9babf367b729743743035e79150b122c.ppt

- Количество слайдов: 48

Chapter 10 Capital Investment Decisions Prof. Liu Bin (Ph. D) Dalian Maritime University Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Key Skills • 1. determine the relevant cash flows for various types of proposed investments • 2. compute depreciation expense for tax purposes • 3. various methods for computing operating cash flow 10 -1

Key Concept • 1. Sunk costs – costs that have accrued in the past • 2. Opportunity costs – costs of lost options • 3. Side effects • Positive side effects – benefits to other projects • Negative side effects – costs to other projects • 4. Changes in net working capital • 5. Financing costs • 6. Taxes 10 -2

Key Expressions 7. Sale price: product price sold to by seller to buyer. 8. Depreciation: 9. Tax on sale: 10. Net working capital 11. Terminal cash flow 12. Cash flow after tax 13. MACRS: modified accelerated cost recovery system 14. Installed cost 15. Accumulated depreciation 16. Book value 10 -3

Key Words 17. capital gain 18. Recaptured depreciation 19. After tax proceeds from sale of old 20. Proceeds from sale of old equipment 10 -4

Chapter Outline • 1. Pro Forma Financial Statements and • Project Cash Flows • Project Cash Inflow and cash outflow • 2. Project Incremental Cash Flows • 3. Definitions of Operating Cash Flow • 4. Some Special Cases of Cash Flow Analysis 10 -5

Relevant Cash Flows • The cash flows that should be included in a capital budgeting analysis are those that will only occur if the project is accepted • These cash flows are called incremental cash flows • The stand-alone principle allows us to analyze each project in isolation from the firm simply by focusing on incremental cash flows 10 -6

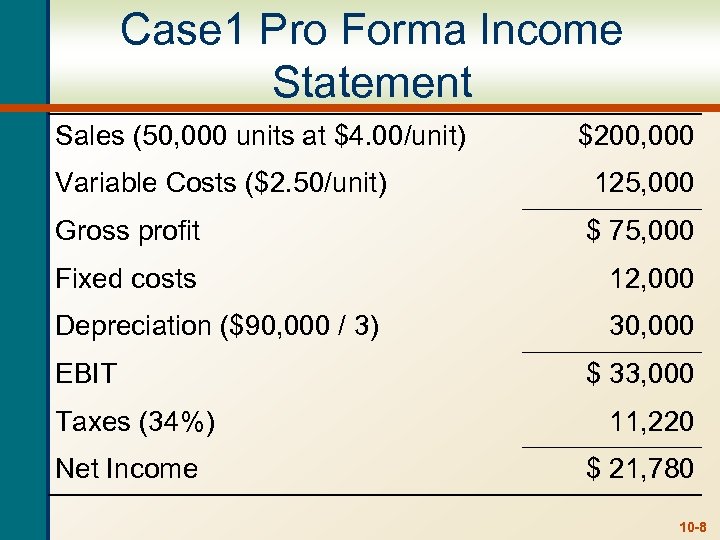

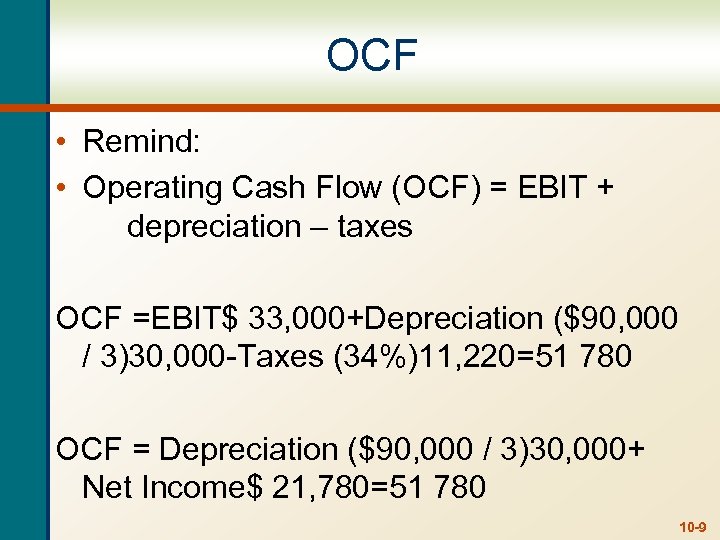

Pro Forma Statements and Cash Flow • Capital budgeting relies heavily on pro forma accounting statements, particularly income statements • Computing cash flows – refresher 1. Operating Cash Flow (OCF) = EBIT + depreciation – taxes 2. OCF = Net income + depreciation when there is no interest expense 3. Cash Flow From Assets (CFFA) = OCF – net capital spending (NCS) – changes in NWC 10 -7

Case 1 Pro Forma Income Statement Sales (50, 000 units at $4. 00/unit) $200, 000 Variable Costs ($2. 50/unit) 125, 000 Gross profit $ 75, 000 Fixed costs 12, 000 Depreciation ($90, 000 / 3) 30, 000 EBIT Taxes (34%) Net Income $ 33, 000 11, 220 $ 21, 780 10 -8

OCF • Remind: • Operating Cash Flow (OCF) = EBIT + depreciation – taxes OCF =EBIT$ 33, 000+Depreciation ($90, 000 / 3)30, 000 -Taxes (34%)11, 220=51 780 OCF = Depreciation ($90, 000 / 3)30, 000+ Net Income$ 21, 780=51 780 10 -9

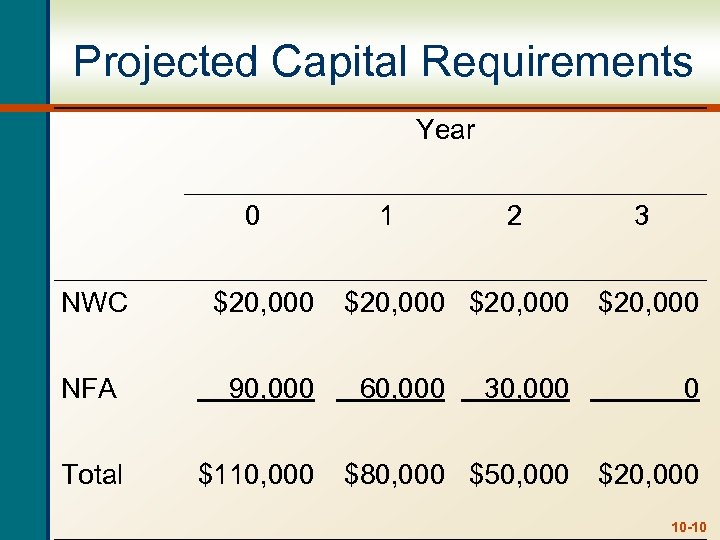

Projected Capital Requirements Year 0 NWC $20, 000 1 2 $20, 000 3 $20, 000 NFA 90, 000 60, 000 30, 000 0 Total $110, 000 $80, 000 $50, 000 $20, 000 10 -10

