2bfa7f9df13744b43ed2905319a14f38.ppt

- Количество слайдов: 18

Chapter 10 Corporate Development: Building and Restructuring the Corporation Strategic Management An Integrated Approach Charles W. L. Hill Gareth R. Jones Power. Point Presentation by Charlie Cook Fifth Edition

Reviewing the Corporate Portfolio Planning under the Boston Consulting Group (BCG) matrix: v Identifying the Strategic Business Units (SBUs) by business area or product market v Assessing each SBU’s prospects (using relative market share and industry growth rate) relative to other SBUs in the portfolio. v Developing strategic objectives for each SBU. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 2

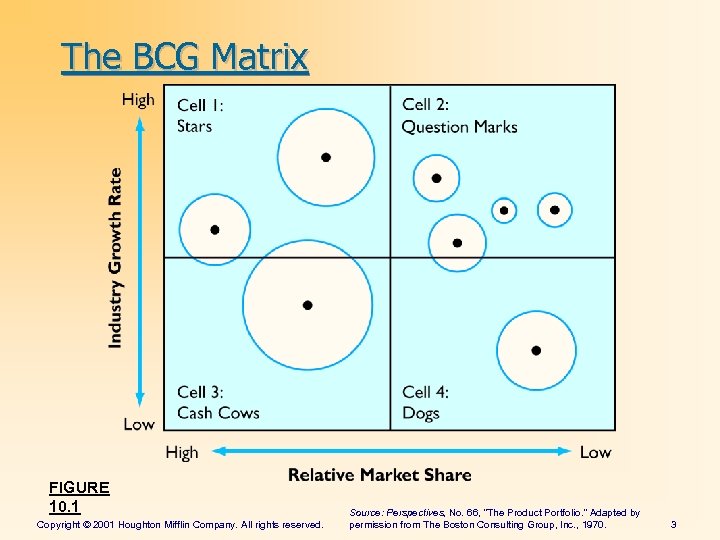

The BCG Matrix FIGURE 10. 1 Copyright © 2001 Houghton Mifflin Company. All rights reserved. Source: Perspectives, No. 66, “The Product Portfolio. ” Adapted by permission from The Boston Consulting Group, Inc. , 1970. 3

The BCG Matrix Stars v High relative market shares in fast growing industries. Question marks v Low relative market shares in fast growing industries. Cash cows v High relative market shares in low-growth industries. Dogs Copyright © 2001 Houghton Mifflin Company. All rights reserved. 4

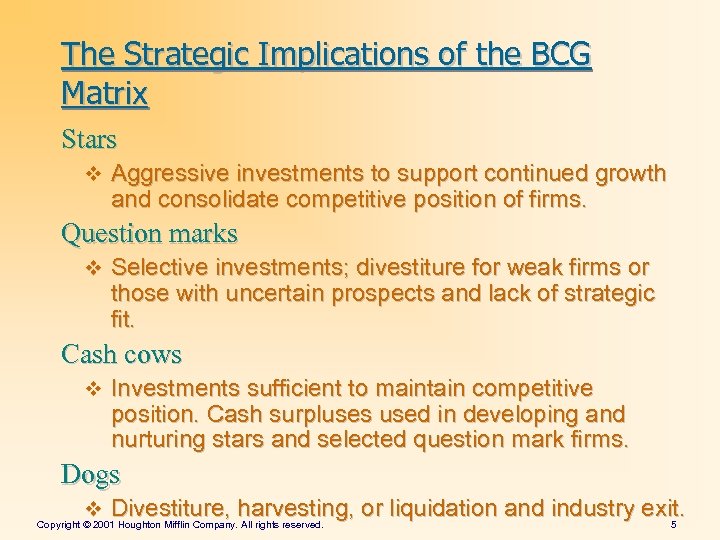

The Strategic Implications of the BCG Matrix Stars v Aggressive investments to support continued growth and consolidate competitive position of firms. Question marks v Selective investments; divestiture for weak firms or those with uncertain prospects and lack of strategic fit. Cash cows v Investments sufficient to maintain competitive position. Cash surpluses used in developing and nurturing stars and selected question mark firms. Dogs v Divestiture, harvesting, or liquidation and industry exit. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 5

