f8fb324ce03dede7985754cf20b0bf40.ppt

- Количество слайдов: 25

Chapter 10 Banking Industry: Structure and Competition © 2008 Pearson Education Canada

Evolution of the Banking Industry • Financial innovation is driven by the desire to earn profits • A change in the financial environment will stimulate a search by financial institutions for innovations that are likely to be profitable – Responses to change in demand conditions – Responses to changes in supply conditions – Avoidance of regulations © 2008 Pearson Education Canada

Responses to Changes in Demand Conditions: Interest Rate Volatility • Adjustable-rate mortgages – Flexible interest rates keep profits high when rates rise – Lower initial interest rates make them attractive to home buyers • Financial Derivatives – Ability to hedge interest rate risk – Payoffs are linked to previously issued securities © 2008 Pearson Education Canada

Responses to Changes in Supply Conditions: Information Technology • Bank credit and debit cards – Improved computer technology lowers transaction costs • Electronic banking – – ATM Home banking ABM Virtual banking • Junk bonds • Commercial paper market • Securitization © 2008 Pearson Education Canada

Avoidance of Regulations: Loophole Mining • Reserve requirements act as a tax on deposits • Restrictions on interest paid on deposits led to disintermediation – Money market mutual funds – Sweep accounts © 2008 Pearson Education Canada

Decline of Traditional Banking • Decline in Cost advantage of Acquiring Funds (Liabilities) • Decline in Income Advantage on uses of funds (Assets) • Bank Responses - No decline in overall profitability - Increase in income from off-balancesheet activities © 2008 Pearson Education Canada

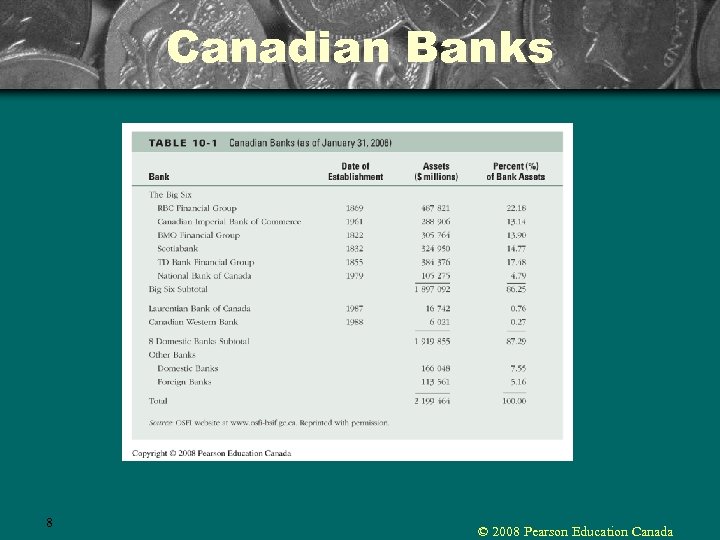

Schedule I, II and III Banks • The Big Six, together with the Laurentian Bank of Canada, the Canadian Western Bank, and another 8 domestic banks are Canada’s Schedule I banks • Schedule II banks are some domestic banks controlled by eligible foreign institutions • A Schedule III bank is a foreign bank branches of foreign institutions 7 © 2008 Pearson Education Canada

Canadian Banks 8 © 2008 Pearson Education Canada

Competition and Technology • Besides chartered banks, there are over 4000 financial institutions providing services, these include trust, mortgage loan companies, credit unions, caisses populaires, government saving institutions, insurance companies, pension funds, mutual funds and investment dealers • New technology and the internet have led to more competition and innovative banking in Canada • 2001 changes in bank ownership laws have encouraged the establishment of new banks © 2008 Pearson Education Canada