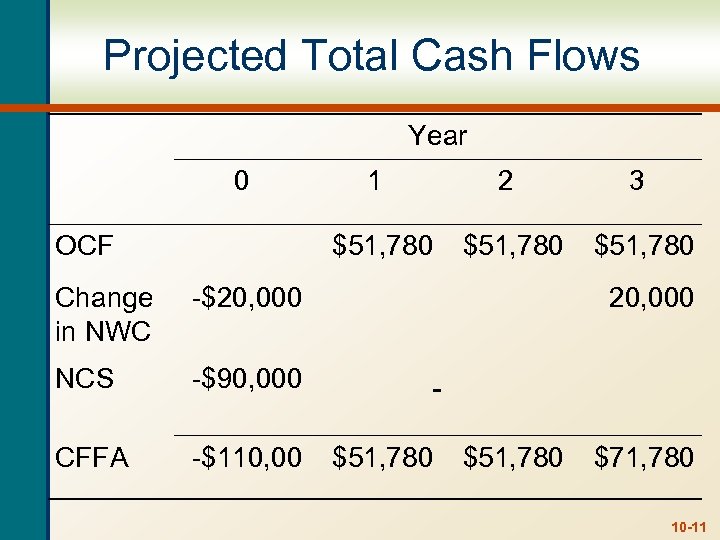

Projected Total Cash Flows Year 0 Change in NWC -$110, 00 $51, 780 -$90, 000 CFFA 3 -$20, 000 NCS 2 $51, 780 OCF 1 20, 000 $51, 780 $71, 780 10 -11

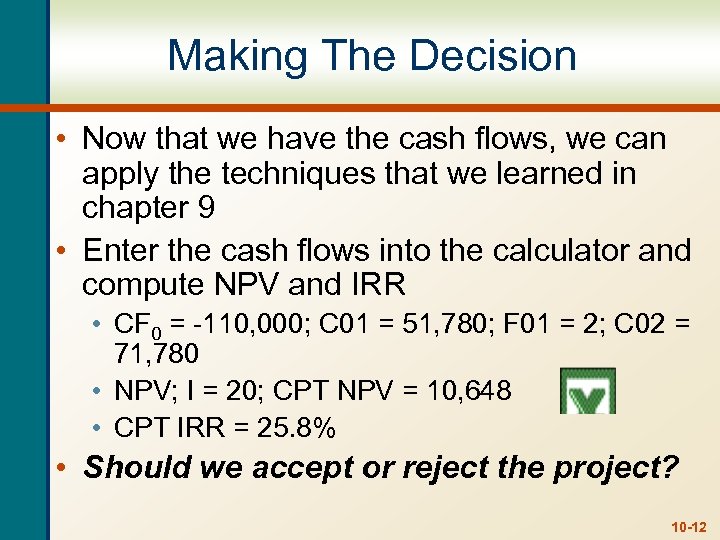

Making The Decision • Now that we have the cash flows, we can apply the techniques that we learned in chapter 9 • Enter the cash flows into the calculator and compute NPV and IRR • CF 0 = -110, 000; C 01 = 51, 780; F 01 = 2; C 02 = 71, 780 • NPV; I = 20; CPT NPV = 10, 648 • CPT IRR = 25. 8% • Should we accept or reject the project? 10 -12

More on NWC • Why do we have to consider changes in NWC separately? • GAAP requires that sales be recorded on the income statement when made, not when cash is received • GAAP also requires that we record cost of goods sold when the corresponding sales are made, whether we have actually paid our suppliers yet • Finally, we have to buy inventory to support sales although we haven’t collected cash yet 10 -13

Depreciation • The depreciation expense used for capital budgeting should be the depreciation schedule required by the IRS for tax purposes • Depreciation itself is a non-cash expense; consequently, it is only relevant because it affects taxes • Depreciation tax shield = DT • D = depreciation expense • T = marginal tax rate 10 -14

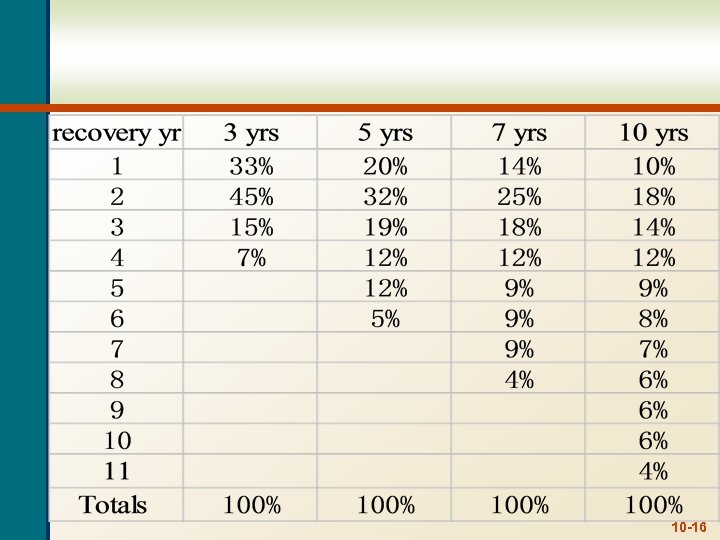

Computing Depreciation • Straight-line depreciation • D = (Initial cost – salvage) / number of years • Very few assets are depreciated straight-line for tax purposes • MACRS • Need to know which asset class is appropriate for tax purposes • Multiply percentage given in table by the initial cost • Depreciate to zero • Mid-year convention 10 -15

10 -16

After-tax Salvage • If the salvage value is different from the book value of the asset, then there is a tax effect • Book value = initial cost – accumulated depreciation • After-tax salvage = salvage – T(salvage – book value) 10 -17

Example 1: Depreciation and After -tax Salvage • You purchase equipment for $100, 000 and it costs $10, 000 to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $17, 000 when you are done with it in 6 years. The company’s marginal tax rate is 40%. What is the depreciation expense each year and the after-tax salvage in year 6 for each of the following situations? 10 -18

Example 1: Straight-line Depreciation • Suppose the appropriate depreciation schedule is straight-line • D = (110, 000 – 17, 000) / 6 = 15, 500 every year for 6 years • BV in year 6 = 110, 000 – 6(15, 500) = 17, 000 • After-tax salvage = 17, 000 -. 4(17, 000 – 17, 000) = 17, 000 10 -19

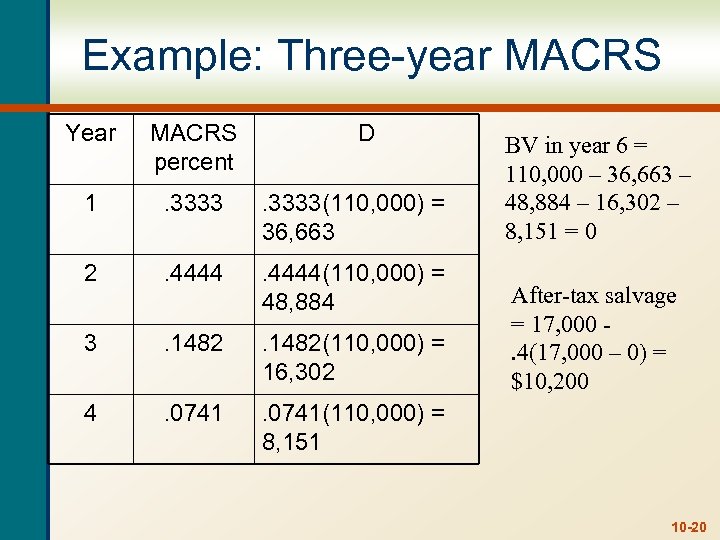

Example: Three-year MACRS Year MACRS percent D 1 . 3333(110, 000) = 36, 663 2 . 4444(110, 000) = 48, 884 3 . 1482(110, 000) = 16, 302 4 . 0741(110, 000) = 8, 151 BV in year 6 = 110, 000 – 36, 663 – 48, 884 – 16, 302 – 8, 151 = 0 After-tax salvage = 17, 000. 4(17, 000 – 0) = $10, 200 10 -20