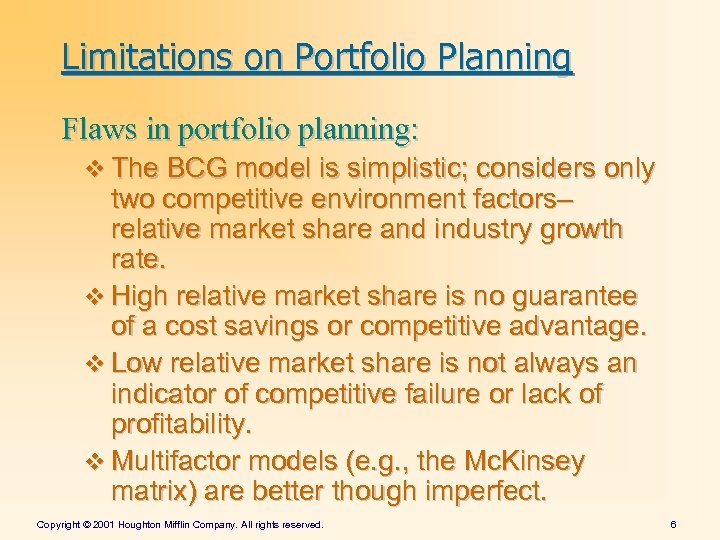

Limitations on Portfolio Planning Flaws in portfolio planning: v The BCG model is simplistic; considers only two competitive environment factors– relative market share and industry growth rate. v High relative market share is no guarantee of a cost savings or competitive advantage. v Low relative market share is not always an indicator of competitive failure or lack of profitability. v Multifactor models (e. g. , the Mc. Kinsey matrix) are better though imperfect. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 6

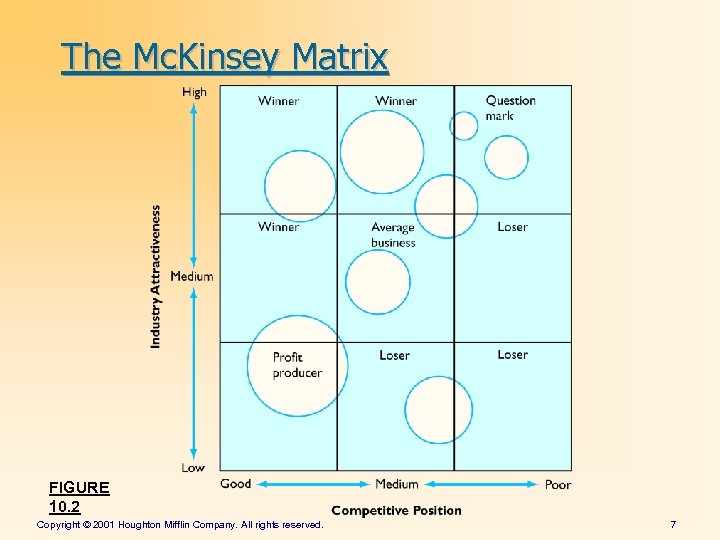

The Mc. Kinsey Matrix FIGURE 10. 2 Copyright © 2001 Houghton Mifflin Company. All rights reserved. 7

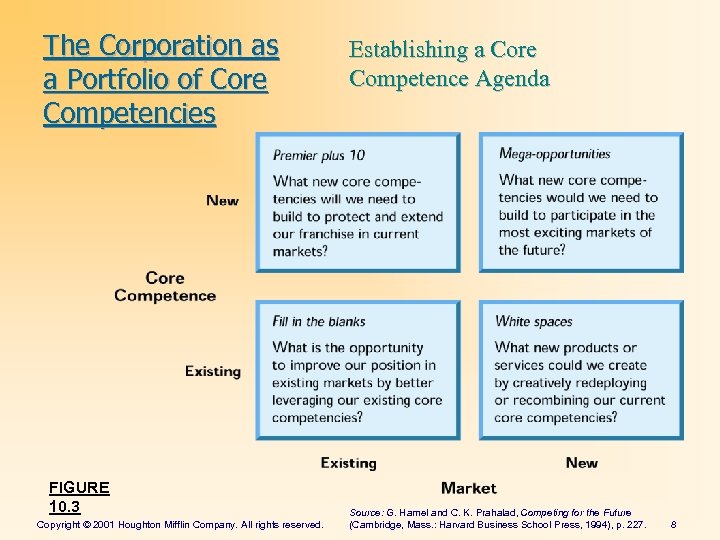

The Corporation as a Portfolio of Core Competencies FIGURE 10. 3 Copyright © 2001 Houghton Mifflin Company. All rights reserved. Establishing a Core Competence Agenda Source: G. Hamel and C. K. Prahalad, Competing for the Future (Cambridge, Mass. : Harvard Business School Press, 1994), p. 227. 8