Comparison with the United States • As of 2005 there were 68 chartered banks in Canada and around 7500 in the United States • The presence of so many banks in the U. S. reflects past regulations that restricted the ability of these financial institutions to open branches • Many small U. S. banks stayed in existence because a large bank capable of driving them out of business was often restricted from opening a branch nearby • It was easier for a bank to open a branch in a foreign country than in another state in the U. S. 10 © 2008 Pearson Education Canada

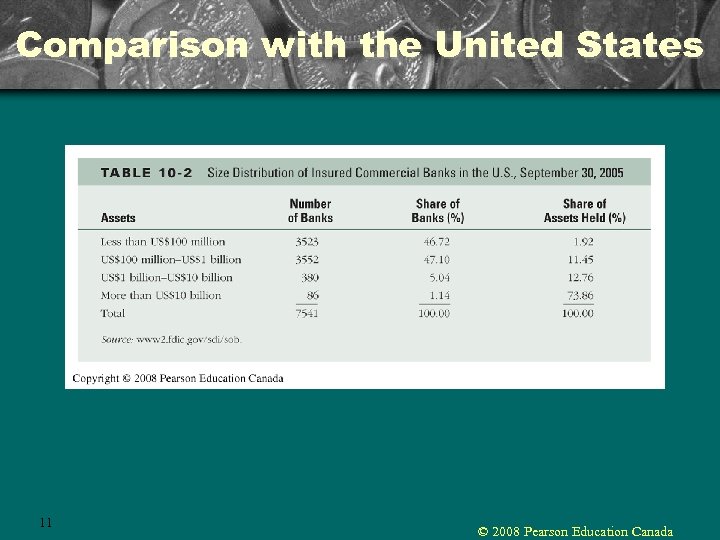

Comparison with the United States 11 © 2008 Pearson Education Canada

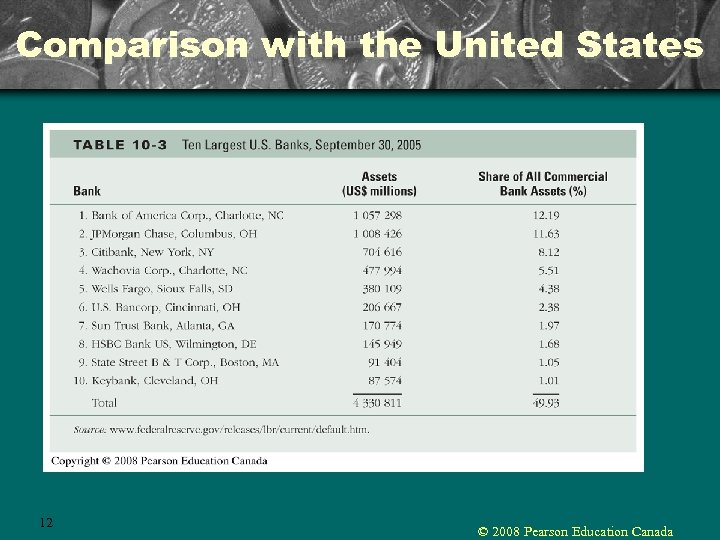

Comparison with the United States 12 © 2008 Pearson Education Canada

Response to Branching Restrictions in the U. S. Response to Branching Restrictions 1. Bank Holding Companies 2. Automated Teller Machines © 2008 Pearson Education Canada

Competition Across All Four Pillars and Convergence • In the past, Canada’s financial services industry was regulated by institution (banks, securities, insurance, and real estate). This approach to regulation has been known as the four-pillar approach • Recent legislative changes allowed cross-ownership via subsidiaries between financial institutions • As a result, Canada’s traditional four pillars have now converged into a single financial services marketplace 14 © 2008 Pearson Education Canada

Bank Consolidation 1. The way is now open to consolidation in terms not only of the number of banking institutions, but also across financial service activities 2. Banking institutions will become not only larger, but increasingly complex organizations, engaging in the full gamut of financial service activities taking advantage of economies of scale and economies of scope 3. Mega-mergers like that of Citicorp and Travelers in the U. S. should become increasingly common 15 © 2008 Pearson Education Canada