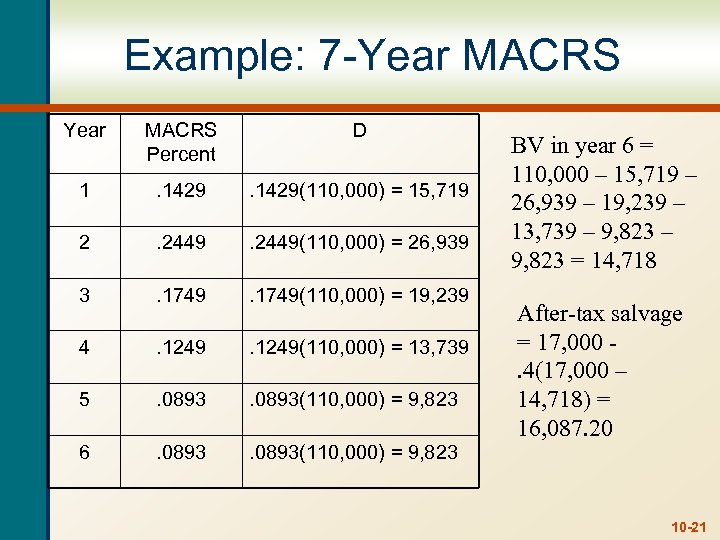

Example: 7 -Year MACRS Percent D 1 . 1429(110, 000) = 15, 719 2 . 2449(110, 000) = 26, 939 3 . 1749(110, 000) = 19, 239 4 . 1249(110, 000) = 13, 739 5 . 0893(110, 000) = 9, 823 6 . 0893(110, 000) = 9, 823 BV in year 6 = 110, 000 – 15, 719 – 26, 939 – 19, 239 – 13, 739 – 9, 823 = 14, 718 After-tax salvage = 17, 000. 4(17, 000 – 14, 718) = 16, 087. 20 10 -21

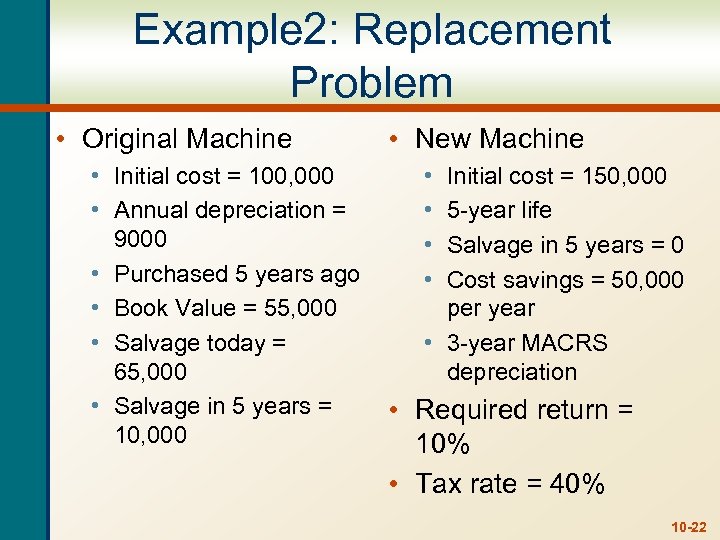

Example 2: Replacement Problem • Original Machine • Initial cost = 100, 000 • Annual depreciation = 9000 • Purchased 5 years ago • Book Value = 55, 000 • Salvage today = 65, 000 • Salvage in 5 years = 10, 000 • New Machine • • Initial cost = 150, 000 5 -year life Salvage in 5 years = 0 Cost savings = 50, 000 per year • 3 -year MACRS depreciation • Required return = 10% • Tax rate = 40% 10 -22

Replacement Problem – Computing Cash Flows • Remember that we are interested in incremental cash flows • If we buy the new machine, then we will sell the old machine • What are the cash flow consequences of selling the old machine today instead of in 5 years? 10 -23

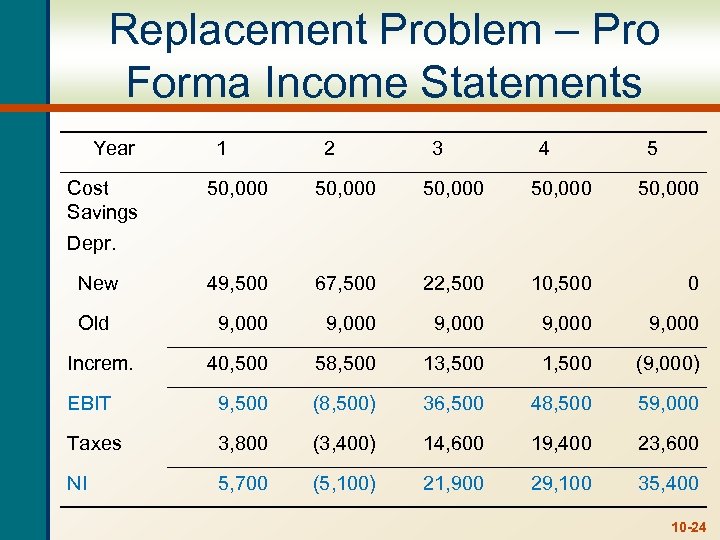

Replacement Problem – Pro Forma Income Statements Year Cost Savings 1 2 3 4 5 50, 000 50, 000 New 49, 500 67, 500 22, 500 10, 500 0 Old 9, 000 9, 000 40, 500 58, 500 13, 500 1, 500 (9, 000) EBIT 9, 500 (8, 500) 36, 500 48, 500 59, 000 Taxes 3, 800 (3, 400) 14, 600 19, 400 23, 600 NI 5, 700 (5, 100) 21, 900 29, 100 35, 400 Depr. Increm. 10 -24

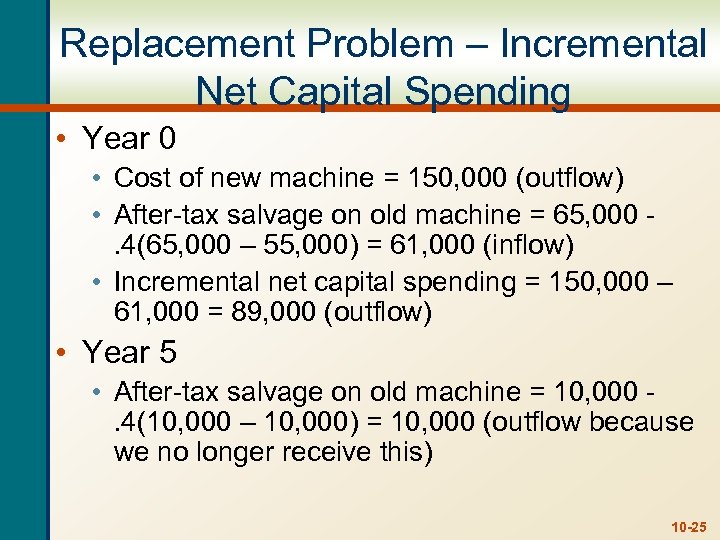

Replacement Problem – Incremental Net Capital Spending • Year 0 • Cost of new machine = 150, 000 (outflow) • After-tax salvage on old machine = 65, 000 - . 4(65, 000 – 55, 000) = 61, 000 (inflow) • Incremental net capital spending = 150, 000 – 61, 000 = 89, 000 (outflow) • Year 5 • After-tax salvage on old machine = 10, 000 - . 4(10, 000 – 10, 000) = 10, 000 (outflow because we no longer receive this) 10 -25