Internal New Venturing Internal new venturing is attractive when: v Entering as a science-based company. v Entering an emerging industry with no established competitors. Pitfalls of new venturing: v Scale of entry– Low-scale entry can reduce the v v probability of long-term success. Commercialization– Failure to develop a product that meets basic customer needs. Poor Implementation– Using “shotgun” approach, not setting clear strategic objectives, abandoning projects too soon. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 9

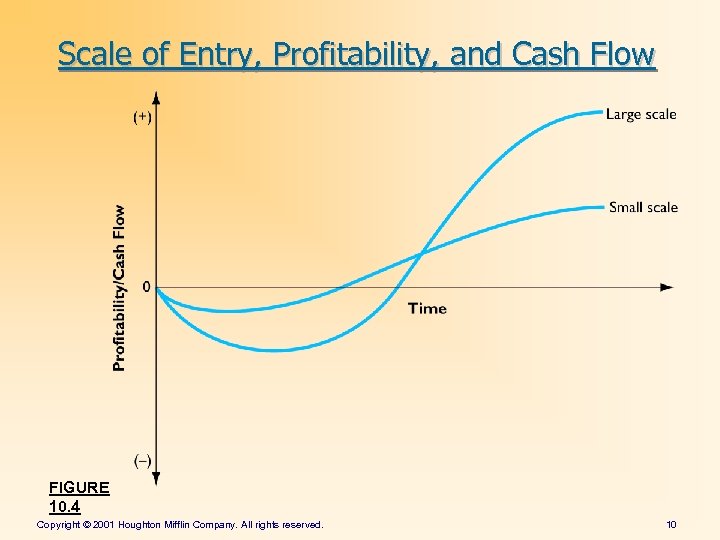

Scale of Entry, Profitability, and Cash Flow FIGURE 10. 4 Copyright © 2001 Houghton Mifflin Company. All rights reserved. 10

Internal New Venturing Guidelines for successful new venturing: v Adopt a structural approach with clear strategic objectives setting R&D direction. v Foster close links between R&D and marketing. v Use project teams to reduce development time. v Use a selection process to pick venture projects with the highest probability of success. v Monitor progress of ventures in gaining initial market share goals. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 11

Acquisitions as an Entry Strategy Acquisition is an attractive strategy when: v Competencies important in a new business area are lacking in the entering firm. v Speed of entry is considered important. v Acquisition is perceived as a less risky form of entry. v Barriers to entry can be overcome by acquisition of a firm in the industry targeted for entry. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 12

Acquisitions as an Entry Strategy Pitfalls of acquisitions: v Failing to follow through on postacquisition integration of the acquired firm. v Overestimating the economic benefits of the acquisition. v Underestimating the expense of an acquisition. v Failing to properly screen candidates before acquisition. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 13

Acquisitions as an Entry Strategy Guidelines for successful acquisitions: v Properly identify acquisition targets and conduct a thorough preacquisition screening of the target firm. v Use a bidding strategy with proper timing to avoid overpaying for an acquisition. v Follow through on postacquisition integration synergy-producing activities of the acquired firm. v Dispose of unwanted residual acquisition assets. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 14

Joint Ventures as an Entry Strategy Attractions v Sharing new project costs and risks. v Increasing the probability of success in establishing the new business. Drawbacks v Requires a sharing of control with partner firms. v Requires that partner firms share profits. v Risks giving away critical knowledge. v Risks creating a potential competitor. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 15

Restructuring Why restructure? v Pull-back from overdiversification. v Attacks by competitors on core businesses. v Diminished strategic advantages of vertical integration and diversification. Exit strategies v Divestment– spinoffs of profitable SBUs to investors; management buy outs (MBOs). v Harvest– halting investment, maximizing cash flow. v Liquidation– Cease operations, write off assets. Copyright © 2001 Houghton Mifflin Company. All rights reserved. 16

Turnaround Strategy The causes of corporate decline v Poor management– incompetence, neglect v Overexpansion– empire-building CEO’s v Inadequate financial controls– no profit responsibility v High costs– low labor productivity v New competition– powerful emerging competitors v Unforeseen demand shifts– major market changes v Organizational inertia– slow to respond to Copyright © 2001 Houghton Mifflin Company. All rights reserved. 17

The Main Steps of Turnaround Changing the leadership v Replace entrenched management with new managers. Redefining strategic focus v Evaluate and reconstitute the organization’s strategy. Asset sales and closures v Divest unwanted assets for investment resources. Improving profitability v Reduce costs, tighten finance and performance controls. Acquisitions v Make acquisitions of skills and competencies to Copyright © 2001 Houghton Mifflin Company. All rights reserved. 18

2bfa7f9df13744b43ed2905319a14f38.ppt