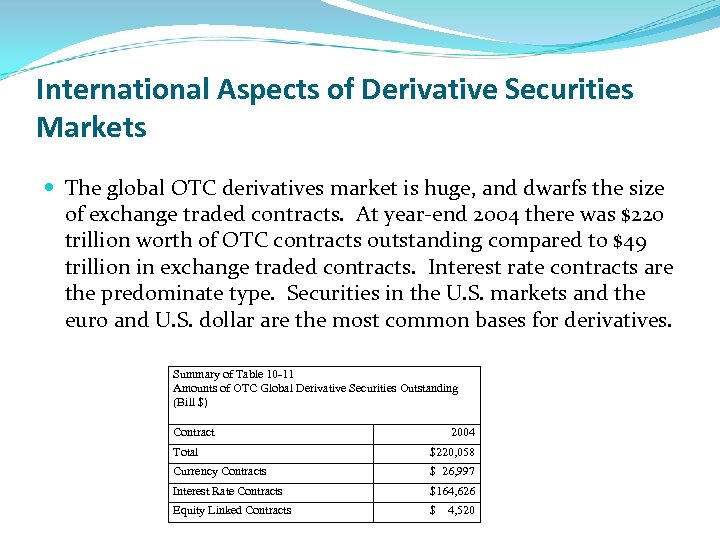

International Aspects of Derivative Securities Markets The global OTC derivatives market is huge, and dwarfs the size of exchange traded contracts. At year-end 2004 there was $220 trillion worth of OTC contracts outstanding compared to $49 trillion in exchange traded contracts. Interest rate contracts are the predominate type. Securities in the U. S. markets and the euro and U. S. dollar are the most common bases for derivatives. Summary of Table 10 -11 Amounts of OTC Global Derivative Securities Outstanding (Bill $) Contract 2004 Total $220, 058 Currency Contracts $ 26, 997 Interest Rate Contracts $164, 626 Equity Linked Contracts $ 4, 520

International Aspects of Derivative Securities Markets The global OTC derivatives market is huge, and dwarfs the size of exchange traded contracts. At year-end 2004 there was $220 trillion worth of OTC contracts outstanding compared to $49 trillion in exchange traded contracts. Interest rate contracts are the predominate type. Securities in the U. S. markets and the euro and U. S. dollar are the most common bases for derivatives. Summary of Table 10 -11 Amounts of OTC Global Derivative Securities Outstanding (Bill $) Contract 2004 Total $220, 058 Currency Contracts $ 26, 997 Interest Rate Contracts $164, 626 Equity Linked Contracts $ 4, 520