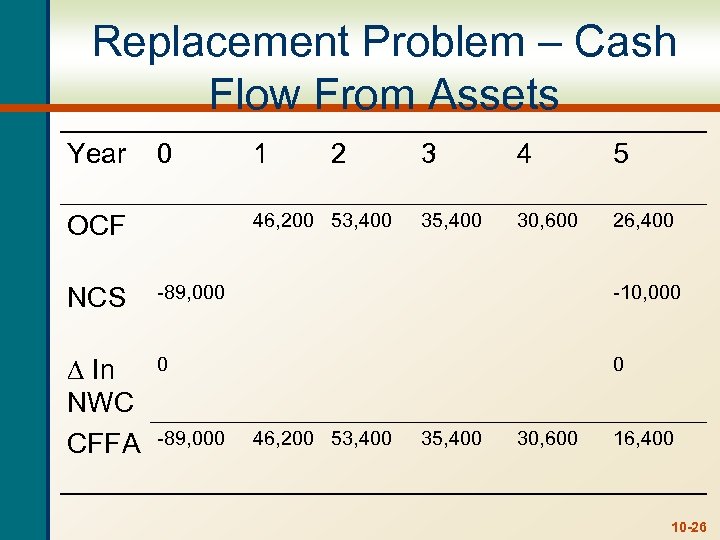

Replacement Problem – Cash Flow From Assets Year 0 1 2 46, 200 53, 400 OCF 3 4 5 35, 400 30, 600 26, 400 NCS -89, 000 -10, 000 In NWC CFFA 0 0 -89, 000 46, 200 53, 400 35, 400 30, 600 16, 400 10 -26

Replacement Problem – Analyzing the Cash Flows • Now that we have the cash flows, we can compute the NPV and IRR • Enter the cash flows • Compute NPV = 54, 812. 10 • Compute IRR = 36. 28% • Should the company replace the equipment? 10 -27

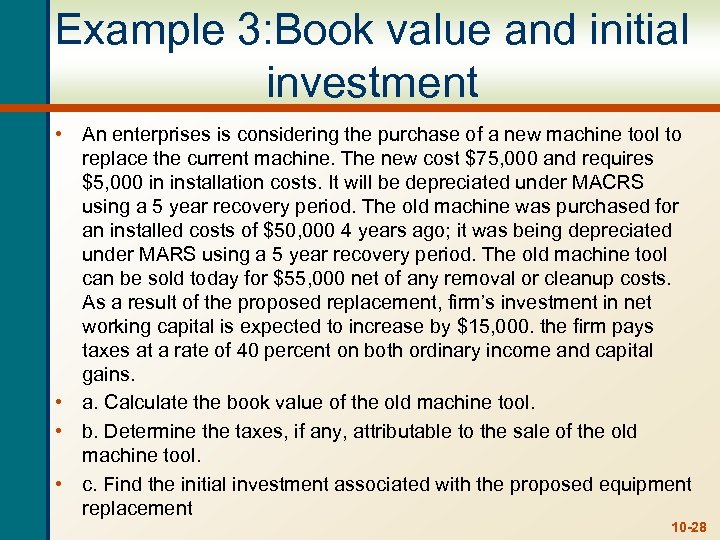

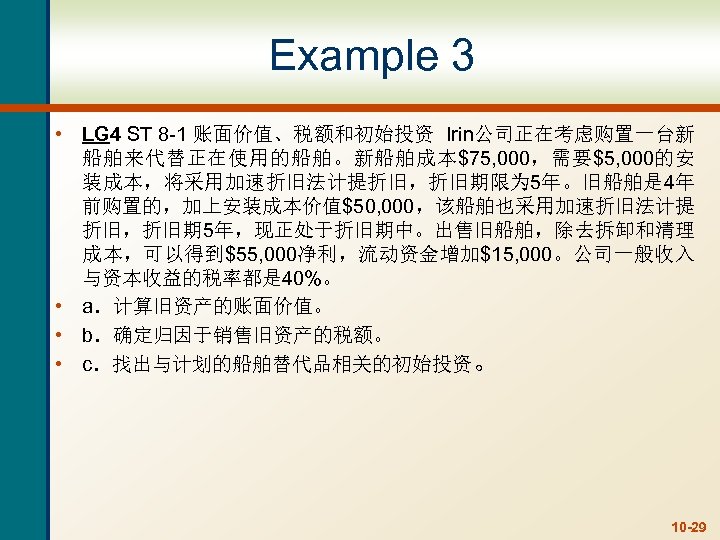

Example 3: Book value and initial investment • An enterprises is considering the purchase of a new machine tool to replace the current machine. The new cost $75, 000 and requires $5, 000 in installation costs. It will be depreciated under MACRS using a 5 year recovery period. The old machine was purchased for an installed costs of $50, 000 4 years ago; it was being depreciated under MARS using a 5 year recovery period. The old machine tool can be sold today for $55, 000 net of any removal or cleanup costs. As a result of the proposed replacement, firm’s investment in net working capital is expected to increase by $15, 000. the firm pays taxes at a rate of 40 percent on both ordinary income and capital gains. • a. Calculate the book value of the old machine tool. • b. Determine the taxes, if any, attributable to the sale of the old machine tool. • c. Find the initial investment associated with the proposed equipment replacement 10 -28

Example 3 • LG 4 ST 8 -1 账面价值、税额和初始投资 Irin公司正在考虑购置一台新 船舶来代替正在使用的船舶。新船舶成本$75, 000,需要$5, 000的安 装成本,将采用加速折旧法计提折旧,折旧期限为 5年。旧船舶是 4年 前购置的,加上安装成本价值$50, 000,该船舶也采用加速折旧法计提 折旧,折旧期 5年,现正处于折旧期中。出售旧船舶,除去拆卸和清理 成本,可以得到$55, 000净利,流动资金增加$15, 000。公司一般收入 与资本收益的税率都是 40%。 • a.计算旧资产的账面价值。 • b.确定归因于销售旧资产的税额。 • c.找出与计划的船舶替代品相关的初始投资。 10 -29