Three Basic World Frameworks 1. Universal banking - No separation between banking and securities industries 2. British-style universal banking - May engage in security underwriting 3. Japanese Model - Some legal separation of banking and other financial services © 2008 Pearson Education Canada

Trust and Mortgage Loan Companies (TMLs) • • 17 Operate under a charter issued by either the federal government or one of the provinces Federally incorporated TMLs are regulated and supervised by the OSFI and must also register in all provinces in which they operate and conform to their regulations The fiduciary component of trust companies is only subject to provincial legislation, even if the company is federally incorporated CDIC and QDIB (for Québec TMLs) © 2008 Pearson Education Canada

Credit Unions and Caisses Populaires • • 18 Established under provincial legislation Are non-profit seeking institutions Accept deposits and make loans only to members Members have voting rights, elect board of directors, which determine lending and investment policies Have their own set of institutions, including central banking and deposit insurance The main source of funds is deposits (85% of liabilities) followed by members equity (7%) Asset portfolio made up largely of mortgages (55%) © 2008 Pearson Education Canada

Government Savings Institutions Province of Ontario Savings Office • Established in 1921 • Today only lends to the Treasurer of Ontario for provincial government purposes Alberta Treasury Branches • Established in 1938 • Today there are 150 branches and 225 ATMs in 242 communities across Alberta, operating in three target markets: individual financial services, agricultural operations, and independent business 19 © 2008 Pearson Education Canada

International Banking • Rapid growth – Growth in international trade and multinational corporations – Global investment banking is very profitable – Ability to tap into the Eurodollar market © 2008 Pearson Education Canada

Eurocurrencies Market • Mostly dollar-denominated deposits held in banks outside of the U. S. • Most widely used currency in international trade • Offshore deposits not subject to regulations © 2008 Pearson Education Canada

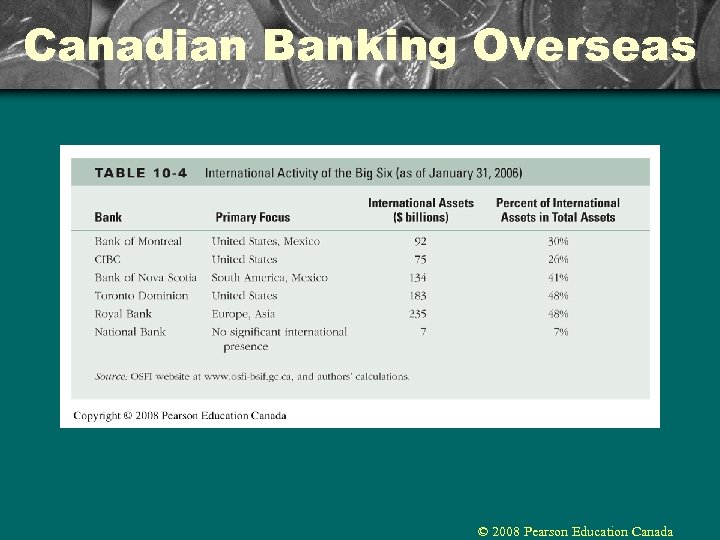

Canadian Banking Overseas © 2008 Pearson Education Canada

Foreign Banks in Canada © 2008 Pearson Education Canada

The 2001 Bank Act • • Bank Holding Companies Permitted Investment Ownership Rules Canadian Payments Act and Access to the Payments and Clearance System • Merger Review Policy • The National Financial Services Ombud Service 24 © 2008 Pearson Education Canada

Implications for Canadian Banking Industry • The financial consolidation process will increase with the 2001 legislation as the way is open to new mergers and acquisitions, strategic alliances, partnership and joint ventures • Financial groups will become larger and increasingly complex, engaging in a full gamut of financial activities 25 © 2008 Pearson Education Canada

f8fb324ce03dede7985754cf20b0bf40.ppt