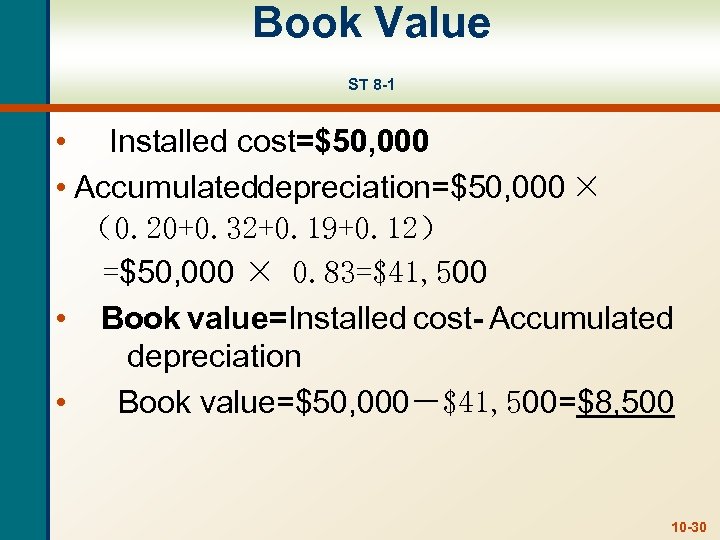

Book Value ST 8 -1 • Installed cost=$50, 000 • Accumulated epreciation=$50, 000 × d (0. 20+0. 32+0. 19+0. 12) =$50, 000 × 0. 83=$41, 500 • Book value=Installed cost- Accumulated depreciation • Book value=$50, 000-$41, 500=$8, 500 10 -30

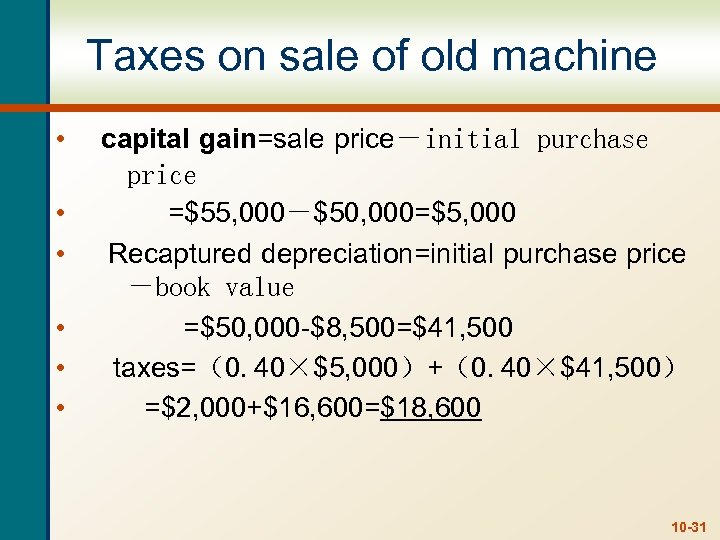

Taxes on sale of old machine • capital gain=sale price-initial purchase price • =$55, 000-$50, 000=$5, 000 • Recaptured depreciation=initial purchase price -book value • =$50, 000 -$8, 500=$41, 500 • taxes=(0. 40×$5, 000)+(0. 40×$41, 500) • =$2, 000+$16, 600=$18, 600 10 -31

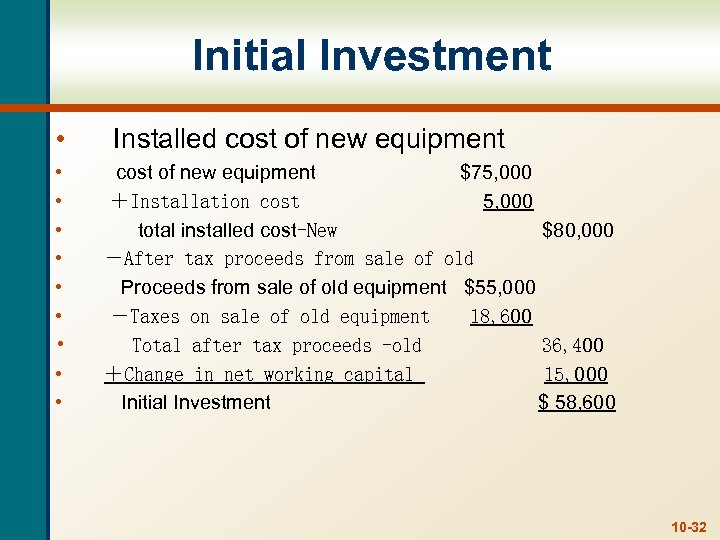

Initial Investment • Installed cost of new equipment • • • cost of new equipment $75, 000 +Installation cost 5, 000 total installed cost-New $80, 000 -After tax proceeds from sale of old Proceeds from sale of old equipment $55, 000 -Taxes on sale of old equipment 18, 600 Total after tax proceeds -old 36, 400 +Change in net working capital 15, 000 Initial Investment $ 58, 600 10 -32

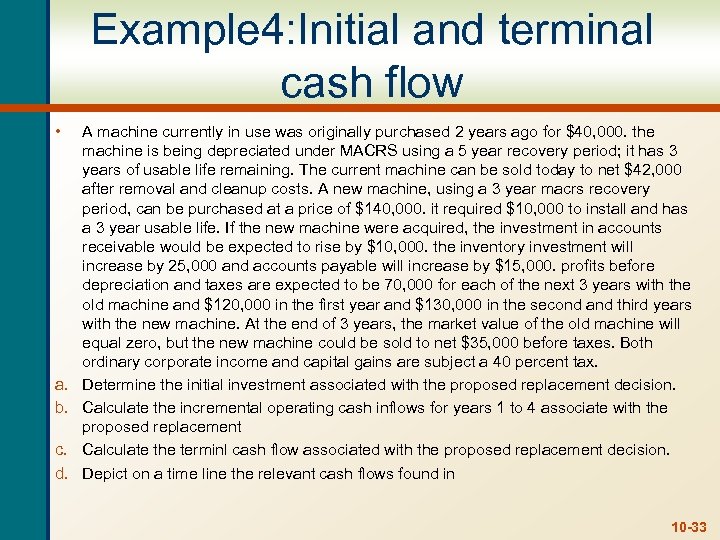

Example 4: Initial and terminal cash flow • a. b. c. d. A machine currently in use was originally purchased 2 years ago for $40, 000. the machine is being depreciated under MACRS using a 5 year recovery period; it has 3 years of usable life remaining. The current machine can be sold today to net $42, 000 after removal and cleanup costs. A new machine, using a 3 year macrs recovery period, can be purchased at a price of $140, 000. it required $10, 000 to install and has a 3 year usable life. If the new machine were acquired, the investment in accounts receivable would be expected to rise by $10, 000. the inventory investment will increase by 25, 000 and accounts payable will increase by $15, 000. profits before depreciation and taxes are expected to be 70, 000 for each of the next 3 years with the old machine and $120, 000 in the first year and $130, 000 in the second and third years with the new machine. At the end of 3 years, the market value of the old machine will equal zero, but the new machine could be sold to net $35, 000 before taxes. Both ordinary corporate income and capital gains are subject a 40 percent tax. Determine the initial investment associated with the proposed replacement decision. Calculate the incremental operating cash inflows for years 1 to 4 associate with the proposed replacement Calculate the terminl cash flow associated with the proposed replacement decision. Depict on a time line the relevant cash flows found in 10 -33

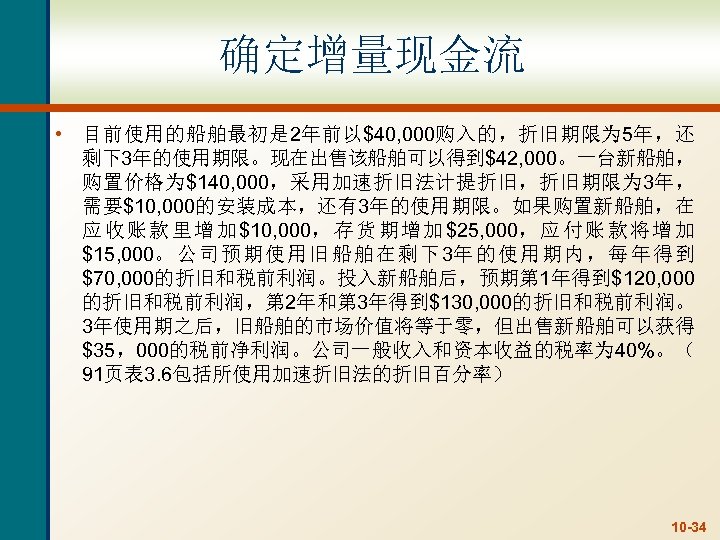

确定增量现金流 • 目前使用的船舶最初是 2年前以$40, 000购入的,折旧期限为 5年,还 剩下3年的使用期限。现在出售该船舶可以得到$42, 000。一台新船舶, 购置价格为$140, 000,采用加速折旧法计提折旧,折旧期限为 3年, 需要$10, 000的安装成本,还有3年的使用期限。如果购置新船舶,在 应 收 账 款 里 增 加 $10, 000, 存 货 期 增 加 $25, 000, 应 付 账 款 将 增 加 $15, 000。 公 司 预 期 使 用 旧 船 舶 在 剩 下 3年 的 使 用 期 内 , 每 年 得 到 $70, 000的折旧和税前利润。投入新船舶后,预期第 1年得到$120, 000 的折旧和税前利润,第 2年和第 3年得到$130, 000的折旧和税前利润。 3年使用期之后,旧船舶的市场价值将等于零,但出售新船舶可以获得 $35,000的税前净利润。公司一般收入和资本收益的税率为 40%。( 91页表 3. 6包括所使用加速折旧法的折旧百分率) 10 -34

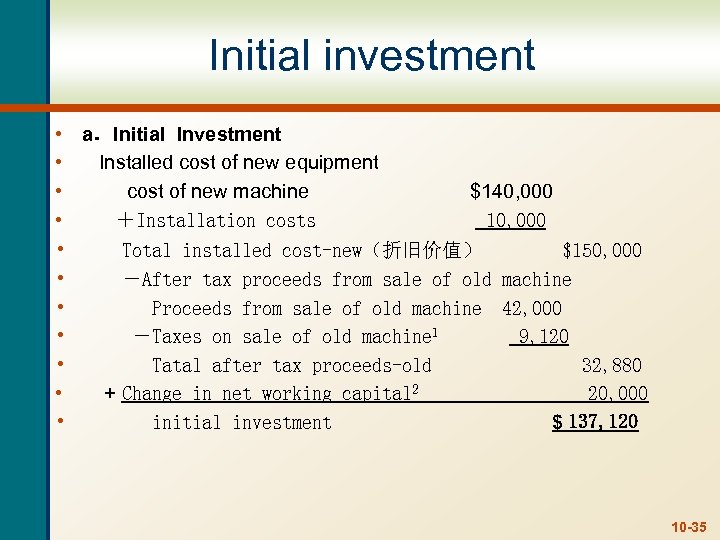

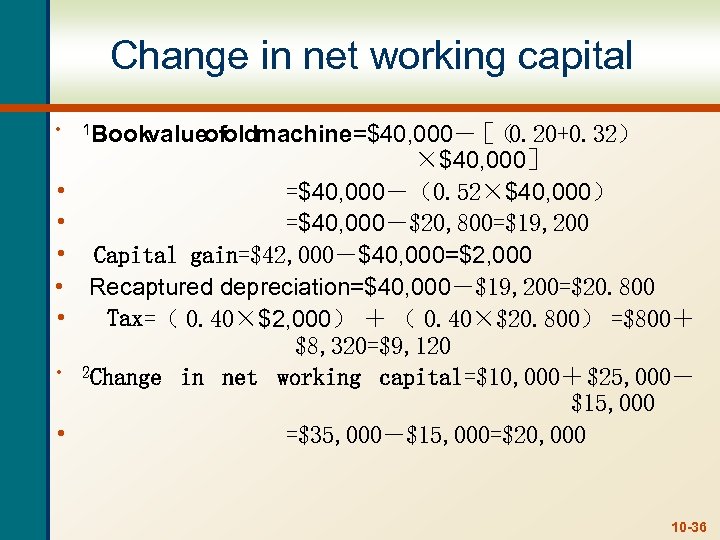

Initial investment • • • a.Initial Investment Installed cost of new equipment cost of new machine $140, 000 +Installation costs 10, 000 Total installed cost-new(折旧价值) $150, 000 -After tax proceeds from sale of old machine Proceeds from sale of old machine 42, 000 -Taxes on sale of old machine 1 9, 120 Tatal after tax proceeds-old 32, 880 + Change in net working capital 2 20, 000 initial investment $ 137, 120 10 -35

Change in net working capital • • 1 Book value old of machine=$40, 000- ( [ 0. 20+0. 32) ×$40, 000] =$40, 000-(0. 52×$40, 000) =$40, 000-$20, 800=$19, 200 Capital gain=$42, 000-$40, 000=$2, 000 Recaptured depreciation=$40, 000-$19, 200=$20. 800 Tax=( 0. 40×$2, 000) + ( 0. 40×$20. 800) =$800+ $8, 320=$9, 120 2 Change in net working capital=$10, 000+ $25, 000- $15, 000 =$35, 000-$15, 000=$20, 000 10 -36

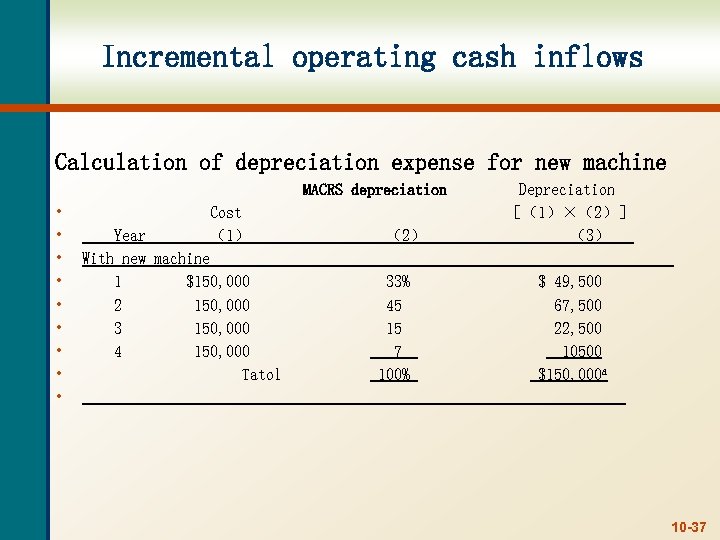

Incremental operating cash inflows Calculation of depreciation expense for new machine MACRS depreciation • • • Cost (1) Year With new machine 1 $150, 000 2 150, 000 3 150, 000 4 150, 000 Tatol (2) 33% 45 15 7 100% Depreciation [(1)×(2)] (3) $ 49, 500 67, 500 22, 500 10500 $150, 000 a 10 -37

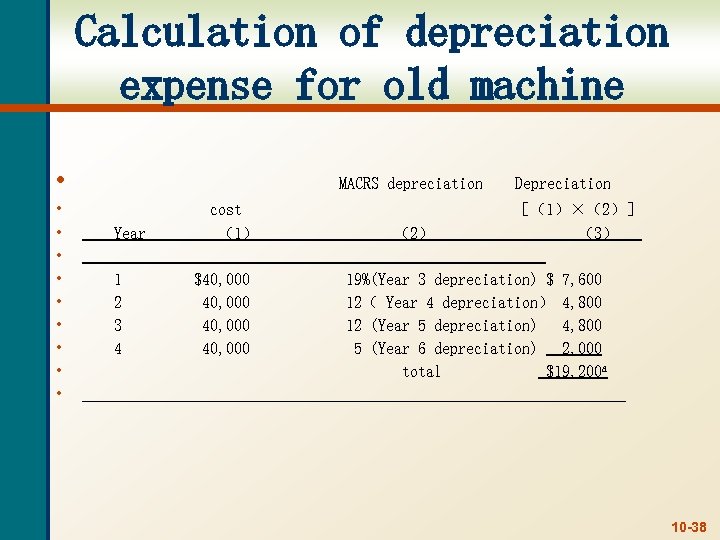

Calculation of depreciation expense for old machine • MACRS depreciation • • • Year 1 2 3 4 cost (1) $40, 000 (2) Depreciation [(1)×(2)] (3) 19%(Year 3 depreciation) $ 7, 600 12( Year 4 depreciation) 4, 800 12 (Year 5 depreciation) 4, 800 5 (Year 6 depreciation) 2, 000 total $19, 200 a 10 -38

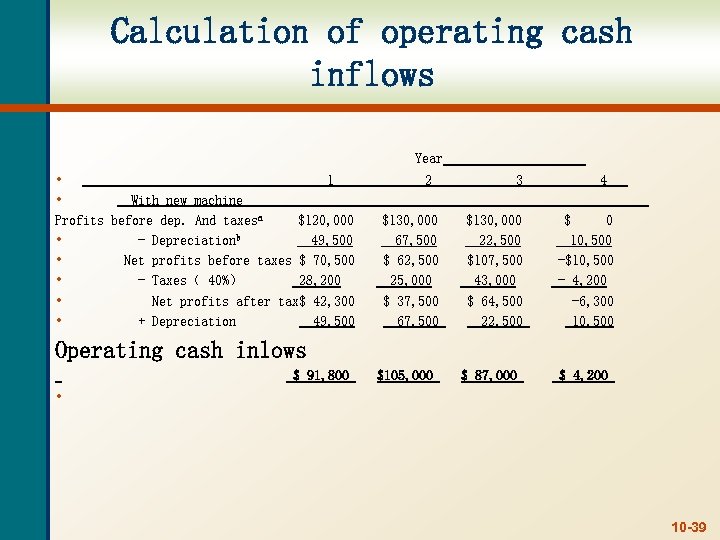

Calculation of operating cash inflows Year • 1 • With new machine Profits before dep. And taxesa $120, 000 • - Depreciationb 49, 500 • Net profits before taxes $ 70, 500 • - Taxes( 40%) 28, 200 • Net profits after tax$ 42, 300 • + Depreciation 49, 500 2 $130, 000 67, 500 $ 62, 500 25, 000 $ 37, 500 67, 500 3 $130, 000 22, 500 $107, 500 43, 000 $ 64, 500 22, 500 4 $ 0 10, 500 -$10, 500 - 4, 200 -6, 300 10, 500 Operating cash inlows $ 91, 800 $105, 000 $ 87, 000 $ 4, 200 • 10 -39

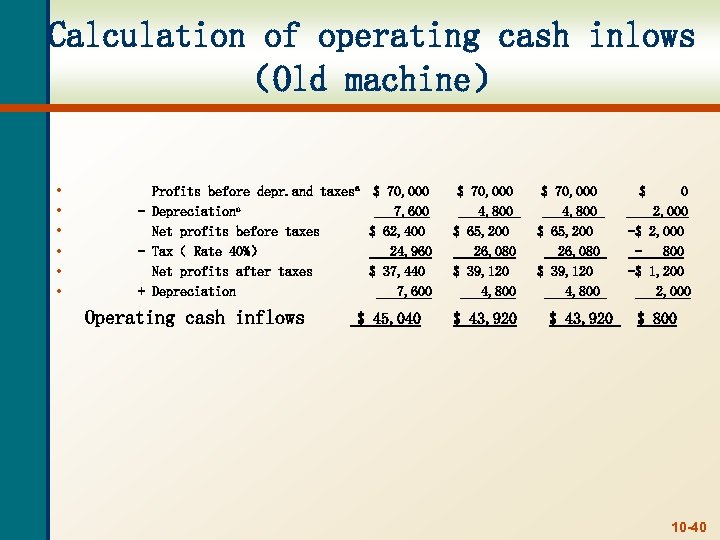

Calculation of operating cash inlows (Old machine) • • • Profits before depr. and taxesa $ 70, 000 - Depreciationc 7, 600 Net profits before taxes $ 62, 400 - Tax( Rate 40%) 24, 960 Net profits after taxes $ 37, 440 + Depreciation 7, 600 Operating cash inflows $ 45, 040 $ 70, 000 4, 800 $ 65, 200 26, 080 $ 39, 120 4, 800 $ 43, 920 $ 0 2, 000 -$ 2, 000 800 -$ 1, 200 2, 000 $ 800 10 -40

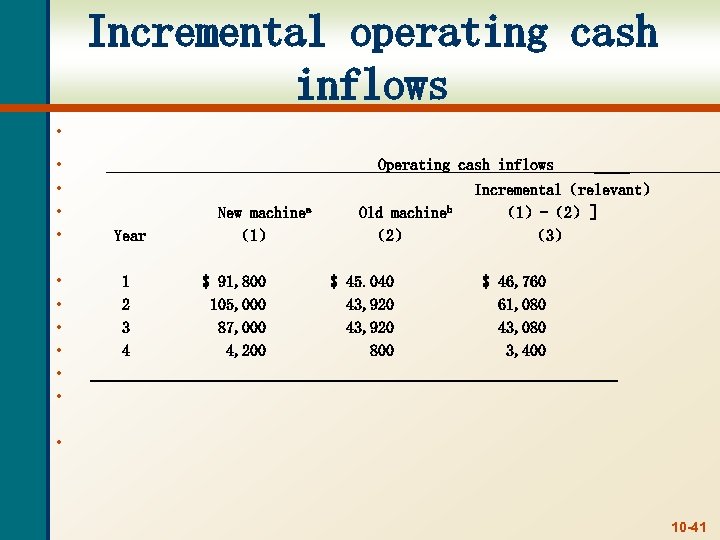

Incremental operating cash inflows • • • Operating cash inflows Year 1 2 3 4 New machinea (1) $ 91, 800 105, 000 87, 000 4, 200 Old machineb (2) $ 45. 040 43, 920 800 Incremental(relevant) (1)-(2)] (3) $ 46, 760 61, 080 43, 080 3, 400 • 10 -41

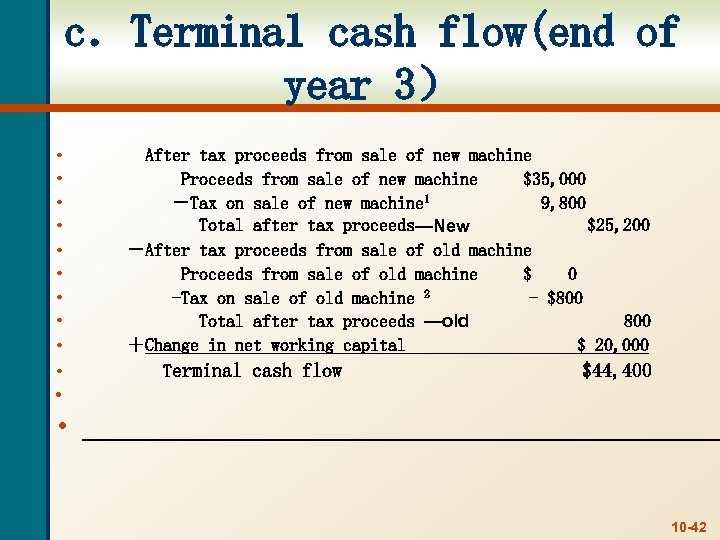

c.Terminal cash flow(end of year 3) • • • After tax proceeds from sale of new machine Proceeds from sale of new machine $35, 000 -Tax on sale of new machine 1 9, 800 Total after tax proceeds—New $25, 200 -After tax proceeds from sale of old machine Proceeds from sale of old machine $ 0 -Tax on sale of old machine 2 - $800 Total after tax proceeds —old 800 +Change in net working capital $ 20, 000 Terminal cash flow $44, 400 • 10 -42

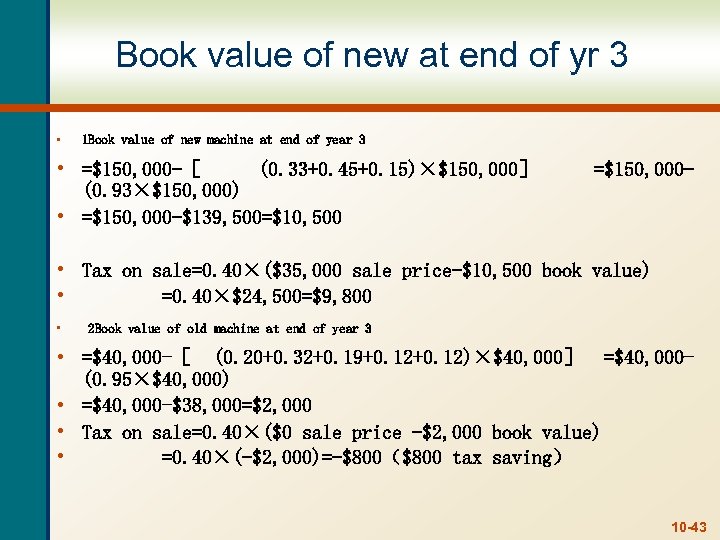

Book value of new at end of yr 3 • 1 Book value of new machine at end of year 3 • =$150, 000 -[ (0. 33+0. 45+0. 15)×$150, 000] (0. 93×$150, 000) • =$150, 000 -$139, 500=$10, 500 =$150, 000 - • Tax on sale=0. 40×($35, 000 sale price-$10, 500 book value) • =0. 40×$24, 500=$9, 800 • 2 Book value of old machine at end of year 3 • =$40, 000 -[ (0. 20+0. 32+0. 19+0. 12)×$40, 000] =$40, 000(0. 95×$40, 000) • =$40, 000 -$38, 000=$2, 000 • Tax on sale=0. 40×($0 sale price -$2, 000 book value) • =0. 40×(-$2, 000)=-$800($800 tax saving) 10 -43

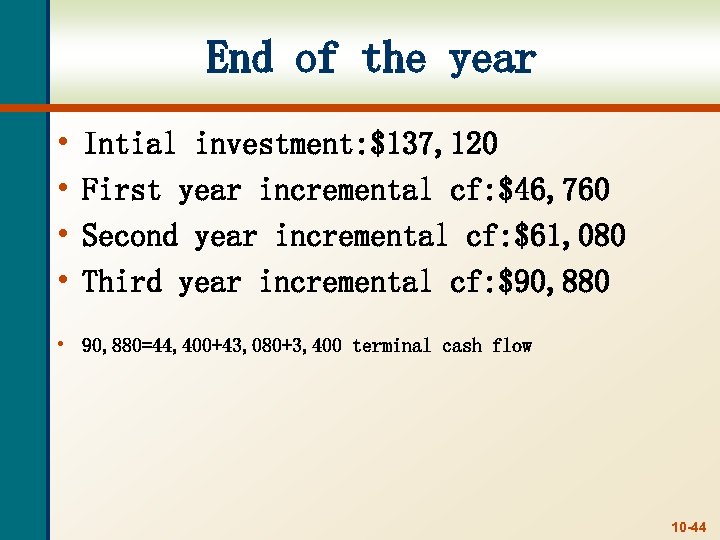

End of the year • • Intial investment: $137, 120 First year incremental cf: $46, 760 Second year incremental cf: $61, 080 Third year incremental cf: $90, 880 • 90, 880=44, 400+43, 080+3, 400 terminal cash flow 10 -44

Quick Quiz • How do we determine if cash flows are relevant to the capital budgeting decision? • What are the different methods for computing operating cash flow and when are they important? • What is the basic process for finding the bid price? • What is equivalent annual cost and when should it be used? 10 -45

Chapter 10 • End of Chapter Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

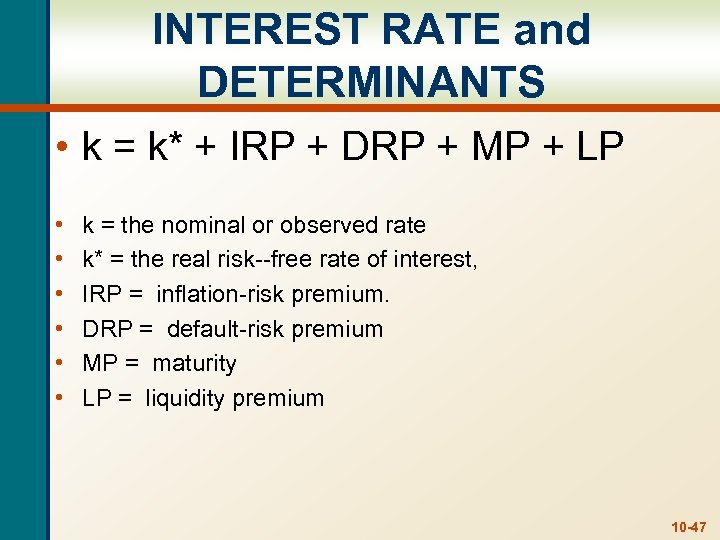

INTEREST RATE and DETERMINANTS • k = k* + IRP + DRP + MP + LP • • • k = the nominal or observed rate k* = the real risk--free rate of interest, IRP = inflation-risk premium. DRP = default-risk premium MP = maturity LP = liquidity premium 10 -47

9babf367b729743743035e79150b122c.ppt